TC

Auto Added by WPeMatico

Auto Added by WPeMatico

When Okta announced that it was acquiring Auth0 yesterday for $6.5 billion, the deal raised eyebrows. After all, it’s a substantial amount of money for one identity and access management (IAM) company to pay to buy another, similar entity. But the deal ultimately brings together two companies that come at identity from different sides of the market — and as such could be the beginning of a beautiful identity friendship.

The deal ultimately brings together two companies that come at identity from different sides of the market — and as such could be the beginning of a beautiful identity friendship.

On a simple level, Okta delivers identity and access management (IAM) to companies who use the service to provide single-sign-on access for employees to a variety of cloud services — think Gmail, Salesforce, Slack and Workday.

Meanwhile, Auth0 is a developer tool providing coders with easy API access to single-sign-on functionality. With just a couple of lines of code, the developer can deliver IAM tooling without having to build it themselves. It’s a similar value proposition to what Twilio offers for communications or Stripe for payments.

The thing about IAM is that it’s not exciting, but it is essential. That could explain why such a large number of dollars are exchanging hands. As Auth0 co-founder and CEO Eugenio Pace told TechCrunch’s Zack Whittacker in 2019, “Nobody cares about authentication, but everybody needs it.”

Putting the two companies together generates a fairly comprehensive approach to IAM covering back end to front end. We’re going to look at why this deal matters from an identity market perspective, and if it was worth the substantial price Okta paid to get Auth0.

When you think about identity and access management, it’s about making sure you are who you say you are, and that you have the right to enter and access a set of applications. That’s why it’s a key part of any company’s security strategy.

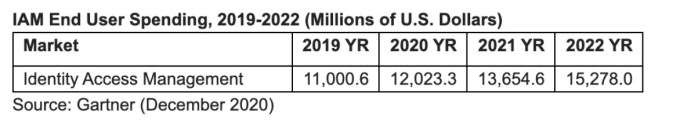

Gartner found that IAM was a $12 billion business last year with projected growth to over $13.5 billion in 2021. To give you a sense of where Okta and Auth0 fit, Okta just closed FY2021 with over $800 million in revenue. Meanwhile Auth0 is projected to close this year with $200 million in annual recurring revenue.

Image Credits: Gartner

Among the top players in this market according to Gartner’s November 2020 Magic Quadrant market analysis are Ping Identity, Microsoft and Okta in that order. Meanwhile Gartner listed Auth0 as a key challenger in their market grid.

Michael Kelly, a Gartner analyst, told TechCrunch that Okta and Auth0 are both gaining something from the deal.

“For Okta, while they have a very good product, they have marketing muscle and adoption rates that are not available to smaller vendors like Auth0. When having [IAM] conversations with clients, Okta is almost always on the short list. Auth0 will immediately benefit from being associated with the larger Okta brand, and Okta will likewise now have credibility in the deals that involve a heavy developer focused buyer,” Kelly told me.

Okta co-founder and CEO Todd McKinnon said he was enthusiastic about the deal precisely because of the complementary nature of the two companies’ approaches to identity. “How a developer interacts with the service, and the flexibility they need is different from how the CIO wants to work with [identity]. So by giving customers this choice and support, it’s really compelling,” McKinnon explained.

Powered by WPeMatico

For founder Najette Fellache, coming to the Bay Area a few years ago from Nantes, France was a way to grow a company she’d founded and which was already beginning to count major U.S. corporations like GE, Tesla, Amazon, and Medtronics as customers.

What that six-year-old outfit, Speach, sells is essentially knowledge-sharing between colleagues via videos produced by the employees themselves, often to augment written instructions. The idea is to maximize learning, fast, and investors liked it enough to provide Speach with $14 million in funding.

But while the technology has only become more relevant in a world shut down by COVID-19, an internal project within the company began to interest Fellache even more after her children abruptly began attending school remotely from home. As she tells it, her aha moment came in the form of a drawing from her youngest son, who struggled to understand why his mother’s meetings kept taking precedent over him.

Image Credit: Najette Fellache

Like many parents trying to figure out how to balance work and family over the last year, Fellache wasn’t immediately sure of how to parent around the clock while also leading a company. Unlike a lot of parents, she had access to engineers who could create a technology that enabled her, along with other members of Speach’s team, to create short videos that could quickly communicate important information and be viewed at the recipient’s convenience — as well as saved for future reference.

In fact, as sometimes happens with internal projects, the technology worked so well for Speach that it has since taken on a life of its own. Indeed, using a bit of that earlier funding from Speach — its backers are Alven and Red River West, a fund co-managed by Artémis, the investment company of the Pinault family — Fellache and a team of 10 employees this week launched Weet, a new asynchronous video startup.

It’s entering a crowded field. Fellache is hardly alone in recognizing the power of asynchronous meetings as an attractive alternative to phone calls, real-time meetings and even email, where tone is often lost and content can be misconstrued. Loom, for example, a six-year-old enterprise collaboration video messaging service that enables users to send short clips of themselves, has already raised at least $73 million from investors, including Sequoia Capital, Kleiner Perkins and Coatue.

Another, newer entrant is SuperNormal, a year-old, Stockholm, Sweden-based work communication platform that employs video and screen recording tools to help teams create and send asynchronous video updates throughout the day and which raised $2 million in seed funding led by EQT Ventures in December.

Still, if you believe that the future of work is remote, it’s clear that the opportunity here is a big one. Further, Weet — which is accessible for free via a browser extension and whose integrations with both Slack and Microsoft Teams are scheduled to go live next month — is fast becoming a better product than some of what’s available in the market already, says Fellache.

Weet already features instant recording, screen sharing, virtual backgrounds, video filters, emoji reactions, commenting options and auto transcription. For a premium paid version in the works, it is also developing features that will make it easier to organize discussions for users. Imagine, for example, a salesperson looking for communications about a potential client and wanting notes from those auto-transcriptions that are presented together in one email to them.

As for privacy, Fellache points to the data management expertise that Speach has developed over time working with clients like Airbus and Colgate-Palmolive that are acutely mindful of privacy. Weet — which Fellache says is already being used by units inside Colgate-Palmolive — employs the same standards and practices.

Weet is seemingly taking a different approach on the marketing front, too. Fellache says while some rivals enable users to publish one video at a time, Weet is a more conversational tool where teammates and contacts can create sections of the same video for a back-and-forth, sending video feedback, audio feedback, sharing their screen or reacting with emoticons.

Put another way, Weet enables not only the exchange of more critical information but can invite more interaction broadly and, presumably, strengthen team relationships in the process.

“It’s a discussion, not a transaction,” Fellache offers, and that’s important, she suggests. As she has seen firsthand, in a world where teams are increasingly scattered around the globe, open communication is more central than ever to a company’s success — and that of its employees.

Powered by WPeMatico

It’s not uncommon these days to hear of U.S.-based investors backing Latin American startups.

But it’s not every day that we hear of Latin American VCs investing in U.S.-based startups.

Berkeley-based fintech Flourish has raised $1.5 million in a funding round led by Brazilian venture capital firm Canary. Founded by Pedro Moura and Jessica Eting, the startup offers an “engagement and financial wellness” solution for banks, fintechs and credit unions with the goal of helping them engage and retain clients.

Also participating in the round were Xochi Ventures, First Check Ventures, Magma Capital and GV Angels as well as strategic angels including Rodrigo Xavier (former Bank of America CEO in Brazil), Beth Stelluto (formerly of Schwab), Gustavo Lasala (president and CEO of The People Fund) and Brian Requarth (founder of Viva Real).

With clients in the U.S., Bolivia and Brazil, Flourish has developed a solution that features three main modules:

In the U.S., Flourish began by testing end-user mechanics with organizations such as CommonWealth and Opportunity Fund. In 2019, it released a B2C version of the Flourish app (called the Flourish Savings App) as a pilot for its banking platform, which can integrate with banks through an SDK or an API. It is also now licensing its engagement technology to banks, retailers and fintechs across the Americas. Flourish has piloted or licensed its solution to U.S.-based credit unions, Sicoob (Brazil’s largest credit union) and BancoSol in Bolivia.

The startup makes money through a partnership model that focuses on user activation and engagement.

Both immigrants, Moura and Eting met while in the MBA program at the Haas School of Business at UC Berkeley. Moura came to the U.S. from Brazil as a teen, while Eting is the daughter of a Filiponio father and mother of Mexican descent.

The pair bonded on their joint mission of building a business that empowered people to create positive money habits and understand their finances.

Currently, the 11-person team works out of the U.S., Mexico and Brazil. It plans to use its new capital to increase its number of customers in LatAm, do more hiring and develop new functionalities for the Flourish platform.

In particular, it plans to next focus on the Brazilian market, and will scale in a few select countries in the Americas.

“There are three things that make Latin America, and more specifically Brazil, attractive to us at this moment,” Moura said. “Currently, the B2B financial technology market is still in its nascency. This combined with open banking regulation and the need for more responsible products provides Flourish a unique opportunity in Brazil.”

Powered by WPeMatico

Maintaining company culture when the majority of staff is working remotely is a challenge for every organization — big and small.

This was an issue, even before COVID. But it’s become an even bigger problem with so many employees working from home. Employers have to be careful that workers don’t feel disconnected and isolated from the rest of the company and that morale stays high.

Enter Workvivo, a Cork, Ireland-based employee experience startup that is backed by Zoom founder Eric Yuan and Tiger Global that has steadily grown over 200% over the past year.

The company works with organizations ranging in size from 100 employees to over 100,000 and boasts more than 500,000 users. According to CEO and co-founder John Goulding, it’s had 100% retention since it launched. Customers include Telus International, Kentech, A+E Networks and Seneca Gaming Corp., among others.

Founded by Goulding and Joe Lennon in 2017, Workvivo launched its employee communication platform in mid-2018 with the goal of helping companies create “an engaging virtual workplace” and replace the outdated intranet.

“We’re not about real time, we’re more asynchronous communication,” Goulding explained. “We have a lot of transactional tools, and typically carry the bigger message about what’s going on in a company and what positive things are happening. We’re more focused on human connection.”

Using Workvivo, companies can provide information like CEO updates, recognition for employees via a social style — “more things that shape the culture so workers can get a real sense of what’s happening in an organization.” It launched podcasts in the second quarter and livestreaming in Q4.

In 2019, Workvivo showed its product to Zoom’s Yuan, who ended up becoming one of the company’s first investors. Then in May of 2020, the company raised $16 million in a Series A funding led by Tiger Global, which is best known for large growth-oriented rounds.

Workvivo, which was built out long before the COVID-19 pandemic, found itself in an opportune place last year. And demand for its offering has reflected that.

“Since COVID hit, growth has accelerated,” Goulding told TechCrunch. “We grew three times in size over where we were before the pandemic started, in terms of revenue, users, customers and employees.”

The SaaS operator’s deals range from $50,000 to close to $1 million a year, he said. Workvivo is Europe-based and operates in 82 countries. But the majority of its customers are located in the U.S. with 80% of its growth coming from the country.

The startup opened an office in San Francisco in early 2020, which it is expanding. Thirty percent of its 65-person team is currently U.S.-based, with some working remotely from other states.

While Workvivo would not reveal hard revenue figures, Goulding only said it’s not seeking additional funding anytime soon considering the company is “in a very strong capital position.”

To tackle the same problem, Microsoft last month launched Viva, its new “employee experience platform,” or, in non-marketing terms, its new take on the intranet sites most large companies tend to offer their employees. With the move, Microsoft is taking on the likes of Facebook’s Workplace platform and Jive in addition to Workvivo.

Despite the increasingly crowded space, Workvivo believes it has an advantage over competitors in that it integrates well with Slack and Zoom.

“We’re sitting alongside Slack and Zoom in the ecosystem,” Goulding said. “There’s Zoom, Slack and us.”

Slack is real-time messaging and what’s happening in the immediate future, and Zoom is real-time video and “about the moment,” he said.

To Goulding, Microsoft’s new offering is unproven yet and a reactionary move.

“It’s obvious there’s a battle to be won for the center of the digital workplace,” he said. “We’re here to capture the heartbeat of an organization, not pulses.”

Powered by WPeMatico

Coursera, an online education platform that has seen its business grow amid the coronavirus pandemic, is planning to file paperwork tomorrow for its initial public offering, sources familiar with the matter say. The company has been talking to underwriters since last year, but tomorrow could mark its first legal step in the process to IPO.

The Mountain View-based business, founded in 2012, was last valued at $2.4 billion in the private markets, during a Series F fundraising event in July 2020. Bloomberg pegs Coursera’s latest valuation at $5 billion.

The latest financing event brought its cash balance to $300 million, right around the money that Chegg had before it went public. Coursera CEO Jeff Maggioncalda did confirm then that the company is eyeing an eventual IPO.

Coursera has had a busy pandemic. Similar to Udemy, another massive open online course provider planning to go public, Coursera added an enterprise arm to its business. It launched Coursera for Campus to help colleges bring on online courses (credit optional) with built-in exams; more than 3,700 schools across the world are using the software. It is unclear how much money this operation has brought in, but we know that Udemy for Business is nearing $200 million in annual recurring revenue. In February, the company announced that it has received B Corp. certification, which means that it hits high standards for social and environmental performance. It also converted to a public benefit corporation.

GSV, a venture capital firm that exclusively backs edtech companies, had its largest position of its first fund in Coursera. GSV announced a $180 million Fund II yesterday.

It makes sense that edtech companies want to go public while the markets remain hot and remote education continues to be a central way that instruction is delivered. Other companies from the sector that have gone public in recent weeks include Nerdy and Skillsoft, two companies that used a SPAC to make their public debuts. Once – and if – Coursera does go public, it will join these newbies as well as the long-time edtech public companies including 2U, Chegg, and K12 Inc, and Zovio Solutions.

Coursera declined to comment.

Update: The previous version of this story stated that Skillshare has gone public. This is incorrect. Skillsoft has gone public. An update to reflect this change has been made.

Powered by WPeMatico

Hepster, an insurtech platform from Germany, has raised $10 million in a Series A funding round led by Element Ventures. Also participating was Seventure Partners, MBMV and GPS Ventures, as well as previous investors. The funds will be used to broaden the Hepster insurance ecosystem and scale up its network, with an emphasis on automation.

The German insurance market is famously slow at adopting new practices, and Hepster is part of a new wave of insurtech startups in the country taking advantage of this. It allows businesses to build insurance policies from scratch, matched specifically to the needs of their individual service or industry. E-commerce players, for instance, can then embed these insurance products into the e-commerce journey.

Its products are therefore better suited to the new sector of, for example, shared e-bike schemes and peer-to-peer rental platforms, which are rarely covered by traditional brokers in Germany. However, it also caters to traditional, established industries as well.

It now has more than 700 partners, including European bike retailers and rental companies Greenstorm Mobility and Baron Mobility, as well as Berlin-based cargo bike provider Citkar and Munich e-bike startup SUSHI.

Christian Range, Hepster co-founder and CEO, said in a statement: “Hepster is now a key player within the European insurance market. Our state-of-the-art technology with our API-driven ecosystem, as well as our highly service-oriented approach, sets us apart.”

In an interview he told me: “Germany is the toughest market with the most regulations, the most laws. We have a saying in Germany, if you can make it in Germany, you can make it everywhere. Also, it’s a big market in terms of selling insurance products because Germans really like insurance in every regard. So there is huge market potential in Germany I think.”

Michael McFadgen, partner at Element Ventures, said: “As new industries and business models emerge, companies need much more flexible insurance propositions than what is currently being offered by traditional brokers. Hepster is the breakout company in the space, and their focus on embedded insurance will pay dividends in years to come.”

Powered by WPeMatico

Healthcare is one of the most complex industries out there, creating frustration on the consumer side but also the opportunity for huge improvements from, in a way, rather simple methods. Halo Diagnostics (or Dx for short) has raised a $19 million Series A to improve diagnosis of several serious illnesses by crossing the streams from multiple tests and making the improved process easily available to providers. They’ve also taken the unusual step of taking out an eight-figure line of credit to buy outright the medical facilities they’ll need to do it.

As anyone who’s had to deal with major health concerns can attest, the care you get differs widely from one provider to another depending on many factors, not least of which are what your insurance covers and what methods are already in use by the provider.

For men going in to get a prostate cancer screening, for instance, the common bloodwork and rectal exam haven’t changed in years, and really aren’t that great at predicting problems, leading to uncertainty and unnecessary procedures like biopsies.

Of course, if you’re lucky, your provider might offer multiparametric MRIs, which are much better at finding problems — and if you combine that MRI with a urine test that checks for genetic markers, the detection accuracy rises to practically foolproof levels.

But these tests are more expensive, take special facilities and personnel and may otherwise not fit into the provider’s existing infrastructure. Halo aims to provide that infrastructure by revamping the medical data stream to allow for this kind of multi-factor diagnosis.

“Basically doctors and imaging centers aren’t offering latest level of care. If you’re lucky you might get it, but in community medicine you’re not going to,” said Brian Axe, co-founder and chief product officer at Halo Dx. “As perverse as it sounds, what the healthcare industry needs to adopt the latest medical advancements is better financial alignment in addition to better outcomes. The challenge is the integrated diagnostic solution — how do you get these orders, go to market and talk with primary care providers?”

An added obstacle is that multi-modal testing isn’t really the kind of thing medical imaging or testing providers just decide to get into. An imaging center isn’t going to hear that a urine test improves reliability and think “well let’s buy the building next door and start doing that too!” It’s costly and complex to build out testing facilities, and getting the expertise to run them and combine the results is another hurdle.

So Halo Dx is parachuting in with tens of millions of dollars and purchasing the imaging and testing centers themselves (four so far), taking over their operations and combining them with other tests.

Assuming that much liability as a young company may seem like folly, but it helps that these imaging centers are strong businesses already — not derelict, half-paid-off MRI machines being operated at a loss.

“The imaging orders are coming in already; the centers are profitable. They’re coming on board because they see how technology is coming to disrupt them, and they want to help drive the change,” said Axe.

Prostate and breast cancers are the first target, but more and better data produce similarly improved diagnosis and treatment planning for more conditions, potentially (these are still being proven out), like Multiple Sclerosis, Parkinson’s and other neurodegenerative diseases.

With one company running multiple intake, imaging and testing facilities and integrating the results, it’s much more likely that providers will sign up. And Halo Dx is trying to bring some of the enterprise-grade software expertise to bear on the historically neglected field of medical data storage and communication.

Axe deferred to the company’s chief medical officer, Dr. John Feller, on the perils of that aspect of the field.

“Dr Feller describes this so well: ‘I have this state of the art MRI machine that can see inside your body, but because of the fragmented solutions that are out there, from intake to the storage centers, I feel like I’m living with pre-dot-com era tech and it’s crippling,’ ” Axe recalled. “If you want to look at records or recommend additional tests, software vendors don’t talk to each other or integrate. You have three providers that need to talk to each other and there’s a dozen systems between them.”

Axe compared the company’s approach here to One Medical’s — increasing efficiency and using that to make the relationship with the consumer lighter and easier, leading to more interactions.

In some ways it seems like a risky move, taking on nearly a hundred million in obligations and jumping into a hugely complex and highly regulated space. But the team is accomplished, the backers are notable, the potential for growth is there, and the success of the likes of One Medical have likely emboldened all involved.

Zola Global Investors led the round, and a who’s-who in medical and tech participated: Anne Wojcicki, Fred Moll, Stephen Pomeranz, Bob Reed, Robert Ciardi, Jim Pallotta and, believe it or not, Ronnie Lott of 49ers fame.

These and others involved make for a strong statement of confidence in both the model and the specific approach Halo Dx is taking to expanding and advancing care. Here’s hoping, however, that you won’t have to make use of their services.

Powered by WPeMatico

If you’re a startup that’s worried about building your team today for tomorrow’s successes you’re not going to want to miss our session with Bain Capital Ventures’ Sarah Smith at TechCrunch Early Stage on April 1 & 2.

The current Bain Capital Ventures partner who invests in early to mid-stage companies saw what it was like to grow a startup business firsthand as the vice president of human resources at Quora, a position she held from 2012 to 2016.

While at Quora, Sarah built the HR and operations teams responsible for company culture, compensation, benefits, equity refreshers, performance reviews, HRIS/ATS implementation, people development, policy enforcement and content moderation.

She scaled the company from 40 to 200 employees across all hiring from university to executive search.

After that, she became the vice president of advertising sales and operations, where she led the launch of monetization and onboarding of more than 500 advertisers to the self-service ads platform.

Smith joins an all-star cast of speakers at Early Stage. They range from Zoom CRO Ryan Azus (“How to build a sales team”) to Calendly founder Tope Awotona (“How to bootstrap”) to Kleiner Perkins’ Bucky Moore (“How to prep for Series A fundraising”), and they are making themselves available to answer your burning questions on just about any topic. And that’s just the tip of the iceberg.

Unlike other TechCrunch events, there is no “main stage” at our TC Early Stage events. Each session is designed to tackle one of the many core competencies any startup needs to be successful. But this isn’t just about listening — every session includes plenty of time built in for audience Q&A. Essentially, it’s all breakout sessions, all day.

What’s more — everyone who buys a ticket to TC Early Stage gets free access to Extra Crunch! Folks who buy a ticket to one of the two events get three months free, and folks who purchase a combination ticket (to both events) get six months free! An Extra Crunch membership includes:

Of course, TC Early Stage dual event ticket holders will get access to both events (April 1-2 and July 8-9) and have access to all the content that comes out of the event on demand. Plus you can take advantage of additional savings with Early Bird pricing for another couple of weeks!

Mercenary CEOs know all too well that this is about the most bang you can get for your buck. Period.

Check out the full list of speakers here and you can get your ticket now!

Powered by WPeMatico

Fintech startup ClearGlass Analytics has closed a £2.6 million ($3.6 million) funding round for its platform, which aims to create greater transparency on fees in the long-term savings market, such as pensions and the wider asset management market.

The £2.6 million seed round includes European VC Lakestar and Outward VC, the venture arm of Investec, as well as several angels from both the asset management and pension fund worlds. These include Ruston Smith, a pension trustee; Richard Butcher, chair of the PLSA (U.K. pension trade body); Chris Wilcox, former Global Head of JP Morgan Asset Management; and Rob O’Rahilly, Sikander Ilyas and Alex Large, also former JP Morgan employees.

ClearGlass is targeting the £1.5 trillion mature “Defined Benefit” pension schemes market and claims to now work with more than 500 DB pension funds. It will use the funding to expand into the U.K. Defined Contribution pension market, and consolidate its early footprint in Europe and Africa.

How ClearGlass works is that it acts as a data interface between asset managers and their clients. Pension funds then use the platform to see all of their investment costs in one place, thus getting more data than usual from more asset managers and other suppliers. This helps the funds see the “true cost” of what they are paying for the management of their investments. ClearGlass claims to be able to uncover the kinds of costs of asset management that, in some instances, can be more than double those expected.

The startup recently did an analysis of the cost and performance of more than 400 asset managers. It found that while most U.K. asset managers were meeting minimum standards for data delivery, quality and accuracy, 30 (including some powerful players) did not pass their tests.

The company was founded by Dr. Christopher Sier, a World Bank and FCA expert who previously developed the cost transparency standard at the request of the FCA, and co-founders Ritesh Singhania and Kunal Varma.

Sier, founder and CEO, said: “Finding your costs are so much larger is shocking, but also something to be celebrated. These incremental costs were always there, they just weren’t exposed, and now you can identify those and bring about change. You can’t manage what you don’t measure.”

In an interview with TechCrunch, Ritesh Singhania, COO, said getting the data about pension funds is normally “super challenging and complicated. And second of all, even when you got the data, you couldn’t make head nor tail of it because you can’t compare it across funds. What we have done is that we have been the line of communication between the manager and the pension fund. So we have built a piece of technology that helps with the communication between the asset managers, and the pension funds to be able to collect that data, check that data. And finally, give them something that doesn’t require them to spend 20 hours to understand it.”

ClearGlass was incubated by the Founders Factory accelerator.

Powered by WPeMatico

On the 25th of January, Techstars Seattle announced its 12th class, featuring 10 startups from different parts of the world. The accelerator, which has accepted only a handful of African startups, included one from Zimbabwe in this class.

AfriBlocks is a global pan-African marketplace of vetted African freelance professionals. The startup was founded by Tongayi Choto and Roger Roman in July 2020 and has offices in Harare and Los Angeles.

The company is trying to address the high unemployment rate that plagues many African countries by making it easier for people to find work. Quite a number of international and local freelance websites exist to meet these needs. Still, according to CEO Choto, most of them offer too many options with no adequate vetting process.

“It can be very hard to find African freelancers. If a customer is lucky enough to get past those hurdles and find a freelancer to work with, they often don’t have the proper collaboration tools to complete the project in a precise and timely manner,” he told TechCrunch.

In a global freelance market worth more than $800 billion, AfriBlocks says it is doing this different by equipping African freelancers with intuitive collaboration tools and a secure payment system that makes it easy to get remote contract projects completed.

When a job is posted on its platform, the company claims that they save the customer the trouble of perusing thousands of freelancers profiles and portfolios. Instead, they use automation tools to match three freelancers who fit the user’s qualifications.

Also, AfriBlocks assigns to the selected freelancer a project manager who manages the project through completion. Once the job is complete, AfriBlocks collects a transaction fee, and the payment is released from escrow. This ensures that expectations are clear and deadlines are met for freelancers and customers.

In addition, Choto says the company offers community and development resources that help them upskill and remain competitive in the global marketplace. This has been done in partnership with edtech company Coursera and African nonprofit Ingressive for Good. It is also in talks with online learning platform Datacamp to do the same for data scientists.

Roger Roman (co-founder). Image Cedits: AfriBlocks

As peculiar to most African startups, funding has been hard to come by for the team. Bootstrapping seemed like the only course of action to take, and it seems to have taken them far. In less than a year, the company has onboarded more than 2,000 freelancers and more than 400 buyers. It has also completed up to 250 jobs generating over $60,000 in revenue. This progress has attracted the likes of Techstars and Google to provide them with funding and networking.

“We’ve encountered the problems that many Black founders face, such as scarce fundraising sources. However, organizations like Techstars Seattle, Transparent Collective and Google for Startups have helped us by providing mentorship, networking opportunities and investor demo days showcases,” Roman said.

AfriBlocks joins African startups like Farmcrowdy, OnePipe, Risevest, Eversend and OjaExpress, who have participated in different Techstars accelerators worldwide.

Before AfriBlocks, Choto, who grew up in Zimbabwe, served as a product manager at BillMari, a pan-African remittance service leveraging bitcoin technology. For Roger, whose upbringing was on the west side of Chicago, he doubles as an active angel investor and a VC scout.

It is predicted that freelancers will account for as much as 80% of the entire workforce worldwide by 2030. Freelance work has become a viable source of employment and has shifted from being a vocation people engage in to supplement their income to being a full-time source of jobs for Africans.

The long-term goal for AfriBlocks is to build the tech infrastructure for the future of work in Africa. According to the company, participating in Techstars is the right path to that destination.

“In anticipation of the impending global human talent shortage that could result in 85 million jobs being unfilled and the loss of $85 trillion annually, our long-term goal is to make Africa the global hub for technical and creative freelancers by providing the rails for companies to work in Africa and with remote African talent,” Choto said.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico