Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Founders. This is your shot. TechCrunch is officially in the hunt for the most disruptive startups for this year’s Startup Battlefield at TechCrunch Disrupt San Francisco 2019. Startups can apply here to compete on our world-famous stage for a $100,000 equity-free prize and the coveted Disrupt Cup. With more than 10,000 attendees, hundreds of press outlets and top investors from around the world, your company will launch to the most influential players in tech.

The application. Simple. Fill out your app here. There is no cost to apply or participate. TechCrunch does not take any fees or equity. Early-stage startups from any country and any vertical are eligible. TechCrunch’s editors will review the applications and select the most promising startups to pitch the world’s top VCs on the main stage at Disrupt SF (October 2-4) — set to be the biggest event in TechCrunch’s history.

The training. The Startup Battlefield team will work intensively over many weeks with the Startup Battlefield contestants to hone pitches, sharpen business models and perfect demos.

The conference. At TechCrunch Disrupt SF, Startup Battlefield contestants are welcome at VIP events, backstage and more. The Battlefield startups receive complimentary exhibition space on the show floor for all three days, as well as access to CrunchMatch, TechCrunch’s investor-founder matching system. Battlefield startups also receive complimentary tickets to all future TechCrunch events, access to alumni events and free subscriptions to Extra Crunch.

The competition. The Startup Battlefield contestants, approximately 20 in number, pitch for six minutes each, including a live demo, followed by a six-minute Q&A with our elite judges — investors like Roelof Botha, Jeff Clavier, Cyan Banister, Kirsten Green and Aileen Lee. After the initial round, 4-6 companies will be selected to pitch again on the final day of the conference in front of a new panel of judges. They will choose the winner, who will receive the Disrupt Cup, a check for $100,000 and a post in TechCrunch, as well as the attention of media and investors around the world. All Startup Battlefield sessions are streamed live on TechCrunch to a global audience in the millions.

The Startup Battlefield Alumni Community. Join the ranks of alumni like Vurb, Dropbox, Get Around, Cloudflare, Mint.com and more. Don’t just take our word for it! Our Startup Battlefield Alumni metrics speak for themselves — 857 contestants have raised about $8.8 billion and produced 108 successful exits (IPOs or acquisitions).

So what are you waiting for? Apply now.

Powered by WPeMatico

The future of healthcare isn’t entirely digital. For encounters as intimate as the client-therapist dynamic, a face-to-face relationship is still key.

For those able to afford tech-enabled therapy services, Two Chairs, a San Francisco-headquartered mental healthcare business, may be of interest. The startup believes in the power of in-person therapy, as opposed to the new variety of affordable digital tools meant to replace or coexist with therapy services. Today, the company is announcing a $7 million Maveron-led Series A financing to open additional brick-and-mortar clinics and build out its client-therapist matching app, which leverages technology to pair its customers with a therapist best-tailored to their needs.

The company currently operates four clinics in the Bay Area, where patients can access individual or group therapy. Each of those clinics was built with modern, young professionals in mind using “thoughtful design” to create “non-judgmental spaces.”

A Two Chairs clinic, which emphasizes “non-judgmental” design

The app and clinic interior design are the key differences between Two Chairs and a neighborhood private practice, it says. As far as pricing, at $180 an hour, a session doesn’t differ terribly from a typical session at a Bay Area private practice. The startup currently employs 30 therapists, who also are available over video chat should a client be sick or traveling, with a customer base of “several thousand.”

Two Chairs was founded in 2017 by former Palantir employee Alex Katz (pictured). In a conversation with TechCrunch, Katz admitted procuring real estate for Two Chairs’ brick-and-mortar clinics has been an expensive and difficult endeavor. It’s no wonder venture capitalists tend to favor IT startups devoid of the overhead costs associated with firms in the real estate business. Katz is hoping the latest investment, which brings Two Chairs’ total raised to $8 million, will help the business quickly sign additional leases outside of the most expensive city in the U.S.

The cash will also be used to advance Two Chairs’ matching app. The app surveys potential clients on their history, preferences and goals, then uses a library of data to match the client with the most suitable therapist in its roster and to create a customized treatment plan. Katz says they’ve provided clients with an accurate match 95 percent of the time.

“We know that the client-therapist relationship is the best predictor of an outcome with care and while it sounds intuitive, matching is not a concept that has existed in the mental health field historically,” Katz told TechCrunch.

Two Chairs is one of several mental health startups to capture the attention of venture capitalists lately. Basis, which helps people cope with anxiety and depression through guided conversations via chat and video, emerged from stealth in 2018 with a $3.75 million investment led by Bedrock. Wisdo, a community-focused app that connects people seeking help with those who can offer help, brought in an $11 million investment in December and emotional well-being app Aura raised $2.7 million from Cowboy Ventures in October.

Those three businesses have one thing in common: they are digital-first endeavors looking to innovate on top of a broken mental healthcare model. Two Chairs’ plan to build additional therapy clinics, however, doesn’t feel particularly inventive. Opening a chain of therapy offices, rather, sounds like a hard-to-scale, expensive business idea.

As for the uptick in capital for mental health tech, Katz is satisfied Silicon Valley has finally acknowledged the problem: “I think Silicon Valley venture has had a preference for models that don’t involve brick-and-mortar and minimize the use of people; they prefer software businesses,” he said. “The reason we are taking this approach is we know from the research that really well-matched in-person therapy is really effective. Still, at a high level, it’s exciting. There are a lot of people thinking in innovative ways of how we can provide improved mental healthcare.”

Goldcrest Capital also participated in Two Chairs’ Series A.

Powered by WPeMatico

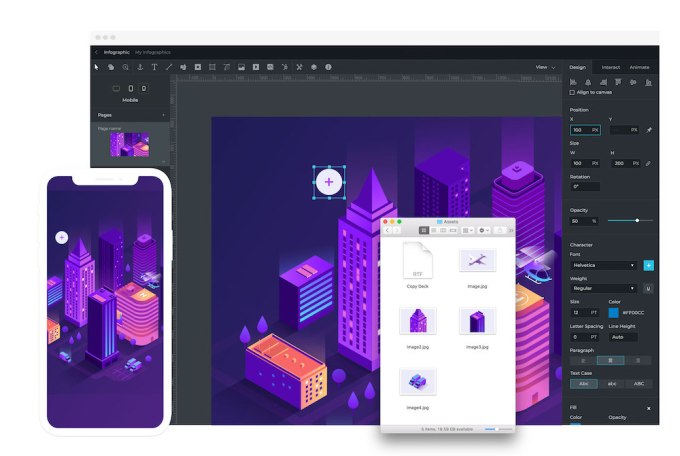

Ceros allows marketers to create animated, interactive content — but don’t call it a content marketing company.

“We think content is just a dry, bland, over-leveraged, oversaturated space,” said founder and CEO Simon Berg. “The goal is not to hack the system, the goal is to make a great experience for your customers.”

That’s why he describes Ceros as a platform for creating experiences. The company is focused on powering beautiful, well-designed graphics and web pages, instead of blog posts or white papers that mostly exist to snare search traffic.

Ceros is announcing today that it has raised $14 million in Series C funding.

Ceros previously raised $19.5 million in funding, according to Crunchbase. The new round was led by Greenspring Associates, with participation from Grotech Ventures, CNF Investments, Sigma Prime Ventures, StarVest Partners, Greycroft and Silicon Valley Bank.

“Ceros is well known for empowering marketers to think creatively, but we have also come to know Ceros as a highly capital efficient business, which is a refreshing change in the burn-rate happy world of digital,” said Greenspring’s John Avirett, general partner, in a statement. “We’re confident that this investment will catalyze Ceros’ continued growth while enabling their team to opportunistically pursue acquisitions that enhance the core product and further penetration of key markets.”

For examples of the difference between Ceros “experiences” and run-of-the-mill content marketing, check out Ceros/Inspire, where some of the most-viewed projects include a comic book-style blockchain explainer from Ozy and a “friend versus pro” created to promote H&R Block.

“What we’ve continued to work on over the last seven years is to comply with laws of physics that are laws of internet, whilst giving as much creative freedom as possible,” Berg said. “We want to put the creative and the design piece first.”

The company says it’s now working with more than 400 customers, including well-known brands like United Airlines and Red Bull, as well as publishers including Condé Nast and Vice, plus sports teams like the Baltimore Ravens and Detroit Lions.

“Both in terms of the revenues that we’ve reached and the clients that we’ve worked with … you never really ‘arrive,’ but I feel like we’ve reached a critical milestone,” Berg said.

Powered by WPeMatico

Ridesharing isn’t just for transporting teenagers and adults anymore. Zūm, a ridesharing startup for kids, just raised a $40 million Series C round led by BMW i Ventures with participation from Spark Capital and Sequoia Capital. This brings the company’s total funding to $70 million.

Zūm is a mobile app that enables parents to schedule rides for their kids from fully vetted drivers. It also partners with school districts to support their transportation needs. To date, the company has partnered with 150 school districts across the country and transported more than 500,000 students.

“Zūm has proven itself as a force to be reckoned with in a market that has a lot of untapped opportunity,” BMW i Ventures managing partner Ulrich Quay said in a statement. “Its leadership is strong not only because of their drive to help working families, but because they themselves have families and understand the need for better child transportation, today. We’re proud to be supporting Zūm and look forward to seeing its momentum as it continues driving funds back into schools.”

The plan with the funding is to support the increase of partnerships with schools throughout the nation. Additionally, Zūm plans to use the funding to further develop its one-stop platform technology for schools. This platform features route optimization, vehicle and quality tracking and real-time vehicle dashboards for schools.

“I’m honored to gain the support of our incredible investors who believe in what Zūm does, and our mission to build the world’s largest and safest transportation service for students,” Zūm founder and CEO Ritu Narayan (pictured above) said in a press release. “It is beyond exciting to have investors who have supported transportation, tech and marketplace startups across the globe, and to know they see in Zūm what I’ve seen since the beginning—ineffective, inefficient school transportation is a massive issue and we need to build a better future for our children.”

Zūm, however, is not the only startup tackling transportation for kids. HopSkipDrive, a rideshare service that picks up your kids, similarly partners with school districts for school bus alternatives. In 2017, HopSkipDrive raised a $7.4 million round to bring its total funding to $21.5 million. There’s also Kango, a more Uber-like service for kids. However, you may recall Shuddle’s shutdown of its Uber-like service for kids in 2016. Shuddle had raised $12.2 million prior to shutting down. Perhaps partnering with schools and school districts is the way to go in this kid ride-hailing business.

Powered by WPeMatico

SoftBank’s Vision Fund is taking a bet on China’s auto market after it agreed to pour $1.5 billion into online car trading group Chehaoduo, which literally means “many cars” in Chinese.

The Beijing-based company operates two main sites — peer-to-peer online marketplace Guazi for used vehicles, and Maodou, which retails new sedans through direct sales and financial leasing. (These sub-brands are more subtly named; they translate to “sunflower seeds” and “edamame,” respectively.)

Chehaoduo said it will deploy the proceeds on technology investments as well as the development of new products and services. It also plans to ramp up its marketing efforts and continue to open brick-and-mortar stores, an omnichannel move it believes can enhance trust in consumers used to meeting dealers in person and differentiate it from peers with an exclusively online focus. Chehaoduo currently runs 600 offline stores nationwide supporting new and used car dealing along with after-sales services.

The sizable funding round arrived at a time when China’s softening economy is sapping consumer confidence, but the company’s two-pronged strategy makes sure it covers a broad range of consumer demands. New passenger car sales in China — the world’s largest auto market — fell for the first time since the 1990s to 23.7 million units last year, according to a report by China’s Association of Automobile Manufacturers, the country’s top auto association.

On the other hand, used cars became a more economical choice in a consumer culture that, unlike many countries in the west, has been slow to embrace second-hand goods. But that mindset is shifting as people feel the heat of the Chinese economic downturn: Secondhand car sales were up 13 percent during the first 11 months of 2018, data from China’s Automobile Dealers Association show.

“China’s used car market is growing rapidly but online penetration remains low and auto financing is underutilized compared to developed markets. In just three years, Chehaoduo Group, through the Guazi brand, has leveraged the latest innovations in data-driven technology to establish China’s leading car trading platform,” says Eric Chen, partner at SoftBank’s Investment Advisers, in a statement.

The Japanese investment group has been a prolific backer in the mobility industry through a variety of affiliated companies with Vision Fund being one. SoftBank’s massive portfolio includes the likes of Uber, Didi Chuxing and Grab .

Chehaoduo counts Uxin and Renrenche as its most serious rivals. Uxin raised $225 million from a U.S. initial public offering last June while Renrenche lured Goldman Sachs in a $300 million funding round last year that also saw participation from Didi and Tencent.

Powered by WPeMatico

French startup Mirakl raised a $70 million funding round. Bain Capital is leading the round, with existing investors 83North, Felix Capital and Elaia Partners also participating.

If you’ve bought a few products from a third-party seller on an e-commerce website that isn’t Amazon or Alibaba, chances are you’ve used Mirakl in the past. The company has built a solution to manage the marketplace of your e-commerce platform.

While Mirakl doesn’t have a ton of customers, each customer is very valuable. The company has worked with some of the biggest names in e-commerce so that they could add a new revenue stream with a marketplace. Examples include Best Buy in Canada, Walmart in Mexico, Office Depot and Darty.

The startup also lets you create B2B marketplaces for bulk selling and other complicated transactions. Sellers can set minimum and maximum quantities and customize their listings.

In 2018, the startup managed to add 60 customers and launch 37 marketplaces — it doubled the gross merchandise volume compared to 2017. And it’s true that marketplaces are attractive. You can greatly increase your sales without any physical infrastructure investment as third-party sellers handle logistics.

Behind the scene, Mirakl has developed connectors that work with multiple e-commerce platforms. After setting up Mirakl, your third-party sellers will also get their own on-boarding back end. And Mirakl continuously helps you when it comes to maintaining a certain level of quality and handling orders.

More recently, Mirakl has developed a catalog manager so that you can more easily manage product listings. It lets you get product information, merge product listings and moderate your platform in general. Any e-commerce website can use it, not just websites that operate a Mirakl marketplace.

The company has also launched a services marketplace so you can upsell your customers with extended warranties and insurance products from third-party companies before they check out.

Mirakl works with global B2B platforms as well as retail websites that usually operate in a country or a handful of countries. Thirty percent of retail clients are French, 30 percent are American and 40 percent are from the rest of the world. The startup charges an upfront fee as well as a monthly subscription that varies according to the success of your marketplace.

With today’s funding round, the company plans to do more of the same, at a bigger scale. Mirakl will expand the team, expand to new countries and improve its product offering.

Powered by WPeMatico

The “restaurant of the future” may elicit thoughts of a chrome diner with robot servers and an otherwise hefty amount of Tokyo futurist kitsch, but the fact is that the forthcoming sit-down dining experience may just end up looking a lot like ordering from a takeout app.

Presto is working with restaurants to update the 21st century dine-in experience, letting customers order and pay from their table with a tablet device while also providing hardware like wearables for servers so they can be alerted when they are needed by customers.

The company announced today that they’ve raised $30 million in growth funding from Recruit Holdings and Romulus Capital. I2BF Global Ventures, EG Capital and Brainchild Holdings also participated in the raise.

Considering how much online shopping has shaped commerce and apps like Instacart and Uber Eats are changing how we get food delivered to our houses, it’s a bit peculiar that physical restaurants with hundreds of locations have been so slow to shift the customer experience toward a greater reliance on tech.

Presto has launched partnerships with a number of restaurant chains like Applebee’s, Red Lobster, Denny’s and Outback Steakhouse. These aren’t exactly mom-and pop locations, but Presto CEO Raj Suri says these large restaurant groups are always looking to shift their weight to improve efficiencies across the board with new tech in a way that most small businesses just aren’t.

“I would say most restaurant groups are looking at how they can become more of a tech company… and adopt technology that could help them become more efficient,” Suri tells TechCrunch. “The industry is moving in this direction in a pretty significant way and it won’t be long before you see our technology in every restaurant.”

Beyond the ordering hardware, Presto’s new AI platform is aiming to give restaurants a more robust look at the state of each individual business and insights that help managers make decisions about staffing or deciding which food items to stock. The platform leverages a variety of data inputs so that things like nearby sporting events or weather patterns can be integrated into suggestions about how many servers should be staffed on a given Tuesday.

Presto is looking to supercharge their platform with the funding and rapidly expand their footprint. The 11-year-old company is now supporting 5,000 restaurant locations, but Suri says that Presto will double that number in 2019.

Powered by WPeMatico

Party planning can be fun if you have the time for it and happen to know what you’re doing. For the rest of us, it can be a daunting, time-consuming endeavor, one that requires visits to numerous websites, in-store visits when those products invariably don’t arrive in time, then return visits to pick up those last items that you could have sworn you’d thrown in your shopping cart but did not.

Enter Coterie, a nine-month-old, New York-based startup that was incubated with the help of the investment firm Female Founders Fund and that is assembling party kits that it’s delivering to customers’ doorsteps, for everything from birthday parties to baby showers to friendversary get-togethers.

Just tell the site how many people you expect, whether it’s 10 or 50, then pick a kit. For example, the “lux” version of its “shine on” package — which could pretty much suit any occasion — comes with glittery plates, metallic flatware, votives, string lights, gold paper straws, dressed-up paper cups and napkins and confetti. Oh, also, gold paper fans as either wall or table decoration.

In the near future, customers of the site will also be able to handpick their products.

It’s less expensive to assemble your own party items, particularly if they are made of paper. That “lux” kit for 50 guests costs $329, with free shipping. These are also mostly items that can’t be reused.

Still, many of Coterie’s products can be recycled and, more to the point for Coterie, the sum of their parts can make a party sparkle in photos. Indeed, ease aside, a big motivator for Coterie customers seemingly will be how their parties look on social media, though venture capitalist Laura Chau disagrees with this assessment.

In fact, Chau, an investor at Canaan Partners who wrote a check to Coterie on behalf of her firm — Coterie has raised $2.75 million altogether, including from Female Founders Fund — says the company more or less pokes fun at social media. As she explains it, Coterie is building a modern brand that gives consumers a “frictionless, elevated and more beautiful experience. But the goal is not to feed on the fake perfection of Instagram but to blow up the idea that such perfection is real.”

Either way, party kits done the right way looks like a big business opportunity to Chau, who says she sees dozens of direct-to-consumer brands every month that might be interesting but don’t fit the venture model because the market is too small or too crowded. With Coterie, she says, it’s a “massive category with only one legacy player — Party City. And no one likes Party City.”

This last part is true, though there are also other, legacy players that no one really likes, including Oriental Trading Company.

Canaan and Female Founders Fund also appear to be betting that the tailwinds from Instagram and Pinterest will drive consumer demand for this kind of product. Just look up “festive planning” on Pinterest to see what we mean.

Coterie was founded by Sarah Raffa and Linden Ellis, two early employees of another e-commerce brand, Daily Harvest. According to an interview with CNN earlier this week, the friends were determined to start their own company, bouncing ideas off the partners at Female Founders Fund until collectively striking on Coterie.

The service launched on Monday.

Powered by WPeMatico

Compass, the real estate tech platform that is now worth $4.4 billion, has made an acquisition to give its agents a boost when it comes to looking for good leads on properties to sell. It is acquiring Contactually, an AI-based CRM platform designed specifically for the industry, which includes features like linking up a list of homes sold by a brokerage with records of sales in the area and other property indexes to determine which properties might be good targets to tap for future listings.

Contactually had already been powering Compass’s own CRM service that it launched last year, so there is already a degree of integration between the two.

Terms of the deal are not being disclosed. Crunchbase notes that Contactually had raised around $18 million from VCs that included Rally Ventures, Grotech and Point Nine Capital, and it was last valued at around $30 million in 2016, according to PitchBook. From what I understand, the startup had strong penetration in the market, so it’s likely that the price was a bit higher than this previous valuation.

The plan is to bring over all of Contactually’s team of 32 employees, led by Zvi Band, the co-founder and CEO, to integrate the company’s product into Compass’s platform completely. They will report to CTO Joseph Sirosh and head of product Eytan Seidman. It will also mean a bigger operation for Compass in Washington, DC, which is where Contactually had been based.

“The Contactually team has worked for the past 8 years to build a best-in-class CRM that aggregates relationships and automatically documents every touchpoint,” said Band in a statement “We are proud that our investment into machine learning has resulted in new features like Best Time to Email and other data-driven, follow-up recommendations which help agents be more effective in their day-to-day. After working extensively with the Compass team, it was apparent that joining forces would accelerate our missions of building the future of the industry.”

For the time being, customers who are already using the product — and a large number of real estate brokers and agents in the U.S. already were, at prices that ranged from $59/month to $399/month depending on the level of service — will continue their contracts as before.

I suspect that the longer-term plan, however, will be a little different: You have to wonder if agents who compete against Compass would be happy to use a service where their data is being processed by it, and for Compass itself. I would suspect that having this tech for itself would give it an edge over the others.

Compass, I understand from sources, is on track to make $2 billion in revenues in 2019 (its 2018 targets were $1 billion on $34 billion in property sales, and it had previously said it would be doubling that this year). Now in 100 cities, it’s come a long way from its founding in 2012 by Ori Allon and Robert Reffkin.

The bigger picture beyond real estate is that, as with many other analog industries, those who are tackling them with tech-first approaches are sweeping up not only existing business, but in many cases helping the whole market to expand. Contactually, as a tool that can help source potential properties for sale that owners hadn’t previously considered putting on the market, could end up serving that very end for Compass.

The focus on using tech to storm into a legacy industry is also coming at an interesting time. As we’ve pointed out before, the housing market is predicted to cool this year, and that will put the squeeze on agents who do not have strong networks of clients and the tools to maximise whatever opportunities there are out there to list and sell properties.

The likes of Opendoor — which appears to be raising money and inching closer to Compass in terms of valuation — is also trying out a different model, which essentially involves becoming a middle part in the chain, buying properties from sellers and selling them on to buyers, to speed up the process and cut out some of the expenses for the end users. That approach underscores the fact that, while the infusion of technology is an inevitable trend, there will be multiple ways of applying that.

This appears to be Compass’s first full acquisition of a tech startup, although it has made partial acqui-hires in the past.

Powered by WPeMatico

French startup Blade, the company behind Shadow, is launching a new set-top box to access its cloud gaming service — the Shadow Ghost. I’ve been playing with the device for a couple of weeks and here’s my review.

The Shadow Ghost is a tiny little box that doesn’t do much. The true magic happens in a data center near your home. When you sign up to Shadow, you don’t even have to get a box. You can simply subscribe to the service without any hardware device and use the company’s apps instead.

Shadow is a cloud computing service for gamers. For $35 per month, you can access a gaming PC in a data center and interact with this computer. Right now, Shadow gives you eight threads on an Intel Xeon 2620 processor, an Nvidia Quadro P5000 GPU that performs more or less as well as an Nvidia GeForce GTX 1080, 12GB of RAM and 256GB of storage. You can optionally get more storage with an extra subscription. It’s a full Windows 10 instance and you can do whatever you want with it.

Most subscribers now access Shadow using one of the company’s apps on Windows, macOS or Linux. You also can connect to your virtual machine from your iOS or Android phone or tablet. And now, you can buy the Shadow Ghost if you want to use the service on a TV or without a computer.

I first used Shadow during the early days of the service back in early 2017. My first experience of the service felt like magic. Thanks to my high-speed fiber connection, I could play demanding games on a laptop. The best part was that the laptop fan would remain silent.

But it wasn’t perfect. Nvidia driver updates failed sometimes. Or your virtual machine would become completely unaccessible without some help from the customer support team.

In other words, the concept was great, but the service wasn’t there yet.

Things have changed quite drastically after years of iteration on the apps, the streaming engine, the infrastructure and even the GPUs in the data centers. Blade co-founder and CEO Emmanuel Freund told me that the service has been working fine for just a few months.

It’s no surprise that those technical improvements have led to less churn, more referrals and more subscriptions. In July 2018, the startup had 20,000 subscribers. Now there are 65,000 subscribers. There’s even more demand, but the company has had a hard time keeping up with new machines in data centers.

Shadow is currently available in France, the U.K., Germany, Belgium, Luxembourg, Switzerland and parts of the U.S. The company simply can’t accept customers from anywhere in the world because they need to live near a data center with Shadow servers.

The original Shadow box was a bit clunky. You could hear the fan, you had to rely on dongles if you wanted to pair a Bluetooth device or connect to a Wi-Fi network and there was no HDMI port — only DisplayPort. Internally, Blade has been debating whether the company needs another box.

In 2017, it was too hard to explain the product without some sort of physical device — you can replace a PC tower with a tiny box. But now that gamers understand the benefits of cloud gaming, there’s no reason to force you to buy a box.

And yet, the Shadow Ghost can be a useful little device in some cases. For instance, while the company has released an Android TV app and is testing a new app for the Apple TV, your current TV setup might not be compatible with Shadow. Or maybe you primarily use a laptop and you want to create a desktop PC setup with a display, a keyboard, a mouse and a Shadow Ghost.

Everything has been improved. It is now a fanless device that consumes less than 5W when it’s on. It has an Ethernet port, two USB 3.0 ports, two USB 2.0 ports, an audio jack and a single HDMI port. Bluetooth and Wi-Fi have finally been integrated in the device.

When you boot up the device, you get a menu to connect to a Wi-Fi network or control your Bluetooth devices. You also can change some streaming settings, like in the app launcher.

Once you press the start button, the video stream starts and it feels like you’re using a Windows computer. With Steam’s Big Picture mode, you get a convenient setup for couch gaming. I had no issue playing demanding games, such as Hitman 2. It works perfectly fine with a Wi-Fi connection and a Bluetooth controller.

Using the Shadow Ghost feels just like using the Shadow app on a computer. So it’s hard to say whether you need the Shadow Ghost or not. It depends on your setup at home and how you plan to use the service.

Last summer, Blade planned to manufacture 5,000 units. But now that the user base has grown significantly, that first batch could disappear in no time. It is available starting today for $140.

Cloud gaming is a hot space right now. While some companies have been experimenting with this concept for a while (Nvidia, Sony), it feels like everyone is working on a new service of some sort. Maybe the next Xbox is going to be about streaming a game from a data center. Maybe Amazon will offer a game library in the cloud as part of your Amazon Prime subscription.

Emmanuel Freund believes that it could be an opportunity for Shadow. Everybody is going to talk about cloud gaming if Apple and Google announce new services. But the startup has years of experiences in the space and has tried hard to compensate when it comes to latency and internet speeds.

It’s going to be harder to compete on content though. Game publishers and console manufacturers could start releasing exclusive titles on their cloud gaming services. That’s why Blade is thinking about new gaming experiences and exclusive content that would make Shadow more than a technical service.

(Controller for scale)

Powered by WPeMatico