TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Employers today often use perks to attract new talent in the form of discounts and deals, commuter funds, gym memberships, child care, free lunches and more. But the pandemic has impacted what sort of in-office or other in-person perks employees can access. That’s led to booming growth — and now, a fundraise — for a startup called Fringe, which offers companies a personalized marketplace of perks that people really want, like Netflix, Uber, Airbnb, DoorDash, Headspace, Talkspace and over 100 other apps.

The idea for Fringe came about from the co-founders’ work as financial advisors where they regularly found themselves consulting people who were weighing new job options and their associated benefits.

“Companies are spending a lot money on traditional benefits … $800, $1,000 a month per person. But the perceived value for most employees is relatively small, given the cost,” explains Fringe CEO Jordan Peace. “I started thinking about what could [companies] offer employees that would be a pretty low actual cost, but a really high perceived value?”

He landed on the idea of subscription services — things people use all the time in their daily lives, but sometimes feel just out of reach from a budgetary standpoint.

That’s where Fringe comes in.

Employers sign up for access to Fringe’s platform at a starting cost of $5 per employee per month. (The rate may decrease for larger organizations.) They then place the dollars they would normally spend on lifestyle benefits into the Fringe accounts of their employees, where they’re converted to “points” that can be spent on any of the apps and services.

Fringe Platform Walkthrough from Fringe on Vimeo.

Today, the marketplace offers a range of benefits, including streaming services like Netflix, Spotify, Disney+ and Audible, as well as virtual fitness, virtual coaching and wellness, online therapy like Talkspace, food and grocery delivery, like Grubhub, Uber Eats, Instacart, and Shipt, prepackaged meals, child care like UrbanSitter, and more.

In the U.S., there are 135 services partners to choose from, with another couple hundred that are available overseas.

The startup’s business model involves negotiating a discount of anywhere from 10% to up to 60% off these services, which it passes along to the employees through its points back (rebate) system. Initially, it only allowed employees to spend their employer-provided lifestyle benefits dollars on Fringe. But due to user demand, it later opened up to allow employees to spend their own money, too — a feature they wanted specifically because of the points back.

Fringe first launched in 2019 — well ahead of the pandemic — and saw some slow but steady growth. It ended the year with 15 clients, representing a couple hundred employees in total.

But then the COVID-19 pandemic hit, which sent a number of employees to work from home in a radical change to business culture that appears to have lasting impacts.

“After the dust settled from the first few months of COVID, we started getting 10 … 20 times more inbound interest,” Peace says, as companies realized Fringe could be a way to support their employees working from home.

“We were just in the right place at the right time to begin to profit from this changed workplace. And it’s not just a ‘pandemic perk.’ We’re going to get past COVID, and we’re still going to have two-thirds of people working from home. The workplace has changed,” he adds.

Image Credits: Fringe CEO Jordan Peace

By the end of 2020, Fringe had grown its client base to over 70 employers, representing now over 12,000 users on its platform. Today, its pipeline includes companies with between 200 and 2,000 employees — a sweet spot that allows them to move relatively quickly. This client base often includes tech companies, like car-sharing startup Turo or talent management system Cornerstone OnDemand, for example.

This year, Fringe expects to grow to well over 100,000 users on its platform, and increase its own team’s headcount, which is today around 20. It also plans to update its marketplace website to include things like automatic point gifting, charitable giving, new Slack integrations, improved navigation, and more.

As a result of the recent growth, Fringe has raised $2.2 million in new funding, in a round led by Sovereign’s Capital, with participation from Felton Group, Manchester Story, the Center for Innovative Technology and angel investors, including Jaffray Woodriff. As part of this investment, the company also added longtime advisor William Boland, senior director of Corporate Development and Strategy at Mission Lane, to its board of directors.

With the addition of the new funds, the startup’s total raise to date is $4 million.

Fringe believes the advantage of its marketplace is that it can be personalized to the user. Typically, employers determine what benefits to offer by running employee surveys, where the majority wins. That’s why many companies today provide perks like backup child care or discounted gym access. But this system discounts the minority’s needs — people who may not have kids or don’t want to work out. People who wish they could use their benefits dollars in a different way.

In addition to employee perks, Fringe believes that having so many subscriptions under one roof could present other opportunities farther down the line.

Woodriff, for example, sees Fringe’s potential as a big data play, in terms of who is signing up for what subscriptions and why.

“But if you think about the fact that you’ve got a subscription service marketplace … there’s more applications to that than just employee benefits,” Peace explains. “I’d like our Series A to be predicated upon the much greater total addressable market. And so I think we’re going to spend the next year to 18 months laying down concrete plans and building the tech to be ready to roll out a couple of different use cases,” he says.

Powered by WPeMatico

Virtual events platform Hopin is hopin’ for a mega valuation.

According to multiple sources who spoke with TechCrunch, the company, which was founded in mid-2019, is running around the fundraise circuit and perhaps nearing the end of a fundraise in which it is looking to raise roughly $400 million at a pre-money valuation of $5 billion for its Series C. The two names out in front, likely part of a joint ticket, are thought to be Andreessen Horowitz and General Catalyst.

Two sources implied that the valuation could have gone as high as $6 billion, but with greater dilution based on some offered terms the company has received. The deal is in flux, and both the round size and valuation are subject to change.

One source told TechCrunch that the company’s ARR has grown to $60 million, implying a valuation multiple of 80-100x if the valuation we’re hearing pans out. That sort of multiple wouldn’t be out of line with other major fundraises for star companies with SaaS-based business models.

Hopin has been on a fundraise tear in recent months. The company raised $125 million at a $2.125 billion valuation late last year for its Series B, which came just a few months after it raised a Series A of $40 million over the summer and a $6.5 million seed round last winter. All told, the roughly 20-month-old company has raised a known $171.4 million in VC according to Crunchbase.

When we last reported on the company, Hopin’s ARR had gone from $0 to $20 million, while its overall userbase had grown from essentially zero to 3.5 million users in November. The company reported then that it had 50,000 groups using its platform.

Hopin’s platform is designed to translate the in-person events experience into a virtual one, providing tools to recreate the experience of walking exhibition floors, networking one-on-one and spontaneously joining fireside chats and panels. It’s become a darling in the midst of the COVID-19 pandemic, which has seen most business and educational conferences canceled in the midst of mass restrictions on domestic and international travel worldwide.

It’s probably also useful to note that our business team uses Hopin to run all of TechCrunch’s editorial events, including Disrupt, Early Stage, Extra Crunch Live and next week’s TechCrunch Sessions: Justice 2021 event (these software selections and their costs are — thankfully — outside the purview of our editorial team).

Hopin may be the mega-leader of the virtual events space right now, but it isn’t the only startup trying to take on this suddenly vital industry. Run The World raised capital last year, Welcome wants to be the “Ritz-Carlton for event platforms,” Spotify is getting into the business, Clubhouse is arguably a contender here, InEvent raised a seed earlier this month and Hubilo is another entrant, which nabbed a check from Lightspeed a few months ago. Plus, quite literally dozens of other startups have either started in the space or are pivoting toward it.

We have reached out to Hopin for comment.

Post updated to report that Andreessen Horowitz and General Catalyst are in the lead.

Powered by WPeMatico

Many companies spend a significant amount of money and resources processing data from logs, traces and metrics, forcing them to make trade-offs about how much to collect and store. Hydrolix, an early-stage startup, announced a $10 million seed round today to help tackle logging at scale, while using unique technology to lower the cost of storing and querying this data.

Wing Venture Capital led the round with help from AV8 Ventures, Oregon Venture Fund and Silicon Valley Data Capital.

Company CEO and co-founder Marty Kagan noted that in his previous roles, he saw organizations with tons of data in logs, metrics and traces that could be valuable to various parts of the company, but most organizations couldn’t afford the high cost to maintain these records for very long due to the incredible volume of data involved. He started Hydrolix because he wanted to change the economics to make it easier to store and query this valuable data.

“The classic problem with these cluster-based databases is that they’ve got locally attached storage. So as the data set gets larger, you have no choice but to either spend a ton of money to grow your cluster or separate your hot and cold data to keep your costs under control,” Kagan told me.

What’s more, he says that when it comes to querying, the solutions out there like BigQuery and Snowflake are not well-suited for this kind of data. “They rely really heavily on caching and bulk column scans, so they’re not really useful for […] these infrastructure plays where you want to do livestream ingest, and you want to be able to do ad hoc data exploration,” he said.

Hydrolix wanted to create a more cost-effective way of storing and querying log data, while solving these issues with other tooling. “So we built a new storage layer which delivers […] SSD-like performance using nothing but cloud storage and diskless spot instances,” Kagan explained. He says that this means that there is no caching or column scales, enabling them to do index searches. “You’re getting the low cost, unlimited retention benefits of cloud storage, but with the interactive performance of fully indexed search,” he added.

Peter Wagner, founding partner at investor Wing Venture Capital, says that the beauty of this tool is that it eliminates trade-offs, while lowering customers’ overall data processing costs. “The Hydrolix team has built a real-time data platform optimized not only to deliver superior performance at a fraction of the cost of current analytics solutions, but one architected to offer those same advantages as data volumes grow by orders of magnitude,” Wagner said in a statement.

It’s worth pointing out that in the past couple of weeks SentinelOne bought high-speed logging platform Scalyr for $155 million, then CrowdStrike grabbed Humio, another high-speed logging tool for $400 million, so this category is getting attention.

The product is currently compatible with AWS and offered through the Amazon Marketplace, but Kagan says they are working on versions for Azure and Google Cloud and expect to have those available later this year. The company was founded at the end of 2018 and currently has 20 employees spread out over six countries, with headquarters in Portland, Oregon.

Powered by WPeMatico

Not every company’s founders find themselves on a first-name basis with the local bomb squad, but then again not every company is Noya Labs, which wants to turn the roughly 2 million cooling towers at industrial sites and buildings across the U.S. into CO2-sucking weapons in the fight against global climate change.

When the company first started developing prototypes of its devices that attach to water coolers, the company’s founders, Josh Santos and Daniel Cavero, did what all good founders do, they started building in their backyard.

The sight of a 55-gallon oil drum and a yellow refrigeration tank in a sous vide bath attached to red and blue cables didn’t sit so well with the neighbors, so Santos and Cavero found themselves playing host to the bomb squad multiple times, according to the company’s chief executive, Santos.

“We proved that it could capture CO2, and we achieved something that no startup should achieve,” Santos said of the dubious bomb squad distinction.

Santos and Cavero were inspired to begin their experiments with direct air capture by an article describing some research into plants’ declining ability to capture carbon dioxide that Santos read on Caltrain on his way to work back in 2019. That article spurred the would-be entrepreneur and his roommate to get to work on experimenting with carbon chemistry.

Their first product was a consumer air purifier that would pull carbon dioxide from the atmosphere in homes and capture it. Homeowners could then sell the captured gases to Santos and Cavero who would then resell it. But the two quickly realized that the business model wasn’t economical, and went back to the drawing board.

They found their eventual application in industrial cooling towers, which the company’s tech can turn into CO2-capturing devices that have the capacity to take in between half a ton and a ton of carbon dioxide per day.

Noya’s tech works by adding a blend of CO2-absorbing chemicals to the water in the cooling towers. They then add an attachment to the cooling tower that activates what Santos called a regeneration process to convert the captured CO2 back into gas. Once they have captured the CO2 the company will look to resell it to industrial CO2 consumers.

It’s not green yet, at least not exactly, because that CO2 is being recirculated instead of sequestered, but Santos said it’s greener than existing sources of the gas, which come from ammonia and ethanol plants.

Noya Labs co-founders Josh Santos and Daniel Cavero. Image Credit: Noya Labs

“Five years from now we fully intend to have vertically integrated carbon capture and sequestration. Our first step is locally produced low-cost atmospherically captured CO2,” said Santos. “If we were to go all-in on a carbon capture, that would require a lot of time for us to develop. What this initial model allows us to do is fine-tune our capture technology while building up long-term to go to market.”

Santos called it the “Tesla roadster approach” so that the company can build up capital and get revenue and prove one piece of it as an MVP so they can prove other steps of it down the line.

Noya Labs already is developing a pilot plant with the Alexandre Family Farm that should capture between the estimated half a ton and one-ton target.

To develop the initial pilot and build out its team, the company has managed to raise $1.2 million from the frontier tech investment firm Fifty Years, founded by Ela Madej and Seth Bannon, and Chris Sacca’s Lowercarbon Capital (whose mission statement to invest in companies that will buy time to “unf*ck the planet” might be one of the greatest). The company’s also in Y Combinator.

“One of the things that makes us excited about this technology is that in the U.S. alone there are 2 million cooling towers. Looking conservatively — if our initial pilot plant can capture 1 ton per day — we’re at right over half a gigaton of CO2 capture.”

And companies are already raising their hands to pick up the CO2 that Noya would sell on the market. There’s a growing collection of startups that are using CO2 to make products. These companies range from the slightly silly, like Aether Diamonds, which uses CO2 to make… diamonds; to companies like Dimensional Energy or Prometheus Fuels, which make synthetic fuels with CO2, or Opus12, which uses CO2 in its replacements for petrochemicals.

Prices for commercial CO2 range between $125 per ton to $5,000 per ton, according to Santos. And Noya would be producing at less than $100 per ton. Current Direct Air Capture companies sell their CO2 from somewhere between $600 to $700 per ton.

Stoya’s first installation could cost around $250,000, Santos said. For Bannon, that means the company passes his “Mr. Burns test.”

“We’ve been digging into the DAC space but haven’t liked the techno-economics we’ve seen. Previous approaches have had too much capex and opex and not enough revenue potential,” Bannon wrote in an email. “That’s what Noya has solved. By leveraging existing industrial equipment, their model is profitable. And better yet, they make their carbon capture partners money, allowing them to scale this up fast. This creates an opportunity to profitably remove 1 gigaton-plus a year.”

Powered by WPeMatico

Patch, the carbon offset API developer, has raised $4.5 million in financing to build out its business selling customers a way to calculate their carbon footprint and identify and finance offset projects that capture the equivalent carbon dioxide emissions associated with that footprint.

Confirming TechCrunch reporting, Andreessen Horowitz led the round, which also included previous investors VersionOne Ventures, MapleVC and Pale Blue Dot Ventures.

Patch’s application protocol interface works for both internal and customer-facing operations. The company’s code can integrate into the user experience on a company’s internal site to track things like business flights for employees, recommending and managing the purchase of carbon credits to offset employee travel.

The software allows companies to choose which projects they’d like to finance to support the removal of carbon dioxide from the atmosphere, with projects ranging from the tried and true reforestation and conservation projects to more high-tech early-stage technologies like direct air capture and sequestration projects, the company said.

Patch founders Brennan Spellacy and Aaron Grunfeld, two former employees at the apartment rental service Sonder, stressed in an interview that the company’s offset work should not be viewed as an alternative to the decarbonization of businesses that use its service. Rather, they see Patch’s services as a complement to other work companies need to do to transition away from a reliance on fossil fuels in business operations.

Patch co-founders Brennan Spellacy and Aaron Grunfeld. Image Credit: Patch

Patch currently works with 11 carbon removal suppliers and has plans to onboard another 10 before the end of the first quarter, the company said. These are companies like CarbonCure, which injects carbon dioxide into cement and fixes it so that it’s embedded in building materials for as long as a building lasts.

“Carbon removal credits can help to dramatically accelerate the deployment of technologies like CarbonCure’s, which are absolutely critical to helping us reach our global climate targets. Demand for high-quality, permanent credits is sky-rocketing, and listing credits on Patch will help us to attract a broader range of buyers,” said Jennifer Wagner, president of CarbonCure Technologies, in a statement.

It also has around 15 customers already using its service, according to earlier TechCrunch reporting. Those buyers include companies like TripActions and the private equity firm EQT, which intends to extend the integration of Patch’s API from its own operations to those of its portfolio companies down the road, according to Spellacy.

Grunfeld said that the company would be spending the money to hire more staff and developing new products. From its current headcount of six employees, Patch intends to bring on another 24 by the end of the year.

As the company expands, it’s looking to some of the startups providing carbon emissions audit and verification services as a channel that the company’s API can integrate with and sell through. These would be businesses like CarbonChain, Persefoni and another Y Combinator graduate, SINAI Technologies.

“An increasing number of businesses are taking leadership positions in an effort to reduce emissions to try to counteract global warming,” said Jeff Jordan, managing partner at Andreessen Horowitz. “Patch makes it much easier for companies to add carbon removal to their core business processes, aggregating verified carbon-removal supply and offering turn-key access to it to companies through an easy-to-implement API.”

Powered by WPeMatico

Engineering teams face steep challenges when it comes to staying on schedule, and keeping to those schedules can have an impact on the entire organization. Acumen, an Israeli engineering operations startup, announced a $7 million seed investment today to help tackle this problem.

Hetz, 10D, Crescendo and Jibe participated in the round, designed to give the startup the funding to continue building out the product and bring it to market. The company, which has been working with beta customers for almost a year, also announced it was emerging from stealth today.

As an experienced startup founder, Acumen CEO and co-founder Nevo Alva has seen engineering teams struggle as they grow due to a lack of data and insight into how the teams are performing. He and his co-founders launched Acumen to give companies that missing visibility.

“As engineering teams scale, they face challenges due to a lack of visibility into what’s going on in the team. Suddenly prioritizing our tasks becomes much harder. We experience interdependencies [that have an impact on the schedule] every day,” Alva explained.

He says this manifests itself in a decrease in productivity and velocity and ultimately missed deadlines that have an impact across the whole company. What Acumen does is collect data from a variety of planning and communications tools that the engineering teams are using to organize their various projects. It then uses machine learning to identify potential problems that could have an impact on the schedule and presents this information in a customizable dashboard.

The tool is aimed at engineering team leaders, who are charged with getting their various projects completed on time with the goal of helping them understand possible bottlenecks. The software’s machine learning algorithms will learn over time which situations cause problems, and offer suggestions on how to prevent them from becoming major issues.

The company was founded in July 2019 and the founders spent the first 10 months working with a dozen design partners building out the first version of the product, making sure it could pass muster with various standards bodies like SOC-2. It has been in closed private beta since last year and is launching publicly this week.

Acumen currently has 20 employees with plans to add 10 more by the end of this year. After working remotely for most of 2020, Alva says that location is no longer really important when it comes to hiring. “It definitely becomes less and less important where they are. I think time zones are still a consideration when speaking of remote,” he said. In fact, they have people in Israel, the U.S. and eastern Europe at the moment among their 20 employees.

He recognizes that employees can feel isolated working alone, so the company has video meetings every day during which they spend the first part just chatting about non-work stuff as a way to stay connected. Starting today, Acumen will begin its go to market effort in earnest. While Alva recognizes there are competing products out there like Harness and Pinpoint, he thinks his company’s use of data and machine learning really helps differentiate it.

Powered by WPeMatico

Over the past year, the coronavirus crisis has spurred app usage in the United States as people stay indoors to limit contact with others. Mobile games particularly have enjoyed a boom, and among them, games from Chinese studios are gaining popularity.

Games released on the U.S. App Store and Google Play Store raked in a total of $5.8 billion in revenue during the fourth quarter, jumping 34.3% from a year before and accounting for over a quarter of the world’s mobile gaming revenues, according to a new report from market research firm Sensor Tower.

In the quarter, Chinese titles contributed as much as 20% of the mobile gaming revenues in the U.S. That effectively made China the largest importer of mobile games in the U.S., thanks to a few blockbuster titles. Chinese publishers claimed 21 spots among the 100 top-grossing games in the period and collectively generated $780 million in revenues in the U.S., the world’s largest mobile gaming market, more than triple the amount from two years before.

Occupying the top rank are familiar Chinese titles such as the first-person shooter game Call of Duty, a collaboration between Tencent and Activision, as well as Tencent’s PlayerUnknown’s Battlegrounds. But smaller Chinese studios are also quickly infiltrating the U.S. market.

Mihoyo, a little-known studio outside China, has been turning heads in the domestic gaming industry with its hit game Genshin Impact, a role-playing action game featuring anime-style characters. It was the sixth-most highest-grossing mobile game in the U.S. during Q4, racking up over $100 million in revenues in the period.

Most notable is that Mihoyo has been an independent studio since its inception in 2011. Unlike many gaming startups that covet fundings from industry titans like Tencent, Mihoyo has so far raised only a modest amount from its early days. It also stirred up controversy for skipping major distributors like Tencent and phone vendors Huawei and Xiaomi, releasing Genshin Impact on Bilibili, a popular video site amongst Chinese youngsters, and games downloading platform Taptap.

Magic Tavern, the developer behind the puzzle game Project Makeover, one of the most installed mobile games in the U.S. since late last year, is another lesser-known studio. Founded by a team of Tsinghua graduates with offices around the world, Magic Tavern is celebrated as one of the first studios with roots in China to have gained ground in the American casual gaming market. KKR-backed gaming company AppLovin is a strategic investor in Magic Tavern.

Other popular games in the U.S. also have links to China, if not directly owned by a Chinese company. Shortcut Run and Roof Nails are works from the French casual game maker Voodoo, which received a minority investment from Tencent last year. Tencent is also a strategic investor in Roblox, the gaming platform oriented to young gamers and slated for an IPO in the coming weeks.

Powered by WPeMatico

BigCommerce has partnered with Walmart to allow its customers to sell on the Bentonville, Arkansas-based retailer’s e-commerce marketplace, it announced this morning. Shares of Austin-based BigCommerce rose sharply in pre-market trading after the news, gaining around 10% before the bell.

Walmart, best-known for in-person shopping, has proven an e-commerce success story in recent years. For example, in its most recent quarter while Walmart as a whole grew 7.3%, its e-commerce sales advanced 69%.

BigCommerce has also reported strong growth in recent quarters, supported in part by partnerships similar to the one that it announced today. The e-commerce SaaS provider rolled out an integration with Wish last year, for example.

In a call concerning its earnings, which were announced before the Walmart news was announced, BigCommerce CEO Brent Bellm told TechCrunch that his company had been impressed with customer uptake of the Wish integration. Regarding the Walmart partnership, in a second interview Bellm told TechCrunch that it was overdue on the BigCommerce side; given the historical success of the Wish deal, it will be curious to dig into how many of the e-commerce platform’s customers opt to sell on Walmart, and how quickly they do so.

TechCrunch also spoke with Walmart exec Jeff Clementz about the arrangement. He stressed Walmart’s online customer monthly-actives — 120 million, per his company — and the breadth of their demand; BigCommerce customers selling on Walmart could expand its product diversity, helping the traditionally physical retailer possible continue its rapid growth.

The two companies are incentivizing adoption of the deal amongst BigCommerce customers by waiving certain fees for a month for retailers that sign up to sell on Walmart; Clementz described it as the first time that his company had offered a “new-seller discount.”

TechCrunch has had its eye on BigCommerce for some quarters now, thanks in part to its 2020 IPO. But the company is also interesting as its regular earnings results provide a lens into the world of e-commerce growth amongst independent digital retailers. Shopify, a chief BigCommerce rival, provides a similar view into the e-commerce world.

Shopify previously integrated with Walmart in the middle of 2020.

Looking ahead, it will be interesting to see if the Walmart partnership helps BigCommerce continue its improving revenue growth. The company is in a market share race with Shopify. But while BigCommerce’s rival has posted impressive growth from its integrated solutions, like its payments service, the Austin-based company stresses what it calls a more open model. Shopify charges many customers a percentage of their transaction volume for using a third-party payment solution over its own, for example, which Bellm described as a “tax” during an interview.

“Merchant Solutions” revenue at Shopify, which it generates “principally” from “payment processing fees from Shopify Payments,” grew 116% in 2020 to a little over $2 billion.

So with BigCommerce collecting a partnership with Walmart to match Shopify’s own, we’re seeing not merely two e-commerce platforms go toe-to-toe on providing their customers with as much market access as they can, but two different business philosophies compete. Akin to Microsoft Teams and Slack, it’s a competition to spectate.

Powered by WPeMatico

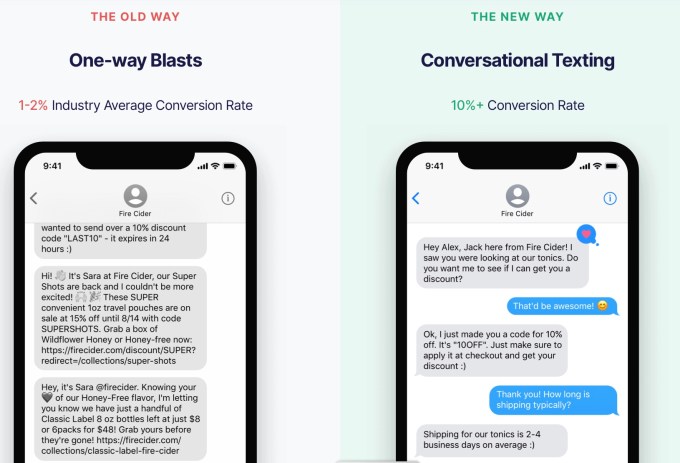

While more businesses are turning to text messages as a marketing channel, Emotive CEO Brian Zatulove argued that most of them are just treating it as another “newsletter blast.”

“The reason the channel performs so well is it’s not saturated,” Zatulove said. But that’s changing, and as it does, companies will have to do more to “cut through the noise.”

That’s what he said Emotive enables, with a platform focused on text marketing that feels like a real conversation with another human being, rather than just another email blast. He compared it to the sales associate who would greet you when you first walked into a department store, pre-COVID.

“The online sales associate really didn’t exist,” he said. “That’s what we’re trying to provide.”

Emotive saw 466% year-over-year revenue growth in 2020 and is announcing today that it has raised $50 million in a Series B funding round that values the company at $400 million. It was led by CRV, with participation from Mucker Capital, TenOneTen Ventures and Stripes.

Image Credits: Emotive

“Never underestimate the importance of building a product that your customers, and your customers’ customers adore,” said CRV general partner Murat Bicer in a statement. “One of the things that struck us about Emotive is the sheer amount of customer love Brian and [co-founder Zachary Wise] get from meal delivery services, manufacturing companies and even toddler shoe brands. Small businesses find it easy to set up campaigns and their customers genuinely prefer communicating with someone over text rather than email.”

Zatulove said he founded the company with Wise after they’d worked together on cannabis loyalty startup Reefer, eventually deciding there was a bigger opportunity after their early successes with text marketing. He explained that while Emotive works with larger customers, its sweet spot is mid-sized e-commerce businesses on Shopify, Magento, BigCommerce and WooCommerce.

Because those businesses usually don’t have any salespeople of their own yet, Emotive serves that function. It can start conversations around shopping cart abandonment and promote sales and new products, resulting in what the company says are 8% to 10% conversion rates (compared to 1% or 2% for a standard text marketing campaign). Zatulove said the platform largely relied on human responders at first, and although it’s become increasingly automated, Emotive still has an internal team handling responses when necessary.

“We never plan on losing that human touch as part of the dialog,” he added. “We see ourselves as a human-to-human marketing platform. That’s our biggest differentiator.”

Emotive had previously raised $8.2 million in funding, according to Crunchbase. Zatulove said this new round will allow the company to continue developing the product, to grow its headcount to more than 200 people and to open offices in Atlanta and Boston. Eventually, it could also expand beyond texting.

“Longer term, we see ourselves more as a conversation platform, not just as a text message platform,” he said.

Powered by WPeMatico

Join TechCrunch for its first 2021 installment of the Ask Me Anything series, where TechCrunch interviews experts and answers your burning questions about virtual events.

Our first guest is Xiaoyin Qu, co-founder and CEO of Run The World.

Friday, February 26, 1 p.m. PT

Run The World is a one-stop shop virtual events platform with a focus on community engagement. TechCrunch has written about Run The World in the past. It launched in 2019, with backers like Andreessen Horowitz and Founders Fund, and skyrocketed in popularity when COVID canceled in-person events and created an overwhelming desire for one-on-one connection. Run The World has since grown to 45 employees and has hosted more than 10,000 events, including for TechCrunch.

At this AMA, Xiaoyin and TechCrunch will discuss:

Who should attend? Event organizers, event marketers, event sponsors.

It’s free. Register here and submit your questions for Xiaoyin.

Powered by WPeMatico