Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Heyday, a startup aiming to make facials more affordable and personalized, announced today that it has raised $8 million in Series A funding.

I first wrote about the company a year ago, when it raised its $3 million seed round. At the time, co-founder and CEO Adam Ross said his goal was to offer something that sits between expensive, high-end facials and “random little places that are generally cheap in a bad way.” (Heyday pricing starts at $65 for a 30-minute session.)

The company currently operates six brick-and-mortar locations — it started in New York City but recently opened its first Los Angeles store. At the same time, Ross said the website was recently redesigned to offer a more “frictionless” booking experience, and the company also says it can use its “Facial Record” of customers to personalize the treatment and products.

Moving forward, the goal is to both open new physical locations (particularly in LA), but also to continue investing in the technology.

“It’s not an either/or — we see mutual growth and expansion across both channels,” Ross said. “The physical footprint is always going to be a key pillar of our brand strategy, but to win and service customers’ needs in this space, you need to be online.”

Ross also suggested that Heyday is changing the way customers look at facials. For one thing, 30 percent of its customers say they’ve never had a facial before. In addition, Ross said they’re starting to see facials not as an occasional luxury, but as a regular part of their wellness routine: “Most of our clients think about us like an Equinox membership.” And they should, he argued, especially since “your skin is your largest organ.”

The new funding was led by Fifth Wall Ventures, with participation from Lerer Hippeau, Brainchild Funding, M3 Ventures and CircleUp. Fifth Wall partner Kevin Campos is joining Heyday’s board of directors.

“We are in the midst of a significant shift in the retail industry, where marquee brands are moving from digitally native to an omnichannel model,” Campos said in the funding announcement. “We believe the team at Heyday is offering the best experience across both digital and physical touchpoints, and we are thrilled to partner with them to help navigate this complex process and position them for success.”

Powered by WPeMatico

Lime, the well-funded startup known for its fleet of brightly colored dockless bicycles and electric scooters, has a new way for its customers to get around: cars.

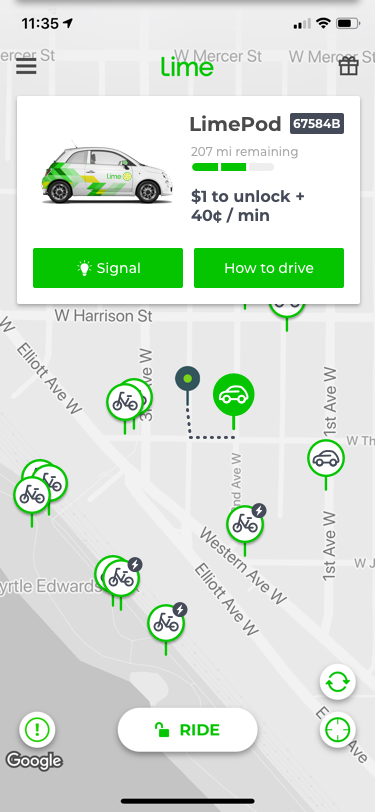

Beginning this week, Lime users in Seattle will be able to reserve a “LimePod,” a Lime-branded 2018 Fiat 500, within the Lime mobile app. There will be 50 cars available to start as part of the company’s initial rollout. Lime plans to increase that number at the end of the month.

“LimePods, Lime’s car-sharing product line, a convenient, affordable, weather-resistant mobility solution for communities,” a spokesperson for Lime said in a statement provided to TechCrunch. “The ease of use of finding, unlocking, and paying for cars will be consistent with how riders use Lime scooters and e-bikes today.”

Lime will roll out 50 “LimePods” in Seattle this week.

Rides in the LimePod will cost $1 to unlock the car and 40 cents per minute of use. The company plans to unleash additional shareable cars in California early next year. Its scooters and e-bikes, for reference, are $1 to unlock and 15 cents per minute and regular pedal bikes are $1 to unlock and 5 cents per minute.

Founded in 2017 by Berkeley graduates Toby Sun and Brad Bao, the startup has raised a total of $467 million to date from GV, Andreessen Horowitz, IVP, Section 32, GGV Capital and more. Reports indicate that Lime is on the fundraising circuit now, targeting a $3 billion valuation, or nearly 3x its latest valuation.

LimePods will be available to order in the Lime mobile app.

The company is expanding rapidly, most recently releasing a fleet of e-scooters and bikes in Australia, as well as making notable hires on what seems like a weekly basis. In the last month, Lime has tapped Joe Kraus, a general partner at Alphabet’s venture arm GV and an existing member of the startup’s board of directors, as its first chief operating officer. Before that, it brought on Uber’s former chief business officer David Richter as its first-ever chief business officer and interim chief financial officer.

In July, the company hired Peter Dempster from ReachNow to lead the LimePod initiative out of Seattle.

Powered by WPeMatico

RideCell, a transportation software startup, has doubled its previously announced Series B funding round to $60 million, a sign that investors believe demand for cloud-based mobility platforms will grow as more companies try to scale up car-sharing, ride-hailing and even robotaxi businesses.

The company, which has developed a platform designed to help car-sharing, ride-sharing and autonomous technology companies manage their vehicles, announced it raised $28 million in May.

Activate Capital led this round; its co-founder and managing director Raj Atluru has joined RideCell’s board. Reinsurance group Munich Re’s ERGO fund, LG Technology Ventures, BNP Paribas, Sony Innovation Fund, Ally Ventures and Khosla Ventures joined this extended round. Denso also upped its investment in the Series B round.

Nearly half a dozen other companies had already invested in the Series B round, including Cox Automotive, Initialized Capital, Denso, Penske, Deutsche Bahn and Mitsui.

“Investor interest in cloud-based mobility platforms and autonomous vehicles increases almost daily as the disruptive potential of these new technologies are realized,” RideCell CEO Aarjav Trivedi said in a statement.

The company recently received a permit from the California Department of Motor Vehicles to test its Auro autonomous vehicles on public roads. RideCell acquired self-driving car company Auro in October 2017. Auro initially developed and operated driverless shuttles for private geo-fenced locations such as corporate and university campuses. The company has since expanded its focus to include passenger vehicle models and minivans, although it still plans to target low-speed urban use cases focused on solving last-mile transportation.

The company’s real-world trials will start on Ford Fusion vehicle platforms equipped with Auro’s autonomous driving system.

Powered by WPeMatico

Approximately 90 percent of people in need of rehabilitation services for drug and alcohol abuse don’t have access to them, according to a Substance Abuse and Mental Health Services Administration survey. Why? Often, because they don’t know where to look.

Santa Monica-based WeRecover wants to fill that information gap with its Kayak-like online booking engine for rehab centers. The startup’s matching algorithm pairs people with an accredited rehab center with open beds, tailored to that person’s budget, insurance, clinical needs and location. The goal is to make it easier for anyone seeking treatment for themselves or otherwise to quickly discover and secure a spot at a facility, streamlining what can be a daunting and logistically complicated process that prevents people from receiving the care they need.

Today, WeRecover is announcing another $2 million fundraise led by Crosslink Capital, bringing its total venture capital backing to $4.5 million. Box Group, Wonder Ventures, Struck Capital and others also participated in the round.

“It’s a really obvious idea … but truly no entrepreneurs anywhere were working to build a marketplace for addiction recovery centers,” WeRecover co-founder and chief executive officer Stephen Estes told TechCrunch. “There’s an overwhelming need for a simpler way to connect with patients.”

WeRecover co-founder and chief executive officer Stephen Estes.

Founded in 2016 by Estes and Max Jaffe, WeRecover has rapidly grown from connecting a few hundred people seeking treatment per month to roughly 4,000 users last month. The startup now provides information on 11,000 treatment centers in 29 states. The goal is to have at least 1 program listed in every state by the end of 2018. Currently, most of the programs the company tracks are located in California, Florida, Arizona and Colorado.

Estes said the WeRecover database is the most comprehensive database of free, nonprofit and state-funded treatment programs in existence, simply because no one had set out to aggregate this particular set of information until now.

The startup plans to use the latest round of venture financing to continue hunting down treatment centers to add to its database, expand its 16-person team and, eventually, Estes said, WeRecover would like to craft and integrate content into the experience.

“We play a really important role in somebody’s journey,” he said. “They find treatment through us and we are part of one of the most important decisions they make in their life, so we should keep them engaged. We do think there’s room to build an app to help people sustain their sobriety and connect them with their peers.”

Powered by WPeMatico

WeWork has picked up another $3 billion in financing from SoftBank Corp, not to be confused with SoftBank Vision Fund. The deal comes in the form of a warrant, allowing SoftBank to pay $3 billion for the opportunity to buy shares before September 2019 at a price of $110 or higher, ultimately valuing WeWork at $42 billion minimum.

In August, SoftBank Corp invested $1 billion in WeWork in the form of a convertible note.

According to the Financial Times, SoftBank will pay WeWork $1.5 billion on January 15, 2019 and another $1.5 billion on April 15.

SoftBank is far and away WeWork’s biggest investor, with SoftBank Vision Fund having poured $4.4 billion into the company just last year.

The real estate play out of WeWork is just one facet of the company’s strategy.

More than physical land, WeWork wants to be the central connective tissue for work in general. The company often strikes deals with major service providers at “whole sale” prices by negotiating on behalf of its 300,000 members. Plus, WeWork has developed enterprise products for large corporations, such as Microsoft, who tend to sign longer, more lucrative leases. In fact, these types of deals make up 29 percent of WeWork’s revenue.

The biggest issue is whether or not WeWork can sustain its outrageous growth, which seems to have been the key to its soaring valuation. After all, WeWork hasn’t yet achieved profitability.

Can the vision become a reality? SoftBank seems willing to bet on it.

Powered by WPeMatico

Cognigo, a startup that aims to use AI and machine learning to help enterprises protect their data and stay in compliance with regulations like GDPR, today announced that it has raised an $8.5 million Series A round. The round was led by Israel-based crowdfunding platform OurCrowd, with participation from privacy company Prosegur and State of Mind Ventures.

The company promises that it can help businesses protect their critical data assets and prevent personally identifiable information from leaking outside of the company’s network. And it says it can do so without the kind of hands-on management that’s often required in setting up these kinds of systems and managing them over time. Indeed, Cognigo says that it can help businesses achieve GDPR compliance in days instead of months.

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

The company tells me that it plans to use the new funding to expand its R&D, marketing and sales teams, all with the goal of expanding its market presence and enhancing awareness of its product. “Our vision is to ensure our customers can use their data to make smart business decisions while making sure that the data is continuously protected and in compliance,” the company tells me.

Powered by WPeMatico

Today, Real Estate Technology Ventures (RET Ventures) announced the final close of $108 million for its first fund. RET focuses on early-stage investments in companies that are primarily looking to disrupt the North American multifamily rental industry, with the firm boasting a roster of LPs made up of some of the largest property owners and operators in the multifamily space.

RET is one of the latest in a rising number of venture firms focused on the real estate sector, which by many accounts has yet to experience significant innovation or technological disruption.

The firm was founded in 2017 by managing director John Helm, who possesses an extensive background as an operator and investor in both real estate and real estate technology. Helm’s real estate journey began with a position right out of college and eventually led him to the commercial brokerage giant Marcus & Millichap, where he worked as CFO before leaving to build two venture-backed real estate technology companies. After successfully selling both companies, Helm worked as a venture partner at Germany-based DN Capital, where he invested in companies such as PurpleBricks and Auto1.

Speaking with investors and past customers, John realized there was a need for a venture fund specifically focused on the multifamily rental sector. RET points out that while multifamily properties have traditionally fallen under the commercial real estate umbrella, operators are forced to deal with a wide set of idiosyncratic dynamics unique to the vertical. In fact, outside of a select group, most of the companies and real estate investment trusts that invest in multifamily tend to invest strictly within the sector.

Now, RET has partnered with leading multifamily owners to help identify innovative startups that can help the LPs better run their portfolios, which account for nearly a million units across the country in aggregate. With its deep sector expertise and its impressive LP list, RET believes it can bring tremendous value to entrepreneurs by providing access to some of the largest property owners in the U.S., effectively shortening a notoriously lengthy sales cycle and making it much easier to scale.

Photo: Alexander Kirch/Shutterstock

One of the first companies reaping the benefits of RET’s deep ties to the real estate industry is SmartRent, the startup providing a property analytics and automation platform for multifamily property managers and renters. Today, SmartRent announced it had closed $5 million in series A financing, with seed investor RET providing the entire round.

SmartRent essentially provides property managers with many of the smart home capabilities that have primarily been offered to consumers to date, making it easier for them to monitor units remotely, avoid costly damages and streamline operations, all while hopefully enhancing the resident experience through all-in-one home controls.

By combining connected devices with its web and mobile platform, SmartRent hopes to provide tools that can help identify leaks or faulty equipment, eliminate energy waste and provide remote access control for door locks. The functions provided by SmartRent are particularly valuable when managing vacant units, in which leaks or unnecessary energy consumption can often go unnoticed, leading to multimillion-dollar damage claims or inflated utility bills. SmartRent also attempts to enhance the leasing process for vacant units by pre-screening potential renters that apply online and allowing qualified applicants to view the unit on their own without a third-party sales agent.

Just like RET, SmartRent is the brainchild of accomplished real estate industry vets. Founder and CEO Lucas Haldeman was still the CTO of Colony Starwood’s single-family portfolio when he first rolled out an early version of the platform in around 26,000 homes. Haldeman quickly realized how powerful the software was for property managers and decided to leave his C-suite position at the publicly traded REIT to found SmartRent.

According to RET, the strong industry pedigree of the founding team was one of the main drivers behind its initial investment in SmartRent and is one of the main differentiators between the company and its competitors.

With RET providing access to its leading multifamily owner LPs, SmartRent has been able to execute on a strong growth trajectory so far, with the company on pace to complete 15,000 installations by the end of the year and an additional 35,000 apartments committed for 2019. And SmartRent seems to have a long runway ahead. The platform can be implemented in any type of rental property, from retrofit homes to high rises, and has only penetrated a small portion of the nearly one million units owned by RET’s LPs alone.

SmartRent has now raised $10 million to date and hopes to use this latest round of funding to ramp growth by broadening its sales and marketing efforts. Longer-term, SmartRent hopes to permeate throughout the entire multifamily industry while continuing to improve and iterate on its platform.

“We’re so early on and we’ve made great progress, but we want to make deep penetration into this industry,” said Haldeman. “There are millions of apartment units and we want to be over 100,000 by year one, and over a million units by year three. At the same time, we’re continuing to enhance our offering and we’re focused on growing and expanding.”

As for RET Ventures, the firm hopes the compelling value proposition of its deep LP and industry network can help RET become the go-to venture firm startups looking to disrupt the real estate rental sector.

Powered by WPeMatico

Some more comments from readers on the changing culture around startups filing their Form Ds with the SEC, and then a short update on SoftBank and a bunch more article reviews.

We are experimenting with new content forms at TechCrunch. This is a rough draft of something new – provide your feedback directly to the authors: Danny at danny@techcrunch.com or Arman at Arman.Tabatabai@techcrunch.com if you like or hate something here.

If you haven’t been following our obsession with Form Ds, be sure to read our original piece and follow up. The gist is that startups are increasingly foregoing filing a Form D with the SEC that provides details of their venture rounds like investment size and main investors in order to stay stealth longer. That has implications for journalists and the public, since we rely on these filings in many cases to know who is funding what in the Valley.

Morrison Foerster put together a good presentation two years ago that provides an overview of the different routes that startups can take in disclosing their rounds properly.

Traditionally, the vast majority of startups used Rule 506 for their securities, which mandates that a Form D be filed within 15 days of the first money of the round closing. These days though, more and more startups are opting to use Section 4(a)(2), which doesn’t require a Form D, but also doesn’t provide a “blue sky” exception to start securities laws, which means that startups have to file in relevant state jurisdictions and no longer have preemption from the SEC.

David Willbrand, who chairs the Early Stage & Emerging Company Practice at Thompson Hine LLP, read our original articles on Form Ds and explained by email that the practices around securities disclosures have indeed been changing at his firm and others:

We started pushing 4(a)(2) very hard when our clients kept getting “outed” thru the Form D and upset about it. In my experience, for 99% is the desire to remain in stealth mode, period.

[…]

When I started in 1996, Form Ds were paper, there was no internet, and no one looked. Now they are electronic and the media and blogs scrape daily and publish the information. It actually really is true disclosure! And it’s kind of ironic, right, which goes to your point – now that it’s working, these issuers don’t want it.

[…]

What I find is that the proverbial Series A is the brass ring, and issuers wants to call everything seed rounds (saving the title) until something chunky shows up, and stay below the radar too. So they pop out of the cake publicly for the first time with a big “Series A” that they build press around – and their first Form D.

Another piece of feedback we received was from Augie Rakow, the co-founder and managing partner of Atrium, which bills itself as a “better law firm for startups” that TechCrunch has covered a few times before. He wrote to us that in addition to the media concerns, startups also have to be aware of the broad cross-section of interested parties to Form Ds that hasn’t existed in the past:

Today, there is a bigger audience in terms of who cares about venture backed companies. Whether this spun off from the launch of the Facebook movie or the fact that over two billion people across the global have the internet at their fingertips via smartphones, people are connected and curious. The audience is not only larger but also encompasses more national and international interests. This means there are simply more eyes on trends, announcements, and intel on privately held companies whether they are media, investors, or your competitors. Companies that have a good reason to stay stealth may want to avoid attracting this attention by not making a public Form D filing.

For startups, the obvious advice is to just consult your attorney and consider the tradeoffs of having a very clean safe harbor versus more work around regulatory filings to stay stealthy.

But the real message here is for journalists. Form Ds are no longer common among seed-stage startups, and indeed, startup founders and venture investors have a lot of latitude in choosing how and when they file. You can no longer just watch the SEC’s EDGAR search platform and break stories anymore. Building up a human sourcing capability is the only way to get into those early investment rounds today.

Finally — and this is something that is hard to prove one way or the other — the lack of disclosure may also mean that the fears around seed financing dropping off a cliff may be at least a little bit unfounded. Eliot Brown at the Wall Street Journal reported just yesterday that the number of seed financings is down 40 percent, according to PitchBook data. How much of that drop is because of changing macroeconomic conditions, versus changes in filing disclosures?

Tokyo Stock Exchange. Photo by electravk via Getty Images

Last week, I also got obsessed with SoftBank. The company confirmed today that it intends to move forward with the IPO of its Japanese mobile telecom unit, according to WSJ and many other sources. The company is targeting more than $20 billion in proceeds, and its overallotment could drive that above $25 billion, or roughly the level of Alibaba’s record IPO haul.

One interesting note from Taiga Uranaka at Reuters on the public issue is that everyday investors will likely play an outsized role in the IPO process:

Yet SoftBank’s brand name is still likely to draw retail investors long accustomed to using SoftBank’s phone and internet services. Many still see CEO Son as a tech visionary who challenged entrenched rivals NTT DoCoMo Inc ( 9437.T ) and KDDI, and brought Apple Inc’s ( AAPL.O ) iPhone to Japan.

Japanese households are commonly seen as an attractive target in IPOs with their 1,829 trillion yen in financial assets, even if they are traditionally risk-averse with over 50 percent of assets in cash and deposits.

More than 80 percent of the shares will be offered to domestic retail investors, a person with knowledge of the matter told Reuters.

Pavel Alpeyev at Bloomberg noted that “SoftBank is looking to tempt investors with a dividend payout ratio of about 85 percent of net income, according to the filing. Based on net income in the last fiscal year, that would work out to an almost 5 percent yield at the indicated IPO price.” A higher dividend ratio is particularly attractive to retired individual investors.

Despite SoftBank’s horrifying levels of debt, Japanese consumers may well save the company from itself and allow it to effectively jump start its balance sheet yet again. Complemented with a potential Vision Fund II, Masayoshi Son’s vision for a completely transformed SoftBank seems waiting for him in the cards.

Tech C.E.O.s Are in Love With Their Principal Doomsayer – Nellie Bowles writes a feature on Yuval Noah Harari, the noted philosopher and popular author of Sapiens. Bowles investigates the paradoxical popularity of Harari, who sees technology as creating a permanent “useless class” and criticizes Silicon Valley with his now enduring popularity in the region. Interesting personal details on the somewhat reclusive Israeli, but ultimately the question of the paradox remains sadly mostly unanswered. (2,800 words)

Why Doctors Hate Their Computers – Atul Gawande discusses learning and using Epic, the dominant electronic medical records software platform, and discovers the challenges of building static software for the complex adaptive system that is health care. His observations of the challenges of software engineering will be well-known to anyone who has read Fred Brooks, but the piece does an excellent job of exploring the balancing act between the needs of technocratic systems and the human design needed to make messy and complicated professions work. Worth a read. (8,900 words)

Picking flowers, making honey: The Chinese military’s collaboration with foreign universities – An excellent study by Alex Joske at the Australia Strategic Policy Institute on the hundreds of military scientists from China who use foreign academic exchanges as a means of information acquisition for critical scientific and engineering knowledge, including in the United States. China’s government under Xi Jinping has made indigenous technology development a chief domestic priority, and the U.S. innovation economy is encouraged to increasingly guard its intellectual property. (6,500 words)

The Digital Deciders – New America report by Robert Morgus who investigates the fracturing of the internet, which I have written about at some length. Morgus finds that a small group of countries (the “digital deciders”) will determine whether the internet continues to be open or whether nationalist interests will close it off. Let’s all hope that Iraq believes in freedom of expression and not Chinese-style surveillance. Worth a skim. (45 page report, but with prodigious tables)

Powered by WPeMatico

French startup BlaBlaCar is announcing plans to acquire Ouibus, the bus division of France’s national railway company SNCF. For the first time, BlaBlaCar is moving beyond carpooling and plans to offer both long-distance carpooling rides and bus rides.

BlaBlaCar already ran a test with Ouibus for the past six months on popular corridors. It looks like both companies are happy with this test, as SNCF is willing to let BlaBlaCar run Ouibus from now on.

As part of this deal, BlaBlaCar is announcing a new $114 million investment (€101 million) from SNCF and existing BlaBlaCar investors. I’d guess that this isn’t just cash but probably cash and shares as part of the move with SNCF. Yes, you read that correctly, SNCF is now an investor in BlaBlaCar.

Ouibus has transported more than 12 million passengers over the past few years in France and Europe. Many thought that buses would hurt BlaBlaCar over the long run. By offering buses on BlaBlaCar directly, the company can capitalize on its brand and huge community to counter that trend. BlaBlaCar is now a marketplace for road travel.

BlaBlaCar is taking a risk, as Ouibus has been relentlessly losing money. Just like other bus companies, Ouibus relies heavily on contractors, which means that BlaBlaCar could quickly adjust the offering. It’ll also depend on product integrations on BlaBlaCar, OUI.sncf and other platforms.

BlaBlaCar currently has 65 million users in 22 countries and is about to reach profitability. And you can expect to find ridesharing offers on OUI.sncf in the coming months.

Powered by WPeMatico

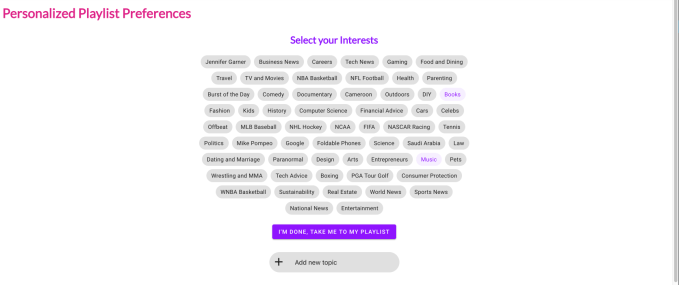

Tel Aviv-based Audioburst has been developing a search engine for audio news, which allows users to locate audio content within podcasts and other talk radio programs. Today, the company is capitalizing on its technology to launch personalized playlists that deliver custom news briefs that get better over time the more you use the product.

The feature has been built using deep AI learning, the company says.

The content itself is drawn from top podcasts and the radio stations in Audioburst’s index, and will alert you to new information based on your chosen keywords and topics.

To use the feature, you first sign up on the Audioburst website, then select from a set of interests or add your own. When you’re finished with the selection process, you just hit the “I’m done” button to be taken to your personalized playlist of audio clips.

The end result is being able to listen to the parts of the podcasts or other audio programs you would actually care about, rather than slogging through half an hour or more of chatter for the one tidbit of news you were interested in.

For example, when testing the feature this morning, I chose a variety of topics like “tech news,” “movies,” “entertainment,” “science,” “parenting” and more, and was delivered a set of audio clips that included a discussion of Disney’s “Star Wars” spin-off series starring Diego Luna; a chat about the 2018 MacBook Air overhaul; an assessment of the smog in L.A.; and a lot of other clips I chose to skip (but will hopefully train the AI further).

You can try the feature yourself at search.audioburst.com by clicking on “Personalized Playlist” in the top left.

The results were hit or miss, which is expected — to some extent — fresh out of the gate. But there were also times when the clips didn’t actually serve up too much information. That is, you’d still need to turn to the podcast itself for the full story.

However, the feature itself isn’t necessarily going to be used by consumers directly on Audioburst’s website. Instead, its development came about thanks to requests from partners using its API.

The company says you can expect to see the personalized playlists integrated into its partners’ products in the smart speaker, mobile, in-car infotainment, and wearable tech spaces in 2019.

Audioburst currently has partnerships with ByteDance, Nippon, Bose, Harman, Samsung and more.

Powered by WPeMatico