Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Wefox Group, the Berlin-based insurtech startup behind the consumer-facing insurance app and carrier One and the insurance platform Wefox, has raised $125 million in Series B funding. Notably, the round is led by Abu Dhabi government-owned Mubadala Ventures (which is also an LP in SoftBank’s Vision Fund) and is the first investment from Mubadala’s newly created European Investment Fund. Chinese investor Creditease also participated.

The investment, which Wefox Group says is the first tranche in the Series B round, will be used for expansion into the European broker market. The German company will also grow its product and engineering teams, specifically in relation to applying “advanced data analytics” to realise Wefox’s vision for an all-in-one insurance platform that places personalisation at the heart of how various insurance coverage is sold and delivered.

Wefox’s existing investors include Target Global, Salesforce Ventures, Seedcamp, Idinvest and Hollywood actor Ashton Kutcher’s investment vehicle Sound Ventures. The startup raised $28 million in Series A funding in late 2016.

In a call with Wefox Group co-founder and CEO Julian Teicke, he disclosed that Wefox has grown its revenues to around $40 million since being founded in 2014. The company now serves more than 1,500 brokers and more than 400,000 customers, making it “Europe’s number one insurtech platform.”

As it exists today, Wefox Group consists of two main products and subsidiaries: Wefox, and One.

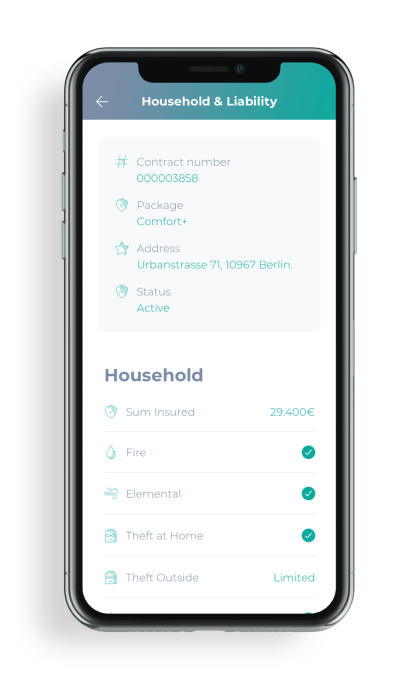

Wefox is a platform that connects insurance providers, brokers and customers in an attempt to drag the insurance industry into the digital age. Rather than bypass human brokers entirely, Wefox lets independent brokers on-board their existing customers onto the platform to help deliver a better experience and more easily manage their clients’ coverage.

Efficiencies are achieved through a degree of automation, helping a broker scale the admin side of their business while also ensuring customers get the most appropriate coverage. From a consumer’s perspective, the Wefox app and website also acts as a “digital” wallet, where they can store details of the various insurance coverage to which they have subscribed.

Teicke says that about 80 percent of customers on the Wefox platform come via brokers. The remaining 20 percent sees customers sign-up direct. In this scenario, Wefox effectively acts as a lead generation or matching service for local brokers.

One is a direct-to-consumer fully digital insurance provider, offering various personal insurance coverage — and is only one of multiple insurance providers that reside on the Wefox platform and can be recommended by brokers. Teicke says it is also modular in design, letting customers select areas of coverage and essentially plugging in additional coverage based on their needs and appetite for risk at any given time. This includes pioneering the use of IoT and other data, customer permitting, to make insurance coverage proactive rather than reactive.

One is a direct-to-consumer fully digital insurance provider, offering various personal insurance coverage — and is only one of multiple insurance providers that reside on the Wefox platform and can be recommended by brokers. Teicke says it is also modular in design, letting customers select areas of coverage and essentially plugging in additional coverage based on their needs and appetite for risk at any given time. This includes pioneering the use of IoT and other data, customer permitting, to make insurance coverage proactive rather than reactive.

“The modular, timestamp and IoT triggered product design will be the role model for all insurance incumbents,” says Teicke. Related to this, Wefox Group plans to make the underlying technology of One available to other insurance providers so they too can plug proactive insurance provision into the Wefox platform, based on specific cohorts, scenarios and specialist coverage.

Ultimately, the grand vision and big bet — and no doubt what attracted such large amounts of capital into this Series B round — is that insurance will transition to a platform play, fueled by responsibly harnessing various types of data. The will see a platform exist to deliver the right coverage at the right time from a multitude of providers rather than the outdated and disparate model that exists today.

“Our hypothesis is that insurance will be massively impacted by the IoT data revolution,” says Teicke. “Insurers will have access to an exponentially grown number of real-time variables in order to price insurance products in real time. This trend will change insurance from a pure financial service to a service that offers proactive advice to reduce risk and consists of a financial service component only as an add-on to the core business model.”

Meanwhile, the new round of funding draws a line under a particularly tough period for Wefox Group after it was threatened with a lawsuit by New York-based insurance platform Lemon. The complaint, filed in the U.S. District Court Southern District of NY, alleged that Wefox reverse-engineered Lemonade to create One, and infringed Lemonade’s intellectual property. Ultimately, however, the dispute panned out to be a “much ado about nothing,” with Lemonade quietly dropping the lawsuit a few months later.

Powered by WPeMatico

Blueground, the startup providing turnkey flexible rental apartments, has raised $20 million in a round led by Athens-based VentureFriends, with participation from Endeavor Catalyst, Dubai’s Jabbar Internet Group and serial entrepreneur Kevin Ryan. Ryan — who helped found MongoDB, Gilt Groupe, Zola and others — will also join Blueground’s board of directors.

It’s no secret that remote work and frequent business travel are becoming more and more commonplace. As a result, a growing number of people are shying away from lengthy rental or lease commitments and are instead turning to companies like Blueground for more flexible short-term solutions.

Blueground is trying to be the go-to option for individuals moving or traveling to a city for as little as a month, or any duration longer. Similar to flexible office space providers, Blueground partners with major property owners to sign long-term leases for units it then furnishes and rents out with more flexible terms.

Users can rent listings for anywhere between one month to five years, and rates are set on a monthly basis, which can often lead to more favorable prices over medium-to-long-term stays relative to the short-term pricing structures commonly used by hospitality companies.

CEO Alex Chatzieleftheriou is intimately familiar with the value flexible leasing can unlock. Before founding Blueground, Chatzieleftheriou worked as a consultant for McKinsey, where he was frequently sent off to projects in far-off cities for months at a time — living in 15 cities over just seven years.

However, no matter how much time Alex logged in hotels, he constantly felt the frustration and mental strain of not having a stable personal living arrangement.

“I spent so much time in hotels but they never really resembled a home. They didn’t have enough space or enough privacy,” Chatzieleftheriou told TechCrunch. “But renting an apartment can be a huge pain in these cities. They can be hard to find, they usually have a minimum rental term of a year or more, and you usually have to deal with filling out paperwork and buying furniture.”

Knowing there were thousands of people at his company alone dealing with the same frustrations, Alex launched what would become Blueground, beginning with a handful of apartments in his home city of Athens, Greece.

Chatzieleftheriou and his team structured the platform to make the rental process as seamless as possible for the needs of flexible renters like himself. Through a quick plug-and-play checkout flow — more similar to the booking process for a hotel or Airbnb — renters can lock down an apartment without having to deal with the painful, costly and time-consuming traditional rental process. Tenants are also able to switch to any other Blueground listing during their rental period if their preferences change or if they want to explore different locations during their stay.

Every Blueground listing also comes completely furnished by the company’s design team, so renters don’t have to deal with buying, transporting — and eventually selling — furniture. And each apartment comes outfitted with digital and connected infrastructure so that tenants can monitor their apartment and arrange maintenance, housekeeping and other services directly through Blueground’s mobile app.

The value proposition is also fairly straightforward for the landlords Blueground partners with, as they avoid costs related to marketing and coordinating with fragmented brokers to fill open units, while also benefiting from steady rental payments, tenant vetting and free property management.

The offering certainly seems to be compelling for renters — while Chatzieleftheriou initially focused on serving business travelers and those moving for work, he quickly realized the market for flexible leasing was in fact much bigger. Blueground’s sales have tripled over the past three years and after its expansion in the U.S. last year, Blueground now hosts 1,700 listings in 10 cities across three continents.

“The trend of flexible and seamless real estate is bigger and is happening everywhere,” Chatzieleftheriou said. “A lot of people throughout the real estate sector really want this seamless, turnkey, furnished solution.”

To date, Blueground has raised a total of $28 million and plans to use funds from the latest round for additional hiring and to help the company reach its goal of growing its portfolio to 50,000 units over the next five years.

Powered by WPeMatico

The French government has unveiled a complete overhaul of the French Tech Visa for employees working for a tech company. And France is taking a contrarian stance by making it easier to come work in France.

Let’s start with the big number. According to French Tech Mission director Kat Borlongan, there are more than 10,000 startups that meet the requirements to access the French Tech Visa and hire foreign employees more easily. (And if you live in the European Union, you don’t need a visa, of course.)

I asked Borlongan why it was important to overhaul the French Tech Visa. “Because our startups needed it,” she told me. “There are two dimensions to that. There’s the economic supply-demand part — all the high-growth startups we interviewed pretty unanimously said that hiring was their number one priority and that they were looking for profiles that weren’t readily available in France.”

“The second is cultural. As strong an ecosystem as the French Tech is becoming, it’s still perceived as overwhelmingly French. To succeed globally, we need to become global ourselves, in terms of team composition, mindset, markets, etc.”

Unlike many American visas, you don’t need to prove that you’ve been looking for candidates in France. You don’t need to pay crazy-high immigration lawyer fees — the French Tech Visa costs €368 in administrative fees. Future employees don’t need to meet any diploma requirement.

The previous version of the visa was limited to roughly 100 companies that were selected as part of the Pass French Tech program. Employees also had to graduate with a master’s degree. So it’s a huge change.

And it’s a pretty sweet deal for foreign employees as well. Your visa is valid for four years and renewable after that. You don’t have to stay in the same company — you can work for another company and keep your visa. Your family also gets visas so they can come with you.

If your startup has raised money from a VC fund, has been part of an accelerator, has received state funding or has the JEI status, then you’re eligible.

La French Tech and the French government have created various lists of VC funds, accelerators, grants, etc. If you meet one of those conditions, you can apply to the visa program. You’ll find most VC funds and accelerators based in France (but not all of them), as well as a few foreign companies (Y Combinator, 500 Startups, Techstars, Entrepreneur First, Plug and Play, Startupbootcamp). Those lists will be updated multiple times per year.

Startups that want to take advantage of the French Tech Visa need to complete an online form first — the full list of VC funds and accelerators is embedded in the form. Future employees can then get their visa from their home country at the French Consulate.

The French tech ecosystem has been growing rapidly. And many French startups have chosen to work in English and hire foreign talent. Tech talent is becoming a global talent pool, so this visa scheme is essential for the future of the French tech ecosystem.

Powered by WPeMatico

San Francisco-based mobile banking startup Chime announced this morning it has raised an additional $200 million in Series D financing led by DST Global, valuing its business at $1.5 billion. The oversubscribed round also included participation from new investors Coatue, General Atlantic, ICONIQ Capital and Dragoneer Investment Group, along with existing investors Menlo Ventures, Forerunner Ventures, Cathay Innovation and others.

To date, Chime has raised approximately $300 million, including last year’s $70 million Series C, which then saw the company valued at $500 million.

With the new funding, Chime has now raised the most funding and has the highest valuation among other U.S. challenger banks.

The company is now one of several going after a younger, millennial audience who no longer sees the need for banks with physical branches, and who are sick of being nickel-and-dimed by bigger banks’ numerous fees. Like others in this space, Chime offers a “no fees” bank account, which won’t penalize users for things like dropping below a minimum balance or even overdrafts.

On top of this is a modern-day banking app with features that make it look like it was actually built by a technology company — not a traditional bank. That’s because its team’s background is a mix of both tech and finance. Chime’s co-founder and CEO Chris Britt previously worked at Flycast, was an early comScore employee and worked at Visa and Green Dot; co-founder and CTO Ryan King spent time at Plaxo and Comcast before Chime.

Chime also includes a couple of innovative features that help differentiate it from the other mobile banking apps on the market. This includes an automatic savings feature that rounds up purchases to pocket the change; another feature that automatically saves 10 percent of your paycheck into Chime’s savings account; and one that offers a no-fee paycheck advance that makes your money available sooner.

To date, customers have opened more than 3 million FDIC-insured bank accounts on Chime, which makes it the largest brand in its category, the company claims. (This appears to be true. SoFi had 500,000 members as of last year. Simple doesn’t disclose its account base beyond “hundreds of thousands.” Moven and Varo Money are smaller, according to American Banker’s round-up.)

Its size, scale and growth trajectory, perhaps, have aided Chime in poaching a few execs from its other fintech businesses — including rivals. For example, the company recently added Chime VP, Risk Brian Mullins, who was the former head of Risk Ops at Square; and Chime GM, Lending Aaron Plante, who was the former Business Unit leader for Student Loans at SoFi.

The company says it plans to use the new investment to continue to accelerate growth and launch new products, including those in lending and credit. It also plans to double its San Francisco-based team to more than 200 employees and expand its leadership.

“We’re excited to welcome some of the world’s leading growth investors to Chime,” said Britt in a statement about the funding. “Banking should be free, helpful and easy to use but traditional banks are reluctant to embrace this reality. We aim to set a new standard in the industry by using technology to create services that are truly aligned with the best interests of consumers.”

Powered by WPeMatico

Soldo, the London-based fintech startup that offers a multi-user spending account primarily for businesses, has secured an Electronic Money Institution licence from Ireland’s Central Bank, a move the company says is designed to mitigate against the uncertainty of Brexit.

The Accel-backed company is currently licensed by U.K. financial regulator the FCA and benefits from so-called “passporting,” European Union regulation that lets a company regulated in one EU country offer financial services across the whole of the EU and other EAA countries. That arrangement could come to an abrupt end post-Brexit, leaving Soldo unable to service its European customers, which it says represents half of its business.

Explains Soldo: “The E-Money licence enables Soldo to operate its services smoothly during a time of unprecedented turbulence in the business and political sphere and demonstrates the company’s commitment to providing uninterrupted enterprise level financial technology services for businesses of all sizes. With the licence the company will be able to issue payments in Ireland across the European Union under passporting rights.”

Furthermore, in a move that Soldo says will ensure it is Brexit-ready whatever the outcome of ongoing Brexit talks, the company plans to migrate to Ireland the accounts of its EU customers, as well as the team that supports them, from its U.K.-regulated E-Money Institution.

“It’s crazy to think we’ve been forced to work for a year and a half on a hugely complex project, mostly duplicating something that we had already, to prepare our business for something that may or may not happen,” says Soldo co-founder and CEO Carlo Gualandri.

In an email, Gualandri told me he chose Ireland because it was a recognised jurisdiction with a “high reputation,” and has the benefit of being an English language country with a similar legal system to the U.K. and strong ties to the U.K., where Soldo is headquartered.

Asked how much of Soldo’s staff will be moved to Ireland, Gualandri says that after March — the official Brexit deadline — all of the company’s financial services activities related to EU market customers will be managed from Ireland, meaning that the new Irish team will quickly grow to around 10 people, a mixture of relocations and new hires.

“Given that we will continue to serve the U.K. from our FCA-regulated entity initially, all this will just be a duplication, but over time as we expand in Europe most of the personnel growth in our financial services organisation will happen in Dublin,” he adds. “All this would have been based in London but Brexit forced us to change our plans because in a regulated business the people must be located where you are legally established.”

And although Gualandri says he is “delighted” to have passed the robust checks that an Irish license entails, there are a number of other uncertainties related to Brexit that could heavily affect the business. They include issues around data transfer and processing, taxation and, of course, freedom of movement or the ability to hire talent from abroad.

“We have a diverse workforce with a lot of internal mobility and that will become much more difficult if not impossible,” he tells me. “I actually just did the process to obtain settled status myself (and my family) and luckily I have been in the U.K. for quite a long time but some of our younger people are much less confident.”

Given all of the above, does Gualandri have a message for the U.K. government?

“My message to the U.K. government would be this: We just spent a huge amount of time, energy and money (that as a startup is a very very scarce resource) to be ready for Brexit but we don’t know if it will ever happen, or if yes, how and when. So if it happens I’ll be relieved to have done the right thing for the business even though I’ll personally be very sad as a person living in this country. If it doesn’t happen I’ll be personally happy but I’ll have to face the responsibility that I have wasted my company’s time and money by doing the ‘proper’ thing.

“How can we have come to the point where something so big and impactful on the country and the lives of everybody has been managed without any level of planning whatsoever. It is hard to believe this has happened and is still happening today.”

Powered by WPeMatico

Eargo wants to become the ultimate consumer hearing brand.

The company’s small and virtually invisible direct-to-consumer hearing aids, which come in an AirPods-style chargeable case, are designed to help destigmatize hearing loss. One month after revealing its newest product — the Eargo Neo ($2,550), which can be customized remotely via the case’s Bluetooth connectivity — the startup has closed a $52 million Series D, bringing its total raised to date to $135 million.

The latest round of capital comes from new investor Future Fund (Australia’s sovereign wealth fund) and existing investors NEA, the Charles and Helen Schwab Foundation, Nan Fung Life Sciences and Maveron.

Headquartered in San Jose, Eargo, which counts 20,000 users, will use the cash to continuing crafting and innovating new products targeting baby boomers. The newly launched Eargo Neo is the business’s third line of high-tech hearing aids. The first, Eargo Plus ($1,450), was released in 2017 and the Eargo Max ($2,150) was launched the following year.

“We can see that the product is really making a difference for users,” Eargo chief executive officer Christian Gormsen told TechCrunch. “We have the opportunity to really create a leading brand in the consumer hearing health space.”

Roughly 48 million Americans, or 20 percent of the population, suffer from hearing loss, but, aside from some Medicare Advantage programs, insurance companies provide no reimbursement for hearing aids. Despite high price tags — this is expensive tech — Eargo’s priority is still to make its hearing aids as accessible as possible and to send a message that there’s nothing wrong with admitting to hearing loss.

“Getting a hearing aid feels like admitting a defeat, like there’s something wrong with you, but that’s not true, hearing loss is natural and happens,” Gormsen said. “The number one challenge for the entire industry is awareness. There is so little knowledge about hearing loss out there; it’s such a stigmatized category and how do you change that? The current channel doesn’t do anything to address it, the only way you can address it is through education and communication.”

“I think we’ve come far, but we are looking at 48 million Americans and we are still barely scratching the surface.”

Powered by WPeMatico

Quip, the dental care startup, is releasing a new product aimed toward kids. Similar to the electric toothbrush it makes for adults, the kids’ brush features a timer that pulsates every 30 seconds and automatically turns off after two minutes.

The main differences between the brush for kids and one for adults is the non-slip grip plastic handle, smaller brush head and new colors. Quip for kids costs $25 for a brush head starter set with a flavored toothpaste subscription ($10 every three months) or $30 with a starter set and brush head subscription ($5 every three months).

“If we’re going to fulfill our mission of improving oral health for every age, it’s better to cast those habits and form those habits at an early age,” Quip CEO Simon Enever told TechCrunch. “And build right habits before you’re nine years old.”

Quip began as a subscription-based electric toothbrush service that replaces toothpaste and brush heads, partly because you’re apparently supposed to change your toothbrush every three months. Since its launch, Quip has steadily evolved its offerings by inviting dentists to join the platform to connect with Quip’s consumer subscribers.

“The features dentists were asking for was the same Quip for kids,” Enever said. “Knowing that the timer and pulses would guide basic habits, the biggest thing dentists wanted was getting kids to want to brush their teeth. That would be the win.”

Last May, Quip raised $10 million and acquired dental insurance startup Afora to live inside Quip Labs, the startup’s venture studio. The idea with Labs is to fuel innovation in oral health products, platforms and services. This brush for kids, however, is Quip’s first new product since launch.

That’s thanks to Quip’s $40 million funding round back in November. At the time, Enever told me Quip had a lot of new products and services launches ahead of it. To date, Quip has raised more than $60 million in funding.

Powered by WPeMatico

Last month, Coinbase’s acquisition of blockchain analytics startup Neutrino was criticized because of the founders’ ties to a controversial surveillance technology company called Hacking Team. Today Coinbase CEO Brian Armstrong said in a blog post that employees of Neutrino who previously worked at Hacking Team will transition out of Coinbase instead of joining its team in London as originally planned.

Neutrino maps blockchain networks, focusing on crypto token transactions, and one of its main services is working with law enforcement to track stolen digital assets, investigate ransomware attacks and analyze activity on the “darknet.” Before launching Neutrino, CEO Giancarlo Russo, CTO Alberto Ornaghi and chief research officer Marco Valleri worked at Hacking Team, a security and surveillance tech company that has been criticized for selling products to governments with a history of human rights violations, including Egypt, Kazakhstan, Russia, Saudi Arabia, Sudan and Turkey. As The Intercept reported in 2015, Hacking Team’s malware has also been found on the computers of activists and journalists.

The close link between Hacking Team and Neutrino concerned many members of the blockchain community. Amber Baldet, CEO of Clovyr and the former lead of JP Morgan’s blockchain program, told Motherboard that “given the number of accounts Coinbase has opened, how they choose to implement compliance tools and their relationship with law enforcement will impact a lot of people.”

In his post, Armstrong said there was “a gap in our diligence process” while Coinbase was shopping for a blockchain analytics startup to acquire.

“While we looked hard at the technology and security of the Neutrino product, we did not properly evaluate everything from the perspective of our mission and values as a crypto company,” he wrote. “We took some time to dig further into this over the past week, and together with the Neutrino team have come to an agreement: those who previously worked at Hacking Team (despite the fact that they have no current affiliation with Hacking Team), will transition out of Coinbase. This was not an easy decision, but their prior work does present a conflict with our mission. We are thankful to the Neutrino team for engaging with us on this outcome.”

“Coinbase seeks to be the most secure, trusted, and legally compliant bridge to cryptocurrency,” he added. “We sometimes need to make practical tradeoffs to run a modern, regulated exchange, but we did not make the right tradeoff in this specific case. We will fix it and find another way to serve our customers while complying with the law.”

Coinbase achieved an $8 billion valuation last October after raising a $300 million Series E and is focused on broadening its user base from consumers to institutional investors. Neutrino’s eight employees had planned to move to Coinbase’s office in London as part of the acquisition.

Powered by WPeMatico

Several weeks after a sudden shutdown left customers and vendors in the lurch, meal-kit service Munchery has filed for bankruptcy. In the Chapter 11 filing, Munchery chief executive officer James Beriker cites increased competition, over-funding, aggressive expansion efforts and Blue Apron’s failed IPO as reasons for its demise.

Munchery owes $3 million in unfulfilled customer gift cards and another $3 million to its vendors, suppliers and various counterparties, the filing reveals. The company’s remaining debt includes $5.3 million in senior secured debt and convertible debt of approximately $23 million. Munchery says its scrounged up $5 million from a buyer of its equipment, machinery and San Francisco headquarters.

The business had raised more than $100 million in venture capital funding, reaching a valuation of $300 million in 2015 before ceasing operations on January 22 and laying off 257 employees in the process. Munchery was backed by Menlo Ventures, Sherpa Capital, e.Ventures, Cota Capital and others.

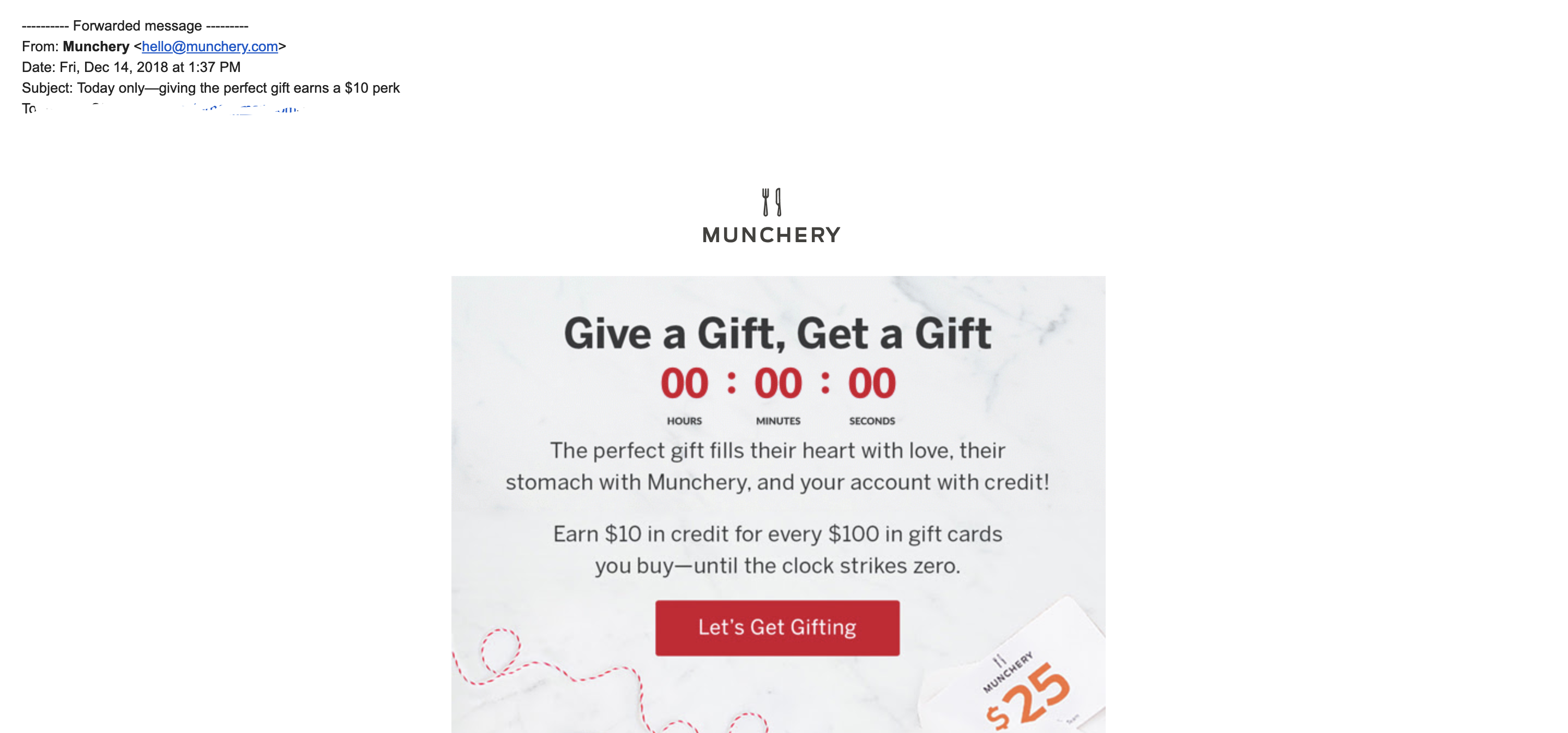

The company, which failed to notify its vendors it was going out of business, has been scrutinized for failing to pay those vendors in the wake of its shutdown. To make matters worse, emails viewed by TechCrunch show Munchery continued aggressively marketing its gift cards in emails sent to customers in December, weeks before a final email to those very same customers announced it was ceasing operations, effectively immediately.

An email advertising Munchery gift cards sent to a customer weeks before the startup went out of business.

The latest court filings shed light on Beriker’s decision-making process in those final months, touching on Munchery’s frequent pivots, the company’s 2017 layoffs, its plans to scale sales of Munchery products in Amazon Go stores and failed attempts at a sale. Beriker is the sole remaining Munchery board member. He has not responded to several requests for comment from TechCrunch.

In the third quarter of 2018, Munchery, at the recommendation of its board, hired an investment bank to find a buyer for the startup, to no avail. Beriker suggests the lack of a buyer, coupled with industry trends like larger-than-necessary venture capital rounds and inflated valuations, were cause for the startup’s failure to deliver.

“The company expanded too aggressively in its early years,” the filing states. “The access to significant amounts of capital from leading Silicon Valley venture capital firms at high valuations and low-cost debt from banks and venture debt firms, combined with the perception that the on-demand food delivery market was expanding quickly and would be dominated by one or two brands– as Uber had dominated the ridesharing market– drove the company to aggressively invest in its business ahead of having a well-established and scalable business model.”

Increased competition from well-funded competitors drove the startup off course, too, and the epic failure that was Blue Apron’s IPO, which had a “material negative impact on access to financing for startups in the online food delivery business,” was just the cherry on top, according to Beriker’s statements.

Former Munchery vendors protested today at @sherpa, one of the startup’s investors that’ve stayed silent as former employees, vendors and drivers claim to be owed thousands: “Startup idea don’t steal pies!” Photo by @ThreeBabesBake pic.twitter.com/kfaOZ9CFkq

— Kate Clark (@KateClarkTweets) January 30, 2019

Munchery’s vendors, who were not notified or paid following Munchery’s announcement, have provided outspoken criticism to the company and venture capital’s lack of accountability in the weeks following Munchery’s shutdown. Lenore Estrada of Three Babes Bakeshop, among several vendors owed thousands of dollars in unpaid invoices, orchestrated a protest outside of Munchery investor Sherpa Capital’s offices in January. She said she has spoken with Beriker and founding Munchery CEO Conrad Chu in an attempt to pick up the pieces of the failed startup puzzle.

“None of us who are owed money are going to get anything,” Estrada told TechCrunch earlier today. “But the CEO, after fucking it all up, is still getting paid.”

Beriker, indeed, is still earning a salary of $18,750 per month, one-half of his pre-bankruptcy salary, as well as a “success fee based on the net proceeds recovered from the sale of the company’s assets up to a maximum of $250,000,” the filing states.

View the full bankruptcy filing here:

Powered by WPeMatico

Glossier, known for its line of understated makeup products and a cult-following of millennial Instagrammers, is getting colorful with the launch of its first spin-off brand, Glossier Play.

The company — led by founder and chief executive officer Emily Weiss, who built the nearly $400 million business from a makeup blog called Into The Gloss — has raised a total of $92 million in venture capital funding from top-tier consumer investors Forerunner Ventures, Index Ventures and IVP. Stitch Fix founder Katrina Lake and Forerunner founder and general partner Kirsten Green, are among the company’s board members.

Weiss introduced Glossier in 2014 as a clean-skincare and natural beauty advocate. Today, the direct-to-consumer business boasts a growing line of barely there makeup, designed to mimic Weiss’s own subtle, au naturale vibe. The launch of Glossier Play, inspired by 1970s’ nostalgia, is its first foray into bright colors, glitter and, in the brand’s own words, “dialed-up extras.”

Glossier Play’s initial line-up of “extras” includes colored eyeliners ($15), highlighters ($20), multi-purpose glitter gel ($14) and the “Vinylic Lip” ($16). Customers can purchase “The Playground,” a set that includes each of the new products, for $60.

Introducing Glossier Play! A brand of dialed-up beauty extras that make getting ready the best part about going out. Four new makeup products at https://t.co/4PxDM67E2R pic.twitter.com/ULRrc9Ycn3

— Glossier (@glossier) March 4, 2019

The advertising campaign for the Instagram -friendly line will be led by none other than Instagram star Donté Colley, as well as pop musician Troye Sivan. The new line and future spin-offs will help Glossier compete with beauty incumbents, Estée Lauder and L’Oréal, for example, in a market estimated to be worth $750 billion by 2024.

Glossier, headquartered in New York, counts 200 employees, meager in comparison to its nearly 2 million — and growing — social media following. The company surpassed $100 million in annual revenue in 2018, it tells TechCrunch, and acquired 1 million new customers. In total, Glossier retails 29 products across skincare, makeup, body, and fragrance.

The company won’t be introducing additional brands this year and clarified it is not a brand incubator.

Powered by WPeMatico