TC

Auto Added by WPeMatico

Auto Added by WPeMatico

The U.K.’s more expansive, post-Brexit role in digital regulation continues to be felt today via a policy change by Google, which has announced that it will, in the near future, only run ads for financial products and services when the advertiser in question has been verified by the financial watchdog, the FCA.

The Google Ads Financial Products and Services policy will be updated from August 30, per Google, which specifies that it will start enforcing the new policy from September 6 — meaning that purveyors of online financial scams who’ve been relying on its ad network to net their next victim still have more than two months to harvest unsuspecting clicks before the party is over (well, in the U.K., anyway).

Google’s decision to allow only regulator-authorized financial entities to run ads for financial products and services follows warnings from the Financial Conduct Authority that it may take legal action if Google continued to accept unscreened financial ads, as the Guardian reported earlier.

The FCA told a parliamentary committee this month that it’s able to contemplate taking such action as a result of no longer being bound by European Union rules on financial adverts, which do not extend to online platforms, per the newspaper’s report.

Until gaining the power to go after Google itself, the FCA appears to have been trying to combat the scourge of online financial fraud by paying Google large amounts of U.K. taxpayer money to fight scams with anti-scam warnings.

According to the Register, the FCA paid Google more than £600,000 (~$830,000) in 2020 and 2021 to run “anti-scam” ads — with the regulator essentially engaged in a bidding war with scammers to pour enough money into Google’s coffers so that regulator warnings about financial scams might appear higher than the scams themselves.

The full-facepalm situation was presumably highly lucrative for Google. But the threat of legal action appears to have triggered a policy rethink.

Writing in its blog post, Ronan Harris, a VP and MD for Google UK and Ireland, said: “Financial services advertisers will be required to demonstrate that they are authorised by the UK Financial Conduct Authority or qualify for one of the limited exemptions described in the UK Financial Services verification page.”

“This new update builds on significant work in partnership with the FCA over the last 18 months to help tackle this issue,” he added. “Today’s announcement reflects significant progress in delivering a safer experience for users, publishers and advertisers. While we understand that this policy update will impact a range of advertisers in the financial services space, our utmost priority is to keep users safe on our platforms — particularly in an area so disproportionately targeted by fraudsters.”

The company’s blog also claims that it has pledged $5 million in advertising credits to support financial fraud public awareness campaigns in the U.K. So not $5 million in actual money then.

Per the Register, Google did offer to refund the FCA’s anti-scam ad spend — but, again, with advertising credits.

The U.K. parliament’s Treasury Committee was keen to know whether the tech giant would be refunding the spend in cash. But the FCA’s director of enforcement and market insight, Mark Steward, was unable to confirm what it would do, according to the Register’s report of the committee hearing.

We’ve reached out to the FCA for comment on Google’s policy change, and with questions about the refund situation, and will update this report with any response.

In recent years the financial watchdog has also been concerned about financial scam ads running on social media platforms.

Back in 2018, legal action by a well-known U.K. consumer advice personality, Martin Lewis — who filed a defamation suit against Facebook — led the social media giant to add a “report scam ad” button in the market as of July 2019.

However research by consumer group, Which?, earlier this year, suggested that neither Facebook nor Google had entirely purged financial scam ads — even when they’d been reported.

Per the BBC, Which?’s survey found that Google had failed to remove around a third (34%) of the scam adverts reported to it versus Facebook failing to remove well over a fifth (26%).

It’s almost like the incentives for online ad giants to act against lucrative online scam ads simply aren’t pressing enough.

More recently, Lewis has been pushing for scam ads to be included in the scope of the U.K.’s Online Safety Bill.

The sweeping piece of digital regulation aims to tackle a plethora of so-called “online harms” by focusing on regulating user generated content. However, Lewis makes the point that a scammer merely needs to pay an ad platform to promote their fraudulent content for it to escape the scope of the planned rules, telling the “Good Morning Britain” TV program today that the situation is “ludicrous” and “needs to change.”

It’s certainly a confusing carve-out, as we reported at the time the bill was presented. Nor is it the only confusing component of the planned legislation. However on the financial fraud point the government may believe the FCA has the necessary powers to tackle the problem.

We’ve contacted the Department for Digital, Media, Culture and Sport for comment.

Update: A government spokesperson said:

We have brought user-generated fraud into the scope of our new online laws to increase people’s protection from the devastating impact of scams. The move is just one part of our plan to tackle fraud in all its forms. We continue to pursue fraudsters and close down the vulnerabilities they exploit, are helping people spot and report scams, and we will shortly be considering whether tougher regulation on online advertising is also needed.

The government also noted that the Home Office is developing a Fraud Action Plan, which is slated to be published after the 2021 spending review; and pointed to the Online Advertising Programme that it said will consider the extent to which the current regulatory regime is equipped to tackle the challenges posed by the rapid technological developments seen in online advertising — including via a consultation and review of online advertising it plans to launch later this year.

Powered by WPeMatico

Toca Football, a nine-year-old, Costa Mesa, Ca.-based company that operates 14 sports centers across the U.S. that are focused on soccer training, has raised $40 million in Series E funding to roughly double the number of facilities that are now up and running in the U.S., as well as to open a site in the U.K. that CEO Yoshi Maruyama describes as a “highly themed game-experiences-based dining and entertainment facility focused on soccer training.”

Maruyama knows a thing or two about building destinations to which people gravitate. Before joining Toca — which was founded by the American former soccer player Eddie Lewis (“toca” refers to the first touch of the ball in soccer) — Maruyama spent six years as the global head of location-based entertainment for Dreamworks. He spent 14 years before that as an SVP with Universal Parks & Resorts.

Indeed, he was brought into Toca in 2019 to transform it from a manufacturing business that sells Major League Soccer teams a ball-tossing machine that Lewis had developed, to the services business it has become.

On its face, its new model seems like a pretty smart one, given soccer’s growing popularity in the U.S. According to Statista, the number of participants in U.S. high school soccer programs recorded an all-time high in the 2018/19 season, with more than 850,000 playing the sport across the country.

But Toca isn’t built just for kids, even if kids — and their parents –are its primary customers. According to Maruyama, there are several populations that are coming to its various centers throughout the day. In the morning, the centers feature a curriculum for children up to age six to introduce them to soccer; the afternoons feature largely one-on-one soccer training programs where Toca is able to employ its touch trainer; and during the evenings, Toca operates a leagues business for both children and adults.

Some of the centers are huge, by the way. Among Toca’s newest sites, for example, in Naperville, Illinois, outside of Chicago, it has built a 95,000-square-foot facility that features four indoor, full-size soccer fields, as well as one-on-one individual training spaces. (Maruyama suggests the company has been able to take advantage of a depressed commercial real estate market over the last year or so.)

Little wonder that investors see a big opportunity potentially.

The newest round of funding for Toca comes from earlier investors WestRiver Group, RNS TOCA Partners, and D2 Futbol Investors; they were joined by new investors, including angel investor Jared Smith, the co-founder and former COO of Qualtrics.

The company — which plans to expand into Asia as quickly as possible (China has been mandated by the country’s leadership to become “a first-class football superpower” by 2050) — has now raised $105 million in total funding.

Powered by WPeMatico

As companies expand worldwide and meet online in tools like Zoom, the language barrier can be a real impediment to getting work done. Zoom announced that it intends to acquire German startup Karlsruhe Information Technology Solutions or Kites for short, to bring real-time machine-learning-based translation to the platform.

The companies did not share the terms of the deal, but with Kites, the company gets a team of top researchers, who can help enhance the machine-learning translation knowledge at the company. “Kites’ talented team of 12 research scientists will help Zoom’s engineering team advance the field of [machine translation] to improve meeting productivity and efficiency by providing multilanguage translation capabilities for Zoom users,” the company said in a statement.

The deal appears to be an acqui-hire as the company adds those 12 researchers to the Zoom engineering group. It intends to leave the team in place in Germany with plans to build a machine-learning translation R&D center with additional hires over time as the company puts more resources into this area.

While the Kites website reveals little about it other than an address, the company’s About page on LinkedIn indicates that the startup was founded in 2015 by two researchers who taught at Carnegie Mellon and Karlsruhe Institute of Technology with the goal of building machine-learning translation tooling.

“The Kites mission is to break down language barriers and make seamless cross-language interaction a reality of everyday life,” the LinkedIn overview stated. It claims to be among a handful of companies, including Google and Microsoft, to have developed “leading speech recognition and translation technologies,” which would suggest that Zoom has acquired some key technologies.

It does not appear the company had a commercial product, but the site does indicate that there is a machine-learning translation platform that is in use in academia and government. Regardless, the fruits of the company’s research will now belong to Zoom.

Powered by WPeMatico

While the digital revolution has transformed nearly every social interaction and communication type in the past couple decades, the humble birthday card has shown surprising resiliency.

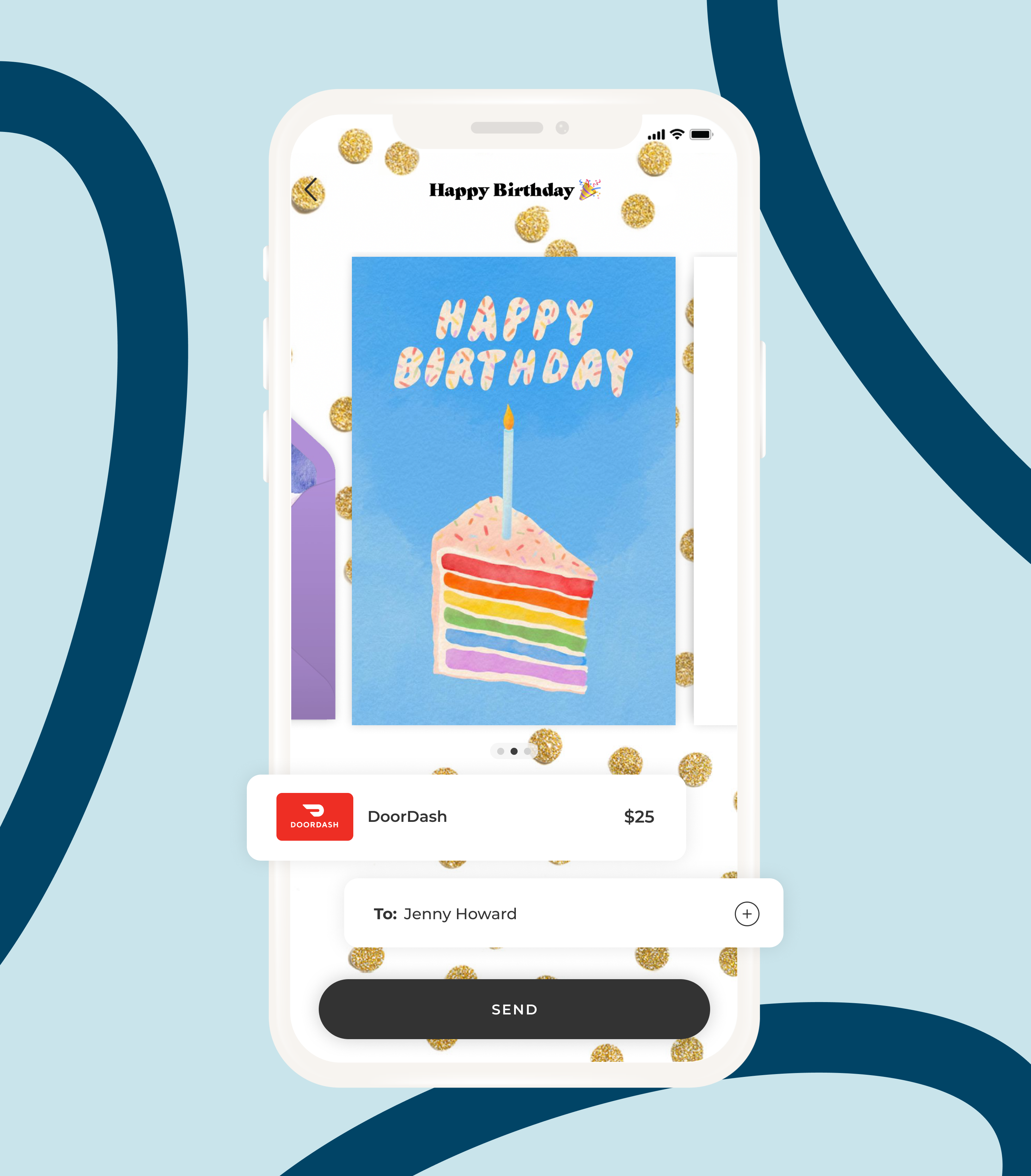

Givingli, a small LA-based startup with an app aiming to challenge how Gen Z sends digital greeting cards, is picking up some seed funding from investors betting on their philosophy around modern gifting. The startup has raised a $3 million seed round led by Reddit co-founder Alexis Ohanian’s Seven Seven Six, while Snap’s Yellow Accelerator also participated in the raise.

The wife and husband co-founding team stumbled into the world of digital greetings and gifts after abandoning physical invitations for their wedding and exploring how the digital greetings space had and hadn’t evolved. They’ve taken a mobile-first approach to tackling greetings for special events and moments where users just want to let someone know they’re thinking of them.

Image Credits: Givingli

“Initially, we thought it would mainly be birthdays and categories like weddings, graduation, etc., and I think we just threw in some ‘just because’ cards, but then that became the most popular category, by far,” CEO Nicole Emrani Green tells TechCrunch. “I think that it’s what kicked off our virality, because obviously with every Givingli sent you’re pulling someone else in and then the conversation continues.”

The app monetizes through a $3.99 monthly premium subscription that gives users access to a greater variety of digital greeting designs from the more than 40 artists that the startup has licensed work from. Alongside paying for premium subscriptions, users can also shop for digital gift cards to send along with their greetings. Givingli’s gift card storefront has more than 150 brands available including Amazon, Spotify, Nike and DoorDash.

A big sell for Givingli’s offering has been its customization. Although users are pushed to select from the hundreds of available greeting cards, they can also spice them up by adding photos or videos in addition to writing text. The aim is to create a moment that rivals messages that can be shared via email, text or on social media services.

“For a generation of digitally native users, it’s not surprising that the ability to like, swipe, upvote or shoot a quick text from our phones have become the predominant ways we connect with others,” said Ohanian in a press release announcing the seed round. “What first attracted me to Givingli is that Nicole and Ben acutely understood this evolution and built a platform that provides the creative tools needed to elevate those interactions and deepen connections. Whether it’s sending a digital birthday gift, or a note just because — it’s clear that Givingli has put snail mail on notice.”

One of the team’s big challenges has been highlighting the visibility of their native app that users download to send greetings. Last fall, the Givingli team debuted a partnership with Snap that brought their gifting service inside Snapchat via a bite-sized Snap Mini app integration. The rollout followed the startup’s participation in Snap’s Yellow Accelerator program.

Emrani Green says that partnership has helped bring more users to their platform, and that more than 5 million people have used Givingli to send greetings since the app launched in 2019.

Powered by WPeMatico

Bees are absolutely critical to the health of our agricultural system, ecosystem, and overall wellbeing as a species here on Earth. And yet bee populations are decreasing and extinction concerns are growing.

Beeflow, a startup that today announced the close of a $8.3 million Series A round, is looking to both save the bees and help farmers be more efficient and effective at the same time.

The startup uses proprietary scientific technology that essentially makes bees healthier, particularly in cold weather. A wealth of research led the company to understand that certain plant-based foods and molecules, when fed to the bees, can reduce the mortality rate of bees by up to 70 percent, and help them perform better in colder weather.

You might be wondering what I mean by performance. That’s fair.

Bees are the planet’s natural pollinators. They turn flowers into fruit, spreading pollen from one landing spot to another. Many farmers will ‘rent out’ bees from beekeepers to hang out on their farms and pollinate their plants. In almost every way, the effectiveness of this can’t be measured, and the bees themselves can’t truly be controlled.

Beeflow’s technology ensures that the bees are healthy and strong, and can fly up to 7x more during colder weather than they’d be able to without it. This means that those bees are much more likely to effectively and efficiently pollinate crops for the farmers.

Beyond reducing the mortality rate of bees, the company also offers a second product called ToBEE, which trains the bees to target a specific crop, such as blueberries or almonds.

Combined, these Beeflow products have increased crop yields for farmers up to 90 percent.

Beeflow’s business model is two-fold. They have their own bees that they loan out to farmers for pollination, and also work with beekeepers to bring them into the Beeflow network. Bee keepers do not pay for Beeflow’s technology, but do hand over the rights to their relationships with farmers.

The startup was founded by Matias Viel, who is from Argentina, and is mostly operational in Latin America and the West Coast of the U.S., with plans to expand to the East Coast and Mexico.

“The greatest challenge is operational and around execution,” said Viel. “There is so much demand and we need to scale our team and our operations now.”

The financing round was led by Ospraie Ag Science, with participation from Future Ventures’ Steve Jurvetson, Jeff Wilke, Vectr Ventures, SOSV’s IndieBio and Grid Exponential.

Powered by WPeMatico

TechCrunch has covered Acceleprise several times over the years, including a look at its mid-2020 accelerator startup batch from its three accelerators. The firm has long focused on business-to-business SaaS startups, helping them get their start in a competitive global software market.

As of today, Acceleprise is now Forum Ventures, according to the group’s CEO and managing partner, Michael Cardamone, and it has a bushel of funds to power its work. And befitting its new name, the company is now more than merely a collection of software-focused accelerators.

In addition to a new, larger $17 million fund for its pre-seed work, Forum Ventures has also raised its first seed fund. The new seed vehicle totals $13.2 billion, with Cardamone telling TechCrunch that the group intends to write checks ranging from $100,000 to $650,000 into rounds valued between $1 million and $4 million. It’s an actual seed fund, in other words.

While it’s interesting that Forum has put together a seed fund that will invest both in its accelerator graduates and other SaaS companies, the firm’s new pre-seed investing vehicle is noticeably larger than its preceding accelerator fund. Why is it so much bigger? Per Cardamone, the group added a third accelerator since its last fund, helping explain the size shift.

The technology market is also simply more expensive in every way than it was, and Forum has expanded its staff, so more capital under management makes sense.

There is synergy between the pre-seed and seed funds, of course. Forum can now better defend early ownership in standout companies from its accelerator batches. But why keep the door open to investing in other startups that it didn’t help incubate? It comes back to the company’s new name, it turns out. Cardamone and the team chose Forum Ventures because of the work it has done to build a SaaS community that from time to time spins up companies that didn’t go through Forum’s programs, he said, and it wants to invest in some of them.

Reasonable.

Undergirding Forum’s new raise are results from its earlier funds. Its first accelerator fund, deployed from the end of 2014 through the next two years, has returned “86% of committed capital to date and the rest of the fund is marked at 3.36X and growing with 18 companies still live at various stages,” the firm shared in an email.

Funds 2 and 3 are a bit nascent yet to have similarly concrete returns; we’ll have to wait a bit to see how they perform.

But TechCrunch did want to know, regardless, what impact COVID-19 had on Forum and its various funds and batches. Did they catch a COVID-induced wave? We wondered if some good recent results may have helped the firm raise not only larger funds, but two of them at the same time.

According to Cardamone, the answer is somewhat. In its most recent pre-seed fund, the CEO said that its accelerator cohorts are seeing more startups raise faster seed and Series A rounds. And, as TechCrunch has written lately, they are, at times, raising Series A deals at lower ARR thresholds than we might have expected. So, it’s a good time to be putting pre-seed dollars to work, we reckon, provided that you have the deal flow.

Forum is now 11 people, including six women and one nonbinary individual. That’s about as diverse in gender terms as we’ve seen in the SaaS venture capital world. From its new seed fund, 53% of Forum’s investments have had a woman or otherwise underrepresented founder. Not bad.

Now let’s see if Forum can replicate its early accelerator returns with more capital, more financial vehicles and more people.

Powered by WPeMatico

Accel announced Tuesday the close of three new funds totaling $3.05 billion, money that it will be using to back early-stage startups, as well as growth rounds for more mature companies. Notably, the 38-year-old Silicon Valley-based venture firm is doubling down on global investing.

The announcement underscores both the robust confidence investors continue to have for backing startups in the tech sector and the amount of money available to startups these days.

Specifically, today Accel is announcing its 15th early-stage U.S. fund at $650 million; its seventh early-stage European and Israeli fund also at $650 million and its sixth global growth stage fund at $1.75 billion. The latter fund is in addition, and designed to complement, a previously unannounced $2.3 billion global “Leaders” fund that is focused on later-stage investing that Accel closed in December.

Accel expects to invest in about 20 to 30 companies per fund on average, according to Partner Rich Wong. Its average investment in its growth fund will be in the $50 million to $75 million range, and $75 million and $100 million out of its global Leaders fund.

But the firm is also still eager and “excited” to incubate companies, Wong said.

“We’ll still write $500,000 to $1 million seed checks,” he told TechCrunch. “It’s important to us to work with companies from the very beginning and support them through their entire journey.”

Indeed, as TechCrunch recently reported, Accel has a history of backing companies that were previously bootstrapped (and often profitable) -– the latest example being Lower, a Columbus, Ohio-based fintech, which just raised a $100 million Series A.

Interestingly, Accel is often referred to some of these companies by existing portfolio companies (also in the case of Lower, whose CEO was referred to Accel by Galileo Clay Wilkes). More often than not, companies that Accel backs out of its early-stage and growth funds are bootstrapped and located outside of Silicon Valley.

The venture firm has long looked outside of Silicon Valley for opportunities, and has had offices not only in the Bay Area, but in London and Bangalore for years. Part of its investment thesis is to “invest early and locally,” according to Wong. Examples of this philosophy include investments in companies based all over the world — from Mexico to Stockholm to Tel Aviv to Munich.

Since the time of its last fund closure in 2019, the firm has seen 10 portfolio companies go public, including Slack, Austin-based Bumble, Bucharest-based UiPath, CrowdStrike, PagerDuty, Deliveroo and Squarespace, among others.

It also had 40 companies experience an M&A, including Utah-based Qualtrics’s $8 billion acquisition by SAP and Segment’s $3.2 billion acquisition by Twilio. Also, just last week, Rockwell Automation announced it was buying Michigan-based Plex Systems for $2.22 billion in cash. Accel first invested in Plex, which has developed a subscription-based smart manufacturing platform, in 2012.

Recent investments include a number of fintech companies such as LatAm’s Flink, Berlin-based Trade Republic, Unit and Robinhood rival Public. Accel has also backed as existing portfolio companies such as Webflow, a software company that helps businesses build no-code websites and events startup Hopin.

Wong says Accel is “open-minded but thematic” in its investment approach.

Accel Partner Sonali de Rycker, who is based out of London, agrees.

“For example, we’ll look at automation companies, consumer businesses and security companies, but at a global scale. Our goal is to find the best entrepreneurs regardless of where they are,” she said.

That has only been intensified by the recent rise of the smartphone and cloud, Wong said.

“Before, companies were mostly selling to the consumer in their own country,” he added. “But now the size of the market is so dramatically bigger, allowing them to become even larger, which is one of the reasons why I believe we’re seeing investment pace at this speed.”

To support this, it’s notable that Accel’s global Leaders fund is “dramatically” larger than the $500 million Leaders fund the firm closed in 2019.

Also, de Rycker points out, companies are staying private longer so the opportunity to invest in them until they sell or go public is greater.

Accel is also patient. In some cases, the firm’s investors will develop “years-long” relationships with companies they are courting.

“1Password is an example of this approach,” Wong said. “Arun [Mathew] had that relationship for at least six years before that investment was made. Finally, 1Password called and said ‘We’re ready, and we want you to do it.’ ”

And so Accel led the Canadian company’s first external round of funding in its 14-year history — a $200 million Series A — in 2019.

While the firm is open-minded, there are still some industries it has not yet embraced as much as others. For example, Wong said, “We’re not announcing a $2.2 billion crypto fund, but we have done crypto investments, and see some very interesting trends there. We’ll look at where crypto takes us.”

Powered by WPeMatico

Family offices have existed since the 1800s, but they’ve never been so manifold as in recent years. According to a 2019 Global Family Office Report by UBS and Campden Wealth, 68% of the 360 family offices surveyed were founded in 2000 or later.

Their rise owes to numerous factors, including the tech startups that mint new centi-millionaires and billionaires each year, along with the increasingly complex choices that people with so much moolah encounter. Think household administration, legal matters, trust and estate management, personal investments, charitable ventures.

Still, family offices tend to cater to people with investable assets of $1 billion or more, according to KPMG. Even multi-family offices, where resources are shared with other families, are more typically targeting people with at least $20 million to invest. That high bar means there are still a lot of people with a lot of resources who need hand-holding.

Enter Harness Wealth, a three-year-old, New York-based outfit that was founded by David Snider and Katie Prentke English to cater to individuals with increasingly complex financial pictures, including following liquidity events. The two understand as well as anyone how one’s vested interests can abruptly change — and how hard these can be to manage when working full-time.

Snider got his start out of school as an associate with Bain & Company and later as an associate with Bain Capital before becoming the first business hire at the real estate company Compass and getting promoted to COO and CFO after the company’s $25 million Series A raise in 2013. That little company grew, of course, and now, less than four months after its late-March IPO, Compass boasts a market cap of nearly $27 billion.

Indeed, over the years, Snider, who rejoined Bain as an executive-in-residence after 4.5 years with Compass, began to see a big opportunity in bringing together the often siloed businesses of tax planning and estate planning and investment planning, including it because “it resonated with me personally. Despite all these great things on my resume, every six months I found something I could or should have been doing differently with my equity.”

Prentke English is also like a lot of the clients to which Harness Wealth caters today. After spending more than six years at American Express, she spent two years as the CMO of London-based online investment manager Nutmeg. She left the role to start Harness after being introduced to Snider through a mutual friend; in the meantime, Nutmeg was just acquired by JPMorgan Chase.

While there is no shortage of wealth managers to whom such individuals can turn, Harness says it does far more than pair people with the right independent registered investment advisors — which is a key part of its business and part of the secret sauce of its tech platform, it says. It also helps its customers, depending on their needs, connect with a team of pros across an array of verticals — not unlike the access an individual might have if they were to have a family office.

As for how Harness makes money, it shares revenue with the advisers on the platform. Snider says the percentage varies, though it’s an “ongoing revenue share to ensure alignment with our clients.” In other words, he adds, “We only do well if they find long-term success with the advisers on our platform,” versus if Harness merely collected an upfront lead generation fee by pointing new customers to so-so financial planners or tax attorneys.

Ultimately, the company thinks it can replace a lot of the do-it-yourself services available in the market, like Personal Capital and Mint. That confidence is rooted in part in Snider’s experience with Compass, which, in its earlier days, though it could navigate around real estate agents but “found that while people wanted better data insights and a better user interface, they also wanted that coupled with someone who’d had many clients who looked like them,” says Snider.

He adds that Prentke English joined forces with him after discovering that Nutmeg, too, was “running into the limitations of a non-human-powered solution.”

Investors think the thesis makes sense, certainly. Harness just closed on $15 million in Series A funding led by Jackson Square Ventures, a round that brings the company’s total funding to $19 million. (Both new and existing investors include Bain Capital; Torch Capital; Activant; GingerBread Capital; FJ Labs; i2BF Ventures; First Minute Capital; Liquid2 Ventures; Alleycorp, Marc Benioff; Compass founder Ori Allon; and Paul Edgerley, who is the former co-head of Bain Capital Private Equity.

As for what Harness Wealth does with that fresh capital, part of it, interestingly, will be used to develop its own captive business line called Harness Tax. As Snider explains it, more of its clients are finding that tax planning is among their biggest concerns, given all that is happening on the IPO front, with SPACs, with remote work, and also with cryptocurrencies, into which more people are pouring money but around which the tax code has been playing catch-up.

It makes sense, given that tax planning can be time-sensitive and often dictate the overall financial planning strategy. At the same time, it’s fair to wonder whether some of Harness Wealth’s adviser partners will be turned off from working with the outfit if it thinks its partner is evolving into a rival.

Snider insists that Harness Wealth — which currently employs 22 people and is not-yet profitable — has no such designs. “Our goal is only to help people where we can add value, and we saw an opportunity to lean in on tax side.”

Harness has a “a very large population of people who may not understand their tax liabilities” because of the crypto boom in particular, he explains, adding, “We want to make sure we’re front and center” and ready to help as needed.

Powered by WPeMatico

Email has the highest return on investment of any other marketing channel. On average, email earns you $40 for every $1 spent. And the best part is that email is an owned channel, which means you can reach your subscriber directly instead of relying on social media algorithms to surface your content.

At Demand Curve, we’ve worked with over 500 startups, meticulously documenting growth tactics for all growth channels. We also incorporate what we’ve learned from our agency, Bell Curve, which works with Outschool, Imperfect Produce and Microsoft to name a few.

To understand how to use email marketing effectively, we interviewed email marketers at this year’s fastest-growing startups. This post covers the most profitable tactics they use that capture 80% of the value using 20% of the effort.

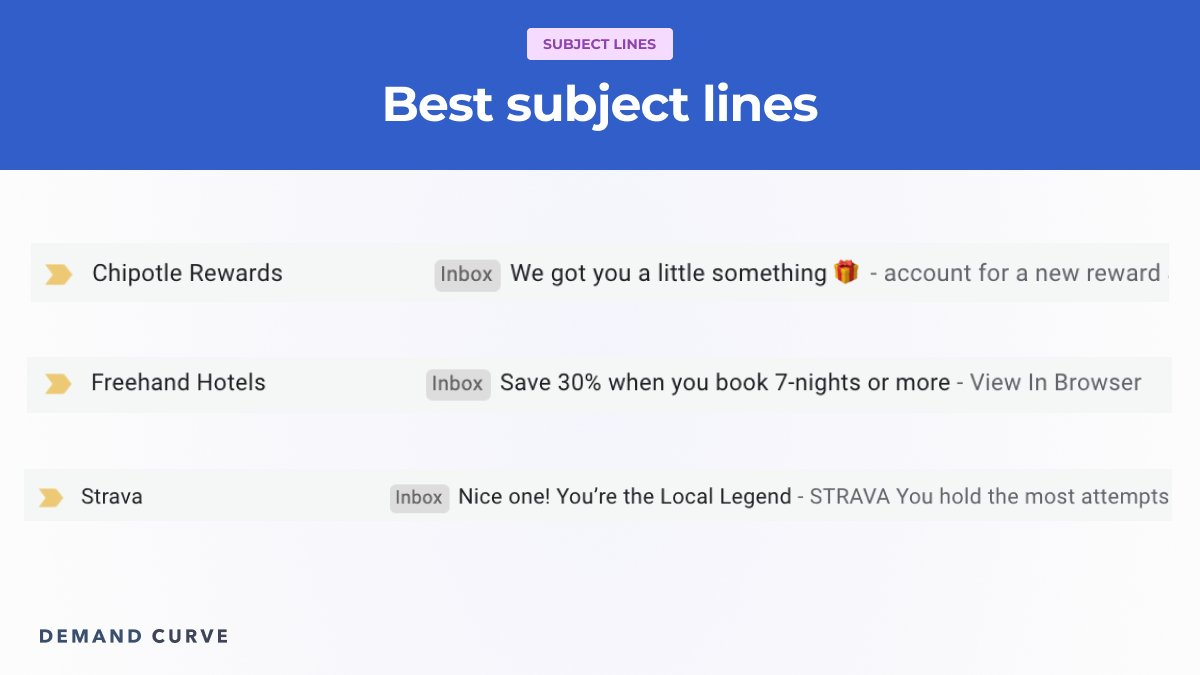

The subject line of your email is the most important, yet most marketers neglect it until after crafting the body of the email.

The subject line of your email is the most important, yet most marketers neglect it until after crafting the body of the email.

Increase the open-rate of your subject lines by making them self-evident. You don’t want people guessing why you want them to pay attention to your email. If the subject line is unclear or vague, your subscribers will ignore it.

One trick is to write like you speak. Try using subject lines that use informal language and contractions (it’s, they’re, you’ll). Not only will this save character count, it will also make your copy more friendly and quick to read.

Subject lines should be relevant to your subaudiences. Marketers generate 760% more revenue from segmented email campaigns than from untargeted emails.

A good subject line will increase the chances of your email being read. Image Credits: Demand Curve

If you’re collecting emails from multiple areas on your website, chances are the context will be slightly different for each. For example, people who subscribe after reading an article on ketogenic diets should receive emails that further educate them on keto and seeds products relevant to that lifestyle. Sending them information and product recommendations for vegetarians would not be relevant and could lead to them unsubscribing.

To ensure you’re sending relevant emails to the right audiences, segment your audience using tags and filters within your email marketing platform. Each platform will do this slightly differently, but all modern platforms should allow you to do this. When crafting your email subject line, ask yourself: “Would this email make sense to receive for this segment of subscriber?”

Your subject lines should be short and concise. About 46% of all emails are opened on mobile devices, which means the subject line must be short enough to fit on a smaller screen while getting your point across. Fifty characters is approximately the maximum length a subject line can be before it gets cut off on a mobile screen.

Founders, help TechCrunch find the best growth marketers for startups.

Provide a recommendation in this quick survey and we’ll share the results with everybody.

Keeping your subject lines short also makes them easier to scan when your subscriber is looking through their inbox. Including emojis in your subject line can cut down your character count and emulates how friends send text messages to each other. Including emojis in your subject lines will make your email feel less corporate and more friendly.

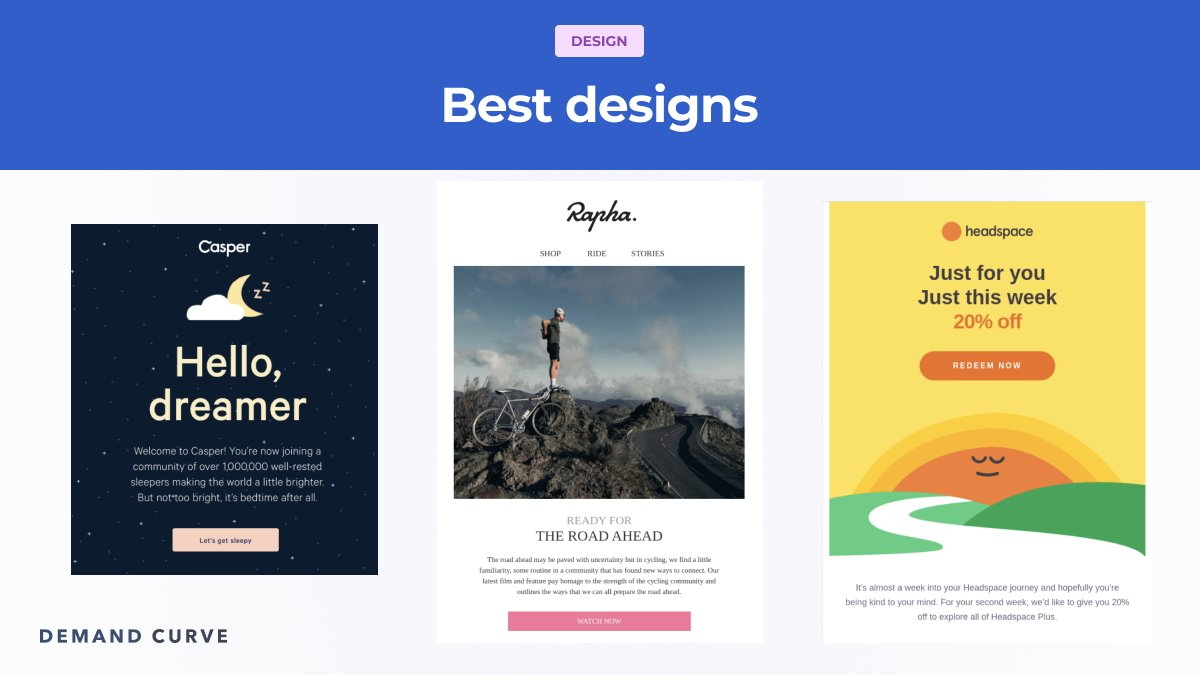

Once your subscriber opens your email, there are three outcomes that can follow: read, skim or bounce.

Subscribers that read your emails are the most valuable, because they will consume the full contents of your email. Skimmers will only read the headlines and look at the images you include. Subscribers who bounce will open your email, but if nothing catches their attention right away, they will simply delete or close your email.

You’re going to want to design your emails to minimize the number of bouncers, satisfy readers and provide enough high-level information that skimmers still understand your message.

To minimize the number of bounces, choose an email design that catches the eye and is relevant to your brand. Take the Casper email below for example. The starry night background and moon illustration is directly relevant to the mattresses they sell. Visually branded email designs will help elevate your brand perception.

Design your emails to appeal to all kinds of readers. Image Credits: Demand Curve

To optimize for skimmers, write action-focused headlines. Use designs that draw the eye of your reader to key elements. As you can see in the Headspace example, the image of the rising sun pushes your gaze upward to the headline and the call-to-action button. Skimmers should be able to understand the context of the entire email and take action without needing to read the body.

To convert more readers, fulfill the expectation set by the subject line. Readers will be looking for any promises or hints you gave them in your subject line. Be sure to deliver on this promise in the body. Do so in an aggressively concise way — just because they’re reading doesn’t mean they don’t value their time.

The goal of your body copy is to drive people to your call-to-action button (CTA). Your CTA is crucial, because it’s how you convert an email subscriber into a paying customer. To increase the conversion of your CTA, make a valuable promise in your body copy and headers that’s only delivered through your CTA.

Good CTA copy typically begins with a verb that teases what the reader will encounter next:

Low-converting CTA copy is vague or nonactive:

Your email should only have one CTA. Any more and your conversion will decrease due to unnecessary decision-making. Ensure that the page on your site that your CTA leads to fulfills the promise you made in your body and CTA button.

Once the focus of the subject line is clear and the desired outcome is chosen, everything else should be crafted to carry the reader step by step through the email, eventually taking them to the desired action.

It’s a good idea to work backward from the desired outcome you want the reader to perform. If the desired outcome is for them to click on a CTA button, frame your subject line, headers and body copy as a valuable promise that can only be achieved by clicking the button.

Consider the experience of your email through the eyes of all three types of subscribers: readers, skimmers and bouncers. Use visual and written prompts that make the purpose of your email clear to all three categories. Failing to do so could lead to unsubscribes and lost revenue.

Email has the highest return on investment than any other marketing channel because you have a captive audience who has opted-in to you communicating with them. Email can drive six times more conversions that a Twitter post and is 40 times more likely to get noticed than a Facebook post.

Powered by WPeMatico

One of the biggest factors in the success of a startup is its ability to quickly and confidently deliver software. As more consumers interact with businesses through a digital interface and more products embrace those interfaces as the opportunity to differentiate, speed and agility are paramount. It’s what makes or breaks a company.

As your startup grows, it’s important that your software delivery strategy evolves with you. Your software processes and tool choices will naturally change as you scale, but optimizing too early or letting them grow without a clear vision of where you’re going can cost you precious time and agility. I’ve seen how the right choices can pay huge dividends — and how the wrong choices can lead to time-consuming problems that could have been avoided.

The key to success is consistency. Create a standard, then apply it to all delivery pipelines.

As we know from Conway’s law, your software architecture and your organizational structure are deeply linked. It turns out that how you deliver is greatly impacted by both organizational structure and architecture. This is true at every stage of a startup but even more important in relation to how startups go through rapid growth. Software delivery on a team of two people is vastly different from software delivery on a team of 200.

Decisions you make at key growth inflection points can set you up for either turbocharged growth or mounting roadblocks.

The founding phase is the exciting exploratory phase. You have an idea and a few engineers.

The key during this phase is to keep the architecture and tooling as simple and flexible as possible. Building a company is all about execution, so get the tools you need to execute consistently and put the rest on hold.

One place you can invest without overdoing it is in continuous integration and continuous deployment (CI/CD). CI/CD enables developer teams to get feedback fast, learn from it, and deliver code changes quickly and reliably. While you’re trying to find product-market fit, learning fast is the name of the game. When systems start to become more complex, you’ll have the practices and tooling in place to handle them easily. By not having the ability to learn and adapt quickly, you give your competitors a massive edge.

One other place where early, simple investments really pay off is in operability. You want the simplest possible codebase: probably a monolith and a basic deploy. But if you don’t have some basic tools for observability, each user issue is going to take orders of magnitude longer than necessary to track down. That’s time you could be using to advance your feature set.

Your implementation here may be some placeholders with simple approaches. But those placeholders will force you to design effectively so that you can enhance later without massive rewrites.

At 10 to 20 engineers, you likely don’t have a person dedicated to developer efficiency or tooling. Company priorities are still shifting, and although it may feel cumbersome for your team to be working as a single team, keep at it. Look for more fluid ways of creating independent workstreams without concrete team definitions or deep specialization. Your team will benefit from having everyone responsible for creating tools, processes and code rather than relying on a single person. In the long run, it will help foster efficiency and productivity.

Powered by WPeMatico