TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Before kids graduate to the expansive virtual worlds in games like Roblox, Minecraft and Fortnite, they often get their start in online social gaming with a game like Animal Jam. Here, kids learn to personalize their avatar, explore a world, chat with other players and trade items in a safe environment with parental controls. Today, the company behind this popular title, WildWorks, is launching a new game, Fer.al, which builds on Animal Jam’s legacy while catering to a slightly older crowd of Gen Z teens.

“When we started talking about Fer.al, it was the idea of where do kids go when they age out of Animal Jam?,” explains Clark Stacey, co-founder and CEO of WildWorks. “Because there isn’t a transitional space between a completely walled garden like Animal Jam and … Instagram and the adult social networks and games that don’t have those same protections,” he continues.

“We knew we wanted to provide a place for these older kids to go where the walls are a little bit lower,” Stacey adds.

The new game is meant to cater to older kids — meaning young teens ages 13 to around 18 — who are now choosing their own games, have their own email address and don’t need parental permission to play. The guardrails on chat also won’t be as high on Fer.al as on Animal Jam and will focus more on preventing bullying and abuse than blocking words. Players will also be able to connect their online social accounts to their game accounts in the future.

Image Credits: WildWorks

With Fer.al, WildWorks is introducing another animal-centered title, but this time it’s moving into the fantasy realm. Players choose between bipedal humanoid creatures based on folklore and myth including a Kitsune, Senri, Dragon, Jackelope, Werewolf, Kirin or a Shinigami, with more to come in time.

The characters’ style was inspired by Animal Jam fan art, Stacey says, where kids would create animal avatars that were sort of a mix between manga, Animal Jam’s style, and other, older animation styles.

Like its predecessor, Fer.al players will also be able to personalize their character and change their appearance, design their personal space (this time, a “sanctuary” instead of a “den,”) discover a world where they can interact with other players, collect items and trade, and venture on quests. But the storyline has also evolved to reflect teens’ interests, including their growing understanding of social media and the desire to grow an online fan base.

The larger narrative involves a reality show where two warring queens, Aradia and Delilah — each with their own Instagram account, naturally — are angling for control. The company isn’t offering a lot of details as to how this narrative plays out in the long term, but it will involve weekly and monthly contests as the game ramps up, in addition to the everyday missions and quests that are undertaken to gain ingredients to create new clothes or a new “glamour” (a rendering effect that goes around your character.)

Image Credits: WildWorks

Much like Animal Jam — or even other virtual worlds like some Roblox games — players are meant to engage in cooperative gameplay to advance. There will be tasks you can’t complete on your own, meaning you’ll need to interact and chat. You will also be able to join factions, initially driven by the two queens, as the game advances.

Another notable aspect to Fer.al is that it’s largely designed to cater to girl gamers.

“It’s certainly not intended to be to the exclusion of boys who are in this age range,” explains Stacey. “But we recognize the fact that, among the most engaged Animal Jam players, it’s about 80% girls. We’ve leaned into that pretty heavily in Animal Jam — we’re trying to feature a lot of female scientists and working with them on causes that promote girls in STEM. So we know a lot of the built-in audience is coming from that,” he says.

“And I think the need that we recognized is that it’s not hard for adolescent boys to find online communities that jive with them. It’s pretty hard for girls to find the same thing. So, as we’re creating this community — everything from the rules to the visuals — we are very conscious of that. And the people that we’re going to and asking for what works for you and what doesn’t, is primarily girls,” he adds.

Image Credits: WildWorks

Building off the Animal Jam fan base has been an advantage for getting Fer.al off the ground. Today, Animal Jam has anywhere between 2.5 million to 4 million monthly active users out of a total of 135 million registered accounts. The gulf between the registered and active figures is indicative of how many kids have grown out of Animal Jam since its October 2010 launch. But Stacey admits the title has seen some decline since its peak usage, as well.

Still, there’s a lot of interest in what WildWorks does next, it seems.

Within a week of launching the Fer.al website, the game had 75,000 kids sign up to become beta testers. The testers were brought into the beta slowly, starting in April 2020, and initially on desktop only. Now, the beta version of the game sees daily actives in the low 10,000’s pre-launch. On the Apple App Store and Google Play, over 100,000 people have registered for the pre-release, as well.

Like Animal Jam, Fer.al will offer a freemium experience. But while Animal Jam generated nearly 80% of revenues through subscriptions, Fer.al will use a season pass model of monetization. Users buy the season — priced around $10 to $20 — via an in-app purchase, which will unlock unique items and experiences specific to that season. It expects to launch around seven seasons per year.

Image Credits: WildWorks

The company didn’t offer seasons until later in the beta test, but Stacey says the conversion rate was at “the high end of our expectations so far on desktop.” If the mobile conversion rates remain as high as desktop, it will be in the range to start investing in user acquisition, he says. The company may also consider ads at a later date as well as merchandise, if all goes well.

Salt Lake City-headquartered WildWorks (formerly Smart Bomb Interactive) is majority owned by Signal Peak Ventures, which has invested $20+ million into the company over the years. The company shifted in 2008 to focus on its own IP, resulting in the launch of Animal Jam and other titles.

Over the past few years, WildWorks’ revenue — largely from Animal Jam and another game, Tag with Ryan — has ranged between $20+ million to below $30 million. If Fer.al is able to successfully capture the Animal Jam graduates who are looking to move up to “older kid” gameplay, it could grow that revenue base by a sizable amount.

Fer.al is launching publicly today in all countries and will be available initially in English. It can be played on PC, Mac, iOS and Android.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

It was only a matter of time before someone married the nascent nootropic supplements for brain health to the snack bar craze that continues to attract dollars and exits.

That time is apparently now, as Rob Dyrdek, the MTV-famous celebrity, pro-skater and entrepreneur, and Chris Bernard announce a new investment in the company they co-founded, Mindright, alongside celebrity investors including Joe Jonas, Travis Barker and The Profit’s Marcus Lemonis.

“When we started down the path of condition-specific food and beverage… we started doing a lot of research into the nootropics and adaptogens space,” said co-founder Bernard. Working with a food scientist who did not want to be named (which isn’t sketchy at all), Dyrdek and Bernard were introduced to several companies producing ashwagandha, which the two had settled on as the new key ingredient in their snack bars.

Along with ginseng and cordyceps mushrooms, the company has a trifecta of new (and old) supplements that have taken the nutraceutical world by storm.

Bernard had initially approached the Dyrdek Machine group about another product, but the company was too far along and not something that Dyrdek felt passionate about backing. The story changed when Bernard returned with plans for this nootropic nosh.

“[Bernard] brought back the concept of the path of what’s evolved from functional foods and probiotics and collagen and sort of the mental health and adaptogen and the supplement world and said here’s how to merge these,” Dyrdek said of Bernard’s second pitch. “It was a home-run for us. Our process is supporting a solopreneur where we help shape and build the company together and provide the outsourced resources. We fund the development of the idea to go to the capital markets.”

So far, Dyrdek and his team have made 15 investments in consumer and entertainment businesses, and five of those business have since been acquired.

Most deals from Dyrdek Machine follow a similar trajectory. The firm becomes a co-founder and shares common stock and then negotiate a preferred equity investment for the capital infusion. Typically those deals range from $250,000 to $500,000.

“We co-found it and we share that common share class and our first money is preferred and pick a valuation that balances out the deal,” Dyrdek said. “How much equity do we want to develop it with you is what we negotiate with that initial capital.”

Portrait of Rob Dyrdek, founder of Dyrdek Machine. Image Credits: Dyrdek Machine

Dyrdek describes his investment firm as founder-driven and market agnostic. “We want a well-rounded, multi-dimensional founder and then we look at the market and how do we evolve it into something that has a larger, broader appeal,” Dyrdek said. “Rather than chasing down nootropics, we found that ‘good mood’ was the important thing to the consumer base. That’s why we drove ‘Good mood superfood.’ ”

Bernard’s faith in Dyrdek’s ability to move the business forward has been proven in the evolution of other companies in the firm’s portfolio. Dyrdek pointed to Outstanding Foods, another investment, which he said had recently closed a $10 million round at a $100 million valuation. Another startup in the portfolio, Momentous, a supplement manufacturer, also closed on a big round recently after raising $5 million in 2019, Dyrdek said.

For Mindright, Dyrdek’s involvement brought in other celebrity names once they tried the product. The company counts Joe Jonas and Travis Barker among its seed investors.

“They were excited to get involved in this because they believed in what we took the time to create,” Bernard said.

Powered by WPeMatico

TechCrunch is hosting a small virtual meetup this Thursday centered around Miami. We hope you can attend. It’s free.

This is our first (virtual) field trip to Miami. Even though we can’t be there physically right now, it’ll sure feel like we are. All lights will be shining on the Magic City. The area is quickly transforming thanks to active investors, interesting companies, a Twitter-proficient mayor and beautifully scenic living.

If you’re interested in what’s happening in Miami in general, seeking out a new, up-and-coming city to live in, looking for cool companies and talented founders to invest in, then you’ll want to register and drop March 11 on your calendar. This is a virtual event, but space is still limited, so register early.

Here’s just some of what you can expect:

All along the way we’ll be asking for your feedback by way of polls, Q&As and surveys. We want to hear from everyone who lives in the birthplace of sunscreen, and we’re looking to you for suggestions on folks who should be getting all of the attention we can throw at them on March 11. Drop suggestions in the comments below.

It’s going to be one to remember, and it’s the perfect setup for when we can safely crash the city in person again!

Powered by WPeMatico

Security firm McAfee announced this morning that it will be selling its enterprise business to a consortium led by the private equity firm Symphony Technology Group for $4 billion.

It should pair well with RSA, another enterprise-focused security company the private equity firm purchased last February for $2 billion.

McAfee President and Chief Executive Officer Peter Leav says that his company has decided to direct the firm’s resources to the consumer side of the business. “This transaction will allow McAfee to singularly focus on our consumer business and to accelerate our strategy to be a leader in personal security for consumers,” he said in a statement.

The company has been making some moves in the last year, returning to the public markets after a decade as a private company. In January, the company reportedly laid off a couple of hundred employees and shut down its software development center in Tel Aviv.

Although Symphony did not point directly to the RSA acquisition, the two investments create a large combined legacy security business for the firm, both of which have strong brand recognition, but might have lost some of their edge to more modern competitors in the marketplace.

Looking at McAfee’s latest earning’s report, Q42020, which the company reported on February 24, 2021, the consumer business grew at a much brisker rate than the enterprise side of the house. The former was up 23% YoY, while the latter grew at a far slower 5% rate.

As for the entire year, the company reported $2.9 billion in total FY2020 revenue, up 10% YoY. That broke down to $1.6 billion in consumer net revenue up 20% YoY, and $1.3 billion in enterprise net revenue, an increase of just 1% for the full year.

The company has a complex history, starting life in the 1980s selling firewall software. It eventually went public before being purchased by Intel for $7.7 billion in 2010 and going private again. In 2014, the company changed names to Intel Security before Intel sold a majority stake to TPG in 2017 for $4.2 billion and changed the name back to McAfee.

The transaction is expected to close by the end of this year, subject to regulatory oversight.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

As the restaurant industry across different cities was massively hit by the pandemic-induced lockdowns last year, food aggregator platforms helped by driving online customers to them.

Koinz is one such startup in Egypt. Its value for food and beverages brands before, during and after the lockdowns has bagged the startup a $4.8 million seed round.

Founded in 2018 by Hussein Momtaz, Ahmed Said and Abdullah Al Khaldi, Koinz set out to solve two major problems in Egypt’s food aggregation industry.

The offline and online food and restaurant experience in the country are totally separate. Most food aggregators who deal with delivery tend to focus on the online customer, and there’s no sophisticated experience for the offline customer.

Next, the unit economics of the food aggregation industry is quite challenging. According to Momtaz, the startup’s CEO, the food aggregation industry usually takes about 25%-30% average commission from F&B players for business to start to make sense.

“This is not because they want to squeeze money from the hands of restaurants or brands,” Momtaz told TechCrunch. “But the cost of acquiring customers and retaining them for the food aggregator itself is very high; that’s why they need very high commissions from the brands or restaurants.”

This is where Koinz comes in. The company developed a mobile app for takeout and delivery orders that manages offline customer experiences while delivering an engagement platform to manage loyalty programs, customer feedback and analytics about the online and offline customer base.

Abdullah Al Khaldi (CRO), Hussein Momtaz (CEO), and Ahmed Said (CTO). Image Credits: Koinz

Online food experience for Koinz customers is like a treasure hunt, and Momtaz claims the company’s business model has cracked the industry’s unit economics. This, alongside providing brands with insights, differentiates the platform from other aggregators and makes its customer acquisition cost and retention cost 60% less than most of them.

Here’s how the platform works. When customers visit a brand using for the first time, they enter their phone numbers to instantly receive points for their order via text message. After various restaurant visits and making orders, they accumulate enough points. They’ll need to download the Koinz mobile application to redeem them, thereby converting these offline customers to online ones.

Furthermore, these offline customers can now discover new places to eat, read and leave reviews, and order delivery or takeout.

“None of the small or big brands in the region had something like this before. The offline customer is like a ghost. He walks into the brands, takes his orders and leaves without the brands knowing anything about him. Koinz is changing that,” the CEO remarked.

Building its platform this way, Koinz tries to be different from other online aggregators that erode restaurant owners’ profit margins while delivering limited customer access and interaction. How? By collecting real-time data and leveraging a digital rewarding system designed to drive customers to deepen their relationship with restaurants.

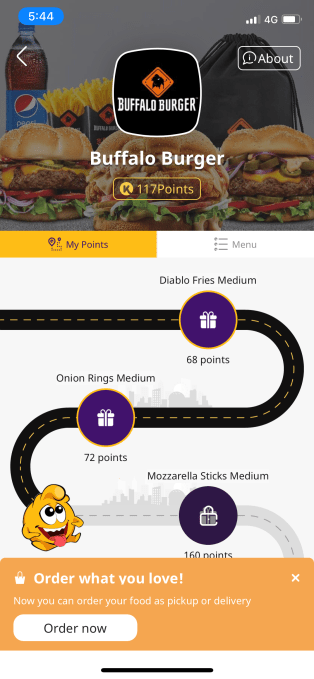

Image Credits: Koinz

Brands can configure their gifts lists and determine for which items customers can redeem their points. For instance, customers in an Egyptian restaurant called Buffalo Burger can exchange 68 points for a Diablo Fries Medium; or wait till they get to 160 points to get a Mozzarella Sticks Medium; or 236 points for a Double Diggler.

Similarly, every brand has its own configuration. A customer cannot get points in Buffalo Burger and redeem them at Hamburgini. Koinz charges subscriptions to the brands for its engagement and feedback platform and collects commission whenever an order is made via its platform, which varies across its markets.

Because of its original business model, Koinz had to iterate several times. Before using phone numbers to collect customers’ information, the company used QR codes and NFC tags. Momtaz says this was highly ineffective, and the move to phone numbers helped skyrocket its growth and value.

The six-man team back in 2018 is now 80, and the platform, which is basically powering the growth of restaurants in the Middle East, claims to have had up to 4 million consumers earn points on its platform. These consumers have redeemed almost 300,000 rewards, while almost 800,000 customers have left reviews.

Since launching in Egypt, Koinz has expanded to Saudi Arabia and the UAE. Like Egypt, these markets have similar dynamics and demographics. They have also witnessed one of the highest rates of new or increased users in online deliveries — restaurant products and groceries — during the pandemic.

Besides, consumers in the Middle East are outpacing the global appetite in food delivery, with 64% ordering in at least once a week compared to 40% made by global consumers. And with the fast-food industry in MENA estimated at nearly $31 billion in 2020 and expected to reach nearly $60 billion by 2025, there’s so much room for Koinz to grow in the region. Momtaz says the company is also considering a move to Sub-Saharan Africa in the near future despite them having distinct demographics.

Entrepreneur and investor Justin Mateen led this seed round. Since leaving Tinder in 2014, Mateen has been an active investor in early-stage companies. Koinz is his first investment in the MENA region. According to him, Koinz’s ability to allow food and beverages brands to understand their customers’ needs and simultaneously increase their profit margins was one of the reasons he invested in the Egyptian-based startup.

“The company’s unique business model will continue to scale as the food delivery space evolves. Hussein’s drive and excitement for what the team is building are what convinced me to lead a round in the Middle East for the first time,” Mateen added.

African-focused VC 4DX Ventures and strategic angel investors from Egypt, Turkey and Saudi Arabia participated as well.

Peter Orth, co-founder and managing director of the firm, said of the investment that with restaurants in the region suffering under the traditional aggregator model, especially during the pandemic, Koinz has quickly become a win-win for both consumers and restaurant owners across the Middle East.

As the three-year-old company plans to use the capital to hire more talent and fuel its expansion across the Middle East, Mateen and Orth will join its board of directors.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Planted, a startup pursuing a unique method of creating a vegetarian chicken alternative, has raised an $18 million (CHF 17 million) Series A to expand its product offerings and international footprint. With new kebabs and pulled-style faux meats available and steak-like cuts in the (literal) pipeline, Planted has begun to set its sights outside central Europe.

The company was a spinout from ETH Zurich and made its debut in 2019, but has not rested on the success of its plain chicken recipe. Its approach, which relied on using pea protein and pea fiber extruded to recreate the fibrous structure of chicken for nearly 1:1 replacement in recipes, has proven to be adaptable for different styles and ingredients as well.

“We aim to use different proteins, so that there is diversity, both in terms of agriculture and dietary aspects,” said co-founder Christoph Jenny.

“For example our newly launched planted.pulled consists of sunflower, oat and yellow pea proteins, changing both structure and taste to resemble pulled pork rather than chicken. The great thing about the sunflower proteins, they are upcycled from sunflower oil production. Hence, we are establishing a circular economy approach.”

When I first wrote about Planted, its products were only being distributed through a handful of restaurants and grocery stores. Now the company has a presence in more than 3,000 retail locations across Switzerland, Germany and Austria, and works with restaurant and food service partners as well. No doubt this strong organic (so to speak) growth, and the growth of the meat alternative market in general, made raising money less of a chore.

The cash will be directed, as you might expect for a company at this stage, towards R&D and further expansion.

“The funding will be used to expand our tech stack, to commercialize our prime cuts that are currently produced at lab scale,” said Jenny. “On the manufacturing side we look to significantly increase our current capacity of half a ton per hour to serve the increasing demand coming from international markets, first in neighboring countries and then further into Europe and overseas.”

“We will further invest in our structuring and fermentation platforms. Combining structuring technologies with the biochemical toolboxes of natural microorganisms will allow us to create ultimately new products with transformative character – all clean, natural, healthy and tasty,” said co-founder Lukas Böni in a press release.

No doubt this all will also help lower the price, a goal from the beginning but only possible by scaling up.

As other companies in this space also raise money (incidentally, rather large amounts of it) and expand to other markets, competition will be fierce — but Planted seems to be specializing in a few food types that aren’t as commonly found, at least in the U.S., where sausages, ground “beef” and “chicken” nuggets have been the leading forms of meat alternatives.

No word on when Planted products will make it to American tables, but Jenny’s “overseas” suggests it is at least a possibility fairly soon.

The funding round was co-led by Vorwerk Ventures and Blue Horizon Ventures, with participation from Swiss football (soccer) player Yann Sommer and several previous investors.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Ready? Let’s talk money, startups and spicy IPO rumors.

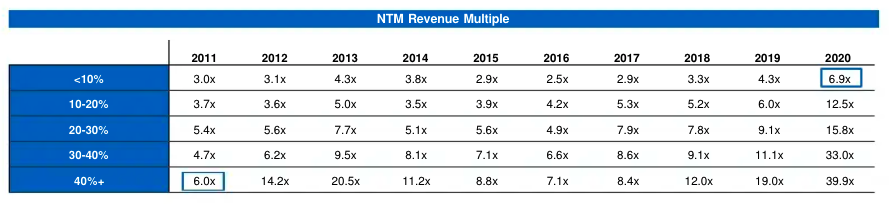

Despite some recent market volatility, the valuations that software companies have generally been able to command in recent quarters have been impressive. On Friday, we took a look into why that was the case, and where the valuations could be a bit more bubbly than others. Per a report written by few Battery Ventures investors, it stands to reason that the middle of the SaaS market could be where valuation inflation is at its peak.

Something to keep in mind if your startup’s growth rate is ticking lower. But today, instead of being an enormous bummer and making you worry, I have come with some historically notable data to show you how good modern software startups and their larger brethren have it today.

In case you are not 100% infatuated with tables, let me save you some time. In the upper right we can see that SaaS companies today that are growing at less than 10% yearly are trading for an average of 6.9x their next 12 months’ revenue.

Back in 2011, SaaS companies that were growing at 40% or more were trading at 6.0x their next 12 month’s revenue. Climate change, but for software valuations.

One more note from my chat with Battery. Its investor Brandon Gleklen riffed with The Exchange on the definition of ARR and its nuances in the modern market. As more SaaS companies swap traditional software-as-a-service pricing for its consumption-based equivalent, he declined to quibble on definitions of ARR, instead arguing that all that matters in software revenues is whether they are being retained and growing over the long term. This brings us to our next topic.

I’ve taken a number of earnings calls in the last few weeks with public software companies. One theme that’s come up time and again has been consumption pricing versus more traditional SaaS pricing. There is some data showing that consumption-priced software companies are trading at higher multiples than traditionally priced software companies, thanks to better-than-average retention numbers.

But there is more to the story than just that. Chatting with Fastly CEO Joshua Bixby after his company’s earnings report, we picked up an interesting and important market distinction between where consumption may be more attractive and where it may not be. Per Bixby, Fastly is seeing larger customers prefer consumption-based pricing because they can afford variability and prefer to have their bills tied more closely to revenue. Smaller customers, however, Bixby said, prefer SaaS billing because it has rock-solid predictability.

I brought the argument to Open View Partners Kyle Poyar, a venture denizen who has been writing on this topic for TechCrunch in recent weeks. He noted that in some cases the opposite can be true, that variably priced offerings can appeal to smaller companies because their developers can often test the product without making a large commitment.

So, perhaps we’re seeing the software market favoring SaaS pricing among smaller customers when they are certain of their need, and choosing consumption pricing when they want to experiment first. And larger companies, when their spend is tied to equivalent revenue changes, bias toward consumption pricing as well.

Evolution in SaaS pricing will be slow, and never complete. But folks really are thinking about it. Appian CEO Matt Calkins has a general pricing thesis that price should “hover” under value delivered. Asked about the consumption-versus-SaaS topic, he was a bit coy, but did note that he was not “entirely happy” with how pricing is executed today. He wants pricing that is a “better proxy for customer value,” though he declined to share much more.

If you aren’t thinking about this conversation and you run a startup, what’s up with that? More to come on this topic, including notes from an interview with the CEO of BigCommerce, who is betting on SaaS over the more consumption-driven Shopify.

Next Insurance bought another company this week. This time it was AP Intego, which will bring integration into various payroll providers for the digital-first SMB insurance provider. Next Insurance should be familiar because TechCrunch has written about its growth a few times. The company doubled its premium run rate to $200 million in 2020, for example.

The AP Intego deal brings $185.1 million of active premium to Next Insurance, which means that the neo-insurance provider has grown sharply thus far in 2021, even without counting its organic expansion. But while the Next Insurance deal and the impending Hippo SPAC are neat notes from a hot private sector, insurtech has shed some of its public-market heat.

Stocks of public neo-insurance companies like Root, Lemonade and MetroMile have lost quite a lot of value in recent weeks. So, the exit landscape for companies like Next and Hippo — yet-private insurtech startups with lots of capital backing their rapid premium growth — is changing for the worse.

Hippo decided it will debut via a SPAC. But I doubt that Next Insurance will pursue a rapid ramp to the public markets until things smooth out. Not that it needs to go public quickly; it raised a quarter billion back in September of last year.

What else? Sisense, a $100 million ARR club member, hired a new CFO. So we expect them to go public inside the next four or five quarters.

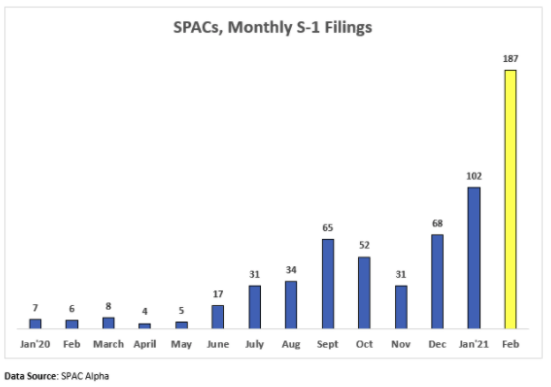

And the following chart, which is via Deena Shakir of Lux Capital, via Nasdaq, via SPAC Alpha:

Powered by WPeMatico

Product manager might be one of the most grey roles within a startup. However, as a company progresses and the team grows, there comes a time when a founder needs to carve out dedicated roles. Of these positions, product management might be one of the most elusive — and key — roles to fill.

Ken Norton, who recently left his job as director of product at Figma to consult rising PMs, thinks it’s easier to start with defining what they aren’t: the CEO of the product.

“Product managers need to realize that there is a lot of janitorial work that gets done in product management,” he said. “It’s not fun or glamorous, and it’s certainly not being the CEO of the product. It’s just stuff that needs to get done.” I wrote up a guide on how and when to hire your first product manager that expands on some of these insights, including how focus might be the biggest trait to interview for:

Hiring continues to be one of the hardest parts of building a startup, and those early employees can define the trajectory, culture and eventual success of it. Even during TC Sessions: Justice this past week, Precursor’s Sydney Thomas explained how startups need to make “pretty final decisions, pretty early on in what type of company you want to build.”

It’s a slight asterisk to the common narrative of how startups pivot every other day. It’s not that simple, and I’ll probably remind you of that every other week, dear Startups Weekly readers.

The rest of today’s newsletter will include notes on a hot up-and-coming edtech IPO, an exit that includes Jay-Z, and the latest in agricultural tech robots. Also, remember you can always find me on Twitter @nmasc_ or e-mail me at natasha.m@techcrunch.com.

It’s been yet another busy week for the public markets. I published a scoop earlier this week that Coursera is filing to go public soon, which would be one of the first debuts that will let us see how an education company’s finances changed, and accelerated, amid the pandemic’s impact on remote learning.

Here’s what to know: Like clockwork, Coursera’s S-1 dropped late Friday, giving us the first glance of the numbers behind the business. The startup tried to pain a picture of a path of profitability, with rising revenues as well as rising net losses. We get into the meat of it here.

Image Credits: Fotograzia / Getty Images

One of the biggest headlines of this past week was Square buying a majority stake of Tidal. A fintech and music collaboration might not seem that obvious, but the music economy remains one of the most under-tapped (and under-innovated) opportunities that remains out there.

Here’s what to know: Square CEO Jack Dorsey used his other company, Twitter, to share more information about the $297 million deal. As part of this transaction, Tidal owner Jay-Z got a board seat with Square, triggering conversations about the future of musical NFTs. The deal also officially confirmed that Jay-Z isn’t just a businessman, he’s a business, man.

Singer Jay-Z performs before US President Barack Obama speaks at a campaign rally in Columbus, Ohio, on November 5, 2012. After a grueling 18-month battle, the final US campaign day arrived Monday for Obama and Republican rival Mitt Romney, two men on a collision course for the world’s top job. The candidates have attended hundreds of rallies, fundraisers and town halls, spent literally billions on attack ads, ground games, and get out the vote efforts, and squared off in three intense debates. AFP PHOTO/Jewel Samad (Photo credit should read JEWEL SAMAD/AFP/Getty Images)

In this week’s Equity Wednesday episode, we brought on TC’s climate tech editor, Jonathan Shieber, to talk about the opportunities within agtech right now. We covered a lot within the 20-minute episode: from $100 million for mealworms, farm-to-grill robots and decentralized insect farming.

Here’s what to know: Farms have always had a compelling reason to turn to robotics to make tedious work much, much easier. We got into two different businesses and their approaches on how to serve farm robots, from SaaS leases to selling the robots one by one.

Image Credits: Fernando Trabanco Fotografía / Getty Images

Thanks to all of you who tuned into TC Sessions: Justice this past week, it was so fun to hang — and make sure to give virtual kudos to my colleague, and showrunner, Megan Rose Dickey.

Next up is TechCrunch Early Stage, our yearly event that is all about tactical advice to help new and first-time founders navigate the Wild West world that is venture capital and startups. We just announced the judges of the pitch-off competition, and have already landed top-tier venture capitalists to share what you won’t find on Twitter: behind the scenes startup advice that is beyond 180 characters.

It’s the bootcamp you always wished you could attend, so get your tickets here.

Seen on Extra Crunch

Understanding how investors value growth in 2021

Dear Sophie: Can you demystify the H-1B process and E-3 premium processing

11 words and phrases to cut from your VC pitch deck

Making sense of the $6.5B Okta-Auth0 deal

Seen on TechCrunch

SoftBank makes mountains of cash off of human laziness

Mary Meeker’s Bond has closed its second fund with $2 billion

The technology selloff is getting to be somewhat material

What China’s Big Tech CEOs propose at the annual parliament meeting

I wanted to end by using this platform to address the rise of anti-Asian violence across our country. Conversations around how to be a more inclusive and anti-racist society need to be more loud, and more collaborative in order for change to actually happen. Intention around inclusion will impact the world we live in, the startups we create and the success of our collective. Here are some resources to donate, petition and learn.

Thanks,

Powered by WPeMatico

After TechCrunch broke the news yesterday that Coursera was planning to file its S-1 today, the edtech company officially dropped the document Friday evening.

Coursera was last valued at $2.4 billion by the private markets, when it most recently raised a Series F round in October 2020 that was worth $130 million.

Coursera’s S-1 filing offers a glimpse into the finances of how an edtech company, accelerated by the pandemic, performed over the past year. It paints a picture of growth, albeit one that came at steep expense.

In 2020, Coursera saw $293.5 million in revenue. That’s a roughly 59% increase from the year prior when the company recorded $184.4 million in top line. During that same period, Coursera posted a net loss of nearly $67 million, up 46% from the previous year’s $46.7 million net deficit.

Notably the company had roughly the same noncash, share-based compensation expenses in both years. Even if we allow the company to judge its profitability on an adjusted EBITDA basis, Coursera’s losses still rose from 2019 to 2020, expanding from $26.9 million to $39.8 million.

To understand the difference between net losses and adjusted losses it’s worth unpacking the EBITDA acronym. Standing for “earnings before interest, taxes, depreciation and amortization,” EBITDA strips out some nonoperating costs to give investors a possible better picture of the continuing health of a business, without getting caught up in accounting nuance. Adjusted EBITDA takes the concept one step further, also removing the noncash cost of share-based compensation, and in an even more cheeky move, in this case also deducts “payroll tax expense related to stock-based activities” as well.

For our purposes, even when we grade Coursera’s profitability on a very polite curve it still winds up generating stiff losses. Indeed, the company’s adjusted EBITDA as a percentage of revenue — a way of determining profitability in contrast to revenue — barely improved from a 2019 result of -15% to -14% in 2020.

Powered by WPeMatico

Snowflake reported earnings this week, and the results look strong with revenue more than doubling year-over-year.

However, while the company’s fourth quarter revenue rose 117% to $190.5 million, it apparently wasn’t good enough for investors, who have sent the company’s stock tumbling since it reported Wednesday after the bell.

It was similar to the reaction that Salesforce received from Wall Street last week after it announced a positive earnings report. Snowflake’s stock closed down around 4% today, a recovery compared to its midday lows when it was off nearly 12%.

Why the declines? Wall Street’s reaction to earnings can lean more on what a company will do next more than its most recent results. But Snowflake’s guidance for its current quarter appeared strong as well, with a predicted $195 million to $200 million in revenue, numbers in line with analysts’ expectations.

Sounds good, right? Apparently being in line with analyst expectations isn’t good enough for investors for certain companies. You see, it didn’t exceed the stated expectations, so the results must be bad. I am not sure how meeting expectations is as good as a miss, but there you are.

It’s worth noting of course that tech stocks have taken a beating so far in 2021. And as my colleague Alex Wilhelm reported this morning, that trend only got worse this week. Consider that the tech-heavy Nasdaq is down 11.4% from its 52-week high, so perhaps investors are flogging everyone and Snowflake is merely caught up in the punishment.

Snowflake CEO Frank Slootman pointed out in the earnings call this week that Snowflake is well positioned, something proven by the fact that his company has removed the data limitations of on-prem infrastructure. The beauty of the cloud is limitless resources, and that forces the company to help customers manage consumption instead of usage, an evolution that works in Snowflake’s favor.

“The big change in paradigm is that historically in on-premise data centers, people have to manage capacity. And now they don’t manage capacity anymore, but they need to manage consumption. And that’s a new thing for — not for everybody but for most people — and people that are in the public cloud. I have gotten used to the notion of consumption obviously because it applies equally to the infrastructure clouds,” Slootman said in the earnings call.

Snowflake has to manage expectations, something that translated into a dozen customers paying $5 million or more per month to Snowflake. That’s a nice chunk of change by any measure. It’s also clear that while there is a clear tilt toward the cloud, the amount of data that has been moved there is still a small percentage of overall enterprise workloads, meaning there is lots of growth opportunity for Snowflake.

What’s more, Snowflake executives pointed out that there is a significant ramp up time for customers as they shift data into the Snowflake data lake, but before they push the consumption button. That means that as long as customers continue to move data onto Snowflake’s platform, they will pay more over time, even if it will take time for new clients to get started.

So why is Snowflake’s quarterly percentage growth not expanding? Well, as a company gets to the size of Snowflake, it gets harder to maintain those gaudy percentage growth numbers as the law of large numbers begins to kick in.

I’m not here to tell Wall Street investors how to do their job, anymore than I would expect them to tell me how to do mine. But when you look at the company’s overall financial picture, the amount of untapped cloud potential and the nature of Snowflake’s approach to billing, it’s hard not to be positive about this company’s outlook, regardless of the reaction of investors in the short term.

Powered by WPeMatico