Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Darkstore, a technology-driven fulfillment solution for companies like Nike and others, has raised a $7.5 million Series A round. With the additional funding in hand, Darkstore plans to expand its fulfillment center into more categories.

Currently, Darkstore fulfills products for brands in the areas of footwear, home and consumer electronics. With the funding, Darkstore will expand into lifestyle, health and beauty and athletic leisure, Darkstore founder and CEO Lee Hnetinka told TechCrunch over the phone.

“There are other categories where we get inbound and turn it down,” Hnetinka said. Down the road, Hnetinka said he envisions additional categories, including groceries and perishables.

Darkstore works by exploiting excess capacity in storage facilities, malls and bodegas and enables them to be fulfillment centers with just a smartphone. The idea is that brands without local inventory can store it in a Darkstore and then ship out same-day. Darkstore charges brands across three areas: fulfillment, storage and delivery.

“Up until now, Darkstore has really been behind the scenes,” Hnetinka said. “We want to continue to do that and to be a superpower to our brands. Our mission is to enable the brands to be direct to consumer and we believe we can help them do that even better by creating what we call a branded movement.”

Specifically, Darkstore envisions creating a badge for brands to place on their websites to signal that it offers same-day delivery via Darkstore. Brands currently see Darkstore as a competitive advantage, Hnetinka said, so they’re unwilling to promote its use of Darkstore, but he hopes to change that. That change would ideally help brands to increase trust with its customers, while also undoubtedly providing more visibility and therefore more business for Darkstore.

Also on the docket for 2019 is to explore a new giving initiative. Tentatively called Darkstore Giving, the idea is to make it easier for brands to reduce return-driven waste. Instead of throwing away lightly used items, Darkstore could facilitate the donation of those items to nonprofit organizations.

Darkstore first launched in 2016, counting mattress startup Tuft & Needle as one of its first customers. To date, Darkstore has raised almost $10 million in funding.

Powered by WPeMatico

Despite a number of well-publicized hiccups, venture capitalists are betting another $500 million on health insurance provider Clover Health, TechCrunch has learned.

Existing investor Greenoaks Capital led the round, according to the startup, which confirmed it was closing a new round of capital in the coming weeks. Clover Health has raised a total of $925 million to date, garnering a valuation of $1.2 billion with a $130 million Series D funding in 2017. The company, backed by Alphabet’s venture arm GV, Sequoia Capital, Floodgate, Bracket Capital, First Round Capital and more, declined to disclose its latest valuation.

San Francisco-based Clover Health was founded in 2012 by chief executive officer Vivek Garipalli, the former founder of New Jersey healthcare system CarePoint Health; and Kris Gale, who served as the startup’s chief technology officer until transitioning into an adviser role in December 2017. As part of its latest funding round, the company told TechCrunch it’s promoting Andrew Toy, its chief technology officer since early 2018, to the role of president and CTO. He will also join its board of directors.

Varsha Rao, Airbnb’s former chief operating officer, joined the company in September 2017 as COO.

The tech-enabled health insurer differentiates itself from incumbents by collecting and analyzing health and behavioral data to lower costs and improve medical outcomes for its members. It’s part of a new cohort of heavily funded insurtech startups, including Devoted Health and Bright Health, both of which similarly provide Medicare Advantage plans. Devoted Health, backed by Andreessen Horowitz, raised a $300 million Series B funding round three months ago. Bright Health, for its part, brought in a $200 million Series C in late November at a $950 million valuation. It’s backed by Bessemer Venture Partners, Greycroft, NEA and Redpoint Ventures, among others.

Founded in 2012, Clover Health is years older than its aforementioned counterparts. The business, though supported by top-tier investors and plenty of capital, has struggled in the past to shrink its losses. In 2015, Clover Health posted a net loss of $4.9 million only to increase it 7x the following year to $34.6 million, according to financial documents obtained by Axios. At the time, Clover Health had 20,600 Medicare Advantage members, earning it $184 million in taxpayer revenue. According to reporting from CNBC, the company had initially planned to double its membership base each year but was only able to expand from 20,000 in 2016 to 27,000 in September 2017.

Clover Health currently has 40,000 members in Georgia, New Jersey, Arizona, Pennsylvania, South Carolina, Tennessee and Texas. The business earns roughly $10,000 in revenue per member from the Centers for Medicare and Medicaid Services, or currently about $400 million in annual revenue. As a Medicare Advantage plan, Clover Health makes a majority of its cash from the government.

“Clover’s continuously improving economic fundamentals have allowed us to build sustainably, thoughtfully enter new markets and increase our overall membership by 35 percent during the last 12 months, compared with nationwide growth of 8 percent for Medicare Advantage overall,” the company said in a statement provided to TechCrunch. “This has made Clover one of the fastest growing insurers in [Medicare Advantage] over the past three years. That said, there is much more to accomplish, which is why I am so excited about entering this next phase in our company’s history.”

Powered by WPeMatico

What could Google’s parent company Alphabet, and the wealth management office of the likes of Jack Dorsey, Mark Zuckerberg and Sheryl Sandberg, understand better than the need for a service to manage all the data their companies are collecting?

As regulations in Europe begin to take effect (and European regulators show their teeth), companies like Collibra, which just raised $100 million at a valuation of more than $1 billion from new investor CapitalG (the growth equity investment fund from Alphabet) and returning backers like Iconiq (the family office of Dorsey, Zuckerberg, et al.), are only going to become more important.

Indeed, the recent $57 million fine from France’s data protection watchdog is only a taste of what could be in store for companies like Facebook and Google for non-compliance with new privacy laws. Companies like Collibra and its competitors like Alation, Adaptive Insights, Datum and Informatica are reaping the benefits of this by providing software to oversee how the data that companies are collecting is handled.

The company got its first big boost back in 2008 in the wake of the financial crisis when big banks were confronted with a whole new slew of regulations. Collibra is used to track what data is stored where and how, and to ensure that the data is being processed in ways that align with laws on the books.

Collibra’s new round is something of a victory lap for the company — which is coming off a record revenue year, according to a statement.

The company said it would use the new funding to add new products and push sales and marketing.

“Collibra is putting organizations back in control of their data, helping them comply with changing legislation, embrace emerging technologies and capture the information that will enable them to design services and solutions built for the future,” said Derek Zanutto of CapitalG. “We look forward to partnering with Collibra and marrying Google and Alphabet’s machine learning and AI expertise with Collibra’s leadership in data collaboration, workflow management and risk management.”

Collibra says it has more than 300 customers across industries like financial services, healthcare, retail and technology.

Powered by WPeMatico

Taiwanese technology giant Foxconn International is backing Carbon Relay, a Boston-based startup emerging from stealth today that’s harnessing the algorithms used by companies like Facebook and Google for artificial intelligence to curb greenhouse gas emissions in the technology industry’s own backyard — the data center.

Already, the computing demands of the technology industry are responsible for 3 percent of total energy consumption — and the addition of new technologies like Bitcoin to the mix could add another half a percent to that figure within the next few years, according to Carbon Relay’s chief executive, Matt Provo.

That’s $25 billion in spending on energy per year across the industry, Provo says.

A former Apple employee, Provo went to Harvard Business School because he knew he wanted to be an entrepreneur and start his own business — and he wanted that business to solve a meaningful problem, he said.

Variability and dynamic nature of the data center relating to thermodynamics and the makeup of a facility or building is interesting for AI because humans can’t keep up.

“We knew what we wanted to focus on,” said Provo of himself and his two co-founders. “All three of us have an environmental sciences background as well… We were fired up about building something that was true AI that has positive value… the risk associated [with climate change] is going to hit in our lifetime, we were very inspired to build a company whose technology would have an impact on that.”

Carbon Relay’s mission and founding team, including Thibaut Perol and John Platt (two Harvard graduates with doctorates in applied mathematics) was able to attract some big backers.

The company has raised $6 million from industry giants like Foxconn and Boston-based angel investors, including Dr. James Cash — a director on the boards of Walmart, Microsoft, GE and State Street; Black Duck Software founder, Douglas Levin; Karim Lakhani, a director on the Mozilla Corporation board; and Paul Deninger, a director on the board of the building operations management company, Resideo (formerly Honeywell).

Provo and his team didn’t just raise the money to tackle data centers — and Foxconn’s involvement hints at the company’s broader goals. “My vision is that commercial HVAC systems or any machinery that operates in a business would not ship without our intelligence inside of it,” says Provo.

What’s more compelling is that the company’s technology works without exposing the underlying business to significant security risks, Provo says.

“In the end all we’re doing are sending these floats… these values. These values are mathematical directions for the actions that need to be taken,” he says.

Carbon Relay is already profitable, generating $4 million in revenue last year and on track for another year of steady growth, according to Provo.

Carbon Relay offers two products: Optimize and Predict, that gather information from existing HVAC devices and then control those systems continuously and automatically with continuous decision making.

“Each data center is unique and enormously complex, requiring its own approach to managing energy use over time,” said Cash, who’s serving as the company’s chairman. “The Carbon Relay team is comprised of people who are passionate about creating a solution that will adapt to the needs of every large data center, creating a tangible and rapid impact on the way these organizations do business.”

Powered by WPeMatico

Game engine maker Unity believes voice communications are going to grow to become a critical part of gaming across platforms, and it’s buying one of the top companies in the space to bolster what its customers can build on its platform.

Unity has acquired Vivox, a company that powers voice and text chat for the world’s most massive gaming titles, from Fortnite to PUBG to League of Legends. The company’s positional voice chat enables gamers to hear other players chatting around them directionally in 3D space. The company also provides text-based chat. No details on deal terms.

“We thought, I thought, that voice is just one of those things that we should offer our customers,” Unity CEO John Riccitiello tells TechCrunch. “There are just a lot of places to innovate there and I was excited by the roadmap of Vivox .”

Unity plans to use its cross-platform support expertise to make it easier for developers on platforms traditionally underserved by voice chat tools, like mobile, to take advantage of the deeper communication that’s made possible by Vivox. As Unity looks toward new customers beyond gaming, this acquisition has broader reach, as well.

“We’re increasingly supporting industries like architecture, engineering, construction and the auto industry and they talk a lot about collaborating and communicating,” Riccitiello says.

Vivox was founded in 2005 and raised more than $22 million in venture funding from firms like Benchmark and Canaan Partners before it struck hard times some time after its last reported funding in 2010. The startup’s name and some of its assets were acquired by a new entity, Mercer Road Corp, we are told. The company has maintained much of the original leadership during this time; founder and CEO Rob Seaver will continue on with the company after its acquisition.

For his part, Riccitiello doesn’t seem to have immediate plans to shake things up at the Massachusetts-based company, which will maintain its offices and 50+ employees situated in The Bay State. Seaver will report directly to Riccitiello.

Though the company’s previous customers include studios like Unity-rival Epic Games that used the tool to bolster voice chat in Fortnite, there don’t seem to be any plans to cut off non-Unity customers from using the service. “Nothing is changing,” Riccitiello tells TechCrunch.

“It can be nerve-racking to count on something from a smaller company when they might get acquired by a competitor or might go out of business,” he says. “I don’t think anyone is worried about Unity going out of business and I don’t think anyone is worried about Unity being bad hands, we’re sort of Switzerland in our world, we support all platforms and virtually every publisher in the world.”

Asked whether he felt the company’s status as an open platform had been harmed by recent feuds with U.K.-based cloud-gaming startup Improbable, Riccitiello minimized the issue, saying it was a skirmish based on “them claiming a partnership that didn’t exist,” reiterating that “relative to developers, I think they can count on us morning, noon and night to do the right things for them.”

Unity has raised more than $600 million and is valued at north of $3 billion.

Powered by WPeMatico

It’s a big day for Timescale, makers of the open-source time-series database, TimescaleDB. The company announced a $15 million investment and a new enterprise version of the product.

The investment is technically an extension of the $12.4 million Series A it raised last January, which it’s referring to as A1. Today’s round is led by Icon Ventures, with existing investors Benchmark, NEA and Two Sigma Ventures also participating. With today’s funding, the startup has raised $31 million.

Timescale makes a time-series database. That means it can ingest large amounts of data and measure how it changes over time. This comes in handy for a variety of use cases, from financial services to smart homes to self-driving cars — or any data-intensive activity you want to measure over time.

While there are a number of time-scale database offerings on the market, Timescale co-founder and CEO Ajay Kulkarni says that what makes his company’s approach unique is that it uses SQL, one of the most popular languages in the world. Timescale wanted to take advantage of that penetration and build its product on top of Postgres, the popular open-source SQL database. This gave it an offering that is based on SQL and is highly scalable.

Timescale admittedly came late to the market in 2017, but by offering a unique approach and making it open source, it has been able to gain traction quickly. “Despite entering into what is a very crowded database market, we’ve seen quite a bit of community growth because of this message of SQL and scale for time series,” Kulkarni told TechCrunch.

In just over 22 months, the company has more than a million downloads and a range of users from older guard companies like Charter, Comcast and Hexagon Mining to more modern companies like Nutanix and and TransferWise.

With a strong base community in place, the company believes that it’s now time to commercialize its offering, and in addition to an open-source license, it’s introducing a commercial license. “Up until today, our main business model has been through support and deployment assistance. With this new release, we also will have enterprise features that are available with a commercial license,” Kulkarni explained.

The commercial version will offer a more sophisticated automation layer for larger companies with greater scale requirements. It will also provide better lifecycle management, so companies can get rid of older data or move it to cheaper long-term storage to reduce costs. It’s also offering the ability to reorder data in an automated fashion when that’s required, and, finally, it’s making it easier to turn the time series data into a series of data points for analytics purposes. The company also hinted that a managed cloud version is on the road map for later this year.

The new money should help Timescale continue fueling the growth and development of the product, especially as it builds out the commercial offering. Timescale, which was founded in 2015 in NYC, currently has 30 employees. With the new influx of cash, it expects to double that over the next year.

Powered by WPeMatico

Hims, known by many for its phallic New York subway advertisements, has raised an additional $100 million in venture capital funding on a pre-money valuation of $1 billion. The round was first reported by Recode and confirmed to TechCrunch by sources with knowledge of the deal.

A growth-stage investor has led the round, which is ongoing, with participation from existing investors. Our source declined to name the lead investor but did say it was a “super big fund” that isn’t SoftBank and that hasn’t previously invested in Hims.

Hims officially launched just over one year ago and has raised $197 million already, as well as launched a women’s wellness brand, Hers, to go alongside its flagship men’s wellness brand. The business sells sexual wellness products, skin care and hair loss treatments directly to consumers. In addition to erectile dysfunction medication, it offers the birth control pill to customers with prescriptions and Addyi, the only FDA-approved medication for women with hypoactive sexual desire disorder.

According to Recode, Hims spent months negotiating with investors, “with some of them balking at the valuation.” Meanwhile, our source says Hims passed on several viable terms sheets and had plenty of IVP — which led its last round — money in the bank ahead of their latest infusion.

$1 billion, a 2x increase from its previous valuation, is a hefty price tag for such an early-stage digital health startup. Then again, most valuations for venture-backed businesses are foolish.

San Francisco-based Hims is also backed by Forerunner Ventures, Founders Fund, Redpoint Ventures, SV Angel, 8VC, Maverick Capital and more.

Powered by WPeMatico

The Munchery saga continues.

In a new class-action lawsuit, former Munchery facilities worker Joshua Philips is claiming the startup owes him and 250 other employees 60 days’ wages, citing The Worker Adjustment and Retraining Notification Act, a U.S. labor law that requires employers with an excess of 100 employees to give notice 60 days ahead of mass layoffs.

Munchery, a prepared meal delivery company headquartered in San Francisco, announced in an email to customers on January 21 that it would cease operations, effectively immediately. The abrupt shutdown not only came as a surprise to Munchery’s community of customers, but shocked vendors, many whom had been expecting payments from the business for several weeks. Munchery’s own employees were left in the dark, too, according to several former workers who spoke to TechCrunch about their debt and dissatisfaction with chief executive James Beriker.

Munchery ordered mass layoffs on January 21, per the lawsuit, the same day customers were notified the company would go out of business. In total, Philips is seeking equal to the sum of his and other affected employees’ “unpaid wages, salary, commissions, bonuses, accrued holiday pay, accrued vacation pay, pension and 401(k) contributions and other ERISA benefits, for 60 days, that would have been covered and paid under the then-applicable employee benefit plans.”

Munchery is deep in a pile of debt. The startup’s former vendors, which includes San Francisco-based Dandelion Chocolate and Three Babes Bakeshop, say they’re owed tens of thousands in overdue payments. Those businesses, and several other small vendors in San Francisco and Los Angeles that notified TechCrunch following the publication of this story, are still awaiting overdue payments, with one supplier claiming to be owed north of $100,000.

As of Monday morning, Munchery had yet to file for bankruptcy.

“They entered into a 14-month payment plan with us to cover nearly $150,000 in debt, but never had the intention of fulfilling their obligation,” an LA-based Munchery vendor, who asked not to be named, told TechCrunch. “The entire meal prep business is not sustainable on a grand scale like these companies envision.”

On top of its outstanding debts to vendors and facilities workers, Munchery also failed to send final paychecks to delivery drivers. Several Instagram messages provided to TechCrunch show a cluster of drivers in the San Francisco and Sacramento area are confused by the lack of communication from the venture-funded startup and are hopeful checks will arrive.

After arguing with Munchery employees, a delivery driver in Sacramento by the name of Sharon Howard said she finally received a “janky looking handwritten check” from the business on Monday and is hopeful it will clear.

“My co-workers up here in Sacramento have not received their final checks and are just um…waiting,” Howard wrote in an Instagram message shared with TechCrunch. “I sort of have the feeling that if they don’t speak up, they’re just gonna be forgotten about … It’s just not right to work with the expectation of getting paid and then just allow Munchery to turn a blind eye.”

Munchery chief executive officer James Beriker joined the startup in 2016

Munchery had raised $125 million in venture capital funding at a peak valuation of $300 million from key investors e.Ventures, Infinity Ventures, Sherpa Capital and Menlo Ventures, as well as from Greycroft, M13, Northgate Capital and more since its founding in 2010 by Tran and Conrad Chu. Aside from a small $5 million check, all that cash was deployed under the leadership of Tran, who struggled to improve Munchery’s margins and was eventually replaced by Beriker, the former CEO of Simply Hired.

Munchery, however, struggled under Beriker, too, and ultimately shut down its Los Angeles, Seattle and New York operations and laid off 30 percent of its workforce. A former Munchery employee, who asked not to be named, said Beriker’s poor leadership is to blame for the startup’s failure.

“The CEO was very disconnected to the business,” the person said in a text message. “We would see him maybe once every other week and only for 15 minutes — if that. The kitchen staff didn’t even know who he was when he came to the facility. In my time with the company, he was rarely truthful or transparent about the current state of the business and the future direction. Not to mention his very hefty salary that compared to that of a publicly traded Fortune 500 company.”

“My heart goes out to all of the big and small businesses that Munchery’s closure has and will affect,” the person added. “I am also hopeful that the staff who had zero advance knowledge of the closure will find employment quickly.”

Beriker has not responded to multiple requests for comment from TechCrunch. We’ve reached out to Munchery’s investors for additional details surrounding the strange, sudden and silent shutdown.

Here’s a look at the full legal complaint:

Powered by WPeMatico

Sapphire Ventures, formerly the corporate venture capital arm of SAP, has lassoed $115 million from new limited partners (LPs) to invest at the intersection of tech, sports, media and entertainment.

A majority of the LPs for the new fund, called Sapphire Sport, have ties to the sports industry, from City Football Group, which owns English Premier League team Manchester City, to Adidas, the owners of the Indiana Pacers, New York Jets, San Jose Sharks and Tampa Bay Lightning, among others.

The firm plans to do five to six investments per year, sized between $3 million and $7 million. So far, they’ve deployed capital to five startups: at-home fitness system Tonal, live soccer streaming platform mycujoo, digital sports network Overtime, ticketing and events platform Fevo and gaming studio Phoenix Labs. Sapphire began backing tech startups in 2008; in 2016, the firm closed on $1 billion for its third flagship venture fund.

Sapphire managing director and co-founder Doug Higgins is leading the effort alongside newly tapped partner Michael Spirito, who joined from 21st Century Fox, where he focused on business development and digital media for the Fox Sports-owned Yankees Entertainment and Sports (YES) Network, in September.

Higgins was an investment manager at Intel Capital for four years prior to co-launching Sapphire. Throughout his career, he’s managed the firm’s investments in LinkedIn, DocuSign, Square and more.

“We invest in anything that tech is disrupting,” Higgins told TechCrunch. “We were early investors in Fitbit, so we saw the beginning of digital fitness and how tech can impact the lives of anyone, not just high-performance athletes … We are also investors in Square, TicketFly and Paytm and what we’ve been seeing — the dream as a VC — is these massive markets in the sports, media and digital health world that are getting disrupted by tech.”

Sapphire is betting its traditional and well-established venture platform, coupled with the expertise of leading sports entities on board as LPs, will give it a competitive edge as it targets some of the best emerging sports tech companies.

“We see a lot of FOMO happening in this world, where everyone wants to have a play, but to make the best investment you need to have the widest perspective,” Higgins said. “So if you’re a team owner of a particular football team you are going to make better decisions if you are able to share perspectives with owners of other teams.”

“The best entrepreneurs, the ones we all want to invest in, there’s not a draft, they have to select you,” he added.

Investment in esports and gaming has skyrocketed, surpassing a total of $2.5 billion in VC funding in 2018. According to PitchBook, a handful of startups have already raised a total of $65 million in VC backing this year, including a $10.8 million financing for ReKTGlobal, a provider of esports infrastructure services.

“You can’t ignore the numbers on esports,” Higgins added. “They just continue to grow massively and people who have teenage kids, like myself, [those kids] want to grow up to be the next ninja, not the next Tom Brady .”

Powered by WPeMatico

Kite, a San Francisco-based startup that uses machine learning to build what is essentially a very smart code-completion tool, today announced that it has raised a $17 million funding round. The round was led by Trinity Ventures, with personal participation from now-GitHub CEO Nat Friedman. In addition to the funding, Kite also today announced that its tools are now significantly smarter and that developers can run them locally on their machines, even if they don’t have an internet connection.

As Kite founder and CEO Adam Smith told me, the idea for Kite is based on the simple fact that a lot of programming is repetitive. “That’s why [developers] spend so much time on Stack Overflow. That’s why they spend so much time debugging really basic errors and looking up documentation, but not so much time looking at how the solution should work,” he said. “We thought we can use machine learning to fix that.”

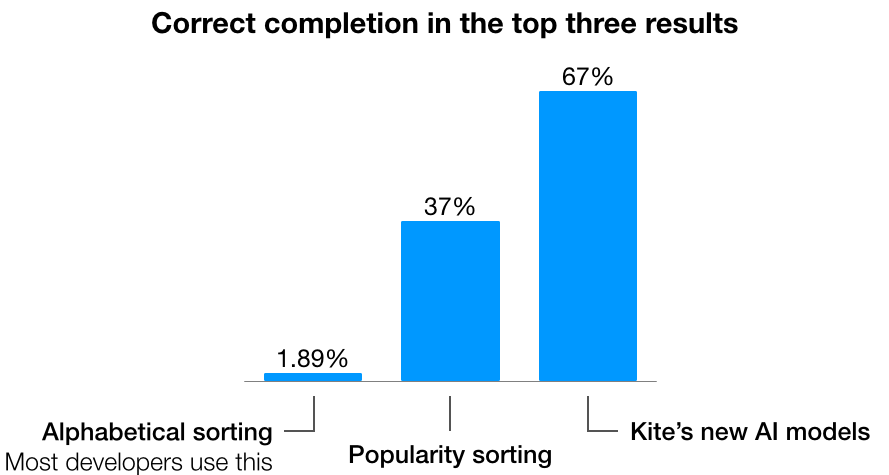

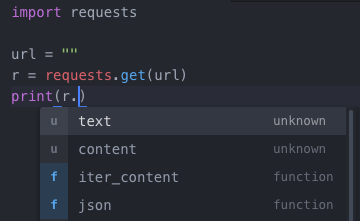

Standard code completion tools often still use alphabetical sorting, while Kite uses AI to infer what a developer is likely trying to do (though, to be fair, the likes of IntelliSense and others are also starting to get smarter). In its first iteration, Kite, which sadly still only works for Python code right now, sorted its hints by popularity. Unsurprisingly, that was already more useful than alphabetical sorting, and the right answer appeared in the top three results 37 percent of the time.

What’s interesting here is that if you can predict the next part of a line of code with high accuracy, you can start predicting a few more words ahead, too. And that’s exactly what Kite is starting to do now.

To do this, the team had to build its own machine learning models that worked well for code. As Smith told me, Kite first looked at using standard natural language processing (NLP) models, but it turns out that those don’t really work well for code, which has a different structure. As training data, Kite fed the system all the Python code on GitHub .

Looking ahead, what Smith really wants to achieve is what he calls “fully automated programming.” “It’s that Star Trek vision of where you tell computers in a high-level language what to do,” he said. “If it’s ambiguous, the computer will ask questions.”

Looking ahead, what Smith really wants to achieve is what he calls “fully automated programming.” “It’s that Star Trek vision of where you tell computers in a high-level language what to do,” he said. “If it’s ambiguous, the computer will ask questions.”

It’ll take a few more breakthroughs in AI to realize that vision, but for the time being, Kite’s tools are freely available and come with editor plugins for Atom, Sublime Text3, VS Code, Vim, PyCharm and IntelliJ. Currently, about 30,000 Python developers use its tools.

With today’s release, developers can also use these models locally, without the need for an internet connection. That’s a sign of how efficient the models are, but as Smith also acknowledged, running the model locally means his company doesn’t have to manage a complex cloud infrastructure either. This should also make the tool more appealing to more developers — especially in larger corporations — given that the original tool would send all of your code to Kite’s servers (and in that context, it’s worth noting the company managed to create its own little scandal around some open-source contributions that favored its auto-completion engine).

The company plans to use the new funding to build out the team, which mostly consists of engineers. It’ll also build out its product, with a special focus on supporting more languages.

As for its business model, it’s worth noting that Kite did test a subscription service last year, but as Smith argues, that was mostly to test if the company could monetize the service. “Now we want to optimize for growth,” he said and noted that the focus of the company’s monetization strategy will be on enterprise users. Indeed, that’s a common refrain I hear from startups that focus on developers. It’s very hard to sell subscriptions to individual developers, it seems, so most start to focus on enterprises sooner or later.

Powered by WPeMatico