Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Floyd Mayweather Jr. and DJ Khaled have agreed to “pay disgorgement, penalties and interest” for failing to disclose promotional payments from three ICOs, including Centra Tech. Mayweather received $100,000 from Centra Tech while Khaled got $50,000 from the failed ICO. The SEC cited Khaled and Mayweather’s social media feeds, noting they touted securities for pay without disclosing their affiliation with the companies.

Mayweather, you’ll recall, appeared on Instagram with a whole lot of cash while Khaled called Centra Tech a “Game changer.”

“You can call me Floyd Crypto Mayweather from now on,” wrote Mayweather. Sadly, the SEC ruled he is no longer allowed to use the nom de guerre “Crypto.”

Without admitting or denying the findings, Mayweather and Khaled agreed to pay disgorgement, penalties and interest. Mayweather agreed to pay $300,000 in disgorgement, a $300,000 penalty, and $14,775 in prejudgment interest. Khaled agreed to pay $50,000 in disgorgement, a $100,000 penalty, and $2,725 in prejudgment interest. In addition, Mayweather agreed not to promote any securities, digital or otherwise, for three years, and Khaled agreed to a similar ban for two years. Mayweather also agreed to continue to cooperate with the investigation.

“These cases highlight the importance of full disclosure to investors,” said Stephanie Avakian of the SEC. “With no disclosure about the payments, Mayweather and Khaled’s ICO promotions may have appeared to be unbiased, rather than paid endorsements.”

The SEC indicted Centra Tech’s founders Raymond Trapani, Sohrab Sharma, and Robert Farkas for fraud.

Powered by WPeMatico

A flurry of digital-first insurers are betting they can surpass industry incumbents with a little help from technology and a lot of help from venture capitalists.

The latest to land a massive check is Bright Health, a Minneapolis-headquartered provider of affordable individual, family and Medicare Advantage healthcare plans in Alabama, Arizona, Colorado, New York City, Ohio and Tennessee. The company, founded by the former chief executive officer of UnitedHealthcare Bob Sheehy; Kyle Rolfing, the former CEO of UnitedHealth-acquired Definity Health; and Tom Valdivia, another former Definity Health executive, has brought in a $200 million Series C.

The funding values Bright Health at $950 million, according to PitchBook — more than double the $400 million valuation it garnered with its $160 million Series B in June 2017. Sheehy, Bright Health’s CEO, declined to comment on the valuation. New investors Declaration Partners and Meritech Capital participated in the round, with backing from Bessemer Venture Partners, Greycroft, NEA, Redpoint Ventures and others. Bright Health has raised a total of $440 million since early 2016.

VCs have deployed significantly more capital to the insurance technology (insurtech) space in recent years. Startups in the industry, long-known for a serious dearth of innovation, have raked in nearly $3 billion in private capital this year. U.S.-based insurtech startups have raised $2 billion in 2018, a record year for the sector and more than double last year’s total.

Deal count, meanwhile, is swelling. In 2016, there were 72 deals conducted in the space, followed by 86 in 2017 and 94 so far this year, again, according to PitchBook’s data.

Oscar Health, the health insurance provider led by Josh Kushner, is responsible for about 25 percent of the capital invested in U.S. insurtech startups this year. The company has raised a total of $540 million across two notable deals in 2018. The first saw Oscar pulling in $165 million at a $3 billion valuation and the second, announced in August, had Alphabet investing a whopping $375 million. Devoted Health, a Waltham, Mass.-based Medicare Advantage startup, followed up with a massive round of its own. The company nabbed $300 million and announced that it would begin enrolling members to its Medicare Advantage plan in eight Florida counties. Devoted is led by Todd Park, the co-founder of Athenahealth and Castlight Health.

Bright Health co-founders Bob Sheehy, CEO; Tom Valdivia, chief medical officer; and Kyle Rolfing, president

VC’s interest in insurtech isn’t limited to healthcare.

Hippo, which sells home insurance plans at lower premiums, officially launched in 2017 and has brought in $109 million to date. Earlier this month the company announced a $70 million Series C funding round led by Felicis Ventures and Lennar Corporation. Lemonade, which is similarly an insurer focused on homeowners, raised $120 million in a SoftBank-led round late last year. And Root Insurance, an app-based car insurance company founded in 2015, itself raised a $100 million Series D led by Tiger Global Management in August. The financing valued the company at $1 billion.

Together, these companies have raised well over $1 billion this year alone. Why? Because building a health insurance platform is incredibly cash-intensive and particularly difficult given the breadth of incumbents like Aetna or UnitedHealth. Sheehy, considering his 20-year tenure at UnitedHealthcare, may be especially well-positioned to disrupt the industry.

The opportunity here for investors and startups alike is huge; the health insurance market alone is forecasted to be worth more than $1 trillion by 2023. Companies that can leverage technology to create consumer-friendly, efficient and, most importantly, reasonably priced insurance options stand to win big.

As for Bright Health, the company plans to use its $200 million infusion to rapidly expand into new markets, planning to triple its geographic footprint in 2019.

“Bright Health has continued to execute at a fast pace towards our goal of disrupting the old health care model that places insurers at odds with providers,” Sheehy said in a statement. “[Its] current high re-enrollment rate shows that consumers are ready for this improved healthcare experience – especially when it is priced competitively.”

Powered by WPeMatico

Thirteen companies took the stage today at Disrupt Berlin, delivering six-minute pitches and demos, then answering free-for-all questions from expert judges. Now that the judges have given us their feedback, we’ve chosen five finalists.

These finalists will all take the stage again tomorrow afternoon to present in front of a new set of judges, who will have time to ask more in-depth questions. Then one winner will be chosen to take home the Disrupt Cup — not to mention $50,000, equity-free.

Here are the finalists. The competition will be live-streamed on TechCrunch starting at 2:05pm Berlin time on Friday.

Imago AI is applying AI to help feed the world’s growing population by increasing crop yields and reducing food waste. To accomplish this, it’s using computer vision and machine learning technology to fully automate the laborious task of measuring crop output and quality.

Read more about Imago AI here.

Kalepso says it can do better than other database offerings out there by melding strong security with high reliability, while filling in the spots where sensitive data can be accessed or obtained in the clear. Its Harvard-educated founders argued that all the existing database services out there are either slow or insecure.

Legacy is tackling an interesting problem: the reduction of sperm motility as we age. By freezing men’s sperm, this Swiss-based company promises to keep our boys safe and potent as we get older, a consideration that many find vital as we marry and have kids later.

Polyteia is building a platform that would allow city leaders to unify and analyze the data that represents the constituents they serve. The problem, the company says, is that local governments collect a lot of data, but they aren’t always great at organizing and using it efficiently.

Read more about Polyteia here.

Spike lets family and doctors lend a hand to diabetes patients by sending them real-time alerts about their stats. And the app’s artificial intelligence features can even send helpful reminders or suggest the most diabetes-friendly meals when you walk into a restaurant.

Read more about Spike Diabetes here.

Powered by WPeMatico

Lyft has finally given us a glimpse of its forthcoming line of shareable bikes, which the ridesharing company says will be available to rent within its mobile app in select cities “soon.”

The news comes as the $15 billion company announces the final close of its acquisition of Motivate, the New York City-based mobility startup that owns a number of bike-rental services, like Citi Bike, Ford GoBike, Divvy, Blue Bikes and Capital Bikeshare. The transaction was reportedly worth some $250 million.

Lyft brought in $600 million in fresh funding in June from backers Fidelity Research & Management, AllianceBernstein, Baillie Gifford, KKR, CapitalG, Rakuten and others.

Now that its bike deal is complete, Lyft becomes the largest bike service provider in the U.S. That’s a big leap forward for a company that hopes to have the largest dockless bike fleet in the world — outside of China, of course, where companies like Mobike have deployed millions of bikes.

As part of the deal, Lyft will invest $100 million in New York’s Citi Bike, tripling the number of bikes available to 40,000 by 2023.

Lyft launched its first fleet of scooters earlier this year in Denver, hot off the heels of scooter-mania, which saw companies like Bird and Lime garner billion-dollar valuations and complete launches all over the world.

The company says the scooters have been a success thus far. In Denver, for example, 15 percent of Lyft rides in 2018 were taken on scooters. The company has also made scooters available to rent within its app in Santa Monica and Washington, DC — a list that will undoubtedly swell in 2019.

Here’s hoping Lyft’s bike wheels are actually pink. If not, I will be gravely disappointed.

Powered by WPeMatico

Legacy is tackling an interesting problem: the reduction of sperm motility as we age. By freezing our sperm, this Swiss-based company promises to keep our boys safe and potent as we get older, a consideration that many find vital as we marry and have kids later. Legacy, which exhibited in Startup Alley at Disrupt Berlin 2018, was chosen as the wildcard company to present its services onstage during Startup Battlefield.

How does it work? Well, the company delivers a system for grabbing sperm. The material is kept in a specially made container and shipped to a nearby clinic where they then test the sperm and place it in cryogenic storage. You can then make a withdrawal when you’re ready for babies.

“Our unique at-home solution allows men to have their sperm analyzed and frozen at a clinic without leaving their home or having to meet with a physician,” said founder Khaled Kteily. “All clients receive a full fertility analysis, including personalized recommendations using our machine learning-driven technology.”

Kteily ensures us that our special sauce will stay safe over the years.

“Our core values of privacy, quality, and security ensure discretion, anonymity, and the highest level of quality for all our clients, including multi-site storage, whereby our clients’ deposits are stored in multiple tanks in multiple locations at high security.”

The company offers three packages: Bronze, Gold and Platinum. The $1,000 Bronze package requires you to take your sperm to a clinic where it will be tested and cryogenically stored. The Platinum plan costs $10,000 and ensures the company will keep up to six samples of your swimmers indefinitely, affording your genetic material practical immortality.

Kteily founded the company after a friend looked for solutions to sperm storage while facing cancer treatment. Realizing there was nothing that looked trustworthy or usable, he used his background in health and entrepreneurship to build Legacy.

The company has raised $250,000 and they are profitable. Kteily sees his company as the “Swiss Bank” of sperm storage.

“Male fertility has declined by 50 percent. Every 8 months, men produce a new genetic mutation that gets passed on to their children. Birth rates around the world are plummeting and men are responsible for infertility in 30-50 percent of couples. Meanwhile, you can freeze sperm indefinitely with no loss in quality — through Legacy, without having to leave your home and at a tenth of the cost of egg freezing,” he said. “We treat our clients as a private bank would — our core values of quality, privacy and security ensure our clients are taken care of at every level.”

Powered by WPeMatico

Alexandre Meregan says that music, and audio in general, has always been core to his life. But one day on his five-minute commute to work, trying to listen to a podcast for the first time, he realized that by the time he arrived at work he had only heard an introduction and a commercial jingle.

He immediately went to work on Koo!, a short-form podcast app aimed at young people. Koo! lets users record up to one minute of audio, add “sound stickers” like a drum roll or a poop sound, and share the “Koo” in a feed with their friends and followers.

Meregan believes that some young people are hesitant to share their thoughts on social media, which is mostly picture or video-based, because of the quantification of their self-worth through Like counters. With Koo! users can simply speak their thoughts without having to share a picture or video.

Meregan believes that some young people are hesitant to share their thoughts on social media, which is mostly picture or video-based, because of the quantification of their self-worth through Like counters. With Koo! users can simply speak their thoughts without having to share a picture or video.

“At Koo! we believe a lot of great content is being held back by teenagers due to insecurities that comes with photo and video,” said Meregan onstage at TechCrunch Disrupt Berlin on the Startup Battlefield. “We feel that what you say should be more important than how you look.”

Like most social networks, Koo! is primarily focused on acquiring new users before focusing on a revenue model. Ad-supported revenue is the most obvious option to make money, but Meregan says that the team has been floating around a few other ideas, as well.

One user-acquisition tactic, according to Meregan, is to target YouTube content creators and give them a complimentary service to share their thoughts and voice.

A handful of startups have tried their hand at audio-based social networks, but few have managed to gain much traction.

Koo! is backed by Sweet Studio, though Meregan declined to share the amount of funding the company has received to date.

Powered by WPeMatico

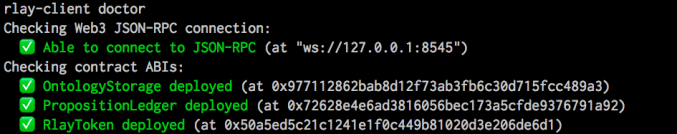

The team behind Rlay believes that blockchain technology can play a crucial role in helping businesses crowdsource their data-gathering tasks.

Founder Michael Hirn said this is a problem he encountered while working with Sunstone Capital to develop a more quantitative approach to venture capital, which meant pulling startup data from a wide variety of online sources. It ended up being an incredibly time-consuming process, and he said, “90 percent of the time was spent cleaning the data and acquiring the data.”

CTO Max Goisser argued that this is a broad problem. There are already successful examples of crowdsourced data, most notably Wikipedia, but in his view, they succeeded because “these things were of value for the entire world — everyone’s interested in that.”

“But what if you wanted to crowdsource something that is [only] interesting to you as a company?” Goisser said. Then you’d need the right incentive system to convince people to contribute. And that’s where Rlay (pronounced “relay”) comes in — the startup is launching onstage today as part of our Startup Battlefield at Disrupt Berlin.

There are other startups, like Dirt Protocol, offering blockchain-powered tools for data collection and verification. But it sounds like one of Rlay’s big selling points is its ability to integrate with existing enterprise database technology.

In other words, Rlay leverages the blockchain side of things to provide a mechanism for people to contribute data and be rewarded for their contributions (each customer decides how they want to structure the incentives), but the goal is to collect the data in a format that’s useful for the company, and where, if the company desires, it can be kept private.

“We abstract over the backend database that you as a company would use, we abstract over the blockchain or ledger technology — it’s currently Ethereum, but technically, it doesn’t matter,” Hirn said. “So you don’t have to figure out how to work between Postgres and Ethereum, you don’t have to figure out ‘How do we represent the data?’, all of that is taken care of by Rlay.”

As for the incentives, he said:

There are almost as many ways [of] incentivizing as there are different types of financial products. Obviously some ways are more robust than others and we outlined a very general and universal incentive mechanism in our whitepaper, but for most of the applications that is a little bit to complex. So with Rlay, we will provide some templates in the future and certainly advice for certain ways when we work with a client, but Rlay just gives a good interface to define these things very easily.

Ultimately, this should allow companies to acquire the data they need at a lower cost than going out and buying data sets or hiring their own data collection team. For example, Hirn said Rlay is working with “a big name in the blockchain space” to gather environmental, social and governance (ESG) data required by hedge funds and other investors.

For now, Hirn said Rlay is focused on working with developers to collect data that’s online but not aggregated or structured in a way that makes it easily accessible. In the ESG case, that means writing scripts to pull the data from the reports that many companies are already publishing. Ultimately, Rlay could move into collecting data from the physical world, as well.

Goisser said the company is also developing various ways to recognize and resolve conflicting data, so its customers can be sure that the information they’re collecting is accurate.

Powered by WPeMatico

Presenting onstage today in the 2018 TC Disrupt Berlin Battlefield is Indian agtech startup Imago AI, which is applying AI to help feed the world’s growing population by increasing crop yields and reducing food waste. As startup missions go, it’s an impressively ambitious one.

The team, which is based out of Gurgaon near New Delhi, is using computer vision and machine learning technology to fully automate the laborious task of measuring crop output and quality — speeding up what can be a very manual and time-consuming process to quantify plant traits, often involving tools like calipers and weighing scales, toward the goal of developing higher-yielding, more disease-resistant crop varieties.

Currently they say it can take seed companies between six and eight years to develop a new seed variety. So anything that increases efficiency stands to be a major boon.

And they claim their technology can reduce the time it takes to measure crop traits by up to 75 percent.

In the case of one pilot, they say a client had previously been taking two days to manually measure the grades of their crops using traditional methods like scales. “Now using this image-based AI system they’re able to do it in just 30 to 40 minutes,” says co-founder Abhishek Goyal.

Using AI-based image processing technology, they can also crucially capture more data points than the human eye can (or easily can), because their algorithms can measure and asses finer-grained phenotypic differences than a person might pick up on or be easily able to quantify just judging by eye alone.

“Some of the phenotypic traits they are not possible to identify manually,” says co-founder Shweta Gupta. “Maybe very tedious or for whatever all these laborious reasons. So now with this AI-enabled [process] we are now able to capture more phenotypic traits.

“So more coverage of phenotypic traits… and with this more coverage we are having more scope to select the next cycle of this seed. So this further improves the seed quality in the longer run.”

The wordy phrase they use to describe what their technology delivers is: “High throughput precision phenotyping.”

Or, put another way, they’re using AI to data-mine the quality parameters of crops.

“These quality parameters are very critical to these seed companies,” says Gupta. “Plant breeding is a very costly and very complex process… in terms of human resource and time these seed companies need to deploy.

“The research [on the kind of rice you are eating now] has been done in the previous seven to eight years. It’s a complete cycle… chain of continuous development to finally come up with a variety which is appropriate to launch in the market.”

But there’s more. The overarching vision is not only that AI will help seed companies make key decisions to select for higher-quality seed that can deliver higher-yielding crops, while also speeding up that (slow) process. Ultimately their hope is that the data generated by applying AI to automate phenotypic measurements of crops will also be able to yield highly valuable predictive insights.

Here, if they can establish a correlation between geotagged phenotypic measurements and the plants’ genotypic data (data which the seed giants they’re targeting would already hold), the AI-enabled data-capture method could also steer farmers toward the best crop variety to use in a particular location and climate condition — purely based on insights triangulated and unlocked from the data they’re capturing.

One current approach in agriculture to selecting the best crop for a particular location/environment can involve using genetic engineering. Though the technology has attracted major controversy when applied to foodstuffs.

Imago AI hopes to arrive at a similar outcome via an entirely different technology route, based on data and seed selection. And, well, AI’s uniform eye informing key agriculture decisions.

“Once we are able to establish this sort of relation this is very helpful for these companies and this can further reduce their total seed production time from six to eight years to very less number of years,” says Goyal. “So this sort of correlation we are trying to establish. But for that initially we need to complete very accurate phenotypic data.”

“Once we have enough data we will establish the correlation between phenotypic data and genotypic data and what will happen after establishing this correlation we’ll be able to predict for these companies that, with your genomics data, and with the environmental conditions, and we’ll predict phenotypic data for you,” adds Gupta.

“That will be highly, highly valuable to them because this will help them in reducing their time resources in terms of this breeding and phenotyping process.”

“Maybe then they won’t really have to actually do a field trial,” suggests Goyal. “For some of the traits they don’t really need to do a field trial and then check what is going to be that particular trait if we are able to predict with a very high accuracy if this is the genomics and this is the environment, then this is going to be the phenotype.”

So — in plainer language — the technology could suggest the best seed variety for a particular place and climate, based on a finer-grained understanding of the underlying traits.

In the case of disease-resistant plant strains it could potentially even help reduce the amount of pesticides farmers use, say, if the the selected crops are naturally more resilient to disease.

While, on the seed generation front, Gupta suggests their approach could shrink the production time frame — from up to eight years to “maybe three or four.”

“That’s the amount of time-saving we are talking about,” she adds, emphasizing the really big promise of AI-enabled phenotyping is a higher amount of food production in significantly less time.

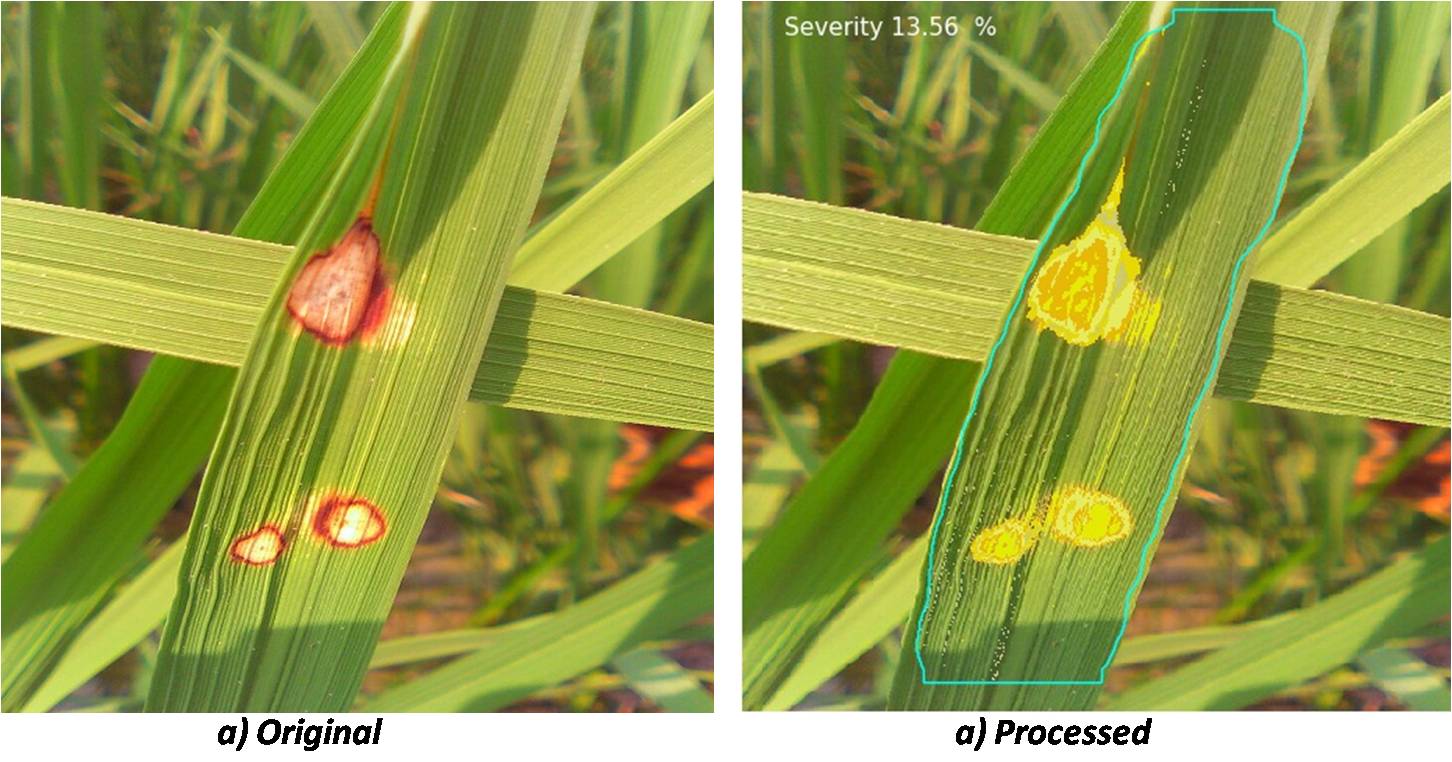

As well as measuring crop traits, they’re also using computer vision and machine learning algorithms to identify crop diseases and measure with greater precision how extensively a particular plant has been affected.

This is another key data point if your goal is to help select for phenotypic traits associated with better natural resistance to disease, with the founders noting that around 40 percent of the world’s crop load is lost (and so wasted) as a result of disease.

And, again, measuring how diseased a plant is can be a judgement call for the human eye — resulting in data of varying accuracy. So by automating disease capture using AI-based image analysis the recorded data becomes more uniformly consistent, thereby allowing for better quality benchmarking to feed into seed selection decisions, boosting the entire hybrid production cycle.

Sample image processed by Imago AI showing the proportion of a crop affected by disease

In terms of where they are now, the bootstrapping, nearly year-old startup is working off data from a number of trials with seed companies — including a recurring paying client they can name (DuPont Pioneer); and several paid trials with other seed firms they can’t (because they remain under NDA).

Trials have taken place in India and the U.S. so far, they tell TechCrunch.

“We don’t really need to pilot our tech everywhere. And these are global [seed] companies, present in 30, 40 countries,” adds Goyal, arguing their approach naturally scales. “They test our technology at a single country and then it’s very easy to implement it at other locations.”

Their imaging software does not depend on any proprietary camera hardware. Data can be captured with tablets or smartphones, or even from a camera on a drone or using satellite imagery, depending on the sought for application.

Although for measuring crop traits like length they do need some reference point to be associated with the image.

“That can be achieved by either fixing the distance of object from the camera or by placing a reference object in the image. We use both the methods, as per convenience of the user,” they note on that.

While some current phenotyping methods are very manual, there are also other image-processing applications in the market targeting the agriculture sector.

But Imago AI’s founders argue these rival software products are only partially automated — “so a lot of manual input is required,” whereas they couch their approach as fully automated, with just one initial manual step of selecting the crop to be quantified by their AI’s eye.

Another advantage they flag up versus other players is that their approach is entirely non-destructive. This means crop samples do not need to be plucked and taken away to be photographed in a lab, for example. Rather, pictures of crops can be snapped in situ in the field, with measurements and assessments still — they claim — accurately extracted by algorithms which intelligently filter out background noise.

“In the pilots that we have done with companies, they compared our results with the manual measuring results and we have achieved more than 99 percent accuracy,” is Goyal’s claim.

While, for quantifying disease spread, he points out it’s just not manually possible to make exact measurements. “In manual measurement, an expert is only able to provide a certain percentage range of disease severity for an image example; (25-40 percent) but using our software they can accurately pin point the exact percentage (e.g. 32.23 percent),” he adds.

They are also providing additional support for seed researchers — by offering a range of mathematical tools with their software to support analysis of the phenotypic data, with results that can be easily exported as an Excel file.

“Initially we also didn’t have this much knowledge about phenotyping, so we interviewed around 50 researchers from technical universities, from these seed input companies and interacted with farmers — then we understood what exactly is the pain-point and from there these use cases came up,” they add, noting that they used WhatsApp groups to gather intel from local farmers.

While seed companies are the initial target customers, they see applications for their visual approach for optimizing quality assessment in the food industry too — saying they are looking into using computer vision and hyper-spectral imaging data to do things like identify foreign material or adulteration in production line foodstuffs.

“Because in food companies a lot of food is wasted on their production lines,” explains Gupta. “So that is where we see our technology really helps — reducing that sort of wastage.”

“Basically any visual parameter which needs to be measured that can be done through our technology,” adds Goyal.

They plan to explore potential applications in the food industry over the next 12 months, while focusing on building out their trials and implementations with seed giants. Their target is to have between 40 to 50 companies using their AI system globally within a year’s time, they add.

While the business is revenue-generating now — and “fully self-enabled” as they put it — they are also looking to take in some strategic investment.

“Right now we are in touch with a few investors,” confirms Goyal. “We are looking for strategic investors who have access to agriculture industry or maybe food industry… but at present haven’t raised any amount.”

Powered by WPeMatico

Fintech startup Revolut has been teasing Asian market expansions for more than a year, but it sounds like it might finally happen. The company has secured licenses to operate in Singapore and Japan. It now expects to launch its service in Q1 2019.

In Singapore, the company was granted a Remittance License by the Monetary Authority and a Stored Value Facility approval — these two things combined let Revolut users hold money as well as send and spend money. In Japan, the company has been authorized to operate by Japan’s Finance Service Agency.

According to Revolut, those approvals are enough to launch the service in those countries. But not all features will make their way to Singapore and Japan. Regulation varies from one country to another, so the company might not be able to provide the same limits and feature set everywhere.

At launch, Revolut will focus on the electronic wallet and the payment card. You won’t be able to buy cryptocurrencies, create business accounts and more. Limits should be more or less the same in local currency equivalent.

In Japan, Revolut says it has already signed deals with Rakuten, Sompo Japan Insurance (SJNK) and Toppan. It sounds like there will be new insurance products, special card designs and more.

Revolut plans to open its APAC office in Singapore. Let’s see if Revolut ends up convincing expats to sign up or if they can have a real impact outside of Europe.

And if you’re a potential user in the U.S. or Canada, you’ll have to wait a bit more. Revolut says there will be more news in the coming weeks.

Powered by WPeMatico

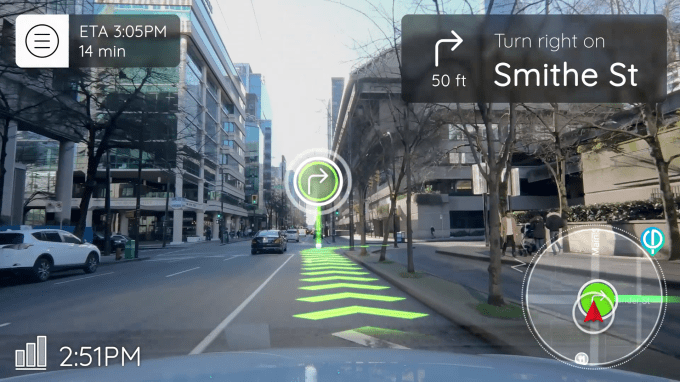

Augmented reality is a very buzzy space, but the fundamental technologies underpinning it are pushing boundaries across a lot of other verticals. Machine learning, object recognition and visual mapping tech are the pillars of plenty of new ventures, enabling there to be companies that thrive in the overlap.

Phiar (pronounced fire) is building an augmented reality navigation app for drivers, but the same tech it’s built to help drivers easily pinpoint where they need to make their next turn also helps them build up rich mapping data that can give partners like autonomous car startups the high-quality data they so deeply need.

The SF-based company has just closed a $3 million seed deal led by Norwest Venture Partners and The Venture Reality Fund. Other investors include Anorak Ventures, Mayfield Fund, Zeno Ventures, Cross Culture Ventures, GFR Fund, Y Combinator, Innolinks Ventures and Half Court Ventures.

While phone and headset-based AR have received a lot of the broader media attention, the automotive industry is a central focus for a lot of augmented reality startups attracted by the proposition of a mobile environment that can showcase and integrate bulky tech. There certainly have been quite a few heads-up display startups looking to take advantage of a car’s windshield real estate, and prior to joining Y Combinator, Phiar was actually looking to build some of this hardware themselves before deciding on a more software-focused route for the company.

Unlike a lot of phone AR apps built on top of Apple or Google’s developer platforms, Phiar’s use case doesn’t quite work with the limitations of these systems, which understandably weren’t built with the idea a user would be moving at 60 miles per hour. As a result, the company has had to build tech to greater understand the geometry of a quickly updating world through a single camera while ensuring that it’s not just some ugly directional overlay, using techniques like real-time occlusion to ensure that the digital and physical worlds interact nicely.

While the startup’s big consumer-facing play is the free AR mobile app, Phiar is really just an augmented reality company on the surface; its real sell is what it can do with the data and insights gathered from an always-on dash camera. The same object recognition tech that will allow the app to seamlessly toss AR animations onto the scene in front of you is also analyzing that environment and uploading metadata to build up its mapping insights.

In addition, the app saves up to 30 minutes of footage from each ride, offering users the utility of a free dash cam in case they get in an accident and need video for an insurance claim, while providing some rich anonymized data for the company to build up high-quality mapping data it can sell to partners.

This kind of data is incredibly useful to companies building autonomous car tech, ridesharing companies and a lot of entities that are interested in access to quickly updating map data. The challenge for Phiar will be building up enough users so their map data is as rich as their partners will demand.

CEO Chen-Ping Yu says that the startup is in talks with partners in the automotive space to integrate their tech and is also working to bring what they’ve built to companies in the ridesharing space. Yu says the company plans to release their consumer app in mid-2019.

Powered by WPeMatico