Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Greetings from Chittorgarh, one of my stops on a two-week excursion through Goa and Rajasthan, India. I’ve been a little too busy exploring, photographing cows and monkeys and eating a lot of delicious food to keep up with *all* the tech news, but I’ve still got the highlights.

For starters, if you haven’t heard yet, TechCrunch launched Extra Crunch, a paid premium subscription offering full of amazing content. As part of Extra Crunch, we’ll be doing deep dives on select businesses, beginning with Patreon. Read Patreon’s founding story here and learn how two college roommates built the world’s leading creator platform. Plus, we’ve got insights on Patreon’s product, business strategy, competitors and more.

Sign up for Extra Crunch membership here.

On to other news…

Y Combinator’s latest batch of startups is huge

So huge the Silicon Valley accelerator had to move locations and set up two stages at its upcoming demo days (March 18-19) to accommodate the more than 200 startups ready to pitch investors (who will have to hop between stages at the event). There will also be a virtual demo day live-streamed for some investors to watch “because there are so few seats.” Here’s what I’m wondering… At what point is a YC cohort too big? If investors aren’t even able to view all the companies at Demo Day, what exactly is the point? Send me your thoughts.

Another week, another SoftBank deal. The Vision Fund’s latest bet is autonomous delivery. The Japanese telecom giant has invested $940 million in Nuro, the developer of a custom unmanned vehicle designed for last-mile delivery of local goods and services. The startup, also backed by Greylock and Gaorong Capital, will use the cash to expand its delivery service, add new partners, hire employees and scale up its fleet of self-driving bots. And while we’re on the subject of autonomous, TuSimple, a self-driving truck startup, has raised a $95 million Series D at a unicorn valuation.

Mamoon Hamid and Ilya Fushman

TechCrunch’s Connie Loizos spoke with Mamoon Hamid and Ilya Fushman, who joined Kleiner Perkins from Social Capital and Index Ventures, respectively. The pair talked about Kleiner Perkins, touching on people who’ve left the firm, how its decision-making process now works, why there are no senior women in its ranks and what they make of SoftBank’s Vision Fund.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

Facebook CEO Mark Zuckerberg considered a multi-billion-dollar purchase of Unity, a game development platform. This is according to a new book coming out next week, “The History of the Future,” by Blake Harris, which digs deep into the founding story of Oculus and the drama surrounding the Facebook acquisition, subsequent lawsuits and personal politics of founder Palmer Luckey. Here’s more on the acquisition-that-could-have-been from TechCrunch’s Lucas Matney.

Indonesia-focused Intudo Ventures raised a new $50 million fund this week to invest in the world’s fourth most populated country; InReach Ventures, the “AI-powered” European VC, closed a new €53 million early-stage vehicle; and btov Partners closed an €80 million fund aimed at industrial tech startups.

Xiaomi-backed electric toothbrush startup Soocas raises $30M

Jobvite raises $200M+ and acquires three recruitment startups to expand its platform play

Opendoor files to raise another $200M

DriveNets emerges from stealth with $110M for its cloud-based alternative to network routers

Figma gets $40M Series C to put design tools in the cloud

Xiaomi-backed electric toothbrush Soocas raises $30 million Series C

Malt raises $28.6 million for its freelancer platform

Elevate Security announces $8M Series A to alter employee security behavior

Massless raises $2M to build an Apple Pencil for virtual reality

Just when you thought the scooter boom and the subscription-boom wouldn’t intersect, Grover arrived to prove you wrong. The startup is launching an e-scooter monthly subscription service in Germany. Their big idea is that instead of purchasing an e-scooter outright, GroverGo customers can enjoy unlimited e-scooter rides without the upfront costs or commitment of owning an e-scooter.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and General Catalyst’s Niko Bonatsos chat startups.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Apple has just bought up the talent it needs to make talking toys a part of Siri, HomePod, and its voice strategy. Apple has reportedly acquired PullString, also known as ToyTalk, according to Axios’ Dan Primack and Ina Fried. The company makes voice experience design tools, artificial intelligence to power those experiences, and toys like talking Barbie and Thomas The Tank Engine toys in partnership with Mattel. Founded in 2011 by former Pixar executives, PullString went on to raise $44 million.

Apple’s Siri is seen as lagging far behind Amazon Alexa and Google Assistant, not only in voice recognition and utility, but also in terms of developer ecosystem. Google and Amazon has built platforms to distribute Skills from tons of voice app makers, including storytelling, quizzes, and other games for kids. If Apple wants to take a real shot at becoming the center of your connected living room with Siri and HomePod, it will need to play nice with the children who spend their time there. Buying PullString could jumpstart Apple’s in-house catalog of speech-activated toys for kids as well as beef up its tools for voice developers.

PullString did catch some flack for being a “child surveillance device” back in 2015, but countered by detailing the security built intoHello Barbie product and saying it’d never been hacked to steal childrens’ voice recordings or other sensitive info. Privacy norms have changed since with so many people readily buying always-listening Echos and Google Homes.

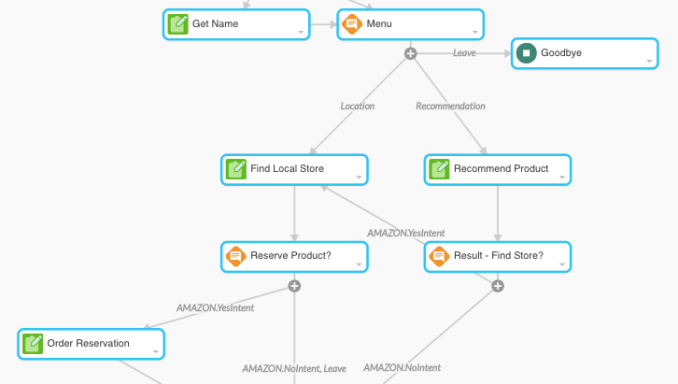

In 2016 it rebranded as PullString with a focus on developers tools that allow for visually mapping out conversations and publishing finished products to the Google and Amazon platforms. Given SiriKit’s complexity and lack of features, PullString’s Converse platform could pave the way for a lot more developers to jump into building voice products for Apple’s devices.

We’ve reached out to Apple and PullString for more details about whether PullString and ToyTalk’s products will remain available.

The startup raised its cash from investors including Khosla Ventures, CRV, Greylock, First Round, and True Ventures, with a Series D in 2016 as its last raise that PitchBook says valued the startup at $160 million. While the voicetech space has since exploded, it can still be difficult for voice experience developers to earn money without accompanying physical products, and many enterprises still aren’t sure what to build with tools like those offered by PullString. That might have led the startup to see a brighter future with Apple, strengthening one of the most ubiquitous though also most detested voice assistants.

Powered by WPeMatico

Thanks to environmentally conscious young buyers, throwaway culture is dying not only in the U.S., but also in Latin America — and startups are poised to jump in with services to help people recycle used clothing.

GoTrendier, a peer-to-peer fashion marketplace operative in Mexico and Colombia, has raised $3.5 million USD to do just that. And investors are eyeing the startup as the digital fashion marketplace growth leader in Spanish-speaking countries.

GoTrendier, founded by Belén Cabido, is a platform that lets users buy and sell secondhand clothing. Cabido tells me that the new capital will enable GoTrendier to expand deeper into Mexico and Colombia, and launch in a new country: Chile.

GoTrendier enables users to buy and sell used items through the GoTrendier site and app. The platform categorizes users as either salespeople or buyers. Salespeople create their own stores by uploading photos of garments along with a description and sale price. Buyers browse the platform for deals and once a buyer bites, the seller is given a prepaid shipping label.

Sound familiar? Businesses like Poshmark and GoTrendier have no actual inventory, which allows the companies to take on less of a risk by having smaller overhead costs. In turn, the company acts as more of a social community for fashion exchanges.

In order to make money, Poshmark takes a flat commission of $2.95 for sales under $15. For anything more than that, the seller keeps 80 percent of their sale and Poshmark takes a 20 percent commission. Poshmark also owes its success to the socially connected shopping experience it created and the audience building features available to sellers — as detailed in this Harvard Business School study. GoTrendier has a similar commission pricing strategy, taking 20 percent off plus an additional nine pesos (about 48 cents in U.S. currency) for all purchases. The service also takes advantage of social media and sharing features to help connect and engage its fashion-loving community.

But these companies are also largely venture-backed. In the case of GoTrendier, the round gave shareholder entry to Ataria, a Peruvian fund that invests in early-stage tech companies with high earning potential. Existing investors Banco Sabadell and IGNIA reinforced their position, along with Barcelona-based investors Antai Venture Builder, Bonsai Venture Capital and Pedralbes Partners.

GoTrendier amassed a user base of 1.3 million buyers and sellers throughout its four years of existence. The service operates in Mexico and Colombia, and will use its newest capital to launch in Chile — another market Cabido says is experiencing high demand for a secondhand fashion buying and selling service.

Online marketplace companies are growing in Latin America as smartphone adoption and digital banking services multiply in the region. But international expansion has proven to be an issue. Enjoei, a similar fashion marketplace that owns the market share in Brazil, had a botched attempt at expanding to Argentina due to Portugese-Spanish language barriers and eventually determined that Brazil was a large enough market in which to build its business — thus carving out an opportunity for companies like GoTrendier that offer the same services to dominate the surrounding Spanish-speaking markets in Latin America.

Many have remarked that Latin America’s tech scene is filled with copycats — or companies that emulate the business models of American or European startups and bring the same service to their home market. In order to secure bigger foreign investment checks, founders from growing tech regions like Latin America certainly must invent proprietary technologies. Yet there’s still value — and capital — in so-called copycat businesses. Why? Because the users are there and in some cases it’s just easier to start up.

According to investor Sergio Pérez of Sabadell Venture Capital, “The volume of the market for buying and selling second-hand clothes in the world was 360 million transactions in 2017 and is expected to reach 400 million in 2022.” A 2018 report from ThredUp also claimed that the size of the global secondhand market is set to hit $41 billion by 2022. The “throwaway” culture is disappearing thanks to environmentally conscious millennial buyers. As designer Stella McCartney famously said, “The future of fashion is circular – it will be restorative and regenerative by design and the clothes we love never end up as waste.” By buying on GoTrendier, the company claims its users have been able to save USD $12 million and have avoided more than 1,000 tons of CO2 emissions.

Founders building companies in Latin America aren’t necessarily as capital-hungry as Silicon Valley-based founders, (where a Series A can now equate to $68 million, apparently). Cabido tells me her company is able to fulfill operations and marketing needs with a lean staff of 30, noting that there’s a lot of natural demand for buying and selling used clothing in these regions, thus creating organic growth for her business. She wasn’t looking to raise capital, but investors had their eye on her. “[Investors] saw the tension of the marketplace, and we demonstrated that GoTrendier’s user base could be bigger and bigger,” she says. With sights set on new markets like Chile and Peru, Cabido decided to move forward and close the round.

Poshmark, which benefits from indirect and same-side network effects, has raised $153 million to date from investors like Temasek Holdings, GGV and Menlo Ventures. Just like GoTrendier, Poshmark’s Series A was also a $3.5 million round.

Who’s to say that that amount of capital can’t boost a network effects growth model in Latin America too? The users are certainly waiting.

Powered by WPeMatico

3DEN is building spaces for what it calls the “in-between moments” of your day.

The name (pronounced “Eden”) comes from the idea of the “third place” — a space that’s neither home nor work. Founder and CEO Ben Silver told me the goal is to create a space that people can use if, say, they’ve got 45 minutes to fill between meetings, or if they’ve just gotten off a red-eye flight and need somewhere to freshen up.

Coffee shops, co-working spaces, gyms or hotels might serve some of those functions, but Silver said 3DEN is “aggregating many different services” and bringing them together into “a very reliable space.” He suggested that the closest analogue might be a members-only clubhouse — except that instead of charging a steep membership fee, 3DEN requires no commitment, with pricing starting at $6 for each 30 minutes of your visit.

Earlier this week, I dropped by the site of the first 3DEN, located in the shopping area of New York City’s Hudson Yards development. The space is still being built, but I saw booths for phone calls, private showers and even swings for relaxing.

Silver said there will be a meditation space and Casper nap pods, too. He emphasized the nature-inspired design, with plenty of trees and plants, as well as the space’s “acoustic zoning,” with some areas designated for socializing and others designed to be quieter and more restful.

So if you want to catch up on some work, make some calls or even host a meeting (you can invite and pay for up to two guests), you can do that. If you just want to chill out and relax, you can do that, too.

Silver said that while the space will be staffed with a few hosts, technology will be key to the experience, with most transactions being handled via smartphone app. If you’re interested in visiting an 3DEN space, you check-in via the app (which will tell you the current crowd level, and put you on the waiting list if the space is at capacity); you can also reserve a shower and make purchases.

3DEN’s core services will be included in that $6-per-half-hour price, but Silver said there will be a retail element as well, with visitors able to buy products in categories like food and health/beauty. He also said he’s exploring additional pricing models (such as corporate memberships) for regular guests, but he emphasized the importance of “no commitments” pricing that makes the space accessible to a wide swath of visitors.

The seed round was led by b8ta and Graphene Ventures, with participation from Colle Capital Partners, The Stable, JTRE, InVision CEO Clark Valberg, Target’s former Chief Strategy and Innovation Officer Casey Carl and Firebase founder Andrew Lee.

The first 3DEN location has a planned opening of March 15, and Silver said the company is also negotiating for four additional locations across New York City.

Powered by WPeMatico

ChargedUp, a U.K. startup that offers a mobile charging network that takes inspiration from bike sharing, has closed £1.2 million in seed investment. Leading the round is Sir John Hegarty’s fund The Garage, and the ex-Innocent Smoothie founders fund JamJar. The funding will be used to grow the offering across the U.K. and for international expansion.

Founded by Hugo Tilmouth, Charlie Baron, Hakeem Buge and Forrest Skerman Stevenson, ChargedUp has set out to solve the dead mobile phone battery problem with a charging network. However, rather than offer fixed charging points, the team has developed a solution that lets you rent a mobile charging pack from one destination and return it at a different location if needed. That way, mobile phone use remains mobile.

“It’s annoying and inconvenient to be out and about with a dying phone battery,” says CEO Hugo Tilmouth. We’ve all been there and I was inspired to do something about it through my own experiences. I was at a cricket match at London’s Lord’s Cricket Ground and waiting for a call for a last round interview with a large tech firm, and was running very low on charge! I ended up having to leave the cricket ground, buy a power bank and then rode a Boris Bike home and the light bulb went off in my head! Why not combine the flexibility of the sharing economy with the need of a ‘ChargedUp’ phone!”

The solution was to create multiple distribution points across a city, located in the venues where people spend most of their time. This includes cafes, bars and restaurants. “Our solution uses an app to enable users to find the nearest stations, unlock a sharable power bank and then return it to any station in the network and only pay for the time they use. Our goal is to be never five minutes from a charge,” adds Tilmouth.

In the next six months, ChargedUp says it will expand its network of over 250 vending stations in London’s bars, cafes and restaurants across to other large metropolitan areas in the U.K. Last month, the young startup partnered with Marks & Spencer to trial the platform in its central London stores. If the trial is successful, ChargedUp says it could lead to providing its phone-charging solution to all M&S customers by the end of 2019.

“Since launch we have delivered over 1 million minutes of charge across the network, and our customers love the service,” says Tilmouth. “Like the sharing scooter and bike companies, we operate a time-based model. We simply charge our users a simple price of 50p per 30 mins to charge their phones. We also make revenue from the advertising space both on our batteries and within our app.”

With regards to competition, Tilmouth says ChargedUp’s most direct competitor is the charging lockers found in some public spaces, such as ChargeBox. “We do not see this as a viable alternative to ChargedUp as users are forced to lock their phones away preventing them from using them while it charges. They are also prone to theft and damage. We are also differentiated by our use of green energy offsetting throughout the network,” he says.

Meanwhile, in a statement, investor Sir John Hegarty talks up the revenue opportunities beyond rentals, which includes advertising, rewards and loyalty. “At its simplest, ChargedUp addresses a massive need in the market, mobile devices running out of power. But more than that, ChargedUp provides advertisers with a powerful medium that connects directly with their audience at point of purchase,” he says.

Prior to today’s seed round, ChargedUp received investment from Telefonica via the Wayra accelerator and Brent Hoberman’s Founders Factory.

Powered by WPeMatico

If you’re a video creator in 2019, you’re probably thinking about a long list of publishing destinations: YouTube, of course, but also Facebook, Instagram, Twitter, Snapchat and more.

StayTuned Digital is a new startup trying to help video creators and publishers push their content to multiple platforms. The company, which bills itself as “content’s best friend,” is officially unveiling its product today and announcing that it’s raised $2.5 million in funding.

StayTuned was founded by CEO Serge Kassardjian (previously the global head of media app business development for Google Play) and Randy Jimenez (previously CTO at SinglePlatform). Kassardjian told me he saw the need for a product like this during his time at Google, when he would talk to content creators becoming “overwhelmed” by the fragmentation across all the different devices and platforms available to them.

“What’s happened is every single one of the platforms is releasing new formats, new ways to optimize, it’s constantly changing every couple of months,” Kassardjian said.

So with StayTuned, publishers shouldn’t have to worry about all that. Kassardjian said the product does three big things: optimizes the video so it looks good and can perform well on each platform, pushes the video to each platform and then measures the results, which feeds back into the optimization.

Kassardjian acknowledged that getting into the media business, even as a technology provider, might seem like a bad idea right now, but he said, “There’s a misconception that what’s happening in the world is that media and content is dead, but there’s more media and content than ever before.”

Nor does Kassardjian believe that publishers can stop relying on Facebook and other platforms. Sure, they may want to drive more traffic to their own properties or launch their own subscription services, but unless they’re Netflix-sized, they can’t ignore the big platforms entirely.

“We provide ubiquity to where the audience is,” he said.

And when he talks about video publishers, he isn’t just thinking about traditional media companies (although he’s looking to work with them too). He also said StayTuned could work with newer digital companies, e-commerce retailers and other brands that are creating content — and eventually, small businesses.

As for the funding, it was led by Bowery Capital, with participation from CourtsideVC, Quaker Health, Social Leverage, Liquid 2 Ventures, The Fund, Hive Ventures, Grape Arbor and a number of angel investors. StayTuned is also part of the current GCT Startup-in-Residence program.

Powered by WPeMatico

One of the very first things we ask Israeli entrepreneurs who are hoping to break into the U.S. market is to tell us how their product or service is being received by their target market. What is the feedback? Are potential customers hungry for what the team is selling?

Validation, both of the broader vision and the early product itself, has to be a key focus for any aspiring entrepreneur. Testing your product and getting specific feedback is the only way to know if the company is on the right track or wasting its time chasing down the wrong path. However, even for seasoned founders who understand how vital market validation is to the success of their company, it can be all too easy to get distracted chasing the wrong kind of validation.

Not all validation is created equal. It is crucial that founders differentiate between meaningful validation and vanity “wins” that do little more than make you feel good. Fake validation is everywhere. Here are some common traps founders need to beware of.

Founders need to be careful about soliciting customers that are either too small or too big for their entry point into the market, or not even in the actual market segment they are targeting. If your early customers are different from those you eventually hope to acquire, then the things they ask for and feedback they provide will skew your short-term goals and put your business on the wrong path.

The best companies and founders are the ones that aren’t afraid to go out and get real, tangible feedback from potential customers.

This is especially common when targeting companies outside the U.S., where startups build long lists of customers in their home market that may or may not have the same set of needs as U.S.-based customers. But by the time these startups are “ready” to expand beyond their home country, they have a hard time selling investors and foreign customers on a product that has only been validated by unfamiliar brands in a small domestic market. Many times, these early customers do not have exposure to competing products in the larger U.S. market, or they have a different set of problems they are aiming to solve altogether, which sends misleading signals to the startup.

Securing customers is obviously crucial to any startup’s success, and can be helpful in shaping how a startup markets itself in the early days. Yet founders must be able to properly contextualize the pedigree of those customers, and always keep the long-term vision front and center. The product isn’t truly validated until you have the right type of customers validating your product.

Large corporations are constantly looking for the next cutting-edge technology that will propel their next phase of growth. This is why countries like Israel, with its deep talent pool in AI, IoT, cybersecurity, etc., have become hotbeds for corporate innovation labs.

At first glance, this is a great thing for Israeli entrepreneurs because it gives them exposure and access to the biggest companies in the world. But proximity and feedback from these groups isn’t everything. Many of these innovation labs accept local startups into their program, which can obviously be exciting for those founders, especially at the early stage. The corporate will then aim to work on a pilot program with the startup to test their product, which could be beneficial for the startup. However, gaining just this one customer doesn’t always guarantee future success, nor does it truly validate the product.

Getting a pilot with a larger corporate can be a great opportunity, but diligent founders must also continue to pursue other pilots. First, pilot programs do not always translate to becoming real customers and founders need to avoid placing all their eggs in one basket. Second, the feedback founders receive from just one large customer may not be representative of the entire customer segment. Simply being in the innovation hub is often not enough by itself to signal long-term success.

This one may seem obvious, but it remains just as pervasive as ever. It’s easy for first-time founders to drink their own Kool-Aid and get overly hung up on any positive feedback that’s heaped upon them or their product. An overwhelming number of new startups are created in heavily concentrated markets like Silicon Valley, which can make it difficult to find unbiased feedback outside the echo chamber.

It’s not only nice to be told your product is awesome, but it can become downright addicting.

This is especially true for startups that are just beginning to validate their product offering, or a specific piece of their technology. Afraid of approaching someone who “won’t get it,” we see founders chasing the feedback they want to hear, often from peer entrepreneurs, who will be excited by a piece of technology but obviously won’t be the ones who end up buying and using it as real customers.

By self-soliciting feedback from the wrong people, founders make the mistake of focusing on the wrong aspects of the product instead of taking it directly to potential customers in the market who will specifically tell you what they do and don’t like.

Even raising a sizable round from VCs can be a form of fake momentum. Much has been written on the topic, but it’s easier than ever for some entrepreneurs in specific domains to raise significant capital these days. There are more seed funds out there than ever before. Valuations and deal sizes at the seed and Series A stages continue to climb. What this truly means is that bets on the success or failure of a startup are being made earlier in the life cycle of the company.

Just because a VC chooses to invest in a company does not mean that startup has reached the promised land. VCs are not your customers, and while capital they provide is a critical means to further the development of the business, it does not replace getting real validation from and selling to the target market.

Founders often misunderstand or overestimate the tangible impact that awards and PR recognition will have on their businesses. We see this all the time when entrepreneurs come bragging about some competition they won, or a top 10 list they were included in. Don’t get me wrong, awards are nice to have and they can help with attracting talent and hiring into your startup. However, founders need to realize that the value is capped, does not serve as real validation and is typically meaningless to investors and potential customers alike in their evaluation of the startup.

There are several potential traps on the journey to validation, and it can be easy to fall victim if entrepreneurs take their eyes off the prize. It’s not only nice to be told your product is awesome, but it can become downright addicting. The best companies and founders are the ones that aren’t afraid to go out to market and get real, tangible feedback from potential customers. If you’re not doing that, you’re simply making yourself more susceptible to fake validation that can derail your vision.ᐧ

Powered by WPeMatico

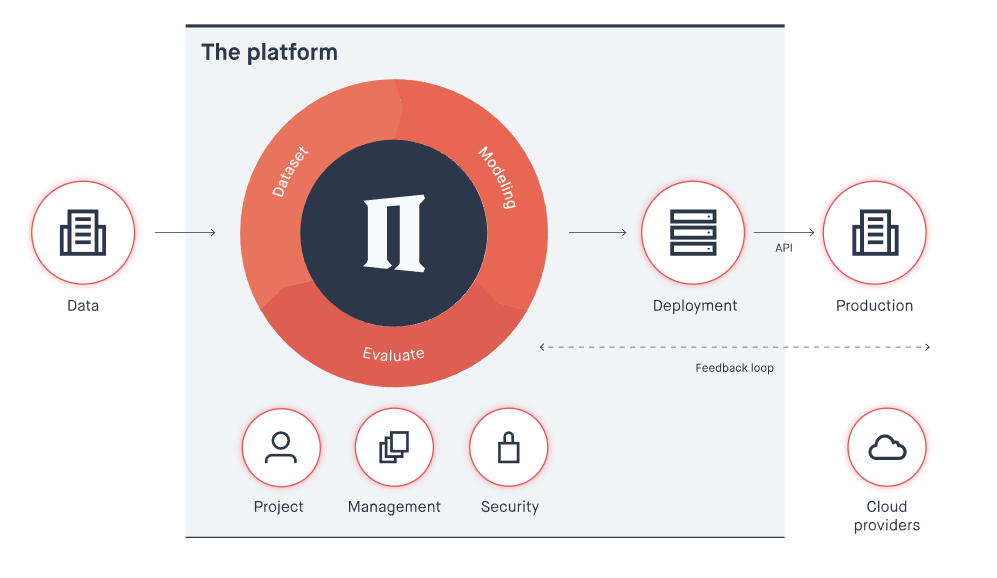

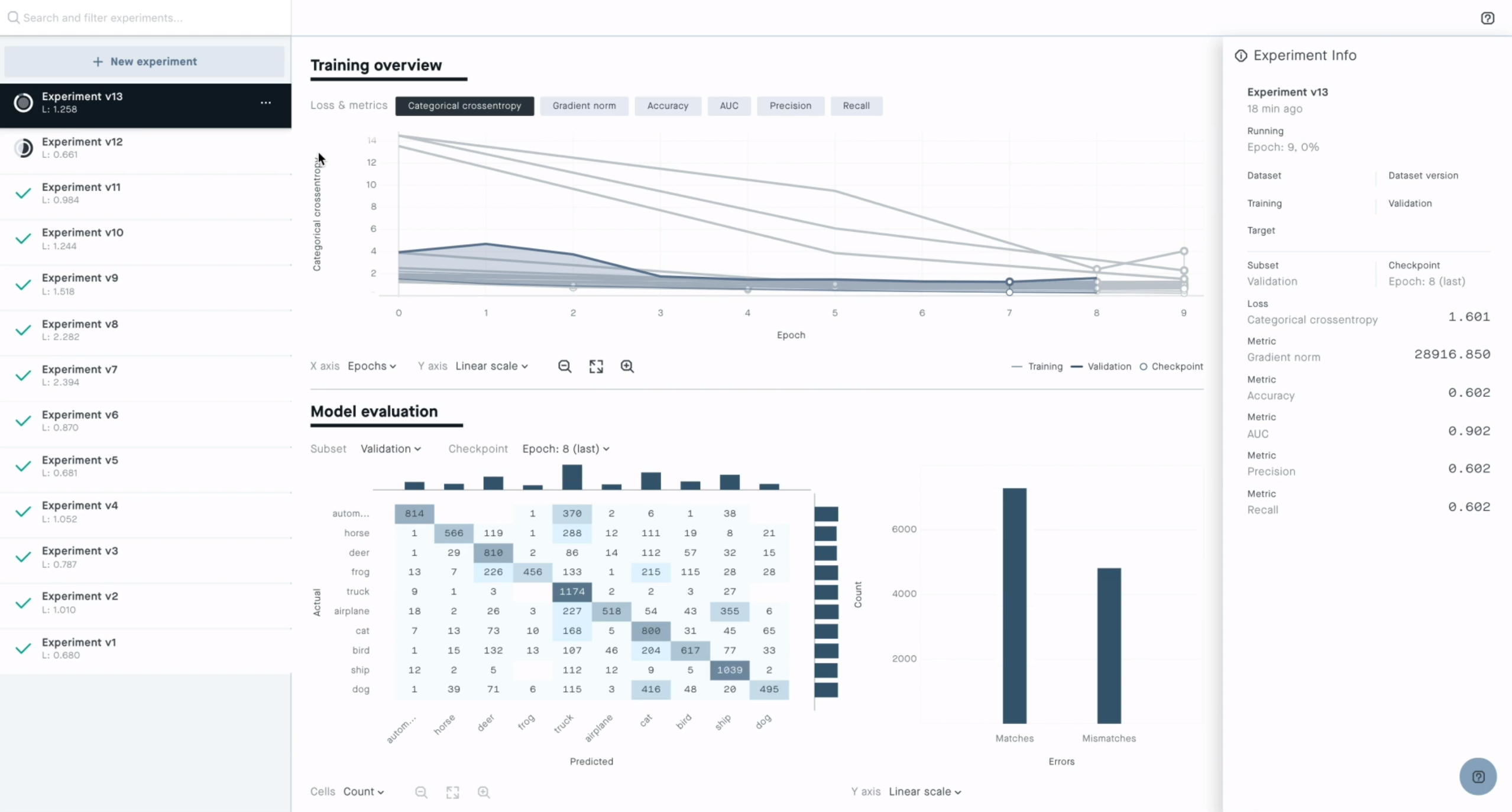

Peltarion, a Swedish startup founded by former execs from companies like Spotify, Skype, King, TrueCaller and Google, today announced that it has raised a $20 million Series A funding round led by Euclidean Capital, the family office for hedge fund billionaire James Simons. Previous investors FAM and EQT Ventures also participated, and this round brings the company’s total funding to $35 million.

There is obviously no dearth of AI platforms these days. Peltarion focus on what it calls “operational AI.” The service offers an end-to-end platform that lets you do everything from pre-processing your data to building models and putting them into production. All of this runs in the cloud and developers get access to a graphical user interface for building and testing their models. All of this, the company stresses, ensures that Peltarion’s users don’t have to deal with any of the low-level hardware or software and can instead focus on building their models.

“The speed at which AI systems can be built and deployed on the operational platform is orders of magnitude faster compared to the industry standard tools such as TensorFlow and require far fewer people and decreases the level of technical expertise needed,” Luka Crnkovic-Friis, of Peltarion’s CEO and co-founder, tells me. “All this results in more organizations being able to operationalize AI and focusing on solving problems and creating change.”

In a world where businesses have a plethora of choices, though, why use Peltarion over more established players? “Almost all of our clients are worried about lock-in to any single cloud provider,” Crnkovic-Friis said. “They tend to be fine using storage and compute as they are relatively similar across all the providers and moving to another cloud provider is possible. Equally, they are very wary of the higher-level services that AWS, GCP, Azure, and others provide as it means a complete lock-in.”

Peltarion, of course, argues that its platform doesn’t lock in its users and that other platforms take far more AI expertise to produce commercially viable AI services. The company rightly notes that, outside of the tech giants, most companies still struggle with how to use AI at scale. “They are stuck on the starting blocks, held back by two primary barriers to progress: immature patchwork technology and skills shortage,” said Crnkovic-Friis.

The company will use the new funding to expand its development team and its teams working with its community and partners. It’ll also use the new funding for growth initiatives in the U.S. and other markets.

Powered by WPeMatico

Qloo announced this morning that it has acquired TasteDive.

The two companies sound pretty similar — according to the announcement, Qloo is “the leading artificial intelligence platform for culture and taste,” while TasteDive is “a cultural recommendation engine and social community.”

What’s the difference? Well TasteDive is a website where you can create a profile, connect with other users and, as you like and dislike things, it will recommend music, movies, TV shows, books and more. Qloo, meanwhile, is trying to understand patterns in consumer taste and then sell that data to marketers.

Or, as Qloo CEO Alex Elias (pictured above) put it in a statement, “TasteDive does for millions of individuals what Qloo has been doing for brands for years – using AI to make better decisions about culture and taste.”

Apparently TasteDive has 4.5 million active users, and it will continue to operate as a separate team and product, with founder Andrei Oghina remaining on-board as CEO. (Elias will become chairman.)

At the same time, the companies say the addition of Qloo technology will allow TasteDive to get smarter and to expand into different categories, while Qloo benefits from TasteDive’s global customer base and its API ecosystem.

The financial terms of the acquisition were not disclosed.

Powered by WPeMatico

After two years of development, Medivis, a New York-based company developing augmented reality data integration and visualization tools for surgeons, is bringing its first product to market.

The company was founded by Osamah Choudhry and Christopher Morley who met as senior residents at NYU Medical Center.

Initially a side-project, the two residents roped in some engineers to help develop their first prototypes and after a stint in NYU’s Summer Launchpad program the two decided to launch the company.

Now, with $2.3 million in financing led by Initialized Capital and partnerships with Dell and Microsoft to supply hardware, the company is launching its first product, called SurgicalAR.

In fact, it was the launch of the HoloLens that really gave Medivis its boost, according to Morley. That technology pointed a way toward what Morley said was one of the dreams for technology in the medical industry.

“The Holy Grail is to be able to holographically render a patient,” he said.

For now, Medivis is able to access patient data and represent it visually in a three-dimensional model for doctors to refer to as they plan surgeries. That model is mapped back to the patient to give surgeons a plan for how best to approach an operation.

“The interface between medical imaging and surgical utility from it is really where we see a lot of innovation being possible,” says Morley.

So far, Medivis has worked with the University of Pennsylvania and New York University to bring their prototypes into a surgical setting.

The company is integrating some machine learning capabilities to be able to identify the most relevant information from patients’ medical records and diagnostics as they begin to plan the surgical process.

“What we’ve been working on over this time is developing this really disruptive 3D pipeline,” says Morley. “What we have seen is that there is a distinct lack of 3D pipelines to allow people to directly interface… very quickly try to automate the entire rendering process.”

For now, Medivis is selling a touchscreen monitor, display and a headset. The device plugs into a hospital network and extracts medical imaging to display from their servers in about 30 seconds, according to Choudhry.

“That’s where we see this immediately being useful in that pre-surgical planning stage,” Choudhry says. “The use in surgical planning and being able to extend this through surgical navigation… Streamline the process that requires a large amount of pieces and components and setups so you only need an AR headset to localize pathology and make decisions off of that.”

Already the company has performed 15 surgeries in consultation with the company’s technology.

“When we first met Osamah and Chris, we immediately understood the magnitude of the problem they were out to solve. Medical imaging as it relates to surgical procedures has largely been neglected, leaving patients open to all sorts of complications and general safety issues,” said Eric Woersching, general partner, Initialized Capital, in a statement. “We took one look at the Medivis platform and knew they were poised to transform the operating room. Not only was their hands-free approach to visualization meeting a real need for greater surgical accuracy, but the team has the passion and expertise in the medical field to bring it all to fruition. We couldn’t be more thrilled to welcome Medivis to the Initialized family.”

Powered by WPeMatico