TC

Auto Added by WPeMatico

Auto Added by WPeMatico

When I was at Open Market in the 1990s, our CEO gave out the recently published book “Crossing the Chasm” to the executive team and told us to read it to gain insight into why we had hit a speed bump in our scaling. We had gone from zero to $60 million in revenue in four years, went public at a billion-dollar market cap, and then stalled.

We found ourselves stuck in what author Geoffrey Moore called “the chasm,” a difficult transition from visionary early adopters who are willing to put up with an incomplete product and mainstream customers who demand a more complete product. This framework for marketing technology products has been one of the canonical foundational concepts to product-market fit for the three decades since it was first published in 1991.

Why is it that in recent years, wild-eyed optimistic VCs and entrepreneurs keep undershooting market size across the tech and innovation sector?

I have been reflecting on why it is that we venture capitalists and founders keep making the same mistake over and over again — a mistake that has become even more glaring in recent years. Despite our exuberant optimism, we keep getting the potential market size wrong. Market sizes have proven to be much, much larger than any of us had ever dreamed. The reason? Today, everyone aspires to be an early adopter. Peter Drucker’s mantra — innovate or die — has finally come to pass.

A glaring example in our investment portfolio is database software company MongoDB. Looking back at our Series A investment memo for this disruptive open-source, NoSQL database startup, I was struck that we boldly predicted the company had the opportunity to disrupt a subsegment of the industry and successfully take a piece of a market that could grow as large as $8 billion in annual revenue in future years.

Today, we realize that the company’s product appeals to the vast majority of the market, one that is forecast to be $68 billion in 2020 and approximately $106 billion in 2024. The company is projected to hit a $1 billion revenue run rate next year and, with that expanded market, likely has continued room to grow for many years to come.

Another example is Veeva, a vertical software company initially focused on the pharmaceutical industry. When we met the company for their Series A round, they showed us the classic hockey stick slide, claiming they would reach $50 million in revenue in five years.

We got over our concerns about market size when we and the founders concluded they could at least achieve a few hundred million in revenue on the backs of pharma and then expand to other vertical industries from there. Boy, were we wrong! The company filed their S-1 after that fifth year showing $130 million in revenue, and today the company is projected to hit $2 billion in revenue run rate next year, all while still remaining focused on just the pharma industry.

Veeva was a pioneer in “vertical SaaS” — software platforms that serve niche industries — which in recent years has become a popular category. Another vertical SaaS example is Squire, a company my partner Jesse Middleton angel invested in as part of a pre-seed round before he joined Flybridge.

Powered by WPeMatico

Apple announced a batch of accessibility features at WWDC 2021 that cover a wide variety of needs, among them a few for people who can’t touch or speak to their devices in the ordinary way. With Assistive Touch, Sound Control and other improvements, these folks have new options for interacting with an iPhone or Apple Watch.

We covered Assistive Touch when it was first announced, but recently got a few more details. This feature lets anyone with an Apple Watch operate it with one hand by means of a variety of gestures. It came about when Apple heard from the community of people with limb differences — whether they’re missing an arm, or unable to use it reliably, or anything else — that as much as they liked the Apple Watch, they were tired of answering calls with their noses.

The research team cooked up a way to reliably detect the gestures of pinching one finger to the thumb, or clenching the hand into a fist, based on how doing them causes the watch to move — it’s not detecting nervous system signals or anything. These gestures, as well as double versions of them, can be set to a variety of quick actions. Among them is opening the “motion cursor,” a little dot that mimics the movements of the user’s wrist.

Considering how many people don’t have the use of a hand, this could be a really helpful way to get basic messaging, calling and health-tracking tasks done without needing to resort to voice control.

Speaking of voice, that’s also something not everyone has at their disposal. Many of those who can’t speak fluently, however, can make a bunch of basic sounds, which can carry meaning for those who have learned — not so much Siri. But a new accessibility option called “Sound Control” lets these sounds be used as voice commands. You access it through Switch Control, not audio or voice, and add an audio switch.

The setup menu lets the user choose from a variety of possible sounds: click, cluck, e, eh, k, la, muh, oo, pop, sh and more. Picking one brings up a quick training process to let the user make sure the system understands the sound correctly, and then it can be set to any of a wide selection of actions, from launching apps to asking commonly spoken questions or invoking other tools.

For those who prefer to interact with their Apple devices through a switch system, the company has a big surprise: Game controllers, once only able to be used for gaming, now work for general purposes as well. Specifically noted is the amazing Xbox Adaptive Controller, a hub and group of buttons, switches and other accessories that improves the accessibility of console games. This powerful tool is used by many, and no doubt they will appreciate not having to switch control methods entirely when they’re done with Fortnite and want to listen to a podcast.

One more interesting capability in iOS that sits at the edge of accessibility is Walking Steadiness. This feature, available to anyone with an iPhone, tracks (as you might guess) the steadiness of the user’s walk. This metric, tracked throughout a day or week, can potentially give real insight into how and when a person’s locomotion is better and worse. It’s based on a bunch of data collected in the Apple Heart and Movement study, including actual falls and the unsteady movement that led to them.

If the user is someone who recently was fitted for a prosthesis, or had foot surgery, or suffers from vertigo, knowing when and why they are at risk of falling can be very important. They may not realize it, but perhaps their movements are less steady toward the end of the day, or after climbing a flight of steps, or after waiting in line for a long time. It could also show steady improvements as they get used to an artificial limb or chronic pain declines.

Exactly how this data may be used by an actual physical therapist or doctor is an open question, but importantly it’s something that can easily be tracked and understood by the users themselves.

Among Apple’s other assistive features are new languages for voice control, improved headphone acoustic accommodation, support for bidirectional hearing aids, and of course the addition of cochlear implants and oxygen tubes for memoji. As an Apple representative put it, they don’t want to embrace differences just in features, but on the personalization and fun side as well.

Powered by WPeMatico

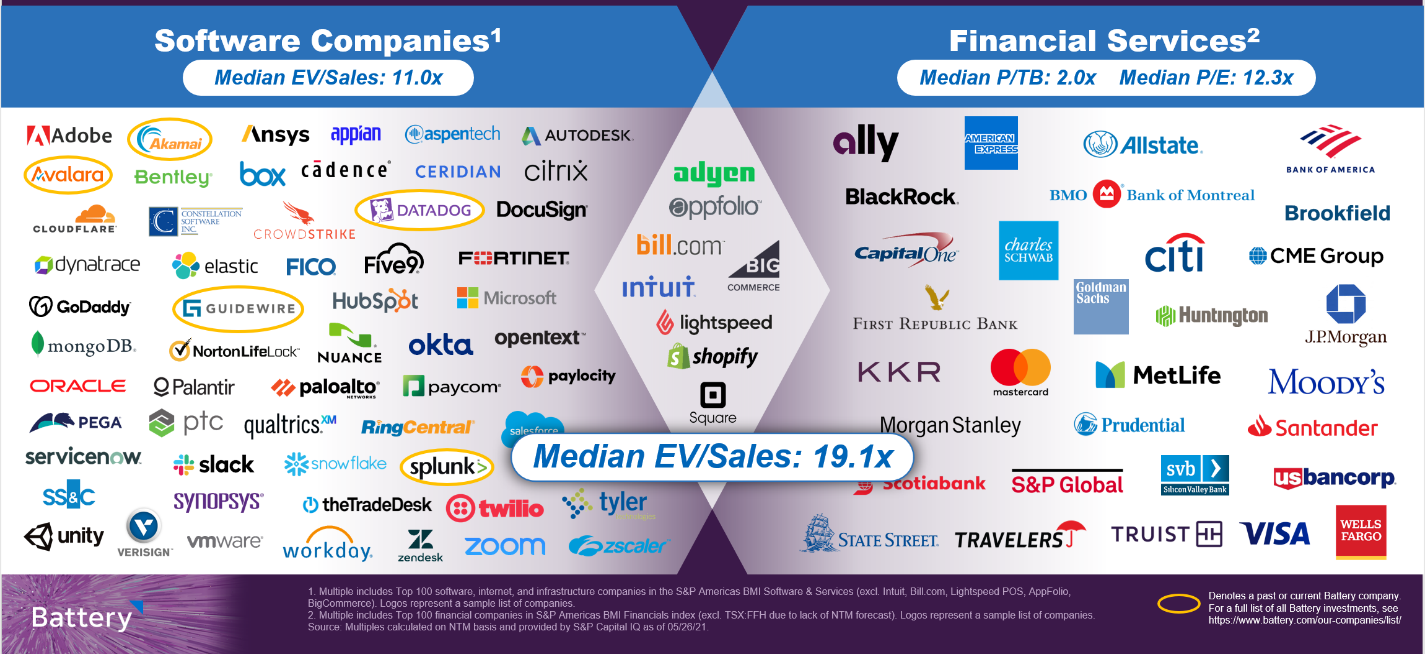

If money is the ultimate commodity, how can fintechs — which sell money, move money or sell insurance against monetary loss — build products that remain differentiated and create lasting value over time?

And why are so many software companies — which already boast highly differentiated offerings and serve huge markets— moving to offer financial services embedded within their products?

A new and attractive hybrid category of company is emerging at the intersection of software and financial services, creating buzz in the investment and entrepreneurial communities, as we discussed at our “Fintech: The Endgame” virtual conference and accompanying report this week.

These specialized companies — in some cases, software companies that also process payments and hold funds on behalf of their customers, and in others, financial-first companies that integrate workflow and features more reminiscent of software companies — combine some of the best attributes of both categories.

Image Credits: Battery Ventures

From software, they design for strong user engagement linked to helpful, intuitive products that drive retention over the long term. From financials, they draw on the ability to earn revenues indexed to the growth of a customer’s business.

Fintech is poised to revolutionize financial services, both through reinventing existing products and driving new business models as financial services become more pervasive within other sectors.

The powerful combination of these two models is rapidly driving both public and private market value as investors grant these “super” companies premium valuations — in the public sphere, nearly twice the median multiple of pure software companies, according to a Battery analysis.

The near-perfect example of this phenomenon is Shopify, the company that made its name selling software to help business owners launch and manage online stores. Despite achieving notable scale with this original SaaS product, Shopify today makes twice as much revenue from payments as it does from software by enabling those business owners to accept credit card payments and acting as its own payment processor.

The combination of a software solution indexed to e-commerce growth, combined with a profitable payments stream growing even faster than its software revenues, has investors granting Shopify a 31x multiple on its forward revenues, according to CapIQ data as of May 26.

Before even talking about how investors should value these hybrid companies, it’s worth making the point that in both private and public markets, fintechs have been notoriously hard to value, fomenting controversy and debate in the investment community.

Powered by WPeMatico

Productivity analytics startup Time is Ltd. wants to be the Google Analytics for company time. Or perhaps a sort of “Apple Screen Time” for companies. Whatever the case, the founders reckon that if you can map how time is spent in a company, enormous productivity gains can be unlocked and money better spent.

It’s now raised a $5.6 million late-seed funding round led by Mike Chalfen, of London-based Chalfen Ventures, with participation from Illuminate Financial Management and existing investor Accel. Acequia Capital and former Seal Software chairman Paul Sallaberry are also contributing to the new round, as is former Seal board member Clark Golestani. Furthermore, Ulf Zetterberg, founder and former CEO of contract discovery and analytics company Seal Software, is joining as president and co-founder.

The venture is the latest from serial entrepreneur Jan Rezab, better known for founding SocialBakers, which was acquired last year.

We are all familiar with inefficient meetings, pestering notifications chat, video conferencing tools and the deluge of emails. Time is Ltd. says it plans to address this by acquiring insights and data platforms such as Microsoft 365, Google Workspace, Zoom, Webex, MS Teams, Slack and more. The data and insights gathered would then help managers to understand and take a new approach to measure productivity, engagement and collaboration, the startup says.

The startup says it has now gathered 400 indicators that companies can choose from. For example, a task set by The Wall Street Journal for Time is Ltd. found the average response time for Slack users versus email was 16.3 minutes, comparing to emails which was 72 minutes.

Chalfen commented: “Measuring hybrid and distributed work patterns is critical for every business. Time Is Ltd.’s platform makes such measurement easily available and actionable for so many different types of organizations that I believe it could make work better for every business in the world.”

Rezab said: “The opportunity to analyze these kinds of collaboration and communication data in a privacy-compliant way alongside existing business metrics is the future of understanding the heartbeat of every company — I believe in 10 years time we will be looking at how we could have ignored insights from these platforms.”

Tomas Cupr, founder and Group CEO of Rohlik Group, the European leader of e-grocery, said: “Alongside our traditional BI approaches using performance data, we use Time is Ltd. to help improve the way we collaborate in our teams and improve the way we work both internally and with our vendors — data that Time is Ltd. provides is a must-have for business leaders.”

Powered by WPeMatico

Amid a recent tear in residential real estate investment, venture capitalists are looking to get a piece of homebuying startup Flyhomes.

The five-year-old startup announced today that they’ve closed a $150 million Series C round co-led by Norwest Venture Partners and Battery Ventures. Fifth Wall, Camber Creek, Balyasny Asset Management, Zillow’s Spencer Rascoff and existing investors Andreessen Horowitz and Canvas Partners also participated in the round. Norwest’s Lisa Wu and Battery’s Roger Lee are joining Flyhomes’ board as part of the deal.

The end-to-end residential real estate startup says they handle “every step of the homebuying process, from brokerage to mortgage,” building financial tools that customers need throughout the process. The company has now raised some $310 million in total.

The startup is well-positioned during a historic run-up of home prices in the U.S. that has made deals more competitive than ever for prospective buyers. A recent report by Redfin notes that more than half of U.S. homes are selling above their asking price right now, up from one in four a year ago. A Zillow report notes that nearly half of U.S. homes are selling within one week of going on the market.

Flyhomes’s Cash Offer lending product allows consumers purchasing homes to make more attractive all-cash offers to sellers, with the company noting that even if a buyer ends up backing out of the deal, Flyhomes will still buy the home themselves. Central to the startup’s business is sellers being more amenable to all-cash offers, allowing consumers making them to win deals even when they aren’t the highest bidders.

The company says it has bought and sold more than $2.6 billion worth of homes since launching in 2016.

Powered by WPeMatico

One clear outcome of the pandemic was that it pushed more people to do their shopping online, and that was as true for B2B as it was for B2C. Knowing which of your B2B customers are most likely to convert puts any sales team ahead of the game. Slintel, a startup providing that kind of data, announced a $20 million Series A today.

The company has attracted some big-name investors, with GGV leading the round and Accel, Sequoia and Stellaris also participating. The investment brings the total raised to over $24 million, including a $4.2 million seed round from last November.

That’s a quick turnaround from seed to A, and company founder and CEO Deepak Anchala says that while he had plenty of runway left from the seed round, the demand was such that it seemed prudent to take the A money sooner than he had planned. “So we had enough cash in the bank, but investors came to us and we got a pretty good valuation compared to the previous round, so we decided to take it and use that money to go faster,” Anchala said.

Certainly the market dynamics were working in Slintel’s favor. Without giving revenue details, Anchala said that revenue grew 5x last year in the middle of the worst of the pandemic. He says that meant buyers were spending less time with sales and marketing folks to understand products and more time online researching on their own.

“So what Slintel does as a product is we mine buyer insights. We understand where the buyers are in their journey, what their pain points are, what products they use, what they need and when they need it. So we understand all of this to create a 360-degree view of the buyer that you provide these insights to sales and marketing teams to help them sell better,” he said.

After growing at such a rapid clip last year, the company expected more modest growth this year at perhaps 3x, but with the added investment, he expects to grow faster again. “With the funding we’re actually looking at much bigger numbers. We’re looking at 5x in our revenue this year, and also trying for 4x revenue next year.”

He says that the money gives him the opportunity to improve the product and put more investment into marketing, which he believes will contribute to additional sales. Since the round closed six weeks ago, he says that he has increased his advertising budget and also hopes to attract customers via SEO, free tools on the company website and events.

The company had 45 employees at the time of its seed round in November and has more than doubled that number in the interim, to 100 spread out across 10 cities. He expects to double again by this time next year as the company is growing quickly. As a global company with some employees in India and some in the U.S., he intends to be remote-first even after offices begin to reopen in different areas. He says that he plans to have company gatherings each quarter to let people gather in person on occasion.

Powered by WPeMatico

Microsoft will soon launch a dedicated device for game streaming, the company announced today. It’s also working with a number of TV manufacturers to build the Xbox experience right into their internet-connected screens and Microsoft plans to bring cloud gaming to the PC Xbox app later this year, too, with a focus on play-before-you-buy scenarios.

It’s unclear what these new game streaming devices will look like. Microsoft didn’t provide any further details. But chances are we’re talking about either a Chromecast-like streaming stick or a small Apple TV-like box. So far, we also don’t know which TV manufacturers it will partner with.

It’s no secret that Microsoft is bullish about cloud gaming. With Xbox Game Pass Ultimate, it’s already making it possible for its subscribers to play more than 100 console games on Android, streamed from the Azure cloud, for example. In a few weeks, it’ll open cloud gaming in the browser on Edge, Chrome and Safari, to all Xbox Game Pass Ultimate subscribers (it’s currently in limited beta). And it is bringing Game Pass Ultimate to Australia, Brazil, Mexico and Japan later this year, too.

In many ways, Microsoft is unbundling gaming from the hardware — similar to what Google is trying with Stadia (an effort that, so far, has fallen flat for Google) and Amazon with Luna. The major advantage Microsoft has here is a large library of popular games, something that’s mostly missing on competing services, with the exception of Nvidia’s GeForce Now platform — though that one has a different business model since its focus is not on a subscription but on allowing you to play the games you buy in third-party stores like Steam or the Epic store.

What Microsoft clearly wants to do is expand the overall Xbox ecosystem, even if that means it sells fewer dedicated high-powered consoles. The company likens this to the music industry’s transition to cloud-powered services backed by all-you-can-eat subscription models.

“We believe that games, that interactive entertainment, aren’t really about hardware and software. It’s not about pixels. It’s about people. Games bring people together,” said Microsoft’s Xbox head Phil Spencer. “Games build bridges and forge bonds, generating mutual empathy among people all over the world. Joy and community — that’s why we’re here.”

It’s worth noting that Microsoft says it’s not doing away with dedicated hardware, though, and is already working on the next generation of its console hardware — but don’t expect a new Xbox console anytime soon.

Powered by WPeMatico

On the heels of acquiring sales tax specialist TaxJar in April, today Stripe is making another big move in the area of tax. The $95 billion payments behemoth is launching a new product called Stripe Tax, which will provide automatic, updated sales tax calculations (covering sales tax, VAT and GST) and related accounting services to Stripe payments customers initially in some 30 countries and across the U.S.

Stripe Tax is a separate service from TaxJar, but the two are not unconnected. As Stripe Tax was being built out of Stripe’s offices in Dublin over the last several months, Stripe’s business lead for EMEA Matt Henderson told me that the team had identified TaxJar as a strong company in the field. That ultimately led to M&A between them.

Sales tax — and specifically a more seamless way to deal with charging and tracking sales tax — is a painful issue for people doing business online.

Digital and physical goods are taxed in over 130 countries, Stripe said, and within that there can be a huge amount of variation and compliance complexity, since codes get updated all the time, too. Mishandled sales tax, meanwhile, can result in pretty hefty fines, sometimes up to 30% interest on past-due amounts.

Unsurprisingly, a sales tax tool has been the most-requested feature from Stripe’s customers, Henderson said, a call that presumably only got louder in the last year, as e-commerce and digital transactions went through the roof with COVID-19.

Arguably, that makes Stripe Tax one of the company’s more significant product launches, not to mention the first since announcing its monster funding round earlier this year.

Previously, Stripe customers would have resorted to using a third-party service (like TaxJar) to work out sales tax. Or, more typically, those Stripe customers would have opted to limit the number of places they sold goods and services, in order to minimize the pain of dealing with multiple, complex and usually quite localized tax codes.

“No one leaps out of bed in the morning excited to deal with taxes,” said John Collison, co-founder and president of Stripe in a statement. “For most businesses, managing tax compliance is a painful distraction. We simplify everything about calculating and collecting sales taxes, VAT, and GST, so our users can focus on building their businesses.”

Stripe said that a survey of its customers found that two-thirds of respondents said the challenge of implementing sales tax actually limited their growth.

TaxJar has built a strong system for handling that, but the company — based out of Massachusetts but with a remote team — is primarily focused on the U.S. market, which has sales tax that is complicated enough (there are 11,000 different tax jurisdictions in the country).

That leaves a lot on the table for building out sales tax tools for the rest of the world: The wider focus of Stripe Tax thus fills a particular geographical gap for the company, regardless of how well TaxJar and Stripe integrate over time.

There is another key difference worth noting between the two.

TaxJar came to Stripe’s attention with an established operation — 23,000 customers at the time of the announcement. Stripe (wisely) bolted that on as a standalone business, which means that new and existing customers that use TaxJar can continue to use it as is. That is to say, at least for now, they do not need to be Stripe payments customers in order to use TaxJar, even if the integration between the two platforms will only improve over time.

Stripe Tax, on the other hand, is being built from the ground up as a product aimed specifically at increasing touchpoints and stickiness with Stripe customers.

Stripe Tax provides real-time tax calculation based on customer location and product sold; transparent itemizing for customers; tax ID management in areas (like Europe) where business customers can provide their code and get a reverse charge on tax if they are under a certain turnover threshold themselves; and reconciliation and reporting across all transactions to make filing and remittance easier.

But there is for now no way to use Stripe Tax outside of Stripe payments.

This could pose some problems for some customers. These days, many of the strongest retailers will take an “omnichannel” approach that might cover selling through marketplaces, selling through websites, selling through social media and more — and not all of those experiences may be powered by Stripe. It will be worth watching whether future iterations of Stripe Tax can account for that.

Stripe’s most significant product launch prior to Stripe Tax — Stripe Treasury last December — underscores how the company is currently very focused on diversifying outside of its basic payments business and opening the platform to much wider, more scaled transactions.

Treasury, which is still in invite-only mode, saw Stripe partner with established banks to provide a business banking service, providing a way for its customers to handle money that they generate from their Stripe-powered businesses.

The full country list where Stripe Tax is launching is Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, New Zealand, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United States and the United Kingdom.

Updated to correct the number of customers TaxJar has to 23,000.

Powered by WPeMatico

BukuWarung, a fintech focused on Indonesia’s micro, small and medium enterprises (MSMEs), announced today it has raised a $60 million Series A. The oversubscribed round was led by Valar Ventures, marking the firm’s first investment in Indonesia, and Goodwater Capital. The Jakarta-based startup claims this is the largest Series A round ever raised by a startup focused on services for MSMEs. BukuWarung did not disclose its valuation, but sources tell TechCrunch it is estimated to be between $225 million to $250 million.

Other participants included returning backers and angel investors like Aldi Haryopratomo, former chief executive officer of payment gateway GoPay, Klarna co-founder Victor Jacobsson and partners from SoftBank and Trihill Capital.

Founded in 2019, BukuWarung’s target market is the more than 60 million MSMEs in Indonesia, according to data from the Ministry of Cooperatives and SMEs. These businesses contribute about 61% of the country’s gross domestic product and employ 97% of its workforce.

BukuWarung’s services, including digital payments, inventory management, bulk transactions and a Shopify-like e-commerce platform called Tokoko, are designed to digitize merchants that previously did most of their business offline (many of its clients started taking online orders during the COVID-19 pandemic). It is building what it describes as an “operating system” for MSMEs and currently claims more than 6.5 million registered merchant in 750 Indonesian cities, with most in Tier 2 and Tier 3 areas. It says it has processed about $1.4 billion in annualized payments so far, and is on track to process over $10 billion in annualized payments by 2022.

BukuWarung’s new round brings its total funding to $80 million. The company says its growth in users and payment volumes has been capital efficient, and that more than 90% of its funds raised have not been spent. It plans to add more MSME-focused financial services, including lending, savings and insurance, to its platform.

BukuWarung’s new funding announcement comes four months after its previous one, and less than a month after competitor BukuKas disclosed it had raised a $50 million Series B. Both started out as digital bookkeeping apps for MSMEs before expanding into financial services and e-commerce tools.

When asked how BukuWarung plans to continue differentiating from BukuKas, co-founder and CEO Abhinay Peddisetty told TechCrunch, “We don’t see this space as a winner takes all, our focus is on building the best products for MSMEs as proven by our execution on our payments and accounting, shown by massive growth in payments TPV as we’re 10x bigger than the nearest player in this space.”

He added, “We have already run successful lending experiments with partners in fintech and banks and are on track to monetize our merchants backed by our deep payments, accounting and other data that we collect.”

BukuWarung’s new funding will be used to double its current workforce of 150, located in Indonesia, Singapore and India, to 300 and develop BukuWarung’s accounting, digital payments and commerce products, including a payments infrastructure that will include QR payments and other services.

Powered by WPeMatico

Community has never felt louder in startupland. Bringing people together over a shared interest is innate to human nature, and coming out of a lonely, draining pandemic, every startup is looking to cultivate community, conversation and camaraderie.

Last week, though, the outside world got a look at how Y Combinator, one of Silicon Valley’s most famed and feared accelerators, deals with the intricacies of a scaled, yet still ultra-exclusive, community after the accelerator kicked out two founders from its internal messaging board, Bookface.

The two founders, Dark CEO Paul Biggar and Prolific CEO and co-founder Katia Damer, say they were removed from YC after publicly critiquing YC — for very different reasons. Biggar had noted on social media back in March that another YC founder was tipping off people on how to cut the vaccine lines to get an early jab, while Damer expressed worry and frustration more recently about the alumni community’s support of a now-controversial alum, Antonio García Martínez.

Y Combinator says that the two founders were removed from Bookface because they broke community guidelines, namely the rule to never externally post any internal information from Bookface.

The now-public ousting of Biggar and Damer, who turned to Twitter to first explain their experiences, is a nuanced situation. Y Combinator says that it has only removed a “dozen or so” founders in its 16 year history for violating YC ethics and Bookface forum guidelines.

Still, YC’s decision to remove these founders, especially in light of a broader reckoning around free speech and dissent within startups, has triggered a series of questions — some by YC founders themselves — around how the accelerator moderates its community, handles negative publicity and draws its own line around what can be openly said by its alumni base without consequence.

The best curated communities allow participants to safely, and freely, share personal experiences, debate, and even disagree. Part of that safety comes from what some see as a common rule within communities: don’t share private information publicly.

Per YC, respecting privacy is a key rule for anyone who joins Bookface, an internal messaging forum that includes some 6,000 founders of the YC community, from alumni to management to current batch companies. Founders log in daily, asking for introductions to a crypto accountant or bringing up a recent job posting for crowdsourced suggestions, among other topics.

“We ask that founders don’t share anything from the forum with anyone outside of YC, as this is a community built on trust and privacy,” Lindsay Wiese-Amos, Y Combinator head of communications, told TechCrunch.

It’s more than a polite request. Amos said that when a company is accepted into YC, the founders must sign investment documents, one of which is its founder ethics policy. Within the policy, there are guidelines around the Bookface forum, including the language: “Don’t share anything in the Forum, or any links to the content posted to it, with anyone outside of YC.”

YC claims that when a founder breaks the rules, it reaches out to them with a warning, and if the rule is broken multiple times, that individual is removed from the community.

When a startup is removed from the YC community, YC “generally” returns the shares to the company, though it says there are exceptions. In Damer’s case, says Amos, her “co-founder is still actively working on Prolific, and both he and Prolific remain part of the YC community.”

Meanwhile, Biggar’s YC startup closed eight months after graduating from the accelerator, so YC didn’t have to sever financial ties.

Garry Tan, co-founder of Initialized Capital, and a former YC partner who has stakes in alumni companies including Coinbase, thinks there is a difference between a critical discussion and breaking community rules. Tan told TechCrunch that discussions are fine, but that these “founders violated privacy expectations of other people within the community.”

“I think YC has become an institution, and institutions are viewed with high scrutiny,” he said. “That’s not a bad thing, it’s probably how it should be.”

The “‘too far’ moment is when people try to ascribe specific political viewpoints to an institution when that institution is A) a lot of people not just a few and B) probably innocent of specifically pushing one viewpoint or another,” Tan continues.

YC’s Bookface rules are seemingly cut and dried. However, in light of the actions it took against Biggar and Damer, it’s fair to wonder what happens if someone in the community disparages YC publicly, but not having to do with Bookface. Is that also an offense that would get them kicked out of the organization? And would the organization make an exception for especially promising founders?

Amos suggests that all founders are treated equally and that dissent is welcome. “We believe strongly in free speech and are open to criticism. People are allowed to criticize YC and would not get kicked out of the community for doing so,” she said.

Biggar went through Y Combinator in 2010. “I was like a Paul Graham acolyte,” he says. “I have a signed copy of Hackers and Painters, read every essay that he put out, and as soon as I finished my PhD, I applied to Y Combinator.”

For over a decade, Biggar says, he has been an active participant in Bookface, recently helping multiple companies with financial and relationship advice on co-founder break-ups.

When the Black Lives Matter movement was growing last summer, Biggar noticed that Bookface was relatively quiet and, as he describes it, “apolitical, but in a derogatory way” around issues such as diversity and police brutality. He compared the tone of Bookface to that of Coinbase, after CEO Brian Armstrong published a memo that banned political discussions at work.

Biggar’s frustration grew, hitting a tipping point in March when he spotted a founder bragging on the forum that he had skipped a vaccine queue and offering tips to help other founders do the same.

Soon after, Biggar tweeted: “For the second time, a @ycombinator founder has posted to the internal YC forum about how they lied to skip the vaccine queue in Oakland, with instructions for other founders to do the same. Absolutely fucking disgusted.”

Biggar left out screenshots of the founder’s post or any identifying material to protect the individual’s anonymity. But within hours of publishing the tweet, Biggar received a direct message on Twitter from Y Combinator co-founder Jessica Livingston, asking him to alert a partner at YC about inappropriate content on Bookface. She added: “You may get a faster and more thorough response than posting to all of Twitter.”

His response to her: “Hey Jessica! Truth be told, I’m so disillusioned with YC that it never even occurred to me.”

Biggar decided to leave up the tweet. Meanwhile, because Biggar was apparently not alone in his view of the content on Bookface — Amos says that “the community made its perspective quite clear in the comments: they were not in agreement with this founder” offering vaccination hacks — YC says it deleted the post less than 24 hours after it appeared on Bookface.

The episode wasn’t even on his mind, Biggar says, when he received an email from Jon Levy, the managing director of partnerships at YC, asking to chat last week. To Biggar’s surprise, Levy told him that he was being removed from the YC community. That meant he was being removed not just from Bookface, says Biggar, but he is no longer invited to Demo Day or allowed on YC Slack.

Notably, Biggar says that YC didn’t give him a warning or the option to take down any posts before ushering him out of the broader YC community, though he suspected it was becoming stricter about its community rules. A week before he was booted, Biggar says that Y Combinator reminded founders about a “no leak” policy within Bookface.

YC offers a different recounting of the events, saying it was only “recently” notified of Biggar’s tweet through someone in the YC community and that all founders are given a warning. YC also states that a founder is removed only after violating its terms “multiple” times, while Biggar maintains that he only once tweeted about Bookface. Asked about other examples of Biggar violating its terms, YC declined to comment further.

Says Biggar now of these recent events: “I got criticized for not posting it internally, which I think is kind of bullshit. But, you know, the reason I didn’t post it internally is just that I had no faith in Y Combinator doing the right thing. I didn’t think that going public would do anything, either. I mean, I’m not someone who actually matters here.”

“This is the smallest way that one could possibly call out YC,” Biggar continues. “A couple of community members did a shitty thing, which I think is reflective of the community. That for them is, like, too much dissent — shut it all down.”

If you are not “the people who have been elevated to part-time partners [or are] tight with the people that matter,” no one “cares what you think. No one ever asks what you think . . .You can’t have dissent internally. There are just too many disciples.”

Damer’s own removal from Bookface might not have been publicized if not for Biggar sharing on Twitter last week that he’d just been “kicked out.” Soon after, she came forward, tweeting to him that “2 weeks ago, YC kicked me out as well” for her public critique. Specifically, says Damer, she was thrown off Bookface because she called out misogyny and the lack of diversity within the accelerator community.

It began with a memo on Bookface with the title: “Is YC an inclusive organization? If we continue like this, YC will lose its great reputation.”

In her post, Damer explained that she noticed many people defending Antonio García Martínez, the author of Chaos Monkeys who recently was invited to join Apple, then asked to leave Apple, after a petition to investigate his hiring was signed by more than 2,000 Apple employees. They were concerned about specific book passages, including one that reads: “[M]ost women in the Bay Area are soft and weak, cosseted and naive despite their claims of worldliness, and generally full of shit.”

Like the Apple employees who circulated the petition, Damer believes the book is proof that García Martínez is a “misogynist,” writing on Bookface about how “disconcerting” she found the outpouring of support for him on the internal platform.

“I care about YC and that’s why I am writing this,” Damer said. “What is happening right now is not normal, and it looks like YC is soul searching. If this doesn’t get under control, YC will start missing out on some of the best deal flow, especially from women and underrepresented founders.”

Livingston soon responded.

“YC is not ‘soul-searching’,” Livingston wrote. “Antonio participated in YC a decade ago, and I remember him as a decent person…I think if anything the YC community should be the ones defending Antonio, because many of us have first-hand knowledge of him, instead of just cherry picked quotes from a book. And we know from being in the startup world how often people are criticized unfairly by the press and in social media.”

Livingston’s post received hundreds of upvotes, while Damer’s post received a handful. Aggravated, Damer soon went to LinkedIn and Twitter to post screenshots of the interaction, “retracting” any previous praise she’d given to YC’s founders, and advising founders not to give up equity before VCs earn their trust.

Soon, a YC partner e-mailed Damer with an invitation to reach out to group partners or this partner directly about any YC concerns, according to a document shared with TechCrunch by the accelerator. The partner also explained that one of the community rules at Bookface was not to share anything from the forum with anyone outside of YC. The partner asked Damer to take down the Bookface screenshots. Damer did not respond to the email and did not take down the screenshots.

Less than two weeks later, Damer received a second email from the partner, this time with a clear message: Because she did not delete her posts, Damer had been removed from Bookface and could reach out if she wished to re-engage.

The communication was extensive compared with the organization’s handling of Biggar’s tweet, and suggests that YC did a far better job in following its own protocols in Damer’s case.

Either way, Damer thinks that YC’s guidelines encourage complacency, especially around issues of diversity, and suggests her waning enthusiasm for the organization ties directly to its not “stepping up” for “women when given the chance.” Adds Damer, “I don’t think any one of [the partners] is malicious, I actually think they are good people. It’s more about the complacency — that is what bothers me so much,” she said.

As for whether she regrets airing her exasperation publicly, she suggests she didn’t have a choice. “People use rules when they don’t know what else to do. This is about courage, this is about actually standing up for what is right.”

There is plainly an argument for and against Y Combinator’s deciding to remove founders from its forum. It’s typical of investors to ask portfolio companies to agree to certain terms and conditions. In this case, YC specifically alerts those who join its organization that the privilege of using Bookface comes with its own, additional, terms and conditions.

Still, whether the terms and conditions around its community are fair or reasonable could become a question mark in the minds of founders who haven’t yet applied to the program — as could YC’s different handling of two founders who broke the rules.

Broadly speaking, people within communities who feel like they are not being heard internally — yet who are also being asked not to express their disdain publicly — are pushing back on such limits. Coinbase saw at least 60 employees leave last fall after being told that the company would no longer tolerate internal political dissent or debate. In late May, the company Basecamp reportedly lost a third of its staff following disagreements over the company’s attitude toward internal political debates. Most recently, Medium lost half its staff in July after a strategy shift and an internally criticized culture memo.

Because of its successful track record, YC may be more powerful as an institution than any one company, but rivals are always looking for weaknesses, and asking members not to air their grievances outside of YC could ultimately impair the outfit. A generation of founders and operators is showing it is less and less willing to suppress a viewpoint in the service of others, and the most talented of these individuals have no shortage of options when it comes to both mentorship and capital.

YC, with its extensive network — perhaps even because of it — may increasingly find it isn’t immune to the trend.

Powered by WPeMatico