TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Eneba, a marketplace for gamers that sells games and other products, has raised an $8 million round of funding from Practica Capital and InReach Ventures. The funding is described as a “combination” of a seed and Series A round. Also participating in the funding for the Lithuanian startup was FJ Labs and a group of angel investors, including Mantas Mikuckas, COO of Vinted. The investment highlights once again the strength of the Baltics region as a tech ecosystem, after Lithuania produced its first Unicorn in the shape of Vinted, and Estonia added Pipedrive to its unicorns list.

With the increased shift to digital entertainment during the pandemic, the startup has managed to garner much more U.S. traffic. Launched in 2018 by two Lithuanian school friends, Vytis Uogintas and Žygimantas Mikšta, Eneba says it has attracted 26 million unique users because of its security features, “one-click to buy” gamer experience and fingerprinting technology. The site also optimizes its localized gaming experiences to show locally trending gaming products. Eneba’s platform is designed to reduce risky transactions, simplify the refunding process and deal with fraud threats.

Co-founder and CMO Žygimantas Mikšta said: “We had a lot of new users coming to Eneba during these uncertain times. While it was extremely satisfying to see our numbers increasing tenfold, there was a challenge to meet the demand. To better reflect our user numbers, we had to quickly expand our team to 130.”

Security has risen up the agenda in online gaming as virtual goods and services connected to games can be highly susceptible to fraud or theft. Although it competes with outlets like Amazon, eBay and retailers like GameStop and Game.co.uk, Eneba thinks it has found a better, tailored online pre/post-buying experience for gamers, while addressing the risk problems for sellers and buyers in the gaming world.

Donatas Keras, partner at Practica Capital said: “We are thrilled to be backing Vytis and Žygimantas. We’ve been impressed by their ability to execute at such speed as their company quickly scales, and to drive an incredible product with a unique value proposition for gamers.”

Co-founder of InReach Ventures, Roberto Bonanzinga, said: “In Europe we have a tradition of building successful companies in the gaming space. We are very excited to have discovered Eneba thanks to our AI platform when the company was unknown and under the radar. We have been extremely impressed by what the founders have been able to build in such a short amount of time.”

Powered by WPeMatico

The busy year in M&A continued this weekend when private equity firm Thoma Bravo announced it was acquiring RealPage for $10.2 billion.

In RealPage, Thoma Bravo is getting a full-service property management platform with services like renter portals, site management, expense management and financial analysis for building and property owners. Orlando Bravo, founder and a managing partner of Thoma Bravo, sees a company that they can work with and build on its previous track record.

“RealPage’s industry leading platform is critical to the real estate ecosystem and has tremendous potential going forward,” Bravo said in a statement.

As for RealPage, company CEO Steve Winn, who will remain with the company, sees the deal as a big win for stock holders, while giving them the ability to keep investing in the product. “This will enhance our ability to focus on executing our long-term strategy and delivering even better products and services to our clients and partners,” Winn said in a statement.

RealPage, which was founded in 1998 and went public in 2010, is a typical kind of mature platform that a private equity firm like Thoma Bravo is attracted to. It has a strong customer base with more than 12,000 customers, and respectable revenue, growing at a modest pace. In its most recent earnings statement, the company announced $298.1 million in revenue, up 17% year over year. That puts it on a run rate of more than $1 billion.

Under the terms of the deal, Thoma Bravo will pay RealPage stockholders $88.75 in cash per share. That is a premium of more 30% over the $67.83 closing price on December 18th. The transaction is subject to standard regulatory review, and the RealPage board will have a 45-day “go shop” window to see if it can find a better price. Given the premium pricing on this deal, that isn’t likely, but it will have the opportunity to try.

Powered by WPeMatico

OneTrust, the four-year-old privacy platform startup from the folks who brought you AirWatch (which was acquired by VMmare for $1.5 billion in 2014), announced a $300 million Series C on an impressive $5.1 billion valuation today.

The company has attracted considerable attention from investors in a remarkably short time. It came out of the box with a $200 million Series A on a $1.3 billion valuation in July 2019. Those are not typical A round numbers, but this has never been a typical startup. The Series B was more of the same — $210 million on a $2.7 billion valuation this past February.

That brings us to today’s Series C. Consider that the company has almost doubled its valuation again, and has raised $710 million in a mere 18 months, some of it during a pandemic. TCV led today’s round joining existing investors Insight Partners and Coatue.

So what are they doing to attract all this cash? In a world where privacy laws like GDPR and CCPA are already in play, with others in the works in the U.S. and around the world, companies need to be sure they are compliant with local laws wherever they operate. That’s where OneTrust comes in.

“We help companies ensure that they can be trusted, and that they make sure that they’re compliant to all laws around privacy, trust and risk,” OneTrust Chairman Alan Dabbiere told me.

That involves a suite of products that the company has already built or acquired, moving very quickly to offer a privacy platform to cover all aspects of a customer’s privacy requirements, including privacy management, discovery, third-party risk assessment, risk management, ethics and compliance and consent management.

The company has already attracted 7,500 customers to the platform — and is adding1,000 additional customers per quarter. Dabbiere says that the products are helping them be compliant without adding a lot of friction to the building or buying process. “The goal is that we don’t slow the process down, we speed it up. And there’s a new philosophy called privacy by design,” he said. That means building privacy transparency into products, while making sure they are compliant with all of the legal and regulatory requirements.

The startup hasn’t been shy about using its investments to buy pieces of the platform, having made four acquisitions already in just four years since it was founded. It already has 1,500 employees and plans to add around 900 more in 2021.

As they build this workforce, Dabbiere says being based in a highly diverse city like Atlanta has helped in terms of building a diverse group of employees. “By finding the best employees and doing it in an area like Atlanta, we are finding the diversity comes naturally,” he said, adding, “We are thoughtful about it.” CEO Kabir Barday also launched a diversity, equity and inclusion council internally this past summer in response to the Black Lives Matter movement happening in the Atlanta community and around the country.

OneTrust had relied heavily on trade shows before the pandemic hit. In fact, Dabbiere says that they attended as many as 700 a year. When that avenue closed as the pandemic hit, they initially lowered their revenue guidance, but as they moved to digital channels along with their customers, they found that revenue didn’t drop as they expected.

He says that OneTrust has money in the bank from its prior investments, but they had reasons for taking on more cash now anyway. “The number one reason for doing this was the currency of our stock. We needed to revalue it for employees, for acquisitions, and the next steps of our growth,” he said.

Powered by WPeMatico

The rest of the world may be slowing down as we prepare for Christmas and the new year, but we are not taking our foot off the gas.

Alex Wilhelm keeps a close watch on the public markets in his column The Exchange, but this week, he branched out to look at some of the metrics underpinning soaring cryptocurrency prices and turned his gaze on StockX, the consumer reseller marketplace that just raised $275 million in a Series E that values the company at approximately $2.8 billion.

“Selling a tenth of your company for north of a quarter-billion may be somewhat common among late-stage software startups with tremendous growth,” he says, but “don’t laugh — the round actually makes pretty OK sense.”

Our staff continues to file their end-of-year stories: We ran a post this morning by Manish Singh that studies India’s massive total addressable market for retail. The nation has more than 60 million mom-and-pop neighborhood stores, and companies like Walmart and Amazon are eager to offer help with payments, logistics and inventory management — as are hundreds of native and foreign startups.

In an interview with author and MIT professor Sinan Aral, Managing Editor Danny Crichton discussed some of the debates currently swirling around the desire in some quarters to regulate social media platforms. In “The Hype Machine,” Aral explores topics like neuroscience, economics and misinformation before offering potential solutions for resolving what he calls “a full-blown social media crisis.”

The stories that follow are an overview of Extra Crunch from the last five days. Complete articles are only available to members, but you can use discount code ECFriday to save 20% off a one or two-year subscription. Details here.

Thank you very much for reading Extra Crunch this week; I hope you have a safe, relaxing weekend!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Nigel Sussman (opens in a new window)

How did fashion marketplace Poshmark go from posting regular losses in 2019 to generating net income in 2020?

After the company filed a public S-1 last night, Alex Wilhelm pondered the question this morning in The Exchange.

Like many e-commerce platforms, Poshmark saw a surge in activity during the COVID-19 pandemic, but it also slashed its marketing spend, which helped boost profits. As the cash-rich company prepares its road show, “Poshmark is valuable,” Alex concluded.

“How valuable the market will decide. But who will it enrich with its final pricing decision?”

WASHINGTON, D.C. – APRIL 22, 2018: A statue of Albert Gallatin, a former U.S. Secretary of the Treasury, stands in front of The Treasury Building in Washington, D.C. The National Historic Landmark building is the headquarters of the United States Department of the Treasury. (Photo by Robert Alexander/Getty Images)

The breach of FireEye and SolarWinds by hackers working on behalf of Russian intelligence is “the nightmare scenario that has worried cybersecurity experts for years,” reports Zack Whittaker.

The intrusion began several months ago, but news of the breach wasn’t made public until this week.

“Given that potential victims include defense contractors, telecoms, banks, and tech companies, the implications for critical infrastructure and national security, although untold at this point, could be significant,” said Erin Kenneally, director of cyber risk analytics at Guidewire, an industry platform for insurance carriers.

In his analysis for Extra Crunch, Zack breaks down the rippling effects of supply-chain attacks that can compromise platforms like SolarWinds, which is used by more than 420 of the Fortune 500.

Image Credits: dowell (opens in a new window) / Getty Images

Embedded finance connects services like payment processing with everyday activities like grabbing a coffee before unlocking an e-scooter.

“The ability to be at the right place at the right time, supporting consumers and merchants alike, where they want it, how they want it and when they want it — cannot be understated,” says Simon Wu, an investment director with Cathay Innovation.

In a post that identifies embedded finance’s top providers and enablers, he offers advice for startups and established brands that are hoping to “earn and build customer loyalty while generating new revenue streams.”

Image Credits: Nigel Sussman (opens in a new window)

Bitcoin is at an all-time high.

CoinMarketCap reports that crypto market values have reached almost $659 billion; that figure was just $140 billion in March 2020.

“These gains have created a huge amount of wealth for crypto holders,” Alex Wilhelm wrote yesterday.

To get a better handle on why crypto values are sky-bound, he parsed some basic industry metrics, including the number of unique bitcoin addresses, fees paid and transactions per day.

“Do the price gains make sense in the short term? Who knows,” he wrote, “but they are not based on nothing.”

Stage Light on Black. Image Credits: Fotograzia / Getty Images

For his year-end Extra Crunch story, security reporter Zack Whittaker looked back at the myriad security challenges and vulnerabilities COVID-19 brought to the fore.

The hacks of Fire Eyes and SolarWinds were just one link in the chain: How well is your company prepared to deal with file-encrypting malware, hackers backed by nation-states or employees accessing secure systems from home?

“With 2020 wrapping up, much of the security headaches exposed by the pandemic will linger into the new year,” says Zack.

Zoox Fully Autonomous, All-electric Robotaxi. Image Credits: Zoox

After six years of research and development, autonomous vehicle company Zoox this week unveiled an electric robotaxi that can carry four people at a maximum speed of 75 miles per hour.

Automotive writer Kirsten Korosec interviewed Zoox co-founder and CTO Jesse Levinson to learn more about the vehicle’s development and how the company overcame a series of technical and legal challenges.

“I would say that if you have a big idea and you’re confident that it makes sense, you should at least explore the idea, rather than giving up because the current regulations aren’t designed for it,” said Levinson.

Kirsten only had 15 minutes to interview Levinson, but this comprehensive interview covers topics like regulatory compliance, Zoox’s relationship with parent company Amazon and the highest (and lowest) moments he experienced along the way.

Fairy dust flying in gold light rays. Computer-generated abstract raster illustration. Image Credits: gonin / Wikimedia Commons

In one of the largest enterprise acquisitions of 2020, Visa Equity Partners this week purchased Utah-based edtech startup Pluralsight for $3.5 billion.

According to the entrepreneurs and investors reporter Natasha Mascarenhas spoke to, this deal “shows the strength of edtech’s capital options as the pandemic continues.”

“What’s happening in edtech is that capital markets are liquidating,” a major change from “the old days where the options to exit were very narrow,” says Deborah Quazzo, a managing partner at GSV Advisors and seed investor in Pluralsight.

Image Credits: Sophie Alcorn

Dear Sophie:

I’m on an F1 OPT and am about to incorporate a startup with my two American co-founders.

What were the biggest immigration changes in 2020 affecting us?

—Ambitious in Albany

High angle view of young man walking towards white doorways on blue background Image Credits: Klaus Vedfelt / Getty Images

Founders and the VCs who back them may not be friends, but they’re usually friendly.

Investors are on a first-name basis with entrepreneurs from their portfolio companies and frequently have candid conversations with them about life, work and the world in general. In the before times, they might even have shared a meal or attended a baseball game together.

But make no mistake, it is a top-down relationship — the investor will always have the upper hand. When an entrepreneur accepts a check, they are hiring their next boss.

In an Extra Crunch guest post, Quiq CEO and founder Mike Myer poses two questions for founders who are considering a new relationship with a VC:

NEW DELHI, INDIA – 2011/12/18: Rice is sold at a night market in Paharganj, the urban suburb opposite New Delhi Railway Station. (Photo by Frank Bienewald/LightRocket via Getty Images)

In India, about 90% of consumers buy their everyday goods from neighborhood-based kirana stores instead of supermarkets.

As a result, U.S. retail giants like Walmart and Amazon have adopted an “if you can’t beat them, join them” approach, offering the nation’s 60 million mom-and-pop shops software for inventory control, payments and e-commerce.

India’s retail market will be worth an estimated $1.3 trillion by 2025, but e-commerce represents just 3% of that activity today, reports Manish Singh.

For his final Extra Crunch story of 2020, he looked at the startups and major players who are hoping to carve out their niche in one of the world’s largest retail ecosystems.

Image Credits: PM Images / Getty Images

Earlier this year, business productivity software startup ClickUp raised a $35 million Series A.

Now, just six months later, the company has closed a second round of $100 million that values the San Diego-based startup at $1 billion.

Lucas Matney interviewed CEO Zeb Evans this week to learn more about how the company was buoyed by pandemic-based behavior shifts that doubled its customer base and multiplied revenue by a factor of nine.

“I think that the biggest thing that we’ve always focused on is shipping a new version of ClickUp every week. That is our differentiation,” he said. “We’ve kind of created these iterative cycles called natural product-market fit and it’s been hard to keep up with that.”

Multi Colored Bling Bling Dollar Sign Shape Bokeh Backdrop on Dark Background, Finance Concept. Image Credits: MirageC / Getty Images.

In 2018, the total value of the year’s 10 top enterprise mergers and acquisitions reached $87 billion; last year, that figure fell to just $40 billion.

But in 2020, 10 M&A deals accounted for $165.2 billion.

“Last year’s biggest deal — Salesforce buying Tableau for $15.7 billion — would have only been good for fifth place on this year’s list,” notes enterprise reporter Ron Miller. “And last year’s fourth largest deal, where VMware bought Pivotal for $2.7 billion, wouldn’t have even made this year’s list at all.”

Powered by WPeMatico

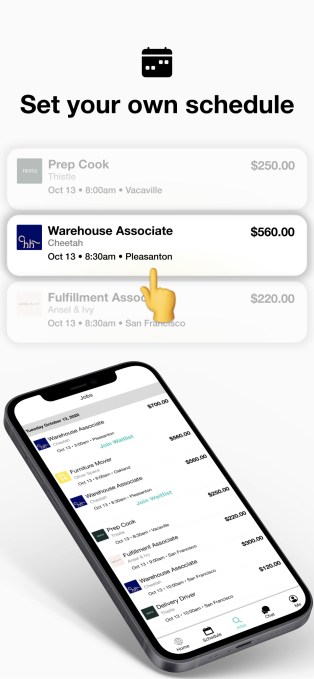

While there’s been plenty of recent debate around the gig economy, Jarah Euston argued that it’s time to rethink a bigger part of the workforce — hourly workers.

Euston, who was previously an executive at mobile advertising startup Flurry and a co-founder at data operations startup Nexla, told me that although 80 million Americans are paid on an hourly basis, the current system doesn’t work particular well for either employers or workers.

On the employer side, there are usually high rates of turnover and absenteeism, while workers have to deal with unpredictable schedules and often struggle to get assigned all the hours they want. So Euston has launched WorkWhile to create a better system, and she’s also raised $3.5 million in seed funding.

WorkWhile, she explained, is a marketplace that matches hourly workers with open shifts — employers identify the shifts that they want filled, while workers say which hours they want to work. That means employers can grow or shrink their workforce as needed, while the workers only work when they want.

“By pooling the labor force … we can provide the flexibility that both sides want,” Euston said.

Image Credits: WorkWhile

WorkWhile screens workers with one-on-one interviews, background checks and tests based on cognitive science, with the goal of identifying applicants who are qualified and reliable.

Employers pay WorkWhile a service fee, while the platform is free for users. And because the startup aims to build a long-term relationship with its workforce, Euston said it will also invest by providing additional benefits, starting with sick leave credits earned when you work and next-day payments to your debit cards.

“It’s hard to find a job that works with you and doesn’t give you a take it or leave it schedule,” said Michael Zavala, one of the workers on the platform, in a statement. “WorkWhile was exactly what I was looking for with the ability to create your own schedule for full time.”

The startup is launching in the San Francisco Bay Area, Los Angeles, Orange County and Dallas-Forth Worth.

Given the broader economic and employment trends during the pandemic, there should plenty of people looking for more work, while Euston said she’s seen a “feast or famine” situation on the employer side — yes, some companies have had to freeze or cut staff, but others have grown rapidly, including WorkWhile customers including restaurant supplier Cheetah, meal delivery service Thistle and horticultural e-commerce company Ansel & Ivy.

The funding, meanwhile, was led by Khosla Ventures, with participation from Stitch Fix founder and CEO Katrina Lake, Jennifer Fonstad, F7, Siqi Chen, Philipp Brenner, Zouhair Belkoura and Nicholas Pilkington.

“The majority of hourly workers are honest and reliable but some have difficult personal circumstances they need help with,” Vinod Khosla said in a statement. “Companies treat these employees as high turnover and expendable but, if given respect and appropriate support, they can become longer-term, model employees. WorkWhile wants to help solve this problem.”

Powered by WPeMatico

Today Bumble, a popular dating-focused startup, was reported by Bloomberg to have filed IPO documents, albeit privately.

The news that Bumble is pursuing an IPO is not a surprise. TechCrunch covered the story in September, noting the huge revenues that its rival Tinder has managed to accrete, possibly indicative of a sufficiently large market to support two public dating players.

That Bumble has privately filed puts it, along with the crypto-focused Coinbase, as far along the IPO path before we can see their numbers. When they make their S-1 filings public the two companies will provide the market a look into their financial results.

Bumble and Coinbase are preceded in making such disclosures by Roblox, Affirm and Poshmark. The five companies will join others in seeking IPOs over the next few months.

According to a recent interview with GGV’s Hans Tung — an investor in Affirm and Airbnb and other unicorns — TechCrunch understands that quarters one, three and four in 2021 could prove to be active IPO periods. Bumble joining the fray in the final weeks of 2020 underscores how active the start of the year could be for highly priced private companies seeking liquidity while public markets trade near all-time highs.

TechCrunch reached out to Bumble for comment on the IPO report. The company declined to comment.

Bloomberg reports that Bumble could target a valuation of between $6 and $8 billion. This squares with prior reporting. How much revenue the market will require of Bumble to reach those prices, and at what pace of growth, is not clear.

But with the company reaching 100 million users earlier this year, perhaps all the math will pencil out.

Powered by WPeMatico

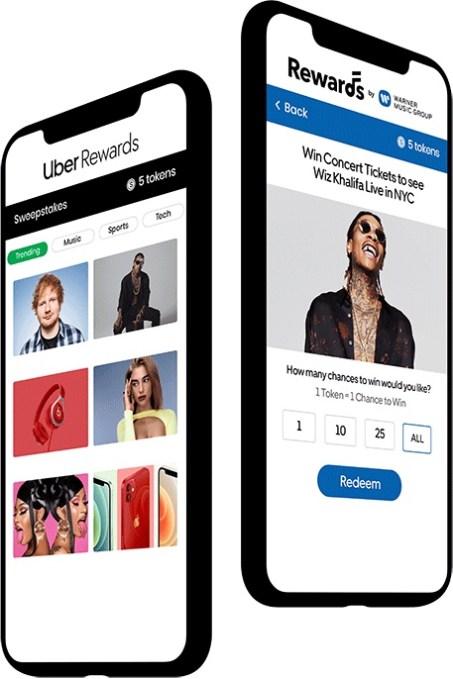

Tap Network is providing a new approach to loyalty rewards programs that it describes as “rewards as a service.”

You may recognize the Tap Network name, as well as its co-founder and CEO Lin Dai, from Hooch, a startup that offered a drink-a-day subscription service before shifting focus to a broader rewards program. Dai told me he “learned a lot from the Hooch experience” but ultimately “decided that Tap is a much bigger opportunity, we’re really looking at rewards in general.”

So Tap Network is a new startup, one that recently raised $4 million in funding from investors including Revelis Capital, Nima Capital, the Forbes family office, Warner Music Group, Access Industries, Bill Tai, Bob Hurst, Edward Devlin and others.

Dai said that normal rewards programs are only accessible to the top 10% or 20% of a company’s customers. So in his view, businesses have an opportunity to “super serve the average customers who 40 years ago might not have been considered important customers, but who today could be building a loyalty behavior pattern.”

Image Credits: Tap Network

He added that making rewards programs accessible to more customers has an added benefit for many businesses, because “whether it’s a major bank or major travel company, they are starting to accrue billions of dollars that are locked up in these wallets.” Those points might never be redeemed, but they’re still considered liabilities from an accounting perspective.

Tap Network aims to solve this problem by allowing customers to spend those points through a broader network of rewards, which can usually be redeemed at a lower point level. It’s offered as a white-label addition to an existing rewards program, with each program choosing the rewards that might be the best fit for their customers.

For example, Uber recently worked with Tap Network to expand its Uber Rewards program, offering new Tap Network-powered rewards like free Apple Music or HBO Max, as well as the option to donate to causes like World Central Kitchen. And the minimum number of points needed to claim a reward fell from 500 points to 100 points.

Other companies using Tap Network include Warner Music Group (which, as previously mentioned, is also an investor) and privacy-focused browser company Brave.

Dai said that in the future, Tap could even allow consumers to combine rewards points from different programs: “If I want to redeem something, I might be able to take a little bit of my Uber points, a little bit of my Warner points, a little bit of points from another program,” and combine them.

Powered by WPeMatico

Space Force’s Lt. Gen. John Thompson spoke at TC Sessions: Space earlier this week. Throughout the wide-ranging interview, General Thompson explained the various ways and means for how private companies like startups should interact with Space Force.

Gen. Thompson knows what he’s talking about. As the commander of the Space and Missiles Systems Center, he oversees research, design, development and acquisition of satellites and their associated command and control systems for the U.S. Space Force. His role puts him in direct contact with some of the most ambitious and innovative startups.

He pointed to three things when asked what’s a good first step for interfacing with the Space Force:

1) Join the Space Enterprise Consortium (SpEC). He describes it as “a purpose-built consortium that values partnerships between government, traditional industry partners, and non-traditional partners like academia, small businesses and startups” that’s grown to more than 440 members in three years.

At the end of the interview, Gen. Thompson notes that he’s working on expanding the deployment of SpEC’s funds to reach more “game-changing technologies that those non-traditional small businesses and startups are bringing to SpEC.

2) Watch for Space Pitch Days. The next event is in the spring of 2021. These pitch days give startups an inside track to government contracts. Apparently, after the first event held with the Air Force, which Gen. Thompson hosted, contracts were offered within three minutes of the pitches.

3) Look into SpaceWERX; a program launched this December to help Space Force work with private sector companies to field new technology for military applications. Like its Air Force counterpart, this “werx” center is a key component for Space Force’s acquisition strategy.

“Dr. Roper just announced it last week at the Space and Missile System Center,” Gen. Thompson said, “[This] is an integral part of the acquisition enterprise of the United States. Space Force is a full partner in the SpaceWERX endeavor. And using the WERX model, we hope to inject more small businesses and startups into our innovation ecosystem.”

Powered by WPeMatico

Creditas, the Brazilian lending business, has raised $255 million in new financing as financial services startups across Latin America continue to attract massive amounts of cash.

The company’s credit portfolio has crossed 1 billion reals ($196.66 million) and the new round will value the company at $1.75 billion thanks to $570 million raised in outside financing over five rounds.

Creditas is the latest company to benefit from a boom in financial services startup investing across the region. As the year dawned, venture investments into fintech startups in Latin America had grown from $50 million in 2014 to top $2.1 billion in 2020 across 139 deals, according to a report from CB Insights.

Investors in the round include new investors like LGT Lightstone, Tarsadia Capital, Wellington Management, e.ventures and an affiliate of Advent International, Sunley House Capital. Previous investors including SoftBank Vision Fund 1, SoftBank Latin America DFund, VEF, Kaszek and Amadeus Capital Partners also returned to put more money into the company.

“Creditas is still in the early innings of penetrating the huge untapped secured lending market in Brazil and Mexico” says Paulo Passoni, managing partner of SoftBank Latam fund, in a statement.

The company’s growth is a testament both to the need for new lending products across Latin America and the perspicacity of investors like Kaszek Ventures, whose portfolio has included several massive wins from bets on startups tackling financial services in Latin America.

“The journey since our investment in the Series A has been absolutely extraordinary. The team has executed on its vision, and Creditas has evolved into an asset-light ecosystem that resolves key financial needs of its customers throughout their lifetimes,” says Nicolas Szekasy, managing partner of Kaszek Ventures, in a statement.

Another big winner is Redpoint’s e.ventures fund, which has focused on investments in Latin America for the last several years.

“By empowering Brazilians to take control of their lending needs at reasonable rates, Creditas creates a beloved consumer product that will drive significant value for customers and investors. Having been involved since the seed stage through Redpoint e.ventures, we’re thrilled to support the company with our Global Growth Fund as well, as they change the Brazilian fintech landscape,” said Mathias Schilling, co-founder and managing partner of e.ventures.

Creditas has plans to use the cash to expand its home and auto lending as well as a payday lending service based on customers’ salaries and a retail option to sell through buy now, pay later loans based on a customer’s salary.

The company is also looking to expand to other markets, with an eye toward establishing a foothold in the Mexican market.

Founded in 2012, when the founders worked out of a five-square-meter office on Berrini Avenue in São Paulo, the company now boasts a robust business with hundreds of employees and a business resting on a secured lending marketplace and independent home and auto lending operations.

The company also released quarterly results for the first time, showing losses narrowing from 74.9 million Brazilian reals to 40.5 million reals in the year ago quarter.

Powered by WPeMatico

We’ve seen a big wave of proptech startups emerge to reimagine how houses are bought and sold, with some tapping into the opportunity with distressed property, and others exploring the “iBuyer” model where houses are bought and fixed up by a single startup and resold to homeowners who don’t want to invest in a fixer-upper. But the vast majority of homes are still sold the traditional way, by way of a real estate agent working via a broker.

Today, a startup is announcing that it has raised seed funding not to disrupt, but improve that basic model with a more flexible approach that can help agents work in a more modern way, and to ultimately scale out the number of people working as agents in the market.

Avenue 8, which describes itself as a “mobile-first residential real estate brokerage” — providing a new set of tools for agents to source, list and sell homes, and handle the other aspects of the process that fall between those — has raised $4 million. This is a seed round, and Avenue 8 plans to use it to expand further in the cities where it is already active — it’s been in beta thus far in the San Francisco and Los Angeles areas — as well as grow to several more.

The funding is notable because of the backers that the startup has attracted early on. It’s being led by Craft Ventures — the firm co-founded by David Sacks and Bill Lee that has amassed a prolific and impressive portfolio of companies — with Zigg Capital and Good Friends (an early-stage fund from the founders of Warby Parker, Harry’s and Allbirds) also participating.

There has been at least $18 billion in funding raised by proptech companies in the last decade, and with that no shortage of efforts to take the lessons of tech — from cloud computing and mobile technology, through to artificial intelligence, data science and innovations in e-commerce — and apply them to the real estate market.

Michael Martin, who co-founded Avenue 8 with Justin Fichelson, believes that this pace of change, in fact, means that one has to continually consider new approaches.

“It’s important to remember that Compass’s growth strategy was to roll out its technology to traditional brokerages,” he said of one of the big juggernauts in the space (which itself has seen its own challenges). “But if you built it today, it would be fundamentally different.”

And he believes that “different” would look not unlike Avenue 8.

The startup is based around a subscription model for a start, rather than a classic 30/70 split on the sales commissions that respectively (and typically) exist between brokers and agents.

Around that basic model, Avenue 8 has built a set of tools that provides agents with an intuitive way to use newer kinds of marketing and analytics tools both to get the word out about their properties across multiple channels; analytics to measure how their efforts are doing, in order to improve future listings; and access to wider market data to help them make more informed decisions on valuations and sales. It also provides a marketplace of people — valets — who can help stage and photograph properties for listing, and Avenue 8 doesn’t require payments to be made to those partners unless a home sells.

It also provides all of this via a mobile platform — key for people in a profession that often has them on the move.

Targeting agents that have in the past relied essentially on using whatever tools the brokers use — which often were simply their own sites plus some aggregating portals — Avenue 8’s pitch is not just better returns but a better process to get there.

“We’ve heard time and time again that agents struggle to identify and leverage the technology and tools to successfully manage their relationships and properties. Changing buyer/seller expectations have accelerated the digital transformation of most agents’ workflows,” said Ryan Orley, partner at Zigg Capital, in a statement. “Avenue 8 is building and integrating the right software and resources for our new reality.”

What’s also interesting about Avenue 8 is how it can open the door to a wider pool of agents in the longer run.

The real estate market has been noticeably resilient throughout the pandemic, with lower interest rates, a generally lower overall home inventory and people spending more time at home (and wanting a better space) creating a high level of demand. With a number of other industries feeling the pinch, a flexible platform like Avenue 8’s creates a way for people — who have taken and passed the certifications needed to become agents — to register and flexibly work as an agent as much or as little as they choose, creating a kind of “Uber for real estate agents,” as it were.

That scaling opportunity is likely one of the reasons why this has potentially caught the eye of investors.

“Avenue 8’s organic growth is clear evidence that the market demands a mobile-first, digital platform,” said Jeff Fluhr, general partner at Craft Ventures, in a statement. “Michael and Justin have a clear vision for modernizing real estate while keeping agents at the center. Avenue 8’s model helps agents take home more even in today’s environment where commissions are compressing.”

Interestingly, just as Uber’s changed the way that on-demand transportation is ordered and delivered, Avenue 8 is starting to see some interesting traction in terms of its place in the real estate market. Although it was originally targeted at agents with the pitch of being like “a better broker” — providing the services brokers are regulated to provide, but with a more modern wrapper around it — it’s also in some cases attracting brokerages, too. Martin said that it’s already working with a few smaller ones, and ultimately might consider ways of providing its tools to larger ones to manage their businesses better.

Powered by WPeMatico