TC

Auto Added by WPeMatico

Auto Added by WPeMatico

General Catalyst has made early bets on some of the biggest companies in tech today, including Airbnb, Lemonade and Warby Parker.

We sat down with Katherine Boyle and Peter Boyce, who co-lead the firm’s seed-stage investments, to discuss what they look for in founders, which sectors they’re most excited about and how business has changed in the wake of the COVID-19 pandemic.

This conversation is part of our broader Extra Crunch Live series, where we sit down with VCs and founders to discuss startup core competencies and get advice. We’ve spoken to folks like Aileen Lee, Mark Cuban, Roelof Botha, Charles Hudson and many, others. You can browse the full library of episodes here.

Check out our full conversation with Boyce and Boyle in the YouTube video below, or skim the text for the highlights.

Katherine Boyle: I look for what I would call this obsessive trait, where they are learning more about the regulatory complications, where they are constantly trying to figure out how to solve a problem.

I’d say that the common theme among the founders that I support are that they have this sort of obsessive gene or personality, where they will go deeper and deeper and deeper. When we invest in these companies, it becomes very clear that they often have sort of a contrarian view of the industry. Maybe they are not industry-native. They come at it from a different perspective of problem solving. They’ve had to defend that thesis for a very, very long time in front of a variety of different customers and different people. In some ways, that makes them much stronger in terms of the way they approach problems.

Peter Boyce: I think the first would be being magnetic for talent. It ends up influencing the speed of learning and development. Really incredible founding teams that can be magnetic for talent and learning just kind of spirals out of control in really good ways over time. I really look for the speed and the sources of learning. And can folks be really intentional? Can they get the right set of advisors and teammates around them?

The second would be the personal connection to the problem space. It’s like there’s this kind of deep-seated source of energy and fuel that actually isn’t going to run out. Catherine and I’ve been lucky to work across a number of different particular thematic areas, but the thing they have in common is just this personal connection to how and why their business needs to exist. Because I just think that that fuel doesn’t run out, you know what I mean? Like, that’s renewable.

Boyle: If you’re someone who’s comfortable presenting on Zoom, making connections on Zoom, or using Signal and using Twitter and being very online, then I 100% think that you can make investments, build community and build connections through digital worlds and digital platforms. If you really like that in-person connectivity, then you might consider staying in a tech hub, or you might consider sort of these distanced walks until things go back to normal.

Powered by WPeMatico

It was an unprecedented year for [insert anything under the sun], and while plenty of tech verticals saw shifts that warped business models and shifted user habits, the gaming industry experienced plenty of new ideas in 2020. However, the loudest trends don’t always take hold as predicted.

This year, Google, Microsoft, Facebook and Amazon each leaned hard into new cloud-streaming tech that shifts game processing and computing to cloud-based servers, allowing users to play graphics-intensive content on low-powered systems or play titles without dealing with lengthy downloads.

It was heralded by executives as a tectonic shift for gaming, one that would democratize access to the next generation of titles. But in taking a closer look at the products built around this tech, it’s hard to see a future where any of these subscription services succeed.

Massive year-over-year changes in gaming are rare because even if a historically unique platform launches or is unveiled, it takes time for a critical mass of developers to congregate and adopt something new — and longer for users to coalesce. As a result, even in a year where major console makers launch historically powerful hardware, massive tech giants pump cash into new cloud-streaming tech and gamers log more hours collectively than ever before, it can feel like not much has shifted.

That said, the gaming industry did push boundaries in 2020, though it’s unclear where meaningful ground was gained. The most ambitious drives were toward redesigning marketplaces in the image of video streaming networks, aiming to make a more coordinated move toward driving subscription growth and moving farther away from an industry defined for decades by one-time purchases structured around single-player storylines, one dramatically shaped by internet networking and instantaneous payments infrastructure software.

Today’s products are far from dead ends for what the broader industry does with the technology.

But shifting gamers farther away from one-off purchases wasn’t even the gaming industry’s most fundamental reconsideration of the year, a space reserved for a coordinated move by the world’s richest companies to upend the console wars with an invisible competitor. It’s perhaps unsurprising that the most full-featured plays in this arena are coming from the cloud services triumvirate, with Google, Microsoft and Amazon each making significant strides in recent months.

The driving force for this change is both the maturation of virtual desktop streaming and continued developer movement toward online cross-play between gaming platforms, a trend long resisted by legacy platform owners intent on maintaining siloed network effects that pushed gamers toward buying the same consoles that their friends owned.

The cross-play trend reached a fever pitch in recent years as entities like Epic Games’ Fortnite developed massive user bases that gave developers exceptional influence over the deals they struck with platform owners.

While a trend toward deeper cross-play planted the seeds for new corporate players in the gaming world, it has been the tech companies with the deepest pockets that have pioneered the most concerted plays to side-load a third-party candidate into the console wars.

It’s already clear to plenty of gamers that even in their nascent stages, cloud-gaming platforms aren’t meeting up to their hype and standalone efforts aren’t technologically stunning enough to make up for the apparent lack of selection in the content libraries.

Powered by WPeMatico

This quarter, strong earnings results from public cloud companies were overshadowed by a seemingly endless IPO cycle. Another moment we somewhat missed over the last few weeks was the stock market pushing the value of public cloud companies to all-time highs.

These events are connected. And they bode well for startups working on SaaS and API-delivered software, which are keeping the climate for cloud venture investment warm and valuations stretched by historical norms.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

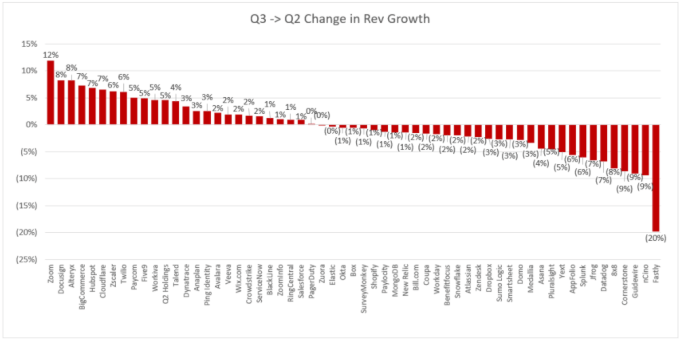

The earnings results that have made Wall Street content include a growing number of cloud companies that are seeing revenue growth accelerate from Q2 2020 to Q3 2020, according to a recent analysis by Redpoint’s Jamin Ball.

Astute readers will recall that The Exchange chatted with Ball after the Q2 earnings cycle, a conversation that included puzzling over how to square a nearly uniform deceleration in revenue growth from Q1 to Q2 in the software sector, which, at the very same time, was supposedly undergoing a boom in demand thanks to the pandemic and a suddenly remote workforce.

One hypothesis Ball offered was that deals signed in Q2 by SaaS companies would not show up much until Q3 if they were signed in the back-half of the quarter. Regardless of the reason, Q3 featured a far-stronger crop of cloud results that imply a strengthening sector.

For us startup watchers on the hunt for a hint of what is going on in opaque private markets, this is a useful data point. If you’ve been slightly befuddled as to why the venture capital space has seen deals accelerate with time-to-conviction falling from weeks to minutes — and pre-emption the new normal — this is part of the why.

For us startup watchers on the hunt for a hint of what is going on in opaque private markets, this is a useful data point. If you’ve been slightly befuddled as to why the venture capital space has seen deals accelerate with time-to-conviction falling from weeks to minutes — and pre-emption the new normal — this is part of the why.

As the future has been pulled forward when it comes to digitizing the American and global economies, it’s a good time to be a software company. This was visible in SaaS company Smartsheet’s earnings this quarter. The Exchange chatted with CEO Mark Mader about his company’s recent earnings results that beat expectations and led to the company’s shares rising. Analyst upgrades have followed.

This morning, let’s examine the data regarding how many cloud companies are seeing revenue growth accelerate, dig into Smartsheet’s results to see what we can learn (hint: SMBs matter), and then apply all our findings to the startup market itself so that we can go into the weekend as informed as possible.

At the risk of being cheeky, I’ve embedded Ball’s chart concerning Q3 revenue acceleration from cloud companies below. (If you are into similar data sets, he’s worth following on Twitter.) Here’s the data:

Image: Jamin Ball

This chart shows Q2’s cloud year-over-year growth rates subtracted from Q3’s own; a result greater than one shows that a company’s year-over-year growth accelerated from the second quarter to the third. The higher the number of cloud companies that wind up with a result of 1% or greater in the above chart, the faster the cloud market as a whole is accelerating.

Powered by WPeMatico

Gorillas, a grocery delivery startup that operates its own hyper local fulfillment centers and has already been a hit in Berlin, has raised $44 million in Series A funding.

Probably one of European tech’s worst kept secrets this year, the round is led by hedge fund Coatue, with participation from other unnamed European investors. Coatue’s Daniel Senft and Bennett Siegel will join Gorillas‘ board.

Noteworthy, Accel and Index were reportedly in the running, but ultimately didn’t invest. Atlantic Food Labs previously backed Gorillas in a seed round thought to be around €1.2 million.

Founded by Kağan Sümer and Jörg Kattner in May this year and operating in Berlin and Cologne, Gorillas delivers groceries within an average of ten minutes. Unlike gig economy models, it employs riders directly and is emphasising its ability to get fresh groceries, along with other household items, to shoppers at very short notice and at “retail prices”. The idea is that the startup can address a large part of the groceries market that falls outside of a weekly bulk shop.

Some have dubbed the model that Gorillas is attempting to make work, “dark” convenience stores, in reference to the dark kitchens that run on top of Deliveroo and UberEats and operate as delivery only restaurants. In this instance, Gorillas and other European competitors, such as Dija (which we reported is closing its own large funding round) and Weezy, are building out local delivery only grocery/convenience stores. These startups are also often compared to goPuff in the U.S.

Gorillas CEO Kağan Sümer says that mass supermarkets, including their delivery models, are designed so that the consumer organises their grocery shopping around the needs of the supermarket and supply chain, rather than the supermarket being designed around the needs of the consumer.

This sees an emphasis on long shelf life products, where even fresh goods are treated for longer expiry dates, and a model that serves the weekly bulk shop well, but at the detriment of two other use-cases: “emergency” shopping, such as when you’re missing a key ingredient, or quickly replenishing your fridge based on what you fancy consuming right now.

“The biggest problem is that bulk purchases are super served. What I mean by that is this: all of the supermarket infrastructure is shaped around bulk purchases,” Sümer tells me, arguing that this leaves one third of the market underserved.

“You have penne but no Arrabiata; how do you get that sauce that you need now? [There is] no way.

“So we asked ourselves, what would happen if a company pops up and serves people with what they need when they need it? Our hypothesis was that people would appreciate it and shift their interaction with groceries to more on demand purchases”.

With a slogan that reads: “Faster than you,” and a delivery fee of just €1.80, one question mark over Gorillas (and others in the space) is if the unit economics can ever stack up, especially at scale and if the company really isn’t marking up prices significantly. “Through our procurement relationships, we have healthy margins which allow us to sell at retail prices,” says Sümer, pushing back. “Taking into account the solid basket sizes and procurement margins we are able to build a long-term sustainable business”.

He says the average delivery time is 10 minutes. “Through our network of centrally located fulfillment centers we are able to service customers in a small delivery radius. Ultimately we strive to deliver an efficient and fast service with full transparency on delivery times,” adds the Gorillas CEO.

Meanwhile, Gorillas says the new funding will be used for expansion across Germany and will accelerate its rollout across more of Europe — first stop, Amsterdam. Additionally, the company will use the capital to build out its team in Berlin. More ambitious, by the end of Q2 next year, Gorillas says it plans to be available in over 15 cities in Germany and across Europe, operating over 60 fulfillment centers.

Powered by WPeMatico

All over the world startups are piling into the space marked “virtual interaction and collaboration”. What if a startup created a sort of “Club Penguin for adults”?

Step forward Cosmos Video, which has a virtual venues platform that allows people to work, hang out and socialize together. It has now raised $2.6 million in seed funding from LocalGlobe, with participation from Entrepreneur First, Andy Chung and Philipp Moehring (AngelList), and Omid Ashtari (former president of Citymapper).

Founders Rahul Goyal and Karan Baweja previously led product teams at Citymapper and TransferWise, respectively.

Cosmos allows users to create virtual venues by combining game mechanics with video chat. The idea is to bring back the kinds of serendipitous interactions we used to have in the real world. You choose an avatar, then meet up with their colleagues or friends inside a browser-based game. As you move your avatars closer to another person you can video chat with them, as you might in real life.

The competition is the incumbent video conferencing platforms such as Zoom and Microsoft Teams, but calls on these platforms have a set agenda, and are timeboxed — they’re rigid and repetitive. On Cosmos you sit on the screen and consume one video call after another as you move around the space, so it is mimicking serendipity, after a fashion.

As well as having a social application, office colleagues can work collaboratively on tools such as whiteboards, Google documents and Figma, play virtual board games or gather around a table to chat.

Cosmos is currently being used in private beta by a select group of companies to host their offices and for social events such as Christmas parties. Others are using it to host events, meetup groups and family gatherings.

Co-founder Rahul Goyal said in a statement: “Once the pandemic hit, we both saw productivity surge in our respective teams but at the same time, people were missing the in-office culture. Video conferencing platforms provide a great service when it comes to meetings, but they lack spontaneity. Cosmos is a way to bring back that human connection we lack when we spend all day online, by providing a virtual world where you can play a game of trivia or pong after work with colleagues or gather round a table to celebrate a friend’s birthday.”

George Henry, partner at LocalGlobe, said: “We were really impressed with the vision and potential of Cosmos. Scaling live experiences online is one of the big internet frontiers where there are still so many opportunities. Now that the video infrastructure is in place, we believe products like Cosmos will enable new forms of live online experiences.”

Powered by WPeMatico

Swell Energy, an installer and manager of residential renewable energy, energy efficiency and storage technologies, is raising $450 million to finance the construction of four virtual power plants representing a massive amount of energy storage capacity paired with solar power generation.

It’s a sign of the distributed nature of renewable energy development and a transition from large-scale power generation projects feeding into utility grids at their edge to smaller, point solutions distributed at the actual points of consumption.

The project will pair 200 megawatt hours of distributed energy storage with 100 megawatts of solar photovoltaic capacity, the company said.

Los Angeles-based Swell was commissioned by utilities across three states to establish the dispatchable energy storage capacity, which will be made available through the construction and aggregation of approximately 14,000 solar energy generation and storage systems. The goal is to make local grids more efficient.

To finance these projects — and others the company expects to land — Swell has cut a deal with Ares Management Corp. and Aligned Climate Capital to create a virtual power plant financing vehicle with a target of $450 million.

That financing entity will support the development of power projects like the combined solar and battery agreement nationwide.

Over the next 20 years, Swell is targeting the development of over 3,000 gigawatt hours of clean solar energy production, with customers storing 1,000 gigawatt hours for later use, and dispatching 200 gigawatt hours of this stored energy back to the utility grid.

It has the potential to create a more resilient grid less susceptible to the kinds of power outages and rolling blackouts that have plagued states like California.

“Utilities are increasingly looking to distributed energy resources as valuable ‘grid edge’ assets,” said Suleman Khan, CEO of Swell Energy, in a statement. “By networking these individual homes and businesses into virtual power plants, Swell is able to bring down the cost of ownership for its customers and help utilities manage demand across their electric grids,” said Khan. “By receiving GridRevenue from Swell, customers participating in our VPP programs pay less for their solar energy generation and storage systems, while potentially reducing the risk of a local power outage, and keeping their homes and businesses securely powered through any outages.”

Along with the launch of the virtual power plant financing vehicle, Swell is also giving homeowners a way to finance their home energy systems through Swell. They need the buy-in from homeowners to get these power plants off the ground, and for homeowners, there’s a way to get some money back by feeding power into the grid.

It’s a win-win for the company, customers and early investors like Urban.us, which was seed investor in the company.

Powered by WPeMatico

Cityblock Health, a company that provides healthcare services to low-income communities, is now commanding a high-priced valuation of over $1 billion after venture capitalists poured $160 million into the company.

The round was led by new investor General Catalyst with participation from crossover investor Wellington Management and support from major existing investors, including Kinnevik AB, Maverick Ventures, Thrive Capital, Redpoint Ventures and more, according to a statement from the company.

Cityblock works with community caregivers to work with residents to provide primary care, behavioral health and other services to address social determinants of health, in person and… increasingly… through virtual consultations.

The company first spun out of Alphabet’s Sidewalk Labs in 2017 and initially partnered with EmblemHealth. By relying primarily on licensed clinical social workers, community health partners and a network of specialized practice clinicians and doctors to provide basic primary care and supporting health services, Cityblock believes it can drive down the costs of healthcare.

Some 70,000 patients use Cityblock services in four major U.S. cities, the company said.

To date, Cityblock has raised $300 million.

The company said in a statement that the new funding will be used to support Cityblock’s national expansion in caring for Medicaid and dually-eligible communities, to attract and onboard talent across its product, engineering, data science, clinical and business operations, to launch new service lines and to continue investing in its proprietary technology platform, Commons.

Powered by WPeMatico

As remote work continues to solidify its place as a critical aspect of how businesses exist these days, a startup that has built a platform to help companies source and bring on one specific category of remote employees — engineers — is taking on some more funding to meet demand.

Turing — which has built an AI-based platform to help evaluate prospective, but far-flung, engineers, bring them together into remote teams, then manage them for the company — has picked up $32 million in a Series B round of funding led by WestBridge Capital. Its plan is as ambitious as the world it is addressing is wide: an AI platform to help define the future of how companies source IT talent to grow.

“They have a ton of experience in investing in global IT services, companies like Cognizant and GlobalLogic,” said co-founder and CEO Jonathan Siddharth of its lead investor in an interview the other day. “We see Turing as the next iteration of that model. Once software ate the IT services industry, what would Accenture look like?”

It currently has a database of some 180,000 engineers covering around 100 or so engineering skills, including React, Node, Python, Agular, Swift, Android, Java, Rails, Golang, PHP, Vue, DevOps, machine learning, data engineering and more.

In addition to WestBridge, other investors in this round included Foundation Capital, Altair Capital, Mindset Ventures, Frontier Ventures and Gaingels. There is also a very long list of high-profile angels participating, underscoring the network that the founders themselves have amassed. It includes unnamed executives from Google, Facebook, Amazon, Twitter, Microsoft, Snap and other companies, as well as Adam D’Angelo (Facebook’s first CTO and CEO at Quora), Gokul Rajaram, Cyan Banister and Scott Banister, and Beerud Sheth (the founder of Upwork), among many others (I’ll run the full list below).

Turing is not disclosing its valuation. But as a measure of its momentum, it was only in August that the company raised a seed round of $14 million, led by Foundation. Siddharth said that the growth has been strong enough in the interim that the valuations it was getting and the level of interest compelled the company to skip a Series A altogether and go straight for its Series B.

The company now has signed up to its platform 180,000 developers from across 10,000 cities (compared to 150,000 developers back in August). Some 50,000 of them have gone through automated vetting on the Turing platform, and the task will now be to bring on more companies to tap into that trove of talent.

Or, “We are demand-constrained,” which is how Siddharth describes it. At the same time, it’s been growing revenues and growing its customer base, jumping from revenues of $9.5 million in October to $12 million in November, increasing 17x since first becoming generally available 14 months ago. Current customers include VillageMD, Plume, Lambda School, Ohi Tech, Proxy and Carta Healthcare.

A lot of people talk about remote work today in the context of people no longer able to go into their offices as part of the effort to curtail the spread of COVID-19. But in reality, another form of it has been in existence for decades.

Offshoring and outsourcing by way of help from third parties — such as Accenture and other systems integrators — are two ways that companies have been scaling and operating, paying sums to those third parties to run certain functions or build out specific areas instead of shouldering the operating costs of employing, upsizing and sometimes downsizing that labor force itself.

Turing is essentially tapping into both concepts. On one hand, it has built a new way to source and run teams of people, specifically engineers, on behalf of others. On the other, it’s using the opportunity that has presented itself in the last year to open up the minds of engineering managers and others to consider the idea of bringing on people they might have previously insisted work in their offices, to now work for them remotely, and still be effective.

Siddarth and co-founder Vijay Krishnan (who is the CTO) know the other side of the coin all too well. They are both from India, and both relocated to the Valley first for school (post-graduate degrees at Stanford) and then work at a time when moving to the Valley was effectively the only option for ambitious people like them to get employed by large, global tech companies, or build startups — effectively what could become large, global tech companies.

“Talent is universal, but opportunities are not,” Siddarth said to me earlier this year when describing the state of the situation.

A previous startup co-founded by the pair — content discovery app Rover — highlighted to them a gap in the market. They built the startup around a remote and distributed team of engineers, which helped them keep costs down while still recruiting top talent. Meanwhile, rivals were building teams in the Valley. “All our competitors in Palo Alto and the wider area were burning through tons of cash, and it’s only worse now. Salaries have skyrocketed,” he said.

After Rover was acquired by Revcontent, a recommendation platform that competes against the likes of Taboola and Outbrain, they decided to turn their attention to seeing if they could build a startup based on how they had, basically, built their own previous startup.

There are a number of companies that have been tapping into the different aspects of the remote work opportunity, as it pertains to sourcing talent and how to manage it.

They include the likes of Remote (raised $35 million in November), Deel ($30 million raised in September), Papaya Global ($40 million also in September), Lattice ($45 million in July) and Factorial ($16 million in April), among others.

What’s interesting about Turing is how it’s trying to address and provide services for the different stages you go through when finding new talent. It starts with an AI platform to source and vet candidates. That then moves into matching people with opportunities, and onboarding those engineers. Then, Turing helps manage their work and productivity in a secure fashion, and also provides guidance on the best way to manage that worker in the most compliant way, be it as a contractor or potentially as a full-time remote employee.

The company is not freemium, as such, but gives people two weeks to trial people before committing to a project. So unlike an Accenture, Turing itself tries to build in some elasticity into its own product, not unlike the kind of elasticity that it promises its customers.

It all sounds like a great idea now, but interestingly, it was only after remote work really became the norm around March/April of this year that the idea really started to pick up traction.

“It’s amazing what COVID has done. It’s led to a huge boom for Turing,” said Sumir Chadha, managing director for WestBridge Capital, in an interview. For those who are building out tech teams, he added, there is now “No need for to find engineers and match them with customers. All of that is done in the cloud.”

“Turing has a very interesting business model, which today is especially relevant,” said Igor Ryabenkiy, managing partner at Altair Capital, in a statement. “Access to the best talent worldwide and keeping it well-managed and cost-effective make the offering attractive for many corporations. The energy of the founding team provides fast growth for the company, which will be even more accelerated after the B-round.”

PS. I said I’d list the full, longer list of investors in this round. In these COVID times, this is likely the biggest kind of party you’ll see for a while. In addition to those listed above, it included [deep breath] Founders Fund, Chapter One Ventures (Jeff Morris Jr.), Plug and Play Tech Ventures (Saeed Amidi), UpHonest Capital (Wei Guo, Ellen Ma), Ideas & Capital (Xavier Ponce de León), 500 Startups Vietnam (Binh Tran and Eddie Thai), Canvas Ventures (Gary Little), B Capital (Karen Appleton Page, Kabir Narang), Peak State Ventures (Bryan Ciambella, Seva Zakharov), Stanford StartX Fund, Amino Capital, Spike Ventures, Visary Capital (Faizan Khan), Brainstorm Ventures (Ariel Jaduszliwer), Dmitry Chernyak, Lorenzo Thione, Shariq Rizvi, Siqi Chen, Yi Ding, Sunil Rajaraman, Parakram Khandpur, Kintan Brahmbhatt, Cameron Drummond, Kevin Moore, Sundeep Ahuja, Auren Hoffman, Greg Back, Sean Foote, Kelly Graziadei, Bobby Balachandran, Ajith Samuel, Aakash Dhuna, Adam Canady, Steffen Nauman, Sybille Nauman, Eric Cohen, Vlad V, Marat Kichikov, Piyush Prahladka, Manas Joglekar, Vladimir Khristenko, Tim and Melinda Thompson, Alexandr Katalov, Joseph and Lea Anne Ng, Jed Ng, Eric Bunting, Rafael Carmona, Jorge Carmona, Viacheslav Turpanov, James Borow, Ray Carroll, Suzanne Fletcher, Denis Beloglazov, Tigran Nazaretian, Andrew Kamotskiy, Ilya Poz, Natalia Shkirtil, Ludmila Khrapchenko, Ustavshchikov Sergey, Maxim Matcin and Peggy Ferrell.

Powered by WPeMatico

As the pandemic has raged on, it has shone a spotlight on the importance of procurement, especially in certain sectors. Fairmarkit, a Boston startup, is working to bring a modern digital procurement system to the enterprise. Today, the company announced a $30 million Series B.

GGV Capital and Insight Partners led the round with help from existing investors 1984 VC, NewStack and NewFund. Today’s investment brings the total raised to $42 million, according to the company.

Fairmarkit wants to replace large procurement software systems from companies like Oracle and SAP that have been around for decades, says company co-founder and CEO Kevin Frechette. When he looked around a couple of years ago, he saw a space full of these legacy vendors and ripe for disruption.

What’s more, he says that these systems have been designed to track only the biggest purchases over $500,000 or $1 million. Anything under that is what’s known as tail spend. “So procurement really focuses on companies’ biggest purchases, say things over a million, but anything under that size just gets forgotten about and neglected. It’s called tail spend, and it’s still 80% of what they buy, 80% of their vendors and 20% of the budget,” he told me.

This spending accounts for billions of dollars, yet Frechette says, it has lacked a good tracking system. He saw an opportunity, and he and his co-founders built a solution. Its first customer was the MBTA, Boston’s mass transit system (a system that could use all the help it can get in terms of getting more efficient). Today the company has more than 50 customers across a variety of industries.

The system acts as a marketplace for vendors and a central buying system for customers where they can find goods and services at this price point below $1 million. It imports a customer’s vendor data, and then combines this with other data to build a huge database of buying information. From that, they can determine what a customer needs and using AI, find the best prices for a particular order.

Frechette says this not only provides a way to save money — he says customers have been able to cut purchase costs by 10% with his system — it also provides a way to surface diverse vendors, whether that’s businesses owned by women, people of color, veterans, local business or however you define that.

He says too often what happens is that these deals aren’t put under typical procurement department scrutiny and they just get passed through, but Fairmarkit helps surface these companies and give them a shot at the business. “So because the core of our technology is a vendor recommendation engine […], we can help to invite those diverse vendors and really just give them a fair shot,” he said.

The company started the year with 40 employees and have added 30 since. The plan is to double that number next year, and as they do, Frechette hopes to reflect the diversity of the company’s product by building a correspondingly diverse employee base.

“It’s really just keeping it at the forefront. We want to make sure that we’re not just doing surveys around how we are doing for diversity and inclusion, but we’re putting programs in place to help out with it. It’s something I’m very very passionate about because it’s been such a sticking point as well on how we’re helping diverse vendors,” he said.

Frechette says that he has managed to grow the company and build a culture in spite of the pandemic not allowing employees to come into an office. He doesn’t see a world where the office will be a requirement in the future.

“We’ve hit an inflection point this year where there’s no world where we need everyone to be in an office […], which once again only helps to accelerate our business because we’re not constricted by everyone in this one small [geographical] sector. We can operate across the board [from anywhere],” he said.

Powered by WPeMatico

Product managers can only be successful if they can make effective use of both quantitative and qualitative data. But mapping the former to the latter, and collecting high-quality data, is a huge challenge to organizations looking to rapidly productize and innovate.

UserLeap, a company founded by serial product manager Ryan Glasgow, thinks it has found a better way, and so do its investors. The company today announced the close of a $16 million Series A financing led by Accel (Dan Levine led the round), with participation from angels like Elad Gil, Dylan Field, Ben Porterfield, Akshay Kothari, Jack Altman and Bobby Lo.

One of the main challenges of rapid product development is that the ratio of quantitative data to qualitative data isn’t equal. It can take weeks or even months to get results from user surveys, and that’s only if users actually respond. According to UserLeap, the average response rate for email surveys is between 3% and 5%. To add to the headache, PMs and data teams usually have to parse that information and organize it manually.

UserLeap offers product teams the ability to put a short line of code into their product that then delivers contextual micro-surveys to users right within the product. The company says that these micro-surveys usually see a 20% to 30% response rate, and sometimes that even pops all the way to 90%.

Plus, the UserLeap dashboard processes the natural language from respondents and organizes the data. For example, if one user references price and another references cost, those responses are grouped together.

Because the surveys are built right into the product and targeted to a specific action or flow, and because the data is parsed and automatically sorted, product teams usually have access to this data within a few hours.

UserLeap charges based on the number of end users tracked, plus the number of surveys sent out per month, offering tiers for those surveys in groupings of five. Glasgow says this is a bit of a differentiator when compared to other survey products like SurveyMonkey or TypeForm.

“We have a usage-based pricing model, where our competitors often have a seat-based pricing model,” said Glasgow. “We don’t care how many people have access to us. Really, our goal is to get you to use our product.”

In other words, the insights gleaned from UserLeap can be shared and used across the entire organization without affecting the price.

This latest funding brings UserLeap’s total funding to $20 million — First Round Capital previously led a $4 million seed round.

Customers include Square, Opendoor and Codecademy. Thus far, the company has tracked more than 500 million visitors, and gotten 600,000 survey question responses.

The UserLeap team is currently made up of 15 people, with females representing 50% and people of color making up 33% of the leadership team. Across the company, women represent 32% of the team and people of color represent 42%.

“UserLeap cares deeply about diversity and inclusion,” said Glasgow. “Having a diverse team helps to ensure our employees feel comfortable and valued so that they can bring their whole selves to work. For that reason, UserLeap has a part-time recruiting sourcer dedicated to engaging underrepresented candidates and these efforts have contributed towards our diversity goals.”

Powered by WPeMatico