Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

A Juul is not a cigarette. It’s much easier than that. Through devilishly slick product design I’ll discuss here, the startup has massively lowered the barrier to getting hooked on nicotine. Juul has dismantled every deterrent to taking a puff.

The result is both a new $38 billion valuation thanks to a $12.8 billion investment from Marlboro Cigarettes-maker Altria this week, and an explosion in popularity of vaping amongst teenagers and the rest of the population. Game recognize game, and Altria’s game is nicotine addiction. It knows it’s been one-upped by Juul’s tactics, so it’s hedged its own success by handing the startup over a tenth of the public corporation’s market cap in cash.

Juul argues it can help people switch from obviously dangerous smoking to supposedly healthier vaping. But in reality, the tiny aluminum device helps people switch from nothing to vaping…which can lead some to start smoking the real thing. A study found it causes more people to pick up cigarettes than put them down.

Photographer: Gabby Jones/Bloomberg via Getty Images

How fast has Juul swept the nation? Nielsen says it controls 75 percent of the U.S. e-cigarette market up from 27 percent in September last year. In the year since then, the CDC says the percentage of high school students who’ve used an e-cigarette in the last 30 days has grown 75 percent. That’s 3 million teens or roughly 20 percent of all high school kids. CNBC reports that Juul 2018 revenue could be around $1.5 billion.

The health consequences aside, Juul makes it radically simple to pick up a lifelong vice. Parents, regulators, and potential vapers need to understand why Juul works so well if they’ll have any hope of suppressing its temptations.

It’s tough to try a cigarette for the first time. The heat and smoke burn your throat. The taste is harsh and overwhelming. The smell coats your fingers and clothes, marking you as smoker. There’s pressure to smoke a whole one lest you waste the tobacco. Even if you want to try a friend’s, they have to ignite one first. And unlike bigger box mod vaporizers where you customize the temperature and e-juice, Juul doesn’t make you look like some dorky hardcore vapelord.

Juul is much more gentle on your throat. The taste is more mild and can be masked with flavors. The vapor doesn’t stain you with a smell as quickly. You can try just a single puff from a friend’s at a bar or during a smoking break with no pressure to inhale more. The elegant, discrete form factor doesn’t brand you as a serious vape users. It’s casual. Yet the public gesture and clouds people exhale are still eye catching enough to trigger the questions, “What’s that? Can I try?” There’s a whole other article to be written about how Juul memes and Instagram Stories that glamorized the nicotine dispensers contributed to the device’s spread.

And perhaps most insidiously, vaping seems healthier. A lifetime of anti-smoking ads and warning labels drilled the dangers into our heads. But how much harm could a little vapor do?

A friend who had never smoked tells me they burn through a full Juul pod per day now. Someone got him to try a single puff at a nightclub. Soon he was asking for drag off of strangers’ Juuls. Then he bought one and never looked back. He’d been around cigarettes at parties his whole life but never got into them. Juul made it too effortless to resist.

Lighting up a cigarette is a garish activity prohibited in many places. Not so with discretely sipping from a Juul.

Cigarettes often aren’t allowed to be smoked inside. Hiding it is no easy feat and can get you kicked out. You need to have a lighter and play with fire to get one started. They can get crushed or damp in your pocket. The burning tip makes them unruly in tight quarters, and the bud or falling ash can damage clothing and make a mess. You smoke a cigarette because you really want to smoke a cigarette.

Public establishments are still figuring out how to handle Juuls and other vaporizers. Many places that ban smoking don’t explicitly do the same for vaping. The less stinky vapor and more discrete motion makes it easy to hide. Beyond airplanes, you could probably play dumb and say you didn’t know the rules if you did get caught. The metal stick is hard to break. You won’t singe anyone. There’s no mess, need for an ashtray, or holes in your jackets or couches.

As long as your battery is charged, there’s no need for extra equipment and you won’t draw attention like with a lighter. Battery life is a major concern for heavy Juulers that smokers don’t have worry about, but I know people who now carry a giant portable charger just to keep their Juul alive. But there’s also a network effect that’s developing. Similar to iPhone cords, Juuls are becoming common enough that you can often conveniently borrow a battery stick or charger from another user.

And again, the modular ability to take as few or as many puffs as you want lets you absent-mindedly Juul at any moment. At your desk, on the dance floor, as you drive, or even in bed. A friend’s nieces and nephews say that they see fellow teens Juul in class by concealing it in the cuff of their sleeve. No kid would be so brazen as to try smoke in cigarette in the middle of a math lesson.

Gillette pioneered the brilliant razor and blade business model. Buy the sometimes-discounted razor, and you’re compelled to keep buying the expensive proprietary blades. Dollar Shave Club leveled up the strategy by offering a subscription that delivers the consumable blades to your door. Juul combines both with a product that’s physically addictive.

When you finish a pack of cigarettes, you could be done smoking. There’s nothing left. But with Juul you’ve still got the $35 battery pack when you finish vaping a pod. There’s a sunk cost fallacy goading you to keep buying the pods to get the most out of your investment and stay locked into the Juul ecosystem.

(Photo by Scott Olson/Getty Images)

One of Juul’s sole virality disadvantages compared to cigarettes is that they’re not as ubiquitously available. Some stores that sells cigs just don’t carry them yet. But more and more shops are picking them up, which will continue with Altria’s help. And Juul offers an “auto-ship” delivery option that knocks $2 off the $16 pack of four pods so you don’t even have to think about buying more. Catch the urge to quit? Well you’ve got pods on the way so you might as well use them. Whether due to regulation or a lack of innovation, I couldn’t find subscription delivery options for traditional cigarettes.

And for minors that want to buy Juuls or Juul pods illegally, their tiny size makes them easy to smuggle and resell. A recent South Park episode featured warring syndicates of fourth-graders selling Juul pods to even younger kids.

Juul co-founder James Monsees told the San Jose Mercury News that “The first phase is proving the value and creating a product that makes cigarettes obsolete.” But notice he didn’t say Juul wants to make nicotine obsolete or reduce the number of people addicted to it.

Juul co-founder James Monsees

If Juul actually cared about fighting addiction, it’d offer a regimen for weaning yourself off of nicotine. Yet it doesn’t sell low-dose or no-dose pods that could help people quit entirely. In the US it only sells 5% and 3% nicotine versions. It does make 1.7% pods for foreign markets like Israel where that’s the maximum legal strengths, though refuses to sell them in the States. Along with taking over $12 billion from one of the largest cigarette companies, that makes the mission statement ring hollow.

Juul is the death stick business as usual, but strengthened by the product design and virality typically reserved for Apple and Facebook.

Powered by WPeMatico

The story of the game Star Citizen and Cloud Imperium, the company developing it, is almost too ludicrous to believe: a crowdfunding effort to create a space sim of unparalleled size and realism, raising hundreds of millions, with backers paying thousands for ships and gear in a game that’s years from release. Yet it’s real enough that it just pulled in $42 million in private funding to help bring it closer to release.

Star Citizen began as the brainchild of Chris Roberts, architect of the Wing Commander series and other well-received space games. His idea was to crowdfund the team’s next game, and did so in 2012; the money started rolling in, and it never really stopped. Nor has the game ceased to grow in its ambitions, adding things like entire planets to the lineup that seem, on their face, somewhat insane.

There’s no shortage of histories of the game and its developers out there, so for our purposes let it suffice to say that over the last six years the company has raised $211 million, the vast majority of which comes from gamers “pledging” anywhere from a few bucks to thousands of dollars for all manner of things related to the title. Early access to builds, exclusive ships, testing new content, etc.

A huge amount of work has been done on the game, so this isn’t just a colossal con, though there are plenty who think the game, and its first-person shooter counterpart Squadron 42, can’t possibly ever fulfill its ambitions and justify the money people have put into it.

That doesn’t seem to be the opinion of Clive Calder, founder of Zomba and producer in a variety of entertainment formats, whom Roberts met during a clandestine campaign to solicit funding.

Roberts, who writes the story in one of his candid messages to the project’s fanbase, had decided a while back that he didn’t want to use pledged funds for marketing purposes — at least not the kind of marketing blitz AAA games tend to require for a successful global release. So he went looking for investment, and found Calder, with whom he “got on like a house on fire.”

Calder’s family office agreed to invest $46 million for a 10 percent stake in Cloud Imperium, which all told puts it near a half-billion valuation. One may very well question the sanity of such a valuation for a company that has not yet shipped an actual product — working prototypes, sure, but not a completed game — but hell, at least they’re making something people are excited about. That’s got to be worth a couple bucks.

Cloud Imperium gains two new board members from outside, though Roberts, who commands the kind of loyalty that only decades in an industry can create, was quick to point out that “control of the company and the board still firmly stays with myself as chairman, CEO and majority shareholder.”

In another act of not exactly radical but not legally required transparency, the company also posted an outline of the company’s financials over the last six years. Unsurprisingly, the company has been investing most of its cash into game development in the form of salaries, contracts and overhead; a non-trivial amount has gone toward “publishing operations, community, events and marketing,” which with a game as community-focused as Star Citizen is not surprising.

The company has grown steadily, adding a hundred people a year or so to a present size of 464 — which is the kind of size you’d expect on a AAA game like Assassin’s Creed or Red Dead Redemption. Even more would be added on as temporary artists, actors and so on.

I’m sure it has escaped no one that pledges appear to have peaked, though if they remain steady the company clearly will have enough to continue operations if it doesn’t expand. But one does also see perhaps a secondary motive in seeking investment from outside the community. At some point people are going to want a game.

To that end, Squadron 42, at least, is scheduled for release in Q2 2020 — though backers and critics will both chuckle a little at the idea that Cloud Imperium will be able to hit those goals. The games, infamously, were originally slated for release long ago. But the scope of the project has grown since its conception and although some no doubt would rather be playing the completed game today, they may very well find that good things come to those who wait. And wait. And wait…

Powered by WPeMatico

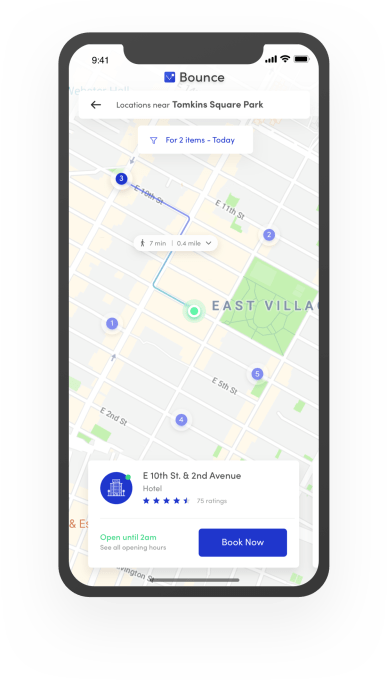

If you’ve ever found yourself lugging a big suitcase from meeting to meeting, a startup called Bounce could make your life easier. Using Bounce, you’ll be able to pay for short-term storage at hotels, dry cleaners and other local businesses.

The San Francisco-based startup is announcing that it has raised $1.2 million in seed funding from investors including Structured Capital managing partner Jillian Manus, Seabed VC, Airbnb general counsel Rob Chesnut and Canadian entrepreneur Michael Hyatt.

CEO Cody Candee (pictured above with his co-founder and CTO Aleksander Rendtslev) said he’s actually not someone who owns a lot of stuff himself, but he realized that “people are constantly planning their days and planning their lives around the things that they own,” whether that’s running home to drop something off or heading straight to your hotel from the airport because you need to get rid of your luggage.

So Bounce has already signed up more than 100 locations across New York, San Francisco, Washington, DC and Chicago, and it says they’ve been used to store tens of thousands of bags. You currently browse these locations through the Bounce website, but Candee said an iOS app launch is imminent. Apparently Bounce vets its locations, partly to ensure that they have secure storage areas and that their posted store hours are accurate — so that you don’t rush to the store to pick something up before closing, only to discover that everyone left early. Candee added that the most common use cases include travelers who have checked out of their hotels, people attending events (I once tried to carry my gym bag into Madison Square Garden and I will never do that again) and salespeople who are hopping from meeting to meeting.

Apparently Bounce vets its locations, partly to ensure that they have secure storage areas and that their posted store hours are accurate — so that you don’t rush to the store to pick something up before closing, only to discover that everyone left early. Candee added that the most common use cases include travelers who have checked out of their hotels, people attending events (I once tried to carry my gym bag into Madison Square Garden and I will never do that again) and salespeople who are hopping from meeting to meeting.

There are other companies that appear to have a similar idea — for example, Vertoe was part of winter class at Techstars NYC — but Candee said that competitors are mostly “attacking just the luggage storage space,” which he suggested is “relatively easy to build.”

In contrast, he said, “The way we see it is, we’re really building a tech platform and basically thinking about these broader use cases.” In fact, he said Bounce is already testing out a system where items are transported by local couriers between different storage locations.

“We’re thinking about what could be built on top of that platform,” Candee said. “A drycleaner could come on our platform and they could basically say, ‘Hey, drop your clothes off’ and then Bounce it back to wherever that user is.”

Powered by WPeMatico

A year ago, crypto was reaching ever new highs, and I was talking about whether ICOs would supplant the VC funding round and warning about Kim Jong Un’s crypto trading operations.

And then the world turned upside down.

Crypto prices are near rock-bottom prices, with Bitcoin hanging around $4,000 and Ethereum around $113, down from their highs earlier this year of around $16,600 and $1,400, respectively.

While that has put a dampener on the enthusiasm of a lot of cryptocurrency retail investors, the bigger question is how do institutional players work through this market? What’s the strategy for finding value in this technology sector long-term?

I chatted with Alexander Liegl, who may just have at least part of the answer. He’s the founder of Layer1, which announced a $2.1 million fundraise this week from Peter Thiel, Digital Currency Group and Jeffrey Tarrant.

Liegl saw a huge challenge in the blockchain and cryptocurrency spaces: too many good ideas and not enough developers working on product development work. So he decided to create an “activist fund for cryptocurrencies” that would “take concentrated bets on protocols that we think have a need in this world.” Layer1 then supplies developers and other experts to provide “infrastructure and support,” he explained. “An operating entity like us can have a lot of influence in moving the needle.” He describes Layer1 as “a combination of Polychain and Blockstreet” and “the Rocket Internet of crypto.”

That might sound vaguely similar to ConsenSys, the loosely coupled group of startups and infrastructure engineers trying to build out Ethereum, which has run into very hard times recently. Unlike ConsenSys, which was founded by Ethereum co-founder Joe Lubin and is directly focused on that ecosystem, Layer1 isn’t wedded to one blockchain or ecosystem, and instead selects a single project at a time through a mix of financial analysis and thesis development.

With capital in the bank, Layer1 has backed Grin as its first cryptocurrency. Grin is designed to be a completely private and censorship-resistant transaction medium, and Liegl says that “conceptually it really reconciles with our view in the space.” He particularly liked that Grin has an anonymous founder like Bitcoin, as no founder controls the governance of the project. Grin is intending to publicly launch in mid-January.

I asked Liegl how he was responding to the crypto crunch this year in the markets, and he considered it far more of an opportunity than a detriment to his work. “I’m really pumped about all of this,” he explained. “A lot of the bad actors have to be flushed out.” He noted that the low of the bear market may not be reached yet, but that Layer1 was in a good position to take advantage of the timing. “We raised the newest dollars, so we are not suffering from any of these ICO-induced problems,” he said.

Liegl, who graduated from Stanford in 2015 and briefly worked at Stanford’s endowment, has certainly seen the vagaries of the cryptocurrency markets. He learned about Bitcoin during its first popular run-up in 2013, even convincing his parents to invest in the budding project.

Now, he has his eyes set on Grin, and then additional projects. He thinks Layer1 will invest in a new project roughly every six to nine months, which will accelerate over time with additional capital.

While these “platform” models have struggled a bit in the venture world, I think it’s reasonable that blockchain projects, which often suffer from a lack of attention from developers and end uses, could use a strong engineering and popularization boost. Layer1 isn’t the first in the blockchain world to take this approach nor I am sure will it be the last, but it might be just the ticket forward for a world that has struggled to pay its employees and bills in a crash.

Powered by WPeMatico

Meet Spot, a beautifully designed mobile app to control your cryptocurrencies. Spot looks like a portfolio-tracking app. But the company has built a strong foundation to add more features in the coming months. Spot wants to be your unique gateway to the world of cryptocurrencies.

“Spot’s vision isn’t to build a portfolio tracker — we went a bit overboard with this feature,” co-founder and CEO Edouard Steegmann told me. “Eventually, we want to become the app to manage all your cryptos, a sort of Revolut but with a crypto DNA.”

When you first install the app, you can connect it to your existing wallets by adding public addresses. Even if you store your tokens on a hardware wallet, Spot can read the public details of your wallet to show them in the app.

“We have our own nodes on Ethereum, Bitcoin, Litecoin, Stellar and others to recover the amount on your wallet,” Steegmann said. Data is also cross-checked with third-party services to make sure that everything is fine.

Spot also lets you connect to an exchange account using API keys. Right now, the app supports Binance, Kraken, Bitfinex and Poloniex, but the company already plans to add more exchanges.

The app then gives you a detailed overview of your holdings across all services and wallets. You can see detailed charts, and discover which token is performing better than the rest. It’s also one of the most well-designed mobile apps I’ve seen this year — the animations and interactions are gorgeous.

But Spot doesn’t rely on an API to get pricing information for each token. “We’ve rebuilt CoinMarketCap from the ground up, and we’re one of the few companies that have done it,” Steegmann said. The company stores pricing information for dozens of tokens across 150 exchanges. That’s a lot of pairings.

If you tap on the Spot logo at the top of the app, you can see the maximum value of your portfolio if you cash out on exchanges with the highest prices for your tokens. The company makes sure that there’s enough volume to show you coherent prices.

Spot thinks that controlling your own data is too important to rely on API calls. When you have your own data, you don’t have any API rate limits, you don’t have a major dependency and you can scale more calmly.

Up next, you’ll be able to trade directly in the app. The company isn’t going to build its own exchange, but you can expect to buy and sell tokens on a third-party exchange without having to visit the website.

“We think that many things will be tokenized and that there’s no user-friendly interface to transfer, receive, buy and sell,” Steegmann said.

The company raised a $1.2 million round (€1.056 million to be exact) from Kima Ventures and business angels, including Eric Larchevêque and Thomas France from Ledger, Jean-Daniel Guyot, Thibaud Elzière, Eduardo Ronzano, Nicolas Steegmann, Sébastien Lucas and Nicolas Debock.

Disclosure: I own small amounts of various cryptocurrencies.

Powered by WPeMatico

Social game developer Zynga has entered into an agreement to acquire Small Giant Games, the startup behind the popular mobile game Empires & Puzzles, in a deal expected to total $700 million.

Zynga, which has tumbled since its 2011 Nasdaq initial public offering, will initially acquire 80 percent of Small Giant Games for $560 million, composed of $330 million in cash and $230 million of unregistered Zynga common stock. Zynga will fund part of the transaction with a $200 million credit facility.

“We’ve been impressed by the quality and momentum of Empires & Puzzles as we add another Forever Franchise into Zynga’s portfolio,” Zynga chief executive officer Frank Gibeau said in a statement. “Small Giant has created an innovative game that delivers a unique player experience that engages over the long term.”

The deal is expected to close on January 1. Zynga will purchase the remaining 20 percent of Small Giant over the next three years “at valuations based on specified profitability goals.”

Helsinki-based Small Giant Games had raised $52 million in equity funding from EQT Ventures, Creandum, Spintop Ventures, Profounders and others since it was founded in 2013. The company reported $33 million of revenue for Empires & Puzzles, its most popular game, 10 months after its launch in 2017. Small Giant, which is also behind Alliance Wars and Season 2: Atlantis, says they exceeded 2017’s revenue just four months into 2018.

“Our studio was founded on the idea that small, skillful teams can accomplish giant things, and I am confident that partnering with Zynga is the right next step in our evolution,” Small Giant CEO Timo Soininen said in a statement. “We will now operate as a separate studio within Zynga, maintaining our identity, culture and creative independence. By leveraging the expertise and support from the wider Zynga team, we will amplify the reach of Empires & Puzzles and the new games in our development pipeline.”

Zynga, founded in 2007, is the developer of FarmVille, Zynga

Zynga expects to bring in $243 million in revenue in the fourth quarter of 2018.

Powered by WPeMatico

Before Ram Palaniappan founded Earnin, he developed a system for employees at a payments company called UniRush, where he spent eight years as president. If you needed money before payday, he would write you a check from his checking account and when payday rolled around, employees would reimburse him.

Despite being paid what Palaniappan thought were fair wages, his workers often found themselves in a bind, needing access to wages they couldn’t expect to see in their own bank accounts for days.

“This is such a core pain point,” Palaniappan told TechCrunch. “Over three-fourths of the country live paycheck to paycheck … It’s an issue of fairness. We all have gotten used to getting paid every two weeks, but most employees would rather be paid before they work.”

Palaniappan decided to transform what he had been doing as a favor to employees into a real business with Earnin (formerly known as Activehours), a startup that helps hourly, gig and salary workers track their earnings and transfer them to their checking accounts in real time using a mobile application. Today, the company is announcing a $125 million Series C funding from top-tier investors DST Global, Andreessen Horowitz, Spark Capital, Matrix Partners, March Capital Partners, Coatue Management and Ribbit Capital. Palaniappan declined to disclose the valuation.

Earnin founder and chief executive officer Ram Palaniappan

Here’s how it works: An employee signs up on the Earnin app and connects their bank account. Earnin infers the person’s pay cycle and debits their account the amount they’ve borrowed on their payday. Earnin charges no fees or interest; instead, it operates on a pay it forward revenue model some would balk at. Earnin users have the option to “tip” the app after each transaction and that tip, in turn, is used to fund the next user’s withdrawal. If a user tips more than Earnin thinks is reasonable for the given withdrawal, it will notify the user and give them the option to dial back the tip amount.

What the company has found is that users are usually more than happy to contribute to the Earnin community of workers.

“So often, people are trying to help each other out,” Palaniappan said. “That’s the most powerful piece — how much support the community is providing to each other.”

Earnin was launched in 2014 and has previously raised $65 million in venture capital funding. With the latest investment, it will expand its engineering and product teams across its offices in Palo Alto — where it’s headquartered — as well as in Cincinnati and Vancouver.

The app, often among the App Store’s top 10 financial apps, has more than 1 million downloads, the company says, and is used by employees at more than 50,000 companies — many of which check the app every day. Palaniappan says its users are working more than 15 million hours per week. If each user works an estimated 40 hours per week, that means the app has roughly 375,000 weekly active users.

He added that the startup’s growth in the last four years has been “quite remarkable.” Given the investor support it’s received, it’s likely to step into “unicorn” territory soon. Ribbit Capital, for example, is a leading fintech investing firm with capital invested in Coinbase, Revolut, Gusto, Wealthfront, NuBank, Brex and more.

Powered by WPeMatico

Boosted has scored some serious cash as it looks to move beyond the world of electric skateboards to conquer new forms of personal transportation.

The startup announced today that it has closed a $60 million round of Series B funding co-led by Khosla Ventures and iNovia Capital. Stanford-StartX Fund and Bay Meadows also participated in the round. Boosted has now raised north of $70 million.

Founded in 2012, the company is the most recognizable name in the growing field of electric skateboards, but Boosted is now looking to grow its ambitions to new personal transportation verticals in the “light vehicle type” category.

So, does this mean Boosted is building a scooter?

Well, that certainly seems like a serious possibility, though we mainly just have a statement from Khosla Ventures partner Samir Kaul to go off of at the moment.

“From day one, Boosted has been built as a scalable light electric vehicle company that can expand its portfolio to all kinds of vehicle form factors, including perfecting the vehicle types we see on the street today, and introducing others that are more novel,” Kaul wrote in a release. “We’re very much looking forward to 2019 and sharing what is coming next.”

The company’s bread-and-butter has long been their longboards, but they switched things up a little bit this year when they introduced the $749 Boosted Mini S. The shortboard shrunk the company’s form factor, but more critically lowered the cost of entry to their line of products.

The company also pushed further into the high-end with the $1,599 Boosted Stealth. More interestingly, the new line of hardware started being built entirely in-house. The wheels, the decks and the trucks are all Boosted-built.

With $60 million in fresh funding, investors are obviously channeling some of their newfound excitement in bike and scooter transportation platforms into the Boosted brand. While the on-demand platforms have largely been the ones gathering venture cash to date, Boosted has developed a pretty solid brand name for itself in the electric skateboard space, one that can probably step into new vehicle verticals with a certain level of prestige already attached.

Powered by WPeMatico

After a long year fighting underage use of its products, Juul Labs has today struck a deal with Altria Group, the owners of Philip Morris USA and makers of Marlboro cigarettes.

The deal values Juul at $38 billion, according to Bloomberg, and injects the company with a fresh $12.8 billion in exchange for a 35 percent stake in Juul Labs.

Here’s what Juul Labs CEO Kevin Burns had to say in a prepared statement:

We understand the controversy and skepticism that comes with an affiliation and partnership with the largest tobacco company in the US. We were skeptical as well. But over the course of the last several months we were convinced by actions, not words, that in fact this partnership could help accelerate our success switching adult smokers. We understand the doubt. We doubted as well.

He goes on to explain the strict criteria Juul Labs had for a potential investor, particularly one from the Big Tobacco space. For one, Altria entered into a standstill agreement that limits to 35 percent the company’s ownership in Juul. Altria also must use its database and its distribution network to get out to current smokers the message of Juul.

For the past year, many have seen Juul as a dangerous toy for teenagers. In November, FDA Commissioner Scott Gottlieb announced new measures for the e-cig industry meant to keep the products out of the hands of teens. One of those measures includes restricting the sale of flavored non-combustible tobacco products beyond the usual cigarette flavors of tobacco and menthol.

But after nearly a year of playing defense, this new deal marks a bit of an offensive push from Juul Labs. The company has always stressed that its main goal is to give smokers a meaningful alternative to combustible cigarettes. Partnering with Big Tobacco may not seem like the best way to do that, optically speaking. But Altria has agreed to a few measures that would get into the hands of actual smokers information about Juul, including:

In the release, Altria said that part of the reason for the investment is simply that the organization understands change is coming to the tobacco industry.

Howard Willard, Altria’s chairman and chief executive officer, had this to say in a prepared statement:

We are taking significant action to prepare for a future where adult smokers overwhelmingly choose non-combustible products over cigarettes by investing $12.8 billion in JUUL, a world leader in switching adult smokers. We have long said that providing adult smokers with superior, satisfying products with the potential to reduce harm is the best way to achieve tobacco harm reduction. Through JUUL, we are making the biggest investment in our history to achieve that goal. We strongly believe that working with JUUL to accelerate its mission will have long-term benefits for adult smokers and our shareholders.

Altria has made a few big moves lately, including acquiring a 45 percent stake in cannabis company Cronos earlier this month. The company also announced this month that it would discontinue its own e-cig products, including all MarkTen and Green Smoke e-vapor products, and VERVE oral nicotine products.

“This decision is based upon the current and expected financial performance of these products, coupled with regulatory restrictions that burden Altria’s ability to quickly improve these products,” read the press release. “The company will refocus its resources on more compelling reduced-risk tobacco product opportunities.”

Now we know that those opportunities look like an extra-long thumb drive called Juul.

Powered by WPeMatico

Gamelearn, which develops video games to deliver corporate training, has scored $5 million in Series A funding. Participating in the new financing round is previous backer Kibo Ventures, along with Oak3Capital, All Iron Ventures, UL Invest, and Inveready.

The Madrid-based startup says that it will use the new capital to boost the company’s production of “serious games” and reinforce its international presence. It currently has customer a base of 2,000 clients, spanning 50 countries. Those clients include LG, Thyssen Krupp, UPS, Hyundai, P&G, KPMG, Tetrapak, and Merck&Co.

Founded in 2007, Gamelearn is attempting to shake up the corporate training industry via its in-house developed game-based learning solutions and gamification for corporations. Its video games and simulators are designed to “train, communicate, inform, raise awareness and engage” employees. The company’s founders are Ibrahim Jabary, Mai Apraiz and Eduardo Monfort, each of whom has experience in corporate training.

Their take is that the startup’s bespoke video games and simulators can be used to meet a plethora of corporate needs, such as internal communication, digital transformation, management of change, leadership training, negotiation, time management, customer service, product training, project management or compliance.

“Corporate training is boring and non-engaging,” Gamelearn co-founder Mai Apraiz tells me. “Only 30 percent of e-learning courses are completed, meaning 3 out of 4 dollars invested in e-learning are wasted by corporations around the world. We create fun and engaging training experiences that allow our clients to achieve a 93 percent completion rate”.

Apraiz says these experiences are delivered through high-quality content, gamification, and simulation in a single product, which, she claims, no other company does. “The quality of our games is the best in the market. You can compare our products by checking our competitors’ websites against our own. That’s why we are the most awarded game-based learning company in the world”.

Proof that European tech companies are increasingly thinking globally, including pan-European, Gamelearn not only sells its products internationally, but offers “Customer Success” support in 4 different languages, and the startup’s games are translated into a dozen different languages.

On Gamelearn’s business model, Apraiz says the company sells licenses to play its games on the Gamelearn platform or on other commercial Learning Management Systems that it integrates with. “We sell projects as well as subscriptions,” she adds.

Powered by WPeMatico