TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Sebastian Siemiatkowski, the co-founder and CEO of Klarna — the Swedish fintech “buy now, pay later” sensation that is currently Europe’s most valuable private tech company — is dismissive of the suggestion that non U.S. companies should relocate to Silicon Valley if they really want to grow.

“We did hear that and I think it’s very poor advice,” he says. An overheated market for tech talent and the fickle nature of employees that are constantly job-hopping, he argues, make it harder to build a company for the long term.

Then he goes further.

“When I went to San Francisco for the first time about 10 years ago, [it] was a magical place. It was the early days of Facebook, there was an amazing vibe. When I go to San Francisco today, it’s changed to become, in my opinion, fairly cold.”

Siemiatkowski, a Swedish national and the son of two immigrants from Poland, is also sceptical of the “American dream.” In contrast to America, he points out how Sweden is among the most successful societies in the world from a social mobility perspective — referencing its free education and free health care, which sets up as many people as possible for success. But there is one caveat: he doesn’t think first-generation immigrants in Sweden do nearly as well as their children.

“We didn’t have a lot of money,” he tells me. “My father was driving a cab, he was unemployed for many years, even though he had basically a doctorate in agronomy. That’s kind of the unfortunate part of this, but that has obviously created a massive amount of hunger with me.”

As second generation success stories go, the rise of Klarna is up there with the best, even if it has already been 15 years in the making.

Backed by the likes of Sequoia, Silverlake, and Atomico, a new $650 million funding round in September gave the company a whopping $10.65 billion valuation — almost double the price achieved a year earlier, cementing its status as a poster child for Europe’s ability to build tech companies valued far above $1 billion. Siemiatkowski still owns an 8.1 percent stake.

Klarna is also, perhaps, even more mythical than a unicorn: a fintech that has been profitable nearly from the get-go. That only changed in 2019, when it decided to incur losses in favor of investing millions trying to conquer the U.S. market, choosing New York and L.A. over San Francisco for its American offices.

The company has been built on the concept of giving consumers a way to buy things online without having to pay for them upfront, and without resorting to a credit card. It does this both by offering online retailer integrations where Klarna appears as an option at check out, and through its own “shopping mall” app, where users can browse all the stores that let you pay with Klarna. On the back of this, the company hopes to foster a bigger financial relationship with its users as a fully-fledged bank.

If a bank is partly about corralling enough users on to your platform to pay money in and out, Klarna is well on its way. Today, the company boasts a registered customer base of 90 million, 11 million of which are in the U.S. In the last year alone, 21 million users were added globally. Klarna’s direct to consumer app, which sits alongside its 200,000 strong merchant point of sale integrations, has 14 million active users globally. Combined, Klarna is processing over 1 million transactions per day through its platform.

Image Credits: Klarna

This growth has continued apace as Klarna rides one macro trend and bucks another: Prompted by the pandemic, e-commerce has gone gangbusters, while, conversely, consumer credit as a whole has been in decline as people are paying down longer-term debt in record numbers. Even before COVID-19, Klarna and other buy now, pay later providers had been successfully picking up the slack created by a credit card market that, in some countries, has been steadily contracting.

Yet with a business model that generates the majority of its revenue by offering consumers short-term credit — and against a backdrop where the idea of easy credit and infinite consumption is increasingly criticised — the fintech giant is not without detractors.

When I mention Klarna to people who work in the European tech industry, the reaction tends to fall into one of three camps: those who reference the company’s “weird” above the line advertising and social media campaigns; those who use the service regularly and talk in terms of guilty pleasures; and those who are outright scornful of the impact on society they perceive Klarna to be making. And it’s true: You can’t help but be suspicious of something that gives consumers the feeling that they can spend money they might not have. And those “Smoooth” ads (below) certainly don’t offer much reassurance.

Delve a little deeper, however, and it becomes clear that the company’s business model can be misunderstood and that the arguments playing out in the media for and against buy now, pay later is only one part of the Klarna story.

In a wide-ranging interview, Siemiatkowski confronts criticisms head on, including that Klarna makes it too easy to get into debt, and that buy now, pay later needs to be regulated. We also discuss Klarna’s business model and the balancing act required to win over consumers and keep merchants onside.

We also learn how, under his watch and as the company began to scale, Klarna missed the next big opportunity in fintech, instead being usurped by Adyen and Stripe. Siemiatkowski also shares what’s next for the company as it ventures further into the world of retail banking after gaining a bank license in 2017.

And, told publicly for the first time, Siemiatkowski reveals how he once sought out PayPal co-founder Max Levchin as an advisor, only to learn a little later that he had started Affirm, one of Klarna’s most direct U.S. competitors and sometimes described by Europeans as a Klarna clone.

But first, let’s go back to the beginning.

Klarna’s first ever transaction took place at 11:06:40 am on April 10, 2005 at a Swedish bookshop called Pocketklubben, according to the abbreviated history published on the company’s website. However, what is made less explicit is that there was likely very little technology involved. The real innovation was a business one, with Klarna’s young and non-technical founders, Sebastian Siemiatkowski, Niklas Adalberth and Victor Jacobsso, taking an old idea and reconfiguring it for the burgeoning e-commerce industry.

By enabling customers that shopped online to be mailed an invoice with 30 days to pay, online shopping could be made easier and safer for consumers, which in turn helped increase sales for retailers.

“The invoicing company”

“When they started, they didn’t position themselves so much as a startup or as a tech company,” recalls Skype founder Niklas Zennström, whose venture capital firm Atomico would eventually become a Klarna investor in 2012. “People referred to them as the invoicing company.”

Today, Klarna is most certainly a tech company, employing 1,300 software engineers out of a staff of over 3,500. The company is now entirely cloud based and with various fully automated processes, from credit risk processing to algorithms in the Klarna shopping app to personalize content for individual consumers to AI/machine learning for 24 hour customer service.

Crucially, however, even this early and rudimentary version of what would become ‘buy now, pay later’ ticked two important boxes. Consumers, especially those who were distrusting of e-commerce, could be sure they’d receive goods before being charged, and if for any reason a product needed to be returned, customers wouldn’t have to wait weeks to be reimbursed as they hadn’t outlaid cash in the first place. Arguably both problems were already solved by credit cards, but in countries like Sweden, credit card take up was low, while the humble debit card doesn’t carry the same consumer protections as a credit card.

“The reason that we were able to launch it and be successful was because we were in a market where debit cards were much more prevalent than credit cards,” says Siemiatkowski. “And most people who have credit cards don’t reflect on the fact that if you have a debit card and you shop online, you face a number of struggles that a credit card holder does not.”

Those “struggles” include tying up your own money for the time it takes to return an item and process a refund. In contrast, when you spend on a credit card, the merchant is effectively holding your credit card company’s money.

“If I am buying some items and feel a bit unsafe about the merchant I’m using, if there’s a credit card, I don’t feel like I’m risking my money. If it’s my salary money you’re actually holding as a merchant for three weeks while you’re processing the return, that’s a problem,” Siemiatkowski argues.

Instead, Klarna would step in and offer to pay the merchant up front while providing customers 30 days to settle their invoice. Later this would be extended to include installments as an option. In return for taking on all of the risk and promising to increase conversions, merchants would give the Swedish upstart a percentage cut of the transactions.

“They wanted to make it really simple by just putting in your name, your Social Security number, and then you can instantaneously get an option to get an invoice sent to you later on. So what it did was remove a lot of friction from buying,” says Zennström.

Meanwhile, the more retailers sold, the more revenue Klarna would generate, all without consumers having to be charged interest on what might otherwise be described as a short-term loan. Pitch perfect, you might think. However, in early 2005 and before the company was incorporated, the concept was stress-tested at a “Shark Tank”-style event held at the Stockholm School of Economics and attended by the King of Sweden. The judging panel, made up of prominent Swedish financiers, were not convinced and Klarna’s invoicing idea came last in the competition. Despite the loss, Siemiatkowski held on to feedback from an unknown member of the audience, who surmised that banks would never launch something similar. Siemiatkowski left undeterred.

Angel investment from a former Erlang Systems sales manager, Jane Walerud, followed and she put Klarna’s founders in contact with a team of developers who helped build the first version of the platform. However, it soon surfaced that there was a misunderstanding in relation to the equity promised and how it should be linked to a longer commitment to the project.

Reflects Siemiatkowski: “One of the drawbacks that we had at the company was that none of the three co-founders had any engineering background; we couldn’t code. We were connected to five engineers that by themselves were amazing engineers, but we had a slight misunderstanding. Their idea was that they were going to come in, build a prototype, ship it, and then leave for 37% of the equity. Our understanding was that they were going to come in, ship it, and if it started scaling they would stay with us and work for a longer period of time. This is the classic mistake that you do as a startup.”

Eventually, the original five engineers quit, leaving Siemiatkowski to manage something he didn’t understand. “We obviously hired a CTO, but I also needed to be able to evaluate his decision making and all of these things in order to be able to assess whether we had the right setup to achieve what we want to achieve,” he says.

Between 2006 and 2008, Klarna continued to grow as more people started shopping online. The company expanded beyond Sweden to neighboring Nordic countries Norway, Finland and Denmark, with a headcount that had reached 120 employees. Even though there were signs of growth, Siemiatkowski says it still took a long time to realise that if Klarna was ever going to be really successful, it needed to fully transform into a tech company.

“We were really good at sales, we were okay at marketing, [and] we were service oriented: we really delivered to our customers. But it wasn’t really that technology driven,” he concedes.

To attract the kind of tech talent required, Siemiatkowski decided he needed to woo a renowned tech investor. Further backing had come in 2007 from Swedish investment firm Investment AB Öresund, but by 2010 the Klarna CEO had two new targets in his sights: Niklas Zennström, the Swedish entrepreneur who had already achieved legend status back home after building and selling Skype, and Sequoia Capital, the Silicon Valley venture capital firm that had invested in Apple, Google and PayPal.

“Part of our thinking about how we make Klarna attractive for people with engineering backgrounds was to get an investor that really had the brand and could kind of put their mark on us and say, ‘this is a tech company,’” says Siemiatkowski.

There is every likelihood that Zennström’s Atomico would have joined Klarna’s cap table in 2010 if it weren’t for a single line of text published on the VC firm’s website, which read something like, “don’t contact us, we’ll contact you.” Europe’s startup ecosystem was still immature and what now seems like aloofness was probably nothing more than a crude way to deter cold pitches from non-venture type businesses. But whatever the intent, it would be another two years before the firm eventually had the opportunity to invest in Klarna at what was almost certainly a much higher valuation.

“That was our loss for being too arrogant,” says Zennström. “Clearly we didn’t pursue them, we didn’t discover them because we didn’t have them on our radar. When we got to know them [two years later], what we liked a lot as a firm was the pain point that they were addressing.

“E-commerce was a relatively low single digit penetration of all retail, but of course growing, and we have always believed that e-commerce is going to continue to grow and become bigger than physical retailers. We thought that if you can remove that friction of the payment, and offer people different payment methods, that’s a really big proposition.”

“I always tease Niklas about it,” admits Siemiatkowski. “They wanted to, you know, keep it exclusive and I get it. So we were like, ‘okay, we can’t get hold of them, so let’s talk to Sequoia instead.’”

However, cold calling Sequoia wasn’t going to cut it either, not only because the firm didn’t generally invest in Europe, but also by Siemiatkowski’s own admission, Klarna didn’t look much like a tech company at the time. Luckily, a mutual contact got wind that Sequoia was on the lookout for interesting companies in the region and Klarna’s name was promptly thrown into the mix.

“Chris [Olsen], who was working at Sequoia at the time, called me, [but] I had this idea that I needed to be hard to catch. So I decided to not call back for three days, which was a very nervous time where I was just sitting on my hands not doing anything,” he said. “It was like, I don’t want to look like I’m too interested in this. Eventually, after three days, I call back and we did an exclusive deal with them, which I don’t recommend companies do.”

In hindsight, the Klarna CEO advises that it’s always smarter to foster competition in a round. As the only show in town, Sequoia invested at a $100 million valuation. “They bought 25 percent of the company and that was kind of it,” he says.

Siemiatkowski believes a company is made up of three things.

The first he calls internal momentum: “How fast are we moving as an organisation? How good are the decisions we are taking? How much are we avoiding [company] politics? How much of a true meritocracy are we?”

The second is profit and loss.

And the third is valuation. In a small company these three things are closely correlated in time, he says, “so if you have great internal momentum, you will instantly see it in your P&L, and then you will instantly see that hopefully in your company valuation as well.”

But in a large company, because of its size, the challenge is that they start to become disconnected. “They’re obviously in the long term always 100% correlated, but in the short term, they can vary a lot,” cautions Siemiatkowski.

Unsurprisingly, fueled by Sequoia’s cash, Klarna continued to grow in 2010, ending the year with $54 million in annual revenue, an increase of 80%. In December 2011, General Atlantic and DST would invest $155 million in a round that gave Klarna the coveted status of a unicorn.

Siemiatkowski says, compared to the company’s subsequent $5.5 billion and $10.65 billion valuations, this is the one that put him under the most self-scrutiny.

“In just one and a half years, we went from $100 million to a $1 billion. And then I felt the pressure,” he tells me. “I felt like we made it such a competitive round because we wanted to compensate for what we saw partially as a mistake with Sequoia that we kind of went too far the other way.”

Klarna finally took Atomico’s money in 2012, and within two years had grown to over 1,000 employees. Along with multiple offices around the globe, the company moved to bigger headquarters in Stockholm and expanded to the U.K. with an office in central London. Yet, somewhere along the way, Siemiatkowski says Klarna had lost internal momentum.

“As the company scaled and we started adding more markets and growing fast, for me as CEO and co-founder, I found that very difficult,” he admits. “As long as we were up to 100 people, I found it easier, I understood how to talk to people, how to get things done, how to develop new products or features and so forth. It was all much less complex, and then we started approaching a couple of hundred people and I felt more and more lost in all of that.

“It was difficult, and at the same point of time, we still had a lot of success because we had built this product that worked really well and there was a lot of momentum coming solely from the product itself.”

Siemiatkowski says that most startups don’t recognize that “once you get the snowball rolling, you can actually do quite a lot of stupid things, and the snowball will continue rolling.”

The Klarna CEO doesn’t say it, but one of those “stupid things” came in 2012 when the startup faced a backlash in its home country. Instead of sending payment instructions in the post, the company had switched to email without considering that messages might go to spam or simply remain unread. This saw customers unintentionally defaulting and then being chased for payment, leading to accusations in the media that Klarna was tricking people so it could generate more revenue through late fees.

Powered by WPeMatico

Practically speaking, it’s nearly impossible to offer a real review of “Cyberpunk 2077,” the long-awaited follow-up to “The Witcher 3” from developer CD Projekt Red. In the first place, it’s so big that the few days I’ve had with it aren’t enough to realistically evaluate the game; second, it’s so buggy and janky now that it feels wrong to review it before it becomes the game I know it will be; and finally, everyone’s going to buy it anyway.

The Witcher 3 is among the most universally lauded games of the last decade, up there with “Breath of the Wild,” “The Last of Us” and “Dark Souls.” Though it had its flaws — lackluster combat, a limited scope — it did the open world thing better than anyone before or since, largely through improved writing, interesting characters and consequences to player choices.

It was during what you might call that game’s honeymoon period that “Cyberpunk 2077” was announced, and in the years since then the game has approached untenable levels of hype: It could never live up to what people expected, but it could very feasibly be a good game in its own right.

Recent controversies, however, have cast a pall over the launch: A seemingly hypocritical condemnation of pre-release crunch from the developer, some indefensible choices regarding diversity in the game (racialized gangs and a questionable approach to gender and trans representation) and delays suggested this may not be the magnum opus people hoped for.

In the first place I can confirm that the game probably should have been given a few more months of polish, at least on PC, the platform on which I played it. From the very start I encountered obvious bugs like characters failing to animate, objects floating in mid-air and the admittedly expected physics silliness one finds in every open-world game with simulated objects interacting. A day-one patch may fix some of them, but it’s clear that a game this big is nearly impossible to smooth out entirely. (I should say that I’m only partway through the 40-odd-hour campaign, though like its predecessor that will be padded out considerably with side quests.)

In the first place I can confirm that the game probably should have been given a few more months of polish, at least on PC, the platform on which I played it. From the very start I encountered obvious bugs like characters failing to animate, objects floating in mid-air and the admittedly expected physics silliness one finds in every open-world game with simulated objects interacting. A day-one patch may fix some of them, but it’s clear that a game this big is nearly impossible to smooth out entirely. (I should say that I’m only partway through the 40-odd-hour campaign, though like its predecessor that will be padded out considerably with side quests.)

That’s a shame, because the world CD Projekt Red has created — or rather adapted from the tabletop RPG on which it is based — is undeniably rich and lovingly fashioned. The easiest way to describe it is simply to say that it’s exactly what you imagine when you think of “cyberpunk,” no more, but surely no less.

The look of overcrowded streets filled with weirdo future people, shuffling between food carts offering vat-grown meat, beneath floating neon advertisements for cybernetic limbs and hacking tools, all watched over by enormous corporations of dubious intention… it’s right out of Blade Runner, Johnny Mnemonic, Strange Days, Ghost in the Shell, Neuromancer and dozens of other genre pieces that informed both the original RPG and the general ideas that constitute “cyberpunk” in the zeitgeist.

It’s a familiar world you’ll be entering in some ways, with few real surprises if you’re at all conversant in the genre. That is a good thing in many ways, as it feels like a lived-in place: a crystallization and expansion of ideas that, while you have seen them elsewhere, have never been at your fingertips so readily, save perhaps in the original “Deus Ex,” which had its own limitations.

Yet at the same time there is very much the feel of a lack of imagination and willingness to update those ideas in ways that seem obvious. The gangs based on racial identities seem like such a poor fit for both this era and for a future in which such distinctions have no doubt declined in relevance, especially in a vast melting pot like Night City. The stereotypical “Mexican tough guy” dialogue of your otherwise likeable companion Jackie grates, for instance, as do for example the stilted, supposedly Japanese mannerisms of staff at an Arasaka corporate hotel.

Yet at the same time there is very much the feel of a lack of imagination and willingness to update those ideas in ways that seem obvious. The gangs based on racial identities seem like such a poor fit for both this era and for a future in which such distinctions have no doubt declined in relevance, especially in a vast melting pot like Night City. The stereotypical “Mexican tough guy” dialogue of your otherwise likeable companion Jackie grates, for instance, as do for example the stilted, supposedly Japanese mannerisms of staff at an Arasaka corporate hotel.

Gender is also a mixed bag. Reviews by queer-identifying reviewers at Polygon and Kotaku have much more relevance here than anything I can say, but I can only concur that the freedom the player has in selecting their presentation is an important step toward better representation of queerness in games — but also has a “do as I say, not as I do” feeling. Elsewhere in the game sex and gender are handled regressively or inconsistently with the clear implication that, with body modification something anyone one can do on a street corner for a few eurobucks, race and gender are fluid and unimportant in this world.

This future feels like it was extrapolated exclusively from the forward-thinking but still limited minds of a bunch of smart white guys from the ’90s. Perhaps that’s why I feel so comfortable in it. But as “Ready Player One” demonstrated, there’s a limit to how much can be accomplished by those methods.

At the same time I want to call out the care that was obviously taken in some ways to have a future filled with people of different shapes, sizes, colors, inclinations and everything else — it’s clear there is genuine good intention here, even if it stumbles with unfortunate regularity.

“What about the game itself, you babbler,” you ask, after 800 words, “is it any good?”

“What about the game itself, you babbler,” you ask, after 800 words, “is it any good?”

Yes, it’s good, but difficult to categorize. On one hand, you have a paralysis-inducing freedom in shaping the capabilities with which your character approaches the various situations he or she will encounter. Brute force, stealth, hacking, gunplay — all are quite viable, but don’t expect to get far relying on only one. A “pure hacking” approach, for instance, will be far more tedious than it’s worth, while a “pure gunplay” one will likewise miss the point.

In navigating an enemy base, taking down some rando street gang, or getting through one of the game’s highly involved criminal operations, there are many options for any given situation, but none is reliable enough (certainly not early on, anyway) to get you through without resorting to the others.

One inconveniently placed guard may be susceptible to having his eyes hacked, while another may be easily distracted by one of the numerous items you can make fizzle out and attract their attention. But when you eventually slip up and the bullets start to fly, you’re not going to hack your way out of it. That’s okay, though: You’re not a scalpel, you’re a Swiss Army knife. Act like it!

The open world in which you’ll be undertaking all these missions is a rich one… perhaps too rich. Open the map and you’re presented with a sea of icons, though they’re not quite the Ubisoft-style to-do list so much as letting you know that this is a big, dense city where you’ll never lack for gun shops, criminal activities to engage in or disrupt and interesting locations to explore. If you think of the map as more “where’s a ripper around here? Let me check my phone” than generic “video game map” it makes more sense, though it’s obviously the latter, as well.

You’ll be driving around a lot as well, a process that is about as smooth as it was in “Grand Theft Auto 3.” Using the totally inadequate keyboard controls for my car, I’ve caused panics and accidents, mowed people down and obstructed traffic constantly, while attempting to follow every law and attract as little attention as possible. This part of the game feels hilariously last-generation, like how in “Assassin’s Creed: Odyssey,” your all-terrain horse vehicle was an object of terror and lethality to any peasant stupid enough to walk on one of that game’s many mountain trails.

The helpful GPS directions once took me through a pedestrian-occupied area with a gate that was just narrow enough to completely trap the car, though it extricated itself offscreen when I called it. Another time I summoned the car to my location and instantly heard a distant explosion and screams. The car arrived 30 seconds later completely trashed, missing the doors on one side. Fortunately it seems to repair itself by mysterious means when you’re not looking.

But when you’re doing what you’re supposed to be doing — you know, cyberpunk stuff — things are smoother, if not what I’d call completely modern. I had this feeling the whole time like I was playing a game whose bones were built eight years ago and then wrapped in layer after layer of stuff, creating systems and environments that feel incredibly cool in some ways and, like the car, huge throwbacks in others. The gunplay isn’t as good as any shooter today, the melee is about at “Skyrim” quality, the hacking is perhaps “Deus Ex” levels and stealth is nowhere near “Metal Gear” — but none of those games actually offered the breadth or richness of systems and environments as “Cyberpunk 2077.”

But when you’re doing what you’re supposed to be doing — you know, cyberpunk stuff — things are smoother, if not what I’d call completely modern. I had this feeling the whole time like I was playing a game whose bones were built eight years ago and then wrapped in layer after layer of stuff, creating systems and environments that feel incredibly cool in some ways and, like the car, huge throwbacks in others. The gunplay isn’t as good as any shooter today, the melee is about at “Skyrim” quality, the hacking is perhaps “Deus Ex” levels and stealth is nowhere near “Metal Gear” — but none of those games actually offered the breadth or richness of systems and environments as “Cyberpunk 2077.”

In the final — for the purpose of this article, which is to say incredibly limited and initial — analysis, it’s both accurate to say that this game is “GTA: Night City 2077” and totally inadequate. It’s both unique and totally derivative, futuristic and regressive, wide-open and painfully restrictive. Like many AAA games these days, “Cyberpunk 2077” contains multitudes, and short of being a total faceplant, which it undeniably isn’t, it has a huge draw and value for the millions of players who want to hoon around a cyberpunk dystopia, hacking and shooting and scheming and getting better armblades, eyeball replacements and future-guns.

I suppose the simplest summary of my review would be that I look forward to playing “Cyberpunk” when it’s finished. “The Witcher 3” came out to acclaim but also criticism of many of its systems, and over time it has evolved into the genre-leading game it is. “Cyberpunk” has that potential, but it undeniably also has real issues that I would like to let them address before I play it. If you have any patience, I’d give it a few months at least so you don’t have the best of the game spoiled by the worst. At some point in the future I think “Cyberpunk” will be a pivotal title in gaming, but not yet — let’s just hope it gets there before 2077.

Powered by WPeMatico

Aurora Innovation, the autonomous vehicle startup backed by Sequoia Capital and Amazon, has reached an agreement with Uber to buy the ride-hailing firm’s self-driving unit in a complex deal that will value the combined company at $10 billion.

Aurora is not paying cash for Uber ATG, a company that was valued at $7.25 billion following a $1 billion investment last year from Toyota, DENSO and SoftBank’s Vision Fund. Instead, Uber is handing over its equity in ATG and investing $400 million into Aurora, which will give it a 26% stake in the combined company, according to a filing with the U.S. Securities and Exchange Commission. (As a refresher, Uber held an 86.2% stake (on a fully diluted basis) in Uber ATG, according to filings with the SEC. Uber ATG’s investors held a combined stake of 13.8% in the company.) Shareholders in Uber ATG will now become minority shareholders of Aurora. Notably, once the deal closes, Uber together with existing ATG investors and the ATG employees who continue their employment with Aurora are expected to collectively hold about 40% interest in Aurora on a fully diluted basis.

Uber CEO Dara Khosrowshahi will take a board seat in the newly expanded Aurora.

Aurora, which was founded in 2017, is focused on building the full self-driving stack, the underlying technology that will allow vehicles to navigate highways and city streets without a human driver behind the wheel. Aurora has attracted attention and investment from high-profile venture firms, management firms and corporations such as Greylock Partners, Sequoia Capital, Amazon and T. Rowe Price, in part because of its founders Sterling Anderson, Drew Bagnell and Chris Urmson, all of whom are veterans of the autonomous vehicle industry.

Urmson led the former Google self-driving project before it spun out to become the Alphabet business Waymo. Anderson is best known for leading the development and launch of the Tesla Model X and the automaker’s Autopilot program. Bagnell, an associate professor at Carnegie Mellon, helped launch Uber’s efforts in autonomy, ultimately heading the autonomy and perception team at the Advanced Technologies Center in Pittsburgh.

Aurora plans to bring autonomous trucks to market first. However, Urmson has maintained that the company is still pursuing other applications of its self-driving stack such as robotaxis. The deal with Uber ATG provides Aurora with talent and operational facilities. But it delivers on two other important areas: relationships with Uber ATG investors, specifically Toyota, as well as a partnership with Uber that will give it access to its vast ride-hailing platform.

“The way we want to build this company has been with this mindset of let’s build it to scale — let’s create an environment where people can do their best work,” Urmson said in an interview Monday. “And then let’s go look for great teams and bring them in. It’s one way to get a combination of talent and technology, and in this case, also relationships.”

The announcement, which confirms TechCrunch’s reporting in November, marks the beginning of what promises to be a huge undertaking to merge Uber ATG, a 1,200-person business unit with operations in Pittsburgh, San Francisco and Toronto with its smaller competitor.

It’s not clear if all Uber ATG employees will be folded into Aurora, which has 600-person workforce and operations in San Francisco Bay Area, Pittsburgh, Texas and Bozeman, Montana. At least one executive — Uber ATG CEO Eric Meyhofer — will not be joining the company.

Urmson emphasized that work to integrate the companies and their technology will begin without haste.

“One of the most fun things we’ll be doing over the next 60 days is bringing the two teams together,” Urmson said. “And then kind of dispassionately looking at what is the technology that accelerates our first product to market and then amplifying that — whether it’s from the existing Aurora team or to the new Aurora team — and pushing that forward, whether it’s ideas or code or bits of hardware together to accelerate our time to market.”

The company plans to assess the workforce and technology as quickly as possible, Urmson said.

For Uber, the deal marks one of the last expensive pursuits that it had yet to either spin or sell off as the company narrowed in on its core businesses of ride-hailing and delivery. In the past year, Uber has dumped shared micromobility unit Jump, sold a stake in its growing but still unprofitable logistics arm, Uber Freight and acquired Postmates. Uber is also reportedly in talks to sell off its autonomous air taxi business Uber Elevate.

Uber ATG was one of those businesses that promised financial benefits in the long term, but delivered lots of pain, controversy and upfront costs since almost the moment it was created.

In early 2015, Uber kicked off its pursuit of autonomous vehicles when it announced a strategic partnership with Carnegie Mellon University’s National Robotics Center. The agreement to work on developing driverless car technology resulted in Uber poaching dozens of NREC researchers and scientists. A year later, Uber acquired a self-driving truck startup called Otto, a startup founded by one of Google’s star engineers, Anthony Levandowski, along with three other Google veterans: Lior Ron, Claire Delaunay and Don Burnette.

Two months after the acquisition, Google made two arbitration demands against Levandowski and Ron. Uber wasn’t a party to either arbitration. While the arbitrations played out, Waymo separately filed a lawsuit against Uber in February 2017 for trade secret theft and patent infringement. Waymo alleged in the suit, which went to trial but ended in a settlement in 2018, that Levandowski stole trade secrets, which were then used by Uber.

With the trial over, Uber pressed on, but almost immediately was involved in another deadlier controversy when one of its autonomous test vehicles — which had a human safety driver behind the wheel — struck and killed a pedestrian in March 2018. The entire industry took pause and Uber halted all testing.

Uber spun out Uber ATG in spring 2019 after closing $1 billion in funding from Toyota, auto parts maker Denso and SoftBank’s Vision Fund. Even with the spin off, Uber still faced a costly enterprise. Uber reported in November that ATG and “other technologies” (which includes Uber Elevate) had a net loss of $303 million in the nine months that ended September 30, 2020. In its S-1 document, Uber said it incurred $457 million of research and development expenses for its ATG and “other Technology Programs” initiatives.

Despite the trail of problems that have plagued Uber ATG, Urmson insists that the company has the talent and some interesting technology that makes it a worthy asset.

“Some of the work they’ve been doing in designing their next-generation hardware for the vehicles is exciting and interesting,” he said. “On the software side, they have really cool stuff in prediction, and how they’ve combined prediction and the perception system together.”

Others close to the deal said Uber ATG has valuable and talented mid-level and low-level engineers, making the acquisition particularly appealing to Aurora.

This is not Aurora’s first acquisition, although it is certainly its largest and most complex. In 2019, Aurora acquired Blackmore, a Bozeman, Montana-based lidar company, and simulation startup 7D Labs. Aurora has touted its “no jerks” policy and its company culture, which is now about to absorb hundreds of new people.

Post-merger integrations can take months, even years, which can in turn slow down technological or operational progress. Urmson thinks differently.

“If anything, this accelerates our objectives,” he said.

Powered by WPeMatico

Do people want their at-home fitness to come in video-game form? The incredible popularity of games like Ring Fit Adventure suggests yes.

London-based startup Quell thinks it’s just the beginning for this genre, and they’ve raised a $3 million seed round to help prove it.

At the core of Quell’s gameplay is the “Gauntlet” — a harness, of sorts, that the player slips on to control Quell’s games. As players punch and dodge their way through the world, Gauntlet’s built-in sensors measure things like punch speed and accuracy, while customizable resistance bands keep things challenging.

We initially wrote about Quell back in August, and named it as one of our top startups from the Y Combinator S20 Demo Day.

Investors in this round include Twitch co-founders Kevin Lin and Emmett Shear, AngelList founder Naval Ravikant, WikiHow founder Josh Hannah, TenCent, Khosla Ventures, Heartcore, Social Impact Capital and JamJar Investments. Quell co-founder Doug Stidolph tells me they were initially raising at a valuation of $10 million; by the time they’d closed the final investors in this round, the valuation had increased to $15 million. The company also recently closed a Kickstarter campaign, where it raised £501,341 (around $670,000 USD) from nearly 3,000 backers. With the ongoing pandemic making it scarier and riskier to hit the gym (if your state/county even allows it), interest and demand for home fitness options will just keep going up.

Image Credits: Quell

Quell’s hardware and games are initially being built to work with PC, Mac and mobile devices. That means no console support at first — a bummer, as a big ol’ TV seems like the ideal display for games like this, and consoles are probably the most user-friendly way of getting it there. It’s something the company says it has on its roadmap to hopefully tackle in the future, but the added cost/complexity of the console hardware approval process was a bit too much to take on at launch.

Meanwhile, Quell is building out its own in-house game studio, hiring folks like Peter Cornelius (formerly lead producer at the developer-centric gaming tech company Improbable) as Game Production director. One of the main goals, Quell co-founder Cameron Brookhouse tells me, is to build games that get the player exercising while still being deeply immersive; they want the gameplay to encourage movement intuitively, rather than tossing up prompts that say something like, “OK! Time for jumping jacks!”

The Quell team tells me they expect their first hardware to ship by the end of 2021. They’re currently working on transitioning their prototypes into production, figuring out how to do things like make it easier to adjust resistance or swap the Gauntlet from user to user, and to increase the number of different exercises its sensors can detect and gamify.

Powered by WPeMatico

Finn.auto — which allows people to subscribe to their car instead of owning it, and offsetting their CO₂ emissions — has raised a $24.2 million / €20 million Series A funding round. White Star Capital (which has also invested in Tier Mobility), and the Zalando co-CEOs Rubin Ritter, David Schneider and Robert Gentz, are new investors in this round. All previous investors participated.

The funding comes just under a year since the company launched, after selling just 1,000 car subscriptions. It’s also partnered with Deutsche Post AG and Deutsche Telekom AG.

A number of car manufacturers have launched similar subscription services powered by various providers, such as Drover, LeasePlan and Wagonex.

U.K.-based startup Drover has raised a total of $40 million in funding over five rounds. Their latest Series B funding round was with Shell Ventures and Cherry Ventures . Plus, there are branded services which include Audi on Demand, BMW, Citroën, DS, Jaguar Carpe, Land Rover Carpe, Mini, Volkswagen and Care by Volvo.

Digitally led subscription services have the potential to disrupt the traditional car sales model, and new startups are entering the market all the time.

The finn.auto model is proving to appeal to environment-conscious millennials. For each car subscription, the company is offsetting the CO₂ emissions of its vehicles, meaning subscribers can drive their cars in a climate-neutral manner. It’s now expanding its range of fully electric vehicles and, in cooperation with ClimatePartner, is supporting selected regional climate protection and development projects.

Key to the Munich-based startups’ play is the automation of fleet management processes and customer interactions, meaning it’s much easier and cheaper to run this kind of subscription operation.

Max-Josef Meier, CEO and founder of finn.auto, said: “We are delighted to have been able to bring such high-caliber investors on board and that our existing investors are cementing their confidence with the current round. Mobility with your own car becomes as easy as buying shoes on the internet. We already offer a large selection of different car brands, whose cars can be ordered online on our platform in just five minutes and at flexible runtimes. The delivery is then conveniently made to the front door.”

Nicholas Stocks, general partner at White Star Capital added: “There is a huge opportunity globally to streamline outdated customer experiences in the automotive retail space and become the Amazon of the automotive industry. This is something finn.auto is excellently placed to capitalize on with its offering of convenience, flexibility, value and sustainability.”

Powered by WPeMatico

As a product manager, I’m a true believer that you can solve any problem with the right product and process, even one as gnarly as the multiheaded hydra that is microservice overhead.

Working for Vertex Ventures US this summer was my chance to put this to the test. After interviewing 30+ industry experts from a diverse set of companies — Facebook, Fannie Mae, Confluent, Salesforce and more — and hosting a webinar with the co-founders of PagerDuty, LaunchDarkly and OpsLevel, we were able to answer three main questions:

Out of dozens of companies we spoke with, only two had not yet started their journey to microservices, but both were actively considering it. Industry trends mirror this as well. In an O’Reilly survey of 1500+ respondents, more than 75% had started to adopt microservices.

It’s rare for companies to start building with microservices from the ground up. Of the companies we spoke with, only one had done so. Some startups, such as LaunchDarkly, plan to build their infrastructure using microservices, but turned to a monolith once they realized the high cost of overhead.

“We were spending more time effectively building and operating a system for distributed systems versus actually building our own services so we pulled back hard,” said John Kodumal, CTO and co-founder of LaunchDarkly.

“As an example, the things we were trying to do in mesosphere, they were impossible,” he said. “We couldn’t do any logging. Zero downtime deploys were impossible. There were so many bugs in the infrastructure and we were spending so much time debugging the basic things that we weren’t building our own service.”

As a result, it’s more common for companies to start with a monolith and move to microservices to scale their infrastructure with their organization. Once a company reaches ~30 developers, most begin decentralizing control by moving to a microservice architecture.

Teams may take different routes to arrive at a microservice architecture, but they tend to face a common set of challenges once they get there.

Large companies with established monoliths are keen to move to microservices, but costs are high and the transition can take years. Atlassian’s platform infrastructure is in microservices, but legacy monoliths in Jira and Confluence persist despite ongoing decomposition efforts. Large companies often get stuck in this transition. However, a combination of strong, top-down strategy combined with bottoms-up dev team support can help companies, such as Freddie Mac, make substantial progress.

Some startups, like Instacart, first shifted to a modular monolith that allows the code to reside in a single repository while beginning the process of distributing ownership of discrete code functions to relevant teams. This enables them to mitigate the overhead associated with a microservice architecture by balancing the visibility of having a centralized repository and release pipeline with the flexibility of discrete ownership over portions of the codebase.

Teams may take different routes to arrive at a microservice architecture, but they tend to face a common set of challenges once they get there. John Laban, CEO and co-founder of OpsLevel, which helps teams build and manage microservices told us that “with a distributed or microservices based architecture your teams benefit from being able to move independently from each other, but there are some gotchas to look out for.”

Indeed, the linked O’Reilly chart shows how the top 10 challenges organizations face when adopting microservices are shared by 25%+ of respondents. While we discussed some of the adoption blockers above, feedback from our interviews highlighted issues around managing complexity.

The lack of a coherent definition for a service can cause teams to generate unnecessary overhead by creating too many similar services or spreading related services across different groups. One company we spoke with went down the path of decomposing their monolith and took it too far. Their service definitions were too narrow, and by the time decomposition was complete, they were left with 4,000+ microservices to manage. They then had to backtrack and consolidate down to a more manageable number.

Defining too many services creates unnecessary organizational and technical silos while increasing complexity and overhead. Logging and monitoring must be present on each service, but with ownership spread across different teams, a lack of standardized tooling can create observability headaches. It’s challenging for teams to get a single-pane-of-glass view with too many different interacting systems and services that span the entire architecture.

Powered by WPeMatico

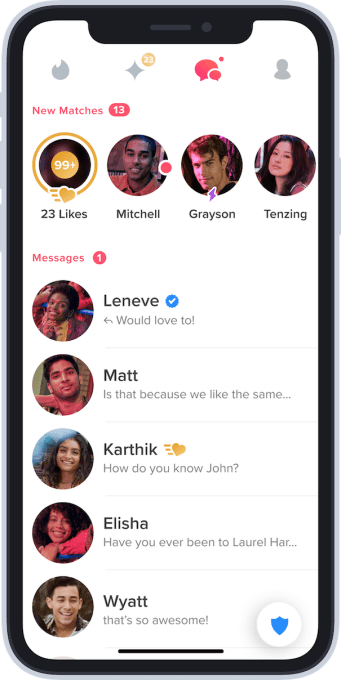

Last month, Bumble introduced a new feature that would prevent bad actors from using the dating app’s “unmatch” feature to hide from victims. Now Tinder has done something similar. The company announced on Friday it will soon roll out an update to its app that will make it easier for users to report someone who has used the unmatch feature in an effort to get away with their abuse. But in Tinder’s case, it’s only making it easier for users to learn how to report the violation, rather than giving the victims a button in the chat interface to report the abuse more directly.

Tinder notes that users have always been able to report anyone on the app at any time — even if the person had used the unmatch feature. But few users likely knew how to do so, as there weren’t obvious explanations in the app’s user interface about how to report a chat after it disappeared.

With the update, Tinder says it will soon add its “Safety Center” shield icon within the Match List, where the chats take place. This will direct users to the Safety Center in the app, where they can learn how to report users who aren’t displayed on the Match List because they used the unmatch feature.

Image Credits: Tinder

The updates to both Tinder and Bumble came about following an investigation by the Australian Broadcasting Corporation, which found that 48 out of 231 survey respondents who had used Tinder said they had reported other users for some kind of sexual offense. But only 11 of those reports had received any replies, and even fewer offered specific information about what was being done.

The story had also explained how bad actors would take advantage of the dating app’s “unmatch” feature to hide from their victims. After unmatching, their chat history would disappear from the victim’s phone, which would have allowed the user to more easily report the abuse to Tinder or even to law enforcement, if needed.

Though Tinder was the focus of the story, Bumble quickly followed up to say it was changing how unmatching on its app would work. Instead of having the chat disappear when unmatched, Bumble users are now shown a message that says the other person has ended the chat. Here, they’re given the option to also either delete the chat or report it.

The ability to report the chat directly from the messaging inbox is what makes Bumble’s solution more useful. Tinder, on the other hand, is just redirecting users to what’s essentially its help documentation — the Tinder Safety Center — to learn how to go about making such a report. The addition of this extra step could end up being a deterrent to making these reports, as it’s less straightforward than simply clicking a button that reads “Report.”

Tinder also didn’t address the other issues raised by the investigation, which said many reports lacked follow-up or clear information about what actions Tinder was taking to address the issues.

Instead, the company says that it will continue to acknowledge when reports are received to let the member making the report know an appropriate action will be taken. Tinder added it will also direct users to trained resources for crisis counseling and survivor support; remove accounts if it finds account holders have been reported for violent crimes; and will continue to work with law enforcement on investigations, when required. These actions, however, should be baseline features for any dating app, not points of pride.

Tinder stressed, too, that it would not remove the unmatch feature, which is necessary for safety and privacy of its members. That seems to miss the point of what users’ complaints were about. Tinder users were not angry or concerned that an unmatching feature existed in the first place, but that it was being used by bad actors to avoid repercussions for their abuse.

The company didn’t say precisely when the changes to the dating app would roll out, beyond the “coming weeks.”

Today, Tinder’s parent company also announced a partnership with RAINN, a large anti-sexual violence organization, to conduct “a comprehensive review of sexual misconduct reporting, moderation, and response across Match Group’s dating platforms” and “to work together to improve current safety systems and tools.”

The organization will review Tinder, Hinge and Plenty of Fish to determine what best practices should be. Match says the partnership begins today and will continue through 2021.

“Every person deserves safe and respectful experiences, and we want to do our part to create safer communities on our platforms and beyond,” said Tracey Breeden, head of Safety and Social Advocacy for Match Group, in a statement. “By working together with courageous, thought-leading organizations like RAINN, we will up level safety processes and strengthen our responses for survivors of sexual assault. Safety challenges touch every corner of society. We are committed to creating actionable solutions by working collaboratively with experts to innovate on meaningful, industry-led safety approaches,” she added.

Powered by WPeMatico

When one of AWS’s east coast data centers went down at the end of last month, it had an impact on countless companies relying on its services, including Roku, Adobe and Shipt. When the incident was resolved, the company had to analyze what happened. For most companies, that involves manually pulling together information from various internal tools, not a focused incident platform.

Jeli.io wants to change that by providing one central place for incident analysis, and today the company announced a $4 million seed round led by Boldstart Ventures with participation by Harrison Metal and Heavybit.

Jeli CEO and founder Nora Jones knows a thing or two about incident analysis. She helped build the chaos engineering tools at Netflix, and later headed chaos engineering at Slack. While chaos engineering helps simulate possible incidents by stress-testing systems, incidents still happen, of course. She knew that there was a lot to learn from them, but there wasn’t a way to pull together all of the data around an incident automatically. She created Jeli to do that.

“While I was at Netflix pre-pandemic, I discovered the secret that looking at incidents when they happen — like when Netflix goes down, when Slack goes down or when any other organization goes down — that’s actually a catalyst for understanding the delta between how you think your org works and how your org actually works,” Jones told me.

She began to see that there would be great value in trying to figure out the decision-making processes, the people and tools involved and what companies could learn from how they reacted in these highly stressful situations, how they resolved them and what they could do to prevent similar outages from happening again in the future. With no products to help, Jones began building tooling herself at her previous jobs, but she believed there needed to be a broader solution.

“We started Jeli and began building tooling to help engineers by [serving] the insights to help them know where to look after incidents,” she said. They do this by pulling together all of the data from emails, Slack channels, PagerDuty, Zoom recordings, logs and so forth that captured information about the incident, surfacing insights to help understand what happened without having to manually pull all of this information together.

The startup currently has eight employees, with plans to add people across the board in 2021. As she does this, she is cognizant of the importance of building a diverse workforce. “I am extremely committed to diversity and inclusion. It is something that’s been important and a requirement for me from day one. I’ve been in situations in organizations before where I was the only one represented, and I know how that feels. I want to make sure I’m including that from day one because ultimately it leads to a better product,” she said.

The product is currently in private beta, and the company is working with early customers to refine the platform. The plan is to continue to invite companies in the coming months, then open that up more widely some time next year.

Eliot Durbin, general partner at Boldstart Ventures, says that he began talking to Jones a couple of years ago when she was at Netflix just to learn about this space, and when she was ready to start a company, his firm jumped at the chance to write an early check, even while the startup was pre-revenue.

“When we met Nora we realized that she’s on a lifelong mission to make things much more resilient […]. And we had the benefit of getting to know her for years before she started the company, so it was really a natural continuation to a conversation that we were already in,” Durbin explained.

Powered by WPeMatico

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7 a.m. PT). Subscribe here.

Did you follow all of the unicorn news from the last couple of weeks? No? Here’s a list of headlines to catch you up, because this holiday season is already featuring mega acquisitions, even more IPO filings, and a steady drumbeat of fundraises.

Somehow, after one of the toughest years in recent memory, the tech industry is heading into December with more enthusiasm than ever. (Still remember the WeWork IPO fiasco from last year? No?)

Salesforce buys Slack in a $27.7B megadeal

Everyone has an opinion on the $27.7B Slack acquisition

What to make of Stripe’s possible $100B valuation

How the pandemic drove the IPO wave we see today

A roundup of recent unicorn news

C3.ai’s initial IPO pricing guidance spotlights the public market’s tech appetite (EC)

Working to understand C3.ai’s growth story (EC)

Insurtech’s big year gets bigger as Metromile looks to go public (EC)

Wall Street needs to relax, as startups show remote work is here to stay (EC)

In first IPO price range, Airbnb’s valuation recovers to pre-pandemic levels (EC)

3 new $100M ARR club members and a call for the next generation of growth-stage startups (EC)

Connie Loizos sat down with Jason Green of leading enterprise-focused firm Emergence Capital to get his view of SPACs, and how they are likely to be used next year and beyond. But early-stage startups, don’t miss his affirmation of Zoom meetings as part of the fundraising process going forward.

I would say that over the last five years, we’ve made almost a total transition. Now we’re very much a data-driven, thesis-driven outbound firm, where we’re reaching out to entrepreneurs soon after they’ve started their companies or gotten seed financing. The last three investments that we made were all relationships that [date back] a year to 18 months before we started engaging in the actual financing process with them. I think that’s what’s required to build a relationship and the conviction, because financings are happening so fast.

I think we’re going to actually do more investments this year than we maybe have ever done in the history of the firm, which is amazing to me [considering] COVID. I think we’ve really honed our ability to build this pipeline and have conviction, and then in this market environment, Zoom is actually helping expand the landscape that we’re willing to invest in. We’re probably seeing 50% to 100% more companies and trying to whittle them down over time and really focus on the 20 to 25 that we want to dig deep on as a team.

Thousands of startup founders will resume the trek around Silicon Valley VC offices, once the vaccines arrive. But we’ll remember 2020 as the year that venture truly joined the cloud.

Image Credits: Brighteye Ventures

Every level of education was forced online by the pandemic this year, at least temporarily. While the children might be back in the classroom already, higher education and corporate education are still booming remotely. Natasha Mascarenhas analyzed the latest market changes for Extra Crunch, and put together a panel of industry leaders for a special Thanksgiving edition of Equity. Here’s more about what you’ll find on the show:

For this Equity Dive, we zero onto one part of that conversation: Edtech’s impact on higher education. We brought together Udacity co-founder and Kitty Hawk CEO Sebastian Thrun, Eschaton founder and college dropout Ian Dilick, and Cowboy Ventures investor Jomayra Herrera to answer our biggest questions.

Here’s what we got into:

- How the state of remote school is leading to gap years among students.

- A framework for how to think of higher education’s main three products (including which is most defensible over time).

- What learnings we can take from this COVID-19 experiment on remote schooling to apply to the future.

- Why edtech is flocking to the notion of life-long learning.

- The reality of who self-paced learning serves — and who it leaves out.

SaaS is continuing to be reshaped by consumer internet techniques, with top companies of our era competing through word-of-mouth growth versus incumbent sales forces. The revenue model must be precise for this to scale, though. In a guest post for Extra Crunch, Caryn Marooney and David Cahn of Coatue lay out a strategic framework for how to price your bottoms-up SaaS product the right way for the market. Called “MAP,” for Metrics, Activity and People, it helps you sort your product against the actual ways that people are trying to use and pay for it. Here’s how they describe the A:

Activity: How do your customers really use your product and how do they describe themselves? Are they creators? Are they editors? Do different customers use your product differently? Instead of metrics, a key anchor for pricing may be the different roles users have within an organization and what they want and need in your product. If you choose to anchor on activity, you will need to align feature sets and capabilities with usage patterns (e.g., creators get access to deeper tooling than viewers, or admins get high privileges versus line-level users). For example:

- Figma — Editors versus viewers: Free to view, starts changing after two edits.

- Monday — Creators versus viewers: Free to view, creators are charged $10-$20/month.

- Smartsheet — Creators versus viewers: Free to view, creators are charged $10+/month.

Extra Crunch membership now available to readers in Israel

Find out how we’re working toward living and working in space at TC Sessions: Space 2020

Aerospace’s Steve Isakowitz to speak at TC Sessions: Space 2020

Investors Lockheed Martin Ventures and SpaceFund are coming to TC Sessions: Space 2020

TechCrunch

Calling VCs in Israel: Be featured in The Great TechCrunch Survey of European VC

SEC issues proposed rulemaking to give gig workers equity compensation

The downfall of adtech means the trust economy is here

How Ryan Reynolds and Mint Mobile worked without becoming the joke

What will tomorrow’s tech look like? Ask someone who can’t see

Extra Crunch

Mental health startups are raising spirits and venture capital

Who’s building the grocery store of the future?

Strike first, strike hard, no mercy: How emerging managers can win

This is a good time to start a proptech company

7 things we just learned about Sequoia’s European expansion plans

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

We’re back with not an Equity Shot or Dive of Monday, this is just the regular show! So, we got back to our roots by looking at a huge number of early-stage rounds. And a few other things that we were just too excited about to not mention.

So from Chris and Danny and Natasha and I, here’s the rundown:

That was a lot, but how could we leave any of it out? We’re back Monday with more!

Equity drops every Monday at 7:00 a.m. PDT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

With the amount of time you’re spending at home these days, you deserve a better headset. A wireless one that works with your computer and maybe your console as well, with a mic for calls and great sound for games and movies. Fortunately there are a lot to choose from, and I’ve tested out your best options.

I asked the leading audio and peripheral companies to send over their flagship wireless headset, with prices ranging from about $100 to $250. Beyond this price range returns diminish swiftly, but right now that’s the sweet spot for comfort, sound and usability.

For years I’ve avoided wireless headsets because there were too many compromises, but I’m pleased to say that the latency has been eliminated and battery life in the ones I reviewed is uniformly excellent. (NB: If the wireless version feels too expensive, you can often get wired ones for $50-100 less.)

To test the headphones, I used them all for a variety of everyday tasks, from video calls to movies and music (with only minimal EQing to get a sense of their natural sound) to AAA games and indies. None require an app to work, though some have companion software for LEDs or game profiles. I have a fairly large head and medium-sized ears, for what it’s worth. All the headphones are rather bulky, though the angle I shot them at individually makes them look huge — you can see in the image up top that they’re all roughly the same size.

None of these headphones have active noise cancelling, but many offer decent physical isolation to the point where they offer a “monitor” feature that pipes in sound from the outside world — useful if you’re playing a game but waiting for the oven to preheat or something. Only the first set has a built-in mic, the rest have detachable ones of generally solid quality, certainly good enough for streaming and chatting, though for broadcast a separate one would be better. All these headphones use a USB-A style dongle, though the 7P/7X also has a USB-C connector.

The 7P and 7X headsets, designed with the PS5 and Xbox Series X in mind (as well as PC) respectively, are my first and most unreserved recommendation.

The standout feature on these is, to me, a truly surprising sound with an almost disturbingly broad stage and clarity. I almost couldn’t believe what I was hearing when I put on some familiar tracks I use for reference. This isn’t a 7.1 simulation or anything like that — but no doubt the gaming focus led to creating a large soundstage. It worked!

I also found the headphones to be very comfortable, with a “ski goggle” strap instead of a per-band adjustment that lets them sit very lightly as well as “remembering” your setting. The spacious earcups rotate for travel or comfort.

The built-in mic is unobtrusive and stows away nicely, but if you’re picky about placement it was a bit floppy to adjust. Many of the other headsets have nicer mics that completely detach — maybe that’s a plus for you, but I tend to lose them.

My main issues with these are that the controls feel cheap and not particularly well laid out. The bottom of the headset is a jumble of ports and buttons and the volume dials don’t have much travel — it’s 0 to 100 in one full swipe. (Volume control is independent from system volume.)

The dongle is different from the others in that it is itself USB-C, but with a USB-A cable attached. That’s good for compatibility, but the cable is three feet long, making it kind of silly to attach to some laptops and whatnot. You could easily get your own short cord, though.

At $150 I think these are an easy recommendation for just about anyone looking at that price range.

The high price on these is partly because they are the wireless version of a headset that also comes wired, so if you want the solid audio performance and comfy fit, you can save some money by going wired.

The sound of the AT-GWLs is rich and naturally has a focus on the upper-mid vocal range, which makes voices in media really pop. I did find the sound a bit confined, which hitting the “surround” setting actually helped with. I know that this sort of virtualization has generally been frowned on, but it’s been a while since these settings have been over the top and distortive. I found surround better for games but not necessarily for music, but it’s very easy to switch on and off.

The headphones are light and adjusted with traditional, no-nonsense metal bands, with a single pad on the top. I would say they are the lightest-feeling pair I tested, with the SteelSeries and Razer coming in just behind owing to some extra weight and bulk. Despite being compact, the AT-GWLs felt airy but not big. The leather-microfiber combo cups are nice, and I think they’ll break in well to provide better isolation over time.

Where they fall short is in the interface. First, a note to Audio-Technica: Turn down the notification noises! Turning the headset on, the mic on or off or hitting the system-independent volume max produces loud, surprising beeps. Too loud!

Second, the buttons and dials are stiff, small and same-feeling. Lifting a hand quickly to turn down the volume (maybe after a huge beep) you may very easily mistake the power switch for the volume dial. The dial also doubles as a button for surround mode, and next to it is a microscopic button to turn on and off the sound of surroundings. It’s a bit of a jumble — nothing you can’t get used to, but considering how nice other headsets on this list made their controls, it has to be said.

HyperX (owned by Kingston) wasn’t exactly known for audio until fairly recently, but its previous Cloud headset got the crucial Wirecutter endorsement, and it’s easy to see why. For less money than any of the other headsets in this roundup, the follow-up to that headset (which I’m wearing right now) has excellent sound and isolation.

I was surprised to find a soundstage nearly as wide as the 7P/7X, but with more of a focus on the punchy lower register instead of on detail and placement. My music felt big and close, and the atmosphere of games likewise, more immediately present.

The Cloud II’s controls are simple and effective. The volume dial, tied directly to the system volume, is superb: grippy, with smooth motion and just the right amount of friction, and just-barely-there clicks. There are two good-size buttons, the power one concave and the mic mute (which gives different sounds for muted and active) convex.

It’s unfortunate that they’re not as comfortable, for me anyway, as the others on this list. The cups (though a bit on the warm side) and band are perfectly fine. It’s that there’s little rotation to those cups, meaning there’s no play to accommodate the shape of your head. I don’t know, maybe it’s just my big dome, but they were noticeably tighter at the front of my ear than the back, so I was constantly adjusting or trying to twist them.

I’ll say this: If they add a bit more adjustment to the cups, these would be my default recommendation over the 7P/7X. As exciting as the SteelSeries sound is to me, the Cloud IIs seem more like what people expect, and are $50 cheaper.

The matte texture of the G733s had a weird interaction with my camera — they don’t look speckly IRL. Image Credits: Devin Coldewey / TechCrunch

These are Logitech’s streamer-friendly, color-coordinated, LED-sporting set, but they’re better than the loud design would suggest.

The sound is definitely gaming-forward, with a definite emphasis on the low end and a very central, present sound that was a lot like the Cloud II.

To be honest, I was not expecting the G733s to be very comfortable — their stiff plastic look suggested they’d creak, weigh down my ears and crush my noggin. But in fact they’re really light and quite comfy! There’s a lot of play in the positions of the earcups. The fit is a little odd in that there’s a plainly inferior version of the 7P/7X’s “ski goggle” strap that really only has four settings, while the cups slide up and down about two thirds of an inch. It was just enough to accommodate my (again, apparently very large) head.

The mic boom is rather short, and sadly there is no indicator for when the mic is on or off, which is sometimes a minor inconvenience and sometimes a major pain. You can tell from the sound the mute button makes, though.

The volume dial is nice and smooth, though the “clicks” are really far apart. I like the texture of it and the mic mute button, the power button not so much. But it works.

The colors may not be to everyone’s liking, but I have to hand it to Logitech for going all the way. The headset, mic and even the USB dongle are all the same shade, making it much easier to keep track of them in my growing pile of headphones and widgets.

Currently Logitech’s most premium set of gaming headphones, the Pro-X abandon the bright, plasticky look of its other sets and goes for understated and black.

The sound of the Logitech is big and very clear, with almost a reference feel in how balanced the bands are. I felt more presence in the mid-lows of smart bass-playing than the other sets. There is a “surround” feel that makes it feel more like you’re in a room of well-configured speakers than headphones, something that I think emerges from a de-emphasis of the center channel. The media is “out there,” not “in here.” It’s not a bad or a good thing, just distinct from the others.

The controls are about on par with the Cloud II’s: a nice frictiony volume wheel controlling system volume, a nice mic toggle button and a fairly meaty on-off switch you’re unlikely to trip on purpose.

Also like the Cloud IIs, there is no rotation to the earcups, making them less comfortable to me than the ATs and SteelSeries, and Logitech’s cheaper G-733s. A larger head than my own, if that’s possible, would definitely feel clamped. I do think these would wear in well, but all the same a bit of play would help a lot.

The external material, a satinized matte plastic, looks truly lovely but is an absolute fingerprint magnet. Considering you’ll be handling these a lot (and let’s be honest, not necessarily with freshly washed hands), you’re going to need to wipe them down rather more than any of the others I tested.

The understated Razer Blackshark V2 Pro soon became my go-to for PC gaming when the SteelSeries set was attached to the PS5.

Their sound is definitely gaming-focused, with extra oomph in the lows and mid-lows, but music didn’t sound overly shifted in that direction. The soundstage is full but not startlingly so, and everything sounded detailed without being harsh.

The Razers look heavy but aren’t — it varies day to day but I think they’re definitely competing for “most comfortable” with the A-Ts and SteelSeries. The cups feel spacious and have a nice seal, making for a very isolated listening experience. Adjustment is done with the wires attached to the cups, which is nothing special — I kind of wish this setup would let you adjust the cant as well as the height. The material is like the Logitechs — prone to fingerprints, though a little less so, in my experience.

Their controls are very well designed and laid out, all on one side. The protruding (system-independent) volume knob may seem odd at first but you’ll love it soon. The one big notch or click indicates exactly 50%, which is super useful for quick “calibration,” and turning the knob is smooth yet resistant enough that I never once accidentally changed it. Meanwhile there are conveniently placed and distinguishable buttons for mute and power, and ports for the detachable mic, charge cord and 3.5mm input.

I’m hard pressed to think of any downsides to the Blackshark except that it doesn’t work with consoles.

Powered by WPeMatico