Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

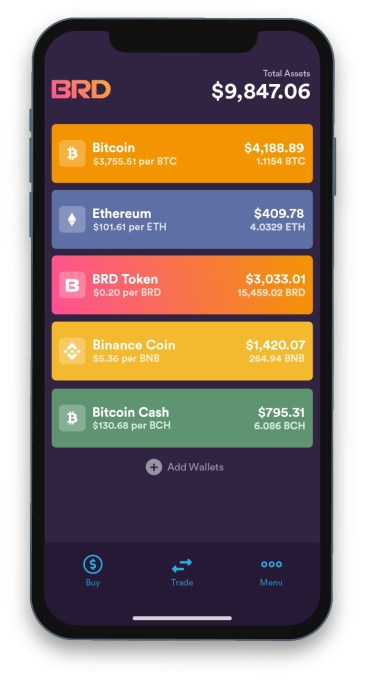

Mobile cryptocurrency wallet BRD is announcing that it has raised $15 million in Series B funding.

The funding comes from SBI Crypto Investment, a subsidiary of Japanese financial services company SBI Holdings (formerly a subsidiary of SoftBank). BRD said the funding will allow it to grow its product and engineering teams, and to expand in Japan and across Asia.

“SBI Group’s investment in BRD allows us to firmly cement ourselves in the Asian market,” said BRD co-founder and CEO Adam Traidman in a statement. “It shows incredible support for the foundation that we have built in North America and reinforces our proven ability to scale the success we have achieved in the past 4 years. The new investment will ensure our long-term global growth, and we are incredibly excited about collaborating with SBI as a strategic investor and business partner to make that happen.”

It’s surprising to see a crypto startup raising money now, given the broader crypto downturn. After all, BRD bills itself as the simplest way to start buying and storing cryptocurrencies — but does that mean anything if consumers are being scared away from investing?

When I asked Spencer Chen, the company’s vice president of global marketing (and an occasional friend of mine), about the industry’s recent challenges, he argued, “The need for a single, global currency still exists.”

“That’s what all got lost in 2018 as the fast-money, traders, and speculators came piling into the crypto space,” Chen told me via email. “It really convoluted the core mission of a natively digital currency. Money that worked just like the open internet. As a company that’s built-to-last and committed to the core mission of crypto currency, there was nothing more frustrating than to witness the many steps backwards the industry at large took in 2018.”

In fact, BRD says it doubled its total install base in 2018, ending the year with 1.8 million users globally. It also says it’s currently being used to store the equivalent of $6 billion mostly in Bitcoin and Ethereum — with a 24 percent increase in monthly active users between November and December, after it started accepting stablecoins (which are pegged to the value of a fiat currency).

BRD has now raised a total of $55 million. It’s also announcing a partnership with Coinify, allowing users to make cryptocurrency purchases using bank accounts in the European market.

Powered by WPeMatico

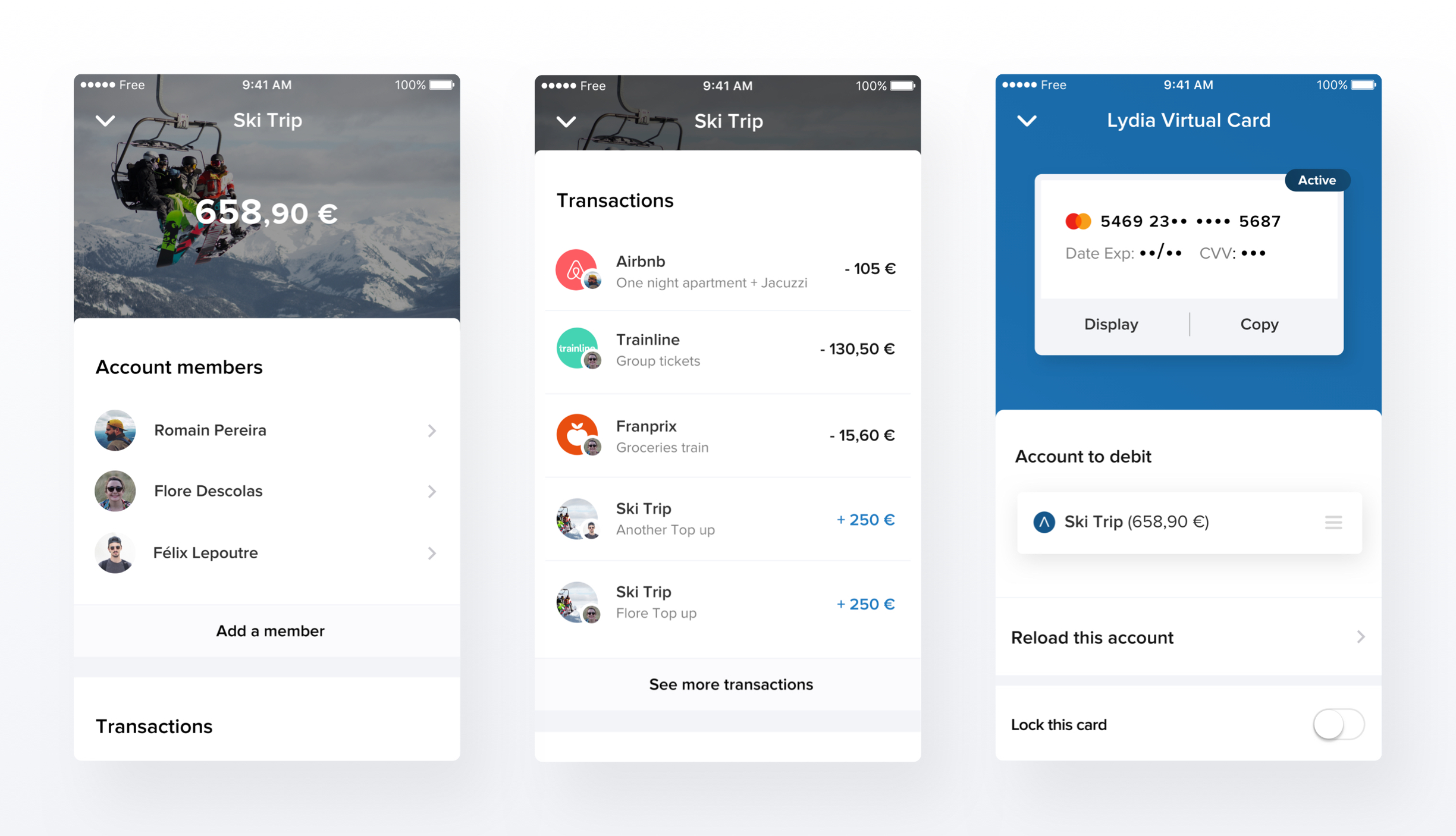

French startup Lydia now lets you share your Lydia sub-accounts with other people. The company wants to make it easier to manage money when you’re traveling with friends, sharing an apartment with someone and more.

When Lydia introduced its premium offering back in March 2018, the company completely rethought the way Lydia accounts worked. Users had a single Lydia account and were basically limited to sending, receiving and withdrawing money — it was all about peer-to-peer payments. Now, you can create as many Lydia accounts as you want, move money around, set money aside and top up each account separately.

That was just the first step as you can now share those accounts with other people. This way, you don’t have to create a Splitwise group and track who owes what to whom. Instead of getting your money back after a while, people chip in and top up the shared account directly. Anybody can then safely spend that money.

As always, Lydia is all about getting money in the app and out of the app as seamlessly as possible. When you create a shared account, each user can top up the account using other Lydia sub-accounts, a traditional bank account that you have already connected to the app or a debit card if it’s a small amount.

If your bank account isn’t compatible with Lydia, you also get an IBAN number for this sub-account in particular. So you can initiate a traditional bank transfer from your bank account as well.

Once the account is up and running, anybody can spend money. You can generate a virtual card, add it to Apple Pay, Google Pay or Samsung Pay, and associate it with the shared account. If you’re on a ski trip and buying raclette cheese for your group of friends, you can then pay with your phone and debit the shared account.

If you’re a premium user and have a good old plastic Lydia card, you can also use it in any card reader and associate transactions with your shared account. Some websites already let you pay with your Lydia account directly as well. You can select your sub-account when confirming the transaction on your phone.

You can imagine multiple different use cases for such a feature. This is a good way to share an account with your significant other without switching to the same bank. This could be a way to pay for utility bills with your roommates.

“I use it with my son for instance. I created a shared account, I set up a virtual card and he added it to his Google Pay,” co-founder and CEO Cyril Chiche told me. He can then send him money that he can use instantly whenever he needs to.

This feature will become more valuable over time, when you can pay with your Lydia account in more places. Mobile payment systems, such as Apple Pay and Google Pay, are slowly becoming more widespread. And Lydia has also been working with popular payment service providers to add support for more e-commerce websites.

It’s a radical way of sharing expenses with friends and family members, but it could become the obvious way if Lydia becomes ubiquitous.

Powered by WPeMatico

San Jose cannabis company Caliva is proving that weed’s still hot, even as some markets cool off.

The company is announcing a $75 million round of investment that includes participation from former Yahoo CEO Carol Bartz and football legend Joe Montana . If that pair seems unlikely, it just goes to show that cannabis attracts an eclectic mix.

With what the company itself refers to as a “war chest,” Caliva intends to expand its portfolio of products as well as ramping up its efforts courting cannabis users in California through a combination of branded brick and mortar stores, direct to consumer sales and sales to distributors. While state regulations slowed the overall market over the last year, Caliva grew its revenues by 350 percent, growing its company to 440 workers.

A general partner at Liquid 2 Ventures, Montana isn’t new to cannabis investing. In 2017, the former quarterback participated in a seed round for Herb, a cannabis-focused media company. Given the extreme toll pro sports take on the human body, it’s not uncommon for former athletes to get involved in the cannabis business, particularly with CBD products.

“As an investor and supporter, it is my opinion that Caliva’s strong management team will successfully develop and bring to market quality health and wellness products that can provide relief to many people and can make a serious impact on opioid use or addiction,” Montana said of his interest in the cannabis industry.

Caliva currently operates a popular retail location situated conveniently for Silicon Valley’s droves of weed acolytes, but the company is more than just a well-liked dispensary. Beyond just carrying popular brands, Caliva sells its own products at its own stores — everything from vape pen oil cartridges to pre-rolls — in addition to operating a distribution center nearby.

“I know great opportunities when I see them,” said Bartz, who will also join the company’s board.

Powered by WPeMatico

When one food delivery startup fails, another gets funded.

Chowbus, an Asian food ordering platform headquartered in Chicago, has brought in a $4 million “seed” funding led by Greycroft Partners and FJ Labs, with participation from Hyde Park Angels and Fika Ventures. The startup, aware of the challenges that plague startups in this space, says offering exclusive access to restaurants and eliminating service fees sets it apart from big-name competitors like Uber Eats, Grubhub, DoorDash and Postmates.

The Chowbus platform focuses on meals rather than restaurants. While scrolling through the mobile app, a user is connected to various independent restaurants depending on what particular dish they’re seeking. Chowbus says only a small portion of the restaurants on its platform, 15 percent, are also available on Grubhub and Uber Eats.

The app is currently available in Chicago, Boston, New York City, Philadelphia, Champaign, Ill. and Lansing, Mich. With the new investment, which brings Chowbus’ total raised to just over $5 million, the startup will launch in up to 20 additional markets. Eventually, Chowbus says it will expand into other cuisines, too, beginning with Mexican and Italian.

Chowbus was founded in 2016 by chief executive officer Linxin Wen and chief technology officer Suyu Zhang.

“When I first came to the U.S. five years ago, I found most restaurants I really liked [weren’t] on Grubhub nor other major delivery platforms and the delivery fees were quite high,” Wen told TechCrunch. “So I thought, maybe I can build a platform to support these restaurants,”

TechCrunch chatted with Wen and Zhang on Tuesday, the day after Munchery announced it was shutting down its prepared meal delivery business. Naturally, I asked the founders what made them think Chowbus can survive in an already crowded market, dominated by the likes of Uber.

“The central kitchen model doesn’t work; the cost is too high,” Zhang said, referring to Munchery’s business model, which prepared food for its meal service in-house rather than sourcing through local restaurants.

“We don’t own the kitchen or the chef, we just take advantage of the resources and help restaurants make more money,” Wen added. “The food delivery space is really huge and growing so quick.”

Powered by WPeMatico

Swarm Technologies is one of several companies looking to populate low Earth orbit with communications satellites, setting itself apart with the sheer smallness of its devices — and of course with the notoriety of having defied the FCC and earned a fine. But investors are bullish, and the company has just raised a $25 million Series A round to put 150 of its tiny SpaceBEEs in orbit.

There are many communications markets to be served from space: Starlink wants to do mobile broadband; Ubiquitilink wants to eliminate “no signal;” and Swarm is taking aim at embedded devices, the so-called Internet of Things.

IoT devices don’t need high speeds or low latency; the data they produce can usually wait a few minutes, or even days. While they very well could be registered on your ordinary Wi-Fi network or even connect by a cellular connection, it’s easy to see that they would benefit from a separate form of connectivity more suited to their needs.

This is especially true when you consider how areas like farms and wildernesses are being outfitted with sensors to monitor soil, warn of poachers or lost hikers and otherwise provide some basic data on the huge swathes of land that are more or less off the grid.

“Swarm has developed something entirely new: a low-bandwidth, latency-tolerant network that is extremely inexpensive, low-power and very easy to integrate for things that need to be connected anywhere in the world,” said Sky Dayton, EarthLink founder and leading participant in the round alongside Craft Ventures, Social Capital, 4DX Ventures and NJF Capital.

The focus at Swarm now is on speed and cost reduction. Especially in space, there’s a strong argument to get something, anything in place so you can demonstrate the utility of your service, however limited, while others are still at the drawing board.

That’s what the $25 million will be dedicated to — expansion and in particular the deployment of a 150-satellite constellation over the next 18 months.

Of course the success of the company’s ambitions here depend much upon finalization, regulatory approval, manufacturing and launch schedules. But Swarm’s satellites really are small — so small that the FCC was leery about allowing them to be launched — so dozens may well be launched at a time.

The company has already launched and tested seven of its satellites; a representative told me that the design is final and that the 150 it plans to launch by mid-2020 are being made in its lab right now.

Powered by WPeMatico

MaaS Global, the company behind the all-in-one mobility app Whim, which offers a subscription service for public transportation, ridesharing, bike rentals, scooter rentals, taxis or car rentals, will be making its U.S. debut later this year.

The company will choose its American launch city from Austin, Boston, Chicago, Dallas and Miami, according to Sampo Hietanen, the company’s chief executive.

The Whim app is currently available in Antwerp, Birmingham, U.K., Helsinki and Vienna, according to Hietanen, and offers a range of subscription options. The top of the line version is a €500 per month all-inclusive package giving users unlimited access to ride hailing, bike and car rentals and public transportation.

“Cars take 70 percent of the market and it’s used 4 percent of the time so you’re paying for the optional capacity,” says Hietanen. Using Whim, which, at the high end costs about as much as a car in Europe, users can get all of the optionality without paying for the unused capacity. It should ideally reduce transportation costs and cut down on emissions, if Hietanen’s claims are accurate.

The Helsinki-based company uses APIs to connect with the back end of a number of service providers. For car rentals, it’s working with businesses like Hertz, Enterprise and EuropeCar; for ridesharing, the company has linked with Gett and local European taxi companies, according to Hietanen.

Users have already booked 3 million trips through the company’s app since its launch and the company is continuing to expand not just in North America, but in Asia as well. There are plans in the works for the company to launch operations in Singapore.

Giving consumers more options for transit through a single gateway could reduce demand for vehicles, but some analysts argue that it won’t do much to alleviate congestion on roads. Consumers, they argue, will choose the convenience of rideshare over mass transit and could actually increase.

As Richard Rowson, a mobility consultant from the U.K., noted in this post:

MaaS doesn’t implicitly mean a net decrease nor increase in the number of road vehicle miles. The changes are complex, but in balance look likely to result in an increase.

Factors such as migration from private car to public transport should cause a reduction, but migration from train and bus, to private hire and smaller demand responsive buses will cause an increase. Other factors such as ‘positioning’ movements as ‘on demand’ vehicles are positioned to exploit demand also create journeys.

Smart journey planning and navigation systems should make better use of available road capacity, such as identifying alternative routes – but at the expense of migrating through traffic to local access roads.

There is the potential that having a single point of access to mobility may actually help cities push riders to favor public transportation by offering a window into the amount of time using each service would take and showing users the fastest route.

Last August the company said it had raised a €9 million round from undisclosed investors. It had previously received capital from Toyota Financial Services and its insurance partner Aioi Nissay Dowa Insurance.

Powered by WPeMatico

Okay, I’ll admit it: Sometimes, I write stories because I think they’re going to be popular. And sometimes, those stories fall flat anyway.

It makes sense — both on a cosmic level, because life isn’t fair, but also in the more specific sense that some topics are simply over-covered. Yes, people seem to like reading about Apple, but are they going to read my Apple post if it’s the fiftieth story published on the same topic?

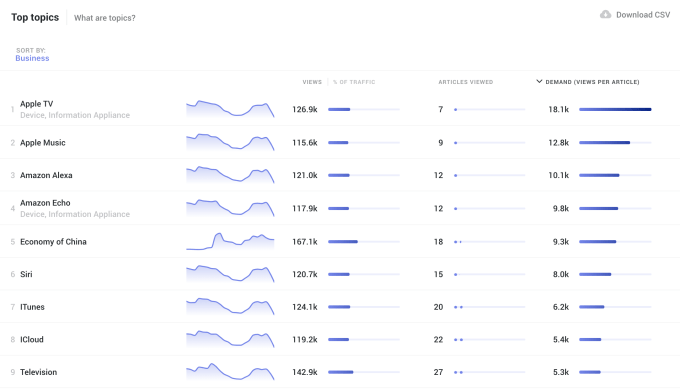

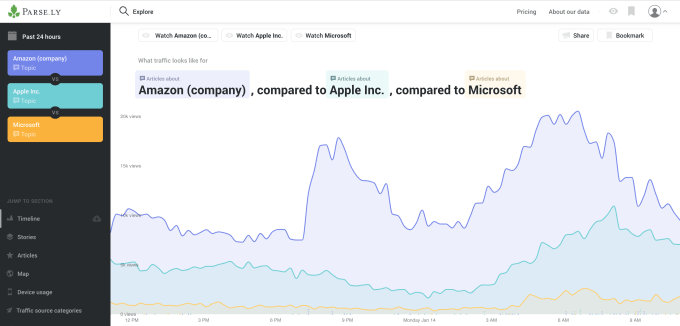

Analytics company Parse.ly is trying to address that very problem with a new feature in Currents, its free product highlighting broader audience trends. The feature is called “demand sorting,” because it points out the topics that are most “in demand” by the audience.

Demand, in this case, is determined by taking the total number of views for a topic and then dividing that by the number of articles. In other words, if a topic is in demand, it’s attracting a lot of views but has been covered by relatively few stories — creating an opportunity for a writer looking for their next subject.

In part, CEO Sachin Kamdar said this is highlighting Parse.ly’s “differentiated data, showing what people are actually reading versus what people are sharing or searching for.”

Special Projects Lead Sal Gionfriddo said it’s also taking advantage of the natural language processing technology used in Currents to identify the main topic of a story and understand the relationship between different topics.

So it’s not just a list of story subjects. You can compare the demand for different topics, and if you learn that (say) Amazon may be under-covered relative to Apple, you can also look more closely and see which Amazon-related topics are currently experiencing the most demand. And there’s historical data, so you can see the demand in past years for coverage around events like CES or the State of the Union, and plan accordingly.

When I wondered whether this will just give thirsty publications another number to chase — as opposed to focusing on what’s genuinely newsworthy or important — Kamdar replied, “It’s not like you can game this. It’s not something like slideshows, where you can generate X number of [slides] to increase your pageviews. It’s a unique person viewing a piece of content … In that sense, it stays a little bit truer what is actually of interest to people.”

I previously spoke to Kamdar about the need for new, non ad-based business models in the online news business. In our more recent discussion of Currents, he suggested that one of the ways demand-sorting could evolve is a focus on “loyalty based metrics” — so news organizations could see the topics that are driving people to return to their site and potentially sign up for subscriptions.

Powered by WPeMatico

People are increasingly interested in finding a way to participate in the cannabis industry, and for good reason. It’s growing like a weed (yes, we said it). According to a San Francisco-based research company, Grand View Research, the global legal marijuana market is expected to reach $146.4 billion by the end of 2025.

Still, it isn’t easy for potential recruits to know where to look for both temporary and permanent jobs, and it’s just as challenging for companies to find candidates who understand their business. Enter Vangst, a now three-year-old, Denver-based startup that just raised $10 million in Series A funding from earlier backers Casa Verde Capital and Lerer Hippeau to become the go-to recruiting platform for the industry, even while going up against several older entrants, including Seattle-based Viridian Staffing and Ganjapreneur, in Bellingham, Wash.

Yesterday, we with chatted with the CEO and founder of the now 70-person company, Karson Humiston, about launching the platform in college, and why she isn’t so worried about the competition. She also shared some interesting stats around how much cannabis jobs pay.

TC: Some people launch startups in college. Not many of them grow them into sustainable companies. How did Vangst get going?

KH: I went to St. Lawrence [University] and while there, I’d started a student travel company and compiled a database of students and recent grads — people who’d gone on trips through the startup or expressed an interest in going on trips. The spring of my senior year, in 2015, I sent an email to all of them asking what jobs they were interested in, and more than 70 percent said the cannabis industry.

TC: Wow, interesting.

KH: That was my reaction, but living in upstate New York where recreational cannabis isn’t yet legal, I didn’t know a lot about it. So I took a weekend off from school to go to a trade show in Colorado, where I saw everything from cultivation to extraction to retail to ancillary businesses. And when I asked what jobs they were looking to fill, they said, essentially, everything: a director of cultivation, retail dispensary store managers, HR, marketing. They all said it was their top pain point because if they posted on a traditional jobs board — and remember, this was 2015 — the listing would often get taken down. Meanwhile, there was no industry-specific resource because [marijuana] is federally illegal.

TC: So you dropped the travel startup idea and pursued this. Where did you start?

KH: First, I rushed back to St. Lawrence and made an inexpensive site on Wix and started connecting people in my database with summer internships. I’d told the companies I’d met with that I could find them employees for $500 and I called this new company Graduana, [with the tagline] green jobs for grads. My thought was, I’ll go to Colorado and do Graduana for six months and see where the industry really is.

By the spring of 2016, I realized that demand far exceeded interns and recent grads and that we needed to find recruiters who know what they’re doing. We brought on recruiters who were just focused on cultivation, for example, and who know the difference between someone who can grow cannabis in the garage and someone who has done large-scale agricultural growing. They they started pulling in people from the tomato and tulip and big commercial ag who’ve grown [plants] in big state-of-the-art greenhouses and could bring important skills to the table. We also brought in recruiters to just focus on the retail side of things.

It became this profitable, 25-person, boutique staffing agency. But we also saw an opportunity for on-demand labor, because of the seasonality of the industry. Cannabis grows, then it needs to be trimmed and packaged. . .

TC: So it was time for venture capital?

KH: When you’re talking about temporary staffing, it’s really been done manually in this industry, so we wanted to build a platform that would notify candidates that a certain company needs 20 trimmers and is willing to pay $12 an hour and where, meanwhile, employers could see that someone has trimmed for 2,000 hours. And each could rate each other. So we needed to hire engineering and a customer success team and legal, and our revenue wasn’t going to cover those costs.

Thankfully, a founder friend in the space, Ryan Smith of LeafLink, introduced us to Lerer Hippeau when he heard were raising a seed round. We received a warm intro to Casa Verde, too. And both have been amazingly helpful to us.

TC: Are you still doing high-end hiring, too?

KH: We are. Revenue from that piece of our business, where we’re helping companies find maybe COOs or a director of cultivation or extraction, more than doubled last year and continues to be profitable. We get 1,000 resumes some days. We now have 200,000 job candidates on the platform.

TC: Obviously, you’re charging employers different amounts depending on the the type of role that you’re filling. Can you share some specifics?

KH: Right. On the direct hire side, we take a percentage of their first year’s salary. On the gig side, a company tells us how much they’d like to pay for gig workers, and there’s a mark-up on that that we keep.

TC: No matter how long that person works for your client?

KH: It’s usually for a matter of weeks. If it’s longer than that, we charge them a buyout fee [to step out of the relationship].

TC: I take it you’re marketing the service to college students largely.

KH: We market the service through career fairs that we throw in different states, and at trade shows in and out of the industry. We also spend time going to college campuses. But our acquisition costs have been relatively low. Everyone who gets placed with us is known as an original Vangster and we do Vangster nights, where anyone in our network can bring a friend and we can help turn them into employees, too.

TC: More states are legalizing recreational cannabis; how are you drumming up workforces in different places?

KH: We have a team now in Denver, in Santa Monica and a small team in Oakland, and as we launch additional cities for Vangst gigs, we’re hiring managers and people who can do client outreach and candidate vetting and onboarding. We just hired an early employee of Uber, Will Zinsmeister, who helped oversee the launch of cities in Texas for Uber, so we’re excited to have Will and others thinking through supply-and-demand issues as we launch more widely.

TC: Out of curiosity, how much do cannabis jobs pay, and how many people work in the industry right now — do you have any idea?

KH: I think there’s more than 160,000 employees across the cannabis industry right now, and by 2022, the industry is expected to grow to around 340,000 full-time employees.

We did survey 1,500 people to put together a salary guide and one of the questions we asked was how much of their labor needs are seasonable versus otherwise, and they said about 30 percent.

As for the salaries, the on-demand jobs are very in line with other industries. When it comes to full-time jobs, outside sales jobs pay on average a salary of $73,000, which is in line with other outside sales jobs. On the higher end, a compliance manager can make $149,000, a director of extraction makes on average $191,000, and a director of cultivation on the high end can make $250,000.

TC: I think that’s more than people might have imagined. Who is landing these higher-end jobs other than people with backgrounds in traditional large-scale farming?

KH: You’re seeing people graduating with a degree in botany who’ve maybe worked for a cannabis company for six years and are seen as having very unique experience. We’re seeing a lot of clients in Maryland and other places saying they want candidates from Colorado.

Powered by WPeMatico

Microsoft today announced that it has acquired Citus Data, a company that focused on making PostgreSQL databases faster and more scalable. Citus’ open-source PostgreSQL extension essentially turns the application into a distributed database and, while there has been a lot of hype around the NoSQL movement and document stores, relational databases — and especially PostgreSQL — are still a growing market, in part because of tools from companies like Citus that overcome some of their earlier limitations.

Unsurprisingly, Microsoft plans to work with the Citus Data team to “accelerate the delivery of key, enterprise-ready features from Azure to PostgreSQL and enable critical PostgreSQL workloads to run on Azure with confidence.” The Citus co-founders echo this in their own statement, noting that “as part of Microsoft, we will stay focused on building an amazing database on top of PostgreSQL that gives our users the game-changing scale, performance, and resilience they need. We will continue to drive innovation in this space.”

PostgreSQL is obviously an open-source tool, and while the fact that Microsoft is now a major open-source contributor doesn’t come as a surprise anymore, it’s worth noting that the company stresses that it will continue to work with the PostgreSQL community. In an email, a Microsoft spokesperson also noted that “the acquisition is a proof point in the company’s commitment to open source and accelerating Azure PostgreSQL performance and scale.”

Current Citus customers include the likes of real-time analytics service Chartbeat, email security service Agari and PushOwl, though the company notes that it also counts a number of Fortune 100 companies among its users (they tend to stay anonymous). The company offers both a database as a service, an on-premises enterprise version and the free open-source edition. For the time being, it seems like that’s not changing, though over time I would suspect that Microsoft will transition users of the hosted service to Azure.

The price of the acquisition was not disclosed. Citus Data, which was founded in 2010 and graduated from the Y Combinator program, previously raised more than $13 million from the likes of Khosla Ventures, SV Angel and Data Collective.

Powered by WPeMatico

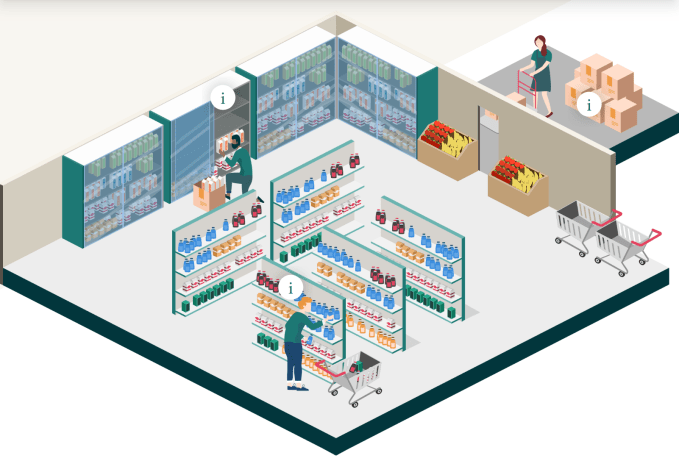

What if instead of just accepting Uber rides, gig workers could pick from higher-paying skilled tasks around town like stocking shelves, checking inventory or driving a forklift at a local grocer? When they work quickly and accurately or learn new trades, they get to choose between more complex jobs. That’s the idea that’s racked up $400 million in staffing contracts for Jyve, an on-demand labor platform that’s coming out of stealth today after 3.5 years. It already has 6,000 workers doing tasks for 4,000 stores across the country.

“I believe the skill economy is way bigger than the gig economy,” says Jyve CEO and founder Brad Oberwager. He sees Uber driving as just the low-expertise beginning of a massive new job type where people with specializations or experience are efficiently matched to retail work. Jyve’s secret sauce is the work quality review system built into its app for managers and stores that lets it know who got the job done right and deserves even better opportunities.

Jyve’s potential to become the skilled labor marketplace has quietly attracted $35 million in funding across a seed and Series A round raised over the past few years, led by SignalFire and joined by Crosscut Ventures and Ridge Ventures. “Jyve is one of the fastest-growing companies we’ve seen, having already reached $400 million in bookings in three short years,” writes Chris Farmer, CEO of SignalFire. “They are creating a new economic class.”

It’s all because Safeway hasn’t touched a bag of Doritos in 50 years, Oberwager tells me. Grocery stores have long outsourced the shelving and arrangement of products to the big brands that make them, which is why the retail consumer packaged good industry employs 10 million people in the U.S., or more than 10 percent of the country’s workforce. But instead of relying on one person to drive goods to the store, load them in and shelve them, Jyve can cut costs and divide those tasks and match them to nearby people with sufficient skills.

“Retail isn’t dying, it’s changing, and brands that are thriving are the ones investing in their in-store experience as well as owning their e-commerce initiatives,” observed Oberwager. “The question we must ask then is how do we fill this labor shortage and also enable people to refine special skills that are multi-dimensional and rewarding.”

Oberwager knows the tribulations of grocery shelving well. He built online drugstore More.com before the dot-com boom, then started making his own food products. He created True Fruit Cups, one of the country’s largest importer of grapefruit, and founded and sold his Bare apple chips company. Competing for shelf space with big brands paying workers to set up elaborate displays in grocery stores, he saw a chance to reimagine retail labor.

But it was when his daughter got sick and he realized the surgeon who performed the operation was essentially a high-skilled mercenary that he seized on the opportunity beyond grocers. “He walks in, does the surgery, walks out. He’s a gig worker, but it’s a skill I’m willing to pay a lot for,” says Oberwager.

He created Jyve to aggregate the demand from different stores and the skills from different workers. When someone signs up for Jyve, they start with easier tasks like moving boxes in the backroom. If they do that well, they could unlock higher-paying shelf stocking and display arrangement, then product ordering and brand ambassadorship. At each step, they take photos and leave comments about their work that are reviewed by a combination of store and brand managers, as well as Jyve’s machine vision algorithms and human quality-control team. It can quickly tell if someone puts the Cheerios box on the shelf the wrong way, and won’t give them public-facing tasks if they don’t improve

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

But to fulfill that prophecy, Jyve will have to out-tech old-school staffing firms like Acosta, Advantage and Crossmark. It’s also hoping to ween grocers off of Instacart by bringing shopping for online orders back to stores’ in-house staff — provided by Jyve. A worker could be stocking shelves, then use that knowledge to quickly pick up all the items for an online order and give them to a curbside driver, then return to their task.

Keeping work quality up to snuff will be a challenge, but by dangling higher wages, Jyve aligns its incentives with its workers. The bigger hurdle may be convincing big brands and retail institutions to change the way they’ve done staffing forever. Oberwager professes that it takes a long time to onboard, but also a long time to offboard, so it could build a solid moat if it’s the first to win this market. Jyve is now in more than 1,200 cities across the U.S.., and a real-time map showed a plethora of gigs available around San Francisco during the demo.

Oberwager admits the unskilled gig economy is “a little dehumanizing. It makes people a cog in a machine.” But he hopes each “Jyver,” as he calls them, can become more like a circuit — a complex machine of its own that powers something bigger.

Powered by WPeMatico