Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Rothy’s, a three-year-old, San Francisco-based company that makes a variety of colorful flats for women, has some more walking-around money today. According to Bloomberg, the company just closed on $35 million in funding from Goldman Sachs’ asset management unit.

The round brings the young company’s total funding to $42 million, including an early $5 million investment from Lightspeed Venture Partners, and $2 million in convertible notes, including from Finn Capital Partners, M13 and Grace Beauty Capital.

Goldman’s interest in the company isn’t surprising. Rothy’s doesn’t disclose how many pairs of shoes it has sold, but the company tells Bloomberg that it expects to see slightly more than $140 million in revenue this year, and, as the outlet surmises from some back-of-the-napkin math, that equates to roughly 1.4 million pairs of shoes sold.

Judging by its enthusiastic consumer base — it has 161,000 Instagram followers, for example — many of those are likely women who own multiple pairs, too.

What they love about the shoes, seemingly: their style, in large part. On this front, it helps that some fashion icons have gravitated toward the shoes, including actress-turned-Duchess of Sussex, Meghan Markle, who has been photographed in Rothy’s.

The company is also selling eco-conscious comfort by making the shoes out of recycled materials that include water bottles. Because of their constitution, they are also machine washable, yet another selling point.

Yet where Rothy’s has really shined is in marketing, including spending hugely on Facebook and to a lesser extent, Instagram and other social media platforms. Indeed, the company has been recognized repeatedly (including by us) for its shoes’ seeming ubiquity online. Though these platforms have grown more crowded in the short time since Rothy’s launched, it spent big on marketing from the outset — it flooded the zone, so to speak — and that campaign has seemingly paid off for the startup.

Today, the company, which runs its own 100,000-square-foot factory in China and employs roughly 500 people — including 50 people in the Bay Area — is selling four types of shoes, including its two best-known silhouettes — a $125 rounded flat shoe and a $145 pointed flat — along with loafers and, more newly, sneakers that are reminiscent of Van’s iconic shoes.

Somewhat ironically, one of the biggest threats to Rothy’s ongoing rise — other than fickle shoppers — is companies that are beginning to copy Rothy’s designs, reports Bloomberg.

The company says, for instance, that it is currently suing at least one outfit, a Virginia-based company, for selling a shoe that looks to Rothy’s alarmingly like one of its own productions.

Powered by WPeMatico

It’s hard to believe that you still had to convert your BTC into USD in order to buy ETH on Coinbase. The company is finally adding direct cryptocurrency-to-cryptocurrency conversions.

The feature works with Bitcoin (BTC), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), 0x (ZRX) and Bitcoin Cash (BCH). It is only available to U.S. customers for now, but the company plans to roll out the feature to other countries too.

Let’s look at the fees more closely. If you live in Europe or the U.S., every time you buy or sell cryptocurrencies using USD or EUR, you pay at least 1.49 percent in fees on top of the spread (the difference between the highest selling price and the lowest purchasing price). Fees are even higher if you’re using a credit or debit card.

Coinbase says that the spread between a fiat currency and a cryptocurrency should be around 0.5 percent but may vary depending on the trading pair and the order queue.

If you buy or sell less than 200 USD or equivalent, fees get much more expensive. For instance, a $10 order will generate $0.99 in fees, or 9.9 percent. Customers pay 3 percent in fees for a $100 order.

But the good news is that it’s a completely different story with token-to-token transactions. Coinbase doesn’t charge you any markup fee — but there’s some inevitable spread. And with some obscure trading pairs (exchanging ZRX for BCH for instance), you might end up paying around 1 percent in spread. Still, it’s a much better user experience for those who just want to trade on Coinbase.

Without even mentioning other exchanges, Coinbase Pro users have been able to trade between multiple cryptocurrencies for a long time. But Coinbase is still the entry gate for many new cryptocurrency users.

Powered by WPeMatico

Our distinct skill sets and shortcomings mean people and robots will join forces for the next few decades. Robots are tireless, efficient and reliable, but in a millisecond through intuition and situational awareness, humans can make decisions machine can’t. Until workplace robots are truly autonomous and don’t require any human thinking, we’ll need software to supervise them at scale. Formant comes out of stealth today to “help people speak robot,” says co-founder and CEO Jeff Linnell. “What’s really going to move the needle in the innovation economy is using humans as an empowering element in automation.”

Linnell learned the grace of uniting flesh and steel while working on the movie Gravity. “We put cameras and Sandra Bullock on dollies,” he bluntly recalls. Artistic vision and robotic precision combined to create gorgeous zero-gravity scenes that made audiences feel weightless. Google bought his startup Bot & Dolly, and Linnell spent four years there as a director of robotics while forming his thesis.

Now with Formant, he wants to make hybrid workforce cooperation feel frictionless.

The company has raised a $6 million seed round from SignalFire, a data-driven VC fund with software for recruiting engineers. Formant is launching its closed beta that equips businesses with cloud infrastructure for collecting, making sense of and acting on data from fleets of robots. It allows a single human to oversee 10, 20 or 100 machines, stepping in to clear confusion when they aren’t sure what to do.

“The tooling is 10 years behind the web,” Linnell explains. “If you build a data company today, you’ll use AWS or Google Cloud, but that simply doesn’t exist for robotics. We’re building that layer.”

“This is going to sound completely bizarre,” Formant CTO Anthony Jules warns me. “I had a recurring dream [as a child] in which I was a ship captain and I had a little mechanical parrot on my should that would look at situations and help me decide what to do as we’d sail the seas trying to avoid this octopus. Since then I knew that building intelligent machines is what I would do in this world.”

So he went to MIT, left a robotics PhD program to build a startup called Sapient Corporation that he built into a 4,000-employee public company, and worked on the Tony Hawk video games. He too joined Google through an acquisition, meeting Linnell after Redwood Robotics, where he was COO, got acquired. “We came up with some similar beliefs. There are a few places where full autonomy will actually work, but it’s really about creating a beautiful marriage of what machines are good at and what humans are good at,” Jules tells me.

Formant now has SaaS pilots running with businesses in several verticals to make their “robot-shaped data” usable. They range from food manufacturing to heavy infrastructure inspection to construction, and even training animals. Linnell also foresees retail increasingly employing fleets of robots not just in the warehouse but on the showroom floor, and they’ll require precise coordination.

What’s different about Formant is it doesn’t build the bots. Instead, it builds the reins for people to deftly control them.

First, Formant connects to sensors to fill up a cloud with LiDAR, depth imagery, video, photos, log files, metrics, motor torques and scalar values. The software parses that data and when something goes wrong or the system isn’t sure how to move forward, Formant alerts the human “foreman” that they need to intervene. It can monitor the fleet, sniff out the source of errors, and suggest options for what to do next.

For example, “when an autonomous digger encounters an obstacle in the foundation of a construction site, an operator is necessary to evaluate whether it is safe for the robot to proceed or stop,” Linnell writes. “This decision is made in tandem: the rich data gathered by the robot is easily interpreted by a human but difficult or legally questionable for a machine. This choice still depends on the value judgment of the human, and will change depending on if the obstacle is a gas main, a boulder, or an electrical wire.”

Any single data stream alone can’t reveal the mysteries that arise, and people would struggle to juggle the different feeds in their minds. But not only can Formant align the data for humans to act on, it also can turn their choices into valuable training data for artificial intelligence. Formant learns, so next time the machine won’t need assistance.

With rock-star talent poached from Google and tides lifting all automated boats, Formant’s biggest threat is competition from tech giants. Old engineering companies like SAP could try to adapt to the new real-time data type, yet Formant hopes to out-code them. Google itself has built reliable cloud scaffolding and has robotics experience from Boston Dynamics, plus buying Linnell’s and Jules’ companies. But the enterprise customization necessary to connect with different clients isn’t typical for the search juggernaut.

Linnell fears that companies that try to build their own robot management software could get hacked. “I worry about people who do homegrown solutions or don’t have the experience we have from being at a place like Google. Putting robots online in an insecure way is a pretty bad problem.” Formant is looking to squash any bugs before it opens its platform to customers in 2019.

Linnell fears that companies that try to build their own robot management software could get hacked. “I worry about people who do homegrown solutions or don’t have the experience we have from being at a place like Google. Putting robots online in an insecure way is a pretty bad problem.” Formant is looking to squash any bugs before it opens its platform to customers in 2019.

With time, humans will become less and less necessary, and that will surface enormous societal challenges for employment and welfare. “It’s in some ways a continuation of the industrial revolution,” Jules opines. “We take some of this for granted but it’s been happening for 100 years. Photographer — that’s a profession that doesn’t exist without the machine that they use. We think that transformation will continue to happen across the workforce.”

Powered by WPeMatico

Every year I teach an MBA course at Stanford about the exciting opportunities for tech investors and entrepreneurs in developing economies. When we designed the syllabus back in 2013, Rocket Internet was still firing on all cylinders on four continents. The unapologetic machine built to copy big American internet companies created billions of dollars for the Samwer brothers and its backers. During Rocket’s golden years, the best startups in the developing economies seemed to inevitably have an original reference in Silicon Valley.

Accordingly, we added a class about the opportunity of replicating business models to seize this information arbitrage. Call it the second-mover advantage.

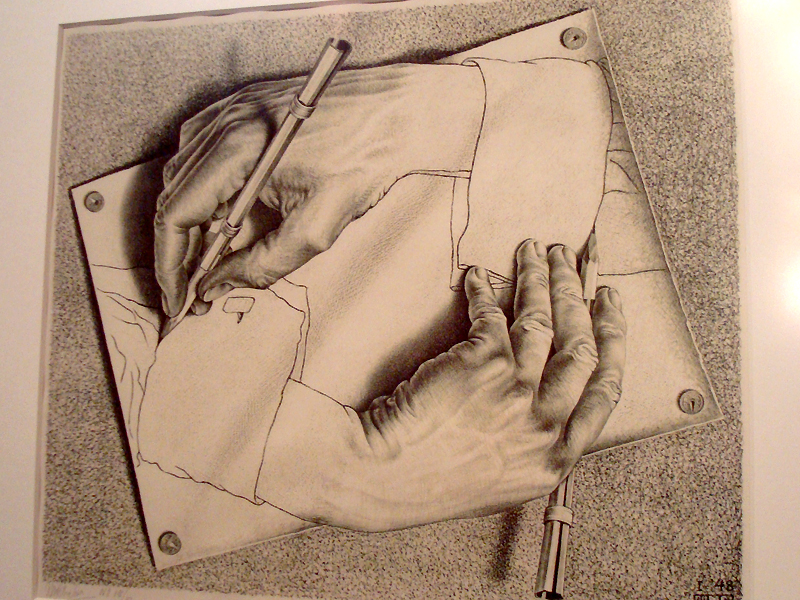

Despite my conviction about the model, the copycat word — short for replicating startups and attached to these ventures — annoyed me from the start. More than a term to describe a straightforward recipe to launch, I see it as an unconscious way to belittle an entire group of hard-charging founders and investors.

Indeed, while in foreign eyes, we have been building a Mexican Kickstarter, a Middle Eastern Uber, an Indian Amazon or a Colombian Postmates, I argue visionary founders are taking a simple idea that already exists and creating new worlds.

On the internet, there are Einsteins and there are Bob the Builders. I’m Bob the Builder. Oliver Samwer, founder of Rocket Internet

While impact is the final goal, founders can approach the journey in different ways. The most common approach in the startup world is to use the business method, or more pompously, the design thinking methodology. “Fall in love with the problem, not the solution,” mentors keep telling a succession of startup clusters in acceleration programs. The best and “leanest” way to product market fit is by starting small then keep iterating the solution until you nail it.

A second way to start is favored by engineers and scientists: Take a new promising technology or a forgotten molecule, then find a big problem. Keep iterating until you find a problem worth solving, like a hammer looking for a nail.

A third way is starting like painters create, building skills by copying classics, or like a new chef cooks by starting with iconic recipes: replicate a proven idea and iterate until you find traction.

Until a few years ago it was ostensibly the only way to scale in developing economies. The model helped raise local capital from risk-averse investors who needed reassurance. The playbook to scale was unfolding a couple of years ahead and served as a guide to founders without previous startup experience and no local role models. The potential acquirer was identified and sometimes contacted in advance. Founders weren’t crazy and investors weren’t dumb.

Replicating a business model has served in emerging ecosystems as the gateway to entrepreneurship and venture investing.

Photo courtesy of Flickr/A_Marga

According to conventional wisdom, new ecosystems around the world grow through the following three stages, be them in developing economies or more developed countries. First, local and foreign entrepreneurs replicate successful models focused on local markets. Then as the ecosystem evolves, founders start applying existing technologies to solve local problems. Finally, as the tech space matures, new technologies begin to flourish.

In my opinion, those stages never happen sequentially as stated by ecosystem observers. Successful startups that started with a foreign inspiration can outgrow the master. If they are not bought into submission by the first mover, some of the most famous copycats reinvented the original and made it better: Mercado Libre is much more relevant in the e-commerce space than eBay . Flipkart is hardly an Amazon, not to mention WeChat. These companies are in turn some of the most prolific tech innovators on the globe. Truly ecosystems evolve organically in unique ways reflecting their history, geopolitical environment, economic structure and cultural features.

Two ways to defend the status quo: “It’s been done before” and “It’s never been done before.” –Thibault @Kpaxs

Recently, it’s hard to hear American observers use the word copycat to describe any American company. After all, Guilt replicated VentesPrivees and Lime, Chinese dockless bike sharing and many more examples. All American startups are treated as innovators while the rest as mere followers.

Recently, Chinese or Indian startups seem to be given the benefit of the doubt regarding their originality. Is it because these regions have become more innovative? Maybe. But it’s also because these ecosystems have gained the respect of Silicon Valley. Indeed, Chinese consumer tech surpassed decisively the U.S. as the most important country in terms of investments.

So here’s my humble suggestion to our wealthier and more accomplished colleagues: stop using the c-word with founders. It’s offensive. Most probably, these founders are facing more challenges to build their companies and lower odds for success that the first mover. If anything, they have more merit than the originals.

As for founders, when they call you a me-too, remember all teams started somewhere, somehow. In fact, most started like Bob the Builder before turning into Einsteins. The truth is, it doesn’t matter where you start. You can start by applying a new technology or protocol. You can start with a problem you feel passionate about. You can start by replicating a business model. It doesn’t really matter if you take a big swing at the future and trust you will figure out how to make it happen. It doesn’t matter what label they use while you change the world for the better.

Powered by WPeMatico

Moonbug, a kid-focused media business founded by a pair of entertainment executives, has brought in a $145 million Series A investment led by The Raine Group, a merchant bank that supports technology, media and telecom efforts.

Venture capital firms Felix Capital and Fertitta Capital also participated in the financing.

Moonbug, headquartered in London, acquires and distributes media content made for kids. Recently, the company completed its first IP acquisition of Little Baby Bum, a children’s sing-along show popular on YouTube, Amazon and Netflix. According to a Los Angeles Times report, one of the show’s videos is the 20th most popular video in YouTube history, boasting 2.1 billion views. In total, Moonbug says Little Baby Bum has clocked in 23 billion views across multiple platforms.

With its Series A investment, Moonbug will amp up its M&A activity to expand its portfolio of content that “helps children build essential life skills.” Moonbug chief executive officer René Rechtman, who spent the last three years as the head of digital studios at The Walt Disney Co., says they plan to acquire eight media businesses.

Rechtman and John Robson, a former senior vice president of digital distribution at Paramount Pictures and vice president of global content at HTC, launched Moonbug earlier this year.

“I see an independent creator and I put them in very simple brackets: one is high viewership and engagement and one is quality of IP,” Rechtman told TechCrunch. “If they have both of those, I am very interested.”

Powered by WPeMatico

Lightspeed China Partners, the China-focused affiliate of Silicon Valley-based Lightspeed Venture Partners, has set a $360 million target for its fourth flagship venture fund, according to a document filed with the U.S. Securities and Exchange Commission today.

If the target is reached, the fund will be Lightspeed China’s largest yet, per PitchBook. Lightspeed China’s previous two funds each closed on $260 million. The VC raised $168 million for its debut fund in 2013.

Lightspeed China is led by David Mi (pictured). Mi, an investor in multiple billion-dollar Chinese companies, was previously the director of corporate development at Google, where he helped lead the search giant’s investment in Baidu. He joined Lightspeed in 2008 and established the firm’s China presence in 2011. Yan Han, a long-time Lightspeed investor and a founding partner of the firm’s Chinese branch, is also listed on the filing.

Lightspeed China has backed e-commerce platform Pingduoduo and loan provider Rong360, a pair of Chinese “unicorns” that both completed U.S. initial public offerings since 2017. Typically, the firm makes early-stage investments in the internet, mobile and enterprise spaces.

Earlier this year, Lightspeed Venture Partners filed to raise a record $1.8 billion in new capital commitments. This month, it tacked five new partners onto its consumer and enterprise investment teams, including Slack’s former head of growth and Twitter’s former vice president of global business development.

Lightspeed didn’t immediately respond to a request for comment.

Powered by WPeMatico

Fintech startup N26 recently launched in the U.K. with a single product offering. You could sign up to a free account that gives you free payments around the world, but no insurance and no free withdrawals in foreign currencies.

The company just added a second tier to its lineup in the U.K. And N26 is choosing to focus on N26 Metal in the U.K. You can now sign up to a Metal account for £14.90 per month (€16.59).

In other N26 markets, people can currently subscribe to N26 Black for €9.90 per month or N26 Metal for €16.90 per month. It’s interesting to see that N26 is using its fresh start in the U.K. to simplify its offering and target premium customers. The startup can still change its mind and launch N26 Black later down the road.

Basic customers can pay anywhere in the world without any foreign fee. The company uses Mastercard’s foreign exchange rates and doesn’t add anything on top. But ATM withdrawals in a foreign currency still cost 1.7 percent of the total amount.

Metal customers get the same perks in the U.K. and other European countries, such as foreign ATM withdrawals with no fee, a travel insurance package from Allianz and dedicated customer support.

N26 also provides partner offerings for N26 Metal subscribers. For instance, you can work from a WeWork office for free one day per month. Deals vary from one country to another; British customers get airport lounge access thanks to LoungeKey.

Your mileage may vary depending on your favorite airport, as LoungeKey doesn’t have a lounge in all terminals in all airports around the world. Now let’s see if N26 users outside of the U.K. will get a similar service in the future.

Powered by WPeMatico

RightHand Robotics announced a $23 million Series B this week. That brings the pick and place robotic arm manufacturer’s total funding up to around $34 million, including last year’s $8 million Series A.

The robotics startup has impressed investors with the dexterity and speed of its robotic picking system, having recruited some big VC names along the way. This latest round is led by Menlo Ventures, along with investments from GV (nee Google Ventures) joining the likes of existing investors Playground Global, Dream Incubator and Matrix partners.

Picking and placing has been a difficult robotics problem and one that’s only become more pronounced with the growth of fulfillment centers from the likes of Amazon. The online mega-retailer purchased logistics robotics company Kiva Systems for $775 million back in 2012, and has been rumored to be working on its own pick and place system.

As part of this round, former Kiva CEO Mick Mountz will be joining RightHand’s board of directors. “RightHand is picking up where we left off,” he said in a press release tied to the news. “Customers saw products coming directly to operators for picking and packing and would ask: ‘Why don’t you also automate this step with a robotic arm and gripper?’ But that was a difficult problem that we knew would require years of research and technical breakthroughs.”

RightHand will be using the funding to build out its technical and business teams.

Powered by WPeMatico

I’ve been living for the past few years in a limbo between journalist and entrepreneur, trying to build startups the way I saw them being built onstage at Disrupt and discovering that my skill and will to win are no match against the world. That’s fine. These days I’ll take it.

But for a few minutes in Chicago last May, I couldn’t.

That day was normal for me. I woke up, went and met some folks at a cool startup, visited a great guitar store and had a mediocre deep dish pizza. I then went to an event where I gave my usual rant (and pissed people off) about how smaller market cities are having huge trouble innovating, and then went out with some good people to talk about cool stuff.

Then, on my way back to the hotel, I looked both ways on a busy, dark street and thought long and hard about stepping in front of a Chicago city bus.

Why not? I wasn’t helping. My first startup had failed and everything else was a slow burn. I wasn’t thinking about my family. I wasn’t thinking about my existence on a global scale but on a local one. I could turn off this brain once and for all and I thought everyone would be happier.

I got help. I discovered I was anhedonic and chronically depressed — I couldn’t feel happiness. I had been traveling through life in a haze. I drank a lot to hide this from myself — after all, if you’re hosed you don’t worry about not feeling anything — and I traveled obsessively and spoke onstage so I could feel something, anything, better than the flat grey note that played constantly in my head.

I feel better now. I have a lot of digging to do. I wonder if you’re in the same position.

I’m noodling on this because of Colin Kroll. The specifics of Kroll’s story are unclear, but an overdose is definitely in the mental illness wheelhouse. Maybe he was having a blast, flush on investor money and celebrating a win. I won’t judge.

But he’s dead. And I don’t want you to follow him.

Any of us could end up gone for any number of reasons associated with entrepreneurship. There is the stress, the overwork. There is the sense of failure even amid the greatest successes. There is deep frustration and deep anger. Entrepreneurs are high performers who are used to getting As in life. When that same life gives you a D-, you feel that it’s your fault, that your dreams of success are gold foil over a rotten sweet.

This isn’t true. We all have to work to remind ourselves of this. A startup, like any creative endeavor, is doomed to fail, but its very existence is a miracle. We do it not because we want to make millions but because we want to fix something broken in the world. I write to share cool things with you all. I make startups to help bring the next level of innovation. But I let these efforts get in the way of life. I thought my failures were systemic, that I was proving that I was a failure over and over again and that I had visible proof through my failed efforts. My startup wasn’t me, but I didn’t know that.

In the dull, hot blush of a depressive episode, the embarrassing moment you look at yourself and see nothing but junk, we have to remember that we are making real efforts, building real things, moving way ahead of the pack. The world will catch up.

There are lots of ways to get help. Ask around. You’ll be surprised to hear that your friends and family know great shrinks who can help. You’ll be surprised that going to meetings or talking to someone on the phone can be a great way to assuage mental grief. You’ll be surprised to know that there are people out there for you. Email me if you need help: john@techcrunch.com

This shit is hard. Don’t make it harder by letting it fester.

The National Suicide Prevention Lifeline is a 24-hour, toll-free, confidential suicide prevention hotline available to anyone in suicidal crisis or emotional distress. It provides Spanish-speaking counselors, as well as options for deaf and hard of hearing individuals. It is only available in the United States. A 24-hour Online Chat in partnership with Contact USA is also available.

Powered by WPeMatico

B-Social, a London fintech that currently offers a “social finance” app and beta debit Mastercard, has raised £3.2 million in seed-round funding from undisclosed high-net-worth individuals. However, the fundraise is just the first step in a journey in which B-Social wants to eventually become a fully licensed bank that reimagines banking around everyday social interactions.

As it exists today, the B-Social app and accompanying card enables users to have control over everyday spending, track expenditures and create groups between friends to split bills and record settlements. It’s currently in the hands of a limited number of beta testers, spanning employees, investors, friends and family, with plans for a wider U.K. launch in February next year.

“We recognise that almost all financial transactions are inherently social,” B-Social co-founder and CEO Nazim Valimahomed tells me. “We want to change the relationship people have with money by helping them overcome the anxiety, awkwardness and wasted time when they engage with their social finances. We are doing that by building a digital bank that truly accommodates the way people live their lives and is dedicated to connecting a person’s finances to their social world.”

The idea was born in part out of Valimahomed’s own frustrations and is informed by his belief that individuals are often a bank themselves, lending and borrowing to friends and family by making shared purchases and then getting paid back.

“A simple example might be that you pay for flights for two or more people and then get paid back individually,” he says. “For multiple transactions, this becomes complex, often resulting in the trip organiser having to create a spreadsheet to work out what people owe across multiple transactions.”

To simplify this problem, B-Social wants to let you to make purchases with your card, which are flagged as an expense on behalf of a group of individuals. From here the bank to be will enable all members of a group — and where groups can be ad hoc and temporary or more long-term — to continuously see who is owed how much and to get paid back easily within the app and record settlements.

Dubbing this future proposition as the seeds of a “social bank,” the B-Social CEO cites competitors as traditional high-street banks that currently dominate the U.K. consumer market (the so-called big 5 have around 87 percent market share in the U.K.).

“We are aiming at winning a part of their market share by targeting customers looking for a bank as social as they are that offers a unique digital experience in order to help change the banking ecosystem forever,” Valimahomed tells me, although he also concedes that challengers such as Monzo, N26, Starling and Revolut have also built some basic social features into their apps.

“Our entire technology and product focus is to build a bank from scratch through a social lens,” he says.

Powered by WPeMatico