TC

Auto Added by WPeMatico

Auto Added by WPeMatico

We are more than seven years into the notion of modern containerization, and it still requires a complex set of tools and a high level of knowledge on how containers work. The DockerSlim open-source project developed several years ago from a desire to remove some of that complexity for developers.

Slim.ai, a new startup that wants to build a commercial product on top of the open-source project, announced a $6.6 million seed round today from Boldstart Ventures, Decibel Partners, FXP Ventures and TechAviv Founder Partners.

Company co-founder and CEO John Amaral says he and fellow co-founder and CTO Kyle Quest have worked together for years, but it was Quest who started and nurtured DockerSlim. “We started coming together around a project that Kyle built called DockerSlim. He’s the primary author, inventor and up until we started doing this company, the sole proprietor of that community,” Amaral explained.

At the time Quest built DockerSlim in 2015, he was working with Docker containers and he wanted a way to automate some of the lower-level tasks involved in dealing with them. “I wanted to solve my own pain points and problems that I had to deal with, and my team had to deal with dealing with containers. Containers were an exciting new technology, but there was a lot of domain knowledge you needed to build production-grade applications and not everybody had that kind of domain expertise on the team, which is pretty common in almost every team,” he said.

He originally built the tool to optimize container images, but he began looking at other aspects of the DevOps lifecycle. including the author, build, deploy and run phases. He found as he looked at that, he saw the possibility of building a commercial company on top of the open-source project.

Quest says that while the open-source project is a starting point, he and Amaral see a lot of areas to expand. “You need to integrate it into your developer workflow and then you have different systems you deal with, different container registries, different cloud environments and all of that. […] You need a solution that can address those needs and doing that through an open source tool is challenging, and that’s where there’s a lot of opportunity to provide premium value and have a commercial product offering,” Quest explained.

Ed Sim, founder and general partner at Boldstart Ventures, one of the seed investors, sees a company bringing innovation to an area of technology where it has been lacking, while putting some more control in the hands of developers. “Slim can shift that all left and give developers the power through the Slim tools to answer all those questions, and then, boom, they can develop containers, push them into production and then DevOps can do their thing,” he said.

They are just 15 people right now including the founders, but Amaral says building a diverse and inclusive company is important to him, and that’s why one of his early hires was head of culture. “One of the first two or three people we brought into the company was our head of culture. We actually have that role in our company now, and she is a rock star and a highly competent and focused person on building a great culture. Culture and diversity to me are two sides of the same coin,” he said.

The company is still in the very early stages of developing that product. In the meantime, they continue to nurture the open-source project and to build a community around that. They hope to use that as a springboard to build interest in the commercial product, which should be available some time later this year.

Powered by WPeMatico

Cockroach Labs, makers of CockroachDB, have been on a fundraising roll for the last couple of years. Today the company announced a $160 million Series E on a fat $2 billion valuation. The round comes just eight months after the startup raised an $86.6 million Series D.

The latest investment was led by Altimeter Capital, with participation from new investors Greenoaks and Lone Pine, along with existing investors Benchmark, Bond, FirstMark, GV, Index Ventures and Tiger Global. The round doubled the company’s previous valuation and increased the amount raised to $355 million.

Co-founder and CEO Spencer Kimball says the company’s revenue more than doubled in 2020 in spite of COVID, and that caught the attention of investors. He attributed this paradoxical rise to the rapid shift to the cloud brought on by the pandemic that many people in the industry have seen.

“People became more aggressive with what was already underway, a real move to embrace the cloud to build the next generation of applications and services, and that’s really fundamentally where we are,” Kimball told me.

As that happened, the company began a shift in thinking. While it has embraced an open-source version of CockroachDB along with a 30-day free trial on the company’s cloud service as ways to attract new customers to the top of the funnel, it wants to try a new approach.

In fact, it plans to replace the 30-day trial with a newer version later this year without any time limits. It believes this will attract more developers to the platform and enable them to see the full set of features without having to enter credit card information. What’s more, by taking this approach, it should end up costing the company less money to support the free tier.

“What we expect is that you can do all kinds of things on that free tier. You can do a hackathon, any kind of hobby project […] or even a startup that has ambitions to be the next DoorDash or Airbnb,” he said. As he points out, there’s a point where early-stage companies don’t have many users, and can remain in the free tier until they achieve product-market fit.

“That’s when they put a credit card down, and they can extend beyond the free tier threshold and pay for what they use,” he said. The newer free tier is still in the beta testing phase, but will be rolled out during this year.

Kimball says the company wasn’t necessarily looking to raise, although he knew that it would continue to need more cash on the balance sheet to run with giant competitors like Oracle, AWS and the other big cloud vendors, along with a slew of other database startups. As the company’s revenue grows, he certainly sees an IPO in its future, but he doesn’t see it happening this year.

The startup ended the year with 200 employees and Kimball expects to double that by the end of this year. He says growing a diverse group of employees takes good internal data and building a welcoming and inclusive culture.

“I think the starting point for anything you want to optimize in a business is to make sure that you have the metrics in front of you, and that you’re constantly looking at them […] in order to measure how you’re doing,” he explained.

He added, “The thing that we’re most focused on in terms of action is really building the culture of the company appropriately and that’s something we’ve been doing for all six years we’ve been around. To the extent that you have an inclusive environment where people actually really view the value of respect, that helps with diversity.”

Kimball says he sees a different approach to running the business when the pandemic ends, with some small percentage going into the office regularly and others coming for quarterly visits, but he doesn’t see a full return to the office post-pandemic.

Powered by WPeMatico

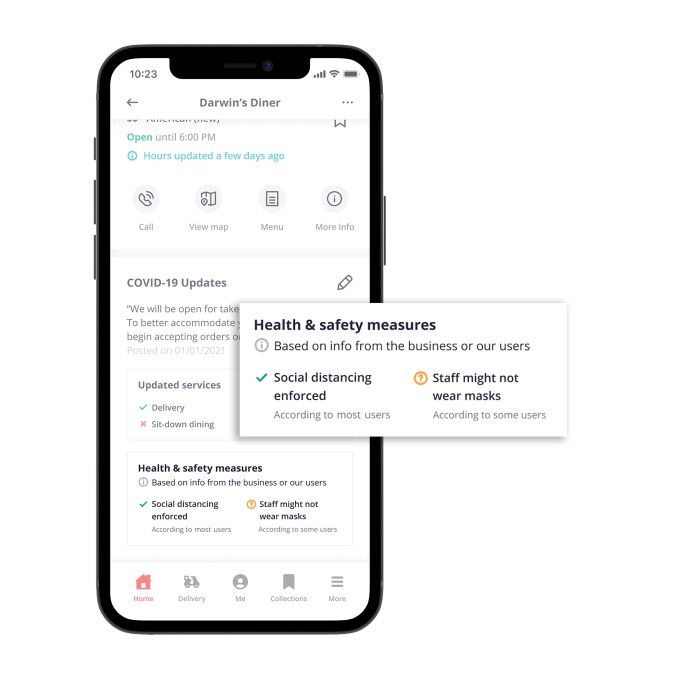

Moving forward, Yelp users won’t just be asked whether a business has good food or accepts credit cards — the platform is also allowing them to share feedback on whether the staff is wearing masks and enforcing social distancing.

Yelp’s head of consumer product, Akhil Kuduvalli Ramesh, suggested that this is the next phase of how the company is trying to help local businesses, after allowing them to highlight virtual services, manage their waitlists in accordance with new regulations and indicate the health and safety measures that they’re taking.

Of course, it’s one thing to see that a business claims to have strict mask-wearing and social distancing procedures, and another to hear other customers confirm that it’s true (or not). So Ramesh said it’s less about warning users away from certain businesses and more working “to continue to instill confidence in consumers to continue to connect with and support local businesses.”

When users visit a business profile they’ll now be asked whether social distancing was enforced and whether the staff wore masks — Ramesh said other health and safety questions could be added in the future (and users can offer slightly more detailed feedback on safety measures by hitting the Edit button in a profile), but those are the ones that users seem to care about most.

Image Credits: Yelp

When Yelp receives enough answers to offer present meaningful data (the company, understandably, isn’t disclosing the exact threshold), it will add a message in the health and safety section of the profile: “Social distancing enforced according to most users” with a green checkmark, or “Social distancing might not be enforced according to most users” with an orange question mark, with similar messages for mask-wearing.

In cases where the responses are mixed, but there’s still “significant” feedback indicating that these practices aren’t followed, the message will be attributed to “some users” instead.

Ramesh said that Yelp has already been collecting this user feedback, and at launch, only “a couple hundred” of the millions of businesses on Yelp will be marked with an orange label, “which also means that many businesses are doing the right thing.”

Image Credits: Yelp

He noted that in cases of multi-location businesses, the health and safety data will be specific to each location. Also, the labels will be based on feedback from the past 28 days — so if a business gets an orange label but starts doing better, their profile should eventually be updated to reflect that.

In addition, Yelp says it’s adding new service offerings and safety measures that businesses can include on their profiles, including checking staff for symptoms, disposable or contactless menus, heated outdoor seating and covered outdoor seating.

Powered by WPeMatico

Launched in South Korea five years ago, content discovery platform Dable now serves a total of six markets in Asia. Now it plans to speed up the pace of its expansion, with six new markets in the region planned for this year, before entering European countries and the United States. Dable announced today that it has raised a $12 million Series C at a valuation of $90 million, led by South Korean venture capital firm SV Investment. Other participants included KB Investment and K2 Investment, as well as returning investor Kakao Ventures, a subsidiary of Kakao Corporation, one of South Korea’s largest internet firms.

Dable (the name is a combination of “data” and “able”) currently serves more than 2,500 media outlets in South Korea, Japan, Taiwan, Indonesia, Vietnam and Malaysia. It has subsidiaries in Taiwan, which accounts for 70% of its overseas sales, and Indonesia.

The Series C brings Dable’s total funding so far to $20.5 million. So far, the company has taken a gradual approach to international expansion, co-founder and chief executive officer Chaehyun Lee told TechCrunch, first entering one or two markets and then waiting for business there to stabilize. In 2021, however, it plans to use its Series C to speed up the pace of its expansion, launching in Hong Kong, Singapore, Thailand, mainland China, Australia and Turkey before entering markets in Europe and the United States, too.

The company’s goal is to become the “most utilized personalized recommendation platform in at last 30 countries by 2024.” Lee said it also has plans to transform into a media tech company by launching a content management system (CMS) next year.

Dable currently claims an average annual sales growth rate since founding of more than 50%, and says it reached $27.5 million in sales in 2020, up from 63% the previous year. Each month, it has a total of 540 million unique users and recommends five billion pieces of content, resulting in more than 100 million clicks. Dable also says its average annual sales growth rate since founding is more than 50%, and in that 2020, it reached $27.5 million in sales, up 63% from the previous year.

Before launching Dable, Lee and three other members of its founding team worked at RecoPick, a recommendation engine developer operated by SK Telecom subsidiary SK Planet. For media outlets, Dable offers two big data and machine learning-based products: Dable News to make personalized recommendations of content, including articles, to visitors, and Dable Native Ad, which draws on ad networks including Google, MSN and Kakao.

A third product, called karamel.ai, is an ad-targeting solution for e-commerce platforms that also makes personalized product recommendations.

Dable’s main rivals include Taboola and Outbrain, both of which are headquartered in New York (and recently called off a merger), but also do business in Asian markets, and Tokyo-based Popin, which also serves clients in Japan and Taiwan.

Lee said Dable proves the competitiveness of its products by running A/B tests to compare the performance of competitors against Dable’s recommendations and see which one results in the most clickthroughs. It also does A/B testing to compare the performance of articles picked by editors against ones that were recommended by Dable’s algorithms.

Dable also provides algorithms that allow clients more flexibility in what kind of personalized content they display, which is a selling point as media companies try to recover from the massive drop in ad spending precipitated by the COVID-19 pandemic. For example, Dable’s Related Articles algorithm is based on content that visitors have already viewed, while its Perused Article algorithm gauges how interested visitors are in certain articles based on metrics like how much time they spent reading them. It also has another algorithm that displays the most viewed articles based on gender and age groups.

Powered by WPeMatico

SoleSavy, a community built around buying hot sneakers and related items that are increasingly hard to acquire at retail, raised $2 million in a round that closed late last year. SoleSavy is a group of communities that is currently mostly hosted on Slack.

SoleSavy’s co-founders Dejan Pralica and Justin Dusanj founded the company in 2018 as a paid community for collectors and enthusiasts seeking pairs that were getting snapped up by bots or resellers. Pralica previously co-founded Kicks Deals, a sneaker shipping site focused on less than retail pricing and Dusanj is the former director of Operations at New Age Sports, a Nike retailer.

SoleSavy’s $2 million party raise includes investment from Panache Ventures, Jason Calacanis’ LAUNCH, Turner Novak, Ben Narasin, Morning Brew’s Alex Lieberman and Austin Rief, Tiny Capital, Wesley Pentz (yes, Diplo), Matthew Hauri aka Yung Gravy, Ryan Holmes, Roham Gharegozlou and Bedrock Capital.

SoleSavy has built an engaged community (several communities, really) around the ebb and flow of the sneakerhead consumer universe (SCU). I just coined that, by the way, please make it a thing. The SCU is an interesting place filled with fascinating characters and behaviors. Every once in a while it pokes its head into the mainstream, whether via a documentary, a hot shoe release or a strong-arm robbery attempt. In 2021, I believe that we will see more of this world breaking out of its box into the larger consumer consciousness.

The trends that are leading us to this place are varied, but some of them have been front and center during the pandemic, as a decade’s worth of consumer behavioral change has occurred in the space of a few months. You only have to look at how hard it was to get a PS5 or Xbox One X or a GPU for the holiday season, and how many services, Twitter accounts and monitor groups rose up to try to help people do that to see what the future of shopping looks like.

I joked about not being able to buy butter without a bot, but it’s not far from the truth — nearly every category of goods has had its own shortages over the last year. But the mother of all limited goods category for decades now has been sneakers.

Every release is hotly anticipated and eagerly purchased by people looking for the latest shoe. The massive increase in interest in the sneaker as the marquee desirable item and the unwillingness of the biggest manufacturers to lose the hype halo has led to each drop being harder to get than the last. Second-market startups like StockX and GOAT have sprung up to facilitate those who don’t mind paying 30%-200% premiums on each release.

The solution for many lies in the countless “cook groups” that help buyers anticipate demand and stock for each drop and plan to purchase them on release date.

SoleSavy’s function is ostensibly to do just that: help regular enthusiasts to strategize and execute the release-day cop. But beyond that, Pralica says that the group has come to be about the community of people around those shoes more than the purchase itself.

SoleSavy is at its heart a Slack group (a series of groups actually that act as cohorts, leading people through the tiers of community that the team has built) with rooms that help people to understand what’s happening in sneakers, get the releases and commiserate around the culture. Pralica says that they’ve built that community out slowly (the waitlist for the group grows by 400 people per day) in order to maintain a positive atmosphere and to properly onboard new people to the group. They also have an app that drives push notifications and a podcast.

That positive community vibe is what Pralica says is SoleSavy’s long-term focus and differentiating factor that keeps the 4,000 members across the U.S. and Canada interacting with the group on a nearly daily basis.

I’ve been in a dozen or so different groups focused on buying large quantities of each release to re-sell over the years and many of them are, at best, rowdy and at worst toxic. That’s an environment that SoleSavy wanted to stay away from, says Pralica. Instead, SoleSavy tries to court those who want to buy and wear the shoes, trade them and yes, maybe even resell personal pairs eventually to obtain and wear another grail.

Though cook groups have been the “core” of the Discord and Slack-based communities in the sneaker world, other iterations have been booming too. Entrepreneurial communities based in the same hustle principles like Tyler Blake’s In This Economy and fanbase-focused groups around popular streamers top the Disboard. And bets on social token outfits like Zora are also focused on community as the glue that holds together a user base.

Community is the future of all commerce, whether you’re looking for a specific product (see the huge PS5 monitors) or want to steep yourself in a particular universe of product interest (the SCU). The trends that I’ve been seeing all point to 2021 being the year that community-driven purchasing breaks out of the underbelly of fandom and becomes officially “a thing.”

SoleSavy has been experimenting with a variety of ways to keep the community knit going, including live chats, get-togethers and even a handsome custom community-designed Jordan 1. These efforts have driven the previously bootstrapped company to some impressive early numbers. Pralica says that SoleSavy is currently profitable, with $1.5 million ARR on $33 monthly subscriptions plus affiliate revenue and that their DAUs are at 90% — an engagement number that would make any retailer salivate.

Though the funding closed (very) late last year I thought that this would be a great kick-off story for the year ahead. Though SoleSavy seems to have a really compelling story and a great growth curve, I think they’re at the tip of a very large trend, one that we will see continue to build throughout the year.

Powered by WPeMatico

Snapchat’s parent company Snap has acquired StreetCred, a New York City startup building a platform for location data.

Snap confirmed the news to TechCrunch and said the acquisition will result in four StreetCred team members — including co-founders Randy Meech and Diana Shkolnikov — joining the company, where they’ll be working on map and location-related products.

A big component of that strategy is the Snap Map, which allows users to view public snaps from a given area and to share their location with friends. Last summer, the Snap Map was added to Snapchat’s main navigation bar, and the company announced that the product was reaching 200 million users every month.

At the same time, Snapchat has been adding other products that tie into a user’s locations, such as Local Lenses, which allow developers to create geography-specific augmented reality lenses that interact with physical locations.

Meech and Shkolnikov should be bringing plenty of mapping experience to Snap — Meech was formerly CEO at Samsung’s open mapping subsidiary Mapzen, and before that the senior vice president of local and mapping products at TechCrunch’s parent company AOL (subsequently rebranded as Verizon Media). Shkolnikov, meanwhile, is the former engineering director at Mapzen.

StreetCred had raised $1 million in seed funding from Bowery Capital and Notation Capital. When I spoke to Meech in 2018, he said his goal was to “open up and decentralize” location data by building a blockchain-based marketplace where users are rewarded for helping to collect that data.

While the financial terms of the acquisition were not disclosed, the existing StreetCred platform will be shut down as part of the deal.

Powered by WPeMatico

Envisics founder and CEO Dr. Jamieson Christmas launched the startup three years ago to “revolutionize” the in-car experience with its holographic technology. Now, it has a partner that could help it achieve that mission.

The U.K.-based holographic technology startup said Friday it reached an agreement with Panasonic Automotive Systems to jointly develop and commercialize a new generation of head-up displays for cars, trucks and SUVs. Panasonic Automotive Systems is a Tier 1 automotive supplier and a division of Panasonic Corporation of North America. The head-up displays are units integrated in the dash of a vehicle that project images onto the windshield to aid drivers with navigation and provide other alerts. The Panasonic HUDs, as they’re often called, will use Envisics holographic technology.

The deal, announced ahead of the virtual 2021 CES tech trade show, follows Envisics’ $50 million Series B funding round and news that its tech will be integrated in the upcoming Cadillac Lyriq electric vehicle. The funding round, which brought Envisics a valuation of more than $250 million, included investments from Hyundai Mobis, GM Ventures, SAIC Ventures and Van Tuyl Companies.

Envisics’ technology, the foundation of which came out of Christmas’ PhD studies at Cambridge University more than 15 years ago, electronically manipulates the speed of light. This process enables images to appear three-dimensional, Christmas explained in a recent interview. The company has secured more than 250 patents and has another 160 pending certification.

The company is solely focused upon the automotive application of holography, Christmas said, adding that its first generation is already integrated in more than 150,000 Jaguar Land Rover vehicles.

Christmas said this new agreement aims to combine Panasonic’s expertise in optical design and its global reach as a Tier 1 supplier with Envisics’ technology to bring holography into the mainstream. Mass production of vehicles using its technology is slated for 2023, according to the companies.

“This is very much about part of our business plan, you know the Series B funding round we undertook was about scaling the business and enabling us to move forward as we enter the market,” Christmas said. “Part of that was a commitment to engage in partnerships with Tier ones that we can then work with to deliver these products to market.

“This is the first of those agreements,” he added, suggesting that Envisics has a much larger aim.

What that means, Christmas said, will be head-up displays with high resolution, wide color gamut and large images that can be overlaid upon reality. The technology can also project information at multiple distances simultaneously.

“That really unlocks very interesting applications,” he said. “In the short term, it will be kind of relatively simple augmented reality applications like navigation, highlighting the lane you’re supposed to be in and some safety applications. But as you look forward into things like autonomous driving it unlocks a whole realm of other opportunities like entertainment and video conferencing.”

He added that it could even be used for night vision applications such as overlaying enhanced information upon a dark road to make it clear where the road is going and what obstacles might be out there.

Powered by WPeMatico

This has been quite a week.

Instead of walking backward through the last few days of chaos and uncertainty, here are three good things that happened:

Despite many distractions in our first full week of the new year, we published a full slate of stories exploring different aspects of entrepreneurship, fundraising and investing.

We’ve already gotten feedback on this overview of subscription pricing models, and a look back at 2020 funding rounds and exits among Israel’s security startups was aimed at our new members who live and work there, along with international investors who are seeking new opportunities.

Plus, don’t miss our first investor surveys of 2021: one by Lucas Matney on social gaming, and another by Mike Butcher that gathered responses from Portugal-based investors on a wide variety of topics.

Thanks very much for reading Extra Crunch this week. I hope we can all look forward to a nice, boring weekend with no breaking news alerts.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

Image Credits: Nigel Sussman (opens in a new window)

In February 2020, gaming platform Roblox was valued at $4 billion, but after announcing a $520 million Series H this week, it’s now worth $29.5 billion.

“Sure, you could argue that Roblox enjoyed an epic 2020, thanks in part to COVID-19,” writes Alex Wilhelm this morning. “That helped its valuation. But there’s a lot of space between $4 billion and $29.5 billion.”

Alex suggests that Roblox’s decision to delay its IPO and raise an enormous Series H was a grandmaster move that could influence how other unicorns will take themselves to market. “A big thanks to the gaming company for running this experiment for us.”

I asked him what inspired the headline; like most good ideas, it came to him while he was trying to get to sleep.

“I think that I had ‘The Queen’s Gambit’ somewhere in my head, so that formed the root of a little joke with myself. Roblox is making a strategic wager on method of going public. So, ‘gambit’ seems to fit!”

Image Credits: Erik Von Weber (opens in a new window) / Getty Images

For our first investor survey of the year, Lucas Matney interviewed eight VCs who invest in massively multiplayer online games to discuss 2021 trends and opportunities:

Having moved far beyond shooters and sims, platforms like Twitch, Discord and Fortnite are “where culture is created,” said Daniel Li of Madrona.

Rep. Alexandria Ocasio-Cortez uses Twitch to explain policy positions, major musicians regularly perform in-game concerts on Fortnite and in-game purchases generated tens of billions last year.

“Gaming is a unique combination of science and art, left and right brain,” said Gigi Levy-Weiss of NFX. “It’s never just science (i.e., software and data), which is why many investors find it hard.”

Image Credits: C.J. Burton (opens in a new window) / Getty Images

Startups that lack insight into their sales funnel have high churn, low conversion rates and an inability to adapt or leverage changes in customer behavior.

If you’re hoping to convert and retain customers, “reinforcing your value proposition should play a big part in every level of your customer funnel,” says Joe Procopio, founder of Teaching Startup.

Image Credits: Bloomberg (opens in a new window) / Getty Images

Alex Wilhelm followed up his regular Friday column with another story that tries to find a well-grounded rationale for Tesla’s sky-high valuation of approximately $822 billion.

Meanwhile, GM just unveiled a new logo and tagline.

As ever, I learned something new while editing: A “melt up” occurs when investors start clamoring for a particular company because of acute FOMO (the fear of missing out).

Delivering 500,000 cars in 2020 was “impressive,” says Alex, who also acknowledged the company’s ability to turn GAAP profits, but “pride cometh before the fall, as does a melt up, I think.”

Note: This story has Alex’s original headline, but I told him I would replace the featured image with a photo of someone who had very “richest man in the world” face.

Image Credits: piranka / Getty Images

On Tuesday, enterprise reporter Ron Miller covered a major engineering project at customer data platform Segment called “Centrifuge.”

“Its purpose was to move data through Segment’s data pipes to wherever customers needed it quickly and efficiently at the lowest operating cost,” but as Ron reports, it was also meant to solve “an existential crisis for the young business,” which needed a more resilient platform.

Image Credits: Sophie Alcorn

Dear Sophie:

Now that the U.S. has a new president coming in whose policies are more welcoming to immigrants, I am considering coming to the U.S. to expand my company after COVID-19. However, I’m struggling with the morass of information online that has bits and pieces of visa types and processes.

Can you please share an overview of the U.S. immigration system and how it works so I can get the big picture and understand what I’m navigating?

— Resilient in Romania

The first “Dear Sophie” column of each month is available on TechCrunch without a paywall.

Image Credits: Hiraman (opens in a new window) / Getty Images

For founders who aren’t interested in angel investment or seeking validation from a VC, revenue-based investing is growing in popularity.

To gain a deeper understanding of the U.S. RBI landscape, we published an industry report on Wednesday that studied data from 134 companies, 57 funds and 32 investment firms before breaking out “specific verticals and business models … and the typical profile of companies that access this form of capital.”

Image Credits: Westend61 (opens in a new window)/ Getty Images

Mike Butcher continues his series of European investor surveys with his latest dispatch from Lisbon, where a nascent startup ecosystem may get a Brexit boost.

Here are the Portugal-based VCs he interviewed:

Image Credits: John Lund (opens in a new window)/ Getty Images

How do you scale online tutoring, particularly when demand exceeds the supply of human instructors?

This month, Chegg is replacing its seven-year-old marketplace that paired students with tutors with a live chatbot.

A spokesperson said the move will “dramatically differentiate our offerings from our competitors and better service students,” but Natasha Mascarenhas identified two challenges to edtech automation.

“A chatbot won’t work for a student with special needs or someone who needs to be handheld a bit more,” she says. “Second, speed tutoring can only work for a specific set of subjects.”

Image Credits: Treedeo (opens in a new window) / Getty Images

While I watched insurrectionists invade and vandalize the U.S. Capitol on live TV, I noticed that staffers evacuated so quickly, some hadn’t had time to shut down their computers.

Looters even made off with a laptop from Senator Jeff Merkley’s office, but according to security reporter Zack Whittaker, the damages to infosec wasn’t as bad as it looked.

Even so, “the breach will likely present a major task for Congress’ IT departments, which will have to figure out what’s been stolen and what security risks could still pose a threat to the Capitol’s network.”

Image Credits: Catherine Falls Commercial (opens in a new window) / Getty Images

On New Year’s Eve, I made a list of the 10 “best” Extra Crunch stories from the previous 12 months.

My methodology was personal: From hundreds of posts, these were the 10 I found most useful, which is my key metric for business journalism.

Some readers are skeptical about paywalls, but without being boastful, Extra Crunch is a premium product, just like Netflix or Disney+. I know, we’re not as entertaining as a historical drama about the reign of Queen Elizabeth II or a space western about a bounty hunter. But, speaking as someone who’s worked at several startups, Extra Crunch stories contain actionable information you can use to build a company and/or look smart in meetings — and that’s worth something.

Powered by WPeMatico

Zack Parisa and Max Nova, the co-founders of the carbon offset company SilviaTerra, have spent the last decade working on a way to democratize access to revenue-generating carbon offsets.

As forestry credits become a big, booming business on the back of multibillion-dollar commitments from some of the world’s biggest companies to decarbonize their businesses, the kinds of technologies that the two founders have dedicated 10 years of their lives to building are only going to become more valuable.

That’s why their company, already a profitable business, has raised $4.4 million in outside funding led by Union Square Ventures and Version One Ventures, along with Salesforce founder and the driving force between the One Trillion Trees Initiative, Marc Benioff .

“Key to addressing the climate crisis is changing the balance in the so-called carbon cycle. At present, every year we are adding roughly 5 gigatons of carbon to the atmosphere. Since atmospheric carbon acts as a greenhouse gas this increases the energy that’s retained rather than radiated back into space which causes the earth to heat up,” writes Union Square Ventures managing partner Albert Wenger in a blog post. “There will be many ways such drawdown occurs and we will write about different approaches in the coming weeks (such as direct air capture and growing kelp in the oceans). One way that we understand well today and can act upon immediately are forests. The world’s forests today absorb a bit more than one gigatons of CO2 per year out of the atmosphere and turn it into biomass. We need to stop cutting and burning down existing forests (including preventing large scale forest fires) and we have to start planting more new trees. If we do that, the total potential for forests is around 4 to 5 gigatons per year (with some estimates as high as 9 gigatons).”

For the two founders, the new funding is the latest step in a long journey that began in the woods of Northern Alabama, where Parisa grew up.

After attending Mississippi State for forestry, Parisa went to graduate school at Yale, where he met Louisville, Kentucky native Max Nova, a computer science student who joined with Parisa to set up the company that would become SilviaTerra.

SilviaTerra co-founders Max Nova and Zack Parisa. Image Credit: SilviaTerra

The two men developed a way to combine satellite imagery with field measurements to determine the size and species of trees in every acre of forest.

While the first step was to create a map of every forest in the U.S., the ultimate goal for both men was to find a way to put a carbon market on equal footing with the timber industry. Instead of cutting trees for cash, potentially landowners could find out how much it would be worth to maintain their forestland. As the company notes, forest management had previously been driven by the economics of timber harvesting, with over $10 billion spent in the U.S. each year.

The founders at SilviaTerra thought that the carbon market could be equally as large, but it’s hard for most landowners to access. Carbon offset projects can cost as much as $200,000 to put together, which is more than the value of the smaller offset projects for landowners like Parisa’s own family and the 40 acres they own in the Alabama forests.

There had to be a better way for smaller landowners to benefit from carbon markets too, Parisa and Nova thought.

To create this carbon economy, there needed to be a single source of record for every tree in the U.S. and while SilviaTerra had the technology to make that map, they lacked the compute power, machine learning capabilities and resources to build the map.

That’s where Microsoft’s AI for Earth program came in.

Working with AI for Earth, SilviaTierra created their first product, Basemap, to process terabytes of satellite imagery to determine the sizes and species of trees on every acre of America’s forestland. The company also worked with the U.S. Forestry Service to access their data, which was used in creating this holistic view of the forest assets in the U.S.

With the data from Basemap in hand, the company has created what it calls the Natural Capital Exchange. This program uses SilviaTerra’s unparalleled access to information about local forests, and the knowledge of how those forests are currently used to supply projects that actually represent land that would have been forested were it not for the offset money coming in.

Currently, many forestry projects are being passed off to offset buyers as legitimate offsets on land that would never have been forested in the first place — rendering the project meaningless and useless in any real way as an offset for carbon dioxide emissions.

“It’s a bloodbath out there,” said Nova of the scale of the problem with fraudulent offsets in the industry. “We’re not repackaging existing forest carbon projects and trying to connect the demand side with projects that already exist. Use technology to unlock a new supply of forest carbon offset.”

The first Natural Capital Exchange project was actually launched and funded by Microsoft back in 2019. In it, 20 Western Pennsylvania land owners originated forest carbon credits through the program, showing that the offsets could work for landowners with 40 acres, or, as the company said, 40,000.

Landowners involved in SilviaTerra’s pilot carbon offset program paid for by Microsoft. Image Credit: SilviaTerra

“We’re just trying to get inside every landowners annual economic planning cycle,” said Nova. “There’s a whole field of timber economics… and we’re helping answer the question of given the price of timber, given the price of carbon does it make sense to reduce your planned timber harvests?”

Ultimately, the two founders believe that they’ve found a way to pay for the total land value through the creation of data around the potential carbon offset value of these forests.

It’s more than just carbon markets, as well. The tools that SilviaTerra have created can be used for wildfire mitigation as well. “We’re at the right place at the right time with the right data and the right tools,” said Nova. “It’s about connecting that data to the decision and the economics of all this.”

The launch of the SilviaTerra exchange gives large buyers a vetted source to offset carbon. In some ways it’s an enterprise corollary to the work being done by startups like Wren, another Union Square Ventures investment, that focuses on offsetting the carbon footprint of everyday consumers. It’s also a competitor to companies like Pachama, which are trying to provide similar forest offsets at scale, or 3Degrees Inc. or South Pole.

Under a Biden administration there’s even more of an opportunity for these offset companies, the founders said, given discussions underway to establish a Carbon Bank. Established through the existing Commodity Credit Corp. run by the Department of Agriculture, the Carbon Bank would pay farmers and landowners across the U.S. for forestry and agricultural carbon offset projects.

“Everybody knows that there’s more value in these systems than just the product that we harvest off of it,” said Parisa. “Until we put those benefits in the same footing as the things we cut off and send to market…. As the value of these things goes up… absolutely it is going to influence these decisions and it is a cash crop… It’s a money pump from coastal America into middle America to create these things that they need.”

Powered by WPeMatico

Applications networking company F5 announced today that it is acquiring Volterra, a multi-cloud management startup, for $500 million. That breaks down to $440 million in cash and $60 million in deferred and unvested incentive compensation.

Volterra emerged in 2019 with a $50 million investment from multiple sources, including Khosla Ventures and Mayfield, along with strategic investors like M12 (Microsoft’s venture arm) and Samsung Ventures. As the company described it to me at the time of the funding:

Volterra has innovated a consistent, cloud-native environment that can be deployed across multiple public clouds and edge sites — a distributed cloud platform. Within this SaaS-based offering, Volterra integrates a broad range of services that have normally been siloed across many point products and network or cloud providers.

The solution is designed to provide a single way to view security, operations and management components.

F5 president and CEO François Locoh-Donou sees Volterra’s edge solution integrating across its product line. “With Volterra, we advance our Adaptive Applications vision with an Edge 2.0 platform that solves the complex multi-cloud reality enterprise customers confront. Our platform will create a SaaS solution that solves our customers’ biggest pain points,” he said in a statement.

Volterra founder and CEO Ankur Singla, writing in a company blog post announcing the deal, says the need for this solution only accelerated during 2020 when companies were shifting rapidly to the cloud due to the pandemic. “When we started Volterra, multi-cloud and edge were still buzzwords and venture funding was still searching for tangible use cases. Fast forward three years and COVID-19 has dramatically changed the landscape — it has accelerated digitization of physical experiences and moved more of our day-to-day activities online. This is causing massive spikes in global Internet traffic while creating new attack vectors that impact the security and availability of our increasing set of daily apps,” he wrote.

He sees Volterra’s capabilities fitting in well with the F5 family of products to help solve these issues. While F5 had a quiet 2020 on the M&A front, today’s purchase comes on top of a couple of major acquisitions in 2019, including Shape Security for $1 billion and NGINX for $670 million.

The deal has been approved by both companies’ boards, and is expected to close before the end of March, subject to regulatory approvals.

Powered by WPeMatico