Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Signal Sciences, an LA-based firm that helps customers secure their web applications, announced a $35 million Series C investment today.

Lead Edge Capital led the round (which seems appropriate, given its name). CRV, Index Ventures, Harrison Metal and OATV also participated. Today’s investment brings the total raised to around $62 million, according to the company.

The company helps protect web applications like online banking, shopping carts, email or any application you access online. It acts as a protection layer or firewall around the application, Andrew Peterson, CEO and company co-founder told TechCrunch.

“We protect people’s websites or mobile sites. We have software that actually fits in line between the internet and traffic coming into those web applications and all of the data that are behind it,” Petersen explained. It sounds simple enough, but given the onslaught of breaches we have seen across the internet, it’s obviously a difficult problem to solve.

Signal Sciences looks at behavior and tries to determine if it’s malicious. “We combine attack information with behavior about what that attacker is doing.” He says this gives customers a real understanding of the behavior of the attacker and what they’re trying to do against their site, instead of trying to randomly trying to determine if each suspicious activity is an attack or not.

Petersen won’t identify a specific number of customers. He feels it’s a misleading metric because some of his large enterprise customers have multiple business units running almost as independent entities and it doesn’t necessarily reflect the size of the business. He will say that Signal Sciences is protecting more than 10,000 applications involving 1 trillion requests every month from companies like Adobe, Under Armour and WeWork.

The company is up to 150 employees, a number Petersen says has been doubling every year. That trend is expected to continue with this new influx of money. The company wants to get the word out to more customers and help people understand there is a way to attack this problem.

“We started this company to build an innovative technology. We want to continue to drive the bar up for what customers should be expecting from their web protection in the future,” Petersen said.

Powered by WPeMatico

Single-use plastics are the scourge of the environment, which is why many lawmakers are working to eliminate them.

Today, a new brand is launching to try to eliminate single-use plastic in the area of personal care. With $4 million in seed funding led by Lerer Hippeau (with participation from Red Sea Ventures, BoxGroup, SV Angel, Great Oaks, SoulCycle co-founder Elizabeth Cutler, and CPO of Adobe, Scott Belsky, among others), By Humankind offers deodorant, shampoo and mouthwash.

But unlike your typical personal care products, the By Humankind portfolio products are rethought from the ground up to eliminate single-use plastic and be kind to the environment.

For example, the mouthwash doesn’t come in a big plastic container, but rather in tablet form. Users can drop a tablet into a small cup of water and the mouthwash, which is alcohol-free, dissolves into a liquid. With the shampoo, the By Humankind team decided to eliminate the plastic bottle by simply taking a page out of the old soap bar playbook, creating a shampoo bar.

Meanwhile, the By Humankind deodorant comes in a refillable plastic roller, with paper-pod refills (which the company calls KindFills).

The company says that its products eliminate single-use plastic by 90 percent when compared to other products in their respective categories. Moreover, By Humankind has designed its shipping packages with biodegradable, bamboo fiber-based materials.

“Keeping our packaging footprint to a minimum is an extension of our mission, which is enabling our customers to reduce their single-use plastic waste, while not sacrificing quality or convenience,” said co-founder and CEO Brian Bushell.

Bushell came from Baked By Melissa, where he was co-founder and CEO. A couple of years after leaving the company, Bushell went on a trip with his girlfriend to Southeast Asia. On a scuba excursion, he noticed a large amount of plastic trash in the ocean, which took him by surprise as he believed to be in one of the few untouched, idyllic parts of the planet.

“We went to the hotel into the bathroom and looked at the stuff we brought on the trip and realized that we were part of the problem,” said Bushell. “That’s when the idea was hatched to build a personal care brand that not only cared about ingredients but about the containers they come in.”

But Bushell knew that the mission would only be successful if the products performed well. That’s why the company spent time and resources creating high-performance formulas for its products, such as the By Humankind deodorant, which the company says kills odor-causing bacteria 40 percent faster than other leading natural deodorants.

According to By Humankind, customers that switch from their current products to all three By Humankind products, with normal usage, will save five pounds of single-use plastic over the course of a year.

Powered by WPeMatico

Nayeem Islam spent nearly 11 years with chipmaker Qualcomm, where he founded its Silicon Valley-based R&D facility, recruited its entire team and oversaw research on all aspects of security, including applying machine learning on mobile devices and in the network to detect threats early.

Islam was nothing if not prolific, developing a system for on-device machine learning for malware detection, libraries for optimizing deep learning algorithms on mobile devices and systems for parallel compute on mobile devices, among other things.

In fact, because of his work, he also saw a big opportunity in better protecting enterprises from cyberthreats through deep neural networks that are capable of processing every raw byte within a file and that can uncover complex relations within data sets. So two years ago, Islam and Saumitra Das, a former Qualcomm engineer with 330 patents to his name and another 450 pending, struck out on their own to create Blue Hexagon, a now 30-person Sunnyvale, Calif.-based company that is today disclosing it has raised $31 million in funding from Benchmark and Altimeter.

The funding comes roughly one year after Benchmark quietly led a $6 million Series A round for the firm.

So what has investors so bullish on the company’s prospects, aside from its credentialed founders? In a word, speed, seemingly. According to Islam, Blue Hexagon has created a real-time, cybersecurity platform that he says can detect known and unknown threats at first encounter, then block them in “sub seconds” so the malware doesn’t have time to spread.

The industry has to move to real-time detection, he says, explaining that four new and unique malware samples are released every second, and arguing that traditional security methods can’t keep pace. He says that sandboxes, for example, meaning restricted environments that quarantine cyberthreats and keep them from breaching sensitive files, are no longer state of the art. The same is true of signatures, which are mathematical techniques used to validate the authenticity and integrity of a message, software or digital document but are being bypassed by rapidly evolving new malware.

Only time will tell if Blue Hexagon is far more capable of identifying and stopping attackers, as Islam insists is the case. It is not the only startup to apply deep learning to cybersecurity, though it’s certainly one of the first. Critics, some who are protecting their own corporate interests, also worry that hackers can foil security algorithms by targeting the warning flags they look for.

Still, with its technology, its team and its pitch, Blue Hexagon is starting to persuade not only top investors of its merits, but a growing — and broad — base of customers, says Islam. “Everyone has this issue, from large banks, insurance companies, state and local governments. Nowhere do you find someone who doesn’t need to be protected.”

Blue Hexagon can even help customers that are already under attack, Islam says, even if it isn’t ideal. “Our goal is to catch an attack as early in the kill chain as possible. But if someone is already being attacked, we’ll see that activity and pinpoint it and be able to turn it off.”

Some damage may already be done, of course. It’s another reason to plan ahead, he says. “With automated attacks, you need automated techniques.” Deep learning, he insists, “is one way of leveling the playing field against attackers.”

Powered by WPeMatico

Databricks, the company founded by the original team behind the Apache Spark big data analytics engine, today announced that it has raised a $250 million Series E round led by Andreessen Horowitz. Coatue Management, Green Bay Ventures, Microsoft and NEA, also participated in this round, which brings the company’s total funding to $498.5 million. Microsoft’s involvement here is probably a bit of a surprise, but it’s worth noting that it also worked with Databricks on the launch of Azure Databricks as a first-party service on the platform, something that’s still a rarity in the Azure cloud.

As Databricks also today announced, its annual recurring revenue now exceeds $100 million. The company didn’t share whether it’s cash flow-positive at this point, but Databricks CEO and co-founder Ali Ghodsi shared that the company’s valuation is now $2.75 billion.

Current customers, which the company says number around 2,000, include the likes of Nielsen, Hotels.com, Overstock, Bechtel, Shell and HP.

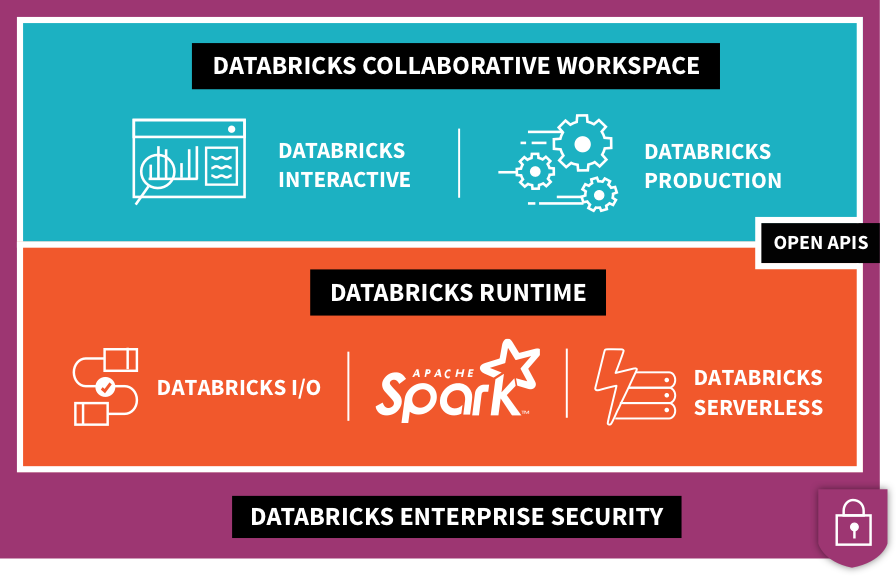

While Databricks is obviously known for its contributions to Apache Spark, the company itself monetizes that work by offering its Unified Analytics platform on top of it. This platform allows enterprises to build their data pipelines across data storage systems and prepare data sets for data scientists and engineers. To do this, Databricks offers shared notebooks and tools for building, managing and monitoring data pipelines, and then uses that data to build machine learning models, for example. Indeed, training and deploying these models is one of the company’s focus areas these days, which makes sense, given that this is one of the main use cases for big data, after all.

On top of that, Databricks also offers a fully managed service for hosting all of these tools.

“Databricks is the clear winner in the big data platform race,” said Ben Horowitz, co-founder and general partner at Andreessen Horowitz, in today’s announcement. “In addition, they have created a new category atop their world-beating Apache Spark platform called Unified Analytics that is growing even faster. As a result, we are thrilled to invest in this round.”

Ghodsi told me that Horowitz was also instrumental in getting the company to re-focus on growth. The company was already growing fast, of course, but Horowitz asked him why Databricks wasn’t growing faster. Unsurprisingly, given that it’s an enterprise company, that means aggressively hiring a larger sales force — and that’s costly. Hence the company’s need to raise at this point.

As Ghodsi told me, one of the areas the company wants to focus on is the Asia Pacific region, where overall cloud usage is growing fast. The other area the company is focusing on is support for more verticals like mass media and entertainment, federal agencies and fintech firms, which also comes with its own cost, given that the experts there don’t come cheap.

Ghodsi likes to call this “boring AI,” since it’s not as exciting as self-driving cars. In his view, though, the enterprise companies that don’t start using machine learning now will inevitably be left behind in the long run. “If you don’t get there, there’ll be no place for you in the next 20 years,” he said.

Engineering, of course, will also get a chunk of this new funding, with an emphasis on relatively new products like MLFlow and Delta, two tools Databricks recently developed and that make it easier to manage the life cycle of machine learning models and build the necessary data pipelines to feed them.

Powered by WPeMatico

Slack, the provider of workplace communication and collaboration tools, has submitted paperwork with the Securities and Exchange Commission to go public later this year, the company announced on Monday.

This is its first concrete step toward becoming a publicly listed company, five years after it launched.

Headquartered in San Francisco, Slack has raised more than $1 billion in venture capital investment, including a $427 million funding round in August. The round valued the business at $7.1 billion, cementing its position as one of the most valuable privately held businesses in the U.S.

The company counted 10 million daily active users around the world and 85,000 paying users as of January 2019. According to data provided (via email) by SensorTower, Slack’s new users on mobile increased roughly 21 percent last quarter compared to Q4 2017, while total installs on mobile grew 24 million. The company recorded 8 million installs in 2018, up 21 percent year-over-year.

Slack’s investors include SoftBank’s Vision Fund, Dragoneer Investment Group, General Atlantic, T. Rowe Price Associates, Wellington Management, Baillie Gifford, Social Capital and IVP, as well as early investors Accel and Andreessen Horowitz.

Slack is one of several tech unicorns on deck to go public this year. Uber and Lyft have both similarly filed confidentially to go public in what are expected to be traditional initial public offerings. Slack, however, is expected to pursue a direct listing, following in Spotify’s footsteps. Instead of issuing new shares, Slack will sell directly to the market existing shares held by insiders, employees and investors, a move that will allow it to bypass a roadshow and some of Wall Street’s exorbitant IPO fees.

Powered by WPeMatico

Solar installations are becoming a no-brainer for anyone with a roof in much of the country. But getting an estimate on how much it would cost and how much juice it would generate can be complicated and time-consuming. Aurora Solar has made an automated process for doing this, and attracted $20 million in funding as a result.

A big part of the uncertainty anyone has about getting solar installed is the upfront cost and return on investment. An on-site visit may cost hundreds, or thousands for a commercial property, or that cost may be rolled up into the overall charge. But why send someone out when all the data you need can be acquired in bulk from the air?

Aurora uses lidar data for this — but not the kind of lidar where you have to fly a drone with the instrument over the house. That would hardly be less expensive and time-consuming than a normal visit. Instead they use lidar collected by small aircraft making low-altitude passes over the city.

The resulting data (you can see it above) produces detailed 3D models of the terrain and all the buildings on it; the exact size and slope of a roof can be determined with high precision. It’s actually similar in a way to how archaeologists used it to map out an ancient Mayan metropolis.

There are some programs and services out there that do virtual site visits, but many just estimate your roof area and orientation by looking at satellite imagery. That’s good for a basic estimate, but Aurora uses multiple sources of data to create a detailed 3D map of your roof, and it’s proud of its results.

“From the get-go, we have been very ambitious about the way we address the problem, probably since we faced the same issues our clients face ourselves,” said co-founder Christopher Hopper in an email to TechCrunch. That would have been in 2012, when he and co-founder Samuel Adeyemo experienced significant friction with a solar install in East Africa. The installation itself was a snap, they found, but the planning and design of the system took months.

“Aurora pioneered the concept of ‘remote site visits,’ which enables solar installers to precisely calculate how many solar panels fit on a property, and how much energy they produce without traveling to the site,” Hopper said. “We have a large dataset of LIDAR data pre-loaded in the application that’s accessible to our users. We estimate that that covers about 2/3 of the US population.”

This and other data lets Aurora create a detailed CAD model of the building in just a few minutes, and generate a basic plan for solar cell placement as well that accounts for slope, exposure, and any shade-producing obstacles like chimneys or trees nearby. (Shade reports are usually done in person, and are necessary to receive certain rebates.)

From there users can go straight into the sales and financing process, even including line diagrams for the electrical system you’ll be building. And theoretically it could all take less than an hour, which is probably how much time you’d spend on the phone trying to get a local solar installer to come out.

The A round was led by Energize Ventures, whose managing director Amy Francetic will be joining the board, with S28 and seed investor Pear also contributing.

Once nice thing about companies relying on data and automation: they scale well. So Aurora won’t need to buy a thousand new trucks to get its next few thousand customers — it needs to hire engineers, sales and support people, which is exactly what it plans to do.

“We expect to expand all of the functions in our organization,” said Hopper. “We are particularly excited about all of the things we can do on the product side and in customer success. And finally, this funding means that we are here to stay. For companies [i.e. Aurora’s clients] that rely on a software provider for their day-to-day operations this is an important factor.”

Adeyemo notes in the press release announcing the funding that “the solar professional” is the “fastest growing occupation in the U.S.” Hopefully making things easier for the customer will keep it that way for a while.

Disclosure: Former TechCruncher Rahul Nihalani now works for Aurora. Rahul’s great, but this does not affect our coverage.

Powered by WPeMatico

Robotics process automation (RPA) is as hot as any enterprise technology at the moment, as companies look for ways to marry their legacy systems with a more modern flavor of automation. Catalytic, a startup from the Midwest, is putting its own flavor on RPA, aiming at more unstructured data. Today it was rewarded with a $30 million Series B investment.

The investment was led by Intel Capital, with participation from Redline Capital and existing investors NEA, Boldstart and Hyde Park Angel. Today’s round brings the total raised to almost $42 million, according to the company.

RPA helps automate highly mundane processes. Sean Chou, Catalytic co-founder and CEO, says there are a couple of ways his company’s solution diverts from his competition, which includes companies like Blue Prism, Automation Anywhere and UIPath.

For starters, Chou says, his company’s solution concentrates on unstructured data, like pulling information from documents or emails using a variety of techniques, depending on requirements. It could be old-fashioned scanning and OCR or more modern natural language process (NLP) to “read” the document, depending on requirements.

It is designed like all RPA tools to take humans out of the loop when it comes to the most mundane business processes, but, as Chou says, his company wants human employees in the loop whenever needed, whether that’s exception processing or tasks that are simply too challenging to program at the moment.

The company launched in 2015 using money Chou had earned from the sale of his previous company, Fieldglass, which he had sold the previous year to SAP for more than $1 billion dollars. Fieldglass helped with outsourcing, and as Chou developed that company, he saw a growing problem around automating certain tedious business processes, especially when they touched legacy systems inside an organization. He raised $3.1 million in seed money from Boldstart Ventures in NYC in 2016 and began building out the product in earnest.

Today, Catalytic has a dozen customers, including Bosch, the German manufacturing conglomerate. It employs 60 people in its Chicago headquarters. While its investors come from the coasts, Catalytic is building a company in the heart of the Midwest, a part of the country that has often been left out of the startup economy.

With $30 million, Catalytic can begin expanding the number of employees, including helping service its large customers, building out it partner network with other software companies and systems integrators and bringing in more engineering talent to continue building out the product.

The product is offered on a subscription basis as a cloud service.

Powered by WPeMatico

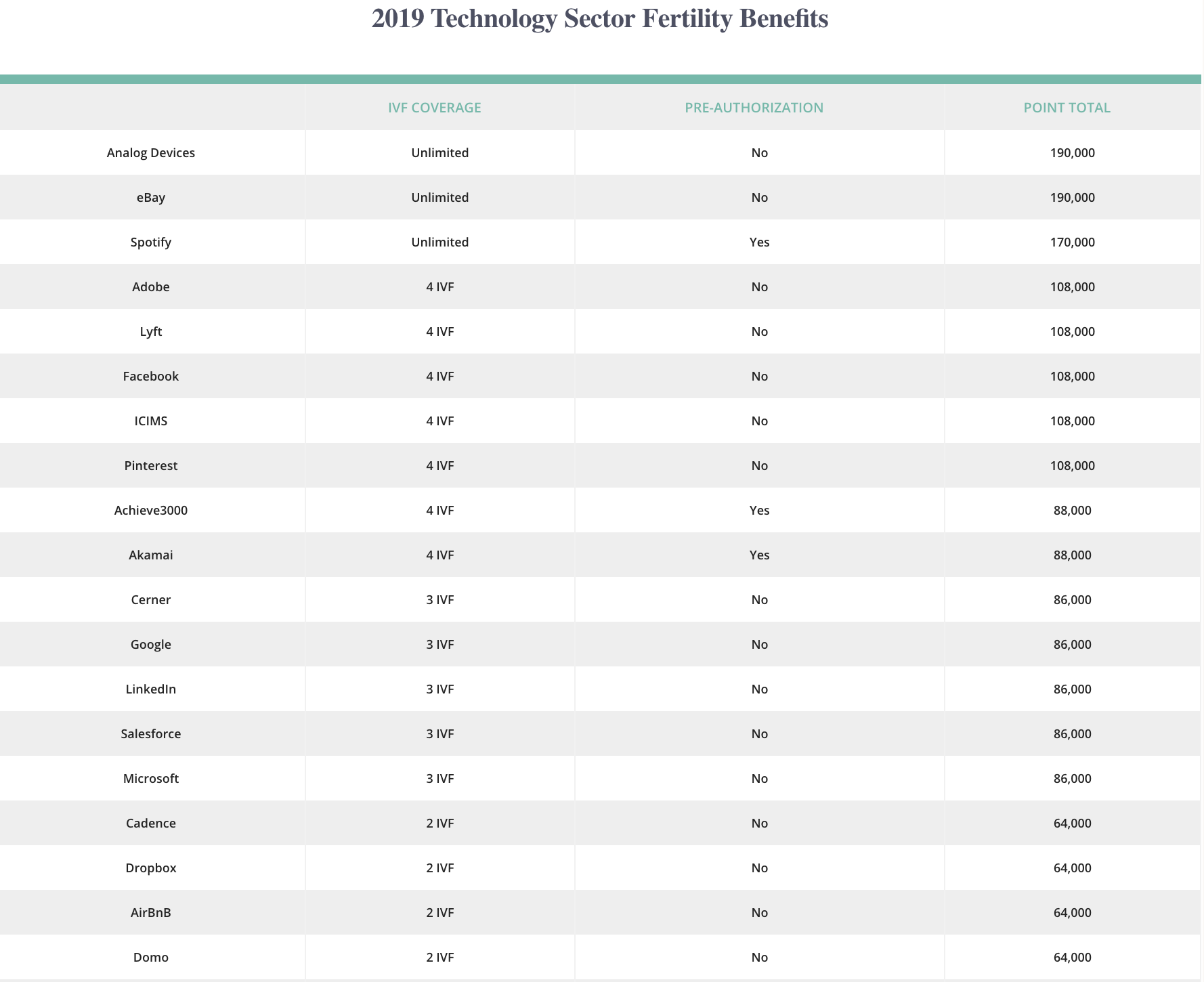

The technology sector awards women and same-sex couples the most comprehensive fertility benefit packages, according to a survey by FertilityIQ, an online platform for fertility patients to review doctors and research treatments.

The company asked 30,000 in vitro fertilisation (IVF) patients across industries about their employers’ — or their spouse’s employer’s’ — 2019 fertility treatment policy, and allocated points based on their support for IVF procedures and egg freezing, among other services.

Silicon Valley semiconductor business Analog Devices and eBay led the ranking. The two companies offer employees unlimited IVF cycles with no pre-authorization requirement, meaning employees do not need permission from insurance providers before seeking certain medical services. Pre-authorization has historically impacted lesbian, gay or unpartnered employees from accessing care quickly or at all, FertilityIQ co-founder Jake Anderson explained

Spotify, Adobe, Lyft, Facebook and Pinterest were amongst the highest-ranked technology businesses, too.

“I think a lot of people see the tech sector as being unenlightened when it comes to family values but it’s still the sector that makes the fertility benefits the most widely acceptable,” Anderson, a former consumer internet investor at Sequoia Capital, told TechCrunch.

FertilityIQ’s fertility benefits survey results.

Despite an initial outpouring of skepticism, Facebook and Apple became leaders in the fertility benefit category when they began paying for their female employees to freeze their eggs in 2014. Since then, smaller firms have opted to beef up those benefits to stay competitive with their much larger and richer counterparts.

“The Lyfts, the Airbnbs and the Ubers of the world, who clearly need to compete for those companies for talent, have effectively matched those companies dollar-for-dollar despite a much smaller war-chest,” Anderson said. “These companies that are worth 1/1000th of these bigger companies are effectively going toe-to-toe to offer whatever women need.”

Anderson and his wife, FertilityIQ co-founder Deborah Anderson, noticed improved benefits in 2018 from companies implicated by the #MeToo movement, such as Vice Media, Under Armour and Uber.

“Silicon Valley is notorious for talent moving around on you but it’s probably not coincidental that some of the companies that were in the spotlight in the #MeToo movement have added really generous benefits,” Deborah Anderson told TechCrunch.

Uber, for example, now pays for its employees to complete two IVF cycles but still requires pre-authorization.

One in 7 Americans struggle with infertility and the rate of IVF procedures only continues to increase, with the latest data indicating a 15 percent year-over-year growth rate. IVF costs roughly $22,000 per cycle, per FertilityIQ’s survey, a cost which has similarly increased 15 percent since 2015.

That’s a whole lot of cash for a fertility patient to dole out. If companies foot the bill, they’ll have a better shot at retaining talent.

“Best we can tell, there is no question that employees that get this benefit and use it are more loyal and more likely to stick around,” Jake Anderson said. “The company that helps you build your family is the company that you remain committed to.”

Powered by WPeMatico

Bud, the U.K. fintech that helps banks connect their apps and data to other fintech companies and financial service providers, has closed over $20 million in further funding.

The Series A round sees the company pick up backing from a number of banks: HSBC (which, via First Direct, it also counts as a customer), Goldman Sachs, ANZ, Investec’s INVC fund, and InnoCells (the corporate venture arm of Banco Sabadell).

Others participating include Lord Fink (the former chief executive of hedge fund Man Group), and 9Yards Capital (the VC firm to which George Osborne is an advisor).

Originally launched back in 2016 as a consumer app that wanted to make various financial services accessible from a single aggregated interface, the London-based startup has since pivoted to a tech platform it offers to banks to help them remain more competitive in the Open Banking/PSD2 era. Its tech lets banks create new apps and services that enable customers to manage all of their financial products within a single app.

Essentially, Bud acts as the tech layer that intelligently connects bank account data to third-party financial services, including those provided by fintechs and more traditional financial providers, as well as doing a lot of the other heavy-lifting required to create new consumer experiences from bank data.

“The work we have done with First Direct… is a showcase of features and functionalities made possible by new regulation, data science and relevant connections to fintech and banking services,” Bud CTO and co-founder George Dunning tells me.

“We have built a number of data enrichment features using transactional data to make people’s lives that little bit easier. Connection and aggregation of people’s accounts is the standard now, so we focussed on things like increasing financial literacy. ‘Smart Balance’ is a feature that shows users what they can safely spend and ‘Goals’ help them plan ahead. Our advanced regular payment finder filters and tracks bill payments and if you can save money Bud connects you to a service that will make it happen”.

Many of these features are powered by Bud’s ability to use data to detect patterns and behaviours. “Something as simple as detecting if someone is going abroad and helping them get insurance for their trip using one of our partners from within the app is much better than if you do it the traditional way,” says Dunning.

Other than HSBC-owned First Direct, the Bud co-founder isn’t able to disclose any of the company’s other bank customers. “We are working with a handful of banks across the industry, using open banking and our marketplace of services to solve problems for their customers which couldn’t be solved before now,” he says.

On the fintech and financial services side, Bud currently works with 85 different companies. These include fintechs Wealthify and PensionBee to more established companies like Hiscox and AJ Bell.

One other partner Dunning can talk about is the U.K. government, which Bud is working with as part of the Rent Recognition Challenge to create new solutions for people wishing to get on the housing ladder. “First-time buyers have it harder now than ever before. Work we are just finalising with The Treasury uses rent payments to help people grow their credit history to buy a home,” he says.

Meanwhile, Bud says the new capital will support the expansion of the Bud team, as the company moves to double its headcount creating what it claims will be the “largest team dedicated to Open Banking in the world”. Its current headcount is 62.

Cue statement from Raman Bhatia, Head of digital bank at HSBC Retail Banking and Wealth Management: “Since the start of our partnership with Bud back in 2017, we’ve been impressed with the team’s approach to innovation. They have helped to shape our approach to open banking, working with us to deliver services that makes banking easier for our customers. They stand out as motivated by their mission to help people have a better relationship with financial services”.

Powered by WPeMatico

Bird’s electric scooters were on full display at the Upfront Summit in Malibu last week, a two-day event that brings together the likes of Hollywood, Silicon Valley and Washington, DC’s elite.

Not only were a dozen or so brand spanking new scooters available to ride throughout the event but Upfront general partner Mark Suster, an investor in the startup, was seen riding a Bird on stage to the tune of Chamillionaire’s ‘Ridin’ Dirty.’ Plus, Bird founder and chief executive officer Travis VanderZanden was on site to mingle with attendees before closing the summit with a fireside chat with Suster himself.

The pair hit on a number of topics, including the unit economics, safety and seasonality of the scooter business. Neither confirmed Bird’s latest raise; the startup is said to be in the process of securing another $300 million at a $2.3 billion valuation, according to PitchBook. In a 12-month period, the company brought in more than $250 million at a roughly $1 billion valuation.

On unit economics: When Bird bursted onto the scene in 2017, VanderZanden knew he had to move quickly to beat copycats, he explained. Operating under Reid Hoffman’s ‘Blitzscaling’ philosophy, he dispersed hundreds of Alibaba-imported electric scooters that were, well, pretty shitty.

“Those things were fragile,” VanderZanden told Suster. “Clearly the unit economics didn’t work on those scooters but that was a test anyway … Once we knew people liked riding them, we quickly scrambled and started creating our own scooters. Bird Zero is the first iteration of that. What we see on the unit economics of those, it’s like night and day.”

The company unveiled Bird Zero, in October, equipped with a digital screen to display riders’ speed, a tougher exterior and improved battery life.

“2018 was about scaling,” he said. “2019 is about really focusing on the unit economics of the business.”

On seasonality: Some have critiqued Bird for poor unit economics, while others have pointed out that the success of the business is heavily dependent on…weather. No one wants to ride a Bird in the snow, slashing its revenue potential in the cold months. VanderZanden said he’s not concerned with seasonality and revealed Bird operates on a $100 million revenue run rate even in the winter. He did not, however, clarify if that run rate is based on fourth quarter 2018 projections — when Bird introduced Bird Zero — or 2018 annual revenue.

“Obviously, there is seasonality in the scooters business, there’s no doubt about that,” he said. “Yes, it’s slower in December but this market is so big, even in our slow [weeks] most companies would love to have that in their best [month] … We used to say when we’re heading into the holiday season that the Birds would migrate south but it turns out the logistics are really expensive, so the Birds hibernate. That’s a lesson we learned.”

On safety: In the year or so that scooters hit the mainstream in the U.S., there were casualties. Moreover, many — kids included — realized just how easy it is to get away with scootering sans helmet, while others rode throughout the night. Bird, to keep children off scooters, at least, requires customers to provide a driver’s license when they sign up. Given the number of issues that have arisen as scooters become increasingly popular, improved safety measures are bound to be in the news in the year ahead.

“Safety has to be prioritized over growth,” VanderZanden said.

On electric bikes: Bird is one of few scooter businesses that doesn’t offer bikes. With all the capital its raised, will Bird make the leap? VanderZanden seemed lukewarm toward the prospect.

“Yeah, we think about it,” he said. “We [aren’t] religious [about] scooters per se, we just think it’s the thing people like the most so that’s where we started and we think that’s the best thing to do now. We get excited about micromobility generally… We are open and looking at all sorts of different short-range electric vehicles in the future.”

On Bird Platform: Last year, Bird began selling its electric scooters to entrepreneurs and small business owners, who can then rent them out as part of a service called Bird Platform. VanderZanden said the service has opened Bird up to tons of new markets.

“From early on at Bird, we had people asking ‘hey, how do we take Bird to my city,’” he said. “We thought why don’t we empower the local entrepreneurs to take Bird to their market… Now we have people from 77 countries from around the world that are interested in taking Bird to their market, which is exciting because there is no way we as a company could get there in the short-term. This is a way to bring Bird to the world.”

On growth: Given the number of stories on Bird and its competitors in the tech press, it’s easy to forget that most of the startups in the space have launched in the last year or so. VanderZanden took a moment to remind the venture capitalists in the audience that in that time, Bird has expanded to 100 cities. Impressive, yes, but let’s remember the manner in which Bird introduced scooter fleets to new markets. The company showed up unannounced in Santa Monica, for example, a decision that resulted in a lawsuit in the startup’s own hometown.

“It’s pretty incredible that 100 cities have opened their arms and embraced electric scooters,” VanderZanden said.

On Bird’s future: VanderZanden explained that despite a long-held interest in transportation — his mother was a public school bus driver for 30 years — he’s only recently come to understand the industry’s most urgent needs. He plans to put more energy in transportation infrastructure in 2019 as a result.

“The deeper I get into transportation, the more I realize we don’t need autonomous vehicles, we don’t need tunnels, all we need are more bike lanes,” he said.

Powered by WPeMatico