Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Lime, similar to its competitors Spin and JUMP, just got word that while its appeal to operate electric scooters in phase one of San Francisco’s pilot program was denied, it may be able to deploy scooters during phase two. This comes following San Francisco Municipal Transportation Agency Neutral Hearing Officer James Doyle’s decision regarding Ford’s Spin, Uber’s JUMP and now Lime’s appeals of the permitting process.

Currently, Skip and Scoot are the only two companies permitted to operate shared electric scooter services in the city. After the first six months of the program, in April, the SFMTA can potentially increase the number of scooters from the current max of 625 to 2,500. This juncture, Doyle said, should be able to accommodate the addition of other operators.

“As a well-experienced and well-qualified vendor, I would expect that Lime’s entry into the city’s Pilot Program should result not only in increased services on our streets, but allowing additional capable operators in the Pilot Program can only enhance the probability of an eventual success of the powered scooter share program in San Francisco,” Doyle wrote in his decision.

Moving forward, it’s unclear if the SFMTA will take the recommendation, but SFMTA Communications Manager Ben Jose previously told TechCrunch, “The SFMTA will be consulting with the City Attorney’s Office to determine next steps as we near the second half of the pilot.”

In a statement to TechCrunch, Lime said it appreciates the hearing officer’s recommendation that Lime be considered to operate its shared electric scooters during phase two of the program. A Lime spokesperson also said they appreciate Doyle’s note that Lime has the expertise and operational capacity to meet the SFMTA’s requirements.

Lime has been one of the more outspoken companies following the SFMTA’s electric scooter decision. When, in October, the SFMTA selected Skip and Scoot as the only two electric scooter companies permitted to operate in the city, competitor Lime took legal steps to attempt to prevent Skip and Scoot from deploying. A San Francisco judge, however, promptly denied Lime’s request for a temporary restraining order. Then, in December, Lime held a protest on the steps of SF City Hall to challenge the decision.

In its appeal, Lime argued the SFMTA was biased against it, as well as Spin and Bird, for deploying its scooters without explicit permission back in March. In Doyle’s decision, he said, while the “instances that Lime highlights may establish possible bias on the part of the SFMTA,” there was not a preponderance of evidence to show the SFMTA was biased against Lime.

“My review of Lime’s application proposals, when compared side-by-side with those of Scoot and Skip, confirms my opinion that an even-handed evaluation of Lime’s written descriptions in its application of its planned scooter rollout was conducted by the SFMTA scorers,” he said.

Powered by WPeMatico

When we interact with computers today we move the mouse, we scroll the trackpad, we tap the screen, but there is so much that the machines don’t pick up on — what about where we’re looking, the subtle gestures we make and what we’re thinking?

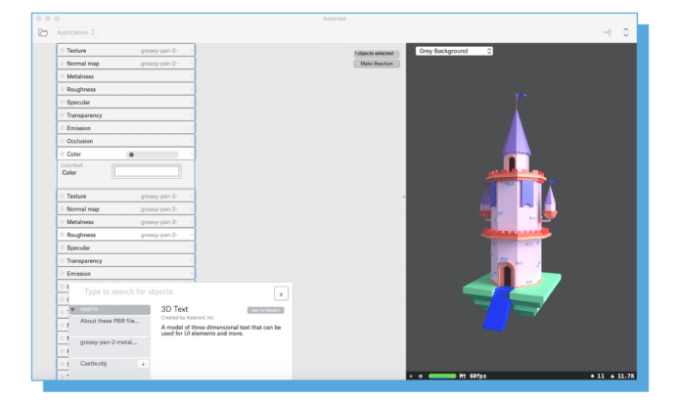

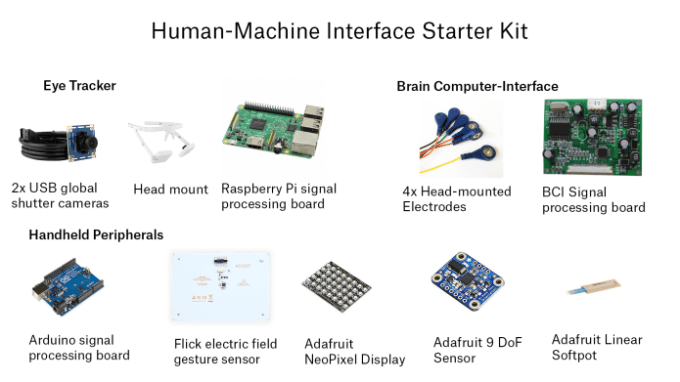

Asteroid is looking to get developers comfortable with the idea that future interfaces are going to take in much more biosensory data. The team has built a node-based human-machine interface engine for macOS and iOS that allows developers to build interactions that can be imported into Swift applications.

“What’s interesting about emerging human-machine interface tech is the hope that the user may be able to ‘upload’ as much as they can ‘download’ today,”Asteroid founder Saku Panditharatne wrote in a Medium post.

To bring attention to their development environment, they’ve launched a crowdfunding campaign that gives a decent snapshot of the depth of experiences that can be enabled by today’s commercially available biosensors. Asteroid definitely doesn’t want to be a hardware startup, but their campaign is largely serving as a way to expose developers to what tools could be in their interaction design arsenal.

There are dev kits and then there are dev kits, and this is a dev kit. Developers jumping on board for the total package get a bunch of open hardware, i.e. a bunch of gear and cases to build out hacked-together interface solutions. The $450 kit brings capabilities like eye-tracking, brain-computer interface electrodes and some gear to piece together a motion controller. Backers can also just buy the $200 eye-tracking kit alone. It’s all very utility minded and clearly not designed to make Asteroid those big hardware bucks.

“The long-term goal is to support as much AR hardware as we can, we just made our own kit because I don’t think there is that much good stuff out there outside of labs,” Panditharatne told TechCrunch.

The crazy hardware seems to be a bit of a labor of love for the time being, while a couple of AR/VR devices have eye-tracking baked-in, it’s still a generation away from most consumer VR devices, and you’re certainly not going to find too much hardware with brain-computer interface systems built-in. The startup says their engine will do plenty with just a smartphone camera and a microphone, but the broader sell with the dev kit is that you’re not building for a specific piece of hardware, you’re experimenting on the bet that interfaces are going to grow more closely intertwined with how we process the world as humans.

Panditharatne founded the company after stints at Oculus and Andreessen Horowitz where she spent a lot of time focusing on the future of AR and VR. Panditharatne tells us that Asteroid has raised more than $2 million in funding, but that they’re not detailing the source of that cash quite yet.

The company is looking to raise $20,000 from their Indiegogo campaign, but the platform is the clear sell here, exposing people to their human-machine interaction engine. Asteroid is taking sign-ups to join the waiting list for the product on their site.

Powered by WPeMatico

It’s well understood that many network breaches begin with phishing emails designed to trick users into giving hackers their credentials. They don’t even have to work to find a vulnerability, they can just waltz in the front door. Elevate Security, a San Francisco startup, wants to change that by helping employees understand phishing attacks better using behavioral techniques. Today, the company announced an $8 million Series A round to build on this idea.

The investment was led by Defy Partners. Existing investor Costanoa Ventures also participated. Today’s round brings the total raised to $10 million, according to the company.

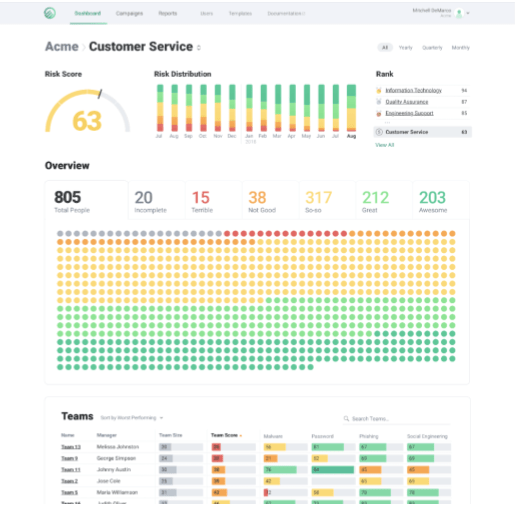

What has the company created to warrant this investment? “We have a solution that motivates, measures and rewards employees to change their security habits, while at the same time giving security teams unprecedented visibility into the security habits and actions of their employees,” co-founder Masha Sedova told TechCrunch.

Specifically, the company has built a Security Behavior platform. “Our platform pulls in data sets that allow employees or security teams to see where the strengths and weaknesses of their organization lie, and then apply a suite of solutions that are rooted in behavioral science that helps them change behavior,” she explained.

Sedova and co-founder Robert Fly started working on this problem when both were part of the Salesforce security team. They began working with the idea of gamifying security to teach employees and customers how to be more security aware.

Elevate Security dashboard

When Fly’s team at Salesforce dug into the root of security problems, it found that it was often simply human error. He said it wasn’t malicious on the employee’s part, but they had jobs to do, and expected the security team to handle these issues. He realized that shifting employees to become more security aware was as much a behavioral psychology problem as a technology one and the roots of Elevate began to take shape.

The first product they built on top of the platform is called Hacker’s Mind, a tool designed to help employees understand how hackers think and operate.

The company launched in 2017 and currently has 15 employees, half of which are women. It also boasts an entirely female board of directors, and the startup plans to continue this trend as it staffs up with the new funding. Its headquarters are in San Francisco, but it just opened an engineering office in Montreal. Current customers include AutoDesk, Exxon and Illumio.

Powered by WPeMatico

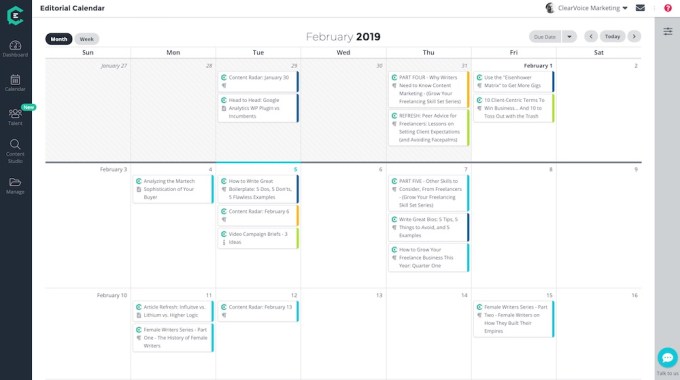

Fiverr is acquiring ClearVoice, a company that helps customers like Intuit and Carfax find professionals to write promotional content.

The two companies seem like a natural fit, as they both operate marketplaces for freelancers. Fiverr covers a much broader swath of freelance work, but CEO Micha Kaufman (pictured above) said the marketplace’s professional writing category grew 220 percent between the fourth quarters of 2017 and 2018, and he predicted that the need for content marketing will only increase.

“The types of channels that brands and companies need to be involved in and engaging in conversation with their audience are just growing,” Kaufman said. “I think any brand today that wants to be relevant needs to create a lot of engaging, interesting, creative content in their space, and I think that that creates a high demand for good content writers.”

Kaufman also noted that this is Fiverr’s third acquisition in two years, and he said he’s a “big believer … in the consolidation of vertical businesses into horizontal businesses such as ours — the fact that we cover over 200 categories gives us a tremendous amount of power to serve customers across many different types of needs.”

So what does the acquisition bring to the table that Fiverr wasn’t offering already? Kaufman said the ClearVoice team has “a lot of know how, both in technology side and the actual content side,” which will allow Fiverr to “cater to customers of all sizes and all needs.”

ClearVoice editorial calendar

More specifically, he said most of Fiverr’s content marketing customers are small businesses, while ClearVoice is able to work with large enterprises, especially with its collaboration and workflow tools that allow those enterprises to create content at “high velocity.”

Founded in 2014 by Jay Swansson and Joe Griffin (who still serve as co-CEOs), ClearVoice has raised a total of $3.1 million in funding from investors, including PC Ventures, Desert Angels, Peak Ventures and Service Provider Capital, according to Crunchbase.

Fiverr is not disclosing the financial terms of the acquisition. The company says ClearVoice will continue to operate as an independent subsidiary.

“We are thrilled to be joining a company that is changing how people and companies work together in the modern era,” Swansson said in a statement. “This new chapter is a chance for us to use Fiverr’s depth and knowledge to globally scale our business and advance our mission of creating a platform that allows for worldwide creative collaboration.”

Powered by WPeMatico

It’s true that DoorDash offsets the amount it pays its drivers with customer tip, according to an FAQ page on its own site.

“For each delivery, you will always receive at least $1 from DoorDash plus 100% of the customer tip,” DoorDash states on a Dasher FAQ page. “Where that sum is less than the guaranteed amount, DoorDash will provide a pay boost to make sure you receive the guaranteed amount. Where that sum is more than the guaranteed amount, you pocket the extra amount.”

To be clear, drivers see the guaranteed amount in the app before deciding to accept or reject the order. That amount is based on the size of the order, whether or not you have to place the order in person, distance away, traffic and other factors.

On another page, DoorDash describes its payment structure as follows: $1 plus customer tip plus pay boost, which varies based on the complexity of order, distance to restaurants and other factors. It’s only when a customer doesn’t tip at all, which DoorDash told Fast Company happens about 15 percent of the time, that DoorDash is on the hook to pay the entire guaranteed amount.

But just because DoorDash is upfront about it, it doesn’t mean drivers are happy about it. There’s a webpage, Reddit and Subreddits that all describe DoorDash’s practices.

On the website, No Tip Doordash, it states:

While the tip may technically be going to the driver, it is only replacing the normal delivery pay. Your tip saves doordash money, and it is not increasing the drivers pay. Please tip in cash, if available.

In a statement to Bloomberg, DoorDash said it implemented this policy to “ensure that Dashers are more fairly compensated for every delivery.”

This comes shortly after Instacart apologized and announced it would stop engaging in that practice. In a blog post last week, Instacart CEO Apoorva Mehta said all shoppers will now have a guaranteed higher base compensation, paid by Instacart . Depending on the region, Instacart says it will pay shoppers between $7 to $10 at a minimum for full-service orders (shopping, picking and delivering) and $5 at a minimum for delivery-only tasks. The company will also stop including tips in its base pay for shoppers.

Amazon also reportedly engages in this practice, according to The Los Angeles Times.

I’ve reached out to DoorDash and will update this story if I hear back.

Powered by WPeMatico

I’m not in the habit of getting naked during meetings at startup offices, but this time it felt appropriate.

Nebia, a shower startup that has attracted investments from the likes of Apple CEO Tim Cook and former Google chairman Eric Schmidt’s foundation is back with some new cash (though it won’t divulge how much) and a new generation of its thoughtfully designed shower heads that aim to dramatically reduce the amount of water people use while cleaning up.

After a lengthy chat with Nebia CEO Philip Winter, who discussed all of the nuances of the Nebia’s second-gen “Spa Shower” for which they just launched a crowdfunding campaign today, he asked whether I’d like to try it out. With a couple hours of empty space in my calendar, I said “Why not?” and wandered over to the startup office’s shower showroom.

This was probably the most analytical thinking I’ve done in the shower about the process of showering itself.

The shower head in my bathroom at home is pretty standard and basically concentrates the water into a couple dozen streams organized in a circle that are firing at an even pace. It’s nothing fancy, and I couldn’t tell you the brand, but I can say that I spend at least 20-30 minutes in there everyday without exception.

Nebia’s shower is wildly more complicated — as a $499 shower should be — but it’s the combination of different techniques that leads to a shower that feels full and refreshing but is using significantly less water than you’re used to. The customer for this is probably placing a healthier premium on the fact that it’s great for the environment rather than that it’s a spa-type experience; the shower head uses 65 percent less water than your average shower head, the company says.

The Nebia shower is all a very strange feat of engineering and involves the water being “atomized” as they called it, with water droplets being significantly smaller when it exits some nozzles, leading to an enveloping mist, and larger and warmer jets being shot out of the shower head’s center. The big improvement in this generation is that the water is about 29 percent warmer.

How does the shower head even control warmth? Isn’t all the water coming from the same heater? As Winter explained to me, things are a lot more complicated when it comes to how Nebia handles thermodynamics. Smaller water droplets means increased surface area exposed to the room temperature, which means greatly sped up heat dissipation. In practice, this means that the distance the water can travel from the shower head before getting chilly is a much shorter journey than your current shower. To adjust that, Nebia fires the water droplets three times quicker and maintains some larger droplet streams to maintain the heat for longer.

Nebia does a bit of cheating by also having a second shower head firing from the hip. The wand adds to the water being used but still keeps the system using about half of the amount of water that the average shower head uses.

Thankfully, there was also room for a side-by-side comparison as I was able to try out both the gen-1 and gen-2 Spa Shower in the same bathroom. The shower experience didn’t feel wildly distinct, but the difference in water heat when cranked to full blast was notable; my own temperature sensing isn’t quite finely tuned enough to confirm the 29 percent figure, but that doesn’t seem off.

Ultimately, it was the best shower I’ve had in a startup’s office to date, but it was also a shower that didn’t feel as though I was resting my head under a light trickle of cold water like other low-flow showers. It’s a real product, though at this point it’s also a decidedly premium product, even with the $100 crowdfunding discount of the $499 retail price. Beyond the warmer water, the new shower’s easy-install system is now compatible with about 95 percent of American homes, the company says. There’s also a new matte black color option and a little matching shower shelf you can add to keep that high-design look.

The company, which launched out of Y Combinator, has attracted some top investors who seem to be intrigued by the water-saving impact. The company says they’ve already shipped more than 16,000 shower heads and that more than 100 million gallons of water have been saved.

This Series A investment was led by Moen, the faucet and shower head maker that also announced a partnership with the startup. The latest round also boasts follow-on investment from Tim Cook and The Schmidt Family Foundation, as well as some new investors like Airbnb co-founder Joe Gebbia, Starwood Hotels co-founder Barry Sternlicht, Fitbit co-founder James Park and Stanford StartX.

The crowdfunding campaign kicked off today and has already blown past $300,000 in pre-orders (they’ve already sold most of the $349 early-bird deals); the company hopes to ship the first 2.0 shower heads in June.

Powered by WPeMatico

Google for Startups has expanded a partnership with startup training program Founder Gym to better serve underrepresented founders through a new scholarship program.

The program typically charges $396 to participate, but thanks to this partnership with Google for Startups, Google will cover the costs for select scholarship recipients to participate in the six-week program. This partnership is an extension of a pilot program that started last March.

“Google for Startups took an early bet on Founder Gym when we were less than six months old, and as any founder knows, you never forget the first people to say ‘yes’ to your dream,” Mandela Schumacher-Hodge Dixon said in a statement.

“Our team at Founder Gym has used that early vote of confidence to help fuel our efforts to train a groundbreaking number of founders around the world in our inaugural year.”

Founder Gym, co-founded by Mandela Schumacher-Hodge Dixon and Gabriela Zamudio,* unveiled its online platform in November 2017 to support and train underrepresented founders building tech startups.

“We are deeply committed to supporting the growth and success of underrepresented founders,” Google for Startups VP Lisa Gevelber said in a statement. “At Google we know that innovation can come from anywhere, but the resources needed to succeed are not evenly distributed. Founder Gym is truly moving the needle in this space – their unique program delivers the tangible resources necessary to level the playing field for founders and help them grow their businesses.”

Instead of describing it as a school, bootcamp or incubator, Founder Gym describes itself as a topical, six-week training program that covers topics like fundraising, pitching, user growth and problem validation. In Founder Gym’s first 12 months of operation, its cohort has collectively raised $35 million in funding.

“As we enter year two of this journey, we couldn’t be more excited to expand our partnership with Google for Startups, an organization that has a long history of supporting the entrepreneur’s journey,” Schumacher-Hodge Dixon said. “There is no doubt in my mind, this partnership will help us achieve our mission of developing the next generation of great innovators and leaders.”

Update 3:14 pm: This story has been edited to reflect the fact that Zamudio is no longer at Founder Gym.

Powered by WPeMatico

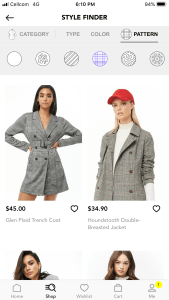

Donde Search has just closed a $6 million Series A investment led by Matrix Partners, with participation from previous investors such as senior leaders from AliExpress, Google and Waze.

Donde first launched in 2014 as a consumer-facing app that helped users search and discover apparel items based on visual characteristics rather than text-based searches. In early 2018, the company pivoted to the enterprise space, helping retailers power suggestions and related items on their websites.

Here’s how it works:

Retailers partnered with Donde hand over their product catalog and run it through the Donde algorithm, which identifies all the visual features associated with each product. Retailers can then add a widget to their site to let users search based on those features (like sleeve length or type, color or material).

As users interact with the products, the website adapts to that behavior to offer personalized product recommendations and related items.

As users interact with the products, the website adapts to that behavior to offer personalized product recommendations and related items.

Moreover, Donde offers an analytics dashboard that not only provides insights on the customer’s own website, but a look into trends being featured on competing e-commerce websites to understand the industry in general.

Donde was founded by Liat Zakay, who previously served as a software engineer and R&D team manager in the Israeli intelligence unit 8200. Using her technical expertise, she built Donde to solve her own problem of not having the time or energy to go through the tedious process of online shopping.

Zakay told TechCrunch that Donde is focused on apparel for now, but that the technology can be applied to almost any vertical.

“One of the interesting pieces about Donde is that it’s language agnostic,” said Zakay. “You don’t need to know what it’s called and it doesn’t matter what language you speak, you can still find what you want based on visual features. Which makes us extremely relevant to global retailers.”

The new funding, which will be used to expand the product and the team, came shortly after the announcement of Donde’s partnership with Forever 21. The fast-fashion retailer tested out the Donde platform on its mobile app and, after a month, saw a 20 percent increase in average purchase value and higher conversions. Forever 21 has now expanded the program, putting Donde on the web, as well.

Donde said it is working on pilot programs with several other retailers across the U.S. and Europe.

Fast fashion, in particular, represents a big opportunity for Donde. Because product turnover is so fast, retailers rarely have reliable data around a certain SKU, with the website being run on outdated data from last “season.”

This latest round brings Donde’s total funding to $9.5 million, with backing from UpWest, Afterdox and Golden Seeds.

Powered by WPeMatico

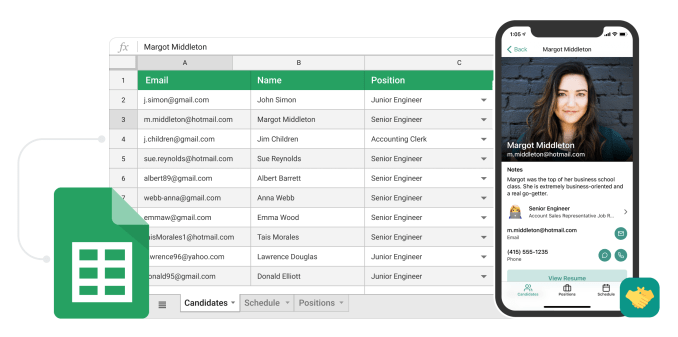

The founders of Glide, a member of the Y Combinator Winter 2019 class, had a notion that building mobile apps in the enterprise was too hard. They decided to simplify the process by starting with a spreadsheet, and automatically turning the contents into a slick mobile app.

David Siegel, CEO and co-founder at Glide, was working with his co-founders Jason Smith, Mark Probst and Antonio Garcia Aprea at Xamarin, a cross-platform mobile development company that Microsoft acquired for $500 million in 2016. There, they witnessed first-hand the difficulty that companies were having building mobile apps. When their two-year stint at Microsoft was over, the four founders decided to build a startup to solve the problem.

“We saw how desperate some of the world’s largest companies were to have a mobile strategy, and also how painful and expensive it is to develop mobile apps. And we haven’t seen significant progress on that 10 years after the smartphone debuted,” Siegel told TechCrunch.

The founders began with research, looking at almost 100 no-code tools, and were not really satisfied with any of them. They chose the venerable spreadsheet, a business tool many people use to track information, as the source for their mobile app builder, starting with Google Sheets.

“There’s a saying that spreadsheets are the most successful programming model of all time, and smartphones are the most successful computers of all time. So when we started exploring Glide we asked ourselves, can these two forces be combined to create something very valuable to let individuals and businesses build the type of apps that we saw Xamarin customers needed to build, but much more quickly,” Siegel said.

Photo: GlideThe company developed Glide, a service that lets you add information to a Google Sheet spreadsheet, and then very quickly create an app from the contents without coding. “You can easily assemble a polished, data-driven app that you can customize and share as a progressive web app, meaning you can get a link that you can share with anybody, and they can load it in a browser without downloading an app, or you can publish Glide apps as native apps to app stores,” Siegel explained. What’s more, there is a two-way connection between app and spreadsheet, so that when you add information in either place, the other element is updated.

The founders decided to apply at Y Combinator after consulting with former Xamarin CEO, and current GitHub chief executive, Nat Friedman. He and other advisors told them YC would be a great place for first-time founders to get guidance on building a company, taking advantage of the vast YC network.

One of the primary lessons Siegel says they learned is the importance of getting out in the field and talking to customers, and not falling into the trap of falling in love with the act of building the tool. The company has actually helped fellow YC companies build mobile apps using the Glide tool.

Glide is live today and people can create apps using their own spreadsheet data, or by using the templates available on the site as a starting point. There is a free tier available to try it without obligation.

Powered by WPeMatico

InReach Ventures, the so-called “AI-powered” venture capital firm based in London, is announcing the first closing of a new €53 million fund targeting early-stage European technology companies — surpassing the original fund target of €50 million, apparently.

Founded by former Balderton Capital General Partner Roberto Bonanzinga, along with Ben Smith (former U.K. Engineering Director at Yammer) and John Mesrie (former General Counsel at Balderton Capital), InReach set out in 2015 to use technology to help scale VC, especially across Europe’s idiosyncratic and highly fragmented market.

The firm’s proprietary software-based approach, which is underpinned by machine learning, claims to be able to generate and evaluate deal-flow more efficiently than traditional venture firms that mostly employ human VCs alone — although, admittedly, practically every VC firm is underpinned by some eliminate of data science and/or technology these days. Berlin’s Fly VC is another machine learning-enabled early-stage VC that comes to mind.

However, InReach certainly appears to be putting its money where its mouth is, disclosing that it has invested over €3 million in the development of its software, codenamed “DIG”. To back this up, Bonanzinga tells me the firm employs “more software engineers than investors”. (I saw an early demo of the software a couple of years ago and even then it seemed legit.)

Regards the new fund, Bonanzinga says InReach is targeting the most promising and innovative startups across Europe, primarily in the areas of consumer internet, software as a service and marketplaces. “We are geographically agnostic and will invest in companies anywhere in Europe, from Helsinki to Barcelona, from Warsaw to Rome,” he says. “In most cases we will be the first institutional investors and our first cheques will be between €500,000 and €2 million”.

To date, InReach Ventures has invested in eight startups from across Europe. They include Oberlo (Lithuania), which was subsequently acquired by Shopify, Soldo (Italy/UK), Tutorful (U.K.), Shapr3D (Hungary), Traitly (Sweden) and Loot (Germany).

Below follows a lightly edited Q&A with Bonanzinga on the new fund, how AI can be used to scale venture capital, and why machines won’t put VCs out of a job entirely any time soon.

TC: You have often said that venture capital doesn’t scale, especially across a fragmented market like Europe, but what do you mean by this?

RB: People get very excited about ecosystems but the data shows that startups can come from anywhere; the big technology hubs or more remote locations. This is carried through to Europe’s largest exists: from Betfair in London to Zalando in Berlin, from Supercell and Spotify in the Nordics, to Critio in France and Yoox in Italy, and so on. So not only is deal sourcing fragmented across Europe, but so are the returns.

Traditional ventures firms have looked to manage this fragmentation by throwing people at the problem, but if you want true coverage you need to have a presence in every city in Europe. This is how you need to think of our technology platform, as like having a highly trained associate in every city and town across the whole of Europe, providing structured diligent deal-flow. With this data/technology driven approach we can be truly pan-European at the early-stage, even as the first institutional investor on the cap-table.

TC: A lot of VCs say they use technology to help find or manage deal-flow, how is InReach any different?

RB: Many venture firms talk about data and software. Lately, it has become a hot topic in pitches to limited partners. I predict a new hype: the rush of needing to check the box of “we have a data strategy”. We will have many firms with 30+ investment professionals and a data engineer in a corner. The real question is how many firms are willing to transform their professional service DNA into a product DNA? As always, this is more of a people/organisational question, rather than a question simply of the use of technology.

Take a look at InReach, we are a very atypical founding team for a venture firm. In particular, Ben Smith comes from a software engineering background and has built many data platforms and product development teams (most recently at Yammer/Microsoft). The majority of the people at InReach are software engineers. This is the only Venture Firm we know in which there are more software engineers than investors! So far we have invested over €3m in developing our proprietary technology platform.

TC: Without giving away your secret sauce, how does the InReach platform work, both in terms of the machine learning/feedback loop or the signals/data you plug into it?

RB: From a technology perspective, our logical architecture is primarily based on 3 distinct layers: data, intelligence, and workflow. The data layer is a mix of massive data aggregation, with deep data enhancement, including the generation of a large set of original data. The intelligence layer makes sense of these millions of data points through an ensemble of machine learning algorithms, ranging in complexity from simple rules to advanced networks. Given this data-driven approach and the significant deal-flow this generates, we invest heavily in building a workflow product which allows us to efficiently process thousands of companies each month.

TC: You say the final investment decision is still made by humans: why is that and do you think this will always be the case?

RB: As with any AI company, it’s all about data. We have spent the past 3 years aggregating data from across the internet and building algorithms to provide us with significant dealflow. Much more crucially, we have been collecting and generating our own proprietary data-set of investment decisions and how these startups grow and adapt over time. Clearly this will only get more powerful.

However, especially at this early-stage, so much of the investment decision is based on the founders and what we call the DNA fit of the founders and the problem they are trying to solve. Some of this can be encoded in algorithms and learnt by AI, but there are still intangibles that ultimately require that we ask the question: do we enjoy spending time together?

RB: What has been the reaction by under the radar founders when they are discovered really early via InReach’s software?

RB: The first question is always ‘How did you find out about us?’. Once we explain what we do and how the platform works we create an immediate connection with the entrepreneur. This is exactly what happened when we reached out to 5 entrepreneurs in Vilnius who had started a company called Oberlo. Over the following year, we helped them grow and expand to 30 people across both Vilnius and Berlin, prior to their acquisition by Shopify.

We are taking a very entrepreneurial approach to investing; we run InReach more as a product development organisation, rather than a professional services firm, so we look and feel native to the entrepreneurs we talk to. We try to share our experiences and current-best-practices through the company building process, whether it be OKRs, different agile development methodologies, product roadmaps, etc.

Reaching out to promising entrepreneurs early is not the only advantage that DIG gives us. We are also very efficient and responsive when analysing inbound opportunities. In fact, if you look at our website, we optimize our website to convert visitors to share their startup with us. We are not concerned with being bombarded by opportunities because we have developed a scalable workflow that allows us to efficiently manage significant dealflow.

Powered by WPeMatico