Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Accurx, the U.K. startup and Entrepreneur First alumni that has developed a messaging service for doctor surgeries, has raised £8.8 million in Series A funding, TechCrunch has learned.

According to multiple sources, London venture capital firm Atomico has led the round, with participation from LocalGlobe and EF. We first heard a term sheet had been put on the table as far back as mid-January, while it is thought the investment only closed last week.

I also understand the round was highly contested, potentially pushing up Accurx’s valuation. One source tells me that Accel was in the running but didn’t end up investing.

Both Atomico and Accurx declined to comment.

Co-founded by Jacob Haddad and Laurence Bargery, who met and subsequently founded the company at Entrepreneur First in 2016, Accurx initially set out to develop a data-set and tools to help tackle the problem of inappropriate use of antibiotics, which is a major contributor to the diminishing effectiveness of antibiotics. Since then the startup has pivoted to focus on creating a broader communication platform to bring medical teams and patients closer together.

(Given Haddad and Bargery’s backgrounds, I dare say that the use of data and machine learning to help improve healthcare delivery is still very much front of mind for the company).

As it exists today, Accurx’s main product is Chain SMS, a messaging app for use by doctor surgeries to communicate with patients. It has been designed to support nurses, administration staff and practice managers etc., as well as GPs. Typical use-cases for Chain SMS includes sending advice to patients, notifying a patient of normal results, and reminding them to book appointments. All communication is saved back to a patient’s medical record to ensure a more joined up approach than might otherwise happen using arcane communication methods such as telephone calls and sending letters in the post.

(Somewhat related: this weekend, British Health Secretary Matt Hancock has called for the use of pagers for communications within the NHS to be phased out by 2021. The outdated technology costs the U.K. taxpayer-funded health service £6.6m per year, apparently).

To that end — and no doubt not gone unnoticed by investors — I gather that Chain SMS is already in use by 20 percent of GP practices in England, from close to zero when it launched in February 2018. The conventional wisdom is that startups find it difficult to penetrate the NHS, when in practice this is starting to change, whilst GP surgeries, although funded through the NHS, are actually run as independent businesses so arguably easier to sell into.

A fun fact: A quick spelunking of Companies House records reveals that prominent Conservative Party politician and former Army officer Tom Tugendhat — who is also the current chairman of the Foreign Affairs Committee and tipped by some to be a possible future PM — is an early investor in Accurx.

Separately, I’m told that Wendy Tan White, the former EF General Partner who recently joined Alphabet’s X (formerly Google X) as Vice President, has also invested as part of this latest round. Meanwhile, I understand that recently recruited Principal Irina Haivas led on behalf of Atomico. Haivas is a former surgeon and former surgical fellow at Harvard Medical School (yes, you read that correctly!) and has previously worked at healthcare investor GHO Capital Partners.

Powered by WPeMatico

It takes a lot more than a good idea and the right timing to build a billion-dollar company. Talent, focus, operational effectiveness and a healthy dose of luck are all components of a successful tech startup. Many of the most successful (or, at least, highest-valued) tech unicorns today didn’t get there alone.

Mergers and acquisitions (M&A) can be a major growth vector for rapidly scaling, highly valued technology companies. It’s a topic that we’ve covered off and on since the very first post on Crunchbase News in March 2017. Nearly two years later, we wanted to revisit that first post because things move quickly, and there is a new crop of companies in the unicorn spotlight these days. Which ones are the most active in the M&A market these days?

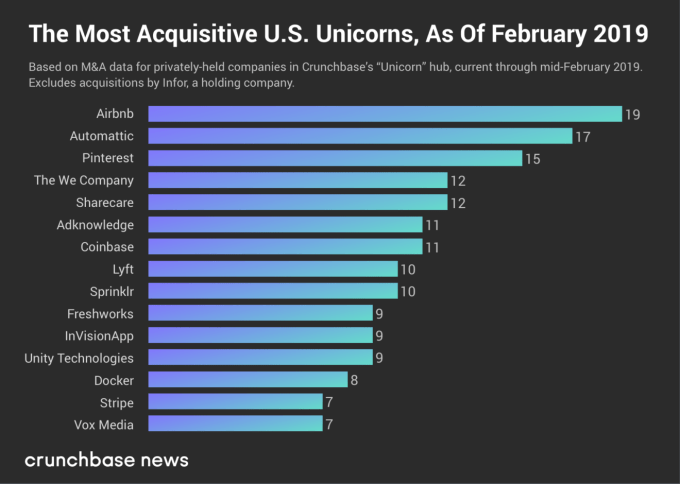

Before displaying the U.S. unicorns with the most acquisitions to date, we first have to answer the question, “What is a unicorn?” The term is generally applied to venture-backed technology companies that have earned a valuation of $1 billion or more. Crunchbase tracks these companies in its Unicorns hub. The original definition of the term, first applied in a VC setting by Aileen Lee of Cowboy Ventures back in late 2011, specifies that unicorns were founded in or after 2003, following the first tech bubble. That’s the working definition we’ll be using here.

In the chart below, we display the number of known acquisitions made by U.S.-based unicorns that haven’t gone public or gotten acquired (yet). Keep in mind this is based on a snapshot of Crunchbase data, so the numbers and ranking may have changed by the time you read this. To maintain legibility and a reasonable size, we cut off the chart at companies that made seven or more acquisitions.

As one would expect, these rankings are somewhat different from the one we did two years ago. Several companies counted back in early March 2017 have since graduated to public markets or have been acquired.

Dropbox, which had acquired 23 companies at the time of our last analysis, went public weeks later and has since acquired two more companies (HelloSign for $230 million in late January 2019 and Verst for an undisclosed sum in November 2017) since doing so. SurveyMonkey, which went public in September 2018, made six known acquisitions before making its exit via IPO.

Which companies are still in the top ranks? Travel accommodations marketplace giant Airbnb jumped from number four to claim Dropbox’s vacancy as the most acquisitive private U.S. unicorn in the market. Airbnb made six more acquisitions since March 2017, most recently Danish event space and meeting venue marketplace Gaest.com. The still-pending deal was announced in January 2019.

WordPress developer and hosting company Automattic is still ranked number two. Automattic href=”https://www.crunchbase.com/acquisition/automattic-acquires-atavist–912abccd”>acquired one more company — digital publication platform Atavist — since we last profiled unicorn M&A. Open-source software containerization company Docker, photo-sharing and search site Pinterest, enterprise social media management company Sprinklr and venture-backed media company Vox Media remain, as well.

There are some notable newcomers in these rankings. We’ll focus on the most notable three: The We Company, Coinbase and Lyft. (Honorable mention goes to Stripe and Unity Technologies, which are also new to this list.)

The We Company (the holding entity for WeWork) has made 10 acquisitions over the past two years. Earlier this month, The We Company bought Euclid, a company that analyzes physical space utilization and tracks visitors using Wi-Fi fingerprinting. Other buyouts include Meetup (a story broken by Crunchbase News in November 2017) reportedly for $200 million. Also in late 2017, The We Company acquired coding and design training program Flatiron School, giving the company a permanent tenant in some of its commercial spaces.

In its bid to solidify its position as the dominant consumer cryptocurrency player, Coinbase has been on quite the M&A tear lately. The company recently announced its plans to acquire Neutrino, a blockchain analytics and intelligence platform company based in Italy. As we covered, Coinbase likely made the deal to improve its compliance efforts. In January, Coinbase acquired data analysis company Blockspring, also for an undisclosed sum. The crypto company’s other most notable deal to date was its April 2018 buyout of the bitcoin mining hardware turned cryptocurrency micro-transaction platform Earn.com, which Coinbase acquired for $120 million.

And finally, there’s Lyft, the more exclusively U.S.-focused ride-hailing and transportation service company. Lyft has made 10 known acquisitions since it was founded in 2012. Its latest M&A deal was urban bike service Motivate, which Lyft acquired in June 2018. Lyft’s principal rival, Uber, has acquired six companies at the time of writing. Uber bought a bike company of its own, JUMP Bikes, at a price of $200 million, a couple of months prior to Lyft’s Motivate purchase. Here too, the Lyft-Uber rivalry manifests in structural sameness. Fierce competition drove Uber and Lyft to raise money in lock-step with one another, and drove M&A strategy as well.

With long-term business success, it’s often a chicken-and-egg question. Is a company successful because of the startups it bought along the way? Or did it buy companies because it was successful and had an opening to expand? Oftentimes, it’s a little of both.

The unicorn companies that dominate the private funding landscape today (if not in the number of deals, then in dollar volume for sure) continue to raise money in the name of growth. Growth can come the old-fashioned way, by establishing a market position and expanding it. Or, in the name of rapid scaling and ostensibly maximizing investor returns, M&A provides a lateral route into new markets or a way to further entrench the status quo. We’ll see how that strategy pays off when these companies eventually find the exit door .

Powered by WPeMatico

The Wall Street Journal published a thought-provoking story this week, highlighting limited partners’ concerns with the SoftBank Vision Fund’s investment strategy. The fund’s “decision-making process is chaotic,” it’s over-paying for equity in top tech startups and it’s encouraging inflated valuations, sources told the WSJ.

The report emerged during a particularly busy time for the Vision Fund, which this week led two notable VC deals in Clutter and Flexport, as well as participated in DoorDash’s $400 million round; more on all those below. So given all this SoftBank news, let us remind you that given its $45 billion commitment, Saudi Arabia’s Public Investment Fund (PIF) is the Vision Fund’s largest investor. Saudi Arabia is responsible for the planned killing of dissident journalist Jamal Khashoggi.

Here’s what I’m wondering this week: Do CEOs of companies like Flexport and Clutter have a responsibility to address the source of their capital? Should they be more transparent to their customers about whose money they are spending to achieve rapid scale? Send me your thoughts. And thanks to those who wrote me last week re: At what point is a Y Combinator cohort too big? The general consensus was this: the size of the cohort is irrelevant, all that matters is the quality. We’ll have more to say on quality soon enough, as YC demo days begin on March 18.

Anyways…

Surprise! Sort of. Not really. Pinterest has joined a growing list of tech unicorns planning to go public in 2019. The visual search engine filed confidentially to go public on Thursday. Reports indicate the business will float at a $12 billion valuation by June. Pinterest’s key backers — which will make lots of money when it goes public — include Bessemer Venture Partners, Andreessen Horowitz, FirstMark Capital, Fidelity and SV Angel.

Ride-hailing company Lyft plans to go public on the Nasdaq in March, likely beating rival Uber to the milestone. Lyft’s S-1 will be made public as soon as next week; its roadshow will begin the week of March 18. The nuts and bolts: JPMorgan Chase has been hired to lead the offering; Lyft was last valued at more than $15 billion, while competitor Uber is valued north of $100 billion.

Despite scrutiny for subsidizing its drivers’ wages with customer tips, venture capitalists plowed another $400 million into food delivery platform DoorDash at a whopping $7.1 billion valuation, up considerably from a previous valuation of $3.75 billion. The round, led by Temasek and Dragoneer Investment Group, with participation from previous investors SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia Capital and Y Combinator, will help DoorDash compete with Uber Eats. The company is currently seeing 325 percent growth, year-over-year.

Here are some more details on those big Vision Fund Deals: Clutter, an LA-based on-demand storage startup, closed a $200 million SoftBank-led round this week at a valuation between $400 million and $500 million, according to TechCrunch’s Ingrid Lunden’s reporting. Meanwhile, Flexport, a five-year-old, San Francisco-based full-service air and ocean freight forwarder, raised $1 billion in fresh funding led by the SoftBank Vision Fund at a $3.2 billion valuation. Earlier backers of the company, including Founders Fund, DST Global, Cherubic Ventures, Susa Ventures and SF Express all participated in the round.

Here’s your weekly reminder to send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

Menlo Ventures has a new $500 million late-stage fund. Dubbed its “inflection” fund, it will be investing between $20 million and $40 million in companies that are seeing at least $5 million in annual recurring revenue, growth of 100 percent year-over-year, early signs of retention and are operating in areas like cloud infrastructure, fintech, marketplaces, mobility and SaaS. Plus, Allianz X, the venture capital arm attached to German insurance giant Allianz, has increased the size of its fund to $1.1 billion and London’s Entrepreneur First brought in $115 million for what is one of the largest “pre-seed” funds ever raised.

Flipkart co-founder invests $92M in Ola

Redis Labs raises a $60M Series E round

Chinese startup Panda Selected nabs $50M from Tiger Global

Image recognition startup ViSenze raises $20M Series C

Circle raises $20M Series B to help even more parents limit screen time

Showfields announces $9M seed funding for a flexible approach to brick-and-mortar retail

Podcasting startup WaitWhat raises $4.3M

Zoba raises $3M to help mobility companies predict demand

Indian delivery men working with the food delivery apps Uber Eats and Swiggy wait to pick up an order outside a restaurant in Mumbai. ( INDRANIL MUKHERJEE/AFP/Getty Images)

According to Indian media reports, Uber is in the final stages of selling its Indian food delivery business to local player Swiggy, a food delivery service that recently raised $1 billion in venture capital funding. Uber Eats plans to sell its Indian food delivery unit in exchange for a 10 percent share of Swiggy’s business. Swiggy was most recently said to be valued at $3.3 billion following that billion-dollar round, which was led by Naspers and included new backers Tencent and Uber investor Coatue.

Lalamove, a Hong Kong-based on-demand logistics startup, is the latest venture-backed business to enter the unicorn club with the close of a $300 million Series D round this week. The latest round is split into two, with Hillhouse Capital leading the “D1” tranche and Sequoia China heading up the “D2” portion. New backers Eastern Bell Venture Capital and PV Capital and returning investors ShunWei Capital, Xiang He Capital and MindWorks Ventures also participated.

Longtime investor Keith Rabois is joining Founders Fund as a general partner. Here’s more from TechCrunch’s Connie Loizos: “The move is wholly unsurprising in ways, though the timing seems to suggest that another big fund from Founders Fund is around the corner, as the firm is also bringing aboard a new principal at the same time — Delian Asparouhov — and firms tend to bulk up as they’re meeting with investors. It’s also kind of time, as these things go. Founders Fund closed its last flagship fund with $1.3 billion in 2016.”

If you enjoy this newsletter, be sure to check out TechCrunch’s venture capital-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I discuss Pinterest’s IPO, DoorDash’s big round and SoftBank’s upset LPs.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

The video conferencing company Zoom is aiming to file a public S-1 by the end of March, according to a new report in Business Insider that adds the company could go public as soon as April.

Business Insider reported last month that Zoom had filed confidentially with the SEC to go public, just months after Reuters reported that the San Jose, Calif.-based company had chosen investment bank Morgan Stanley to lead its eventual IPO.

We’ve reached out to the company for comment.

Zoom was valued at $1 billion when it raised its last funding in 2017 in the form of a $100 million check from Sequoia Capital. Reuters sources have said they expect the company to be valued at several billion dollars at the IPO.

The company, founded in 2011, has raised $145 million altogether, including from Emergence Capital and Horizons Ventures. Its earliest backers include Qualcomm Ventures, Yahoo founder Jerry Yang, WebEx founder Subrah Iyar and former Cisco SVP Dan Scheinman, who has been an active angel investor for years.

We had a chance to sit down with CEO Eric Yuan last year at a small industry event hosted by the venture firm NextWorld Capital. He talked about coming to the United States as a student from China and applying for a U.S. visa nine times over the course of two years before finally receiving it and arriving in Silicon Valley in 1997. We also talked about his experience as the 10th employee of WebEx, and his frustration that the company’s code remained stubbornly unchanged after it was sold for $3.2 billion to Cisco in 2007.

He wasn’t alone, clearly. When Yuan struck out on his own to found Zoom, fully 45 employees from WebEx joined him, a decision for which they’re likely thankful now. Financial rewards aside, Yuan was ranked at the top of Glassdoor’s annual list of best-rated CEOs last year.

We’ll be able to take a deeper dive into the health of Zoom once its reported S-1 is made public. In the meantime, you can check out our chat here.

Powered by WPeMatico

Epic Games, maker of the ultra popular Battle Royale game Fortnite, is putting up another $100 million in prize cash for competitive tournaments in 2019.

The company made waves in the esports world last year, announcing a $100 million prize pool for the 2018 competitive year, dwarfing every other competitive title in one fell swoop.

This year, a significant portion of the $100 million will be awarded to participants of the first-ever Fortnite World Cup. Each of the 200 players who qualify and compete will walk away with at least $50,000, with the winner taking home $3 million.

The Fortnite World Cup will take place July 26 – 28 in New York City, offering $30 million total in prizes. One hundred of the top solo players will be invited, along with the top 50 duos teams.

So how do you get in on this?

Fortnite is holding weekly open online qualifiers, each worth $1 million, from April 13 to June 16. Eligible players who consistently place well will have a shot at being one of those top 200 players.

This announcement comes at an interesting time for Fortnite. While the game still reigns supreme in terms of popularity, other Battle Royale games are picking up traction. Apex Legends (an EA and Respawn title), in particular, is growing in popularity. Several of the top Twitch streamers, including Ninja, Shroud, Timthetatman, High Distortion and Annemunition have started playing more Apex and participated in the first Apex Legends Twitch Rivals tournament.

Keeping the attention of these streamers is surely a priority for Fortnite, and for a game that pulls in some $300 million a month in in-game purchases, spending $100 million a year is a small price to pay.

Powered by WPeMatico

Instagram is threatening to attack Pinterest just as it files to go public the same way the Facebook-owned app did to Snapchat. Code buried in Instagram for Android shows the company has prototyped an option to create public “Collections” to which multiple users can contribute. Instagram launched private Collections two years ago to let you Save and organize your favorite feed posts. But by allowing users to make Collections public, Instagram would become a direct competitor to Pinterest.

Instagram public Collections could spark a new medium of content curation. People could use the feature to bundle together their favorite memes, travel destinations, fashion items or art. That could cut down on unconsented content stealing that’s caused backlash against meme “curators” like F*ckJerry by giving an alternative to screenshotting and reposting other people’s stuff. Instead of just representing yourself with your own content, you could express your identity through the things you love — even if you didn’t photograph them yourself. And if that sounds familiar, you’ll understand why this could be problematic for Pinterest’s upcoming $12 billion IPO.

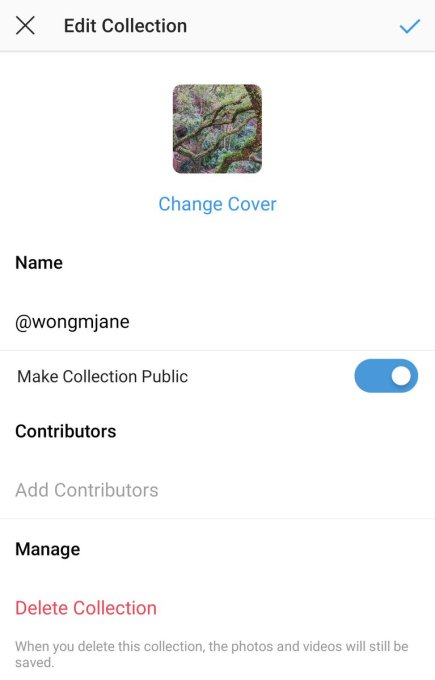

The “Make Collection Public” option was discovered by frequent TechCrunch tipster and reverse engineering specialist Jane Manchun Wong. It’s not available to the public, but from the Instagram for Android code, she was able to generate a screenshot of the prototype. It shows the ability to toggle on public visibility for a Collection, and tag contributors who can also add to the Collection. Previously, Collections was always a private, solo feature for organizing your bookmarks gathered through the Instagram Save feature Instagram launched in late 2016.

Instagram told TechCrunch “we’re not testing this,” which is its standard response to press inquiries about products that aren’t available to public users, but that are in internal development. It could be a while until Instagram does start experimenting publicly with the feature and longer before a launch, and the company could always scrap the option. But it’s a sensible way to give users more to do and share on Instagram, and the prototype gives insight into the app’s strategy. Facebook launched its own Pinterest -style shareable Sets in 2017 and launched sharable Collections in December.

Currently there’s nothing in the Instagram code about users being able to follow each other’s Collections, but that would seem like a logical and powerful next step. Instagrammers can already follow hashtags to see new posts with them routed to their feed. Offering a similar way to follow Collections could turn people into star curators rather than star creators without the need to rip off anyone’s content. Speaking of infuencers, Wong also spotted Instagram prototyping IGTV picture-in-picture, so you could keep watching a long-form video after closing the app and navigating the rest of your phone.

Instagram lets users Save posts, which can then be organized into Collections

Public Collections could fuel Instagram’s commerce strategy that Mark Zuckerberg recently said would be a big part of the road map. Instagram already has a personalized Shopping feed in Explore, and The Verge’s Casey Newton reported last year that Instagram was working on a dedicated shopping app. It’s easy to imagine fashionistas, magazines and brands sharing Collections of their favorite buyable items.

It’s worth remembering that Instagram launched its copycat of Snapchat Stories just six months before Snap went public. As we predicted, that reduced Snapchat’s growth rate by 88 percent. Two years later, Snapchat isn’t growing at all, and its share price is at just a third of its peak. With more than 1 billion monthly and 500 million daily users, Instagram is four times the size of Pinterest. Instagram loyalists might find it’s easier to use the “good enough” public Collections feature where they already have a social graph than try to build a following from scratch on Pinterest.

Powered by WPeMatico

WaitWhat, the digital content production engine behind LinkedIn co-founder Reid Hoffman’s Masters of Scale podcast, has secured a $4.3 million Series A investment led by Cue Ball Capital and Burda Principal Investments.

Launched in January 2017, WaitWhat will use the cash to create additional media properties across a variety of mediums, including podcasts.

Investors are gravitating toward podcast startups as consumer interest in original audio content skyrockets. Podcasting, though an infantile industry that hit just $314 million in revenue in 2017, is maturing, raking in venture capital rounds large and small and recording its first notable M&A transaction with Spotify’s acquisition of Gimlet and Anchor earlier this month. The music streaming giant shelled out a total of $340 million for the podcast production platform and the provider of a suite of podcast creation, distribution and monetization tools, respectively. It plans to spend an additional $500 million on audio storytelling platforms as part of a larger plan to become the Netflix of audio.

WaitWhat, for its part, dubs itself the “media invention company.” Founded by June Cohen and Deron Triff, a pair of former TED executives responsible for expanding the nonprofit’s digital media business, WaitWhat is today launching Should This Exist, a new podcast hosted by Flickr founder and tech investor Caterina Fake. Fake will interview entrepreneurs about the human side and the impact of technology in the show created in partnership with Quartz.

“People don’t just transact with content; they want to feel connected to it through a sense of wonder, awe, curiosity, and mastery,” Cohen said in a statement. “These are contagious emotions, and research shows they stimulate sharing. Where many media companies aim for volume — putting out lots of content with a short shelf life — we’re building a completely distinctive portfolio of premium properties that are continually increasing in value, inspiring deep audience engagement, and creating opportunities for format expansion.”

Other investors in the round include Reid Hoffman, MIT Media Lab director Joi Ito and Liminal Ventures. WaitWhat previously raised a $1.5 million round from Victress Capital, Human Ventures and Able Partners, all of which have joined the A round.

Powered by WPeMatico

I can’t tell you the number of times I’ve heard friends lament how difficult it is to find a decent calendar app. The stock calendar apps are certainly serviceable, but there’s so much that they can’t handle in terms of managing and prioritizing tasks.

Sunsama, launching out of Y Combinator’s latest batch, is taking a crack at solving the calendar conundrum with a $10-per-month professionals-focused productivity planner.

Co-founders Ashutosh Priyadarshy and Travis Meyer began with the idea that the relationship between task managers and calendars were a mess. Devotees to “get things done” to-do apps end up re-typing tasks they’ve been assigned on project-based systems like Trello and Asana, which just leads to a whole lot of confusion. Sunsama’s third-party integrations make it easy to drag these tasks into your to-do list every morning and keep things updated as your tasks evolve and priorities need to shift.

The company takes some pretty clear design inspiration from existing enterprise apps. The influences from Google Calendar, Slack and Trello are pretty clear, but the resulting interface all works together very thoughtfully with a drag-and-drop organizational flow that lets you import projects from linked services. It all makes for a very friendly, pretty system that can enable you to fly through the often cumbersome work of populating your to-do list in the first place. The company currently supports integrations with Asana, Trello, Slack, GitHub, GitLab, Jira and Todoist.

While a lot of other task management apps rely on a freemium model or low annual subscription, Sunsama takes $10-per-month for their service. It’s definitely an expense, but the founders see apps like $30-per-month email service Superhuman as a sign that professionals are willing to drop some cash on a service that cleans up their digital life.

The company wants to snag individual users, but getting small teams onto the service could be their clearest route to wider adoption. When your entire team is on Sunsama, you’re able to check out what other members of your channels have on deck when they’re working on a particular project. There’s the risk of getting lost in the fray of other necessary platforms on the company level, but the founders think the deep integrations will keep people turning to Sunsama when they want to see how a project is going.

The startup seems to have taken more than a few on-boarding cues from Superhuman, which takes you off the waitlist only after they’ve gotten a chance to personally talk you through their service and see whether you’re a good fit. You can sign-up to request Sunsama access on their site now.

Powered by WPeMatico

A few weeks ago, we told you that former Uber CEO Travis Kalanick looks to be partnering with the former COO of the bike-sharing startup Ofo, Yanqi Zhang, to bring his new L.A.-based company, CloudKitchens, to China. Kalanick didn’t respond to our request for more information, but according to the South China Morning Post (SCMP), his plan is to provide local food businesses with real estate, facilities management, technology and marketing services.

He might want to move quickly. Kitchens that invite restaurants to share their space to focus on take-out orders is a concept that’s picking up momentum fast in China. And one company looks to have just assumed pole position in that race: Panda Selected, a Beijing-based shared-kitchen company that just raised $50 million in Series C funding led by Tiger Global Management, with participation from earlier backers DCM and Glenridge Capital. The round brings its total funding to $80 million.

Little wonder there’s a contest afoot. China’s food-delivery market is already worth $37 billion dollars, according to the SCMP, which says 256 million people in China used online food ordering services in 2016, and the number is expected to grow to 346 million this year.

And that’s still a little less than a quarter of the country’s population of 1.4 billion people.

Panda Selected is wasting little time in trying to reach them. While SCMP says that online delivery services already blanket 1,300 cities. Panda Selected, founded just three years ago, says it already operates 120 locations that cover China’s biggest centers, including Shanghai, Beijing, Shenzhen and Hangzhou. It claims to work with more than 800 domestic catering brands, including Luckin Coffee, Kungfu and TubeStation. The company also says that its kitchens are typically 5,000-square-feet in size and can accommodate up to 20 restaurants in each space.

With its new funding, it expects to double that number over the next eight months, too, its founder, Haipeng Li, tells Bloomberg. That’s going to make it difficult to challenge, especially by any U.S.-based company, given overall relations between the two countries and the ever-changing regulatory environment in China.

Then again, this may be just the first inning. Stay tuned.

Powered by WPeMatico

Delivery company DoorDash is announcing that it has raised $400 million in Series F financing.

Earlier this month, The Wall Street Journal reported that the company was looking to raise $500 million at a valuation of $6 billion or more. In fact, DoorDash now says the funding came at a $7.1 billion valuation.

The round was led by Temasek and Dragoneer Investment Group, with participation from previous investors SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia Capital and Y Combinator.

DoorDash has been raising money at an impressive rate, with a $535 million round last March followed by a $250 million round (valuing the company at $4 billion) in August.

Co-founder and CEO Tony Xu told me the round is “a reflection of superior performance over the past year.” Apparently, the company is currently seeing 325 percent growth, year-over-year, and it points to recent data from Second Measure showing that the service has overtaken Uber Eats in U.S. market share for online food delivery — DoorDash now comes in second to Grubhub.

“I think the numbers speak for themselves,” Xu said. “If you just run the math on DoorDash’s course and speed, we’re on track to be number one.”

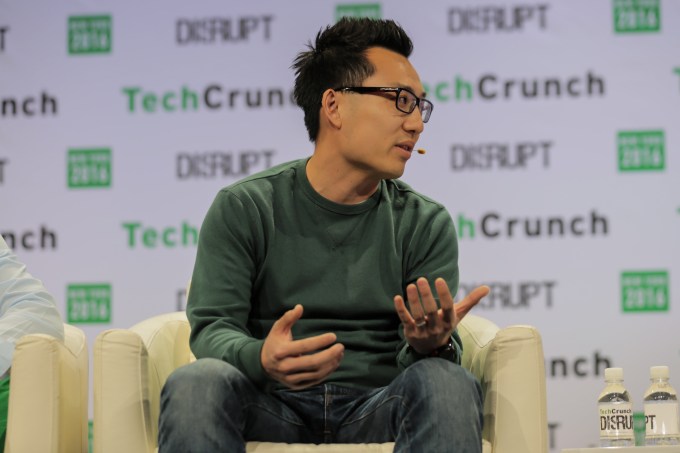

Tony Xu of DoorDash

He attributed the company’s growth to three factors: its geographic reach (3,300 cities in the United States and Canada), its selection of partners (not just restaurants — Walmart is using DoorDash for grocery deliveries) and DoorDash Drive, which allows businesses to use the DoorDash network to make their own deliveries.

He added that DoorDash has been “growing in a disciplined way, turning markets towards profitability.”

The funding, Xu said, will allow the company to continue investing in Drive, in its DashPass subscription service (where you pay $9.99 per month for free deliveries on orders of $15 or more from select restaurants) and in more hiring. And while DoorDash is currently available in all 50 states, Xu said there’s still plenty of room to cover additional territory in the U.S. and especially Canada.

“To me, this round … really changes the position of the company, not only as we march towards market leadership, but as we go beyond restaurants and become the last mile for commerce,” he said.

Not all of DoorDash’s recent news has been good. Along with Instacart, the company has been under scrutiny for subsidizing its driver payments with customer tips.

When asked about the criticism, Xu said the current compensation system was tested “not in a quarter, not in a month, but tested for months” before being implemented in 2017, and since then, there’s been a “significant increase” in retention among “dashers,” along with improved dasher satisfaction and on-time deliveries.

“When it comes to this pay model that has been in the press, the most important thing, I would say, is looking again at the facts and results,” he said.

Powered by WPeMatico