Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

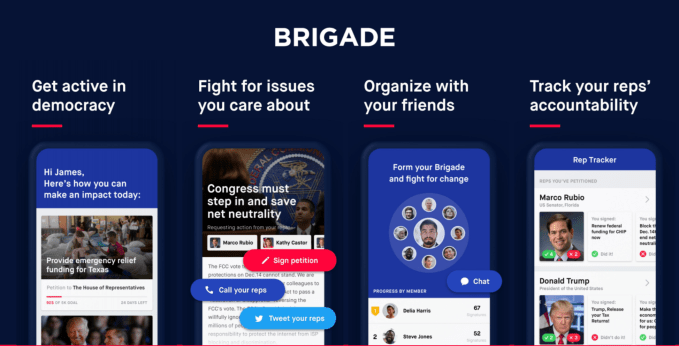

Facebook co-founder Sean Parker bankrolled Brigade to get out the vote and stimulate civic debate, but after five years and little progress the startup is splitting up, multiple sources confirm to TechCrunch. We’ve learned that Pinterest has acqhired roughly 20 members of the Brigade engineering team. The rest of Brigade is looking for a potential buyer or partner in the political space to take on the rest of the team plus its tech and product. Pinterest as well as Brigade CEO Matt Mahan confirmed the fate of the startup to TechCrunch.

While Brigade only formally raised $9.3 million in one round back in 2014, the company had quietly expanded that Series A round with more funding. A former employee said it had burned tens of millions of additional dollars over the years. Brigade had also acquired Causes, Sean Parker’s previous community action and charity organization tool. For now, Brigade’s product will continue running managed by a skeleton crew until a partner or buyer can be found.

After Brigade launched as an app for debating positions on heated political issues but failed to gain traction, it pivoted into what Causes had tried to be — a place for showing support for social movements. More recently, it’s focused on a Rep Tracker for following the stances and votes of elected officials. Yet the 2016 campaign and 2018 midterms seem to fly over Brigade’s head. It never managed to become a hub of activism, significantly impact voter turnout, or really even be part of the conversation.

After several election cycles, I hear the Brigade team felt like there had to be better ways to influence democracy or at least create a sustainable business. One former employee quipped that Brigade could have made a greater impact by just funneling its funding into voter turnout billboards instead of expensive San Francisco office space and talent.

The company’s mission to spark civic engagement was inadvertently accomplished by Donald Trump’s election polarizing the country and making many on both sides suddenly get involved. It did succeed in predicting Trump’s victory, after its polls of users found many democrats planned to vote against their party. But while Facebook and Twitter weren’t necessarily the most organized or rational places for discourse, it started to seem unnecessary to try to build a new hub for it from scratch.

Brigade accepted that its best bet was to refocus on govtech infrastructure like its voter identification and elected official accountability tools, rather than a being a consumer destination. Its expensive, high-class engineering team was too big to fit into a potential political technology acquirer or partner. Many of those staffers had joined to build consumer-facing products, not govtech scaffolding.

Mahan, Brigade’s co-founder and CEO as well as the former Causes CEO, confirms the breakup and Pinterest deal, telling us “We ended up organizing the acqhire with Pinterest first because we wanted to make sure we took care of as many people on the team as possible. We were incredibly happy to find that through the process, 19 members of our engineering team earned offers and ended up going over to Pinterest. That’s about two-thirds of our engineering team. They were really excited about staying in consumer product and saw career opportunities at Pinterest.” A Pinterest spokesperson told us “We’re excited to welcome Brigade engineers to Pinterest, including former Brigade CTO John Thrall and VP of Engineering Trish Gray. As experts across areas like Growth and Product Engineering, they’ve spent years building products that inspire people to go out into the real world and take action.”

Brigade had interest from multiple potential acqhirers and allowed the engineering team’s leadership to decide to go with Pinterest. Several of Brigade’s engineers and its former VP of Engineering Trish Gray already list on LinkedIn that they’ve moved to Pinterest in the past few months. “We had a bunch of employees that took a risk on a very ambitious plan to improve our democracy and we didn’t want to leave them out to dry” Mahan stresses. “We spent more time and more money and more effort in taking care of employees over the last few months than most companies do and I think that’s a testament to Sean and his values.”

Mahan is currently in talks with several potential hosts for the next phase of Brigade, and hopes to have a transition plan in place in the next month. “We’ve in parallel been exploring where we take the technology and the user base next. We want to be sure that it lives on and can further the mission the we set out to achieve even if it doesn’t look like the way it does today.” Though the company’s output is tough to measure, Mahan tells me that “Brigade built a lot of foundational technology such as high quality voter matching algorithms and an entire model for districting people to their elected representatives. My hope for our legacy is that we were able to solve some of these problems that other people can build on.” Given Parker’s previous work with Marijuana legalization campaign Prop 64 in California and his new Opportunity Zones tax break effort, Brigade’s end won’t be Parker’s exit from politics.

Brigade’s breakup could still cast an ominous shadow over the govtech ecosystem, though. Alongside recent layoffs at grassroots campaign text message tool Hustle, it’s proven difficult for some startups in politics to become sustainable businesses. Exceptions like Palantir succeed by arming governments with data science that can be weaponized against citizens. Yet with the 2020 elections around the corner, fake news and election propaganda still a threat, and technology being applied for new nefarious political purposes, society could benefit from more tools built to amplify social justice and a fair democratic process.

Powered by WPeMatico

For years, decades even, startup names have been getting weirder. This isn’t a scientific verdict, but it is how things have seemed to someone who spends a lot of hours perusing this stuff.

Startups have had a long run of branding themselves with creative misspellings, animal names. human first names, made-up words, adverbs and other odd collections of letters. It’s gone on so long it now seems normal. Names like Google, Airbnb and Hulu, which sounded strange at first, are now part of our everyday vocabulary.

Over the past few quarters, however, a peculiar thing has been happening: Startup founders are choosing more conventional-sounding names.

“As we reach the edge of strangeness… they’re saying: ‘It’s too weird. I’m uncomfortable,’” said Athol Foden, president of Brighter Naming, a naming consultancy. While quirky startup monikers haven’t gone away, founders are increasingly comfortable with less-unusual-sounding choices.

Foden’s observations are reflected in our annual Crunchbase News survey of startup naming trends. We’re seeing a proliferation of startups choosing simple words that describe their businesses, including companies like Hitch, an app for long-distance car rides; Duffel, a trip-booking startup named after the popular travel bag; and Coder, a software development platform.

But fortunately for fans of offbeat names, the trend is only toward less weirdness, not no weirdness. Those who wish to patronage seed-stage startups can still buy tampons from Aunt Flow, get parenting tips from an app called Mush or get insurance from a startup called Marshmallow.

Below, we look in more detail at some of the more popular startup naming practices and how they are trending.

For a long time, it seemed like a vast number of startups selected names largely by disabling the spell checker.

Most desirable dictionary words were already in use as domains or too pricey to acquire. So founders took to dropping vowels, subbing a “y” for an “i” or adding an extra consonant to make it work. The strategy worked well for a lot of well-known companies, including Lyft, Tumblr, Digg, Flickr, Grindr and Scribd.

These days, creative misspellings are still pretty common among early-stage founders. Our name survey unearthed a big number (see partial list) that recently raised funding, including Houwser, an upstart real estate brokerage; Swytch, developer of a kit for converting bikes to e-bikes; and Wurk, a provider of human resources and compliance software for the cannabis industry.

However, creative misspellings are getting less popular, Foden said. Early-stage founders are turned off by the prospect of having to spell out their names to people unfamiliar with the brand (which for seed-stage companies includes pretty much everyone).

One of the more fun naming styles is the pun. In our perusal of companies that raised seed funding in the past year, we came across a number of startups employing some sort of play-on words.

We put together a list of seven of the punniest names here. In addition to Aunt Flow, the list includes WeeCare, a network of daycare providers, and Serial Box, a digital content producer. Crunchbase News also created its own fictional startup — drone chicken delivery startup Internet of Wings — in an explainer series on startup funding.

Perhaps some day business naming will harken back to the industrial age, when corporate titans had exceedingly boring and obvious names.

Real companies with pun names that have matured to exit were harder to pinpoint. A couple that have gone public are Groupon and MedMen, a cannabis company that went public in Canada and is valued around CA$2 billion.

For some reason, it appears pun names are more popular in the brick-and-mortar world than the tech startup sphere. Restaurants specializing in the Vietnamese noodle soup Pho have dozens of play-on-word names memorialized in lists like this. Ditto for pet stores.

Personally, I’d like to see more internet startups rolling out pun-based names. Foden would, too, and he has even volunteered one suggestion for someone who wants to start a business applying artificial intelligence to artificial insemination: Ai.ai.

There are more than 170,000 non-obsolete words in the English language, per the Oxford English Dictionary. Startups, however, are convinced we need more.

Hence, one of the more enduringly popular business-naming practices is to come up with something that sounds like an actual word, even if it isn’t.

We put together a list of examples of this naming style among recently seed-funded startups.

It includes Trustology, which is building a platform to safeguard crypto assets; Invocable, a developer of voice design tools for Alexa apps; and Locomation, which focuses on autonomous trucking technology.

Naming advisors like to see the made-up word name trend on the rise, Foden said, because it’s the kind of thing companies pay a consultant to figure out. Another advantage is it’s easier to top search results for a made-up word.

Lastly, let’s look at those rebel startups choosing familiar dictionary words for their names.

We put together a list of some here. Besides the aforementioned Duffel, Hitch and Coder, there’s Decent, a healthcare startup; Chief, a women’s networking group; Journal, a note organizing tool; and many more.

Startups are less concerned than they used to be with snagging a dot-com domain that contains just their name. Commonly, they’ll add a prefix to their domain (joinchief.com, usejournal.com), choose an alternate domain (Hitch.net) or both.

Overall, Foden said, startups today are putting less emphasis on securing a dot-com suffix or an exact domain name match. Google parent Alphabet, in particular, made the alternate domain idea more palatable. It helped to see one of the world’s richest corporations forego Alphabet.com in favor of abc.xyz.

They say history repeats itself. If so, perhaps some day business naming will harken back to the industrial age, when corporate titans had exceedingly boring and obvious names like Standard Oil, U.S. Steel and General Electric.

For now, however, we live in era in which the most valuable companies have names like Google and Facebook. And to us, they sound perfectly normal.

Methodology: For the naming data set, we looked primarily at companies in English-speaking countries that raised seed funding after 2018. To broaden the potential list of names, we also included some companies funded in 2017. We also tried to limit the lists, where possible to companies founded in the past three years, although there were occasional exceptions.

Powered by WPeMatico

Did anyone else listen to season one of StartUp, Alex Blumberg’s OG Gimlet podcast? I did, and I felt like a proud mom this week reading stories of the major, first-of-its-kind Spotify acquisition of his podcast production company, Gimlet. Spotify also bought Anchor, a podcast monetization platform, signaling a new era for the podcasting industry.

On top of that, Himalaya, a free podcast app I’d never heard of until this week, raised a whopping $100 million in venture capital funding to “establish itself as a new force in the podcast distribution space,” per Variety.

The podcasting business definitely took center stage, but Lime and Bird made headlines, as usual, a new unicorn emerged in the mental health space and Instacart, it turns out, has been screwing its independent contractors.

As mentioned, Spotify, or shall we say Spodify, gobbled up Gimlet and Anchor. More on that here and a full analysis of the deal here. Key takeaway: it’s the dawn of podcasting; expect a whole lot more venture investment and M&A activity in the next few years.

This week’s biggest “yikes” moment was when reports emerged that Instacart was offsetting its wages with tips from customers. An independent contractor has filed a class-action lawsuit against the food delivery business, claiming it “intentionally and maliciously misappropriated gratuities in order to pay plaintiff’s wages even though Instacart maintained that 100 percent of customer tips went directly to shoppers.” TechCrunch’s Megan Rose Dickey has the full story here, as well as Instacart CEO’s apology here.

Slack confidentially filed to go public this week, its first public step toward either an IPO or a direct listing. If it chooses the latter, like Spotify did in 2018, it won’t issue any new shares. Instead, it will sell existing shares held by insiders, employees and investors, a move that will allow it to bypass a roadshow and some of Wall Street’s exorbitant IPO fees. Postmates confidentially filed, too. The 8-year-old company has tapped JPMorgan Chase and Bank of America to lead its upcoming float.

Reddit CEO Steve Huffman delivers remarks on “Redesigning Reddit” during the third day of Web Summit in Altice Arena on November 08, 2017 in Lisbon, Portugal. (Horacio Villalobos-Corbis/Contributor)

It was particularly tough to decide which deal was the most notable this week… But the winner is Reddit, the online platform for chit-chatting about niche topics — r/ProgMetal if you’re Crunchbase editor Alex Wilhelm . The company is raising up to $300 million at a $3 billion valuation, according to TechCrunch’s Josh Constine. Reddit has been around since 2005 and has raised a total of $250 million in equity funding. The forthcoming Series D round is said to be led by Chinese tech giant Tencent at a $2.7 billion pre-money valuation.

Runner up for deal of the week is Calm, the app that helps users reduce anxiety, sleep better and feel happier. The startup brought in an $88 million Series B at a $1 billion valuation. With 40 million downloads worldwide and more than one million paying subscribers, the company says it quadrupled revenue in 2018 from $20 million to $80 million and is now profitable — not a word you hear every day in Silicon Valley.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

I listened to the Bird CEO’s chat with Upfront Ventures’ Mark Suster last week and wrote down some key takeaways, including the challenges of seasonality and safety in the scooter business. I also wrote about an investigation by Consumer Reports that found electric scooters to be the cause of more than 1,500 accidents in the U.S. I’m also required to mention that e-scooter unicorn Lime finally closed its highly anticipated round at a $2.4 billion valuation. The news came just a few days after the company beefed up its executive team with a CTO and CMO hire.

Databricks raises $250M at a $2.75B valuation for its analytics platform

Retail technology platform Relex raises $200M from TCV

Raisin raises $114M for its pan-European marketplace for savings and investment products

Self-driving truck startup Ike raises $52M

Signal Sciences secures $35M to protect web apps

Ritual raises $25M for its subscription-based women’s daily vitamin

Little Spoon gets $7M for its organic baby food delivery service

By Humankind picks up $4M to rid your morning routine of single-use plastic

We don’t spend a ton of time talking about the growing, venture-funded, tech-enabled logistics sector, but one startup in the space garnered significant attention this week. Turvo poached three key Uber Freight employees, including two of the unit’s co-founders. What’s that mean for Uber Freight? Well, probably not a ton… Based on my conversation with Turvo’s newest employees, Uber Freight is a rocket ship waiting to take off.

Who knew that investing in female-focused brands could turn a profit for investors? Just kidding, I knew that and this week I have even more proof! This is L., a direct-to-consumer, subscription-based retailer of pads, tampons and condoms made with organic materials sold to P&G for $100 million. The company, founded by Talia Frenkel, launched out of Y Combinator in August 2015. According to PitchBook, it was backed by Halogen Ventures, 500 Startups, Fusion Fund and a few others.

Speaking of ladies getting stuff done, Bessemer Venture Partners promoted Talia Goldberg to partner this week, making the 28-year-old one of the youngest investing partners at the Silicon Valley venture fund. Plus, Palo Alto’s Eclipse Ventures, hot off the heels of a $500 million fundraise, added two general partners: former Flex CEO Mike McNamara and former Global Foundries CEO Sanjay Jha.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase editor-in-chief Alex Wilhelm and I chat about the expanding podcast industry, Reddit’s big round and scooter accidents.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

If you’ve ever seen a lamp or chair that you liked and wished you could just take a picture and find it online, well, GrokStyle let you do that — and now the company has been snatched up by Facebook to augment its own growing computer vision department.

GrokStyle started as a paper — as AI companies often do these days — at 2015’s SIGGRAPH. A National Science Foundation grant got the ball rolling on the actual company, and in 2017 founders Kavita Bala and Sean Bell raised $2 million to grow it.

The basic idea is simple: matching a piece of furniture (or a light fixture, or any of a variety of product types) in an image to visually similar ones in stock at stores. Of course, sometimes the simplest ideas are the most difficult to execute. But Bala and Bell made it work, and it was impressive enough in action that Ikea on first sight demanded it be in the next release of its app. I saw it in action and it’s pretty impressive.

Facebook’s acquisition of the company (no terms disclosed) makes sense on a couple of fronts: First, the company is investing heavily in computer vision and AI, so GrokStyle and its founders are naturally potential targets. Second, Facebook is also trying to invest in its marketplace, and using the camera as an interface for it fits right into the company’s philosophy.

One can imagine how useful it would be to be able to pull up the Facebook camera app, point it at a lamp you like at a hotel and see who’s selling it or something like it on the site.

Facebook did not answer my questions regarding how GrokStyle’s tech and team would be used, but offered the following statement: “We are excited to welcome GrokStyle to Facebook. Their team and technology will contribute to our AI capabilities.” Well!

There’s an “exciting journey” message on GrokStyle’s webpage, so the old site and service is gone for good. But one assumes that it will reappear in some form in the future. I’ve asked the founders for comment and will update the post if I hear back.

Powered by WPeMatico

The head of the U.S. Food and Drug Administration is calling Altria and Juul to meet in Washington to discuss their tie-up and how it impacts the companies’ plans to combat teen vaping. Earlier this year, Altria href=”https://techcrunch.com/2018/12/20/juul-labs-gets-12-8-billion-investment-from-marlboro-maker-altria-group/”>invested $12.8 billion investment in Juul.

“After Altria’s acquisition of a 35 percent ownership interest in JUUL Labs, Inc., your newly announced plans with JUUL contradict the commitments you made to the FDA,” Commissioner Scott Gottlieb wrote in a strongly worded letter addressed to Altria chairman and chief executive, Howard A. Willard III.

“When we meet, Altria should be prepared to explain how this acquisition affects the full range of representations you made to the FDA and the public regarding your plans to stop marketing e-cigarettes and to address the crisis of youth use of e-cigarettes,” Gottlieb wrote.

The commissioner sent a similarly worded message to Juul’s chief executive, Kevin Burns.

As part of that deal, Juul is getting access to Altria’s retail shelf space; the company is sending out direct communications pitching Juul to adult smokers through cigarette pack inserts and mailings to the company’s database of customers; and the two will combine the power of their respective sales and distribution backend which reaches roughly 230,000 retailers across America.

The recent deal comes only months after Juul released its plan to combat teen vaping — something the FDA had required of the company.

In the commitments it made last year, the vape manufacturer and retailer said it would expand its secret shopper program to make sure underage buyers weren’t getting access to its products; pull its campaigns from social media; and limit sales of non-traditional cigarette flavors (menthol, mint, Virginia tobacco, and “classic” tobacco) to the company’s website — which requires age verification.

Gottlieb isn’t the only one who has a problem with Juul. We’ve written about how the company has lowered the barrier to entry for nicotine addiction.

For Gottlieb, the addition of Altria’s marketing firepower and network of 230,000 retail locations likely isn’t an indicator of a company that’s willing to winnow down access to its products.

“I am aware of deeply concerning data showing that youth use of JUUL represents a significant proportion of the overall use of e-cigarette products by children. I have no reason to believe these youth patterns of use are abating in the near term, and they certainly do not appear to be reversing,” Gottlieb wrote. “Manufacturers have an independent responsibility to take action to address the epidemic of youth use of their products. My office will contact you to arrange a meeting to discuss these issues. Pursuant to your request, we intend to schedule this as a joint meeting with both Altria and JUUL.”

Powered by WPeMatico

Pivots can be the making of a startup, helping teams refocus on a good idea when previous things haven’t worked. But sometimes, they are just one more step on a difficult track. TechCrunch has learned and confirmed that Adero — an Amazon-backed maker of Bluetooth-enabled tracking tags that until last December was known as TrackR — is laying off at least 45 percent of its staff. The cuts come as Adero refocuses on building software instead of hardware products, and attempts to build a B2B business that reduces its emphasis on the consumer market ahead of plans to raise another round of funding.

The layoffs, which started last week, follow a pivot about two months ago from selling individual tracking tags — a business that had become increasingly commoditized — to developing solutions to organise and track groups of items that tend to be used together (such as the contents of a school backpack).

It’s not clear exactly how many employees are being affected, but when the pivot was announced at the end of November, the company had 60 employees, which would work out to 27 employees in this latest cut.

A spokesperson said that layoffs were being made to put more focus on building software instead of hardware.

“As our new brand grows, we can now move to the next chapter in developing the intelligent organization platform,” he said. “As a result, we’ve parted ways with a portion of the team that was brought on to help design and deliver the consumer product. We will both support the consumer products and focus new energy on developing the platform that powers our consumer products so it can power the experiences of our strategic partners.”

The layoffs and shift at Adero underscore the more general, continuing challenges of building hardware startups. If the product is unique, chances are that the economies of scale to manufacture it will be too capital-intensive for even well-capitalised startups.

But often, the products are just not unique enough. Adero, for example, competes with Tile and a plethora of smaller brands selling tracking dongles that are either very similar or fulfill a similar purpose, and that in turn commoditizes the core product. The mission then becomes building services around the hardware that are in and of themselves distinctive, or at least trying to be.

“It took a superhuman effort to develop and deliver a new product from scratch — hardware, software, cloud — in nine months,” CEO Nate Kelly wrote in an emailed statement when contacted to provide more detail about the layoffs.

“We threw everything we had into that work and are happy to say that not only did we launch but we have, since launch, delivered two updates to iOS, one to Android and will be delivering… a firmware update that increases the reliability of the product and releases new functionality like removing the limits on the number of taglets.”

Adero’s relaunch in December saw the company building a new line of large and small tags that allowed users to group items that often travelled together to help track them more logically, with plans to add more predictive and other intelligent features over time. “We did more than launch new products, we also built a platform, Activefield, that can scale across many products, many companies and unlimited use cases,” Kelly said.

He added that now the company is trying to work with more (unnamed) strategic partners. That B2B shift also has translated to cutting costs and streamlining particularly in “areas where we had bulked up” to launch the consumer product. “We don’t need that level of support anymore,” he said.

“Now that we’ve launched on our website and on Amazon” — which is an investor in Adero — “we will continue to take our product into other channels and countries, but the push in consumer comes second in focus to the further development of the platform and the deployment into a number of strategic partners,” he said. “This is all very ambitious and we are a small company with limited resources so I’m having to make some changes to the org that makes us leaner and sharpens our focus on deploying our ‘powered by Activefield’ strategy.”

He said that while Adero will continue to support its consumer products, “we hope to come back to you soon to share some good news on partnerships.”

He added that Adero also hoped to have more news of a new round of funding later this quarter. To date, the company has raised about $50 million, but its valuation has yo-yoed from $150 million in August 2017, to just $40 million in July 2018. Investors in the company, in addition to Amazon, include Foundry Group, NTT and Revolution.

While the company would only confirm 45 percent of employees were laid off, our tipsters paint a slightly more dire picture of the company. One tip we received described the layoffs as covering “almost everyone” and another noted that “the majority of the team” at the Santa Barbara-based startup are now gone. “Very few remain to help close the business,” it said.

The news caps off a tricky year for Adero. In January 2018, still branded TrackR, it laid off around 42 employees — at the time just under half its employees. The layoffs came as it was emerging that the startup’s core product, its Bluetooth tag, was becoming increasingly commoditized, with dozens of me-too trackers sold alongside it on Amazon and other marketplaces. (Its biggest rival, Tile, has also seen some big changes and also appears to be shifting its focus to a wider home IoT play.)

Around the time of those layoffs, first one and then both of the company’s founders — Chris Herbert and Christian Smith — stepped away from day-to-day roles at the company. Herbert had been CEO and he was replaced by Kelly, who had been the COO.

Then came the funding round at a big devaluation. “Foundry and Revolution [two of the startup’s investors] were hoping that they would put this money in and I could fix and scale things, similar to how I’d scaled Sonos and so on,” Kelly said about the funding in November (his experience includes Sonos, Tesla and Facebook). “But within six weeks, it became evident that we didn’t need to scale but figure out what the future was and where this is going.”

Where this is going continues to be the question as Adero takes its next steps.

Powered by WPeMatico

Unlike 2000 and 2008, everyone in the startup world is expecting a crash to come at any moment. But few are taking concrete steps to prepare for it.

If you’re running a venture-backed startup, you should probably get on that. First, go read RIP Good Times from Sequoia to get a sense for how bad it can get, quickly. Then take a look at the checklist below. You don’t need to build a bomb shelter, yet, but adopting a bit of the prepper mentality now will pay dividends down the road.

The first step in preparing for a coming downturn is making a plan for how you’d get to a point of sustainability. Many startups have been lulled into a false sense of confidence that profit is something they can figure out “later.” Keep in mind, it has to be done eventually and it’s easier to do when the broader economy isn’t crashing around you. There are two complicating factors to keep in mind.

In a downturn, business customers skip investing in capital equipment and new software. Likewise, consumer discretionary spending goes way down. The result is you’ll likely have less revenue than you do now. War-game a variety of scenarios — what you’d do if you lost 20 percent, 50 percent or 80 percent of your revenue, and what decisions would have to be taken to survive.

When a downturn comes, capital markets don’t soften, they seize. Depending on how bad a hypothetical financial crisis got, there’s a good chance that investors would close up their checkbooks and triage. If you aren’t one of your investor’s favorite portfolio companies, there’s a decent chance you may be left in the cold. Don’t even assume you’ll be able to close a down round. Fortunately, showing a plan with a clear path to profitability will allay investors concerns that you’ll need their capital indefinitely and make it more likely you’ll be able to raise.

Planning around these three realities — the need for profits, while experiencing dropping revenue, in a world where capital can’t be had at any valuation — is going to lead to unpleasant conclusions. A dramatically diminished business, major layoffs, and a decisive drop in morale are likely outcomes. Thankfully, you can take steps now to help soften the landing, or if you’re really successful, avoid it entirely.

Getting acquisition costs under control will help you in two ways. First, it’ll lower your burn rate. Chasing growth for growth’s sake is always a short-sighted decision, but especially during the late part of the business cycle. Avoid this even if you’re VC is encouraging it. Second, by carefully analyzing the inputs to your acquisition cost, it will force you to examine the dynamics of your business. It gives you an opportunity to decide if a poorly performing channel or lackluster sales reps are actually smart investments. Even cutting your payback period from 12 months to nine will provide an increased measure of visibility and control.

Instagram took over the web with a team of a dozen. Craigslist is a pillar of the internet with a staff of 40 employees. WhatsApp supported hundreds of millions of daily users with fewer than 50 people. Chances are you need fewer people than you think.

In his new book, Scott Belsky shares an algorithm he used building Behance into a $100M company — automate, automate, then hire. His point was that founders should encourage teams to push hard on improving processes and other labor-saving tools before adding more FTEs.

Don’t institute a hiring freeze or take other actions that might spook the staff, but do send the message that new hires should be the last resort, not the first response to a challenge.

Founders often try to change spending habits, and in turn culture, when it’s too late. Is there a fair bit of business class flying among the executive team? Do your employees stretch your free dinner policy by staying just past the dinner hour to take advantage of free food? At most tech ventures, everyone is truly an owner. Try to help the entire team to internalize that they are spending their own money.

The week the market drops 50 percent is not the week to start a M&A conversation. You should be getting to know the five most likely buyers of your company, now. Find out who the decision makers at each of the companies are and build relationships. Make it a point to catch up with these people at conferences and even consider sending them regular updates about your company’s progress (but not too much data). You’re not running a formal sales process, but helping build up the internal desire to buy your company if the opportunity presents itself. It may not be the exit of your dreams, but it’s nice to have options if you need them.

If you’re coming to a T-juncture regarding office space, you may want to prioritize price and lease flexibility over quality and location. I remember one of our offices at my start-up was a twelve month lease with 6 months free. The landlords were desperate, and so were we!

If you’re in the kind of business that will support annual contracts, figure out a way to offer them. Pre-sell credits to consumers at a discount. More fundamentally, think about how you might be able to adjust your business model so you can get paid before you deliver services. Plenty of viable businesses are asphyxiated by delays in accounts receivable, don’t allow your ambitions to be thwarted by accounting.

One lesson learned in the 2000 bubble was that startups that serve other startups tend to be hit hardest. It’s important to think about how a downturn will impact your customer base. If more than 30 percent of your revenue comes from one industry (perhaps start-ups!), or heaven help you, a single customer, start thinking about managing risk by diversifying your customer base.

Topping up your balance sheet at this point isn’t a bad idea, provided you have the discipline to treat it as a rainy day fund. Communicate this rationale to your investors. It’s also important to use this moment to reflect on valuation. An eye-popping valuation will feel good when you sign the term sheet, but it’s going to feel like a millstone if the economy turns, and the market for blue-chip tech stocks drops precipitously.

Many VCs discourage venture debt. They’ll say “if you need more money, we’ll backstop you.” The problem is when things ugly, they may not be there. Debt providers are a good way to extend the runway. The thing is that it’s best to raise debt capital when you don’t need it. Venture debt can add ⅓ to ½ of additional capital to some funding rounds with minimal dilution and relatively modest interest rates. Do note that when things get bad, some debt funds can get aggressive so do your homework before taking the notes.

It’s tough to predict the top of the market. CNN, Time, The Atlantic, The Wall Street Journal, and many others argued Facebook paying $1 billion for Instagram was a sure sign of a bubble — in 2012. Reputable commentators have claimed that we’re in a bubble every year since, see 2013, 2014, 2015, 2016, 2017, and 2018. Going into survival mode in any of those years would have been a serious mistake for most startups.

Still, we’re only two quarters away from marking the longest economic expansion in US history. The good times have got to end at some point. Venture capital is a hell of a drug and withdrawal can be painful. Keep in mind that there’s no correlation between how much a company raised and how well they did on the public markets. If you’re struggling to make your startup’s economics work, read up on dozens of “invisible unicorns” who show that you can get big without relying on outsized amounts of venture capital.

If your house is in order when the downturn hits, you may actually be able to grow through it. As unprepared competitors go out of business, you’ll find that talent is more plentiful and customer acquisition costs plummet. Some of the best companies have been founded and thrived in the worst of times — if you’re prepared.

Powered by WPeMatico

Rebag, an online resale marketplace for luxury handbags, is getting another infusion of capital as it prepares to expand its offline retail operations. The company this week announced $25 million in Series C funding, in a round led by private equity firm Novator, with participation from existing investors General Catalyst and FJ Labs.

The round brings Rebag’s total raise to date to $52 million.

Rebag competes with other luxury goods resellers, like TheRealReal, and to some extent with broader resale marketplaces like ThredUP or Poshmark, which also attract shoppers looking to buy quality pre-owned items. And it exists alongside large marketplaces like eBay, as well as rental shops like Rent the Runway, which offers an alternative to a site focused only on handbags.

In fact, Rebag founder and CEO Charles Gorra spent a brief period at Rent the Runway before leaving to start Rebag in 2014. At the time, he said he saw an immediate opportunity to not just rent the items, but to actually resell them on a secondary market.

Today, Rebag’s shop sells bags from more than 50 designer brands, including all the majors, like Chanel, Louis Vuitton, Hermes, Gucci and others.

However, in the years following Rebag’s launch, the company has expanded its offerings beyond just online resale to include brick-and-mortar retail and, more recently, a service called Rebag Infinity, which allows shoppers to turn in any Rebag handbag purchase within six months in exchange to receive a credit of at least 70 percent off their next purchase.

Last year, Rebag made headlines in the fashion world for selling the rare Hermès White Crocodile Himalayan Birkin collectible — typically a bag that costs more than $100,000 — for “just” $70,000, to celebrate the opening of its 57th Street and Madison Avenue store, its second Manhattan flagship location.

With the new funding, Rebag will expand its offline footprint, it says. The company currently operates five stores in New York and L.A. but plans to launch 30 more locations in the “medium term.” This will include both standalone storefronts, as well as presences within luxury malls.

With the new funding, Rebag will expand its offline footprint, it says. The company currently operates five stores in New York and L.A. but plans to launch 30 more locations in the “medium term.” This will include both standalone storefronts, as well as presences within luxury malls.

It’s common for resale marketplaces these days to take their wares to offline shoppers. TheRealReal, Rent the Runway, ThredUP and others all today offer real-world locations, where shoppers can browse in person instead of just online.

Rebag says since it opened its retail stores last year, it moved from being a 100 percent digital operation to 80 percent digital and 20 percent offline. Its sourcing network also grew to include more than 20,000 stylists, partners, shoppers and sales associates.

With the funding, Rebag adds it will also refine its pricing and handbag evaluation tools aimed at standardizing the resale process, something that could represent another business for the brand (or make it attractive to an acquirer).

“We are a technology company first,” noted founder and CEO Charles Gorra, in a statement. “Our goal is to become the standard for the luxury resale industry, just like Kelley Blue Book is the main resource for the auto industry.”

The company plans to triple its team of 100, which today includes newer hires CTO Jay Winters (Delivery.com, Goldman Sachs) and CMO Elizabeth Layne (Bonobos, Appear Here).

Rebag doesn’t share its hard numbers about sales, revenues, valuation, customer base or others, but told us it has tripled revenues since its Series B.

Powered by WPeMatico

Fertility services are raising venture cash left and right. Last week, it was Dadi, a sperm storage startup that nabbed a $2 million seed round. This week, it’s Extend Fertility, which helps women preserve their fertility through egg freezing.

Headquartered in New York, the business has secured a $15 million Series A investment from Regal Healthcare Capital Partners to expand its fertility services, which also include infertility treatments, such as in vitro and intrauterine insemination. The company has also appointed Anne Hogarty, the former chief business officer at Prelude Fertility and vice president of international business at BuzzFeed, to the role of chief executive officer. Hogarty replaces Extend Fertility co-founder Ilaina Edison, who had held the C-level title since the business launched in 2016. Edison will remain on the startup’s board of directors.

Extend Fertility, in its New York cryopreservation and embryology lab and treatment center, completed 1,000 egg-freezing cycles in 2018.

“A lot of amazing things have happened for women over the last century,” Hogarty told TechCrunch earlier this week. “Now, women are permitted and encouraged to seek higher education, pursue a career, follow their dreams and end up with a partner who’s the right partner, not just any partner. Doing all those things has pushed the window for when women want to start a family from their 20s to their 30s and unfortunately, one thing that has not changed in that time is the biological clock.”

Hogarty explained Extend’s fertility services are more affordable than other options because the service was built specifically with egg freezing in mind, and the company later expanded to offer infertility treatments, whereas other services were established to provide IVF and other infertility treatments and integrated cryopreservation tools later.

“We are really purpose-built to be an egg-freezing-first company, where many legacy institutions that were providing infertility services have legacy costs that come with … inefficiencies bred over decades and outmoded technology in their labs that may not be the most efficient and effective,” she said. “We have a state of the art lab with the latest equipment.”

“It’s the classic innovator dilemma,” she added. “Infertility services are extraordinarily expensive and reproductive endocrinology is a new area of medicine. There are a lot of people and institutions that have been taking inordinate amounts of money for their infertility services so they weren’t looking to serve this population of women looking to preserve their fertility.”

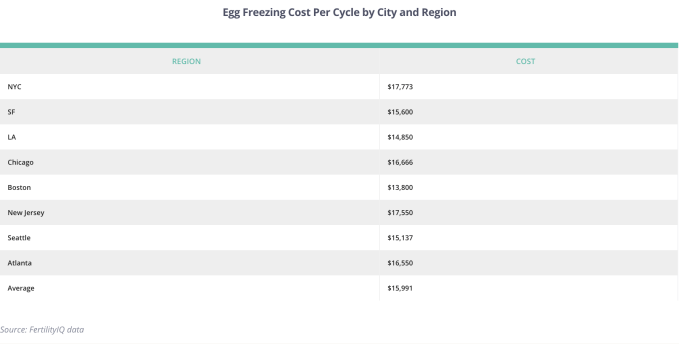

One egg-freezing cycle with Extend costs women $5,500, and additional cycles come at a sticker price of $4,000. Each cycle includes a fertility assessment, private consultation, anesthesia and any monitoring a patient may need during their cycle. The costs don’t include medication, however. Extend can prescribe medications — which typically cost between $2,000 and $5,000 for fertility patients — but they still need to go through a third party to get their prescriptions filled and paid for.

For reference, FertilityIQ, an online platform for researching fertility care providers and treatments, says the typical cost per cycle for egg freezing is more than $17,000 in New York City or $15,600 in San Francisco. Most egg-freezing services, including Extend, do not accept insurance, as most insurance providers don’t cover the steep costs of fertility or infertility treatments.

Some companies, however, are beginning to offer benefits that cover these costs. Facebook and Apple, for example, began subsidizing egg-freezing procedures for employees in 2014. Spotify and eBay, for their part, will pay for an unlimited number of IVF cycles.

Hogarty said Extend’s price point makes it one of the lowest-cost players in the market.

“We want as many women as possible to benefit from the advances from egg-freezing technology,” she said.

Extend Fertility, which has previously raised $10 million, plans to use the latest investment to open labs in new markets and expand its infertility services.

Powered by WPeMatico

Dixa, a Copenhagen-based startup that offers a platform to help companies provide better and more consistent customer service across multiple channels, has raised $14 million in Series A funding. The round is led by Project A Ventures, with participation from early investor SEED Capital.

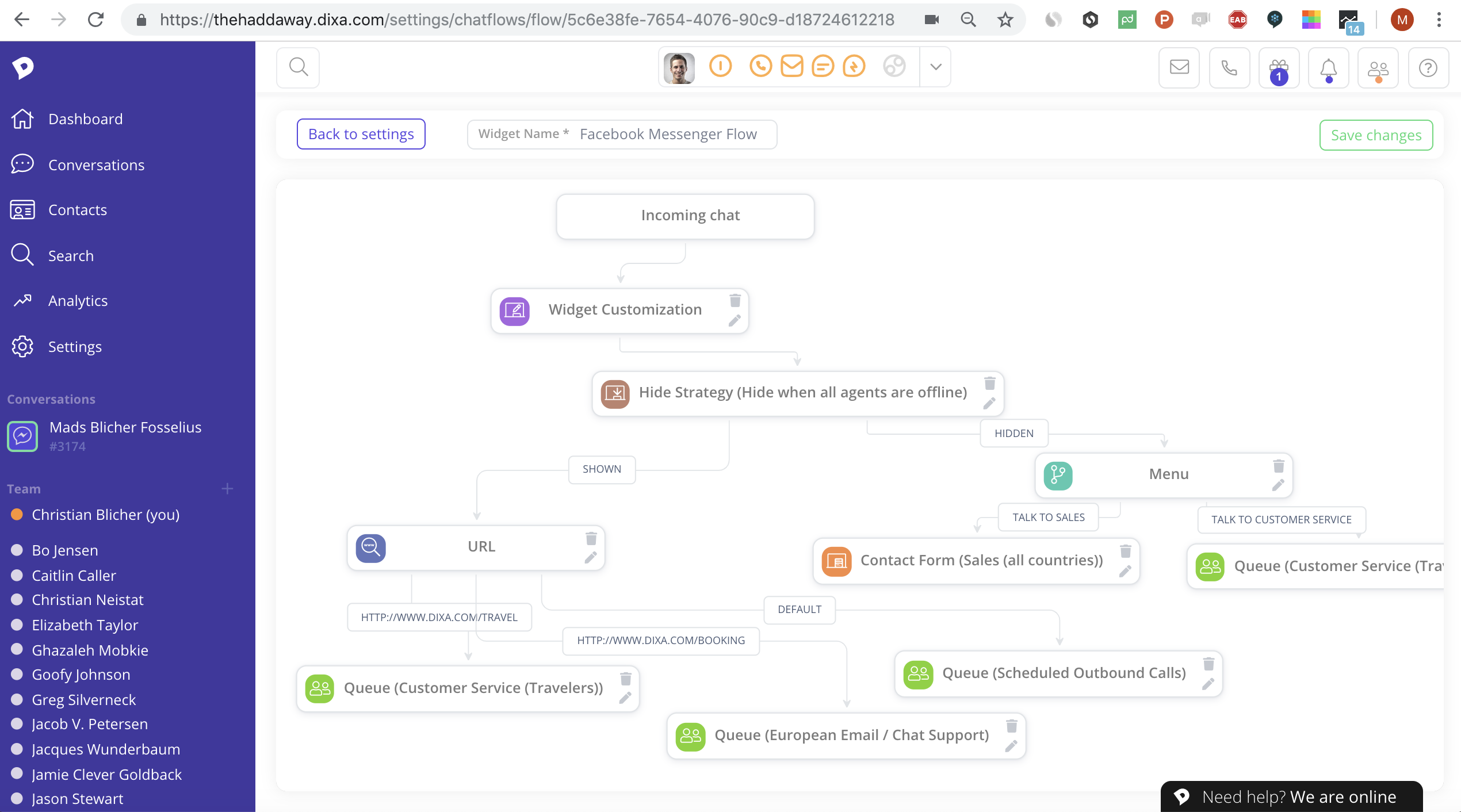

Founded in 2015 by Jacob Vous Petersen and Mads Fosselius, Dixa is on mission to end bad customer service with the help of smarter technology to facilitate more personalised customer support. Dubbed a “customer friendship” platform, the cloud-based software works across multiple channels — including phone, chat, e-mail and Facebook Messenger — and employs a smart routing system so the right support requests reach the right people within an organisation.

“The problem for customer-facing support teams today is that tickets shared in boxes and legacy call center solutions limit a brand’s ability to connect to their customers where they want to and add extra administrative burdens that ultimately harms the customer experience,” co-founder and CEO Mads Fosselius tells me.

“Despite companies and brands promising stellar customer experiences and service, [with] digital transformation and technology vendors promising even more, the facts are that 75 percent of all customers have had a bad customer experience within the past six months and 70 percent say they will leave a brand after just one bad experience,” he says, citing Salesforce’s recent ‘State of the Connected Customer’ 2018 report.

Dixa’s solution is described by Fosselius as a “next-gen” customer engagement platform built for personal and insightful conversations across all channels. To various degrees, it competes with Zendesk, Freshdesk, Salesforce Servicecloud and Avaya, Cisco and 8×8. “Dixa is different as it’s a one channel-neutral platform and it works [how[ friends connect and communicate, but for engagement between brands and their customers. We call it a ‘Customer Friendship’ platform,” says Fosselius.

This sees Dixa help companies ensure that customers can always get the help they need when they need it and on the channel they prefer. The software’s algorithms smartly re-route requests to the correct human or bot based on a raft of data. This includes past conversations, orders, reviews and sentiment. Additionally, the context is taken into account, such as the communication channel used, web page visited, device, etc., and the skills plus availability of the relevant customer-facing employee.

The result, says Dixa, is a system that makes it possible to deliver a consistent level of personal service, regardless of how the customer reaches out.

To that end, the Dixa platform is targeting “customer-centric” brands with 5-500 customer-facing agents, such as scale-ups and companies in the travel, e-commerce, fintech and transport/delivery sectors. Its current customer base spans 23 countries and includes brands like Bosch, Interflora,Trustpilot, Danish design icon Hay and food waste movement company Too Good to Go.

Adds Fosselius: “We don’t believe in tickets and siloed ‘silver bullet’ customer support solutions doing one thing or one channel very well, the world of customer support is moving towards conversational customer engagement or ‘customer friendship’ as we like to call it, where the strong bond and relation between brands and customers are the center piece.”

Powered by WPeMatico