Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

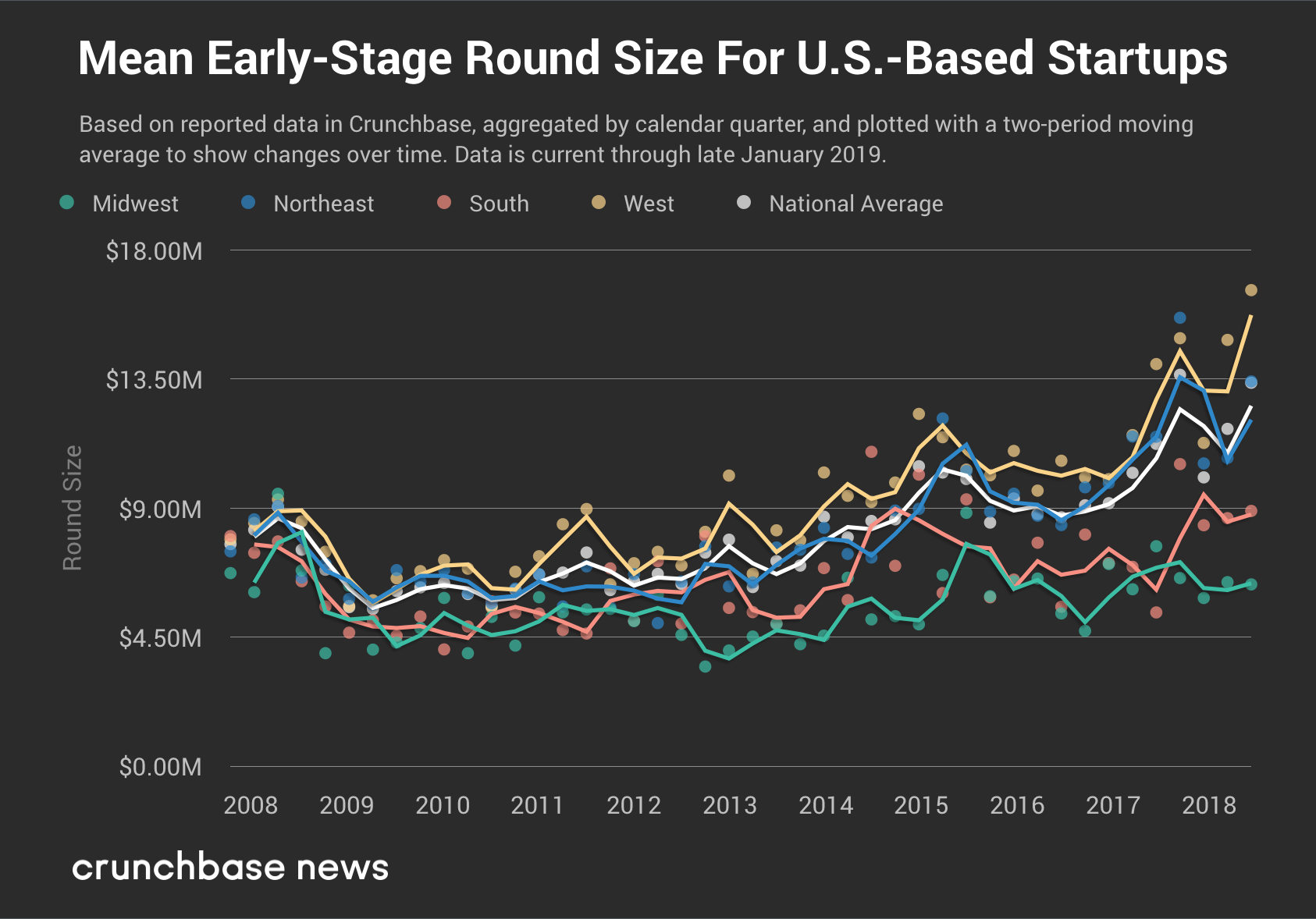

Early-stage startups throughout much of the U.S. are able to raise larger sums today than any other point in at least a decade, and there are more early-stage rounds than ever, both in North America and globally. (Note: “Early-stage” is defined here as Series A and Series B rounds, plus smaller rounds from several other round types, including equity crowdfunding and convertible notes.)

In analysis published earlier this week, we found that the nationwide average early-stage deal grew more than 20 percent between 2017 and 2018. We quantified that companies on the coasts raise more than their inland counterparts and found some indications that the Midwest lags the rest of the nation.

To find this and more, we aggregated round size data for more than 30,000 early-stage venture rounds struck with U.S.-based companies between the start of 2008 and the end of 2018. We segmented the data by the U.S. Census Bureau’s map of regions and “divisions” (basically, subregions by a different label), took the mean (average) early-stage deal size for each calendar quarter and displayed each region against the national average.

Below, you can see how early-stage rounds around the country compare to the national average. To make it easier to see trends, we display a two-period simple moving average line alongside individual data points.

Although the average has certainly crept up, part of that is attributable to a newer trend in companies raising huge sums of money. In the report, we indicated that many of the largest early-stage rounds were raised by companies in the West and Northeast. But startups in these regions don’t hold a monopoly on raising lots of money from venture capitalists.

Here, we wanted to highlight some of the biggest early-stage rounds struck by Midwestern and Southern companies. After all, the coasts tend to dominate the media’s conversation concerning tech. So, here’s some love for the middle of the country, and its biggest deals:

It’s true that the Bay Area is responsible for a huge chunk of the supergiant venture market, but it by no means accounts for all of it. The above should lay to rest the idea that there’s no tech in between EWR and SFO.

Powered by WPeMatico

2019 has been good to the Austin startup scene so far.

Combined, Austin startups have raised $240.3 million in January. That’s not much less than the nearly $300 million raised in all of Q4 2018. And since the beginning of the year, the Texas capital has seen a number of double-digit funding rounds and a nearly quarter of a billion dollar acquisition.

Out of 10 known rounds, six were for $10 million or over. In recent years, Austin has historically been known for having more early-stage companies that raised more seed and Series A rounds. But if this month is any indication, its venture scene is maturing.

Just today, RigUp — an on-demand staffing platform for the oil and gas industry — announced it has secured $60 million in a Series C round. The financing was raised at a $300 million post-money valuation, according to Axios. Founders Fund led the round, which also included participation from existing backers Bedrock Capital and Quantum Energy Partners.

Also of interest is who has been investing in the city. Silicon Valley-based Bessemer Venture Partners put money into at least two of the 10 rounds: legal tech software provider DISCO’s $83 million Series E and ScaleFactor’s $30 million Series B. So, Austin startups are definitely attracting money outside of the local venture ecosystem.

Paul O’Brien, CEO of Austin-based MediaTech Ventures, believes the past few weeks provide validation for venture capitalists who have invested in the area.

“The timing is right on the mark. Just a few years into the nascent local startup scene, we witnessed the growth and enthusiasm of local mentorship and angel investment, and years later, the presence of sophisticated startup programs like Techstars, Mass Challenge and Founder Institute… and now, as if on schedule for investors, we’re seeing substantial outcomes,” he told Crunchbase News. “What’s most exciting about being a part of the local startup community is experiencing that this is really just the beginning.”

Here’s a quick rundown of some of the other big deals that were announced in Austin this month:

With such a great month, Austin now has a lot of pressure to continue the momentum for the rest of the year.

Featured image credit: Mary Ann Azevedo

Powered by WPeMatico

I spent the week in Malibu attending Upfront Ventures’ annual Upfront Summit, which brings together the likes of Hollywood, Silicon Valley and Washington, DC’s elite for a two-day networking session of sorts. Cameron Diaz was there for some reason, and Natalie Portman made an appearance. Stacey Abrams had a powerful Q&A session with Lisa Borders, the president and CEO of Time’s Up. Of course, Gwyneth Paltrow was there to talk up Goop, her venture-funded commerce and content engine.

“I had no idea what I was getting into but I am so fulfilled and on fire from this job,” Paltrow said onstage at the summit… “It’s a very different life than I used to have but I feel very lucky that I made this leap.” Speaking with Frederic Court, the founder of Felix Capital, Paltrow shed light on her fundraising process.

“When I set out to raise my Series A, it was very difficult,” she said. “It’s great to be Gwyneth Paltrow when you’re raising money because people take the meeting, but then you get a lot more rejections than you would if they didn’t want to take a selfie … People, understandably, were dubious about [this business]. It becomes easier when you have a thriving business and your unit economics looks good.”

In other news…

The actor stopped by the summit to promote his startup, HitRecord . I talked to him about his $6.4 million round and grand plans for the artist-collaboration platform.

Backed by GV, Sequoia, Floodgate and more, Clover Health confirmed to TechCrunch this week that it’s brought in another round of capital led by Greenoaks. The $500 million round is a vote of confidence for the business, which has experienced its fair share of well-publicized hiccups. More on that here. Plus, Clutter, the startup that provides on-demand moving and storage services, is raising at least $200 million from SoftBank, sources tell TechCrunch. The round is a big deal for the LA tech ecosystem, which, aside from Snap and Bird, has birthed few venture-backed unicorns.

Pinterest, the nine-year-old visual search engine, has hired Goldman Sachs and JPMorgan Chase as lead underwriters for an IPO that’s planned for later this year. With $700 million in 2018 revenue, the company has raised some $1.5 billion at a $12 billion valuation from Goldman Sachs Investment Partners, Valiant Capital Partners, Wellington Management, Andreessen Horowitz, Bessemer Venture Partners and more.

Kleiner Perkins went “back to the future” this week with the announcement of a $600 million fund. The firm’s 18th fund, it will invest at the seed, Series A and Series B stages. TCV, a backer of Peloton and Airbnb, closed a whopping $3 billion vehicle to invest in consumer internet, IT infrastructure and services startups. Partech has doubled its Africa VC fund to $143 million and opened a Nairobi office to complement its Dakar practice. And Sapphire Ventures has set aside $115 million for sports and entertainment bets.

The co-founder of Y Combinator will throw a sort of annual weekend getaway for nerds in picturesque Boulder, Colo. Called the YC 120, it will bring toget her 120 people for a couple of days in April to create connections. Read TechCrunch’s Connie Loizos’ interview with Altman here.

Consumer wellness business Hims has raised $100 million in an ongoing round at a $1 billion pre-money valuation. A growth-stage investor has led the round, with participation from existing investors (which include Forerunner Ventures, Founders Fund, Redpoint Ventures, SV Angel, 8VC and Maverick Capital) . Our sources declined to name the lead investor but said it was a “super big fund” that isn’t SoftBank and that hasn’t previously invested in Hims.

Five years after Andreessen Horowitz backed Oculus, it’s leading a $68 million Series A funding in Sandbox VR. TechCrunch’s Lucas Matney talked to a16z’s Andrew Chen and Floodgate’s Mike Maples about what sets Sandbox apart.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

In a new class-action lawsuit, a former Munchery facilities worker is claiming the startup owes him and 250 other employees 60 days’ wages. On top of that, another former employee says the CEO, James Beriker, was largely absent and is to blame for Munchery’s downfall. If you haven’t been keeping up on Munchery’s abrupt shutdown, here’s some good background.

Consolidation in the micromobility space has arrived — in Brazil, at least. Not long after Y Combinator-backed Grin merged its electric scooter business with Brazil-based Ride, it’s completing another merger, this time with Yellow, the bike-share startup based in Brazil that has also expressed its ambitions to get into electric scooters.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase editor-in-chief Alex Wilhelm, TechCrunch’s Silicon Valley editor Connie Loizos and Jeff Clavier of Uncork Capital chat about $100 million rounds, Stripe’s mega valuation and Pinterest’s highly anticipated IPO.

Powered by WPeMatico

Former Uber CEO Travis Kalanick may have been nudged out of one of the world’s most highly valuable private companies by investors frustrated over its troubled culture, but his moves remain of great interest given how far he’d driven the rideshare giant.

One such move, according to a new report in the South China Morning Post, looks to be to help foster the growing concept of cloud kitchens to China.

We’ve reached out to Kalanick for more information, but per the SCMP’s report, Kalanick is partnering with the former COO of the bike-sharing startup Ofo, Yanqi Zhang. Their apparent project involves Kalanick’s L.A.-based company, CloudKitchens, which enables restaurants to set up kitchens for the purposes of catering exclusively to customers ordering in, as that’s how many people are consuming restaurant food in increasing numbers. (More on the movement here.) The kitchens are established in underutilized real estate that Kalanick is snapping up through a holding company called City Storage Systems.

According to The Spoon, a food industry blog, the trend is beginning to gain momentum in particular regions, including India, where it says many restaurants struggle to afford the traditional restaurant model, which often involves paying top dollar for rent, as well covering wages for employees, from dishwashers to cooks to servers. Using so-called cloud kitchens enables these restaurateurs to share facilities with others, and to do away with much of their other overhead.

Some are even being promised more affordable equipment. For example, according to The Spoon, the restaurant review site Zomato, through its now two-year-old service called Zomato Infrastructure Services, aims to create kitchen “pods” that restaurants can rent, and it’s using data to identify recently closed restaurants that may be looking to offload their kitchen equipment for whatever they can get for it.

Shared kitchens have also been taking off in China, as notes the SCMP, which cites Beijing-based Panda Selected and Shanghai-based Jike Alliance as just two companies that Kalanick would be bumping up against.

Kalanick wasn’t the first here in the U.S. to spy the trend bubbling up, but he seems to be taking it as seriously as any entrepreneur. Last year, he spent $150 million to buy a controlling stake in City Storage Systems, the holding company of CloudKitchens, through a fund that he established around the same time, called the 10100 fund. The money was used to buy out most of the company’s earlier backers, including venture capitalist Chamath Palihapitiya, according to a report last year by Recode.

That same report said that Kalanick now has a controlling interest in City Storage Systems. It also said that serial entrepreneur Sky Dayton — who previously founded EarthLink, co-founded eCompanies and founded Boingo — is a co-founder.

City Storage Systems isn’t interested in on-demand kitchens alone, reportedly. The idea behind it is to buy distressed real estate, including parking lots, and repurpose it for a number of online-focused ventures.

While the China twist looks like a new development, it wouldn’t be a wholly surprising move. Having had to back out of China with Uber in 2016, Kalanick may be of a mind to jump into the country faster this time around, and with a local partner with whom he has a relationship. Indeed, Zhang spent two years as a regional manager for Uber in China before co-founding Ofo, which has since run into problems of its own.

We’ve also reached to Zhang for this story and hope to update it when we learn more.

Powered by WPeMatico

Juul Labs, the e-cig company under fire for its product’s popularity with young people, has brought on a new VP of Intellectual Property Protection with Adrian Punderson, formerly of PwC and Apple.

Punderson’s job is all about working alongside government agencies, as well as Juul Labs Intellectual Property VP Wayne Sobon, to combat the sale of counterfeit and infringing products. These can range from copycat vapes and pods that are actually marketed as Juul products all the way to products that are designed specifically to be Juul compatible without using the trademark.

These counterfeit and infringing products pose a serious threat to the company. Of course, no business wants its products infringed or its market share stolen.

With Juul, however, it’s far more complicated. Juul Labs is currently under heavy FDA scrutiny over the popularity of its products with minors.

“As you start to enforce generally on the sale of these types of products to youth, oftentimes they are going to look for another seller or distribution point of this product,” said Punderson. “The challenge is that oftentimes they’re going to platforms or places for this and you have no idea what the origin of the product is. A lot of it is counterfeit. So they get something they believe is Juul only to find out they have a counterfeit device or pod.”

He went on to say that, for Juul, a top priority is identifying counterfeit sellers and quickly putting that information into the hands of law enforcement. To the extent that they can’t take action, said Punderson, Juul will take civil action.

Part of the concern is that there is zero transparency into what ingredients are being used in infringing products, whereas Juul’s recipe at least meets the legal requirements for disclosure as it seeks full FDA approval.

Juul doesn’t currently have data around the scale of infringing products on the market, but counterfeit Juul products may inaccurately increase sales figures, intensifying scrutiny from the FDA.

Juul has already taken legal action against many infringing manufacturers and distributors, but Punderson aims to take Juul’s efforts against infringing products to a new level.

He sees the issue as threefold: Juul Labs must work to stop these products from being manufactured in the first place, ensure they aren’t allowed across borders into the country and take action against retailers who sell infringing products and remove them from the market.

“This isn’t a problem where there is only a production problem but there isn’t really a distribution or consumption problem,” said Punderson. “We don’t have the luxury of looking at the problem singly-faceted. From a global perspective, we want to stop the production and distribution of infringing products around the world, and we’ll work closely with government agencies attempting to stop illicit distribution of goods.”

Punderson previously served as managing director of IP Protection at PriceWaterhouse Coopers, VP of Global Anti-Counterfeiting/Anti-Diversion at Oakley and worked at Apple on the Intellectual Property Enforcement team.

Juul is currently viewed by many as a Facebook-ified, 2018 version of Marlboro. Notably, Juul Labs recently closed a $12.8 billion investment from Altria Group, the makers of Marlboro cigarettes. When asked why he chose to work for Juul, Punderson said his initial reaction was no. But after he did some research around the mission of the company, and thought of his own personal experience losing his father to emphysema, he came around quickly.

“I would do anything to get two or three more years with my dad, who was a lifelong smoker,” said Punderson. “[…] We’re trying to do good things here, move people away from tobacco and give them an alternative. To me, it’s a valuable, noble cause that’s worth being involved in and I’m proud to be here.”

It remains to be seen just how big of an issue infringing products are for Juul and other above-board e-cig makers, but Juul is ramping up its efforts to combat copycats from getting into the hands of consumers.

Powered by WPeMatico

In the early 2000s, actor Joseph Gordon-Levitt was frustrated with the roles he was being offered. Instead of starring in critically acclaimed indies, he was typecast as the “the funny kid on TV” due to roles like Tommy from “3rd Rock from the Sun.”

So like anyone who matured alongside the internet, he created a website where he could ideate, produce and share his work. More than 10 years later, he wants to turn that pet project, called HitRecord, into a full-fledged technology company.

Onstage at Upfront Venture’s annual summit outside of Los Angeles, Gordon-Levitt announced a $6.4 million Series A funding to do just that. Javelin Venture Partners has led the round, with participation from Crosslink Capital, Advancit Capital, YouTube co-founder Steve Chen, Twitch co-founder Kevin Lin and MasterClass co-founder David Rogier.

Gordon-Levitt, known for starring in “Inception,” “Snowden” and, my personal favorite, “10 Things I Hate About You,” tells TechCrunch that HitRecord has a team of 24 employees, with himself at the helm as chief executive officer, co-founder Jared Geller serving as president and co-founder Marke Johnson as creative director. The trio plan to use the investment to transform HitRecord from a traditional production company to a new collaborative media platform.

The company provides an online portal for artists to work together on projects, “building off of each other’s contributions, to create things [they] couldn’t have made on our own.” If projects created within the HitRecord community are sold, the creators are paid based on their original contributions. Since 2010, HitRecord has paid its community roughly $3 million.

HitRecord hasn’t accepted outside capital, until now. Initially, Gordon-Levitt used his own cash to push the company forward, and for the last five years, the startup has been cash-flow positive. I sat down with Gordon-Levitt to learn more about what he’s been working on and why he decided to pursue venture capital dollars. The following conversation has been lightly edited for length.

TC: How do you explain HitRecord in one sentence?

JGL: It’s a collaborative media platform where people make all kinds of creative things together. I guess that’s one sentence, but if I can keep going… As opposed to places where people post things that they’ve made on their own, this is a place where people collaborate, right? So they submit their ideas onto the platform and then they find people who want to collaborate with them and then they’re able to make money if the projects [find] a buyer.

We’ve done all kinds of monetized productions, but I certainly wouldn’t include money in the third or fifth or even 10th sentence of why people come to HitRecord.

TC: HitRecord launched a decade ago… what inspired you to create it?

JGL: I started HitRecord as this little hobby message board with my brother and it grew very slowly. It came out of a time in my life when I wanted to be an actor and I wanted to be in sort of like more serious Sundance movies and everyone was like, ‘oh, but you’re the funny kid on TV’ and you know, it was really painful for me. I sort of said, okay, you know what, I can’t just wait around for someone to give me a part. I want to make my own things. And I started making my own. I started making videos and songs and stories and stuff. And my brother helped me set up a website that we called HitRecord. We didn’t spend any money; we had no intention of making any money. It was just a fun thing we were doing.

So I’ve been working on something for years, along with everyone here @hitRECord. No joke—YEARS! Today’s the first day I’m talking about it… https://t.co/F0BYFupaor pic.twitter.com/OeCMkKhUFx

— Joseph Gordon-Levitt (@hitRECordJoe) January 31, 2019

TC: And now you want to expand it into a full-fledged tech platform. But… you’re cash-flow positive and you’ve built a solid community of avid users, why take venture money?

JGL: You know, it started as just a hobby that I was doing for fun. We launched it as a production company as a way to do more ambitious, creative things and do it with everybody. But if you talk to our users, what people really enjoy is having that experience of being creative and being creative with other people because I think honestly, being creative is really hard alone. Venture money will not only allow us to do even cooler productions, but it’ll also allow this whole other world and more people to participate.

TC: Now that you’re venture-funded, how do you plan on making money for your investors?

JGL: So historically, the way we’ve made money was as a production company, and the collaborative efforts of our community and our staff make money because we turn something into a TV show, or we license it to a brand or we do any number of things that we’ve done that has generated revenue. [HitRecord partnered with Ubisoft earlier this year to allow artists and musicians to contribute their own content to be used in its game, for example.] So moving forward, as we grow into a collaborative platform, the idea is that it’s not just our staff that’s leading these projects and letting people collaboratively finish them. The idea is anybody could come to start their own thing and there will be better tools to self-organize and find your collaborators.

TC: And how do you better monetize once you’ve expanded your user base?

JGL: I think, look, we were not ready to talk about exactly how we would make money that way. I think we have a number of ideas. There are ways that the internet gets monetized these days that I think incentivize the wrong things like attention for myself and I don’t want to enter into a business model that incentivizes that kind of behavior.

Actor Joseph Gordon-Levitt attends the 2014 Creative Arts Emmy Awards at the Nokia Theatre L.A. Live on August 16, 2014 in Los Angeles, California. (Photo by Tommaso Boddi/WireImage).

TC: What was the process of raising venture capital like? Did being Joseph Gordon-Levitt make it a little less terrible?

JGL: I think, honestly, it was a double-edged sword. I think there was justified skepticism and people would assume that oh, I’m an actor so I can’t start a company and I faced a certain amount of that skepticism. I don’t blame anybody for having that. The assumption is that there’s not any substance behind the company or the idea, that it’s all sizzle and no steak.

But we’re also not really a startup, per se. It’s not like I was going into these offices and saying, like, I have an idea. It’s like, here’s what we’ve done for the last 10 years and we’ve been cash flow positive five years. We know how to run a business. It’s just we’ve been running a production company business, now we want to run something that’s more like a technology business.

TC: What’s your long-term vision for HitRecord?

JGL: My ultimate goal is for my acting career and HitRecord to kind of become one in the same thing. I would love to be, you know, developing a movie not for a Hollywood studio, but like in this new collaborative way for HitRecord. I mean, we won an Emmy for our TV show. We’re about to release this special that we’re doing with Logic, the rapper, and he used the platform to lead a collaboration and make a song and a music video and we documented the process and that special is going to come out on YouTube. What I really want is to be able to put an app in Logic’s hand where he goes like, oh, I understand this and is able to use it instantly. We don’t have that app yet. This is why we raised capital.

Powered by WPeMatico

“KP used to be a small team doing hands-on company building. We’re moving away from being this institution with multiple products and really just focusing on early-stage venture capital,” Kleiner Perkins partner Ilya Fushman tells me. Indeed, 47 years after its founding, the storied venture fund is going “back to the future” with today’s announcement of an 18th fund — a $600 million fund for seed, Series A and Series B financings. It’s investing across consumer, enterprise, hard tech and fintech, looking for high-potential teams to help mold into unicorns.

Kleiner Perkins partner Ilya Fushman

“We went out to market to LPs. We got a lot of interest. We were significantly oversubscribed,” Fushman says of the firm’s raise.

Kleiner Perkins was recently rocked by the departure of legendary investor Mary Meeker. She took Kleiner partners Mood Rowghani, Noah Knauf and Juliet de Baubigny, and they’re reportedly raising a $1.25 billion growth fund called Bond. Fushman explained that with Kleiner refocusing on early-stage, their funds will be well-differentiated. “They’re going to focus on very late-stage growth,” while he described Kleiner fund 18 as a place where partners can “collaborate and create” alongside new startups.

Other trends Kleiner is seeking to invest in include better distributed work tools, infrastructure for technology businesses, shifts in the urban and economic landscape and security and identity tools to protect the software-enabled future. Recent early-stage investments from the firm have included tax and insurance safety net Catch and food stamps app Propel.

With the explosion of early-stage funds, competition for the best deals is cutthroat. Kleiner will have to trade on its reputation, the expertise of its founders and its extensive connections to lure in founders. If entrepreneurs think Kleiner can fund their mid-stage rounds like some seed funds can’t, or hook them up with potential acquirers whether things go peachy or pear-shaped, they’ll open their cap table.

Powered by WPeMatico

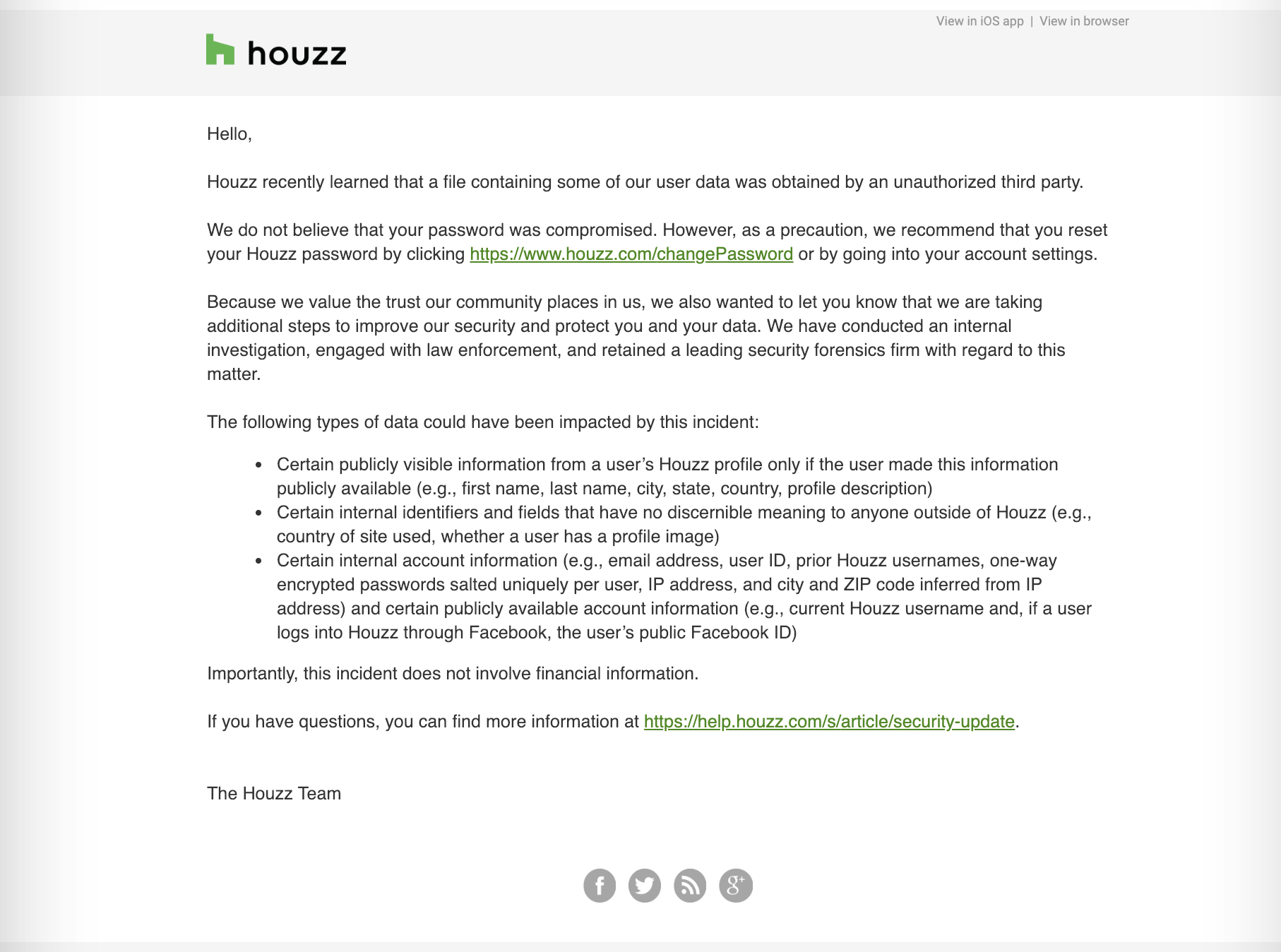

Houzz, a $4 billion-valued home improvement startup that recently laid off 10 percent of its staff, has admitted a data breach.

A reader contacted TechCrunch on Thursday with a copy of an email sent by the company. It doesn’t say much — such as when the breach happened, or if a hacker is to blame or if it was a data exposure that the company could’ve prevented.

Houzz spokesperson Gabriela Hebert would not comment beyond an FAQ posted on the company’s website, citing an ongoing investigation.

In that FAQ, the company said it “recently learned that a file containing some of our user data was obtained by an unauthorized third party.” It added: “We immediately launched an investigation and engaged with a leading forensics firm to assist in our investigation, containment, and remediation efforts.”

The company said it was notifying all of its users who may have been affected.

An email from a Houzz user (Image: supplied)

Houzz said some publicly visible information from a user’s Houzz profile could be affected, such as name, city, state, country and profile description, along with internal identifiers and fields “that have no discernible meaning to anyone outside of Houzz,” such as the region and location of the user and if they have a profile image, for example, the company said.

The company also said that usernames and scrambled passwords were also taken.

Houzz said that the passwords were scrambled and salted using a one-way hashing algorithm, but did not provide specifics on what kind of hashing algorithm was used. Some algorithms, like MD5, are old and outdated but still in use, while newer hashing algorithms — like bcrypt — are stronger and can be more difficult to crack, depending on the number of rounds the passwords go through.

Regardless, the company recommended users change their passwords.

No financial information was taken, according to the FAQ.

The company last year was among many mocked for sending out emails to users alerting them of mandatory changes to their privacy policies ahead of the 2018-introduced EU General Data Protection Regulation (GDPR) law, saying it “value[s]” its customers privacy. “Their opening lines offer a glimpse of the way legal policy and user experience are colliding under the new regulations,” said Fast Company.

But it’s not clear if the company will face penalties — up to four percent of its global revenue — as a result of the regulation, only that the company “notified EU authorities within the statutory period,” said the spokesperson.

Another day, another breach.

Powered by WPeMatico

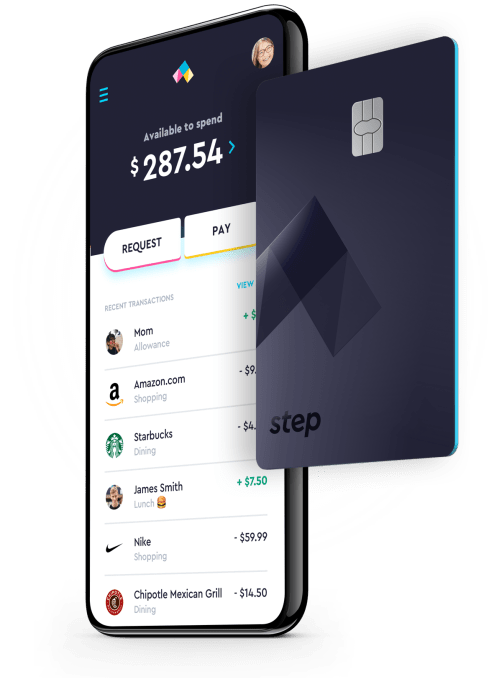

A new mobile banking startup called Step wants to help bring teenagers and other young adults into the cashless era. Today, cash is used less often, as more consumers shop online and send money to one another through payment apps like Venmo. But teenagers in particular are still heavily burdened with cash — even though they, too, want to spend their money on things that require a payment card, like Amazon.com purchases or mobile gaming, for example.

That’s where Step comes in.

The company aims to address the needs of what it believes is an underserved market in mobile banking — the 75 million children and young adults under the age of 21 in the U.S., who are still being forced to use cash.

This market isn’t the “unbanked,” it’s the “pre-banked,” explains Step CEO CJ MacDonald, whose previous startup, mobile gift card platform Gyft, sold to First Data several years ago.

Above: Step CEO, CJ MacDonald

“We’re building an all-in-one banking solution that primarily focuses on teens and parents,” he says. “We want it to be a teen’s first bank account. We want to be a teen’s first spending card. And we want to teach financial literacy and responsibility firsthand.”

MacDonald, along with CTO Alexey Kalinichenko, previously of Square and financial services startup Token, founded Step in May 2018. The 10-person team also includes several prior Gyft employees.

Last summer, Step closed on $3.8 million in seed funding from Sesame Ventures, Crosslink Capital and Collaborative Fund. Crosslink general partner Eric Chin sits on the board.

While there are a number of mobile banking apps out there today — like Chime, Monzo, Simple, Revolut and others — Step will specifically target teens, 13 and up, and other young adults with its marketing. Teens under 18 still need parents’ approval to sign up, of course. But the goal is to encourage the teens to bring the idea to their parents — not the other way around.

Step’s focus on this younger demographic puts it in a different space, where there are fewer competitors. Its more direct rivals are not the bigger mobile banks, but rather startups like teen debit card and bank app Current, or the parent-managed debit card for kids from Greenlight.

Step’s focus on this younger demographic puts it in a different space, where there are fewer competitors. Its more direct rivals are not the bigger mobile banks, but rather startups like teen debit card and bank app Current, or the parent-managed debit card for kids from Greenlight.

The mobile banking service Step provides will also aim to be more comprehensive than just a debit card. It will offer a combination of checking, savings and a Visa card that works as both credit and debit.

The card includes Visa’s Zero Liability Protection on all purchases from unauthorized use, and allows parents to set spending limits.

Parents will also be able to connect their own bank accounts to Step to instantly transfer in funds, which can then be distributed to kids’ accounts for things like allowances and chores, or other everyday spending needs. Step’s bank account itself is backed by Evolve Bank, so it’s FDIC-insured up to $250,000.

Unlike Current, which charges a subscription to use its service, Step aims to be a fee-free bank for consumers. Users don’t have to pay for their account, and there are no fees for things like overdrafts. Instead, Step’s plan is to generate revenue through traditional means — like interchange fees and by way of lending practices, once it has established a deposit base.

The company pays a 2.5 percent interest rate on deposits, offers a round-up savings feature and a range of budgeting tools and supports free instant transfers between Step accounts. It also provides access to a network of 35,000 ATMs with no fees.

The company pays a 2.5 percent interest rate on deposits, offers a round-up savings feature and a range of budgeting tools and supports free instant transfers between Step accounts. It also provides access to a network of 35,000 ATMs with no fees.

Beyond simply facilitating mobile banking, Step’s bigger goal is to teach teens to become financially responsible.

“Schools do not teach kids about money. A lot of families don’t talk about money. And it’s a crucial life skill that’s not really addressed properly when people are growing up,” says MacDonald, who says he was lacking in life skills in this area, even as a young college grad.

“There were ‘Money 101’ skills that I had not learned — that no one had talked to me about. Things like building credit, how many credit cards you should have, debt to income ratio,” he continues. “A lot of people get released into the real world without experience [in those areas],” he says.

Long-term, after solving the needs associated with everyday banking transactions, Step wants to layer on other products and services — like tools that allow a family to save together for college, for example.

The company is launching the banking service under an invite-only system to scale up.

Today, it’s opening a waitlist and referral program. When you invite a friend, you each receive one dollar. Access will then be rolled out on a first-come, first-serve basis this spring. Users can join Step through the website, iOS or Android application.

Powered by WPeMatico

At the end of last year, Grand Central Tech announced plans to work with the Milstein real estate family to transform a midtown Manhattan high-rise into a tech hub called Company. And startups remain an important part of the mix — in fact, Company is unveiling a list of 20 startups participating in this year’s GCT Startup-in-Residence program.

What does Startup-in-Residence mean? Well, Company CEO Matthew Harrigan said the program will continue to offer what it’s always offered — desk space, as well as access to events and amenities, for a select group of early-stage entrepreneurs. And participants don’t have to give up equity or pay rent.

The deal might seem too good to be true, but Harrigan argued that the startups make Company more appealing to its enterprise tenants: “We are retrofitting this building to look and feel and operate like a brand new building … but the one amenity that cannot be simply rolled out is people.”

He also said the program is only taking up 15,000 square feet of the building’s 150,000 total square feet.

“It sounds like an exceptionally generous offering and it isn’t,” he said. “It sounds like it doesn’t make a ton of business sense but that’s actually wrong … Fifteen thousand square feet of space to great early-stage founders helps establish a truly remarkable program and campus in New York City. Those resources are well spent.”

In the past, we’ve written about Grand Central Tech as an accelerator program, but Harrigan said, “We weren’t and aren’t an accelerator” — it just used “the nomenclature that’s known.” Now the program is taking on a more fitting name, though it sounds like the operations won’t be changing too dramatically.

“We typically have very sophisticated founding teams, giving them an ideal environment in which to work,” Harrigan said. “By and large, our companies are left to their own devices — we don’t presume to create a curriculum or some series of programming. It’s a somewhat passive approach, but we make sure all people in the community are linked up with each other.”

Also worth noting: This year’s class consists of 40 percent women founders and CEOs, and it covers industries like energy, mental health, e-commerce, biotech, adtech and food.

Here’s a list of the companies, with descriptions provided by Company (and edited by me for clarity and length). We’ve also written about a number of them before, so I’m including links to past coverage when possible.

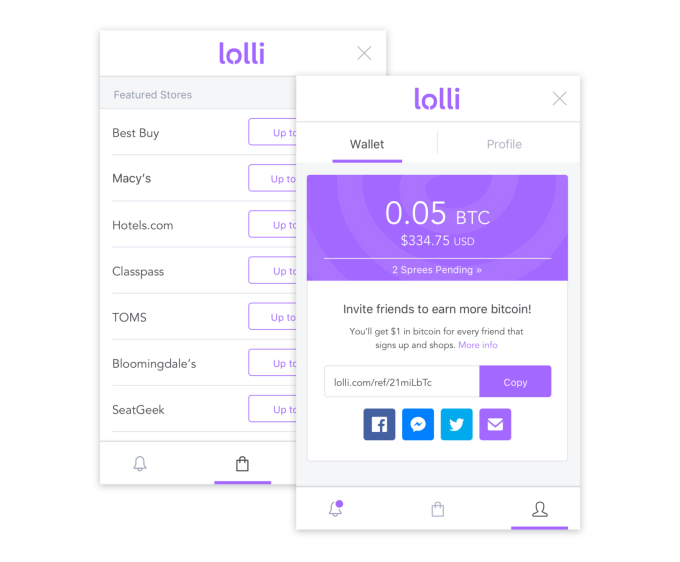

Lolli allows users to receive Bitcoin for their online purchases

Powered by WPeMatico