TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Google Workspace, the company’s productivity platform you’ll forever refer to as G Suite (or even “Google Docs”), is launching a large update today that touches everything from your calendar to Google Meet and how you can use Workspace with Google Assistant.

Indeed, the highlight here is probably that you can now use Assistant in combination with Google Workspace, allowing you to check your work calendar or send a message to your colleagues. Until now, this feature was available in beta and even after it goes live, your company’s admins will have to turn on the “Search and Assistant” service. And this is a bit of a slow rollout, too, with this capability now being generally available on mobile but still in beta for smart speakers and displays like Google’s own Nest Hub. Still, it’s been a long time coming, given that Google promised these features a very long time ago now.

The other new feature that will directly influence your day-to-day work is support for recurring out-of-office entries and segmentable working hours, as well as a new event type, Focus Time, to help you minimize distractions. Focus Time is a bit cleverer than the three-hour blocks of time you may block off on your calendar anyway in that it limits notifications during those event windows. Google is also launching a new analytics feature that tells you how much time you spend (waste) in meetings. This isn’t quite as fully featured (and potentially creepy) as Microsoft’s Productivity Score, since it only displays how much time you spend in meetings, but it’s a nice overview of how you spend your days (though you know that already). None of this data is shared with your managers.

For when you go back to an office, Google is also adding location indicators to Workspace so you can share when you will be working from there and when you’ll be working from home.

And talking about meetings, since most of these remain online for the time being, Google is adding a few new features that now allow those of you who use their Google Nest Hub Max to host meetings at home and to set up a laptop as their own second-screen experience. What’s far more important, though, is that when you join a meeting on mobile, Google will now implement a picture-in-picture mode so you can be in that Meet meeting on your phone and still browse the web, Gmail and get important work done during that brainstorming session.

Mobile support for background replace is also coming, as well as the addition of Q&As and polls on mobile. Currently, you can only blur your background on mobile.

For frontline workers, Google is adding something it calls Google Workspace Frontline, with new features for this group of users, and it is also making it easier for users to build custom AppSheet apps from Google Sheets and Drive, “so that frontline workers can digitize and streamline their work, whether it’s collecting data in the field, reporting safety risks, or managing customer requests.”

Powered by WPeMatico

The U.S.-based oil major Chevron is doubling down on its investment in geothermal power by investing in a Swedish developer of low-temperature geothermal and heat power projects called Baseload Capital.

Oil companies are under pressure to find new lines of business as the world prepares for a massive shift to renewable energy resources to power all aspects of industry in the face of mounting climate-related disasters caused by greenhouse gas emissions warming the temperature on the planet.

Joining Chevron in the investment was the ubiquitous billionaire-backed clean energy investment firm Breakthrough Energy Ventures and a Swedish investment group called Gullspang Invest AB.

The investment into Baseload follows closely on the heels of another commitment that Chevron made to the geothermal technology developer Eavor and a recent Breakthrough Energy Ventures investment in the Google-affiliated company, Dandelion Energy (a spinout from Google’s parent company’s moonshot technology development business unit, called X).

Dandelion and Eavor are just two examples of a groundswell of startups working to leverage the knowledge from the oil and gas industry to tap geothermal resources for applications ranging from baseload energy to home heating and cooling.

They’re joined by businesses like Fervo Energy, GreenFire Energy and Sage Geosystems, who’re all leveraging heat to generate power.

As Chevron noted in its press release, heat power is an affordable form of renewable energy that can be harnessed from either geothermal resources or waste heat.

The investments in Baseload and Eavor are financed by CTV’s Core Venture fund, which identifies companies with technology that can add efficiencies to Chevron’s core business in operational enhancement, digitalization and lower-carbon operations, the company said in a statement.

Together the two businesses are planning pilot projects to test technology and could look to current Baseload operations in Japan, Taiwan, Iceland or the United States to develop projects.

Financial terms of the deal were undisclosed.

“In August, we announced that we were looking for a new strategic investor to help us accelerate deployment in our key markets,” said Baseload’s Chief Executive Officer Alexander Helling. “We couldn’t have asked for a better one. Chevron complements our group of owners and adds expertise in drilling, engineering, exploration and more. These assets are expected to accelerate our ability to deploy heat power and strengthen our way of working.”

Early Stage is the premiere “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included in each for audience questions and discussion.

Powered by WPeMatico

Syniverse Technologies, a company that helps mobile providers move communications across public and private networks, announced an extensive partnership with Twilio this morning. Under the agreement, Twilio is investing up to $750 million to become a minority owner in the company.

The idea behind the partnership is to combine Twilio’s API communications expertise with Syniverse’s mobile carrier contacts to create this end-to-end communications system. Twilio’s strength has always been its ability to deliver communications like texts without having a carrier relationship. This deal gives them access to that side of the equation.

James Attwood, executive chairman at Syniverse, certainly saw the value of the two companies working together. “The partnership will provide Syniverse access to Twilio’s extensive enterprise and API services expertise, creating opportunities to continue to build on Syniverse’s highly innovative product portfolio that helps mobile network operators and enterprises make communications better for their customers,” Attwood said in a statement.

Today’s deal comes on the heels of the company’s $3.2 billion acquisition of Segment at the end of last year as it continues to look for ways to expand its markets. Will Townsend, an analyst at Moor Insight & Strategy who covers the network and carrier markets, sees this deal giving Twilio access to a broader set of technologies.

“Twilio [gets] access to Syniverse’s significant capabilities in massive industrial IoT and private 4G LTE and 5G cellular networking. Both are poised to ramp significantly given newfound enterprise access to licensed spectrum via recent C-Band and CBRS auctions,” Townsend told me. He believes this will help Twilio reach parts of the enterprise not connected by Wi-FI or where the customers are dealing with “a mishmash of solutions that don’t scale or propagate well.”

As it turns out, it’s not a coincidence the two companies are coming together like this. In fact, Twilio has been a Syniverse customer for some time, according to Chee Chew, chief product officer at Twilio.

It’s a case of an old-school company like Syniverse, which was founded in 1987, combining forces with a more modern approach to communications like Twilio, which provides developers with APIs to deliver communications services inside applications with just a couple of lines of code.

The Wall Street Journal, which broke the news of this deal, is also reporting the company could go public via SPAC at a value of between $2 and $3 billion some time later this year. That would suggest that it has not gained much value since the 2010 deal.

Holger Mueller, an analyst at Constellation Research, says the SPAC provides an interesting additional component to the deal. “The high-flying stock market creates all kind of new chickens, one of them being a SPAC, and that’s the financial opportunity that Twilio is likely pursuing with the investment into Syniverse. The more immediate benefit is for Twilio to use the messaging vendor for its services. Call it a partnership with investment upside,” Mueller said.

According to Syniverse, “the company is one of the largest private IP Packet Exchange (IPX) providers in the world and offers a range of networking solutions, excelling in scenarios where seamless connections must cross over networks — either across multiple private networks or between public and private networks.”

The company is currently owned by the Carlyle Group private equity firm, which bought it in 2010 for $2.6 billion. Twilio launched in 2008 and raised over $236 million before going public in 2016 at $15 per share. The stock was up 3.82% in early trading, suggesting that Wall Street approves of the deal.

Early Stage is the premiere “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included in each for audience questions and discussion.

Powered by WPeMatico

Skydio has raised $170 million in a Series D funding round led by Andreessen Horowitz’s Growth Fund. That pushes it into unicorn territory, with $340 million in total funding and a post-money valuation north of $1 billion. Skydio’s fresh capital comes on the heels of its expansion last year into the enterprise market, and it intends to use the considerable pile of cash to help it expand globally and accelerate product development.

In July of last year, Skydio announced its $100 million Series C financing, and also debuted the X2, its first dedicated enterprise drone. The company also launched a suite of software for commercial and enterprise customers, its first departure from the consumer drone market where it had been focused prior to that raise since its founding in 2014.

Skydio’s debut drone, the R1, received a lot of accolades and praise for its autonomous capabilities. Unlike other consumer drones at the time, including from recreational drone maker DJI, the R1 could track a target and film them while avoiding obstacles without any human intervention required. Skydio then released the Skydio 2 in 2019, its second drone, cutting off more than half the price while improving on it its autonomous tracking and video capabilities.

Late last year, Skydio brought on additional senior talent to help it address enterprise and government customers, including a software development lead who had experience at Tesla and 3D printing company Carbon. Skydio also hired two Samsara executives at the same time to work on product and engineering. Samsara provides a platform for managing cloud-based fleet operations for large enterprises.

The applications of Skydio’s technology for commercial, public sector and enterprise organizations are many and varied. Already, the company works with public utilities, fire departments, construction firms and more to do work including remote inspection, emergency response, urban planning and more. Skydio’s U.S. pedigree also puts it in prime position to capitalize on the growing interest in applications from the defense sector.

a16z previously led Skydio’s Series A round. Other investors who participated in this Series D include Lines Capital, Next47, IVP and UP.Partners.

Powered by WPeMatico

Japanese space startup Gitai has raised a $17.1 million funding round, a Series B financing for the robotics startup. This new funding will be used for hiring, as well as funding the development and execution of an on-orbit demonstration mission for the company’s robotic technology, which will show its efficacy in performing in-space satellite servicing work. That mission is currently set to take place in 2023.

Gitai will also be staffing up in the U.S., specifically, as it seeks to expand its stateside presence in a bid to attract more business from that market.

“We are proceeding well in the Japanese market, and we’ve already contracted missions from Japanese companies, but we haven’t expanded to the U.S. market yet,” explained Gitai founder and CEO Sho Nakanose in an interview. So we would like to get missions from U.S. commercial space companies, as a subcontractor first. We’re especially interested in on-orbit servicing, and we would like to provide general-purpose robotic solutions for an orbital service provider in the U.S.”

Nakanose told me that Gitai has plenty of experience under its belt developing robots which are specifically able to install hardware on satellites on-orbit, which could potentially be useful for upgrading existing satellites and constellations with new capabilities, for changing out batteries to keep satellites operational beyond their service life, or for repairing satellites if they should malfunction.

Gitai’s focus isn’t exclusively on extra-vehicular activity in the vacuum of space, however. It’s also performing a demonstration mission of its technical capabilities in partnership with Nanoracks using the Bishop Airlock, which is the first permanent commercial addition to the International Space Station. Gitai’s robot, codenamed S1, is an arm–style robot not unlike industrial robots here on Earth, and it’ll be showing off a number of its capabilities, including operating a control panel and changing out cables.

Long-term, Gitai’s goal is to create a robotic workforce that can assist with establishing bases and colonies on the Moon and Mars, as well as in orbit. With NASA’s plans to build a more permanent research presence on orbit at the Moon, as well as on the surface, with the eventual goal of reaching Mars, and private companies like SpaceX and Blue Origin looking ahead to more permanent colonies on Mars, as well as large in-space habitats hosting humans as well as commercial activity, Nakanose suggests that there’s going to be ample need for low-cost, efficient robotic labor – particularly in environments that are inhospitable to human life.

Nakanose told me that he actually got started with Gitai after the loss of his mother – an unfortunate passing he said he firmly believes could have been avoided with the aid of robotic intervention. He began developing robots that could expand and augment human capability, and then researched what was likely the most useful and needed application of this technology from a commercial perspective. That research led Nakanose to conclude that space was the best long-term opportunity for a new robotics startup, and Gitai was born.

This funding was led by SPARX Innovation for the Future Co. Ltd, and includes funding form DcI Venture Growth Fund, the Dai-ichi Life Insurance Company, and EP-GB (Epson’s venture investment arm).

Powered by WPeMatico

It may be tough to remember, but there was a time long ago when Justworks wasn’t a household name. Though its monthly revenue growth charts were up and to the right, it had not even broken the $100,000 mark. Even then, Bain Capital Venture’s Matt Harris felt confident in betting on the startup.

Harris says that, with any investment (particularly at the early stage of a company), the decision really comes down to the team and more importantly, the founder.

Two of the main reasons this deck “sings” is the line it draws to the Justworks culture and that the deck isn’t “artificially simple.”

“Isaac is a long-term mercenary, but short- and medium-term missionary,” said Harris. “The word that really comes to mind is ‘structured.’ If you ask him to think about something and respond, he’ll think about it and come back with an answer that has four pillars underneath it. He’ll create a framework that not only answers your specific question, but can prove to be a model that will answer future questions of the same type. He’s a systems thinker.”

In 2015, Justworks closed its $13 million Series B, led by Bain Capital Ventures. Harris took a seat on the board. Since, the duo have been working closely together as Justworks has grown into the behemoth it is today.

But these relationships work both ways. Oates said that one of the main things he looks for in an investor is how they’ll react when the chips are down.

“Different people behave different ways under stress,” said Oates. “And people show their values and integrity in those types of situations. That’s when these things are tested. The simple way I think about this is, will this person pick me up from the airport in a pinch?”

Though he’s never asked, he believes Harris absolutely would.

On Extra Crunch Live, Harris and Justworks CEO Isaac Oates sat down to talk through how they resolve disagreements, why Oates never changed what must be one of the most simple pitch decks I’ve ever seen in my life, and how founders should think about pricing their products.

They also gave live feedback on pitch decks submitted by the audience in the Pitch Deck Teardown. (If you’d like to see your deck featured on a future episode, send it to us using this form.)

We record Extra Crunch Live every Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. You can see our past episodes here and check out the March slate right here.

Despite their glowing praise of one another at the top of the episode, the founder/investor duo haven’t always seen eye to eye. But they did provide an excellent framework around how founders and VCs should wade through disagreements around the business.

Oates gave an example from 2017. He was considering putting in a dual-class stock, which would give a kind of high-vote, low-vote structure to the company. He said that it interested him because he’d seen other companies out there who were vulnerable after going public, whether it be activist shareholders or other outside forces, and that that might prevent a CEO from thinking about the long term.

Harris disagreed and gave a long list of reasons why that neither shared on the episode. However, Oates said that one of the great things to come out of that disagreement was seeing how Harris went about this decision.

Harris introduced Oates to every expert on this particular subject that he knew, asking them to have meetings and discuss it further.

In the end, Oates ultimately stuck to his guns and decided to go forward with the dual-class stock, but armed with all the information he needed to feel confident in the decision.

“I learned a lot about how Matt thinks and how he approaches decisions,” said Oates. “The process of making decisions is just as important as the content. As I’ve gotten to know him more, it means that when we find something where we don’t necessarily agree, we’re able to step back and make sure we have an intellectually rigorous way to process it.”

The story reminded me of a similar conversation with Ironclad CEO Jason Boehmig and Accel’s Steve Loughlin. They explained how much time and energy they spent early on in their investor/founder relationship talking about the “why” behind opinions and strategies and decisions, plotting out the short-, medium- and long-term plan for the company.

“I want to know what you want the company to look like so that I can push you and we can have constructive conversations around the plan,” said Loughlin. “That way, I’m not getting a phone call about whether or not they should hire a head of customer success without any context or a true north in mind.”

Powered by WPeMatico

“A lot of founders mix up raising money with making money.”

This quote, which Career Karma founder Ruben Harris mentioned off-hand on a phone call with me, has been on my mind for months. In fact, raising money can cost you money, in the form of that sweet, sweet ownership and equity.

That’s why Clearbanc, a startup I have covered for years, has always had a compelling pitch.

The company, co-founded by Michele Romanow and Andrew D’Souza, positions itself as an alternative equity-free capital solution for early-stage founders. Flexing its “20-minute term sheet” the startup uses an algorithm to shift through a startup’s data, and if it has positive ad spend and positive unit economics, they make an investment worth anything from $10,000 to over $10 million. It makes money through a revenue-share agreement versus an equity stake.

“While we’ve invested in over 4,000 businesses using this model, we’ve also turned away over 50,000 who weren’t at this scale or level of repeatability,” D’Souza tells TechCrunch. So, the startup told me this week that they have raised $10 million to create a new product: ClearAngel.

The startup is trying to back anyone with an online business that has early revenue, but pre-broad traction. Clearbanc wants to replace friends and family money, a concept that D’Souza says is “quite elitist,” with its own version of an angel check, while also offering founder services such as supply chain analysis, introductions to networks and competitive landscape analysis.

The startup just needs to make around $1,000 in monthly revenue to qualify for cash. In return for an investment between $10,000 to $50,000, founders have to pay up to 2% of their revenue over four years.

Clearbanc’s repayment works for some startups, but for others, a traditional bank loan could work better. Its biggest hurdle, I’d argue, is that if a startup has great revenue already, you might not want to take a revenue-share agreement loan.

As for if a startup takes ClearAngel capital and doesn’t make the minimum revenue?

“Then the ClearAngel product isn’t working,” he said. “There are bound to be some companies who still can’t make it, that’s the risk we take.”

Alternative capital has pros and cons, just like venture capital has pros and cons. If the end goal is to become a billion-dollar business, what’s the best route to do that? Is taking a revenue-share agreement going to hurt your chances as a pre-seed startup trying to raise capital? Does YC care at all?

Those are some of my biggest questions, and we’ll explore all (and more!) in my alternative financing panel next week for TC Sessions: Justice. It costs $5 to attend the entire conference, and speakers include Backstage Capital’s Arlan Hamilton and Congresswoman Barbara Lee.

Remember that you can get Startups Weekly in your inbox before anyone else, if you subscribe. It’s free! As always, you can find me @nmasc_ on Twitter or e-mail me at natasha.m@techcrunch.com. That is free too!

After being valued at $100 billion in the secondary markets, Coinbase has finally filed to go public. The S-1, as Winnie founder Sara Mauskopf tweeted, is #goals. The crypto unicorn, as my colleague Alex Wilhelm notes, grew just over 139% in 2020, a massive improvement on its 2019 results.

Here’s what to know:

Other notes:

SAN FRANCISCO, CA – SEPTEMBER 07: Coinbase Co-founder and CEO Brian Armstrong speaks onstage during Day 3 of TechCrunch Disrupt SF 2018 at Moscone Center on September 7, 2018 in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

I caught up with Eric Eldon, managing editor at TechCrunch and former Startups Weekly writer, about the recent work he’s been doing with Kirsten Korosec, our transportation editor.

Here’s what he had to say: Startup employees may not be going into the office as often again — or ever. But everyone will still need to go places, or at least want to! How will they do it? What will we do? How will our altered set of needs and wants reshape cities, right as new technologies are fundamentally altering transportation, too? We’re going to be covering this topic in-depth this year, as we all figure out how to go back to work.

Other reading:

Crazy ride on the night by car. Image Credits: franckreporter/Getty Images.

The Spanish government, led by Prime Minister Pedro Sanchez, has announced plans to turn itself into an entrepreneurial nation. The Startup Act is the first piece of dedicated legislation meant to help create tech innovation within Spain. The goals are to promote innovation, new capital through domestic and foreign investments, and to seed the future of Spain as a hub for new companies.

Here’s what to know: Driving innovation can start with relaxing on regulatory concerns.

Among a package of some 50 support measures, the entrepreneurial strategy makes a reference to “smart regulation” and floats the idea of sandboxing for testing products publicly (i.e. without needing to worry about regulatory compliance first).

Other news this week:

Image Credits: MHJ (opens in a new window) / Getty Images

As loyal Equity listeners may have already noticed, we’ve been quietly experimenting with the concept of adding on a third show to our weekly production. This week, we told the world! Along with our current shows, which help listeners start and end the week with tech news, we’re going to bring on a Wednesday deep dive into a topic, subject area or person. Our first mid-week episode went live this week, and it was all about space (so yes, expect a lot of puns and Elon jokes).

The show is about to celebrate its four-year anniversary, and I’m about to celebrate my one-year anniversary as a co-host. We’re all so thankful for your support, and can’t wait to bring you more laughs and learnings.

Our latest episodes:

Seen on TechCrunch

The startup bootcamp you’ve always needed is finally here

Scoop: VCs are chasing Hopin upwards of $5-6B valuation

Lisbon’s startup scene rises as Portugal gears up to be a European tech tiger

Contra wants to be a community for independent workers

Seen on Extra Crunch

Ironclad’s Jason Boehmig: The objective of pricing is to become less wrong over time

As BNPL startups raise, a look at Klarna, Affirm and Afterpay earnings

4 essential truths about venture investing

And that’s the jam-packed week! As an insider tip to those that subscribe, I’m starting to cover health tech (along with edtech) for the TC team. So throw me the smartest person you know on the topic, and extra points if that’s you.

N

Powered by WPeMatico

Storm Ventures, a venture firm that focuses on early stage B2B enterprise startups, announced this week that it has promoted Pascale Diaine and Frederik Groce to partners at the firm.

The two new partners have worked their way up over the last several years. Groce joined Storm in 2016 and has invested in enterprise SaaS startups like Workato, Splashtop, NextRequest and Camino. Diaine joined a year later and has invested in firms like Sendoso, German Bionic, InEvent and Talkdesk.

Groce, who is also a founder at BLCK VC and helped organize the Black Venture Institute to create a network of Black investors, says that these promotions show that venture needs to be more diverse, and Storm recognizes this. “If you think about the way our team works, that’s the way I think venture teams will need to work to be able to be successful in the next 40 years. And so the hope is that over time everyone does this and we’re just early to it,” Groce told me.

Unfortunately, right now that’s not the case, not even close. According to research by Crunchbase, just 12% of venture capitalists are women and two-thirds of firms don’t have any female investors. Meanwhile, only about 4% of ventures investors are Black.

Those numbers have an impact on the number of Black and female founders because as Groce points out the lack of founders in underrepresented groups is in part a networking problem. “In a business that’s predicated on networks if you don’t have diversity in the network, or the teams that are driving those networks, you just can’t make sure you’re seeing great talent across all ecosystems,” he said.

Diaine, who is French and started her career by founding Orange Fab, the corporate accelerator of the European Telco Orange, has brought her international business background to Storm where they helped her tune that experience to an investor focus and supported her as she learned the nuances of the investment side of the business.

“I don’t come from the VC world. I come from the innovative corporate world. So they had to train me and spend time getting me up to date. And they did spend so much time making sure I understood everything to make sure I got to this level,” she said.

Both partners bring their own unique views looking beyond Silicon Valley for investment opportunities. Diaine’s investment include a German, Brazilian and Portuguese company, while Groce’s investments include companies in Chicago, Atlanta and Seattle.

The two partners have also developed an algorithm to help find investments based on a number of online signals, something that has become more important during the pandemic when they couldn’t network in person.

“Frederik and I have been working on [an algorithm to find] what are the signals that you can identify online that will tell you this company’s doing well, this company growing.You have to have a nice set of startup search tracking [signals], but what do you track if you can’t just get the revenue in real time, which is impossible. So we’ve developed an algorithm that helps us identify some of these signals and create alerts on which startups we should pay attention to,” Diaine explained.

She says this data-driven approach should be helpful and augment their in-person efforts even after the pandemic is over and increase their overall efficiency in finding and tracking companies in their portfolios.

Powered by WPeMatico

Non-fungible tokens have been around for two years, but these NFTs, one-of-one digital items on the Ethereum and other blockchains, are suddenly becoming a more popular way to collect visual art, primarily, whether it’s an animated cat or an NBA clip or virtual furniture.

“Suddenly” is hardly an overstatement. According to the outlet Cointelegraph, during the second half of last year, $9 million worth of NFT goods sold to buyers; during one 24-hour window earlier this week, $60 million worth of digital goods were sold.

What’s going on? A thorough New York Times piece on the trend earlier this week likely fueled new interest, along with a separate piece in Esquire about the artist Beeple, a Wisconsin dad whose digital drawings, which he has created every single day for the last 13 years, began selling like hotcakes in December. If you evidence of a tipping point (and it’s amply available), the work of Beeple, whose real name is Mike Winkelmann, was just made available through Christie’s. It’s the venerable auction house’s first sale of exclusively digital work.

To better understand the market and why it’s blowing up in real time, we talked this week with David Pakman, a former internet entrepreneur who joined the venture firm Venrock a dozen years ago and began tracking Bitcoin soon after, even mining the cryptocurrency at his Bay Area home beginning in 2015. (“People would come over and see racks of computers, and it was like, ‘It’s sort of hard to explain.’”)

Perhaps it’s no surprise that he also became convinced early on of the promise of NFTs, persuading Venrock to lead the $15 million Series A round for a young startup, Dapper Labs, when its primary offering was CryptoKitties, limited-edition digital cats that can be bought and bred with cryptocurrency.

While the concept baffled some at the time, Pakman has long seen the day when Dapper’s offerings will be far more extensive, and indeed, a recent Dapper deal with the NBA to sell collectible highlight clips has already attracted so much interest in Dapper that it is reportedly right now raising $250 million in new funding at a post-money valuation of $2 billion. While Pakman declined to confirm or correct that figure, but he did answer our other questions in a chat that’s been edited here for length and clarity.

TC: David, dumb things down for us. Why is the world so gung-ho about NFTs right now?

DP: One of the biggest problems with crypto — the reason it scares so many people — is it uses all these really esoteric terms to explain very basic concepts, so let’s just keep it really simple. About 40% of humans collect things — baseball cards, shoes, artwork, wine. And there’s a whole bunch of psychological reasons why. Some people have a need to complete a set. Some people do it for investment reasons. Some people want an heirloom to pass down. But we could only collect things in the real world because digital collectibles were too easy to copy.

Then the blockchain came around and [it allowed us to] make digital collectibles immutable, with a record of who owns what that you can’t really copy. You can screenshot it, but you don’t really own the digital collectible, and you won’t be able to do anything with that screenshot. You won’t be able to to sell it or trade it. The proof is in the blockchain. So I was a believer that crypto-based collectibles could be really big and actually could be the thing that takes crypto mainstream and gets the normals into participating in crypto — and that’s exactly what’s happening now.

TC: You mentioned a lot of reasons that people collect items, but one you didn’t mention is status. Assuming that’s your motivation, how do you show off what you’ve amassed online?

DP: You’re right that one of the other reasons why we collect is to show it off status, but I would actually argue it’s much easier to show off our collections in the digital world. If I’m a car collector, the only way you’re going to see my cars is to come over to the garage. Only a certain number of people can do that. But online, we can display our digital collections. NBA Top Shop, for example, makes it very easy for you to show off your moments. Everyone has a page and there’s an app that’s coming and you can just show it off to anyone in your app, and you can post it to your social networks. And it’s actually really easy to show off how big or exciting your collection is.

TC: It was back in October that Dapper rolled out these video moments, which you buy almost like a Pokemon set in that you’re buying a pack and know you’ll get something “good” but don’t know what. But while almost half it sales have come in through the last week. Why?

DP: There’s only about maybe 30,000 or 40,000 people playing right now. It’s growing 50% or 100% a day. But the growth has been completely organic. The game is actually still in beta, so we haven’t been doing any marketing other than posting some stuff on Twitter. There hasn’t been attempt to market this and get a lot of players [talking about it] because we’re still working the bugs out, and there are a lot of bugs still to be worked out.

But a couple NBA players have seen this and gotten excited about their own moments [on social media]. And there’s maybe a little bit of machismo going on where, ‘Hey, I want my moment to trade for a higher price.’ But I also think it’s the normals who are playing this. All you need to play is a credit card, and something like 65% of the people playing have never owned or traded in crypto before. So I think the thesis that crypto collectibles could be the thing that brings mainstream users into crypto is playing out before our eyes.

TC: How does Dapper get paid?

DP: We get 5% of secondary sales and 100% minus the cost of the transaction on primary sales. Of course, we have a relationship with the NBA, which collects some of that, too. But that’s the basic economics of how the system works.

TC: Does the NBA have a minimum that it has to be paid every year, and then above and beyond that it receives a cut of the action?

DP: I don’t think the company has gone public with the exact economic terms of their relationships with the NBA and the Players Association. But obviously the NBA is the IP owner, and the teams and the players have economic participation in this, which is good, because they’re the ones that are creating the intellectual property here.

But a lot of the appreciation of these moments — if you get one in a pack and you sell it for a higher price — 95% of that appreciation goes to the owner. So it’s very similar to baseball cards, but now IP owners can participate through the life of the product in the downstream economic activity of their intellectual property, which I think is super appealing whether you’re the NBA or someone like Disney, who’s been in the IP licensing business for decades.

And it’s not just major IP where this NFT space is happening. It’s individual creators, musicians, digital artists who could create a piece of digital art, make only five copies of it, and auction it off. They too can collect a little bit each time their works sell in the future.

TC: Regarding NBA Top Shot specifically, prices range massively in terms of what people are paying for the same limited-edition clip. Why?

DP: There are two reasons. One is that like scarce items, lower numbers are worth more than higher numbers, so if there’s a very particular LeBron moment, and they made 500 [copies] of them, and I own number one, and you own number 399, the marketplace is ascribing a higher value to the lower numbers, which is very typical of limited-edition collector pieces. It’s sort of a funny concept. But it is a very human concept.

The other thing is that over time there has been more and more demand to get into this game, so people are willing to pay higher and higher prices. That’s why there’s been a lot of price appreciation for these moments over time.

TC: You mentioned that some of the esoteric language around crypto scares people, but so does the fact that 20% of the world’s bitcoin is permanently inaccessible to its owners, including because of forgotten passwords. Is that a risk with these digital items, which you are essentially storing in a digital locker or wallet?

DP: It’s a complex topic, but I will say that Dapper has tried to build this in a way where that won’t happen, where there’s effectively some type of password recovery process for people who are storing their moments in Dapper’s wallet.

You will be able to take your moments away from Dapper’s account and put it into other accounts, where you may be on your own in terms of password recovery.

TC: Why is it a complex topic?

DP: There are people who believe that even though centralized account storage is convenient for users, it’s somehow can be distrustful — that the company could de-platform you or turn your account off. And in the crypto world, there’s almost a religious ferocity about making sure that no one can de-platform you, that the things that you buy — your cryptocurrencies or your NFTs. Long term, Dapper supports that. You’ll be able to take your moments anywhere you want. But today, our customers don’t have to worry about that I-lost-my-password-and-I’ll-never-get-my-moments-again problem.

Powered by WPeMatico

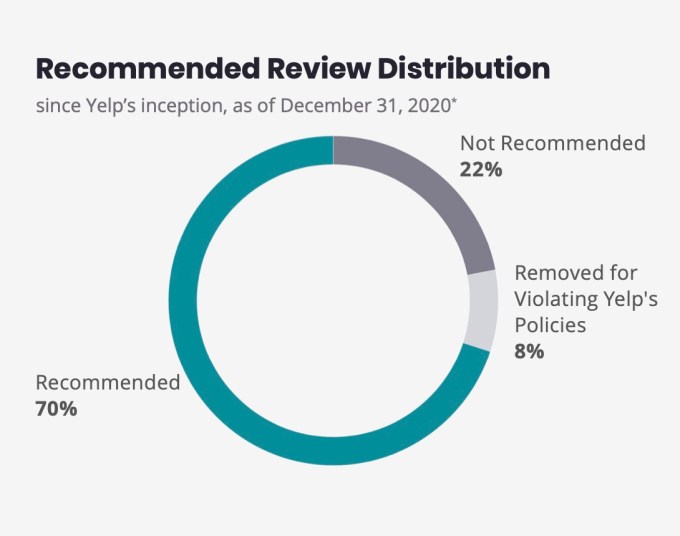

Yelp released its very first trust and safety report this week, with the goal of explaining the work that it does to crack down on fraudulent and otherwise inaccurate or unhelpful content.

With its focus on local business reviews and information, you might think Yelp would be relatively free of the misinformation that other social media platforms struggle with. But of course, Yelp reviews are high stakes in their own way, since they can have a big impact on a business’ bottom line.

Like other online platforms, Yelp relies on a mix of software and human curation. On the software side, one of the main tasks is sorting reviews into recommended and not recommended. Group Product Manager for Trust and Safety Sudheer Someshwara told me that a review might not be recommended because it appears to be written by someone with a conflict of interest, or it might be solicited by the business, or it might come from a user who hasn’t posted many reviews before and “we just don’t know enough information about the user to recommend those reviews to our community.”

“We take fairness and integrity very seriously,” Someshwara said. “No employee at Yelp has the ability to override decisions the software has made. That even includes the engineers.”

He added, “We treat every business the same, whether they’re advertising with us or not.”

Image Credits: Yelp

So the company says that last year, users posted more than 18.1 million reviews, of which 4.6 million (about 25%) were not recommended by the software. Someshwara noted that even when a review is not recommended, it’s not removed entirely — users just have to seek it out in a separate section.

Removals do happen, but that’s one of the places where the user operations team comes in. As Vice President of Legal, Trust & Safety Aaron Schur explained, “We do make it easy for businesses as well as consumers to flag reviews. Every piece of content that’s flagged in that way does get reviewed by a live human to decide whether it should should be removed for violating our guidelines.”

Yelp says that last year, about 710,000 reviews (4%) were removed entirely for violating the company’s policies. Of those, more than 5,200 were removed for violating the platform’s COVID-19 guidelines (among other things, they prohibit reviewers from claiming they contracted COVID from a business, or from complaining about mask requirements or criticizing a business had to close due to safety regulations). Another 13,300 were removed between May 25 and the end of the year for threats, lewdness, hate speech or other harmful content.

“Any current event that takes place will find its way onto Yelp,” acknowledged Vice President of User Operations Noorie Malik. “People turn to Yelp and other social media platforms to have a voice.”

But expressing political beliefs can conflict with what Malik said is Yelp’s “guiding principle,” namely “genuine, first-hand experience.” So Yelp has built software to detect unusual activity on a page and will also add a Consumer Alert when it believes there are “egregious attempts to manipulate ratings and reviews.” For example, it says there was a 206% increase in media-fueled incidents year over year.

It’s not that you can’t express political opinions in your reviews, but the review has to come from firsthand experience, rather than being prompted by reading a negative article or an angry tweet about the business. Sometimes, Malik added, that means the team is “removing content with a point of view that we agree with.”

One example that illustrates this distinction: Yelp will take down reviews that seem driven by media coverage suggesting that a business owner or employee behaved in a racist manner, but at the same time, it also labeled two businesses in December 2020 with a “Business Accused of Racism” alert reflecting “resounding evidence of egregious, racist actions from a business owner or employee.”

Beyond looking at individual reviews and spikes in activity, Someshwara said Yelp will also perform “sting operations” to find groups that are posting fraudulent reviews.

In fact, his team apparently shut down 1,200 user accounts associated with review rings and reported nearly 200 groups to other platforms. And it just rolled out an updated algorithm designed to better detect and unrecommend reviews coming from those groups.

Powered by WPeMatico