TC

Auto Added by WPeMatico

Auto Added by WPeMatico

When you hire a marketing consultant, you don’t necessarily expect to wind up discussing your life’s purpose. Yet, that is what Spanish marketing expert and entrepreneur Alex Barrera often ends up doing with startup founders who hire him to help improve their pitch. They think they are going to get help convincing investors, and they do, but the byproduct of the process is that they reframe their startup’s vision.

In this context, ethical and philosophical considerations aren’t that far away, because more often than not, this includes a deep look at how their company impacts society. “The days where you could do whatever you wanted and dive into grey legal or moral areas are dwindling,” Barrera says. “Growth companies need to be careful about the potential fallouts of pursuing such strategies. While there are still plenty of investors that push for “growth at any cost,” the social pressure is changing and it’s suddenly becoming costlier to take such stances.”

You may have spotted Barrera’s cowboy hat at one of the many startup conferences he is involved with as a mentor, judge, host or speaker — and he does wear many hats.

Having previously co-founded two startup accelerators and Europe-focused tech publication Tech.eu, he now authors The Aleph Report, a periodical publication on cutting-edge technology and its implications. But it is through his Press42 venture that he collaborates with startups and corporations on organizational storytelling and strategic communications, and it is also what we discussed in the interview below (which has been edited for length and clarity).

TechCrunch is asking founders who have worked with growth marketers to share a recommendation in this survey. We’ll use your answers to find more experts to interview.

What do people often misunderstand about pitch training?

Well, it depends on their experience level. When first-time entrepreneurs hear about pitching, they immediately think of the infamous “elevator pitch,” roll their eyes and moan. For those with a bit more experience, pitching is about a set of slides to achieve a certain goal, mostly funding. However, seasoned managers end up discovering that telling the story of their product or service is not a one-way street. Having to sell a future vision of where the company is heading invariably affects your conception of the product in the now and what you need to build to achieve it. The vision impacts the product, because you need consistency between the product and storytelling.

What type of companies do you help?

I have been helping startups with pitching for years. This used to be mostly early-stage startups, and in groups, with accelerators and startup competitions calling me to help their entire batch or portfolio. I still provide that sort of training, but these days I will more often work one-on-one with a single client that is at a later stage. And I also sometimes work with tech companies getting ready for M&As, as well as large corporations.

“I don’t work with companies that sell smoke and mirrors or hurt society because they shamelessly disregard any responsibility for their impact on others.”

What is your sweet spot for startups you work with?

For one-on-one work, I have a preference for David versus Goliath, and less sexy spaces. I love these companies that were built without the noise: There’s a lack of hubris, they are really humble, but the numbers are there — the founders could be obnoxious, but it’s the opposite. I don’t work with companies that sell smoke and mirrors or hurt society because they shamelessly disregard any responsibility for their impact on others.

Luckily, that’s rarely the case of people who call me. Usually, they are a bit out of the circuit, and they often have impostor syndrome. So my work is also about helping them understand what they can be proud of what they do, and then how to show that in their pitch. They value talking to someone who understands them and their challenges. I spend a lot of time doing research on all verticals and thinking about the future, so the conversation will typically go like this: “Dude, you get it!”

What is one of your favorite things about one-on-one pitch-related consulting work?

I find it very fulfilling to see how much value it brings to those involved. I am also a developer, and I do project management, but most of the consulting I do is not the kind of growth marketing stuff that takes more time to show results. When you do growth hacking at the product level, it takes time to see the impact, and even then, it’s not always easy to connect the dots.

When we work together on their pitch, CEOs can instantly see if the new pitch resonates or not; and they also know if the exercise itself worked for them. Working on a pitch requires a lot of reflection and it entails a lot of tension between you and the CEO.

This is especially true at the beginning, when you keep questioning why they did this or that, what the product provides and to whom, or why it grew here and not there. All these questions force many founders and managers to stop and think hard about the product, the market or the roadmap. Sometimes it pushes them to provide data to back up certain claims. The process pushes them to revisit old biases, beliefs or even myths around their company. Many people are surprised by how much clarity they gain into their company when they work on a pitch.

Do you only work with founders and executives?

Sometimes, the clarity and the strategic insight that working on a pitch provides to founders or CXOs becomes a trigger for them wanting to provide that level of understanding to other areas of the company, like sales, customer support or even the product team. In my case, being a developer myself enables me to switch and adapt my process to any layer of the organization, including the development team.

This is rare, but it eventually turns me into a kind of translator of the challenges of different parts of an organization, acting ultimately as the connector bridging different perceptions. In the end, that’s exactly what storytelling provides. It’s not just a tool for pitching, it’s a brutally effective way to communicate between humans, especially around challenging topics.

How would you describe the value that executives get from your collaboration?

One of the usual and even surprising values for most executives is the insight the process provides. When someone is running either a big company or a scaleup, their day to day is all about growing. They rarely have time to sit down and think about where they’re heading in terms of future product. They do have a roadmap, and their KPIs, but I rarely see a strong future vision broken down into steps.

The pitching process provides them with two valuable things: time and perception. Time because as they’re paying me, they’re stuck with me and need to allocate time for our sessions. That bubble, and the need to build a coherent story that tells why the company is at that particular point, create tremendous insight for most. And then, there’s perception. It’s funny because they’re the ones that provide all the pieces of the picture, I just help them put them together and then point at the obvious.

This process is very rewarding at a personal level for them. It helps them build a confidence that, while it was always there, it rarely shone through the pitch before. It also makes them reflect on where they want to go next, not just from a product perspective, but from a mission’s perspective. It reconnects them with that side that most of us care about, and the personal questions we ask ourselves about life and meaning.

How do you bridge the gap between what your clients already know and what’s next?

My clients already know how to grow a company. I always keep this in mind, not just with startups, but also with big corporations — too often, I see consultants talking to them and starting by telling: “You are doing it wrong!” Well, they got to where they are, didn’t they? It doesn’t mean that they don’t need help, but you can make them see that, you don’t have to dismiss what they have achieved. I see myself as the person that helps them get to the next level and build on top of what they have already done. Sometimes it takes some bruising to get there, but there is always massive respect for their achievements.

These people are very good professionals. It’s not that they don’t see or can’t see the vision. It’s that the need to connect the dots in detail allows for the emergence of a strategic vision of the organization. Now, here is where the real “coaching” kicks in. When such a picture emerges, many founders or executives tend to shy away from it. They have a hard time believing that they might be onto something groundbreaking or actually winning in their respective markets.

This is especially true for many scaleup companies. They’ve been fighting, first for market fit, and later on for market share, that they freeze at the possibility that they might be doing a fantastic job. Part of my role is precisely to break through their impostor syndrome and encourage them to be bolder, to believe in themselves, to trust the data.

How do you promote your services?

Well, it would be very hard for me to do cold calling. I wouldn’t be able to say: “It’s not just about pitching, you are going to see the future of your company!” — so I stopped even trying to market that. My best marketing tool is word of mouth from my clients, or even from people that see me perform on stage. But even then, people call for help with a specific milestone, like raising a round. It’s only through the process that they see that there’s way more to it. They begin to understand other parts about themselves that either enhance their capacity to raise more funds, or even take them to the next level like an acquisition or the development of a major breakthrough.

Have you worked with a talented individual or agency who helped you grow your startup?

Respond to our survey and help us find the best startup growth marketers!

What do you end up actually working on with founders?

Going higher up the chain, the pitch becomes a very powerful tool not just for fundraising, but also for thinking about your company strategically. It’s a place where founders can reach clarity about their strategy and what really matters — questions they don’t have time for on a day-to-day basis. They allocate time to it because they think it will help with fundraising, and then they find out that it helps them understand their company.

So typically, they will call me because they are raising a Series B round, or a very large A round. They realize that to unlock the next milestone, they need to fine-tune what they say. The game is different; it’s not about market fit anymore, or just about gaining market share, and what worked for them just no longer works — especially if they were semi-bootstrapped up to that point. They need to talk to someone who understands them and can help them prepare for the future, for instance by researching certain pitfalls or trends. I’m not just the guy that “pitches” but the guy that’s going to provide you with ammo to help you build a compelling case for your audience, whatever it is. The pitch is just an excuse!

“The thing is, scaleups and growth-stage startups have a choice in how they market themselves; so they need to be aware of ethical concerns that may arise sooner than later.”

What’s your take on comparing your startup to another one when pitching; for instance, calling yourself the “Uber for X”?

Analogies are very powerful. The major challenge when you are pitching any company, even a late-stage one, is that people have a tendency to put you in a box. So you have two options: either you let them do it, or you provide the tools to put you in a box. That’s where analogies work really well.

But then, who do you compare yourself to? It’s a challenge, because two elements are becoming increasingly important: capturing the right trends of the moment, and the ethics of how you do what you do. You want to control which box they place you, ideally one that’s trendy but at the same time one that doesn’t position you in apparently direct competition with someone you don’t want to be associated with.

Why do startups need to be careful when communicating?

Over the last few years, we have seen how startups are no longer seen as innocent by society; they no longer have “carte blanche,” and society is becoming a lot more sensitive. There’s a polarization issue around many topics, and we are increasingly going to see a clash between society and startups. It is even going to increase post-COVID, with tensions around automation versus jobs. And the thing is, scaleups and growth-stage startups have a choice in how they market themselves; so they need to be aware of ethical concerns that may arise sooner than later.

Society is going to ask you for responsibility. What’s happening with big brands is trickling down, and scaleups are hitting that threshold sooner. Typically, it catches them unprepared, because they reach that stage only knowing local feelings about what they do, and suddenly getting national or regional blowback. Or they expand internationally with local operations led by really young people with no experience in dealing with politics, who suddenly face strong local blowback.

All of this has a lot to do with pitching, because it’s not about product anymore. So for instance, it’s about convincing public authorities at different levels to let you operate, when their incentives are very different from investors. It’s B2G2C — business to government to consumer. And we are seeing more and more startups, with regulation as a factor in their operations.

How can you talk to public authorities, customers and investors in a unified pitch?

The major pitch needs to bring all elements together. It needs to be clear on what you do, and hit the right notes on ethical concerns. It’s important both for regulators and for fundraising; because from the investors’ perspective, it also reduces uncertainty around your business. As a scaleup, your ability to scale is a concern, so it helps to show that you are thinking and planning around societal impact.

I have to say that an increasing amount of investors do genuinely care about this. It may be because they have been burned, for instance from seeing regulatory blowback firsthand, or just because they are growing conscious. There are still some investors that have the “Uber mindset” and only care about muscle — grow first, and only then, deal with regulators — but more and more, VCs are aware that this might not fly, because society is changing. The pandemic is just highlighting this even more.

What about startups? Do they also care more about their societal impact?

I think it’s a pendulum, and the current generation is a child of the previous regulatory blowback. Crypto might still be on the other side, but increasingly, startups are aware that there are societal implications they will have to deal with. I also try to bring that message across when I prepare my clients to pitch — and warn that it sometimes happens very quickly: We’ve seen how one prohibition in one place can spread like wildfire. So you need to regulate your initial message and also be prepared to adapt quickly.

Powered by WPeMatico

Ants and camels are famously resilient, but when it was time to select a name for a startup that offers open-source, cloud-based distributed database architecture, you can imagine why “Cockroach Labs” was the final candidate.

Database technology is fundamental infrastructure, which partially explains why it’s so resistant to innovation: Oracle Database was released in 1979, and MySQL didn’t reach the market until 1995.

Since hitting the market six years ago, CockroachDB has become “a next-generation, $2-billion-valued database contender,” writes enterprise reporter Bob Reselman, who interviewed the company’s founders to write a four-part series:

Part 1: Origin story: From the creation of the popular open-source image editor GIMP to some of Google’s most well-known infrastructure products.

Part 2: Technical design: Analyzes the key differentiation that CockroachDB offers, particularly its focus on geography and data storage.

Part 3: Developer relations and business: How CockroachDB engages with developers while pivoting to the cloud at a key inflection point.

Part 4: Competitive landscape and future: A look at the fierce competition, and what possible exit routes might look like.

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Our ongoing search for the best startup growth marketers is yielding results: reporter Anna Heim interviewed SaaS and early-stage startup marketing consultant Lucy Heskins to learn more about the mistakes her clients are most likely to make before they seek her help.

“The first is hiring a marketer too soon,” said Heskins. “I’ve come into startups thinking I was coming in to set up their in-house function. However, very quickly you realize that they’ve jumped the gun and think they’ve got product-market fit when they are nowhere near it.”

Heskins shared a few pages from her early-stage marketing playbook, in which she recommends aligning content marketing with the customer experience — as opposed to just putting pages up that score well in search results.

Because their conversation contains a lot of strategic advice for startups that haven’t yet made a marketing hire, we made it available on TechCrunch.

If you know of a skilled growth marketer, please share your recommendation in this quick survey.

Thanks very much for reading!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: z_wei (opens in a new window) / Getty Images

Congratulations: You’ve joined a startup and received an Incentive stock option grant! You now own a percentage of the company, and there’s no telling how much it could be worth one day.

A few questions: Do you know your 409A valuation? What’s your strike price? Surely, you know the preferred share price and which type of options you were granted?

No?

It’s complicated stuff, and for most ISO recipients, this may be the first time they start thinking seriously about how federal tax laws impact them personally.

To break things down, Vieje Piauwasdy, Secfi’s director of equity strategy, recently shared a post with Extra Crunch.

“If you’ve ever been confused about your equity, or haven’t thought much about it, you’re not alone.”

Image Credits: Peter Dazeley (opens in a new window) / Getty Images

First of all, what is suptech?

“The emergence of purpose-built technologies to facilitate regulator oversight has, over the past few years, garnered its own moniker of supervisory technology, or suptech,” Marc Gilman, the general counsel and VP of compliance at Theta Lake, writes in a guest column.

Gilman notes that “nearly every financial services regulator is engaged in some type of suptech activity.”

But as a primer, he focused on three areas: regulatory reporting, machine-readable regulation, and market and conduct oversight.

Image Credits: Superhuman

Superhuman co-founder and CEO Rahul Vohra joined us last week at TechCrunch Early Stage to provide an in-depth look at how he and his company worked to optimize and refine their product early to create a version of “growth hacking” that would not only help Superhuman attract users, but serve them best and retain them, too.

Vohra articulated a system that other entrepreneurs should be able to apply to their own businesses, regardless of area or focus.

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’m a postdoc engineer who started STEM OPT in June after failing to get selected in the H-1B lottery.

A colleague suggested that I apply for an EB-1A for extraordinary ability green card, but I have not won any major awards, much less a Nobel Prize. Would you tell me more about the EB-1A?

Thanks!

— Bashful in Berkeley

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm and Anna Heim dialed in on India for today’s Exchange, noting that the country is a good example of the global trend of booming venture capital dollars invested.

“The country’s venture capital haul thus far in 2021 has nearly matched its 2020 total and is on pace for a record year,” they write. “But as the third quarter gets underway, something perhaps even more important is going on: public-market liquidity.”

They looked at recent venture capital results and considered what Zomato’s flotation means for the country’s IPO pipeline. Don’t miss this analysis of an explosive startup market.

Image Credits: Peter Cade (opens in a new window) / Getty Images

Now that COVID-19 vaccines are encouraging the world to reopen, two trends are underway:

In the first half of 2021, mergers and acquisitions increased by more than 150% YOY to $2.4 trillion; in several surveys, an overwhelming majority of workers said they intend to seek employment elsewhere.

If your startup is angling toward an exit, the promise of a big payday may not be enough to retain employees who feel burned out or dissatisfied.

Many founders don’t have prior management experience, and, frankly, the uncertainty associated with an exit makes it a poor time for on-the-job learning. With that in mind, here are several communication strategies that can help you keep your winning team intact.

Image Credits: TechCrunch/Emergence Capital

How do you go beyond the names and numbers with your startup pitch deck? For Doug Landis, the answer is one simple compound gerund: storytelling. It’s a word that gets thrown around a lot of late in Silicon Valley, but it’s one that could legitimately help your startup stand out from the pack amid the pile of pitches.

Landis joined the TechCrunch Early Stage: Marketing and Fundraising event to offer a presentation about the value of storytelling for startups, whittling down the standard two-hour conversation to a 30-minute version.

Though he still managed to rewind things pretty far, opening with, “400,000 years ago, men and women used to sit around the fire pit and tell stories about their day, about their hunt, about the one that got away.”

Image Credits: Khosla Ventures

We kicked off our TechCrunch Early Stage 2021: Marketing and Fundraising event with a deep dive on all the tips and tricks required to get the most out of pitching and slide decks. On hand was Adina Tecklu, a principal at Khosla Ventures, and who formerly built out Canaan Beta, the consumer seed practice at Canaan Partners.

We talked about the importance of knowing your customer (aka your potential investor), focusing on story, typical slides in a deck, the appendix slides, formatting, and then alternative formats and which to avoid in a pitch deck.

Image Credits: Nigel Sussman (opens in a new window)

News that Apple plans to get into the buy now, pay later game had Alex Wilhelm wondering about the impact on startups in the space.

Shares of public competitors Affirm and Afterpay dropped on the news, but it doesn’t mean a death knell for those looking to jump into the BNPL game, Alex notes.

“Provided that Apple’s BNPL solution is rolled out over time to the same markets where Apple Pay is present, the … company could consume market shares — and therefore oxygen — from generalized rival BNPL services,” he writes.

“Those startups building more niche or targeted solutions will likely enjoy some shelter from the competitive storms.”

Image Credits: Nigel Sussman (opens in a new window)

So how does the math work out for all these startups with minimal revenue, tons of cash and sky-high valuations?

Alex Wilhelm ran through the numbers, explaining why the current state of the venture capital market makes sense for startups and investors alike.

“Today we can make super-expensive startup math work out, provided that growth rates stay generally strong and public-market multiples stay rich,” he writes in The Exchange. “If the latter dips, the former has to improve, and vice versa.”

Image Credits: Getty Images / Rawpixel

At the TechCrunch Early Stage: Marketing and Fundraising event last week, Norwest Venture Partners‘ Lisa Wu took the stage to discuss how founders can think like venture capitalists in all facets of their business.

The overlapping in job roles is uncanny: The best investors and founders have to find focus through the noise, understand the weight of due diligence and pitch others with conviction.

Wu used anecdotes and exercises — such as the eyebrow test — in the tactical, engaging chat.

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm weeds through Revolut’s 2020 financial results again to determine if the U.K.-based consumer fintech player’s $33 billion valuation makes sense.

“The picture that emerges is one of a company with a rapidly improving financial image, albeit with some blank spaces regarding recent customer growth,” he writes.

Image Credits: Abdullatif Omar/EyeEm (opens in a new window) / Getty Images

Jasper Kuria, the managing partner of The Conversion Wizards, breaks down how the CRO consultancy ran an A/B test to boost the conversion rates of a multibillion-dollar company.

“Radical redesigns that incorporate a large number of variables (instead of single-element tests) are more likely to provide substantial gains,” Kuria writes. “Another advantage to doing this is it requires much less time and traffic for your tests to reach statistical significance.”

Here’s a rundown of all the changes that led to a 75% bump in orders.

Powered by WPeMatico

Dayna Grayson has been in venture capital for more than a decade and was one of the first VCs to build a portfolio around the transformation of industrial sectors of our economy.

At NEA, where she was a partner for eight years, she led investments in and sat on the boards of companies including Desktop Metal, Onshape, Framebridge, Tulip, Formlabs and Guideline. She left NEA to start her own fund, Construct Capital, that focuses exclusively on early-stage startups, with a portfolio that includes Copia, ChargeLab, Tradeswell and Hadrian.

It should come as no surprise, then, that we’re absolutely thrilled to have Grayson join us at TechCrunch Disrupt 2021 in September.

Grayson has more than proven that she has a keen eye for transformational technology. Desktop Metal went public in 2020 — she still sits on the board as chair of the compensation committee. Onshape, another NEA-era investment, was acquired by PTC in 2019 for a whopping $525 million. Framebridge was also acquired by Graham Holdings in 2020.

Grayson saw an opportunity to develop a venture brand more hyperfocused on the types of deals she was doing at NEA, which centered around manufacturing and digitizing industrial verticals. That’s where Construct Capital came in. It’s a $140 million fund helmed by Grayson and former Uber exec Rachel Holt.

At Disrupt, Grayson will serve as a Startup Battlefield judge. The Battlefield is one of the world’s most prestigious and exciting startup competitions. Twenty+ early-stage startups hop on our stage and present their wares to a panel of expert VC judges, who then grill the founders on everything about the business, from the revenue model to the go-to-market strategy to the team to the technology itself.

The winner walks away with $100,000 in prize money and the glory of being a Battlefield winner. Households names in tech have gotten their start in the Battlefield, from Dropbox to Mint.

Grayson joins plenty of other seasoned investors on the Battlefield stage, including Camille Samuels, Deena Shakir, Terri Burns, Shauntel Garvey and Alexa Von Tobel.

Disrupt 2021 goes down from September 21 to 23 and is virtual. Snag a ticket here starting under $100 for a limited time!

Powered by WPeMatico

When it comes to M&A in the chip world, the numbers are never small. In 2020, four deals involving chip companies totaled $106 billion, led by Nvidia snagging ARM for $40 billion. One surprise from last year’s chip-laced M&A frenzy was Intel remaining on the sidelines. That would change if a rumored $30 billion deal to buy chip manufacturing concern GlobalFoundries comes to fruition.

The rumor was first reported by The Wall Street Journal yesterday.

Patrick Moorhead, founder and principal analyst at Moor Insight & Strategies, who watches the chip industry closely, says that snagging GlobalFoundries would certainly make sense for Intel. The company is currently pursuing a new strategy to manufacture and sell chips for both Intel and to others under CEO Pat Gelsinger, who came on board in January to turn around the flagging chip maker.

“GlobalFoundries has technologies and processes that are specialized for 5G RF, IoT and automotive. Intel with GlobalFoundries would become what I call a ‘full-stack provider’ that could offer a customer everything. This is in full alignment with IDM 2.0 (Intel’s chip manufacturing strategy) and would get Intel there years before it could without GlobalFoundries,” Moorhead told TechCrunch.

It would also give Intel a chip manufacturing facility at a time when there are global chip shortages and huge demand for product from every corner, due in part to the pandemic and the impact it has had on the global supply chain. Intel has already indicated it has plans to spend more than $20 billion to build two fabs (chip manufacturing plants) in Arizona. Adding GlobalFoundries to these plans would give them a broad set of manufacturing capabilities in the coming years if it came to pass, but would also involve a significant investment of tens of billions of dollars to get there.

GlobalFoundries is a worldwide chip manufacturing concern based in the U.S. The company was spun off from Intel’s rival chip maker AMD in 2012, and is currently owned by Mubadala Investment Company, the investment arm of the government of Abu Dhabi.

Investors seem to like the idea of combining these two companies, with Intel stock up 1.59% as of publication. It’s important to note that this deal is still in the rumor stage and nothing is definitive or final yet. We will let you know if that changes.

Powered by WPeMatico

Yummy, a Venezuela-based delivery app on a mission to create the super app for the country, announced Friday it raised $4 million in funding to expand its dark store delivery operations across Latin America.

Funding backers included Y Combinator, Tinder co-founder Justin Mateen, Canary, Hustle Fund, Necessary Ventures and the co-founders of TaskUs. The total investment includes pre-seeding capital raised in 2020.

“This appears to be a contrarian bet, but Yummy has quickly become the No. 1 super app in Venezuela and proven that the team can scale the business in a difficult territory,” Mateen said in a statement. “Now Vicente and the rest of the Yummy team will expand into more traditional markets with the necessary experience and support to overcome inevitable challenges that they will face.”

Vicente Zavarce, Yummy’s founder and CEO, launched the company in 2020 and is currently part of Y Combinator’s summer 2021 cohort. Born in Venezuela, Zavarce came to the U.S. for school and stayed to work in growth marketing at Postmates, Wayfair and Getaround before starting Yummy. Zavarce was a remote CEO over the past year, stuck in the U.S. due to travel restrictions, but said he is making the most of it.

Yummy’s app can be downloaded for free, and the company charges a delivery fee or merchant fee. In contrast to some of his food delivery competitors, Zavarce told TechCrunch Yummy’s fees are “the lowest in the market” so they do not affect the merchant’s ability to use the app.

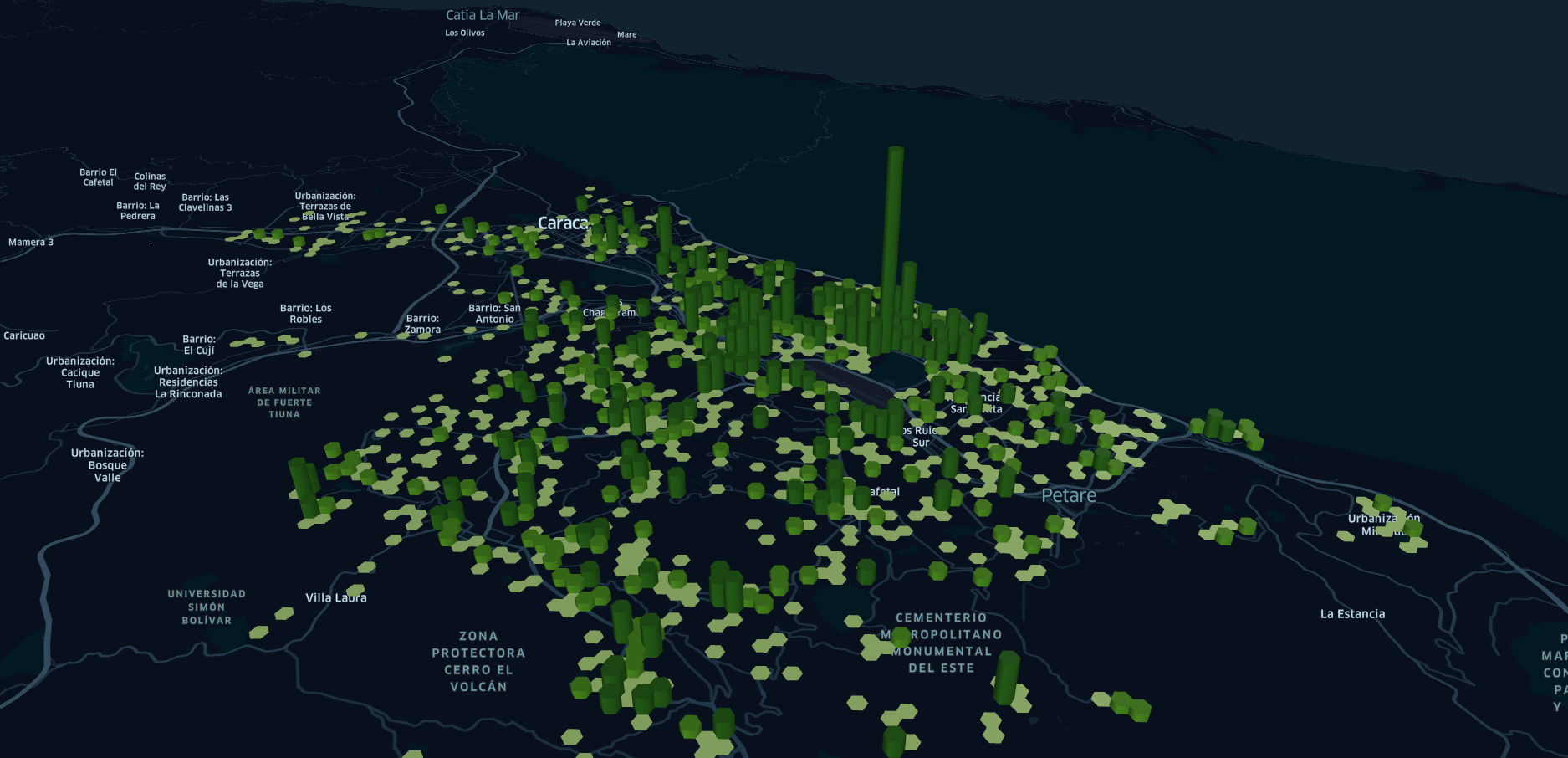

Yummy order heat map. Image Credits: Yummy

The company is pulling together additional key components for its super app strategy, which includes launching a ridesharing vertical this year. Yummy has already connected more than 1,200 merchants with hundreds of thousands of customers.

And, over the past year the company completed more than 600,000 deliveries of food, groceries, alcohol and shopping. It reached $1 million in monthly gross merchandise volume while also growing 38% in revenue month over month.

Over the past eight years, the political and economic challenges faced by the country have led to its recent adoption of the U.S. dollar, Zavarce said. In some cases up to 70% of transactions are happening in dollars on the ground. He said this has protected the business against hyperinflation and ultimately created the opportunity for startups to begin operating in Venezuela.

Because of that, combined with more consumer technology innovation over the past decade, Zavarce said there is no reason why Venezuela should not have the best last-mile logistics. It’s there that Yummy has an opportunity to connect multiple vertices into a super app with little to no competition.

“Eventually, other players will enter, but because we have a super app, we already have an amazing frequency of usage,” he added. “We also already have exclusivity with 60% of the food delivery marketplace, which has enabled us to build a moat around the market. We believe we are the right people to execute on this and feel it is our responsibility to do it.”

Plans for the new funding include user acquisition — the company has close to 200,000 registered users already — and to expand in Peru and Chile by August. At the same time, Zavarce will spend some of that capital to attract more users across Venezuela. He also expects to be in Ecuador and Bolivia by the end of the year.

Powered by WPeMatico

Halla wants to answer the question of how people decide what to eat, and now has $4.5 million in fresh Series A1 capital from Food Retail Ventures to do it.

Headquartered in New York, Halla was founded in 2016 by Gabriel Nipote, Henry Michaelson and Spencer Price to develop “taste intelligence,” using human behavior to steer shoppers to food items they want while also discovering new ones as they shop online. This all results in bigger basket orders for stores. SOSV and E&A Venture Capital joined in on the round, which brings Halla’s total capital raised to $8.5 million, CEO Price told TechCrunch.

The company’s API technology is a plug-and-play platform that leverages more than 100 billion shopper and product data points and funnels it into three engines: Search, which takes into account a shopper’s preferences; Recommend, which reveals relevant complementary products as someone shops; and Substitute, which identifies replacement options.

Halla’s Substitute product was released earlier this year as an answer to better recommendations for out-of-stock items that even retailers like Walmart are creating technology to solve. Price cited a McKinsey report that found 20% of grocery shoppers sought out competitors following a negative outcome from bad substitutions.

Halla Substitute. Image Credits: Halla

None of these data points are linked to any shoppers’ private data, just the attributes around the shopping itself. The APIs, rather, are looking for context to return relevant recommendations and substitutions. For example, Halla’s platform would take into account the way someone adds items to their cart and suggest next ones: if you added turkey and then bread, the platform may suggest cheese and condiments.

“It’s also about personalization when it comes to grocery shopping and food,” Price said. “When you want organic eggs from a specific brand and it is out of stock, it is often up to your personal shopper’s discretion. We want to lead them to the right substitutions, so you can still cook the meal you intended instead of ‘close enough.’ ”

Halla’s technology is now live in more than 1,100 e-commerce storefronts. The new funding gives Halla some fuel for the fire Price said is happening within the company, including plans to double the number of stores it supports across accounts. He also expects to double employees to 30 in order to support growth and customer base, admitting there is “more inbound interest that we can handle.” Halla has been busy fast-tracking big customers for pilots, and at the same time, wants to expand internationally with additional product lines over the next 18 months.

The company is also seeing “a near infinite increase in recurring revenue,” as it attracts six- and seven-figure contracts that push the company closer to cash flow positivity. All of that growth is positioning Halla for a Series B if it needs it, Price said.

Meanwhile, as part of the investment, Food Retail Ventures’ James McCann will join Halla’s board of directors.

McCann, who only invests in food and retail technology, told TechCrunch that grocery stores need a way to inspire shoppers, that Halla is doing that and in a better way than other intelligence versions he has seen.

“Their technology is miles ahead of everyone else,” he added. “They have a terrific team and a terrific product. They are seeing huge uplifts in terms of suggestions and what people are buying, and their measurements are out of this world.”

Photo includes Halla co-founders, from left, Spencer Price (CEO), Henry Michaelson (CTO & President) and Gabriel Nipote (COO).

Powered by WPeMatico

We know how much you love a good startup pitch-off. Who doesn’t? It combines the thrill of live, high-stakes entertainment with learning about the hottest new thing. Plus, you get to hear feedback from some of the smartest folks in the industry, thus learning how to absolutely crush it at your next pitch meeting with a VC.

With all that in mind, we’re introducing a special summer edition of Extra Crunch Live that’s all pitch-off, all the time.

On July 21 and July 28, Extra Crunch Live will feature startups exhibiting in the Startup Alley at TechCrunch Disrupt 2021 in September. Those startups will pitch their products/businesses to a pair of expert VC judges, who will then give their live feedback.

Extra Crunch Live is usually a combination of an interview with a founder/investor duo and an audience pitch-off. But as it’s summer, and Disrupt is right around the corner, we thought it would be fun to bring you even more pitches and even more feedback.

On July 21, our expert VC judges will be Alexa von Tobel of Inspired Capital and Anis Uzzaman from Pegasus Tech Ventures.

REGISTER HERE FOR INSPIRED CAPITAL AND PEGASUS TECH VENTURES

REGISTER HERE FOR INSPIRED CAPITAL AND PEGASUS TECH VENTURES

Alexa von Tobel founded LearnVest, which sold for hundreds of millions of dollars. She then went on to found and serve as general partner at Inspired Capital. She’s been to plenty of TechCrunch events, and has even been a guest on Extra Crunch Live earlier this year. Long story short: She’s a smarty pants and an all-around fun person to hang out with.

Anis Uzzaman is founder and partner at Pegasus Tech Ventures, whose portfolio includes SpaceX, 23andme, Airbnb, Sofi, Coinbase, Robinhood, DoorDash and many more. Before Pegasus, he was at IBM and Cadence, where he drove strategic investments in software development, microelectronics and e-commerce. And if that weren’t enough, he’s founded several companies.

On July 28, our VC judges include Nicole Johnson from Forerunner and Mor Assia from iAngels.

REGISTER HERE FOR FORERUNNER VENTURES AND iANGELS

REGISTER HERE FOR FORERUNNER VENTURES AND iANGELS

Nicole Johnson has a background in psychology and brings that experience into the world of consumer tech, focusing on the consumer psyche to both evaluate and help grow startups in which she is investing. Her portfolio includes Calibrate, Neighborhood Goods, Nécessaire, Heroes, Thingtesting, Prose, Stadium Goods and others.

Mor Assia is founding partner and co-CEO of iAngels. Hailing from Israel, and part of the IDF’s elite intelligence unit 8200, Assia leads the iAngel’s investment committee, deal screening, due diligence and portfolio management. She has a background with SAP, IBM and Amdocs, and specializes in the areas of fintech, AI and automotive technology.

These upcoming episodes are sure to be as exciting as they are informative, and we’ll be hitting you with more special edition Startup Alley pitch-off episodes of ECL throughout the rest of the summer.

Also, buy a ticket to Disrupt. Trust me. The agenda is lit. Along with the heavy hitters on the Disrupt Stage, you can get your founder how-to knowledge at sessions on the Extra Crunch Stage, breakout sessions and intimate roundtable discussions. You’ll be able to find and engage with people from all around the world through world-class networking on CrunchMatch and our virtual platform — all for under $100 for a limited time with even deeper discounts for nonprofit/government agencies, students and up-and-coming founders!

Powered by WPeMatico

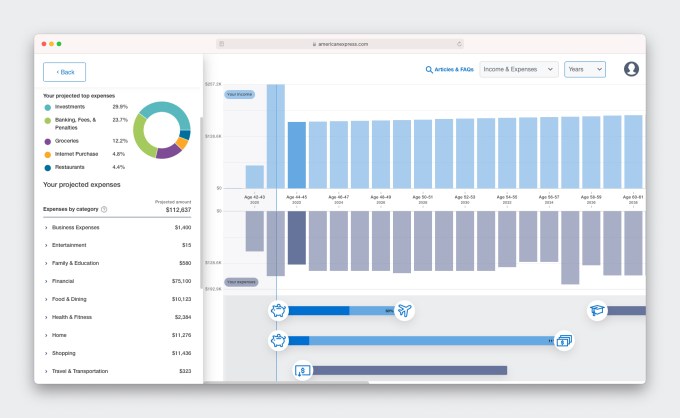

American Express is branching out into financial planning, with a little help from a seven-person startup called BodesWell.

This week, the credit card giant launched a pilot of its first self-service digital financial planning tool, dubbed “My Financial Plan (MFP).” The six-month pilot kicked off on July 11 with about 25,000 select Amex cardmembers.

American Express quietly invested in BodesWell in late 2020 via its venture arm, Amex Ventures. Since then, the financial services behemoth teamed up with the tiny startup to develop the financial planning tool for its users. The new product is designed to give users a complete picture of their financial health and help them make and achieve major life goals, such as buying a house or retirement.

TechCrunch talked with Amex Ventures’ Julia Huang, who led the investment and strategy around the new product, and BodesWell co-founder and CEO Matthew Bellows to learn more details.

The pair actually met while serving on a panel together in 2019.

“I was drawn to the fact that it was not a round-up savings tool, but rather a holistic tool to understand your full financial picture that could be used to plan for the financial impact of your life decisions,” Huang told TechCrunch.

Before deciding to invest in BodesWell, Huang says Amex Ventures — which over time has backed more than 70 startups — had “evaluated the space quite extensively.”

Huang introduced Bellows and his staff to Amex’s Digital Labs team and they embarked on jointly developing a specialized offering for Amex customers. (While Bellow is based in Boston, he says the startup is “globally distributed.”)

“Our goal is to democratize financial planning with our cardmembers by providing detailed insights and forecasts to help them with their holistic planning,” she told TechCrunch.

Image Credits: Amex Ventures

Bellows started BodesWell in early 2019 with the goal of empowering clients and customers to build their own financial plan.

“So much of financial planning software is aimed at financial advisors, and requires them to run it,” he said. “So, most people can’t get the benefits of financial planning…Our hope is to expand benefits to a lot more people.”

BodesWell will guide users in setting up a financial plan and will work even better if they sync with their other financial information via Plaid so it can “update in real time,” Huang said.

The tool “takes into account income, assets, expenses and liabilities — what cash flow looks like holistically so that users can drag & drop to plan life events,” Bellow said.

An estimated 85 million American households don’t have a financial, planner for a variety of reasons — including mistrust of a planner’s intentions or just feeling overwhelmed by the process.

The product is free during the pilot phase and American Express hasn’t yet determined if it will charge for it afterwards.

“We’re gauging first for engagement and the power of the product for our customers,” Huang told TechCrunch. “We want to make sure the product resonates and that we iterate on the product to make sure it’s good for the broader population. Our primary goal is that our customers use it and find it valuable.”

Amex Ventures has formed “some level of partnership” with more than two-thirds of its portfolio companies, she added.

“We try to engage with our portfolio in that way, to provide value with our startup ecosystem,” Huang said.

For its part, BodesWell had previously raised about $1.5 million from investors such as Cleo Capital, Ex Ventures, Riot.vc, GritCapital and Argon Capital and angels like HubSpot CEO Brian Halligan and Kintent CEO Sravish Sridhar.

Powered by WPeMatico

News broke this morning that Revolut, a U.K.-based consumer fintech player, raised a Series E round of funding worth $800 million at a valuation of $33 billion. Those figures are breathtaking not only due to their sheer scale, but also thanks to their radical divergence from Revolut’s preceding funding event.

At times, The Exchange, TechCrunch’s markets-and-startups column, runs into two topics worth exploring in a single day. Today is such a day. You can check out our earlier notes on the buy now, pay later startup market and Apple’s entrance into the BNPL space here. Now, let’s talk about neobanks.

As TechCrunch’s Ingrid Lunden wrote earlier today concerning the news:

This latest Series E is being co-led by Softbank Vision Fund 2 and Tiger Global, who appear to be the only backers in this round. It comes on the heels of rumors earlier this month Revolut was raising big. Revolut last raised about a year ago, when it closed out a Series D at $580 million, but what is stunning is how much its valuation has changed since then, growing 6x (it was $5.5 billion last year).

Stunning indeed.

Lunden also went on to report on the company’s changing financial picture based on Revolut’s recently released 2020 results. In this entry, we’re digging more deeply into those financial results and usage metrics detailed by the fintech megacorn.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The picture that emerges is one of a company with a rapidly improving financial image, albeit with some blank spaces regarding recent customer growth.

Powered by WPeMatico

At the TechCrunch Early Stage: Marketing and Fundraising event last week, Norwest Venture Partners‘ Lisa Wu took the stage to discuss how founders can think like venture capitalists in all facets of their business. The overlapping in job roles is uncanny: The best investors and founders have to find focus through the noise, understand the weight of due diligence and pitch others with conviction. Wu, who has investments in Plaid, Calm and Ritual, used anecdotes and exercises — such as the eyebrow test — in the tactical, engaging chat.

Startup founders often turn to pitch decks when fundraising as a visual representation of their story — from the origins to total addressable market to those juicy metrics. While the format definitely works, the influx of pitch decks in a hot deal environment makes it harder to stand out.

Wu gave some pointers on how she reacts to cold pitch decks, and why founders may want to take some unconventional advice.

I love it because I can quickly flip through the deck and generally form an opinion on it. And I think I’ve read some stat recently, which is that investors really spend 2 minutes and 47 seconds per deck. It’s an easy way for me to, in that short amount of time, just get a calibration of the business to decide whether to move forward.

But, as the founder, I’ll probably tell you don’t do [the cold pitch deck]. Because if you’re sending me the pitch deck, I’m quickly screening and then I’m making a decision of whether it makes sense to meet, but your goal is really just to try to get the meeting with me to tell the story and let that unfold. And so, give us enough of it — like a blurb to tease us to want to continue to engage is great. But if it is possible, I would suggest a late pullback of the pitch deck, even though I love to receive it in advance. (Timestamp: 21:50)

In other words, she loves founders sliding into the DMs with pitch decks, but doesn’t think that strategy always gives the founder storytelling power.

This answer triggered a series of questions from attendees on whether pitch decks are even necessary in the first place. Here, Wu explains how the competitive venture market has impacted her preferences — and her interest in what I’d describe it as a private beta, except for fundraising rounds.

So, everything is shifting these days. Because there’s so much capital [and competition] out there, sometimes if I’m chasing a really hot company, I actually prefer that they don’t have a deck, or they haven’t created one yet. Because once you have a deck, that means you can go and take it out to a bunch of other investors, too. And so it’s helpful to structure the conversation and to storytell around it. I think I like a deck more so than not, unless it’s in a competitive situation. If I’m trying to close the deal, I actually prefer just an open dialogue. (Timestamp: 23:30)

We just have them come in and we just prepare our team internally to let them know that there’s no deck here. And so, it’s just up to the founders to really just tell the story to us. And, it’s worked. (Timestamp: 24:20)

Help TechCrunch find the best growth marketers for startups.

Provide a recommendation in this quick survey and we’ll share the results with everybody.

Powered by WPeMatico