Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Bowery Valuation, a New York-based company that we told you about last year, has raised $12 million in Series A funding for its tech-enabled real estate appraisal platform. The 3.5-year-old company raised the capital from Corigin Ventures, Camber Creek, Navitas Capital, Fika Ventures and Builders.

Bowery caught our attention initially because, like a lot of real estate technology companies, it’s tackling some clunky processes that you might imagine would have been solved long ago. For example, its mobile app enables appraisers to tick off items, rather than write everything down. It automatically pulls in public record data so that appraisers needn’t surf the web to find what they need. It enables passive databasing, meaning that rental and sales comps that are often lost today can be found via a map-based search. It also uses natural language generation to help its appraiser clients produce reports.

What has changed since we last talked: the company was beginning to sell a white-label version of its app to customers, and it has since shifted toward focusing its entire product and engineering team on its own internal software.

It has also expanded its footprint more slowly than it thought it might. Though the company is currently licensed and working throughout New York, New Jersey, Pennsylvania and Connecticut, it hasn’t reached numerous farther-flung cities that continue to remain in its sights, including L.A. and Chicago.

Both are “still our first two choices for expansion,” says co-founder and CEO Noah Isaacs, adding that Bowery’s goal is now to “be in at least one of those two markets within the next nine to 12 months, with the other to follow shortly. We held off on expanding into new geographies prematurely, as we felt we had a lot more room to grow just in the tri-state area.” (Isaacs says the company has more than tripled its customer base and revenue since we last talked with the company last March.)

Though Bowery today focuses on multi-family and mixed-use assets, it also plans to expand to other commercial properties this year, says Isaacs.

Isaacs and his best childhood friend, John Meadows, founded Bowery in 2015 after working together at the same appraisal firm in New York and seeing plenty about the business on which they could improve. After bringing aboard as CTO Cesar Devars, a Princeton grad who’d studied economics and worked on several startups after graduating, the three got to work, applying and gaining acceptance shortly afterward to MetaProp NYC, a local accelerator program that focuses exclusively on real estate.

Bowery, where Meadows and Isaacs are co-CEOs, has since raised $18.8 million altogether, including from real estate giant Cushman & Wakefield.

Powered by WPeMatico

Early last year, LinkedIn co-founder and prolific venture capital investor Reid Hoffman called Chris Urmson “the Henry Ford of autonomous vehicles (AV).” The vote of confidence and big check from Hoffman, coupled with a team of deeply knowledgable AV entrepreneurs, has catapulted his company, Aurora Innovation, squarely into “unicorn” territory.

Aurora, the developer of a full-stack self-driving software system for automobile manufacturers, is raising at least $500 million in equity funding at more than a $2 billion valuation in a round expected to be led by new investor Sequoia Capital, according to a Recode report. A $500 million financing would bring Aurora’s total raised to date to $596 million and would provide a 4x increase to its most recent valuation.

The company, founded in 2016, raised a $90 million Series A last February from Hoffman’s Greylock Partners and Index Ventures . Hoffman and Index general partner Mike Volpi joined Aurora’s board as part of the deal. Greylock and Index are Aurora’s only existing investors, per PitchBook data. The young business has a lean cap table often characteristic of startup’s led by experienced entrepreneurs able to secure financing deals briskly from top VCs.

Aurora’s C-suite is chock-full of veteran AV workers. Urmson, for his part, formerly headed up the self-driving vehicles program at Google, now known as Waymo. Chief technology officer Drew Bagnell was head of perception and autonomy at Uber and Sterling Anderson, Aurora’s chief product officer, directed the autopilot program at Tesla from 2015 to 2016.

“Between these three co-founders, they have been thinking and working collectively in robotics, automation automotive products for over 40 years,” Hoffman wrote in a blog post announcing Aurora’s Series A funding.

In addition to the high-caliber of the founding team, Aurora’s collaborative approach to building self-driving cars has attracted investors, too. The company has partnered with a number of automotive retailers to integrate its technology into their vehicles and make self-driving cars a “practical reality.” Currently, Aurora counts Volkswagen, Hyundai and Chinese manufacturer Byton as partners.

2018 was a banner year for VC investment in U.S. autonomous vehicle startups. In total, investors poured $1.6 billion across 58 deals, nearly doubling 2017’s high of $893 million. Around the world, AV startups secured $3.41 billion, on par with the $3.48 billion invested in 2017, per PitchBook.

Though we are just days into 2019, LiDAR technology developer AEye has completed a previously announced $40 million Series B. The Pleasanton, Calif.-headquartered company raised the funds from Taiwania Capital, Kleiner Perkins, Intel Capital, Airbus Ventures and Tychee Partners. And last week, Sydney-based Baraja, another LiDAR startup, brought in a $32 million Series A from Sequoia China, Main Sequence Ventures’ CSIRO Innovation Fund and Blackbird Ventures.

Powered by WPeMatico

Managed by Q, the office management platform that launched back in 2013, has today revealed that it raised an additional $25 million as a part of its Series C, led by existing investors RRE and Google Ventures, with participation from new investors DivCo West, Oxford Properties and others. The fresh capital brings the total round to $55 million.

Managed by Q launched as an all-encompassing platform for office management, offering IT support, supply inventory management, cleaning and equipment repair. Since, the company has added a full-fledged marketplace, allowing office managers to choose vendors for various needs around the office.

But for 2019, the company is focused on tools and services.

“We want to spend 2019 putting even greater focus on the tools used by our vendors and workplace management teams, like task management tools,” said co-founder and CEO Dan Teran . “We want to build the first set of collaboration tools for the workplace team, the same way that designers use InVision and engineers use GitHub and salespeople use Salesforce. Something purposely built for the workplace team.”

Teran described tools that would allow for employee requests, work orders, task management, inventory management and budgeting to all live on the same platform.

The company hasn’t shared much by way of revenue or customer growth, but Teran told TechCrunch that the marketplace business has been doubling since it launched and is on track to continue on that trajectory. He also wrote in a company blog post that Managed by Q’s top five vendor partners have done more than $1 million in business on the Managed by Q platform, and more than 30 partners will have earned over $100,000 on the platform in 2018.

The NY-based startup also brokered a partnership with Staples to provide office supplies to clients, and acquired Hivy and NVS to further fill out their office management suite of products.

Managed by Q has raised a total of $128.25 million, according to Crunchbase.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here:

1. IBM unveils its first commercial quantum computer

The 20-qubit system combines the quantum and classical computing parts it takes to use a machine like this for research and business applications into a single package. While it’s worth stressing that the 20-qubit machine is nowhere near powerful enough for most commercial applications, IBM sees this as the first step towards tackling problems that are too complex for classical systems.

2. Apple’s trillion-dollar market cap was always a false idol

Nothing grows forever, not even Apple. Back in August we splashed headlines across the globe glorifying Apple’s brief stint as the world’s first $1 trillion company, but in the end it didn’t matter. Fast-forward four months and Apple has lost more than a third of its stock value, and last week the company lost $75 billion in market cap in a single day.

3. GitHub Free users now get unlimited private repositories

Starting today, free GitHub users will now get unlimited private projects with up to three collaborators. Previously, GitHub had a caveat for its free users that code had to be public if they didn’t pay for the service.

Photo credit: Chesnot/Getty Images

4. Uber’s IPO may not be as eye-popping as we expected

Uber’s public debut later this year is undoubtedly the most anticipated IPO of 2019, but the company’s lofty valuation (valued by some as high as $120 billion) has some investors feeling uneasy.

5. Amazon is getting more serious about Alexa in the car with Telenav deal

Amazon has announced a new partnership with Telenav, a Santa Clara-based provider of connected car services. The collaboration will play a huge role in expanding Amazon’s ability to give drivers relevant information and furthers the company’s mission to bake Alexa into every aspect of your life.

6. I used VR in a car going 90 mph and didn’t get sick

The future of in-vehicle entertainment could be VR. Audi announced at CES that it’s rolling out a new company called Holoride to bring adaptive VR entertainment to cars. The secret sauce here is matching VR content to the slight movements of the vehicle to help those who often get motion sickness.

7. Verizon and T-Mobile call out AT&T over fake 5G labels

Nothing like some CES drama to start your day. AT&T recently shared a shady marketing campaign that labeled its 4G networks as 5G and rivals Verizon and T-Mobile are having none of it.

Powered by WPeMatico

Uber is expected to raise $10 billion later this year in one of the largest U.S. initial public offerings in history. The float will value the ride-hailing giant somewhere between $76 billion — the valuation it garnered with its last private financing — and $120 billion — a sky-high figure assigned by Wall Street bankers that’s had even early Uber investors scratching their heads.

A new report from The Information pegs Uber’s initial market cap at $90 billion. To develop the estimate, the site analyzed undisclosed documents Uber provided creditors in 2017 “in which the company projected it would double net revenue to $14.2 billion by 2019,” ran revenue multiples and compared Uber to GrubHub, which investors say is the business’s closest comparison.

Uber declined to comment on The Information’s analysis.

Uber confidentially filed for its long-awaited IPO last month, marking the beginning of a race to the stock markets between it and U.S. competitor Lyft, which filed just hours before, according to a source with knowledge of the situation. Founded in 2009 by Travis Kalanick, Uber has brought in about $20 billion in a combination of debt and equity funding. It counts SoftBank as its largest shareholder in a cap table that also lists Toyota, T. Rowe Price, Fidelity, TPG Growth and many more. As for the skepticism surrounding Uber’s lofty $120 billion valuation, the eye-popping figure seems unachievable considering the company isn’t profitable and has and continues to burn through cash.

An IPO that large would certainly make its investors happy. First Round Capital, for example, seeded Uber with $1.6 million in the company’s first two funding rounds in 2010 and 2011, according to The Wall Street Journal. At a $120 billion valuation, First Round’s shares would be worth some $5 billion. The venture capital firm, however, sold some of its shares to SoftBank alongside Benchmark, which itself would otherwise own shares worth about $14 billion.

Bradley Tusk, an early Uber investor who signed on to help the company surmount political and regulatory barriers in 2011, own shares said to be worth $100 million, though he too gave up 42 percent of his equity in a secondary sale to SoftBank, he recently told TechCrunch.

“I’m quite happy with the 120 number,” Tusk said. “But … I am a little surprised by [it], it does seem to be a really aggressive number.”

“Any investment in Uber is obviously a long-term bet on the future, like someone who invested in Amazon in the early days,” Tusk added. “One thing [Uber chief executive officer Dara Khosrowshahi] is doing well is really expanding Uber into a mobility company as opposed to just a ride-hailing company.”

Dara Kowsrowshahi, chief executive officer of Uber, looks on following an event in New Delhi, India, on Thursday, Feb. 22, 2018. Photographer: Anindito Mukherjee/Bloomberg via Getty Images

Uber has opted to go public in a year poised to see the most high-flying unicorn IPOs in history. As we’ve reported in great detail on this site, both Lyft and Uber are planning to float, as are Slack and Pinterest . Many of these companies, however, made the call to make their public markets debut before the stock market took a quick turn south. Poor performing stocks may discourage unicorns from emerging from their cozy VC-protected stalls.

Uber will garner increased scrutiny from Wall Street investors as they begin to parse out its true value. Fortunately the company, which like Amazon has long prioritized growth over profit, has “’clear levers’ it could pull in order to turn on the cash spigots if it wanted to, by reducing its marketing spending both in the U.S. and developing markets and by finding partners to help finance its self-driving car development,” according to The Information. “Pulling those levers would slow revenue growth by a third—from a 33% growth in net revenue to 22 percent growth in net revenue in 2019 [but] it would save Uber $2 billion annually.”

In its third quarter 2018 financial results, Uber posted a net loss of $939 million on a pro forma basis and an adjusted EBITDA loss of $527 million, up about 21 percent quarter-over-quarter. Revenue for Q3 was up five percent QoQ at $2.95 billion and up 38 percent year-over-year.

“We had another strong quarter for a business of our size and global scope,” Uber chief financial officer Nelson Chai said in a statement. “As we look ahead to an IPO and beyond, we are investing in future growth across our platform, including in food, freight, electric bikes and scooters, and high-potential markets in India and the Middle East where we continue to solidify our leadership position.”

We can speculate on Uber’s valuation for days but ultimately Wall Street will determine just how high Uber will go. For now, all we can do is sit and wait for the company to relinquish its S-1 to the masses.

Powered by WPeMatico

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here:

1. Nvidia launches the $349 GeForce RTX 2060

Nvidia broke with tradition and put a new focus on gaming at CES. Last night the company unveiled the RTX 2060, a $349 low-end version of its new Turing-based desktop graphics cards. The RTX 2060 will be available on Jan. 15.

2. Elon Musk’s vision of spaceflight is gorgeous

This spring SapceX intends to launch the next phase in its space exploration plans. The newly named Starship rocket, previously known as the BFR, intends to to be rocket to rule them all. And it’s going to look good doing it.

3. Apple’s increasingly tricky international trade-offs

Far from its troubles in emerging markets like China, Apple is starting to face backlash from a European population that’s crying foul over the company’s perceived hypocrisy on data privacy. It’s become clear that Apple’s biggest success is now its biggest challenge in Europe.

Photo by Justin Sullivan/Getty Images

4. Marc Andreessen: audio will be “titanically important” and VR will be “1,000” times bigger than AR

In a recently recorded podcast Marc Andreesen gave some predictions on the future of the tech industry. Surprisingly, the all-start investor is continuing his support of the shaky VR industry saying that expanding the immersive world will require us to remove the head-mounted displays we’ve become accustomed to.

5. Fitness marketplace ClassPass acquires competitor GuavaPass

ClassPass, the five-year-old fitness marketplace, is in the midst of an expansion sprint. The company announced yesterday that it’s acquiring one it competitors, GuavaPass, for an undisclosed amount to expand into Asia. The move now puts ClassPass in more than 80 markets across the 11 countries, with plans to expand to 50 new cities in 2019.

6. Apple shows off new smart home products from HomeKit partners

Apple gave a snapshot of its future smart home ecosystem at CES. Looks like an array of smart light switches, door cameras, electrical outlets and more are on the way and will be configurable through the Home app and Siri.

7. Parcel Guard’s smart mailbox protects your packages from porch thieves

Danby is showing off its newly launched smart mailbox called Parcel Guard at CES, which allows deliveries to be left securely at customers’ doorsteps. Turns out you won’t need a farting glitter bomb to protect your packages after all. The Parcel Guard starts at $399 and pre-orders are will be available this week.

Powered by WPeMatico

French startup Ledger unveiled its new hardware wallet to manage your cryptocurrencies. The Ledger Nano X is a Bluetooth-enabled wallet, which means that you’ll be able to send and receive tokens from your phone.

The previous version of the device required you to plug the key to your computer using a microUSB cable in order to execute an order. Switching to Bluetooth and opening it up to smartphones is the next logical step.

Ledger is going to launch a full-fledged mobile app called Ledger Live. You’ll find the same features as the ones in the desktop app. You’ll be able to install new apps, check your balances and manage transactions.

The app will be available on January 28th and existing Ledger users will be able to check their balances in read-only mode thanks to public addresses (in case you’re not using Spot). Ledger has sold 1.5 million Ledger Nano S so far. And it sounds like other companies will be able to build mobile apps that work with your Nano X.

The Nano X looks more or less like the Nano S. It’s a USB key-shaped device with a screen and a couple of buttons. The screen is now slightly bigger.

One of the main issues with the Nano S is that you were limited to 18 different cryptocurrencies. You can now store up to 100 different crypto assets on the Nano X — the device supports 1,100 different tokens overall.

Just like other Ledger devices, the private keys never leave your Ledger wallet. It means that even if your computer or mobile phone get hacked, hackers won’t be able to grab your crypto assets.

The company is presenting the new device at CES, I’ll try to play with it to see how it works when it comes to pairing, battery life, etc.

Powered by WPeMatico

ClassPass, the five-year-old fitness marketplace startup with $239 million in financing, is acquiring competitor GuavaPass, which was founded by Rob Pachter and Jeffrey Liu in 2015.

ClassPass is in the midst of an expansion sprint, both domestically and internationally. The company is hyper-focused on Asian markets, where GuavaPass had carved out its own place with 75 studio partners across 11 cities, including Abu Dhabi, Bnagkok, Beijing, Dubai, Hong Kong, Jakarta, Kuala Lumpur, Manila, Mumbai, Shanghai and Singapore.

The financial terms of the deal were not disclosed.

This is not ClassPass’s first acquisition. In 2014, ClassPass acquired competitor FitMob. But CEO Fritz Lanman says that this is less about competition and more about opportunity.

“The GuavaPass founders reached out to us,” he told TechCrunch. “They said that they were raising more money and had some options developing but that they felt they could continue working on their original mission as a part of ClassPass. They are really missionaries for the space.”

ClassPass will be bringing on about half of the GuavaPass team as part of the acquisition. However, Lanman doesn’t expect to do many acquisitions in the future, saying that “acquisition isn’t a part of the company’s expansion strategy.”

Alongside regularly planned expansion, the acquisition now puts ClassPass in more than 80 markets across the 11 countries, with plans to expand to 50 new cities in 2019.

Powered by WPeMatico

Gousto, the U.K. cook-at-home meal kit service that competes most directly with HelloFresh, has raised a further £18 million in funding. The round is backed by Instagram “health influencer” Joe Wicks, along with existing investors Unilever Ventures, Hargreave Hale, BGF Ventures, MMC Ventures, and Angel CoFund.

The new funding brings the total raised by Gousto to £75 million since being founded in 2012, and follows a £28.5 million fund raise last March, which it used to invest in its machine learning and factory automation.

The startup also recently launched a customer-facing AI recipe recommendation tool, through which half of customer orders are now placed. Gousto says it will continue to prioritize the majority of its investment in technology to accelerate growth.

In a call, Gousto founder and CEO Timo Boldt told me the startup is now delivering over 1.5 million meals a month to customers, and is seeing 170 percent year-on-year growth. However, he declined to break out specific customer numbers, monthly active or otherwise.

Noteworthy, Gousto says two-thirds of customers are families, and Boldt says this proves that a meal kit service that offers the right mixture of choice, personalization and, crucially, price point, can become a viable alternative to the weekly grocery shop for busy families.

The thinking behind meal kit services more generally is that because they send you correctly portioned fresh ingredients matched to each recipe, you save money by only buying what is needed.

Meanwhile, the services themselves have the potential to run a lot more efficiently than a national grocery store chain’s offline or online offering, including throwing significantly less food away.

To that end, Boldt says that Gousto offers more choice to customers than competitors and is further ahead in terms of driving factory and logistics efficiencies through the use of automation and data. The meal kit service offers over 30 weekly recipes and delivers 7 days per a week. It also claims the shortest lead time of 3 days, and the lowest price point, starting at £2.98 per meal.

The investment in Gousto by “body coach” Joe Wicks is also worth noting, as the startup places more emphasis on healthy eating. The pair had already announced they are working together and this month will launch a co-branded range of nutritious meal kits. This will see a minimum of four new Wicks-branded recipes offered per week, including Joe’s Veggie Spag Bol’ and Satay Chicken Lettuce Wraps, along with Herby Crusted Fish, Root Veg Chips & Peas, and 10-Min Nifty Veggie Noodles.

Cue statement from Wicks: “It was clear from when I first approached Gousto that they were a purpose driven business, with a passion for getting more people cooking and in turn improving the health of the nation. As a customer before becoming an investor, I know that Gousto is having a lasting and hugely positive impact on the way families consume and eat food. I’m delighted to join forces and offer my knowledge to a company who has brought huge and much-needed innovation to an industry”.

Powered by WPeMatico

If you have a job today, there’s a good chance you personally reached out to your employer and interviewed with other humans to get it. Now that you’ve been there a while, it’s also likely the workday feels more like a long slog than the fulfilling career move you had envisioned.

But if today’s early-stage startups have their way, your next employment experience could be quite different.

First, forget the networking and interview gauntlet. Instead, let an AI-enabled screening program reach out about a job you don’t seem obviously qualified to do. Or, rather than talk to a company’s employees, wait for them to play some online games instead. If you play similarly, they may decide to hire you.

Once you have the job, software will also make you more efficient and happier at your work.

An AI-driven software platform will deliver regular “nudges,” offering customized suggestions to make you a more effective worker. If you’re feeling burned out, head online to text or video chat with a coach or therapist. Or perhaps you’ll just be happier in your job now that your employer is delivering regular tokens of appreciation.

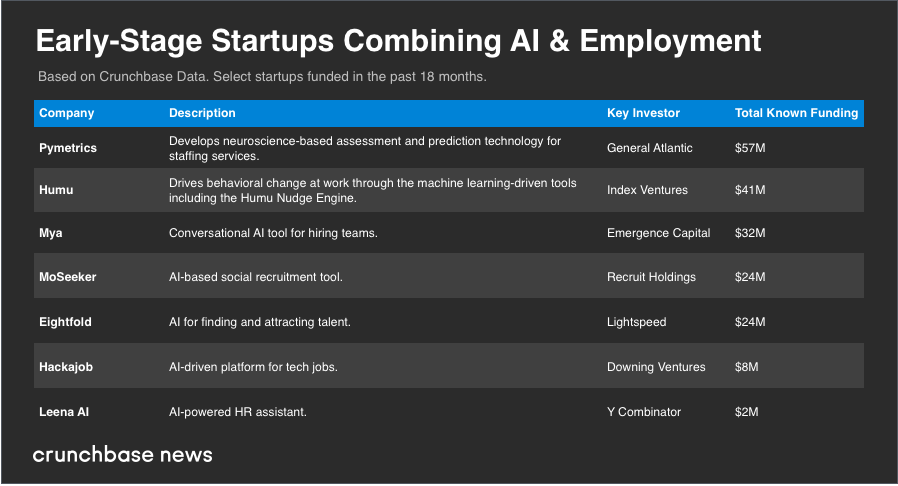

Those are a few of the ways early-stage startups are looking to change the status quo of job-seeking and employment. While employment is a broad category, an analysis of Crunchbase funding data for the space shows a high concentration of activity in two key areas: AI-driven hiring software and tools to improve employee engagement.

Below, we look at where the money’s going and how today’s early-stage startups could play a role in transforming the work experience of tomorrow.

To begin, let us reflect that we are at a strange inflection point for AI and employment. Our artificially intelligent overlords are not smart enough to actually do our jobs. Nonetheless, they have strong opinions about whether we’re qualified to do them ourselves.

It is at this peculiar point that the alchemic mix of AI software, recruiting-based business models and venture capital are coming together to build startups.

In 2018, at least 43 companies applying AI or machine learning to some facet of employment have raised seed or early-stage funding, according to Crunchbase data. In the chart below, we look at a few startups that have secured rounds, along with their backers and respective business models:

At present, even AI boosters don’t tout the technology as a cure-all for troubles plaguing the talent recruitment space. While it’s true humans are biased and flawed when it comes to evaluating job candidates, artificially intelligent software suffers from many of the same bugs. For instance, Amazon scrapped its AI recruiting tool developed in-house because it exhibited bias against women.

That said, it’s still early innings. Over the next few years, startups will be actively tweaking their software to improve performance and reduce bias.

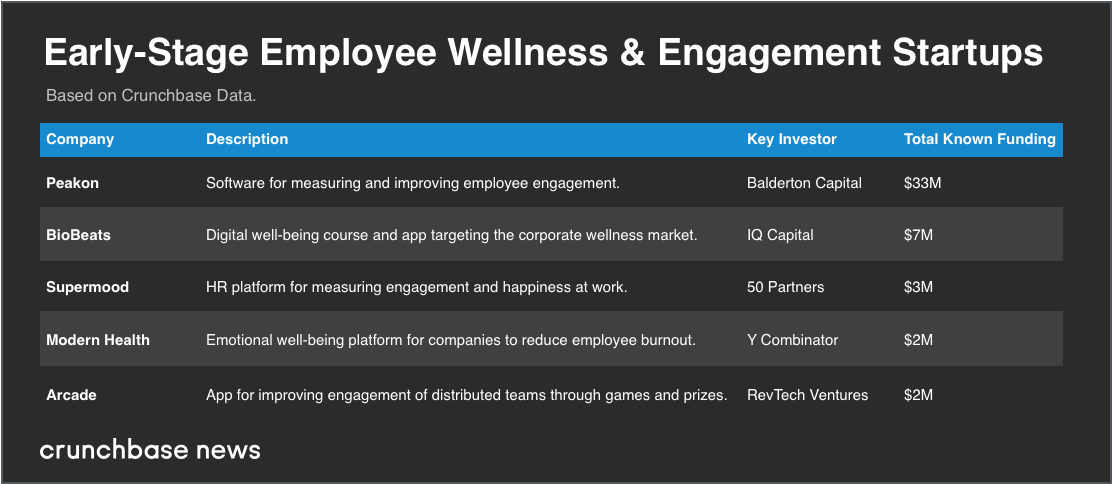

Once the goal of recruiting the best people is achieved, the next step is ensuring they stay and thrive.

Usually, a paycheck goes a long way to accomplishing the goal of staying. But in case that’s not enough, startups are busily devising a host of tools for employers to boost engagement and fight the scourge of burnout.

In the chart below, we look at a few of the companies that received early-stage funding this year to build out software platforms and services aimed at making people happier and more effective at work:

The most heavily funded of the early-stage crop looks to be Peakon, which offers a software platform for measuring employee engagement and collecting feedback. The Danish firm has raised $33 million to date to fund its expansion.

London-based BioBeats is another up-and-comer aimed at the “corporate wellness” market, with digital tools to help employees track stress levels and other health-related metrics. The company has raised $7 million to date to help keep those stress levels in check.

Early-stage funding activity tends to be an indicator of areas with somewhat low adoption rates today that are poised to take off dramatically. For employment, that means we can likely expect to see AI-based recruitment and software-driven engagement tools become more widespread in the coming years.

What does that mean for job seekers and paycheck toilers? Expect to spend more of your time interfacing with intelligent software. Apparently, it’ll make you more employable, and happier, too.

Powered by WPeMatico