TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Spain is preparing to push forward with pro-startup legislation, having recently unveiled a big and bold transformation plan with the headline goal, by 2030, of turning the country into ‘Spain Entrepreneurial Nation’, as the slightly clumsy English translation has it.

Prime minister Pedro Sanchez took a turn on Web Summit’s stage in December to announce the introduction of the forthcoming Startup Act — and to trumpet a new role, a high commissioner, tasked with bringing off a nationwide entrepreneurial economic transformation by working with all the relevant government ministries.

The broad-brush goals for the strategy are to increase growth in startup investments; attract and retain talent; promote scalability; and inject innovation into the public sector so it can bolster and support Spain’s digital development.

The aforementioned Startup Act is the first piece of dedicated legislation for the sector — and is intended to simplify starting up in Spain, as well as bringing in tax concessions and incentives for foreign investments. So it will be something of a milestone.

Chat to local founders and there’s a litany of administrative, tax-based and fundraising pain-points they’ll quickly point to as frustrations. Wider issues seem more cultural; startups not thinking big enough, investors lacking the necessary appetite for risk, and even — among wider society — some latent suspicion of entrepreneurs. While Spain-based investors are champing at the bit for administrative reform and better stock options. Moving the needle on all that is the Spanish government’s self-appointed mission for the foreseeable future.

TechCrunch spoke to Francisco Polo, Spain’s high commissioner overseeing delivery of the entrepreneurial strategy, to get the inside track on the plan to grow the startup ecosystem and find out which bits entrepreneurs are likely to see in action first.

“The high commissioner for Spain entrepreneurial nation is a new body that’s within the presidency. So for the first time we have an institution that, from the presidency, is able to help coordinate the different ministries on one single thing: Creating the first national mission. In this case this nation mission has the goal to turn Spain into the entrepreneurial nation with the greatest social impact in history,” says Polo.

Francisco Polo. Image Credits: Enrique Dans (opens in a new window) / Wikimedia Commons (opens in a new window) under a CC BY 2.0 (opens in a new window) license.

“What we do is that work of coordination with all the ministries. Basically we have a set of internal objectives. First is what we call impacts — different sets of measures that is contained in the Spain entrepreneurial nation strategy. We also work trying to get everyone together on this national mission so we work on different alliances.

“Finally, we are also very focused on helping let the people know that Spain has made a decision to become — by 2030 — this entrepreneurial nation that is going to leave no one behind. So that’s our job.”

The southern European nation doesn’t attract the same level of startup investment as some of its near neighbors, including the U.K., France and Germany. But in some ways Spain punches above its regional weight — with major cities like Barcelona and Madrid routinely ranked as highly attractive locations for founders, owing to relatively low costs and the pull of a Mediterranean lifestyle.

Spanish cities’ urban density, high levels of youth unemployment and a sociable culture that’s eagerly embraced digital chatter makes an attractive test-bed for consumer-facing app-based businesses — one that’s demonstrated disruptive potential over the past decade+, in the wake of the 2008 financial crisis which hit the country hard.

Local startups that have gained global attention over this period — for velocity of growth and level of ambition, at the least — include the likes of Badi, Cabify, Glovo, Jobandtalent, Red Points, Sherpa.ai, TravelPerk, Typeform and Wallapop, to name a few.

Spain’s left-leaning coalition government is now looking to pick up the startup baton in earnest, to drive a broader pro-digital shift in the economy and production base — but in a way that’s socially inclusive. The shift will be based on “an ironclad principle that we leave no one behind”, said Sanchez in December.

For this reason the slate of policy measures Sanchez’s government has distilled as necessary to support and grow the ecosystem — following a long period of consultation with private and public stakeholders — pays close attention to social impact. Hence the parallel goal of tackling a variety of gaps (territorial, gender, socio-economic, generational and so on) that might otherwise be exacerbated by a more single-minded rush to accelerate the size of the digital sector.

“We are a new generation of young people in government. I think in our generation we don’t understand creating a new innovation system or a new industrial-economic system if we are not also talking about its social impact,” says Polo. “That’s why at the basis of the model we have also designed inclusion policies. So all this strategy is aimed at closing the gender gap, the territorial gap, the socio-economic gap and the generational gap. So at the end of the day, by 2030, we have created the entrepreneurial nation with the highest social impact in history.”

There’s money on the table too: Spain will be routing a portion of the “Next Generation EU” coronavirus recovery funding it receives from the pan-EU pot into this “entrepreneurial” push.

“Specifically, for 2021, the budget assigned to the different goals of the strategy — we have more than €1.5 billion for the main measures that we want to start setting up. And for the period 2023 it’s over €4.5 billion dedicated to the rest of the measures. So basically between 2021 and 2023 we will be setting the basis/foundations of the Spain entrepreneurial nation,” says Polo.

Execution of the strategy will be down to the relevant ministries of government — who will be enacting projects and passing legislation, as needed — but Polo’s department is there to “guide and accompany” the various arms and branches of government on that journey; aka “to help make things happen” with a startup hat on.

The national strategy envisages entrepreneurship/startup innovation as the driving force at the top of a pyramid that sits atop existing sectors of the Spanish economy — “spearheading the innovative system that we want to generate”, as Polo puts it. “We are not only focusing on innovative entrepreneurship. We are also trying to create virtuous cycles between this ecosystem and the actual driving sectors of the Spanish economy — that’s why we listed a set of 10 driving sectors that represent above 60% of the GDP. And this is of utmost importance.”

The listed sectors where the government wants to concentrate and foster support — so those same sectors can leverage gains through closer working with digital innovation are: Industry; Tourism and culture; Mobility; Health; Construction and materials; Energy and ecological transition; Banking and finance; Digitalization and telecommunications; Agri-food; and Biotechnology.

“We decided we needed to make the cut at some point and we decided that putting together 60% of the GDP in Spain was a clear direction of the sectors that we could be using in order to accelerate the change that we want to see,” says Polo. “Basically what we want to shift with this model is that the innovative entrepreneurship that has been quite enclosed in the past starts working with the different driving sectors that we have in the country because they can help each other solve their different issues.

“So first, for example, for investment — what if big companies start investing more and more than they are actually doing? We accelerate also that path — into innovative entrepreneurship system. That is going to help close that gap… What if startups and scale-ups in Spain work together with our international companies in order to attract and retain that talent? That is going to put us as a country in a better position.

“To me the best example is about scaling up: Because what is better than scaling up on the shoulders of giants? We have already a big number of international of world-class companies that are in different markets so what is better than being able to scale up with a company that is already there, that has the knowledge and that can help you mature as a scale-up in a shorter period of time. So there are a lot of virtuous cycles that we can generate and that’s why we wanted to make also a broad appeal to the different driving sectors. Because we want to let the country know that everyone is called to make this a reality.”

Lime scooters outside El Retiro Park in Madrid (Image Credits: Natasha Lomas/TechCrunch)

Digital can itself divide, of course, as has been writ large during a global pandemic in which the development of children excluded from attending school in person can hinge on whether or not they have internet access and computer literacy.

So the principle of entrepreneurial growth being predicated upon social inclusion looks like an important one — even if pulling off major industrial transformations which will necessitate a degree of retraining and upskilling in order to bring workers of all ages along the same path is clearly not going to be easy.

But the 10-year time frame for “Spain Entrepreneurial Nation” looks like a recognition that inclusion requires time.

The long-term plan is also intended to address a common criticism of Spain’s politics being too short-termist, per Polo. “In Spain particularly it’s been a regular criticism that politics always look in the small term so this is proof that this government is also addressing the short-term issues but also is preparing Spain for the future,” he says, adding: “We really believe that [presenting a long-term vision is] a good thing and it’s an answer to that social demand.”

The country has also — over the last decade or so — gained a bit of a reputation for successfully challenging digital developments over specific societal impacts in Europe’s courts. Such as, in 2010, when a Spanish citizen challenged Google’s refusal to delist outdated information about him from its index — which led, in 2014, to Europe’s top court backing what’s colloquially referred to as the “right to be forgotten”.

Uber’s regulation-dodging was also successfully challenged by Spanish taxi associations — leading to a 2017 ruling at the highest level in Europe that Uber is a transport service (and therefore subject to local urban transport rules; not just a technology platform as the ride-hailing giant had sought to claim).

Anti-Uber (and anti-Cabify) strikes have, meanwhile, been a quasi-regular (and sometimes violent) feature of Spain’s streets — as the taxi industry has protested at a perceived lack of enforcement of the law against app-based rivals who are not competing fairly, as it sees it.

And while gig platforms (even homegrown European ones) tend to try to shrug off such protests as protectionist (and/or “anti-innovation”), they have oftentimes found themselves losing challenges to the legality of their models — including most recently in the U.K. Supreme Court (which just slapped down Uber’s classification of drivers/riders as self employed — meaning it’s liable for a slew of costs for associated benefits).

All of which is to say that the muscular sense of injustice that segments of Spanish society have willingly — and even viscerally — demonstrated when they feel unfair impacts flowing from shiny new tech tools should not be dismissed; rather it looks like people here have their finger on the pulse of what’s really important to them.

That may also explain why the government is so keen to ensure no one in Spain feels left behind as it unboxes a major packet of startup-friendly policies.

Among a package of some 50 support measures, the entrepreneurial strategy makes a reference to “smart regulation” and floats the idea of sandboxing for testing products publicly (i.e. without needing to worry about regulatory compliance first).

The idea of opening up sandboxing is popular with local gig platform Glovo. “I really believe this is key; allowing innovation to test products/services without having to go through regulatory nightmares to test. This would really drive innovation,” co-founder Sacha Michaud tells us. “This is working well in financial services but could be applied across a wide range of tech areas.”

Attracting more investment to Spain and improving stock options so that local companies can better compete to attract talent are other key priorities for him.

Michaud says he’s fully supportive of the government’s entrepreneurial strategy and the Startup Act, while not expecting immediate results on account of what he expects will be a long legislative process.

He’s less happy about the government’s in-train plan to regulate gig platforms, though — arguing that last-mile delivery is being unfairly singled out there. This reform, which is being worked on by the Ministry of Labor, has been driven by a number of legal challenges to platforms’ employment classifications of gig workers in recent years — including a loss last year for Glovo in Spain’s Supreme Court.

“In Glovo’s case [the government] are specifically looking at regulating only riders, last-mile delivery platforms — yet still allowing over an estimated 500,000 autonomous workers in logistics, services and installations to continue,” says Michaud, dubbing this “very discriminatory; affecting literally a handful of tech companies and ‘protecting’ the status quo of the traditional IBEX35 Spanish companies”.

Asked about progress on the reform of the labor law Polo says only that work is continuing. “I don’t have more transparency on the work they are doing. I have probably the same information that you have and the conversations that we have with the different companies, also the gig companies that we keep an open dialogue with,” he says.

But when pressed on whether reforming regulations to take account of tech-driven changes to how people work is an important component of the wider entrepreneurial strategy he also emphasizes that the “ultimate goal” of the national transformation plan is “to generate more and better jobs”.

“We are always inclined to try to foster the companies that generate these better and increasing new jobs,” says Polo. “And I’m sure that the different gig companies that we have in Spain — I know that they understand this ultimate goal. They understand the benefits for the company and for the country of following this path and that they are willing to transform and evolve as the country is also evolving.”

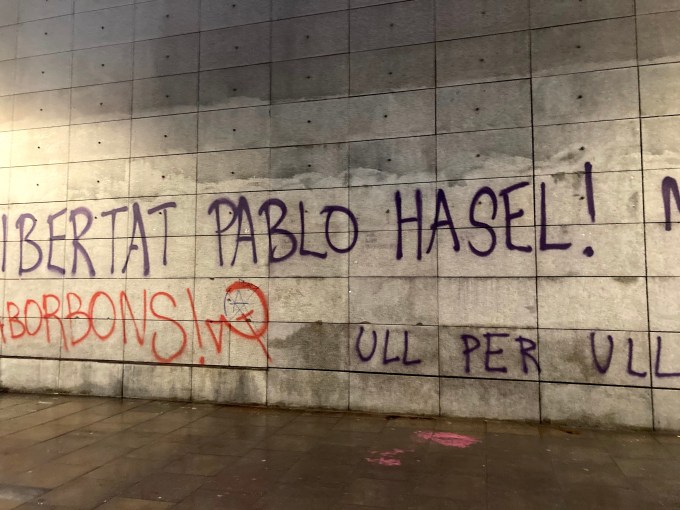

At the time of writing Barcelona is also being rocked by street protests over the jailing of rapper, Pablo Hasél, over certain social media postings — including tweets criticising police brutality — judged, by Spanish courts, to have violated its criminal code around glorifying terrorism.

Spain’s laws in this area have long been denounced as draconian and disproportionate. Including by Amnesty International — which called Hasél’s imprisonment “an excessive and disproportionate restriction on his freedom of expression”. But Polo dismisses the idea that there’s any contradiction in Spain seeking to rebrand itself as a modernizing, pro-entrepreneur nation at the same time as Spain’s courts are putting people in prison over the contents of their tweets. (Hasél is not the only artist or citizen to fall foul of this law — which has also been infamously triggered by social media jokes).

“There’s no opposition of concepts at all,” Polo argues. “Spain is one of the most robust democracies in the world and that is something that is not us who are saying it — it’s the international rankings. And we have a rule of law. And in this case it’s a very clear case of someone who went across the limits that are established in legislation because the freedom of speech has limits of the rights of other people so it’s something that has nothing to do unfortunately with freedom of speech… The reason why Pablo Hasél is in jail is because he promoted terrorism.”

Pressed further on how “jail time for tweets” might look to an international audience, he reiterates a recent government statement that they do intend to reform the penal code. “There are very specific things that, yes, we want to reform. Because times have advanced,” he says, adding: “We are a more mature country than the one we were in the 1980s. And there are specific things that we want to change in the penal code — but they have nothing to do with the recent events.”

Graffiti in a Barcelona street protesting against the imprisonment of rapper, Pablo Hasél, for crimes involving freedom of speech (Image credit: Natasha Lomas/TechCrunch)

On the broader issue of cultural challenge — aka: how to change a national mindset to be more entrepreneurial — Polo expresses confidence in his mission. He says it’s about making sure people see the big picture and their place in the vision of the future you’re presenting to them; so they see you’re actively working to bring them along for the ride.

“This is one of the things that I feel confident about. Particularly based on my background prior to being in politics. That is helping change mindsets,” he tells TechCrunch. “In the past I was able to help tonnes of people realize that they were capable of doing things that they thought they were never capable of doing. My understanding is that in order to generate those cultural changes you need to do one thing first: That is generating a vision for the future.

“That’s why we insist so much that by 2030 Spain is going to become an entrepreneurial nation with the greatest social impact in history and that we have a plan for that… Where we take the entrepreneurship and we help them spearhead this new innovation model. We leverage all the driving sectors of the economy so we are actually building on success; on the actual success of Spain as an international economy. And that there’s something for you in that plan. That’s why we are including in the strategy at the basis of the strategy the inclusion policies in order to close the gender gap, the territorial gap, the socio-economic gap, the generational gap.

“In order to change cultures you need to align people into working together towards building something that is greater than themselves and I think that with the Spain entrepreneurial nation strategy we made that first step. And this is why — and this is a parenthesis — that’s why we say the [startup] law is as important as having this strategy.”

That startup law — due to be presented shortly in draft (aka as an anteproyecto de ley) for approval by the Council of Ministers, before going to parliament for a wider debate process (and potential amendments) — is the first piece of legislation aligned with the wider strategy. It also looks set to be one of its first deliverables.

Although it’s not clear how long it will be before Spain gets its shiny new startup law. (The country’s politics has lacked consensus for years; Sanchez’s “progressive coalition” was only put together after he tried and failed to get a full majority for his Spanish Socialist Workers’ Party (PSOE) twice in a row.)

“That’s something that is difficult to say because there are laws that have a shorter and others that have a longer period of approval,” says Polo, on the timeframe for passing the legislation. “For us the important issue here is that the startup law has a full process — so it has a full agreement on every side of the hill so it becomes robust and stable legislation for the years to come.”

This “long awaited” regulation which the ecosystem has been calling for for “years”, per Polo, will address a number of different issues — from the first legal “definition” of startup (to reflect differentiation vs other types of companies); to measures to help startups retain and attract talent.

“We need to reform stock options so that they become a tool in order to compete internationally for talent,” he says, noting that the idea is to enable Spain to compete with regimes already offered by countries elsewhere in Europe, such as the U.K., France and Germany.

“Also we need to reform visas in order to again retain and attract that talent,” he continues. “The president also talked about incentivizing investment and having a certain degree of tax breaks — and we understand that business angels need more incentives. So we have a more ordain and logical system of investment at the pre-seed and seed stage. And many other actions — it’s the Ministry of Economy that will end up with the final text that will be passed in the Council of Ministers in the coming weeks.”

Polo cautions that the law won’t instantly fix every gripe of founders and investors in Spain. Clearly it’s going to be a marathon, not a sprint.

“That’s why we have a strategy,” he emphasizes. “I understand the interest in the startup law but I always say that as important as the startup law is the Spain entrepreneurial nation strategy. Because it’s in there where we address the big problems that we have as a country when it comes to the ecosystem. And in there we have pointed out four big challenges that we have.

“First is investment. We need to accelerate the velocity of maturity of the investment in Spain… The numbers have been growing, year after year, and they look really good. So what we want to do is to help accelerate those numbers so we are able to run faster and close the gap that we have between us and our neighbours: Basically Germany and France. That they have 4x or 5x the number of investment that we have in Spain. We really want to be in ten years in a place where Spain could be leading the investment in innovative entrepreneurship in mainland Europe.

“Second challenge: Talent. We know that in order to build the entrepreneurial nation we need all the talent that we have. So we need to develop the internal talent but we also need to attract international talent and we need to retain that talent. So that’s why we were talking about the different tools that might be included in the startup law.

“The third challenge is scaling up. We in Spain have a lot of companies that assimilate success to selling. And that’s great — it’s totally legitimate. But what we need as a country is to have an increasing percentage of companies in the future that do not think about selling as a synonym of success; but they think about buying other startups around the world. Of growing. Of scaling up. So they started building today the big companies that in the future by 2030 they will generate thousands of good quality jobs in Spain which is the ultimate goal and the bottom line of the strategy.

“And the fourth goal: Turn the political administration into an entrepreneurial administration. Meaning that the political administration, it’s more agile. That we generate a positive benchmark. And that sometimes the public sector makes the investment that not even the riskier of venture capital funds can do. Because that’s the role of the public sector; to generate this kind of visions and to put the means in in order to achieve those. So among all the challenges that we have in the ecosystem it’s something we have put together in the strategy — that is going to addressed not only with one law but with 50 different measures that we included in the Spain entrepreneurial nation strategy.”

The wider entrepreneur strategy talks about nine priority actions to be developed in the next two years via certain projects — which Polo envisages being accelerated in the near term with the help of EU coronavirus recovery funds.

He highlights a couple of priority projects: One to create a network to link entrepreneurs and policymakers with the wider ecosystem, and another to connect incubators and accelerators to build out a national support network for founders — both of which have been inspired by approaches taken in other European countries.

“Among these projects we have one — Oficina Nacional de Emprendimiento — which is deeply inspired by La French Tech in France. So we want to generate a one-stop shop for entrepreneurs, investors and the rest of the ecosystem to access all of opportunities of collaboration between the central government, regions and CP councils in order to improve entrepreneurship in their respective areas,” says Polo.

“We have other projects like Renace — which is an acronym for Red Nacional de Centros de Emprendimiento — and in there we’ve also been inspired by the network that Portugal has that are doing such exciting things. So what we want to do is help connect the different incubators and accelerators and venture builders that we have in Spain. So they’re at first connected and we add more value — but with one particular focus: The different gaps.

“With Renace in particular we want to help close the territorial gap. Because it’s going to be very interesting to be able to work with engineers in Cáceres for a company that is based in Barcelona. Or to work with a team of designers from the Basque country for a company that is setting up in Malaga. With Renace we can help integrate the country and really talk about an entrepreneurial nation and not just cities. So Spain has the potential to build that. And there are many others issues.”

France alone spends billions annually both on R&D and on direct support for the digital sector. And even with EU funding Spain can’t hope to match the level of “ecosystem” spend of richer, northern European countries. But Polo says the plan is to make the most of what it has with the resources it can marshal — hence, with the Renace project, it’s about linking up existing incubators/accelerators (and adding “a new layer of value” such as via public-private partnerships).

“When you end up reading the Spain entrepreneurial strategy you realize it’s not a billionaire plan of money that you put on the table in order to start building this Spain entrepreneurial nation,” he says. “It’s instead a very robust plan in order to create that vision and putting together the different pieces that we already have — the different assets that we have as a country to start working together intelligently so we can make the best of everything that we can.”

Polo also argues that Spain is already doing well on the startup cluster front — saying it stands alone with Germany in having more than one city ranked among the top 10 “most entrepreneurial” in Europe, per such listings. More recently, he says, Spain has risen further up these listicles — as more of its cities have popped up in the “global competition for innovative entrepreneurship”.

“Meaning that in different places of Spain there are many cities and regions that have the hunger to become a place that is helping entrepreneurs to create this kind of economy. And we can get many more,” he suggests, pointing to Renace‘s hoped for value from a social inclusion angle.

“With Renace what we want to do is generate this network and add more value — provide services, get into public-private partnership in order to add the value of the different places that we have in the country. So let’s say that a company in Barcelona can find tonnes of engineers in a city like Cáceres. The company in Barcelona becomes more competitive because the salaries in Cáceres — if you pay them the best salary in Cáceres they could be two-thirds of the salary in Barcelona. So the company in Barcelona becomes more competitive. But also the engineers in the city of Cáceres who want to stay in the region, who want to stay with their family or to have a life-project in Cáceres they can stay. So this is an example of how we can close the territorial gap and also become really integrated startup nation in the full term of nation.”

“The ultimate goal of the Spain entrepreneurial nation strategy is turning Spain into a country that is able to avoid the effects of different crises. And particularly the effects of that we saw in 2008 when the most vulnerable jobs were destroyed overnight — and they were counted by tens of thousands. That particularly struck the young people with unemployment rates that were above 55%. The immigrants and the people over 50. We don’t want that to happen again. So there’s been a very profound reflection on what needed to happen in Spain for that to change. And the conclusion was that we needed to change the productive basis of the country,” he continues.

“That’s why we are putting together a strategy that is going to help the innovative entrepreneurship sector spearhead these new models, this new economic model for Spain. That is going to be leveraging the different driving sectors of the economy — those ten sectors that we state in the strategy — and that as it could not be differently in a 21st century strategy, and particularly a strategy designed by a new generation of politicians and trying to respond to the ambitions of the new generations that is a strategy that is not including the social impact of this phenomenon. So that’s why we are also focused on putting together inclusion policies.”

Polo won’t be drawn into naming any especially promising startups he’s encountered on his travels around Spain — referring instead to the “tonnes of super innovative companies” he says he’s sure will soon be disrupting business as usual in Spain and (the government hopes) internationally — from battery charging companies to retail disruptors working on new ways to make clothes. (“Different kinds of innovations that people can’t imagine,” is his pithy shorthand.)

“What we are trying to do every time we have an opportunity is to also promote the knowledge of these companies — and also help Spanish people and also people abroad — to know that we have everything that we need in order to succeed as a nation and become that entrepreneurial nation with the greatest social impact in history,” he adds, acknowledging that a big part of his mission is “to tell the rest of the world that we are here”.

Powered by WPeMatico

Miami is quickly becoming a symbol for the tech exodus from Silicon Valley. The area is home to a number of investors, successful tech founders and an eager local government.

For this survey, TechCrunch spoke to a number of investors about the area’s potential, opportunities and key players. This is the second survey TechCrunch published on the area and the first can be found here.

In this survey, these investors agree on several aspects of Miami. They see a huge opportunity for the region to become a major startup hub by utilizing its diverse workforce and wonderful quality of life. As they say below, the future of work is uncertain and Miami is becoming more attractive as workforces disconnect from office buildings.

We spoke to the following investors:

Use discount code MIAMICRUNCH to save 25% off a 1-year Extra Crunch membership

This offer expires on April 30, 2021

Where do you see Miami’s startup scene five years from now?

Miami’s startup scene has been growing and evolving over the past 5+ years thanks to local organizations supporting entrepreneurship including, but not limited to Endeavor Miami, The Knight Foundation, The Lab, Rokk3r Labs, eMerge Americas, Miami Angels and Wyncode. Many of Miami’s entrepreneurs, investors and startups have historically had ties to Latin America. I think going forward, the Miami tech scene will certainly continue to be a conduit to Latin America as it has been in the past. However, I predict more non-Latin American founders, investors, engineers and operators from cities like New York, LA and San Francisco, will also choose to build their businesses in Miami due to higher quality of life and more attractive tax rates. This dynamic will bring more relevant talent and a larger, more robust tech ecosystem to South Florida.

Remote work is pushing and pulling the global workforce. This means that offices will disappear from Miami, even with more companies moving in, but also more locals who work remotely for companies elsewhere. How do you see these factors impacting the city’s tech evolution?

I think we will see more diverse talent flow through Miami as a result of remote work becoming the norm. If employees technically headquartered in other cities are able to work remotely from anywhere, why not try out working from home while based in sunny Miami where one can be outdoors every day of the year? I recently joined a WhatsApp chat called “Nomads in Miami” that includes a variety of intellectually curious people from all walks of life (from creatives, to entrepreneurs, to traditional professionals) who are either temporarily in Miami this winter or have made a permanent move to South Florida. This chat is reflective of new groups of people coming to experience The Magic City. Anecdotally, I’ve found that many of these people who are “testing Miami out,” had never spent significant time in Miami before. I also recently joined another WhatsApp chat #miamitechlife that includes a local community of founders, investors, executives and local leaders to meet, collaborate and network while engaging in fun activities around Miami. There is an excitement and energy in Miami right now, and I believe it’s here to stay!

What industry sectors do you focus on within Miami (and beyond)? What is happening in Miami now that you’re most excited to fund?

I recently launched a growth equity fund called Clerisy with my amazing business partner Lisa Myers who was most recently a partner at L Catterton, a leader in consumer private equity. We are excited to invest in fast-growing consumer and techsumer companies doing over $10 million in revenue, are quickly scaling and need growth capital. We will fund businesses that meet our criteria in categories we like such as health and wellness, consumerization of healthcare, food and beverage, beauty, and other consumer and techsumer areas. I would be thrilled to find an investment based in Miami, however Clerisy is not focused on a specific geography. We will invest in businesses located in cities or countries where we have previous business experience and ample, relevant networks.

What are some of the local challenges you’ve encountered or seen founders struggle with? More generally, how should people looking to hire in, invest in, or relocate to Miami think about doing business in the city?

The Miami tech ecosystem is smaller than in the Bay Area or New York and arguably less intense, with fewer exits so far of which to speak. Although tightly knit, it is indeed welcoming to newcomers. I think this local hospitality is because Miami has had a bit of a transient nature among some of its inhabitants due to many Latin Americans coming and going every year, depending on the political or economic situations in their respective home countries. I think it will be easier than ever to convince new hires to relocate to Miami. The more success and exits Miami’s existing startups have, the easier it will be to attract more investment at the local level and more future talent.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystem roles like lawyers, designers, growth experts, etc.

On a local level, Miami needs a range of people to support its startup ecosystem: founders, high-quality talent ranging from engineers to marketers to creatives, angel investors, venture capital and private equity funds, lawyers, and then ideally a loyal and engaged consumer base that proudly supports its local companies.

Where do you see Miami’s startup scene five years from now?

Miami has everything in place to accelerate its rise to be cemented as a significant tech/startup ecosystem. It now has capital (investors), founders, talent and infrastructure, each growing by the day given the attractiveness to the area. In five years, I am confident Miami will only trail SF, NYC, LA and Boston in terms of size/deals.

Remote work is pushing and pulling the global workforce. This means that offices will disappear from Miami, even with more companies moving in, but also more locals who work remotely for companies elsewhere. How do you see these factors impacting the city’s tech evolution?

It’s a double-edged sword. In a positive sense, you’ll get founders moving here, building out remote/distributed/hybrid teams. You’ll also have individual employees living here, but working remotely for companies based in other areas. What will be harder to get is the giant company all built from scratch with everyone local. These successes (e.g., Uber in SF) create thousands of future founders, operators and investors that pay it forward in their ecosystem. Without that, it will be tough to truly crack the top tier.

What industry sectors do you focus on within Miami (and beyond)? What is happening in Miami now that you’re most excited to fund?

As a firm, we focus broadly on consumer, marketplaces, e-commerce infrastructure, real estate technology and fintech. Given the influx of talent, I’m not sure if Miami needs to be pigeonholed to a few sectors. Traditionally, it’s been known for travel/hospitality, healthcare tech and real estate tech, but I’m already seeing emerging trends around blockchain/crypto, fintech, remote work and even some traditional enterprise SaaS. Miami is also an incredible bridge to Latam and South America and I can see a slew of companies taking advantage of that.

What are some of the local challenges you’ve encountered or seen founders struggle with? More generally, how should people looking to hire in, invest in or relocate to Miami think about doing business in the city?

The physical dispersion can make it more difficult. Just in Miami, there are minihubs in Brickell, Wynwood/Midtown, The Grove, Coral Gables, etc. Then you have completely separate networks up north in Fort Lauderdale, Tampa, etc.

Additionally, Miami needs a bigger focus and contribution from its universities. Silicon Valley, LA, Boston and New York each have top-tier institutions that churn out tech talent. That’s still missing here.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystem roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

Honestly, I am uncovering more each day. And everyone likes to talk about the “big names” that have recently moved here, like Keith Rabois, Anthony Pompliano, Harry Hurst, Jon Oringer, etc. But I also have deference to the folks that have been here, working tirelessly for years, creating the foundation. Some that come to mind: Melissa Medina, Matt Haggman, Nico Berardi, Shervin Pishevar, Raul Moas, Nancy Dahlberg, Rebecca Danta, Moishe Mana, Laura Maydon, Brian Brackeen, Tony Jimenez, Brian Breslin, Juan Pablo Cappello, Mellissa Krinzman, Mark Kingdon, and now, of course, Mayor Francis Suarez.

Where do you see Miami’s startup scene five years from now?

We think that things are still very early, but are bullish on the future of Florida tech. One of the key things to work on over the next five years is the continued community building — right now, there are a lot of disparate groups and not much communication between them. Over time, that cohesiveness could really drive south Florida forward as a tech ecosystem.

Remote work is pushing and pulling the global workforce. This means that offices will disappear from Miami, even with more companies moving in, but also more locals who work remotely for companies elsewhere. How do you see these factors impacting the city’s tech evolution?

We do think there will be a future for offices and in-person collaboration. Across our entire portfolio nearly all companies have some plan to retain in-person talent. The biggest benefit is that remote work has enabled people in Big Tech to work outside of Silicon Valley, and it appears Miami and South Florida, more broadly, are enjoying the benefits of that decentralization. The distribution of talent will benefit founders here locally as the old VC expectations of tech talent to be hyperconcentrated in Silicon Valley is no longer as true, and people here locally will have access to better resources.

What industry sectors do you focus on within Miami (and beyond)? What is happening in Miami now that you’re most excited to fund?

Our fund targets two primary themes: B2B vertical SaaS and SaaS-enabled businesses/marketplaces, and broadly what we call knowledge worker tools — DevOps, cybersecurity and other typically product-led horizontal applications. Within vertical SaaS, logistics and supply chain tech has really taken off within the last few years, with even more tailwinds due to COVID’s impact on consumer demand and delivery expectations. As logistics is a huge industry for Miami and Florida, we think startups here have a very exciting opportunity in that space. We have now funded several companies in Florida across various aspects of logistics, from final mile delivery to long-haul trucking route optimization.

What are some of the local challenges you’ve encountered or seen founders struggle with? More generally, how should people looking to hire in, invest in or relocate to Miami think about doing business in the city?

Access to capital has been a significant problem for Florida-based founders since before we started our first fund back in 2016. There are relatively few funds actively investing in tech companies here at the seed and Series A stage, and essentially none post-Series A. Companies have historically had difficulty getting attention from Silicon Valley-based VCs due to the preconceptions of Florida as a bad place to start a company. Even as recently as last year the standard line from some Bay Area investors was, “Move out of Florida if you are serious about raising money.” That said, some of these preconceptions have been deserved, as historically South Florida as a business community has been prone to falling for flash over substance and that has occasionally been true for investors and startups as well. With the buzz around Miami and Florida as a place of interest for VCs and tech, we hope that attitudes around funding Florida companies have changed, as it is clear that good businesses can be built anywhere.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystem roles like lawyers, designers, growth experts, etc.

We’d like to mention all of our Florida-based companies who have been heads down building great businesses here locally — ReloQuest, CarePredict, OneRail, SmartHop and Plum. They are all hiring and growing like crazy, and several have received follow-on funding from top VCs. Check them out!

Where do you see Miami’s startup scene five years from now?

Cities with a diverse set of well-represented industries are often fertile grounds for building interesting companies. New York is a great example. Tech ecosystems thrive in an environment where you can unearth and solve a myriad of different problems versus just the problems of a single sector. The most interesting and lucrative companies tend to focus on blindspots in big markets. The blindspots are often discovered when they emerge out of silo and there’s a creative flow between industries. This is why I believe the diversity of industries and talent is ultimately a strength for Miami.

Remote work is pushing and pulling the global workforce. This means that offices will disappear from Miami, even with more companies moving in, but also more locals who work remotely for companies elsewhere. How do you see these factors impacting the city’s tech evolution?

One of the reasons it seems a lot of people are moving to Miami now is the fact that their job may not be tethered to a geographic location and they can work where they enjoy living. Given this unique strength to encompass work/life balance, Miami can experiment with hybrid models of working environments. Perhaps the dichotomy of working in an office versus working at home is dated. Offices were created for a time when technology used to be limited and the fastest way to communicate was in person. In-person interaction is important, but perhaps there are ways we can maintain [in-person interaction] that are not necessarily tethered to an office and that incorporate more ways to integrate with one’s life.

What industry sectors do you focus on within Miami (and beyond)? What is happening in Miami now that you’re most excited to fund?

Consumer healthcare is an area I’ve been actively investing in, and it seems like there’s been a lot of activity in Miami in that vertical, ranging from medical robotics to remote monitoring for chronic illnesses. I’m also interested in the future of work and the creator economy, and I believe the diverse set of industries in Miami will breed interesting companies that address the need for people to lucratively pursue their passions.

What are some of the local challenges you’ve encountered or seen founders struggle with? More generally, how should people looking to hire in, invest in, or relocate to Miami think about doing business in the city?

People in Miami joke that they run on “Miami time,” which is something between island time and how New Yorkers think of time.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystem roles like lawyers, designers, growth experts, etc.

Miami is a city built by immigrants, and that strength is what will allow Miami to thrive as a tech ecosystem; immigrants start businesses at higher rates than those who are native born. It seems like female founders in particular have been quietly building interesting and successful businesses here.

Where do you see Miami’s startup scene five years from now? The city has attracted a wide range of people over the years, including more tech and finance companies very recently. How will it add up to something more than the sum of the parts?

If you think of Miami as a product and evaluate its adoption curve, it seems like we have reached the chasm. I.e., those of us who have been here pre-COVID are like those you’d characterize as innovators and the during-COVID crowd as the early adopters. Miami is at the point where we now need to prove we can continue on the curve from early adopters to early majority.

Five years from now we’ll hopefully be focused on headlines showcasing startups that are growing and hiring here, and not just about which investor has relocated here (which is also good, don’t get me wrong, but not the end-all).

We can also wish that Miami’s best traits — its international perspective, its racial, socioeconomic and cultural diversity — will infuse something unique and truly distinctive into the founders and investors building their businesses here.

Remote work is pushing and pulling the global workforce. This means that offices will disappear from Miami, even with more companies moving in, but also more locals who work remotely for companies elsewhere. How do you see these factors impacting the city’s tech evolution?

I don’t see a future where humans stop interacting with each other IRL. While how we “work” will look very different, offices “disappearing” is a bit of a stretch. It’s more likely that we will see an evolution of what an office looks like and how it functions as a “hub.”

Miami is full of disjointed “neighborhood clusters.” Up until now, this has been a negative, but given the changes we are going to see in how we work, I believe this is no longer as critical. In fact, it can be seen as an advantage where someone could live/work on the beach, and go to events/meetings at their “hub,” which may be elsewhere, when needed versus being so focused on living close to your workplace since you need to commute every day.

What industry sectors do you focus on within Miami (and beyond)? What is happening in Miami now that you’re most excited to fund?

While we’ve been based in Miami for the last seven years, we invest globally. In fact, COVID has made it even more acceptable to not be geographically constrained. This is the precise reason you are seeing investors move here.

We invest in fintech, healthcare tech, consumer tech and consumer products.

One of our most exciting portfolio companies is based in Broward: CarePredict. With the changes that COVID has brought about, they are uniquely placed to take advantage and provide the right dose of technology that eldercare requires.

Within our local ecosystem, Chewy and MagicLeap have been large employers. I’m most excited to see what their employees branch out and create in the coming years.

We are also excited to see a growing number of exceptionally talented founders moving to Miami to start their companies. These talents may have selected San Francisco or NYC previously, which is a great opportunity for us to meet exceptional teams at the infancy of an idea.

What are some of the local challenges you’ve encountered or seen founders struggle with? More generally, how should people looking to hire in, invest in or relocate to Miami think about doing business in the city?

Angel rounds are challenging here as compared to other more mature markets where founders or folks from the startup ecosystem play a larger role in angel rounds. Most local angels are used to investing in real estate, and approach early-stage deals differently than those who may be more accustomed to the asset class.

Hiring top-quality talent was also traditionally more challenging here than in tier-one entrepreneurial cities. With the significant influx of remote workers in the past year and the change in perceptions about Miami, we are hopeful that local companies will be able to overcome this challenge.

Miami is a collection of neighborhood clusters, as I mentioned earlier. If someone is looking to relocate here, they should spend some time getting to know what works for them before they commit to a neighborhood.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystem roles like lawyers, designers, growth experts, etc.

Where do you see Miami’s startup scene five years from now?

If the leaps we have made in the last five years are any indication of the next five, we believe Miami will be the next big tech hub in the southern United States. We have all the right pieces to make that true: engineer/developer schools and academies, startup programs and accelerators for seed, a thriving tech community, exits from founders reinvesting in the next generation of founders, influx of new capital, quality of life that tech company founders and employees are starting to prioritize, engaged local government as we have recently seen, as well as an incredibly diverse pool of talent.

Remote work is pushing and pulling the global workforce. This means that offices will disappear from Miami, even with more companies moving in, but also more locals who work remotely for companies elsewhere. How do you see these factors impacting the city’s tech evolution?

We believe talent has no zip code and smart cities are those that attract and retain the best talent — it’s no longer just about connectivity or infrastructures exclusively. In the past, people had to relocate to work at their dream job sacrificing too much personally. 2020 has just confirmed that you don’t need to sacrifice the way you want to live your life because of a dream job. The complaint we used to hear from talent was that there were not enough mid- to senior-level roles in Miami in tech — remote work has significantly strengthened Miami. Miami is a dream destination for a lot of people in different stages of life, so we see Miami also becoming a great remote work hub for those that can be 100% remote, even if they only spend part of the year here and then migrate to other climates. The workforce has more choices now than ever before and we think people will start to really put quality of life over job location. It is a true game changer.

What industry sectors do you focus on within Miami (and beyond)? What is happening in Miami now that you’re most excited to fund?

We have been based in Miami for the past four years and we invest from Miami to where the best founders are. Sometimes [they are] in Miami and sometimes in other states or countries. “We are from Miami to the world.” We are now witnessing a huge internal movement from other states to Miami, but many of us moved from our countries to Miami because of the immense opportunities Miami offers. We invest in software companies disrupting traditional industries, Health tech, fintech, mobility, cybersecurity and jobs. We have also invested in marketplace business models in products disrupting travel, pets, solutions for SMBs. We love giving a first ticket from $100,000 to seed stage companies jointly with a product-led growth program or a pre-Series A to a ticket of an average of $3 million through our Fund II. We love diverse companies, international mindset and execution over anything else.

Miami has always been an extraordinary hub for fintech, we are closely following interesting companies in this space and obviously health tech. We have to say that we have seen very disruptive companies in proptech and also very interesting marketplaces of all kinds B2C and B2B.

What are some of the local challenges you’ve encountered or seen founders struggle with? More generally, how should people looking to hire in, invest in or relocate to Miami think about doing business in the city?

Our biggest challenge has always been fighting the biases of people around Miami. You have to experience Miami to understand the opportunities it brings. It’s a very welcoming city where so many people will help you land. The next biggest challenge is that the amount of capital that Miami moves versus how much is invested in tech is ridiculous, really a pity. For this reason we need a fund of funds that supports the local funds so that they can develop the ecosystem on this front. And I am not talking about leftovers of capital that need to meet a quota or small initiatives. I mean people investing with true conviction in the asset. That is what gets the flywheel running, capital to fund managers that chose the right entrepreneurs from Miami or outside [and] that create jobs, etc. Let’s not forget that capital attracts founders and founders develop a huge industry that creates thousands of jobs. It is not only about investing in Miami, it’s also about investing from here to the world.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc?

Sure, Juha and Johanna Mikola from Wyncode [since submitting these answers, the company was acquired by Brain Station], Andrew Parker from Papa, Claudia Duran from Endeavor, Victor Servin — CTO of TheVentureCity, David Smith — chief data scientist from TheVentureCity, David Marcus — chief product officer at TheVentureCity. Jimena Zubiria — VP of People at TheVentureCity, Anabel Perez-Novo — CEO of NovoPayment, Adolfo Babatz — CEO of Clip, Rodrigo Teijeiro — CEO of RecargaPay, Jackie Baumgarten — CEO of Boatsetter, Justin Meyers — CEO of Explorest and Vivek Jayaram (lawyer).

Powered by WPeMatico

Mark your calendar for TechCrunch’s annual celebration of the startup community — TC Disrupt 2021 returns this September 21-23! At Disrupt, you’ll rub virtual elbows with the thousands of startup founders, investors and innovators building cutting-edge products and companies. Disrupt will be all-virtual, allowing more builders from around the world to share in the learning, growth, connection and excitement that you can only experience with TechCrunch.

As always, networking will be front and center. You’ll have the opportunity to make spontaneous connections, curated connections with CrunchMatch and chat with other attendees, all while watching sessions. Between the tools provided by our virtual event platform and curated matches, you’ll make valuable connections and expand your network.

Every year we iterate on the Disrupt experience to make sure the event includes more of what founders, investors and innovators want and need to be successful. This year, on the Disrupt Stage we’ll not only bring you the minds behind the headlines but also incorporate analysts’ viewpoints, and highlight emerging founders in Startup Alley in an engaging format geared toward helping you find solutions, build your business or expand your portfolio.

We’re also growing the Startup Battlefield cohort this year. Featuring more startups means more opportunity for founders. If you’re a founder or startup selected for Startup Battlefield, you’ll be able to pitch to a panel of renowned VCs for a chance to win $100,000 in equity-free prize money. Applications for Startup Battlefield will open Q2 2021.

Our Extra Crunch Stage will continue to be a valuable resource for entrepreneurs who are looking to tap the minds of experts and VCs across a variety of industries and categories. In highly interactive sessions, you’ll be able to get your questions answered live or have your pitch deck analyzed to help you refine your fundraising and business development strategies. Plus, all applicable passes will get a three-month membership to Extra Crunch, which gives you a library of insider analyst content that you can put into action at your company right away.

For those early-stage founders who are looking to get some extra exposure for their products and company, the Startup Alley experience is for you. The founders who are accepted into Startup Alley will get a dedicated listing at the virtual event, where they can hold live product demos, generate leads and chat with interested attendees. Founders in Startup Alley will also give a live 60-second elevator pitch to TechCrunch staff for feedback and there will be dedicated time for attendees to browse startups in each category during the Startup Alley Crawl. With a dedicated success manager in your corner providing you tips on how to use all of the items in your toolkit, this is a perfect opportunity to gain new customers, meet potential investors and expand your professional social graph.

From the Startup Alley exhibitors we will also select up to 50 founders to participate in Startup Alley+, which will give them access to a pre-Disrupt series of master classes to prep for the event, pitch-off opportunities at Extra Crunch Live and white-glove curated meetings with investors from the TechCrunch network.

There is much more happening behind the scenes to add to your TC Disrupt 2021 experience that we will be sharing with you over the coming weeks, but we know you’ll want to secure your spot at Disrupt now. Passes are now available at the lowest Super Early-Bird rate, with additional savings available on top of that for founders, students and employees of nonprofits and government organizations. These passes are your full-access ticket to everything Disrupt has to offer and more for under $100 — but only for a limited time. Be a part of the startup world’s annual rite of passage online this September 21-23 and register today!

Powered by WPeMatico

Building a front-end for business applications is often a matter of reinventing the wheel, but because every business’ needs are slightly different, it’s also hard to automate. Kleeen is the latest startup to attempt this, with a focus on building the user interface and experience for today’s data-centric applications. The service, which was founded by a team that previously ran a UI/UX studio in the Bay Area, uses a wizard-like interface to build the routine elements of the app and frees a company’s designers and developers to focus on the more custom elements of an application.

The company today announced that it has raised a $3.8 million seed round led by First Ray Venture Partners. Leslie Ventures, Silicon Valley Data Capital, WestWave Capital, Neotribe Ventures, AI Fund and a group of angel investors also participated in the round. Neotribe also led Kleeen’s $1.6 million pre-seed round, bringing the company’s total funding to $5.3 million.

After the startup he worked at sold, Kleeen co-founder, CPO and President Joshua Hailpern told me, he started his own B2B design studio, which focused on front-end design and engineering.

“What we ended up seeing was the same pattern that would happen over and over again,” he said. “We would go into a client, and they would be like: ‘we have the greatest idea ever. We want to do this, this, this and this.’ And they would tell us all these really cool things and we were: ‘hey, we want to be part of that.’ But then what we would end up doing was not that. Because when building products — there’s the showcase of the product and there’s all these parts that support that product that are necessary but you’re not going to win a deal because someone loved that config screen.”

The idea behind Kleeen is that you can essentially tell the system what you are trying to do and what the users need to be able to accomplish — because at the end of the day, there are some variations in what companies need from these basic building blocks, but not a ton. Kleeen can then generate this user interface and workflow for you — and generate the sample data to make this mock-up come to life.

Once that work is done, likely after a few iterations, Kleeen can generate React code, which development teams can then take and work with directly.

As Kleeen co-founder and CEO Matt Fox noted, the platform explicitly doesn’t want to be everything to everybody.

“In the no-code space, to say that you can build any app probably means that you’re not building any app very well if you’re just going to cover every use case. If someone wants to build a Bumble-style phone app where they swipe right and swipe left and find their next mate, we’re not the application platform for you. We’re focused on really data-intensive workflows.” He noted that Kleeen is at its best when developers use it to build applications that help a company analyze and monitor information and, crucially, take action on that information within the app. It’s this last part that also clearly sets it apart from a standard business intelligence platform.

Powered by WPeMatico

Archer Aviation, the electric aircraft startup that recently announced a deal to go public via a merger with a blank-check company, plans to launch a network of its urban air taxis in Los Angeles by 2024.

The announcement comes two months after the formation of the Urban Air Mobility Partnership, a one-year initiative between Los Angeles Mayor Eric Garcetti’s office, the Los Angeles Department of Transportation and Urban Movement Labs to develop a plan for how to integrate urban aircraft into existing transportation networks and land use policies. Urban Movement Labs, launched in November 2019, is a public-private partnership involving local government and companies to develop, test and deploy transportation technologies. Urban Movement Labs and the city of Los Angeles are working on the design and access of “vertiports,” where people can go to fly on an “urban air mobility” aircraft. Urban air mobility, or UAM, is industry-speak for a highly automated aircraft that can operate and transport passengers or cargo at lower altitudes within urban and suburban areas.

Archer Aviation’s announcement comes two weeks since it landed United Airlines as a customer and an investor in its bid to become a publicly traded company via a merger with a special purpose acquisition company. Archer Aviation reached an agreement in early February to merge with special purpose acquisition company Atlas Crest Investment Corp., an increasingly common financial path that allows the startup to eschew the once traditional IPO process. The combined company, which will be listed on the New York Stock Exchange with ticker symbol “ACHR,” will have an equity valuation of $3.8 billion.

United Airlines, which has a major hub in Los Angeles, was one of the investors in the deal. Under the terms of its agreement, United placed an order for $1 billion of Archer’s aircraft. United has the option to buy an additional $500 million of aircraft.

“Archer’s commitment to launch their first eVTOL aircraft in one of United’s hubs means our customers are another step closer to reducing their carbon footprint at every stage of their journey, before they even take their seat,” Michael Leskinen, vice president of corporate development and investor relations at United Airlines, said in a statement. “We’re confident that Los Angeles is only the beginning for Archer and we look forward to helping them extend their reach across all of our Hubs.”

Archer has a ways to go before it’s ready to shuttle passengers. The company has yet to mass produce its electric vertical take-off and landing aircraft, which is designed to travel up to 60 miles on a single charge at speeds of 150 miles per hour. The company previously said it plans to unveil its full-scale eVTOL later this year and is aiming to begin volume manufacturing in 2023.

Designing and building a hub of vertiports is among the numerous tasks that must be completed in the next three years. Brett Adcock and Adam Goldstein, the company’s co-founders and co-CEOs, have said they’re open to using existing infrastructure such as helipads and parking garages in the short term. Their eVTOL, known as “Maker,” is built to fit within the size of the existing infrastructure, according to the company. That flexibility, assuming the Urban Air Mobility Partnership agrees with the strategy, could help Archer meet its 2024 deadline.

Powered by WPeMatico

What is working in the office going to look like in a post-COVID-19 world?

That’s something one startup hopes to help companies figure out.

Saltmine, which has developed a web-based workplace design platform, has raised $20 million in a Series A funding round.

Existing backers Jungle Ventures and Xplorer Capital led the financing, which also included participation from JLL Spark, the strategic investment arm of commercial real estate brokerage JLL.

Notably, JLL is not only investing in Saltmine, but is also partnering with the San Francisco-based startup to sell its service directly to its clients — opening up a whole new revenue stream for the four-year-old company.

Saltmine claims its cloud-based technology does for corporate real estate heads what Salesforce did for CROs in digitizing and streamlining the office design process. It saw an 80% spike in ARR (annual recurring revenue) last year while doubling the number of companies it works with, according to CEO and founder Shagufta Anurag. Its more than 35 customers include PG&E, Snowflake, Fidelity and Workday, among others. Its mission, put simply, is to help companies “create the best possible workplaces for their employees.”

Saltmine claims to have a 95% customer retention rate and in 2020 saw 350% year over year growth in monthly active users of its SaaS platform. So far, the square footage of all the office real estate properties designed and analyzed by customers on Saltmine totals 50 million square feet across 1,500 projects.

Saltmine says it offers companies tools to do things like establish social distancing measures in the office. Its platform, the company says, houses all workplace data — including strategy, design, pricing and portfolio analytics — in one place. It combines and analyzes floor plans with project requirements with real-time behavioral data (aggregated through a combination of utilization sensors and employee feedback) to identify companies’ design needs. Besides aiming to improve the workplace design process, Saltmine claims to be able to help companies “optimize their real estate portfolios.”

The pandemic has dramatically increased the need for a digital transformation of how workplaces are designed and reimagined, according to Anurag.

“Given the need for social distancing capabilities and a greater emphasis on work-life balance in many office settings, few workers expect a complete ‘return to normal,’ ” she said. “There is now enormous pressure on corporate heads of real estate to adapt and modify their workplaces.”

Once companies identify their new needs, Saltmine uses “immersive” digital 3D renderings to help them visualize the necessary changes to their real estate properties.

Singapore-based Anurag has previous experience in the design world, having founded Space Matrix, a large interior design firm in Asia, as well as Livspace, a digital home interior design company.

“I saw the same pain points and unmet needs in office real estate that I did in the residential market,” she said. “Real estate is the second-largest cost for companies and has a direct impact on their largest cost — their people.”

Looking ahead, Saltmine plans to use its new capital to (naturally) do some hiring and continue to acquire customers — in particular, seeking to expand its portfolio of Global 2000 companies.

Saltmine has about 125 employees in five offices across Asia, Europe and North America. It expects to have 170 employees by year’s end and to be profitable by the end of fiscal year 2021.

The company’s initial focus has been in North America, but it is now beginning to expand into APAC and Australia.

JLL Technologies’ co-CEO Yishai Lerner said JLL Spark was drawn to Saltmine’s approach of making data and analytics accessible in one place.

“Having a single source of truth for data also facilitates collaboration across teams, which is important, for example, in workspace planning,” he told TechCrunch. “This reduces inefficiencies and improves workflows in today’s fragmented design, build and fit-out market.”

JLL Spark invests in companies that it believes can benefit from its distribution and network — hence the firm’s agreement to sell Saltmine’s software directly to its customers.

“As JLL tenants and clients continue to embrace the future of work, they are seeking technology solutions that keep their buildings running efficiently and effectively,” Lerner said. “Saltmine’s platform checks all of the boxes by streamlining stakeholder collaboration, increasing transparency and simplifying data management.”

Powered by WPeMatico

Whether you’re working on something new according to your Twitter bio, or self-employed, according to your LinkedIn bio, founder Ben Huffman thinks his platform, Contra, will be the best way for independent workers to explain and monetize what they are working on.

Contra is a platform that wants professionals to create profiles that show project-based identities, versus a role-based identity that one would show on LinkedIn. It’s been built for what Huffman thinks is the future: digital knowledge workers, a term he uses to describe independent tech workers who freelance for different companies or gigs.

The early adopters are independent workers who want to work or advise for a product team.

“So you can think about any type of modern-day product team consisting of like a designer, an engineer, a PM, maybe a writer, or maybe someone else distributing content. There’s a high degree of referability amongst these user types,” he said.

Users would showcase the tools they use, projects they’ve led and initiatives they’ve pushed instead of simply writing “Former Stripe Engineer” and calling it a day.

“What you don’t know is what problems they solved at Stripe,” Huffman explained, and Contra wants to give users space to explain that.

A Contra profile looks like a storefront for an independent creators’ business. The first thing you will see is project experience, with the option to toggle between services currently available for sale, recommendations from the referral network and, finally, the About page.

A goal of Contra’s, per Huffman, is to help independent workers create high-signal referral networks so they can land new opportunities and gigs. Whenever a user posts a new project experience to their resume, they can add who they worked with as a collaborator.

It’s different from LinkedIn, where you can add anyone you meet and they become a “connection.” Contra requires you to have work experience with your network, making the referral network high-signal. Contra positions referrals high-up on profiles, reminiscent of the MySpace Top 10.

Referrals as a core mechanism to get jobs could disproportionately hurt Black and brown founders, who have been left out of networks. But Huffman says that Contra doesn’t only rely on referrals, it also helps position someone as more than their resume.

“Most resumes are filtered out by AI today and have historically disadvantaged BPOC candidates,” he said. “With a project focus instead of roles and education credential-focus on the identity, we help undiscovered talent get ahead.”

Huffman, who experienced resume bias first-hand as a college dropout with no-credentials from a rural area, thinks that his tool can combat bias in an effective way. The best-case scenario would be if Contra could help a talented designer based in Minneapolis get an opportunity in a city like San Francisco or New York by showcasing their work.

But Contra has ambition to be more than just the latest startup to aim at LinkedIn, Huffman tells TechCrunch. Beyond being a professional network, it wants to also be a place where independent workers can make money for their services and get inbound customers. He describes Contra as a LinkedIn meets Shopify for independent workers.

In other words, Contra is a profile that independent workers can build and then monetize off of, as well as track engagement on how certain services of theirs might be in more demand than others.

“We’re trying to enable people to monetize the value they create, versus the time they spend in places,” says Huffman. The goal here is to “enable people to build these identities, and give them infrastructure to be successful as an independent worker. Contra integrates with Stripe to bring on payments infrastructure, letting workers actually sell their services on the platform.

From an independent worker’s perspective, the internal view offers analytics to understand what the public is looking at on their profile, from what services are most in demand to what projects get the most attention. The analytics, which are private to everyone except the user, also helps workers understand what the conversion rate is once people come to their platform.

It is free to make money and a profile on Contra, which differentiates it from freelance marketplaces like UpWork and Fiverr, which take a percent cut of earnings. Since Contra doesn’t charge a commission on earnings, it monetizes through a SaaS subscription, $29 a month, that includes benefits such as same-day payouts and higher visibility in the platform to eventually get better opportunities.

A potentially large new competitor might be from LinkedIn itself, which is developing a new service called Marketplaces to help freelancers find and book work. Facebook is also working on a tool related to freelancers. Huffman sees Contra’s focus on professional identity as a competitive advantage, and the fact that the tool might be taking commissions.

“It makes what we are doing that much more relevant,” he said.

Luckily, the startup has raised a $14.5 million Series A round to meet its competition head on. The financing event was led by Unusual Ventures, with participation from Cowboy Ventures and Li Jin’s recently announced Atelier Ventures.

Contra wouldn’t disclose the number of users it currently has but did confirm that the total is “in the six-figure range.”

The cash will be used to increase the speed in which it can ship features, as well as build out an ambassador program, in which it will pay users $1,000 a month to test out the product and support the shift to independent work.

Powered by WPeMatico

Over more than two decades of advising founders, I’ve heard all kinds of stories — good, bad and everything in between. While everyone is different, I’ve noticed that the very best stories have something in common: They pass the RIBS test. I’ve talked a lot about this over the years, and it’s stood the test of time and trends.

The test is designed to tell you if your story is memorable (will it “stick to your ribs?”) so you can turn it into a compelling message. It looks something like this:

Before you can come up with a good story, you need to think about the audience. Who are you trying to reach? Are you solving a problem they care about? What matters to them about that problem? Why does your solution deserve attention?

The test is designed to tell you if your story is memorable (will it “stick to your ribs?”) so you can turn it into a compelling message.

Marc Benioff could have launched Salesforce by describing it as an online way for companies to manage relationships with their customers. It’s true and it would have been interesting, at least to some people. But instead, Marc went bigger: He ran a campaign that described Salesforce as the “end of software.”

At the time, software was everywhere and it was creating all kinds of problems: It was massively expensive, time consuming and prone to failure. By taking on those issues, Marc made the company instantly more relevant to a bigger market and audience. The conversation went from a discussion of feature checklists, contacts and leads, to how an entire industry would change. Marc looked like a visionary — and Salesforce seemed revolutionary.

Powered by WPeMatico

This morning Shippo, a software company that provides shipping-related services to e-commerce companies, announced a new $45 million investment. The new capital values the startup at $495 million. TechCrunch is calling the new funding a Series D as it is a priced round that followed its Series C; the company did not award the round a moniker.