TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Google has selected 30 startups to receive a share of its $2 million Black Founders Fund in Europe, providing these companies with a spot of cash, some valuable cloud services and a bit of good old-fashioned networking among the Google crew.

The fund was announced last fall as part of a company-wide effort toward “building a more equitable future for everyone,” alongside grants and new sponsorships. More than 800 companies applied and Google interviewed 100 of them, ultimately winnowing that down to the 30 announced today.

Each company will receive “up to” $100,000 in non-dilutive funding, and up to $120,000 in Ads grants and $100,000 in Cloud credits. (I’ve asked Google for more details on how the fund was divided, and if any company received this full amount. I’ll update if I hear back.)

They’ll also get access to Google’s entrepreneurial network, tech support and some other assets that don’t have hard numbers associated with them.

All the startups are led by Black founders, and 40% by women of color. One of the latter is Nancy de Fays, co-founder of LINE, which makes these cool battery-hub combos for the MacBook “Pro” that add a ton of ports and battery life and look sweet to boot. I’ve learned a lot chatting with her at trade shows, and regret that I do most of my work at a desktop so I don’t have an excuse to use one of the company’s gadgets.

In response to being selected for Google funding, de Fays penned a blog post exhorting corporations to throw their weight around in favor of social change, and for startups to lead the way in diversity and equity:

We buy values and standards more than we buy the product itself. We buy ideals of life more than the actual features. Putting the these two parameters in the equation – the capability of big corps to shout loud, and consumers’ receptiveness to brands values and messages – it does make sense to me that to drive such a society change, big companies should voice and convey strong messages.

Founders need to build diverse teams without falling into compassion fatigue. They must show empathy and respect and bring onboard the best talents. Period. They need to be outspoken about their values, convey a strong, global mindset and build their organisation around them. And if they find themselves scoring low on diversity along the way, they should question themselves on the why and act on it without doing charity.

It’s something of a counterpoint to the idea, also commonly expressed these days, that companies should be mission-focused and objective.

Here are the other 29 companies that Google will be giving a boost to (descriptions taken from the blog post):

Feels like we’ll be hearing from most of these folks again. You can find out more about Google’s startup programs here.

Powered by WPeMatico

Gaslighting is a form of psychological abuse, but Elizabeth Ruzzo says she experienced it firsthand after telling a doctor that she suffered from suicidal ideation after taking birth control pills.

Hormonal health sits at the center of conversations around personalized medicine and women’s health: By 2025, women’s health could be a $50 billion industry, and by 2026, digital health more broadly is estimated to hit $221 billion.

Ruzzo’s doctor told her there was no connection between birth control and self-harm, but she decided to stop taking the pill to see if her mental health improved. When it did, Ruzzo grasped the disconnect between women’s unique hormonal makeup and blanket-statement practices from medicine today.

Her realization led her to found Adyn Health, a startup that proactively helps women make health decisions that complement their hormonal state and background. The company started with, of course, helping people pick more personalized birth control.

Ruzzo is part of a group of growing entrepreneurs who are betting that hormonal health is the key wedge into the digital health boom. Hormones are fluctuating, ever-evolving and diverse — but these founders say they’re also key to solving many health conditions that disproportionately impact women, from diabetes to infertility to mental health challenges.

Many believe it’s that complexity that underscores the opportunity. Hormonal health sits at the center of conversations around personalized medicine and women’s health: By 2025, women’s health could be a $50 billion industry, and by 2026, digital health more broadly is estimated to hit $221 billion.

Still, as funding for women’s health startups drops and stigma continues to impact where venture dollars go, it’s unclear whether the sector will remain in its infancy or hit a true inflection point.

Ruzzo views Adyn as a precision medicine startup. Its main product is an at-home test that tracks hormone levels, assesses genetic risk for specific side effects, and then gives recommendations for which birth control methods best suits the customer with the fewest side effects.

By Ruzzo’s estimates, 98% of sexually active women use birth control for 30 years of their life. That sort of lifetime value proposition made the company look like a sweet deal to founders, and Adyn raised a $2.5 million seed in April 2021 in a round co-led by Lux Capital and M13.

The moonshot, though, is using that as a way to become a trusted partner in a woman’s life, helping understand baseline hormone levels throughout those 30 years.

“My hope is that we can use precision medicine approaches, including looking at genetic markers to identify reliable diagnostic criteria, that can remove that uncertainty and pain and diagnostic odyssey that people have to go through,” Ruzzo said.

If Adyn becomes a trusted partner with teenage women, it could reach a point where it can detect changes in hormone levels over time.

“The hormone reference ranges that are used [in labs] are too broad to be personalized, let alone prescriptive,” she said. “And so what we’re hoping to do is correct for things that we know affect hormone levels like age, weight, ethnicity and compare you to your own expectations.”

If the first wave of digital health was a company like Ro, which answers consumers when they have a condition such as erectile dysfunction or hair loss, the second wave will look more like Adyn, which helps consumers navigate their health before getting diagnosed with a condition or experiencing issues.

The industry standard is still to wait for consumers to realize they have a condition, and then go to the doctor to manage their symptoms or look for a cure. A new startup that recently graduated from Y Combinator is finding its way into hormonal health through that angle.

Veera Health is a startup that wants to help women in India manage polycystic ovary syndrome, or PCOS. The hormonal condition can cause irregular periods, infertility or gestational diabetes in women, as well as acne, weight gain and excessive hair growth. Plus, PCOS is far from rare, impacting one in 10 women.

Powered by WPeMatico

Simplified, a marketing-focused design software looking to take on Canva, has raised $2.2 million in seed funding led by Craft Ventures. Superhuman’s Rahul Vohra and Todd Goldberg, former Uber CPO Manik Gupta, Pelican Ventures’ Ajay Yadav (also Roomie founder), Form Capital, 8Bit Capital, Early Grey Capital, GFR Fund, MyAsia VC and others participated in the round.

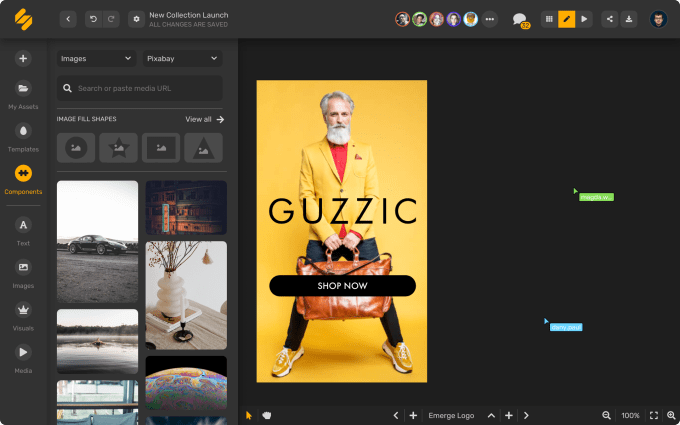

Simplified is aimed directly at marketers, who are inevitably responsible for generating an enormous amount of content across a variety of channels. The platform uses machine learning to automate as much of the content creation process as possible, including copy, imagery, format and sizing, and more.

For example, a marketer could be looking to post an inspirational quote on social media. They can designate that the content is meant for social media, run a search for inspirational quotes and ask the system to automatically provide an appropriate background. From there, the user can tweak whatever they’d like, like typeface or image cropping, and instantly publish.

Image Credits: Simplified

Simplified also features collaborative tools that let teams share work and assets across the organization, as well as integrations with stock photo and video services.

The general principle here is to take what has already become a simplified process, through products like Canva, to the next level through machine learning and GPT3.

According to founder KD Deshpande, it’s all about scale. While it may be easier than ever to create a single piece of content, there is still the matter of volume. Simplified looks to speed up the process of content creation using its machine learning automation algorithms.

This comes in the midst of a massive evolution of the design space over the past several years, with players like InVision, Figma and Canva leading the charge in providing fresh, new design tools that meet the demands of a new generation of designers and design-oriented organizations.

Powered by WPeMatico

The agriculture sector is ripe for technological improvements, but beyond satellite-based crop management and bees-as-a-service, the actual people who work in the fields should be benefiting as well. Ganaz, empowered by a $7 million A round, aims to change how people with little documentation and no bank account get paid and send money with a modern workforce stack that embraces low tech as well.

Growers — that is to say, the companies that own and operate the fields and sell the crops — are under pressure from multiple directions as wages rise, regulations increase and willing workers dwindle. They need to save money to make money, but they can’t do so by paying less; in addition to being cruel to a marginalized class of people, it would only exacerbate the labor shortage in the sector.

There are plenty of companies out there that help save costs by automating things like payroll and onboarding, but the agriculture business has some unique limitations.

“It’s still operating like it’s the ’80s,” explained Ganaz founder and CEO Hannah Freeman. The number one service these workers rely on is check cashing or payday loans, and fees from these, currency exchange, ATM fees and remittances eat up a significant portion of each paycheck. “The workforce in our world definitely doesn’t have corporate email and rarely uses personal email. They have trouble downloading and using mobile apps, don’t use usernames. But they’re very conversant in WhatsApp and SMS — so you have to kind of know how to build for them.”

The ecosystem has parallels to other regions that have stuck with older, cheaper technologies instead of adopting the latest and most expensive tech. Entire markets in Africa and South America, for instance, run on text-based commerce taking place on aging and unreliable infrastructure.

Ganaz has opted for a hybrid approach. The company’s platform offers several services on both the worker and employer side.

Onboarding and basic training can be done simply and intuitively for people who may not be highly literate, via tablets loaded with apps that also operate offline. The most common alternative seems to be file folders served out of a crate in the back of a pickup — that’s not a dig, it’s just what has made sense for years for this highly fluid, distributed workforce.

Payment and balance checks all happen over SMS or WhatsApp with workers, but for sensitive information they are shunted to a web app; similarly, integrated remittance partnerships are coming that will keep things simple and reduce fees.

On the employer side, the workers and all their vital stats and documents are tracked centrally in the kind of interface companies have grown to expect. And Ganaz works as an intermediary to send text alerts and questions.

So far Ganaz has 75 employers signed up, one of which is a Costco supplier group, and all told around 175,000 workers on the platform. Their ARR and user count both approximately tripled year over year, so they’re clearly on to something.

The company has tempered its rapid growth with designation as a public benefit corporation, which emphasizes the intention to do more than grow shareholder value. I asked about the tension between needing to show a profit and working in the service of a marginalized group.

“This keeps me up at night,” admitted Freeman. “We try to make sure to set ourselves up to be true to our mission. That means the folks we hire, our board of directors… we want to make sure we’re empathizing and honoring the trust we’ve built with people.”

That includes investors as well, and Freeman noted that the company ended up going with Trilogy as lead for this round partly because of that firm’s experience with Remit.ly.

For instance, Freeman noted, while it would be easy to juice profits by bumping ATM fees, that directly harms the people they’re trying to help. Instead, when they issue their payroll Mastercard later this year, that will allow workers to skip the check cashing step and its fees, and then Ganaz gets a share of the normal card transaction fee. “We can be equally successful that way,” said Freeman, and it doesn’t just replace another predatory structure.

After the cards the plan is to automate remittances, so a user can easily choose to send money to their family in a way that minimizes handling fees and so on. And there will be other options, accessible via text, to choose where money goes if not to the card.

Ganaz’s main market is the U.S. and Mexico, since the agriculture business and workforce are both largely binational, but there are other targets on the horizon. First, though, the company wants to solidify its position and feature set here. “There’s no breakaway winner yet, so we want to be that winner,” said Freeman.

The $7 million round also had participation from Bessemer Venture Partners, Founders’ Co-op, Taylor Ventures, AgFunder and Techstars. Rapid expansion and aggressive pursuit of the roadmap are next up for Ganaz.

“We are conscious of both the huge opportunity ahead of us to digitize billions of dollars in payroll, as well as the responsibility to build inclusive, low-cost, wealth-building tools for workers,” said Freeman.

Powered by WPeMatico

What happens to technology companies with slowing growth and a rising focus on profitability before they reach behemoth scale? How much does the market value hypergrowth?

Just because a technology startup has a hot start, that doesn’t mean it will grow quickly forever. Most will wind up somewhere in the middle — or worse. Put simply, there is a larger number of tech companies that do fine or a little bit worse after they reach scale.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

But what every investor hopes for is the hot company that can keep growth alive even after reaching material scale, running through walls, competitors, economic headwinds and anything else that comes its way. Those companies don’t end up worth a few hundred million, or a billion, but can end up valued in the dozens of billions or more.

In reverse, tech companies — even those with strong gross margins — with slipping growth can see their multiples compress rapidly. Then, the vultures circle.

In reverse, tech companies — even those with strong gross margins — with slipping growth can see their multiples compress rapidly. Then, the vultures circle.

Which explains some of the news we’ve seen recently in the market. As Dropbox comes under fresh pressure from external parties, joining its erstwhile rival Box in the public-market growth penalty box, we’re seeing companies like Braze, Gong, Shippo and others rip ahead with rapid-fire funding rounds or public brags about their growth.

While the differential between the two groups is clear, it’s still worth exploring in more detail. Let’s talk about the growth dividend. Or, if you’d prefer, the existential cost of growth deceleration.

The news this week that Dropbox has attracted an activist shareholder should not have been a surprise. Its former rival Box is in the midst of a long-running struggle with an activist investor of its own. (More here.)

Powered by WPeMatico

Early-stage startups are increasingly looking for alternative ways to access capital, meaning not every company wants to raise money from VCs or take on debt.

In recent years, a flurry of startups have emerged to give companies other options. (Think Pipe, for example.)

And today, San Francisco-based Architect Capital is a new firm that is launching with over $100 million in funds to serve as an “asset-based lender” to “high-growth,” early-stage tech companies. Specifically, the new firm aims to provide non-dilutive or less-dilutive financing options to asset-rich fintech, e-commerce and SaaS companies in the U.S. and Latin America, but with an emphasis on the latter. The region, Architect maintains, does not have a plethora of institutional financing available against assets.

The firm is not out to replace traditional venture capital or venture debt, emphasizes founder and CEO James Sagan, but rather to offer asset-based products that will complement them.

For some context, Sagan is no stranger to the startup world, having co-founded and served as managing partner of Arc Labs, an early-stage credit fund focused on lending to technology-enabled businesses. He’s been investing in Latin America for years, and recognized the need for new forms of financing to fund “novel and underappreciated assets.”

Also, he believes the region is home to “the most prominent fintech ecosystem in the world.”

To Sagan, traditional forms of equity and debt financing in the venture world are vital for things like growing headcount, but he believes they are “not engineered to support the growth of a company’s underlying financial products.”

“VC is highly dilutive and should be used for ROI activities such as hiring engineers and building great teams,” Sagan told TechCrunch. “It’s expensive to use equity to fund assets. Equity should not be put in a loan book. We’ll fund the loan book.”

Image Credits: Architect Capital founder James Sagan / Architect Capital

Architect’s goal is to provide “tailored and less dilutive funding,” especially to companies that produce repeatable revenues, such as SaaS and subscription businesses.

Sagan said he first discovered the strategy in 2015 when he was working for a multifamily office that was lending against a bunch of traditional assets.

“A colleague and good friend of mine started a business and raised some equity and venture debt, but he couldn’t find the asset-specific financing for the receivables he was generating,” Sagan recalls. “He was lending to small businesses and needed asset-specific financing against those receivables.”

Venture debt doesn’t really work for receivables-based lending because venture debt shops typically are underwriting assets, or rather, underwriting the quality of the investors in the company, Sagan believes.

“So we really tailor our underwriting towards those assets themselves right and those assets range from unsecured consumer receivables to secure small business receivables to real estate,” he told TechCrunch. “Essentially, we’re providing an additional instrument for asset-heavy businesses that will allow them to scale in a way that venture debt will not.”

Architect’s LPs are mostly large institutions, as opposed to traditional high net worth individuals. The firm’s average check size will land at around $10 million to $15 million.

“Our portfolio allocation is more concentrated in general,” Sagan said. “We expect to grow our AUM (assets under management) pretty precipitously.”

Architect Capital has invested in six companies since inception, including PayJoy, a company that delivers consumer financing and smartphone technology to customers in emerging markets; Forum Brands, a U.S.-based e-commerce marketplace aggregator; and ADDI, a fintech that aims to give Colombian consumers access to fair and affordable credit through point-of-sale-financing that recently raised $65 million.

Powered by WPeMatico

Our relationship with fashion has changed, and not just because of the pandemic. Months in lockdown means people are probably more aware of their fashion purchases and how they consume, given its been such a long time without socializing. But the oft-talked about “Clueless” wardrobe, which would allow women to both see into their collections, as well as share and potentially borrow from friends, has yet to go mainstream. Now a U.K. startup aims to change this.

The Little Black Door app, previously in closed beta, has just launched on the Apple iOS store here and on Android.

The app allows women to share the content of their wardrobes in an Instagram-like manner by creating collections (“Lookbooks”), as well as curate their private wardrobe for their own use, with a focus on premium and luxury fashion. Women, says LBD, can “see, style and share”, as well as resell and borrow clothes offline.

The Lookbook feature allows women to share wardrobes collections with friends or followers in a controlled way, a feature that lets users borrow from each other.

Co-founder Lexi Willetts tells me: “We’d simply gotten to a point where we didn’t know what fashion we owned, given that almost every other area of life allows this. Most fashion can be easily dash-boarded on our phones — we couldn’t understand why our wardrobe wasn’t! Equally the effort required to list an item on resale was also super hard.”

Willetts and co-founder Marina Pengilly came up with the app when they realized they could make as much as £30,000 a year reselling their luxury clothes and accessories online. LBD is going after four key trends: the rise of resale (Depop etc); rentals like Rent the Runway; AI in e-commerce; and re-receipts.

Users upload their wardrobe by taking a photo of an item. The app will then recognize the item using computer vision. Lookbooks showcases fashion collections; new and old also have an “I have this” button, allowing users to add items to their own wardrobes, or add as they buy automatically via links to retailers.

Another key feature allows users to see into their own wardrobes to see what they have, and, crucially, see how much they’ve spent, and own, in value.

Users can also create a Lookbook, not unlike on Pinterest, which can be shared with friends or a wider fashion community in a public or private group-controlled way. Lookbooks can be shared with a user’s network to allow them to see your style, or borrow the outfit in real life. As well as this, LBD itself also curates a feed of fashion/lifestyle news and surveys.

Willetts says partnerships with retailers and supplier deals for sales and fashion repairs are also in the offing.

LBD competes with the Save Your Wardrobe’ app.

But it is pushing the fact that it places a greater emphasis on sharing the wardrobe as well, also allowing people to borrow items With this focus on premium and luxury fashion this makes it a truly social wardrobe, says LBD.

The business model is likely to be a Premium version that unlocks extra features, affiliate revenues, advertising, and resale commissions.

Disclosure: Mike Butcher was an early, informal, adviser.

Powered by WPeMatico

Builders, creators and developers, this one’s for you! TechCrunch has always been about discovering fresh solutions and shining the light on exciting, new products that have the potential to make a difference. Our past hackathons have been the breeding ground for products like Alexa Shop Assist, Quick Insurance, reVIVE and GroupMe, which went on to be acquired by Skype.

This year, we’ve partnered with Product Hunt’s Makers Festival to give builders a platform to unleash their creativity and bring their ideas to reality — and even have a chance to get some exposure at Disrupt 2021. This Makers Festival is centered all around green tech and environmental ingenuity. As humans, our daily connections to the environment are all-encompassing, including how we eat, pay, invest, shop, advocate and travel. That means there are better solutions everywhere, too. Get inspired and ask yourself “what haven’t we tried yet?”

The grand prize winner will get a free spot to launch their product to the TechCrunch community at Disrupt 2021 in Startup Alley along with a bunch of other prizes and tools to help you kickstart your product.

Register here for free and get your creative juices flowing. Make sure you sign up asap as registration closes tomorrow, June 4.

And who knows — maybe your product will be the next one snapped up at Disrupt!

Powered by WPeMatico

Gong, the revenue intelligence startup, has been raising capital at a rapid pace, and today the company announced another $250 million on a $7.25 billion valuation, a number that triples its previous valuation from last summer.

Franklin Templeton led today’s festivities with participation from Coatue, Salesforce Ventures, Sequoia, Thrive Capital and Tiger Global. The company raised $200 million last August at a $2.2 billion valuation, and has now raised $584 million, $450 million coming in the last year.

What is making investors open their wallets and pull out such large sums of cash? The company is helping solve a hard problem on how to bring more intelligence to the revenue process. They do this by using artificial intelligence to listen to every customer interaction, whether that’s a sales or service call (or anything else), and use that information to determine valuable information like who is most likely to buy and who is most likely to churn.

It’s been going well and CEO Amit Bendov says the company’s performance really validates the valuation. While he wasn’t ready to discuss specific numbers, he did say that ARR grew 2.3x between Q1 last year and this year, and he says Q2 is on pace to triple ARR.

“The valuation is up about 3x from last summer, but sales are more than 3x. We have high logo customers. [Last year], it was still unclear how COVID was going to impact us. People believed [our business] was going to do well [during the pandemic], but it wasn’t as obvious. Now, it is obvious. And all the […] financials are way better, so from a pure financials [perspective] our multipliers are pretty reasonable for our revenue trajectory,” he said.

With all this growth, the company is adding employees at a rapid pace. It closed the year with 400 people, and is up to around 550 today with a goal of reaching 950 by year end. It has partnered with a consulting firm called ReadySet, which helps companies build diverse and inclusive organizations, and Bendov says they are an equal-pay company.

Women represent around 40% of the employees and around 4% are Black, a number he hopes to increase by growing the Atlanta office. In the office in Israel, he has set up employment and training programs to build bridges to the Arab community.

Bendov says he looks forward to meeting his U.S. employees in the coming weeks when he’ll be visiting the Atlanta office for the first time.

Powered by WPeMatico

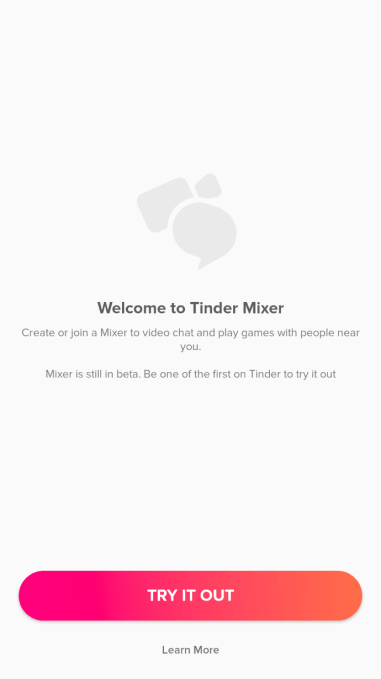

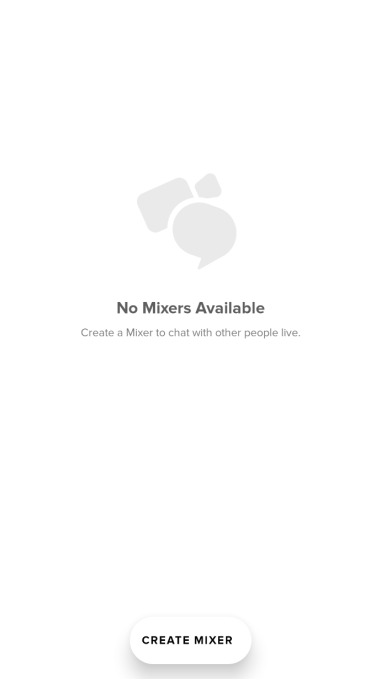

As dating app Tinder and its parent company Match explore the future of personal connection through apps, it’s interesting to see what sort of ideas it tested but later discarded. One such experiment was something called “Tinder Mixer,” which had briefly offered Tinder users a way to join group video chats, and “play games” with others nearby.

The feature was tested for a short period of time last year in New Zealand, we understand, but will not be launching.

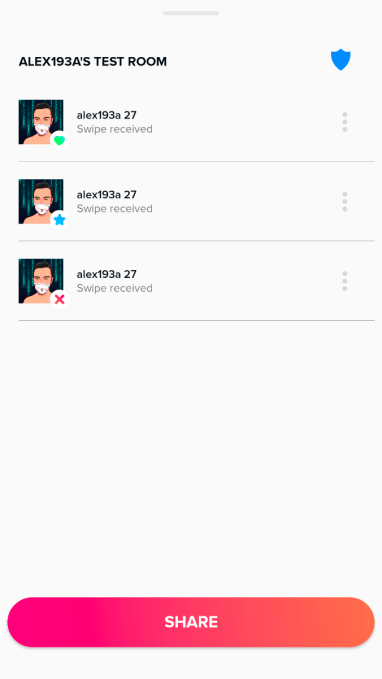

The Tinder Mixer experience was uncovered by app researcher Alessandro Paluzzi, who found references the product in the Tinder Android app’s code. He had not yet publicized the finding, as we worked to learn more about the origins of the product.

Image Credits: Alessandro Paluzzi (opens in a new window)

The resources he found in the dating app had given the appearance of a product in the midst of development, Paluzzi noted, but as it turns out it was one that had already been tested and quickly shut down as Tinder continued its other, ongoing experiments in the dating market.

According to Tinder, the Tinder Mixer test has no impact on its product roadmap this year, and the Tinder Mixer experience described here will likely never come into existence.

That said, what made the product particularly intriguing was that it saw Tinder venturing, however briefly and experimentally, into more of a social discovery space, compared with the usual Tinder experience. Typically, Tinder users swipe on daters’ profiles, match, chat and sometimes even video call each other on a one-on-one basis. But live video chatting with a group is not something Tinder today offers.

Image Credits: Alessandro Paluzzi (opens in a new window)

That said, the idea of going live on video is not new to Match.

This is an area where the company has experimented before, including with its apps Plenty of Fish, which offers a one-to-many video broadcasting feature, and Ablo, which offers one-on-one video chats with people around the world. These experiments constitute what the company considers “dating-adjacent” experiences. In other words, you could meet someone through these video interactions, but that’s not necessarily their main goal.

Image Credits: Alessandro Paluzzi (opens in a new window)

These video experiences have continued even as Match announced its $1.73 billion acquisition of Seoul-based Hyperconnect — its biggest acquisition ever, and one that puts the company more on the path towards a future that involves the “social discovery” and live streaming market.

The company believes social discovery an area with vast potential, and a market it estimates that could be twice the size of dating, in fact.

Match Group CEO Shar Dubey spoke to this point recently at the JP Morgan Technology, Media and Communications Conference, noting that on some of its bigger platforms, Match has seen that a number of its users were looking for more of “a shared experience and a sense of community among other like-minded single people on the platform,” she said.

She noted that technology has reached a point where people could now interact with others through richer experiences than the traditional dating flow of swipe-match-chat allowed for, including few-to-few, many-to-many, and one-to-many type of experiences.

Hyperconnect brings to Match much of the technology that would allow the company to expand in these areas.

Today, it offers two apps, Azar and Hakuna Live, which let users to connect with one another online. The former, launched in 2014, is focused on one-on-one live video and voice chats while the latter, launched in 2019 is in the online broadcast space. Not coincidentally, these apps mirror the live stream experiences that Match has been running on Plenty of Fish and Ablo.

Because these live streaming services are often more heavily adopted by younger demographics, it makes sense that Match may have wanted to also test out such a live stream experience on Tinder, which also skews younger, even if the test ultimately only served as a way to collect data as opposed to informing a specific future product’s development.

With the Hyperconnect deal soon to be finalized, the incoming apps will initially give Match an expanded footprint in the live streaming and social discovery market in Asia — 75% of Hyperconnect’s usage and revenue comes from markets in Asia. Match then plans to leverage its international experience and knowledge to accelerate their growth in other markets where they haven’t yet broken through.

But another major reason for the acquisition is that Match sees the potential in deploying Hyperconnect’s technology across its existing portfolio of dating apps to not only create richer experiences but also to cater to users in markets where the “Western” way of online dating hasn’t yet been fully embraced, but social discovery has.

“We think there is real synergy of bringing some of these experiences that are popular in social discovery platforms onto our dating platforms, as well as sort of enhance the social discovery platforms and help people get to their dating intent, should they choose to,” Dubey explained, at the JP Morgan conference.

What any of that may mean for Tinder, more specifically, is not yet known.

Powered by WPeMatico