Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Paris-based Shift Technology has raised another $60 million funding round. Bessemer Venture Partners is leading the round and existing investors Accel, General Catalyst, Iris Capital and Elaia Partners are also participating.

Shift Technology is all about detecting fraudulent insurance claims. There are 70 insurance companies around the world relying on its product, such as MACIF in France, Axa in Spain, and CNA and HyreCar in the U.S. And given the size of those companies, it means that Shift Technology is processing a ton of claims every day.

It’s easy to sell this kind of product, as fraudulent claims cost a ton of money. If Shift Technology can help you catch more fraudulent claims, you can spend a bit of money to save a lot of money.

The startup has already grown quite a lot since its previous funding round. They now have 200 employees, and customers all around the globe. In addition to its headquarters in Paris, Shift Technology also has offices in Boston, London, Hong Kong, Madrid, Singapore and Zurich.

With today’s funding round, the company plans to hire more people in Boston, including data scientists and developers. The company is also playing around with an automated claim-processing solution.

Shift Technology is creating a strong barrier to entry. Thanks to its huge data set, it can create an AI-powered detection model that is getting more and more accurate. A new company would have a hard time catching up.

Powered by WPeMatico

Scytale, a startup that wants to bring identity and access management to application-to-application activities, announced a $5 million Series A round today.

The round was led by Bessemer Venture Partners, a return investor that led the company’s previous $3 million round in 2018. Bain Capital Ventures, TechOperators and Work-Bench are also participating in this round.

The company wants to bring to applications and services in a cloud native environment the same kind of authentication that individuals are used to having with a tool like Okta. “What we’re focusing on is trying to bring to market a capability for large enterprises going through this transition to cloud native computing to evolve the existing methods of application to application authentication, so that it’s much more flexible and scalable,” company CEO Sunil James told TechCrunch.

To help with this, the company has developed the open-source, cloud-native project, Spiffe, which is managed by the Cloud Native Computing Foundation (CNCF). The project is designed to provide identity and access management for application-to-application communication in an open-source framework.

The idea is that as companies transition to a containerized, cloud-native approach to application delivery, there needs to a smooth automated way for applications and services to very quickly prove they are legitimate, in much the same way individuals provide a username and password to access a website. This could be, for example, as applications pass through API gateways, or as automation drives the use of multiple applications in a workflow.

Webscale companies like Google and Netflix have developed mechanisms to make this work in-house, but it’s been out of reach of most large enterprise companies. Scytale wants to bring to any company this capability to authenticate services and applications.

In addition to the funding announcement, the company announced Scytale Enterprise, a tool that provides a commercial layer on top of the open-source tools the company has developed. The enterprise version helps companies that might not have the personnel to deal with the open-source version on their own by providing training, consulting and support services.

Bain Capital Venture’s Enrique Salem sees a startup solving a big problem for companies that are moving to cloud-native environments and need this kind of authentication. “In an increasingly complex and fragmented enterprise IT environment, Scytale has not only built Spiffe’s amazing open-source community but has also delivered a commercial offering to address hybrid cloud authentication challenges faced by Fortune 500 identity and access management engineering teams,” Salem said in a statement.

Based in the Bay Area, Scytale launched in 2017 and currently has 24 employees.

Powered by WPeMatico

Startups reporters everywhere rejoiced Friday morning when the first unicorn S-1 of 2019 emerged from under lock and key for us all to unpack, analyze and enjoy. The TechCrunch office, at least Megan Rose Dickey’s and my corner, was buzzing with excitement, and Crunchbase News editor-in-chief, (my Equity co-host), apparently had to make himself a cup of Earl Grey tea to calm down post-S-1 deep dive.

I’ve already said a lot about the filing on Equity’s latest episode, available here, and in my story on the document, so I will keep this short. Here are the nuts and bolts:

Lyft’s revenue grew from $1.06 billion to nearly $2.2 billion from 2017 to 2018. Lyft’s costs rose dramatically during 2018, compared to the year prior. In fact, Lyft’s total cost profile rose from $1.77 billion in 2017 to a staggering $3.13 billion in 2018. And as far as losses, the business posted a net loss of $911 million in 2018 and $688 million in losses the previous year.

Lyft’s key stakeholders: Rakuten (13% pre-IPO stake), General Motors (7.76%), Fidelity (7.1%), Andreessen Horowitz (6.25%) and Alphabet (5.3%): https://t.co/AQyu18AILQ

— Kate Clark (@KateClarkTweets) March 1, 2019

Onwards.

VCs want to help you get pregnant

This week, I published a sweeping report on startups focused on improving various pain points in a women’s fertility journey. I spent months reporting on the space, learning from the founders of FertilityIQ, Kindbody, Nurx, Natural Cycles and more. Check it out here and be warned, you need an Extra Crunch subscription to read the entire piece. You can purchase an Extra Crunch subscription here.

Despite its mountain of venture capital funding, WeWork confirmed layoffs that affected 3 percent of its global workforce on Friday. The company told TechCrunch the cuts were part of an annual performance review process and that they still plan to wildly increase the size of their workforce in 2019. And while we’re on the subject of layoffs, Rackspace, the hosted private cloud vendor, let go of around 200 workers, or 3 percent of its worldwide workforce of 6,600 employees.

SoftBank’s Vision Fund is pouring $1.5 billion into online car trading group Chehaoduo, which literally means “many cars” in Chinese. The startup, based in Beijing, operates peer-to-peer online marketplace Guazi for used vehicles, and Maodou, which retails new sedans through direct sales and financial leasing. TechCrunch’s Rita Liao reports “the sizable funding round arrived at a time when China’s softening economy is sapping consumer confidence, but the company’s two-pronged strategy makes sure it covers a broad range of consumer demands.”

You thought it was over; Binary Capital has shut down after all. But here’s the latest: Binary co-founder Justin Caldbeck has sued his former co-founder Jonathan Teo, alleging breach of contract, breach of fiduciary duty, fraud and more. Caldbeck, accused of sexual harassment and unwanted sexual advances in 2017, took an indefinite leave of absence from Binary, leaving to Teo all the responsibilities of the $175 million fund. Shortly after, Teo offered to step down in a last-ditch effort to keep the firm afloat. Ultimately, neither of them could save the fallen firm.

Sequoia-backed Medallia raises $70M at a $2.4B valuation

SoFi founder Mike Cagney’s new company Figure just raised another $65M

ThirdLove, the direct-to-consumer lingerie startup, gets a $55M boost

Zum, a ridesharing service for kids, raises $40M

ClassDojo, an app to help teachers and parents communicate better, raises $35M

Presto raises $30M to bring its AI platform and tabletop ordering hardware to restaurant chains

Two Chairs nabs $7M for its client-therapist matching app and brick-and-mortar clinics

Dipsea raises $5.5M for short-form, sexy audio stories

I think tech for seniors will be amongst the hottest sectors for venture capital investment in the next few years, and HAX Labs looks to be on top of the trend. The accelerator program, located in San Francisco and Shenzhen, announced the launch of an initiative targeted at helping startups advance the state of tech for people over the age of 65. The program will invest $250,000 in the startups, as well as provide mentorship, office space, education and the other standard accelerator offerings.

Short answer: No. According to TechCrunch’s Danny Crichton, a shorter term sheet isn’t always better, despite popular beliefs. “Here’s the thing, term sheets have an incredibly important purpose, which is to set forth in clear language the terms of a deal. Unfortunately in modern venture capital, there are a lot of terms that have to be negotiated in any equity round, from financial terms to option pools, to board structure, to voting rights on major business decisions like selling the company, and much more. Simpler term sheets either relegate many of these items to ‘standard venture capital terms apply’ or some other vague language, or just wholly don’t mention them at all.” Keep reading here.

OK, just a little more on the ride-hailing giants before we close out. If you’ve been wondering why Uber and Lyft have been sending you push notifications complete with sweet discounts, here’s the deal: To gain market share in the final weeks ahead of their respective IPOs, Uber and Lyft have been deploying discounts to riders to encourage them to take additional rides. The strategy appears to be working; Lyft reportedly increased its market share from 30 to 34 percent amid the discount campaign.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase editor-in-chief Alex Wilhelm, TechCrunch’s Silicon Valley editor Connie Loizos and I chatted with NEA’s Jonathan Golden about female-founded startup cash, Lyft and Uber’s discounts and more.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

A Chinese startup that’s taking a dorm-like approach to urban housing just raised $500 million as its valuation jumped over $2 billion. Danke Apartment, whose name means “eggshell” in Chinese, closed the Series C round led by returning investor Tiger Global Management and newcomer Ant Financial, Alibaba’s e-payment and financial affiliate controlled by Jack Ma.

Four years ago, Beijing-based Danke set out with a mission to provide more affordable housing for young Chinese working in large urban centers. It applies the co-working concept to housing by renting apartments that come renovated and fully furnished, a model not unlike that of WeWork’s WeLive. The idea is by slicing up a flat designed for a family of three to four — the more common type of urban housing in China — into smaller units, young professionals can afford to live in nicer neighborhoods as Danke takes care of hassles like housekeeping and maintenance. To date, the startup has set foot in 10 major Chinese cities.

With the new funds, Danke plans to upgrade its data processing system that deals with rental transactions. Housing prices are set by AI-driven algorithms that take into account market forces such as locations rather than rely on the hunches of a real estate agent. The more data it gleans, the smarter the system becomes. That layout is the engine of the startup, which believes an internet platform play is a win-win for both homeowners and tenants because it provides greater transparency and efficiency while allowing the company to scale faster.

“We are focused on business intelligence from day one,” Danke’s angel investor and chairman Derek Shen told TechCrunch in an interview. Shen was the former president of LinkedIn China and was instrumental in helping the professional networking site enter the country. “By doing so we are eliminating the need to set up offline retail outlets and are able to speed up the decision-making process. What landlords normally care is who will be the first to rent out their property. The model is also copyable because it requires less manpower.”

“We’ve proven that the rental housing business can be decentralized and done online,” added Shen.

Photo: Danke Apartment via Weibo

Danke doesn’t just want to digitize the market it’s after. Half of the company’s core members have hailed from Nuomi, the local services startup that Shen founded and was sold to Baidu for $3.2 billion back in 2015. Having worked for a business whose mission was to let users explore and hire offline services from their connected devices, these executives developed a propensity to digitize all business aspects, including Danke’s day-to-day operations, a scheme that will also take up some of the new funds. This will allow Danke to “boost operational efficiency and cut costs” as it “actively works with the government to stabilize rental prices in the housing market,” the company says.

The rest of the proceeds will go toward improving the quality of Danke’s apartment amenities and tenant experiences, a segment that Shen believes will see great revenue potential down the road, akin to how WeWork touts software services to enterprises. The money will also enable Danke, which currently zeroes in on office workers and recent college graduates, to explore the emerging housing market for blue-collar workers.

Other investors from the round include new backer Primavera Capital and existing investors CMC Capital, Gaorong Capital and Joy Capital.

China’s rental housing market has boomed in recent years as Beijing pledges to promote affordable apartments in a country where few have the money to buy property. As President Xi Jinping often stresses, “houses are for living in, not for speculation.” As such, investors and entrepreneurs have been piling into the rental flat market, but that fervor has also created unexpected risks.

One much-criticized byproduct is the development of so-called “rental loans.” It goes like this: Housing operators would obtain loans in tenants’ names from banks or other lending institutions allegedly by obscuring relevant details from contracts. So when a tenant signs an agreement that they think binds them to rents, they have in fact agreed to take on loans and their “rent” payments become monthly loan repayments.

Housing operators are keen to embrace such practices because the loans provide working capital for renovation and their pipeline of properties. On the other hand, the capital allows companies like Danke to lower deposits for cash-strapped young tenants. “There’s nothing wrong with the financial instrument itself,” suggested Shen. “The real issue is when the housing operator struggles to repay, so the key is to make sure the business is well-functioning.”

Danke, alongside competitors Ziroom and 5I5J, has drawn fire for not fully informing tenants when signing contracts. Shen said his company is actively working to increase transparency. “We will make it clear to customers that what they are signing are loans. As long as we give them enough notice, there should be little risk involved.”

Powered by WPeMatico

Co-working juggernaut WeWork (now known as the We Company) has laid off 3 percent of its global workforce, or roughly 300 employees, the company told TechCrunch. The heavily funded business, most recently valued at a whopping $47 billion, employs 10,000 people around the world.

Headquartered in New York, the layoffs were performance-related, part of the company’s routine process of shedding underperformers. Among the departments impacted by the cuts were WeWork’s engineering team, product and user experience design.

“Over the past nine years, WeWork has grown into one of the largest global physical networks thanks to the hard work and dedication of our team,” the company said in a statement provided to TechCrunch. “WeWork recently conducted a standard annual performance review process. Our global workforce is now more than 10,000 strong, and we remain committed to continuing to grow and scale in 2019, including hiring an additional 6,000 employees.”

WeWork has raised more than $8 billion in venture capital funding since it emerged to disrupt office sharing. The business is backed significantly by the SoftBank Vision Fund, which invested $2 billion in WeWork as recently as January.

Powered by WPeMatico

The Nordic Web Ventures, the “pre-seed” investment firm founded by Neil Murray in late 2017, has raised a second fund to continue backing very early-stage startups within the Nordic ecosystem.

The remit of the new “Fund II” is largely unchanged from the first fund, promising to write the first cheque of between $50,000 and $75,000 for the most promising founders in the region.

In total, the size of The Nordic Web Ventures’ second fund is $1.5 million, which should see it have enough capital to make another 20 or more investments across the next 18-24 months, making the firm one of the most active investors in the region. Existing portfolio startups from Fund I include Engaging Care, TPH, Uizard, Meeshkan, SafetyWing and Confrere.

In addition to an all-star investor lineup of Fund I LPs returning for a second bite — such as Index’s Martin Mignot, Point Nine’s Christoph Janz and Philipp Moehring and Andy Chung of AngelList — Fund II sees a number of new LPs join. Most notably, perhaps, Skype and Atomico founder Niklas Zennström has invested, in addition to Atomico partner Sophia Bendz, who was previously an exec at Spotify and is already a very active angel investor in the Nordics and beyond.

Revealing that The Nordic Web Ventures plans to raise a much larger fund in the future, Murray tells me the plan for Fund II is to “fundamentally change” the early-stage landscape in one of Europe’s most interesting regions. He says the fund is also a great example of how Europe’s investment landscape is changing, with individuals from major European venture capital firms invested, as well as receiving backing “from some of the Nordic’s most successful entrepreneurs.”

Cue a statement from Atomico’s Sophia Bendz: “Neil and I share the same passion for entrepreneurship and both care a lot about the early stage ecosystem… The Nordic Web Ventures can, through their LP networks and expertise, provide dealflow, hands-on support and advice for Nordic pre-seed and seed companies, something that is super helpful for the founders and that’s what it’s all about in the end, being valuable to the entrepreneurs in a meaningful and relevant way.”

To that end, I’m also told that having raised Fund II, The Nordic Web publication and The Nordic Web Ventures will merge into a single entity, with The Nordic Web’s core focus moving forward “to support and strengthen the Nordic ecosystem through investment, analysis and community.”

Powered by WPeMatico

Figure, a 13-month-old, San Francisco-based company that says it uses blockchain technology to provide home equity loans online in as little as five days, has raised a whole lot of money in not a lot of time: $120 million to date, including $65 million in fresh funding from RPM Ventures and partners at DST Global, with participation from DCG, Nimble Ventures, Morgan Creek and earlier investors Ribbit Capital and DCM.

The money isn’t entirely surprising, given who founded the company — Mike Cagney, who founded SoFi and built it into a major player in student loan refinancing in the U.S. before leaving amid allegations of sexual harassment and an anything-goes corporate culture that saw at least two former employees sue the company.

Today, SoFi has moved on under the leadership of CEO Anthony Noto, a former Twitter executive who is working to reshape SoFi from a lending company into more of a full-fledged financial services company, with savings and checking accounts, as well as exchange-traded funds, all with the aim of making its platform stickier than in the past.

It may be a bigger endeavor than Noto had realized. Though Cagney once predicted the company would IPO in 2018 or 2019, SoFi isn’t even considering a public offering this year, Noto told reporters earlier this week.

Cagney has meanwhile moved on, too, though he still seems set on taking on traditional banks. Indeed, while Figure is providing home loans today — it says it has provided more than 1,500 home equity lines to date — it’s also moving to diversify into new areas, including wealth management, unsecured consumer loans and checking accounts offered (for now) in partnership with an existing bank.

Interestingly, Figure, which employs 100 people, is targeting a very different demographic than did SoFi, as Cagney told American Banker recently. Whereas SoFi marketed to young people earning high salaries, Figure is going after older customers who may not be seeing much in the way of income but have much of their wealth tied up in their homes instead.

Given that older Americans are projected to outnumber children for the first time in history by 2030, according to U.S. census data, Cagney clearly sees the writing on the wall.

Unsurprisingly, he’s not the only one. Other startups trying to make it easier for Americans to borrow against their homes include Point, a roughly four-year-old startup that lends capital to people and receives partial ownership in their homes in return.

Cagney co-founded Figure with his wife, June Ou, who is the company’s chief operating officer. She was previously chief technology officer at SoFi.

As for its culture and lingering questions that customers and potential partners may have about what happened at SoFi, Cagney — who has said he had consensual sexual relationships with female subordinates at SoFi — insists that Figure is benefiting from lessons learned.

At SoFi, he told American Banker, “[W]e grew so fast and we never really understood what we were going to grow into, and culture never took a front seat.” Figure meanwhile has a “very clear adherence to a no-asshole policy.”

Powered by WPeMatico

Forget the office ping pong table, Cherry, a startup in Y Combinator’s latest batch, wants to let employees take company perks into their own hands.

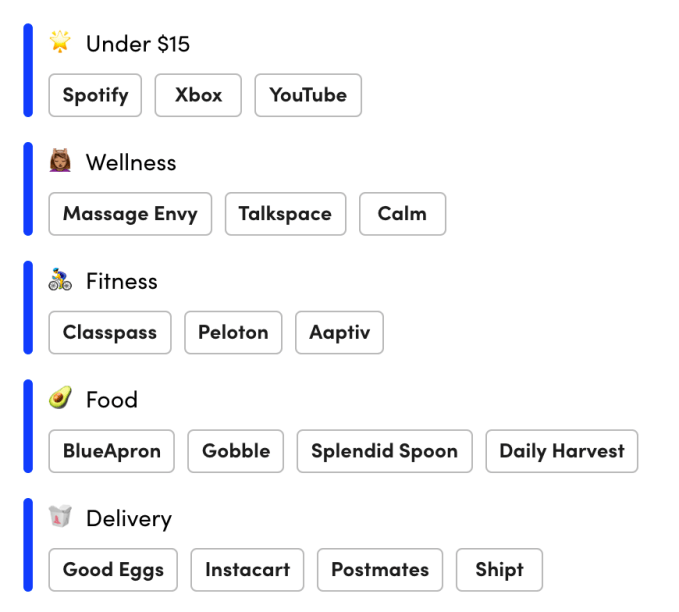

Cherry co-founders (and sisters) Gillian and Emily O’Brien say their Slackbot marketplace will let employees completely personalize the lifestyle benefits they get from their company, allowing them to set up a Spotify Premium account or buy a subscription to Classpass instead of just taking what perks their company dishes out at face value.

Companies will pay huge amounts of money to deliver sweeping employee memberships or build a company gym even if there are only a few people interested in using them. Cherry could potentially eliminate a lot of wasted efforts while still managing to potential recruits. The available subscriptions run the gamut from things like Classpass, Netflix, Spotify, Peloton, Postmates and other services that allow employees to feel like they’re getting.

A sampling of Cherry’s 40+ available services.

“There’s money that [companies] are wasting that they could save by just giving everyone this budget and letting them choose for themselves,” CEO Gillian O’Brien told TechCrunch. “We also feel [our service] really stands out on an offer — it could be a big differentiator in terms of hiring or just having that on a company’s careers page.”

Users set up their own subscription accounts; Cherry handles paying for employee perks via gift codes and lets them make changes to their cyber-benefits whenever they’d like.

Cherry is charging startups $149 per month to manage the first 10 employees with $15 per person. You can designate as little as $15 per month per employee, but given that it costs that much per employee to even use the service, it’s more likely that customers will be throwing down a bit more.

For now, all of this takes place in Slack via a Cherry chatbot, you can pick from available options by tapping buttons; it’s all pretty lightweight and simple.

The service seems like something that would be especially attractive to remote teams, giving employees who aren’t able to stop in for a free lunch or get a monthly massage the ability to treat themselves on company dime. This also enables smaller startups to just throw money at an attractive employee perks solution without having to add more responsibilities to someone’s job.

Cherry’s platform is live now, you can sign-up and check things out on their website.

Powered by WPeMatico

Women’s health has long been devoid of technological innovation, but when it comes to fertility options, that’s starting to change. Startups in the space are securing hundreds of millions in venture capital investment, a significant increase to the dearth of funding collected in previous years.

Fertility entrepreneurs are focused on a growing market: couples are choosing to reproduce later in life, an increasing number of female breadwinners are able to make their own decisions about when and how to reproduce, and overall, around 10% of women in the US today have trouble conceiving, according to the Centers for Disease Control and Prevention.

Startups, as a result, are working to improve various pain points in a women’s fertility journey, whether that be with new-age brick-and-mortar clinics, information platforms, mobile applications, wearables, direct-to-consumer medical tests or otherwise.

Although the investment numbers are still relatively small (compared to, say, scooters), the trend is up — here’s the latest from founders and investors in the space.

Clue, a period and ovulation-tracking app, co-founder and CEO Ida Tin talks at TechCrunch Disrupt Berlin 2017 (Photo by Noam Galai/Getty Images for TechCrunch)

This fall, TechCrunch received a tip that SoftBank, a prolific venture capital firm known for its nearly $100 billion Vision Fund, was investing in Glow, a period-tracking app meant to help women get pregnant. Max Levchin, Glow’s co-founder and a well-known member of the PayPal mafia, succinctly responded to a TechCrunch inquiry regarding the deal via e-mail: “Fairly sure you got this particular story wrong,” he wrote. Glow co-founder and chief executive officer Mike Huang did not respond to multiple requests for comment at the time.

Needless to say, some semblance of a SoftBank fertility deal got this reporter interested in a space that seldom populates tech blogs.

Femtech, a term coined by Ida Tin, the founder of another period and ovulation-tracking app Clue, is defined as any software, diagnostics, products and services that leverage technology to improve women’s health. Femtech, and more specifically the businesses in the fertility and contraception lanes, hasn’t made headlines as often as AI or blockchain technology has, for example. Probably because companies in the sector haven’t closed as many notable venture deals. That’s changing.

The global fertility services market is expected to exceed $21 billion by 2020, according to Technavio. Meanwhile, private investment in the femtech space surpassed $400 million in 2018 after reaching a high of $354 million the previous year, per data collected from PitchBook and Crunchbase. This year already several companies have inked venture deals, including men’s fertility business Dadi and Extend Fertility, which helps women freeze their eggs.

“In the last three to six months, it feels like investor interest has gone through the roof,” Jake Anderson-Bialis, co-founder of FertilityIQ and a former investor at Sequoia Capital, told TechCrunch. “It’s three to four emails a day; people are coming out of the woodwork. It feels like somebody shook the snow globe here and it just hasn’t stopped for months now.”

Dadi, Extend Fertility and FertilityIQ are among a growing list of startups in the fertility space to crop up in recent years. FertilityIQ, for its part, provides a digital platform for fertility patients to research and review doctors and clinics. The company also collects data and issues reports, like this one, which ranked businesses by fertility benefits. Anderson-Bialis launched the platform with his wife, co-founder Deborah Anderson-Bialis, in 2016 after the pair overcame their own set of infertility issues.

Anderson-Bialis said he has recently fielded requests from seed, Series A and growth-stage investors interested in exploring the growing fertility market. His company, however, has yet to raise any outside capital. Why? He doesn’t see FertilityIQ as a venture-scale business, but rather a passion project, and he’s skeptical of the true market opportunity for other businesses in the space.

Powered by WPeMatico

Customer experience management platform Medallia has filed to raise up to $70 million in Series F funding, according to regulatory documents obtained by the Prime Unicorn Index. The new shares were priced at $15 apiece, valuing the nearly two-decades-old business at $2.4 billion.

Medallia confirmed the funding. A previous version of this report pinpointed Medallia’s valuation at $1.7 billion.

Medallia is expected to finally transition to the public markets in 2019, a year chock-full of high-profile unicorn IPOs. The downsized round, which is less than half of its Series E funding, will likely be Medallia’s final infusion of private investment.

San Mateo-headquartered Medallia, led by newly appointed chief executive officer Leslie Stretch, operates a platform meant to help businesses better provide for their customers. Its core product, the Medallia Experience Cloud, provides employees real-time data on customers collected from online review sites and social media. The service leverages that data to provide insights and tools to improve customer experiences.

Leslie Stretch, president and CEO of Medallia (PRNewsfoto/Medallia)

According to PitchBook, Medallia boasts a particularly clean cap table, especially for a roughly 18-year-old business. It’s backed by four venture capital firms: Sequoia Capital, Saints Capital, TriplePoint Venture Growth and Grotmol Solutions, the latter which invested a small amount of capital in 2010. Medallia has raised a total of $268 million in equity funding, including a $150 million round in 2015 that valued the company at $1.25 billion.

Prior to hiring Stretch to lead the company to IPO, Medallia co-founder Borge Hald ran the company as CEO since its 2001 launch. Hald is now executive chairman and chief strategy officer.

Powered by WPeMatico