TC

Auto Added by WPeMatico

Auto Added by WPeMatico

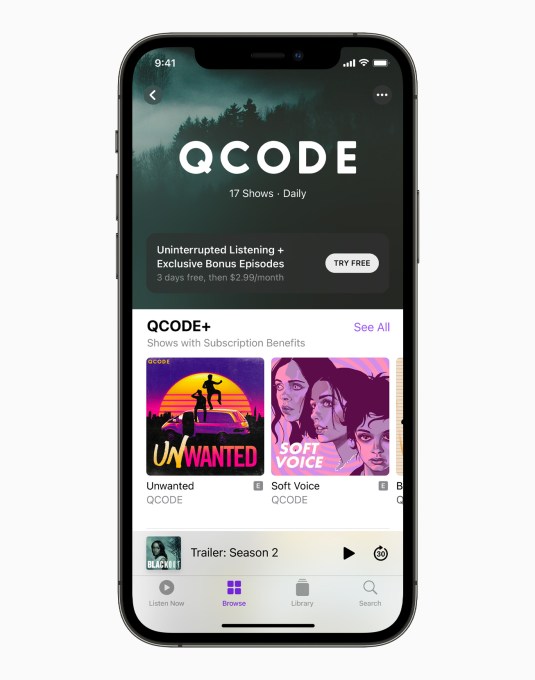

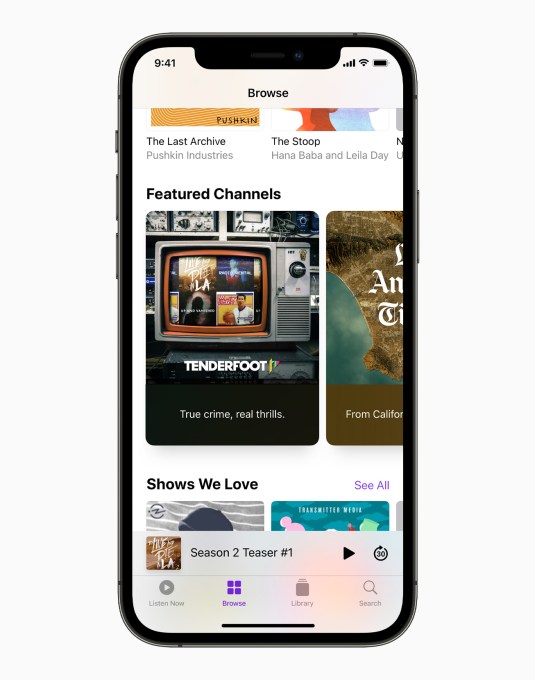

Apple Podcasts Subscriptions are now live across more than 170 countries and regions, Apple announced this morning. First unveiled this spring, subscriptions allow listeners to unlock additional benefits for their favorite podcasts, including things like ad-free listening, early access to new episodes, bonus material, exclusives or whatever else the podcast creator believes will be something their fans will pay for. Channels allow podcasters to group their shows however they like — for instance, to highlight a set of shows with a shared theme, or to offer different mixes of free and paid content.

The new subscription features were initially set to arrive in May, but Apple later emailed creators that the launch was being pushed to June. This was likely due to a series of back-end issues impacting the service, including things like delayed episodes and malfunctioning analytics, among other things.

At launch, Apple says there are thousands of subscriptions and channels available, with more expected to arrive on a weekly basis.

When listeners purchase a subscription to a show, they’ll automatically follow the show in the redesigned Apple Podcasts app. The show’s page will also be updated with a Subscriber Edition label, so they’ll be able to more easily tell if they have access to the premium experience.

The app’s Listen Now tab will expand with new rows that provide access to paid subscriptions, including their available channels.

In the app, users can discover channels from show pages and through Search, browse through recommendations from the Listen Now and Browse tabs, and share channels with friends through Messages, Mail and other apps.

Apple’s delay to invest in the Podcasts market has given its rivals a head start on growing their own audience for podcasts. At the time of the spring announcement of subscriptions, for example, an industry report suggested that Spotify’s podcast listeners would top Apple’s for the first time in 2021.

Despite the competition, Apple is betting its massive install base will bring in creators. Those creators agree to pay Apple a 30% cut of their subscription revenue in year one, just like subscription-based iOS apps. That cut drops to 15% in year two. Spotify, by comparison, is taking no revenue cut for the next two years while its program gets off the ground. It will then take only a 5% fee.

Based on the debut lineup, it seems many creators and studios believe Apple’s footprint is worth the larger revenue share.

Early adopters of subscriptions include notable names like Lemonada Media, Luminary, Realm and Wondery; media and entertainment brands, including CNN, NPR, The Washington Post and Sony Music Entertainment.

Other studio participants include Audio Up, Betches Media, Blue Wire, Campside Media, Imperative Entertainment, Lantigua Williams & Co., Magnificent Noise, The Moth, Neon Hum Media, Three Uncanny Four, Wondery, Audacy’s Cadence13 and Ramble, Barstool Sports, Jake Brennan’s Double Elvis, Headgum, iHeartMedia’s The Black Effect, Big Money Players, Grim & Mild, Seneca Women, Shondaland, Relay FM, Tenderfoot TV, Radiotopia from PRX, Pushkin Industries, QCODE and others,

Image Credits: Apple

In the news category, there’s also The Athletic, Fox News, Los Angeles Times, Bloomberg Media, Politico and Vox Media, plus channels from other newspapers, magazines, broadcasters, radio stations and digital publishers, including ABC News, Axios, Billboard, Bravo, CNBC, CNN, Crooked Media, Dateline, Entertainment Weekly, Futuro Media, The Hollywood Reporter, LAist Studios, National Geographic, MSNBC, NBC News, NBC Sports, New York Magazine, The New York Times, SiriusXM, SB Nation, Southern Living, The Verge, TODAY, VICE, Vogue, Vox and WBUR.

Kids’ podcasts are also available, including those from GBH, Gen-Z Media, Pinna, Wonkybot Studios, TRAX from PRX and others.

Apple also highlighted independent creators offering subscriptions like “Birthful” with Adriana Lozada, “Pantsuit Politics” with Beth Silvers and Sarah Stewart Holland, “Snap Judgment” with Glynn Washington and “You Had Me At Black” with Martina Abrams Ilunga.

Image Credits: Apple

Meanwhile, international subscriptions and channels are being offered from ABC, LiSTNR and SBS from Australia; Abrace Podcasts from Brazil; CANADALAND and Frequency Podcast Network from Canada; GoLittle from Denmark; Europe 1, Louie Media, and Radio France from France; Der Spiegel, Podimo, and ZEIT ONLINE from Germany; Il Sole 24 Ore and Storielibere.fm from Italy; J-WAVE from Japan; Brainrich from Korea; libo/libo from Russia; Finyal Media from the UAE; and Broccoli Productions, The Bugle, Content Is Queen, the Guardian, Immediate Media, and Somethin’ Else from the U.K.

Subscriptions start at $0.49 U.S. per month and go up, with some popular shows priced at $2.99 per month and some channels, like Luminary, at $4.99 per month, to give you an idea of pricing. Apple Card users get a 3% cash back on their subscriptions, which can be viewed in Apple Wallet.

Once subscribed, you can listen across Apple devices, including iPhone, iPad, Mac, Apple Watch, Apple TV, CarPlay, HomePod and HomePod mini.

Subscriptions were announced alongside a redesigned version of the Apple Podcasts app, which has received a number of usability complaints and sent some users in search of third-party apps. Apple has been responding to user feedback and addressed some issues in the iOS 14.6 update with other Library tab updates planned to arrive in future releases, perhaps iOS 14.7.

Powered by WPeMatico

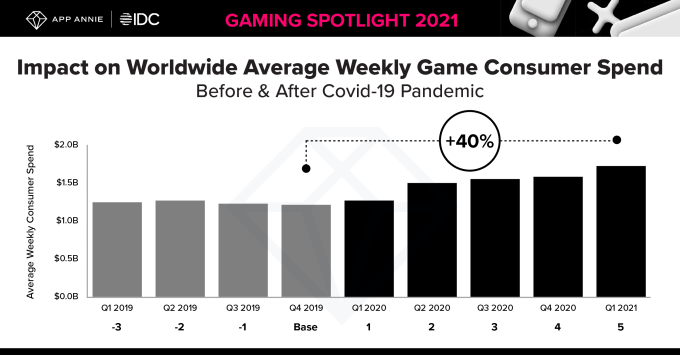

The COVID-19 pandemic drove increased demand for mobile gaming, as consumers under lockdowns looked to online sources of entertainment, including games. But even as COVID-19 restrictions are easing up, the demand for mobile gaming isn’t slowing. According to a new report from mobile data and analytics provider App Annie in collaboration with IDC, users worldwide downloaded 30% more games in the first quarter of 2021 than in the fourth quarter of 2019, and spent a record-breaking $1.7 billion per week in mobile games in Q1 2021.

That figure is up 40% from pre-pandemic levels, the report noted.

Image Credits: App Annie

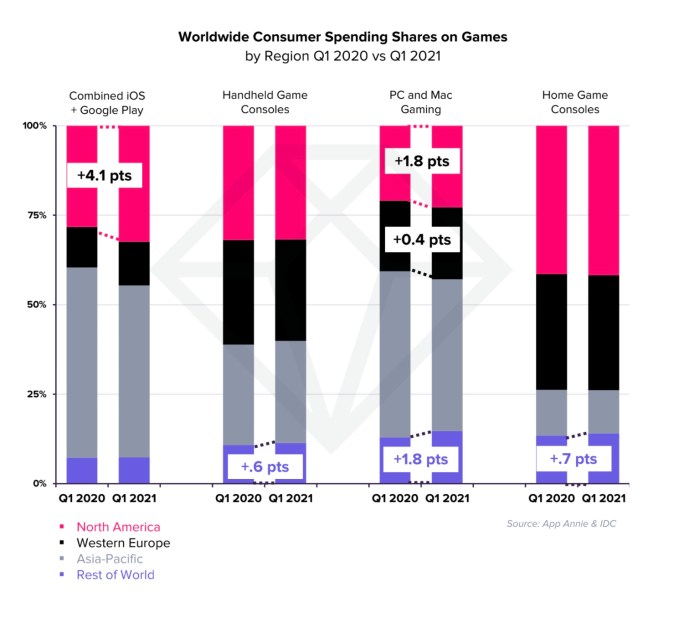

The U.S. and Germany led other markets in terms of growth in mobile game spending year-over-year as of Q1 2021 in the North American and Western European markets, respectively. Saudi Arabia and Turkey led the growth in the rest of the world, outside the Asia-Pacific region. The latter made up around half of the mobile game spend in the quarter, App Annie said.

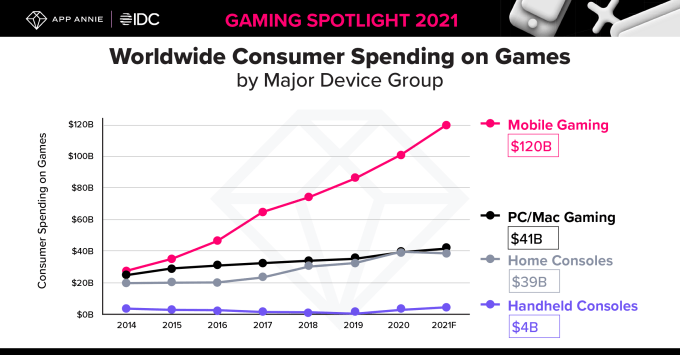

The growth in mobile gaming, in part accelerated by the pandemic, also sees mobile further outpacing other forms of digital games consumption. This year, mobile gaming will increase its global lead over PC and Mac gaming to 2.9x and will extend its lead over home games consoles to 3.1x.

Image Credits: App Annie

However, this change comes at a time when the mobile and console market is continuing to merge, App Annie notes, as more mobile devices are capable of offering console-like graphics and gameplay experiences, including those with cross-platform capabilities and social gaming features.

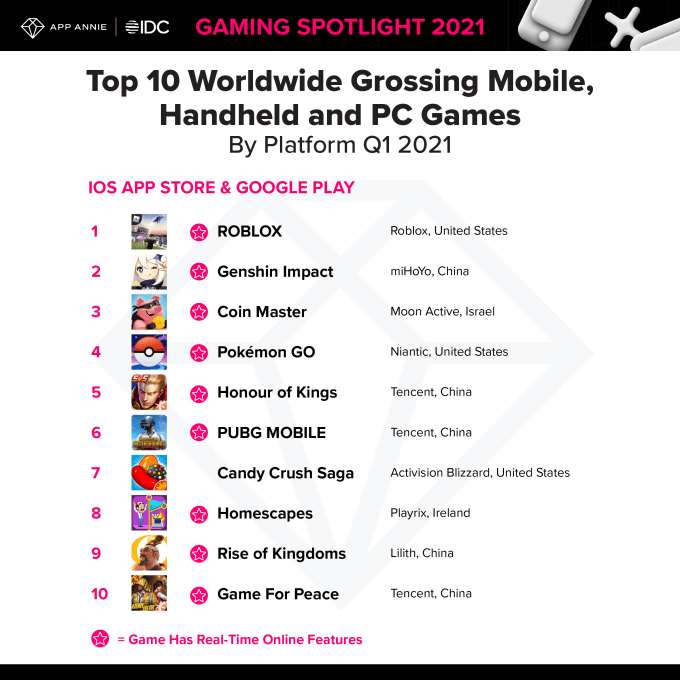

Games with real-time online features tend to dominate the Top Grossing charts on the app stores, including things like player-vs-player and cross-play features. For example, the top grossing mobile game worldwide on iOS and Google Play in Q1 2021 was Roblox. This was followed by Genshin Impact, which just won an Apple Design Award during the Worldwide Developer Conference for its visual experience.

Image Credits: App Annie

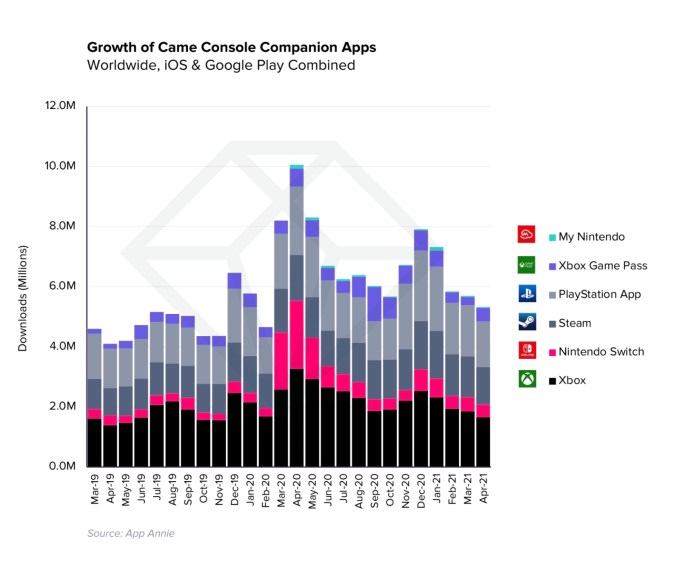

The report also analyzed the ad market around gaming and the growth of mobile companion apps for game consoles, including My Nintendo, Xbox Game Pass, PlayStation App, Steam, Nintendo Switch and Xbox apps. Downloads for these apps peaked under lockdowns in April 2020 in the U.S., but continue to see stronger downloads than pre-pandemic.

Image Credits: App Annie

On the advertising front, App Annie says user sentiment toward in-game mobile ads improved in Q3 2020 compared with Q3 2019, but rewarded video ads and playable ads were preferred in the U.S.

Powered by WPeMatico

G2 Venture Partners, a firm that spun out of Kleiner Perkins Caufield & Byers, has raised $500 million to support entrepreneurs that aim to make existing industries more efficient, environmentally friendly and socially responsible.

With Fund II, G2 is most bullish about technologies in transportation, logistics, manufacturing, agriculture and energy, with an increasing focus on sustainability, according to a spokesperson for the firm.

“The launch of our second fund expands our ability to work with companies that are moving the needle to redefine and revolutionize their respective industries,” said G2VP founding partner David Mount in a statement. “We will continue to partner with technology companies that are pushing the future of industry forward, driving economic growth with reduced resource intensity.”

Investors in the new fund include Shell Ventures, Mitsui & Co., Daimler AG, ABB Switzerland Ltd. and The McKnight Foundation, a G2 spokesperson told TechCrunch. John Doerr, famed investor and VC at Kleiner, also personally invested in the fund. Doerr invested in G2VP’s initial $350 million fund back in 2018, and he’s known for delivering an emotional TED Talk in which he argued for increased investments in clean energy.

The team’s interest in sustainability and cleantech goes back to Kleiner. While at Kleiner Perkins, the team led rounds in AVEVA-acquired industrial data management platform OSIsoft and solar energy company Enphase. In 2017, Doerr stepped back in to help Enphase with another $10 million alongside T.J. Rodgers.

G2 would not provide names of portfolio companies for this newest fund yet, but a spokesperson did say Fund II will be investing in a new set of companies. Any follow-on investments in companies from Fund I will be made out of that fund.

The firm invested in 15 late-stage companies in Fund I and expects to invest in a similar number of companies in Fund II. G2 typically invests $10 million to $50 million in each company. Past portfolio companies include lidar manufacturer Luminar, EV tech company Proterra, computer vision solutions provider Scandit, autonomous robot company Seegrid and agricultural supply chain platform ProducePay, among others.

“This team has consistently shown vision and taken action that is ahead of the curve on many aspects of the digital industrial transition the world is in the midst of,” said Robert Linck, chief investment officer of Shell Ventures, a limited partner in G2’s first and second funds, in a statement. “The brain trust at this firm will be a significant asset to the new generation of technology leaders and path breakers that is emerging today.”

Powered by WPeMatico

Carro, one of the largest automotive marketplaces in Southeast Asia, announced it has hit unicorn valuation after raising a $360 million Series C led by SoftBank Vision Fund 2. Other participants include insurance giant MSIG and Indonesian-based funds like EV Growth, Provident Growth and Indies Capital. About 90% of vehicles sold through Carro are secondhand, and it offers services that cover the entire lifecycle of a car, from maintenance to when it is broken down and recycled for parts.

Founded in 2015, Carro started as an online marketplace for cars, before expanding into more verticals. Co-founder and chief executive officer Aaron Tan told TechCrunch that, roughly speaking, the company’s operations are divided into three sections: wholesale, retail and fintech. Its wholesale business works with car dealers who want to purchase inventory, while its retail side sells to consumers. Its fintech operation offers products for both, including B2C car loans, auto insurance and B2B working capital loans.

Carro’s last funding announcement was in August 2019, when it said it had extended its Series B to $90 million. The company’s latest funding will be used to fund acquisitions, expand its financial services portfolio and develop its AI capabilities, which Carro uses to showcase cars online, develop pricing models and determine how much to charge insurance policyholders.

It also plans to expand retail services in its main markets: Indonesia, Thailand, Malaysia and Singapore. Carro currently employs about 1,000 people across the four countries and claims its revenue grew more than 2.5x during the financial year ending March 2021.

The COVID-19 pandemic helped Carro’s business because people wanted their own vehicles to avoid public transportation and became more receptive to shopping for cars online. Those factors also helped competitors like OLX Autos and Carsome fare well during the pandemic.

The adoption of electric vehicles across Southeast Asia has resulted in a new tailwind for Carro, because people who buy an EV usually want to sell off their combustion engine vehicles. Carro is currently talking to some of the largest electric vehicle countries in the world that want to launch in Southeast Asia.

“For every car someone typically buys in Southeast Asia, there’s always a trade-in. Where do cars go, right? We are a marketplace, but on a very high level, what we’re doing is reusing and recycling. That’s a big part in the environmental sustainability of the business, and something that sets us apart of other players in the region,” Tan said.

Cars typically stay in Carro’s inventory for less than 60 days. Its platform uses computer vision and sound technology to replicate the experience of inspecting a vehicle in-person. When someone clicks on a Carro listing, an AI bot automatically engages with them, providing more details about the cost of the car and answering questions. They also see a 360-degree view of the vehicle, its interior and can virtually start the engine to see how it sounds. Listings also provide information about defects and inspection reports.

Since many customers still want to get an in-person look before finalizing a purchase, Carro recently launched a beta product called Showroom Anywhere. Currently available in Singapore, it allows people to unlock Carro cars parked throughout the city, using QR codes, so they can inspect it at any time of the day, without a salesperson around. The company plans to add test driving to Showroom Anywhere.

“As a tech company, our job is to make sure we automate everything we can,” said Tan. “That’s the goal of the company and you can only assume that our cost structure and our revenue structure will get better along the years. We expect greater margin improvement and a lot more in cost reduction.”

Pricing is fixed, so shoppers don’t have to engage in haggling. Carro determines prices by using machine-learning models that look at details about a vehicle, including its make, model and mileage, and data from Carro’s transactions as well as market information (for example, how much of a particular vehicle is currently available for sale). Carro’s prices are typically in the middle of the market’s range.

Cars come with a three or seven-day moneyback guarantee and 30-day warranty. Once a customer decides to buy a car, they can opt to apply for loans and insurance through Carro’s fintech platform. Tan said Carro’s loan book is about five years old, almost as old as the startup itself, and is currently about $200 million.

Carro’s insurance is priced based on the policyholders driving behavior as tracked by sensors placed in their cars. This allows Carro to build a profile of how someone drives and the likelihood that they have an accident or other incident. For example, someone will get better pricing if they typically stick to speed limits.

“It sounds a bit futuristic,” said Tan. “But it’s something that’s been done in the United States for many years, like GEICO and a whole bunch of other insurers,” including Root Insurance, which recently went public.

Tan said MSIG’s investment in Carro is a “statement that we are really trying to triple down in insurance, because an insurer has so much linkage with what we do. The reason that MSIG is a good partner is that, like ourselves, they believe a lot in data and the difference in what we call ‘new age’ insurance, or data-driven insurance.”

Carro is also expanding its after-sale services, including Carro Care, in all four of its markets. Its after-sale services reach to the very end of a vehicle’s lifecycle and its customers include workshops around the world. For example, if a Toyota Corolla breaks down in Singapore, but its engine is still usable, it might be extracted and shipped to a repair shop in Nairobi, and the rest of its parts recycled.

“One thing I always ask in management meetings, is tell me where do cars go to die in Indonesia? Where do cars go to die in Thailand? There has to be a way, so if there is no way, we’re going to find a way,” said Tan.

In a statement, SoftBank Investment Advisers managing partner Greg Moon said, “Powered by AI, Carro’s technology platform provides consumers with full-stack services and transparency throughout the car ownership process. We are delighted to partner with Aaron and the Carro team to support their ambition to expand into new markets and use AI-powered technology to make the car buying process smarter, simpler and safer.”

Powered by WPeMatico

When Cory Siskind finished school, she was dropped into a high-stakes job helping large multinational corporations manage their operational security in Mexico City, with almost no relevant lived experience. Eventually, she realized that this was more or less par for the course in the corporate security field, which lagged behind other mission-critical enterprise services, like information security.

The industry still relied on recent grads doing manual work like combing through blogs and local news reports, and on security industry veterans with contacts on the ground to build a sort of “whisper network” of ground truth. Those things are obviously still valuable, but advancements in technology mean that there are many, many more sources of information that can provide valuable insight into the security situation in any particular country, region or even neighborhood, and machine learning has progressed to the point where it can do a lot of the legwork involved in helping analysts parse the data.

Cory tells us all about how she came to the conclusion that Base Operations needed to be built to bring modern tech to bear on the capabilities gap she saw in how companies manage their global security footprint, and how she set out getting the skills needed to build her startup as a sole founder. We talk about the challenges of fundraising in an area where most traditional VCs likely feel out of their depth, and building a sales operation that can handle big clients even very early on in her startup’s life.

We loved our time chatting with Cory, and we hope you love yours listening to the episode. And of course, we’d love if you can subscribe to Found in Apple Podcasts, on Spotify, on Google Podcasts or in your podcast app of choice. Please leave us a review and let us know what you think, or send us direct feedback either on Twitter or via email at found@techcrunch.com. And please join us again next week for our next featured founder.

Powered by WPeMatico

Andrea Campos has struggled with depression since she was eight years old. Over the years, she’s tried all sorts of therapies — from behavioral to pharmacotherapy.

In 2017, when Campos was in her early 20s, she learned to program and created a system to help manage her mental health. It started as a personal project, but as she talked to more people, Campos realized that many others might benefit from the system as well.

So she built an application to provide access to mental health tools for Spanish-speaking people and began testing it with a small group. At first, Campos herself was her own chatbot, texting with users who were tired of dealing with depression.

“During the month, I was pretending I was an app, and would send these people a list of activities they had to complete during the day, such as writing in a gratitude journal, and then asking them how those activities made them feel,” Campos recalls.

Her thinking was that sometimes with depression and anxiety comes “a lot of avoidance,” where people resist potential treatment out of fear.

The results from her small experiment were encouraging. So, Campos set out to conduct a bigger sample of experiments, and raised about $10,000 via a crowdfunding campaign. With that money, she hired a developer to build a chatbot for her app, which was mostly being used via Facebook Messenger.

Then an earthquake hit Mexico City and that developer lost everything — including his home and computer — and had to relocate.

“I was left with nothing,” Campos says. But that developer introduced her to another, who disappeared with his payment, and again, left Campos, “with nothing.”

“I realized at the beginning of 2019, I was going to have to do this by myself,” Campos said. So she used a site that she described as a “Wix for chatbots,” and created one herself.

After experimenting with the app with a sample of 700 people, Campos was even more encouraged and raised an angel round of funding for Yana, the startup behind her app. (Yana is an acronym for “You Are Not Alone.”) By early 2020, with just three months of runway left, she pivoted to create an app with chatbot integration that wasn’t just limited to use via Facebook Messenger.

Campos ended up launching the app more broadly during the same week that her city in Mexico went into quarantine.

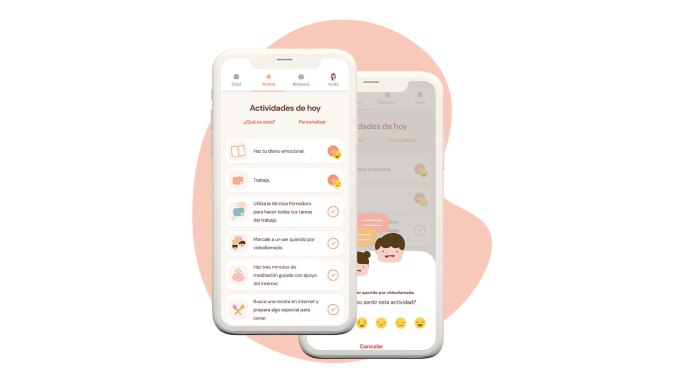

Image Credits: Yana

At first, she said, she saw “normal, steady growth.” But then on October 10, 2020, Apple’s App Store highlighted Yana for International Mental Health Day, and the response was overwhelming.

“It was also my birthday so I was at a spa in a nearby town, relaxing, when I started hearing my cell phone go crazy,” Campos recalls. “Everything went nuts. I had to go back to Mexico City because our servers were exploding since they were not used to having that kind of volume.”

As a result of that exposure, Yana went from having around 80,000 users to reaching 1 million users two weeks later. Soon after that, Google highlighted the app as one of best for personal growth in 2020, and that too led to another spike in users. Today, Yana is about to hit the 5 million-user mark and is also announcing it has raised $1.5 million in funding led by Mexico’s ALLVP, which has also invested in the likes of Cornershop, Flink and Nuvocargo.

When the pandemic hit last year, six of Yana’s nine-person team decided to quarantine together in a “startup house” in Cancun to focus on building the company. Earlier this year, the company had raised $315,000 from investors such as 500 Startups, Magma and Hustle Fund. The company had pitched ALLVP, which was intrigued but wanted to wait until it could write a bigger check.

That time is now, and Yana is now among the top three downloaded apps in Mexico and 12 countries, including Spain, Chile, Ecuador and Venezuela.

With its new capital, Yana is planning to “move away from the depression/anxiety narrative,” according to Campos.

“We want to compete in the wellness space,” she told TechCrunch. “A lot of people were looking for us to deal with crises such as a breakup or a loss but then they didn’t always see a necessity to keep using Yana for longer than the crisis lasted.”

Some of those people would download the app again months later when hit with another crisis.

“We don’t want to be that app anymore,” Campos said. “We want to focus on whole wellness and mental health and transmit something that needs to be built every single day, just like we do with exercise.”

Moving forward, Yana aims to help people with their mental health not just during a crisis but with activities they can do on a daily basis, including a gratitude journal, a mood tracker and meditation — “things that prevent depression and anxiety,” Campos said.

“We want to be a vitamin for our soul, and keeping people mentally healthy on an ongoing basis,” she said. “We also want to include a community inside our application.”

ALLVP’s Federico Antoni is enthusiastic about the startup’s potential. He first met Campos when she was participating in an accelerator program in 2017, and then again recently.

The firm led Yana’s latest round because it “wanted to be on her team.”

“She [Campos] has turned into an amazing leader, and we realized her potential and strength,” he said. “Plus, Yana is an amazing product. When you download it, it’s almost like you can see a soul in there.”

Powered by WPeMatico

For most startups, the hardest early challenge is identifying a market and a product to serve it. That wasn’t the case for Nubank CEO David Velez, who understood the massive potential for success if he could break into Latin America’s most valuable economy with even a moderately modern banking offering.

Instead, the challenge was how to rebuild the concept of a bank in a country where banking is widely hated, all while the incumbents heavily entrenched with the state worked to block every move.

Nubank knew its market and geography, and through tenacious fundraising, inventive marketing and product development, and a series of contrarian hires, Velez and his team stripped bare the morass of Brazilian banking to build one of the world’s great fintech companies.

The challenge was how to rebuild the concept of a bank in a country where banking is widely hated, all while the incumbents heavily entrenched with the state worked to block every move.

In the first part of this EC-1, I’ll look at how Velez brought his skills and experience to bear on this market, how Nubank was founded in 2013, and how the team brought a Californian rather than Brazilian vibe to their first office on — no joke — California Street, in a neighborhood called Brooklin in the city of São Paulo.

The idea of being his own boss was ingrained in Velez from his earliest days in Colombia, where he grew up in an entrepreneurial family, with a father who owned a button factory. “I heard from my dad over and over again that you need to start your own company,” Velez said.

But years would pass and Velez still had no idea what he wanted to do. To “kill time,” and also to surround himself with entrepreneurial energy, Velez attended Stanford University — partially financed by the sale of some livestock — and then worked as an analyst at Goldman Sachs and Morgan Stanley before switching to venture capital at General Atlantic and Sequoia.

Powered by WPeMatico

As we mentioned in part 1 of this EC-1, David Velez had two key co-founding roles he needed to fill to get started building Nubank. For one, he needed a CTO to lead the engineering side of the business, as Velez didn’t have an engineering background.

Edward Wible, an American computer science graduate who spent most of his career in private equity, would take that responsibility. He didn’t bring years of coding experience, but he had qualities that Velez considered more important: A strong belief in the potential of the product and an equally intense commitment to working on it.

Given the occasionally hostile reaction of most incumbent banks to their customers in Brazil, Nubank’s starkly contrasting openness and transparency has garnered a huge following.

That left an even more important role to fill — one that was much harder to define. This other co-founder would need to blend knowledge of the Brazilian market and local savvy with expertise in banking, all while embodying a Silicon Valley ethos of focusing on customers. This person would also have to work in São Paulo for minimal wages out of a small office with just one bathroom, all in the belief that their equity (both stock and sweat) would one day be worth it.

Velez would eventually stumble upon Cristina Junqueira, who was qualified to do all this, and much, much more.

“Once someone said I was the glue of the operation, and that someone else was the brains. And I said, ‘No, I’m the glue and the brains, and I bet my brain is even better than his,”’ Junqueira said.

Junqueira didn’t just lead Nubank’s drive into the Brazilian market, she also upended age-old notions of what it means to be a 21st-century bank. Her inspiration was nothing short of Disney, and her mission was to create a bank as popular as the magical kingdom itself.

A bank. As popular as Disney. Sounds like a fairy tale, frankly.

Unlike her co-founders Velez and Wible, Junqueira grew up in Nubank’s home market of Brazil. The eldest of four sisters, she remembers her parents — both dentists — always assiduously working to maintain their practice.

Their work ethic trickled down, but so did responsibility. As the oldest at home, she was forced to grow up quickly and take on responsibilities from an early age. “I remember being 11 years old and doing grocery shopping for the month,” she said. “I did everything very young.”

Powered by WPeMatico

As we saw in parts 1 and 2 of this EC-1, by mid-2013, Nubank CEO David Velez had most of what he needed to get started. He’d brought on two co-founders, assembled ambitious engineering and operations teams, raised $2 million in seed funding from Sequoia and Kaszek, rented a tiny office in São Paulo, and was armed with a mission to deliver the kind of banking services that customers in a market as large and lucrative as Brazil’s should expect.

Despite being named Nubank, however, the startup couldn’t actually be a bank: Brazil’s laws made it illegal at the time for a foreigner-run company to operate a bank. That restriction required the team to develop an inventive product strategy to find a foothold in the market while they waited for a license directly from the country’s president.

Nubank was so adamant about differentiating itself from other banks that it chose Barney purple for its brand color and first credit card.

Nubank therefore pursued a credit card as its first offering, but it had to race against a clock counting quickly down to zero. At the time, Brazil didn’t have ownership restrictions on this product segment like it did with banking, but new rules were coming into force in just a few months in May 2014 that would block a company like Nubank from launching.

The company needed to execute rapidly over the next eight months if it wanted to be grandfathered into the existing regulations. The speed of operations was frantic to say the least, and the company would go on to work even faster, ultimately propelling itself into the stratosphere of fintech startups.

It’s easy to assume that the name Nubank refers to “new bank,” but that’s not really what the founders were going for. The word “nu” in Portuguese means “naked,” and Velez and his team wanted the name to reflect their vision: To build a 21st-Century bank without any of the shackles imposed by the traditional banks in Brazil.

The team wanted to offer services to as many people as possible, as there is a huge wealth gap in Brazil, where the minimum wage is around $200 a month.

Launching with just a credit card was both a strategic and practical business decision. Credit cards were widely used in the country, and everyone understood how they worked. Additionally, you could only use credit cards to shop online in Brazil, because debit cards weren’t accepted.

Powered by WPeMatico

Nubank’s first office, on California Street in the Brooklin neighborhood of São Paulo, makes for a great beginning to the company’s story. It wasn’t a Silicon Valley garage, but this tiny, one-bathroom rented house, where 30 people worked insane hours to push out the company’s debut credit card, lends just as well to an image of entrepreneurial spirit and drive.

As Nubank continues to make international waves, more and more VC investors are taking a look at the Brazilian ecosystem and could potentially fund other upstarts in the years to come.

But as Nubank’s story continued, the team eventually had to move out of that early office, and the next several offices, too. Eventually Nubank had to relocate to an eight-story building in São Paulo, which houses a large part of the company’s now 3,000-person team.

The startup reached decacorn status in far less than a decade, and it is growing faster than ever. When I interviewed CEO David Velez back in January to discuss Nubank’s $400 million Series G, he said, “We’ve gone from 12 million customers in 2019 to 34 million solely based on word of mouth.” By September last year, the company was onboarding 41,000 new customers per day.

In the five months since our interview, Nubank has managed to rope in a whopping 6 million customers to reach 40 million. It’s now valued at $30 billion.

Nubank’s present day headquarters in São Paulo, Brazil. Image Credits: NELSON ALMEIDA/AFP / Getty Images

Getting there hasn’t been easy. The company’s three co-founders, Velez, Edward Wible and Cristina Junqueira, had to make key strategic decisions about how to scale themselves to retain the company’s lead in the neobanking market. That lead is getting tougher to sustain every day. Nubank’s proliferating offerings and broader geographical remit has painted a massive target on its back, and a wide number of competitors have cropped up to run on the paths it pioneered.

Like most Disney films, a fairy-tale ending seems in order, but it’ll take a few more rotations of the film wheel to get to the ending.

For the co-founding trio, it became increasingly clear that Nubank’s growing scale demanded critical strategic decisions on how to bring order to the company.

By 2018, the company had thousands of employees, millions of customers, and they still didn’t have a head of HR. Growth until then had been somewhat unstructured. According to Junqueira, waiting so long to hire a head of HR was one of their early mistakes, because it stunted their ability to grow. “[Good] people continue to be our biggest bottleneck,” she says.

Powered by WPeMatico