TC

Auto Added by WPeMatico

Auto Added by WPeMatico

In January, former Uber executive Liz Meyerdirk announced that she took over as chief executive of The Pill Club. The company, which offers an online birth control prescription and delivery service to hundreds of thousands of women, had hit record revenues, crossing $100 million in annual run rate for the first time in its four-year history.

She found the bridge between ride-sharing to healthcare to be smoother than some might expect, saying that she focused on how to apply technology “to logistics for an everyday use case, [to know] how that simplifies your everyday life.”

Now, six months into her new job, Meyerdirk announced that her company has raised more capital to capitalize on the momentum in women’s health right now. The Pill Club announced today that it has raised a $41.9 million Series B extension round led by Base 10. Existing investors, including ACME, Base10, GV, Shasta Ventures and VMG, participated in the round, as well as new investors, including Uber’s Dara Khosrowshahi and Honey’s George Ruan and iGlobe.

The extension round comes over two years after the company announced its initial Series B investment, a $51 million financing led by VMG Partners. After reportedly being valued at $250 million, the company declined to provide its latest valuation, other than saying that the extension was an up-round.

When a customer joins The Pill Club, they are given a medical questionnaire and a digital form to input personal information. The company gives them a sense of how much the service will cost, and if the price works, it connects them to a nurse either live or via text.

“In a happy case, you can see a nurse immediately,” she said. “Obviously if it’s midnight, we haven’t figured that out yet.” The nurse walks though different options, since, Meyerdirk added, “contraception is not one size fits all.”

Once a customer makes a decision, The Pill Club can then prescribe birth control through their own pharmacy, which will be delivered to their door within two or three days.

The Pill Club launched in 2016 with an at-home delivery service of birth control. Between 2016 and January 2021, it launched in 43 states plus the District of Columbia. It has added five states in the past six months, and plans to get to 50 states by the end of 2021.

The company makes money from medical visits, insurance reimbursement for prescription drugs and cash patients who aren’t covered by insurance.

The chief executive views a big part of its value proposition as embedding with existing insurance plans of its customers, including Medi-CAL and Family PACT. In the last three months, 16% of The Pill Clubs’ new patients were on Medicaid.

“You’ve got companies like Oscar [Health] that are reimagining health insurance, and you’ve got Ro, Hims and Hers, who are [taking] cash as a primary…way to serve…patients,” she said. “That’s fantastic for those who can afford it, but for us, because so much of our value system is around access to equity, we believe everyone should have the right to get access to birth control.”

The company believes that it has to work within the system of insurance to have true innovation.

“Telemedicine that ignores the reality of insurance is always going to have a limited piece of the pie,” a spokesperson from the company said said. “Cash-only systems simply aren’t a product built for a scale. A truly innovative healthcare platform exists within the realities of the system.”

Long-term, The Pill Club wants to replace the old model of going to a primary care provider for annual visits with ongoing care for women.

“I’m generally healthy [but] I actually do have questions on mammograms…colonoscopies, or anything,” Meyerdirk said. “And being able to have a person other than my mom” to talk to that doesn’t require a trip to the doctor or urgent care is the gap that The Pill Club wants to fill.

“We think it’s too good to be true, when we actually get what we deserve,” Meyerdirk said when describing women’s health. Part of her goal going forward is to think bigger, beyond contraception, and figure out how The Pill Club could bring a digital refresh to other areas of women’s health.

In March, the company launched a dermatology pilot, and also expanded its 2020 period care pilot. A portion of the new capital is earmarked toward launching new services for its members.

The Pill Club also shared the diversity metrics of its 350-person staff as part of its announcement.

The Pill Club has 72% of employees identifying as women, and 28% of employees identifying as male. The executive leadership similarly sees predominantly women, with the ratio being 62.5% women and 37.5% male. As for racial diversity, the overall company identifies as 33% white, 19% Asian, 16% Hispanic or Latino and 14% Black or African American; 13% of employees declined to identify.

“We’re by women for women,” Meyerdirk said. “It’s very, very different when you’re by men, for women.” Her appointment came as The Pill Club’s founder and former chief executive officer Nick Chang stepped down from day to day operations. He didn’t take a board seat, but does still have shares in the company.

Liz Meyerdirk, chief executive of The Pill Club. Image Credits: The Pill Club

The wave of prescription, for-delivery medication is only getting bigger, with The Pill Club joined by startups such as Nurx and SimpleHealth, and bigger corporations such as Walmart and Amazon.

“The idea of creating more choice and flexibility across healthcare is long overdue,” she said. “Everyone deserves to have great options when they consider who can best address their daily needs.”

Editor’s note: A prior version of this story noted that The Pill Club does birth control for pick up. This is incorrect. It delivers birth control through its own pharmacies. A correction has been made to reflect this change.

Powered by WPeMatico

Dataiku is going downstream with a new product today called Dataiku Online. As the name suggests, Dataiku Online is a fully managed version of Dataiku. It lets you take advantage of the data science platform without going through a complicated setup process that involves a system administrator and your own infrastructure.

If you’re not familiar with Dataiku, the platform lets you turn raw data into advanced analytics, run some data visualization tasks, create data-backed dashboards and train machine learning models. In particular, Dataiku can be used by data scientists, but also business analysts and less technical people.

The company has been mostly focused on big enterprise clients. Right now, Dataiku has more than 400 customers, such as Unilever, Schlumberger, GE, BNP Paribas, Cisco, Merck and NXP Semiconductors.

There are two ways to use Dataiku. You can install the software solution on your own, on-premise servers. You can also run it on a cloud instance. With Dataiku Online, the startup offers a third option and takes care of setup and infrastructure for you.

“Customers using Dataiku Online get all the same features that our on-premises and cloud instances provide, so everything from data preparation and visualization to advanced data analytics and machine learning capabilities,” co-founder and CEO Florian Douetteau said. “We’re really focused on getting startups and SMBs on the platform — there’s a perception that small or early-stage companies don’t have the resources or technical expertise to get value from AI projects, but that’s simply not true. Even small teams that lack data scientists or specialty ML engineers can use our platform to do a lot of the technical heavy lifting, so they can focus on actually operationalizing AI in their business.”

Customers using Dataiku Online can take advantage of Dataiku’s pre-built connectors. For instance, you can connect your Dataiku instance with a cloud data warehouse, such as Snowflake Data Cloud, Amazon Redshift and Google BigQuery. You can also connect to a SQL database (MySQL, PostgreSQL…), or you can just run it on CSV files stored on Amazon S3.

And if you’re just getting started and you have to work on data ingestion, Dataiku works well with popular data ingestion services. “A typical stack for our Dataiku Online Customers involves leveraging data ingestion tools like FiveTran, Stitch or Alooma, that sync to a cloud data warehouse like Google BigQuery, Amazon Redshift or Snowflake. Dataiku fits nicely within their modern data stacks,” Douetteau said.

Dataiku Online is a nice offering to get started with Dataiku. High-growth startups might start with Dataiku Online as they tend to be short on staff and want to be up and running as quickly as possible. But as you become bigger, you could imagine switching to a cloud or on-premise installation of Dataiku. Employees can keep using the same platform as the company scales.

Powered by WPeMatico

Niantic has encouraged the world to roam the streets as Pokémon trainers and wizards… next up? Time to transform and roll out.

Eighties mega toy Transformers is the latest IP to partner with Niantic to build a map-heavy, geolocation-centric game.

Details are still a bit light, but here’s just about everything we know:

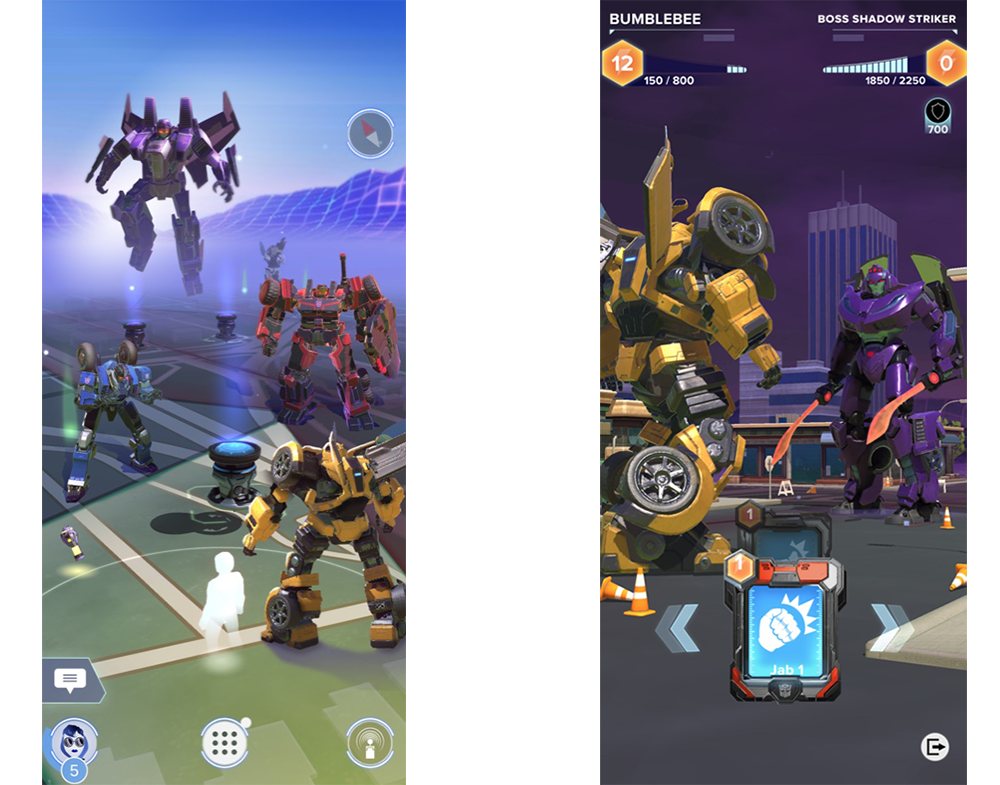

They’ve only released a bit of concept art so far, and it suggests gameplay not unlike GO and Wizards Unite. That battle screen on the right definitely looks a whole lot like a Pokémon GO battle:

Image Credits: Niantic

Will this one take over the world the way Pokémon GO did in the summer of 2016? Maybe not — that one hit a lot of the right notes at the right time, the perfect blend of novelty and nostalgia. But Wizards Unite has found enough of an audience that it’s still in active development two years after launch, so it seems Niantic sees room for more map-centric games. A rep for Niantic mentioned this being one of 10 real-world titles that the company currently has in development, suggesting that they see lots of room there.

Powered by WPeMatico

Google today announced that it is making Workspace, the service formerly known as G Suite (and with a number of new capabilities), available to everyone, including consumers on free Google accounts. The core philosophy behind Workspace is to enable deeper collaboration between users. You can think of it as the same Google productivity apps you’re already familiar with (Gmail, Calendar, Drive, Docs, Sheets, Slides, Meet, Chat, etc.), but with a new wrapper around it and deeper integrations between the different apps.

For individual users who want more from their Workspace, there will also be a new paid offering, though Google isn’t saying how much you’ll have to pay yet. (Update: Google Workspace Individual subscription will be $9.99/month, with an introductory price of $7.99/month.) With that, users will get access to “premium capabilities, including smart booking services, professional video meetings and personalized email marketing, with much more on the way.” We’ll likely hear more about this later this year. This new paid offering will be available “soon” in the U.S., Canada, Mexico, Australia, Brazil and Japan.

Consumers will have to switch from the classic Hangouts experience (RIP) to the new Google Chat to enable it — and with this update, all users will now have access to the new Google Chat, too. Until now, only paying G Suite/Workspace users had access to this new Workspace user experience.

“Collaboration doesn’t stop at the workplace — our products have been optimized for broad participation, sharing and helpfulness since the beginning,” said Javier Soltero, VP and GM, Google Workspace. “Our focus is on delivering consumers, workers, teachers and students alike an equitable approach to collaboration, while still providing flexibility that allows these different subsets of users to take their own approach to communication and collaboration.”

Once enabled, users will encounter quite a few user interface changes. The left rail, for example, will look a little bit like the bottom bar of Gmail on iOS and Android now, with the ability to switch between Mail, Chat, Meet and Spaces (which — yeah — I’m not sure anybody really understands this one, but more about this later). The right rail will continue to bring up various plugins and shortcuts to features like Google Calendar, Tasks and Keep.

A lot of people — especially those who simply want Gmail to be Gmail and don’t care about all of this collaboration stuff in their private lives — will hate this. But at least for the time being, you can still keep the old experience by not switching from Hangouts to the new Google Chat. But for Google, this clearly shows the path Workspace is on.

“Back in October of last year, we announced some very significant updates to our communication and collaboration product line and our business, starting with the new brand and identity that we chose around Google Workspace that’s meant to represent what we believe is the future direction and real opportunity around our product — less around being a suite of individual products and more around being an integrated set of experiences that represent the future of work,” Soltero explained in a press briefing ahead of today’s announcement.

And then there is “Spaces.” Until now, Google Workspace features a tool called “Rooms.” Rooms are now Spaces. I’m not quite sure why, but Google says it is “evolving the Rooms experience in Google Chat into a dedicated place for organizing people, topics, and projects in Google Workspace.”

Best I can tell, these are Slack-like channels where teams can not just have conversations around a given topic but also organize relevant files and upcoming tasks, all with an integrated Google Meet experience and direct access to working on their files. That’s all good and well, but I’m not sure why Google felt the need to change the name. Maybe it just doesn’t want you to confuse Slack rooms with Google rooms. And it’s called Google Workspace, after all, not Workroom.

New features for Rooms/Spaces include in-line topic threading, presence indicators, custom statuses, expressive reactions and a collapsible view, Google says.

Both free and paid users will get access to these new Spaces once they launch later this year.

But wait, there’s more. A lot more. Google is also introducing a number of new Workspace features today. Google Meet, for example, is getting a companion mode that is meant to foster “collaboration equity in a hybrid world.” The idea here is to give meeting participants who are in a physical meeting room and are interacting with remote participants a companion experience to use features like screen sharing, polls, in-meeting chat, hand raise and Q&A live captions on their personal devices. Every participant using the companion mode will also get their own video tile. This feature will be available in September.

Also new is an RSVP option that will allow you to select whether you will participate remotely, in a meeting room (or not at all), as well as new moderation controls to allow hosts to prevent the use of in-meeting chat and to mute and unmute individual participants.

On the security side, Google today also announced that it will allow users to bring their own encryption keys. Currently, Google encrypts your data, but it does manage the key for you. To strengthen your security, you may want to bring your own keys to the service, so Google has now partnered with providers like Flowcrypt, Futurex, Thales and Virtru to enable this.

“With Client-side encryption, customer data is indecipherable to Google, while users can continue to take advantage of Google’s native web-based collaboration, access content on mobile devices, and share encrypted files externally,” writes Google directors of product management Karthik Lakshminarayanan and Erika Trautman in today’s announcement.

Google is also introducing trust rules for Drive to give admins control over how files can be shared within an organization and externally. And to protect from real phishing threats (not those fake ones your internal security organization sends out every few weeks or so), Google is also now allowing admins to enable the same phishing protections it already offers today to content within an organization to help guard your data against insider threats.

Powered by WPeMatico

Twelve years ago, Joby Aviation consisted of a team of seven engineers working out of founder JoeBen Bevirt’s ranch in the Santa Cruz mountains. Today, the startup has swelled to 800 people and a $6.6 billion valuation, ranking itself as the highest-valued electric vertical take-off and landing (eVTOL) company in the industry.

As in any disruptive industry, the forecast may be cloudier than the rosy picture painted by passionate founders and investors.

It’s not the only air taxi company to reach unicorn status. The field is now dotted with new or soon-to-be publicly traded companies courtesy of mergers and special purpose acquisition companies. Partnerships with major automakers and airlines are on the rise, and CEOs have promised commercialization as early as 2024.

As in any disruptive industry, the forecast may be cloudier than the rosy picture painted by passionate founders and investors. A quick peek at comments and posts on LinkedIn reveals squabbles among industry insiders and analysts about when this emerging technology will truly take off and which companies will come out ahead.

Other disagreements have higher stakes. Wisk Aero filed a lawsuit against Archer Aviation alleging trade secret misappropriation. Meanwhile, valuations for companies that have no revenue yet to speak of — and may not for the foreseeable future — are skyrocketing.

Electric air mobility is gaining elevation. But there’s going to be some turbulence ahead.

Taking an eVTOL from design through to manufacturing and certification will likely cost about $1 billion, Mark Moore, then-head of Uber Elevate, estimated in April 2020 during a conference held by the Air Force’s Agility Prime program.

That means in some sense, the companies that will come out on top will likely be the ones that have managed to raise enough money to pay for all the expenses associated with engineering, certification, manufacturing and infrastructure.

“The startups that have successfully raised or that will be able to raise significant amounts of capital to get them through the certification process … that’s the number one thing that’s going to separate the strong from the weak,” Asad Hussain, a senior analyst in mobility technology at PitchBook, told TechCrunch. “There’s over 100 startups in the space. Not all of them are going to be able to do that.”

Just consider some of the expenses accrued by the biggest eVTOLs last year: Joby Aviation spent a whopping $108 million on research and development, a $30 million increase from 2019. Archer spent $21 million in R&D in 2020, according to regulatory filings. Meanwhile, Joby’s net loss last year was $114.2 million and Archer’s was $24.8 million, though, of course, neither company has brought a product to market yet. Operating expenses will likely only continue to grow into the future as companies enter into manufacturing and deployment phases.

What that means for the future of the industry is likely two things: more SPAC deals and more acquisitions.

Mobility companies, including those working on electrified transport, are often pre-revenue and have capitally intensive business models — a combination that can make it difficult to find buyers in a traditional IPO. SPACs have become increasingly popular as a shorter, less expensive path to becoming a public company. SPACs have also historically received less scrutiny than IPOs. Should the U.S. Securities Exchange Commission start to take a closer look at SPAC mergers in the future, it may impair the ability of other air taxi companies to go public this way, Hussain said.

That means market consolidation is nearly guaranteed, as smaller companies may find it more advantageous to sell than continue to raise more capital. It’s already begun: At the end of April, eVTOL developer Astro Aerospace announced the acquisition of Horizon Aircraft.

Horizon cited “greater access to capital” as one of the many benefits of the transaction, and other companies will likely find the buy or sell route to be the most beneficial on the road to commercialization. And just last week, British eVTOL Vertical Aerospace, which has an order for 150 aircraft from Virgin Atlantic, said it would go public via a merger with Broadstone Acquisition Corp. at an equity value of around $2.2 billion.

Powered by WPeMatico

This morning, Anna Heim and Alex Wilhelm dug into the EU insurtech market, interviewing European VCs and collating the biggest recent rounds to take the temperature of the waters across the pond:

Several European-based insurtech startups entered unicorn territory this year, such as Bought By Many, which offers pet insurance; London-based Zego; and Alan, a French startup that raised a $220 million round.

According to Brittain, EU startups in this sector are “still at the very early stages of innovation,” having only shown “a fraction of what’s possible” in a market that is “as large as banking.” Interestingly, he predicted that AI will play a larger role in the future as companies deploy it for fraud detection, improved customer experiences and processing claims more quickly.

“We are fully expecting the next generation of AI-driven business to unlock real-time risk analysis, pricing and claims resolution in the next few years,” he said.

Thanks very much for reading Extra Crunch; I hope you have a safe, relaxing weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Nigel Sussman (opens in a new window)

Earlier this week, The Exchange assessed the looming Monday.com IPO before reading the tea leaves about that flotation and three others to sum up the overall state of the market.

So what do the Marqeta, Monday.com, Zeta Global and 1stDibs debuts tell us? We may have been too conservative.

Image Credits: Bessemer Venture Partners / Toast

On a recent episode of Extra Crunch Live, we spoke to Toast founder Aman Narang and Kent Bennett of Bessemer Venture Partners about how they came together for a deal, what makes the difference for both founders and investors when fundraising, and the biggest lessons they’ve learned so far.

The episode also featured the Extra Crunch Live Pitch-Off, where audience members pitched their products to Bennett and Narang and received live feedback.

Extra Crunch Live is open to everyone each Wednesday at 3 p.m. EDT/noon PDT, but only Extra Crunch members are able to stream these sessions afterward and watch previous shows on-demand in our episode library.

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm and Anna Heim solicited feedback from investors to get a temperature on the market for AI startup investments.

“The startup investing market is crowded, expensive and rapid-fire today as venture capitalists work to preempt one another, hoping to deploy funds into hot companies before their competitors,” they write. “The AI startup market may be even hotter than the average technology niche.”

But that’s not surprising. The Exchange was on it.

“In the wake of the Microsoft-Nuance deal, The Exchange reported that it would be reasonable to anticipate an even more active and competitive market for AI-powered startups,” Alex and Anna note. “Our thesis was that after Redmond dropped nearly $20 billion for the AI company, investors would have a fresh incentive to invest in upstarts with an AI focus or strong AI component; exits, especially large transactions, have a way of spurring investor interest in related companies.”

Their expectation is coming true: Investors reported a fierce market for AI startups.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I started a tech company about two years ago, and ever since I’ve dreamed of expanding my company in the United States.

I would love to have a green card. Someone mentioned that I should apply for a diversity green card. Would you please provide me with more details about it and how to apply?

— Technical in Tanzania

Image Credits: MediaProduction (opens in a new window) / Getty Images

Pulley founder and three-time YC alum Yin Wu offers a tactical guide to getting a startup running in four days. Yes, just four days.

“The logistics of setting up a startup should be simple, because over the long run, complicated equity setups and cap tables cost more money in legal fees and administration time,” Wu notes.

Read on for guidance on how to get your business going in less than a week.

Image Credits: Natali_Mis / Getty Images

Innovaccer founder and CEO Abhinav Shashank and CTO Mike Sutten write in a guest column that the U.S. healthcare industry is in the middle of a massive transformation.

This shift, they write, “is being stimulated by federal mandates, technological innovation, and the need to improve clinical outcomes and communication between providers, patients and payers.”

Improving healthcare now means we need to process tremendous amounts of healthcare data. How do we do it? The cloud, which “plays a pivotal role in meeting the current needs of healthcare organizations.”

Image Credits: MrJub / Getty Images

SOSV’s Benjamin Joffe and Meghan Hind round up a “who’s who” from the venture capital firm’s SOSV Climate Tech 100, a list of the best startups addressing climate change that SOSV has supported from the very beginning.

“What can founders learn from the list about climate tech investors? In other words, who invested in the Climate Tech 100?” they ask.

Image Credits: Donald Iain Smith (opens in a new window) / Getty Images

Now that we can transact from anywhere, a new, hybrid class of software companies with embedded financial services are scooping up consumers — and investors are following the action.

Using data from a Battery Ventures report about “the intersection of software and financial services,” this post examines why these companies can be so hard to value and offers a framework for better understanding their business models and investor appeal.

Image Credits: Grant Faint (opens in a new window) / Getty Images

Geoffrey Moore’s “Chasm,” a framework for marketing technology products that has been one of the canonical foundational concepts to product-market fit for three decades, needs a bit of an upgrade, Flybridge Capital’s Jeff Bussgang writes.

“I have been reflecting on why it is that we venture capitalists and founders keep making the same mistake over and over again — a mistake that has become even more glaring in recent years,” he writes.

Bussgang goes on to consider the Chasm — and propose tweaks for thinking about market size in the modern era.

Powered by WPeMatico

Didi filed to go public in the United States last night, providing a look into the Chinese ride-hailing company’s business. This morning, we’re extending our earlier reporting on the company to dive into its numerical performance, economic health and possible valuation.

Recall that Didi has raised tens of billions worth of private capital from venture capitalists, private equity firms, corporations and other sources. The size of the bet riding on Didi is simply massive.

Didi is approaching the American public markets at a fortuitous moment. While the late-2020 IPO fervor, which sent offerings from DoorDash and others skyrocketing after their debuts, has cooled, valuations for public companies remain high compared to historical norms. And Uber and Lyft, two American ride-hailing companies, have been posting numbers that point to at least a modest recovery in the ride-hailing industry as COVID-19 abates in many parts of the world.

As further grounding, recall that Didi has raised tens of billions worth of private capital from venture capitalists, private equity firms, corporations and other sources. The size of the bet riding on Didi is simply massive. As we explore the company’s finances, then, we’re more than vetting a single company’s performance; we’re examining what sort of returns an ocean of capital may be able to derive from its exit.

In that vein, we’ll consider GMV results, revenue growth, historical profitability, present-day profitability and what Didi may be worth on the American markets, given current comps. Sound good? Into the breach!

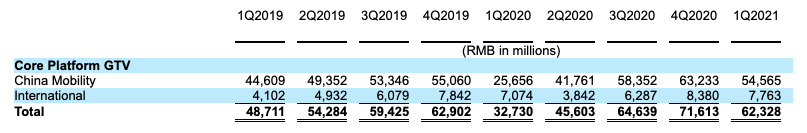

Starting at the highest level, how quickly has gross transaction volume (GTV) scaled at the company?

Didi is historically a business that operates in China but has operations today in more than a dozen countries. The impact and recovery of China’s bout with COVID-19 is therefore not the whole picture of the company’s GTV results.

COVID-19 began to affect the company starting in the first quarter of 2020. From the Didi F-1 filing:

Core Platform GTV fell by 32.8% in the first quarter of 2020 as compared to the first quarter of 2019, and then by 16.0% in the second quarter of 2020 as compared to the second quarter of 2019.

The dips were short-lived, however, with Didi quickly returning to growth in the second half of the year:

Our businesses resumed growth in the second half of 2020, which moderated the impact on a year-on-year basis. Our Core Platform GTV for the full year 2020 decreased by 4.8% as compared to the full year 2019. Both our China Mobility and International segments were impacted, but whereas the GTV for our China Mobility segment decreased by 6.6% from 2019 to 2020, the GTV for our International segment increased by 11.4% from 2019 to 2020.

Holding to just the Chinese market, we can see how rapidly Didi managed to pick itself up over the last year. Chinese GTV at Didi grew from 25.7 billion RMB to 54.6 billion RMB from the first quarter of 2020 to the first quarter of 2021; naturally, we’re comparing a more pandemic-impacted quarter at the company to a less-affected period, but the comparison is still useful for showing how the company recovered from early-2020 lows.

The number of transactions that Didi recorded in China during the first quarter of this year was also up more than 2x year over year.

On a whole-company basis, Didi’s “core platform GTV,” or the “sum of GTV for our China Mobility and International segments,” posted numbers that are less impressive in growth terms:

Image Credits: Didi F-1 filing

You can see how quickly and painfully COVID-19 blunted Didi’s global operations. But seeing the company settle back to late-2019 GTV numbers in 2021 is not super bullish.

Takeaway: While Didi managed an impressive GTV recovery in China, its aggregate numbers are flatter, and recent quarterly trends are not incredibly attractive.

Powered by WPeMatico

Now that we have your attention, know this: Prices go up tonight on passes to TC Early Stage 2021: Marketing & Fundraising. If you’re an early-stage founder (pre-seed through Series A), don’t miss this chance to save $100 on our two-day virtual event dedicated to helping you build a stronger startup. It’s one of the best investments you’ll ever make.

It’s Now O’clock: Buy your pass here before the sale expires tonight at 11:59 p.m. (PT).

Why should you attend TC Early Stage 2021? Chloe Leaaetoa, the founder of Socicraft and an Early Stage 2020 attendee, explains:

What you learn at Early Stage is so much better than the random information you find on YouTube. You get to interact with industry experts and ask them specific questions. It’s like a mini bootcamp, and you’re going to walk away with a lot of knowledge.

What can you expect at Early Stage 2021? The first day is packed with presentations designed to help you learn (or deepen your knowledge of) essential startup skills — product fit, growth marketing, fundraising and a whole bunch more. We’ve tapped some of the best startup ecosystem experts who will not only impart their wisdom, but they’ll also take and answer your questions.

Check out the event agenda and our roster of speakers.

We’re talking an interactive experience — from which you’ll take away tips and advice that you can implement in your business now when you need it most. Case in point, again from Chloe Leaaetoa:

Sequoia Capital’s session, Start with Your Customer, looked at the benefits of storytelling and creating customer personas. I took the idea to my team, and we identified seven different user types for our product, and we’ve implemented storytelling to help onboard new customers. That one session alone has transformed my business.

Day two is all about the TC Early-Stage Pitch-Off. Tune in and watch as 10 early-stage founders bring the heat. Each team will deliver a five-minute pitch in front of TC editors, global investors, press and hundreds of attendees. After each team pitches, they’ll engage in a five-minute Q&A with our panel of top VC judges.

You’ll learn so much by watching those pitches and hearing the VC’s questions. It’s a great way to improve your own pitch deck. And if notetaking is not your forte, don’t stress. All sessions, including the pitch-off, will be available courtesy of video-on-demand.

TC Early Stage 2021: Marketing & Fundraising takes place July 8-9, but you have just hours left before the early bird flies south and the prices head north. It’s now o’clock — beat the deadline and register here before 11:59 p.m. (PT) tonight.

Is your company interested in sponsoring or exhibiting at Early Stage 2021: Marketing & Fundraising? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The war for talent in the tech world can be brutal — and so, it turns out, can the war between platforms that help companies source it. In the latest developement, Toptal — a marketplace for filling engineering and other tech roles with freelance, remote workers — has filed a lawsuit against direct competitor Andela and several of its employees, alleging the theft of trade secrets in pursuit of “a perfect clone of its business”, according to the complaint. All of the Andela employees previously worked at Toptal.

Toptal’s lawsuit, filed in the Supreme Court of the State of New York and embedded below, alleges that the employees reneged on confidentiality, non-solicitation and non-compete agreements with Toptal. Toptal also alleges interference with contract, unfair competition and misappropriation of trade secrets.

While both Toptal and Andela have built businesses around the idea of remote freelancers filling tech jobs — a concept that has increased in profile and acceptance as people shifted to remote work during the pandemic — the pair only emerged as very direct competitors in the last year or so.

Toptal was co-founded by CEO Taso Du Val in 2010, and since then it has grown to become one of the world’s most popular on-demand talent networks. The company matches skilled tech personnel like engineers, software developers, designers, finance experts and product managers to clients across the globe. According to company data, it currently serves over 1,000 clients in more than 10 countries.

Andela, on the other hand, only recently turned to using a similar approach. Founded in 2014 in Lagos, Andela’s original business model was based on building physical hubs to source, vet, train and house talent across the continent. It did this in Kenya, Nigeria, Rwanda and Uganda.

However, Andela struggled with scaling and operating that business model, and in 2019 it laid off 400 developers. Early last year as the pandemic took hold, it laid off a further 135 employees. However this time around it did so with a strategy pivot in mind: after testing satellite models in Egypt and Ghana, the talent company decided to go forego physical hubs completely and go remote, first across Africa in 2020 and globally this year.

“We thought, ‘What if we accelerated [the African remote network] and just enabled applicants from anywhere?’ Because it was always the plan to become a global company. That was clear, but the timing was the question,” Andela CEO Jeremy Johnson told TechCrunch in April.

Yet Toptal believes Andela’s choice to scrap its hubs and source remote talent from everywhere was specifically to replicate Toptal’s business model — and success.

“Until recently, Andela operated an outsourcing operation focused on in-person, on-site hubs in Africa,” Toptal notes in the complaint. “Over the course of the past year, Andela has moved away from its prior focus on in-person hubs situated in Africa and is engaging in a barely disguised attempt to become a clone of Toptal.”

Toptal claims that for Andela to pull off a “perfect clone of its business,” it poached key Toptal employees to exploit their knowledge, and that the ex-employees knowingly breached their confidentiality and non-solicitation obligations to Toptal.

Companies often try to uncover each other’s trade secrets by poaching, and many blatantly copy a competitor and do so without repercussions. On top of this, these two are hardly the only two places to for tech talent to connect with remote freelance job opportunities. Others include Fiverr, Malt, Freelancer.com, LinkedIn, Turing, Upwork and many more.

In a global economy with an estimated 1 billion so-called knowledge workers, and with freelancers accounting for some 35% of the world’s workforce, it’s a pretty gigantic market, which you could alternately look at as a major opportunity, but also a ripe field for many players with multiple permutations of the marketplace concept.

So why is Toptal crying foul play? The company says its ex-employees have not only revealed Toptal’s trade secrets and confidential information to compete unfairly but are also poaching additional Toptal personnel, clients and the talent that Toptal matches and sources to clients.

The ex-employees cited by Toptal include Sachin Bhagwata, vice president of enterprise; Martin Chikilian, head of talent operations; Courtney Machi, vice president of product; and Alvaro Oliveira, executive vice president of talent operations. Toptal says three additional former employees in non-executive roles breached express covenants not to compete in their agreements with Toptal.

While some of the allegations focus on the expertise of the employees, one of the trade secret allegations more directly references Toptal’s technology.

Toptal claims Machi tapped into her extensive knowledge of Toptal’s “proprietary software platform” and used that to help transform Andela “from a group of outsourcing hubs situated in various African locations into a fully remote, global company like Toptal.”

Asked to comment on the suit, Johnson at Andela said he believes Toptal is suing Andela for being competitive.

“With regards to the situation overall, I can say that frivolous lawsuits are the price of doing anything that matters,” he told TechCrunch in an email. “And this is the kind of baseless bullying and fear tactics that make employees want to leave in the first place. We will defend ourselves and our colleagues vigorously.”

Toptal has an unconventional story for a company that started only a decade ago. It is one of the few companies in the Valley that doesn’t issue stock options to its investors or employees. Even Du Val’s co-founder, Breanden Beneschott, was ousted from the company without any shares, according to an article from The Information.

How did it pull this off? In 2012, Toptal raised a $1.4 million seed via convertible notes and investors were entitled to 15% of the company, according to The Information article.

But there was one condition: Toptal had to raise more money.

However, the company hasn’t needed to secure additional capital because of its profitability and growing revenue ($200 million annually as of 2018, per The Information). So investors are stuck in limbo — as are employees who joined hoping that the company would raise money down the line so their stock options would convert.

The Information story strikes a distinct note of resentment, noting that some employees felt “tricked out of stock in a company that Du Val has said publicly is worth more than $1 billion.”

Given that situation, TechCrunch asked Du Val if he thought it played any role in employee departures, and ex-employee relations.

“The issuance of stock options does not excuse theft of trade secrets,” he replied. “Also, there are more than 800 full-time people at Toptal [but] the complaint names seven individual defendants.”

The full complaint is embedded below.

Powered by WPeMatico

Beauty and wellness businesses have come roaring back to life with the decline of COVID-19 restrictions, and a startup that’s built a platform that caters to the many needs of small enterprises in the industry today is announcing a big round of funding to grow with them.

Fresha — a multipurpose commerce tool for independent wellness and beauty businesses such as hair, nail and skin salons, yoga instructors and more, based first and foremost around a completely free subscription platform for those businesses to schedule bookings from customers — has picked up $100 million.

Fresha plans to use the funds to expand the list of countries where it operates, to grow the categories of companies that use its services (mental health practitioners is one example; fitness is another) and to build more services complementing what it already provides, helping customers do their work by providing them with more insights and data about what they do already. It will also be making acquisitions to expand its customer base.

General Atlantic is leading this Series C, with Huda Kattan, Michael Zeisser of FMZ Ventures and Jonathan Green of Lugard Road Capital also participating, along with past investors Partech, Target Global and FJ Labs.

Fresha has raised $132 million to date, and it’s not disclosing its valuation. But as a point of reference, when it closed its Series B (as Shedul; the company rebranded in February 2020), it was valued at $105 million.

Chances are that figure is significantly higher now.

Fresha’s current range of services include a free-to-use platform for booking appointments; free software for managing accounts; a payments service that includes both a physical point of sale and digital interface; and a wider marketplace both to provide goods to the businesses (B2B); and for the businesses to sell goods to customers (B2C).

The London-based company has 50,000 business customers and 150,000 stylists and professionals in 120+ countries (mostly in the U.K., the U.S., Canada, Australia, New Zealand and Europe), with some 250 million appointments booked to date.

And while many businesses did have to curtail how they operated (and in some countries had to stop operating altogether), Fresha found that it was attracting a lot of new business in part because of its “free” model that meant customers didn’t have to pay to maintain a booking platform at a time when they weren’t taking bookings, but could use Fresha to generate revenues in other ways (such as through the sale of goods, vouchers for future services and more.)

So in a year when you might have thought that a company based around providing services to industries that were hard hit by COVID would have also been hard-hit, in fact Fresha saw a 30x increase in card payment transactions versus the year before, and more than $12 billion worth of booking appointments made on its platform.

In a market that is very crowded with tech companies building platforms to book beauty (and other) services and to manage the business of independent retailers — they include giants like Lightspeed POS, as well as smaller players like Booksy (which also recently raised) and StyleSeat, but also players like Square and PayPal, and many others — the core of Fresha’s offering is a booking platform built as a totally free product.

Why free? To attract more users to its other services (such as payments, which do come at a price), and because co-founders William Zeqiri (CEO) and Nick Miller (product chief) — pictured above, respectively left and right — think this the only way to build a business like this in a crowded market.

“We believe that software is a commodity,” said Zeqiri in an interview. “A lot of our competitors are beating each other on price to the bottom. We wanted to consolidate the supply side of the software, gather data about the businesses, how they use what they use.”

That data led, first, to identifying the need for and building out software and launching its B2B and B2C marketplaces, and the idea is that it will likely lead to more products as it continues to mature, whether it’s better analytics for its current customers so that they can better price or develop their services accordingly, or entirely new tools for new categories of users.

Meanwhile, the services that it already provides, like payments, have taken off like a shot, not least because they’ve served a need for any virtual transactions, like selling vouchers or items.

Miller noted that while a lot of its customers actually interface with tech with a lot of reluctance — they are the essence of “physical” retailers when you think about it — they also found themselves having to use more digital services simply because of circumstances. “Looking back at what happened, tech adoption accelerated for our customers,” said Miller. He said that current customers usage for the point-of-sale systems and online payments is roughly equal.

Looking ahead, Fresha’s investor list is notable for its strategic mix and might shed some light on how it grows. Kattan, a “beauty influencer” and the founder of Huda Beauty, is investing by way of HB Investments, a strategic venture arm; while Zeisser’s FMZ focuses on “experience economy” investments today, but he himself has a long history working at tech companies building marketplaces, including years with Alibaba as head of its U.S. investment practice. These speak to areas where Fresha is likely interested in expanding its reach — more marketplace activity; and perhaps more social media angles and exposure for its customers at a time when social media really has become a key way for beauty and wellness businesses to market themselves.

“Fresha has emerged as a leader powering the beauty and wellness industry,” said Aaron Goldman, Global co-head of financial services and managing director at General Atlantic, in a statement. “William, Nick and the Fresha team have built a product that is resonating with the market and creating long-term value through the intersection of its payments, software and marketplace offerings. We are thrilled to be partnering with the company and believe Fresha has significant opportunity to further scale its innovative platform.”

“I’ve witnessed firsthand the positive impact Fresha has for beauty entrepreneurs,” added Kattan. “The company is a force for good in the growing community of beauty professionals around the globe, who are increasingly adopting a self-employed approach. By making top business software accessible without any subscription fees, Fresha lets professionals focus on what they do best — offering great experiences for their customers.”

Powered by WPeMatico