TC

Auto Added by WPeMatico

Auto Added by WPeMatico

When an accident on a building site resulted in the death of their friend, the founders of Safesight were inspired to launch the platform to digitize safety programs for construction. The data from that gave birth to a new insurtech startup this year, Foresight, which covers workers’ compensation. The startup has now released, for the first time, news that it raised a $15 million funding round back in May this year, with participation from Blackhorn Ventures and Transverse Insurance Group. To date, it has raised $20.5 million from industrial technology venture capital firms, led by Brick and Mortar Ventures and Builders VC.

Foresight launched in August of this year but has already covered $30 million in risks. The company says it is now on pace to reach $50 million in underwritten premium in 2021. By leveraging the data from sister company Safesite, the platform says it has been able to reduce workers’ comp incidents by up to 57% in a study conducted by actuarial consulting firm Perr & Knight.

Foresight’s algorithm leverages Safesight data to predict incidents, highlight risks and inform underwriting. By wrapping Safesite risk management technology and services into every policy, Foresight provides a path to lower incident rates and lower premiums for customers.

Of the $57 billion national workers’ compensation market, Foresight focuses on policies ranging from $150,000 to $1 million+ in annual premiums. The company says this segment has been largely overlooked by well-funded insurtech startups such as Next Insurance and Pie, which provide small business policies under $50,000 in annual premiums.

Foresight and Safesite were developed by longtime friends and co-founders David Fontain, Peter Grant and Leigh Appel.

Fontain said: “Foresight strengthens the correlation between safety and savings while providing the fast and easy user experience insurtechs are known for. We leverage purpose-built technology to drive behavioral shifts and provide an irresistible alternative to traditional workers compensation coverage.”

Darren Bechtel, the founder and managing director at Brick & Mortar Ventures, commented: “We first invested in 2016 and have known the founders since 2015 when it was just the two of them, squatting at a couple of empty desks inside another portfolio company’s office. Their initial vision was both elegant and powerful, and the demonstrated impact of their solution on safety performance, even in early interactions with the product, was impossible to ignore.”

Foresight now covers Nevada, Oklahoma, Arizona, Arkansas, Louisiana and New Mexico. The company expects to launch workers’ compensation in the eastern U.S. and a general liability line in early 2021.

Powered by WPeMatico

V7 Labs, the makers of a computer vision platform that helps AI teams “automate” and future-proof their training data workflows as advances in AI continue, has picked up $3 million in funding. Leading the seed round is Amadeus Capital Partners, with participation from Partech, Nathan Benaich’s Air Street Capital and Miele Venture.

Founded in 2018 by Singularity University alumnus Alberto Rizzoli and former R&D lead at RSI, Simon Edwardsson (the same team behind “seeing” app Aipoly), the V7 Labs platform promises to accelerate the creation of high-quality training data by 10-100x. It does this by giving users the ability to build automated image and video data pipelines, organize and version complex data sets, and train and deploy “state-of-the-art” vision AI models.

“For companies to build computer vision solutions that deliver business value, they must continuously collect, label and retrain their models,” explains V7 Labs’ Rizzoli. “When we built Aipoly in 2015, we needed to build and maintain our own tools, whilst keeping up with the rapid state of the art of AI, because no third-party SaaS products were available”.

Fast-forward to today and Rizzoli says that many of the best computer vision companies are now turning to SaaS platforms like V7 to solve this problem. “There’s a lot to think of when building an AI startup, and ‘how can we efficiently store and query 100 different video data sets’ is something you only think of when you’re mid-flight in trying to deliver your service.

“V7 codifies industry best-practices for organizing data, labelling and launching computer vision models for real-world problems”.

Image Credits: V7 Labs

The browser and cloud-based platform claims the ability to quickly upload and render large image/video data sets “without lag,” and enable labelling to be automated (to varying degrees) without the need for prior training data. V7 has also been designed to make it possible to keep track of a very large number of labels per image/video, supporting thousands of annotations per image and millions of images per data set. Crucially, Rizzoli tells me it is possible to train, deploy and run computer vision models within the platform “in a few clicks without having to worry about DevOps”.

“Customers will soon be able to audit those models — and their corresponding training sets — to debug, test data quality, discover failure cases and eliminate any unwanted bias,” he adds, noting that these are all huge unsolved pain-points in the AI industry.

To that end, V7 Labs’ existing 100 or so customers include Tractable, GE Healthcare and Merck. It is growing fastest within medical imaging, in part because it offers support for DICOM annotation and HIPAA compliance, both must-haves in healthcare.

However, measured by the quantity of data processed on the platform, Rizzoli tells me that routine “expert inspections” are the most popular tasks. “These include dozens of companies using AI to look for damage or anomalies in cars, oil rigs, power lines, pipelines or roads,” he says.

Powered by WPeMatico

UiPath, the robotic process automation startup that has been growing like gangbusters, filed confidential paperwork with the SEC today ahead of a potential IPO.

“UiPath, Inc. today announced that it has submitted a draft registration statement on a confidential basis to the U.S. Securities and Exchange Commission (the “SEC”) for a proposed public offering of its Class A common stock. The number of shares of Class A common stock to be sold and the price range for the proposed offering have not yet been determined. UiPath intends to commence the public offering following completion of the SEC review process, subject to market and other conditions,” the company said in a statement.

The company has raised more than $1.2 billion from investors like Accel, CapitalG, Sequoia and others. Its biggest raise was $568 million led by Coatue on an impressive $7 billion valuation in April 2019. It raised another $225 million led by Alkeon Capital last July when its valuation soared to $10.2 billion.

At the time of the July raise, CEO and co-founder Daniel Dines did not shy away from the idea of an IPO, telling me:

We’re evaluating the market conditions and I wouldn’t say this to be vague, but we haven’t chosen a day that says on this day we’re going public. We’re really in the mindset that says we should be prepared when the market is ready, and I wouldn’t be surprised if that’s in the next 12-18 months.

This definitely falls within that window. RPA helps companies take highly repetitive manual tasks and automate them. So for example, it could pull a number from an invoice, fill in a number in a spreadsheet and send an email to accounts payable, all without a human touching it.

It is a technology that has great appeal right now because it enables companies to take advantage of automation without ripping and replacing their legacy systems. While the company has raised a ton of money, and seen its valuation take off, it will be interesting to see if it will get the same positive reception as companies like Airbnb, C3.ai and Snowflake.

Powered by WPeMatico

Social gaming platform Rec Room has scored some new funding as it aims to bring its once VR-centric world to every major gaming platform out there.

The startup has closed a $20 million Series C led by Madrona Venture Group . Existing investors, including First Round Capital, Index, Sequoia and DAG, also participated in the round. They’ve raised just shy of $50 million to date.

The platform has been around for years serving as a social hub and gaming platform for virtual reality users. In recent years, the company has tried to scale its ambitions past being known as the “Roblox of VR” and scale its capabilities to meet its young user base. This year was big for the platform doing just that.

CEO Nick Fajt estimates that the company has tripled its total audience since this time last year as the company has made a concerted drive on new platforms. While a substantial portion of Rec Room’s audience still comes from its bread-and-butter VR audience, the platform’s base of console users has grown substantially in 2020 and, by the end of next year, Fajt expects that mobile will have grown to be Rec Room’s most common point of entry. Meanwhile, mobile Android remains one of the last major gaming platforms on which Rec Room still doesn’t have a home.

One of the company’s big aims heading into the new year is scaling their creation tools, which allow players to build their own experiences inside the game. More than 1 million of the platform’s 10 million registered users have engaged with creator tools, building 4 million distinct rooms on the platform. Next year, Fajt plans to scale up creator payments estimating that by the end of 2021 they’ll have paid out $1 million to their network.

Fajt says he wants creation tools on Rec Room to be more accessible to the general player base than other platforms, including Roblox, aiming to keep tools simple for now and push everyday users to invest time in the creation platform.

Image via Rec Room

“Roblox has an incredible business, that’s certainly no secret,” Fajt tells TechCrunch. “We want breadth of expression over depth of expression; we want anyone who comes into to Rec Room to be able to build.”

Despite the slow maturation of the VR market, Fajt says the company doesn’t plan on moving away from its VR roots anytime soon. The company has just updated its popular battle royale mode Rec Royale for the new Quest 2, as well as on iOS.

Powered by WPeMatico

Businesses today feel, more than ever, the imperative to have flexible e-commerce strategies in place, able to connect with would-be customers wherever they might be. That market driver has now led to a significant growth round for a startup that is helping the larger of these businesses, including those targeting the B2B market, build out their digital sales operations with more agile, responsive e-commerce solutions.

Spryker, which provides a full suite of e-commerce tools for businesses — starting with a platform to bring a company’s inventory online, through to tools to analyse and measure how that inventory is selling and where, and then adding voice commerce, subscriptions, click & collect, IoT commerce and other new features and channels to improve the mix — has closed a round of $130 million.

It plans to use the funding to expand its own technology tools, as well as grow internationally. The company makes revenues in the mid-eight figures (so, around $50 million annually) and some 10% of its revenues currently come from the U.S. The plan will be to grow that business as part of its wider expansion, tackling a market for e-commerce software that is estimated to be worth some $7 billion annually.

The Series C was led by TCV — the storied investor that has backed giants like Facebook, Airbnb, Netflix, Spotify and Splunk, as well as interesting, up-and-coming e-commerce “plumbing” startups like Spryker, Relex and more. Previous backers One Peak and Project A Ventures also participated.

We understand that this latest funding values Berlin -based Spryker at more than $500 million.

Spryker today has around 150 customers, global businesses that run the gamut from recognised fashion brands through to companies that, as Boris Lokschin, who co-founded the company with Alexander Graf (the two share the title of co-CEOs) put it, are “hidden champions, leaders and brands you have never heard about doing things like selling silicone isolations for windows.” The roster includes Metro, Aldi Süd, Toyota and many others.

The plan will be to continue to support and grow its wider business building e-commerce tools for all kinds of larger companies, but in particular Spryker plans to use this tranche of funding to double down specifically on the B2B opportunity, building more agile e-commerce storefronts and in some cases also developing marketplaces around that.

One might assume that in the world of e-commerce, consumer-facing companies need to be the most dynamic and responsive, not least because they are facing a mass market and all the whims and competitive forces that might drive users to abandon shopping carts, look for better deals elsewhere or simply get distracted by the latest notification of a TikTok video or direct message.

For consumer-facing businesses, making sure they have the latest adtech, marketing tech and tools to improve discovery and conversion is a must.

It turns out that business-facing businesses are no less immune to their own set of customer distractions and challenges — particularly in the current market, buffeted as it is by the global health pandemic and its economic reverberations. They, too, could benefit from testing out new channels and techniques to attract customers, help them with discovery and more.

“We’ve discovered that the model for success for B2B businesses online is not about different people, and not about money. They just don’t have the tooling,” said Graf. “Those that have proven to be more successful are those that are able to move faster, to test out everything that comes to mind.”

Spryker positions itself as the company to help larger businesses do this, much in the way that smaller merchants have adopted solutions from the likes of Shopify .

In some ways, it almost feels like the case of Walmart versus Amazon playing itself out across multiple verticals, and now in the world of B2B.

“One of our biggest DIY customers [which would have previously served a mainly trade-only clientele] had to build a marketplace because of restrictions in their brick and mortar assortment, and in how it could be accessed,” Lokschin said. “You might ask yourself, who really needs more selection? But there are new providers like Mano Mano and Amazon, both offering millions of products. Older companies then have to become marketplaces themselves to remain competitive.”

It seems that even Spryker itself is not immune from that marketplace trend: Part of the funding will be to develop a technology AppStore, where it can itself offer third-party tools to companies to complement what it provides in terms of e-commerce tools.

“We integrate with hundreds of tech providers, including 30-40 payment providers, all of the essential logistics networks,” Lokschin said.

Spryker is part of that category of e-commerce businesses known as “headless” providers — by which they mean those using the tools do so by way of API-based architecture and other easy-to-integrate modules delivered through a “PaaS” (clould-based Platform as a Service) model.

It is not alone in that category: There have been a number of others playing on the same concept to emerge both in Europe and the U.S. They include Commerce Layer in Italy; another startup out of Germany called Commercetools; and Shogun in the U.S.

Spryker’s argument is that by being a newer company (founded in 2018) it has a more up-to-date stack that puts it ahead of older startups and more incumbent players like SAP and Oracle.

That is part of what attracted TCV and others in this round, which was closed earlier than Spryker had even planned to raise (it was aiming for Q2 of next year) but came on good terms.

“The commerce infrastructure market has been a high priority for TCV over the years. It is a large market that is growing rapidly on the back of e-commerce growth,” said Muz Ashraf, a principal at TCV, to TechCrunch. “We have invested across other areas of the commerce stack, including payments (Mollie, Klarna), underlying infrastructure (Redis Labs) as well as systems of engagement (ExactTarget, Sitecore). Traditional offline vendors are increasingly rethinking their digital commerce strategy, more so given what we are living through, and that further acts as a market accelerant.

“Having tracked Spryker for a while now, we think their solution meets the needs of enterprises who are increasingly looking for modern solutions that allow them to live in a best-of-breed world, future-proofing their commerce offerings and allowing them to provide innovative experiences to their consumers.”

Powered by WPeMatico

While 2020 won’t be remembered fondly by many of us for much of anything, it was a blockbuster year for enterprise M&A with the top 10 deals totaling an astounding $165.2 billion.

This is the third straight year I’ve done this compilation. Last year the number was $40 billion. The year prior it was $87 billion. Those numbers pale in comparison to 2020’s result.

Last year’s biggest deal — Salesforce buying Tableau for $15.7 billion — would have only been good for fifth place on this year’s list. And last year’s fourth largest deal, where VMware bought Pivotal for $2.7 billion, wouldn’t have even made this year’s list at all.

The 2020 number was lifted by four chip company deals totaling $106 billion alone. Consider that the largest of these deals at $40 billion matched last year’s entire list. But let’s not forget the software company acquisitions, which accounted for the remainder, three of which were via private equity deals.

It’s worth noting that the $165.2 billion figure doesn’t include the Oracle-TikTok debacle, which remains for now in regulatory limbo and may never emerge from it. Nor does it include two purely fintech deals — Morgan Stanley acquiring E-Trade for $13 billion or Intuit snagging Credit Karma for $7.1 billion — but we did include the $5.3 billion Visa-Plaid deal because as it involved an enterprise-y API company we felt like it fit our criteria.

Keep in mind as you go through this year’s list that it appears to be an outlier year in terms of total deal flow. Most years have maybe one or two megadeals, which I would define as over $10 billion. There were six this year. And there were a host of unlisted deals worth between $1 billion and $3.2 billion, several of which would have made it to the list in quieter years.

Without further adieu, here is this year’s Top 10 deals in M&A organized from smallest to largest:

This deal happened just this week as we were writing the story, vaulting into 10th place past the $3.2 billion Twilio-Segment deal. Vista has been active as always and it has added Pluralsight, an online education platform for IT pros with plans to take it private again. At a time when more people are online, this deal seems like a wise move.

This was one of those under-the-radar private equity deals, but one with a bushel of money changing hands. Epicor, hardly a household name, is a mature ERP company dating back to the early 1970s. The company has been on a rocky financial road for much of the 21st century. This could be one of those deals where KKR sees a way to squeeze life from maintenance contracts. Otherwise this one is hard to figure.

In yet another private equity deal, Insight acquired Veeam, a cloud data backup and recovery startup based in Switzerland for $5 billion. This one was one of the earliest deals of 2020 and set the tone for the year. The firm had previously invested $500 million into Veeam and apparently liked what it saw and bought the company. Unlike the Epicor deal, Insight probably plans to invest in the company with an end goal of going public or flipping it for a profit at some point.

Powered by WPeMatico

It’s been an eventful fall for Perigee CEO and founder Mollie Breen. The former NSA employee participated in the TechCrunch Disrupt Startup Battlefield in September, and she just closed her first seed round on Thanksgiving, giving her a $1.5 million runway to begin building the company.

Outsiders Fund led the round, with participation from Westport, Contour Venture Partners, BBG Ventures, Innospark Ventures and a couple of individual investors.

Perigee wants to secure areas of the company like HVAC systems or elevators that may interact with the company’s network, but which often fall outside the typical network security monitoring purview. Breen says the company’s value proposition is about bridging the gap between network security and operations security. She said this has been a security blind spot for companies, often caught between these two teams. Perigee provides a set of analytics that gives the security team visibility into this vulnerable area.

As Breen explained when we spoke in September around her Battlefield turn, the solution learns normal behavior from the operations systems as it interacts with the network, collecting data like which systems and individuals normally access it. It can then determine when something seems off and cut off an anomalous act, which may be indicative of hacker activity, before it reaches the network.

She says that as a female founder getting funding, she is acutely aware how rare that is, and part of the reason she wanted to publicize this funding round was to show other women who are thinking about starting a company that it’s possible, even if it remains difficult.

She plans to grow the company to about six people in the next 12 months, and Breen says that she thinks deeply about how to build a diverse organization. She says that starts with her investors, and includes considering diversity in terms of gender, race and age. She believes that it’s crucial to start with the earliest employees, and she actively recruits diverse candidates.

“I write a lot of cold emails, particularly around hiring and that’s partly because with job listings it’s all inbound and you can’t necessarily guarantee that that is going to be diverse. And so by writing cold emails and really following up with those people and having those conversations, I have found a way of actually making sure that I’m talking to people from different perspectives,” she said.

As she looks ahead to 2021, she’s thinking about the best approach to office versus remote and she says it will probably be mostly remote with some in-person. “I’m really balancing at this point in time, how do we really make the connections, and make them strong and genuine with a lot of trust and do that with balancing some elements of remote, knowing that is where the industry is going and if you’re going to be a company and in a post-2020 world, you probably need to adopt to some element of remote working,” she said.

Powered by WPeMatico

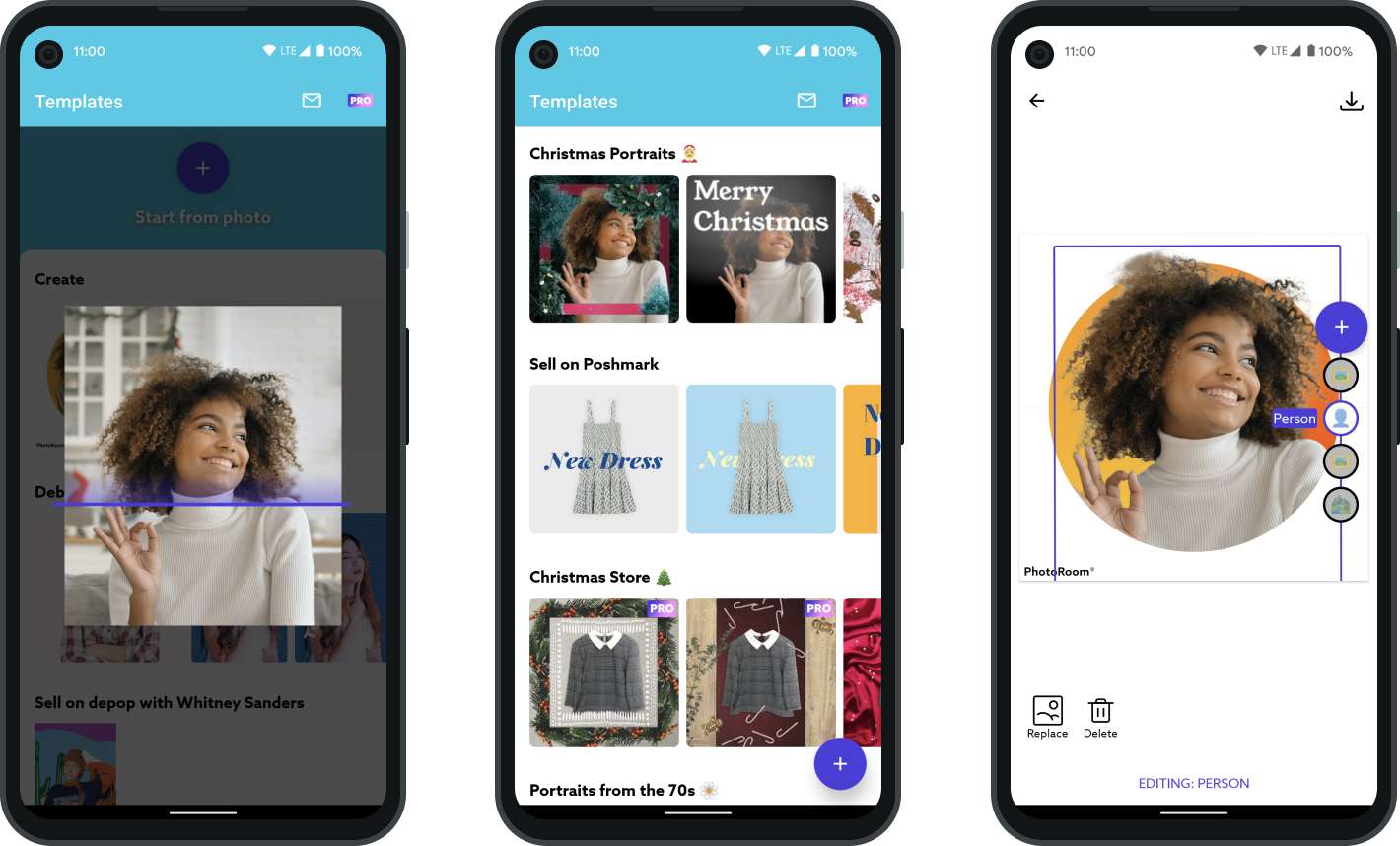

French startup PhotoRoom is launching its app on Android today. The company has been working on a utility photography app that lets you remove the background from a photo, swaps it for another background and tweaks your photo.

And it’s been working well on iOS already, as the company attended Y Combinator, doubled its annual recurring revenue to $2 million and raised a $1.2 million seed round.

In particular, influencers and people reselling clothes and fashion items have been relying on PhotoRoom . They use their phone as their main creativity platform. Like other professional photography apps, the startup relies on subscriptions to generate revenue ($9.49 per month or $46.99 per year).

PhotoRoom relies on machine learning to identify objects and separate them from the rest of the photo. This way, you can manipulate a specific part of your photo.

Image Credits: PhotoRoom

When the startup raised its seed round after Y Combinator, it chose to raise from Nicolas Wittenborn’s Adjacent fund, Liquid2 Ventures, as well as two groups:

With this funding round, the company plans to grow the team from three to eight persons and work on its deep learning algorithm. If you want to learn more about PhotoRoom, feel free to read my take on the product:

Powered by WPeMatico

Facebook already made it clear that it isn’t happy about Apple’s upcoming restrictions on app tracking and ad targeting, but the publicity battle entered a new phase today.

Over the summer, Apple announced that beginning in iOS 14, developers will have to ask users for permission in order to use their IDFA identifiers for ad targeting. On one level, it’s simply giving users a choice, but because they’ll have to opt-in to participate, the assumption is that we’ll see a dramatic reduction in app tracking and targeting.

The actual change was delayed until early next year, but in the meantime Facebook suggested that this might mean the end of its Audience Network (which uses Facebook data to target ads on other websites and apps) on iOS.

Then, this morning, Facebook placed print ads in The New York Times, The Wall Street Journal and The Washington Post declaring that it’s “standing up to Apple for small businesses everywhere,” and it published a blog post and website making the same argument.

While it’s easy to see all of this as an attempt to put a more sympathetic face on a PR campaign that’s really just protecting Facebook’s ad business, Dan Levy — the company’s vice president of ads and business products — got on a call with reporters today to argue otherwise.

Image Credits: Facebook

For one thing, he said that with its “diversified” advertising business, Facebook won’t feel the impact as keenly as small businesses, particularly since it already acknowledged potential ad targeting challenges in its most recent earnings report.

“We’ve already been factoring this into our expectations for the business,” he said.

In contrast, Levy said small businesses rely on targeting in order to run efficient advertising campaigns — and because they’ve got small budgets, they need that efficiency. He predicted that if Apple moves forward with its plans, “Small businesses will struggle to stay afloat and many aspiring entrepreneurs may never get off the ground.”

Levy was joined by two small business owners, Monique Wilsondebriano of Charleston Gourmet Burger Company in South Carolina and Hrag Kalebjian of Henry’s House of Coffee in San Francisco. Kalebjian said that while business in the coffee shop is down 40% year-over-year, his online sales have tripled, and he credited targeted Facebook campaigns for allowing him to tell personal stories about his family’s love for Armenian coffee.

Wilsondebriano, meanwhile, said that when she and her husband Chevalo started a business selling their homemade burger marinade, “we did not have the option to run radio ads or TV ads, we just didn’t have a budget for that” — and so they turned to Facebook and Instagram. With the marinade now available in 50 states and 17 countries, Wilsondebriano said, “It makes me sad that if this update happens, so many small businesses won’t get that same opportunity that Cheval and I had.”

Levy also suggested that Apple’s bottom line might benefit from the changes — if developers make less money on ads from Facebook and other platforms, they may need to rely more on subscriptions or in-app transactions (with Apple collecting its much-discussed fee), and they might turn to Apple’s own targeted advertising platform.

A number of ad industry groups have also taken issue with Apple’s policy, with SVP Craig Federighi fighting back in a speech criticizing what he called “outlandish” and “false” claims from the adtech industry. In that speech, Federighi said Apple’s App Tracking Transparency feature is designed “to empower our users to decide when or if they want to allow an app to track them in a way that could be shared across other companies’ apps or websites.”

Update: Apple sent out the following statement.

We believe that this is a simple matter of standing up for our users. Users should know when their data is being collected and shared across other apps and websites — and they should have the choice to allow that or not. App Tracking Transparency in iOS 14 does not require Facebook to change its approach to tracking users and creating targeted advertising, it simply requires they give users a choice.

Powered by WPeMatico

It’s been more than two years since the Pentagon announced its $10 billion, decade-long JEDI cloud contract, which was supposed to provide a pathway to technological modernization for U.S. armed forces. While Microsoft was awarded the contract in October 2019, Amazon went to court to protest that decision, and it has been in legal limbo ever since.

Yesterday marked another twist in this government procurement saga when Amazon released its latest legal volley, asking a judge to set aside the decision to select Microsoft. Its arguments are similar to ones it has made before, but this time takes aim at the Pentagon’s reevaluation process, which after reviewing the contract and selection process, still found in a decision released this past September that Microsoft had won.

Amazon believes that reevaluation was highly flawed, and subject to undue influence, bias and pressure from the president. Based on this, Amazon has asked the court to set aside the award to Microsoft:

The JEDI reevaluations and re-award decision have fallen victim to an Administration that suppresses the good-faith analysis and reasoning of career officials for political reasons — ultimately to the detriment of national security and the efficient and lawful use of taxpayer dollars. DoD has demonstrated again that it has not executed this procurement objectively and in good faith. This re-award should be set aside.

As you might imagine, Frank X. Shaw, corporate vice president for communications at Microsoft, does not agree, believing his company won on merit and by providing the best price.

“As the losing bidder, Amazon was informed of our pricing and they realized they’d originally bid too high. They then amended aspects of their bid to achieve a lower price. However, when looking at all the criteria together, the career procurement officials at the DoD decided that given the superior technical advantages and overall value, we continued to offer the best solution,” Shaw said in a statement shared with TechCrunch.

As for Amazon, a spokesperson told TechCrunch, “We are simply seeking a fair and objective review by the court, regarding the technical errors, bias and political interference that blatantly impacted this contract award.”

And so it goes.

The Pentagon announced it was putting out a bid for a $10 billion, decade-long contract in 2018, dubbing it JEDI, short for Joint Enterprise Defense Infrastructure. The procurement process has been mired in controversy from the start, and the size and scope of the deal has attracted widespread attention, much more than your typical government contract. It brought with it claims of bias, particularly by Oracle, that the bidding process was designed to favor Amazon.

We are more than two years beyond the original announcement. We are more than a year beyond the original award to Microsoft, and it still remains stuck in a court battle with two major tech companies continuing to snipe at one another. With neither likely to give in, it will be up to the court to decide the final outcome, and perhaps end this saga once and for all.

Note: The DoD did not respond to our request for comment. Should that change, we will update the story.

Powered by WPeMatico