Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

The Morgan Stanley Multicultural Innovation Lab, Morgan Stanley’s in-house accelerator focused on companies founded by multicultural and female entrepreneurs, hosted its second Annual Showcase and Demo Day. The event also featured companies from accelerators HearstLab, Newark Venture Partner Labs and PS27 Ventures. (Note: I was formerly employed by Morgan Stanley and have no financial ties.)

The showcase represented the culmination of the program’s second year, which followed an initial five company class that has already seen two acquisitions. Through the six-month program, Morgan Stanley provides early-stage companies with a wide range of benefits including an equity investment from Morgan Stanley, office space at Morgan Stanley headquarters, access to Morgan Stanley’s extensive network, and others. Applications are now open for its third cohort of companies with the application window closing on January 4th, 2019.

The 16 presenting startups, all led by a female or multicultural founder, offered solutions to structural inefficiencies across a wide array of categories including fintech, developer tools, and health. Though all of the companies offered impressive presentations and strong value propositions, here are three of the companies that stood out to us.

In hopes of democratizing software and app development, Hatch Apps provides a platform that allows users and companies to build iOS, Android and web applications without any code through pre-built templates and custom plug-and-play functions. In essence, Hatch Apps provides a solution for application building similar to what Squarespace or Wix provide for websites.

In the modern economy, every company is in one way or another a tech or tech-enabled company. Now the demand for strong engineers has made the fight for talent increasingly competitive and has made engineering quite costly, even when only needed for simple tasks.

For an implementation and subscription fee, Hatch Apps allows companies with less sophisticated engineering DNA to reduce entering costs by launch native apps on their own, across platforms, and often on faster timelines than those seen through third-party developers. Once an app is launched, Hatch Apps provides customers with detailed analytics and allows them to send targeted push notifications, export data and make in-app changes that can automatically go live in app stores.

The company initially took a bootstrapping approach to financing and raised funds by selling a 2016 election-themed “Cards Against Humanity”-style game created on the platform. Since then, Hatch Apps has already received funding from the Y Combinator Fellowship, Morgan Stanley, and a number of other investors.

While estate planning is a topic many don’t like to think about, it’s a critical issue for managing cross-generational wealth. But will drafting can often be very complex, time-consuming, and costly, requiring hours of legal consultation and coordination between various parties.

Founded by two former classmates at Stanford Business School, FreeWill looks to simplify the estate planning process by providing a free online platform that automates will drafting, in a similar function to what TurboTax does for taxes. Using FreeWill, users can quickly set allocations for their estate and select personal recipients, charitable donations, executor specifications, and other ancillary requests. The platform then creates a finalized legal document that is legally valid in all 50 states, which users can also quickly make changes to and replace without incurring expensive legal costs.

FreeWill is able to provide the platform to consumers for free due to the proceeds it receives from its non-profit customers, who pay to be featured on the platform as a partner organization. FreeWill offers a compelling value proposition for partnering companies. By acting as a channel to funnel user donations to listed organizations, FreeWill has been able to drive a 600% increase in charitable giving to partner organizations on average. FreeWill also provides partner organizations with backing analytics that allow non-profits to track bequests and donors through monthly reports.

FreeWill currently boasts an impressive roster of 75 paying non-profit partners that include American Red Cross, Amnesty International and many others. In the long-run hopes to be the go-to solution financial and legal end of life planning for investment advisors, life insurance and employee benefits providers.

Shoobs is looking to be the go-to platform for local “urban” events, which the company defined as events centered on local nightlife, comedy and concerts in the hip-hop, R&B, and reggae genres to name a few. But unlike the genre-agnostic, transaction-focused event management platforms that can make the space seem pretty crowded, Shoobs focused on providing genre-specific even discovery. Shoobs matches urban event goers with artists of their choice and related smaller scale events that can be harder to discover, acting as a form of curation, quality control and discovery.

For event organizers, Shoobs helps provide digital ticketing and promotion services, with event recommendation capabilities that target the most promising potential customers. Through its offering to event organizers, Shoobs is able to monetize its services through ticket sale commission, advertising and brand partnerships.

Since its initial launch in London, Shoobs notes it has become one of the top urban events platforms in the city, with an extensive base of recurring registered users and event organizers. After previously working with AEG for its London launch, Shoobs is looking to expand stateside with the help of organizers like Live Nation. Shoobs joins a long list of promising Y Combinator alumni companies with YC also acting as one of Shows initial investors

Morgan Stanley Multicultural Innovation Lab

Hearst Labs

Newark Venture Partners Labs

PS27 Ventures

Cleaning System — a water free, detergent free, and chemical free plasma device that cleans items that are extremely hard or impossible to clean with a washer and dryer.”

Cleaning System — a water free, detergent free, and chemical free plasma device that cleans items that are extremely hard or impossible to clean with a washer and dryer.”Powered by WPeMatico

PlayVS, the company bringing esports infrastructure to high schools across the country, has today announced the close of a $30.5 million Series B financing. The round was led by Elysian Park Ventures, the investment arm of the L.A. Dodgers, with participation from five existing investors, including New Enterprise Associates, Science Inc., Crosscut Ventures, Coatue Management and WndrCo.

New investors also joined in on the round, including Adidas (the company’s first esports investment), Samsung NEXT, Plexo Capital, as well as angel investors such as Sean “Diddy” Combs, David Drummond, DST Global partner Rahul Mehta, Michael Dubin and others.

It’s certainly worth noting that PlayVS raised a $15 million Series A just six short months ago. Founder and CEO Delane Parnell explained that this Series B was an opportunistic raise, as the company received a lot of inbound from investors to get a slice of the next round.

“This gives us much more stability and runway so that we can hire more senior employees and leadership,” said Parnell. “It also gives us a bit of a war chest to let the team go out and work their strategies.”

Alongside the raise, PlayVS also announced new game partnerships, bringing Rocket League and SMITE into the company’s portfolio. Rocket League and SMITE join League of Legends, which was added to the platform two months ago.

PlayVS launched early this year with a relatively novel approach to the esports world. Instead of focusing on the current esports space, PlayVS realized there was a huge opportunity to bring infrastructure to the esports landscape in high school. As more and more esports careers are created through investment by colleges (via scholarships) and esports orgs, PlayVS gives students a place to show off their skills and get in front of recruiters.

The first step in the process was establishing a partnership between PlayVS and the NHFS, which is essentially the NCAA of high school sports. Through that partnership, PlayVS handles team schedules, district league schedules, coaching clinics and referees, and sets up an in-person live spectator event for the State Championship at the end of the year.

Right now, the company is in the midst of its Season Zero, testing out the platform with a small number of states — Connecticut, Georgia, Kentucky, Massachusetts and Rhode Island — in preparation for the official Inaugural Season, which will begin in 2019. Today, PlayVS is adding Alabama (AHSAA), Mississippi (MISSHSAA) and parts of Texas (TCSAAL).

But the growth of the company is largely dependent on states and school districts, which is why PlayVS is announcing the launch of Club Leagues. Club Leagues is identical to the PlayVS sports league product, except there is no State Championship at the end. Still, students who do not yet have access to the official PlayVS sports league can create teams, join up and play matches.

Eventually, Parnell says, the company will phase out Club Leagues as soon as official sports leagues are available to those players.

Powered by WPeMatico

Radio giant iHeartMedia announced today that it’s reached an agreement to acquire Jelli, a company bringing programmatic ad-buying to radio broadcasters.

In fact, iHeartMedia was already working with Jelli to allow businesses to use programmatic tools to buy advertising on the company’s 850 broadcast radio stations. iHeartMedia also invested in Jelli’s most recent funding round.

As a result of the deal, the Jelli team in Silicon Valley will become iHeartMedia’s main adtech operation, and it will still be led by CEO Michael Dougherty. At the same time, iHeartMedia says Expressway by Katz, the programmatic ad exchange created using Jelli technology, will be run independently by Katz Media Group.

In a statement, iHeartMedia CEO Bob Pittman said:

At iHeart we believe marketing is both math and magic. The math is our rich data and insights about our users and how they relate to our partners’ products and services — and the magic is the incredible creative ideas we bring to our partners, such as our iconic music events, award shows, influencers, podcasts, social reach and our unique on air promotions. Jelli allows us to do something no other company can do — advertisers can now buy and use our broadcast assets, reach and impact just as they use the major digital players. We now offer heavy data and heavy creative innovation all in one place.

The financial terms of the acquisition were not disclosed. Jelli’s other investors include Relay Ventures, Intel Capital, First Round Capital and Universal Music Group, and, according to Crunchbase, it raised more than $40 million total.

iHeartMedia, meanwhile, filed for bankruptcy in March, though it looks like it’s now preparing to leave Chapter 11 protection.

Powered by WPeMatico

Sometimes, it’s hard to imagine a product or industry that a new e-commerce startup hasn’t tried to remake already, from slippers to mattresses, from luggage to lipstick.

Yet two childhood friends in New York have seemingly struck on a fresh idea: taking on the stodgy and often expensive world of cookware, where one’s options out of college are usually limited to a few pieces of Calphalon or Farberware or, in the best-case scenario, some Le Creuset, the premium French cookware manufacturer founded back in 1925 and known for its vibrant colors, including Marseille, Cerise, and Soleil.

In fact, what the pair are building with their 10-month-old startup, Great Jones, appears to be a Le Creuset for the next generation: a handful of cookware items, including a cast-iron Dutch oven, that come in an array of colorful, if comparatively more muted, tones. Think Broccoli and Mustard.

The cookware is also more affordable than Le Creuset, which charges upward of $300 for a similar Dutch oven, compared with $145 for Great Jones’s new product. Notably, Great Jones’s full collection, which also includes a stainless steel stock pot, a stainless sauce pot, a stainless deep saute and a ceramic nonstick skillet, retails for $395.

Cookware is a smart sector to chase. According to the market consultancy IBIS World, the so-called “kitchen and cookware stores” industry has been growing steadily, reaching revenue of $17 billion last year.

One of the big questions for Great Jones will be whether its offerings hold up, and whether its customers find them compelling enough to recommend to others. After all, the old adage tends to hold up that you get what you pay for. And most new products take off because of favorable word of mouth, not merely because they’re Instagrammable.

Great Jones’s 28-year-old founders — Sierra Tishgart, previously a food editor at New York Magazine, and Maddy Moelis, who worked in customer insights and product management at a variety of e-commerce companies, including Warby Parker and Zola — seem to have thought these things through. Indeed, in a recent Forbes profile, they say they conducted extensive interviews with chefs and cookbook authors in their network in order to establish, for example, how to design a comfortable handle.

They also smartly made certain that their introductory offerings come in a range of metals. As even so-so cooks know, stainless steel is ideal for browning and braising; durable nonstick coatings make preparing delicate foods, including eggs and pancakes, less nightmarish.

In the meantime, Great Jones has easily captured the press’s imagination with what they are cooking up — a sign, perhaps, that the industry is ready for a refresh. In addition to Forbes, Great Jones also received recent coverage in The New York Times and Vogue — valuable real estate that most months-old startups can only dream of landing.

Great Jones has also raised outside funding already, including $2.75 million that it closed on last month led by venture capital firm General Catalyst, with participation from numerous individual investors.

Now the company just needs to convince its target demographic that it should ditch the older, established brands that may not feel particularly modern but are known to be durable, easy to clean, dishwasher safe and not insanely heavy (among the other things that keep people from throwing their pots in the garbage).

Great Jones also has plenty of newer competition to elbow out of the way if it’s going to succeed.

As the Times piece about the company notes, just a few of the other startups that are suddenly chasing the same opportunity include Potluck, a five-month-old, New York-based startup that sells a $270 “essentials bundle” that features 22 pieces, including utensils; Misen, a four-year-old, Brooklyn-based startup that sells cookware and chefs knives; and Milo, a year-old, L.A.-based startup that’s solely focused on Dutch ovens, to start.

According to Crunchbase, Misen has raised $2 million, including through a crowdfunding campaign; Milo has raised an undisclosed amount of seed funding.

Powered by WPeMatico

Crypto news got a little boost last week after a dark month of crashes, stablecoins and birthdays. The SEC ruled that two ICO issuers, CarrierEQ Inc. and Paragon Coin Inc., were in fact selling securities instead of so-called utility tokens.

“Both companies have agreed to return funds to harmed investors, register the tokens as securities, file periodic reports with the Commission, and pay penalties,” wrote Pamela Sawhney of the SEC. “These are the Commission’s first cases imposing civil penalties solely for ICO securities offering registration violations.”

From the release:

Airfox, a Boston-based startup, raised approximately $15 million worth of digital assets to finance its development of a token-denominated “ecosystem” starting with a mobile application that would allow users in emerging markets to earn tokens and exchange them for data by interacting with advertisements. Paragon, an online entity, raised approximately $12 million worth of digital assets to develop and implement its business plan to add blockchain technology to the cannabis industry and work toward legalization of cannabis. Neither Airfox nor Paragon registered their ICOs pursuant to the federal securities laws, nor did they qualify for an exemption to the registration requirements.

This behavior — a sort of “damn the torpedoes” for the fintech set — was all the rage at the beginning of the year as no clear guidance was available for filing security tokens — essentially pieces of company equity — versus utility tokens which were, in theory, used within the company ecosystem. In fact, ICOed companies contorted themselves into all sorts of knots to appear to fit their “utility token” within the torturous confines of securities law.

“We have made it clear that companies that issue securities through ICOs are required to comply with existing statutes and rules governing the registration of securities,” said Stephanie Avakian, co-director of the SEC’s Enforcement Division. “These cases tell those who are considering taking similar actions that we continue to be on the lookout for violations of the federal securities laws with respect to digital assets.”

The SEC fined both companies $250,000 each. Future ICOs, at least in the U.S., would do well to keep this in mind.

Powered by WPeMatico

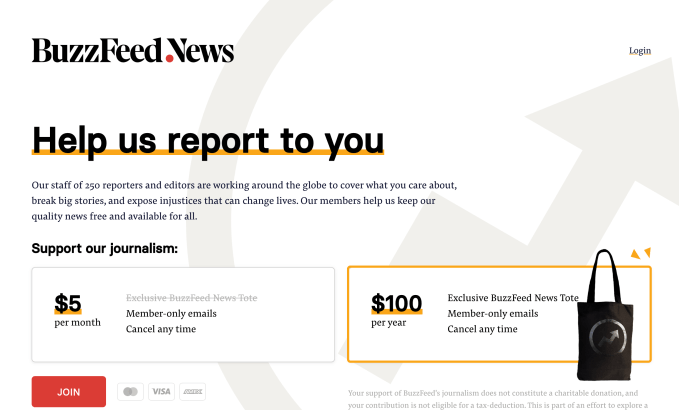

BuzzFeed News is giving readers a new way to support its journalism — by paying a monthly or yearly fee.

BuzzFeed might not seem like the most obvious publication to ask readers for financial support, as it doesn’t really have the high-minded appeal of (say) NPR or The New Yorker. However, the company has been working to establish a separate identity for its team focused on real journalism (as opposed to the quizzes and other entertainment for which BuzzFeed is known). In fact, it launched a separate website for BuzzFeed News a few months ago.

In August, BuzzFeed News started giving readers a way to make one-off donations of between $5 and $100. It says the average donation was more than $20, with some readers asking for a way to support the organization on an ongoing basis.

So today, it’s launching a recurring membership program. For $5 a month, readers will receive members-only emails highlighting the latest scoops and taking them behind the scenes of BuzzFeed reporting. For $100 a year, they’ll also receive a BuzzFeed News tote bag.

The memberships are available internationally, but you can only get a tote bag if you’re in the United States.

BuzzFeed reportedly missed its revenue target last year by as much as 20 percent, so it’s not surprising that the company is looking beyond advertising for ways to make money. However, in an email to the BuzzFeed team, Global News Director Lisa Tozzi said, “A membership program takes time to build, and we don’t expect it to be a huge portion of BuzzFeed’s revenue in 2019. That’s why we’re investing in it now and hope to see it contribute more to our work over time.”

And if you’re worried that this might be setting the stage for a paywall or meter on BuzzFeed News stories, Tozzi said flatly, “This is not a prelude to any sort of paywall.”

Powered by WPeMatico

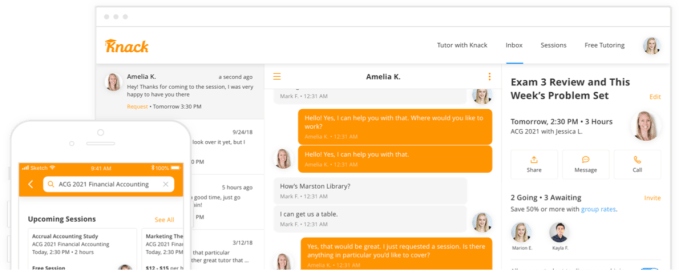

Knack, a peer tutoring platform aimed at college students, is taking a different approach than some online tutoring marketplaces have in the past. As a result, the Florida-based startup has raised a $1.5 million seed round co-led by Charles Hudson’s Precursor Ventures and Tampa Bay Lighting owner and Fenway Sports Group Partner, Jeff Vinik.

Other investors in the round include Bisk Ventures, the corporate venture-arm of Bisk Education; Arizona State University Enterprise Partners; Doug Feirstein, founder of Hired, uSell, and LiveOps; former State of Florida CFO Alex Sink; Tom DiBenedetto of Fenway Sports Group; PAR Inc.; and Elysium Venture Capital.

While many tutoring marketplaces have focused on only connecting students with others who could help them with their studies, Knack has instead also been focusing on adding institutional partners as its customers.

Today, it works with more than 50 colleges across the U.S., like seed investor ASU, which is licensing Knack to modernize their student support services and increase access to supplemental help for students.

“Although most universities already have on-campus tutoring centers,” explains company co-founder and CEO Samyr Qureshi, “Knack partners with institutions as a technology-enabled supplemental solution, filling in the gaps by increasing course and topical coverage for nuanced courses that campus learning centers may not be able to cover due to budgetary and resource constraints,” he says.

In addition, Knack is also now working with corporate employer sponsors like PwC and ConnectWise, which want to engage with high-potential students from Knack’s campus networks.

“We’re focusing on the full life cycle of learning from ‘I need some help on Knack’ to ‘I can offer help through Knack’ to ‘my skills built and showcased through Knack helped me land a job,’” notes Qureshi.

The CEO says he was inspired to work in the edtech space because, as a first-generation immigrant, education has been at the forefront of his life. His mother brought Qureshi and his sister to the U.S. to allow them to pursue college degrees.

During his own time in school, Qureshi both sought tutoring and provided tutoring, which led him to believe that one of the best ways to learn was from a peer.

In 2016, the startup applied to the University of Florida’s Business Plan Competition and took home first place, winning a $25,000 cash prize. That opened the door to venture capital, and its first pre-seed round of funding.

While institutions and businesses are the focus in terms of monetization, Knack still caters directly to students today. Those who need help with their coursework can use Knack to book tutoring, and those who want to offer their skills can create a tutoring profile with basic info, like their bio, courses, rates and availability.

The platform then handles all the logistics, including searching, matching, scheduling, tracking, billing and rating and reviewing.

Knack takes a 20 percent service fee on this tier of its service. University partners are on a SaaS-based annual platform, and Employer partners are charged a sponsorship amount depending on their targeting criteria.

The team of eight is based in Tampa, Florida and plans to use the seed funding for sales and marketing, as well as making some key engineering hires, the CEO says.

Powered by WPeMatico

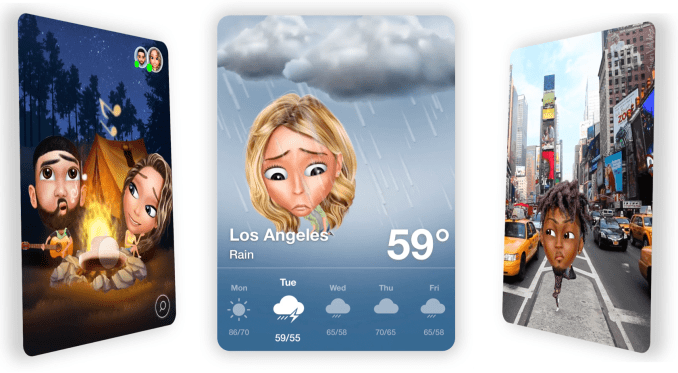

Genies is emerging as the top competitor to Snapchat’s wildly popular Bitmoji as Facebook, Apple and Google have been slow to get serious about personalized avatars. More than one million people have customized dozens of traits to build a realistic digital lookalike of themselves from over a million possible permutations.

When Genies launched a year ago after raising $15 million in stealth, it misstepped by trying to show people’s Genies interpreting a few weekly news stories and seasonal moments. Now the startup has figured out users want more control, so it’s shifting its iOS and Android apps to let you chat through your avatar, which acts out keywords and sentiments in reaction to what you type, which you can then share elsewhere. And Genies is launching a software developer kit that charges other apps to let you create avatars and use them for chat, stickers, games, animations and augmented reality.

Genies’ SDK puts its avatars in other apps

To power these new strategies and usher in what CEO Akash Nigam calls “the next wave of communication through avatars where people feel comfortable expressing themselves,” Genies has raised $10 million more. The party round comes from a wide range of investors, from institutional firms like NEA and Tull Co. to angels like Tinder’s Sean Rad, Raya’s Jared Morgenstern and speaker Tony Robbins; athletes like Carmelo Anthony, Kyrie Irving and Richard Sherman; and musicians, including A$AP Rocky, Offset from Migos, The Chainsmokers and 50 Cent. Some like Offset have even used their Genie to stand in for them for brand sponsorships, so their avatar poses for photos instead of them.

“We’ve transitioned from being an app to an avatar services company,” Nigam tells me. The son of WebMD’s co-founder, Nigam build a string of failed apps while at University of Michigan and worked with Genies co-founders Evan Rosenbaum and Matt Geiger on a startup called Blend that raised some money. Watching Snapchat-owned Bitmoji stay glued atop the app download charts inspired them to see more opportunity in the avatar space. Genies has had some talent issues, though. Nigam says it fired co-founder and president Matt Geiger, and a source tells me there were company culture issues that led to issues with the content writers it hired to create scenes for Genies to act out. Now it’s getting out of that scripted content creation business to focus on algorithmic suggestions of animations.

Genies in-app chat

The revamped Genies app lets you chat with up to six friends through your avatar. As you type, Genies detects actions, places, things and emotions, and offers you corresponding animations your avatar acts out with a tap. Given people already have plenty of place to chat, it might be tough to get people to move real conversations inside Genies for more than a quick hit of novelty. But that functionality is also coming to Facebook Messenger, WhatsApp and iMessage’s keyboards, where the expressive animations could naturally augment your threads.

Gucci paid to let Genies users add its luxury clothes to their avatars

With the Genies SDK, the startup is ready to challenge Snapchat’s new Snap Kit that lets apps build Bitmoji into their keyboards. But for $100,000 to $1 million in licensing fees, Genies allows apps to develop much deeper avatar features. Beyond creating keyboard stickers, games can plaster your Genies’ face over your character’s head, and utilities apps can have your Genie act out the weather or celebrate transactions. And since Genies is still taking off, partners can create experiences that feel fresh rather than just a repurposing of Bitmoji’s already-established cartoony avatars. Users spent an average of 19 minutes creating their Genie, so the SDK could add significant engagement to these apps. Genies has also launched its first official brand deal, where Gucci has created a wheel in the Genies creator so you can deck out your mini-you with luxury clothing.

The Avatar Wars (from left): Facebook Avatars, Google Gboard Mini Stickers, Apple Memoji

Despite Bitmoji’s years of success, it’s yet to have a scaled competitor. TechCrunch broke the news that Facebook is working on a “Facebook Avatars” feature, but seven months later it’s still not publicly testing and the prototype looks childish. Google’s Gboard just added the ability to create avatars based on a selfie, but they’re bland, low on detail and far from fun looking. And Apple’s latest mobile operating system lets you create a Memoji, though they too look generic like actual emoji rather than something instantly identifiable as you. By designing avatars that not only look like you but like a cooler version of you, Genies could capture the hearts and faces of millions of teens and the influencers they follow.

Powered by WPeMatico

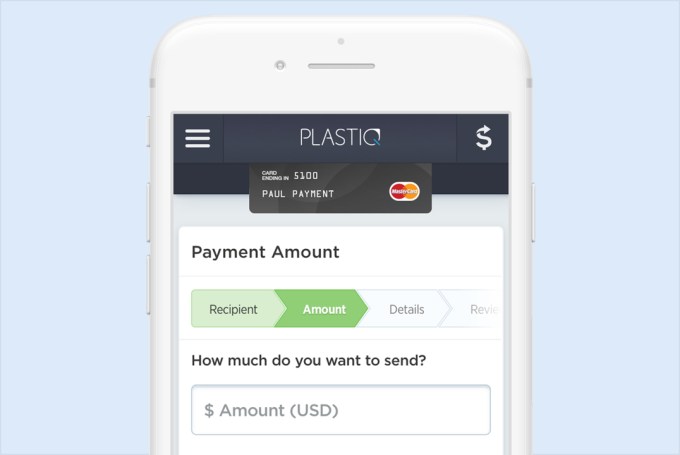

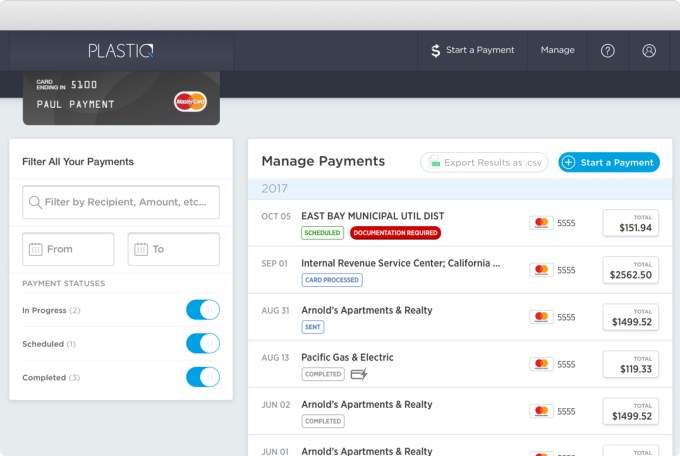

“I wasn’t asking to pay in Bitcoin!” Plastiq CEO and co-founder Eliot Buchanan recalls with a laugh. “I went to pay part of my tuition at Harvard and I was told that they didn’t (and never would) accept credit cards. It was inconvenient and seemed odd. Credit cards had been around for 50 years.” That set off the a light bulb in his head. “Why couldn’t I use a credit card to pay for this important bill? So, I set out to solve my own problem.”

Whether you’re trying to pay your rent or tuition on credit, or you have a business and want to invest in a new opportunity or get a better rate by paying vendors up front, Plastiq can help. For a flat 2.5 percent fee, you pay Plastiq through your credit card, and it issues the proper wire transfer, check or deposit for up to $500,000, or even more, on your behalf to whomever you owe.

Now with more than 1 million clients, growth-stage VCs are taking notice. Kleiner Perkins has just led a $27 million Series C for Plastiq with partner Ilya Fushman joining the board. A source says the raise that also comes from DST Global between doubles and triples Plastiq’s valuation over its 2017 Series B-1 rounds of $11 million and $16 million. Now with $73 million in total funding, it plans to add 100 people to its current team of 60, while building out its small business product and bank partnerships.

“As tens of thousands of business owners started using Plastiq actively for billions of dollars in payments, we realized we had this incredible opportunity to serve as the hub/platform on which they (SMBs) could run all their payments. The very fabric of America’s economy — and certainly much of the world — is run by rising or aspiring small business owners,” Buchanan tells me. He says that’s “the main reason that seeded this Kleiner financing and our renewed vision to ‘accelerate how small businesses grow.’ [Helping people pay with credit cards] is merely the entry point to a much broader play where we are central to how a small business runs.”

For example, if a small business wants to ramp up production of something it’s selling, it’d typically have to pay up front for manufacturing, but wait months until the stuff is shipped and sold to recoup its investment. That can put a major squeeze on the company’s operating capital. With Plastiq, the business can pay with credit up front so they don’t have to worry about being in danger of running out of money in the meantime. Plastiq also lets businesses accept credit card payments, which can win them favor with partners.

Plastiq co-founders (from left): Eliot Buchanan and Dan Choi

Specialty medical clinic chain Metro Vein pays vendors who don’t take credit with Plastiq instead. “I was able to invest in a new line of business that has enabled me to more than double our revenues in the last 10 months,” said CEO Dmitri Ivanov. And thanks to tax write-offs, business users of Plastiq can push its realized fee down to 2 percent.

Buchanan claims Plastiq doesn’t have any direct competitors that allow SMBs to pay for all their bills via credit. It does carry platform risk, though. “Like any payments business, we rely heavily on Visa, MasterCard and American Express. A challenge or risk factor is that you’re relying on very large companies that are very successful. You have to learn to work hand in hand with those partners instead of ‘disrupt them.’” He says Plastiq’s relationships with them are positive right now since it’s driving new revenue for them and helping their customers spend in new areas.

There’s also the risk that people misuse Plastiq to procrastinate on actually paying their personal bills or get in over their head investing in their business. But Plastiq’s new board member Fushman calls the service “this elegant way for businesses to tap into credit they’ve been issued but they haven’t been able to utilize before.” For many who are happy to pay though just need some time and flexibility, Plastiq can pitch in.

Powered by WPeMatico

VOI Technology, an e-scooter startup headquartered in Sweden but with pan-European ambitions, has raised $50 million in Series A funding, confirming our earlier scoop. As I previously reported, London-based venture capital firm Balderton Capital has led the round, alongside LocalGlobe, Raine Ventures, and previous VOI backer Vostok New Ventures.

A number of angel investors also participated. They include Cristina Stenbeck, Jeff Wilkes (Amazon), Justin Mateen (co-founder of Tinder), Nicolas Brusson (CEO and co-founder of BlaBlaCar), Sebastian Knutsson (co-founder of King), Spencer Rascoff (CEO of Zillow), and Keith Richman.

A source with knowledge of VOI’s early fundraising tells me this is in actual fact two rounds effectively being announced at the same time, although both VOI and Balderton say this is not the case. The e-scooter startup had previously raised around $3 million earlier this year.

What I do know, however, is the size of this new round got increased significantly very late on as VOI continues to gain early traction and the round became more competitive with a lot of VC interest. According to my sources, the initial target was $15 million at a pre-money valuation of between $35-40 million. Unfortunately, I haven’t been able to confirm the new valuation based on this much larger fundraise. Both VOI and Balderton declined to comment.

Launched in Sweden’s Stockholm in August 2018 by founders Fredrik Hjelm, Douglas Stark, Adam Jafer and Filip Lindvall, VOI has since expanded to Madrid, Zaragoza and Malaga in Spain. The plan is to use the new funding to continue to expand into new European markets. Belgium, the Netherlands, Luxembourg, France, Germany, Italy, Norway, and Portugal are said to be launching “in the coming months”. The VOI jobs page reveals that VOI is recruiting country managers for Denmark, Switzerland, Greece, Turkey, and Finland, too.

Like other e-scooter startups, VOI pitches itself as a way to ease traffic-clogged city centres and reduce pollution, with VOI’s scooters offering a “clean, efficient, cost-effective and zero emission” first-and-last-mile alternative to cars and taxis. After downloading the VOI app, you simply locate a nearby scooter on the street or via the app’s map, press the ‘ride’ button, scan the VOI QR code, and ride anywhere in the city. The company charges a €1 unlocking fee and a ride costs €0.15 per minute.

In just 12 weeks, VOI claims to have garnered 120,000 users, who have taken 200,000 rides, travelling 350,000 kilometres. It says this makes VOI Europe’s leading e-scooter sharing company.

“We see that we’ve changed user behaviour drastically in a very short time period,” VOI CEO Fredrik Hjelm tells me. “We changed how people commute, people move themselves. We changed how people transport within cities almost instantly after they try the scooters for the first time”.

He says this has resulted in “very strong retention rates, recurring use, and also friend referrals”.

“I’m from up in the North in Sweden, and for me it’s very difficult to understand, and it’s absurd, why we have so many cars and why our cities are built for cars, taxes and trucks, and not for people, animals, scooters, bikes, and light electric vehicles,” explains Hjelm. “That’s more from an ideological perspective. For me, scooters power freedom”.

VOI is also talking up its “distinctive” European approach in the way the company works collaboratively with city authorities. This is very different to the ‘ask for forgiveness not permission’ mentality of Silicon Valley.

“When you are reading the news, you get the feeling that city politicians are against scooters. The reality is the other way around,” Hjelm says. “The only thing is that they want a say in this and how it should be operated, so we don’t end up in a scooter graveyard situation that we see in some U.S. cities… Pretty much every European city has some kind of ambition or vision to become less dependent on fossil fuel driven cars and other vehicles”.

Balderton’s entrance into the e-scooter market comes after three of the other “big four” London VC firms have already made U.S. investments in the space. Index and Accel have backed Bird, and Atomico has backed Lime.

Last month also saw Berlin’s Tier raise €25 million in Series A funding led by Northzone, in another attempt to create the “Bird or Lime of Europe,” even if it is far from clear that Bird or Lime won’t take that title for themselves (which is obviously the bet being made by Index, Accel and Atomico). And two month’s ago Taxify also announced its intention to do e-scooter rentals under the brand Bolt, first launched in Paris but also planning to be pan-European.

This has led some VCs to describe the e-scooter space in Europe as a venture capital “blood bath” waiting to happen. The thinking is that the market has become so competitive so early, a lot of VC dollars are going to be spent (and potentially wasted) before it is far from clear who will be the eventual winner. That feels quite unusual for Europe, where it is more common for competing VCs to back off or co-invest once one or two of the big firms (or Rocket Internet) have made their move or when there is a better-funded U.S. competitor on the horizon — a point I put to Balderton Partner Lars Fjeldsoe-Nielsen.

“Yeah, and I think if we kept doing that as a VC community, we would never see any billion dollar companies coming out of Europe,” he replies. “This is why we’re backing VOI. [But] I get your point: it’s up against large amounts of capital”.

Describing e-scooters as a massive opportunity to change that, Fjeldsoe-Nielsen says that in the last four weeks VOI has doubled it revenues and that Balderton is seeing the same kind of traction and market reaction as Bird and Lime in the U.S.

“We believe an equally big company can come out of Europe,” he adds.

Powered by WPeMatico