TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Chris Hays and Mark Jeffrey wanted to create a way for everyone to be able to tell their loved ones if they were in trouble. Their first product, Guardian Circle, did just that, netting a mention a few years ago. Now the same team is truly decentralizing alerts with a new token called, obviously, Guardium.

The plan is to create an ad hoc network of helpers and first responders. “Guardium and Guardian Circle together open the emergency response grid to vetted citizens, private response and compatible devices for the very first time,” write the founders. “Providing an economic framework on our global distributed emergency response network; Guardium brings first responders to the 4 billion people on the planet without government-sponsored emergency response.”

Because the product already works, the team is taking on the token sale as a new challenge.

“We’re serial entrepreneurs — both of us have been venture-backed in the past by names like SoftBank and Intel, and we’ve been senior execs in companies backed by Sequoia and Elon Musk. Transitioning to the token sale-backed universe has been an interesting study in contrasts,” said Hays. “There are a number of ‘panic button apps’ — but without exception, all of them have forgotten ‘the second half of the problem’ — organizing the response. Getting people who do not know one another into instant communication and location sharing during an emergency — the importance of that cannot be overstated.”

The founders found that their idea wasn’t fundable in the valley. After all, what VC wants to help people when they can invest in Snapchat? Instead, Hays and Jeffrey are aiming bigger.

“We’re rebooting the world’s safety grid,” said Hays. “We’re creating a new global public utility. And we want it to service everyone, everywhere on earth. Although it is a very big vision, and it is a capitalist, multibillion dollar ecosystem that we’re chasing — it’s still a very different vision, and not the one venture capitalists are looking for.”

The token works to create a flash mob of help. Guard tokens pay first responders and dispatchers and “cities, campuses, and resorts stake $GUARD to access Alerts created within their geofenced borders,” allowing local folks to help immediately. They’ve sold half of their hard cap of $10 million thus far.

While tokens are always an iffy investment, this team has produced product and, more important, it’s clear they’ll never raise venture. A token, no matter how it’s used in the future, seems like a solid solution.

Powered by WPeMatico

We are experimenting with new content forms at TechCrunch. This is a rough draft of something new — provide your feedback directly to the authors: Danny at danny@techcrunch.com or Arman at Arman.Tabatabai@techcrunch.com if you like or hate something here.

Ignoring the midterm hysteria, we continue our obsession with SoftBank today by looking at the group’s IPO of its telecom unit. But first, some thoughts about Form Ds.

Recently, I was looking up the investment history of Patreon (Note: I was an investor in the company through my previous venture firm CRV). I did what I normally do: I went straight to the SEC’s EDGAR system and started searching for the company and its filings. And came up with nothing. Full-text search, office address searches and founder name searches — nothing was returned.

And yet, the company has publicly raised more than $100 million in venture capital according to Crunchbase, and to my knowledge, is not incorporated outside of the United States.

There should be a whole spate of filings, and yet none exist. What’s up with that?

After some investigation, my working hypothesis is that startups are (increasingly?) not filing disclosures with the SEC as a specific strategy to avoid scrutiny.

To take a step back, when companies take money from investors, they sell those investors securities. Under American laws, all securities need to be registered with the Securities and Exchange Commission using pre-defined templates (such as an S-1 registration form) to ensure that all investors know exactly what they are buying.

However, registration is expensive and time-consuming, and so U.S. law also provides a set of exemptions from registration for companies where that process is impractical. Startups take advantage of these exemptions and stay private, until they eventually want to become public through a registration with the SEC.

One mandated component of taking advantage of these registration exemptions is that the startup needs to file a Form D with the SEC. The Form D is free to file and relatively simple, requiring basic information such as the amount of capital fundraised and who the investors were in the round. It’s required to be filed 15 days after the first sale of securities, and, conveniently, the form preempts most state securities laws so that startups don’t have to file in state jurisdictions.

There are theoretically large penalties for failing to file — a company could open itself to investor lawsuits, and there are various financial felonies available that could be applied, as well.

But that’s legal theory, and the practicalities are that almost nothing bad happens to startups that fail to file a Form D. American courts, along with the SEC, have upheld that a startup does not lose its covered security exemption by failing to file the form. The only additional requirement is generally to file state security forms in lieu of the federal form.

A bigger question is why go through this when filing is easy and free? The obvious answer is that startups don’t want to put their round’s information out in the public eye where the good people at TechCrunch will see it and report on it. Of course, the whole point of Form D disclosure is to provide the public a modicum of information about what is happening in the economy.

But actually, the motivations go far beyond that. One reader, Paul David Shrader, saw our note yesterday that we were investigating Form Ds and offered this list of reasons on why companies in general (and to be clear, not specific to any company he has advised) choose to forgo filing:

As for the “why,” there are a few reasons why management, the board of directors, or even investors may be sensitive to fundraising disclosures:

1. The company doesn’t want the increased scrutiny internally that comes along with a new funding round. This can come from employees demanding different levels of compensation.

2. The company doesn’t want increased regulatory scrutiny. Many startups operate in regulatory gray areas, and increased attention from regulators before they are ready can be a Bad Thing.

3. The company has security concerns. For startups that operate in certain environments internationally, raising a monster round can place a target on the backs of its employees. This has been an issue in Latin America from time to time.

4. The company has competitive concerns. Raising a big round may attract new entrants to the market or heighten attention from existing competitors before a startup has solidified its position in the market.

5. Investors don’t want disclosure. Some investors want to disclose new investments on their own timeframe, and they make this a condition of their investment. Publicly-traded investors or sovereign wealth funds may only want to disclose at the time of their quarterly reports.

6. Flat rounds or down rounds can suck away any positive momentum. When founders are trying to convince customers and employees to join the rocket ship that is their company, a flatlining fundraise can look like… well, a flatlining company.

7. The round may not be closed yet. Companies sometimes have optimistic goals about the size of a round (“We’re raising $4 million!”), but only have a smaller amount committed at the outset of the round. Sometimes a single round can take 18+ months to close, even though a sizable (or not so sizable) percentage closed at the outset.

Some of these are obvious, but others, such as internal compensation concerns or international security concerns, were more surprising to me. Thanks Paul David for the thoughts.

Now, I said at the outset that my hypothesis is that startups are increasingly foregoing Form D disclosure. Arman and I are still doing work on this (the SEC has some data sets), but to be frank, it is very hard to operationalize and prove. Form D filings are up or steady, which makes sense given that the number of startups in areas like San Francisco have skyrocketed over the past decade. We are trying to prove something that doesn’t exist, and Karl Popper has helpfully explained that that is impossible.

Nonetheless, we are still interested in whether the legal norms have shifted here, and will hopefully report back on this again. If you are a startup attorney with an opinion here, please email Danny@techcrunch.com or Arman.tabatabai@techcrunch.com with your thoughts.

Photo by Alessandro Di Ciommo/NurPhoto via Getty Images

Talking about filings, one of the most complicated filings in the world is underway. While we were digging into SoftBank’s financing strategies yesterday, all the activity around the looming IPO of its telco business caught our attention.

As we analyzed yesterday, though SoftBank’s debt balance continues to balloon, the company’s balance sheet has rarely prevented it from pursuing investments in the past.

SoftBank continues to dole out multi-billion-dollar checks with stunning regularity, having invested around one-third of its $90+ billion Vision Fund. And we know SoftBank has no intention of slowing its torrid pace, with chairman and CEO Masayoshi Son previously stating he plans to raise $100 billion funds that would spend around $50 billion annually, every two or three years.

One way SoftBank is looking to access additional funding to pour into the next batch of unicorns is by taking a portion of its Japanese mobile business public. For some context, SoftBank is generally considered to be the third largest telco in Japan behind NTT DoCoMo and KDDI.

Even though initial estimates expect SoftBank to only sell around 30-40 percent of the company’s shares, the offering is widely expected to be one of the largest listings ever at potentially more than $25 billion, which would value the overall business at $90 billion on the high end. Reuters recently reported via a Japanese news service that the Tokyo Stock Exchange is expected to give SoftBank approval to list shares next Monday, with a likely listing date of December 19th.

But the progression of the IPO has been oddly complex and unique from the beginning.

First, there was an issue with a set of bonds SoftBank had issued in 2013, which were guaranteed by the telecom business and had covenants requiring that the company hold investment-grade credit ratings before pursuing a sale of any sort. However, SoftBank’s bonds hold junk status from major credit ratings agencies. To fix that roadblock, SoftBank issued a new set of bonds with better terms to buy back the bonds with the prohibitive covenants, undercutting and aggravating some investors of the initial bonds.

Then, it was reported that while lining up the underwriting banks for the IPO, SoftBank reportedly asked banks to commit to loans to the Vision Fund that total around $9 billion, a claim SoftBank has not commented on. As reported by Bloomberg:

The IPO’s top underwriters, which include Nomura Holdings Inc. and Goldman Sachs Group Inc., have given non-binding assurances while they finalize terms of the loan to the Vision Fund, the people said. Stakes in around five of the investment fund’s holdings will be used as collateral, according to the people, who asked not to be identified because the information is private.

Deutsche Bank AG, Mizuho Financial Group Inc. and Sumitomo Mitsui Financial Group Inc. were also among banks chosen to lead SoftBank’s wireless unit IPO, Bloomberg News reported last week. Details of the loan are still being worked out, and terms could change, the people said. Meanwhile, Deutsche Bank and Goldman Sachs committed about $1 billion each, they said.

While the fund’s holdings (perhaps Uber or WeWork or others) would be set as collateral, Bloomberg also reported in the same article that the loans were non-recourse, meaning that if for some reason SoftBank were unable to repay the loan, the lenders would have no claim to any assets outside of the company stakes set as collateral. The loan terms become more concerning with the Vision Fund since it invests in many unlisted and, in many cases, unprofitable companies. As we noted yesterday, at least one potential lender, Bank of America, decided not to participate due to concerns that the terms were too risky.

Such sausage-making isn’t usually visible to the public, which would seem to indicate that at least some of the banks are grousing to reporters about terms they find egregious. As always, feel free to grouse to us as well.

What we are reading (or at least, trying to read)

Powered by WPeMatico

Because solar and wind power are now cheaper to produce than energy from fossil fuels, the only obstacle that remains to the mass adoption of renewable power is the amount of money utilities need to spend to store the energy those systems produce.

Right now, storing 100 megawatts of renewable energy (enough to power roughly 600,000 homes) means spending roughly $65.6 million on massive batteries like the kind made by Tesla, or relying on huge pumped hydro-electric storage projects that essentially create man-made dams where the release of water spins turbines to generate energy (those projects are typically far larger than 100 megawatts).

A new company called Energy Vault, launched from Bill Gross’ Idealab incubator in Pasadena, Calif., has developed a technology, based on the principles of pumped hydro storage, that it claims can slash the cost of energy storage to a fraction of the current price and make renewable energy cost-effective all day, every day.

As climate change worries mount, finding a solution that can make renewables even more compelling and cost-effective isn’t just a good business — it’s a global priority.

Energy Vault’s technology consists of a 33-story-high, six-armed crane with booms extending to nearly the length of a football field (about 87 yards). That crane is surrounded by 5,000 huge concrete blocks weighing roughly 35 metric tons altogether (or around 172,000 pounds).

“These would typically be built out near wind farms or solar plants,” said Robert Piconi, the chief executive of Energy Vault. “This is not something that you’d drop in the middle of the city.”

The cranes are controlled by a software system that manages the movement of the cement blocks to either store the energy generated by solar or wind farms, or discharge that energy onto the power grid.

According to Piconi, each of the company’s systems will have 35 megawatt hours of nominal energy capacity and 4 megawatts of peak power capacity. Ramp times occur in as little as a millisecond with 100 percent power achieved in 2.9 seconds.

The systems have roundtrip efficiencies of roughly 90 percent and there’s no energy loss, as the technology relies on mechanical energy from incredibly durable materials that have a roughly 30-year lifetime.

And all of this at a price tag of around $7 million to $8 million per system, according to Piconi. What makes the system even more sustainable, according to Piconi, is the use of recycled concrete that was only going to be landfilled — instead of new cement construction.

Energy Vault has already set up a demonstration system in Biasca, Switzerland, next to the company’s Lugarno headquarters. That demonstration plant likely had a role in the company’s ability to sign up a clutch of initial customers, including The Tata Power Company Limited, India’s largest integrated power company, to deploy an initial 35 MWh Energy Vault system by 2019.

“Innovation in energy storage represents the largest and most near-term opportunity to accelerate renewable deployments and bring us closer to replacing fossil fuels as the primary source to meet the world’s continual growth in energy demand,” said Bill Gross, co-founder, Energy Vault and founder of Idealab. “We’re excited to support Energy Vault in bringing this groundbreaking technology to the market.”

Indeed, over the next two years, Energy Vault expects customers to build between 500 megawatts and one gigawatt of storage capacity using its systems, according to Piconi.

“We have customers on every continent to build these units,” he said.

Piconi, a former Danaher executive, met Gross 12 years ago as the Idealab founder was beginning his push into renewable energy technologies. The two men stayed in touch and began seriously contemplating the creation of Energy Vault after nearly a decade of collaboration and contact.

It was back in 2017 that Piconi, Gross and fellow co-founder and chief technical officer Andrea Pedretti hit upon the idea for Energy Vault’s novel approach to energy storage.

“It became clear to him a few years ago how important storage was going to be,” said Piconi.

The three men started looking at the efficiencies available through pumped hydroelectric storage, and began brainstorming ways to mimic that process using mechanical energy. “We looked at a steel tower first, but that was too expensive. We thought about water in a tower pumped up, but there were efficiency issues there,” Piconi said. “Then we got to the concrete bricks and the crane.”

The concrete was important for the cost of materials, and because of the energy intensity and pollution that’s involved with manufacturing cement, the team decided to use recycled cement to make the blocks that its energy storage system would use.

Enter, Cemex, one of the largest cement manufacturers in the world, which has joined with Energy Vault as a partner.

Energy Vault has already raised capital through several “seed” rounds to develop its technology and get the prototype in Switzerland up and running.

“Energy Vault’s team has developed a disruptive platform, and we are enthusiastic to work with their team to deploy an environmentally efficient and cost-effective energy storage solution that is highly viable,” said Dr. Davide Zampini, head of Cemex Global R&D and IP. “We share a common commitment to enable a future where resources are used responsibly, which is paramount to Cemex’s strategy for sustainable development.”

Powered by WPeMatico

Tiny houses are all the rage, but once you put more than a few people in one you have a problem: Where can you go from there?

Nowhere. Exactly.

What you do is, if you need that extra push over the cliff, you know what you do? Talk to Brian Gaudio. Gaudio is the founder of Module Housing, an incremental-building startup from Pittsburgh. Gaudio, formerly of Walt Disney Imagineering, has an architecture background and saw firsthand the need for incremental housing in his work in Biloxi and Latin America. His idea is simple: create a little house that grows with you over time, allowing a single room to turn into a mansion with a few turns of a wrench.

“We think of the home as a recurring revenue stream — buy a starter home today, purchase additions and upgrades in the future. All our homes are designed to change over time — as a homebuyer’s family grows, income grows or needs change,” he said. “We are capital-light compared to other prefab startups in that we don’t own the manufacturing facilities where our homes are built. We leverage existing network of high-performance prefab manufacturers on the East Coast.”

The service does it all: They offer multiple-room dwellings and work with you to order the modules, find land that lets you add on over time and assemble the houses. Like the Craftsman houses of old, you have a few basic styles, but in this case you can buy a one-bedroom Nook house for $212,000 and then add on over time instead of buying a house with seven rooms and realizing you only needed two.

Additional costs include building a foundation and land preparation. It’s also dead easy to add onto your house when you’re ready, said Gaudio, thanks to work they’ve done in modularizing the houses.

“We have patents pending on a removable roof and wall system that simplifies the addition process when a customer is ready to add on,” he said.

The company has raised $1.2 million so far and they have prototype houses in Pittsburgh. They already have orders and they’ve created a Tesla-like reservation system for the folks who want to try out their product.

“I moved back to Pittsburgh to start Module with the goal of making good design accessible to everyone,” he said. “Affordable housing is one of the most critical issues our country faces today. Module is a vehicle to promote responsible, equitable development in cities. We are reimagining housing to be more sustainable, adaptable and better designed.”

Powered by WPeMatico

Brooklinen, the direct-to-consumer bed linens brand, has today announced the opening of a four-month pop-up shop in NYC.

The company has been around for four years thus far, and recently hit $100 million in revenue after raising just $10 million in funding.

Part of the company’s success comes down to its attention to detail. The process of shopping for sheets is often difficult for new adults who don’t understand how to weigh quality and price, and usually don’t get much help in stores like Bed Bath & Beyond.

Brooklinen isn’t necessarily inexpensive — 270-thread-count sheets start at $129 for a queen, and 480-thread-count sheets start at $149 for a queen — but the process of purchasing quality sheets is leaps and bounds more convenient. Brooklinen handles fulfillment, including the packaging, and has invested in customer service to ensure that there are no hiccups from the point of purchase to the point of making the bed.

Moreover, Brooklinen has designed many of their sheets to easily mix and match with other sets, creating an environment that begs for repeat purchases.

That said, there are still customers who either need the instant gratification of a purchase or to touch and feel the product before converting. Which is why Brooklinen is launching the pop-up shop on Spring Street in Soho.

Co-founder and CEO Rich Fulop explained to TechCrunch that the timing of the pop-up was very intentional.

Co-founder and CEO Rich Fulop explained to TechCrunch that the timing of the pop-up was very intentional.

“We’re doing a four-month pop-up to learn as much as we can and talk to customers,” said Fulop. “We understand that shopping picks up ahead of the holidays, so we set it up to go through the holidays and then into the slower time following the holidays. We want to see the difference between holiday season and through to February so we don’t get a false positive in terms of the model.”

Interestingly, Brooklinen is opting to hold inventory in the store so that purchasing customers can take home their wares. Many pop-up shops offer portals to purchase items and have them shipped as opposed to holding inventory. The company wants to capitalize on any customer who’s flirting with the idea of purchasing and believes holding inventory is the best way to do that.

However, Brooklinen expressed no interest in going the wholesale route, selling inventory to other retailers. Controlling every step of the process, from design all the way to fulfillment, is part of what makes Brooklinen successful, according to the founders.

The 2,000-square-foot space is at 119 Spring St. and officially opens on Friday.

Powered by WPeMatico

Fraugster, the Berlin-based startup that uses artificial intelligence to prevent fraud for online retailers, has raised $14 million in a Series B funding. The round is led by CommerzVentures, the venture capital subsidiary of Commerzbank, alongside early Fraugster investors Earlybird, Speedinvest, Seedcamp and Rancilio Cube.

Notably, Munich Re/HSB Ventures, the VC arm of global reinsurer Munich Re, also participated in the round. That’s because Munich Re is insuring Fraugster’s “Fraud Free” product, which takes on the full liability for each transaction to ensure retailers utilizing Fraugster’s fraud detection technology never lose out — a sign that the company is pretty confident in its machine learning.

Selling its wares to payments companies — including Ingenico ePayments and Six Payments — the Fraugster AI technology takes data from multiple sources, then analyzes and cross-checks it in a fraction of a second to determine whether a transaction is fraudulent or not.

The idea isn’t just to block any potential fraud, which rules-based systems can already do, but to actually let more transactions through. That’s because false-positives (i.e. accidentally preventing perfectly valid purchases) is the real bane of the industry.

Citing industry average stats of false positives, Fraugster CEO and co-founder CEO Max Laemmle tells me that for every dollar lost to fraud, $17 is lost through transactions that are wrongly turned down, leading to lower revenues for merchants. He says that Fraugster’s technology has already got that down to $2.

Meanwhile, the anti-fraud startup says it will use the new funds to continue expansion into new markets. This includes the U.S., Asia and Europe, where retailers are facing “an accelerating battle against fraud.”

Powered by WPeMatico

PressLogic founders Ryan Cheung and Edward Chow

PressLogic, a Hong Kong-based social media content and data analytics startup, announced today that it has raised a $10 million Series A+ round from Meitu, developer of the popular Chinese selfie app. PressLogic will use the funds to launch its new lifestyle brand GirlStyle and enter e-commerce with its proprietary algorithms, which predict what topics will trend on social media among specific groups.

The new round brings PressLogic’s total raised to $15 million. Meitu first acquired a minority stake in PressLogic last year.

After launching a data-analytics service for social media managers called MediaLens in 2016, founders Ryan Cheung and Edward Chow began creating social media publishing and marketing brands in order to show potential clients how their technology could boost audience engagement. PressLogic, their social media publishing platform, now claims a total of 8 million Facebook and Instagram followers and more than 700 million monthly content impressions across its social media profiles and websites, with about 75 percent of its visitors aged 18 to 34.

MediaLens still serves as PressLogic’s core technology, underpinning its content brands, as well as the insights it provides to partners in order to increase their social media engagement and return on investment. CEO Cheung (Chow serves as PressLogic’s CTO) told TechCrunch that MediaLens “creates a pipeline from data sourcing to content suggestion to optimization” and has an edge against its competitors because it is able to make more granular suggestions about what content is likely to be popular among specific groups based on trending topics.

With its new round of funding, PressLogic will launch GirlStyle, a lifestyle and fashion-based social network targeted to young women, as an app and website in Hong Kong, Taiwan, Singapore, India, Korea and Malaysia by the end of this year. In terms of e-commerce, Cheung says the company will start by focusing on skincare and cosmetics by leveraging data from its online traffic and readers.

PressLogic hasn’t revealed if Meitu’s photo imaging technology will be integrated into its platform, but Cheung says it would like to extend MediaLens’ analytics to images, too, as data from photos and videos shared on social media is potentially valuable, but still difficult to transform into the kind of insights that help predict which content will go viral next.

Powered by WPeMatico

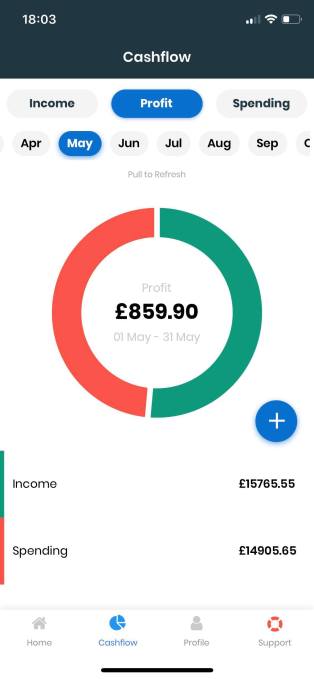

Portify, a London fintech startup that offers an app and various financial products to help gig economy workers better manage their finances and in turn improve financial well-being, has raised £1.3 million in seed investment. The round was led by Kindred Capital and company builder and investor Entrepreneur First (EF), with participation from various unnamed angel investors.

Founded in May last year by EF alumni Sho Sugihara (CEO) and Chris Butcher (CTO), Portify is setting out to address the financial volatility many flexible or so-called gig economy workers face. The startup offers a number of tailored financial products, accessible via its mobile app, to help flexible workers get insights into their current financial status and income, as well as do short and long-term financial planning.

The app — primarily a B2B2C play — is distributed in partnership with various gig economy platforms and also includes earning “rewards” at partnering merchants or service providers. The current Portify website lists TransferWise, Amazon and Spotify as rewards.

“Portify’s vision is to enable financial security and well-being for independent workers,” Portify co-founder and CEO Sho Sugihara tells me. “While we’ve seen rapid growth in the numbers of independent workers (6 million in the U.K., and up to 162 million in the E.U. and U.S., according to McKinsey), there is still a large gap in the market for financial services to ensure these workers are secure, and have access to an economic ladder.

“Portify’s vision is to enable financial security and well-being for independent workers,” Portify co-founder and CEO Sho Sugihara tells me. “While we’ve seen rapid growth in the numbers of independent workers (6 million in the U.K., and up to 162 million in the E.U. and U.S., according to McKinsey), there is still a large gap in the market for financial services to ensure these workers are secure, and have access to an economic ladder.

“We work with companies to help build access to financial products that enable this security and progression, and offer this through a mobile app which workers can port between different jobs.”

Sugihara says there are three elements to Portify’s mission: helping flexible workers control “immediate income volatility,” helping them budget effectively on a day-to-day basis and support with financial planning for the long term.

“Once a user gets access to our app, the first thing they do is securely connect their bank account,” he explains. “We then help control volatility by offering emergency credit with select stores to buy essential products if required. We also help our users manage cash flow and budget for tax and other recurring expenses. By building up financial security and well-being from the ground up, our goal is to improve our user’s financial standing over the long term, whether through saving for retirement or helping them invest into their own businesses and careers.”

To that end, Sugihara says Portify is currently being used by independent workers in the gig economy and temp staffing sector. This covers couriers, ride-hailing drivers, retail shop floor staff and hospitality workers, amongst others. Its B2B customers span large gig economy platforms and digital temporary staffing agencies “with global coverage.”

Powered by WPeMatico

Home Made, the London premium online lettings agency, has raised a further £2 million in funding. The round is led by Athens-based venture capital firm VentureFriends, and follows the proptech startup’s £850,000 “pre-seed” round nine months ago.

Founded in 2016 by Asaf Navot, a former Bain strategy consultant and INSEAD graduate, and Nick Binnington, a former British Army Captain and LBS graduate, Home Made’s proposition is based on the premise that the letting agent model is broken. Specifically, that high-street agents offer average service and charge extortionate fees, while online agents typically charge low fees but offer a worse service as a result.

The company positions itself as the only estate agency in the U.K. that offers a premium service akin to a high-end traditional estate agent, including accompanied property viewings and working until 10 pm at night, on weekends and bank holidays — for a low online fee starting at £948 +VAT. However, competitor Rentify also occupies a more upmarket space, but charges a monthly fee and is fully-managed and provides a ‘rent guarantee’. At the lower end are startups like OpenRent and uPad that operate more more an à la carte model with various services to help you rent out your property.

To that end, Home Made says it plans to use the new funding to expand its offering and further develop its underlying technology, focus on growing its customer base in London “and beyond”. This will include hiring 20-25 new sales and marketing staff in the coming months.

The company’s proprietary online platform allows landlords to manage their properties from marketing to move-in. This includes full control during the marketing phase – landlords can add or remove marketing photos on the portals, write or enhance existing descriptions and change the price – and visibility of progress during tenancy progression.

International expansion has also begin: Home Made recently opened an office in Athens and says it is looking to develop several company functions in the country, including lead generation, tech support, and customer service and support. The startup says it has selected Greece for its first international office primarily due to “the growing Greek startup ecosystem which offers access to high caliber talent with international experience”.

Meanwhile, Home Made recently announced the launch of Sentinel, a tool that detects illegal subletting by tenants via short-let websites such as AirBnB. The idea is to help landlords tackle a growing illegal subletting problem that sees “tenants” rent out properties with no intention of ever ever staying in the property.

This activity commonly violates the terms of a Tenancy Agreement, and may also violate the building lease, local authority regulations, buildings insurance, and mortgage terms. It also withdraws these properties from the market for long-

term tenants, which in turn contributes to rental increases in London.

Powered by WPeMatico

The holiday season is here again, touting all sorts of kids’ toys that pledge to pack ‘STEM smarts’ in the box, not just the usual battery-based fun.

Educational playthings are nothing new, of course. But, in recent years, long time toymakers and a flurry of new market entrants have piggybacked on the popularity of smartphones and apps, building connected toys for even very young kids that seek to tap into a wider ‘learn to code’ movement which itself feeds off worries about the future employability of those lacking techie skills.

Whether the lofty educational claims being made for some of these STEM gizmos stands the test of time remains to be seen. Much of this sums to clever branding. Though there’s no doubt a lot of care and attention has gone into building this category out, you’ll also find equally eye-catching price-tags.

Whatever STEM toy you buy there’s a high chance it won’t survive the fickle attention spans of kids at rest and play. (Even as your children’s appetite to be schooled while having fun might dash your ‘engineer in training’ expectations.) Tearing impressionable eyeballs away from YouTube or mobile games might be your main parental challenge — and whether kids really need to start ‘learning to code’ aged just 4 or 5 seems questionable.

Buyers with high ‘outcome’ hopes for STEM toys should certainly go in with their eyes, rather than their wallets, wide open. The ‘STEM premium’ can be steep indeed, even as the capabilities and educational potential of the playthings themselves varies considerably.

At the cheaper end of the price spectrum, a ‘developmental toy’ might not really be so very different from a more basic or traditional building block type toy used in concert with a kid’s own imagination, for example.

While, at the premium end, there are a few devices in the market that are essentially fully fledged computers — but with a child-friendly layer applied to hand-hold and gamify STEM learning. An alternative investment in your child’s future might be to commit to advancing their learning opportunities yourself, using whatever computing devices you already have at home. (There are plenty of standalone apps offering guided coding lessons, for example. And tons and tons of open source resources.)

For a little DIY STEM learning inspiration read this wonderful childhood memoir by TechCrunch’s very own John Biggs — a self-confessed STEM toy sceptic.

It’s also worth noting that some startups in this still youthful category have already pivoted more toward selling wares direct to schools — aiming to plug learning gadgets into formal curricula, rather than risking the toys falling out of favor at home. Which does lend weight to the idea that standalone ‘play to learn’ toys don’t necessarily live up to the hype. And are getting tossed under the sofa after a few days’ use.

We certainly don’t suggest there are any shortcuts to turn kids into coders in the gift ideas presented here. It’s through proper guidance — plus the power of their imagination — that the vast majority of children learn. And of course kids are individuals, with their own ideas about what they want to do and become.

The increasingly commercialized rush towards STEM toys, with hundreds of millions of investor dollars being poured into the category, might also be a cause for parental caution. There’s a risk of barriers being thrown up to more freeform learning — if companies start pushing harder to hold onto kids’ attention in a more and more competitive market. Barriers that could end up dampening creative thinking.

At the same time (adult) consumers are becoming concerned about how much time they spend online and on screens. So pushing kids to get plugged in from a very early age might not feel like the right thing to do. Your parental priorities might be more focused on making sure they develop into well rounded human beings — by playing with other kids and/or non-digital toys that help them get to know and understand the world around them, and encourage using more of their own imagination.

But for those fixed on buying into the STEM toy craze this holiday season, we’ve compiled a list of some of the main players, presented in alphabetical order, rounding up a selection of what they’re offering for 2018, hitting a variety of price-points, product types and age ranges, to present a market overview — and with the hope that a well chosen gift might at least spark a few bright ideas…

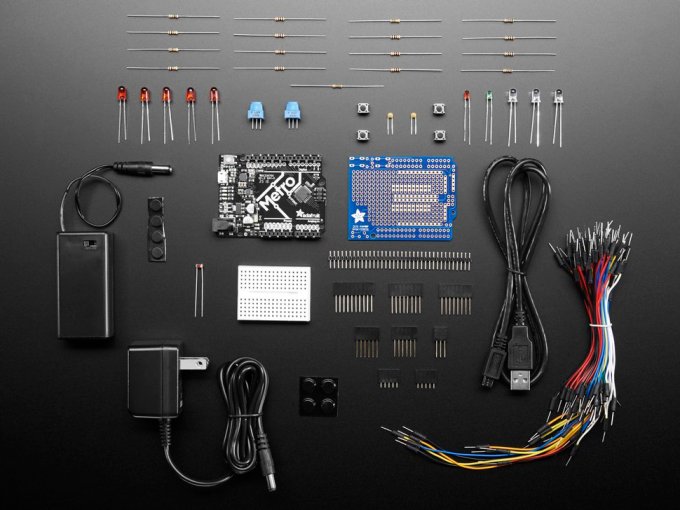

Product: Metro 328 Starter Pack

Price: $45

Description: Not a typical STEM toy but a starter kit from maker-focused and electronics hobbyist brand Adafruit. The kit is intended to get the user learning about electronics and Arduino microcontrollers to set them on a path to being a maker. Adafruit says the kit is designed for “everyone, even people with little or no electronics and programming experience”. Though parental supervision is a must unless you’re buying for a teenager or mature older child. Computer access is also required for programming the Arduino.

Be sure to check out Adafruit’s Young Engineers Category for a wider range of hardware hacking gift ideas too, from $10 for a Bare Conductive Paint Pen, to $25 for the Drawdio fun pack, to $35 for this Konstruktor DIY Film Camera Kit or $75 for the Snap Circuits Green kit — where budding makers can learn about renewable energy sources by building a range of solar and kinetic energy powered projects. Adafruit also sells a selection of STEM focused children’s books too, such as Python for Kids ($35)

Age: Teenagers, or younger children with parental supervision

[inline-ads]

Product: Cozmo

Price: $180

Description: The animation loving Anki team added a learn-to-code layer to their cute, desktop-mapping bot last year — called Cozmo Code Lab, which was delivered via free update — so the cartoonesque, programmable truck is not new on the scene for 2018 but has been gaining fresh powers over the years.

This year the company has turned its attention to adults, launching a new but almost identical-looking assistant-style bot, called Vector, that’s not really aimed at kids. That more pricey ($250) robot is slated to be getting access to its code lab in future, so it should have some DIY programming potential too.

Age: 8+

Product: Kamigami Jurassic World Robot

Price: ~$60

Description: Hobbyist robotics startup Dash Robotics has been collaborating with toymaker Mattel on the Kamigami line of biologically inspired robots for over a year now. The USB-charged bots arrive at kids’ homes in build-it-yourself form before coming to programmable, biomimetic life via the use of a simple, icon-based coding interface in the companion app.

The latest addition to the range is dinosaur bot series Jurassic World, currently comprised of a pair of pretty similar looking raptor dinosaurs, each with light up eyes and appropriate sound effects. Using the app kids can complete challenges to unlock new abilities and sounds. And if you have more than one dinosaur in the same house they can react to each other to make things even more lively.

Age: 8+

Product: Harry Potter Coding Kit

Price: $100

Description: British learn-to-code startup Kano has expanded its line this year with a co-branded, build-it-yourself wand linked to the fictional Harry Potter wizard series. The motion-sensitive e-product features a gyroscope, accelerometer, magnetometer and Bluetooth wireless so kids can use it to interact with coding content on-screen. The company offers 70-plus challenges for children to play wizard with, using wand gestures to manipulate digital content. Like many STEM toys it requires a tablet or desktop computer to work its digital magic (iOS and Android tablets are supported, as well as desktop PCs including Kano’s Computer Kit Touch, below)

Age: 6+

Product: Computer Kit Touch

Price: $280

Description: The latest version of Kano’s build-it-yourself Pi-powered kids’ computer. This year’s computer kit includes the familiar bright orange physical keyboard but now paired with a touchscreen. Kano reckons touch is a natural aid to the drag-and-drop, block-based learn-to-code systems it’s putting under kids’ fingertips here. Although its KanoOS Pi skin does support text-based coding too, and can run a wide range of other apps and programs — making this STEM device a fully fledged computer in its own right

Age: 6-13

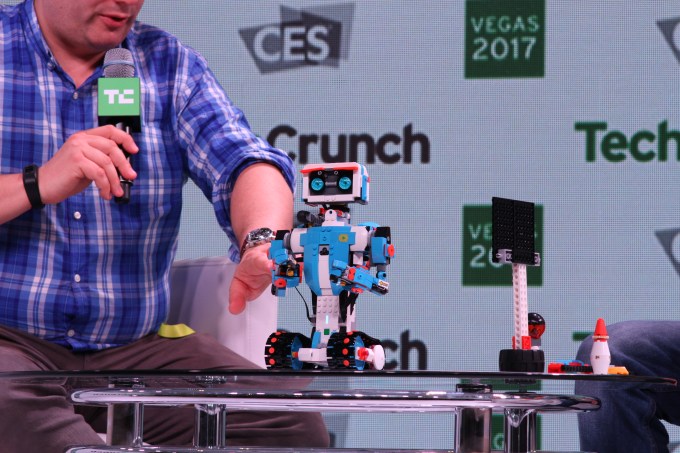

Product: Boost Creative Toolbox

Price: $160

Description: Boost is Lego’s relatively recent foray into offering a simpler robotics and programming system aimed at younger kids vs its more sophisticated and expensive veteran Mindstorms creator platform (for 10+ year olds). The Boost Creative Toolbox is an entry point to Lego + robotics, letting kids build a range of different brick-based bots — all of which can be controlled and programmed via the companion app which offers an icon-based coding system.

Boost components can also be combined with other Lego kits to bring other not-electronic kits to life — such as its Stormbringer Ninjago Dragon kit (sold separately for $40). Ninjago + Boost means = a dragon that can walk and turn its head as if it’s about to breathe fire

Age: 7-12

Product: Avengers Hero Inventor Kit

Price: $150

Description: This Disney co-branded wearable in kit form from the hardware hackers over at littleBits lets superhero-inspired kids snap together all sorts of electronic and plastic bits to make their own gauntlet from the Avengers movie franchise. The gizmo features an LED matrix panel, based on Tony Stark’s palm Repulsor Beam, they can control via companion app. There are 18 in-app activities for them to explore, assuming kids don’t just use amuse themselves acting out their Marvel superhero fantasies

Age: 8+

It’s worth noting that littleBits has lots more to offer — so if bringing yet more Disney-branded merch into your home really isn’t your thing, check out its wide range of DIY electronics kits, which cater to various price points, such as this Crawly Creature Kit ($40) or an Electronic Music Inventor Kit ($100), and much more… No major movie franchises necessary

Product: Codey Rocky

Price: $100

Description: Shenzhen-based STEM kit maker Makeblock crowdfunded this emotive, programmable bot geared towards younger kids on Kickstarter. There’s no assembly required, though the bot itself can transform into a wearable or handheld device for game playing, as Codey (the head) detaches from Rocky (the wheeled body).

Despite the young target age, the toy is packed with sophisticated tech — making use of deep learning algorithms, for example. While the company’s visual programming system, mBlock, also supports Python text coding, and allows kids to code bot movements and visual effects on the display, tapping into the 10 programmable modules on this sensor-heavy bot. Makeblock says kids can program Codey to create dot matrix animations, design games and even build AI and IoT applications, thanks to baked in support for voice, image and even face recognition… The bot has also been designed to be compatible with Lego bricks so kids can design and build physical add-ons too

Age: 6+

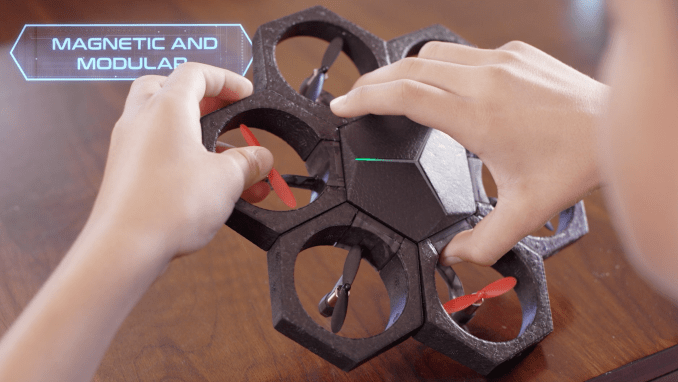

Product: Airblock

Price: $100

Description: Another programmable gizmo from Makeblock’s range. Airblock is a modular and programmable drone/hovercraft so this is a STEM device that can fly. Magnetic connectors are used for easy assembly of the soft foam pieces. Several different assembly configurations are possible. The companion app’s block-based coding interface is used for programming and controlling your Airblock creations

Age: 8+

Product: Evo

Price: $100

Description: This programmable robot has a twist as it can be controlled without a child always having to be stuck to a screen. The Evo’s sensing system can detect and respond to marks made by marker pens and stickers in the accompanying Experience Pack — so this is coding via paper plus visual cues.

There is also a digital, block-based coding interface for controlling Evo, called OzoBlockly (based on Google’s Blockly system). This has a five-level coding system to support a range of ages, from pre-readers (using just icon-based blocks), up to a ‘Master mode’ which Ozobot says includes extensive low-level control and advanced programming features

Age: 9+

Product: Modular Laptop

Price: $320 (with a Raspberry Pi 3 Model B+), $285 without

Description: This snazzy 14-inch modular laptop, powered by Raspberry Pi, has a special focus on teaching coding and electronics. Slide the laptop’s keyboard forward and it reveals a built in rail for hardware hacking. Guided projects designed for kids include building a music maker and a smart robot. The laptop runs pi-top’s learn-to-code oriented OS — which supports block-based coding programs like Scratch and kid-friendly wares like Minecraft Pi edition, as well as its homebrew CEEDUniverse: A Civilization style game that bakes in visual programming puzzles to teach basic coding concepts. The pi-top also comes with a full software suite of more standard computing apps (including apps from Google and Microsoft). So this is no simple toy. Not a new model for this year — but still a compelling STEM machine

Age: 8+

Product: Starter Kit

Price: $200

Description: Programmable robotics blocks for even very young inventors. The blocks snap together and are color-coded based on function so as to minimize instruction for the target age group. Kids can program their creations to do stuff like drive, play music, detect obstacles and more via a drag-and-drop coding interface in the companion Robo Code app. Another app — Robo Live — lets them control what they’ve built in real time. The physical blocks can also support Lego-based add-ons for more imaginative designs

Age: 5+

Product: Root

Price: $200

Description: A robot that can sense and draw, thanks to a variety of on board sensors, battery-powered kinetic energy and its central feature: A built-in pen holder. Root uses spirographs as the medium for teaching STEM as kids get to code what the bot draws. They can also create musical compositions with a scan and play mode that turns Root into a music maker. The companion app offers three levels of coding interfaces to support different learning abilities and ages. At the top end it supports programming in Swift (with Python and JavaScript slated as coming soon). An optional subscription service offers access to additional learning materials and projects to expand Root’s educational value

Age: 4+

Product: Bolt

Price: $150

Description: The app-enabled robot ball maker’s latest STEM gizmo. It’s still a transparent sphere but now has an 8×8 LED matrix lodged inside to expand the programmable elements. This colorful matrix can be programmed to display words, show data in real-time and offer game design opportunities. Bolt also includes an ambient light sensor, and speed and direction sensors, giving it an additional power up over earlier models. The Sphero Edu companion app supports drawing, Scratch-style block-based and JavaScript text programming options to suit different ages

Age: 8+

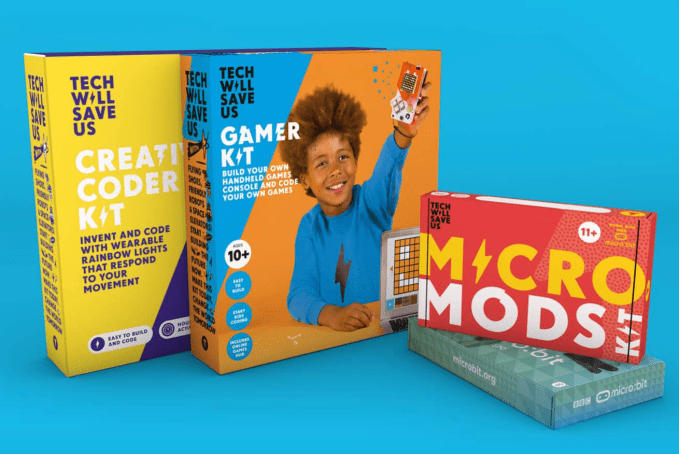

Product: Range of coding, electronics and craft kits

Price: From ~$30 up to $150

Description: A delightful range of electronic toys and coding kits, hitting various age and price-points, and often making use of traditional craft materials (which of course kids love). Examples include a solar powered moisture sensor kit ($40) to alert when a pot plant needs water; electronic dough ($35); a micro:bot add-on kit ($35) that makes use of the BBC micro:bit device (sold separately); and the creative coder kit ($70), which pairs block-based coding with a wearable that lets kids see their code in action (and reacting to their actions)

Age: 4+, 8+, 11+ depending on kit

Product: JIMU Robot BuilderBots Series: Overdrive Kit

Price: $120

Description: More snap-together, codable robot trucks that kids get to build and control. These can be programmed either via posing and recording, or using Ubtech’s drag-and-drop, block-based Blockly coding program. The Shenzhen-based company, which has been in the STEM game for several years, offers a range of other kits in the same Jimu kit series — such as this similarly priced UnicornBot and its classic MeeBot Kit, which can be expanded via the newer Animal Add-on Kit

Age: 8+

Product: Dot Creativity Kit

Price: $80

Description: San Francisco-based Wonder Workshop offers a kid-friendly blend of controllable robotics and DIY craft-style projects in this entry-level Dot Creativity Kit. Younger kids can play around and personalize the talkative connected device. But the startup sells a trio of chatty robots all aimed at encouraging children to get into coding. Next in line there’s Dash ($150), also for 6+ year olds. Then Cue ($200) for 11+. The startup also has a growing range of accessories to expand the bots’ (programmable) functionality — such as this Sketch Kit ($40) which adds a few arty smarts to Dash or Cue.

With Dot, younger kids play around using a suite of creative apps to control and customize their robot and tap more deeply into its capabilities, with the apps supporting a range of projects and puzzles designed to both entertain them and introduce basic coding concepts.

Age: 6+

Powered by WPeMatico