TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Carbon tracking is very much the new hot thing in tech, and we’ve previously covered more generalist startups doing this at scale for companies, such as Plan A Earth out of Berlin.

But there’s clearly an opportunity to get deep into a vertical sector and tailor solutions to it.

That’s the plan of Vaayu, a carbon tracking platform aimed specifically at retailers. It has now raised $1.57 million in pre-seed funding in a round led by CapitalT. Several angels also took part, including Atomico’s Angel Program, Planet Positive LP, Saarbrücker 21, Expedite Ventures and NP-Hard Ventures.

Carbon tracking for the retail fashion industry, in particular, is urgently needed. Unfortunately, the fashion industry remains responsible for 10% of annual global carbon emissions, which ads up to more than all international flights and maritime shipping combined.

Vaayu says it integrates with various point-of-sale systems, such as Shopify and Webflow. It then pulls in data on logistics, operations and packaging to monitor, measure and reduce their carbon emissions. Normally, retailers calculate emissions once a year, which is obviously far less accurate.

Vaayu was founded in 2020 by Namrata Sandhu (CEO), former head of Sustainability at fashion retailer Zalando, as well as Anita Daminov (CPO) and Luca Schmid (CTO). Vaayu currently has 25 global brand customers, including Missoma, Armed Angels and Organic Basics.

Commenting on the fundraise, Sandhu said: “We have only nine short years left to achieve the UN’s goal of reducing carbon emissions by 50% by 2030 and as the third-largest contributor to global emissions, retailers need to take action — and fast. Vaayu is here to help retailers measure, monitor, and reduce their carbon footprint at scale across the entire supply chain — something that I know from my own experience can be complex and expensive.”

Speaking to me over a call, Sandhu told me: “Putting the focus on retail basically allows us to automate the calculation, which means in three clicks you can get your carbon footprint right away. That then allows us to really get accurate data, and with that, we can basically do reductions specific to the business but using software, rather than any kind of manual intervention or a kind of ‘intermediate’ state where you need to put together an Excel sheet. Because we focus on retail we can automate the entire process and also automate the reductions.”

“We are delighted to be backed by female-led CapitalT who understood us and our vision right from the start. We look forward to developing Vaayu further in the coming months so we can reach as many retailers as possible and help put the brakes on the impending climate crisis,” she added.

Janneke Niessen, founding partner, CapitalT commented: “We are very excited to join Vaayu on their mission to reduce carbon emission for retailers worldwide. The Vaayu product is very scalable and its quick and easy implementation allows for fast adoption. We are confident that with this experienced team, Vaayu will soon be one of the fastest-growing climate tech companies in Europe and the world.”

Powered by WPeMatico

Allan Jones dropped out of college and spent a decade learning how to run a startup. In 2016, that education resulted in the launch of Los Angeles-based Bambee, which helps small companies by acting as their HR department with the goal of keeping them in compliance with government rules and regulations.

But he found getting funded a challenge in spite of his background. He said that as a Black man, he had to move more carefully in the startup world.

“I think it came as part of the complexities of navigating a mostly white male ecosystem, a mostly straight cis white male ecosystem that either helps you create some skills that make you really effective at the job, or generates so much resentment that it becomes hard to be effective. […] I think that I was always one comment away from the opposite direction [I ended up going],” he explained.

Fortunately, that didn’t happen, and he kept on climbing and gaining skills and single-handedly founded his own company, one which has reached Series B and raised $33 million, a significant amount of money for any startup, but particularly for a startup run by a Black founder.

A study published by Crunchbase in February found that VC firms distributed $150 billion in venture funding in 2020. Of that, less than 1%, or around $1 billion, went to Black founders. That highlights just how difficult it has been for him to raise from such a limited pool of money in spite of having a great idea and the business skill and acumen to pull it off.

Jones got his start at the age of 20 at a startup called Helio, which targeted the youth market for multimedia services on mobile phones. It was eventually acquired by Virgin Mobile. He went on to run product at a couple of companies before landing as CMO at ZipRecruiter in 2013. He left that position after three years to launch Bambee in 2016.

In spite of all that experience, he felt that as a gay Black man in Silicon Valley that he was continually saddled with the label of “the kid with potential,” and not always taken as seriously as his straight white counterparts. “And I don’t think those intentions necessarily were bad, I think it was quite the opposite, which actually makes them almost worse because they were entrenched in a bias of how to characterize [my abilities].”

Jones launched Bambee, a startup that is going after SMBs with fewer than 500 employees, most of which are operating without an HR department, and could be out of compliance with federal mandates because they don’t have anyone in charge who is aware of the rules.

“Bambee aims to put an HR manager in every American small business. We’ve done so by building a model that allows you to hire one on our platform for $99 a month. So you pay us a flat fee and you get access to our platform and your own dedicated HR professional. […] She acts as your human resource manager and your human resource arm for your company. And our platform helps keep those companies compliant,” Jones explained.

Jones says that while he might not encounter direct bias as he builds his business, there is an unconscious bias that investing in Bambee could be riskier than investing in someone who fits the prototypical startup founder mold, and this is especially true in early-stage investing when investors are essentially betting on the entrepreneur.

“They take bets that they deem as a bit safer — entrepreneurs that look like a certain profile — white cis-gender males that come from Stanford and Harvard that match the profile of confidence and they have kind of built in an anti-bias determination around, so they automatically get the benefit of the doubt to those pedigrees, and those profiles,” Jones said.

He says that means that Black founders have to work that much harder to overcome those biases. Today Bambee has some decent metrics to show investors with revenue reaching tens of millions, growing 300% year over year with thousands of customers across all 50 states, according to Jones. With 100 employees, he plans to double that number by the end of this year.

Even with that, he says there are still barriers to entry he has to deal with. Even if it’s harder for investors to ignore the company’s numbers, he still sees a tendency to accentuate the negative.

“Building a great company with the deficit in belief in you that starts so early on in the venture process, the [obstacles] that you have to [overcome] to get here. It seems impossible with less than 1% of venture capital dollars going to Black founders, and it isn’t because Black founders don’t exist, it’s because the belief in us is not there at scale,” he said.

As Jones continues to build the company, he has learned to look for investors who believe in him and his vision for the company. If he senses that negativity from a potential investor, he moves on because he wants to work with people who want to help build the company and believe in it as much as he does. He says this won’t change when he goes to raise his C round, a stage few Black entrepreneurs reach.

“Is it going to be easier for me going forward? I don’t think so. I think the type of bias that I have to combat based on the class of entrepreneur I’m becoming, it starts to shift and change, and I’ve seen that in every round and I’m prepared for it in my Series C, as well.”

He says that the progress he’s made in the company and his belief in the business will help him find the right partners to continue on that journey, just as he has in previous rounds.

“We will navigate this […] and I think we’ll build a really great business, and ultimately the partners we discover along this journey will be the exact right ones who we were meant to.”

Powered by WPeMatico

Jake Rothstein is the co-founder of Papa, a Miami-based company that offers care and companionship to seniors. The business, which pairs elderly Americans with uncertified-yet-vetted pals, helps offer casual services, such as technology support, grocery delivery or even a fun conversation. It has raised upwards of $91 million in venture capital to date.

While Rothstein left day to day responsibilities at Papa in 2017, his experience there gave him a deeper look into the priorities of older adults and families as they go through the aging journey. While Papa was about meeting the elderly where they are, the co-founder began to think of a more complex question: What if “where they are” isn’t as supportive as it should be 24/7?

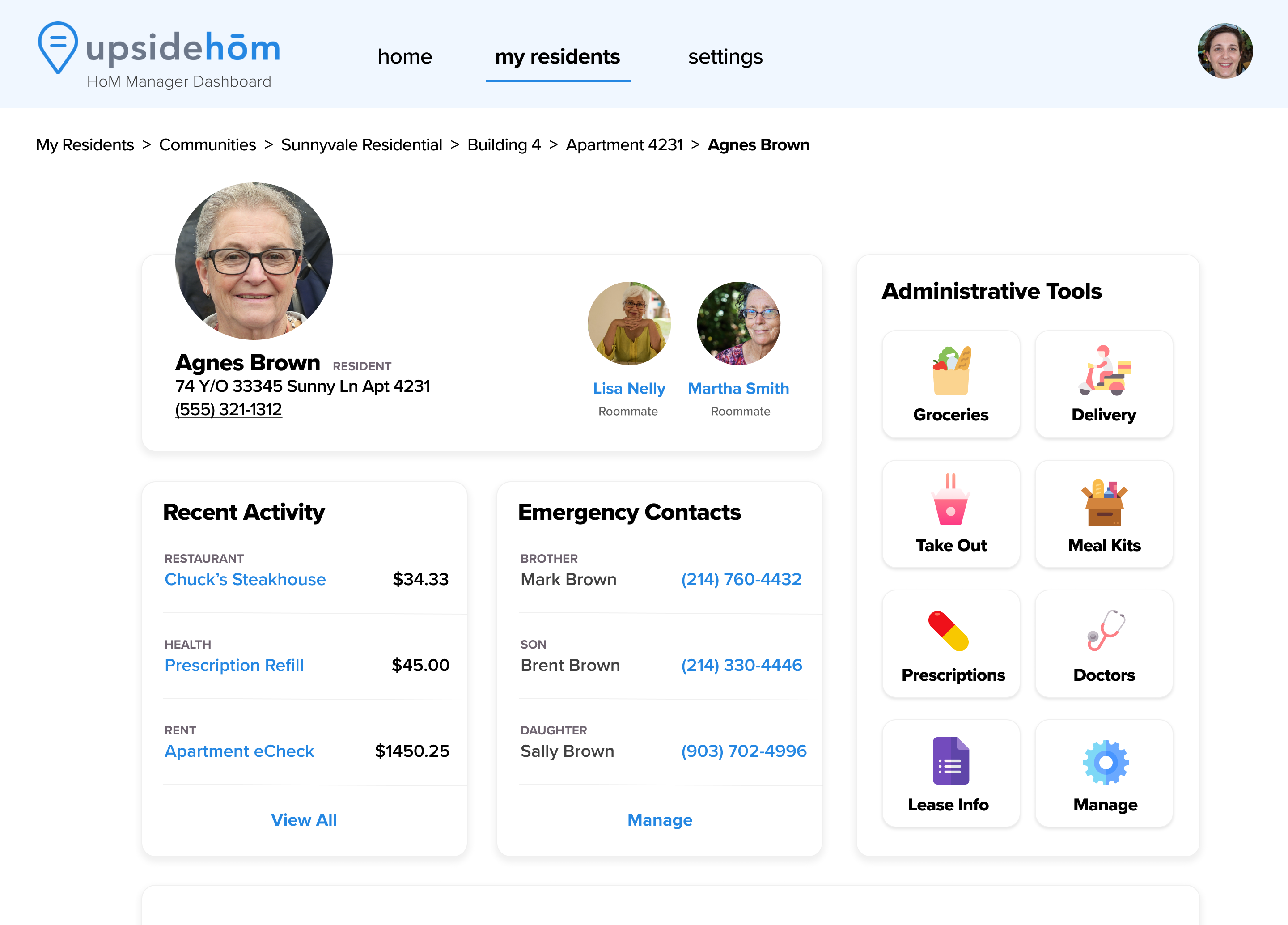

After a stint at another tech company, Rothstein launched a more modern take on senior living communities in January 2020, alongside co-worker turned co-founder Peter Badgley. UpsideHōM is a fully managed, tech-enabled living space for older adults in the United States. After a year of beta testing, the duo announced today that they have raised a $2.25 million seed round for UpsideHōM, led by Triple Impact Capital and Freestyle Capital, with participation from Techstars.

Alongside the funding, UpsideHōM announced its next big bet, dubbed a relaunch, that will sit atop furnished and furnished apartments that sit throughout Raleigh, Atlanta, Jacksonville, Tampa and South Florida: a software platform to take out all the clutter from move-in and maintenance. The platform will give residents one spot to chat with their house manager, pay bills and access perks such as on-demand tech support, house-keeping and companion visits thanks to a partnership with Papa. The company also offers add-on services and amenities, including freshly prepared meals, grocery delivery, fitness programming and accompanied transportation.

Image Credits: UpsideHōM

Part of UpsideHōM’s focus is in creating personalized solutions. Elders are diverse in age, needs and financial circumstances — which means the turnkey solution needs to be easily adaptable to service needs when they pop up. The company needs to be careful though: It can’t offer traditional caregiver services due to state by state compliance; instead Rothstein describes the offerings as supportive services, not in replacement of health assistant caregivers.

Image Credits: UpsideHoM

When the company first launched, it was betting on a more unconventional idea.

“I thought, let’s solve loneliness even more completely than what Papa is doing by building in companionship,” Rothstein said, instead of letting people order it on demand. The company decided to offer roommate matching services for elders as one of its core services, alongside the aforementioned supported living characteristics. It didn’t fully stick. Over half of inbound participants responded to the marketing efforts by saying that they liked the idea, but didn’t want to share the space. Today, 50% of UpsideHōM’s business covers individuals or people with spouses or significant others; the other half covers those looking to share units.

The synergies between UpsideHōM and Papa, Rothstein’s previous company, are clear beyond an overlapping customer base. Papa offered up to and almost including actual care, stopping at traditional care-giving services, which require their own vetting and compliance measures. UpsideHōM offers up to and almost including traditional senior living services, but gives supportive services instead of assisted living services, which similarly have their own logistic hurdles to figure out.

As for why Rothstein didn’t just launch supportive living services as a new product vertical within his earlier company, he chalked it up to the “tremendous” opportunity in the former, which warranted it’s own company. He also said that customer acquisition looks different between the two companies.

“At Papa, what we found was that acquiring customers in this space was incredibly challenging [so we went through] the Medicare Advantage route,” he said. “But senior living is a completely different segment.”

The millions in new venture capital money are coming as UpsideHōM prepares for aggressive growth. While the company did not disclose revenue or total residents, it did say it has hit 1,000% in new resident headcount in the first half of 2021 as a vague proxy. As the startup prepares for its next phase of growth, the co-founders will need to focus heavily on sustainable customer acquisition.

Rothstein thinks that downsizing elders into homes that work for them is a simple argument to make.

“You can age in place for as long as it’s practical, but there’s going to be a day and time when it’s not [going to] be practical,” Rothstein said. “Why would you want to make this decision after you’ve broken your hip, after you run out of money or after your spouse died?”

Editor’s note: A previous version of this story wrote that Rothstein had spent six years scaling Papa. This is incorrect. He left in 2017 but remains an investor in the company.

Powered by WPeMatico

API publishers among Postman’s community of more than 15 million are working toward more seamless and integrated developer experiences for their APIs. Distilled from hundreds of one-on-one discussions, I recently shared a study on increasing adoption of an API with a public workspace in Postman. One of the biggest reasons to use a public workspace is to enhance developer onboarding with a faster time to first call (TTFC), the most important metric you’ll need for a public API.

If you are not investing in TTFC as your most important API metric, you are limiting the size of your potential developer base throughout your remaining adoption funnel.

To understand a developer’s journey, let’s first take a look at factors influencing how much time and energy they are willing to invest in learning your technology and making it work.

With that context in mind, the following stages describe the developer journey of encountering a new API:

A developer browses your website and documentation to figure out what your API offers. Some people gloss over this step, preferring to learn what your tech offers interactively in the next steps. But judgments are formed at this very early stage, likely while comparing your product among alternatives. For example, if your documentation and onboarding process appears comparatively unorganized and riddled with errors, perhaps it is a reflection of your technology.

Signing up for an account is a developer’s first commitment. It signals their intent to do something with your API. Frequently going hand-in-hand with the next step, signing up is required to generate an API key.

Making the first API call is the first payoff a developer receives and is oftentimes when developers begin more deeply understanding how the API fits into their world. Stripe and Algolia embed interactive guides within their developer documentation to enable first API calls. Stripe and Twitter also use Postman public workspaces for interactive onboarding. Since many developers already use Postman, experiencing an API in familiar territory gets them one step closer to implementation.

Powered by WPeMatico

Bioengineering may soon provide compelling, low-carbon alternatives in industries where even the best methods produce significant emissions. Utilizing natural and engineered biological process has led to low-carbon textiles from AlgiKnit, cell-cultured premium meats from Orbillion and fuels captured from waste emissions via LanzaTech — and leaders from those companies will be joining us onstage for the Extreme Tech Challenge Global Finals on July 22.

We’re co-hosting the event, with panels like this one all day and a pitch-off that will feature a number of innovative startups with a sustainability angle.

I’ll be moderating a panel on using bioengineering to create change directly in industries with large carbon footprints: textiles, meat production and manufacturing.

AlgiKnit is a startup that is sourcing raw material for fabric from kelp, which is an eco-friendly alternative to textile crop monocultures and artificial materials like acrylic. CEO Aaron Nesser will speak to the challenge of breaking into this established industry and overcoming preconceived notions of what an algae-derived fabric might be like (spoiler: it’s like any other fabric).

Orbillion Bio is one of the new crop of alternative protein companies offering cell-cultured meats (just don’t call them “lab” or “vat” grown) to offset the incredibly wasteful livestock industry. But it’s more than just growing a steak — there are regulatory and market barriers aplenty that CEO Patricia Bubner can speak to, as well as the technical challenge.

LanzaTech works with factories to capture emissions as they’re emitted, collecting the useful particles that would otherwise clutter the atmosphere and repurposing them in the form of premium fuels. This is a delicate and complex process that needs to be a partnership, not just a retrofitting operation, so CEO Jennifer Holmgren will speak to their approach convincing the industry to work with them at the ground floor.

It should be a very interesting conversation, so tune in on July 22 to hear these and other industry leaders focused on sustainability discuss how innovation at the startup level can contribute to the fight against climate change. Plus it’s free!

Powered by WPeMatico

Digital technologies have disrupted the structure of markets with unprecedented breadth and scale. Today, there is yet another wave of innovation emerging, and that is the decarbonization of the global economy.

While governments still lack the conviction necessary to truly fight the climate crisis, the overall direction is clear. The carbon price in Europe rose from below $10 to over $50 per ton. Shell was handed a resounding defeat by a Dutch court. The major blackout in Texas at the beginning of the year revealed the fragility of the existing energy supply even in a highly industrialized country. We must urgently invest more into developing and deploying reliable, clean electricity generation technologies to make decarbonization a reality.

Forward-thinking investors understand this. Global investment in low-carbon technologies climbed to $500 billion in 2020, according to Bloomberg. Renewable energy accounted for around $300 billion of that, followed by electrification of transport ($140 billion) and heating ($50 billion).

However, we remain far from the finish line. According to the International Energy Agency, global emissions of CO2 this year are set to jump 1.5 billion tons over 2020 levels. And more than 80% of global energy consumption is still made up of coal, oil and gas.

Fusion, the process that powers the stars, could be the cleanest energy source for humanity.

That’s why we need to continue backing new technologies with breakthrough potential. Of particular promise is nuclear fusion. Fusion, the process that powers the stars, could be the cleanest energy source for humanity. We are already indirectly harvesting the power of fusion through solar energy. Being able to build fusion reactors would give us an “always on” version, independent of weather conditions.

But why fund fusion at all, given that we don’t yet know how to do it? First, this isn’t an either-or proposition. We can afford to build out renewable energy and investigate new forms of energy production at the same time because the latter — at least at this early stage of development — will require a comparatively trivial amount of money. The U.S. government’s latest plan is to spend $174 billion over 10 years on the electrification of car transport alone, so to invest $2 billion to create a fusion power plant seems doable.

Second, we are about to need a lot more electricity than we ever have. The global demand for carbon-free energy sources is set to triple by 2050, driven by increasing urbanization, the electrification of industrial processes, the loss of biodiversity and the increase in energy consumption in emerging markets.

Third, there’s been tremendous progress in the necessary supporting technologies. Superconducting magnets for the magnetic-confinement approach to fusion have become much cheaper, lasers for inertial confinement fusion have become much more powerful, and breakthroughs in material science have made nanostructured targets available, which enable the use of completely new approaches to fusion, such as the low-neutronic fuel pB11.

Thankfully, there is a growing number of entrepreneurial efforts from world-class teams to try and build fusion. At least 25 startups around the world are targeting fusion right now, approaching the problem with a wide range of technologies. The amount invested in private fusion companies across the world increased tenfold to almost $1 billion in 2020, according to Crunchbase.

The upside of successful fusion is nearly unlimited. The clean energy generation market represents a trillion-dollar opportunity. An estimated 26 TW of primary energy capacity needs to be built globally from 2030 to 2050 to serve the rising global energy needs, according to Materials Research Society. Just 1 TW of capacity will generate $300 billion in revenue, and a 15% market share from 2030 to 2050 would yield more than $1 trillion in annual revenue.

We need many shots on goal here, which is why Susan Danziger and I have personally invested in three different fusion startups already (Zap Energy and Avalanche in the United States and Marvel Fusion in Germany).

But it is not primarily the potential for financial upside that motivates us: There is an opportunity to make an indelible difference in the trajectory of human history. If even a small fraction of the large wealth accumulated by entrepreneurs and investors in the last couple of decades is invested here, the likelihood of successful fusion rises dramatically. That, in turn, will unlock much more investment from both venture funds and governments.

Now is the time to go all-in on decarbonization. Funding fusion with its breakthrough potential must be part of that effort.

Powered by WPeMatico

Last year, during the pandemic, a free browser extension called Netflix Party gained traction because it enabled people trapped in their homes to connect with far-flung friends and family by watching the same Netflix TV shows and movies simultaneously. It also enabled them to dish about the action in a side bar chat.

Yet that company — later renamed Teleparty — was just the beginning, argue two young companies that have raised seed funding. One, a year-old upstart in London that launched in December, just closed its round this week led by Craft Ventures. The other, a four-year-old, Bay Area-based startup, has raised $3 million in previously undisclosed seed funding, including from 500 Startups.

Both believe that while investors have thrown money at virtual events and edtech companies, there is an even bigger opportunity in developing a kind of multiplayer browsing experience that enables people to do much more together online. From watching sports to watching movies to perhaps even reviewing X-rays with one’s doctor some day, both say more web surfing together is inevitable, particularly for younger users.

The companies are taking somewhat different approaches. The startup on which Craft just made a bet, leading its $2.2 million seed round, is Giggl, a year-old, London-based startup that invites users of its web app to tap into virtual sessions. It calls these “portals” to which they can invite friends to browse content together, as well as text chat and call in. The portals can be private rooms or switched to “public” so that anyone can join.

Giggl was founded by four teenagers who grew up together, including its 19-year-old chief product officer, Tony Zog. It only recently graduated from the LAUNCH accelerator program. Still, it already has enough users — roughly 20,000 of whom use the service on an active monthly basis — that it’s beginning to build its own custom server infrastructure to minimize downtime and reduce its costs.

The bigger idea is to build a platform for all kinds of scenarios and to charge for these accordingly. For example, while people can chat for free while web surfing or watching events together like Apple Worldwide Developers Conference, Giggl plans to charge for more premium features, as well as to sell subscriptions to enterprises that are looking for more ways to collaborate. (You can check out a demo of Giggl’s current service below.)

Hearo.live is the other “multiplayer” startup — the one backed by 500 Startups, along with numerous angel investors. The company is the brainchild of Ned Lerner, who previously spent 13 years as a director of engineering with Sony Worldwide Studios and a short time before that as the CTO of an Electronic Arts division.

Hearo has a more narrow strategy in that users can’t browse absolutely anything together as with Giggl. Instead, Hearo enables users to access upwards of 35 broadcast services in the U.S. (from NBC Sports to YouTube to Disney+), and it relies on data synchronization to ensure that every user sees the same original video quality.

Hearo has also focused a lot of its efforts on sound, aiming to ensure that when multiple streams of audio are being created at the same time — say users are watching the basketball playoffs together and also commenting — not everyone involved is confronted with a noisy feedback loop.

Indeed, Lerner says, through echo cancellation and other “special audio tricks” that Hearo’s small team has developed, users can enjoy the experience without “noise and other stuff messing up the experience.” (“Pretty much we can do everything Clubhouse can do,” says Lerner. “We’re just doing it as you’re watching something else because I honestly didn’t think people just sitting around talking would be a big thing.”)

Like Giggl, Hearo Lerner envisions a subscription model; it also anticipates an eventual ad revenue split with sports broadcasters and says it’s already working with the European Broadcasting Union on that front. Like Giggl, Hearo’s users numbers are conservative by most standards, with 300,000 downloads to date of its app for iOS, Android, Windows, and macOS, and 60,000 actively monthly users.

It begs the question of whether “watching together online” is a huge opportunity, and the answer doesn’t yet seem clear, even if Hearo and Giggl have more compelling tech and viable paths to generating revenue.

The startups aren’t the first to focus on watch-together type experiences. Scener, an app founded by serial entrepreneur Richard Wolpert, says it has 2 million active registered users and “the best, most active relationship with all the studios.” But it markets itself a virtual movie theater, which is a slightly different use case.

Rabbit, a company founded in 2013, enabled people to more widely browse and watch the same content simultaneously, as well as to text and video chat. It’s closer to what Giggl is building. But Rabbit eventually ran aground.

Lerner says that’s because the company was screen-sharing other people’s copyrighted material and so couldn’t charge for its service. (“Essentially,” he notes, “you can get away with some amount of piracy if it’s not for your personal financial benefit.”) But it’s probably fair to wonder if there will ever be massive demand for services like his, particularly as the coronavirus fades into the distance and people reengage more actively in the physical world.

For his part, Lerner isn’t worried. He points to a generation that is far more comfortable watching video on a phone than elsewhere. He also notes that screen time has become “an isolating thing,” and predicts it will eventually become “an ideal time to hang out with your buddies,” akin to watching a game on the couch together.

There is a precedent, in his mind. “Over the last 20 years, games went from single player to multiplayer to voice chats showing up in games so people can actually hang out,” he says. “Because mobile is everywhere and social is fun, we think the same is going to happen to the rest of the media business.”

Zog thinks the trends play in Giggl’s favor, too. “It’s obvious that people are going to meet up more often” as the pandemic winds down, he says. But all that real-world socializing “isn’t really going to be a substitute” for the kind of online socializing that’s already happening in so many corners of the internet.

Besides, he adds Giggl wants to “make it so that being together online is just as good as being together in real life. That’s the end goal here.”

Powered by WPeMatico

Netskope, focused on Secure Access Service Edge architecture, announced Friday a $300 million investment round on a post-money valuation of $7.5 billion.

The oversubscribed insider investment was led by ICONIQ Growth, which was joined by other existing investors, including Lightspeed Venture Partners, Accel, Sequoia Capital Global Equities, Base Partners, Sapphire Ventures and Geodesic Capital.

Netskope co-founder and CEO Sanjay Beri told TechCrunch that since its founding in 2012, the company’s mission has been to guide companies through their digital transformation by finding what is most valuable to them — sensitive data — and protecting it.

“What we had before in the market didn’t work for that world,” he said. “The theory is that digital transformation is inevitable, so our vision is to transform that market so people could do that, and that is what we are building nearly a decade later.”

With this new round, Netskope continues to rack up large rounds: it raised $340 million last February, which gave it a valuation of nearly $3 billion. Prior to that, it was a $168.7 million round at the end of 2018.

Similar to other rounds, the company was not actively seeking new capital, but that it was “an inside round with people who know everything about us,” Beri said.

“The reality is we could have raised $1 billion, but we don’t need more capital,” he added. “However, having a continued strong balance sheet isn’t a bad thing. We are fortunate to be in that situation, and our destination is to be the most impactful cybersecurity company in the world.

Beri said the company just completed a “three-year journey building the largest cloud network that is 15 milliseconds from anyone in the world,” and intends to invest the new funds into continued R&D, expanding its platform and Netskope’s go-to-market strategy to meet demand for a market it estimated would be valued at $30 billion by 2024, he said.

Even pre-pandemic the company had strong hypergrowth over the past year, surpassing the market average annual growth of 50%, he added.

Today’s investment brings the total raised by Santa Clara-based Netskope to just over $1 billion, according to Crunchbase data.

With the company racking up that kind of capital, the next natural step would be to become a public company. Beri admits that Netskope could be public now, though it doesn’t have to do it for the traditional reasons of raising capital or marketing.

“Going public is one day on our path, but you probably won’t see us raise another private round,” Beri said.

Powered by WPeMatico

It’s not easy following a larger-than-life founder and CEO of an iconic company, but that’s what former AWS CEO Andy Jassy faces this week as he takes over for Jeff Bezos, who moves into the executive chairman role. Jassy must deal with myriad challenges as he becomes the head honcho at the No. 2 company on the Fortune 500.

How he handles these challenges will define his tenure at the helm of the online retail giant. We asked several analysts to identify the top problems he will have to address in his new role.

Handling that transition smoothly and showing investors and the rest of the world that it’s business as usual at Amazon is going to be a big priority for Jassy, said Robin Ody, an analyst at Canalys. He said it’s not unlike what Satya Nadella faced when he took over as CEO at Microsoft in 2014.

Handling the transition smoothly and showing investors and the rest of the world that it’s business as usual at Amazon is going to be a big priority for Jassy.

“The biggest task is that you’re following Jeff Bezos, so his overarching issue is going to be stability and continuity. … The eyes of the world are on that succession. So managing that I think is the overall issue and would be for anyone in the same position,” Ody said.

Forrester analyst Sucharita Kodali said Jassy’s biggest job is just to keep the revenue train rolling. “I think the biggest to-do is to just continue that momentum that the company has had for the last several years. He has to make sure that they don’t lose that. If he does that, I mean, he will win,” she said.

As an online retailer, the company has thrived during COVID, generating $386 billion in revenue in 2020, up more than $100 billion over the prior year. As Jassy takes over and things return to something closer to normal, will he be able to keep the revenue pedal to the metal?

Powered by WPeMatico

French startup PowerZ has raised another $8.3 million (€7 million at today’s exchange rate) including $1.2 million (€1 million) in debt — the rest is a traditional equity round. The company is both an edtech startup and a video game studio with an ambitious goal — it wants to build a game that is as engaging as Minecraft or Fortnite, but with a focus on education.

In February, PowerZ launched the first version of its game on computers. It doesn’t have a lot of content, but the company wanted to start iterating as quickly as possible. Aimed at kids who are six years old and over, PowerZ teleports the player into a fantasy world with cute dragons and magic spells.

“The idea is really to build a sort of Harry Potter,” co-founder and CEO Emmanuel Freund told me. “You have this world that is super nice and very interesting. Like with Hogwarts, you want to come back regularly, and the story will progress over a very long time.”

15,000 children tried out the first chapter. On average, they spent four hours in the game. I asked whether Freund was satisfied with those metrics. He told me he thought his company’s vision was “completely validated.”

Bpifrance Digital Venture, RAISE Ventures and Bayard are investing in today’s round. Existing investors Educapital, Hachette Livres, Pierre Kosciusko-Morizet and Michaël Benabou are also investing once again.

Image Credits: PowerZ

Now, it’s time to add content, expand to other platforms and launch new languages. When it comes to content, the company wants to partner with other game studios. They’re going to create new islands and design games that make you learn new stuff. Zero Games, Opal Games and ArkRep are the first third-party studios to contribute to PowerZ.

When those new chapters are available, kids will be able to practice mental calculation, geometry, vocabulary, foreign languages, sign language, but also astronomy, photography, architecture, sculpture, cooking, wildlife, yoga, etc.

“Basically we want to position ourselves as a publisher,” Freund said. “The only thing we want to keep in-house is the main storyline.”

As for new platforms, PowerZ is launching its game on the iPad this week. The company realized that launching on computers was a mistake. Adults are already using computers or don’t want to leave your kid on the computer. That’s why PowerZ is starting with the iPad and the iPhone will follow suite. In 2022, the company expects to release its game on the Nintendo Switch and potentially other game consoles.

While the game is only available in French for now, the startup is also thinking about launching an English version soon.

“The game is completely free right now. We have an idea to monetize it. We’ll copy every other games with in-app purchases for visual items,” Freund said.

When you look further down the roadmap, PowerZ has some radically ambitious goals. Freund believes that educational games will become mainstream really quickly. Many companies don’t want to develop this kind of stuff because screens are bad for kids.

“If we just say that screens are bad, we’ll end up with an Amazon product to learn math. I feel a sense of urgency to develop an educational platform for screens that can scale,” Freund told me.

PowerZ wants to reach hundreds of thousands of children as quickly as possible. And just like Fortnite or Minecraft, the company believes its game can act as a platform for other stuff that can evolve over time.

Powered by WPeMatico