TC

Auto Added by WPeMatico

Auto Added by WPeMatico

The war between Box’s current leadership and activist shareholder Starboard took a new turn today with a detailed timeline outlining the two groups’ relationship, thanks to an SEC filing and companion press release. Box is pushing back against a slate of board candidates put forth by Starboard, which wants to shake up the company’s leadership and sell it.

The SEC filing details a lengthy series of phone calls, meetings and other communications between the technology company and Starboard, which has held a stake in Box greater than 5% since September of 2019. Since then shares of Box have risen by around $10 per share.

Today’s news is multi-faceted, but we’ve learned more concerning Starboard’s demands that Box sell itself; how strongly the investor wanted co-founder and CEO Aaron Levie to be fired; and that the company’s complaints about a KKR-led investment into Box that it used to repurchase its shares did not match its behavior, in that Starboard asked to participate in the transaction despite its public statements.

Activist investors, a bit like short-sellers, are either groups that you generally like or do not. In this case, however, we can learn quite a lot from the Box filing. Including the sheer amount of time and communication that it takes to manage such an investor from the perspective of one of its public-market investments.

What follows are key excerpts from Box’s SEC filing on the matter, starting with its early stake and early agreement with Starboard:

Then Box reported earnings, which Starboard appeared to praise:

The same pattern repeated during Box’s next earnings report:

Then Box reported its next quarter’s results, which was followed by a change in message from Starboard (emphasis TechCrunch):

Recall that Box shares are now in the mid-$26s. At the time, however, Box shares lost value (emphasis: TechCrunch)

Over the next few months, Box bought SignRequest, reported earnings, and engaged external parties to try to help it bolster shareholder value. Then the KKR deal came onto the table:

The deal was unanimously approved by Box’s board, and announced on April 8th, 2021. Starboard was not stoked about the transaction, however:

Box was like, all right, but Feld doesn’t get to be on the board:

And then Starboard initiated a proxy war.

What to make of all of this? That trying to shake up a company from the position of a minority stake is not impossible, with Starboard able to exercise influence on Box despite having a sub-10% ownership position. And that Box was not willing to put a person on the board that wanted to fire its CEO.

What’s slightly silly about all of this is that the fight is coming at a time when Box is doing better than it has in some time. Its profitability has improved greatly, and in its most recent quarter the company topped expectations and raised its forward financial guidance.

There were times in Box’s history when it may have deserved a whacking for poor performance, but now? It’s slightly weird. Also recall that Starboard has already made quite a lot of money on its Box stake, with the company’s value appreciating sharply since the investor bought in.

Most media coverage is surrounding the public criticism by Starboard of the KKR deal and its private demand to be let into the deal. That dynamic is easily explained: Starboard thought that the deal wouldn’t make it money, but later decided that it could. So it changed its tune; if you are expecting an investor to do anything but try to maximize returns, you are setting yourself up for disappointment.

A person close to the company told TechCrunch that the current situation should be a win-win for everyone involved, but Starboard is not seeing it that way. “If you’re a near term shareholder, [like Starboard] then the path Box has taken has already been better. And if you’re a long term shareholder, Box sees significantly more upside. […] So overwhelmingly, the company believes this is the best path for shareholders and it’s already been proven out to be that,” the person said.

Alan Pelz-Sharpe, founder and principal analyst at the Deep Analysis, who has been watching the content management space for many years, says the battle isn’t much of a surprise given that the two have been at odds pretty much from the start of the relationship.

“Like any activist investor Starboard is interested in a quick increase in shareholder values and a flip. Box is in it for the long run. Further, it seems that Starboard may have mistimed or miscalculated their moves, Box clearly was not as weak as they appeared to believe and Box has been doing well over the past year. Bringing in KKR was the start of a big fight back, and the proposed changes couldn’t make it any clearer that they are fed up with Starboard and ready to fight back hard,” Pelz-Sharpe said.

He added that publicly revealing details of the two companies’ interactions is a bit unusual, but he thinks it was appropriate here.

“Actually naming and shaming, detailing Starboard’s moves and seemingly contradictory statements, is unusual but it may be effective. Starboard won’t back down without a fight, but from an investor relations/PR perspective this looks bad for them and it may well be time to walk away. That being said, I wouldn’t bet on Starboard walking away, as Silicon Valley has a habit of moving forward when they should be walking back from increasingly damaging situations”

What comes next is a vote on Box’s board makeup, which should happen later this summer. Let’s see who wins.

It’s worth noting that we attempted to contact Starboard Value, but as of publication they had not gotten back to us. Box indicated that the press release and SEC filing speak for themselves.

Powered by WPeMatico

The pet care industry has boomed over the past several years. From Chewy’s IPO to the various veterinarian startups that have sprung up, VC money (and consumer cash) is flowing into the space.

Wagmo is no different. The pet insurance and perks startup has closed on a $12.5 million Series A financing, led by Revolution Ventures with participation from Female Founders Fund, Clocktower Technology Ventures, and Vestigo Ventures. Angels, including Jeffrey Katzenberg, Jim Grube, Marilyn Hirsch, David Ronick, and Michael Akkerman, also participated in the round.

The company was founded by Christie Horvath and Ali Foxworth, who both came from the world of finance and insurance and realized the gap in the market when it comes to pet insurance. Most pet insurance providers cover the big emergencies, such as surgeries, broken bones, etc. But anyone with a pet, and especially a new puppy (like myself), knows that the costs of basic care can add up very quickly.

Wagmo offers the same basic coverage as your usual pet insurance, but also offers a wellness service. The Wellness Program reimburses pet parents for the more basic stuff, like vaccinations, grooming, regular vet visits, fecal tests, and bloodwork.

Users simply pay anywhere between $20/month and $59/month and submit photos of their receipts in the app. Wagmo then reimburses what’s covered via Venmo, PayPal, or direct deposit within 24 hours.

The premise here is two-fold. A healthy dog, who has access to all the basics listed above, is less likely to have major issues later on. The second piece is that the earliest costs associated with owning a dog are these basic ones, like vaccinations, vet visits, fecal tests and grooming.

Wagmo offers the wellness plan without an insurance plan. That means that users can onboard to the platform with what they need first, and upgrade to an insurance plan later on.

Wagmo generates revenue through both the wellness and insurance plan, but is actively looking into an enterprise model, as well, signing on larger organizations as part of their benefits package to employees.

The now-14-person team has onboarded thousands of users, with 20 percent user growth month over month since the beginning of the pandemic, and has processed 30,000 wellness claims.

The team is 58 percent female identifying, with Black, Asian and Latinx each making up 17 percent of the workforce.

“The greatest challenge is figuring out how to break down the opportunity ahead of us, particularly in the employer benefit space,” said Horvath. “What keeps us up at night is thinking about where to start, what to prioritize, how to allocate limited resources and limited time.”

Powered by WPeMatico

Influential entrepreneurs like Paul Graham and Naval Ravikant always preach the need for startups to have founders-turned-investors on their cap table. As Ravikant puts it, “founders want to know that the people they are taking money from have first-hand experience.”

His platform AngelList has helped individual founders-cum-investors source and participate in deals via collectives. However, some venture firms have taken this up a notch by bringing founders to create a fund and invest together.

Today, one of such, MAGIC Fund, a global collective of founders, is announcing that it has raised a second fund of $30 million to continue backing early-stage startups across Africa, Europe, Latin America, North America, and Southeast Asia.

Since the firm’s first fund launched in 2017, MAGIC has invested in 70 companies at pre-seed and seed stages across these emerging markets. Some of these companies include Retool, Novo, Payfazz, and Mono.

MAGIC Fund has 12 founders who act as general partners. TechCrunch caught up with managing partner Adegoke Olubusi and operating partner Matt Greenleaf to learn more about the fund’s thesis and activities.

Olubusi, who had built and exited a couple of startups over the years, also dabbled with angel investing for some time. In 2017, Olubusi’s current startup Helium Health got accepted into Y Combinator. It was there he met more founders like him who were angel investors with impressive portfolios. The interesting bit? Each founder wanted to invest in other companies during YC’s Demo Day.

“So about three years ago, I was at YC, and I was going to invest in my own batch. I was pitching on the day, but I was also listening to other pitches. However, it wasn’t just me; there were many other founders as well,” Olubusi said.

After building and exiting multiple startups, some founders turn into angel investing to support startups and their ecosystems. However, most of them tend to go alone and are stuck with cutting checks in their local markets, which limits opportunities.

Some MAGIC portfolio companies

Here’s a scenario. In 2016, when unicorns Flutterwave and Kavak raised their seed rounds in Nigeria and Mexico respectively, an African biotech founder who knew about Kavak and a Latin American edtech founder interested in African fintech would not have had the capacity to evaluate those deals even if they wanted; the reason being a lack of reach and experience in both the industry or geography.

Olubusi and the other founders knew this would be a limitation in the long run if they went solo. Thus, they decided to create MAGIC. The idea was to bring global founders together with diverse skillsets in diverse industries and geographies to evaluate deals better and drive value for each other. Hence, they can participate in two unicorns instead of one.

“Instead of us investing individually because obviously, we have somewhat limited capacity in terms of how much time we have as founders because of our respective companies, why don’t we collaborate on a strategy together and co-invest together?”

“The way we thought of MAGIC was a fund of micro funds built by founders for founders,” Greenleaf continued.

In some of the personal conversations I’ve had with founders about their investors, a recurring theme has been that the most useful investors didn’t necessarily sign the biggest checks. It’s a theme Olubusi also relates to all too well.

“It was like every time we think about it, everyone who gave the most money rarely had time for us. It was so frequent that we all identified this as an actual thing. What actually drove value for us were other investors who were founders and operators, and other experienced people who were able to help us find product-market fit and fight regulators. These were actually the people in the trenches with us.”

Olubusi believes the early-stage part of investing, particularly in pre-seed and seed, is where VCs who are founder-operators find their sweet spot. They are precious when startups are trying to figure out product-market fit. And unlike traditional investors who are looking to get multiples on investments, Olubusi argues that for founders-investors, what matters is how much value they can drive for startups.

Image Credits: MAGIC Fund

MAGIC’s play is even more essential considering that it also plays in emerging markets where on-the-ground operational help is needed in industries with numerous unknowns and uncertainties.

“There is so much money in the market now and early-stage decision making at pre-seed and seed should be left in the hands of founders. Because think about it really, to make an evaluation of whether I should invest in a healthcare or fintech company in Africa, it makes sense to have those who’ve spent years battling through it in the trenches make those decisions. And what we’re trying to do with the fund is publish as much information as possible and keep performing at the 100 percentile and say this is still the best strategy and is very scalable.”

MAGIC Fund 1 was $1.5 million and Olubusi says the investments performed 5x over the period of three years. As some of these companies exited, their founders invested in MAGIC and came on board as Fund 2 partners.

MAGIC has also enlisted additional investors who, according to Olubusi, are respected for their investing abilities and ecosystem support. For instance, Olugbenga Agboola, Flutterwave CEO, is known across the African tech ecosystem as a founder who goes out of his way to help established and up-and-coming fintech companies. Hendra Kwik of Payfazz has such a reputation in Southeast Asia as well. They, alongside other founders, join MAGIC as limited partners.

Per the firm’s statement, one-third of the entire fund was contributed by the founder GPs. For its LPs, diversity play is considered as 50% of them are black while 33% are women. Some of them include Michael Seibel, Tim Draper, Rappi’s Andres Bilbao, Paystack’s Shola Akinlade, Katie Lewis, and Octopus Ventures’ Kirsten Connell. For its partners, MAGIC has brought on the likes of Stitchroom’s Tom Chen, Medumo’s Adeel Yang, Juice’s Michael Lisovetsky, and Troy Osinoff, and Evercare’s Temi Awogboro.

Magic Fund 2 will be writing $100,000 to 300,000 checks at pre-seed and seed stages focusing on fintech, healthcare, SaaS and enterprise, women’s health, developer tools.

What does the fund look for in founders? Olubusi gives two answers. One, MAGIC wants to back founders with incentives to stick through the hard times of a company.

“At pre-seed and seed, you don’t have enough data about a company to make an investment decision. Your bet is entirely on the founder and the founding team. What we know, having done this several times, is that things get harder. So when we’re looking at the founder, we’re evaluating whether or not the founder has the grit to stick through the toughest times which are going to come up.”

The second indicator factors if the founder has the willingness, openness, the flexibility to learn and use that knowledge to succeed. Greenleaf believes these strategies have incredibly helped the firm fund exceptional companies and maintain good relationships with founders.

“Most of these founders don’t view us as their investors. They view us as fellow founders who are helping them along their journey. I think that also ties into them keeping it real with us and allows us to see them as people, and not just founders. That’s one of the things that have worked in our favor,” he said.

Powered by WPeMatico

TechCrunch Early Stage is coming up soon, and all attendees can get 3 months of free access to Extra Crunch as a part of a ticket purchase. Extra Crunch is our members-only community focused on founders and startup teams.

Head here to buy your ticket to TC Early Stage.

Extra Crunch unlocks access to our investor surveys, private market analysis, and in-depth interviews with experts on fundraising, growth, monetization and other core startup topics. Get feedback on your pitch deck through Extra Crunch Live, and stay informed with our members-only Extra Crunch newsletter. Other benefits include an improved TechCrunch.com experience and savings on software services from AWS, Crunchbase, and more.

Learn more about Extra Crunch benefits here, and buy your TC Early Stage tickets here.

What is TC Early Stage?

TC Early Stage is a two-day virtual event where early-stage founders can take part in highly interactive group sessions with top investors and ecosystem experts. This particular Early Stage event has a focus on marketing and fundraising.

The event will take place July 8-9, and we’d love to have you join.

View the event agenda here, and purchase tickets here.

Once you buy your TC Early Stage pass, you will be emailed a link and unique code you can use to claim the free 3 months of Extra Crunch.

Already bought your TC Early Stage ticket?

Existing pass holders will be emailed with information on how to claim the free 3 months of Extra Crunch membership. All new ticket purchases will receive information over email immediately after the purchase is complete.

Already an Extra Crunch member?

We’re happy to extend a free 3 months of access to existing users. Please contact extracrunch@techcrunch.com, and mention that you are an existing Extra Crunch member who bought a ticket to TC Early Stage 2021: Marketing and Fundraising.

Powered by WPeMatico

Whether you are part of the accounting department, or just any employee at an organization, managing expenses can be a time-consuming and error-filled, yet also quite mundane, part of your job. Today, a startup called Pleo — which has built a platform that can help some of that work more smoothly, by way of a vertically integrated system that includes payment cards, expense management software, and integrated reimbursement and pay-out services — is announcing a big round of growth funding to expand its business after seeing strong traction.

The Copenhagen-based startup has raised $150 million — money that it will be using to continue building out more features for its users, and for business development. The round, which sets a record for being the largest Series C for a Danish startup, values Pleo at $1.7 billion, the startup has confirmed.

There are around 17,000 small and medium businesses now using Pleo, with companies at the medium end of that numbering around 1,000 employees. Now with Pleo moving into slightly larger customers (up to 5,000 employees, CEO Jeppe Rindom, said), the startup has set an ambitious target of reaching 1 million users by 2025, a very lucrative goal, considering that expenses management is estimated to be a $80 billion market in Europe (with the global opportunity, of course, even bigger).

It will also be using the funds simply to expand its business. Pleo has around 330 employees today spread across London, Stockholm, Berlin and Madrid, as well as in Copenhagen, and it will be using some of the investment to grow that team and its reach.

Bain Capital Ventures and Thrive Capital co-led this round, a Series C. Previous backers, including Creandum, Kinnevik, Founders, Stripes and Seedcamp, also participated. Stripes led the startup’s Series B in 2019. It looks like this round was oversubscribed: the original intention had been to raise just $100 million.

Like other business processes, managing expenses and handling company spending has come a long way in the last many years.

Gone are the days where expenses inevitably involved collecting paper receipts and inputting them manually into a system in order to be reimbursed; now, expense management software links up with company-issued cards and taps into a range of automation tools to cut out some of the steps in the process, integrating with a company’s internal accounting policies to shuffle the process along a little less painfully. And there are a number of companies in this space, from older players like SAP’s Concur through to startups on the cusp of going public like Expensify as well as younger entrants bringing new technology into the process.

But, there is still lots more room for improvement. Rindom, Pleo’s CEO who co-founded the company with CTO Niccolo Perra, said the pair came up with the idea for Pleo on the back of years of working in fintech — both were early employees at the B2B supply chain startup Tradeshift — and seeing first-hand how short-changed, so to speak, small and medium businesses in particular were when it came to tools to handle their expenses.

Pleo’s approach has been to build, from the ground up, a system for those smaller businesses that integrate all the different stages of how an employee might spend money on behalf of the company.

Pleo starts with physical and virtual payment cards (which can be used in, for example, Apple Wallet) that are issued by Pleo (in partnership with MasterCard) to buy goods and services, which in turn are automatically itemized according to a company’s internal accounting systems, with the ability to work with e-receipts, but also let people use their phones to snap pictures of receipts when they are only on paper, if required. This is pretty much table stakes for expense software these days, but Pleo’s platform is going a couple of steps beyond that.

Users (or employers) can integrate a users’ own banking details to make it easier to get reimbursed when they have had to pay for something out of their own pocket; or conversely to pay for something that shouldn’t have been charged on the card. And if there are invoices to be paid at a later date from the time of purchase, these too can be actioned and set up within Pleo rather than having to liaise separately with an accounts payable department to get those settled. Higher priced tiers (beyond the basic service for up to five users) also lets a company set spending limits for individual users. Pricing is based on number of users, per month.

Pleo also has built fraud protection services into the platform to detect, for example, cases when a card number might have been compromised and is being used for non-work purposes.

What’s notable is that the startup has built all of the tech that it uses, including the payments feature, from the ground up, to have full control over the features and specifically to be able to add more of them more flexibly over time.

“In the beginning we ran with a partner in services like payments, but it didn’t allow us to move fast enough,” Rindom said in an interview. “So we decided to take all of that in-house.”

It seems like this opens the door to a lot of possibilities for how Pleo might evolve in the years ahead now that it’s focused on hyper-growth. However, Rindom added that whatever the next steps might be, they will remain focused on continuing to solve the expenses problem.

“When it comes to our infrastructure we use it only for ourselves,” he said. “We have no plans of selling [for example, payments] as a service, even if we do have a lot of other ideas for broadening our offerings.” Indeed, the ability to pay invoices was launched only in April of this year. “We come up with things all the time, but will launch only those relevant to customers.” For now, at least.

That focus and perhaps even more than that the execution and customer traction are what have brought investors around to backing a fintech out of Copenhagen.

“The future of work empowers employees with the tools they need to be effective, productive, and successful,” said Keri Gohman, a partner at Bain Capital Ventures, in a statement. “Pleo understands this critical shift for modern companies toward employee centricity—providing workers with a fun-to-use spend management app that automatically tracks their corporate spending and generates expense reports, paired with the powerful tools businesses need to create full visibility and management of every penny spent.”

Bain has been a pretty active investor in European fintech, also backing GoCardless in its recent round. “BCV invests in founders who aren’t afraid to tackle big problems, and Jeppe and Nicco saw a big challenge that employers faced—tracking all corporate spending and reconciling expenses back to the general ledger—and solved it with elegant technology that both employers and employees love,” added Merritt Hummer, a partner at Bain Capital Ventures.

Thrive is also a notable backer here, and it will be interesting to see how and if Pleo links up with others in the VC’s portfolio, which include companies like Plaid, Gong and Trade Republic.

“Pleo has already transformed the way that over 17,000 companies think about managing their expenses, saving them time and lowering costs while increasing transparency,” noted Kareem Zaki, a general partner at Thrive Capital, in a statement. “We are excited to partner closely with the Pleo team to help drive their next phase of growth.”

Powered by WPeMatico

E-commerce is booming in Southeast Asia, but in many markets, the fragmented logistics industry is struggling to catch up. This means sellers run into roadblocks when shipping to buyers, especially outside of major metropolitan areas, and managing their supply chains. Locad, a startup that wants to help with what it describes as an “end-to-end solution” for cross-border e-commerce companies, announced today it has raised a $4.9 million seed round.

The funding was led by Sequoia Capital India’s Surge (Locad is currently a part of the program’s fifth cohort), with participation from firms like Antler, Febe Ventures, Foxmont, GFC and Hustle Fund. It also included angel investors Alessandro Duri, Alexander Friedhoff, Christian Weiss, Henry Ko, Huey Lin, Markus Bruderer, Dr. Markus Erken, Max Moldenhauer, Oliver Mickler, Paulo Campos, Stefan Mader, Thibaud Lecuyer, Tim Marbach and Tim Seithe.

Locad was founded in Singapore and Manila by Constantin Robertz, former Zalora director of operations Jannis Dargel and Shrey Jain, previously Grab’s lead product manager of maps. It now also has offices in Australia, Hong Kong and India. The startup’s goal is to close the gap between first-mile and last-mile delivery services, enabling e-commerce companies to offer lower shipping rates and faster deliveries while freeing up more time for other parts of their operations, such as marketing and sales conversions.

Since its founding in October 2020, Locad has been used by more than 30 brands and processed almost 600,000 items. Its clients range from startups to international brands, and include Mango, Vans, Payless Shoes, Toshiba and Landmark, a department store chain in the Philippines.

Locad is among a growing roster of other Southeast Asia-based logistics startups that have recently raised funding, including Kargo, SiCepat, Advotics and Logisly. Locad wants to differentiate by providing a flexible solution that can work with any sales channel and is integrated with a wide range of shipping providers.

Robertz told TechCrunch that Locad is able to keep an asset-light business model by partnering with warehouse operators and facility managers. What the startup brings to the mix is a cloud software platform that serves as a “control tower,” letting users get real-time information about inventory and orders across Locad’s network. The company currently has seven fulfillment centers, with four of its warehouses in the Philippines and the other three in Singapore, New South Wales, Australia and Hong Kong. Part of its funding will be used to expand into more Asia-Pacific markets, focusing on Southeast Asia and Australia.

Locad’s seed round will also used to add integrations to more couriers and sales channels (it can already be used with platforms like Shopify, WooCommerce, Amazon, Shopee, Lazada and Zalora), and develop new features for its cloud platform, including more data analytics.

Powered by WPeMatico

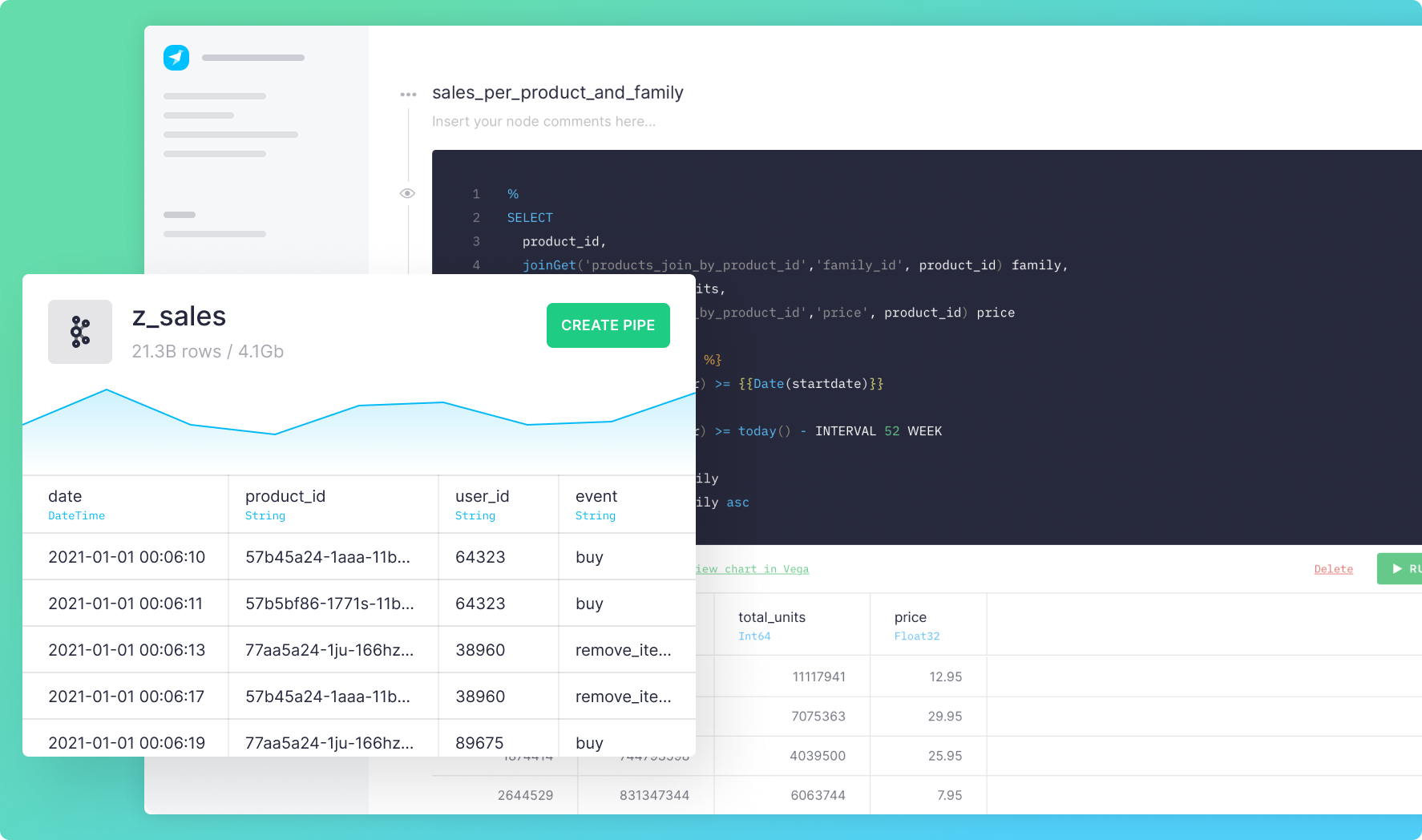

Meet Tinybird, a new startup that helps developers build data products at scale without having to worry about infrastructure, query time and all those annoying issues that come up once you deal with huge data sets. The company ingests data at scale, lets you transform it using SQL and then exposes that data through API endpoints.

Over the past few years, analytics and business intelligence products have really changed the way we interact with data. Now, many big companies store data in a data warehouse or a data lake. They try to get insights from those data sets.

And yet, extracting and manipulating data can be costly and slow. It works great if you want to make a PowerPoint presentation for your quarterly results. But it doesn’t let you build modern web products and data products in general.

“What we do at Tinybird is we help developers build data products at any scale. And we’re really focused on the realtime aspect,” co-founder and CEO Jorge Gómez Sancha told me.

The team of co-founders originally met at Carto. They were already working on complex data issues. “Every year people would come with an order of magnitude more data,” Gómez Sancha said. That’s how they came up with the idea behind Tinybird.

Image Credits: Tinybird

The product can be divided into three parts. First, you connect your Tinybird account with your data sources. The company will then ingest data constantly from those data sources.

Second, you can transform that data through SQL queries. In addition to the command-line interface, you can also enter your SQL queries in a web interface, divide then into multiple steps and document everything. Every time you write a query, you can see your data filtered and sorted according to your query.

Third, you can create API endpoints based on those queries. After that, it works like a standard JSON-based API. You can use it to fetch data in your own application.

What makes Tinybird special is that it’s so fast that it feels like you’re querying your data in realtime. “Several of our customers are reading over 1.5 trillion rows on average per day via Tinybird and ingesting around 5 billion rows per day, others are making an average of 250 requests per second to our APIs querying several billion row datasets,” Gómez Sancha wrote in an email.

Behind the scene, the startup uses ClickHouse. But you don’t have to worry about that as Tinybird manages all the infrastructure for you.

Right now, Tinybird has identified three promising use cases. Customers can use it to provide in-product analytics. For instance, if you operate a web hosting service and wants to give some analytics to your customers or if you manage online stores and want to surface purchasing data to your customers, Tinybird works well for that.

Some customers also use the product for operational intelligence, such as realtime dashboards that you can share internally within a company. Your teams can react more quickly and always know if everything is running fine.

You can also use Tinybird as the basis for some automation or complex event processing. For instance, you can leverage Tinybird to build a web application firewall that scans your traffic and reacts in realtime.

Tinybird has raised a $3 million seed round led by Crane.vc with several business angels also participating, such as Nat Friedman (GitHub CEO), Nicholas Dessaigne (Algolia co-founder), Guillermo Rauch (Vercel CEO), Jason Warner (GitHub CTO), Adam Gross (former Heroku CEO), Stijn Christiaens (co-founder and CTO of Collibra), Matias Woloski (co-founder and CTO of Auth0) and Carsten Thoma (Hybris co-founder).

Powered by WPeMatico

For kids of a certain age — think 9 to 15 — options for enrichment are somewhat limited to school, sports, and camps, while the ability to make money is largely non-existent.

A new startup called Mighty wants to provide them with a new alternative through a platform it’s building that, like a kind of Shopify for kids, enables younger kids to open their own store online and hopefully learn a bit in the process. In fact, Mighty — led by founders Ben Goldhirsh, who previously founded GOOD magazine, and Dana Mauriello, who spent nearly five years with Etsy and was most recently an advisor to Sidewalk Labs — sees itself as smack dab in the center of fintech, ed tech, and entertainment.

As often happens, the concept derived from the founders’ own experience. In this case, Goldhirsh, who has been living in Costa Rica, began worrying about his two daughters, who attend a small school and he feared might fall behind their stateside peers so began tutoring them after school. He says he was using Khan Academy among other software platforms, but their reaction wasn’t exactly positive.

“They were like, “F*ck you, dad. We just finished school and now you’re going to make us do more school?’”

Unsure of what to do, he encouraged them to sell the bracelets they’d been making online, figuring it would teach them needed math skills, as well as teach them about startup capital, business plans (he made them write one), and marketing. It worked, he says, and as he told friends about this successful “project-based learning effort,” they began to ask if he could help their kids get up and running.

Fast forward and Goldhirsh and Mauriello — who ran a crowdfunding platform that Goldhirsh invested in before she joined Etsy — say they’re now steering a still-in-beta startup that has become home to 3,000 “CEOs” as Mighty calls them.

The interest isn’t surprising. Kids are spending more of their time online than at any point in history. Many of the real-world type businesses that might have once employed young kids are shrinking in size. Aside from babysitting or selling cookies on the corner, it’s also challenging to find a job before high school, given the Department of Labor’s Fair Labor Standards Act, which sets 14 years old as the minimum age for employment. (Even then, many employers worry that their young employees might be more work than is worth it.)

Investor think it’s a pretty solid idea, too. Mighty recently closed on $6.5 million in seed funding led by Animo Ventures, with participation from Maveron, Humbition, Sesame Workshop, Collaborative Fund and NaHCO3, a family office.

Still, building out a platform for kids is tricky. For starters, not a lot of 11-year-olds have the tenacity required to sustain their own business over time. While Goldhirsh likens the business to a “21st century lemonade stand,” running a business that doesn’t dissolve at the end of the afternoon is a very different proposition.

Goldhirsh acknowledges that no kid wants to hear they have to “grind” on their business or to follow a certain trajectory, and he says that Mighty is certainly seeing kids who show up for a weekend to make some money. Still, he insists, many others have an undeniably entrepreneurial spirit and says they tend to stick around. In fact, says Goldhirsh, the company — aided by its new seed funding — has much to do in order to keep its hungriest young CEOs happy.

Many are frustrated, for example, that they currently can’t sell their own homemade items through Mighty. Instead, they are invited to sell items like hats, totes, and stickers that they customize and which are made by Mighty’s current manufacturing partner, Printful, which then ships out the item to the end customer. (The Mighty CEO gets a percentage of the sale, as does Mighty.)

They can also sell items made by global artisans through a partnership that Mighty has struck with Novica, an impact marketplace that also sells through National Geographic.

The idea was to introduce as little friction into the process as possible at the outset, but “our customers are pissed — they want more from us,” says Goldhirsh, explaining that Mighty fully intends to one day enable its smaller entrepreneurs to sell their own items, as well as services (think lawn care), which the platform also does not support currently.

As for how it makes money, Mighty plans to layer in subscription services eventually, as well as collect transaction-based revenue.

It’s intriguing, on the whole, though the startup could need to fend off established players like Shopify to should it begin to gain traction.

It’s also conceivable that parents — if not children’s advocates — could push back on what Mighty is trying to do. Entrepreneurship can be alternately exhilarating and demoralizing, after all; it’s a roller coaster some might not want kids to ride from such a young age.

Mauriello insists they haven’t had that kind of feedback to date. For one thing, she says, Mighty recently launched an online community where its young CEOs can encourage one another and trade sales tips, and she says they are actively engaging there.

She also argues that, like sports or learning a musical instrument, there are lessons to be learned by creating a store on Mighty. Storytelling and how to sell are among them, but as critically, she says, the company’s young customers are learning that “you can fail and pick yourself back up and try again.”

Adds Goldhirsch, “There are definitely kids who are like, ‘Oh, this is harder than I thought it was going to be. I can’t just launch the site and watch money roll in.’ But I think they like the fact that the success they are seeing they are earning, because we’re not doing it for them.”

Powered by WPeMatico

TechCrunch is trying to help you find the best growth marketer to work with through founder recommendations that we get in this survey. We’re sharing a few of our favorites so far, below.

We’re using your recommendations to find top experts to interview and have them write their own columns here. This week we talked to Kathleen Estreich and Emily Kramer of new growth advising firm MKT1 and veteran designer Scott Tong, and published a pair of articles by growth marketing agency Demand Curve.

Demand Curve: Email marketing tactics that convert subscribers into customers — Growth marketing firm Demand Curve shares their approaches to subject line length, the three outcomes of an email and how to optimize your format for each outcome.

(Extra Crunch) Demand Curve: 7 ad types that increase click-through rates — The growth marketing agency tells us how to use customer reactions and testimonials, and other ads types to a startup’s advantage.

MKT1: Developer marketing is what startup marketing should look like — MKT1, co-founded by Kathleen Estreich, previously at Facebook, Box, Intercom and Scalyr, and Emily Kramer, previously at Ticketfly, Asana, Astro and Carta, tell us about the importance of finding the right marketer at the right time, and the biggest mistakes founders are still making in 2021.

The pandemic showed why product and brand design need to sit together — Scott Tong shares the importance of understanding users and his thoughts on how companies manage to work together collaboratively in a remote world.

(Extra Crunch) 79% more leads without more traffic: Here’s how we did it — Conversion rate optimization expert Jasper Kuria shared a detailed case study deconstructing the CRO techniques he used to boost conversion rates by nearly 80% for China Expat Health, a lead generation company.

As always, if you have a top-tier marketer that you think we should know about, tell us!

Marketer: Dipti Parmar

Recommended by: Brody Dorland, co-founder, DivvyHQ

Testimonial: “She gave me an easy-to-implement plan to start with clear outcomes and timeline. She delivered it within one month and I was able to see the results in a couple of months. This encouraged me to hand over bigger parts of our content strategy and publishing to her.”

Marketer: Amy Konefal (Closed Loop)

Recommended by: Dan Reardon, Vudu

Testimonial: “Amy drove scale for us as we grew to a half-billion-dollar company. She identified and exploited efficiencies and built out a rich portfolio of channels.”

Marketer: Karl Hughes (draft.dev)

Recommended by: Joshua Shulman, Bitmovin.com

Testimonial: “Karl is incredibly knowledgeable in the field of content and growth marketing to a large (and equally niche) target audience of developers. He and his team at Draft.dev are some of the best at “developer marketing,” which is a greatly underrated target audience.”

Marketer: Ladder

Recommended by: Anonymous

Testimonial: “They really get what I need. By testing different messaging on different personas, we discover what works and what doesn’t to better understand our users and prospects. This is gold for a company at our stage. Showing those results to our investors blew their minds.”

Powered by WPeMatico

Lordstown Motors continues to stumble. The beleaguered electric vehicle startup is now being investigated by the Department of Justice, in addition to an ongoing investigation by the Securities and Exchange Commission.

The investigation, first broke by the Wall Street Journal on Friday, is still in its early stages, according to unnamed sources. It is being conducted by the U.S. attorney’s office in Manhattan.

“Lordstown Motors is committed to cooperating with any regulatory or governmental investigations and inquiries,” a company spokesperson told TechCrunch. “We look forward to closing this chapter so that our new leadership – and entire dedicated team – can focus solely on producing the first and best full-size all-electric pickup truck, the Lordstown Endurance.”

The probe is just the latest in a series of woes for the startup, which recently said it had to cut production volumes for its debut electric pickup, Endurance, by half — from around 2,200 vehicles to 1,000. Just a few weeks after it made that announcement, there followed news of a corporate shakeup: the resignation of founding CEO Steve Burns and CFO Julio Rodriguez. Burns started the company as an offshoot of his previous startup, Workhorse Group.

Lordstown had a strong start, with investments from General Motors that helped it purchase a 6.2-million-square-foot factory from the leading automaker in late 2019. Lordstown made positive headlines last August, when it announced it would go public via a merger with a special purpose acquisition company (SPAC). The deal injected the EV startup with around $675 million in gross proceeds and skyrocketed its market value to $1.6 billion. Less than a year later, Lordstown informed the SEC that it does not have sufficient capital to manufacture Endurance.

Then, in March, the short-seller firm Hindenburg Research released a report disputing the company’s claims that it had booked 100,000 pre-orders for the electric pickup. It wrote that “extensive research reveals that the company’s orders appear largely fictitious and used as a prop to raise capital and confer legitimacy.” The SEC opened its investigation in the wake of these accusations.

The WSJ story is unclear on the scope of the inquiry and the company declined to provide details. TechCrunch will update the story if it learns more.

Powered by WPeMatico