Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Venture capitalists swore in the new year the only way they know how… by submitting SEC paperwork for new funds! insert party hat/confetti emoji here.

As many of us brainstormed our New Year’s resolutions and let our hangovers wear off, several firms began this week what for some is a long and arduous process of raising a VC fund and for others is as simple as a few phone calls to LPs. What else happened this week? Pokémon GO creator Niantic secured $190 million, Mary Meeker announced the name of her fund and a whole bunch of people played with Popsugar’s somewhat sketchy twinning app.

Mary Meeker will raise up to $1.5 billion for Bond, her new VC fund. Union Square Ventures raised $429 million across two new funds. Lightspeed Venture partners announced a $560 million China fund. And biotech firm Atlas Venture brought in $250 million.

TechCrunch’s Lucas Matney takes a look at struggling augmented reality startups and questions some of the larger players, from Magic Leap to Snap and Niantic. And speaking of Niantic, the Pokémon GO developer closed a $190 million funding round this week at a $3.9 billion valuation.

Indian startups start the year off strong:

Startups based in India raised more than $10 billion in 2018, per Venture Beat, a record amount of capital for the country. Already this year one company has closed a round larger than $100 million. CarDekho, an online marketplace for car sales in India, has pulled in a new $110 million Series C funding round this week to push deeper into financial services and insurance.

Boom Supersonic, which is building and designing what it calls the “world’s first economically viable supersonic airliner,” announced a $100 million Series B funding round led by Emerson Capital. Other investors include Y Combinator’s Continuity Fund, Caffeinated Capital, SV Angel, Sam Altman, Paul Graham, Ron Conway, Michael Marks and Greg McAdoo.

A startup disrupting the … bottled water business:

FloWater has raised $15 million for its reusable water bottle refilling stations to produce purified water. Bluewater, a Swedish company that sells water purifiers, among other things, led the round.

VC subsidized vending machines:

Vengo makes wall-mounted mini-vending machines the size of large picture frames that it then sells to vending machine distributors, asking for a small fee per month in exchange for access to its software. Now it has $7 million to build out its business.

After SpaceX filed more SEC paperwork as part of its $500 million upcoming fundraise, TechCrunch’s Connie Loizos noticed a familiar name on the document: Steve Jurvetson. Jurvetson is a longtime board member of both Tesla and SpaceX, but after he left DFJ, the venture capital firm he co-founded, in 2017 amid questions about his personal conduct, there was uncertainty around whether he would keep those director positions. Well, it looks like Elon Musk is standing by Jurvetson.

And finally, are you smarter than a TechCrunch reporter?

Powered by WPeMatico

A system that uses a technique called constructive solid geometry (CSG) is allowing MIT researchers to deconstruct objects and turn them into 3D models, thereby allowing them to reverse-engineer complex things.

The system appeared in a paper entitled “InverseCSG: Automatic Conversion of 3D Models to CSG Trees” by Tao Du, Jeevana Priya Inala, Yewen Pu, Andrew Spielberg, Adriana Schulz, Daniela Rus, Armando Solar-Lezama, and Wojciech Matusik.

“At a high level, the problem is reverse engineering a triangle mesh into a simple tree. Ideally, if you want to customize an object, it would be best to have access to the original shapes — what their dimensions are and how they’re combined. But once you combine everything into a triangle mesh, you have nothing but a list of triangles to work with, and that information is lost,” said Tao Du to 3DPrintingIndustry. “Once we recover the metadata, it’s easier for other people to modify designs.”

The process cuts objects into simple solids that can then be added together to create complex objects. Because 3D scanning is imperfect, the creation of mesh models of various objects rarely leads to a perfect copy of the original. Using this technique, individual parts are cut away, analyzed and reassembled, allowing for a more precise scan.

“Further, we demonstrated the robustness of our algorithm by solving examples not describable by our grammar. Finally, since our method returns parameterized CSG programs, it provides a powerful means for end-users to edit and understand the structure of 3D meshes,” said Du.

The system detects primitive shapes and then modifies them. This allows it to recreate almost any object with far better accuracy than in previous versions of the software. It’s a surprisingly cool way to begin hacking hardware in order to understand it’s shape, volume and stability.

Powered by WPeMatico

One Denver-based startup’s long-shot bid to move today’s commercial jets beyond supersonic speeds just got a big injection of cash.

Boom Supersonic, which is building and designing what it calls the “world’s first economically viable supersonic airliner,” announced today that they’ve closed a $100 million Series B funding round led by Emerson Capital. Other investors include Y Combinator Continuity, Caffeinated Capital, SV Angel, Sam Altman, Paul Graham, Ron Conway, Michael Marks and Greg McAdoo.

The startup has raised around $140 million to date. The team has about 100 employees, and hopes to double that number this year with its new funding.

“Today, the time and cost of long-distance travel prevent us from connecting with far-off people and places,” said Boom CEO Blake Scholl in a statement. “Overture fares will be similar to today’s business class—widening horizons for tens of millions of travelers. Ultimately, our goal is to make high-speed flight affordable to all.”

Alongside the fundraise, Boom is further detailing its plans to begin testing its Mach 2.2 commercial airliner this year. The company is aiming to launch a 1:3 scale prototype of its planned Overture airliner this year, called the XB-1. The two-seater plane will serve to validate the technologies being built for the full-sized jet.

The startup’s supersonic Overture jet will hold 55 passengers, and the team hopes that the costs of flying more than double the speed of sound will be comparable to today’s business-class ticket prices. The company already has pre-orders from Virgin Group and Japan Airlines for 30 airliners.

Indeed, $100 million may seem like a lot of money, but the development costs for lengthy projects like these can quickly race toward the billions of dollars, suggesting that if they carry out their mission, they’re going to need a whole lot more.

Powered by WPeMatico

Robinhood, the U.S.-based “zero-fee” stock-trading app and cryptocurrency exchange, is stealthily recruiting for a new London office ahead of plans to eventually launch in the U.K., TechCrunch has learned.

According to sources within London’s thriving fintech industry, Robinhood is hiring for multiple U.K. positions. These span recruitment, operations, marketing/PR and customer support. Notably, the company is also seeking people in compliance and product, including product design.

In other words, significant localisation and local product market fit appears to be the intention. Compliance is also an important part of Robinhood’s future U.K. regulatory requirements as it applies to local regulator the FCA for the appropriate licenses. Robinhood declined to comment on its U.K. plans.

Meanwhile, news that Robinhood is stealthily recruiting ahead of a planned U.K. launch is interesting in the context of local fintech startups that have launched or announced their own fee-free trading offerings.

Launched late last year, London-based Freetrade has built a bona-fide “challenger broker,” including obtaining the required license from the FCA, rather than simply partnering with an established broker. The app lets you invest in U.K. stocks and ETFs, but will soon add U.S. stocks, too. Trades are “fee-free” if you are happy for your buy or sell trades to execute at the close of business each day. If you want to execute immediately, the startup charges a low £1 per trade.

In June last year, Revolut, also headquartered in London, announced its intention to add commission-free trading to its banking app, in what was seen as a bid to compete with Robinhood. So far, no product has surfaced, although I’m told we should see trading added to Revolut in Q1 this year.

What’s intriguing about the Revolut-Robinhood comparisons is that the two companies share a number of investors, namely Index and DST. Both companies have incredibly high valuations, too, and, depending on respective burn rates, quite deep pockets.

Co-founded by Baiju Bhatt and Vlad Tenev (pictured above), Robinhood claims 6 million accounts and is valued at $5.6 billion, having raised a total to date of $539 million. It has around 300 employees across its HQ in Menlo Park, California and its regional HQ in Lake Mary, Florida.

Revolut claims 3.5 million users, and at its last funding round was valued at $1.7 billion. The fintech has raised a total of $340 million, and has a headcount of 600 in London and across its various regional offices.

Powered by WPeMatico

Today, many companies provide developer access to their services via APIs. Moesif, a San Francisco startup, wants to help these companies gain insight into their customer’s API usage patterns. Today, the company announced a $3.5 million seed round.

The investment was led by Merus Capital, with participation by Heavybit, Fresco Capital and Zach Coelius, whose investments include Cruise Automation, which was sold to GM in 2016 for $1 billion.

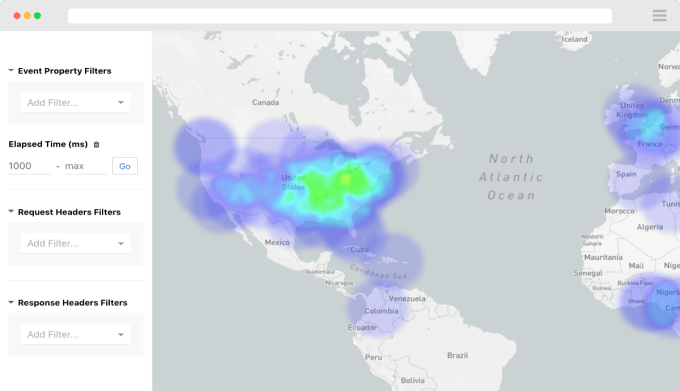

Moesif co-founder and CEO Derric Gilling says Moesif is akin to Mixpanel or Google Analytics, except instead of tracking web or mobile analytics, it looks at API usage. “As more and more companies are using and creating these APIs, there comes a point where you need to understand how your customers are using them, any problems they are running into and how do you actually decrease developer churn.”

Heat map showing API usage by region. Screenshot: Moesif

The company is aiming at two primary types of users. First of all, there are developers who can use the monitoring features to understand when there are issues with the API. These folks have access to the free tier.

Moesif also targets business units like product management, sales and marketing, which use the tool to understand who’s using the API, how often and, with machine learning, understand who is likely to stop using the product based on how they are using it. The tool can tie into other business systems like Mailchimp or a CRM tool to get a more complete picture of customers as they use the API.

The product was released last year, and Gilling says his company already has 2,000 customers, which includes both the free and paid tiers. He said they have had particular success with SaaS and fintech companies, both of which make heavy use of APIs. Customers include PowerSchool, Schwab and DHL.

While the company currently consists of two founders and one employee, flush with the seed investment, it intends to hire around 10 people in the next six months, including a VP of engineering, additional developers and sales and marketing folks.

Moesif was founded in late 2016, and the founders went through the Alchemist Accelerator last year.

Powered by WPeMatico

Monzo, the U.K. challenger bank with more than a million customers and a unicorn valuation to boot, has quietly begun working on a U.S. launch, TechCrunch has learned.

According to multiple sources, the fintech startup has set up a small team to begin laying the groundwork to bring a version of Monzo to North America, which will initially be powered by a U.S. banking partner while Monzo works on the necessary regulatory licenses to go it alone.

The plan, which could still be subject to change, is for Monzo to create a “lite” version of its product for U.S. customers, much in the same way it first launched in the U.K. with a pre-paid debit card before eventually offering a fully fledged bank account.

The thinking, according to one person familiar with the company’s strategy, is that this will enable Monzo to build up a U.S. customer base and iterate its product for the U.S. market in parallel with the challenger bank’s federal charter bank application.

I understand that the plan is for the initial Monzo U.S. product to offer in-app signup, the trademark “hot coral” Monzo debit card, an account and routing number, the ability to make and accept payments, ATM withdrawals, and real-time transaction notifications. In other words, many of the same features that has endeared Monzo with U.K. customers.

Contacted by TechCrunch, a Monzo spokesperson provided the following statement:

We’re really excited about international expansion over the coming months and years. After all, it’s hard to build a bank for a billion people in the UK alone!

However, we don’t have anything specific to share at this stage about those plans. When we do, we’ll be sure to tell the world.

Meanwhile, news that Monzo has begun executing U.S. expansion plans isn’t entirely surprising, even if appears to be happening significantly faster than previously thought.

Meanwhile, news that Monzo has begun executing U.S. expansion plans isn’t entirely surprising, even if appears to be happening significantly faster than previously thought.

Co-founder and CEO Tom Blomfield has openly talked about his ambition to bring Monzo to the U.S. one day, and the London-based challenger bank boasts an array of U.S. investors. They include most recently General Catalyst, along with the likes of Thrive Capital, Goodwater Capital, Stripe, Michael Moritz and Instagram co-founder Kevin Systrom.

The fintech company also recently opened a Las Vegas office, from which it offers twilight hours customer support for U.K. customers. Or at least that is the party line. Now it appears that Las Vegas could soon have Monzo customers closer to home to keep happy, too.

Powered by WPeMatico

FloWater, an eight-year-old, Burlingame, Calif.-based company whose reusable water bottle refilling stations produce purified water, has raised $15 million in its first major round of funding. Bluewater, a Swedish company that sells water purifiers, among other things, led the round.

FloWater caters to schools, colleges, fitness centers, hotels and offices, and, in the words of CEO Rich Razgaitis, set out to address four environmental concerns from the outset: obesity in the U.S., which has been tied in part to the rise of sugary, carbonated beverages; the nearly 40 billion single-use plastic water bottles that are used and tossed aside every year; the millions of barrels of oil and hundreds of millions of pounds of CO2 byproduct waste used to create and transport bottled water; and the toxins in single-use plastic bottles, including endocrine-disrupting chemicals.

It has a pretty compelling case to make, in short, as other purveyors of refilling stations would surely argue, and which clearly persuaded 13 investors altogether (according to a new SEC filing) to write checks to the company.

And it all started with an $18,600 bank loan, according to the company’s founder, Wyatt Taubman, who remains on the company’s board but stepped aside as head honcho in 2015 and has since founded a cold-pressed juice company.

Per his LinkedIn, Taubman, says he used that bank loan to launch a pilot refill station, before shaking $125,000 out of friends and family, and taking out a second, $62,000 loan to launch additional refill stations. The company later raised $950,000 from the Tech Coast Angels and the Hawaii Angels, hired Razgaitis, redesigned the look of its product and, in 2016, raised $2.6 million in Series A funding.

FloWater customers include Google, Airbnb, Specialized Bikes and, somewhat ironically, Red Bull.

It says its stations are now in nearly 50 states.

Powered by WPeMatico

Mobile AR gaming startup Niantic has closed a $190 million round of funding according to newly filed SEC docs.

The filing comes after a WSJ report last month suggested the company was in the process of closing a $200 million raise from investors, including IVP, aXiomatic Gaming and Samsung, at a $3.9 billion valuation. The round closed shortly after that report on December 20 according to the new documents.

With the close of this round, Niantic has now raised more than $415 million to date. The startup’s other investors include Founders Fund, Spark Capital and Alsop Louie Partners, among others. The filing details that there were 26 investors in this funding round.

The new influx of cash comes as the creator of Pokémon GO prepares to release its next major title, Harry Potter: Wizards Unite. The augmented reality game does not have a release date yet, but is expected to launch this year.

Powered by WPeMatico

The only kids’ programming language worth using, Scratch, just celebrated the launch of Scratch 3.0, an update that adds some interesting new functionality to the powerful open-source tool.

Scratch, for those without school-aged children, is a block-based programming language that lets you make little games and “cartoons” with sprites and animated figures. The system is surprisingly complex, and kids have created things like Minecraft platformers, fun arcade games and whatever this is.

The new version of scratch includes extensions that allow you to control hardware, as well as new control blocks.

Scratch 3.0 is the next generation of Scratch – designed to expand how, what, and where you can create with Scratch. It includes dozens of new sprites, a totally new sound editor, and many new programming blocks. And with Scratch 3.0, you are able to create and play projects on your tablet, in addition to your laptop or desk computer.

Scratch is quite literally the only programming “game” my kids will use again and again, and it’s an amazing introduction for kids as young as pre-school age. Check out the update and don’t forget to share your animations with the class!

Powered by WPeMatico

After a limited rollout, Go-Jek said today that it will extend its ride-hailing service to all of Singapore tomorrow while continuing its beta phase. The Indonesian-based company began offering rides in Singapore at the end of November, but only for passengers riding to and from certain areas. It introduced dynamic pricing there, which increases prices during peak times, a few days ago.

“We continue to welcome feedback from driver-partners and riders during this enhanced beta phase, as we work to fine-tune the app and create the best experience for our users,” the company said in a statement.

After Uber exited from Southeast Asia earlier this year by selling its local business to Grab, Go-Jek became Grab’s main rival. Uber still maintains a presence in the region, however, thanks to its 27.5 percent stake in Grab.

There is currently a waiting list for Go-Jek in Singapore, with customers of DBS/POSB being given priority.

When asked about how long new users need to wait, a Go-Jek spokesperson said in a statement that the time depends on supply and demand. “The response from the driver community since we opened pre-registration has been overwhelming with tens of thousands of drivers signing up via the pre-registration portal. While we can’t disclose figure at this moment, we are confident we can meet consumer expectations during the beta service period.”

Powered by WPeMatico