TC

Auto Added by WPeMatico

Auto Added by WPeMatico

I’m a native French data scientist who cut his teeth as a research engineer in computer vision in Japan and later in my home country. Yet I’m writing from an unlikely computer vision hub: Stuttgart, Germany.

But I’m not working on German car technology, as one would expect. Instead, I found an incredible opportunity mid-pandemic in one of the most unexpected places: An ecommerce-focused, AI-driven, image-editing startup in Stuttgart focused on automating the digital imaging process across all retail products.

My experience in Japan taught me the difficulty of moving to a foreign country for work. In Japan, having a point of entry with a professional network can often be necessary. However, Europe has an advantage here thanks to its many accessible cities. Cities like Paris, London, and Berlin often offer diverse job opportunities while being known as hubs for some specialties.

While there has been an uptick in fully remote jobs thanks to the pandemic, extending the scope of your job search will provide more opportunities that match your interest.

I’m working at the technology spin-off of a luxury retailer, applying my expertise to product images. Approaching it from a data scientist’s point of view, I immediately recognized the value of a novel application for a very large and established industry like retail.

Europe has some of the most storied retail brands in the world — especially for apparel and footwear. That rich experience provides an opportunity to work with billions of products and trillions of dollars in revenue that imaging technology can be applied to. The advantage of retail companies is a constant flow of images to process that provides a playing ground to generate revenue and possibly make an AI company profitable.

Another potential avenue to explore are independent divisions typically within an R&D department. I found a significant number of AI startups working on a segment that isn’t profitable, simply due to the cost of research and the resulting revenue from very niche clients.

I was particularly attracted to this startup because of the potential access to data. Data by itself is quite expensive and a number of companies end up working with a finite set. Look for companies that directly engage at the B2B or B2C level, especially retail or digital platforms that affect front-end user interface.

Leveraging such customer engagement data benefits everyone. You can apply it towards further research and development on other solutions within the category, and your company can then work with other verticals on solving their pain points.

It also means there’s massive potential for revenue gains the more cross-segments of an audience the brand affects. My advice is to look for companies with data already stored in a manageable system for easy access. Such a system will be beneficial for research and development.

The challenge is that many companies haven’t yet introduced such a system, or they don’t have someone with the skills to properly utilize it. If you finding a company isn’t willing to share deep insights during the courtship process or they haven’t implemented it, look at the opportunity to introduce such data-focused offerings.

I have a sweet spot for early-stage companies that give you the opportunity to create processes and core systems. The company I work for was still in its early days when I started, and it was working towards creating scalable technology for a specific industry. The questions that the team was tasked with solving were already being solved, but there were numerous processes that still had to be put into place to solve a myriad of other issues.

Our year-long efforts to automate bulk image editing taught me that as long as the AI you’re building learns to run independently across multiple variables simultaneously (multiple images and workflows), you’re developing a technology that does what established brands haven’t been able to do. In Europe, there are very few companies doing this and they are hungry for talent who can.

So don’t be afraid of a little culture shock and take the leap.

Powered by WPeMatico

Forget what you’ve heard: There are many shortcuts to success.

Tapping into someone else’s experience is a tried-and-true method, which is why two-time Y Combinator participant Chris Morton wrote a guest post for Extra Crunch with advice for founders hoping to be accepted by the famed accelerator.

Morton, who has also reviewed thousands of YC applications, shares his thoughts on when to submit an application, what to do if you miss the deadline and whether you’ll need to relocate if accepted.

“Remember that your application should be good enough to get an interview, not win a prize,” says Morton. “Go back to work instead of spending more time perfecting an application.”

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

Image Credits: Robert Katai under a license.

In an interview with reporter Anna Heim, Romania-based marketer Robert Katai discussed some of the methods he uses to help clients refine their content and branding strategies.

“Today, content creation is free — everybody can do it. The hard part is how you distribute and amplify that.”

Katai also shared his impressions of Romania’s startup ecosystem, suggestions for maintaining top-of-mind status with customers, and reinforced the often-overlooked need to continually repurpose content to grab mindshare.

Like our other growth marketing interviews, there’s no paywall.

Thanks very much for reading Extra Crunch this week! I hope you have a fantastic weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Bryce Durbin / TechCrunch

Latin America’s increasingly dynamic venture capital scene has been making headlines of late. To learn more about why investors are so enthusiastic, senior reporter Mary Ann Azevedo spoke to several who are actively engaged with the region:

“I am not surprised by all the activity,” Mary Ann writes. “However, I am a bit taken aback by the sheer number of rounds, the caliber of firms leading them and the sky-high valuations.

“It seems that the region is finally, and deservedly, being taken seriously. This is likely just the beginning.”

Image Credits: Nigel Sussman (opens in a new window)

Corporations are not remaining on the sidelines of the fiery 2021 venture capital game, Alex Wilhelm and Anna Heim note in The Exchange.

After parsing data from CB Insights and Stryber and chatting with a handful of investors, Alex and Anna concluded that the corporate venture capital market looks a lot like other VC markets.

“Perhaps this should not be a surprise,” they write. “We’ve seen non-venture funds flow into the later stages of startup land, pushing VCs toward earlier-stage and more venture-y deals. Why would CVCs be immune to the same trend?”

Image Credits: Bryan Mullennix (opens in a new window) / Getty Images

Corporate spending management startup Brex raised a $300 million Series C and acquired Buyer just a week after rival Brex announced it had acquired Israeli fintech Weav.

Ryan Lawler and Alex Wilhelm dug into the Ramp-Brex rivalry, and what those acquisitions say about their diverging strategies.

“From a high level, all of the recent deal-making in corporate cards and spend management shows that it’s not enough to just help companies track what employees are expensing these days,” they write.

“As the market matures and feature sets begin to converge, the players are seeking to differentiate themselves from the competition.”

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm and Anna Heim interviewed VCs and corralled data to present a detailed picture of Boston’s startup funding scene.

“Boston is benefiting from larger structural changes to at least the U.S. venture capital market, helping close historical gaps in its startup funding market and access funds that previously might have skipped the region,” they write.

“And local university density isn’t hurting the city’s cause, either, boosting its ability to form new companies during a period of rich investment access.”

Image Credits: Andrew Holt (opens in a new window) / Getty Images

Half of the companies offering instant grocery delivery in Europe were founded last year as the pandemic reshaped most aspects of our existence.

To date, they’ve raised about $2 billion, but Picus Capital’s Alexander Kremer says startup lessons from China suggest that “instant delivery is not the magic bullet to crack the dominance” of old-school grocery players.

“If the performance of online grocery platforms in China (a market five to seven years ahead of Europe in terms of online retail) is anything to go by, a range of B2C business models would be more likely to displace the traditional grocery retailers.”

Image Credits: Nigel Sussman (opens in a new window)

For The Exchange, Alex Wilhelm examines the S-1 filing from Warby Parker, “a consumer hardware company with two main sales channels, largely attractive economics, falling losses and rising adjusted profitability. You could even argue that it handled the pandemic well, despite COVID-19’s negative impact on its operations.”

But how are its growth prospects?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I received a conditional green card after my wife and I got married in 2019. Recently, we have made the difficult decision to end our marriage. I want to continue living and working in the United States.

Is it still possible for me to complete my green card based on my marriage through the I-751 process or do I need to do something else, like ask my employer to sponsor me for a work visa?

— Better to Have Loved and Lost

Image Credits: Getty Images under an alashi (opens in a new window)license.

Marketing automation can help boost key metrics, but it can also be a disservice to brands by perpetually devaluing goods and services, ShareThis’ Michael Gorman writes in a guest column.

Companies with a narrow focus on driving conversions are missing the bigger picture: AI can help create richer experiences that identify consumer actions and intent while also improving customer experiences.

“We live in a world rich with data, and insights are growing more vibrant every day,” he writes.

Image Credits: Thitima Thongkham (opens in a new window) / Getty Images

Fintech startups based in Israel raised more than $1.8 billion in 2019, but in Q1 2021, companies in the category raised $1.1 billion.

Facilitating a wide range of services, more than a dozen fintech unicorns have already emerged in a country that has a population slightly smaller than Los Angeles County, many of them started by entrepreneurs who lacked financial backgrounds.

“So what is it about Israeli-founded fintech startups that stand out from their scaling neighbors across the pond?” asks Flint Capital’s Tel Aviv-based investor, Adi Levanon.

Image Credits: Nigel Sussman (opens in a new window)

For The Exchange, Alex Wilhelm takes stock of Forbes’ SPAC combination during a week when POLITICO was snatched up for more than $1 billion by Axel Springer and just a few months after BuzzFeed went public via a blank-check company.

“Is it the most exciting debut? No,” he writes.

“But it does highlight that with enough sheer gumption, one can take a magazine business into the digital age and keep aggregate revenue growing. That’s worth something.”

Image Credits: mevans (opens in a new window) / Getty Images

Technical jargon is one of the most annoying aspects of technology marketing.

Sadly, it tends to perpetuate itself: Marketers are terrified of making a wrong move, so they tend to copy what everyone else is doing.

If you want to attract customers and drive higher conversions, cut the jargon.

“Do everything you can to be immediately understood and you’ll have a much better chance of cutting through the noise and pushing clear and persuasive benefits in a way no prospect can resist,” advises Konrad Sanders, CEO of The Creative Copywriter.

Powered by WPeMatico

Linux is set for a big release this Sunday August 29, setting the stage for enterprise and cloud applications for months to come. The 5.14 kernel update will include security and performance improvements.

A particular area of interest for both enterprise and cloud users is always security and to that end, Linux 5.14 will help with several new capabilities. Mike McGrath, vice president, Linux Engineering at Red Hat told TechCrunch that the kernel update includes a feature known as core scheduling, which is intended to help mitigate processor-level vulnerabilities like Spectre and Meltdown, which first surfaced in 2018. One of the ways that Linux users have had to mitigate those vulnerabilities is by disabling hyper-threading on CPUs and therefore taking a performance hit.

“More specifically, the feature helps to split trusted and untrusted tasks so that they don’t share a core, limiting the overall threat surface while keeping cloud-scale performance relatively unchanged,” McGrath explained.

Another area of security innovation in Linux 5.14 is a feature that has been in development for over a year and a half that will help to protect system memory in a better way than before. Attacks against Linux and other operating systems often target memory as a primary attack surface to exploit. With the new kernel, there is a capability known as memfd_secret () that will enable an application running on a Linux system to create a memory range that is inaccessible to anyone else, including the kernel.

“This means cryptographic keys, sensitive data and other secrets can be stored there to limit exposure to other users or system activities,” McGrath said.

At the heart of the open source Linux operating system that powers much of the cloud and enterprise application delivery is what is known as the Linux kernel. The kernel is the component that provides the core functionality for system operations.

The Linux 5.14 kernel release has gone through seven release candidates over the last two months and benefits from the contributions of 1,650 different developers. Those that contribute to Linux kernel development include individual contributors, as well as large vendors like Intel, AMD, IBM, Oracle and Samsung. One of the largest contributors to any given Linux kernel release is IBM’s Red Hat business unit. IBM acquired Red Hat for $34 billion in a deal that closed in 2019.

“As with pretty much every kernel release, we see some very innovative capabilities in 5.14,” McGrath said.

While Linux 5.14 will be out soon, it often takes time until it is adopted inside of enterprise releases. McGrath said that Linux 5.14 will first appear in Red Hat’s Fedora community Linux distribution and will be a part of the future Red Hat Enterprise Linux 9 release. Gerald Pfeifer, CTO for enterprise Linux vendor SUSE, told TechCrunch that his company’s openSUSE Tumbleweed community release will likely include the Linux 5.14 kernel within “days” of the official release. On the enterprise side, he noted that SUSE Linux Enterprise 15 SP4, due next spring, is scheduled to come with the 5.14 kernel.

The new Linux update follows a major milestone for the open source operating system, as it was 30 years ago this past Wednesday that creator Linus Torvalds (pictured above) first publicly announced the effort. Over that time Linux has gone from being a hobbyist effort to powering the infrastructure of the internet.

McGrath commented that Linux is already the backbone for the modern cloud and Red Hat is also excited about how Linux will be the backbone for edge computing — not just within telecommunications, but broadly across all industries, from manufacturing and healthcare to entertainment and service providers, in the years to come.

The longevity and continued importance of Linux for the next 30 years is assured in Pfeifer’s view. He noted that over the decades Linux and open source have opened up unprecedented potential for innovation, coupled with openness and independence.

“Will Linux, the kernel, still be the leader in 30 years? I don’t know. Will it be relevant? Absolutely,” he said. “Many of the approaches we have created and developed will still be pillars of technological progress 30 years from now. Of that I am certain.”

Powered by WPeMatico

With more than 270,000 stickers, Stipop’s library of colorful, character-driven expressions has a little something for everyone.

The company offers keyboard and social app stickers through ad-supported mobile apps on iOS and Android, but it’s recently focused more on providing stickers to developers, creators and other online businesses.

“We were able to gather so many artists because we actually began as our own app that provided stickers,” Stipop co-founder Tony Park told TechCrunch. The team took what they learned from running their own consumer-facing app — namely that collecting and licensing hundreds of thousands of stickers from artists around the world is hard work — and adapted their business to help solve that problem for others.

Stipop was the first Korean company to go through Yellow, Snapchat’s exclusive accelerator. The company is also part of Y Combinator’s Summer 2021 cohort.

Stipop’s sticker library is accessible through an SDK and an API, letting developers slot the searchable sticker library into their existing software. The company already has more than 200 companies that tap into its huge sticker trove, which offers a “single-day solution” for a process that would otherwise necessitate a lot more legwork. Stipop launched a website recently that helps developers integrate its SDK and API through quick installs.

“They can just add a single line of code inside their product and will have a fully customized sticker feature [so] users will be able to spice up their chats,” Park said.

Park points out that stickers encourage engagement — and for social software, engagement means growth. Stickers are a playful way to send characters back and forth in chat, but they also pop up in a number of other less obvious spots, from dating apps to e-commerce and ridesharing apps. Stipop even drives the sticker search in work collaboration software Microsoft Teams.

The company has already partnered with Google, which uses Stipop’s sticker library in Gboard, Android Messages and Tenor, a GIF keyboard platform that Google bought in 2018. That partnership drove 600 million sticker views within the first month. A new partnership between Stipop and Coca-Cola on the near horizon will add Coke-branded stickers to its sticker library and the company is opening its doors to more brands that understand the unique appeal of stickers in messaging apps.

Park says that people tend to compare stickers and gifs, two ways of wordlessly expressing emotion and social nuance, but stickers are a world unto themselves. Stickers exist in their own creative universe, with star artists, regional themes and original casts of characters that take on a life of their own among fans. “Sticker creators have their own profession,” Park said.

Visual artists can also find a lot of traction releasing stickers, even without sophisticated illustrations. And since they’re all about meaning rather than refinement, non-designers and less skilled artists can craft hit stickers too.

“Stickers are great for them because it [is] so easy to go viral,” Park said. The company has partnered with 8,000 sticker creators across 25 languages, helping those artists monetize their creations and generate income based on how many times a sticker is shared.

Stickers command their own visual language around the world, and Park has observed interesting cultural differences in how people use them to communicate. In the West, stickers are often used in place of text, but in Asia, where they’re used much more frequently, people usually send stickers to enhance rather than replace the meaning of text.

In East Asia, users tend to prefer simple black and white stickers, but in India and Saudi Arabia, bright, golden stickers top the trends. In South America, popular stickers take on a more pixelated, unique quality that resonates culturally there.

“With stickers, you fall in love with [the] characters you send… that becomes you,” Park said.

Powered by WPeMatico

The design space has undergone major changes in the last decade. What once was dominated by a single player in Adobe has now become a burgeoning software landscape, with a handful of major players answering the needs of designers across every industry.

One such player is Canva, the startup valued at over $15 billion. The company started out with a consumer-facing product, making design accessible to non-designers. But on the back of launching an enterprise-centric suite of tools, the growth of Sydney-based Canva has been staggering.

So it should come as no surprise that we’re absolutely thrilled to have Canva co-founder and CEO Melanie Perkins join us at Disrupt (Sept 21-23) for a fireside chat.

Since launching the company in 2013, Perkins has led its growth to now see more than 55 million users each month, ranging from individual creators to SMBs to Fortune 500 companies.

We’ll talk to Perkins about how she shifted the company from individual creators to a B2B platform, what it’s like to run an industry-specific startup in the midst of a fundamental evolution — see: Design may be the next entrepreneurial gold rush — and how she’s handled this period of monumental growth for the company.

Perkins joins a stellar lineup of speakers at Disrupt, including Secretary Pete Buttigieg, Calendly’s Tope Awotona, Slack CEO Stewart Butterfield, Houseplant’s Seth Rogen and investor Chamath Palihapitiya, among many others. Check out a full list of speakers here. Disrupt is less than a month away and you can still get your pass to access it all for less than $100! Register today.

Powered by WPeMatico

TechCrunch Disrupt 2021 takes place September 21-23, and we’re here to call out just some of the awesome content we have scheduled over three very busy days. The Disrupt agenda so far features more than 80 interviews, panel discussions, events and breakout sessions that span the startup tech spectrum… with more to come!

You gotta pay to play: Buy your pass to Disrupt 2021 here and open a door to opportunity.

Let’s talk about the special breakout sessions, which are hosted by our partners. These smaller sessions deliver real value and, according to attendee feedback, that holds true across all TechCrunch events.

I enjoyed the big marquee speakers from companies like Uber, but it was the individual breakout presentations where you really started to get into the meat of the conversation and see how these mobile partnerships come to life. — Karin Maake, senior director of communications at FlashParking

There was always something interesting going on in one of the breakout sessions, and I was impressed by the quality of the people participating. Partners in well-known VC firms spoke, they were accessible, and they shared smart, insightful nuggets. You will not find this level of people accessible and in one place anywhere else. — Michael McCarthy, CEO of Repositax

Now’s the time to start planning your Disrupt 2021 schedule, and you don’t want to miss out on these informative presentations.

With the emergence of concepts such as NFT and GameFi, socialization prosperities are bringing new energy to the crypto world. Known as the People’s Exchange, KuCoin is committed to exploring disruptive technologies and genius ideas to bring crypto closer to the masses. In this session, you will hear from KuCoin CEO Johnny Lyu on what is the outlook of the evolving crypto market and how to achieve better trading experience for cryptocurrency investors. Brought to you by KuCoin.

Empathy deficit is the largest imminent threat to a businesses’ growth, but there’s hope. Humanized AI is allowing brands to create empathetic customer experiences by offering uniquely personal interactions with digital people. But what is empathy, really? And how can it help brands and storytellers better connect with their audiences in a cookie-less world? Soul Machines’ co-founder and CBO Greg Cross explains how embracing AI could be just the competitive advantage your brand needs. Brought to you by Soul Machines.

Together Labs is leveraging the power of blockchain technology to create the new metaverse economy where users can buy, sell, invest and shape its future. Earlier this year, Together Labs launched VCOIN, the first global, digital currency that can be used in and out of the metaverse. VCOIN makes it possible for users to play to earn real value and then convert that value to cash. Soon, Together Labs will introduce additional blockchain offerings to accelerate the transition to a complete blockchain economy, setting the economic model for other metaverses to follow. Brought to you by VCOIN.

Without the right governance tools in place at a company’s inception, a business becomes susceptible to risks as it scales. Adopting governance practices early in a business’s growth process sets them up for long-term growth and a successful IPO. Hear leadership perspectives for securing your business growth in a time of rapid change. Brought to you by Diligent Corporation.

The first hurdle has been cleared: initial funding is in the bank. You’re hiring more talent, seeing the beginnings of a finished product with clear evidence of traction and experiencing the coveted growth that previously felt just out of reach. Before you know it, the decision to raise for what is arguably the most competitive round is staring you in the face. In this panel, join Samsung Next’s David Lee alongside founders Kadie Okwudili (Agapé), Andy Hoang (Aviron), and Jim Bugwadia (Nirmata) as they discuss the learnings and nuances of bridging seed to Series A. Brought to you by Samsung Next.

We present the 13 pioneering Korean companies that will enrich our lives with their innovative edge. The companies specialize in various technologies, including Green Tech, AR/VR, 3D Display, AI & Big Data and Cybersecurity. Don’t miss your chance to catch a glimpse of ingenuity from the technology powerhouse. Brought to you by KOTRA.

Over 380 million tons of plastic are produced every year and 50% of that is for single-use purposes such as product packaging. Until now, companies have been hard-pressed to find a replacement for Styrofoam for protecting fragile items like electronics and appliances. John Felts of Cruz Foam will discuss the development of bio-benign, compostable alternative materials. Tom Chi of At One Ventures will talk about the importance of investing in environmental and climate entrepreneurs. Moderator Scott Cassel of PSI will lead the discussion on how the packaging value chain can create a truly circular economy. Brought to you by Cruz Foam.

Spurred by digital transformation and the recent shift to remote work, the enterprise software industry has gone from strength-to-strength and competition for deals and valuations are at all-time highs. While investor appetite for enterprise software may be strong, it doesn’t mean that all tech businesses make worthy investments. In this panel, hear from Michael Fosnaugh and Monti Saroya, co-heads of Vista’s Flagship investment strategy, and a selection of Vista CEOs on the hallmarks of best-in-class software companies and trends driving the industry. Brought to you by Vista Equity Partners.

TechCrunch Disrupt 2021 takes place September 21-23. Don’t have your pass yet? Buy one here and check out the breakout sessions for trends, advice and opportunities to help grow your business.

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

What a busy week in the world of media liquidity.

That’s a sentence you don’t get to write often. Regardless, news broke this week that Axel Springer is buying U.S. political journalism outfit POLITICO. The transaction was expected, but the eye-popping roughly $1 billion price tag still has tongues wagging. We even got on the podcast to chat about it.

And Forbes announced that it is going public via a SPAC. The business publication’s news follows BuzzFeed’s journey to the public markets through a blank-check company. Hot media liquidity summer? Something like that.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

That TechCrunch is in the process of being sold to private equity, of course, is not something that we should forget. Shoutout to the Verizon bankers who found a way to get rid of us while also deleveraging Verizon’s debt profile. Ten points.

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

I want to take a quick tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are here, in case you want to run comparisons. This will be easy and fun. Perfect Friday morning fare. Into the data!

In corporate-speak, Forbes Global Media Holdings is merging with blank-check company Magnum Opus Acquisition Limited. The transaction will close either Q4 2021 or Q1 2022, Forbes estimates.

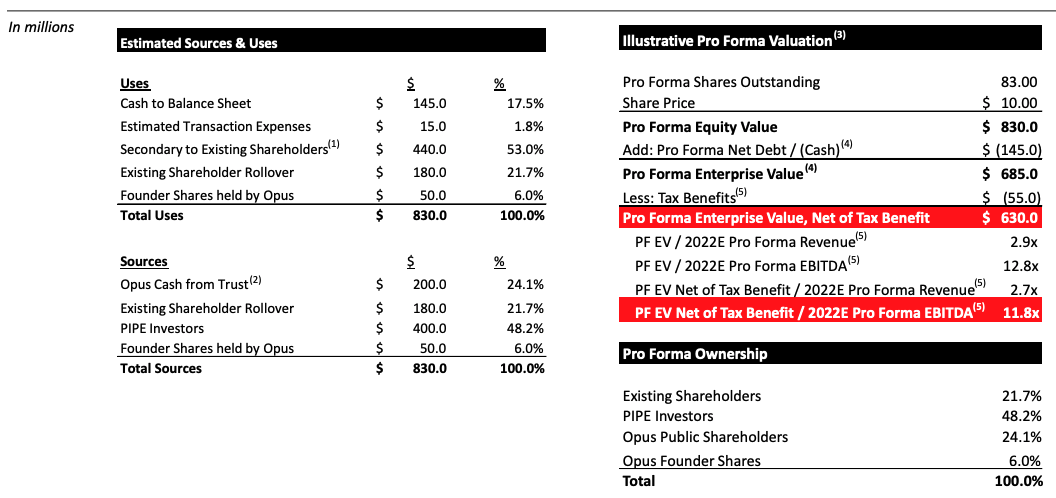

The deal itself is somewhat modest in scale compared with other SPAC deals we’ve recently looked into. Forbes reports that it will sport “an implied pro forma enterprise value of $630 million, net of tax benefits,” after its completion. Some $600 million in gross proceeds will be derived from Magnum Opus funds “and $400 million of additional capital through a private placement of ordinary shares of the combined company,” Forbes writes.

The company will sport an equity valuation of $830 million after the deal closes, per its own calculations. That number will change some depending on redemptions ahead of the combination. The gap between the large dollars going into the deal and the modest final valuation of the public Forbes entity is due to some $440 million in secondary transactions for existing Forbes shareholders.

In case you’d prefer all of that in table form, here’s the Forbes investor deck:

Image Credits: Forbes SPAC deck

Is $830 million a fair price? Let’s dig into Forbes’ results.

Powered by WPeMatico

Stonehenge Technology Labs wants consumer packaged goods companies to gain meaningful use from all of the data they collect. It announced $2 million in seed funding for its STOPWATCH commerce enhancement software.

The round was led by Irish Angels, with participation from Bread and Butter Ventures, Gaingels, Angeles Investors, Bonfire Ventures and Red Tail Venture Capital.

CEO Meagan Kinmonth Bowman founded the Arkansas-based company in 2019 after working at Hallmark, where she was tasked with the digital transformation of the company.

“This was not a consequence of them not being good marketers or connected to mom, but they didn’t have the technology to connect their back end with retailers like Amazon, Walmart or Hobby Lobby,” she told TechCrunch. “There are so many smart people building products to connect with consumers. The challenge is the big guys are doing things the same way and not thinking like the 13-year-olds on social media that are actually winning the space.”

Kinmonth Bowman and her team recognized that there was a missing middle layer connecting the world of dotcom with brick and mortar. If the middle layer could be applied to the enterprise resource plans and integrate public and private data feeds, a company could be just as profitable online as it could be in traditional retail, she said.

Stonehenge’s answer to that is STOPWATCH, which takes in over 100 million rows of data per workspace per day, analyzes the data points, adds real-time alerts and provides the right data to the right people at the right time.

Dan Rossignol, a B2B SaaS investor, said the CPG world is also about consumerizing our life, and the global pandemic showed that even at home, people could have a productive day and business. Rossignol likes to invest in underestimated founders and saw in Stonehenge a company that is getting CPGs out from underneath antiquated technologies.

“What Meagan and her team are doing is really interesting,” he added. “At this stage, it is all about the people, and the ability to bet on doing something larger.”

Kinmonth Bowman said she had the opportunity to base the company in Silicon Valley, but chose Bentonville, Arkansas instead to be closer to the more than 1,000 CPG companies based there that she felt were the prime customer base for STOPWATCH.

The platform was originally created as a subsidiary of a consulting company, but in 2018, one of their clients told them they just wanted the software rather than also paying for the consulting piece. The business was split, and Stonehenge went underground for eight months to make a software product specifically for the client.

Kinmonth Bowman admits the technology itself is not that sexy — it is using exact transfer loads to extract data from hundreds of systems into a “lake house,” and then siloing it by retailer and other factors and then presenting the data in different ways. For example, the CEO will want different metrics than product teams.

Over the past year, the company has doubled its revenue and also doubled the amount of contracts. It already counts multiple Fortune 100 companies and emerging brands as some of its early users and plans to use the new funding to hire a sales team and go after some strategic relationships.

Stonehenge is also working on putting together a diverse workforce that mimics the users of the software, Kinmonth Bowman said. One of the challenges has been to get unique talent to move to Arkansas, but she said it is one she is eager to take on.

Meanwhile, Brett Brohl, managing partner at Bread and Butter Ventures, said the Stonehenge team “is just crazy enough, smart and driven” to build something great.

“All of the biggest companies have been around for a long time, but not a lot of large organizations have done a good job digitizing their businesses,” he said. “Even pre-COVID, they were building fill-in-the-blank digital transformations, but COVID accelerated technology and hit a lot of companies in the face. That was made more obvious to end consumers, which puts more pressure on companies to understand the need, which is good for STOPWATCH. It went from paper to Excel spreadsheets to the next cloud modification. The time is right for the next leap and how to use data.”

Powered by WPeMatico

As Synder’s two co-founders Michael Astreiko and Ilya Kisel wrap up their time at Y Combinator, they also announced their seed round of $2 million from TMT Investments.

Though the round was acquired before going into the accelerator program, the Belarus-based pair wanted to wait to publicly share the milestone. As they focus their sights on their next journey of growth and expansion, the new funding will go toward attracting more clients, visibility and sales.

The company bills itself as an easy accounting platform for e-commerce businesses. It was originally founded as CloudBusiness in 2016 and developed accounting automation and management of business finances for small and mid-size businesses.

Astreiko and Kisel started Synder, in 2018 and a year later focused on the company full-time to develop an easy way for commerce companies to shift to omnichannel sales, something Astreiko told TechCrunch can be “a huge pain” due to the complexity of different payment systems and high fees.

“There are a lot of solutions on the market, but you still have to have special knowledge to operate within accounting or commerce,” Kisel said. “For us, the simplicity means that it is worth it if you can have access in several clicks to consolidated inventory, profits and liabilities. Small businesses sometimes are not sharing this information due to competition, but if something is working and easy, they will definitely share it.”

Synder does the heavy lifting for companies by connecting sales channels like Amazon, Shopify, eBay and Etsy into one platform that users can manage with one-click operations. It also created a way to help the accounting stream so that all of the different payment methods can still be used, Kisel said.

The company is already working with 4,000 clients, and will now be fast-tracking their expansion, but will need the right people on board to help the company grow, Astreiko said.

Igor Shoifot, a partner at TMT Investments, said he will join Synder’s board after the company graduates from YC. He likes the simplicity of what the company is doing.

“Often the best solutions are economical, succinct and elegant — you can be onboarded in 10 minutes,” he added. “There is really nobody that really provides a similar solution that was that easy or didn’t require downloading or installing something. I also like their focus on growth, the fact they have no burn and they are making money.”

Synder’s business model is a subscription SaaS model that starts off as a free trial, and users can purchase additional services inside the platform to fit small and large companies.

Its more than 15 employees are spread around Europe, and the company just started hiring in the areas of marketing and sales in the U.S.

Powered by WPeMatico

Embedded fintech company Zeal secured $13 million in Series A funding to continue developing its platform for building individualized payroll products.

Spark Capital led the Series A, with participation from Commerce Ventures and a group of individual investors, including Marqeta CEO Jason Gardner and CRO Omri Dahan, Robinhood founder Vlad Tenev, UltimateSoftware executives Mitch Dauerman and Bob Manne and Namely founder Matt Straz. The latest round now gives the company $14.6 million in total funding, which includes a $1.6 million seed round in 2020, CEO Kirti Shenoy told TechCrunch.

The Bay Area company’s origin was as Puzzl, a payment processing startup for the gig economy, founded in 2018 by Shenoy and CTO Pranab Krishnan. It was part of Y Combinator’s 2019 cohort. The pair had to pivot the company after needing to move some of its thousands of 1099 contractors to W2 employee status.

They went looking for payroll processors that could handle high volumes of payroll automatically, like ADP or Paycor, but found they didn’t match some of the capabilities Shenoy and Krishnan wanted, including to pay workers daily and customize earning components.

To ensure other companies didn’t run into the same problem, they decided to build a payroll API that enables their customers to build their own payroll products, even being able to pay their workers everyday. Traditionally, companies would layer together antiquated third-party payroll tools and spend millions of dollars on consulting fees. Zeal’s API tool modernizes the payroll process and takes on the payroll liability while managing the back-end payment logistics, Shenoy said.

Currently, enterprises use Zeal to pay large volumes of workers and keep payment data on their own native systems, while software platforms that sell business-to-business services use Zeal to build their own payroll product to sell to their customers.

“Our mission is to touch every American paycheck with our tax and payment technology, ensuring that American employees are paid correctly and efficiently,” Krishnan said.

And that is a complex goal: there are 200 million American employees, over $8.8 trillion of payroll is processed annually in the U.S. and the country’s 11,000 tax jurisdictions produce over 25,000 income tax code changes a year.

Meanwhile, Shenoy cited IRS data that showed more than 40% of small and medium businesses pay at least one payroll penalty per year. That was one of the drivers for Zeal’s latest product, the Abacus gross-to-net calculator, which payroll companies can use to ensure they are compliant in paying their income taxes.

The co-founders intend to use the new funding to build out their team and strengthen compliance measures to ensure its track record with enterprises.

“We are starting to win more enterprise deals and moving millions of dollars each day,” Shenoy said. “This has been a legacy space for so long, so companies want to work with a provider to move fast.”

Shenoy predicts that more companies will shift to hyper-customized experiences in the next five to 10 years. Whereas the default was a company like ADP, companies will want to control their own data and build products so their customers can do everything payroll-related from one platform.

As part of the investment, Spark Capital’s partner Natalie Sandman has joined Zeal’s board of directors. The firm previously invested in other embedded fintech companies like Affirm and Marqeta, and she thinks there are new experiences in the sector that APIs can unlock.

Sandman felt the payroll-building pain points herself when she worked at Zenefits. At the time, the company was trying to do the same thing, but there were no APIs to connect with. There were all of these spreadsheets to transfer data, but one wrong deduction would trickle down and cause a tax penalty.

Shenoy and Krishnan are both “customer-obsessed,” she said, and are balancing speed with thoughtfulness when it comes to understanding how their customers want to build payroll products.

She is seeing a macro shift to audience-driven human resources where bringing new employees online will mean embedding them into products that will be more valuable versus the traditional spreadsheet.

“To me, it is a no-brainer that APIs provide flexibility in the way wages and deductions need to be made,” Sandman said. “You can lose trust in your employer. Payroll is at the deepest trust point and where you want transparency and a robust solution to solve that need.”

Powered by WPeMatico