streaming services

Auto Added by WPeMatico

Auto Added by WPeMatico

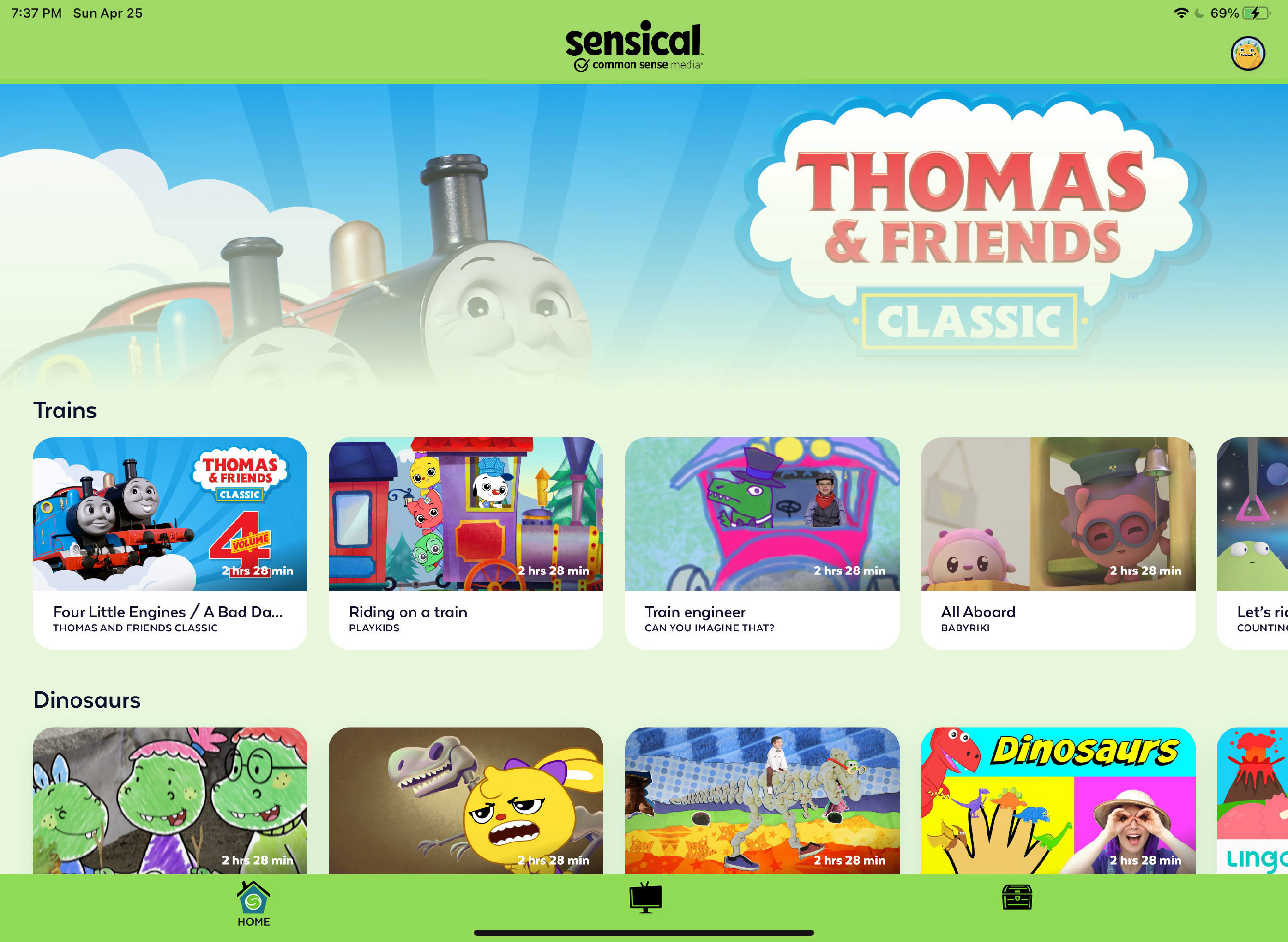

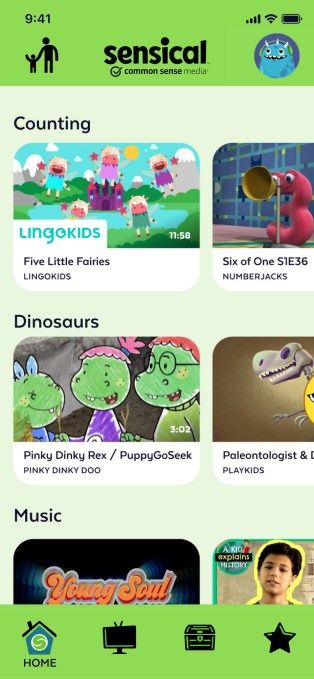

Common Sense Media has made a name for itself among parents as a useful resource for vetting entertainment and technology in terms of its age-appropriateness. Now, the organization’s for-profit affiliate, Common Sense Networks, is taking inspiration from those kid-friendly recommendations with the launch of a new streaming service called Sensical. The service offers age-appropriate, entertaining, and educational videos for children ages 2 through 10.

At launch, the free, ad-supported service includes over 15,000 hand-curated videos and over 50 topic-based channels for children to explore. And unlike other platforms, like Netflix or YouTube, Sensical doesn’t use algorithms to make content recommendations. Instead, kids are encouraged to follow their own interests and passions across over 50 topic-based channels. This includes things like Adventures, Animals, Arts & Crafts, Music, Science, Sports, Video Games, and other sorts of kid-friendly topics.

Kids can star these channels, or individual videos or series, in order to keep up with their favorite content in a dedicated Favorites section within the app.

They will see a selection of these channels based on their age, but the company is working to expand the channel lineup so there will be even more specific categories in the future. For example, instead of just “sports,” there could be channels like “soccer” or “gymnastics.” Instead of “Arts,” there could be “drawing” or “origami.” Instead of just “science,” it could include channels like “geography” or “robotics,” and so on.

Image Credits: Common Sense Networks

The app also features a Live TV section, which is programmed throughout the day with kid-friendly content, so kids don’t have to browse to find something to quickly watch.

While other streaming services on the market offer kid-friendly content — as that’s a huge selling point for subscribers — it’s not always organized in a way that makes sense. Sometimes, all the content gets lumped into a general “Kids” category where videos for little kids are mixed in with content for older children. Sensical, meanwhile, curates the content recommendations into three different experiences, including preschool (2-4), little kids (5-7), and big kids (8-10).

What the child sees is based on how parents configure their profiles. Plus, parents can use the service’s ParentZone in-app dashboard to set screen-time limits, extend limits as needed, and view daily reports on what the child has watched.

The service’s best feature, however, is that the content is assured to be age-appropriate — even the ads.

This is possible because the curation approach Sensical takes is very different from YouTube Kids. YouTube’s app for kids leans on algorithms to filter out adult content from YouTube’s broader library, but the company doesn’t manually review all the videos it includes. It warns parents that some inappropriate content could slip through. (And it has.)

Common Sense Networks, meanwhile, says dozens of trained child-development experts view, vet and rate “every single frame of video” that goes live on its service using its proprietary IP and patent-pending process. This system involves tagging content with specific child-developmental benefits, too.

Sensical also vets its advertising, which is how the service is supported, with similar direct oversight. Its experts review the sponsor’s content to ensure it’s appropriate for children — an area that’s often overlooked on other services.

Image Credits: Common Sense Networks

To fill its library, Common Sense Networks partnered with dozens of studios and distribution partners, as well as digital-first creators.

Studio and distribution partners include CAKE (Poppy Cat), Cyber Group Studios (Leo The Wildlife Ranger), The Jim Henson Company (The Wubbulous World of Dr. Seuss, Jim Henson’s Animal Show with Stinky and Jake), Mattel (Kipper, Pingu, Max Steel), Raydar Media (Five Apples’ limited series, Apple Tree House), Superights (Bo Bear, Handico), WildBrain (Teletubbies, Rev & Roll), Xilam Animation (Learn and Play with Paprika, Moka’s Fabulous Adventures), ZDF Enterprises (Lexi & Lottie, School of Roars), Zodiak Kids (Mister Maker, Tee and Mo), ABC Commercial, CBC & Radio-Canada Distribution, Jetpack Distribution, Nelvana, 9 Story Distribution International, Sesame Workshop, Serious Lunch, and Studio 100.

Digital creators, meanwhile, include ABCMouse, Aaron’s Animals, Alphabet Rockers, batteryPOP, California Academy of Sciences, GoldieBlox, The Gotham Group’s Gotham Reads, Guggenheim Museum, Howdytoons, Kids’ Black History, MEL Science + Chemistry, N*Gen, Pinkfong, Penguin Random House’s Brightly Storytime, Studio71 (Parry Gripp, Maymo, Hyper Roblox), Tankee, Ubongo Kids, Vooks, Bounce Patrol, Hevesh5, Mother Goose Club, StacyPlays, Super Simple Songs and The Whistle.

The service abides by the U.S. children’s privacy laws (COPPA), and is certified by the kidSAFE Seal Program.

Image Credits: Common Sense Networks

Having briefly toyed around with the mobile app, it appears Sensical works as described. If I had any complaints personally, it would only be that the experience could be dismissed as “baby stuff” by older kids approaching their tween years, due to the cute pictures and youthful iconography used in the app’s design. Kids in older age groups take issue with being treated as if they’re younger — and they take particular notice of anything that does so.

The same complaint goes for the Live TV programming, which was clearly aimed at littler kids when we checked it out, despite testing the app as a child profile whose age was set to “10.”

I also think it would be nice if there were a better way to track Favorite channels and see when they’re updated with new videos, as kids moving to Sensical from YouTube will want to “feel” like they’re still connected to new and fresh content and not a library. But Sensical isn’t YouTube. There’s a trade-off between hand-curation and timeliness, and Sensical is favoring the former.

Sensical had been first introduced this spring during a closed beta, but is now publicly available to stream across web and mobile on iOS, Android, Roku, Amazon Fire TV and Apple TV. This summer, it will expand to more distribution platforms, including VIZIO.

Powered by WPeMatico

Subscription services are on the rise. During the pandemic, Americans have been spending more time at home and more money on the digital products that make navigating our new normal easier.

More than ever, Americans’ lives are aided by companies like Netflix, Instacart and, of course, Amazon, which reported record-setting earnings from its 2020 Prime Day savings event.

A recent survey even found that spending on subscription services had more than tripled since March, with one in three respondents saying they’d purchased a new online subscription while quarantining.

Now, a new concern lingers: Is the market getting oversaturated? The question doesn’t just apply to streaming services and food delivery companies — it’s an issue financial technology businesses can’t afford to ignore.

As subscriptions become an increasingly alluring business model, fintechs will be forced to consider whether this proven strategy is worth the risk.

In the CompareCards survey, two-thirds of respondents said they purchased a new streaming service mainly for entertainment. Still, that doesn’t mean there isn’t room for fintechs to carve out their own space.

Bradley Leimer, co-founder of the financial consulting firm Unconventional Ventures, said he’s certainly seen more fintechs exploring subscription models. As Leimer explained, the financial services industry may have not fully embraced the idea, but it’s “starting to take notice.” Leimer, who has more than 25 years of experience in the industry, believes fintechs can learn a lot from subscription services — provided they’re willing to look in the right place.

One major lesson? Transparency. Subscription services give companies an opportunity to be upfront about their fees, as well as their benefits.

“When we talk about subscriptions, the more clear and more transparent we are, the better,” Leimer said.

Acorns is an easy case study. The microinvesting app offers three subscription levels — lite, personal and family — each with a clearly explained list of features. For what it’s worth, the company added more than 2 million users between March 2019 and March 2020, according to Forbes.

Leimer said fintechs should also take note of the way subscription services collaborate. For example, he pointed out how Amazon users can add an HBO subscription to their Prime Video account, essentially “bundling” two subscriptions into one. Fintechs, Leimer said, could stand to take a page out of that playbook.

“There are a lot of ways to sort of skin that cat — for a fintech company to generate income and for a customer to get value on top of that,” Leimer said.

Powered by WPeMatico

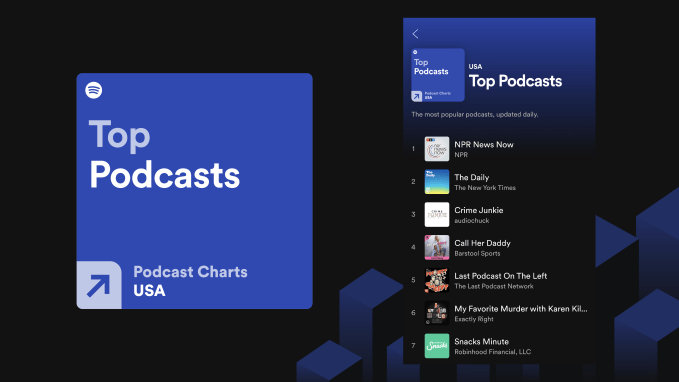

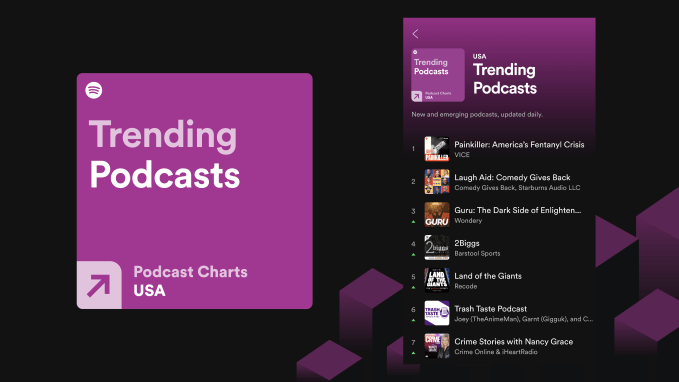

Spotify is today introducing a new feature aimed at helping people discover interesting and popular podcasts. The company this morning announced the launch of two brand-new podcast charts, Top Podcasts and Trending Podcasts, which will showcase both the overall most-listened to and the biggest movers, respectively. The new feature will arrive in the Spotify mobile app across 26 markets. In addition, category-level charts will be available in 7 of the 26, including the U.S., U.K., Mexico, Brazil, Sweden, Germany and Australia.

The new charts will replace the existing “Top Shows” chart to offer a better discovery experience that separates popular from trending and offers, in some cases, category-level detail.

Music services have long since used top charts to help users find new music and discover artists, and Spotify hopes the same will be true for podcasts. Like its music charts, Spotify’s podcast charts will also be updated regularly to help users keep up with which podcasts are seeing the most engagement and growth.

Image Credits: Spotify

The Top Podcasts charts will include the overall most popular audio programs, geared for stability and integrity, as determined by recent listener numbers, Spotify explains. This chart will be updated on a daily basis, giving users a look at which shows have longer-lasting influence. Users will also be able to view the top podcasts for any market where they’re available, not just their own.

Meanwhile, the Trending Podcasts charts use an algorithm that will blend for discovery of newly-launched shows along with the fastest-climbing shows. This will be focused more on helping creators secure a place on the charts to help reach a new audience.

In the seven markets where category-level data is available, Spotify will also separate out the Top and Trending Podcasts by genre — like True Crime, Comedy, News, Lifestyle & Health, TV, Educational, Business & Technology, Celebrities, Sports & Recreation, and others. At the category level, the Top Podcasts charts will list the top 200 overall shows in the selected region and the Trending chart will show the top 50 rapidly rising shows.

Image Credits: Spotify

Related to this, podcasters will also see an updated experience in Spotify’s online dashboard, Spotify for Podcasters, which will now alert them when their podcast is charting. They can then turn this notification into a visual card to share across social media to help further market their podcast.

Podcasts have been of significant interest to all streaming services, and particularly Spotify, in recent years. The company has acquired podcasting software and studios, made deals to secure exclusive and original content (including Joe Rogan) and it has invested in software features like podcast playlists and algorithmic recommendations to introduce podcasts to Spotify’s millions of users.

Today, the service offers over 1 million podcasts, up from the 700,000-plus it was reporting in March. And despite the coronavirus impact on where users listen to podcasts, Spotify said podcast consumption was up by “triple digits” in the first quarter of the year, compared with Q1 2019.

Updated 7/14/20, 11:20 AM ET: Spotify PR originally told us the Top Podcasts chart was “updated monthly.” They corrected this later to say daily. We’ve also updated the article to reflect this change.

Powered by WPeMatico

When I first met Bustle Digital Group’s Jason Wagenheim, it was right as New York City was beginning to go into lockdown. The BDG offices were empty thanks to the company’s newly instituted work-from-home policy, but it still seemed reasonable to meet in-person to learn more about BDG’s broader vision.

At the time, Wagenheim — a former Fusion and Condé Nast executive who joined BDG as chief revenue officer before becoming president in February — acknowledged that we were entering a period of uncertainty, but he sounded a note of cautious optimism for the year ahead.

Since then, of course, things have been pretty rough for the digital media industry (along with the rest of the world), with a rapid reduction in ad spending leading to layoffs, furloughs and pay cuts. BDG (which owns properties like Elite Daily, Input, Inverse, Nylon and Bustle itself) had to make its share of cuts, laying off two dozen employees, including the entire staff of The Outline.

And indeed, when I checked back in with Wagenheim, he told me that he’s anticipating a 35% decline in ad revenue for this quarter. And where he’d once hoped BDG would reach $120 or $125 million in ad revenue this year, he’s now trying to figure out “what does our company look like at $75 or $90 million?”

At the same time, he insisted that executives were determined not to completely dismantle the businesses they’d built, and to be prepared whenever advertising does come back.

We also discussed how Wagenheim handled the layoffs, how the company is reinventing its events sponsorship business and the trends he’s seeing in the ad spending that remains. You can read an edited and condensed version of our conversation below.

TechCrunch: We should probably just start with the elephant in the room, which is that you guys had to make some cuts recently. You were hardly the only ones, but do you want to talk about the thought process behind them?

Jason Wagenheim: Yeah, we ended up having to say goodbye to about 7% of our team, and we had salary reductions to the tune of 18% company-wide for those that made over $70,000. And then we had 30% pay cuts for executives.

You’ve read about all this, I’m sure. It was a really, really hard decision. We spent two weeks in planning, dozens of spreadsheets, negotiating with our investors on a plan that would keep the company moving forward, but [had to] be very sober to the reality of what was happening around us. But also most importantly for us, for our executive team, we weren’t about to disassemble the company that we spent the last 12 to 18 months building.

Powered by WPeMatico

In a world where ad rates are declining for traditional broadcast media, the corporations responsible for making the fictions that millions devour daily need to find a new business model.

Subscription services are on the rise — with every major broadcaster launching an on-demand service — and so are ad-supported video streaming services to replace the traditional networks.

But there’s another Holy Grail of the advertising industry, long thought to be too technologically difficult to achieve, that may finally be within reach. It’s the on-demand product placement of branded goods in a video, and it’s the technology that Ryff has been developing since it was founded in early 2018.

Product placement is an increasingly big business in the U.S., raking in some $11.44 billion in 2019, according to data collected by Statista. That figure is up from $4.75 billion in 2012. The same report indicated that roughly 49% of Americans took action after seeing product placement in media.

The effectiveness of product placement has even been proven by researchers from Indiana University and Emory University. They found that “prominent product placement embedded in television programming does have a net positive impact on online conversations and web traffic for the brand.”

And while streaming services enjoy the dollars their subscribers are throwing at them, they’re also looking at ways to diversify their revenue streams. Netflix and Hulu are both expanding their product marketing divisions and analysts like those from Forrester Research predict that product placement will be a huge moneymaker for the company as traditional ad rates decline.

There are companies that handle product placement already. Startups like Branded Entertainment Network, which works with brands and producers to place real brands into contextually relevant scenes in movies and television, and Mirriad, which adds branded billboards to scenes, are working to bring more money to platforms and producers.

Ryff takes the technology to the next level, using computer vision, machine learning and rendering technologies to identify objects in a scene and replace them with branded products that can be tailored based on customer data.

“The infusion of SVOD/streaming platforms into the market, combined with platforms like Netflix that are unsuccessfully trying to grow their subscriber base will force those same platforms to explore and embrace alternative revenue streams,” said Marlon Nichols, managing general partner at MaC Venture Capital, and a new director on the Ryff board. “In addition, consumers on paid platforms do not want their content consumption interrupted by ads. As such, product placement will be an important growth channel and Ryff’s new marketplace and unique technology set it up to be the unequivocal growth market leader.”

To continue its technology development and ramp up sales and marketing, the company has raised $5 million in financing. According to Crunchbase, Ryff had previously raised $3.6 million from investors, including a subsidiary of the Mahindra Group and undisclosed investors. The new financing came from Valor Siren Ventures, MaC Venture Capital, Moneta Ventures and Vulcan Capital.

“Ryff’s offering is well-timed with the rapidly increasing demand for solutions that extend the reach of a brand’s content and drive business results,” said Uday Ghare, vice president for media and entertainment at Tech Mahindra, in a statement at the time of the company’s investment. “We believe the market will continue to see a shift of brand dollars to both content marketing and programmatic advertising as brands increase their reliance on content-centric programs and look to scale those efforts.”

Ryff’s ads can be tailored to the viewer’s taste, the platform on which video is being distributed, the geography of the broadcast, the date and time of the broadcast and a broader demographic profile, according to the company. Basically it’s like AdWords for videos.

In a blog post writing about the rationale behind his investment firm’s capital commitment to the company, Marlon Nichols of MaC Ventures wrote:

Imagine a future where an IP owner can maximize the value of its content by putting it on the Ryff marketplace, where that content will be mapped for dozens if not hundreds of product placement opportunities and be layered with restrictions that comply with creative needs. Those opportunities will be ranked and priced by their effectiveness to drive marketing goals for brands. Brands can bid on in-video placement opportunities that fit their marketing strategies and budgets. 3D brand assets can be uploaded and inserted dynamically into content right before the moment of video delivery.

Ryff’s first disclosed partnership is with the “reality” television producer Endemol Shine.

“Ryff successfully takes the concept of product placement, the only advertising format that can’t be skipped by the viewer, and delivers a scalable and adaptable advertising solution that can be applied to any content, at any time and in any market,” said Roy Taylor, founder and CEO of Ryff, in a statement. “The result benefits all — content free from annoying distractions, audience-specific brand placement and delivering a new means towards monetizing video assets.”

Powered by WPeMatico

Backed by over $200 million in VC funding, Kobalt is changing the way the music industry does business and putting more money into musicians’ pockets in the process.

In Part I of this series, I walked through the company’s founding story and its overall structure. There are two core theses that Kobalt bet on: 1) that the shift to digital music could transform the way royalties are tracked and paid, and 2) that music streaming will empower a growing middle class of DIY musicians who find success across countless niches.

This article focuses on the complex way royalties flow through the industry and how Kobalt is restructuring that process (while Part III will focus on music’s middle class). The music industry runs on copyright administration and royalty collections. If the system breaks — if people lose track of where songs are being played and who is owed how much in royalties — everything halts.

Kobalt is as much a compliance tech company as it is a music company: it has built a quasi “operating system” to more accurately and quickly handle this using software and a centralized approach to collections, upending a broken, inefficient system so everything can run more smoothly and predictably on top of it. The big question is whether it can maintain its initial lead in doing this, however.

Powered by WPeMatico

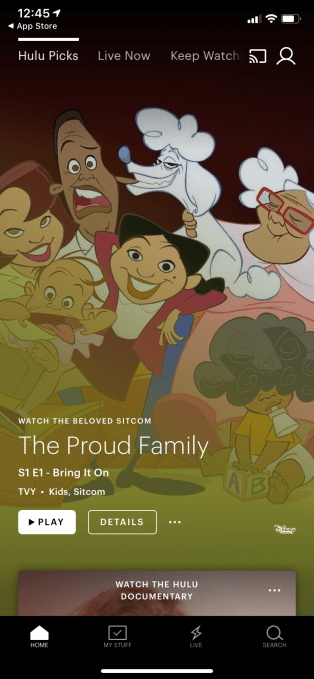

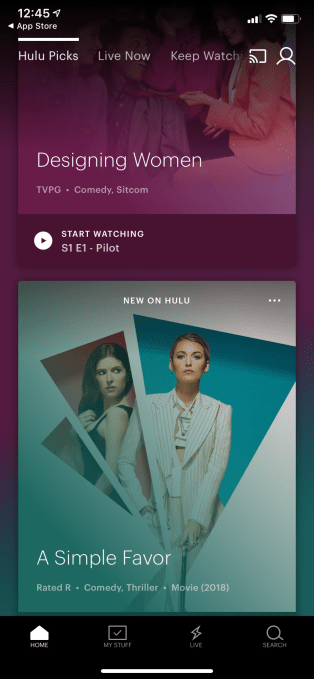

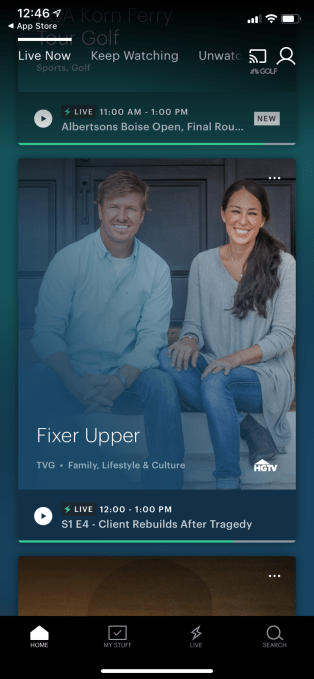

At this year’s CES event, Hulu announced plans to trial an updated version of its user interface that would do away with the confusing landing page called “Lineup.” At the time, the company said it was considering both a “Hulu Picks” option or an “Unwatched in My Stuff” screen as a replacement for “Lineup.” Today, Hulu’s new interface is rolling out across iOS and Android devices, the company says, and “Lineup” is gone.

The Hulu interface launched in 2017 was not always well-liked — something Hulu had acknowledged after a complaint became the most upvoted item on Hulu’s customer feedback forums a couple of years ago. Users felt the interface was too difficult to navigate and the layout was confusing, among other things.

Some of Hulu’s challenges were around the fact that it was trying to merge an on-demand library with a live TV service, while also finding room to promote its original content.

But some of its other design choices were just odd — like its decision to make a single piece of content the main focus for many of its screens, for example. Meanwhile, its landing page “Lineup” never really made sense, either. Its name hinted at some form of personalization, but instead, it was more often filled with suggestions of what Hulu was promoting, like “The Handmaid’s Tale.”

The updated iOS interface ditches “Lineup,” and replaces it with “Hulu Picks.”

This is more clearly a collection of things to watch that’s curated by Hulu staff, rather than algorithmically derived by user viewing behavior.

However, the other landing page Hulu had been considering, “Unwatched in My Stuff,” is still available just a few swipes over.

While Hulu still gives a single piece of content the focus on its main screens on the iPhone, it’s now easier to see there’s more content available if you swipe down, as the top of the next item’s card is peeking up from the bottom of the screen.

On the smartphone, this means you can see two items at a time. On iPad, you can see two rows totaling six cards on the app’s main screen when in landscape mode.

This same format applies not only to “Hulu Picks,” but also to neighboring screens like “Live Now,” “Unwatched in My Stuff,” “My Channels” and the genre-based sections like “Sports,” “News,” “TV,” “Movies,” “Kids,” “Hulu Originals” and others.

Only the “Keep Watching” screen retains the more traditional thumbnails.

This seems like a small change, but it goes a long way to increase the discoverability of Hulu content, as it reduces how many times you have to swipe to see more suggestions.

Other changes touted at CES, like adding expanded metadata next to content (genre, rating, year) or the ability to mark content as “unwatched,” haven’t made an appearance. (Plenty of items still lack a rating). The 14-day live TV guide mentioned at CES isn’t available on iOS, either.

Hulu didn’t publicly announce the launch of the iOS redesign, but did confirm it’s rolling out now, only to mobile devices. They said other devices will get the update “soon.”

Update: Hulu says the update is coming to Android as well now, but it’s only in A/B testing at present. The post has been updated since publication.

Powered by WPeMatico

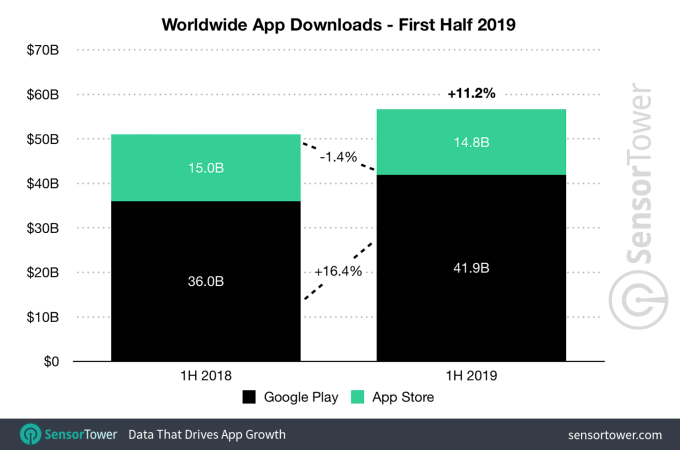

App store spending is continuing to grow, although not as quickly as in years past. According to a new report from Sensor Tower, the iOS App Store and Google Play combined brought in $39.7 billion in worldwide app revenue in the first half of 2019 — that’s up 15.4% over the $34.4 billion seen during the first half of last year. However, at that time, the $34.4 billion was a 27.8% increase from 2017’s numbers, then a combined $26.9 billion across both stores.

Apple’s App Store continues to massively outpace Google Play on consumer spending, the report also found.

In the first half of 2019, global consumers spent $25.5 billion on the iOS App Store, up 13.2% year-over-year from the $22.6 billion spent in the first half of 2018. Last year, the growth in consumer spending was 26.8%, for comparison’s sake.

Still, Apple’s estimated $25.5 billion in the first half of 2019 is 80% higher than Google Play’s estimated gross revenue of $14.2 billion — the latter a 19.6% increase from the first half of 2018.

The major factor in the slowing growth is iOS in China, which contributed to the slowdown in total growth. However, Sensor Tower expects to see China returning to positive growth over the next 12 months, we’re told.

To a smaller extent, the downturn could be attributed to changes with one of the top-earning apps across both app stores: Netflix.

Last year, Netflix dropped in-app subscription sign-ups for Android users. Then, at the end of December 2018, it did so for iOS users, too. That doesn’t immediately drop its revenue to zero, of course — it will continue to generate revenue from existing subscribers. But the number will decline, especially as Netflix expands globally without an in-app purchase option, and as lapsed subscribers return to renew online with Netflix directly.

In the first half of 2019, Netflix was the second highest earning non-game app with consumer spending of $339 million, Sensor Tower estimates, down from $459 million in the first half of 2018. (We should point out the firm bases its estimates on a 70/30 split between Netflix and Apple’s App Store that drops to 85/15 after the first year. To account for the mix of old and new subscribers, Sensor Tower factors in a 25% cut. But Daring Fireball’s John Gruber claims Netflix had a special relationship with Apple where it had an 85/15 cut from year one.)

In any event, Netflix’s contribution to the app stores’ revenue is on the decline.

In the first half of last year, Netflix had been the No. 1 non-game app for revenue. This year, that spot went to Tinder, which pulled in an estimated $497 million across the iOS App Store and Google Play, combined. That’s up 32% over the first half of 2018.

But Tinder’s dominance could be a trend that doesn’t last.

According to recent data from eMarketer, dating app audiences have been growing slower than expected, causing the analyst firm to revise its user estimates downward. It now expects that 25.1 million U.S. adults will use a dating app monthly this year, down from its previous forecast of 25.4 million. It also expects that only 21% of U.S. single adults will use a dating app at all in 2019, and that will only grow to 23% by 2023.

That means Tinder’s time at the top could be overrun by newcomers in later months, especially as new streaming services get off the ground (assuming they offer in-app subscriptions); if TikTok starts taking monetization seriously; or if any other large apps from China find global audiences outside of China’s third-party app stores.

For example, Tencent Video grossed $278 million globally in the first half of 2019, outside of the third-party Chinese Android app stores. That made it the third-largest non-game app by revenue. And Chinese video platform iQIYI and YouTube were the No. 4 and No. 5 top-grossing apps, respectively.

Meanwhile, iOS app installs actually declined in the first half of the year, following the first quarter that saw a decline in downloads, Q1 2019, attributed to the downturn in China.

The App Store in the first half of 2019 accounted for 14.8 billion of the total 56.7 billion app installs.

Google Play installs in the first half of the year grew 16.4% to 41.9 billion, or about 2.8 times greater than the iOS volume.

The most downloaded apps in the first half of 2019 were the same as before: WhatsApp, Messenger and Facebook led the top charts. But TikTok inched ahead of Instagram for the No. 4 spot, and it saw its installs grow around 28% to nearly 344 million worldwide.

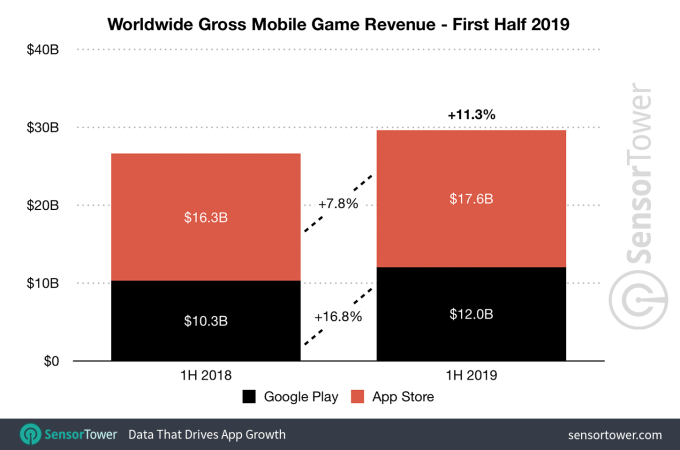

In terms of mobile gaming specifically, spending was up 11.3% year-over-year in the first half of 2019, reaching $29.6 billion across the iOS App Store and Google Play. Thanks to the fallout of the game licensing freeze in China, App Store revenue growth for games was at $17.6 billion, or 7.8% year-over-year growth. Google Play game spending grew by 16.8% to $12 billion.

The top-grossing games, in order, were Tencent’s Honor of Kings, Fate/Grand Order, Monster Strike, Candy Crush Saga and PUBG Mobile.

Meanwhile, the most downloaded games were Color Bump 3D, Garena Free Fire and PUBG Mobile.

Image credits: Sensor Tower

Powered by WPeMatico

Jeffrey Katzenberg’s upcoming mobile streaming service Quibi has added another notable name to its roster of executive talent. The company announced it has hired Tom Conrad, previously VP of product at Snap (maker of Snapchat), and a co-creator of Pandora, where he served as chief technology officer. At Quibi, Conrad will be chief product officer, which will see him leading product, user research and customer support.

The news of Conrad’s hire was first reported by Variety on Monday, which also noted Conrad had served on Quibi’s board since late 2018 and was officially hired as CPO on March 25. He will report to Quibi CEO Meg Whitman in his new role.

Conrad will play a big part in Quibi’s success (or lack thereof, if it doesn’t fare well!), as a significant aspect to the service is to be the app’s mobile design. Unlike modern streaming services like Netflix, Quibi aims to offer short-form, high-quality video cut into smaller pieces for easy consumption on a smartphone. At this year’s SXSW, Whitman explained the Quibi advantage, noting how the technology it’s using will allow the company to do “full-screen video seamlessly from landscape to portrait.”

At Quibi, Conrad’s understanding of streaming services, thanks to his time at Pandora, and apps favored by young users, thanks to his role at Snap, will surely come into play.

Conrad left Snap in 2018 at a critical time for the popular social app. Its massive redesign had just rolled out, and was destroyed by early user reviews, with the majority giving the update one or two stars when it hit. The design was later rolled back. However, Snap CEO Evan Spiegel was the product decision maker — Conrad was more involved in terms of execution. That experience, however, may have given Conrad insight into what doesn’t work for the young Gen Z crowd, as much as what does.

Conrad left Snap in 2018 at a critical time for the popular social app. Its massive redesign had just rolled out, and was destroyed by early user reviews, with the majority giving the update one or two stars when it hit. The design was later rolled back. However, Snap CEO Evan Spiegel was the product decision maker — Conrad was more involved in terms of execution. That experience, however, may have given Conrad insight into what doesn’t work for the young Gen Z crowd, as much as what does.

The executive also spent a decade at Pandora, as CTO and EVP of Product, which saw him leading the teams that designed, developed and maintained the Pandora apps across platforms — including web, mobile and other consumer electronics devices, as well as automotive. While Quibi is focused on being a mobile streaming app, it’s hard to imagine a streaming service that refuses to ever go cross-platform — especially since the majority of viewing of today’s streaming service viewing takes place on a television. (Even when it’s the streaming service from YouTube.)

With its billion-dollar backing from investors, Quibi has been able to snag several big names for its exec ranks, in addition to its CEO Meg Whitman, and now Conrad.

In March, the company said it landed top CAA agent Jim Toth (married to power producer Reese Witherspoon, by the way). Toth’s clients at CAA included Matthew McConaughey, Robert Downey Jr., Scarlett Johansson, Jamie Foxx, Zoe Saldana, Chris Evans, Salma Hayek, Zooey Deschanel and Neil Patrick Harris.

Quibi also hired former DC and Warner Bros. exec Diane Nelson to run operations. Nelson had served as president of DC Entertainment since 2009, and helped spearhead development of the DC Universe movies and shows.

In addition, the streaming service itself has already been signing big-name talent for its content, including Catherine Hardwicke, Antoine Fuqua, Guillermo del Toro, Sam Raimi and Lena Waithe. It’s also working with Steph Curry’s production company and most recently announced — awkward alert? — a show detailing Snapchat’s founding, focused on Evan Spiegel’s rise.

Image credit: Conrad, via Crunchbase

Powered by WPeMatico

Video game revenue in 2018 reached a new peak of $43.8 billion, up 18 percent from the previous years, surpassing the projected total global box office for the film industry, according to new data released by the Entertainment Software Association and The NPD Group.

Preliminary indicators for global box office revenues published at the end of last year indicated that revenue from ticket sales at box offices around the world would hit $41.7 billion, according to comScore data reported by Deadline Hollywood.

The $43.8 billion tally also surpasses numbers for streaming services, which are estimated to rake in somewhere around $28.8 billion for the year, according to a report in Multichannel News.

Video games and related content have become the new source of entertainment for a generation — and it’s something that has new media moguls like Netflix chief executive Reed Hastings concerned. In the company’s most recent shareholder letter, Netflix said that Fortnite was more of a threat to its business than TimeWarner’s HBO.

“We compete with (and lose to) Fortnite more than HBO,” the company’s shareholder letter stated. “When YouTube went down globally for a few minutes in October, our viewing and signups spiked for that time…There are thousands of competitors in this highly fragmented market vying to entertain consumers and low barriers to entry for those with great experiences.”

“The impressive economic growth of the industry announced today parallels the growth of the industry in mainstream American culture,” said acting ESA president and CEO Stanley Pierre-Louis, in a statement. “Across the nation, we count people of all backgrounds and stages of life among our most passionate video game players and fans. Interactive entertainment stands today as the most influential form of entertainment in America.”

Gains came from across the spectrum of the gaming industry. Console and personal computing, mobile gaming, all saw significant growth, according to Mat Piscatella, a video games industry analyst for The NPD Group.

According to the report, hardware and peripherals and software revenue increased from physical and digital sales, in-game purchases and subscriptions.

| U.S. Video Game Industry Revenue | 2018 | 2017 | Growth Percentage |

| Hardware, including peripherals | $7.5 billion | $6.5 billion | 15% |

| Software, including in-game purchases and subscriptions |

$35.8 billion |

$30.4 billion |

18% |

| Total: | $43.3 billion | $36.9 billion | 18% |

Source: The NPD Group, Sensor Tower

Powered by WPeMatico