TC

Auto Added by WPeMatico

Auto Added by WPeMatico

The Exchange is taking a break from vacation to dig into the new Qualtrics S-1 filing. Then the column and newsletter are back on hold until January 4.

This afternoon, Qualtrics, a software company that helps companies poll their employee base, customers and others, filed to go public. It’s the second time that the Utah-based unicorn has done so, failing the first time to complete its offering after SAP swooped in and bought it for around $8 billion in cash.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

SAP announced in late July of this year that Qualtrics would be spun out via an IPO, bringing the smaller company’s saga full-circle.

The new S-1 filing — you can view the 2018 original here — is a different animal from the first. First, Qualtrics is larger than it was, and older. And its financials are more complex as it extricates itself from its soon-to-be-erstwhile corporate parent.

The new S-1 filing — you can view the 2018 original here — is a different animal from the first. First, Qualtrics is larger than it was, and older. And its financials are more complex as it extricates itself from its soon-to-be-erstwhile corporate parent.

Qualtrics intends to list on the Nasdaq under the ticker symbol “XM.”

Looking back at my chat with Ryan Smith, then Qualtrics CEO and today its chairman, and Bill McDermott, then SAP’s CEO and today the CEO of ServiceNow, it’s hard to believe that the acquisition deal was only two years ago.

Much has changed since late 2018. Let’s see what happened to Qualtrics in the meantime. We’ll dig into the financials, the company’s implied valuation range (spoiler: It has gone up) and whatever else we can shake loose.

A few things up top. First, SAP will be the company’s controlling shareholder after the Qualtrics’ IPO. That’s early in the S-1 filing. And, Smith and Silver Lake are investing in the company as part of its new debut.

Powered by WPeMatico

Pokémon GO was created to encourage players to explore the world while coordinating impromptu large group gatherings — activities we’ve all been encouraged to avoid since the pandemic began.

And yet, analysts estimate that 2020 was Pokémon GO’s highest-earning year yet.

By twisting some knobs and tweaking variables, Pokémon GO became much easier to play without leaving the house.

Niantic’s approach to 2020 was full of carefully considered changes, and I’ve highlighted many of their key decisions below.

Consider this something of an addendum to the Niantic EC-1 I wrote last year, where I outlined things like the company’s beginnings as a side project within Google, how Pokémon Go began as an April Fools’ joke and the company’s aim to build the platform that powers the AR headsets of the future.

On a press call outlining an update Niantic shipped in November, the company put it on no uncertain terms: the roadmap they’d followed over the last ten-or-so months was not the one they started the year with. Their original roadmap included a handful of new features that have yet to see the light of day. They declined to say what those features were of course (presumably because they still hope to launch them once the world is less broken) — but they just didn’t make sense to release right now.

Instead, as any potential end date for the pandemic slipped further into the horizon, the team refocused in Q1 2020 on figuring out ways to adapt what already worked and adjust existing gameplay to let players do more while going out less.

As its name indicates, GO was never meant to be played while sitting at home. John Hanke’s initial vision for Niantic was focused around finding ways to get people outside and playing together; from its very first prototype, Niantic had players running around a city to take over its virtual equivalent block by block. They’d spent nearly a decade building up a database of real-world locations that would act as in-game points meant to encourage exploration and wandering. Years of development effort went into turning Pokémon GO into more and more of a social game, requiring teamwork and sometimes even flash mob-like meetups for its biggest challenges.

Now it all needed to work from the player’s couch.

The earliest changes were those that were easiest for Niantic to make on-the-fly, but they had dramatic impacts on the way the game actually works.

Some of the changes:

By twisting some knobs and tweaking variables, Pokémon GO became much easier to play without leaving the house — but, importantly, these changes avoided anything that might break the game while being just as easy to reverse once it became safe to do so.

Like this, just … online. Image Credits: Greg Kumparak

Thrown by Niantic every year since 2017, GO Fest is meant to be an ultra-concentrated version of the Pokémon GO experience. Thousands of players cram into one park, coming together to tackle challenges and capture previously unreleased Pokémon.

Powered by WPeMatico

Global investors are running from Chinese tech stocks in the wake of the government’s crackdown on Ant Group and Alibaba, two high-flying businesses founded by Ma Yun (Jack Ma) that were once hailed as paragons of China’s new tech elite.

Shares of major technology companies in the country have fallen sharply in recent days, with Bloomberg calculating that Alibaba, Tencent, JD.com and Meituan have lost around $200 billion in value during a handful of trading sessions.

Already reeling from the last-minute halt of the public debut of Ant Group, a major Chinese fintech player with deep ties to Alibaba, the e-commerce giant came under new fire, as China’s markets watchdog opened a probe into its business practices concerning potentially anticompetitive behavior.

Ant Group was itself summoned by the government on December 26, leading to a plan that will force the company to “rectify” its business practices.

Shares of Alibaba are off around 30% from their recent record highs set in late October. Tech shares are also off in the country more broadly, with one Chinese-technology-focused ETC falling around 8% from recent highs, including a 1.5% drop today.

The American Depositary Receipts used by traders to invest in Alibaba fell from around $256 per share at the close of Wednesday trading on the New York Stock Exchange to around $222 last Thursday. The company is down another half point today. It was worth more than $319 per share earlier in the quarter.

It’s clear that the rising tensions between China’s tech giants and the country’s ruling Communist Party have investors spooked. But Jack Ma’s relationship with the Chinese government has always been a bit more fraught than that of his peers. Ma Huateng (Pony Ma), the founder of Tencent, and Xu Yong (Eric Yong) and Li Yanhong (Robin Li), the co-founders of Baidu, have kept lower profiles than the Alibaba founder.

Bloomberg has a good synopsis of the state of the market right now. The companies that are most directly in the crosshairs appear to be Ma Yun’s, but at different times, Tencent has been the focus of Chinese regulators bent on curbing the company’s influence through gaming.

Specifically for Alibaba things have gone from bad to worse, and a boosted share buyback program was not enough to halt the bleeding.

Whether this new round of regulations is a solitary blip on the radar or the signal of an increasing interest in Beijing tying tech companies closer to national interests remains to be seen. As the tit-for-tat tech conflict between the U.S. and China continues, many companies that had seen their growth as apolitical may become caught in the diplomatic crossfire.

Other tech companies are seeing their fortunes rise, boosted by newfound interest from the central government in Beijing.

This is already apparent in the chip industry, where China’s push for self-reliance has brought new riches and capital for new businesses. It’s true for Liu FengFeng, whose company, Tsinghon, was able to raise $5 million for its attempt at building a new semiconductor manufacturer in the country. Intellifusion, a manufacturer of chipsets focused on machine learning applications, was able to raise another $141 million back in April.

Private investors may be less enthused at the prospect of backing Chinese tech upstarts who could face government censure should the regulatory winds shift. Whether other startup markets in the region — India, Japan, among others — will benefit from the Chinese regulatory barrage will be interesting to track in 2021.

Powered by WPeMatico

The rivalry between China’s top online learning apps has become even more intense this year because of the COVID-19 pandemic. The latest company to score a significant funding round is Zuoyebang, which announced today (link in Chinese) that it has raised a $1.6 billion Series E+ from investors including Alibaba Group. Other participants included returning investors Tiger Global Management, SoftBank Vision Fund, Sequoia Capital China and FountainVest Partners.

Zuoyebang’s latest announcement comes just six months after it announced a $750 million Series E led by Tiger Global and FountainVest. The latest financing brings Zuoyebang’s total raised so far to $2.93 billion. The company did not disclose its latest worth, but Reuters reported in September that it was raising at a $10 billion valuation.

One of Zuoyebang’s main competitors is Yuanfudao, which announced in October that it had reached a $15.5 billion valuation after closing a $2.2 billion round led by Tencent. This pushed Yuanfudao ahead of Byju as the world’s most valuable edtech company. Another popular online learning app in China is Yiqizuoye, which is backed by Singapore’s Temasek.

Zuoyebang offers online courses, live lessons and homework help for kindergarten to 12th grade students, and claims about 170 million monthly active users, about 50 million of whom use the service each day. In comparison, there were about 200 million K-12 students in 2019 in China, according to the Ministry of Education (link in Chinese).

In fall 2020, the total number of students in Zuoyebang’s paid livestream classes reached more than 10 million, setting an industry record, the company claims. While a lot of the growth was driven by the pandemic, Zuoyebang founder Hou Jianbin said in the company’s funding announcement that it expects online education to continue growing in the longer term, and will invest in K-12 classes and expand its product categories.

Powered by WPeMatico

As the United States entered its first wave of COVID-19 lockdowns, there were wide expectations in startup land that a reckoning had arrived. But the expected comeuppance of high-burn, high-growth startups fueled by cheap capital provided by venture capitalists raising ever-larger funds, failed to arrive.

Instead, the very opposite came to pass.

Layoffs happened swiftly and aggressively during the early months of the pandemic era. But by the middle of Q2, venture activity had warmed and third quarter dealmaking felt swift and competitive, with some investors describing it as the hottest summer in recent years.

Venture capital as an asset class has survived the pandemic’s stress test.

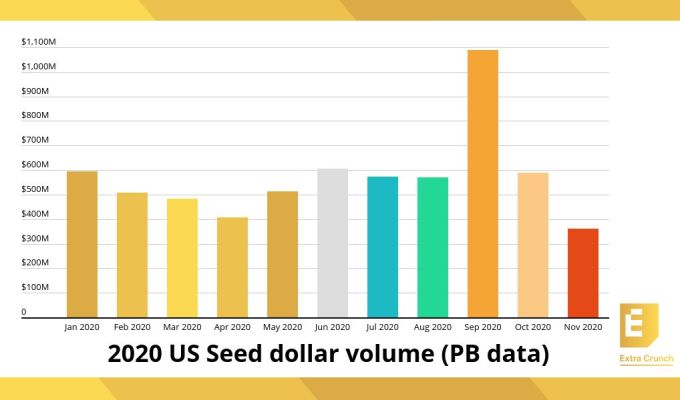

But somewhat lost amongst the splashy megarounds and high-interest IPOs that can dominate the news cycle were seed-stage startups. The raw little companies that represent the grist that will shape itself into the next set of giants.

TechCrunch explored what happened in seed investing to uncover what was missed amidst the storm and fury of late-stage startup activity. According to a TechCrunch analysis of PitchBook data and a survey of venture capitalists, a few trends became clear.

First, the pattern of rising seed-check sizes seen in prior years continued despite the tumultuous business climate. Second, more expensive and larger seed deals were not only caused by excessive capital present in the private markets. Instead, COVID-19 shook up which startups were considered attractive by private investors. And the changeup did not necessarily raise their number.

Let’s dig into the data and see what it can teach us about this wild year. Then we’ll hear from Eniac Ventures’ Nihal Mehta, Freestyle’s Jenny Lefcourt, Pear VC’s Mar Hershenson and Contrary Capital’s Eric Tarczynski about what they saw in 2020 while writing a chunk of the checks that our data encompasses.

If you didn’t think much about seed in 2020, you’re not alone. Late, huge rounds consumed most of the media’s oxygen, leaving smaller startups to compete for scraps of attention. There was so much late-stage activity — around 90 $100 million or larger rounds in Q3, for example — it was difficult for smaller investments to command attention.

But despite living in the background, the dollars invested into seed-stage startups in the United States had an up-and-down year that was fascinating:

Image Credits: PitchBook

Seed dollar volume fell as Q1 progressed, reaching a 2020 nadir in April, the start of Q2. But as May arrived, the pace at which investors put money into seed-stage startups accelerated, recovering to January levels — which is to say, pre-pandemic — by June. The COVID dip, for seed, then, was a short-term affair.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

Today is our holiday look-back at the year, bringing not only our own Danny and Natasha and Chris and Alex into the mix, but also five venture capitalists who we got to leave us their notes as well. The goal for this episode was to reflect on a year that no one could have ever predicted, but with a specific angle, as always, on venture capital and startups.

We asked about the biggest surprise, non-portfolio companies to watch, and trends they got wrong and right. There was also banter on Zoom investing (Alex came up with Zesting, but we’re taking suggestions if anyone comes up with a better moniker) and startup pricing.

Here’s who we asked to call into our super Fancy Equity Hotline:

Thanks to them all for participating, and of course you, our dear Equity listeners, for a blockbuster year for the podcast.

Equity drops every Monday at 7:00 a.m. PST and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

Brightpearl, which allows retailers to streamline their operations thus boosting sales, has raised $33 million in funding to scale its business. This Series C round was led by Sage, which has put $23 million into the U.K. company. Previous backers Cipio Partners, Notion Capital and Verdane also participated, putting in $10 million.

The Bristol, U.K.-based startup has a platform for financial management, CRM, fulfillment, inventory and sales order management, purchasing and supplier management, warehousing and logistics.

Sage now takes a seat on Brightpearl’s board. In a statement it said: “Together, Sage and Brightpearl will help retail and e-commerce customers take advantage of best-of-breed cloud finance and retail management solutions, supporting them on their digital journey. The partnership with Brightpearl is consistent with Sage’s broader strategy to invest in complementary high growth cloud-based software applications.” Brightpearl has existing partnerships with Shopify, eBay and Amazon.

Derek O’Carroll, the chief executive of Brightpearl, said in a statement: “We are delighted to build this new relationship with Sage to further support our retail customers and accelerate the strong presence that Sage and Brightpearl have in the UK and US. Brightpearl’s solution brings significant benefits by automating retail processes so global merchants can save time and deliver outstanding and rapid end-to-end customer experiences.”

Powered by WPeMatico

You’re probably investing in an email newsletter these days, whether you’re an international brand, a nonprofit or a local news publisher.

Maybe email is even your focus now, because you got burned by Facebook, Google or other closed platforms during the past decade. The problem is that the tools you have available are probably too generic, or are built specifically for marketers. What if you want to make money from the newsletter content itself?

Letterhead is slicing through the vast market of existing email SaaS products, betting that a cross-section of revenue and collaboration needs are not being met properly for newsletter creators of all types. Instead, it puts all ad sales, paid subscriptions and newsletter content management into a single, streamlined product.

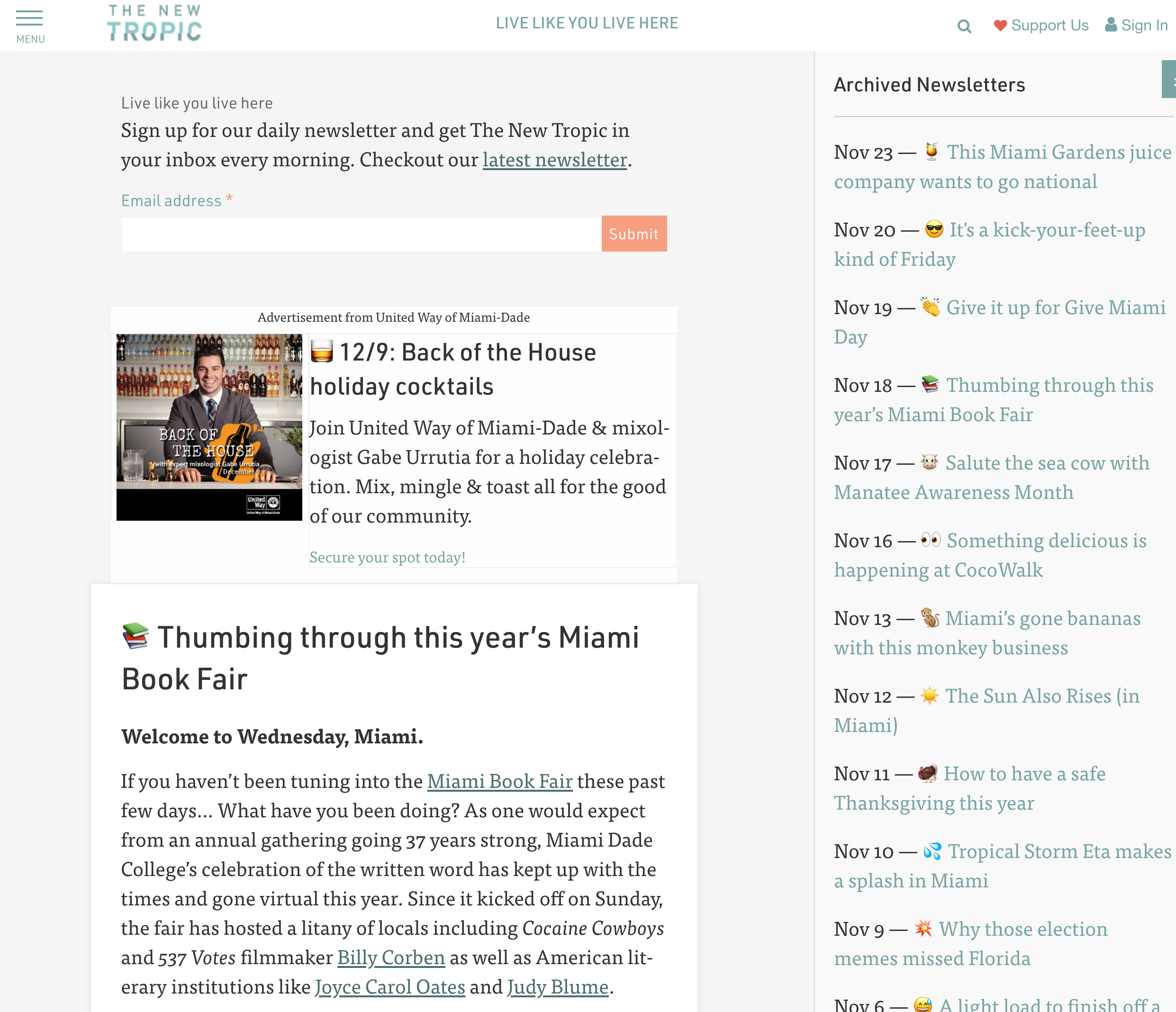

Its viewpoints on the future of newsletters — and its customer base so far — are intriguingly different from your typical SaaS startup in Silicon Valley. And there’s a reason for that. Letterhead is actually a product spinout of a community publisher in Miami called WhereBy.Us that began life in 2014 by launching a local media site, The New Tropic. The publication became a rare success in online local news, once it focused on the email newsletter format.

Image Credits: Letterhead (opens in a new window)

“Initially, our goal was to create a local media product that would help people learn about the city, get more involved and serve a new generation of local news users,” co-founder and CEO Chris Sopher tells me by video chat. “Our ideas had included opening a bar, events and all kinds of other stuff. We quickly pared that back to the things that were working, and email was at the top of the list.”

Advertising inventory in these emails was in high demand, so the company built out a self-service payment system for advertisers, which allowed its newsletter writers to easily publish the correct ads in the correct place.

With this business model and technology as a foundation, it launched or acquired newsletters in Seattle, Portland, Orlando and Pittsburgh. Through this process, it has continued to improve the tool itself.

It also discovered the broader demand.

“People would reach out to us and say ‘I love this newsletter, what tools do you use?’ because it was such a pain to produce emails with all of the different tools out there,” Sopher explains.

(Those tools, in this author’s experience, generally include a combination of Mailchimp, Constant Contact or Sailthru, together with your main web publishing CMS like WordPress, your separate subscription software like Piano and however you are managing ads.)

“We’d tell people that we used our own internal tools and they’d say ‘oh, can we use those, too? And we’d say ‘no, that’s not what we’re doing.’ Eventually, we said no enough that we looked at each other and said, ‘we should figure out how to get to yes on this.’ And that’s where Letterhead came from.”

Image Credits: Letterhead

Today, WhereBy.Us is one of the few success stories from a catastrophic decade in local news. Sopher says that its five city newsletters are comfortably profitable via ads overall — having recovered from a pandemic dip earlier this year — and are continuing to grow.

But the new focus is on Letterhead’s tools, including the ad system, a new paid subscription feature that lets you do things like add paywalled subsections of emails, easy-to-use text editing and template formatting, and soon, analytics.

“Sponsorships and ads were [needs] we heard about most, so that’s where we started,” co-founder and COO Rebekah Monson said by email. “The bigger vision is to create a set of tools and services that feed into each other in one easy place, and help all of those revenue streams grow, eventually branching out from email. We’re seeing demand for that not just from traditional media publishers, but also from marketers, nonprofits, universities, professional associations — all these folks who have engaged communities and want to deepen those relationships and bring in revenue through that engagement.”

On the spectrum of email newsletter products, Letterhead’s focus on revenues and team collaboration places it adjacent to Substack’s focus on the individual writer, and to other products like Lede designed specifically around subscription news organizations.

Letterhead is explicitly a hosted software solution that you pay for your organization to use, not an open-source project like Ghost. Like how Shopify provides a suite of white-label e-commerce features for anyone who wants to run an online business, it wants to be the engine humming away under the hood of your newsletter.

On the much broader spectrum of all email solutions in the SaaS world, Letterhead is betting that its understanding of the market and its product design can beat out the brutally competitive world of SaaS email products.

Image Credits: Letterhead (opens in a new window)

Since soft-launching earlier this year, Sopher says it has already been signing up a broad range of customers. Examples he cited include startups (Shoot My Travel), nonprofits (Vida y Salud and Refresh) and political groups (OD Action) as customers, as well as local news publishers, of course (VTDigger, Choose954 and Santa Cruz Local). Letterhead is also a partner in WordPress’ News Pack program, which is a collection of plug-ins for publishers on that CMS.

“We’re always going to have an affinity to media publishing… but there is a broader need than just that industry,” he explains. “And we’re also seeing this moment where a lot of other organizations are participating in [publishing]. You name a topic, there will be professional reporters out there doing great work. But it’s also pretty likely that there is a brand, an agency, a nonprofit or some other organization creating interesting and useful content, and building a community around it — that would not raise its hand and say that it is part of the news industry.”

Sopher also notes that the product is designed to be modular, so that companies can just use parts of it and integrate its features with other email service providers and most any tech stack.

“What we’re seeing is that smaller customers are coming on for the simplicity of having it all in one place without sacrificing monetization,” he adds, “but larger customers are choosing us as one part of their stack as they build a multifaceted business or grow out of tools geared more to individual or independent creators.”

With the revenue options in place, Sopher says analytics and additional ESP options are coming next.

Over the course of its history, WhereBy.Us has raised $5 million from across tech and media. Backers include the Knight Foundation, Jason Calacanis’ LAUNCH fund, Band of Angels, McClatchy, hundreds of smaller investors via Republic and SeedInvest and, most recently, a round led by Brick Capital.

Powered by WPeMatico

Fluent Forever, a startup that uses a novel learning system to help its users master a new language faster, has raised a $4.9 million funding round led by Denver-based Stout Street Capital. Other investors in this round include The Syndicate, LAUNCH, Mana Ventures, Noveus VC, Flight.VC, Insta VC, UpVentures, Firebrand Ventures, Cultivation Capital, Spero Ventures and Lofty Ventures.

In many ways, Fluent Forever is a direct competitor to Duolingo, Babbel and similar online language learning services. What sets it apart is a focus on a personalized learning system that emphasizes ear training, visual aids and something akin to spaced-repetition for helping you memorize new words and phrases. It’s a paid service (after a 14-day free trial) with subscriptions starting at $10 per month for a monthly subscription and the usual discounts for longer-term commitments.

To teach himself his first languages, the company’s founder and CEO Gabriel Wyner used the popular flashcard service Anki, wrote a book about his approach, and taught workshops on language learning using his system with Anki. But as he noted, Anki is a serious tool, and simply learning how to get the most out of it takes a lot of time and energy.

“I’ve watched everyone else fail at language learning,” he told me. “And the first thought is, okay, well, if you just learn how to do it right, then that’s a fixable thing. That’s exciting. And then once you have a solution for people and they’re all excited about it — but then you watch them fail because of IT reasons. That’s extra frustrating.”

In many ways then, Fluent Forever uses Wyner’s flashcard approach — because building those flashcards by hand is at the core of his learning system — and turns it into a far-easier-to-use application.

What people want, Wyner acknowledged, is a tool where you just press some buttons and learn something. But that doesn’t work. “I had to have a really strong reaction to this — a really strong answer — and say, ‘absolutely not. That is the one thing that teaches you is building it.’ ”

Wyner is not afraid to compare his approach to Duolingo’s and argues that its focus on translation exercises doesn’t translate to real language skills in the long run. At the same time, he freely acknowledges that the Duolingo user experience and gamification are far better than Fluent Forever. But he also believes that learners see far better results with his system.

“We ask [our users]: ‘Why are you with us? Why would you pay for us when you could just get Duolingo for free?” What they come back with is, ‘yeah, your product is rough around the edges. I wish you would fix this, this and that, but you had me thinking in Spanish in two weeks,” Wyner said.

Fluent Forever currently supports nine languages: Japanese, French, Russian, Mexican and Spanish Spanish, Italian, Korean, German and Brazilian Portuguese, with Dutch being the next language the team is tackling.

As Wyner told me, the company had trouble raising in 2019, in part because the service was seeing pretty flat growth at the time. “People are very skeptical about language learning — that is not a sexy field. People don’t like it. The idea of jumping and trying to be competitive with Duolingo was just not appealing to anyone,” he told me. Come 2020, though, growth picked up, even before the COVID pandemic. At the same time, Fluent Forever also participated in Jason Calacanis’ Launch Accelerator.

Looking ahead, Wyner tells me that Fluent Forever is looking at ways to bring live tutors into the loop. Live tutoring online has been done before, of course, and there are some companies like Preply that specialize in it already, but what Fluent Forever wants to do is combine the online language learning service with short live sessions and then use the online component to go back to that conversation over the course of a week or so. One advantage here is that these users — who will likely pay a premium for the live service — will also use their time with live tutors to create their own personalized sentences in the Fluent Forever system, which could then over time become content that’s available to all users, too.

Powered by WPeMatico

The last 12 months have provided us with shocking lows and surprising highs. In startup land, great expectations in January and February were followed by dashed hopes in March.

Those woes were followed by April despair, surprised optimism from May through June, and, finally, a straight shot all the way to the moon through December.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

It’s been a lot. But it’s all behind us. We don’t need to spend more time thinking about 2020 for now. We need to look ahead.

This morning, I’ve compiled notes on what’s coming. We have notes from GGV’s Hans Tung on the 2021 IPO market, Sapphires’s Beezer Clarkson on what fundraising will look like for VCs next year, and a prediction from the PitchBook analyst crew that caught my eye.

This is the last Exchange column for 2020. Thanks for reading so I could keep having fun every day at my job. Now, to work!

We’ll start with the 2021 IPO market, only because so many of you cared so very much about it this year.

Hans Tung, an investor at GGV and recent Extra Crunch Live guest, is an investor with an international perspective and a good read on global startup liquidity. So, when I got on the phone with him last week to catch up, I wanted to know his read on the 2021 IPO market.

Given that we’ve seen a number of blockbuster IPOs this year, I was expecting him to forecast an active start to the year. Correct.

But Tung added that while Q1 could be very busy, Q2 could present a lull. Why? Tung expects IPOs that failed to finish the job in Q4 2020 to slip into the first quarter of next year. That explains why the first quarter is busy. But why the slowdown in the following three months?

Powered by WPeMatico