Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Across the globe, a clutch of companies from Oxford, England to Redwood City, Calif. are working to commercialize a new solar technology that could further boost the adoption of renewable energy generation.

Earlier this year, Oxford PV, a startup working in tandem with Oxford University, received $3 million from the U.K. government to develop the technology, which uses a new kind of material to make solar cells. Two days ago, in the U.S., a company called Swift Solar raised $7 million to bring the same technology to market, according to a filing with the Securities and Exchange Commission.

Called a perovskite cell, the new photovoltaic tech uses hybrid organic-inorganic lead or tin halide-based material as the light-harvesting active layer. It’s the first new technology to come along in years to offer the promise of better efficiency in the conversion of light to electric power at a lower cost than existing technologies.

“Perovskite has let us truly rethink what we can do with the silicon-based solar panels we see on roofs today,” said Sam Stranks, the lead scientific advisor and one of the co-founders of Swift Solar, in a Ted Talk. “Another aspect that really excites me: how cheaply these can be made. These thin crystalline films are made by mixing two inexpensive readily abundant salts to make an ink that can be deposited in many different ways… This means that perovskite solar panels could cost less than half of their silicon counterparts.”

First incorporated into solar cells by Japanese researchers in 2009, the perovskite solar cells suffered from low efficiencies and lacked stability to be broadly used in manufacturing. But over the past nine years researchers have steadily improved both the stability of the compounds used and the efficiency that these solar cells generate.

Oxford PV, in the U.K., is now working on developing solar cells that could achieve conversion efficiencies of 37 percent — much higher than existing polycrystalline photovoltaic or thin-film solar cells.

New chemistries for solar cell manufacturing have been touted in the past, but cost has been an obstacle to commercial rollout, given how cheaply solar panels became thanks in part to a massive push from the Chinese government to increase manufacturing capacity.

Many of those manufacturers eventually folded, but the survivors managed to maintain their dominant position in the industry by reducing the need for buyers to look to newer technologies for cost or efficiency savings.

There’s a risk that this new technology also faces, but the promise of radical improvements in efficiencies at costs that are low enough to attract buyers have investors once again putting money behind alternative solar chemistries.

Oxford PV has already set a world-leading efficiency mark for perovskite-based cells at 27.3 percent. That’s already 4 percent higher than the leading monocrystalline silicon panels available today.

“Today, commercial-sized perovskite-on-silicon tandem solar cells are in production at our pilot line and we are optimizing equipment and processes in preparation for commercial deployment,” said Oxford PV’s CTO Chris Case in a statement.

Powered by WPeMatico

‘Twas the night before Xmas, and all through the house, not a feature was stirring from the designer’s mouse . . . Not Twitter! Not Uber, Not Apple or Pinterest! On Facebook! On Snapchat! On Lyft or on Insta! . . . From the sidelines I ask you to flex your code’s might. Happy Xmas to all if you make these apps right.

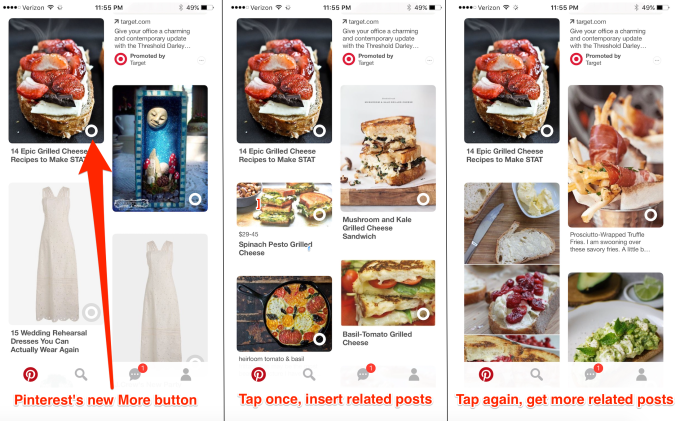

See More Like This – A button on feed posts that when tapped inserts a burst of similar posts before the timeline continues. Want to see more fashion, sunsets, selfies, food porn, pets, or Boomerangs? Instagram’s machine vision technology and metadata would gather them from people you follow and give you a dose. You shouldn’t have to work through search, hashtags, or the Explore page, nor permanently change your feed by following new accounts. Pinterest briefly had this feature (and should bring it back) but it’d work better on Insta.

Web DMs – Instagram’s messaging feature has become the defacto place for sharing memes and trash talk about people’s photos, but it’s stuck on mobile. For all the college kids and entry-level office workers out there, this would make being stuck on laptops all day much more fun. Plus, youth culture truthsayer Taylor Lorenz wants Instagram web DMs too.

Upload Quality Indicator – Try to post a Story video or Boomerang from a crummy internet connection and they turn out a blurry mess. Instagram should warn us if our signal strength is low compared to what we usually have (since some places it’s always mediocre) and either recommend we wait for Wi-Fi, or post a low-res copy that’s replaced by the high-res version when possible.

Oh, and if new VP of product Vishal Shah is listening, I’d also like Bitmoji-style avatars and a better way to discover accounts that shows a selection of their recent posts plus their bio, instead of just one post and no context in Explore which is better for discovering content.

DM Search – Ummm, this is pretty straightforward. It’s absurd that you can’t even search DMs by person, let alone keyword. Twitter knows messaging is a big thing on mobile right? And DMs are one of the most powerful ways to get in contact with mid-level public figures and journalists. PS: My DMs are open if you’ve got a news tip — @JoshConstine.

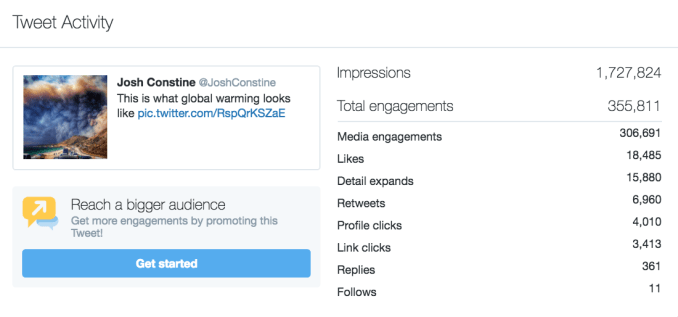

Unfollow Suggestions – Social networks are obsessed with getting us to follow more people, but do a terrible job of helping us clean up our feeds. With Twitter bringing back the option to see a chronological feed, we need unfollow suggestions more than ever. It should analyze who I follow but never click, fave, reply to, retweet, or even slow down to read and ask if I want to nix them. I asked for this 5 years ago and the problem has only gotten worse. Since people feel like their feeds are already overflowing, they’re stingy with following new people. That’s partly why you see accounts get only a handful of new followers when their tweets go viral and are seen by millions. I recently had a tweet with 1.7 million impressions and 18,000 Likes that drove just 11 follows. Yes I know that’s a self-own.

Analytics Benchmarks – If Twitter wants to improve conversation quality, it should teach us what works. Twitter offers analytics about each of your tweets, but not in context of your other posts. Did this drive more or fewer link clicks or follows than my typical tweet? That kind of info could guide users to create more compelling content.

(Obviously we could get into Facebook’s myriad problems here. A less sensationalized feed that doesn’t reward exaggerated claims would top my list. Hopefully its plan to downrank “borderline content” that almost violates its policies will help when it rolls out.)

Batched Notifications – Facebook sends way too many notifications. Some are downright useless and should be eliminated. “14 friends responded to events happening tomorrow”? “Someone’s fundraiser is half way to its goal?” Get that shit out of here. But there are other notifications I want to see but that aren’t urgent nor crucial to know about individually. Facebook should let us decide to batch notifications so we’d only get one of a certain type every 12 or 24 hours, or only when a certain number of similar ones are triggered. I’d love a digest of posts to my Groups or Events from the past day rather than every time someone opens their mouth.

I so don’t care

Notifications In The “Time Well Spent” Feature – Facebook tells you how many minutes you spent on it each day over the past week and on average, but my total time on Facebook matters less to me than how often it interrupts my life with push notifications. The “Your Time On Facebook” feature should show how many notifications of each type I’ve received, which ones I actually opened, and let me turn off or batch the ones I want fewer of.

Oh, and for Will Cathcart, Facebook’s VP of apps, can I also get proper syncing so I don’t rewatch the same Stories on Instagram and Facebook, the ability to invite people to Events on mobile based on past invite lists of those I’ve hosted or attended, and the See More Like This feature I recommended for Instagram?

“Quiet Ride” Button – Sometimes you’re just not in the mood for small talk. Had a rough day, need to get work done, or want to just zone out? Ridesharing apps should offer a request for a quiet ride that if the driver allows with a preset and accepts before you get in, you pay them an extra dollar (or get it free as a loyalty perk), and you get ferried to your destination without unnecessary conversation. I get that it’s a bit dehumanizing for the driver, but I’d bet some would happily take a little extra cash for the courtesy.

“I Need More Time” Button – Sometimes you overestimate the ETA and suddenly your car is arriving before you’re ready to leave. Instead of cancelling and rebooking a few minutes later, frantically rushing so you don’t miss your window and get smacked with a no-show fee, or making the driver wait while they and the company aren’t getting paid, Uber, Lyft, and the rest should offer the “I Need More Time” button that simply rebooks you a car that’s a little further away.

Scan My Collection – I wish I could just take photos of the album covers, spines, or even discs of my CD or record collection and have them instantly added to a playlist or folder. It’s kind of sad that after lifetimes of collecting physical music, most of it now sits on a shelf and we forget to play what we used to love. Music apps want more data on what we like, and it’s just sitting there gathering dust. There’s obviously some fun viral potential here too. Let me share what’s my most embarrassing CD. For me, it’s my dual copies of Limp Bizkit’s “Significant Other” because I played the first one so much it got scratched.

Friends Weekly – Spotify ditched its in-app messaging, third-party app platform, and other ways to discover music so its playlists would decide what becomes a hit in order to exert leverage over the record labels to negotiate better deals. But music discovery is inherently social and the desktop little ticker of what friends are playing on doesn’t cut it. Spotify should let me choose to recommend my new favorite song or agree to let it share what I’ve recently played most, and put those into a Discover Weekly-style social playlist of what friends are listening to.

Growth – I’m sorry, I had to.

Bulk Export Memories – But seriously, Snapchat is shrinking. That’s worrisome because some users’ photos and videos are trapped on its Memories cloud hosting feature that’s supposed to help free up space on your phone. But there’s no bulk export option, meaning it could take hours of saving shots one at a time to your camera roll if you needed to get off of Snapchat, if for example it was shutting down, or got acquired, or you’re just bored of it.

Add-On Cameras – Snapchat’s Spectacles are actually pretty neat for recording first-person or underwater shots in a circular format. But otherwise they don’t do much more, and in some ways do much less, than your phone’s camera and are a long way from being a Magic Leap competitor. That’s why if Snapchat really wants to become a “Camera Company”, it should build sleek add-on cameras that augment our phone’s hardware. Snap previously explored selling a 360-camera but never launched one. A little Giroptic iO-style 360 lens that attaches to your phone’s charging port could let you capture a new kind of content that really makes people feel like they’re there with you. An Aukey Aura-style zoom lens attachment that easily fits in your pocket unlike a DSLR could also be a hit

Switch Wi-Fi/Bluetooth From Control Center – I thought the whole point of Control Center was one touch access, but I can only turn on or off the Wi-Fi and Bluetooth. It’s silly having to dig into the Settings menu to switch to a different Wi-Fi network or Bluetooth device, especially as we interact with more and more of them. Control Center should unfurl a menu of networks or devices you can choose from.

Shoot GIFs – Live Photos are a clumsy proprietary format. Instagram’s Boomerang nailed what we want out of live action GIFs and we should be able to shoot them straight from the iOS camera and export them as actual GIFs that can be used across the web. Give us some extra GIF settings and iPhones could have a new reason for teens to choose them over Androids.

Gradual Alarms – Anyone else have a heart attack whenever they hear their phone’s Alarm Clock ringtone? I know I do because I leave my alarms on so loud that I’ll never miss them, but end up being rudely shocked awake. A setting that gradually increases the volume of the iOS Alarm Clock every 15 seconds or minute so I can be gently arisen unless I refuse to get up.

Maybe some of these apply to Android, but I wouldn’t know because I’m a filthy casual iPhoner. Send me your Android suggestions, as well as what else you want to see added to your favorite apps.

[Image Credit: Hanson Inc]

Powered by WPeMatico

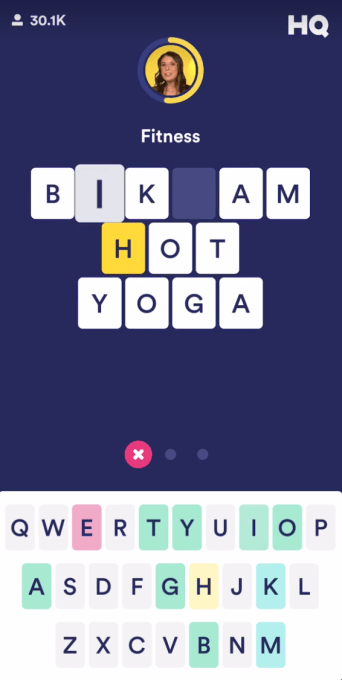

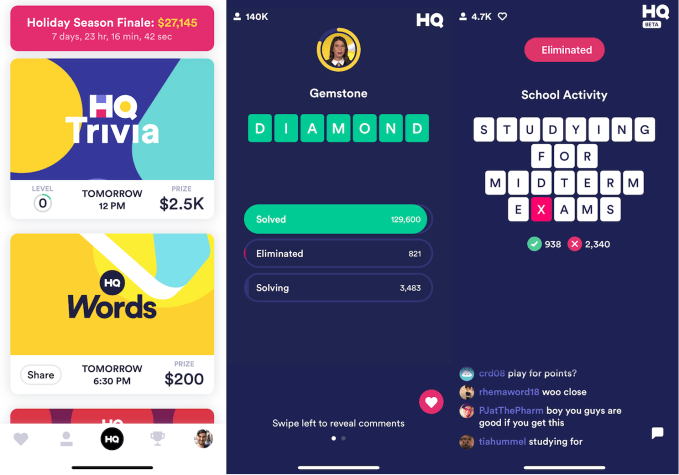

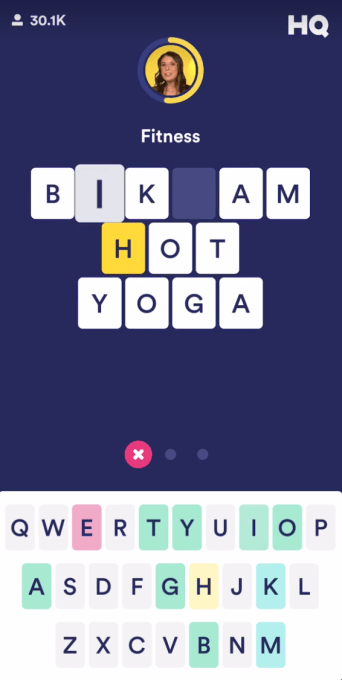

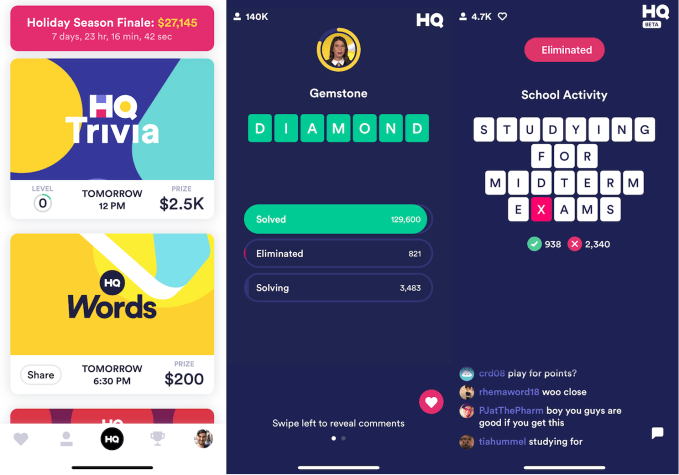

HQ’s expansion beyond trivia is emerging from beta, but the question is whether it’s different and accessible enough to revive the startup’s growth. HQ Words opens to everyone today with games at 6:30pm PT within the HQ Trivia app after several weeks of closed beta testing of the Wheel of Fortune-style game. The launch will be the first big move of Rus Yusupov now that he’s been officially renamed CEO a week after the tragic death of fellow co-founder and former CEO Colin Kroll, HQ confirms to TechCrunch.

“Intermedia Labs introduced the world to a category-defining product, HQ Trivia. Once again, with HQ Words, Intermedia Labs is poised to captivate the world with a revolutionary experience that will bring people together in new ways around live mobile video,” Yusupov tells us. “HQ Words is the most interactive experience we’ve ever made.”

“Intermedia Labs introduced the world to a category-defining product, HQ Trivia. Once again, with HQ Words, Intermedia Labs is poised to captivate the world with a revolutionary experience that will bring people together in new ways around live mobile video,” Yusupov tells us. “HQ Words is the most interactive experience we’ve ever made.”

Kroll’s passing comes at a tough time for HQ. Its daily player count has declined since it became a phenomenon a year ago. The novelty has begun to wear off, and with so many experienced trivia whizzes, cash jackpots are often split between enough people that winners only get a few bucks. Interrupting your days or nights to play at a particular time can be inconvenient compared to the legions of always-available other games. Yusupov, who was HQ’s CEO until Kroll took over in September, will have to figure out what will attract casual crosswords players and those who flocked to Zynga’s Words with Friends — the kind of disruptive thinking Kroll excelled at.

“Colin and I shared many incredible life moments over the last 7 years. We embarked on an incredible journey co-founding two breakthrough companies together – and the lessons we learned at Vine and HQ will continue to have a big impact on me. Like many relationships, we’ve also had our challenges – but it was during these challenging times that Colin’s kind soul and big heart would truly shine,” Yusupov wrote in a statement about his co-founder that was originally published by Digiday in a touching memorial post. Between building Vine and HQ together, the pair have reimagined mobile entertainment, giving millions a chance to show off their wits and creativity. “He had this incredible ability to make everyone feel special. He listened well. He thought deeply. But above all, he cared about people more than work. The driving force behind his innovations was the positive impact they would have on people and world. Colin’s innovations and inventions have changed many people’s lives for the better and will continue to impact the world for years to come.”

HQ Trivia’s co-founder and former CEO Colin Kroll passed away earlier this month

In HQ Words, players compete live to solve word puzzles by correctly choosing which letters are hidden. You can find the game inside the existing HQ Trivia iOS and Android apps. Host Anna Roisman pluckily provides a clue and then dispenses hints as the 25-second timer for each puzzle counts down. If the clue is “gemstone” and you’re shown “_ _ _ m _ _ _”, you’ll have to tap D, I, A, O, and N in any order. Choose three wrong letters or fail to fill out the words and you lose. You’ll spin a wheel before the game starts to get one letter that’s automatically revealed each round.

Make it through 10 rounds and you and other winners get a cut of the cash prize, with the three who solved the puzzles fastest scoring a bigger chunk of the jackpot. The startup earns money through selling you extra lives inside Words, though it will probably feature sponsored games and product placement like Trivia does to pull in marketing dollars. Words will go live daily at 6:30pm Pacific after Trivia’s 6:00 game, so you can turn it into HQ hour with family and friends.

HQ Words is much more frenetic than Trivia. Rather than picking a single answer, you have to rapidly tap letters through a combination of educated and uneducated guesses. That means it really does feel more interactive, since you’re not sitting for minutes with just a sole answer tap to keep you awake. And because it doesn’t require deep and broad trivia knowledge, Words could appeal to a wider audience. The spinner also adds an element of pure luck, as a weaker player who gets to auto-reveal a vowel might fare better than a wiser player who gets stuck with a “Z” like I always seem to.

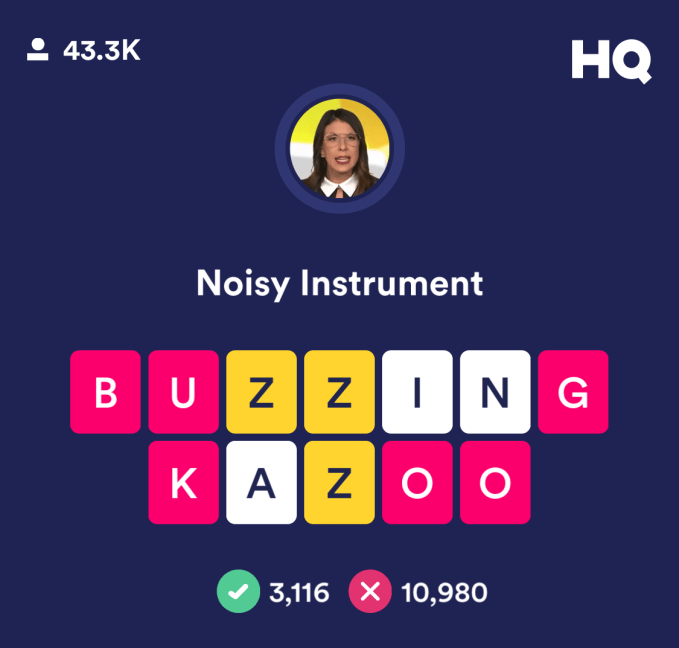

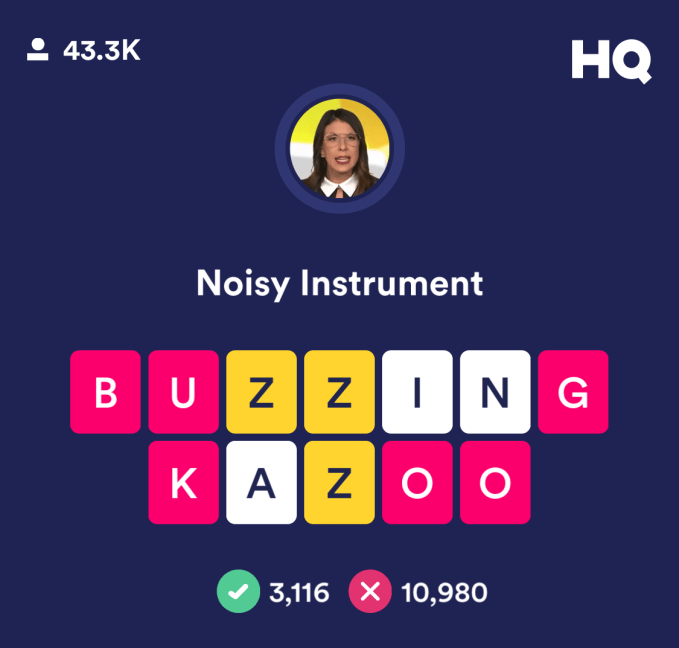

The concern is that at its core, Words is still quite similar to Trivia. They’re both real-time, elimination round-based knowledge games played against everyone for money. Both at times feel like they use cheap tricks to eliminate you. A recent Words puzzle asked you to name a noisy instrument, but the answer wasn’t “kazoo” but “buzzing kazoo” — something I’m not sure anyone has ever formally called it. Given the faster pace of interaction, even tiny glitches or moments of lag can be enough to make you lose a round. An HQ Words beta game earlier this week failed to show some users the keyboard, causing mass elimination. The pressure to get HQ’s engineering working flawlessly has never been higher.

The phrasing of some HQ Words answers seems like a stretch

HQ originally agreed to let TechCrunch interview Kroll about what makes Words different enough to change the startup’s momentum. Yusupov was supposed to fill in after Kroll was sadly found dead last Friday of an apparent drug overdose. He later declined to talk or provide written responses. That’s understandable during this time of mourning and transition. But HQ will still need to build an answer into its app. Meanwhile, Chinese clones and U.S competitors have begun co-opting the live video quiz idea. Facebook has even built a game show platform for content makers to create their own.

HQ could benefit from a better onboarding experience that lets people play a sample game solo to get them hooked and tide them over until the next scheduled broadcast. Mini-games or ways to play along after you’re eliminated could boost total view time and the value of brand sponsorships. A “quiet mode” that silences the between-round chatter and distills HQ to just the questions and puzzles might make it easier to play while multi-tasking. Head-to-head versions of Trivia and Words might help HQ feel more intimate, and there’s an opportunity to integrate peer-to-peer gambling like ProveIt trivia. And branching out beyond knowledge games into more social or arcade-style titles would counter the idea that HQ is just for brainiacs.

HQ could benefit from a better onboarding experience that lets people play a sample game solo to get them hooked and tide them over until the next scheduled broadcast. Mini-games or ways to play along after you’re eliminated could boost total view time and the value of brand sponsorships. A “quiet mode” that silences the between-round chatter and distills HQ to just the questions and puzzles might make it easier to play while multi-tasking. Head-to-head versions of Trivia and Words might help HQ feel more intimate, and there’s an opportunity to integrate peer-to-peer gambling like ProveIt trivia. And branching out beyond knowledge games into more social or arcade-style titles would counter the idea that HQ is just for brainiacs.

Around the height of HQ’s popularity it raised a $15 million funding round at a $100 million valuation. That seems justified, given HQ will reportedly earn around $10 million in revenue this year. Gamers are fickle, though, and today’s Fortnite can wind up tomorrow’s Pokémon GO — a flash in the pan that fizzles out. Words is a great bridge to a world outside of Trivia, but HQ must evolve, not just iterate.

Powered by WPeMatico

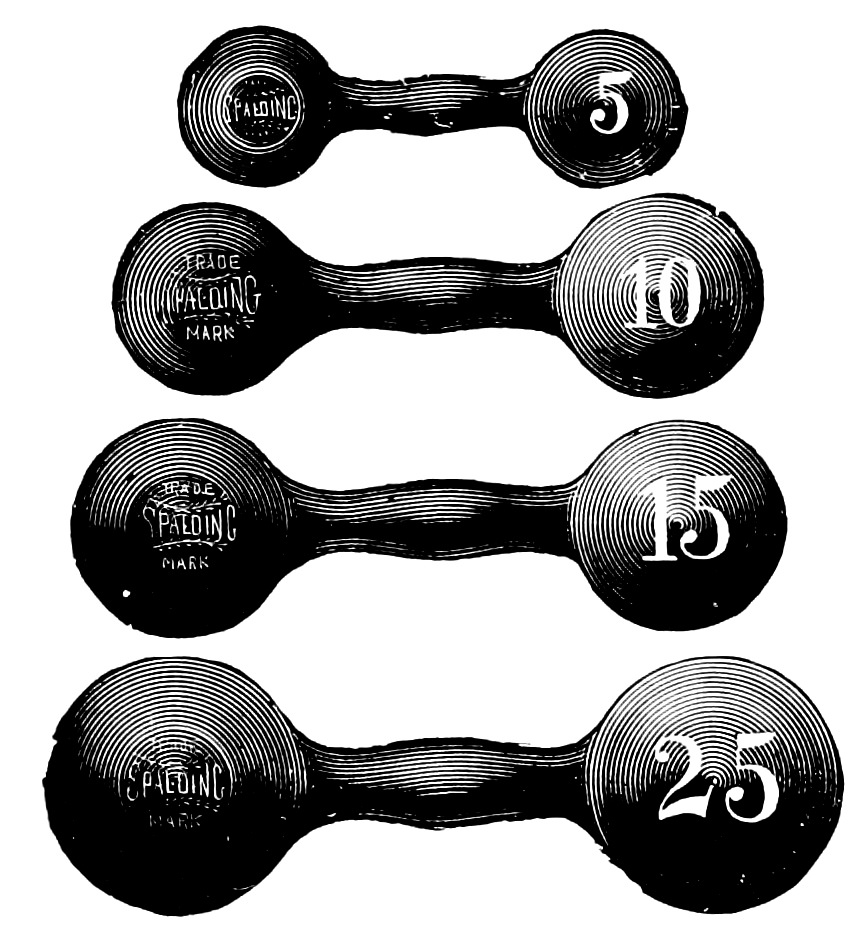

Many founders believe in the myth that the first steps of starting a business are the hardest: Attracting the first investment, the first hires, proving the technology, launching the first product and landing the first customer. Although those critical first steps are difficult, they are certainly not the most difficult on the arduous path of building an iconic company. As early and late-stage funding becomes more abundant, founders and their early VC backers need to get smarter about how to position their companies for a looming valley of death in-between. As we’ll learn below, it’s only going to get much, much harder before it gets easier.

Money will have the look, and heft, of dumbbells as the economic cycle turns. Expect an abundance of small, seed checks at one end, an abundance of massive checks for clear, breakout companies at the other, and a dearth of capital for expanding companies with early proof points and market traction. Read more on how to best prepare for this inevitable future. (Image courtesy Flickr/CircaSassy)

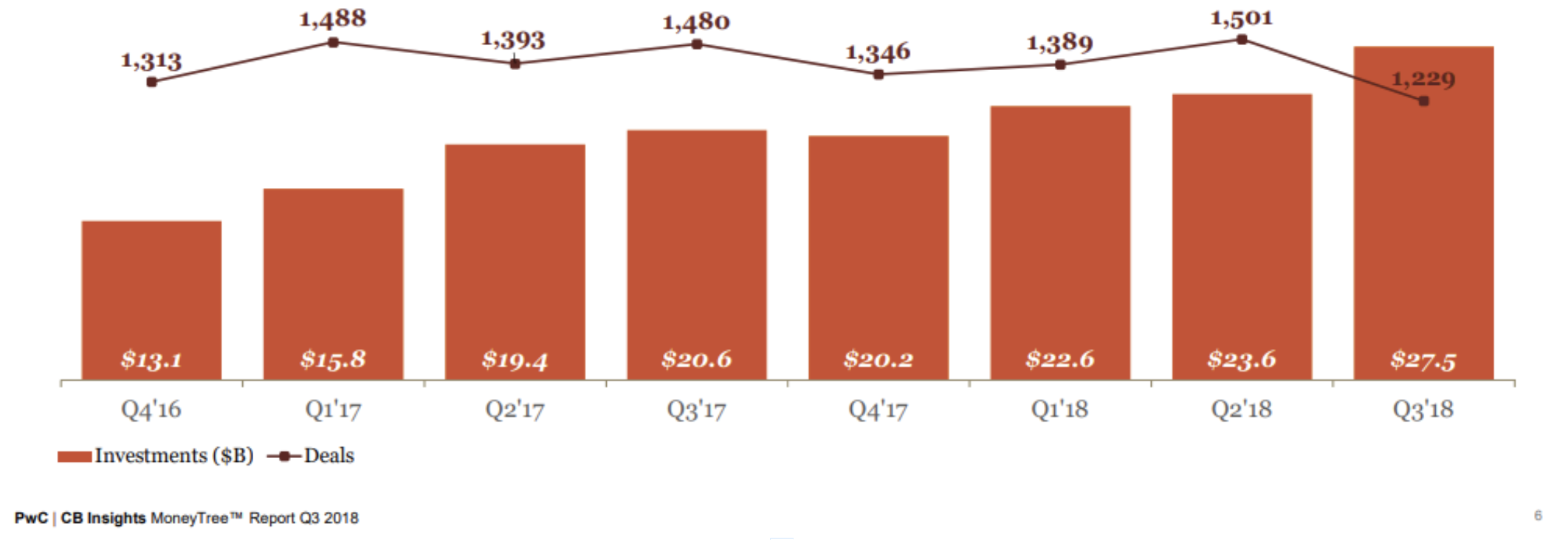

There will be an abundance of capital at the two ends of the startup spectrum. At one end, hundreds of seed and micro VCs, each armed with dozens of $250,000-$1 million checks to write every year, are on the prowl for visionary founders with pedigrees and resumes. At the other end, behemoths like SoftBank, sovereigns, as well “early-stage” firms raising larger funds are seeking breakout companies ready for checks that are in the mid-tens to hundreds of millions. There will be a dearth of capital to grow companies from a kernel of a business, to becoming the clear market-defining leader. In fact, we’re already seeing deal volume decreasing significantly as dollars increase, likely evidence of larger checks going into fewer companies.

Even as the overall number of deals decrease below 2012 levels, the overall dollars invested into startups continue to soar. The 200+ “seed-stage” funds formed since 2012 will continue to chase nascent companies. Meanwhile, the increasing number of mega-funds will seek breakout companies into which to make $100 million+ investments. Companies with early traction seeking ~$20 million to grow will be abundant and have difficulty accessing capital.

Founders should no longer assume that their all-star seed and Series A syndicates will guarantee a successful follow-on financing. Progress on recruiting and product development, though necessary, are no longer sufficient for B-rounds and beyond. Founders should be mindful that investors that specialize in leading $20-50 million rounds will have a plethora of well-funded, well-mentored, well-staffed startups with slick presentations, big visions and some early market traction from which to choose.

Today, there is far more capital chasing fewer quality companies. Fewer breakout companies and fear of missing out is making it easy to raise growth rounds with revenue growth, which may not be scalable or even reflective of an attractive business. This is creating false realities and prompting founders to raise big rounds at high prices — which is fine when there is an over-abundance of capital, but can cripple them when capital later becomes scarce. For example, not long ago, cleantech companies, armed with very preliminary sales, raised massive financings from VCs eager to back winners toward scaling into what they characterized as infinite demand. The reality is that the capital required to meet target economics was far greater and demand far smaller. As the private markets turned, access to cash became difficult and most faltered or were acquired for pennies on the dollar.

There is a likely future where capital grows scarce, and investors take a harder look at the underpinnings of revenue, growth and (dis)economies of scale.

What should startup leadership teams emphasize in an inevitable future where the $30 million rounds will be orders of magnitude harder than their $5 million rounds?

Leadership teams put lots of emphasis on revenue. Unfortunately, revenue that’s not representative of the big vision is probably worse than no revenue at all. Companies are initially seeded with the expectation that the founding team can build and sell something. What needs to be proven is the hypothesis that the company can a) build a special product that b) is inexpensive to convince customers to pay for, and c) that those customers represent a massive market. It should be proven that it is unattractive for customers to switch to the inevitable copycats. It should be clear that over time, customers will pay more for additional features, and the cost of acquiring new customers will go down. Simply selling a product to customers that don’t represent that model is worse than not selling anything at all.

Early founding teams are cognitively diverse individuals that can convince early investors that they can overcome the incredible odds of building a company that until now, shouldn’t have existed. They build a unique product, leveraging unique tools satisfying an unmet need. The early teams need to demonstrate the big vision, and that they can recruit the people that can make that vision a reality. Unfortunately, more founders struggle when it comes to recruiting people that have real experience reducing a technology to practice, executing on a product that customers want and charting the path to expand their market with improving unit economics. There are always exceptions of people that do the above for the first time at startups; however, most of today’s iconic startups knew what kind of talent they needed to execute and succeeded in bringing them on board. Who’s on your team?

The attractive SaaS valuation multiples behoove all founders to apply its metrics to their businesses even if they aren’t really SaaS businesses. Sophisticated later-stage investors see right past that and dismiss numbers associated with metrics that are not representative. Semiconductors are about winning dedicated sockets in growing markets. Design tools are about winning and upselling seats in an industry that’s going to be hooked on those tools. Develop a clear understanding of how your business will be measured. Don’t inundate your investor with numbers; present a concise hypothesis for your unfair advantage in a growing market with your current traction being evidence to back it.

“Pouring fuel on the fire” is a misleading metaphor that leads some into believing that capital can grow any business. That’s just as true as watering a plant with a fire hose or putting TNT in your Corolla’s gas tank: most business models and markets simply are not native to the much-sought-after venture growth profile. In fact, most later-stage startups that fail after raising large amounts of capital fail for this reason. Most markets are conducive to businesses with DIS-economies of scale, implying dwindling margins with scale, which is why many businesses are small, serving local, fragmented markets that technology alone cannot consolidate. How do your unit economics improve over time? What are the efficiencies generated by economies of scale? Is there a real network effect that drives these economies?

Image courtesy Getty Images

I expect today’s resourceful founders to seek partners, whether it’s employees, advisors or investors, to help them answer these questions. Together, these cognitively diverse teams will work together to accelerate past any metaphoric valley and build the iconic companies taking humanity to its fantastic future.

Powered by WPeMatico

Malta, the renewable energy storage project born in Alphabet’s moonshot factory X, is now on its own and flush with $26 million from a Series A funding round led by Breakthrough Energy Ventures .

Concord New Energy Group and Alfa Laval also invested in the round.

Project Malta launched last year in Alphabet’s X (formerly Google X) with an aim to build energy storage facilities that can support full-scale power grids. The independent company spun out of Alphabet is now called Malta Inc.

Malta Inc. has developed a system designed to keep power generated from renewable energy or fossil fuels in reserve for longer than lithium-ion batteries. The electro-thermal storage system first captures energy generated from wind, solar or fossil generators on the grid. The collected electricity drives a heat pump, which converts the electrical energy into thermal energy. The heat is stored in molten salt, while the cold is stored in a chilled antifreeze liquid. A heat engine is used to convert the energy back to electricity for the grid when it’s needed.

The system can store electricity for days or even weeks, Malta says.

Malta is going to use the funds to work with industry partners to turn the detailed designs developed and refined at X into industrial-grade machinery for its first pilot system.

BEV, the lead investor in Malta’s Series A round, was created in 2016 by the Breakthrough Energy Coalition, an investor group that includes Microsoft co-founder Bill Gates, John Doerr, chairman of venture firm Kleiner Perkins Caufield & Byers, Alibaba founder Jack Ma, Amazon founder and CEO Jeff Bezos, and SAP co-founder Hasso Plattner.

Powered by WPeMatico

When founder Bobby Farahi met Shaudi “Shoddy” Lynn, it was at a rave in L.A. Farahi has said he was immediately drawn to the fashion sense of Lynn, who was a DJ at the time; she, meanwhile, might have appreciated the business acumen of Farahi, who had already sold a broadcast monitoring service called Multivision to a rival company.

As Farahi told Inc. magazine several years ago, the couple, now married, decided to try their hand at business together, calling it Dolls Kill and selling foxtail keychains before eventually evolving the brand into an online boutique that sells edgy, risqué clothes and accessories from companies like Killstar and Motel, both in the U.K., as well as makeup from another London company called Skinnydip.

Shoppers like what they see, seemingly. Back in 2014, Inc. reported, Dolls Kill, which is based in San Francisco, generated $7.6 million in sales. It was enough to elicit the attention of the consumer-focused venture firm Maveron, which wrote the company a check for $5 million. Now, shows an SEC filing, seven-year-old Dolls Kill is raising $15 million in new equity funding, and it has secured at least $10.7 million toward that end.

Some of that capital is seemingly being used to test out offline stores. Dolls Kill already has one brick-and-mortar store in San Francisco’s famous Haight neighborhood. In August, the company opened a second concept store in a 6,000-square-foot space on Fairfax Avenue in Los Angeles.

Dolls Kill is sometimes likened to Nasty Gal, founded in 2006 by Sophia Amoruso. Nasty Gal had filed for bankruptcy protection in 2016 after raising tens of millions of dollars from investors and reportedly spending heavily on marketing; two storefronts in L.A.; a downtown L.A. headquarters that quadrupled the size of an earlier HQ; and a fulfillment center in Kentucky.

At the time, industry analyst Richie Siegel told the L.A. Times that a central challenge to the company’s growth was Nasty Gal’s target market, suggesting that there is a ceiling to the number of women to whom a brand like Nasty Gal appeals. The company, since acquired by British online retailer Boohoo, continues as an online business only.

Powered by WPeMatico

There are few things in this world more difficult than launching a successful startup. It takes talent, know-how, money and a hell of a lot of good timing and luck. And even with all of those magical components in place, the odds may still be against you.

At TechCrunch, we take pride in covering the best and brightest of the startup world. But while covering the startup world is one of the most exciting and fulfilling parts of our job, death is a part of any life cycle. Sadly, not all startups that burn bright ultimately make it. In fact, most don’t.

As we wrap up this year and look forward to the next, let’s take a moment to remember some of those startups we lost in 2018.

Total Raised: $118 million

Airware created a cloud software system to help construction companies, mining operations and other enterprise customers use drones to inspect equipment for damage. It also tried to build its own drones, but found that it couldn’t compete with giants like China’s DJI.

The shutdown appears to have been very sudden, coming just four days after Airware opened a Tokyo office, with an investment and partnership from Mitsubishi. In a statement, the company said, “Unfortunately, the market took longer to mature than we expected. As we worked through the various required pivots to position ourselves for long-term success, we ran out of financial runway.”

Total Raised: $131.7 million

Blippar was one of the early pioneers in augmented reality, but unfortunately the AR market has yet to live up to the hopes for mainstream adoption. And despite raising a funding round earlier this year, the startup was apparently losing money quickly as it sought new customers.

Not helping matters was some shareholder drama, where an emergency influx of $5 million was blocked by Khazanah, a strategic investment fund from the Malaysian government. In a blog post, the company said this was “an incredibly sad, disappointing, and unfortunate outcome.”

Total Raised: $25.6 million

One of the major casualties of the FAA’s ban on smart luggage, this New York-based startup was forced to close its doors in May. CEO Tomi Pierucci was extremely outspoken when airlines started to enforce the new rules early this year, calling the news “an absolute travesty.”

From the standpoint of Bluesmart, he was right. The startup went all-in on connected luggage, and ultimately found it impossible to adapt when battery packs were no longer allowed on flights. The startup ended all sales and manufacturing, selling what was left of its tech, designs and IP to luggage giant TravelPro.

Total Raised: $760,000

Things came crumbling down for San Francisco-based Doughbies in July, when the 500 Startups-backed, same-day cookie delivery service announced it was shutting down immediately. But it wasn’t because the startup ran out of money. Doughbies was actually profitable. Rather, its founders, Daniel Conway and Mariam Khan, just wanted to move onto something new.

TechCrunch’s Josh Constine argued at the time that Doughbies really didn’t need venture backing and that pressure to deliver adequate returns may have weighed more heavily on Doughbies than it was willing to admit. RIP Doughbies.

Total Raised: $21.5 million

Like many failed startups before it, San Francisco-based Lantern was forced to shutter operations after an acquisition deal fell through. The mental health startup, founded by Nicholas Bui LeTourneau and Alejandro Foung, had raised millions in venture capital funding from the University of Pittsburgh Medical Center’s venture arm, Mayfield and SoftTechVC, but failed to follow through on its promise.

What was that promise? To offer personalized tools to deal with stress, anxiety and body image based on cognitive behavioral therapy techniques via a mobile application. Despite being an early mover in a now overly crowded field of mental wellness apps, Lantern wasn’t able to find enough customers to survive.

Total Raised: $17 million

Smart security camera maker Lighthouse AI had a promising product with a natural language processing system that allowed users to navigate their footage. But it also faced a crowded market, and it seems consumers didn’t embrace the product. The company announced this month that it’s winding down.

“I am incredibly proud of the groundbreaking work the Lighthouse team accomplished – delivering useful and accessible intelligence for our homes via advanced AI and 3D sensing,” wrote CEO Alex Teichman. “Unfortunately, we did not achieve the commercial success we were looking for and will be shutting down operations in the near future.”

Total Raised: N/A

Mayfield, which was originally part of Bosch, created the adorable home robot Kuri. However, it announced in July that it would stop manufacturing Kuri, and followed with an announcement that it would cease operations altogether.

“Our team is beyond disappointed,” the company said in a blog post. “Together we’ve spent the past four years designing and building not just Kuri, but also an equally incredible company culture and spirit.”

Total Raised: $149.5 million

A major player in industrial robotics, Rethink was founded by iRobot co-founder Rod Brooks and former MIT CSAIL staff researcher Ann Whittaker. The Boston area startup grew into one of the most important players in both the collaborative and educational robotics space, courtesy of creations like Baxter and Sawyer.

Ultimately, however, the company served as yet another testament to just how difficult it is to launch a robotics startup. Even with brilliant minds and nearly $150 million in funding, the company couldn’t turn enough profit to stay afloat. A last-minute planned acquisition fell through, and Rethink was forced to close up shop in October.

Total Raised: $1.4 billion

Startup stories don’t come more film-ready than this. Even before it officially closed its doors, Theranos was set to be the subject of a book, documentary and an Adam McKay-directed feature film starring Jennifer Lawrence as founder Elizabeth Holmes. Holmes founded the company in 2003, promising a breakthrough in blood testing. By age 31, she became the world’s youngest self-made billionaire.

Theranos would go on to raise $1.4 billion, with a $10 billion valuation at its peak. In 2015, medical professionals began to mount criticism against the company’s methods. The following year, the SEC began investigating Theranos, ultimately charging it with “massive fraud.” In September, the company finally called it quits, with Holmes agreeing to pay a $500,000 penalty, while being barred from serving as an officer or director of a public company for 10 years.

Total Raised: $62 million

NEW YORK, NY – MAY 06: Co-founder and CEO of Shyp, Kevin Gibbons speaks onstage during TechCrunch Disrupt NY 2015 – Day 3 at The Manhattan Center on May 6, 2015 in New York City. (Photo by Noam Galai/Getty Images for TechCrunch)

A $250 million valuation and capital from some of the best investors (Kleiner Perkins, Slow Ventures) failed to keep on-demand shipping startup Shyp from dissolving. The San Francisco-based startup raised multiple rounds of venture capital amid a major hype cycle for on-demand shipping companies, but wasn’t able to scale successfully beyond the Bay Area.

“To this day, I’m in awe of the vigor the team possessed in tackling a 200-year-old industry,” CEO Kevin Gibbon wrote at the time. “But, growth at all costs is a dangerous trap that many startups fall into, mine included.”

Total Raised: $54.4 million

Over the past few years, Telltale Games seemed to reinvent adventure gaming, adapting big franchises like The Walking Dead, Game of Thrones and Batman into episodic stories where players’ choices seemed to have real weight. It even partnered with Netflix to bring a version of “Minecraft: Story Mode” to the streaming service.

But it seems the company has had longstanding business issues, with 90 employees laid off in November 2017, then another 250 let go in September of this year. Although a skeleton crew remained employed to finish the work for Netflix, it looks like Telltale is dead. And the fact that those employees were let go without severance seems to reinforce an earlier report of toxic management.

Powered by WPeMatico

Captiv8, a company offering tools for brands to manage influencer marketing campaigns, has released its 2018 Fraud Influencer Marketing Benchmark Report. The goal is to give marketers the data they need to spot fake followers — and thus, to separate the influencers with a real following from those who only offer the illusion of engagement.

The report argues that that this a problem with a real financial impact (it’s something that Instagram is working to crack down on), with $2.1 billion spent on influencer marketing on Instagram in 2017 and 11 percent of the engagement coming from fraudulent accounts.

“For influencer marketing to truly deliver on its transformative potential, marketers need a more concrete and reliable way to identify fake followers and engagement, compare their performance to industry benchmarks, and determine the real reach and impact of social media spend,” Captiv8 says.

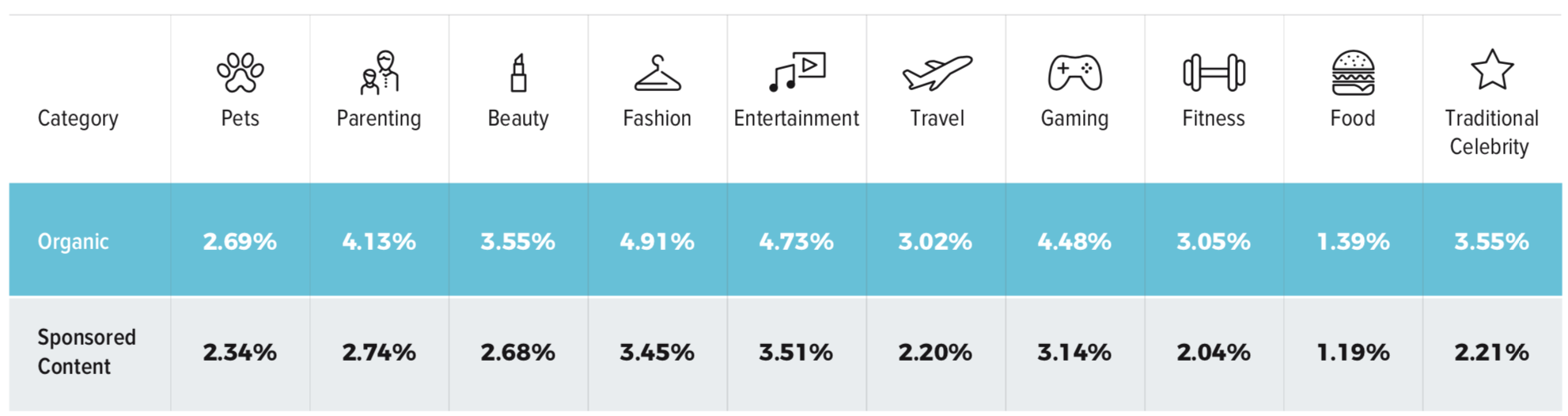

So the company looked at a range of marketing categories (pets, parenting, beauty, fashion, entertainment, travel, gaming, fitness, food and traditional celebrity) and randomly selected 5,000 Instagram influencer accounts in each one, pulling engagement from August to November of this year.

The idea is to establish a baseline for standard activity, so that marketers can spot potential red flags. Of course, everyone with a significant social media audience is going to have some fake followers, but Captiv8 suggests that some categories have a higher rate of fraud than others — fashion was the worst, with an average of 14 percent of fake activity per account, compared to traditional celebrity, where the average was just 4 percent.

So what should you look out for? For starters, the report says the average daily change in follower counts for an influencer is 1.2 percent, so be on the lookout for shifts that are significantly larger.

The report also breaks down the average engagement rate for organic and sponsored content by category (ranging from 1.19 percent for sponsored content in food to 3.51 percent in entertainment), and suggests that a lower engagement rate “shows a high probability that their follower count is inflated through bots or fake followers.”

Conversely, it says it could also be a warning sign if a creator’s audience reach or impressions per user is higher than the industry benchmarks (for example, image posts in fashion have an average audience reach of 23.69 percent, with 1.32 impressions per unique user).

You can download the full report on the Captiv8 website.

Powered by WPeMatico

There’s been plenty of fanfare surrounding Uber and Lyft’s initial public offerings — slated for early 2019 — since the two companies filed confidential IPO paperwork with the U.S. Securities and Exchange Commission in early December. On top of that, public and private investors have had plenty to say about Slack and Pinterest’s rumored 2019 IPOs but those aren’t the only “unicorn” exits we should expect to witness in the year ahead.

Using its proprietary company rating algorithm, data provider CB Insights ranked five billion dollar companies most likely to perform IPOs next year in its latest tech IPO report. The algorithm analyzes non-traditional public signals, including hiring activity, web traffic and mobile app data to make its predictions. These are the startups that topped their list.

Peloton Co-Founder and CEO John Foley speaks onstage during TechCrunch Disrupt SF 2018 on September 6, 2018 in San Francisco, California. (Photo by Kimberly White/Getty Images for TechCrunch).

Peloton, dubbed the “Netflix of fitness,” has raised nearly $1 billion in venture capital funding in the six years since it was founded by John Foley, most recently raising $550 million at a $4 billion valuation. The manufacturer of tech-enabled exercise equipment is more than doubling in size every year and is “weirdly profitable,” an unusual characteristic for a venture-backed business of its age. Headquartered in New York, Peloton doesn’t have any public IPO plans, though Foley recently told The Wall Street Journal that 2019 “makes a lot of sense” for its stock market debut.

Select investors: L Catterton, True Ventures, Tiger Global

Cloudflare co-founder and CEO Matthew Prince appears on stage at the 2014 TechCrunch Disrupt Europe/London. (Photo by Anthony Harvey/Getty Images for TechCrunch)

Cybersecurity unicorn Cloudflare is likely to transition to the public markets in the first half of 2019 in what is poised to be a strong year for IPOs in the security industry. The web performance and security platform is said to be preparing for an IPO at a potential valuation of more than $3.5 billion after last raising capital in 2015 at a $1.8 billion valuation. Since it was founded in 2009, the San Francisco-based company has raised just north of $250 million in VC funding. CrowdStrike, another security unicorn, is also on track to go public next year and it wouldn’t be surprising to see Illumio and Lookout make the jump to the public markets as well.

Select investors: Pelion Venture Partners, NEA, Venrock

San Jose-based Zoom Video Communications has reportedly tapped Morgan Stanley to lead its upcoming IPO.

Zoom, a provider of video conferencing services, online meeting and group messaging tools that’s raised $160 million in VC cash to date, is eyeing a multi-billion IPO in 2019 and has reportedly hired Morgan Stanley to lead the offering. Founded in 2011, the company most recently brought in a $100 million Series D financing, entirely funded by Sequoia, at a $1 billion valuation in early 2017. Based in San Jose, Zoom is hoping to garner a valuation significantly larger than $1 billion when it IPOs, according to Reuters.

Select investors: Sequoia, Emergence Capital Partners, Horizons Ventures

Data management company Rubrik co-founder and CEO Bipul Sinha.

Data management company Rubrik has quietly made moves indicative of an impending IPO. The startup, which provides data backup and recovery services for businesses across cloud and on-premises environments, hired former Atlassian chief financial officer Murray Demo as its CFO earlier this year, as well as its first chief legal officer, Peter McGoff. Palo Alto-based Rubrik was valued at over of $1 billion with a $180 million funding round in 2017. The company has raised nearly $300 million to date.

Select investors: Lightspeed Venture Partners, Greylock, Khosla Ventures

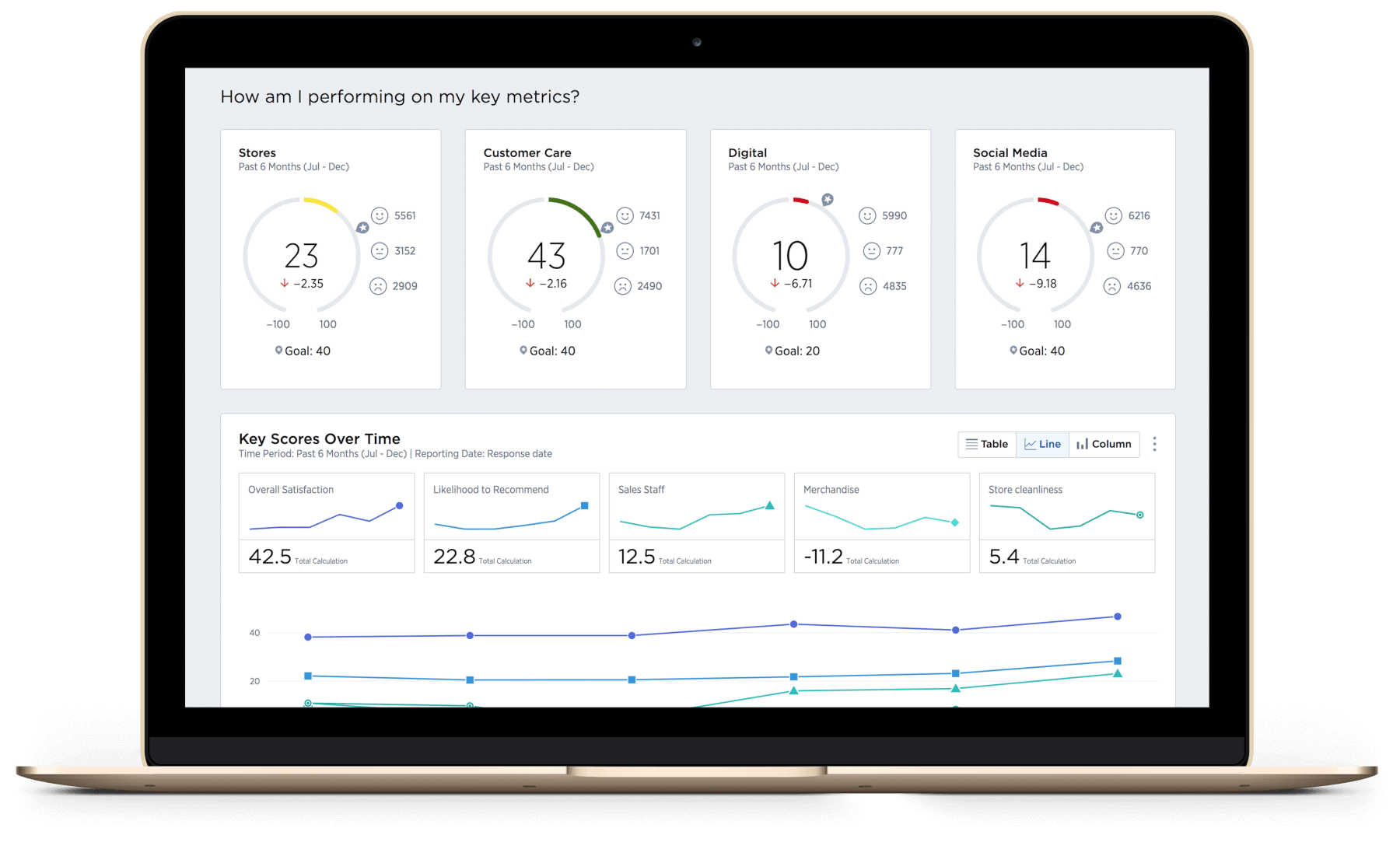

Medallia, a customer experience management platform that’s nearly two decades old, may finally become a public company in 2019. The San Mateo-based company, which has been rumored to be planning an IPO for several years, hired a new CEO this year and reported $250 million in GAAP revenue for the year ending Jan. 31, 2018, according to Forbes. Medallia hasn’t raised capital since 2015, when it secured a $150 million funding deal at a $1.2 billion valuation. It has raised a total of just over $250 million.

Select investor: Sequoia

Powered by WPeMatico

HQ’s expansion beyond trivia emerges from beta tonight, but the question is whether it’s different and accessible enough to revive the startup’s growth. HQ Words opens to everyone with today’s 6:30pm pacific broadcast within the HQ Trivia app after several weeks of closed beta testing of the Wheel Of Fortune-style game. The launch will be the first big move of Rus Yusupov now that’s been officially renamed CEO a week after the tragic death of fellow co-founder and former CEO Colin Kroll, HQ confirms to TechCrunch.

“Intermedia Labs introduced the world to a category defining product, HQ Trivia. Once again, with HQ Words, Intermedia Labs is poised to captivate the world with a revolutionary experience that will bring people together in new ways around live mobile video” Yusupov tells us. “HQ Words is the most interactive experience we’ve ever made.”

“Intermedia Labs introduced the world to a category defining product, HQ Trivia. Once again, with HQ Words, Intermedia Labs is poised to captivate the world with a revolutionary experience that will bring people together in new ways around live mobile video” Yusupov tells us. “HQ Words is the most interactive experience we’ve ever made.”

Kroll’s passing comes at a tough time for HQ. Its daily player count has declined since it became a phenomenon a year ago. The novelty has begun to wear off, and with so many experienced trivia whizzes, cash jackpots are often split between enough people that winners only get a few bucks. Interrupting your days or nights to play at a particular time can be inconvenient compared to the legions of always-available other games. Yusupov, who was HQ’s CEO until Kroll took over in September, will have to figure out what will attract casual crosswords players and those who flocked to Zynga’s Words With Friends — the kind of disruptive thinking Kroll excelled at.

“Colin and I shared many incredible life moments over the last 7 years. We embarked on an incredible journey co-founding two breakthrough companies together – and the lessons we learned at Vine and HQ will continue to have a big impact on me. Like many relationships, we’ve also had our challenges – but it was during these challenging times that Colin’s kind soul and big heart would truly shine” Yusupov wrote in a statement about his co-founder that was originally published by Digiday in a touching memorial post. Between building Vine and HQ together, the pair have reimagined mobile entertainment, giving millions a chance to show off their wits and creativity. “He had this incredible ability to make everyone feel special. He listened well. He thought deeply. But above all, he cared about people more than work. The driving force behind his innovations was the positive impact they would have on people and world. Colin’s innovations and inventions have changed many people’s lives for the better and will continue to impact the world for years to come.”

HQ Trivia’s co-founder and former CEO Colin Kroll passed away earlier this month

In HQ Words, players compete live to solve word puzzles by correctly choosing what letters are hidden. You can find the game inside the existing HQ Trivia iOS and Android apps. Host Anna Roisman pluckily provides a clue and then dispenses hints as the 25-second timer for each puzzle counts down. If the clue is “gemstone” and you’re shown “_ _ _ m _ _ _”, you’ll have to tap D, I, A, O, and N in any order. Choose three wrong letters or fail to fill out the words and you lose. You’ll spin a wheel before the game starts to get one letter that’s automatically revealed each round.

Make it through ten rounds and you and other winners get a cut of the cash prize, with the three who solved the puzzles fastest scoring a bigger chunk of the jackpot. The startup earns money through selling you extra lives inside Words, though it will probably feature sponsored games and product placement like Trivia does to pull in marketing dollars. Words will go live daily at 6:30pm pacific after Trivia’s 6:00 game, so you can turn it into HQ hour with family and friends.

HQ Words is much more frenetic than Trivia. Rather than picking a single answer, you have to rapidly tap letters through a combination of educated and uneducated guesses. That means it really does feel more interactive since you’re not sitting for minutes with just a sole answer tap to keep you awake. And because it doesn’t require deep and broad trivia knowledge, Words could appeal to a wider audience. The spinner also adds an element of pure luck, as a weaker player who gets to auto-reveal a vowel might fare better than a wiser player who gets stuck with a “Z” like I always seem to.

The concern is that at its core, Words is still quite similar to Trivia. They’re both real-time, elimination round-based knowledge games played against everyone for money. Both at times feel like they use cheap tricks to eliminate you. A recent Words puzzle asked you to name a noisy instrument, but the answer wasn’t “kazoo” but “buzzing kazoo” — something I’m not sure anyone has ever formally called it. Given the faster pace of interaction, even tiny glitches or moments of lag can be enough to make you lose a round. An HQ Words beta game earlier this week failed to show some users the keyboard, causing mass elimination. The pressure to get HQ’s engineering working flawlessly has never been higher.

The phrasing of some HQ Words answers seems like a stretch

HQ originally agreed to let TechCrunch interview Kroll about what makes Words different enough to change the startup’s momentum. Yusupov was supposed to fill in after Kroll was sadly found dead last Friday of an apparent drug overdose. He later declined to talk or provide written responses. That’s understandable during this time of mourning and transition. But HQ will still need to build an answer into its app. Meanwhile, Chinese clones and US competitors have begun co-opting the live video quiz idea. Facebook has even built a game show platform for content makers to create their own.

HQ could benefit from a better onboarding experience that lets people play a sample game solo to get them hooked and tide them over until the next scheduled broadcast. Mini-games or ways to play along after you’re eliminated could boost total view time and the value of brand sponsorships. A “quiet mode” that silences the between-round chatter and distills HQ to just the questions and puzzles might make it easier to play while multi-tasking. Head-to-head versions of Trivia and Words might help HQ feel more intimate, and there’s an opportunity to integrate peer-to-peer gambling like ProveIt trivia. And branching out beyond knowledge games into more social or arcade-style titles would counter the idea that HQ is just for brainiacs.

HQ could benefit from a better onboarding experience that lets people play a sample game solo to get them hooked and tide them over until the next scheduled broadcast. Mini-games or ways to play along after you’re eliminated could boost total view time and the value of brand sponsorships. A “quiet mode” that silences the between-round chatter and distills HQ to just the questions and puzzles might make it easier to play while multi-tasking. Head-to-head versions of Trivia and Words might help HQ feel more intimate, and there’s an opportunity to integrate peer-to-peer gambling like ProveIt trivia. And branching out beyond knowledge games into more social or arcade-style titles would counter the idea that HQ is just for brainiacs.

Around the height of HQ’s popularity it raised a $15 million funding round at a $100 million valuation. That seems justified given HQ will reportedly earn around $10 million in revenue this year. Gamers are fickle, though, and today’s Fortnite can wind up tomorrow’s Pokemon Go — a flash in the pan that fizzles out. Words is a great bridge to a world outside of Trivia, but HQ must evolve not just iterate.

Powered by WPeMatico