TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Many of the highest-profile English tutoring platforms focus on children, including VIPKID and Magic Ears. Ringle created a niche for itself by focusing on adults first, with courses like business English and interview preparation. The South Korea-based startup announced today it has raised an $18 million Series A led by returning investor Must Asset Management, at a valuation of $90 million. Ringle is preparing to launch a program for school kids later this year, and also has plans to open offline educational spaces in South Korea and the United States.

Other participants in the round, which brings Ringle’s total raised to $20 million, include returning investors One Asset Management and MoCA Ventures, along with new backer Xolon Invest. Ringle claims its revenue has grown three times every year since it was founded in 2015, and that bookings for lessons have increased by 390% compared to the previous year.

Ringle currently has 700 tutors, who are pre-screened by the company, and 100,000 users. About 30% of its students, who learn through one-on-one live video sessions, are based outside of Korea, including in the U.S., the United Kingdom, Japan, Australia and Singapore.

Ringle’s co-founders are Seunghoon Lee and Sungpah Lee, who both earned MBAs from the Stanford University Graduate School of Business. They developed Ringle based on the challenges they faced as non-native English speakers and graduate students in the U.S. The startup was first created to serve professionals who are already established in their careers or in academia. Its students include people who have worked for companies like Google, Amazon, BCG, McKinsey and Samsung Electronics.

Seunghoon Lee told TechCrunch that Ringle creates proprietary learning materials based on current events to keep its students interested. For example, recent topics have included blockchain NFT tech, how the movie “Parasite” portrayed class conflict and global inequalities in vaccine access.

Ringle’s tutors are recruited from top universities and need to submit proof of education and verify their school emails. The company’s vetting process also includes a mock session with Ringle staff. Lee said applicants are asked to familiarize themselves with some of Ringle’s learning materials and lead a full lesson based on its guidance. Ringle assesses candidates on their teaching skills and ability to lead engaging discussions that also hone their students’ language skills.

Part of Ringle’s new funding is earmarked for its tech platform. It is currently developing a language diagnostics system that tracks the complexity and accuracy of students’ spoken English with researchers at KAIST (Korea Advanced Institute of Science and Technology).

The company already has an AI-based analytics system that uses speech-to-text and measures speech pacing (or words spoken per minute), the amount of filler words and range of words and expressions in lessons. It delivers feedback that allows students to compare their performance with the top 20% of Ringle users in different metrics.

The new language diagnostics system that is currently under development with KAIST will start releasing features over the next few months, including speech fluency scoring, a personalized dictionary and auto-paraphrasing suggestions.

The funding will also be used to create more original learning content, and hire for Ringle’s offices in Seoul and San Mateo, California. Ringle also plans to diversify its revenue sources by providing premium content on a subscription basis, and will launch its junior program for students aged 10 and above later this year.

Powered by WPeMatico

After making investments in 57 startups together, Superhuman CEO Rahul Vohra and Eventjoy founder Todd Goldberg are back at it with a new $24 million fund and big ambitions amid a venture capital renaissance with fast-moving deals aplenty.

“Todd and Rahul’s Angel Fund” announced their first $7.3 million fund just weeks before the pandemic hit stateside last year and they were soon left with more access to deals than they had funding to support; they went on to raise $3.5 million in a rolling fund designed around making investments in later-stage deals beyond seed and Series A rounds.

“We closed right before COVID hit and we had one plan, but then everything accelerated,” Goldberg tells TechCrunch. “A lot of our companies started raising additional rounds.”

With their latest raise, Vohra and Goldberg are looking to maintain their wide outlook with a single fund, saying they plan to invest three-quarters of the fund in early-stage deals while saving a quarter of the $24 million for later-stage opportunities. Still, the duo know they likely could’ve chosen to raise more.

“A lot of our peers were scaling up into much larger funds,” Vohra says. “For us, we wanted to stay small and collaborative.”

Some of the firm’s investments from their first fund include NBA Top Shot creator Dapper Labs, open source Firebase alternative Supabase, D2C liquor brand Haus, alternative asset platform Alt, biowearable maker Levels and location analytics startup Placer. Their biggest hit was an early investment in audio chat app Clubhouse before Andreessen Horowitz led its buzzy seed round at a $100 million valuation. Clubhouse most recently raised at $4 billion.

The pair say they’ve learned a ton through the past year of navigating increasingly competitive rounds and that fighting for those deals has helped the duo hone how they market themselves to founders.

“You never want to be a passive check,” Goldberg says. “We do three things: we help companies find product/market fit, we help them super-charge distribution… and we help them find the best investors.”

A big part of the firm’s appeal to founders has been the “operator” status of its founders. Goldberg’s startup Eventjoy was acquired by Ticketmaster and Vohra’s Rapportive was bought by LinkedIn while his current startup Superhuman has maintained buzz for its premium email service and has raised $33 million from investors, including Andreessen Horowitz and First Round Capital.

Their new fund has an unusual LP base that’s made up of more than 110 entrepreneurs and investors, including 40 founders that Vohra and Goldberg have previously backed themselves. Backers of their second fund include Plaid’s William Hockey, Behance’s Scott Belsky, Haus’s Helena Price Hambrecht, Lattice’s Jack Altman and Loom’s Shahed Khan.

Powered by WPeMatico

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie,

I started a tech company about two years ago, and ever since I’ve dreamed of expanding my company in the United States.

I would love to have a green card. Someone mentioned that I should apply for a diversity green card. Would you please provide me with more details about it and how to apply?

— Technical in Tanzania

Dear Technical,

As a startup founder from Tanzania, you have several immigration options available to you, including the Diversity Immigrant Visa (green card) Program.

My law partner, Anita Koumriqian, and I recently discussed the Diversity Immigrant Visa Program (DV Program) on a podcast episode. Take a listen for how to apply and tips for applying. Each year, the U.S. Department of State, which oversees the DV Program, reserves 50,000 green cards for individuals born in countries that have low rates of immigration to the United States. The State Department publishes instructions each year, which includes the countries whose natives are eligible to register for the annual diversity lottery. Here is the latest version.

You must register online in the fall — usually from early October through early November — for the annual random lottery by completing the Electronic Diversity Visa Entry Form (DS-5501). There is no cost to register for the lottery, but be aware that you will be automatically disqualified if you register yourself more than once, and incomplete forms will not be accepted.

Once you complete the online registration form, you will get a confirmation number. Do not lose this number! It is the only way to access the online system that will tell you whether you were selected in the lottery and are eligible to submit a green card application. In May, registrants can log into the online system to find out whether they’ve been selected. No notification will be sent by email or snail mail; checking online by entering your confirmation code is the only way to find out. After you enter your confirmation code online, you will receive a diversity visa number, which you will use to determine when you can file your green card application.

Powered by WPeMatico

Even as NFT sales dip below their most speculative highs, startups aiming to tap into their potential are still scoring big funding rounds from investors who believe there’s much more to crypto collectibles than the past few months of hype.

Mythical Games, an NFT games startup based out of Los Angeles, has banked a $75 million raise from new and existing investors betting on the startup’s aim to expand the ambitions of their first title and locate a substantial platform opportunity amid helping developers build blockchain-based gaming experiences.

The round was led by WestCap. Existing investors were joined by 01 Advisors and Gary Vaynerchuk’s VaynerFund in the Series B funding. The startup has raised a whopping $120 million to date.

The company has been building a title called Blankos Block Party that seems to be Fall Guys meets Roblox meets Funko Pop. The PC game capitalizes on a number of big social gaming trends around user-created content, while adding in a marketplace where users can buy avatar figures and accessories crafted by a variety of artists and designers that Mythical has partnered with. Users can buy or sell the limited run or open edition items through their marketplace. Unlike some other NFT platforms, the goods live on a private blockchain so they can’t be re-sold on public marketplace platforms like OpenSea.

Mythical Games is part of a growing movement to bring blockchain-based game mechanics mainstream while leaving behind elements of crypto platforms that are seen as less ready for primetime. Users can purchase avatars on the platform with cryptocurrency through BitPay but they can also pay with a credit card. Users don’t need to walk through the mechanics of setting up a wallet or writing down a seed phrase either.

While the company has big hopes for Blankos as it onboards more users, the bigger investor opportunity is likely in the game engine that the team is building. The startup’s “Mythical Economic Engine” is being designed to help budding game builders create NFT-based marketplaces that won’t get them in any regulatory trouble, marrying compliance across geographies and tools that help creators comply with anti-money laundering laws and know-your-customer frameworks.

“With any new market like [NFTs], it goes through all these different cycles,” Mythical Games CEO John Linden tells TechCrunch. “We think this will actually change gaming for the long haul. The more we talk to game studios, we’re finding more and more potential use cases.”

Powered by WPeMatico

TechCrunch Disrupt has a long history of bringing leading venture capitalists to the stage to yammer about their industry. Our impending TC Disrupt conference happening on September 21-23 is no different. This time around one of our investor guests is Arun Mathew of Accel, a venture capitalist that you might recall from his recent participation in Webflow’s huge $140 million Series B.

But we aren’t merely asking Mathew out to the event to chat low-code, or SaaS, or simply current intra-venture capital investing dynamics. Instead, he’ll be taking part in our panel on alternative financing (alt-finance) with a few folks that aren’t venture capitalists, but still deploy capital into startups.

Having an Accel partner take part in the panel makes good sense, as the venture firm has an interesting way of approaching bootstrapped companies. Namely that it is willing to show up to pretty large companies and write huge checks. That’s how Accel got into Qualtrics, for example, a deal that worked out pretty well.

But Accel invests from seed through super-late stage, making Mathew the perfect person to bring the venture perspective to the conversation.

The chat should hit on revenue-based financing, other more exotic forms of alt-finance and where the venture world may see capital partnerships, and funding rivalries. Our goal won’t be to incite an argument, but instead to unfold the private capital markets in a manner that helps fans of traditional VC — if there is still such a thing in today’s Tiger Global-led world — and believers in newer methods of capital deployment learn from each other. And so that founders can carve the most reasonable path for themselves as they seek to grow their businesses.

All told it should be a bop and I will see you there!

Powered by WPeMatico

Swedish battery developer and manufacturer Northvolt AB has raised $2.75 billion in capital as it prepares to ramp up to an annual production capacity of 150 GWh in Europe by 2030.

The funding round — Northvolt’s largest thus far — was co-led by existing investors Goldman Sachs and Volkswagen, and new investors including the Swedish pension funds AP1-4 and OMERS, one of Canada’s largest pension plans. AMF, ATP, Baillie Gifford, Baron Capital Group, Bridford Investments Limited, Compagnia di San Paolo through Fondaco Growth, Cristina Stenbeck, Daniel Ek, IMAS Foundation, EIT InnoEnergy, Norrsken VC, PCS Holding, Scania and Stena Metall Finans also participated in the raise.

Volkswagen’s investment came to €500 million ($620 million), the OEM said Wednesday, maintaining its 20% stake in the battery manufacturer.

CNBC reported that Northvolt’s valuation now stands at $11.75 billion. The company declined to comment on the specific valuation figure to TechCrunch.

Northvolt has already scored major deals with automakers like Volkswagen and BMW. In July 2020, the company inked a $2.3 billion contract with BMW for batteries; more recently, in March, Volkswagen put in a $14 billion order over a 10-year period. The two deals bring Northvolt’s total contracts to $27 billion. Other notable customers include Swedish heavy-duty truck manufacturer Scania and energy storage company Fluence.

This brings Northvolt’s total raised to more than $6.5 billion since the company was founded in 2016. The manufacturer’s first gigafactory in Skellefteå, Sweden, will be expanded from 40 GWh to 60 GWh, in part due to increased demand from the Volkswagen order, the company said in a statement. That facility will commence production later in 2021.

Northvolt’s overarching plan is to ramp up to at least 150 GWh of annual battery production across Europe by 2030. To meet this massive target, the company is considering at least two additional gigafactories, including one in Germany.

Northvolt is one of Europe’s largest battery manufacturers. Company shareholder EIT InnoEnergy said in a statement Wednesday that the funding is key to Europe achieving its Green Deal objectives, which includes creating a European battery value chain.

The Swedish company aims to distinguish itself from other battery manufacturers by producing batteries using renewable energy for the manufacturing process. Northvolt says its batteries have an 80% lower carbon footprint than those made with coal power. It also recycles batteries in-house and reuses the raw materials in its production process.

Powered by WPeMatico

Human resources is generally a salient cornerstone of any organization, but digitization has democratized a lot of the work that goes into HR, and that’s meant more people in businesses interested in, and using, the kind of data that HR people build and typically manage. Today, a startup called ChartHop that’s built a platform to cater to that trend is announcing $35 million in funding on the heels of strong growth.

The Series B is being led by Andreessen Horowitz, a past backer, with Elad Gil and previous investors Cowboy Ventures and SemperVirens also participating. We understand from sources close to the company that the round values ChartHop at between $300 million and $400 million.

ChartHop was founded in New York by Ian White, now the CEO, who first started building the tools to fill what he felt were gaps in his own knowledge when he founded, ran and eventually sold his previous company, Sailthru (which was acquired by CampaignMonitor).

He said he realized the company could build “all the tech we wanted,” but when it came down to thinking about how to run and scale the business, that was at its heart actually a people question, and also understanding how departments, and the entire organization, looked and worked as a whole.

Image Credits: ChartHop

“It was not as important as hiring, structuring a ‘single you’ of the organization,” he said. (Ian’s pictured here to the right.) Similar to the great analytics tools that have been built for developers, sales teams and others, “What I wanted was people analytics,” he said. “I wanted to understand my team.”

That’s actually a very multifaceted question. It’s not just a matter of an org chart — a big enough task in its own right that the very day that ChartHop came out of stealth in early 2020, another org chart startup, The Org, launched, too. It’s also retention strategy, employee satisfaction, turnover statistics, diversity statistics, predictive visualizations on finances if one area was compensated differently, or if hiring were frozen, etc. “All of those problems became mine and there was no great software out there to solve for it,” White said.

The ChartHop platform is built like all strong structures these days in the world of tech: tons of integrations to feed data into ChartHop to make it richer; tons of integrations also to export and use that data in more dedicated applications when needed; and an easy way for everyone to update data but also put in place easy and strong protections to keep confidential data as it should be.

And while HR still “owns” the platform, White said, it can be accessed and used by anyone in the organization, and it is.

It seems that others have found the talent management software market lacking for it, too. Since 2019 it went from a team of one — White himself — to 75, with 130 corporates now using its services. The list has a strong list of household company names with a heavy emphasis in tech, from what White showed me. Revenues in the last 12 months — a time when the spread-out nature of many of our workplaces has meant an even greater need for a platform to manage all the information has possibly reached a high water mark — have grown at a rate of 17% month-by-month.

“With HR and people functions so crucial to the growth and success of businesses, it’s unfortunate that most HR teams lack the critical people data to drive organizational decision making,” said David Ulevitch, general partner at Andreessen Horowitz, in a statement. “ChartHop is the solution to this all-too-common problem, and is built by company leaders who have felt this pain personally. ChartHop’s visual approach to people analytics allows leaders to make organizational planning and strategy decisions with confidence. We’re thrilled to lead ChartHop’s Series B because of their impressive growth, the company’s vision, and the terrific, mission-oriented team they’ve assembled.” He also led the company’s seed round in February 2020.

“Since implementing ChartHop earlier this year, we’ve seen significant improvement in our engagement with talent routines as they’re managed via ChartHop,” said Sara Howe, vice president human resources at ZoomInfo, a customer of ChartHop, in a statement. “Our employees have found the simple user interface and the centralized view of their data as the most helpful features. Leaders across ZoomInfo have also leveraged ChartHop to ensure that their organizations are well structured to support our continued rapid growth.”

Powered by WPeMatico

Every startup is trying to fix something, but Terraformation is tackling the only problem that must matter to all of us: climate change.

This is why it’s in such a big huge hurry. Its mission — as a “forest tech” startup — is to accelerate tree planting by applying a startup-y operational philosophy of scalability to the pressing task of rapidly, sustainably reforesting denuded landscapes — bringing back native trees species to revive former wastelands and shrinking our carbon emissions in the process.

Forests are natural carbon sinks. The problem is we just don’t have enough trees with roots in the ground to offset our emissions. So that at least means the mission is simple: Plant more trees, and plant more trees fast.

Terraformation’s goal is to restore three billion acres of global native forest ecosystems by scaling tree replanting projects in parallel, scaling the use of existing techniques and working with all the partners it can. (For a little context, the U.S. contains some 2.27 billion acres of total land area, per Wikipedia).

So far it says it’s planted “thousands” of trees — with live projects in North America, South America, Africa and Europe, which it hopes will yield up to 20,000 replanted acres. It’s also in talks with partners about more projects that could clad hundreds of thousands of acres with carbon-consuming (and biodiversity-prompting) trees, if they come to full fruition.

That’s still a long way off the 3 billion-acre-wooded moonshot, of course. But Terraformation claims it’s been able to achieve a forestry restoration work-rate that’s 5x the average already. And that’s definitely the kind of “gas stepping” that climate change needs.

Its elevator pitch is also punchy: “Our mission is explicitly to solve climate change through mass reforestation,” says founder Yishan Wong — whose name may be familiar as the ex-Reddit CEO (and also a former early-stage engineer at PayPal/Facebook). “So it’s getting trees in the ground and getting faster at getting trees in the ground.”

It’s not going it alone, either. It’s just announced a first closing of a $30 million Series A funding round, led by Sam & Max Altman at Apollo Projects, the brothers’ “moonshot” fund; plus several high-profile institutional investors (whose names aren’t being disclosed); along with nearly 100 angel investors, including Sundeep Ahuja, Lachy Groom, Sahil Lavingia, Joe Lonsdale, Susan Wu and OVN Cap.

“The [Series A] was a bit larger than we anticipated and the idea is to get us to the next stage of planting orders of magnitude more trees every year,” says Wong. “So it’ll be used both for supporting forestry projects directly, as well as for the development and deployment of forestry acceleration products and technology.”

“The very, very nice thing about mass reforestation or mass restoration as a solution to climate change is that it’s extremely parallelizable,” he adds. “You can plant any tree at the same time as you’re planting some other tree. This is the primary reason why this solution can potentially be implemented within the timetable that we have left. But in order to do so we have to start and drive an enormous, decentralized reforestation campaign across multiple continents and countries.”

The funding follows a $5 million seed last year, as the young startup worked to hone its approach.

Terraformation is targeting the main barriers to successful reforesting: Through early research and pilots it says it’s identified three key bottlenecks to large-scale forest restoration — namely, land availability, freshwater and seed. It then seeks to address each of these pinch-points to viable reforesting — identifying and fashioning modular, sharable solutions (tools, techniques, training etc.) that can help shave off friction and build leafy, branching success.

These products include a seed bank unit it’s devised, housed in a standard shipping container and kitted out with all the equipment (plus solar off-grip capability, if required) to take care of on-site storage for the thousands of native seeds each projects needs to replant a whole forest.

It also offers a nursery kit which also ships in a shipping container — a flat-packed greenhouse that it says a couple of people can put together, and where thousands of seedlings can then be tended and irrigated in pots until they’re ready to plant out.

A third support it offers to the replanting projects it wants to work with is expertise in building solar-powered desalination rigs so young trees can be supplied with adequate water to survive in locations where poor land management may have made conditions for growth difficult and harsh.

It goes without saying that planted trees which fail because of poor processes won’t help cut carbon emissions. Badly managed replanting is at best wasteful — and may be closer to cynical greenwashing in some cases. (Poor quality projects can be a known problem where claims of corporate carbon offsetting are being made, for example.)

Terraformation is thus zeroing in on repeatable ways to scale and accelerate the successful planting and nurturing of trees, from seed to sapling and beyond, to accelerate sustainable reforesting.

Ultimately, it’s the only kind of tree planting that will really count in the fight against climate change.

Its first pilot restoration projects began in Hawai’i in 2019 — where it’s been able to plant thousands of trees at a site called Pacific Flight, reviving a native tropical sandalwood forest that had been logged unsustainably. To enable the young trees to grow in land which had also become arid as a result of cattle grazing, the team built the world’s largest fully off-grid, solar-powered desalination system to supply sustainable freshwater to the baby forest.

“The arid environment, high winds, and degraded soils meant that if a team could restore a forest there, they could do it anywhere,” is the pitch on its website.

The Series A will go toward spinning up lots more such native species forest restoration projects — working via partnerships, with organizations such as Environmental Defenders in Uganda, and other groups in Ecuador, Haiti and Tanzania — as well as on more R&D (additional products are in the pipeline, we’re told); and on expanding headcount so its team has the legs to run faster.

Interestingly, for a startup with a Silicon Valley engineering pedigree at its core, the team’s approach is intentionally light on technology — leaning only on vital tech (like solar and desalination), rather than experimental bells and whistles (drones, robotics etc.) to ensure the processes it’s packaging up for massive replanting parallelism remain as simple, accessible and reliable as possible. So they are able to scale all over the globe.

It’s clear that sci-fi robotic gadgetry isn’t the answer here. It’s sweating toil plus tried and tested horticulture processes, done systematically and repeatedly, in mass parallelism all over the world that’s required, argues Wong, whose years in tech have given him a healthy skepticism on the issue of over-engineering. (“The biggest lesson I learned was, you want to solve a big problem? You want to use as little technology as possible… Technology’s always breaking, it’s always got flaws. The biggest problem with technology is technology.”)

“I would say that the key contribution that ‘tech’ — if you think of a monolith or a culture or whatever — will make to climate change, is not in fact some new invention or some gadget or some sort of special magical technology… I think it really is the practice of scalability,” he goes on. “Which is an organizational end. A management way of thinking. Because that is actually something that has been carefully and painfully developed… over the past 20 years in Silicon Valley. How to take small working solutions, how to solve very big problems, how to scale them. And it isn’t a very glamorous thing — which is why I think it’s one of the more pure disciplines.

“It just has been less corrupt… Scalability is just people thinking hard and grinding it out to address really hard big problems. And I think that practice and all the little tips and rules that we have to doing that is the real contribution that tech is going to make — with one of those principles being use as little tech as you can.”

Terraformation is building software tools too — such as a mobile app to help with cataloguing and monitoring seeds. But the really critical technologies involved, solar and desalination, are very much at the “tried and tested” end of the tech scale (“very, very reliable and refined”.).

Wong points out that a key development for solar and desalination is related to the unit economics — with falling costs allowing for scalability and thus speed.

Asked whether Terraformation is a business in the typical startup sense, Wong says it’s been set up in a familiar way — as a Delaware C Corp — but purely because he says that’s just the quickest way to be able to operate. Doing stuff as a nonprofit would be way too slow, he says, describing it thusly as a “non nonprofit” (rather than a business with a for-profit mission).

Aka: “It’s a corporate with investors but primarily the aim is to solve climate change.”

Startup investors are of course often betting their money on the chance of a quick and meaty return. But not here, confirms Wong. “When we raised funding all of our investors invested primarily because they wanted to see climate change solved,” he tells TechCrunch. “To many of them this was the first time that a plausible, full-scale solution to solving climate change had been presented.

“It’s still very, very hard. It’s very, very large. It’s really daunting. But it’s the first time someone has mapped out a path that could actually get us there. And so all of our investors invested because they want to see that happen.”

So how will a “non nonprofit” startup (even with $30 million just banked) get its hands on enough land to plant enough trees? A variety of ways, per Wong. (Perhaps even, in some instances, landowners could end up paying it to turn their dirt into beautiful woodland.)

“The short answer is anywhere we can!” he adds. “The solution is structured to give us maximum flexibility, given that we can use a large variety of land. We don’t want to count on any particular land owning entity — and I use that very broad term to mean like people, communities, governments, municipalities — we don’t want to rely on any one particular land-owning entity wanting to work with us or allowing us to reforest the land, because you can’t guarantee that.”

He also notes that Terraformation’s plan to fix climate change is based on “worse-case scenarios” — where “no one who owns any land that gets enough natural rainfall for forest restoration will allow it to reforest it”. “We use the least valuable land — basically desertified, degraded land,” he adds. “Is there enough of that? And it turns out there is.”

Even though personal financial upside clearly isn’t front of mind for Terraformation’s investors, Wong still believes there’s plenty of “value” to be unlocked as a byproduct of spreading leafy-green goodness all over the planet versus funding more extractive exploitation.

“It turns out that solving climate change is actually a huge value-creating act,” he argues. “My experience in Silicon Valley is if you have people who believe in you and believe in the thing that you’re creating is ultimately value-creating then it’s actually also wealth creating. If you do something that is fundamentally very, very valuable and you’re right next to it, you will be able to monetize it in some way. You will capture some of that value for your shareholders. So it’s a bet that if you really can solve climate change, that’s super valuable, both for the world and to the entity that’s [investing].”

Of course climate change is more than just a problem; it’s an existential threat to all life on Earth — one which affects humans and every other living creature and thing on the planet.

Given such terminal stakes, reversing climate change should be the highest global priority. Instead, humans have procrastinated — putting dealing with rises in atmospheric CO2 on the back-burner and worse (cutting down existing forests like the Amazon Rainforest, for one).

Set against that backdrop, Terraformation’s answer to humanity’s greatest crisis looks compellingly simple. Its bet is that climate change can be fixed by scaling the most proven technology possible (trees) to capture carbon emissions. Who can argue with that?

But it does also seem clear that reforesting will need to go hand in hand with a mainstreaming of conservation, as a prevailing societal attitude, if the mission is to be pulled off — otherwise all these beautiful baby trees could just meet the same sad fate as all the Earth’s already lost forests.

Nonetheless, conservation is something Wong’s team is deliberately not focusing on.

Not because they don’t care. Rather their hope is that by building the baby forests, the protective partners will come — to watch over and get value from the trees as they grow.

“I don’t want to make it seem like we don’t care about [forestry conservation] but one of the things that I try to do is figure out where people are already doing work and things are already moving in the right direction — and then go work on the thing that other people are not working on,” he says when we ask about this. “When I talk to people in the forestry world many, many people are working on avoiding deforestation, helping solve the broader socioeconomic issues that result in deforestation. And so I feel like there is momentum moving in that direction — so we have to work on this other issue that other people aren’t working on.”

Wong also argues that forests are naturally more valuable than the denuded waste/scrub ground they’re replanting — implying that pure economic interest should help these baby forests survive and thrive far into the future.

However the history of humanity shows that unequal wealth distribution can wreak all sorts of havoc on a resource-rich natural environment. And people who live in poverty may well be disproportionately more likely to like in a rural location, on or near land that Terraformation hopes to target for replanting. So if these forests can’t provide — in crude terms — ‘value’ for their local communities the risk is the same cycle of short-term economic harm will rip all this hard work (and hope) out of the ground once again.

Wealth inequality lies at the core of much of humanity’s counterproductive destruction of the environment. So, seen from that angle, reforesting the planet may require just as much effort toward tackling — root and branch — the wider socioeconomic fault-lines of our world, as it will washing, sorting and storing seed, watering seedlings and nurturing and planting saplings.

And that further dials up an already massive climate challenge. But, again, Wong is quietly hopeful.

“People aren’t cutting down trees because they’re evil, they’re cutting down trees because they need to make a living. So we have to provide them with ways to make a living that is more valuable than cutting down the trees. I think that recognition is moving in the correct direction — so I’m hopeful there,” he says.

Asked what keeps him up at night, he also has a straightforward answer to hand — one we’ve heard many times already from a new generation of climate campaigners, like Greta Thunberg, whose futures will be irrevocably stamped by the effects of climate change: Humanity simply isn’t moving fast enough.

“In order to do this we have to make order of magnitude improvements in both speed and scale — which is technically a thing that we know how to do but is among the most daunting things that you ever try to undertake. So… are we moving fast enough? Are we doing enough? Because time is running out,” warns Wong.

“The time frame that we have left is very small when compared to the planetary scale of the problem. And so I think the only way that we’re going to get there is with proven solutions, moving, growing at exponential speed.”

“I am [hopeful],” he adds. “I’m a big fan of humans working together. People can really do it. I’m very I guess what you’d call pro-human. We have a lot of flaws, we fight amongst ourselves a lot, but I really think that when people work together they can really do amazing, amazing things… Trees gave us life and so now it’s our time to repay that debt.”

Powered by WPeMatico

News broke this morning that Bain Capital Private Equity and Crosspoint Capital Partners are purchasing Seattle-based network security startup ExtraHop.

Part of the Network Detection and Response (NDR) market, ExtraHop’s security solutions are for companies that manage assets in the cloud and on-site, “something that could be useful as more companies find themselves in that in-between state,” report Ron Miller and Alex Wilhelm.

Just one year ago, ExtraHop was closing in on $100 million in ARR and was considering an IPO, so Ron and Alex spoke to ExtraHop CTO and co-founder Jesse Rothstein to learn more about how (and why) the deal came together.

Have a great week, and thanks for reading!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Image Credits: Prasit photo (opens in a new window)/ Getty Images

Xometry, a Maryland-based service that connects companies with manufacturers with excess production capacity around the world, filed an S-1 form with the U.S. Securities and Exchange Commission last week announcing its intent to become a public company.

As the global supply chain tightened during the pandemic in 2020, a company that helped find excess manufacturing capacity was likely in high demand.

But growth aside, it’s clear that Xometry is no modern software business, at least from a revenue-quality profile.

Image Credits: Malorny (opens in a new window) / Getty Images

The average corporate security organization spends $18 million annually but is largely ineffective at preventing breaches, IP theft and data loss. Why?

The fragmented approach we’re currently using in the security operations center (SOC) does not work. It’s time to replace the security information and event management (SIEM) approach with security data lakes.

The reduced reliance on the SIEM is well underway, along with many other changes. The SIEM is not going away overnight, but its role is changing rapidly, and it has a new partner in the SOC — the security data lake.

Image Credits: STR/China News Service (CNS)/AFP (opens in a new window)/ Getty Images

There has been a wave of businesses over the past several years hoping to offer broadband internet delivered from thousands of satellites in low-Earth orbit (LEO), providing coverage of most of the earth’s surface.

In tandem with the accelerated deployment of SpaceX’s Starlink constellation in 2020, China has rapidly responded in terms of policy, financing and technology. While still in early development, a “Chinese answer to Starlink,” SatNet, and the associated GuoWang are likely to compete in certain markets with Starlink and others while also fulfilling a strategic purpose from a government perspective.

With considerable backing from very high-level actors, we are likely to see the rollout of a Red Star(link) over China (and the rest of the world) over the coming years.

Image Credits: Nigel Sussman (opens in a new window)

Babylon Health, a British health tech company, is pursuing a U.S. listing via a blank-check company, or SPAC.

While we wait for Robinhood’s IPO, The Exchange dove into its fundraising history, its product, its numbers and, bracing ourselves for impact, its projections.

Image Credits: Westend61 / Getty Images

Conventional wisdom says your board should include a few CEOs who can offer informed advice from an entrepreneur’s perspective, but adding a technical leader to the mix creates real upside, according to Abby Kearns, chief technology officer at Puppet.

Beyond their engineering experience, CTOs can help founders set realistic timelines, help identify pain points and bring what Kearns calls “pragmatic empathy” to high-pressure situations.

They can also be an effective advocate for founder teams who need help explaining why a launch is delayed or new engineering hires are badly needed.

“A CTO understands the nuts and bolts,” says Kearns.

Image Credits: Marie LaFauci / Getty Images

As someone with “founder” on your resume, you face a greater challenge when trying to get a traditional salaried job.

You’ve already shown that you really want to lead a company, not just rise up the ladder, which means some employers are less likely to hire you.

So what should you do? Especially if your life partner and/or bank account are burnt out on the income volatility of startups?

Here are six options for ex-founders planning their next move.

Image Credits: Nigel Sussman

In the fifth and final part of Expensify’s EC-1, Anna Heim explores how the company built its business, true to form, in an unexpected way.

“You’d expect an expense management company to have a large sales department and advertise through all kinds of channels to maximize customer acquisition, Anna writes. But “Expensify just doesn’t do what you think it should.

“Keeping in mind this company’s propensity to just stick to its guts, it’s not much of a surprise that it got to more than $100 million in annual recurring revenue and millions of users with a staff of 130, some contractors, and an almost non-existent sales team.”

How is that much growth possible without a sales team? Word of mouth.

Powered by WPeMatico

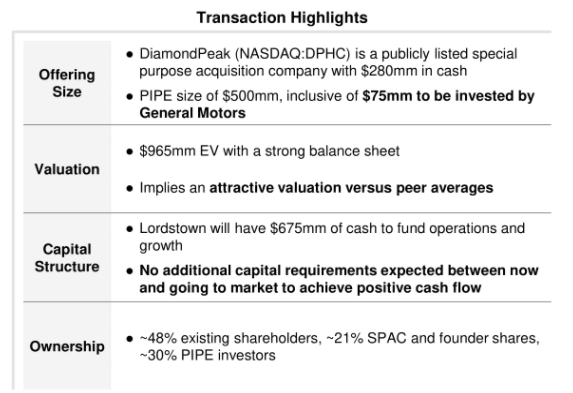

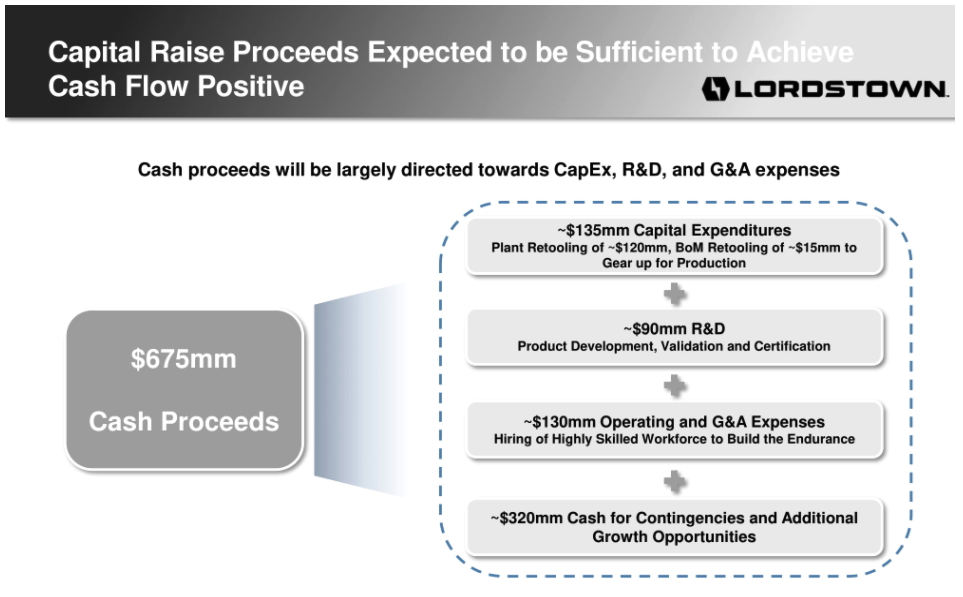

The continuing saga of Lordstown Motor’s struggles as a public company took a new turn today as the electric truck manufacturer made yet more news. Bad news.

Shares of Lordstown are down sharply today after the company reported in an SEC filing that it does not have enough capital to build and launch its electric truck. Here’s the official verbiage (formatting, bolding: TechCrunch):

Since inception, the Company has been developing its flagship vehicle, the Endurance, an electric full-size pickup truck. The Company’s ability to continue as a going concern is dependent on its ability to complete the development of its electric vehicles, obtain regulatory approval, begin commercial scale production and launch the sale of such vehicles.

The Company believes that its current level of cash and cash equivalents are not sufficient to fund commercial scale production and the launch of sale of such vehicles. These conditions raise substantial doubt regarding our ability to continue as a going concern for a period of at least one year from the date of issuance of these unaudited condensed consolidated financial statements.

Now, companies that are trying to invent the future are more risky than, say, established banking concerns that are generating stable GAAP net income. I’m sure that SpaceX looked dicey at times when it was busy crashing rockets on its way to learning how to land them on drone ships.

But in the case of Lordstown’s admission that it cannot “fund commercial scale production and the launch of sale” of its Endurance pickup are fucking galling.

Why? Because when the company pitched its SPAC-led combination and public debut, it was pretty freaking confident that it would have enough cash to do so.

Don’t take my word for it. Here’s an excerpt from Lordstown’s investor deck:

You will note in the “Capital Structure” section that the company claimed that it would not need more funding to go to market.

Now Lordstown is pretty sure it’s going to need more money. If it’s putting the possible need in a filing, it means it.

Here’s what the company may do to solve its problems (formatting, bolding: TechCrunch):

To alleviate these conditions, management is currently evaluating various funding alternatives and may seek to raise additional funds through the issuance of equity, mezzanine or debt securities, through arrangements with strategic partners or through obtaining credit from government or financial institutions.

As we seek additional sources of financing, there can be no assurance that such financing would be available to us on favorable terms or at all. Our ability to obtain additional financing in the debt and equity capital markets is subject to several factors, including market and economic conditions, our performance and investor sentiment with respect to us and our industry.

In other words, the company is going to have to lever itself using debt, or dilute existing shareholders through the sale of equity, and Lordstown can’t promise that it will be able to do either “on favorable terms or at all.”

What we’re seeing here is the difference between SEC filings, which are no-bullshit zones, and SPAC decks, which are business propaganda. Shares of Lordstown fell more than 16% during regular trading, and another 6.9% in after-hours trading, as of the time of writing.

This mess from the company that put out this diagram in its investor deck:

In separate news, TechCrunch received an invite to a media availability to visit Lordstown’s operations in May, which included a note that the company “look[s] forward to opening [its] doors and showing you the latest progress from Lordstown Motors as [it] prepare[s] for the beginning of production in late September.” In a new missive sent today concerning the same event, the production timeline was not present.

So, yeah, maybe don’t trust SPAC decks much, if at all.

Powered by WPeMatico