TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Hightouch, a SaaS service that helps businesses sync their customer data across sales and marketing tools, is coming out of stealth and announcing a $2.1 million seed round. The round was led by Afore Capital and Slack Fund, with a number of angel investors also participating.

At its core, Hightouch, which participated in Y Combinator’s Summer 2019 batch, aims to solve the customer data integration problems that many businesses today face.

During their time at Segment, Hightouch co-founders Tejas Manohar and Josh Curl witnessed the rise of data warehouses like Snowflake, Google’s BigQuery and Amazon Redshift — that’s where a lot of Segment data ends up, after all. As businesses adopt data warehouses, they now have a central repository for all of their customer data. Typically, though, this information is then only used for analytics purposes. Together with former Bessemer Ventures investor Kashish Gupta, the team decided to see how they could innovate on top of this trend and help businesses activate all of this information.

“What we found is that, with all the customer data inside of the data warehouse, it doesn’t make sense for it to just be used for analytics purposes — it also makes sense for these operational purposes like serving different business teams with the data they need to run things like marketing campaigns — or in product personalization,” Manohar told me. “That’s the angle that we’ve taken with Hightouch. It stems from us seeing the explosive growth of the data warehouse space, both in terms of technology advancements as well as like accessibility and adoption. […] Our goal is to be seen as the company that makes the warehouse not just for analytics but for these operational use cases.”

It helps that all of the big data warehousing platforms have standardized on SQL as their query language — and because the warehousing services have already solved the problem of ingesting all of this data, Hightouch doesn’t have to worry about this part of the tech stack either. And as Curl added, Snowflake and its competitors never quite went beyond serving the analytics use case either.

As for the product itself, Hightouch lets users create SQL queries and then send that data to different destinations — maybe a CRM system like Salesforce or a marketing platform like Marketo — after transforming it to the format that the destination platform expects.

Expert users can write their own SQL queries for this, but the team also built a graphical interface to help non-developers create their own queries. The core audience, though, is data teams — and they, too, will likely see value in the graphical user interface because it will speed up their workflows as well. “We want to empower the business user to access whatever models and aggregation the data user has done in the warehouse,” Gupta explained.

The company is agnostic to how and where its users want to operationalize their data, but the most common use cases right now focus on B2C companies, where marketing teams often use the data, as well as sales teams at B2B companies.

“It feels like there’s an emerging category here of tooling that’s being built on top of a data warehouse natively, rather than being a standard SaaS tool where it is its own data store and then you manage a secondary data store,” Curl said. “We have a class of things here that connect to a data warehouse and make use of that data for operational purposes. There’s no industry term for that yet, but we really believe that that’s the future of where data engineering is going. It’s about building off this centralized platform like Snowflake, BigQuery and things like that.”

“Warehouse-native,” Manohar suggested as a potential name here. We’ll see if it sticks.

Hightouch originally raised its round after its participation in the Y Combinator demo day but decided not to disclose it until it felt like it had found the right product/market fit. Current customers include the likes of Retool, Proof, Stream and Abacus, in addition to a number of significantly larger companies the team isn’t able to name publicly.

Powered by WPeMatico

BigID has been on the investment fast track, raising $94 million over three rounds that started in January 2018. Today, that investment train kept rolling as the company announced a $70 million Series D on a valuation of $1 billion.

Salesforce Ventures and Tiger Global co-led the round with participation Glynn Capital and existing investors Bessemer Venture Partners, Scale Venture Partners and Boldstart Ventures. The company has raised almost $165 million in just over two years.

BigID is attracting this kind of investment by building a security and privacy platform. When I first spoke to CEO and co-founder Dimitri Sirota in 2018, he was developing a data discovery product aimed at helping companies coping with GDPR find the most sensitive data, but since then the startup has greatly expanded the vision and the mission.

“We started shifting I think when we spoke back in September from being this kind of best of breed data discovery privacy to being a platform anchored in data intelligence through our kind of unique approach to discovery and insight,” he said.

That includes the ability for BigID and third parties to build applications on top of the platform they have built, something that might have attracted investor Salesforce Ventures. Salesforce was the first cloud company to offer the ability for third parties to build applications on its platform and sell them in a marketplace. Sirota says that so far their marketplace includes just apps built by BigID, but the plan is to expand it to third-party developers in 2021.

While he wasn’t ready to talk about specific revenue growth, he said he expects a material uplift in revenue for this year, and he believes that his investors are looking at the vast market potential here.

He has 235 employees today with plans to boost it to 300 next year. While he stopped hiring for a time in Q2 this year as the pandemic took hold, he says that he never had to resort to layoffs. As he continues hiring in 2021, he is looking at diversity at all levels from the makeup of his board to the executive level to the general staff.

He says that the ability to use the early investments to expand internationally has given them the opportunity to build a more diverse workforce. “We have staff around the world and we did very early […] so we do have diversity within our broader company. But clearly not enough when it came to the board of directors and the executives. So we realized that, and we are trying to change that,” he said.

As for this round, Sirota says like his previous rounds in this cycle he wasn’t necessarily looking for additional money, but with the pandemic economy still precarious, he took it to keep building out the BigID platform. “We actually have not purposely gone out to raise money since our seed. Every round we’ve done has been preemptive. So it’s been fairly easy,” he told me. In fact, he reports that he now has five years of runway and a much more fully developed platform. He is aiming to accelerate sales and marketing in 2021.

The company’s previous rounds included a $14 million Series A in January 2018, a $30 million B in June that year and a $50 million C in September 2019.

Powered by WPeMatico

Just six month after raising its first bit of outside funding, ClickUp has closed $100 million in new funding and reached a $1 billion valuation, a report in Bloomberg first reported.

The company has seen plenty of growth in the past several months to justify that new unicorn status, including doubling the amount of users to 2 million. In a press release the company also detailed it had grown revenue nine times over since the beginning of the year.

This latest $100 million round was led by Canadian firm Georgian with participation from Craft Ventures, which led the startup’s $35 million Series A back in June. The high valuation showcases just how eager investors are to find winners in the productivity software space, which has seen massive customer gains as an industry this year, partially as a result of shifting corporate attitudes toward working from home.

ClickUp is aiming to further capitalize as it scales its team and product. The company of 200 has doubled in size since its last raise and is hoping to double again in the next several months, CEO Zeb Evans tells TechCrunch.

ClickUp sells productivity software, but their main sell has been tying several products in that space into a single platform, aiming to reduce the number of tools their customers use. The team has recently begun integrating tools like email into their platform so that users can complete workflows inside the product.

“It’s not just like a value play of using one app instead of three or four, it’s an efficiency play by saving so much time and frustration from having all the other different solutions,” Evans tells TechCrunch.

Even as the company continues scaling the product through weekly updates to the company’s apps, including a newly revamped iOS app which launched today (Android launches tomorrow), the team is looking toward how they can build for the long-term.

As to how long this cash will last, Evans isn’t making any promises. “I think this will keep us going for a while, though to be honest with you I would’ve said the same thing with the Series A,” Evans says.

Powered by WPeMatico

Fintech startup Revolut is tweaking its subscription plans with a new mid-tier offering called Revolut Plus — it costs £2.99 per month. Like N26 Smart and Monzo Plus, the new plan is a pandemic-proof package that doesn’t focus as much on travel.

For the past couple of years, challenger banks and alternatives to traditional bank accounts have been packaging additional services into paid plans. Essentially, those fintech startups are slowly becoming freemium software-as-a-service companies.

The majority of users don’t subscribe to paid plans. But a small portion is willing to pay a fixed monthly fee to access advanced features, get an insurance package and pay less in variable fees.

Revolut already has two paid plans — Premium and Metal. Premium increases limits on free ATM withdrawals and foreign exchange. You also get overseas medical insurance, delayed baggage and flight insurance and winter sports coverage. You can also access advanced features, such as disposable virtual cards and Revolut Junior accounts

With a Metal plan, your insurance package is a bit more thorough, with purchase protection and car hire excess. You get a tiny bit of cash back on purchases (0.1% in Europe, 1% outside of Europe capped at the monthly subscription price) and higher limits across various products.

Another big selling point has been card designs. With the Metal plan, as the name suggests, you get a metal card. It’s not that useful but some people like it. Premium subscribers can also choose between premium card designs.

Revolut Premium costs £6.99 per month and Revolut Metal costs £12.99 per month (or €7.99 and €13.99, respectively in Europe). You pay a bit less if you pay upfront for a year.

So what is Revolut Plus? It costs £2.99 per month, which makes it a lot more affordable than Revolut Premium. The main selling point is purchase protection provided by Qover. All paid plans now get purchase protection with different limits on damaged or stolen goods (up to £1,000, £2,500 and £10,000 depending on your plan). You can get a refund on purchases up to 90 days after buying eligible products. If you book a ticket and your event is cancelled, you could also get a refund.

In addition to a new card design, Revolut Plus subscribers can also use virtual cards. You can also create junior accounts with the new mid-tier plan.

As you can see, there’s no overseas travel insurance. You also don’t get unlimited free currency exchange (other than spread). Revolut Plus is focused on people who mostly use their Revolut account in their home country.

Revolut is also tweaking other plans, so it’s going to be important to check the terms and conditions before you renew your paid plan. The new Plus plan is available today in the U.K. and will be rolled out next week in the European Economic Area.

Image Credits: Revolut

Powered by WPeMatico

Rocket launch startup Astra has joined an elite group of companies that can say their vehicle has actually made it to orbital space — earlier than expected. The company’s Rocket 3.2 test rocket (yes, it’s a rocket called “Rocket”) passed the Karman line, the separation point 100 km (62 miles) up that most consider the barrier between Earth’s atmosphere and space, during a launch today from Kodiak, Alaska.

This is the second in this series of orbital flight tests by Astra; it flew its Rocket 3.1 test vehicle in September, but while that flight was successful by the company’s own definition, since it lifted off and provided a lot of data, it didn’t reach space or orbit. Both the 3.1 and 3.2 rockets are part of a planned three-launch series that Astra said would be designed to reach orbital altitudes by the end of the trio of attempts.

Astra is a small satellite launch startup that builds its rockets in California’s East Bay, at a factory it established there which is designed to ultimately produce its launchers in volume. Their model uses smaller craft than existing options like either SpaceX or Rocket Lab, but aims to provide responsive, short turnaround launch services at a relatively low cost — a bus to space rather than a hired limousine. They compete more directly with something like Virgin Orbit, which has yet to reach space with its launch craft.

The view from Astra’s Rocket 3.2 second stage from space.

This marks a tremendous win and milestone for Astra’s rocket program, made even more impressive by the relatively short turnaround between their rocket loss error in September, which the company determined was a result of a problem in its onboard guidance system. Correcting the mistake and getting back to an active, and successful launch, within three months, is a tremendous technical achievement, even in the best of times, and the company faced additional challenges because of COVID-19.

Astra was not expecting to make it as far as it did today — the startup has defined seven stages of reaching orbital flight for its development program; today it expected to achieve 1) count and liftoff; and 2) reaching Max Q, the point of maximum dynamic pressure undergone by a rocket in flight in Earth’s atmosphere. Third, they were looking to achieve nominal main-engine cutoff for first stage — and this is where they would’ve pegged success today, but the “rocket continued to perform,” according to CEO and founder Chris Kemp on a call following the launch.

Rocket 3.2 then performed a successful stage separation, and then the second stage passed through the Karman line, reaching outer space. After that, it went farther still, achieving a successful upper-stage ignition, and a nominal upper-stage engine shut off six minutes later. Even then, the rocket reached 390 km, which is its target orbital height, but then reached a velocity of 7.2 km per hours, just one half km/hour less than the 7.68 km required for orbital velocity.

Astra emphasized that the mix for the propellant for this stage is basically only to be nailed down while testing in situ in space, so they say this will just require some upper-stage propellant mixtures to achieve that extra velocity, and Kemp said they’re confident they can do that in the next couple of months, and start reliving payloads early next year. This won’t require any hardware or software changes, the company noted, just a tweak in the variables involved.

Image Credits: John Kraus for Astra (opens in a new window)

He added that this is a big win for the underlying theory behind Astra’s approach, which focuses on using significant amounts of automation in order to reduce costs.

“We’ve only been in business for about four years, and this team only has about 100 people today,” Kemp said. “This team was able to overcome tremendous challenges on the way to this success. We had a member of the team quarantining, and tested positive on the way to Kodiak, which meant they had to quarantine the entire team, and then sent an entire backup team to replace them.” This was possible because they only use five people on the launch team.

“We now are at a point where just five people can go up, and set up the entire launch site and rocket, and launch in just a couple of days,” Kemp said. The team is literally just five people — including labor, rocket unloading, setup and everything on-site — the rest is run remotely from mission control in California via the cloud.

Now they will do some tuning for Rocket 3.3, which is currently in California at the Astra factory, before soon attempting that final orbital test flight with a payload on board to deploy. After that, they intend to continue to iterate with each version of Rocket launched, focusing on reducing costs and improving performance through rapid evolution of the design and technology.

Powered by WPeMatico

BoxCast, a Cleveland-based company aiming to make it easy to live stream any event, has raised $20 million in Series A funding.

Co-founder and CEO Gordon Daily said that when the company first launched in 2013, “streaming wasn’t something that everyone understood,” and you needed professional help to live stream anything. BoxCast is supposed to make that process accessible to anyone.

The company has created several different video encoder devices, but Daily said the “small box” is just a one piece of BoxCast platform, which is designed to cover all your live-streaming needs, with support for 1080p broadcasting; streaming to Facebook Live, YouTube and your own website; analytics and more — plus there are add-ons like automatic scoreboard displays and event ticketing.

Pricing starts at $99 per month for the “essential” streaming plan, plus $399 for a BoxCast encoder. (You can also just stream from an iOS device.)

And it’s no surprise that 2020 has been a “watershed moment” for the company, as Daily put it, with BoxCast now live streaming millions of events per year — everything from sports to religious services to virtual safaris offered by Sri Lanka’s tourism board.

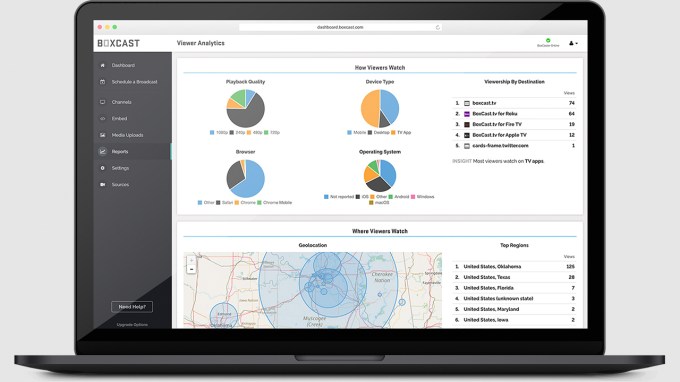

BoxCast dashboard

“When you can’t even meet in-person … we knew that there was going to be higher usage,” he said. “What caught me off-guard was the volume increase — it’s new customers, it’s existing customers, at peak times there’s a 10x increase [from pre-pandemic usage].”

And while in-person events will hopefully become more common next year, Daily said live streams will still be a valuable tool to reach audiences who can’t attend, and to promote your business or organization with new kinds of programming.

COO Sam Brenner added that while BoxCast employed fewer than 40 people before the pandemic, the team has grown to 56, and will likely double within the next 12 months.

The Series A was led by Updata Partners, with participation from audio equipment manufacturer Shure.

“The live streaming video market has grown dramatically over the last decade, and COVID-19 has accelerated adoption in recent months. BoxCast offers a unique end-to-end platform that makes live streaming easy,” said Updata’s Carter Griffin in a statement. “We’re excited to partner with Gordon and his team, and look forward to contributing to their vision of making live events accessible to all.”

Powered by WPeMatico

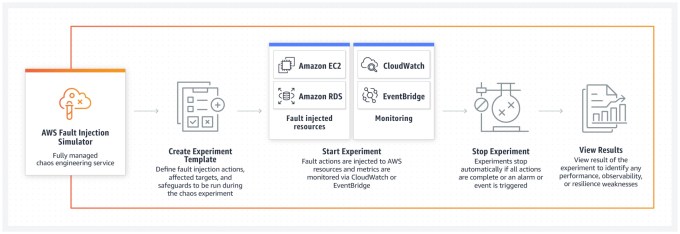

When large companies like Netflix or Amazon want to test the resilience of their systems, they use chaos engineering tools designed to help them simulate worst-case scenarios and find potential issues before they even happen. Today at AWS re:Invent, Amazon CTO Werner Vogels introduced the company’s Chaos Engineering as a Service offering called AWS Fault Injection Simulator.

The name may lack a certain marketing panache, but Vogels said that the service is designed to help bring this capability to all companies. “We believe that chaos engineering is for everyone, not just shops running at Amazon or Netflix scale. And that’s why today I’m excited to pre-announce a new service built to simplify the process of running chaos experiments in the cloud,” Vogels said.

As he explained, the goal of chaos engineering is to understand how your application responds to issues by injecting failures into your application, usually running these experiments against production systems. AWS Fault Injection Simulator offers a fully managed service to run these experiments on applications running on AWS hardware.

Image Credits: Amazon / Getty Images

“FIS makes it easy to run safe experiments. We built it to follow the typical chaos experimental workflow where you understand your steady state, set a hypothesis and inject faults into your application. When the experiment is over, FIS will tell you if your hypothesis was confirmed, and you can use the data collected by CloudWatch to decide where you need to make improvements,” he explained.

While the company was announcing the service today, Vogels indicated it won’t actually be available until some time next year.

It’s worth noting that there are other similar services out there by companies, like Gremlin, which are already providing a broad Chaos Engineering Service as a Service offering.

Powered by WPeMatico

As 2020 comes to a close, some parts of the startup world are completing a loop, ending the year where they began.

Startup valuations, for example, as seen in the Silicon Valley area are effectively back to where they were at the start of the year. According to a report from Fenwick & West examining data through October in the San Francisco Bay area, the percentage of startups that raised up rounds (rounds priced higher than preceding investments) came within spitting distance of its pre-COVID levels.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

There are other positive signs in the data for startup bulls.

Median and average price increases for startup valuations in the Valley have both crested their 2019 averages. The gains have proven especially sharp amongst software startups, which managed somewhat epic valuation gains in October; Fenwick’s data, something we’ve covered before on The Exchange, lags the calendar month somewhat.

Median and average price increases for startup valuations in the Valley have both crested their 2019 averages. The gains have proven especially sharp amongst software startups, which managed somewhat epic valuation gains in October; Fenwick’s data, something we’ve covered before on The Exchange, lags the calendar month somewhat.

This morning, let’s take a break from IPOs to look at startup health in the region still generally heralded as its promised land.

As optimism for business conditions — tech-focused startups in particular — improved in Q3, startup valuations kicked off Q4 on a strong note.

In October, Silicon Valley startup investments that were priced up from their preceding deal rose to 79%. That’s down from what Fenwick reports as 2019’s average, but a dip from 83% to 79% is not much. Notably, startups in the region managed to reach an up-round percentage of rounds in the mid-to-high-seventies over the summer, but during those months down rounds were 11% to 17% of the total.

Powered by WPeMatico

Supabase, a YC-incubated startup that offers developers an open-source alternative to Google’s Firebase and similar platforms, today announced that it has raised a $6 million funding round led by Coatue, with participation from YC, Mozilla and a group of about 20 angel investors.

Currently, Supabase includes support for PostgreSQL databases and authentication tools, with a storage and serverless solution coming soon. It currently provides all the usual tools for working with databases — and listening to database changes — as well as a web-based UI for managing them. The team is quick to note that while the comparison with Google’s Firebase is inevitable, it is not meant to be a 1-to-1 replacement for it. And unlike Firebase, which uses a NoSQL database, Supabase is using PostgreSQL.

Indeed, the team relies heavily on existing open-source projects and contributes to them where it can. One of Supabase’s full-time employees maintains the PostgREST tool for building APIs on top of the database, for example.

“We’re not trying to build another system,” Supabase co-founder and CEO Paul Copplestone told me. “We just believe that already there are well-trusted, scalable enterprise open-source products out there and they just don’t have this usability component. So actually right now, Supabase is an amalgamation of six tools, soon to be seven. Some of them we built ourselves. If we go to market and can’t find anything that we think is going to be scalable — or really solve the problems — then we’ll build it and we’ll open-source it. But otherwise, we’ll use existing tools.”

The traditional route to market for open-source tools is to create a tool and then launch a hosted version — maybe with some additional features — to monetize the work. Supabase took a slightly different route and launched a hosted version right away.

If somebody would want to host the service themselves, the code is available, but running your own PaaS is obviously a major challenge, but that’s also why the team went with this approach. What you get with Firebase, he noted, is that it’s a few clicks to set everything up. Supabase wanted to be able to offer the same kind of experience. “That’s one thing that self-hosting just cannot offer,” he said. “You can’t really get the same wow factor that you can if we offered a hosted platform where you literally [have] one click and then a couple of minutes later, you’ve got everything set up.”

In addition, he also noted that he wanted to make sure the company could support the growing stable of tools it was building and commercializing its tools based on its database services was the easiest way to do so.

Like other Y Combinator startups, Supabase closed its funding round after the accelerator’s demo day in August. The team had considered doing a SAFE round, but it found the right group of institutional investors that offered founder-friendly terms to go ahead with this institutional round instead.

“It’s going to cost us a lot to compete with the generous free tier that Firebase offers,” Copplestone said. “And it’s databases, right? So it’s not like you can just keep them stateless and shut them down if you’re not really using them. [This funding round] gives us a long, generous runway and more importantly, for the developers who come in and build on top of us, [they can] take as long as they want and then start monetizing later on themselves.“

The company plans to use the new funding to continue to invest in its various tools and hire to support its growth.

“Supabase’s value proposition of building in a weekend and scaling so quickly hit home immediately,” said Caryn Marooney, general partner at Coatue and Facebook’s former VP of Global Communications. “We are proud to work with this team, and we are excited by their laser focus on developers and their commitment to speed and reliability.”

Powered by WPeMatico

Twitter has a lot going on, and it’s not always easy to manage that kind of scale on your own. Today, Amazon announced that Twitter has signed a multi-year agreement with AWS to run its real-time timelines. It’s a major win for Amazon’s cloud arm.

While the companies have worked together in some capacity for over a decade, this marks the first time that Twitter is tapping AWS to help run its core timelines.

“This expansion onto AWS marks the first time that Twitter is leveraging the public cloud to scale their real-time service. Twitter will rely on the breadth and depth of AWS, including capabilities in compute, containers, storage and security, to reliably deliver the real-time service with the lowest latency, while continuing to develop and deploy new features to improve how people use Twitter,” the company explained in the announcement.

Parag Agrawal, chief technology officer at Twitter, sees this as a way to expand and improve the company’s real-time offerings by taking advantage of AWS’s network of data centers to deliver content closer to the user. “The collaboration with AWS will improve performance for people who use Twitter by enabling us to serve Tweets from data centers closer to our customers at the same time as we leverage the Arm-based architecture of AWS Graviton2 instances. In addition to helping us scale our infrastructure, this work with AWS enables us to ship features faster as we apply AWS’s diverse and growing portfolio of services,” Agrawal said in a statement.

It’s worth noting that Twitter also has a relationship with Google Cloud. In 2018, it announced it was moving its Hadoop clusters to GCP.

This announcement could be considered a case of the rich getting richer as AWS is the leader in the cloud infrastructure market by far, with around 33% market share. Microsoft is in second with around 18% and Google is in third with 9%, according to Synergy Research. In its most recent earnings report, Amazon reported $11.6 billion in AWS revenue, putting it on a run rate of over $46 billion.

Powered by WPeMatico