Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

As the streaming world continues to grow, startups are looking to take advantage of the opportunity and grab a slice of the pie, and indeed create new revenue models around it entirely.

Camelot, a YC-backed startup, is one of them.

Camelot allows viewers to place bounties on their favorite streamers, putting a monetary value on the things they want to see on stream. This could include in-game challenges like “win with no armor,” as well as stream bounties like “Play Apex” or “add a heartbeat monitor to the stream.”

When a viewer posts a bounty, other viewers can join in and contribute to the overall value, and the streamer can then choose whether or not to go through with it from an admin dashboard.

Because internet platforms can often be used for evil alongside good, cofounder and CEO Jesse Zhang has thought through ways to minimize inappropriate requests.

There is an option for streamers to see and approve the bounty before it’s ever made public to ensure that they avoid inappropriate propositions. Bounties are also paid for up front by viewers, and either returned if the creator declines the bounty or pushed through when the streamer completes the task, raising the barrier to entry for nefarious users.

Camelot generates revenue by taking a five percent stake in every bounty completed.

The platform isn’t just for Twitch streamers — YouTubers can also get in on the mix using Camelot and making asynchronous videos around each bounty. Not only does it offer a new way to generate revenue, but it also offers content creators the chance to get new insights on what their viewers want to see and what they value.

Cofounder and CEO Jesse Zhang believes there is opportunity to expand to streamers and YouTube content creators outside of the gaming sphere in the future.

For now, however, Camelot is working to bring on more content creators. Thus far, streamers and viewers have already come up with some interesting use cases for the product. One streamer’s audience bought his dog some treats, and one viewer of Sa1na paid $100 to play against the streamer himself.

Camelot declined to share how much funding it has received thus far, but did say that lead investors include Y Combinator, the Philadelphia 76ers, Soma Capital, and Plaid cofounders William Hockey and Zach Perret.

Powered by WPeMatico

Venture investors are pouring billions of dollars into feeding their hunger for food and agriculture startups. Whether that trend line is due to enthusiasm for the sector or just broader heavy investing in the VC space is much less clear.

According to a recent report published by AgFunder – a VC and investing marketplace focused on the agriculture and food sectors – the “AgriFood” space is booming. Using data from Crunchbase and several other data partners, the organization published its “2018 AgriFood Tech Investing Report” this morning, finding that investment in AgriFood companies increased 43% year-over-year, reaching $16.9 billion in 2018.

AgFunder classifies AgriFood tech as “the small but growing segment of the startup and venture capital universe that’s aiming to improve or disrupt the global food and agriculture industry.” Their definition is intentionally broad, encompassing everything from crop and livestock biotech, property management systems, and payments, to biomaterials and meat alternatives, all the way up to tech platforms for restaurants, grocers, deliveries and at-home cooks.

While some of the AgriFood tech categories – such as delivery or restaurant software – have long been popular destinations for venture capital, we’re now seeing a more diverse array of startups innovating across the entire food supply chain. According to the report, expansion in AgriFood is fairly consistent across upstream (agricultural and farming) subsectors to downstream (more consumer-facing) subsectors, with each group growing roughly 44% and 42% year-over-year respectively.

The data also shows growth occurring across almost all deal stages. AgriFood saw huge increases in the average deal size and total investment for late-stage companies in particular, as venture-backed startups have grown to global scale. And penetrating and attracting capital from international markets seems more feasible than ever. AgriFood investing, which traditionally has been largely US-centric, is rapidly becoming a global phenomenon, with more than half of total funding – and some of the largest rounds – now coming from companies and investors outside the US.

Powered by WPeMatico

When we first wrote about Hooch, it offered a fun, straightforward deal — for $9.99 per month, you could claim one free drink per day from participating bars and restaurants.

Since then, the company launched Hooch Black, a pricier subscription that includes perks like hotel discounts and concierge service. But even then, co-founder and CEO Lin Dai was hinting at plans to use blockchain technology to create what he called “a decentralized model for consumer rewards.”

Now Hooch is delivering on what Dai promised, with a relaunched app that rewards users for their purchases.

“We were super excited about the feedback and response [to Hooch Black] that we saw from our members,” Dai said. “What we decided to do is just completely update the app with rewards for consumers across four different categories — travel, dining, entertainment and e-commerce.”

He noted that while most loyalty programs reward you for using a specific card or for shopping with a specific company, Hooch has partnered with more than 250,000 merchants (including Marriott hotels, TAO restaurants, Starbucks, Uber and Amazon). The company can actually scan the purchases made on any linked debit or credit card, and you’ll be rewarded whenever you spend money with those partners.

The rewards take the form of what Hooch is calling TAP rewards dollars — the exact reward will vary depending on the merchant, but the company says it could be as high as 10 percent of your spending.

Lin Dai, CEO of Hooch

Dai said TAP dollars are actually a stablecoin pegged to the U.S. dollar, but he emphasized that you don’t need to understand the backend to use the rewards. For most users, TAP dollars will simply be a digital currency they can redeem for hotel bookings, restaurants credits and gift cards.

“Security is our top concern,” Dai added. The idea is to access your transaction history to verify your purchases (Hooch makes money by driving purchases for merchants), but without storing or sharing identifying information. “When we capture the consumer purchase information, we actually don’t capture any of their names or credit card numbers … We don’t store any identity.”

The program also comes with a big perk for enlisting your friends. There is an upfront reward of five TAP dollars, but the real selling point is the fact that you’ll get 20 percent of their rewards — not just on their initial purchases, but for the entire time they use the app.

If you like the Hooch Black plan, you’ll still be able to sign up and pay for it. But the company’s emphasis has shifted to the broader rewards program, which you can join for free.

Powered by WPeMatico

Three miles from Seattle’s South Lake Union neighborhood — better known as Amazonia to locals — sits Pioneer Square. The original heart of the city, the area has managed to hold on to its decades-old charm as other parts of town are besieged by Amazon-contracted architects.

On a mission to champion Seattle’s unique entrepreneurial DNA, startup studio Pioneer Square Labs has not only adopted the neighborhood’s moniker but established its fast-growing HQ at its center.

Pioneer Square Labs, or PSL, cropped up in 2015 to create, launch and fund technology companies headquartered in the Pacific Northwest. Operating under the startup studio model, PSL’s team of former founders and venture capitalists, including Rover and Mighty AI founder Greg Gottesman, collaborate to craft and incubate startup ideas, then recruit a founding CEO from their network of entrepreneurs to lead the business. The team uses an innovative method of rapidly ideating, testing and, if necessary, scrapping ideas, dubbed its “validation engine.”

The model differs from an accelerator or incubator. Y Combinator, for example, admits existing business into its months-long program, deploying its expertise and capital to bolster early-stage startups. PSL, on the other hand, creates startups and provides would-be founders with a derisked platform for company building.

“It’s a dream job,” PSL co-founder Greg Gottesman told TechCrunch. “If someone would say to you ‘hey, you can come into work every day, think about all the problems that are interesting to solve, all the tech that’s available and you have the resources to build companies,’ that’s just a dream come true … It’s just been a very fun ride.”

Xiao Wang, the CEO of Pioneer Square Labs spin-out Boundless, pitching at TechCrunch Disrupt SF 2017

The startup studio model is working for PSL. To date, it has raised $27.5 million in equity funding to build out its platform, in addition to an $80 million fundraise for its debut venture fund, which invests in PSL companies and other Pacific Northwest businesses. Of the 13 companies to emerge from PSL in the last three years, all have raised follow-on rounds from venture capital firms at an aggregate valuation of $200 million. According to PitchBook, PSL companies comprised 14.3 percent of all early-stage VC deals in Washington state in 2018.

Among PSL’s portfolio companies are cloud security compliance platform Shujinko, which closed a $2.8 million seed round from Unusual Ventures, Defy Ventures, Vulcan Capital and more last year. Plus, Boundless, a platform that facilitates the process of applying for immigrant status in the U.S., and Tally, a sports-prediction app spearheaded by football star Russell Wilson. Other recent spin-outs include Remarkably, a marketing and analytics software provider, and Attunely, a debt-collection-tech platform.

Pioneer Square Labs’ growing team of former operators, VCs, data scientists, engineers and more

Greg Gottesman, a former managing director at Seattle VC fund Madrona Venture Group, and the founder of its startup studio Madrona Venture Labs, leads PSL alongside a team of seasoned Pacific Northwest investors and entrepreneurs.

Rounding out PSL’s team of managing directors is Julie Sandler, a former investor at Madrona; Geoff Entress, a former venture partner with Voyager Capital and Madrona; Mike Galgon, the founder of the Microsoft-acquired digital agency aQuantive; and T.A. McCann, a serial entrepreneur behind Google-acquired Senosis and BlackBerry-acquired Gist. Ben Gilbert, who runs product at PSL, is another Madrona alum.

After nearly two decades investing in early-stage startups at Madrona, Gottesman made a peaceful exit with ambitions to launch a scalable startup studio independent of any existing VC firm. Madrona, alongside an additional 13 venture firms and Seattle angel investors, like Jeff Bezos and Zillow -founder Rich Barton, bolstered PSL with seed capital right off the bat.

Pioneer Square Labs’ network of entrepreneurs

To differentiate itself from competing company builders and maintain a high level of efficiency, PSL uses a proprietary strategy of rapidly testing and validating business ideas dubbed its “validation engine.” Its special sauce, PSL leverages digital marketing to validate customer demand before they begin real work on any of their ideas.

Long-time marketer Peter Denton leads the effort. Denton, who joined PSL in early 2017, manages day-to-day market validation, growth strategies and market research for the firm’s portfolio companies.

“We joke in some ways [Denton] is the grim reaper,” PSL’s Ben Gilbert told TechCrunch. “He’s responsible for much more kills than anyone else.”

Among the validation engine’s strategies is to build a website for a “company” to test demand for a potential product. Denton and his team market the website to target customer segments through a variety of digital channels, then measure customer resonance with the messaging. They ask potential customers if they are interested in learning more about a new concept or product when it “becomes available” to help understand how much interest a potential business might have before PSL allocates additional time and resources to a project.

To date, PSL has killed more than 100 ideas.

“A lot of studios ultimately won’t be successful because they don’t kill things fast enough,” Gottesman explained. “We kill nine out of 10 of the companies we start. Most of our ideas don’t make it to the promised land.”

In a sense, they are catfishing potential customers, luring them in with a new idea that more than likely will never come to fruition. But the strategy saves PSL the heartache that comes with investing a lot of time into a business idea that never finds its market.

A glimpse of Seattle’s Pioneer Square neighborhood where Pioneer Square Labs is headquartered

In three years, PSL has spun-out 13 companies, ideas for six of which came from the PSL team and seven originated from founders in the PSL network. All of those companies have secured venture funding — $71 million in total for an aggregate valuation of $200 million.

“The most important lesson we learned is it’s all about the people and the talent,” Gottesman said. “If we have an A-plus idea and partner with a B team, the company isn’t going to be successful. On the other hand, if we partner with the best talent, we are likely to be successful even if we fail on other dimensions.”

PSL’s goal is to invigorate the Seattle tech ecosystem and given the aforementioned stats (PSL companies comprised 14.3 percent of all early-stage VC deals in Washington state in 2018) they are well on their way. In 2019, PSL hopes to spin out between six and nine additional businesses.

“We believe we are building the center for early-stage tech innovation in the Pacific Northwest,” PSL’s Julie Sandler told TechCrunch.

Seattle, home to two of the most valuable businesses in the world, has not created as many founders as anticipated. Amazon’s entrepreneurial culture has succeeded in keeping top talent from pursuing their own businesses. PSL’s derisked platform, the firm hopes, will entice those founders, like Boundless CEO Xiao Wang, a former senior product manager at Amazon.

“The studio model lends itself really well to people who are 99 percent there, thinking ‘damn, I want to start a company,’” Gilbert said. “These are people that are incredible entrepreneurs but if not for the studio as a catalyst, they may not have [left].”

Venture capital investment in Washington state is increasing year-over-year, reaching a high of nearly $3 billion in 2018 across roughly 400 deals, per PitchBook. The Seattle tech scene, given its proximity to tech heavyweights and a growing number of satellite engineering offices, only has room to grow.

“We do think Seattle is the most exciting market in the country because of the amount of technical talent you have,” Gottesman said. “You have to believe that if engineering is at the heart of these startups then Seattle will ultimately be a key city in the world in terms of creating great technology startups.”

“We think part of the issue is a lack of capital and a lack of help,” Gottesman added. “If we can provide a little bit of both of those things, we can really put Seattle where it deserves to be, should be and will be.”

Powered by WPeMatico

A court in Paris has dismissed a case against Airbnb, as Le Monde reported. Last month, the City of Paris sued Airbnb for 1,010 illegal listings. According to the mayor’s office, Airbnb failed to comply with regulation in Paris.

Paris has been trying to limit the effect of Airbnb on the housing market in Paris. Paris is one of the top cities for Airbnb in the world. A few years ago, many people stopped renting their apartments the traditional way in favor of Airbnb. The average rental price in some areas of Paris has increased as a result.

Mayor of Paris Anne Hidalgo didn’t want to ban Airbnb altogether. Instead, the city asked hosts to get an ID number so the city can track how many nights someone is listing their apartment on Airbnb. You can’t rent an apartment more than 120 days a year.

But many listings still don’t have that ID number. The mayor’s office flagged around 1,000 apartments, saying that Airbnb was also responsible by dragging their feet.

But the court has said that screenshots are not enough to prove that these apartments without an ID number are permanently available on Airbnb. Maybe some of these apartments are available for less than 120 days a year, after all.

The case is not over, as this is just a summary judgement. But it sounds like the case is not strong enough to condemn Airbnb.

Powered by WPeMatico

Farming incubator Square Roots is announcing a new partnership today with food distribution giant Gordon Food Service.

Square Roots has built urban farming facilities in refurbished, climate-controlled shipping containers, which it uses to grow food and train farmers in a year-long program.

Until now, it has operated out of a single location in Brooklyn, which meant you could only purchase Square Roots from select locations in New York City, and it was only working with 10 farmers in each cohort. CEO Tobias Peggs (who founded Square Roots with Kimbal Musk) said this partnership changes all that.

The idea is to open Square Roots locations in or near Gordon Food Service’s distribution centers and retail stores across North America, and then to sell the resulting produce through the food distributor’s channels.

The companies aren’t revealing how many locations they’re planning to launch, or when they’ll open, but Peggs described it as “a long-term partnership,” adding, “There is a lot of potential with this partnership. They’re coast-to-coast in Canada, with big swaths in the United States.”

Peggs suggested that by working together, Square Roots and Gordon are answering a growing demand for locally grown food “at scale, across big swaths of the country.”

Gordon Food Services CEO Rich Wolowski made a similar point in the announcement, saying, “Customers want an assortment of fresh, locally grown food all year round. We are on a path to do that at scale with Square Roots and are excited to be the first in the industry to offer this unique solution to our customers.”

Why work with Square Roots? Peggs said the company’s approach requires less water and space than outdoor farms, while also requiring less investment than other indoor farming technologies, thanks to its “modular approach.”

“Certainly, it’s less of a dollar number to add a farm in a shipping container than it is to build a big plant factory,” he said. “What we’re able to do is very cost effectively, just-in-time deploy that capital expense.”

While this deal will allow Square Roots to expand, Peggs said the company will continue to operate its own facilities and handle its own sales in Brooklyn, and the company could still take a similar approach “in other markets where it just makes sense to go direct.”

Powered by WPeMatico

Tia, the company that launched with an app providing health advice and period tracking for women, has launched its first clinic.

From its first location in New York, the two founders of Tia hope they can build a network of care facilities that integrate all of the information their app collects with the benefits of having in-person consultations with physicians that have a holistic view of their patients’ health.

For founders Carolyn Witte and Felicity Yost, the hurdles women need to overcome to receive adequate treatment aren’t theoretical — they’ve faced them directly.

Witte and Yost met a decade ago in college and remained friends ever since. It was when Witte had to diagnose herself with polycystic ovarian syndrome (PCOS), a condition that affects nearly one in 10 women, that she first realized how broken the healthcare system was for more than half of the U.S. population.

“It’s one of those classic issues in healthcare that’s really difficult to diagnose… I spent three years seeing gynecologists, who were treating the symptom and failing to connect the dots,” Witte recalls. “I found myself at age 25 at a fertility specialist in NYC after I diagnosed myself on the internet… and got this really unfortunate diagnosis.”

As someone who worked at Google and had access to what was supposed to be the best healthcare services in the world, Witte realized there were significant gaps between the understanding of healthcare for men and women. “Here I am feeling completely alone and confused… that was the moment for me when I said there has to be a better way.”

Witte moved back to San Francisco and moved in with Yost and began working on what would become the Tia app.

Initially the app was focused on providing advice to women around sexual health and gynecological issues, eventually expanding to include a period tracker and other tools. Now, with the expansion into the clinical space, Tia’s founders see it as the culmination of their evolution as a company.

“I wanted to build a brand company that makes women feel heard,” says Witte. “We wanted to build a one-stop-shop solution that solves the lack of soul in healthcare.”

With that mission accomplished, the next step is to grow.

Growth at the kind of scale that Witte and Yost envision requires capital, which the two women have received in the form of $6 million in capital commitments from a slew of some of venture capital’s best investors, including John Doerr, Homebrew, Combine, Compound, Torch Capital, Canaan Partners and Define Ventures (Lynne Chou O’Keefe from Kleiner Perkins).

“Tia is a revolutionary company that is changing the way women view and access healthcare. Now, with the launch of the first Tia Clinic, they’re introducing a new model of women’s care that will shift the landscape with convenience, compassion, and personalization,” said Lynne Chou O’Keefe, in a statement.

That sentiment is bound up in the branding of the business. Although neither woman is Latinx, they called their company Tia after the Spanish word for aunt — which, can be expanded to include any trusted relationship among women (whether or not they’re actually related), according to Witte.

The decision to expand from an application into physical clinics was bound up in the use cases the two women saw when they launched their service. “We found very quickly after launching the product that women were hacking Tia and bringing their phones into their gynecologist’s office,” Witte says.

At the newly launched Tia clinic, which opens today at its first location in New York near Madison Square Park, the company is providing full-stack care delivery, including gynecological exams, primary care and wellness.

The company charges a $150 membership fee, but its services are covered under insurance. Tia currently accepts Aetna, Cigna, Humana, Oscar, United Oxford/United Healthcare and Empire Blue Cross Blue Shield.

Treatment at the Tia Clinic is informed by the data that the company’s application collects on its users, both Witte and Yost say. Women can come to the clinic for services ranging from holistic annual exams to IUD insertions to treatment for chronic migraines, alongside more mundane services like flu shots and strep throat treatments.

If Tia users track their cycle and daily health and wellness through the app, that can be shared with their Tia Clinic physicians to inform care. The medical service at this point doesn’t integrate other period-tracking apps into its health data.

At the center of Tia’s clinical care is the notion that the menstrual cycle is broadly associated with physiological and emotional manifestations that can inform and effect treatment.

Tia isn’t the only company that is trying to bring information and data specific to women’s health into a clinical setting. In Oakland, NextGen Jane is using tampons embedded with sensors to diagnose severe health problems, like endometriosis.

And investors are pouring money into period-tracking and fertility apps and services around the country and around the world.

As we wrote earlier this month:

Femtech, a term coined by Ida Tin, the founder of another period and ovulation-tracking app Clue, is defined as any software, diagnostics, products and services that leverage technology to improve women’s health. Femtech, and more specifically the businesses in the fertility and contraception lanes, hasn’t made headlines as often as AI or blockchain technology has, for example. Probably because companies in the sector haven’t closed as many notable venture deals. That’s changing.

The global fertility services market is expected to exceed $21 billion by 2020, according to Technavio. Meanwhile, private investment in the femtech space surpassed $400 million in 2018 after reaching a high of $354 million the previous year, per data collected from PitchBook and Crunchbase. This year already several companies have inked venture deals, including men’s fertility business Dadi and Extend Fertility, which helps women freeze their eggs.

“In the last three to six months, it feels like investor interest has gone through the roof,” Jake Anderson-Bialis, co-founder of FertilityIQ and a former investor at Sequoia Capital, told TechCrunch. “It’s three to four emails a day; people are coming out of the woodwork. It feels like somebody shook the snow globe here and it just hasn’t stopped for months now.”

For Tia, the benefits of understanding menstrual health extend far beyond fertility.

“Women’s health is cyclic and changes every single day of a woman’s cycle,” says Yost. With that said, the company is only just now starting to do clinical research to test the validity of its thesis. “For us to be able to do any sort of clinical research on women is very, very challenging,” says Yost. “All of these things can take a really long time because it takes so much information to diagnose.”

For investors like Homebrew’s Hunter Walk, companies like Tia sit at the intersection of a few promising trends — but the investment was driven by the passion the founders expressed for the mission they were on.

“Women and specifically millennial women and younger are increasingly becoming targeted by venture-backed companies,” says Walk. “For years and years and years that audience was unrecognized and underserved… [But with Tia] what we saw was a checkbox on the founders and their abilities. They checked the box on the audience… and because they were going not just with generic women’s health but cycle-targeted women’s care, we thought that was the right and differentiated approach thinking about healthcare for women.”

Powered by WPeMatico

Red Cat, a startup that wants to store drone flight data on the blockchain to guarantee immutability, announced the second beta of its drone data platform today.

Jeff Thompson, CEO of Red Cat, says in 2017 he was looking at what was holding back the commercial drone business and the need for a black-box kind of system became apparent to him. The so-called black box is really a flight recorder that tracks data about a flight. He believed he could create a platform to reproduce this capability for drones and store it on the blockchain to take advantage of the immutability of blockchain data.

“People want to be able to have some accountability and trackability to be able to start utilizing our information, whether it’s regulators or insurance companies, guys that have to write checks if you do a lot of damage,” Thompson told TechCrunch.

This tool could help these interested parties should there be an investigation into a crash, a near-miss with a plane or an incident like the drone that shut down Gatwick Airport in London last year. They can check the record in Red Cat and be assured that the data they are viewing is accurate and hasn’t been tampered with in any way.

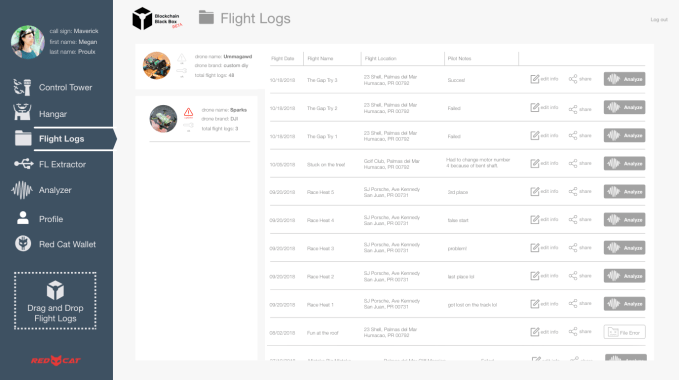

Flight logs in Red Cat / Screenshot: Red Cat

Thompson believes having a system like this in place is absolutely essential if the industry is going to mature and be able to share airspace with other types of commercial air traffic. The company wants to do more than create the data tracking system, however. It wants to give drone companies detailed insight into exactly what’s happening with their drones as they travel to different destinations.

The goal is to help companies control and monitor their drone traffic and better understand how they are being utilized. The company is still refining all of this. This is actually the second beta, with 200 people actively using it in the first round. The purpose of this new beta is to elicit additional feedback from the drone community, including companies, pilots, regulators and insurance companies that could benefit from having access to data stored in Red Cat.

The company is based in Puerto Rico and has raised $2.2 million to date.

Powered by WPeMatico

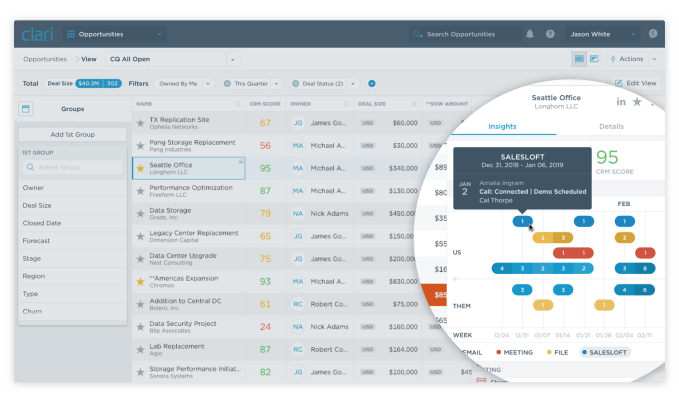

Clari started as a company that wanted to give sales teams more information about their sales process than could be found in the CRM database. Today, the company announced a much broader platform, one that can provide insight across sales, marketing and customer service to give a more unified view of a company’s go-to-market operations, all enhanced by AI.

Company co-founder and CEO Andy Byrne says this involves pulling together a variety of data and giving each department the insight to improve their mission. “We are analyzing large volumes of data found in various revenue systems — sales, marketing, customer success, etc. — and we’re using that data to provide a new platform that’s connecting up all of the different revenue departments,” Byrne told TechCrunch.

For sales, that would mean driving more revenue. For marketing it would it involve more targeted plans to drive more sales. And for customer success it would be about increasing customer retention and reducing churn.

Screenshot: ClariThe company’s original idea when it launched in 2012 was looking at a range of data that touched the sales process, such as email, calendars and the CRM database, to bring together a broader view of sales than you could get by looking at the basic customer data stored in the CRM alone. The Clari data could tell the reps things like which deals would be most likely to close and which ones were at risk.

“We were taking all of these signals that had been historically disconnected from each other and we were connecting it all into a new interface for sales teams that’s very different than a CRM,” Byrne said.

Over time, that involved using AI and machine learning to make connections in the data that humans might not have been seeing. The company also found that customers were using the product to look at processes adjacent to sales, and they decided to formalize that and build connectors to relevant parts of the go-to-market system like marketing automation tools from Marketo or Eloqua and customer tools such as Dialpad, Gong.io and Salesloft.

With Clari’s approach, companies can get a unified view without manually pulling all this data together. The goal is to provide customers with a broad view of the go-to-market operation that isn’t possible looking at siloed systems.

The company has experienced tremendous growth over the last year, leaping from 80 customers to 250. These include Okta and Alteryx, two companies that went public in recent years. Clari is based in the Bay Area and has around 120 employees. It has raised more than $60 million. The most recent round was a $35 million Series C last May led by Tenaya Capital.

Powered by WPeMatico

For a long time, it was the norm for founders to haul their hardware to the 3000 block of Sand Hill Road, where the venture capitalists of “Silicon Valley” would be awaiting their pitches. Today, many of the investors that touted the exclusivity of “The Valley” have moved north to San Francisco, where they have better access to top entrepreneurs.

Y Combinator, a Silicon Valley institution and to many the lifeblood of the startups and venture capital ecosystem, is the latest to pack up shop. YC, which invests $150,000 for 7 percent equity in a few hundred startups per year, is currently searching for a space in SF to operate its accelerator program, sources close to YC confirm to TechCrunch, because the majority of YC’s employees and its portfolio founders reside in the city.

Founded in 2005, YC’s roots are in Mountain View, California. In its first four years, YC offered programs in Cambridge, Massachusetts and Mountain View before opting in 2009 to focus exclusively on The Valley. In late 2013, as more and more of its partners and portfolio companies were establishing themselves in SF, YC opened a satellite office in the city in what would be the beginning of its journey northbound.

The small satellite office, used to support SF-based staff and provide portfolio companies resources and workspace, is located in Union Square. The fate of YC’s Mountain View office is unclear.

YC’s move north will be the latest in a series of small changes that, together, point to a new era for the accelerator. Approaching its 15th birthday, YC announced in September it was changing up the way it invests. No longer would it seed startups with $120,000 for 7 percent equity, it would give startups an additional 30,000 to cover the expenses of getting a business off the ground and it would admit a whole lot more companies.

YC began mentoring its largest cohort of companies to date in late 2018. The astonishing 200-plus group in its winter 2019 batch is more than 50 percent larger than the 132-team cohort that graduated in spring 2018. To accommodate the truly gigantic group at YC Demo Days later this month (March 18 and 19), YC has moved to a new venue, SF’s Pier 48. Historically, YC Demo Days were hosted at the Computer History Museum near its home in Mountain View.

YC has also ditched “Investor Day,” which is typically an opportunity for investors to schedule meetings with startups that just completed the accelerator program. YC writes that the decision came “after analyzing its effectiveness.” On top of that, rumors suggest YC is planning to put an end to Demo Days. Other accelerators, AngelPad for example, put a stop to the tradition last year after realizing demo day was more of a stress to startup founders than a resource. Sources close to YC, however, tell TechCrunch these rumors are categorically false.

YC isn’t the first accelerator to ditch its Silicon Valley digs. 500 Startups, a smaller yet still prolific accelerator, opened an SF satellite office the same year as YC, and in 2018, the nine-year-old program made the decision to permanently relocate to SF. Venture capital firms, too, have realized the opportunities are larger in SF than on Sand Hill Road.

The transition from the peninsula to the city began around 2012, when VC heavyweights like Uber and Twitter-backer Benchmark opened an office in SF’s mid-market neighborhood. Months later, 47-year-old Kleiner Perkins, an investor in Stripe and DoorDash, opened the doors to its new workplace in SF’s South Park neighborhood.

Around that same time a whole bunch of firms followed suit: Shasta Ventures, Norwest Venture Partners, Accel, GV, General Catalyst and NEA opened SF shops, to name a few. Many of these firms, Benchmark, Kleiner and Accel, for example, held onto their Silicon Valley locations. Firms like True Ventures and Peter Thiel’s Founders Fund planted stakes in SF years prior. Both firms have operated SF offices since 2005; True Ventures, for its part, has managed a Palo Alto office from the get-go, as well.

“When we first started, it was [expected] that it would be maybe 60-40 Peninsula to the city; it’s actually turned out to be 80-20 SF to The Valley,” True Ventures co-founder Phil Black told TechCrunch. “For us, it was important to be near our customer: the founder. It’s important for us to be in and around where founders are doing their things.”

The transition out of The Valley is ongoing. Other VC funds are still in the process of opening their first SF offices as more partners beg for shorter commutes. Khosla Ventures, for example, is currently searching for an SF headquarters.

Silicon Valley real estate will likely remain a hot — or warm, at least — commodity, however. Why? Because long-time investors have lives established in that part of the bay, where they’ve built homes in well-kept, affluent cities like Woodside, Atherton and Los Altos.

Still, Y Combinator’s move highlights an increasingly adopted mantra: Silicon Valley isn’t the goldmine it used to be. For the best deals and greatest access to entrepreneurs, SF takes the cake — for now, that is. But with rising rents and a changing attitude toward geographically diverse founders, how long SF will remain the destination for top talent is an entirely different question.

Powered by WPeMatico