Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

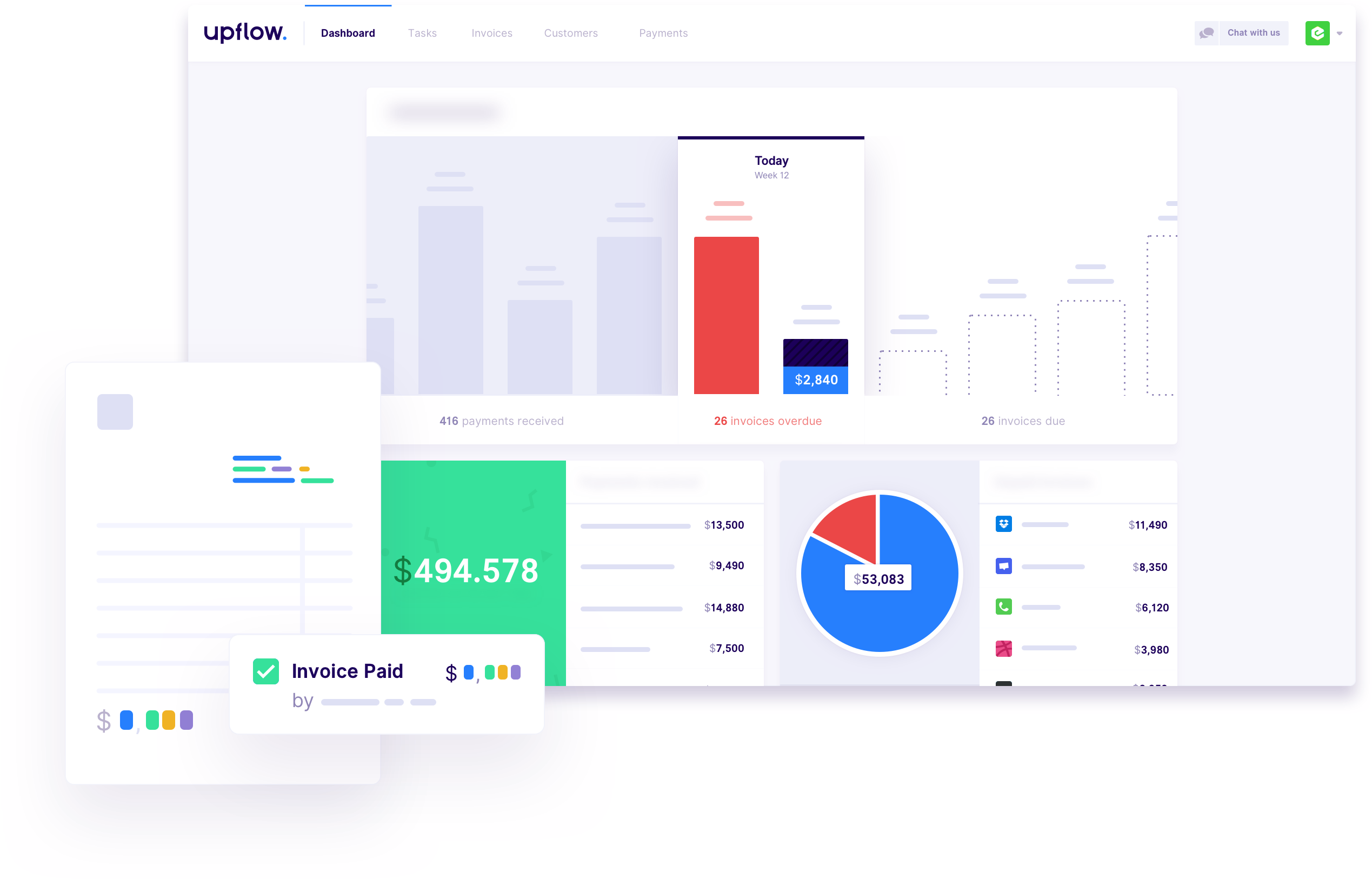

Meet Upflow a French startup that wants to help you deal with your outstanding invoices — the company first started at eFounders. If you’re running a small business, chances are you’re either wasting a ton of time or a ton of money on accounts receivable.

Most companies currently manage invoices using Excel spreadsheets, outdated banking interfaces and unnecessary conversations. Every time somebody signs a deal, they generate an invoice and file it in a spreadsheet somewhere.

Some companies will pay a few days later. But let’s be honest. Too many companies wait 30 days, 40 days or even more before even thinking about paying past due invoices. You end up sending emails, calling your clients and wasting a ton of time just collecting money. You might even feel bad about asking for money even though you already signed a deal.

In France, most companies use bank transfers to pay invoices. But business banking APIs are not there yet. It means that you have to log in to a slow banking website every day to check if somebody paid you. You can then tick a box in an Excel spreadsheet.

If everything I described resonates with you, Upflow wants to manage your invoices for you. It doesn’t replace your bank account, it doesn’t generate invoices for you. It integrates seamlessly with your existing workflow.

After signing up, you can send invoices to your client and cc Upflow in your email thread. Upflow then uses optical character recognition and automatically detects relevant data — the customer name, the amount, the due date, etc.

You can view all your outstanding invoices in Upflow’s interface to see where you stand. The service gives you a list of actionable tasks to get your money. For instance, Upflow tells you if you have overdue payments and tells you to contact your client again.

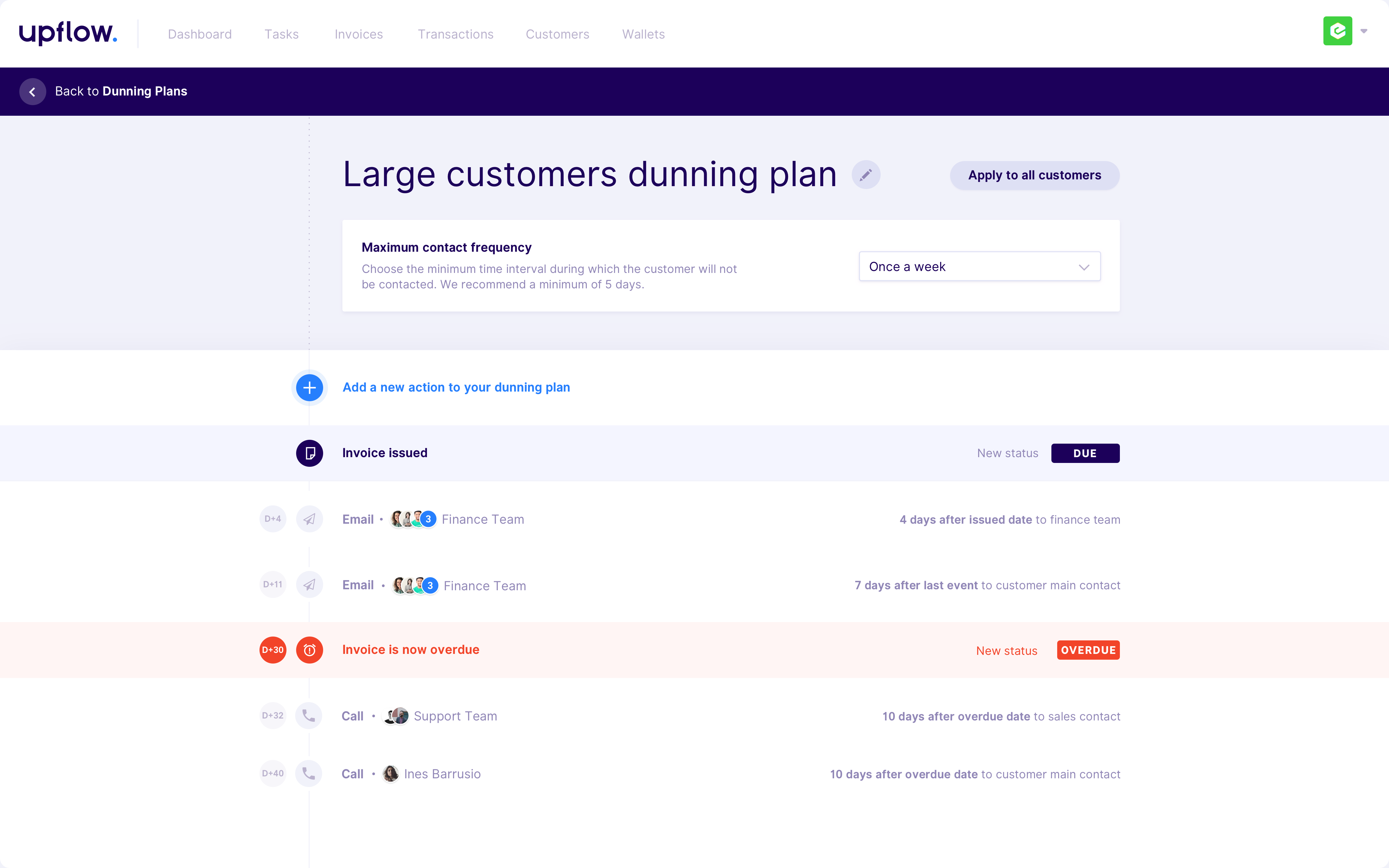

You can set up different rules depending on your clients. For instance, if you have many small clients, you can automate some of those messages. But if you only work with a handful of clients, you want to make sure that somebody has manually reviewed each message before Upflow sends them.

By default, you write your emails in Upflow so that your other team members can see what happened. You can browse invoices by client to see if somebody has multiple unpaid invoices. Upflow lets you assign actions to a particular team member if they’re more familiar with this specific client.

But all of this is just one part of the product. Upflow also generates banking information with the help of Treezor. This way, you can put your Upflow banking information on your invoices.

When a customer pays you, Upflow automatically matches invoices with incoming payments. This feature alone lets you save a ton of time. The startup transfers money back to your company’s bank account every day.

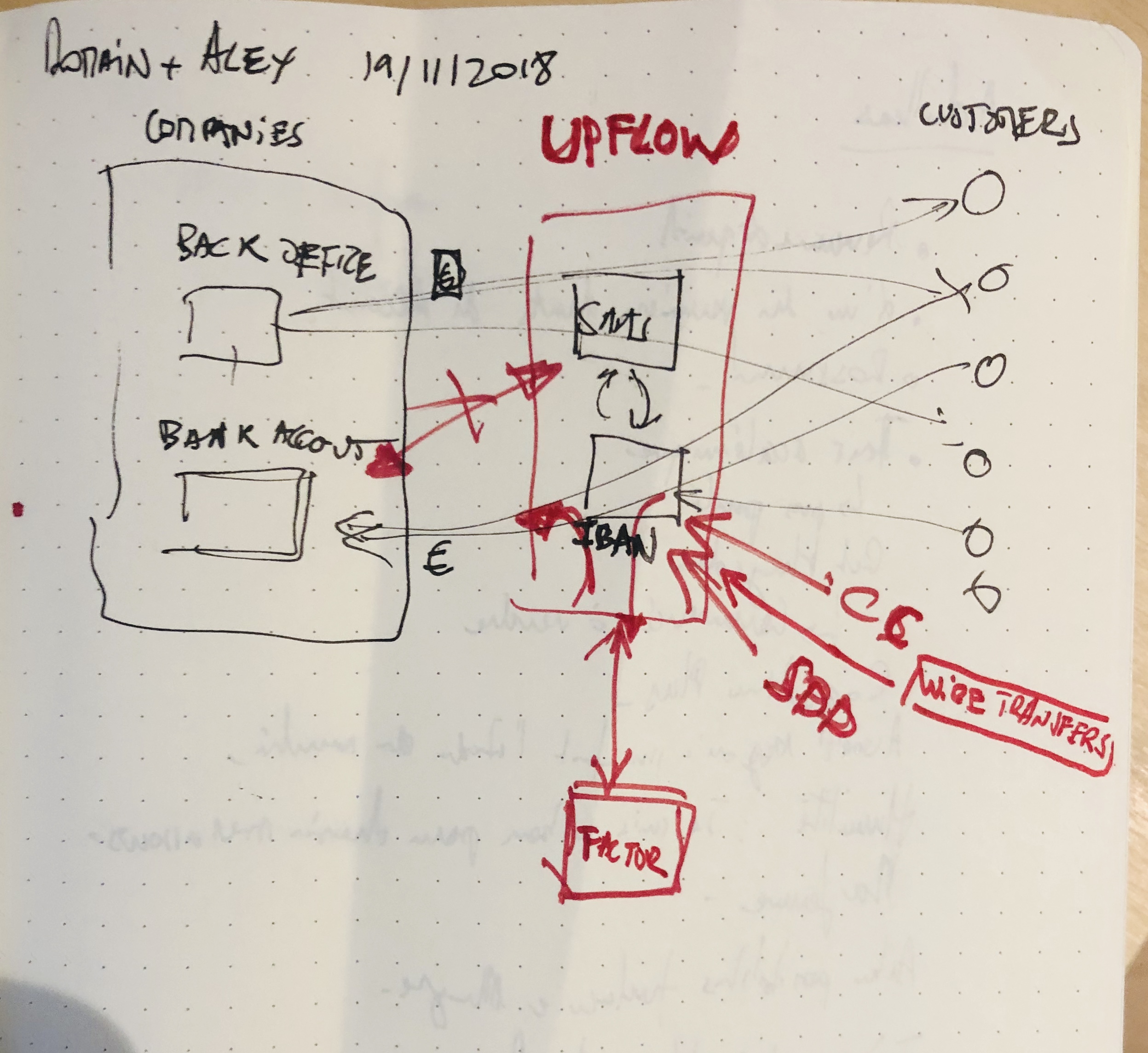

Upflow co-founder and CEO Alexandre Louisy drew me the following chart when we met. It’s probably easier to understand after reading my explanations:

In other words, Upflow has created a brick that sits between your company’s back office and your customers. Eventually, you could imagine more services built on top of this brick as Upflow is learning many things on your company.

According to Louisy, small and medium companies really need this kind of product — and not necessarily tech companies. Those companies don’t have a lot of money on their bank accounts, don’t have a big staff and need to save as much time as possible.

Now let’s see if it’s easy to sell a software-as-a-service solution to a family business that has been around for decades.

Powered by WPeMatico

Meet BlueCargo, a logistics startup focused on seaport terminals. The company was part of Y Combinator’s latest batch and recently raised a $3 million funding round from 1984 Ventures, Green Bay Ventures, Sound Ventures, Kima Ventures and others.

If you picture a terminal, chances are you see huge piles of containers. But current sorting methods are not efficient at all. Yard cranes end up moving a ton of containers just to reach a container sitting at the bottom of the pile.

BlueCargo wants to optimize those movements by helping you store containers at the right spot. The first container that is going to leave the terminal is going to be at the top of the pile.

“Terminals spend a lot of time making unproductive or undesired movements,” co-founder and CEO Alexandra Griffon told me. “And yet, terminals only generate revenue every time they unload or load a container.”

Right now, ERP-like solutions only manage containers according to a handful of business rules that don’t take into account the timeline of a container. Empty containers are all stored in one area, containers with dangerous goods are in another area, etc.

The startup leverages as much data as possible on each container — where it’s coming from, the type of container, if it’s full or empty, the cargo ship that carried it, the time of the year and more.

Every time BlueCargo works with a new terminal, the startup collects past data and processes it to create a model. The team can then predict how BlueCargo can optimize the terminal.

“At Saint-Nazaire, we could save 22 percent on container shifting,” Griffon told me.

The company will test its solution in Saint-Nazaire in December. It integrates directly with existing ERP solutions. Cranes already scan container identification numbers. BlueCargo could then instantly push relevant information to crane operators so that they know where to put down a container.

Saint-Nazaire is a relatively small port compared to the biggest European ports. But the company is already talking with terminals in Long Beach, one of the largest container ports in the U.S.

BlueCargo also knows that it needs to tread carefully — many companies already promised magical IT solutions in the past. But it hasn’t changed much in seaports.

That’s why the startup wants to be as seamless as possible. It only charges fees based on shifting savings — 30 percent of what it would have cost you with the old model. And it doesn’t want to alter workflows for people working at terminals — it’s like an invisible crane that helps you work faster.

There are six dominant players managing terminals around the world. If BlueCargo can convince those companies to work with the startup, it would represent a good business opportunity.

Powered by WPeMatico

Berlin-based Zizoo — a startup which self describes as booking.com for boats — has nabbed a €6.5 million (~$7.4M) Series A to help more millennials find holiday yachts to mess about taking selfies in.

Zizoo says its Series A — which was led by Revo Capital, with participation from new investors including Coparion, Check24 Ventures and PUSH Ventures — was “significantly oversubscribed”.

Existing investors including MairDumont Ventures, aws Founders Fund, Axel Springer Digital Ventures and Russmedia International also participated in the round.

We first came across Zizoo some three years ago when they won our pitching competition in Budapest.

We’re happy to say they’ve come a long way since, with a team that’s now 60-people strong, and business relationships with ~1,500 charter companies — serving up more than 21,000 boats for rent, across 30 countries, via a search and book platform that caters to a full range of “sailing experiences”, from experienced sailor to novice and, on the pricing front, luxury to budget.

Registered users passed the 100,000 mark this year, according to founder and CEO Anna Banicevic. She also tells us that revenue growth has been 2.5x year-on-year for the past three years.

Commenting on the Series A in a statement, Revo Capital’s managing director Cenk Bayrakdar said: “The yacht charter market is one of the most underserved verticals in the travel industry despite its huge potential. We believe in Zizoo’s successful future as a leading SaaS-enabled marketplace.”

The new funds will be put towards growing the business — including by expanding into new markets; plus product development and recruitment across the board.

Zizoo founder and CEO Anna Banicevic at its Berlin offices

“We’re looking to strengthen our presence in the US, where we’ve seen the biggest YoY growth while also expand our inventory in hot locations such as Greece, Spain and the Caribbean,” says Banicevic on market expansion. “We will also be aggressively pushing markets such as France and Spain where consumers show a growing interest in boat holidays.”

Zizoo is intending to hire 40 more employees over the course of the next year — to meet what it dubs “the booming demand for sailing experiences, especially among millennials”.

So why do millennials love boating holidays so much? Zizoo says the 20-40 age range makes up the “majority” of its customer.

Banicevic reckons the answer is they’re after a slice of ‘affordable luxury’.

“After the recent boom of the cruising industry, millennials are well familiar with the concept of holidays at sea. However, sailing holidays (yachting) are much more fitting to the millennial’s strive for independence, adventure and experiences off the beaten path,” she suggests.

“Yachting is a growing trend no longer reserved for the rich and famous — and millennials want a piece of that. On our platform, users can book a boat holiday for as low as £25 per person per night (this is an example of a sailboat in Croatia).”

On the competition front, she says the main competition is the offline sphere (“where 90% of business is conducted by a few large and many small travel agents”).

But a few rival platforms have emerged “in the last few years” — and here she reckons Zizoo has managed to outgrow the startup competition “thanks to our unique vertically integrated business model, offering suppliers a booking management system and making it easy for the user to book a boat holiday”.

Powered by WPeMatico

Wluper, the London-based tech startup building a conversational AI to power knowledge-based voice assistants, has raised $1.3 million in seed funding. Leading the round is “deep tech” VC IQ Capital, with participation from Seedcamp, Aster, and Magic Pony co-founder Dr Zehan Wang.

Founded in 2016 and originally backed by Jaguar Land Rover’s InMotion Ventures, Wluper’s “conversational AI” is initially targeting navigation products with what it describes as “goal-driven dialogue” technology that is designed to have more natural conversations to help with various navigation tasks.

The ‘secret sauce’, as it were, is that Wluper believes voice assistants work much better when the underlying AI is tasked with becoming an expert in a more narrow and specialist domain.

“When we think of intelligent assistants like Alexa or Siri, the only time you’ll believe they’re really good is if they understand you properly; most of the time, they simply can’t,” says Wluper co-founder Hami Bahraynian. “It is not the speech recognition which fails. It is the missing focus and lacking reasoning of these systems, because they all can do a lot of things reasonably well, but nothing perfectly”.

Describing the goal of “general” conversation AI as one that could take 15, 20 or more years to achieve, Bahraynian says that in the interim what is needed is “intelligent agents” that are created for a certain purpose, now.

“This is exactly what we do,” he says. “We build domain-expert conversational intelligence, which does one thing, understanding everything transport-related, but that one thing perfectly”.

Furthermore, Wluper’s approach is able to make clear assumptions regarding what the user is talking about, and therefore claims to be able to understand much more complex questions and in a more natural way. This includes multi-intent queries, and follow-up questions to enable a “true” conversation, says Bahraynian.

In addition, Wluper has been conducting R&D in what comes after the “understanding” bit of the NLP pipeline, leading the startup to undergo further research on a machine’s “knowledge acquisition” capabilities, which it believes is a crucial piece of the puzzle needed to solve conversational AI.

“Even if naturally asked user queries are eventually understood correctly, extracting and providing relevant and useful information from the right places is even more challenging, and with current mostly ruled-based approaches, ultimately impossible to scale,” adds Bahraynian.

“We work on this problem by moving away from traditional handcrafted methods and work on new ways to optimise a machine’s knowledge acquisition and finding the right balance between structured and unstructured data in order to provide more meaningful results”.

Meanwhile, Wluper’s seed investment will be used to hire more engineers and research scientists to expand the startup’s research and development capabilities.

Powered by WPeMatico

French crowd-lending platform October (formerly known as Lendix), wants to educate more people about new ways to borrow money. That’s why the company is launching a project called Grandir Ensemble (grow together).

11 big companies are borrowing €100,000 each on October at a 2.5 percent interest rate. October users will be able to lend as little as €20 to one of these companies.

If you look at the list of companies, all those names will sound familiar to French readers and beyond. Most of them are public companies, most of them are originally from France — AccorHotels, Adecco Group, Allianz France, Arkéa, Edenred, Engie, Iliad, JCDecaux, Suez, Unibail-Rodamco-Westfield and Webhelp.

According to October, annual revenue of those companies ranges from €1.8 billion to €122 billion, with Allianz generating more revenue than anyone else.

At a press conference, October co-founder and CEO Olivier Goy explained the idea behind this project. Those credit lines won’t change anything for big public companies. But many of those companies work with small and medium companies.

Today’s partners will be able to refer small companies. October will wave the application fees for those companies up to €11 million in loans.

Thanks to this vote of confidence, you could imagine small companies applying to October because a big company they trust has done it before.

France’s Economy Minister Bruno Le Maire recorded a video message for the press conference, saying that he supports October and today’s campaign.

One of October’s key advantages compared to borrowing money from the bank is that it’s much faster. You can apply to a credit line and get an answer just a few days later. This is quite useful if you need to move quickly to launch a new product, open a new office and more.

October currently operates in France, Spain, Italy and soon the Netherlands. I already covered the company in depth back in June if you want to read more.

Powered by WPeMatico

There’s hardly enough room to turn around in Livin Farms’ office. Pretty standard, really, in Central, Hong Kong, where space is at a perpetual premium. It’s a small operation for the HAX-backed startup — there’s space for a few desks and not much more. The startup’s last product, the Hive, stands next to the door. It’s a series of innocuous trays stacked atop one another.

But it’s the Hive Explorer I’m here to see. The small tray sits in the middle of the room. Its top is open, the brightly colored bits of plastic drawing the eye from the moment you step through the door. Its contents pulsate with strange, random rhythms. Upon closer inspection, the browns are whites and blacks are alive, a small bed of mealworms wriggle atop one other, chowing down of the remnants of oats left behind by the team.

Above them, a neon yellow tray houses a trio of fully grown beetles and a couple dozen pupae. The former are constant on the move, butting up against one another and sometimes doing more with aims of continuing the life cycle. The pupae lie around, seemingly lifeless, occasionally twitching out a reminder that there’s still life inside.

The Explorer finds Livin Farms broadening its horizons into the world of STEM education. Where past products were focused on scalable sustainability, the new Kickstarter project is firmly targeted at youngsters. And there’s a fair amount to be learned in the bucket full of beetles. Mortality, for one. Founder Katharina Unger grabs a nearby jar and twists off the cap.

It’s filled to the top with dried mealworms. She pulls one out and pops it in her mouth, handing it to me, hopefully. I follow suit. It’s crispy. Not flavorless, exactly, but not particularly distinct. Maybe a bit salty. Mostly it just feels overwhelmingly morbid, showing down on on a little larva as its brothers continue to feast a few inches away.

Protein source of the future, now, to quote The Mountain Goats. Livin Farms also produces a unflavored larva-based powder and a surprising tasty granola as a kind of proof concept for its sustainable high-protein foodstuffs. The mission hits home here in one of the world’s most densely packed places.

[She gave me some to take home, if anyone’s hungry.]

The Explorer also offers youngsters a peak at what many consider the future of sustainable farming — assuming food manufacturers are ever able to break through the stigma of eating insects. Kids are encourage to harvest the larva to avoid overpopulation with a bit of dry roasting. The box serves as a relatively odor-free form of composting. Feeding the bugs simply entails tossing excess foodstuffs into the bin. The little buggers will tear through it, leaving a thin powder of waste in a tray below.

The setup also features a heat plate to keep the worms warm and a fan to regulate humidity, assuring that settings are ideal for the beetles to do their thing. Livin Farms is also opening up the controls to the system via Swift, in an attempt to bring a coding component to the system.

The Explorer went live on Kickstarter this week. Early bird pledges can pick up a the box of worms for ~$113.

Powered by WPeMatico

Machine learning is everywhere now, including recruiting. Take CV Compiler, a new product by Andrew Stetsenko and Alexandra Dosii. This web app uses machine learning to analyze and repair your technical resume, allowing you to shine to recruiters at Google, Yahoo and Facebook.

The founders are marketing and HR experts who have a combined 15 years of experience in making recruiting smarter. Stetsenko founded Relocate.me and GlossaryTech while Dosii worked at a number of marketing firms before settling on CV Compiler.

The app essentially checks your resume and tells you what to fix and where to submit it. It’s been completely bootstrapped thus far and they’re working on new and improved machine learning algorithms while maintaining a library of common CV fixes.

“There are lots of online resume analysis tools, but these services are too generic, meaning they can be used by multiple professionals and the results are poor and very general. After the feedback is received, users are often forced to buy some extra services,” said Stetsenko. “In contrast, the CV Compiler is designed exclusively for tech professionals. The online review technology scans for keywords from the world of programming and how they are used in the resume, relative to the best practices in the industry.”

The product was born out of Stetsenko’s work at GlossaryTech, a Chrome extension that helps users understand tech terms. He used a great deal of natural language processing and keyword taxonomy in that product and, in turn, moved some of that to his CV service.

“We found that many job applications were being rejected without even an interview, because of the resumes. Apparently, 10 seconds is long enough for a recruiter to eliminate many candidates,” he said.

The service is live now and the team expects the corpus of information to grow and improve over time. Until then, why not let a machine learning robot tell you what you’re doing wrong in trying to get a job? That is, before it replaces you completely.

Powered by WPeMatico

Quantum Machines, an Israeli startup launched by three Ph.D. physicists, wants to build the operational and control layer for quantum computing. Today, it announced a $5.5 million seed investment led by TLV Partners with participation from Battery Ventures.

The three principals have been studying quantum computing for a decade and they understand that to commercialize it, it’s going to require a complete solution. Right now the majority of the research is centered on increasing the number of qubits at the processor level. Co-founder and CEO Itamar Sivan says in order to advance the technology, it’s going to take an operational and control layer to make it all work, and that is where the founders decided to concentrate the company’s efforts, he said.

Sivan explained that there is a point where the classical computers we use today and the quantum computers of the future will have to work together to pass data and interpret commands. He described three layers in a quantum computing stack. The first is the quantum processor. Next is a classical computing control layer with classical electronics you would find on any computer today. Finally, there is the software layer where you program a classical algorithm that has to be passed to the quantum processor.

He says that some companies are trying to build full stacks, but the bulk of research as been concentrated on building quantum processors. Quantum Machines decided to focus on one part of the stack. “We have come to the conclusion that there must be a company laser-focused on a vertically integrated control solution that includes the classical hardware and software,” Sivan said.

“The power of quantum computers stems from their complexity and richness, though it is also this complexity which makes them incredibly difficult to control and operate — this is the problem our company is attempting to solve,” he added in a statement.

The company is currently working on prototype hardware to build this layer and is working with several beta customers at the moment. It’s early days for the company, but the seed money should help them accelerate that vision and get a product to market more quickly.

Powered by WPeMatico

TechCrunch will soon be returning to Africa to hold its Startup Battlefield competition dedicated to the African continent, in Lagos, Nigeria, on December 11th.

The event will showcase the launch of 15 of the hottest startups in Africa onstage for the first time. We’ll also be joined by some of the leading investment firms in the region. If you want to be in the same room, you’d better grab your tickets now.

Here are just some of the investors and founders who will be judging the startups competing for US$25,000.

Dr. Eleni Gabre-Madhin is founder and chief executive of blueMoon, Ethiopia’s first youth agribusiness/agritech incubator and seed investor. Prior to this, she founded eleni LLC, Africa’s leader in designing, building and supporting the operations of commodity exchange ecosystems in frontier markets. Dr. Gabre-Madhin is also founder and former CEO of Ethiopia Commodity Exchange (ECX), having successfully traded $1.2 billion annually after three years of operation.

Erik Hersman is the CEO of BRCK a rugged wireless Wi-Fi device designed and engineered in Kenya for use throughout the emerging markets. In 2010 he founded iHub, Nairobi’s innovation hub for the technology community, bringing together entrepreneurs, hackers, designers and the investment community.

Minette Havemann is strategy director at Naspers Ventures, which finds and backs promising technology startups across the world. She plays a leading role in identifying consumer and market trends shaping the team’s overall investment agenda and represents the team in Africa. Before this, Minette worked as general manager of Strategy and Research at Media24, where she focused on business strategy development across a diverse portfolio spanning media, B2C e-commerce and classifieds assets.

Sangu is the co-founder and managing director of Africa Health Holdings, a company based in West Africa and focused on “building Africa’s healthcare future.” He also serves as chairman of Golden Palm Investments Corporation, a holding company that has backed startups, including Andela, mPharma and Flutterwave. GPI portfolio companies have raised more than $300 million in venture financing.

Wale Ayeni leads the IFC’s Venture Capital practice focused on Africa, South of the Sahara – the International Finance Organization is part of the World Bank Group. The IFC’s venture capital team invests in technology companies in frontier markets, and has deployed ~$800 million in early/growth-stage tech investments over the past decade. Prior to the IFC, Wale led venture capital early-stage investments in disruptive startups across various technology sectors for Orange in Silicon Valley with representative investments in the U.S.

Tickets to this event cost $10 (N3600 +VAT), and you can buy them right here.

Startup Battlefield consists of three preliminary rounds with 15 teams — five startups per round — who have only six minutes to pitch and present a live demo to a panel of expert technologists and VC investors. After each pitch, the judges have six minutes to grill the team with tough questions. This is all after the free pitch-coaching they receive from TechCrunch editors.

One startup will emerge the winner of TechCrunch Startup Battlefield Africa 2018 — and receive a US$25,000 no-equity cash prize and win a trip for two to compete in the Startup Battlefield at TechCrunch Disrupt in 2019 (assuming the company still qualifies to compete at the time).

Powered by WPeMatico

Wind Mobility, a Berlin-based mobility startup that offers “dockless” e-scooter (and electric bicycle) rentals, has raised $22 million in seed funding, throwing its hat into the ring as European competitor to Bird and Lime.

It follows recent raises by Sweden’s VOI ($50 million Series A led by Balderton) and Germany’s Tier (€25 million Series A led by Northzone). All three companies are attempting to be pan-European from the get-go.

In other words, you wait all year for the “Bird or Lime of Europe” to appear and three contenders get funded at once. And that’s before we mention Taxify’s entrance into e-scooter rentals or Delivery Hero and Team Europe founder Lukasz Gadowski’s reported plans to enter the space, having picked up backing from the mobility arm of Target global.

Meanwhile, despite being U.S. companies, Bird and Lime have received substantial investment from three of Europe’s top venture capital firms. Index and Accel have backed Bird, and Atomico has backed Lime.

But I digress…

Investing in Wind Mobility’s rather large seed round is Chinese Source Code Capital, and Europe’s HV Holtzbrinck Ventures. The company says the investment will be used for global expansion and to further develop its e-scooter product. Wind currently operates its e-scooter rental service in various cities in Spain, France and the U.S., and its dockless bicycle rental service Byke in Germany.

Notably, Wind is currently developing its first proprietary model of electric scooters specifically designed for the sharing market, which co-founder and CEO Eric Wang tells me will become a significant differentiator going forward.

“Currently, almost all the scooters on the market are from Ninebot, which is designed for personal use rather than sharing,” he says. “Our own scooters are specifically designed for sharing: longer battery range, swappable battery, more capability to climb hills, sturdy and more fit for sharing. We can also tailor our scooters to the requirement of certain cities. This gives us an edge in continuing to adopt to customer needs and regulatory requirements.”

Alongside this, Wind Mobility has developed a proprietary “IoT technology and communication module” that it says gives it better location accuracy of its scooters. The system is also capable of delivering over-the-air updates to the Wind communication module to control certain functionality of its scooters remotely.

For example, it can tell a scooter light to flash via a tap on the Wind app so that users and operational personnel can spot the scooter more easily at night. “We can change the speed limit of the fleet in each city or certain scooters via our servers. We also limit the speed to zero via the communication module once a scooter is taken outside of the operating area,” adds Wang.

Like other European players in the space, Wind says it works in co-operation with local governments, with the goal of solving mobility problems and reducing congestion in urban areas.

“The scooter market in Europe is still relatively new,” says the Wind CEO. “The bigger competition is still to convert more users from using cars to using scooters along with public transportation. We are at the forefront of this transformation. We look forward to working with cities and authorities to serve this growing demand.”

Powered by WPeMatico