TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Therapy is rapidly becoming a standard part of many people’s lives, but 2020 interrupted that trend by nixing in-person sessions and forcing therapists to migrate their entire practice online — and it turns out that’s not so easy. Frame simplifies it with an all-in-one portal for clients and therapists, unifying the listings, tools and management software that run the countless small businesses making up the industry.

Kendall Bird and Sage Grazer are old friends who happened to be in the right place at the right time — a strange thing to say about anyone anywhere at the start of 2020, but it’s true. The startup’s pitch of bringing your practice entirely online and offering all-online sessions, bookkeeping, scheduling and everything turned out to be exactly what would soon be needed — though as they tell it, it has actually been needed for some time.

Grazer, a therapist herself, experienced firsthand the unexpected difficulties of getting up and running.

“When I started my practice in 2016, I was really passionate about the clinical work, but I was very overwhelmed by setting up a business, marketing, financial stuff,” she said. “So we wanted to help other therapists through that.”

She and Bird happened to reconnect around that time and the two saw an opportunity to improve things.

“We think about therapists as being a one-on-one thing, but they’re really a small business,” said Bird, who formerly worked in marketing at Snapchat, Google and YouTube. “They’re underserved and undersupported as mental health professionals — they don’t have the back-office support that doctors do, and they’re not trained how to run businesses. It just made sense to build a scalable SaaS solution that lets these people work for themselves.”

The therapy industry, like other medical institutions, has two sides: client-facing and practitioner-facing. While there are a handful of services online that combine these, many essentially recruit therapists as contractors. If you want to run your own practice, you’ll likely be using a combination of specialty scheduling, telehealth, billing and other tools made with medical privacy considerations in mind.

“The therapy tools and services landscape is incredibly fragmented — the average therapist is using 5-7 tools, and most of those are not built for therapy,” said Bird.

And then of course there’s Psychology Today: a periodical that straddles the roles of pop psych and industry rag, but whose chief reason for existing for many is its voluminous therapist listings, which dominate search and provide an overwhelming first stop for anyone looking to find one in their area. But for such a personal and consequential decision these brief listings don’t give wary potential clients the impression they’re making an informed choice.

“We wanted an experience that was more approachable, uses language that doesn’t feel overwhelming or pathologizing,” said Grazer. “There are people going to therapy feeling alone and confused, who don’t identify with a disorder or checking a check box.”

Frame eschews the oversimplified “scroll through therapists near your area code” with a short quiz — not a diagnosis or personality test but just a few basic questions — that winnows down your choices to a handful of local and appropriate therapists, with whom you can instantly set up free introductory video calls. If you find someone you like, the rest of the professional relationship takes place on Frame, though of course soon in-person sessions may return.

For those not quite ready to take the plunge, the company organizes livestreamed sessions between volunteers and therapists to show what a full hour of work might look like. (Whatever courage it may take to confront one’s issues in therapy, it surely takes even more to do so with an audience.)

On the therapist’s side, Frame is meant to be a one-stop shop. Marketing and telehealth sessions are on there, as noted above, but so are things like scheduling, notes, billing, notifications, and so on, all tailored specifically to the needs of the industry. And while the shift to online services has been a long time coming, the company just happened to drop in just as the need went into overdrive.

“We built it before COVID ever existed — launched in March 2020 and had telehealth as an option, thinking ‘oh, well maybe some people will do this.’ The majority of therapists in America weren’t doing sessions online at the time… but after COVID they all are,” Bird said. “And they’re looking for these tools now because they’re seeing the rewards of running a lot of their business through telehealth.”

Many therapists are finding that after resisting the transition for years, they are encountering all kinds of benefits, explained Grazer. Like other industries, the flexibility inherent to shifting in-person meetings to virtual ones has been freeing and in some cases profitable. The change is here to stay.

The site is in a closed beta limited to a part of California at present, since therapists are limited to operating in-state and there are other regulations to consider, not to mention all the usual struggles of putting together a sprawling professional service. But the $3 million funding round, led by Maven Ventures, will help fill out the product and move the company toward a larger audience. Sugar Capital, Struck Capital, Alpha Edison and January Ventures participated in the raise.

The money is “almost exclusively going to engineering.” The goal is to open up the beta, expand to the rest of California, then move out to other states once they have the infrastructure to do so and have responded to feedback from the initial rollout.

“Sage and I are really aligned in the belief that the best way to make therapy more accessible to America is to support therapists,” said Bird.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Danny, Natasha, and Alex were on deck this week, with Grace on the recording and edit. But, if you want to hear more about Robinhood, this is not the episode for you. If you want to learn more about the consumer fintech company’s IPO filing this is the episode you want. Basically, Robinhood filed after we had wrapped taping, so we had to do a special pod for the news.

So, this is the everything-but-Robinhood episode. And here’s what’s inside of it:

A four-episode week! With only Grace handling production! She’s amazing.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday morning at 7:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Swedish gaming giant Modern Times Group (MTG) has acquired Indian startup PlaySimple for at least $360 million, the two firms said Friday.

MTG said it will pay 77% of the acquisition sum to Indian game developer and publisher in cash and the rest in company shares. There’s also another $150 million reward put aside if certain undisclosed performance metrics are hit, the two firms said.

Friday’s deal marks one of the largest exits in the Indian startup ecosystem. PlaySimple had raised $4 million Series A at a valuation of about $16 million from Elevation Capital and Chiratae Ventures in 2016. (The startup, which began its journey in Bangalore, raised just $4.5 million in total from external investors.)

And it’s clear why: the revenues of PlaySimple — which operates nine word games including “Daily Themed Crossword,” “Word Trip,” “Word Jam,” and “Word Wars” — grew by 144% y-o-y to $83 million last year and it was on track to hit over $60 million revenue in the first half of 2021.

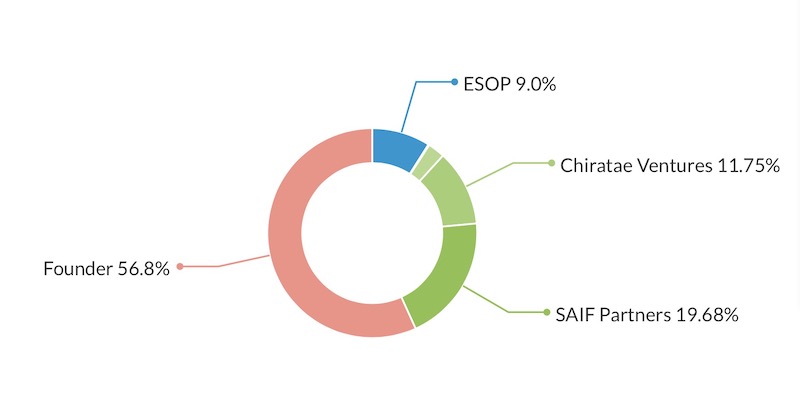

Cap table of PlaySimple after Series A in 2016.

“We’re very proud of the games we’ve developed over the years, and of the infrastructure and scale that we’ve achieved with our team,” said PlaySimple co-founders and management team members — Siddhanth Jain, Suraj Nalin and Preeti Reddy — in a joint statement.

“As we join the MTG family, we look forward to leveraging our proprietary technology across MTG’s gaming portfolio, expanding into the European market, investing in cutting-edge technology and building exciting new games.”

PlaySimple, which says its free-to-play games have amassed over 75 million installs and maintain nearly 2 million daily active users, plans to launch a number of games later this year and also expand into the card games genre.

“PlaySimple is a rapidly growing and highly profitable games studio that quickly has established itself as one of the leading global developers of free-to-play word games, an exciting new genre for MTG,” said Maria Redin, MTG Group President and CEO, said in a statement.

The Stockholm-headquartered firm, which has also acquired Hutch and Ninja Kiwi in recent quarters, said PlaySimple will help it build a diversified gaming vertical. “Scaling and diversifying the GamingCo [an MTG subsidiary] helps to accelerate the operational performance while at the same time creating a more stable business,” the firm said.

Powered by WPeMatico

Edtech startup Microverse has tapped new venture funding in its quest to help train students across the globe to code through its online school that requires zero upfront cost, instead relying on an income-share agreement that kicks in when students find a job.

The startup tells TechCrunch it has closed a $12.5 million Series A led by Northzone with additional participation from General Catalyst, All Iron Ventures and a host of angel investors. We last covered the company after it had closed a bout of seed funding from General Catalyst and Y Combinator; this latest round brings the startup’s total funding to just under $16 million.

The company’s vision has seen added pandemic-era traction as larger tech companies have embraced remote work that spans geographic boundaries and time zones. Microverse has now brought English-speaking students from over 188 countries through its program.

Since we last chatted, CEO Ariel Camus says the startup has landed some 300 early graduates in positions at tech companies including Microsoft, VMWare and Huawei. The company says its has above a 95% employment rate for its students within six months of graduation so far, pushing past one of the bigger issues that income-share-agreement-based schools have had stateside — getting graduates employed.

Microverse does have notably less generous terms than counterparts like Lambda School when it comes to when students begin loan repayment, the terms of both are actually quite different, as noted in my previous article:

While Lambda School’s ISA terms require students to pay 17% of their monthly salary for 24 months once they begin earning above $50,000 annually — up to a maximum of $30,000, Microverse requires that graduates pay 15% of their salary once they begin making more than just $1,000 per month, though there is no cap on time, so students continue payments until they have repaid $15,000 in full. In both startups’ cases, students only repay if they are employed in a field related to what they studied, but with Microverse, ISAs never expire, so if you ever enter a job adjacent to your area of study, you are on the hook for repayments. Lambda School’s ISA taps out after five years of deferred repayments.

The startup has made efforts to streamline their online program since launch to ensure that students are being set up to succeed in the full-time, 10-month program. Part of Microverse’s efforts have included condensing lesson segments into shorter time frames to ensure students aren’t starting the program unless they have enough free time to commit. Camus says the startup is receiving thousands of applications per month, of which only a fraction are accepted in an effort to ensure that the small startup isn’t overcommitting itself early on. The startup estimates it will usher 1,000 students through its program this year.

The startup has big plans for the future, including working more closely with tech companies to ensure that students have easier access to job placement once they graduate.

“We have data now that the day we launch a partner program — which we haven’t done yet but we will eventually — it opens up the market by 5x,” Camus tells TechCrunch. “To get 10,000 students per year in a world where 90% of the world’s population doesn’t have access to higher education — it’s not going to be that hard, to be honest, I’m not too worried.”

Powered by WPeMatico

This afternoon Robinhood filed to go public. TechCrunch’s first look at its results can be found here. Now that we’ve done a first dig, we can take the time to dive into the company’s filing more deeply.

Robinhood’s IPO has long been anticipated not only because there are billions of dollars in capital riding on its impending liquidity, but also because the company became something of a poster child for the savings and investing boom that 2020 saw and the COVID-19 pandemic helped engender.

The consumer trading service’s products became so popular and enmeshed in popular culture thanks to both the “stonks” movement and the larger GameStop brouhaha, that the company’s public offering carries much more weight than that of a more regular venture-backed entity. Robinhood has fans, haters, and many an observer in Congress.

Regardless of all that, today we are digging into the company’s business and financial results. So, if you want to better understand how Robinhood makes money, and how profitable or not it really is, this is for you.

We will start with a more in-depth look at growth and profitability, pivot to learning about the company’s revenue makeup, discuss a risk factor or two, and close on its decision to offer some of its own shares to its users. Let’s go!

Before we get into the how of Robinhood’s growth, let’s discuss how big the company has become.

The fintech unicorn’s revenue grew from $277.5 million in 2019 to $958.8 million in 2020, which works out to growth of around 245%. Robinhood expanded even more quickly in the first quarter of 2021, scaling from year-ago revenue of $127.6 million to $522.2 million, a gain of around 309%.

Those are numbers that we frankly do not see often amongst companies going public; 300% growth is a pre-Series A metric, usually.

Powered by WPeMatico

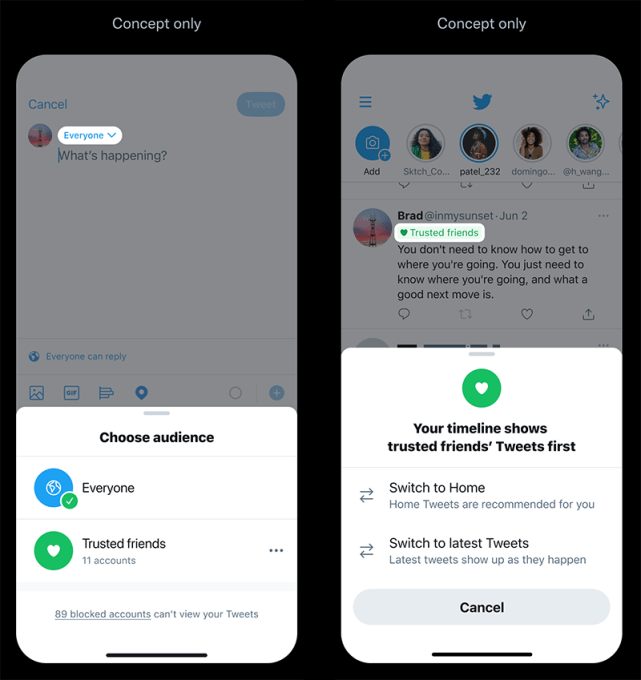

Twitter has a history of sharing feature and design ideas it’s considering at very early stages of development. Earlier this month, for example, it showed off concepts around a potential “unmention” feature that would let users untag themselves from others’ tweets. Today, the company is sharing a few more of its design explorations that would allow users to better control who can see their tweets and who ends up in their replies. The new concepts include a way to tweet only to a group of trusted friends, new prompts that would ask people to reconsider the language they’re using when posting a reply, and a “personas” feature that would allow you to tweet based on your different contexts — like tweets about your work life, your hobbies and interests, and so on.

The company says it’s thinking through these concepts and is looking to now gather feedback to inform what it may later develop.

The first of the new ideas builds on work that began last year with the release of a feature that allows an original poster to choose who’s allowed to reply to their tweet. Today, users can choose to limit replies to only people mentioned in the tweet, only people they follow, or they can leave it defaulted to “everyone.” But even though this allows users to limit who can respond, everyone can see the tweet itself. And they can like, retweet or quote tweet the post.

With the proposed Trusted Friends feature, users could tweet to a group of their own choosing. This could be a way to use Twitter with real-life friends, or some other small network of people you know more personally. Perhaps you could post a tweet that only your New York friends could see when you wanted to let them know you were in town. Or maybe you could post only to those who share your love of a particular TV show, sporting event or hobby.

Image Credits: Twitter

This ability to have private conversations alongside public ones could boost people’s Twitter usage and even encourage some people to try tweeting for the first time. But it also could be disruptive to Twitter, as it would chip away at the company’s original idea of a platform that’s a sort of public message board where everyone is invited into the conversation. Users may begin to think about whether their post is worthy of being shared in public and decide to hold more of their content back from the wider Twitter audience, which could impact Twitter engagement metrics. It also pushes Twitter closer to Facebook territory where only some posts are meant for the world, while more are shared with just friends.

Twitter says the benefit of this private, “friends only” format is that it could save people from the workarounds they’re currently using — like juggling multiple alt accounts or toggling between public to protected tweets.

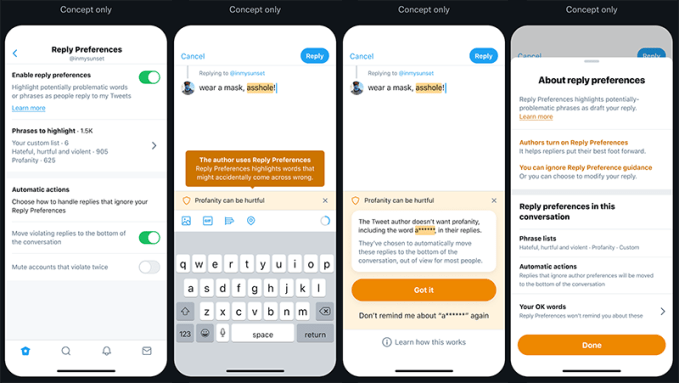

Another new feature under consideration is Reply Language Prompts. This feature would allow Twitter users to choose phrases they don’t want to see in their replies. When someone is writing back to the original poster, these words and phrases would be highlighted and a prompt would explain why the original poster doesn’t want to see that sort of language. For instance, users could configure prompts to appear if someone is using profanity in their reply.

Image Credits: Twitter

The feature wouldn’t stop the poster from tweeting their reply — it’s more a gentle nudge that asks them to be more considerate.

These “nudges” can have impact. For example, when Twitter launched a nudge that suggested users read an article before they amplify it with a retweet, it found that users opened articles before sharing them 40% more often. But in the case of someone determined to troll, it may not do that much good.

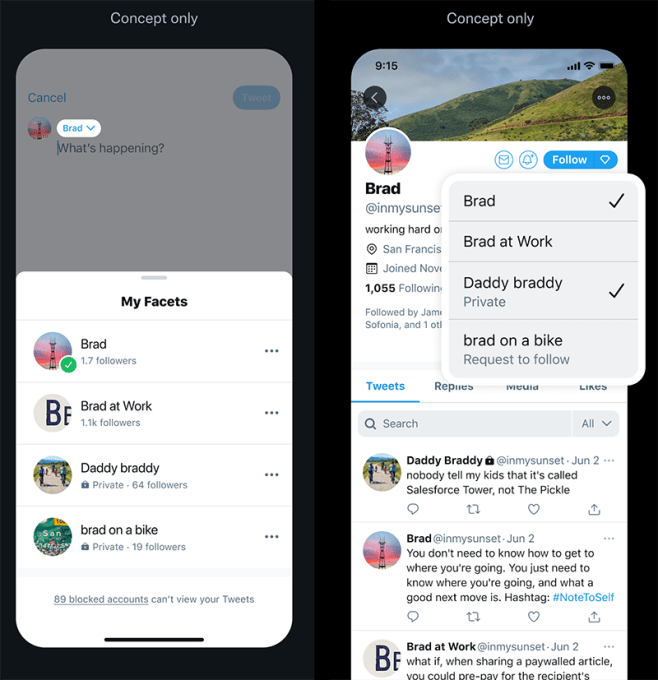

The third, and perhaps most complicated, feature is something Twitter is calling “Facets.”

This is an early idea about tweeting from different personas from one account. The feature would make sense for those who often tweet about different aspects of their lives, including their work life, their side hustles, their personal life or family, their passions and more.

Image Credits: Twitter

Unlike Trusted Friends, which would let you restrict some tweets to a more personal network, Facets would give other users the ability to choose whether they wanted to follow all your tweets, or only those about the “facet” they’re interested in. This way, you could follow someone’s tweets about tech, but ignore their stream of reactions they post when watching their favorite team play. Or you could follow your friend’s personal tweets, but ignore their work-related content. And so on.

This is an interesting idea, as Twitter users have always worried about alienating some of their followers by posting “off-topic” so to speak. But this also puts the problem of determining what tweets to show which users on the end user themselves. Users may be better served by the algorithmic timeline that understands which content they engage with, and which they tend to ignore. (Also: “facets‽”)

Twitter says none of the three features are in the process of being built just yet. These are only design mockups that showcase ideas the company has been considering. It also hasn’t yet made the decision whether any of the three will go under development — that’s what the user feedback it’s hoping to receive will help to determine.

Powered by WPeMatico

It’s easy to forget, but Salesforce bought Slack at the end of last year for almost $28 billion, a deal that has yet to close. We don’t know exactly when that will happen, but Slack continues to develop its product roadmap adding new functionality, even while waiting to become part of Salesforce eventually.

Just this morning, the company made official some new tools it had been talking about for some time, including a new voice tool called Slack Huddles, which is available starting today, along with video messaging and a directory service called Slack Atlas.

These tools enhance the functionality of the platform in ways that should prove useful as it becomes part of Salesforce whenever that happens. It’s not hard to envision how integrating Huddles or the video tools (or even Slack Atlas for both internal and external company organizational views) could work when integrated into the Salesforce platform.

Slack CEO Stewart Butterfield says the companies aren’t working together yet because of regulatory limits on communications, but he could definitely see how these tools could work in tandem with Salesforce Service Cloud and Sales Cloud among others and how you can start to merge the data in Salesforce with Slack’s communications capabilities.

“[There’s] this excitement around workflows from the big system of record [in Salesforce] into the communication [in Slack] and having the data show up where the conversations are happening. And I think there’s a lot of potential here for leveraging these indirectly in customer interactions, whether that’s sales, marketing, support or whatever,” he said.

He said that he could also see Salesforce taking advantage of Slack Connect, a capability introduced last year that enables companies to communicate with people outside the company.

“We have all this stuff working inside of Slack Connect, and you get all the same benefits that you would get using Huddles to properly start a conversation, solve some problem or use video as a better way of communicating with [customers],” he said.

These announcements seem to fall into two main categories: the future of work and in the context of the acquisition. Bret Taylor, Salesforce president and COO certainly seemed to recognize that when discussing the deal with TechCrunch when it was announced back in December. He sees the two companies directly addressing the changing face of work:

“When we say we really want Slack to be this next generation interface for Customer 360, what we mean is we’re pulling together all these systems. How do you rally your teams around these systems in this digital work-anywhere world that we’re in right now where these teams are distributed and collaboration is more important than ever,” Taylor said.

Brent Leary, founder and principal analyst at CRM Essentials says that there is clearly a future of work angle at play as the two companies come together. “I think moves like [today’s Slack announcements] are in response to where things are trending with respect to the future of work as we all find ourselves spending an increasing amount of time in front of webcams and microphones in our home offices meeting and collaborating with others,” he said.

Huddles is an example of how the company is trying to fix that screen fatigue from too many meetings or typing our thoughts. “This kind of ‘audio-first’ capability takes the emphasis off trying to type what we mean in the way we think will get the point across to just being able to say it without the additional effort to make it look right,” he said.

Leary added, “And not only will it allow people to just speak, but also allows us to get a better understanding of the sentiment and emotion that also comes with speaking to people and not having to guess what the intent/emotion is behind the text in a chat.”

As Karissa Bell pointed out on Engadget, Huddles also works like Discord’s chat feature in a business context, which could have great utility for Salesforce tools when it’s integrated with the Salesforce platform

While the regulatory machinations grind on, Slack continues to develop its platform and products. It will of course continue to operate as a stand-lone company, even when the mega deal finally closes, but there will certainly be plenty of cross-platform integrations.

Even if executives can’t discuss what those integrations could look like openly, there has to be a lot of excitement at Salesforce and Slack about the possibilities that these new tools bring to the table — and to the future of work in general — whenever the deal crosses the finish line.

Powered by WPeMatico

With a lot of us spending more time at home these days, home improvement has continued to be a booming market. Now, one of the big players in that space — ServiceTitan, which builds software that today is used by over 100,000 contractors to manage their work — is getting a little bigger.

The company — which also works with contractors that work on business properties — is acquiring Aspire Software, a software provider specifically for commercial landscapers. Along with that, ServiceTitan is announcing another $200 million in funding, a Series G that values that company at $9.5 billion.

The funding is being led by a new backer, Thoma Bravo, with other unnamed existing investors participating. (That list includes Sequoia, Tiger Global, Dragoneer, T. Rowe Price, Battery Ventures, Bessemer Venture Partners and ICONIQ Capital.)

Los Angeles-based ServiceTitan is not disclosing the financial terms of the deal, but it comes on the heels of the company raising $500 million only in March (when it was valued at $8.3 billion) — money that it earmarked at the time for acquisitions.

ServiceTitan also confirmed that this is its biggest acquisition yet, which roughly puts this deal in the hundreds of millions of dollars. Aspire will stay based in Missouri to build out the company further from there.

Aspire itself has some 50,000 users and sees $4 billion in annualized transactions on its platform across areas like landscaping, snow and ice management, and construction. It has never disclosed a valuation, nor how much money it has raised. The St Louis, MO company was previously backed by growth equity firm Mainsail Partners.

The deal underscores not just how much scale and opportunity remains in building technology to serve the home services space, but also what might be a consolidating trend within that, where a smaller number of companies are building technology for contractors and others in the space working across a number of adjacent and related verticals.

ServiceTitan is already bringing in annual recurring revenues of $250 million — a figure it shared in March and hasn’t updated — and as of that month, it had grown 50% over the preceding year. Part of that growth is based on simply more usage of and demand for its software, but part of it also has to do with the company expanding what it covers.

ServiceTitan got its start in residential plumbing, HVAC and electrical — the areas where the the two founders Ara Mahdessian (CEO) and Vahe Kuzoyan (president) went first because they knew them best from their own family businesses — but expanded into areas like garage door, chimney and other areas, as well as commercial property, on its own steam.

In other markets like landscaping or pest control, the expertise is more specialized, however, so it makes sense to make acquisitions in those areas to bring in that software, and teams to manage and build it, to further diversify the company. (ServicePro, a pest control company, was acquired in February.)

ServiceTitan said that its contractor customers have made more than $20 billion in transactions in the last year, but with the wider industry of contracting repair and maintenance services estimated to be worth $1 trillion, there is obviously a lot more potential. Hence expanding the range of areas covered in the industry.

“Both Aspire and ServiceTitan were born out of a desire to improve the lives of contractors who work tirelessly to serve their communities, but who have historically been underserved by technology,” said Mahdessian in a statement. “Mark and his team at Aspire have more than 500 years of combined experience in the commercial landscaping industry. Just like we built ServiceTitan to solve the problems our fathers faced, it’s that first-hand industry knowledge that has enabled Aspire to build the most powerful software in the industry with the highest customer satisfaction.”

Thoma Bravo has been making some prolific moves to take majority positions in a number of older tech companies in recent weeks (see QAD, Proofpoint and Talend for three examples among others). This, however, is a growth investment that is coming as many wonder when and if ServiceTitan might go public.

I’ll hopefully get a chance to ask Mahdessian about that later but in March he hinted that an IPO might come later this year or latest by the end of 2022, depending on market conditions. This Series G round implies perhaps stretching to the later part of that timeframe.

“As the fastest-growing software solution for the trades with an unrelenting focus on customer success, ServiceTitan is poised to extend its leadership and capture increased market share as the industry exceeds $1 trillion globally,” said Robert (Tre) Sayle, a partner at Thoma Bravo, in a statement. “ServiceTitan’s expansion into landscaping, a more than $100 billion market in the US alone, is an important step on its path to provide all home and commercial tradesmen with the tools they need to grow and manage a successful business. We are excited to partner with ServiceTitan and to leverage our software and operational expertise to accelerate the company’s growth and build upon its strong momentum.”

There are a number of companies playing in the wider home services market that speak to the opportunity ahead. Companies like Thumbtack are digging deeper into home management, providing a bridge to contractors to fill out the work needed (and also providing them with the software to do so), while companies like Jobber and BigChange, which have also raised recently, are also looking to build better software to manage individual and fleets of contractors and their fleets.

ServiceTitan, the biggest of the software players now, is likely going to continue making more deals to grow its own empire, but it added that it will also be using the funding to expand more organically, with investments into customer service, R&D, and to hire more people across the board.

Powered by WPeMatico

In 2020 lots of workloads shifted to the cloud due to the pandemic, but that doesn’t mean that figuring out how to migrate those workloads got any easier. Device42, a startup that helps companies understand their infrastructure, has a new product that is designed to analyze your infrastructure and make recommendations about the most cost-effective way to migrate to the cloud.

Raj Jalan, CEO and co-founder, says that the tool uses machine learning to help discover the best configuration, and supports four cloud vendors including AWS, Microsoft, Google and Oracle plus VMware running on AWS.

“The [new tool] that’s coming out is a multi-cloud migration and recommendation [engine]. Basically, with machine learning what we have done is in addition to our discovery tool […] is we can constantly update based on your existing utilization of your resources, what it is going to cost you to run these resources across each of these multiple clouds,” Jalan explained.

This capability builds on the company’s core competency, which is providing a map of resources wherever they exist along with the dependencies that exist across the infrastructure, something that’s extremely hard for organizations to understand. “Our focus is on hybrid IT discovery and dependency mapping, [whether the] infrastructure is on prem, in colocation facilities or in the cloud,” he said.

That helps Device42 customers see how all of the different pieces of infrastructure including applications work together. “You can’t find a tool that does everything together, and also gives you a very deep discovery where you can go from the physical layer all the way to the logical layer, and see things like, ‘this is where my storage sits on this web server…’,” Jalan said.

It’s important to note that this isn’t about managing resources or making any changes to allocation. It’s about understanding your entire infrastructure wherever it lives and how the different parts fit together, while the newest piece finds the most cost-effective way to migrate to the cloud it from its current location.

The company has been around since 2012, has around 100 employees. It has raised around $38 million including a $34 million Series A in 2019. It hasn’t required a ton of outside investment as Jalan reports they are cash flow positive with “decent growth.”

Powered by WPeMatico