Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

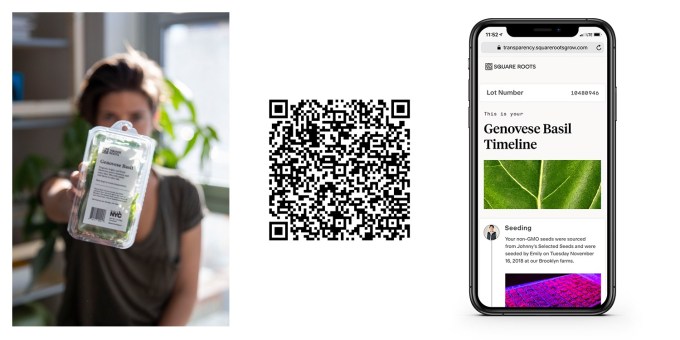

If you’re concerned about what you eat, there’s a good chance you’ve looked at the food in the supermarket, or in your fridge, and wondered where it actually comes from. Now urban farming incubator Square Roots is introducing a new way for you to check full history of the produce that you’re about to purchase.

To do so, you just scan the QR code or type in the lot number that the company says will be included in the packaging of all its produce moving forward. Either way, you’ll be taken to to what Square Roots calls a Transparency Timeline. You can actually try this out on the QR codes included in the announcement — the timelines show where and when the produce was planted, grown and harvested, and when it was delivered to the store.

To do this, Square Roots says it’s taking advantage of its indoor growing system, which involves refurbished, climate-controlled shipping containers, as well as “software that enables us to monitor and control every aspect of the process” — that’s supposed to help the farmers who are being trained at Square Roots, but apparently it gives the company data that it can package for consumers too.

In the announcement, Kimbal Musk (who founded Square Roots with Tobias Peggs) laid out the reasoning behind the Transparency Timeline:

Consumers across the world are demanding greater transparency into where and how their food is grown — and with good reason. As mentioned above, this past Thanksgiving, another ecoli outbreak resulted in the recall of all romaine lettuce grown in the US. This was the third such outbreak in the last two years. It put millions of consumers at major risk of foodborne illnesses. The situation was compounded by opaque supply chains in the Industrial Food System, making it ridiculously difficult to accurately trace the source of guilty pathogens. To their credit, the big lettuce producers did eventually react, and agreed to start labeling their products with a mark of the state in which their products are grown. But that’s not enough. Consumers demand — and deserve — to know more.

Musk acknowledged that some companies are trying to use blockchain technology to introduce more transparency to the food supply chain, but he suggested that the results have been “underwhelming,” and that the solution is more straightforward: “What people want to know, simply, is where and how was my food grown and who grew it? With that information, they can make their own informed choices about whether to trust the food and whether to buy it.”

Square Roots produce is only sold in select New York City locations, so the rest of you probably won’t get a chance to try this out in your own supermarket anytime soon. But it sounds like Musk has expansion plans, and he said, “As we scale, we will keep building local farms in the same neighborhood as the consumers — so we can always own the supply chain end to end.”

Powered by WPeMatico

It was several years ago, at a tech conference in Laguna Beach, Calif., that the venture capitalist Bill Gurley issued one of what would become repeated warnings that startups were staying private too long. Comparing companies that refuse to go public to undergrads whose college careers extend several years past the point that they should, Gurley suggested they should be embarrassed, not proud, for keeping their shares in private hands. “Until you get liquid, you really haven’t accomplished anything,” Gurley said.

Whether Gurley was referring to Uber at the time, only he knows. Though his firm, Benchmark, eventually forced out Travis Kalanick, the co-founder and longtime CEO of Uber, the tipping point was seemingly not Kalanick’s determination to keep Uber privately held as long as possible, but rather an investigation into sexual harassment investigations and the employee misconduct that was discovered in the process.

Either way, it’s looking increasingly like Gurley had a point. As you may have noticed if you care anything about the public markets, they took a nosedive today. In fact, they fell to a new low for the year this afternoon, a reaction in part to the Federal Reserve’s decision earlier today to raise its benchmark overnight lending rate for the fourth time in 2018.

The Fed also signaled minimal rate hikes for next year — forecasting two rate hikes instead of three — but investors were apparently hoping for even better news.

It’s hard to blame them for seeking out more of a silver lining, given everything else that’s going on. Tech stocks are getting battered, with the FANG companies (Facebook, Apple, Netflix and Google) down meaningfully from their share prices of six months ago. (Amazon has held up the best.)

The economy of China — the U.S.’s third largest export partner and its largest import partner — is slowing sharply, which is expected to have an impact on the U.S. and world economies. Add trade tensions into the mix, a sprinkling of uncertainty about regulations, a splash of a possible government shutdown and the growing prospect that Donald Trump will be impeached, and you start to appreciate why the market is finally going off the rails.

Despite so much uncertainty, Uber, Lyft, Slack and now Pinterest, among many others, are racing to become publicly traded at long last. According to Dealogic data quoted in today’s WSJ, 38 unicorn companies went public this year, and more are expected to test the market in 2019. Their venture backers will tell you it’s because the markets recognize a strong growth company when they see it, and that each is finally positioned well to tell their story, aided by some dazzling metrics. Yet it seems just as likely that they see the window, which flew open this year, starting to swing back in the other direction. And if this month is any indicator, it could be hard to pry it open again, at least in the first quarter or two.

“The market is basically closed between now, and the start of a new year is always slow because companies don’t start roadshows [until the markets re-open],” says Kathleen Smith, a principal of Renaissance Capital and the manager of its IPO exchange-traded fund. Pre-IPO companies like Uber are also waiting on their audits to close before they put any numbers in a public document, she notes. But it could be far from smooth sailing after that, suggests Smith. “In normal times, late January and February and March become very active, but we aren’t in a typical market. I can predict from other times that we’ve seen a bear market like this that it will have an impact on IPO activity.”

It’s all part of a vicious cycle, Smith suggests. As public market shareholders begin to feel less affluent and more risk averse, they start redeeming their public market shares. That leaves fund managers who might otherwise gamble on new issuers with less capital to invest, and less flexibility. “Investors are just not going to want to take on any risk positions when market has [taken a turn for the worse],” says Smith.

Put another way, if the markets are as crummy early next year as looks to be the case, it’s too bad, too sad for unicorn companies. “They made the choice to stay private and get capital,” says Smith. “I’ve stated many times that they should be getting while the getting is good. The pain can happen if money dries up, and it will dry up when the public market dries up.”

That doesn’t mean tech’s favorite unicorn companies are doomed, of course, especially those that can show strong fundamentals. For her part, Smith notes that what often happens in a downturn is that offerings get heavily discounted. “Valuations will be chopped if the companies want investors to participate. They’ll have to be sure to make money.”

Even if they don’t get the rich prices that ambitious bankers might pitch them (or that their VCs assigned them before that), they can always grow into the valuations their investors want to see. One need look no further than Facebook to remember why a bumpy offering doesn’t mean all that much longer term.

“Just because a stock crashes below its IPO price isn’t a sign of a bubble,” says Pivotal Research analyst Brian Wieser. “You also have to keep in mind the dynamic of companies going public,” he says. “You expect IPOs to be overvalued. Investors in these companies are necessarily selling to the greatest fool.”

Still, there may be fewer fools willing to buy what they are selling than there might have been this year or last, and if those numbers really change, today’s unicorns will look like tomorrow’s donkeys. They’re certainly going to face more scrutiny than they might have had they moved sooner.

“Maybe we’ll roar into 2019 and all will be well,” says Lise Buyer, the founder of Class V Group, an advisory firm for IPOs. “But to the extent that investors will be more selective, they’ll look at path to profitability, and they’ll look at the valuations these companies took when they were private.” Then they’ll do their own math, suggests Buyer.

If the market is truly shifting, public market shareholders “won’t care what valuations companies achieved when they were private,” says Buyer. “They’ll only be willing to pay what they are willing to pay.”

Powered by WPeMatico

Pinterest may follow Lyft and Uber to the public markets in the first half of 2019, according to a report from The Wall Street Journal.

The visual search engine and shopping tool is expected to tap underwriters in January and complete an initial public offering as soon as April. The company was valued at just over $12 billion with its last private fundraise, a $150 million round in mid-2017, and is on pace to bring in $700 million in revenue this year.

The company, founded in 2008 by Ben Silbermann (pictured), is also in talks to secure a $500 million credit line, per the report, not an uncommon move for a pre-IPO giant like Pinterest.

To date, the company has raised nearly $1.5 billion from key stakeholders such as Bessemer Venture Partners, Andreessen Horowitz, FirstMark Capital, Fidelity and SV Angel.

Pinterest recently reached 250 million monthly active users, up from 200 million in 2017.

This year, it launched several new features to make it easier for passive Pinterest users to actually buy products on the platform, and introduced the “following” tab, where users could view only the content from brands and people they follow. It also added the Pinterest Propel program as part of an effort to create more local content for its users, and implemented full-screen video ads to beef up its advertising options — an area where it competes directly with Facebook and Google.

2019 is poised to be a banner year for venture-backed IPOs. Both Uber and Lyft are in IPO registration, filing privately to go public within hours of each other earlier this month, and Slack, too, has reportedly hired Goldman Sachs to lead its 2019 float.

Pinterest declined to comment.

Powered by WPeMatico

Coinbase acquired Earn.com for at least $120 million back in April. And the company now plans to transform Earn.com into Coinbase Earn, a website with educational content to learn more about cryptocurrencies. Users who complete those classes will earn tokens.

Coinbase bought Earn.com partly so that it could appoint Earn.com co-founder and CEO Balaji Srinivasan as Coinbase’s CTO. The previous iteration of Earn.com wasn’t a priority for Coinbase.

Earn.com started as a service where you can contact busy people for a small fee. Busy people would get paid in cryptocurrencies to accept those requests. The platform quickly became a way to massively contact Earn.com’s user base for initial coin offerings and airdrops.

Coinbase Earn is launching today in private beta. But at the time of this article, the new Coinbase Earn service is not live (Update: Coinbase Earn is now live and is a separate website from Earn.com). Some Coinbase users will receive an invitation to the service. The company says that educational content will go beyond Bitcoin and Ethereum. Developing education pages for obscure cryptocurrencies makes sense as Coinbase plans to add dozens of cryptocurrencies over the coming months.

At first, there is just one track. Users can learn more about 0x (ZRX), a protocol that lets you create decentralized exchanges. Cryptocurrency trades can be executed without a centralized exchange thanks to 0x .

0x content includes video lessons and quizzes — and yes, writing this makes me feel like it’s 2005 and webinars are cool again. Even if you’re not invited to Coinbase Earn, you can view the content. But those who are part of Coinbase Earn will receive a small amount of ZRX at the end of the track.

Coinbase had previously launched a learning hub to understand the basics of cryptocurrencies.

Disclosure: I own small amounts of various cryptocurrencies.

Powered by WPeMatico

Adtech cybersecurity company Devcon announced today that it has raised $4.5 million in seed funding.

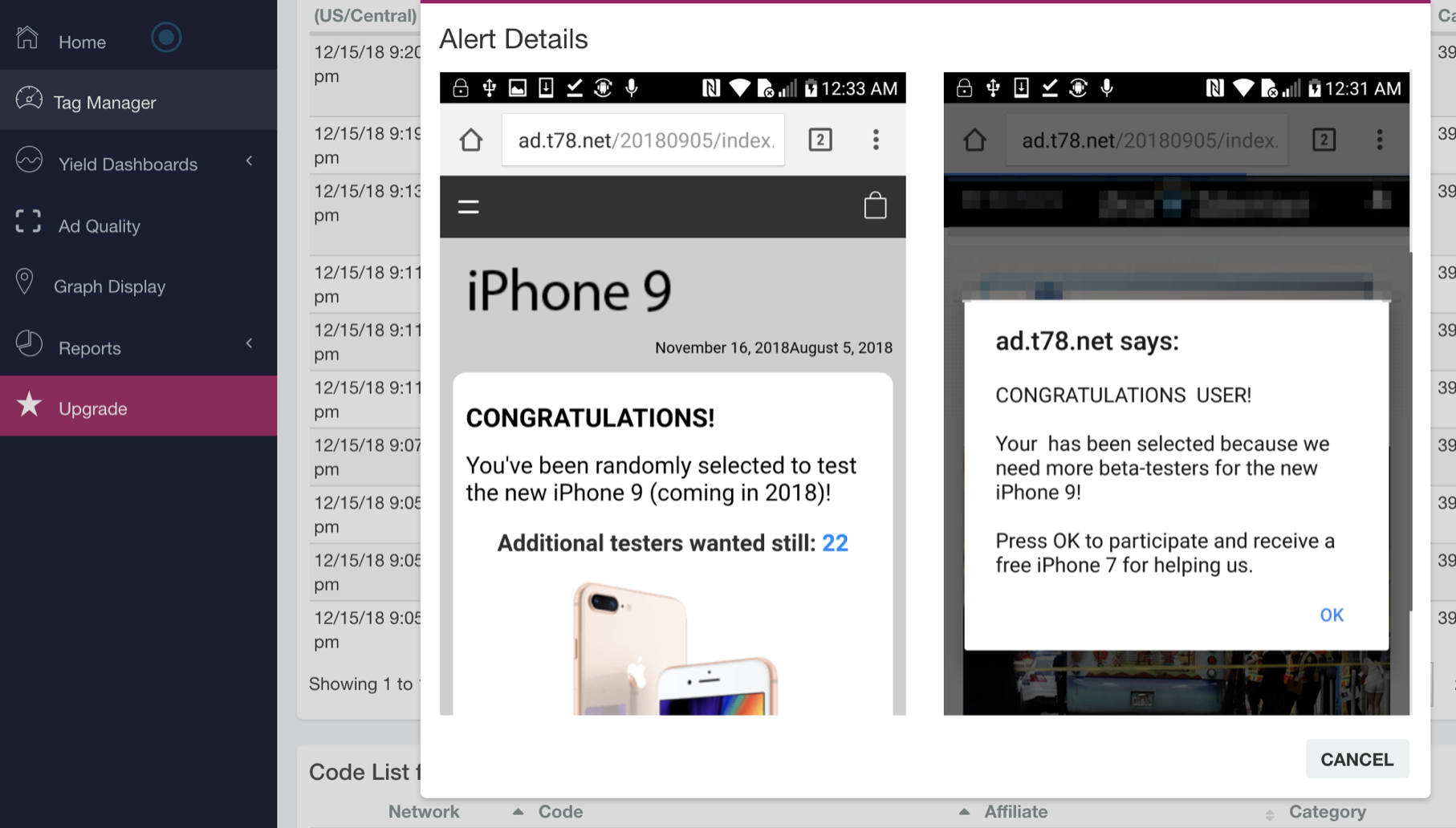

Over the past couple of years, ad fraud has become a bigger concern in the industry, but Devcon co-founder and CEO Maggie Louie said most existing solutions focus on things like verifying ad quality and confirming that impressions aren’t coming from bots. Devcon, in contrast, functions more like “a Norton AntiVirus of adtech,” preventing attempts by bad actors who are “using adtech as a catalyst to attack consumers and companies.”

In other words, Louie said Devcon works with ad networks and publishers to “eliminate 99 percent of the nefarious things that are making their way through the system.” It says it can block malicious ads on an individual basis, whether they include pop-ups and redirects or unauthorized tag injectors. Customers can then view the individually blocked ads and see where they came from, and there’s also a dashboard that shows how much money is being lost to fraud.

Louie pointed to the recent DOJ indictment of eight individuals allegedly involved in a digital ad fraud scheme as a sign that the issue is becoming more serious.

“Some of these attacks have some very concerning potential outcomes [for consumers], so being able to stop those before they get out is akin to stopping a water contamination at the source level,” she added.

At the same time, she argued that this is a particularly challenging area for security, because there’s been “a lack of crossover between cybersecurity and ad ops,” leading to a dearth of “security people or cybersecurity people who understand adtech.”

In contrast, the Devcon team combines media veterans like Louie (who was recently vice president of audience at the Athens Banner-Herald and also worked at the Los Angeles Times) with “white hat” hackers like co-founder and CTO Josh Summitt (who was previously on the ethical hacking team at Bank of America). It’s also hired former FBI Cyber Squad Supervisor Michael F. D. Anaya as its head of global cyber investigations and government relations.

In fact, Devcon says it assisted law enforcement in the first-ever conviction for online ad theft and money laundering, which resulted in a four-year prison sentence.

Devcon was founded in Memphis, Tenn., but has since expanded its headquarters to Atlanta, and it was part of this year’s Techstars Barclay accelerator in London. The seed funding was led by Las Olas VC — among other things, Louie said it will allow Devcon to further develop its machine learning technology to automatically identify emerging threats.

Powered by WPeMatico

PetaGene, the Cambridge, U.K.-based genomics data compression startup, has raised $2.1 million in further funding. Leading the round is U.S. venture firm Romulus Capital, with participation from other unnamed investors Silicon Valley and London. It brings total funding to $3.2 million.

Previous investor Entrepreneur First, the company builder backed by Greylock Partners, also followed on. PetaGene is an alumnus of EF6, although notably its two founders Dan Greenfield and Vaughan Wittorff already knew each other from their time at the Computer Laboratory in Cambridge University. Both hold PhDs from Cambridge University, too.

The new funding will be used by the company to grow its technical team based in Cambridge, its global sales team, and further expand PetaGene’s product offerings. I’m also told the new funding comes off the back of signing a large contract with a major undisclosed pharmaceutical company.

“As whole genome sequencing becomes more and more commonplace, the amount of data it creates places great strain on infrastructure. We help organisations with managing that data,” says PetaGene co-founder Dan Greenfield. “Through our compression technology, we make that data up to ten times smaller and faster to transfer for research and analysis, democratising precision medicine in the process”.

As it stands, the storage and processing of genomics data adds a significant extra cost and acts as a bottleneck for how fast data can be worked with. By some estimates genomics data will reach 40 exabytes per year by 2025 (exabytes, by the way, is a lot of data!). Therefore, better file compression technology has the potential to be a major enabler of innovation and research based on genomics, including developing new personalised medicine and treatments.

Key to this, PetaGene says its software enables compression of huge amounts of genomic data without compromising on access and data quality. The company claims its products go beyond regular data reduction techniques.

“We have dedicated extensive R&D to building extremely high performance compressors for genomic data, the result being that we outperform existing state-of-the-art compression, sometimes by a factor of 6x or more,” explains Greenfield.

“At the same time our customers want to be assured that the original file can be exactly recovered. Other compression solutions unfortunately aren’t able to restore the original file, and can even sometimes discard or modify internal content without telling their users. We’ve spent a great deal of effort to make sure we preserve the original file bit-for-bit, even providing commercial guarantees to our customers. I can’t really go into the details of our secret sauce here, but we’re very proud of our industry-leading performance, and we continue to keep improving it”.

Krishna K. Gupta, founder and general partner of Romulus Capital, says he was impressed by the part of the genomics value chain PetaGene is targeting, which led the firm to first invest in 2017. “Since then, their ability to successfully develop their product for the cloud and the strong interest from potential customers have only served to reinforce our view,” he says.

Meanwhile, PetaGene’s target customers span pharmaceutical companies, academic research institutions, clinical labs in hospitals, and genomic sequencing companies.

“Our clients pay for our software according to the savings they make,” adds the PetaGene co-founder. “The greater the reduction in size of their data files, the more revenue we receive, and the more they are saving in storage and data transfer costs. We don’t charge our clients for accessing or decompressing the compressed data”.

Powered by WPeMatico

Candid, a teeth aligner startup that aims to make straight teeth more accessible and more affordable than Invisalign, is evolving its direct-to-consumer business. In addition to its at-home impression process, Candid recently started enabling people to come into a physical office to get their teeth scans completed.

Today, Candid is opening physical storefronts in San Francisco, Austin, Columbus, Ohio and Santa Monica, Calif. This is in addition to the two locations in New York City, one in Boston and one in West Hollywood, Calif. By the end of next year, Candid aims to have 75 locations across the U.S.

Candid, which 3D prints its FDA-approved aligners, is designed for people who need mild to moderate orthodontic work. It costs $1,900 upfront or $88 per month over two years, while braces can cost up to $7,000 and Invisalign can cost up to $8,000.

In Candid’s physical locations, customers can get their teeth scanned and order aligners within 30 minutes. The studios are operated by Candid’s orthodontists and dental assistants.

This is on the heels of Candid’s $15 million Series A round led by Greycroft last November. SmileDirectClub, a major competitor of Candid, raised $380 million in October at a $3.2 billion valuation.

But Candid doesn’t seem too fazed, having seen 15x growth year over year and expecting to potentially raise more funding in Q1 of next year, CEO Nick Greenfield told TechCrunch.

“The advantage is, if you don’t have access or live two hours away from the city, the impression kit is a viable and effective way,” Greenfield said. “But if you live in a city with a Candid studio, we recommend you come in for a scan.”

This is similar to Uniform Teeth’s strategy. Uniform Teeth, which raised $4 million earlier this year, is a clear teeth aligner startup that competes with the likes of Invisalign and Smile Direct Club. The startup takes a One Medical-like approach in that it provides real, licensed orthodontists to see you and treat your bite.

It’s worth noting that the in-person approach aligns more with the values of the American Association of Orthodontists, which has taken issue with the likes of SmileDirectClub and other teeth-straightening services that don’t require in-person visits with a licensed orthodontist.

As Candid grows and opens more physical locations, it wouldn’t be surprising if the company starts to try to funnel more people through the door than through the virtual shopping cart.

Powered by WPeMatico

Dataiku wants to turn buzzwords into an actual service. The company has been focused on data tools for many years, before everybody started talking about big data, data science and machine learning.

And the company just raised $101 million in a round led by Iconiq Capital, with Alven Capital, Battery Ventures, Dawn Capital and FirstMark Capital also participating.

If you’re generating a lot of data, Dataiku helps you find a meaning behind data sets. First, you import your data by connecting Dataiku to your storage system. The platform supports dozens of database formats and sources — Hadoop, NoSQL, images, you name it.

You can then use Dataiku to visualize your data, clean your data set, run some algorithms on your data in order to build a machine learning model, deploy it and more. Dataiku has a visual coding tool, or you can use your own code.

But Dataiku isn’t just a tool for data scientists. Even if you’re a business analyst, you can visualize and extract data from Dataiku directly. And because of its software-as-a-service approach, your entire team of data scientists and data analysts can collaborate on Dataiku.

Clients use it to track churn, detect fraud, forecast demand, optimize lifetime values and more. Customers include General Electric, Sephora, Unilever, KUKA, FOX and BNP Paribas.

With today’s funding round, the company plans to double its staff. The company currently works with 200 people in New York, Paris and London. It plans to open offices in Singapore and Sydney, as well.

Powered by WPeMatico

On the back of Disney increasing its shareholding in Oslo-based Kahoot to four percent last week, Kahoot today announced a new initiative that helps to position the popular startup — which already has 60 million games and has seen over 1 billion players engage on its platform over the last year — as the “Netflix for education apps.”

It’s launching Kahoot! Ignite, a new accelerator for like-minded startups that are pushing the boundaries of education through gaming and other means.

In addition to that, Kahoot today also said it would move stock exchanges in its home market of Norway, going from the smaller OTC exchange to the Merkur Market, which CEO and co-founder Åsmund Furuseth explained in an interview is also an exchange for private companies, but one that will be able to provide more transparency to the startup’s bigger investors en route to an eventual full public listing. As of last week’s Disney news, the startup is now valued at $376 million.

Participating in the Ignite accelerator, Furuseth said, will give Kahoot the option to invest in startups in each cohort, and if it makes sense for the startup in question, they will build content that will be usable on the Kahoot platform.

“We have close to $30 million in the bank and are in a financial market where we can get more capital,” he said. “We don’t need to invest, but if we want to, we can.”

The startup today has some 60 million games on its platform, with a good portion of those created by users themselves (making it more like a YouTube than a Netflix). The idea is that bringing in outside developers (in this case, by way of the accelerator) could inject more innovation and interesting takes on the concept of “educational gaming” — not unlike how Netflix and Amazon engage outside studios to develop originals for its platform, alongside what they develop themselves or buy in through deals with rights holders.

In addition to the carrots of investment and distribution on the Kahoot platform — which is likely to hit 100 million monthly active users this month (Furuseth said he was confident of the number today) — Kahoot is offering mentorship to potential cohorts in areas like monetization and product development. Given the fact that educational aides can come in all shapes and sizes, that might not take the form of a piece of content for the Kahoot platform.

“Putting something on Kahoot could be an outcome, but we’re also interested in ‘network products,’ which have the same desire to enable learning,” Furuseth said.

The company today has a double focus, with games for K-12 students as well as for enterprise environments. “Learning is the main topic,” he added. “We like to have the mix.”

Powered by WPeMatico

Uber has been granted permission by the state of Pennsylvania to reinstate tests of its autonomous vehicles, as first reported by Reuters.

A spokesperson for Uber confirmed to TechCrunch that the ride-hailing giant received a letter of authorization from the Pennsylvania Department of Transportation and clarified that the company has not yet resumed self-driving operations.

Uber halted testing of its self-driving cars following a fatal accident in Tempe, Arizona this March that left a pedestrian dead. An autonomous Uber SUV accompanied by a safety driver was driving northbound when it struck a woman, who was taken to the hospital where she later died as a result of her injuries.

Investigators later determined the driver, Rafaela Vasquez, had looked down at a phone 204 times during a 43-minute test drive, according to a 318-page police report released by the Tempe Police Department.

In the aftermath of the accident, Uber paused all of its AV testing operations in Pittsburgh, Toronto, San Francisco and Phoenix.

Moving forward, Uber will test its self-driving cars more cautiously, per a recently released Uber safety report. The company will require that two employees are in the front seat of its cars at all times, that an automatic braking system is enabled and that its safety employees are more strictly monitored.

Uber, which first began developing its autonomous vehicle fleet in 2015 and initiated tests the following year, confidentially filed for an initial public offering two weeks ago. The company, currently valued at $72 billion, is expected to debut at a valuation as high as $120 billion early next year.

Powered by WPeMatico