Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Vochlea Music, a U.K. startup and alumni of Abbey Road Red, the music tech incubator from Abbey Road Studios, is launching a crowdfunding campaign today for “Dubler Studio Kit,” a new device and app that turns your voice into a MIDI controller for synths, drum machines, DAWs and other music gear.

Described as a “vocal MIDI controller,” the Dubler Studio Kit consists of a bespoke USB microphone and a desktop application for Mac and Windows. It claims to be able to listen to you sing or beatbox and turn those sounds into MIDI notes and other MIDI control messages in real time.

Designed to be responsive enough to use live or for use in a recording studio, with a bit of practice, its makers say you’ll be able to hum a synth pattern (depending on your ability to sing in relative tune), beatbox to trigger a virtual drum kit or manipulate effects and filters vocally.

Vochlea Music demoed an early version of the technology at SXSW last year and won the festival’s pitch competition for its live vocal recognition for music making. While in pre-launch beta testing, Dubler Studio Kit has been used by Mercury Prize-nominated grime MC and producer Novelist, alongside other musicians and producers.

In a call with Vochlea Music founder and CEO George Wright, he explained that the Dubler Studio Kit was created in part to lower the barriers to generating and recording musical ideas, especially for those who are unable to play an instrument.

It’s common for artists, such as singers, to make a vocal note of their melody ideas using the iPhone’s voice memo app or similar mobile recording apps. However, being able to create MIDI notes and other MIDI data using your voice, instead of raw and often badly recorded audio, has the advantage of being able to edit and manipulate those ideas later within MIDI, including patching the resulting MIDI data to different sounds and effects.

Perhaps even more exciting is the way Dubler Studio Kit can be used in addition to playing an instrument, such as a synth or other keyboard, to control various parameters and effects. Traditionally, you have to lift one hand off the keyboard to make tweaks to the sound, or use a foot pedal. Dubler Studio Kit adds a fifth limb, so to speak.

Furthermore, Dubler Studio Kit doesn’t use the VST or Audio Unit plugin format for integration with a DAW. Rather cleverly, once the software is installed, the Dubler Studio Kit is recognised by your Mac or Windows machine as a standard MIDI controller so that it can be used by any software that accepts MIDI, including Logic or Ableton or the hundreds of virtual instruments on the market.

Related to this out of the box experience is the choice to couple the Dubler Studio Kit software with a Dubler-branded low-latency USB microphone. Wright says he wanted to avoid the user needing to have to conduct lengthy calibration with the Dubler machine-learning powered software, which would be the case if third-party microphones were supported.

In the future, that doesn’t prohibit Vochlea Music developing a version of Dubler Studio Kit for iPhone — where device specs are well-known — but will make supporting Android more tricky.

Live on Kickstarter, Vochlea Music wants to raise £40,000 for the Dubler Studio Kit over the next 35 days. During the campaign, backers have the opportunity to pledge to be amongst the first owners of Dubler Studio Kit at what promises to be an early-bird price starting from £175.

Powered by WPeMatico

Time is Ltd., a Prague-based startup offering “productivity software analytics” to help companies gain insights from employees’ use of Slack, Office 365, G Suite and other enterprise software, has raised €3 million in funding.

Leading the round is Mike Chalfen — who previously co-founded London venture capital firm Mosaic Ventures but has since decided to operate as a solo investor — with participation from Accel. The investment will be used by Time is Ltd. to continue building the platform for large enterprises that want to better understand the patterns of behaviour hidden inside the various cloud software on which they run.

“Time is Ltd. was founded… to help large corporations and companies get a view into insights and productivity of teams,” co-founder and CEO Jan Rezab tells me. “Visualising insights around calendars, time and communication will help companies to understand real data behind their productivity.”

Powered by machine learning, the productivity software analytics platform plugs into the cloud software tools that enterprises typically use to collaborate across various departments. It then analyses various metadata pulled from these software tools, such as who is communicating with whom and time spent on Slack, or which teams are meeting, where and for how long as per various calendars. The idea is to enable managers to gain a better understanding of where productivity is lost or could be improved and to tie to business goals changes in these patterns.

Rezab cites the example of a large company undergoing “agile” transformation. “If you want to steer a massive company of 5,000 plus people, you really should understand the impact of your actions a bit more much earlier, not after the fact,” he says. “One of the hypothesis of an agile transformation is, for example, that managers really get involved a bit less and things work a bit more streamlined. You see from our data that this is or is not happening, and you can take corrective action.”

Or it could be something as simple as a large company with multiple offices that is conducting too many meetings. Time is Ltd. is able to show how the number of meetings held is increasing and which departments or teams are instigating them. “You can also show the inter-departmental video meeting efficiency, and if the people, for example, often need to travel to these meetings, how long does that takes versus digital meetings — so you can generally help and recommend the company take specific actions,” explains Rezab.

Sales is another area that could benefit from productivity analytics, with Time is Ltd. revealing that most sales teams actually spend the majority of their meeting time inside the company, not outside as you would think. “The structure of these internal meetings varies; planning for these events or just on-boarding and education,” says the Time is Ltd. CEO. “You can, so to speak, follow the time from revenue to different teams… and then see over time how it changes, and how it impacts sales productivity.”

Meanwhile, investor Mike Chalfen describes the young startup as a new breed of data-driven services that use “significant but under-utilised datasets.” “Productivity is one of the largest software markets globally, but lacks deep enterprise analytics to drive intelligent operational management for large businesses,” he says in a statement.

That’s not to say Time is Ltd. isn’t without competition, which includes Microsoft itself. “Our biggest competitor is Microsoft Workplace Analytics,” says Rezab. “However, Microsoft does not integrate other than MS products. Our advantage is that we are a productivity platform to integrate all of the cloud tools. Starting with Slack, SAP Success Factors, Zoom and countless others.”

Powered by WPeMatico

If you’re like me, you let out a heavy sigh every month or so when you reach out and unexpectedly find an empty bag of coffee. Bottomless, one of the 200-plus startups in Y Combinator’s latest batch, has a solution for us caffeine addicts.

For a $36 annual membership fee, a cost which co-founder Michael Mayer says isn’t set in stone, plus $11.29 per order depending on the blend, Bottomless will automatically restock your coffee supply before you run out. How? The startup sends its members an internet-connected scale free of charge, which members place under their bag of coffee grounds. Tracking the weight of the bag, Bottomless’ scales determine when customers are low on grounds and ensure a new bag of previously selected freshly roasted coffee is on their doorstep before they run out.

Voilà, no more coffee-less mornings.

Founded by Seattle-based husband and wife duo Mayer and Liana Herrera in 2016, Bottomless began as a passion project for Mayer, a former developer at Nike.com. Herrera kept working as a systems implementations specialist until Bottomless secured enough customers to justify the pair working on the project full-time. That was in 2018; months later, after their second attempt at applying, they were admitted into the Y Combinator accelerator program.

Bottomless’ smart scale

Bottomless today counts around 400 customers and has inked distribution deals with Four Barrel and Philz Coffee, among other roasters. Including the $150,000 investment YC provides each of its startups, Bottomless previously raised a pre-seed round from San Francisco and Seattle-area angel investors.

Before relocating to San Francisco for YC, the Bottomless founders were working feverishly out of their Seattle home.

The long-term goal is to automate the restocking process of several household items, like pet food, soap and shampoo. Their challenge will be getting customers to keep multiple smart scales in their homes as opposed to just asking their digital assistant to order them some coffee or soap on Amazon .

Amazon recently announced it was doing away with its stick-on Dash buttons, IoT devices capable of self-ordering on Amazon. The devices launched in 2015 before Google Homes and Amazon Alexas hit the mainstream.

So why keep a smart scale in your kitchen as opposed to just asking a digital assistant to replenish your supply? Mayer says it’s coffee quality that keeps it competitive.

“Some of our most enthusiastic customers live out in like deep suburbs far away from city centers, but they really love fresh coffee,” Mayer said. “And there’s no way to get fresh coffee if you live 20 or 30 minutes from a city center, right?”

“Or you might think in a city like San Francisco or Seattle, you can get freshly roasted coffee pretty easily because there are restaurants all over the place, right?” He added. “That’s certainly true, but it does take a little bit of extra thought to remember to grab it on the right day when you’re running low.”

Mayer and Herrera don’t consider themselves coffee experts, despite now running what is essentially a direct-to-consumer coffee marketplace out of Seattle, the coffee capital.

“I’m originally from Portland and Portlanders know a lot about coffee,” Mayer said. “I never really considered myself to be a coffee aficionado or a coffee snob in my head, but I guess compared to like the average American from anywhere in the country, I would be just a regular coffee drinker in Portland. All I really knew about coffee going into this was that it’s better fresh. That’s it.”

Bottomless is currently accepting customers in beta. The team will pitch to investors at YC Demo Days next week.

Powered by WPeMatico

Unmind, a U.K.-based startup that offers a mental health platform for the workplace, has raised £3 million in new funding. The round is led by London-based venture capital firm Felix Capital, with co-investment from Michael Whitfield and Chris Bruce, the founders of Thomsons Online Benefits.

Founded in 2016, Unmind is a B2B service that provides “clinically backed” tools, training and assessments for company employees in a bid to improve workplace mental health. The digital platform, delivered through the Unmind mobile app, includes bite-sized exercises for “everyday wellbeing,” personalised assessments, and customised programmes for improving areas such as stress, focus, and sleep.

“There is not enough support in society for people’s mental health, and this is especially true in the workplace,” explains co-founder and CEO Dr Nick Taylor, who is a Clinical Psychologist. “Everyone has mental health — and supporting it is integral to a successful workforce — but most provisions are highly reactive and heavily stigmatised, leading to low uptake amongst employees.”

To help remedy this, Unmind is designed to offer a “positive, preventative solution” that anyone can use to bolster their mental health. Designed to be anonymous, Taylor says employees can use the platform to proactively measure, manage and improve their mental health and well-being.

“The digital platform offers personalised assessments, bite-sized tools, online interventions and confidential signposting to other services,” he explains. “Employees can anonymously access Unmind at anytime, anywhere, on any device.”

To date, Unmind has partnered with organisations such as John Lewis & Partners, Made.com, Square Enix, William Hill, Yorkshire Building Society, Thomsons Online Benefits and Pentland Brands, to name just a few. “Unmind is now used in many countries around the world, which is an exciting place to be given the early stage of the company,” says Taylor. “We are focused on working with enterprise clients with 1,000 plus employees.”

Meanwhile, Unmind says the new investment will be used to improve the startup’s “consumer grade, mobile first product,” whilst increasing its library of proprietary content. The broader vision, says the company, is to help create a workplace environment where mental health is “universally understood, nurtured and celebrated.”

Powered by WPeMatico

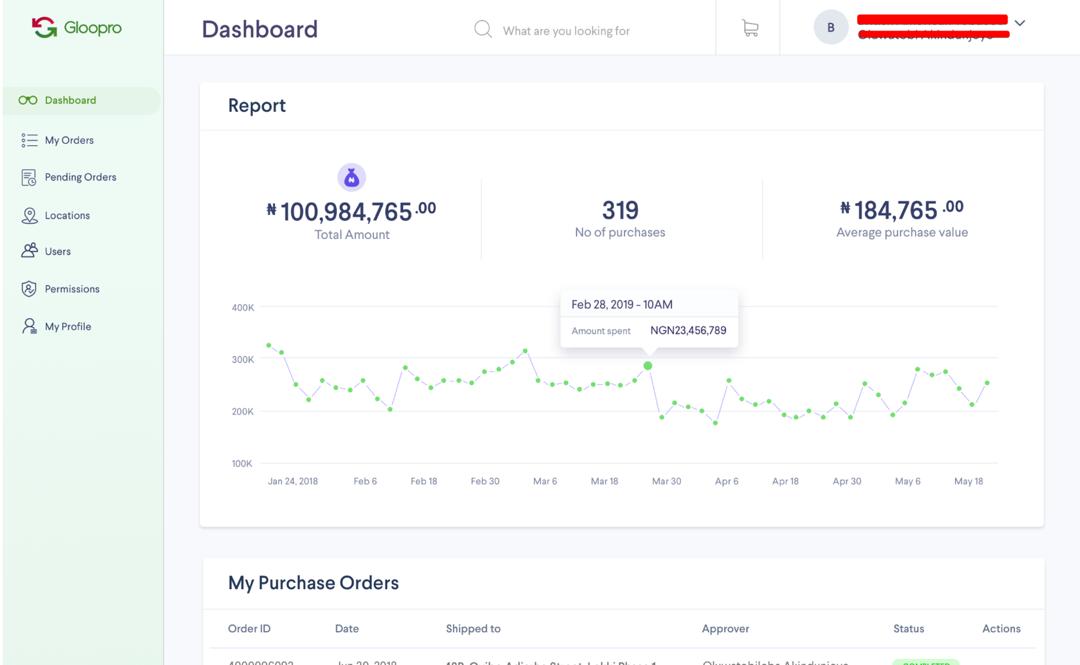

Nigerian startup Gloo.ng is dropping consumer online retail and pivoting to B2B e-procurement with Gloopro as its new name.

The Lagos-based venture has called it quits on e-commerce grocery services, shifting to a product that supplies large and medium corporates with everything from desks to toilet paper.

Gloopro’s new platform will generate revenues on a monthly fee structure and a percentage on goods delivered, according to Gloopro CEO D.O. Olusanya.

Gloopro, which raised around $1 million in seed capital as Gloo.ng, is also in the process of raising its Series A round. The startup looks to expand outside of Nigeria on that raise, “before the end of next year,” Olusanya told TechCrunch.

Gloopro’s move away from B2C comes as several notable consumer digital sales startups have failed to launch in Nigeria — Africa’s most populous nation with the continent’s highest number of online shoppers, per a recent UNCTAD report.

The country is home to the continent’s first e-commerce startup unicorn, Jumia, and serves as an unofficial bellwether for e-commerce startup activity in Africa.

Gloo.ng’s shift to B2B electronic commerce was prompted by Nigeria’s 2016 economic slump and a customer request, according Olusanya.

“When the recession hit it affected all consumer e-commerce negatively. We saw it was going to take a longer time to get to sustainability and profitability,” he told TechCrunch.

Then an existing client, Unilever, requested an e-procurement solution in 2017. “We observed that the unit economics of that business was far better than consumer e-commerce,” said Olusanya.

Gloopro dubs itself as a “secure cloud based enterprise e-procurement and commerce platform…[for]…corporate purchasing,” per a company description.

“The old brand Gloo.ng, is going to be rested and shut down completely. The corporate name will be PayMente Limited with the brand name Gloopro,” Olusanya said.

From the Gloopro interface customers can order, pay for and coordinate delivery of office supplies across multiple locations. The product also produces procurement analytics and allows companies to designate users and permissions.

Olusanya touts the product’s benefits at improving transparency and efficiency in the purchasing process.

“It makes procurement transparent and secure. A lot of companies in Nigeria still use paper invoices and there are some shenanigans,” he said.

Gloopro began offering the service in beta and building a customer base prior to winding down its Gloo.ng grocery service.

In addition to Unilever, Gloopro clients include Uber Nigeria, Cars45 and industrial equipment company LaFarge. Cars45 CEO Etop Ikpe and a spokesperson for Uber Nigeria confirmed their client status to TechCrunch.

Olusanya believes the company can compete with other global e-procurement providers, such as SAP Ariba and GT-Nexus, by “leveraging our sourcing and last-mile delivery experience in Nigeria” and expertise working around local requirements in Africa.

Gloopro expects to hit $4 million in revenue by the end of the year and the company could reach $100 million over the course of its international expansion into countries like South Africa, Kenya, Morocco, Egypt and the Ivory Coast, according to Olusanya. A seed investor briefed on Gloo.ng’s estimates confirmed the company’s revenue expectations with TechCrunch.

Gloo.ng’s pivot to Gloopro and e-procurement comes during an up and down period for B2C online retail in Nigeria, home of Africa’s largest economy.

Last year, e-commerce startup Konga.com, backed by roughly $100 million in VC, was sold in a distressed acquisition, at a loss to investors, including Naspers. In late 2018, Nigerian online sales platform DealDey shut down.

On the possible upside, several outlets reported this year that Jumia — Africa’s largest e-commerce site and first unicorn headquartered in Nigeria — is pursuing an IPO. But that information is unconfirmed based on a February 8, Bloomberg story without named sources. Jumia has declined to comment.

Powered by WPeMatico

Crypto represent a “border-less” asset that anyone can own, but actually getting hold of it isn’t easy for everyone. Amun, a company that wants to make buying crypto as easy as stock, has pulled in $4 million in funding to offer more established channels for crypto ownership.

The startup currently offers punters an ETP (exchange-traded product) on the Swiss Stock Exchange that pulls together five of the most popular crypto assets: Bitcoin, Ethereum, Bitcoin Cash, XRP and Litecoin. HODL — as it is called after “holding” crypto rather than selling it (LOL) — can be purchased just like any stock.

That five-crypto basket is just the start for Amun, which is developing ETPs for other crypto assets individually. The first one is for Bitcoin — ABTC — with others planned to come soon; you’d imagine the usual suspects such as Ethereum and co will follow. Indeed, Amun has licenses to the five crypto assets in HODL as well as EOS.

While the products are ETP and not covered by Collective Investment Schemes Act (CISA), they are protected in custody and by insurance. They are collateralized and backed by an identical amount of crypto assets.

Personally, I’ve been able to buy crypto — just base tokens like Bitcoin and Ethereum rather than company-specific ICO tokens — but it certainly is true that it takes some learning. While, speaking for me and likely many others, exchange-based products aren’t easier to me, it does appeal to more institutionally minded individuals or companies for whom holding an account with an exchange or a crypto wallet isn’t feasible. That’s the target that Amun has in mind, as well as outlier cases, too.

Amun CEO and co-founder Hany Rashwan told TechCrunch that growing up in Egypt, he saw the government ban Bitcoin despite the fact that it offered an alternative to the Egyptian pound, which saw its valuation tank massively in 2016. He believes that products like Amun allow anyone to take part in crypto even when they face local restrictions, as was the case in Egypt and other countries.

“We want to make investing in crypto as easy as buying a stock. Institutional investors around the world are looking for a secure, easy and regulated way of accessing the crypto asset class. Amun’s products do that at a low price in one of the most reputable financial hubs in the world,” Rashwan told TechCrunch.

Investors share his optimism and those who took part in this round include Boost VC founder Adam Draper — son of outspoken pro-Bitcoin VC Tim Draper — Graham Tuckwell, founder of ETFS Capital who built ETF products for gold, and Greg Kidd, co-founder of investment firm Hard Yaka. Four undisclosed family offices also took part.

One reason for their optimism is the fact that Amun is developing technology that could, in theory, be licensed out to allow others to develop their own ETFs.

“We invest a ton of resources in both our product development and underlying tech infrastructure. This allows us to come up with innovative but professional and safe ways of accessing the crypto asset class, as well as do all this on a tech platform that can be used by not just us, but any issuer that wishes to do the same as well,” Rashwan said.

“The world needs a company like Amun to make crypto as easy as buying a stock. Now that they were the first to do that, they can now provide the toolset and be the de facto platform for anyone else looking to take their crypto assets/securities to the public markets,” Draper added.

Still, just giving people access doesn’t guarantee returns — that’s on the crypto market itself.

Last year was a dud across the board in terms of pricing, as Bitcoin, for example, plummeted from a record high of nearly $20,000 at the end of 2017 to $3,930-ish at the time of writing. Plenty in the industry are optimistic that will change as genuine value comes out of blockchain technology.

HODL itself debuted at $15.64 last November; today it is at $12.83

Note: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Powered by WPeMatico

Finding myself talking at a startup conference in Kosovo three years ago (as one does), I realized how close I was to Albania, a place which held some fascination for me. I managed to grab a lift with a friendly techie to Tirana, where they arranged for me to speak to the local tech community. That meetup was held in a small co-working space called Talent Garden. It gradually transpired that, while WeWork and other such co-working/offices spaces were concentrating on New York and London, Talent Garden had been busily populating southern and eastern Europe with a network of spaces crisscrossing the continent.

That strategy has now paid off with their desire to raise money from investors. Today, it announces that it has raised €44 million ($49.5 million) in a funding round led by Italian private equity firm Tamburi Investment Partners alongside Social Capital, Inadco Ventures and a range of European family offices. Tamburi previously led a €12 million funding round for Talent Garden in 2016.

The company, founded in Brescia, Italy in 2011, now plans to expand its co-working and education to places like Spain, Italy, Denmark, Austria and many more countries around Europe, focusing on second or third-tier cities where tech communities tend to grow fastest because costs are lower than in the major capitals.

Talent Garden’s chief executive and co-founder Davide Dattoli now plans to open 20 new international co-working campuses over the next five years and expand the scope of its “Innovation School” in digital training (as an analogy, think a combination of offices and General Assembly) and generating a “second tech ecosystem” around Europe outside London, Paris and Berlin. It’s also a licensee of the SingularityU Summit brand across Italy, Spain and Switzerland, for instance.

So far, it is now present in eight countries and has 23 active campuses with the Talent Garden Innovation School present in five of those countries.

There will, however, be a particular focus on Spain, with new locations in Madrid and Barcelona; France, with one opening planned in 2019; Italy, where it already has more than 10 campuses; and Austria, where it just recently opened.

In 2018, Talent Garden opened a new campus in Dublin as part of a strategic partnership with Dublin City University and also created a joint venture with Rainmaking Loft in Denmark, and has more than three locations across Copenhagen and is now looking for more locations in the Nordic region. Germany, Israel, Benelux and the CEE region are also within its sights. It won’t be ignoring San Francisco, however, with a kind of the “campus” project planned for next year.

Will things be different as Talent Garden tries to make incursions into bigger cities? For starters, WeWork is building from a very expensive base (major capitals) while TG isn’t. There are fewer revenues in these third-tier cities, sure, but geography has been downgraded for startup teams that are well-used to remote working. So TG could try to lock-in members who only need to “pop in” to the major capitals now and again, where TG has a “landing pad” for them to visit. This potentially creates an incursion into WeWork’s space directly from emerging markets and second/third-tier cities.

Powered by WPeMatico

Starling Bank, the U.K. challenger bank founded by banking veteran Anne Boden, is set to open a second U.K. office this summer, where it plans to recruit up to 50 software engineers and up to 100 customer service team members. The planned location is Southampton, on the south coast of England, and will be Starling’s first office outside of London.

In a call with Boden late on Friday, she told me the majority of its Southampton office will be new hires who will be helping to build out the challenger back’s business-banking product. In just less than a year, Starling has garnered more than 30,000 SME business-account sign-ups, adding to around 500,000 consumer current accounts.

The company plans to invest heavily in its business-banking division over the next few years, partly off the back of being awarded a £100 million grant from the Capability and Innovation Fund (CIF), which was set up by Royal Bank of Scotland to fulfill European state aid conditions arising from the bank’s £45 billion U.K. government bailout during the financial crisis.

Boden says that Southampton was chosen as Starling’s new office for its entrepreneurial spirit and high level of tech talent. She says the city is gaining a reputation as a “burgeoning tech hub” and has a growing skilled jobs market and good transport links, including to and from London.

More broadly, she wants Starling to “spread the fintech love” beyond its traditional base of London. There’s an increasing sense that U.K. tech is too London-centric and that the country’s fast-growing tech sector and the employment opportunities it represents should be more evenly distributed.

To that end, Southampton was recently identified in research conducted by global service company CBRE as a technology “Super Cluster” based on the level, concentration and growth of tech-sector employment in the city.

The city’s tech scene is also supported by the University of Southampton (where Tim Berners-Lee was previously Chair of Computer Science) and home to the Web Science Institute, where Dame Wendy Hall is based. Nearby is also “innovation hub” Southampton Science Park, spanning 72 acres and housing a mixture of commercial offices, laboratories and meeting and conferencing facilities.

Meanwhile, the news of a second Starling office comes a month after the challenger bank announced it had raised £75 million (~$97 million) in further funding. The new capital consisted of a £60 million Series C round led by Merian Global Investors, including Merian Chrysalis, with £15 million in follow-on funding from Starling’s existing backer and major shareholder Harald McPike. It brings total funding to date for the London-based challenger bank to £133 million, not including the more recent £100 million CIF grant.

Further forward, I’m told Starling is also committed to opening a second regional contact centre to support its growing customer base of SME businesses and individual current account holders. There was previously talk that Wales, the country from where Boden hails, could be chosen, although the bank is also eyeing up the North of England and the Midlands.

Powered by WPeMatico

Appen just announced that it’s acquiring Figure Eight in an all-cash deal that sees Appen paying $175 million upfront, with an additional payment of up to $125 million based on Figure Eight’s performance this year.

Both companies focus on using crowdsourced labor pools to annotate data, which in turn is used to train artificial intelligence and machine learning — for example, Figure Eight (formerly known as CrowdFlower and Dolores Labs) says its technology has been for everything from mapping to stock photography to scanning receipts for expense reports.

Appen, meanwhile, is a publicly-traded company headquartered in Sydney. CEO Mark Brayan described its technology — and its “crowd” of more than 1 million remote workers — as “highly complementary” to Figure Eight, which he praised for its data annotation and self-serve capabilities.

“We know that to compete and to be able to deliver even higher volumes, we need a richer set of technologies,” Brayan said. “That’s where Figure Eight comes in. They are, in our view, the leader in the market of the platform providers.”

As for what this means for the Figure Eight team, he said, “Everybody stays in place,” and that Appen plans to continue investing in the product.

Brayan also noted that Appen previously acquired another data annotation company called Leapforce in 2017, a move that he said provided the company with greater scale.

“The Figure Eight acquisition is the next step of our evolution,” he said. “Step one was to get bigger, step two is to become much more tech forward, which is what we get with Figure Eight.”

San Francisco-based Figure Eight has raised a total of $58 million in funding, according to Crunchbase, from investors including Trinity Ventures, Industry Ventures, Canvas Ventures and Salesforce Ventures. As CrowdFlower, it launched on-stage at the TechCrunch50 conference nearly a decade ago.

“I’m extremely proud of the team,” said Figure Eight co-founder Lukas Biewald in a statement. “This is a genuine validation of everything we’ve achieved and a great platform for our teams to combine and continue to do amazing things in AI.”

Biewald (a college friend of mine), along with his co-founder Chris Van Pelt, has moved on to a new startup called Weights and Biases, but he remains involved in Figure Eight as chairman. You can watch their TC50 presentation here.

Powered by WPeMatico

In the age of Amazon, where up to 90 percent of all consumers use it to buy goods and Amazon is accounting for a rapidly-growing percentage of a consumer’s total retail spend (along with other giants like Walmart), direct-to-consumer brands — leveraging social media alongside tech-first apps — are emerging as sometimes surprising, but often effective, competition.

In one of the latest developments, London-based celebrity hair colorist Josh Wood — who has worked with the likes of David Bowie, PJ Harvey, Florence Welch, Saoirse Ronan and Elle Macpherson, as well as with fashion designers Miuccia Prada, Donatella Versace and Marc Jacobs (and, disclaimer, me: I tried out his products before agreeing to write this story) — has raised $6.5 million led by Index Ventures, with JamJar Investments and Venrex also participating, to launch his products into cyberspace with the aim of disrupting the at-home hair color industry.

At-home hair color is a huge market that has largely been untouched in terms of innovation. Some 80 percent of women over 25 color their hair, with 75 percent of those doing it at home, working out to an industry worth $20 billion annually.

As with other direct-to-consumer brands, tech is playing a role on multiple levels at Josh Wood, from how the product is developed through to how it will match with consumers, as well as how it is marketed.

But unlike other direct-to-consumer startups, Josh Wood actually put down roots (heh) first in a very non-tech environment.

If you live in London, you might already recognise the name and logo of Josh Wood. Apart from his star list of clients (and the name check he gets in the media for that work), he has already been running his hair coloring business at some scale.

Wood’s products have been adorning a selection of London buses, in part to promote a partnership he’s had for the last year with Boots, a big UK chain of drugstores, where his coloring kits and other products are sold alongside big names like Revlon and L’Oreal.

That partnership has been a big boost for both Wood and Boots so far. Some 240,000 products were sold in the first year, contributing to the first growth spike that Boots has seen in the hair coloring category for more than a decade. (One reason also that the startup attracted the likes of Index, which has been behind other companies that have straddled the worlds of women’s consumer goods and tech, such as Farfetch and Glossier.)

The range of products — which includes hair coloring kits, root concealer products, and color-specific shampoo and conditioners — has been marketed from the start as a new take on hair coloring.

Wood has been working as a colorist himself for some 30 years, and while he has worked with some of the biggest names in women’s hair care in that time — he’d once been a global ambassador for Wella and he is currently global color creative director for Redken — he believes that there is a lot of room for improvement in home coloring.

“You get thousands of boxes of hair colors, and women are usually terrified of making the wrong choice,” he said in an interview. And that’s before you consider how prolonged dying at home can fry your hair if you don’t know what you’re doing, or using the products incorrectly.

Wood’s focus up to this point has been mainly on the product itself. Using his learnings from being a leading colorist, and knowing some of the pros and cons of working with brands that already sell mass-produced consumer goods, he has worked with chemists and other product designers on developing new ranges of shades an add-in product, called “Shade Shot Plus,” that extend the range even further and bring in highlights that are unique to each person’s hair; as well as aftercare products.

Shade Shot Plus has been a particularly notable development. Wood said that up to now the main endgame for producers of at-home hair coloring products has been to create standardised colors that will always look the same on each woman, so that it can be sold more consistently and predictably (think of those slightly macabre locks of hair that you sometimes see hanging in the aisles at drug stores showing “the color”). But the product developers couldn’t standardise how the highlights product would look. That roadblock, Wood said, turned out “to be a gift.”

In fact, standardised color runs counter to how professionals work, and what those who go to professionals want. “No two colors are the same,” he said of Shade Shot Plus “One of the big barriers at home is that women feel they have obvious ‘box color’, cookie-cutter lego hair, but this unlocks that, because the tones deposit differently on everyone’s hair.”

That product development is set to continue. With an approach reminiscent of Third Love how it has redefined shopping for bras by vastly extending the range of bra sizes, the idea will be to extend that color range even further down the line.

“This is the tip of the iceberg in terms of the ideas I’ve got,” he said. “There is a lot to learn from base color and foundation matching. This is a category that has had no innovation for decades and this is just the first iteration.”

But now, with the funding, the plan is to complement that product development with technology to help people find colors that best suit their own preferences — whether it’s for a new color that will go with a specific complexion, or to find the tint that most closely matches the color their hair used to be before it turned grey. At the same time, the aim is to deliver at-home dying in an experience that is more reminiscent of what you get if you pay much more (and spend more time) going to a trusted, professional hair colorist.

“We are pressing heavy on being able to deliver an amazing consultation online that will deliver a bespoke hair color that is very natural and covers grey,” he said. “But at our heart, I’d like to think of us as a brand that cares for the condition of your hair.”

Wood said that he is currently hiring and working with technologists to develop color-finding tools, akin to the kind you might come across in online makeup storefronts, to explore both how a woman (or man) looks, and what she or he is looking for.

This is in progress but the idea, it sounds like, will not only involve computer vision but also machine learning to tap into a bigger database of what “lookalike” complexions and people choose for colors, as well as a database created by Josh Wood itself to match those colors, based on the tinting choices that many professionals would make for those people were they sitting in a chair in a salon.

Wood said that he wanted to raise this money and expand the product as a direct-to-consumer offering because he didn’t think he’d be able to achieve this with something that is sold on a shelf — although the idea will be to complement that, too.

“The reason we are approaching this growth phase from a digital perspective is because we want to develop our business” — the market for at-home coloring is much bigger than professional, in-salon coloring — “but also have a best-in-class consultation tool. I’ve been coloring for nearly 30 years and this is the moment for me to democratize my learnings, and I couldn’t do that without digital. There is no other way to connect with so many consumers, and it’s very difficult to get that element right in a brick-and-mortar point of sale.”

I asked Wood if he would also explore the idea of subscriptions, a la Dollar Shave Club, as part of the mix as well, and his answer was actually a little refreshing and I think is a good sign for how this might develop over time.

“We are less keen on subscriptions and more keen that women feel we’re in the bathroom with them every time, monitoring how their hair color changes over time. We want something much deeper than just selling the same thing to them once a month.”

Powered by WPeMatico