Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

The Intercontinental Exchange’s (ICE) cryptocurrency project Bakkt celebrated New Year’s Eve with the announcement of a $182.5 million equity round from a slew of notable institutional investors. ICE, the operator of several global exchanges, including the New York Stock Exchange, established Bakkt to build a trading platform that enables consumers and institutions to buy, sell, store and spend digital assets.

This is Bakkt’s first institutional funding round; it was not a token sale. Participating in the round are Horizons Ventures, Microsoft’s venture capital arm (M12), Pantera Capital, Naspers’ fintech arm (PayU), Protocol Ventures, Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital, Goldfinch Partners and more.

Bakkt is currently seeking regulatory approval to launch a one-day physically delivered Bitcoin futures contract along with physical warehousing. The startup initially planned for a November 2018 launch, but confirmed this morning an earlier CoinDesk report that it was delaying the launch to “early 2019” as it awaits permission from the Commodity Futures Trading Commission. Along with the funding, crypto news blog The Block Crypto also reports Bakkt has hired Balaji Devarasetty, a former vice president at Vantiv, as its head technology.

ICE’s crypto project was first announced in August and is led by chief executive officer Kelly Loeffler, ICE’s long-time chief communications and marketing officer. Bakkt quickly inked partnerships with Microsoft, which provides cloud infrastructure to the service, and Starbucks, to develop “practical, trusted and regulated applications for consumers to convert their digital assets into U.S. dollars for use at Starbucks,” Starbucks vice president of payments Maria Smith said in a statement at the time.

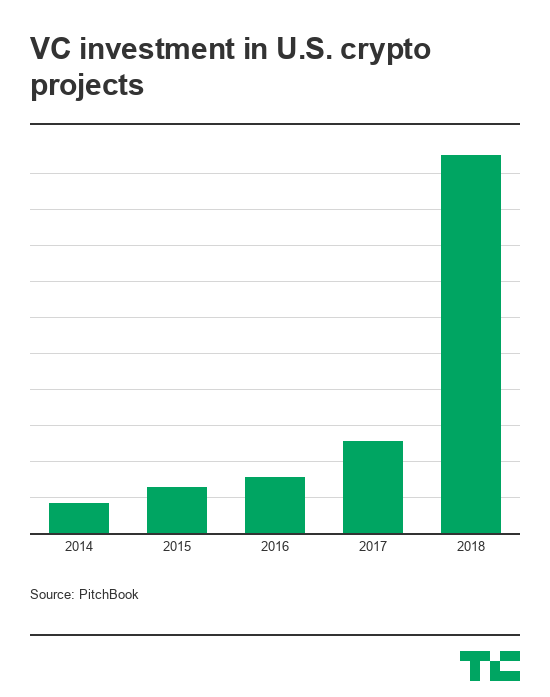

Many Bitcoin startups floundered in 2018, despite record amounts of venture capital invested in the industry. This was as a result of failed initial coin offerings, an inability to scale following periods of rapid growth and the falling price of Bitcoin. Still, VCs remained bullish on Bitcoin and blockchain technology in 2018, funneling a total of $2.2 billion in U.S.-based crypto projects — a nearly 4x increase year-over-year. Around the globe, investment hit a high of $4.6 billion — a more than 4x increase from last year, according to PitchBook.

“Notably, 2018 was the most active year for crypto in its brief ten-year history,” Loeffler wrote. “This was evidenced by rising investment in distributed ledger technology and digital assets, as well as by blockchain network metrics such as daily bitcoin transaction value and active addresses. Yet, these milestones tend to be overshadowed by the more narrow focus on bitcoin’s price, which has been seen by some, as a proxy for the potential of the technology.”

Today, the price of Bitcoin is hovering around $3,700 one year after a historic run valued the cryptocurrency at roughly $20,000. The crash caused many to dismiss Bitcoin and its underlying technology, while others remained committed to the tech and its potential for complete financial disruption. A project like Bakkt, created in-house at a respected financial institution with support from noteworthy businesses, is a logical bet for crypto and traditional private investors alike.

“The path to developing new markets is rarely linear: progress tends to modulate between innovation, dismissal, reinvention, and, finally, acceptance,” Loeffler added. “Each step, whether part of discovery or adversity, ultimately strengthens the product. Twenty years ago, it was controversial to suggest that commodities or bonds could trade electronically on a screen, and many steps were required for that evolution to play out.”

Powered by WPeMatico

Sensor data platform Samsara confirmed this morning that it had closed a new round of funding from existing investors Andreessen Horowitz and General Catalyst that values the startup at $3.6 billion.

The news was first reported by Cheddar, which spotted a filing with the state of Delaware on December 21 disclosing Samsara’s intent to raise a $100 million round at more than double the valuation it garnered upon its $50 million Series D this March.

“Our growth comes from bringing transformational new technologies to solve the problems of operational businesses, a massive segment of the economy that has long been underserved by the technology industry,” wrote Kiren Sekar, Samsara’s vice president of marketing and products, in the funding announcement. “Today, the advent of inexpensive sensors, high-bandwidth wireless connectivity, smartphones, and cloud computing enable these businesses to fully reap the benefits of 21st century technology.”

Founded in 2015, Samsara supports the transportation, logistics, construction, food production, energy and manufacturing industries with its internet-connected sensor systems, which helps businesses collect data and derive insights to improve the efficiency of physical operations.

The company’s co-founders are Sanjit Biswas and John Bicket, who previously launched Meraki, an enterprise Wi-Fi startup acquired by Cisco in an all-cash $1.2 billion deal in 2012.

Samsara’s latest financing brings the company’s total raised to $230 million. According to PitchBook, Andreessen Howoritz and General Catalyst are the only two private investors in the company, with Marc Andreessen and Hemant Taneja of General Catalyst representing the venture capital firms as lead investors on several Samsara deals.

San Francisco-based Samsara says revenue grew 250 percent in 2018 as its customer base swelled to 5,000. As for how it will deploy the new capital, the company plans to hire 1,000 employees, double down on AI and computer vision technology and open its first East Coast office in Atlanta.

The startup has yet to spend a dime of its last financing round, evidence it, like many other venture-funded startups, is pulling in capital before a market downturn strikes the industry and makes it increasingly difficult to raise hefty sums at impressive valuations.

“While the company already had a healthy balance sheet – we hadn’t dipped into our previous round of funding – the new capital enables us to accelerate long-term product investments and expand into new markets while continuing to maintain a strong balance sheet over the long term,” wrote Sekar.

Powered by WPeMatico

About 13 years ago I faced an excruciating decision: whether to sell my company, Pinnacle Systems, to a private equity firm or to another large public company. I felt that both suitors would treat my employees well (and I negotiated hard to make sure that was the case), and both offered a good asking price well above our value on NASDAQ.

After raising what at the time felt like my first child, born in my living room and nurtured into a publicly traded entity, I was ready for it to take its next step and for me to take mine. I ultimately opted for the strategic sale, but I left the process intrigued by what was already an evolving dynamic between private equity firms and tech exits.

In years past, stigma often accompanied private equity sales. I know I felt that way, even under strong deal terms. Plus, private equity exits were only available to companies generating substantial annual revenues and often profits, making this exit option inaccessible for many startups. Today, private equity buyout firms can provide a solid (and on occasion excellent) exit route — as well as an increasingly common one, accounting for 18.5 percent of VC-backed exits in 2017.

Private equity firms are investing in a broad array of technology companies, including highly valued unicorns, but also early- to mid-stage profitable and unprofitable companies that a few years ago would have been unable to secure interest from these buyout firms.

In addition, the lines between venture capital and private equity are increasingly blurring, with more private equity investments in tech, and several-late stage VC firms creating large, billion-dollar plus late-stage growth funds. Further blurring the lines, some of the late-stage VC firms are taking controlling interests in startups, a strategy typically associated with private equity. Recently, one of our portfolio companies received an investment from a late-stage VC firm that acquired a majority stake by providing liquidity to some existing shareholders and investing in the company, utilizing a strategy typically associated with PE buyout firms.

The rise of private equity buyouts within the tech sector presents a viable exit option for founders, given the reality that most startups won’t ultimately IPO. (According to PitchBook, only 3 percent of venture-backed companies in the last decade eventually went public.)

If an IPO is not a realistic long-term option, the remaining primary exit option has typically been a sale to another company (a strategic buyer, in venture parlance). However, in the past few years, private equity firms have become aggressive buyers of private companies, sometimes bidding as high as or higher than strategic buyers. With one of my portfolio companies, a private equity buyer placed the second highest bid ahead of all but one strategic buyer and helped raise the final price from the strategic buyer just by being in the bidding process.

Founders who find themselves in negotiations with strategic buyers should also reach out to PE firms to optimize the outcome. Silver Lake, Francisco Partners, Thoma Bravo and Vista are a few technology-focused PE firms, and PitchBook’s annual liquidity report lists other firms. Vista has been especially active, acquiring many technology companies, including Infoblox, Lithium and Marketo. Not all PE firms are the same, just like not all VCs and strategic buyers are the same.

Years ago, when private equity buyouts were typically only large deals, new management teams were almost always brought in to tweak the edges of already successful companies. Today, each private equity firm has its own strategy — some only buy large profitable companies, others focus on mid-size acquisitions and some only buy early-stage (typically unprofitable) companies, which brings us to the next point.

Even early-stage startups can explore a PE exit, especially if things are not going well

While most readers are familiar with private equity buyers at later stages, what’s new is the emergence of PE activity at early stages. These firms acquire majority stakes in startups that have only raised early-stage investments but are having trouble scaling or raising the next round.

After a buyout, these private equity firms typically provide value by adding the missing elements, such as marketing or sales know-how, in order to kick-start the business and achieve scale. Their goal is to increase the value of the underlying asset by augmenting founder teams with the buyout firm’s own operational experts, sometimes combining newly acquired assets with already existing assets to create a stronger whole, or doubling-down on promising products (while shedding less promising offerings) to unlock potential.

Typically, these PE firms then sell the company to another company (usually a strategic buyer) for greater value. In some cases, these early-stage PE firms sell to another PE buyout firm further up market. In some of these acquisitions, founders can maintain minority ownership in the company (though not a controlling stake), which they can carry through to their “next exit.”

Unlike PE buyouts at later stages, PE buyouts at the earlier stages are not usually high-value exits; they are mostly an avenue to provide the founders some return for their hard work, rather than the disappointing returns they can expect from an acqui-hire or, even worse, a shutdown. If negotiated correctly, a private equity deal can give founders an opportunity to play another hand to the next exit.

Few founders create companies in order to flip them. Strong entrepreneurs create companies to transform their missions into reality and positively impact the world. Steve Jobs said, “I’m convinced that about half of what separates the successful entrepreneurs from the non-successful ones is pure perseverance.” An acquisition — particularly to private equity — may not have been the original goal, but it may fuel the continued pursuit of the founder’s mission. Or, perhaps it will enable the pursuit of a new and worthy mission.

Powered by WPeMatico

2018 saw Africa’s tech sector become more dynamic and international. VC firms on the continent multiplied. There were numerous investment rounds. And startups pursued acquisitions and global expansion. Here’s a snapshot of the news that shaped African tech over the last year.

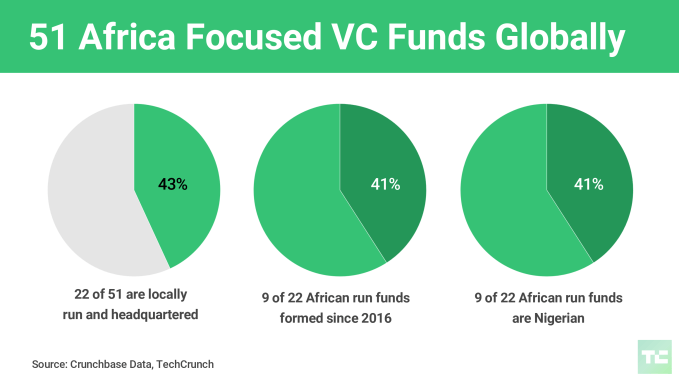

A notable 2018 trend was Africa’s VC landscape becoming more African, with an increasing number of investment funds headquartered on the continent and run by locals, according to Crunchbase data released in this TechCrunch exclusive.

Drawing on its database and primary source research, Crunchbase identified 51 viable Africa-focused VC funds globally with at least 7-10 investments in African startups from seed to series stage.

Of the 51 funds, 22 (or 43 percent) were headquartered in Africa and managed by Africans. Of those 22, nine (or 41 percent) were formed since 2016 and nine were Nigerian.

Four of the nine Nigeria-based funds were formed within the last year: Microtraction, Neon Ventures, Beta.Ventures and CcHub’s Growth Capital fund.

Four of the nine Nigeria-based funds were formed within the last year: Microtraction, Neon Ventures, Beta.Ventures and CcHub’s Growth Capital fund.

The Crunchbase study also tracked more Africans in top positions at outside funds and the rise of homegrown corporate venture arms.

One of those entities with a corporate venture arm, Naspers, announced a $100 million fund named Naspers Foundry to invest in South African tech startups. This was part of a $300 million (4.6 billion Rand) commitment by the South African media and investment company to support South Africa’s tech sector overall, as reported here at TechCrunch.

Another DFI came on the scene when France announced a $76 million African startup fund administered by the French Development Agency, AFD. TechCrunch got the skinny on how it will work here.

If African VC investment headlines were scarce a decade ago, in 2018 we became overwhelmed with them. This was largely a result of several recently closed Africa funds — TLcom’s $40 million, Partech’s $70 million, TPG’s 2 billion — beginning to deploy that capital.

In March, Nigerian consumer data analytics firm Terragon raised $5 million from TLcom. Kenyan business enterprise software company Africa’s Talking raised $8.6 million in a round led by IFC.

Investment startup Piggybank.ng closed $1.1 million in seed funding and announced a new product — Smart Target, for traditional savings groups. Trucking Logistics company Kobo360 raised two rounds, for a total of $7.2 million. Kenya-based agtech supply chain startup Twiga Foods raised $10 million. B2B retail supply chain Sokowatch closed a $2 million seed round led by 4DX ventures.

White-label lending startup Mines.io secured a $13 million Series A round. South African SME payment venture Yoco raised $16 million. Paga Payments added $10 million in fresh funding.

White-label lending startup Mines.io secured a $13 million Series A round. South African SME payment venture Yoco raised $16 million. Paga Payments added $10 million in fresh funding.

And then there were the three huge raises of the year. Kenyan digital payment company Cellulant hauled in $37.5 million in a Series C round led by TPG Growth. South African lending startup Jumo raised $52 million led by Goldman Sachs. And just this month, The Carlyle Group invested $40 million in Africa-focused online travel site Wakanow.com.

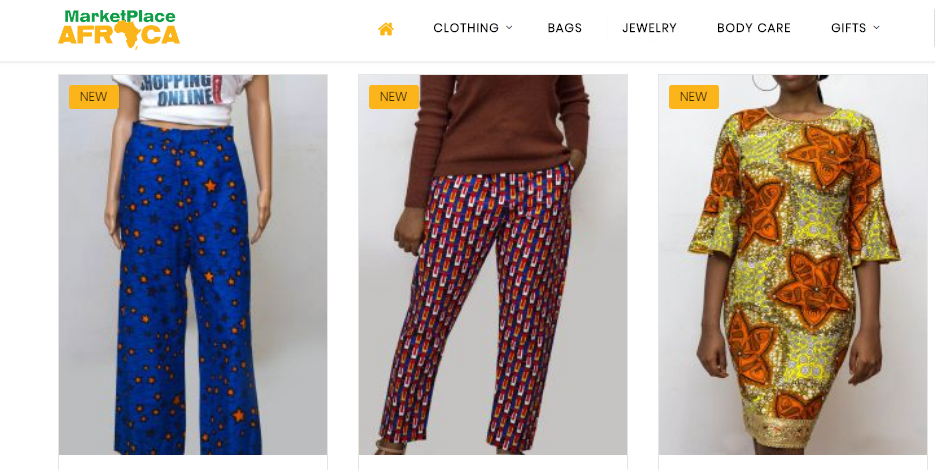

In 2018, African tech demonstrated it can travel, as several digital companies expanded on the continent and abroad. In May, MallforAfrica and DHL launched MarketPlaceAfrica.com, a global e-commerce site for select African artisans to sell wares to buyers in any of DHL’s 220 delivery countries.

Paga announced plans to expand in Africa and internationally, with an eye on Ethiopia, Mexico and the Philippines, CEO Tayo Oviosu told TechCrunch. Kobo360 is moving into in new markets — Ghana, Togo and Cote D’Ivoire.

Paga announced plans to expand in Africa and internationally, with an eye on Ethiopia, Mexico and the Philippines, CEO Tayo Oviosu told TechCrunch. Kobo360 is moving into in new markets — Ghana, Togo and Cote D’Ivoire.

On the back of its $52 million round, Jumo said it would expand in Asia and started by opening an office in Singapore.

On the acquisition front, Terragon bought Asian mobile marketing company Bizense in a cash and stock deal. The company is exploring greater growth opportunities in Latin America and Southeast Asia, CEO Elo Umeh told TechCrunch.

TPG Growth acquired a majority stake (of an undisclosed value) in Africa entertainment content company TRACE. After previous investments, Naspers acquired 96 percent of Southern African e-commerce venture Takealot.

And in December, California-based Emergent Technology Holdings acquired Ghanaian fintech payment company InterpayAfrica.

Collaboration between local tech firms and big global names continued in 2018. Liquid Telecom and Microsoft continued their partnership to offer connectivity cloud services such as Microsoft’s Azure, Dynamics 365 and Office 365 to select startups and hubs. This is part of Liquid Telecom’s strategy to go long on Africa’s startups as its future clients and the continent’s next big companies.

Facebook teamed up with Nigerian tech hub CcHub to launch its NG_Hub high-tech incubator.

As crypto fever gripped many leading economies in 2018, Africa was shaping its own blockchain narrative — one more grounded in utility than speculation. 500 Startups-backed SureRemit launched a crypto token product aimed at disrupting Africa’s multi-billion-dollar remittance market and raised $7 million in an ICO. South African payments venture Wala and solar energy startup Sun Exchange also had ICOs.

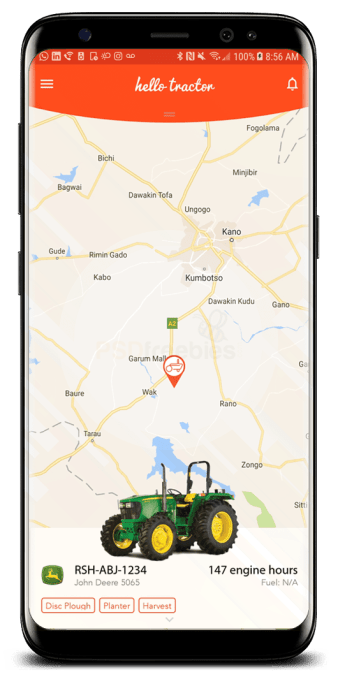

For blockchain as a platform, agtech startups Twiga Foods and Hello Tractor partnered with IBM Research to use the digital ledger tech to advance small-scale farmers and agriculture on the continent.

For blockchain as a platform, agtech startups Twiga Foods and Hello Tractor partnered with IBM Research to use the digital ledger tech to advance small-scale farmers and agriculture on the continent.

Ride-hail tech expanded into the continent’s frequently used motorcycle taxi market. Uber entered the three-wheeled tuk tuk moto taxi market in Tanzania in March and Uber and Taxify launched motorcycle passenger services in East Africa, including Kenya and Uganda.

Last year saw Y Combinator-backed VOD startup Afrostream shutter. In February 2018, Nigerian e-commerce startup Konga — backed by VC — was sold in a distressed acquisition. There were high expectations for Konga and its much-liked founder Sim Shagaya. I made the case that Konga’s acquisition was one of Africa’s first big startup fails that flew under the radar.

TechCrunch did a deep dive into Africa’s drone scene, talking to several experts and looking at emerging use cases across delivery services, agtech and surveying. On the regulatory side, several countries — Rwanda, Tanzania, South Africa, Zambia and Malawi — are doing some interesting things around regulation and creating drone-testing corridors for global players.

In 2018 TechCrunch did more with Africa than any previous year. In addition to more content, there was a market engagement trip to Ghana and Nigeria, with meet-and-greets at Impact Hub, MEST Accra and Lagos, and CcHub.

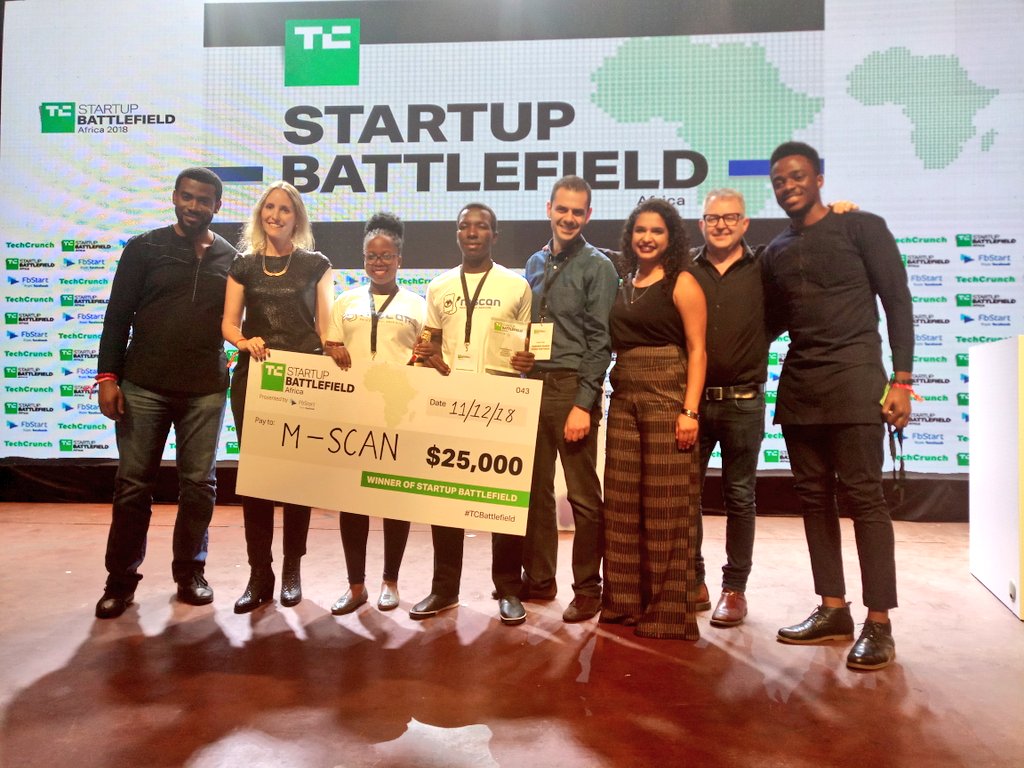

TechCrunch also had its first Africa panel on Disrupt SF’s main stage, an Africa session at Disrupt Berlin and held the second Startup Battlefield Africa in December in Nigeria.

Fifteen startups competed in Lagos in front of a Pan-African and global crowd. South African virtual banking startup Bettr was runner-up. Ultra-affordable ultrasound startup M-Scan from Uganda was the winner.

More Africa-related stories @TechCrunch

African tech around the ‘net

Powered by WPeMatico

There is a prevailing belief that the magic formula for early-stage tech startups hinges on how quickly they achieve $1 million in annual recurring revenue (ARR). Investors in SaaS companies, in particular, are very guilty of pushing this or its equally loaded corollary, “When will you sign your first six-figure deal?”

But in the rush toward these numbers, too many startups lose sight of their primary intent: These metrics are supposed to be an indicator of product/market fit. We’ve seen companies reach $1 million in ARR in less than a year, yet not have enough market momentum to get their next million easily. We’ve seen early-stage companies so concerned about getting those first sales, they don’t validate the market and if they’re building the right product. We’ve also watched a focus on new logos make companies forget about keeping existing customers happy, introducing unexpectedly high churn — something startups can’t afford.

Those first customers and that first million are supposed to be the bedrock on which the rest of the business grows. Founders must constantly ask what they’re learning about their market, product and go-to-market approach — in that order! — so the business becomes a flywheel.

Revenue is a lagging indicator of sales success, so must likewise be prioritized accordingly. That’s not to say revenue isn’t vitally important and that there isn’t a great deal of urgency to it, but focusing on it too much too early can mask big problems that will hurt startups later when the stakes are higher.

Here are a few lessons we’ve learned by watching our early-stage companies go through this crucial phase. Every early-stage company needs to do them well.

We talk about product and knowing customers a lot, but that is insufficient. Startups must understand the market, as well. How do customers do this today? Is there urgency around the problem? What is the community saying? An early investor in PagerDuty went onto Reddit and Quora and just looked at who people were talking about. It made his decision easy.

To be really successful, it is as important to understand market dynamics as it is to deliver a great product. This also helps zero in on all the aspects of your ideal customer profile; it needs to be more specific than you think! This also then helps qualify customers for future sales.

Elevate Security stood out in their super-crowded security space because they carved out a unique position around people-powered security. They used their early sales process to carefully qualify who would help them best develop their products. Their first product got shout-outs on social media from users who loved it — a rare occurrence in security — and were indicators they had found good initial customers and were creating something unique.

You’ll always find smart people saying, “I love what you’re doing.” Some things are so broken even a mediocre improvement is worth a change. But this is why revenue can be a false indicator for scalable success: Founders find enough early adopters to get that first million, which leads them to believe the product is enough. The company starts chasing more revenue, not investing in a product-based growth engine. If sales keeps hitting their numbers, everyone believes things are fine. Until they’re not. And then it’s usually a really heavy lift, with 6-12 months of product, sales or team upgrades.

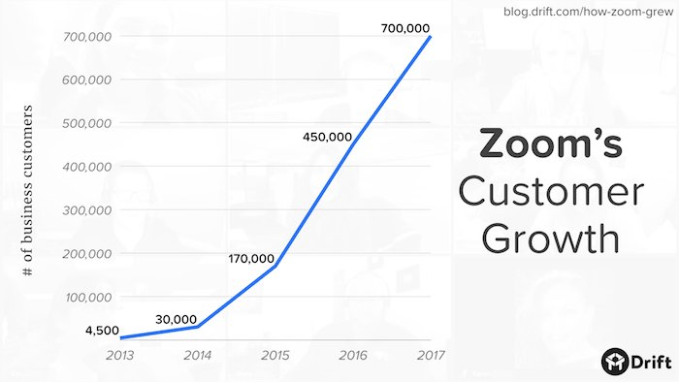

What startup doesn’t want a growth curve like this? Zoom had triple-digit growth for the last four years in a crowded, mature video conferencing category. Janine Pelosi, Zoom’s head of marketing, said the reason they were so successful before and after she arrived was they have a great product. It’s reliable, easy to use, and the founder, Eric Yuan, was selling it every day. Yuan knew the market really well coming out of Webex, and always touching customers meant he could adjust company strategy accordingly. Zoom embodied the real magic formula: know your market + build great product.

Customer satisfaction is simple: It comes from the perception that people get value from their purchase; it’s much less about how much they paid. It’s also always cheaper to make an existing customer happy than it is to acquire a new one, so make sure even in the early days that you’re investing in making current customers happy advocates.

Aquabyte uses computer vision to identify sea lice in the $160 billion aquafarming market. When they showed customers FreckleID (think facial recognition for fish) to uniquely identify fish in a pen of 200,000, fish farmers loved the idea. The price they were willing to pay was 3x what the CEO thought possible. They’re likewise investing heavily in making sure their initial customer is successful with the product and are delighting them in unexpected ways (handwritten holiday cards). They have more prospects in their pipeline than they have capacity, which means they don’t need to expand sales to grow revenue fast.

Your startup may have the coolest tech, be in the biggest market and have the smartest team. No matter what your board says, remember revenue is NOT the primary indicator; it is simply an indicator. To become a breakout success, you need to read the tea leaves of all aspects of your market and build a product and customer experience that is truly superior.

Powered by WPeMatico

The secondary luxury goods market has been growing wildly in recent years, with more shoppers opting to both sell their lightly used luxury goods like clothing and jewelry for cold, hard cash, as well as buying the pre-owned, authenticated luxury goods of others.

One of the biggest beneficiaries of the trend is The RealReal, a nearly eight-year-old shopping destination for the growing population of people who might not be willing or able to purchase a new Hermes Birkin bag but are willing to buy one in like-new condition for considerably less. The idea — which seems to be working — is to create a virtuous cycle, wherein the bag’s original purchaser receives the bulk of that re-sale price, then uses the money to buy another new handbag (or a used one) that can be resold at a later point in time.

Another beneficiary of the trend: TrueFacet, a five-year-old, New York-based marketplace that claims to have more than 40,000 watches and 55,000 pieces of pre-owned authenticated watches and jewelry for sale at its site, and that has more recently begun offering pre-owned timepieces directly through brands like Fendi Timepieces, Raymond Weil and Roberto Coin that now partner with TrueFacet to carry their pre-owned timepieces with a manufacture warranty.

Apparently, shoppers are buying what they’re collectively selling. The company, which had previously raised $14.7 million in funding from investors, looks to be closing in on another $10 million round, judging by freshly filed SEC paperwork that shows it has so far raised $7 million in funding and is targeting $9.8 million altogether.

TrueFacet’s backers include Founders Co-op, Freestyle Capital and Maveron, led by partner Jason Stoffer, who also happens to sit on the board of Dolls Kill, an edgy clothing marketplace that we wrote about on Monday.

TrueFacet has some tough competition in the space, including Crown & Caliber, a six-year-old, Atlanta, Ga.-based company that has never announced outside funding, and 15-year-old, Germany-based Chrono24, which has raised €21 million over the years. Both sell timepieces alone, however.

It also competes directly with The RealReal, which has raised nearly $300 million from investors and sells clothing and high-end home decor, as well as jewelry and watches. (The company doesn’t break out publicly which of these categories outpace the others in terms of sales.)

Interestingly, like The RealReal, which now operates permanent offline stores in both New York and L.A., TrueFacet is also crossing the chasm into the offline world, though it’s taking baby steps toward that end.

Specifically, earlier this month, it announced a partnership with Stephen Silver Fine Jewelry, which sells timepieces to many monied Bay Area VCs and other Silicon Valley bigs at stores in Redwood City and Menlo Park, Calif. For the time being at least, the jeweler will also sell pieces from TrueFacet’s collection.

Powered by WPeMatico

Startups supporting startups are blazing a new trail with support from venture capitalists.

Co-working spaces like The Wing and The Riveter raked in funding rounds this year, as did Brex, the provider of a corporate card built specifically for startups. Now Carta, which helps companies manage their cap tables, valuations, portfolio investments and equity plans, has announced an $80 million Series D at a valuation of $800 million. The company, formerly known as eShares, raised the capital from lead investors Meritech and Tribe Capital, with support from existing investors.

The round brings Carta’s total funding to $147.8 million. Its existing investors include Spark Capital, Menlo Ventures, Union Square Ventures and Social Capital, though the latter didn’t participate in the Series D funding. Tribe Capital, however, is a new venture capital firm launched by Arjun Sethi, who previously led Social Capital’s investment in Carta, Jonathan Hsu and Ted Maidenberg, a trio of former Social Capital partners who exited the VC firm amid its transition from a traditional VC fund to a technology holding company. Tribe is said to be in the process of raising its own $200 million debut fund.

Founded in 2012 by Henry Ward (pictured), the Palo Alto-based company plans to use the latest investment to develop their transfer agent and equity administration products and services to better support startups transitioning into public companies. It also will launch additional products for investors to collect data from their portfolio companies and to manage their back office.

“We’ve come this far by changing how ownership management works for private companies—popularizing electronic securities and cap table software, combined with audit-ready 409As,” Ward wrote in an announcement. “But our ambitions go far beyond supporting privately-held, venture-backed companies.”

Carta, which counts Robinhood, Slack, Wealthfront, Squarespace, Coinbase and more as customers, currently manages $500 billion in equity. This year, Carta expanded its headcount from 310 employees to 450 employees, launched board management and portfolio insights products and completed a study in partnership with #Angels that highlighted the major equity gap female startup employees are victim to.

The study, released in September, revealed that women own just 9 percent of founder and employee startup equity, despite making up 35 percent of startup equity-holding employees. On top of that, women account for 13 percent of startup founders, but just 6 percent of founder equity — or $0.39 on the dollar.

Powered by WPeMatico

Grove Collaborative, a four-year-old, San Francisco-based startup that sells household, personal care, baby, children’s and pet products, has been busy raising money in 2018, shows two new SEC filings that lists representatives from the company’s earlier investors, including Mayfield, Norwest Venture Partners and MHS Capital, as well as apparent new investor General Atlantic, represented by partner Catherine Beaudoin.

One of the filings shows that Grove Collaborative, which had already raised roughly $62 million as of the start of 2018, subsequently raised $27.4 million more this year. A separate, second filing shows another $76.4 million has been secured in what looks to be a newer round that’s targeting $125 million. It’s a lot of money for such a young company, which suggests it has found traction with a growing customer base.

We’ve reached out to Grove Collaborative and are waiting to learn more.

As we reported back in January, co-founder Stuart Landesberg started the company after working with retail brands during two years as an associate with TPG Capital, which focuses on growth equity and middle-market private equity transactions. With shelf space limited for brands in brick-and-mortar stores, he saw an opportunity for a startup that prompts consumers to buy the kinds of items they buy over and over again just as they are running out of them: think dish soap, pet food, deodorant, vitamins and sunscreen.

Amazon, of course, similarly prompts its customers to buy such items, but Grove Collaborative is marketing to a slightly narrower demographic, that of people who want only all-natural products. In fact, along with the brands that it make it easier for its customers to find — think Method and Mrs. Meyers — the company began selling its own all-natural products this year. Among the many dozens of offerings it now retails under the Grove Collaborative label: a coconut body lotion, a foaming hand soap, coffee filters, soy candles and lip balm.

The move puts the startup in more direct competition with other e-commerce companies, like the consumer goods company Honest Company, which similarly sells natural products for the home and personal care, though many of its products are now sold on shelves in big retail stores like Target.

Grove Collaborative also looks to be competing more directly now with well-funded Brandless, which raised $240 million from SoftBank’s Vision Fund in summer at a valuation of slightly more than $500 million. Brandless also sells its own all-natural household and personal care products, though, unlike Grove Collaborative, it also focuses on food and, unlike Grove, it offers a subscription service, yet does not revolve around one. Grove is exclusively selling an auto-shipment service.

Grove had previously raised two separate rounds of funding in quick succession: a $15 million Series B round it closed in March of 2017, following by a $35 million Series C round it announced in January of this year.

Given that Landesberg was formerly an investor himself, he may well have realized — as have many founders — that raising money next year may be far harder in 2019 than it has been this year. As the CEO of Zymergen, whose giant funding round we recently featured, told Bloomberg last week: “We wanted to have some fat on our bones for sure . . . The time to raise money is when people are giving it to you.”

Powered by WPeMatico

This year has been good for tech titles. Books like Bad Blood and Brotopia brought us some in-depth reporting on crashes and burns, while Stephen Hawking brought us his last thoughts. Here are some of our favorite tech titles for 2018.

Powered by WPeMatico

Three U.S. companies raised more than $1 billion in just one funding round in 2018, a year in which total deal value for U.S. startups is expected to surpass $100 billion for the first time.

For the most part, it was the usual suspects, and yes, SoftBank was an accessory in many of these rounds. Here’s a look at the 10 largest venture rounds of 2018.

The video game Fortnite Battle Royale was the star of the year 2018; more than 200 million players worldwide are registered online. (Photo Illustration by Chesnot/Getty Images)

Given the absolute phenomenon Fortnite became in just one year from its original release, it was no surprise private investors wanted to put money into Epic Games, the company behind it. In October, Epic Games announced a whopping $1.25 billion round at $15 billion valuation from KKR, Iconiq Capital, Smash Ventures, Vulcan Capital, Kleiner Perkins and Lightspeed Venture Partners to continue growing its Fortnite empire. That game alone is expected to bring in $2 billion in revenue in 2018 and reports 200 million registered players — not too shabby.

Cary, N.C.-based Epic Games’ monstrous fundraise was a standout in a year when funding for gaming and esports startups really took off. According to Crunchbase, global venture investment in the industry increased nearly 75 percent, to $701 million in the first half of 2018. Given Epic’s round, Discord’s $150 million infusion of capital this week and several others since June, the second half of 2018 undoubtedly set major records in the space.

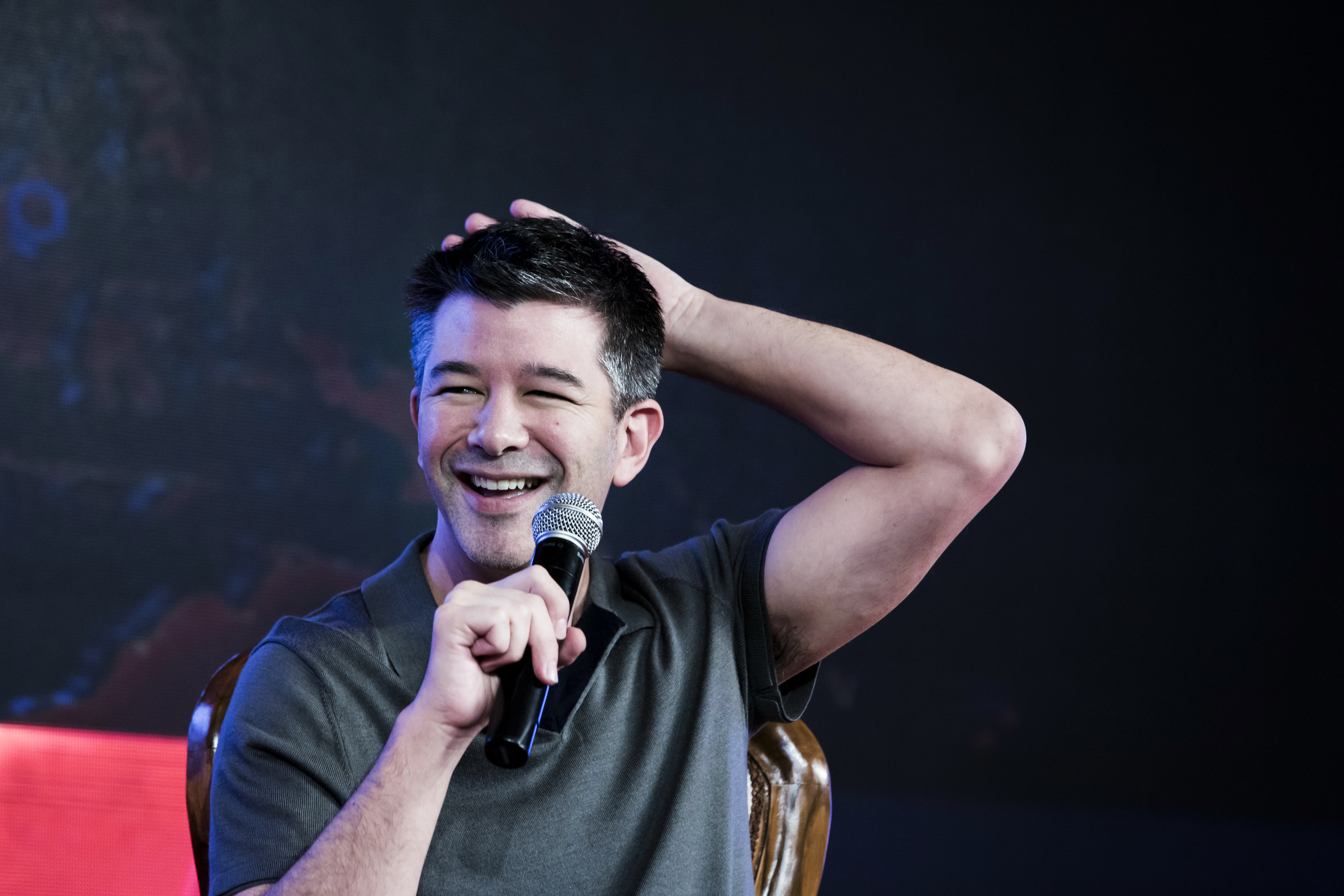

Travis Kalanick, co-founder and former chief executive officer of Uber Technologies Inc., speaks during the TiE Global Entrepreneurs Summit in New Delhi, India, on Friday, December 16, 2016. Kalanick said the company will introduce Uber Moto across India. Photographer: Udit Kulshrestha/Bloomberg via Getty Images

One of the largest rounds of 2018 was also one of the first big financings of the year. To be fair, the negotiations behind Uber’s $1.2 billion SoftBank investment and much of the press coverage surrounding it came in 2017, but the deal officially closed in January. This deal was monumental for many reasons. First of all, it made Uber founder and former chief executive officer Travis Kalanick a billionaire — not just on paper — and it cemented SoftBank’s position as the ride-hailing giant’s largest shareholder.

The financing brought San Francisco-based Uber’s total raised to date to just over $20 billion at a valuation said to be around $72 billion. Of course, Uber has since privately filed for an initial public offering slated for the first quarter of 2019.

Juul Labs, the maker of the popular e-cigarette brand that has recently come under fire from health officials over its popularity with young adults, plans to introduce a line of lower-nicotine pods. Photographer: Gabby Jones/Bloomberg via Getty Images

Juul, one of the buzziest companies of 2018, raised $1.2 billion from private investors Tiger Global, Fidelity and more in mid-2018. Then, this month, the developer of e-cigarettes popular among teenagers accepted a $12.8 billion investment from the makers of Marlboro that valued it at $38 billion. Not only has Juul created significant controversy surrounding the ethics, or lack thereof, of its core product and its marketing to the younger generation in a short time, but it has also accumulated value at a clip rarely seen before. Juul, for context, surpassed a $10 billion valuation just seven months after its first round of VC backing — that’s four times faster than Facebook.

2019 is poised to be an interesting year for San Francisco-based Juul as it navigates public scrutiny, regulations and the completion of its partnership with Altria Group, which, according to Juul’s CEO Kevin Burns, will “help accelerate [Juul’s] success switching adult smokers.”

Magic Leap’s flagship product, the Magic Leap One AR headset, began shipping to consumers this year.

It wouldn’t be an end of the year round-up of the largest VC deals without any mention of Magic Leap, the extremely well-funded virtual reality company. Tucked away in Plantation, Fla., 8-year-old Magic Leap has closed round after round, raising more than $2 billion to develop its hardware and software. The key investors in this year’s big round, which valued the company at $6.3 billion, were Temasek and AT&T, which announced it would become the exclusive “wireless distributor” of Magic Leap products in the U.S. starting this summer. Magic Leap is also backed by Google, Alibaba and Axel Springer.

Not only did Magic Leap land one of the largest VC deals this year, but it also finally began shipping to consumers its flagship product, the Magic Leap One AR headset. That was a long time coming — years, in fact. So long, many doubted whether the buzzy headsets would ever see the light of day. Now, the headsets are available to buyers in 48 states, though it’s worth mentioning they cost more than two grand.

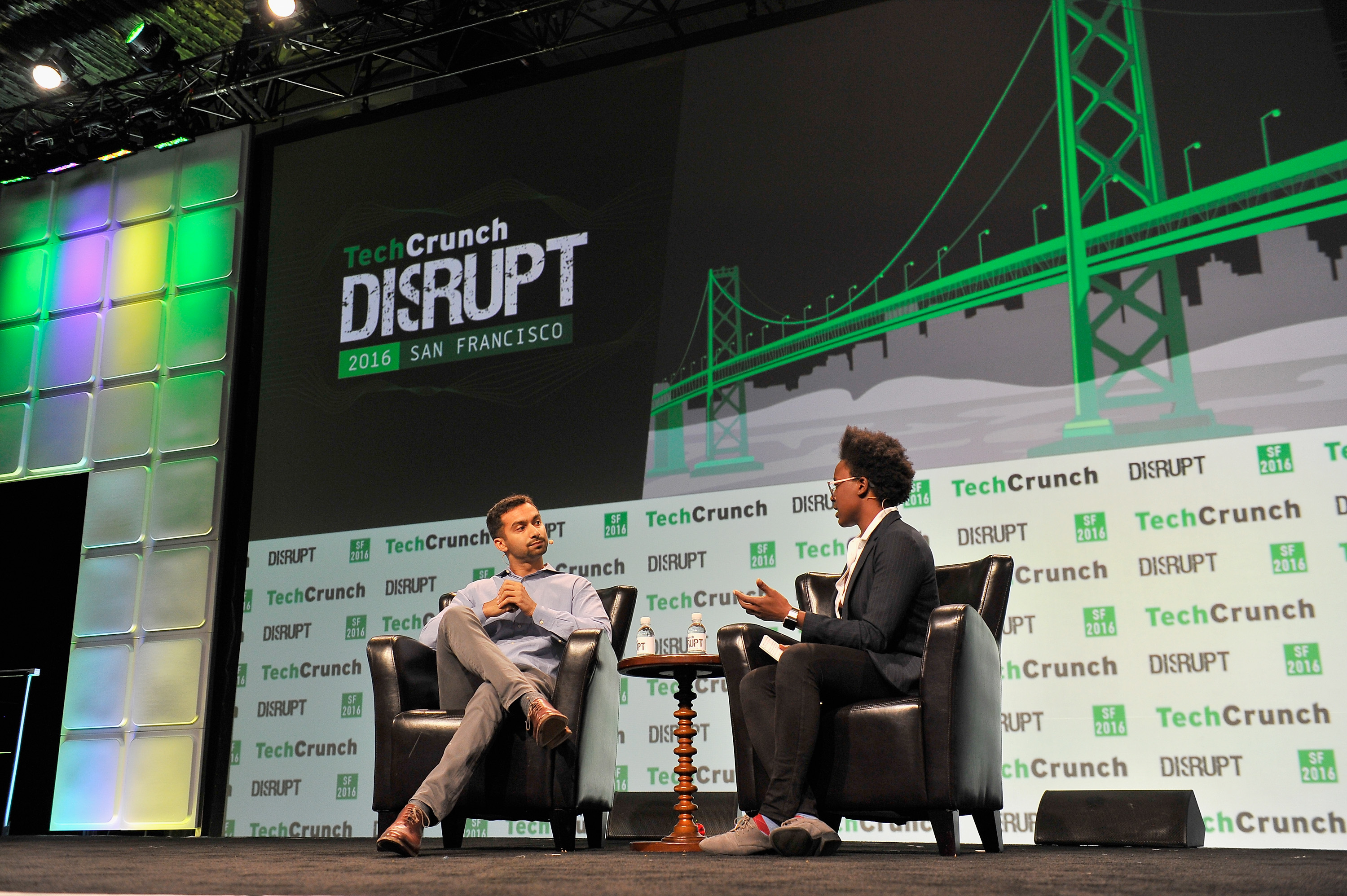

Founder and CEO of Instacart Apoorva Mehta and moderator Megan Rose Dickey speak onstage during TechCrunch Disrupt SF 2016 at Pier 48 on September 14, 2016 in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

Instacart has a lofty goal of delivering groceries to every household in the U.S., and it needs a lot of cash to get there. The company has raised VC every year since it completed the Y Combinator startup accelerator in 2012, and 2018 was no different. In October, the service brought in $600 million at a $7.6 billion valuation in a round led by D1 Capital Partners. Headquartered in San Francisco, the company has raised $1.6 billion to date from Coatue Management, Thrive Capital, Canaan Partners, Andreessen Horowitz and several others.

Instacart CEO Apoorva Mehta told TechCrunch at the time that the startup didn’t really need the capital and that this was more of an “opportunistic” battle. The market is hot, after all, and Instacart has ambitious plans to scale and it has a fierce competitor in Amazon to take on. As for an IPO, Mehta said “it will be on the horizon.”

SoftBank-backed Katerra says it’s brought in more than $1.3 billion in bookings for new construction ranging from residential to hospitality and student housing.

One of SoftBank’s first major bets of 2018 was on construction technology, with an $865 million investment in Katerra at a $3 billion valuation out of its Vision Fund. Katerra, a tech startup based out of Menlo Park, develops, designs and constructs buildings. At the time of its January fundraise, Katerra told TechCrunch it had brought in more than $1.3 billion in bookings for new construction ranging from residential to hospitality and student housing. Founded in 2015 by three former private equity barons, the company has raised a total of $1.1 billion to date from SoftBank, Foxconn, Greenoaks Capital and others.

In June, Katerra announced it would merge with KEF Infra, an offsite manufacturing technology specialist, and would begin operating in India and the Middle East markets.

Yet another SoftBank investment, San Francisco-based Opendoor is also backed by Fifth Wall Ventures, GV, Andreessen Horowitz and more.

Opendoor’s two big SoftBank-backed investments this year totaled $725 million, valuing the company at $2.5 billion. The deal gave SoftBank a minority stake in Opendoor, an online real estate marketplace, and put one of its five managing directors, Jeff Housenbold, on the company’s board of directors. The round brought Opendoor’s total funding to slightly more than $1 billion — most of which it acquired in 2018, a major year for the company. Founded in 2014, the San Francisco-based startup is also backed by Fifth Wall Ventures, GV, Andreessen Horowitz and more.

According to TechCrunch’s Connie Loizos, Housenbold had hoped to work with Opendoor co-founder and CEO Eric Wu for some time. “The minute he joined [SoftBank] he reached out to me and let me know … saying if there was an opportunity to work together, to reach out to him,” Wu said.

Uber competitor Lyft expanded aggressively in 2018, raised hundreds of millions in additional venture capital funding, and filed confidentially to go public.

Lyft managed to stay quite busy this year. Not only did the ridesharing company raise a $600 million round at a $15.1 billion valuation, it also acquired bike-share operator Motivate and filed confidentially to go public. Founded in 2012 by Logan Green and John Zimmer, the company has long competed with Uber, and will continue to do so as the pair race to the public markets in early-2019. Lyft, much smaller than Uber and only active in the U.S. and Canada, has raised nearly $5 billion in venture backing from KKR, Mayfield, Didi Chuxing, Floodgate and others.

San Francisco-based Lyft has spent much of the last two years expanding rapidly across the U.S. market, as well as pursuing its autonomous vehicle ambitions.

Automation Anywhere raised a monstrous $550 million Series A in 2018, with support from the SoftBank Vision Fund.

The only surprise to make this list is Automation Anywhere, a 15-year-old provider of robotic process automation. The company raised a total of $550 million in Series A funding, a large chunk of which came from the SoftBank Vision Fund, as well as NEA, General Atlantic and Goldman Sachs. The round valued Automation Anywhere at $2.6 billion. According to PitchBook, this was the first round of institutional backing for the San Jose, Calif.-based company.

In a conversation with TechCrunch, Automation Anywhere CEO Mihir Shukla said they were attracted to SoftBank because of Masayoshi So — the CEO and founder of SoftBank: “[He} has a vision and he is investing in foundational platforms that will change how we work and travel. We share that vision.”

SAN FRANCISCO, CA – SEPTEMBER 06: Peloton Co-Founder/CEO John Foley speaks onstage during Day 2 of TechCrunch Disrupt SF 2018 at Moscone Center on September 6, 2018 in San Francisco, California. (Photo by Kimberly White/Getty Images for TechCrunch)

Peloton’s growth exploded in 2018 as it launched its $4,000 treadmill, doubled down on original fitness streaming content and raised an additional $500 million in equity funding at a $5 billion valuation. The New York-based startup, often referred to as the “Netflix of fitness,” has raised nearly $1 billion in venture capital funding in the six years since it was founded by John Foley. It’s backed by L Catterton, True Ventures, Tiger Global and others.

It’s likely Peloton will take the public markets plunge in 2019 much like Uber and Lyft. Foley earlier this year told The Wall Street Journal that though he doesn’t have any concrete plans, 2019 “makes a lot of sense” for its stock market debut.

Powered by WPeMatico