Startups

Auto Added by WPeMatico

Auto Added by WPeMatico

Deep learning involves a highly iterative process where data scientists build models and test them on GPU-powered systems until they get something they can work with. It can be expensive and time-consuming, often taking weeks to fashion the right model. New startup Determined AI wants to change that by making the process faster, cheaper and more efficient. It emerged from stealth today with $11 million in Series A funding.

The round was led by GV (formerly Google Ventures) with help from Amplify Partners, Haystack and SV Angel. The company also announced an earlier $2.6 million seed round from 2017, for a total $13.6 million raised to date.

Evan Sparks, co-founder and CEO at Determined AI, says that up until now, only the largest companies like Facebook, Google, Apple and Microsoft could set up the infrastructure and systems to produce sophisticated AI like self-driving cars and voice recognition technologies. “Our view is that a big reason why [these big companies] can do that is that they all have internal software infrastructure that enables their teams of machine learning engineers and data scientists to be effective and produce applications quickly,” Sparks told TechCrunch.

Determined’s idea is to create software to handle everything from managing cluster compute resources to automating workflows, thereby putting some of that big-company technology within reach of any organization. “What we exist to do is to build that software for everyone else,” he said. The target market is Fortune 500 and Global 2000 companies.

The company’s solution is based on research conducted over the last several years at AmpLab at the University of California, Berkeley (which is probably best known for developing Apache Spark). It used the knowledge generated in the lab to build sophisticated solutions that help make better use of a customer’s GPU resources.

“We are offering kind of a base layer that is scheduling and resource sharing for these highly expensive resources, and then on top of that we’ve layered some services around workflow automation.” Sparks said the team has generated state of the art results that are somewhere between five and 50 times faster than the results from tools that are available to most companies today.

For now, the startup is trying to help customers move away from generic kinds of solutions currently available to more customized approaches, using Determined AI tools to help speed up the AI production process. The money from today’s round should help fuel growth, add engineers and continue building the solution.

Powered by WPeMatico

Automation Hero, formerly SalesHero, has secured $14.5 million in new funding led by Atomico, with participation by Baidu Ventures and Cherry Ventures. As part of the deal, Atomico principal Ben Blume will join the company’s board of directors.

The automation startup launched in 2017 as SalesHero, giving sales orgs a simple way to automate back-office processes like filing an expense report or updating the CRM. It does this through an AI assistant called Robin — “Batman and Robin, it worked with the superhero theme, and it’s gender neutral,” co-founder and CEO Stefan Groschupf explained — that can be configured to go through the regular workflow and take care of repetitive tasks.

“We brought computers into the workplace because we believed they could make us more productive,” said Groschupf. “But in many companies, people spend a lot of time entering data and doing painful manual processes to make these machines happy.”

The idea was to give salespeople more time to actually do their job, which is selling to clients. If all the administrative and repetitive “paperwork” is done by a computer, human employees can become more productive and efficient at skilled tasks.

By weaving together click robots, Automation Hero users can build out their own workflows through a no-code interface, tying together a wide variety of both structured and unstructured data sources. Those workflows are then presented in the inbox each morning by Robin, the AI assistant, and are executed as soon as the user gives the go-ahead.

After launch, the team realized that other types of organizations, beyond sales departments, were building out automations. Insurance firms, in particular, were using the software to automate some of the repetitive tasks involved with filing and assessing claims.

This led to today’s rebrand to Automation Hero.

Groschupf said that by automating the process of filling out a single closing form, it saved one insurance firm’s 430 sales reps 18.46 years per year.

Automation Hero has now raised a total of $19 million.

“We’re really excited with Atomico to bring on a great VC and good people,” said Groschupf. “I’ve raised capital before and I’ve worked with some of the more questionable VCs, as it turns out. We’re super-excited we’ve found an investor that really bakes important things, like a diversity policy and a family leave policy, right into the company’s investment agreement.”

Though he didn’t confirm, it’s likely that Groschupf is referring to KPCB, which has run into its fair share of controversy over the past few years and was an investor in Groschupf’s previous startup, Datameer.

Powered by WPeMatico

Email app Spark added collaboration features back in May 2018. And Readdle, the company behind the app, is going one step further with a new feature specifically designed to delegate an email to one of your colleagues.

While you can already collaborate with your team by sharing emails in Spark, the app is still not as powerful as a dedicated shared email client, such as Front. But delegation brings Spark one step closer to its competitor.

You can now treat emails as tasks with a deadline. If you’re a manager, you’re working with a personal assistant or you’re in charge of everyone’s workload, you can now assign a conversation to a person in particular and send a message to add some context.

On the other end, your colleague receives the conversation in their Spark account, in the “Assigned to Me” tab. They can then start working on that email together with other team members.

As a reminder, Spark lets you discuss email threads with your colleagues in a comment area, @-mention your colleague and add attachments and links. When you know what to say, you can create a draft, ask for feedback and collaborate like in Google Docs.

Delegation is a bit more powerful than simply sharing an email with a colleague. For instance, you can set a due date and mute the conversation. This way, you can hand-off some work and focus on something else.

Spark for Teams uses a software-as-a-service approach. It’s free for small teams and you have to pay $6.39 to $7.99 per user per month to unlock advanced features, such as unlimited email templates and unlimited delegations. Free teams are limited to 10 active delegations at any time.

Powered by WPeMatico

Your startup will not succeed unless you, the founder, build an exceptional team. Great teams are built on top of great culture. Yet any venture-backed startup founder will tell you, myself included, that developing a positive corporate culture is more art than science, requiring constant and creative recalibration as your company grows. What then does this have to do with employment law?

First, building an exceptional team means hiring great people; whether that involves W-9s for consultants, I-9s for employees, lengthy H-1B visa applications, or a new employee handbook, you need to hire the right people in the right way. Second, one bad employment-related legal dispute can have ripple effects throughout an organization, undermining employee morale and executive credibility in one fell swoop, with palpable culture fallout.

Fortunately, when working to promote healthy company culture, founders can look to employment law for some preventive medicine. In fact, transparency through written policies, clearly communicated in advance and followed in practice, can help create the trust and accountability which are foundational to positive company culture. Moreover, in the event employment disputes do arise, well-drafted employment policies actually provide valuable guidance through difficult to navigate situations, while limiting downside risks to the company, as well.

This article, the fourth in Extra Crunch’s exclusive five-part “Startup Law A to Z” series, follows previous articles on customer contracts, intellectual property (IP) and corporate matters. This series is calculated to provide founders the information needed to assess legal risks in the areas common to most startups.

After reading this article, or other “Startup Law A to Z” articles, should you identify legal risks facing your startup, Extra Crunch resources can help. For example, the Verified Experts of Extra Crunch include some of the most experienced and skilled startup lawyers in practice today. So use these resources to identify attorneys focused on serving companies at your stage and then reach out for further guidance in the particular issues at hand.

Employee vs. independent contractor classification

Minimum wage and hour laws

Meal and rest breaks, vacation pay

Deferred compensation

Sexual harassment, discrimination, and related claims

Work authorization / immigration

One of the biggest employment law issues that startups get wrong, often willingly, is “employee” versus “independent contractor” classification. For employees, a startup must withhold and pay federal, state, and local income taxes, state disability, and payments under the Federal Unemployment Tax Act and Federal Insurance Contribution Act (i.e. Social Security and Medicare), not to mention contributions for federal and state unemployment and workers compensation insurance. Given this complexity, startups should absolutely hire a payroll provider to help manage the process, such as ADP, Gusto, Paychex or Quickbooks.

Of course, all of this gets expensive. Instead, far too many early-stage startups simply hire “independent contractors” to avoid everything mentioned above, often misclassifying these workers in the process, whether under federal law, state law, or both.

Powered by WPeMatico

Pan-African e-commerce company Jumia filed for an IPO on the New York Stock Exchange today, per SEC documents and confirmation from CEO Sacha Poignonnec to TechCrunch.

The valuation, share price and timeline for public stock sales will be determined over the coming weeks for the Nigeria-headquartered company.

With a smooth filing process, Jumia will become the first African tech startup to list on a major global exchange.

Poignonnec would not pinpoint a date for the actual IPO, but noted the minimum SEC timeline for beginning sales activities (such as road shows) is 15 days after submitting first documents. Lead adviser on the listing is Morgan Stanley .

There have been numerous press reports on an anticipated Jumia IPO, but none of them confirmed by Jumia execs or an actual SEC, S-1 filing until today.

Jumia’s move to go public comes as several notable consumer digital sales startups have faltered in Nigeria — Africa’s most populous nation, largest economy and unofficial bellwether for e-commerce startup development on the continent. Konga.com, an early Jumia competitor in the race to wire African online retail, was sold in a distressed acquisition in 2018.

With the imminent IPO capital, Jumia will double down on its current strategy and regional focus.

“You’ll see in the prospectus that last year Jumia had 4 million consumers in countries that cover the vast majority of Africa. We’re really focused on growing our existing business, leadership position, number of sellers and consumer adoption in those markets,” Poignonnec said.

The pending IPO creates another milestone for Jumia. The venture became the first African startup unicorn in 2016, achieving a $1 billion valuation after a $326 funding round that included Goldman Sachs, AXA and MTN.

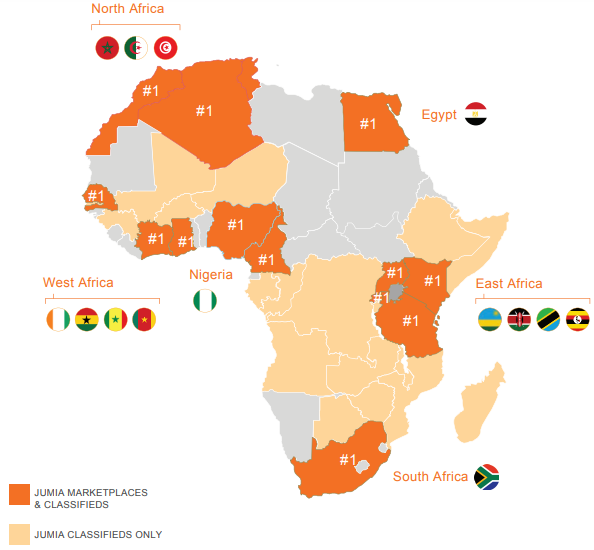

Founded in Lagos in 2012 with Rocket Internet backing, Jumia now operates multiple online verticals in 14 African countries, spanning Ghana, Kenya, Ivory Coast, Morocco and Egypt. Goods and services lines include Jumia Food (an online takeout service), Jumia Flights (for travel bookings) and Jumia Deals (for classifieds). Jumia processed more than 13 million packages in 2018, according to company data.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape.

Starting in Nigeria, the company created many of the components for its digital sales operations. This includes its JumiaPay payment platform and a delivery service of trucks and motorbikes that have become ubiquitous with the Lagos landscape.

Jumia has also opened itself up to traders and SMEs by allowing local merchants to harness Jumia to sell online. “There are over 81,000 active sellers on our platform. There’s a dedicated sellers page where they can sign-up and have access to our payment and delivery network, data, and analytic services,” Jumia Nigeria CEO Juliet Anammah told TechCrunch.

The most popular goods on Jumia’s shopping mall site include smartphones (priced in the $80 to $100 range), washing machines, fashion items, women’s hair care products and 32-inch TVs, according to Anammah.

E-commerce ventures, particularly in Nigeria, have captured the attention of VC investors looking to tap into Africa’s growing consumer markets. McKinsey & Company projects consumer spending on the continent to reach $2.1 trillion by 2025, with African e-commerce accounting for up to 10 percent of retail sales.

Jumia has not yet turned a profit, but a snapshot of the company’s performance from shareholder Rocket Internet’s latest annual report shows an improving revenue profile. The company generated €93.8 million in revenues in 2017, up 11 percent from 2016, though its losses widened (with a negative EBITDA of €120 million). Rocket Internet is set to release full 2018 results (with updated Jumia figures) April 4, 2019.

Jumia’s move to list on the NYSE comes during an up and down period for B2C digital commerce in Nigeria. The distressed acquisition of Konga.com, backed by roughly $100 million in VC, created losses for investors, such as South African media, internet and investment company Naspers .

In late 2018, Nigerian online sales platform DealDey shut down. And TechCrunch reported this week that consumer-focused venture Gloo.ng has dropped B2C e-commerce altogether to pivot to e-procurement. The CEO cited better unit economics from B2B sales.

In late 2018, Nigerian online sales platform DealDey shut down. And TechCrunch reported this week that consumer-focused venture Gloo.ng has dropped B2C e-commerce altogether to pivot to e-procurement. The CEO cited better unit economics from B2B sales.

As demonstrated in other global startup markets, consumer-focused online retail can be a game of capital attrition to outpace competitors and reach critical mass before turning a profit. With its unicorn status and pending windfall from an NYSE listing, Jumia could be better positioned than any venture to win on e-commerce at scale in Africa.

Powered by WPeMatico

When the bubble burst in the year 2000, Tanya Van Court lost over $1 million in stock and options over the course of a few minutes. Then and there she vowed to never let something like that happen to her children.

Five years later, her daughter Gabrielle was born. At the time, she was a VP of Digital Product Dev at ESPN. She then went on to work as SVP of Digital Products, Parenting & Preschool for Nickelodeon and, in 2013, moved to SVP of Marketing at Discovery Education, leading the charge to roll out digital textbooks nationwide.

Today, she runs Goalsetter, an app that allows parents and their kids to replace gift-giving with goal-giving.

It started when her daughter Gabrielle was eight years old. Van Court told her daughter that if she could save $100, Van Court would match that $100 and start her an investment account. After learning how exactly an investment account works, Gabrielle decided all she wanted for her ninth birthday was a bike and an investment account.

“I thought that these are amazing things for a nine-year-old to want, but she was going to get all kinds of stuff she didn’t want or need instead,” said Van Court. “I realized how early consumerism starts. We all have more and more and more and value things less and less and less.”

After conversations with fellow moms, Van Court got to work on Goalsetter. The app has two main branches: a savings account for kids and a financial literacy learning center with fun quizzes.

Kids and parents together sign up for the app, where kids input some of their goals, from college tuition to a new bike or gaming console. Kids can then earn their allowance through the app, and can also receive ‘GoalCards’ (replacing a gift card) from parents and relatives to save towards their goals.

Moreover, parents can round-up their debit card swipes to go towards their kids bigger goals, such as college tuition or a first car. Parents can also set up auto-save to set aside a few dollars each month.

“Moms in particular all feel the pain of their kids having too much stuff,” said Van Court. “When they step on yet another lego in the house or go into the kids room to find 80 toys, only five of which they play with, these become daily pain points for moms. The idea of teaching kids how to save instead of teaching them how to acquire more stuff really resonates with moms.”

Goalsetter also offers a financial literacy quiz game called “It’s LIT” that is mapped to financial literacy standards for K – 12. The game uses pop culture memes, song lyrics, etc. to engage kids while teaching them the fundamentals of personal finance. Parents can choose to reward their kids with money toward their goals for each question they get right.

What’s more, Goalsetter has plans to launch “It’s LIT” as a curriculum to school districts, complete with lesson plan materials, quizzes and more.

Alongside the curriculum, Goalsetter makes money by charging a dollar for every GoalCard sent through the platform. Goalsetter donates 5 percent of its transaction fee to children’s related charities. The company also has a donation function that allows users to pay the company whatever amount they find appropriate for the features offered.

Gaolsetter skews a bit younger than some of its competitors, including Current, Greenlight, and Step.

Goalsetter currently has more than 20,000 users and was recently featured on Shark Tank — Van Court turned down Mr. Wonderful’s investment offer.

The company graduated from the Entrepreneurs’ Roundtable Accelerator in 2017 and has raised a total of $2.1 million, including investment from Morgan Stanley, CFSI sponsored by JP Morgan Chase, Pipeline Angels and Backstage Capital.

“When the bubble burst, I had to learn the hard way that what goes up can actually come down,” said Van Court. “Our mission is to teach children that money has real value that can go towards the things you want to accomplish in life, and to people who are in need of it.”

Powered by WPeMatico

Venture capitalists’ latest on-demand delivery bet is in the pharmaceutical space.

Truepill, an online pharmacy powering delivery for the likes of Hims, Nurx, LemonAID and other direct-to-consumer healthcare brands, has nabbed a $10 million Series A from early-stage VC fund Initialized Capital. The investment brings the Y Combinator graduate’s total raised to $13.4 million. Y Combinator, Sound Ventures, Tuesday Capital and others participated in the round.

Founded in 2016, the San Mateo-based startup employs 150 workers and plans to expand its team and fulfillment facilities into the U.K. with the fresh funding. Truepill is currently active in all 50 states and has delivered 1 million subscriptions for birth control, erectile dysfunction medication, hair loss treatment and more.

It is, as co-founders Sid Viswanathan and Umar Afridi explained, Amazon Web Services for pharmacies.

“We are really only scratching the surface of where this telemedicine landscape is going to go,” Viswanathan, who became a product manager at LinkedIn after the social network acquired his transcription service CardMunch, told TechCrunch. “We are catering to this first wave of those companies and we want to be that pharmacy fulfillment service powering that entire shift … We want to build the next generation of pharmacy infrastructure.”

Afridi, for his part, previously spent more than a decade as a pharmacist at retail chains like CVS and Fred Meyer.

In addition to operating a prescription delivery service, Truepill provides a set of APIs that give its customers programmatic access to its pharmacy and allows brands to fully customize packaging.

Foundation Capital, Index Ventures, Social Capital, Box Group and Joe Montana are also Truepill stakeholders.

Powered by WPeMatico

Stash, the fintech startup and app that aims to introduce new people to the world of investing, is unveiling some interesting new services while also announcing that it has raised more funding to expand its business. The company is introducing mobile-based banking accounts from Green Dot Bank, and, alongside it, a new rewards program called “Stock-Back.” When users spend money using their Stash accounts, they get “points” — which are either stocks in the companies where they are buying goods, or shares in ETFs approved by Stash. On top of that, Stash also said it raised a Series E of $65 million that it will be using to grow its business on the back of these two launches.

A spokesperson for the company said that Stash is not disclosing the full round of investors in this round. For context, Stash was valued at $350 million post-money in its Series D, according to figures from PitchBook, and a source says the valuation is now “much higher” than $400 million.

But from the looks of it, the $65 million appears to include participation from Breyer Capital, a previous investor whose founder Jim Breyer has heartily endorsed the new Stock-Back service and accompanying loyalty program that’s tied in with it, which was tested early with companies like Netflix, T-Mobile and Chipotle all offering stock when people used their Stash accounts to pay for goods and services at the companies.

“I have invested in and served on the Board of many leading companies, and it’s clear how a program like Stock-Back can power immense brand loyalty,” he said in a statement today. “The early data shows unequivocally that share ownership drives increased sales and customer appreciation. This innovative new technology from STASH will have CEOs and CMOs knocking on their door.”

From what we understand, the round was led by a private institutional investor and includes 40 percent existing and 60 percent new investors. Previous backers in addition to Breyer include Union Square Ventures, Coatue Management, Entree, Goodwater and Valar. “We’re really excited and proud to be working with this incredible group of VCs,” the spokesperson noted.

The Green Dot-powered banking service comes with the core features that will sound familiar to those who have used or looked at next-generation banking services before. It will include a debit card-based account, no overdraft or monthly maintenance fees, access to a network of ATMs that can be used for free and direct deposit services, as well as “personal guidance” for their financial planning activities, from saving to investing.

Stash is part of a wave of fintech startups — others include the likes of Robinhood, Acorns, YieldStreet, Revolut and many others — that have tapped into the popularity of apps and the advent of new financial services technology to democratise how individuals can save, spend, invest, borrow and lend money, moving many of those operations and transactions out of the hands of the big incumbent players who used to control them.

The average age of a Stash user is 29 and average income is less than $50,000 per year, and tying in transactions made using Stash’s banking service — by way of reward points that are being picked up incidentally — will make it even more seamless for these users to take some of their money and invest with it, while at the same time demystifying some of the process and making it more likely that those users will choose to invest even more down the line.

The idea of tying investments to what you are actually purchasing is a clever one. For a startup whose user base includes no-nonsense professionals from fields like teaching, nursing and retail, this is the embodiment of putting your money where your mouth is — literally speaking, as the investments can include things like shares in Chipotle each time you buy food there, and T-Mobile every time you pay your phone bill for all the talking you do.

Stash is positioning Stock-Back as a rewards program, with the percentages varying by business or brand and going as high as five percent in Stock-Back in some cases — as is the case, at launch, when people use their Stash debit cards to pay their Spotify and Netflix dues.

Ultimately, the aim of this is to present a way for ordinary, modestly-salaried people not only to potentially make money, but to be better engaged in how financial systems work, and how their daily actions impact that — the idea being that this knowledge can only help them in the long run.

“80% of Americans are living paycheck-to-paycheck. Stock-Back is our way of utilizing STASH’s smart, patent-pending technology to help people build better financial habits and invest in their future,” said co-founder and president, Ed Robinson, in a statement. “Our ability to give customers the opportunity to save and build portfolios that mirror their spending behavior and preferences is incredibly powerful.”

Powered by WPeMatico

Pitched as “travel insurance for people who don’t like insurance,” U.K.-based Pluto Insurance is officially launching today with an online travel insurance product targeting millennials.

Citing research that says 40 percent of millennials don’t actually buy travel insurance, mistakenly believing that it isn’t required, the mobile-first offering not only attempts to demystify travel insurance, but is also unbundling it in a way that ensures you only pay for the cover you need or desire.

“We’ve spoken to hundreds of millennials and three things keep coming up,” says Pluto co-founder and CEO Alex Rainey. “Travel insurance is too complicated and it’s hard to know what you’re actually buying. Secondly, a lot of younger people don’t think they need it. But most importantly, there is a distinct lack of trust towards insurers, and it’s easy to see why. With exclusions buried in the fine print and insurers expecting people to print out a claim form and post it in.”

To remedy this, Rainey says Pluto wants to make travel insurance more tailored, letting you build your own policy online. “We work hard to make sure everything is easy to understand, ensuring we always explain our cover in plain English,” he says. The startup also lets you submit a claim via the mobile web app “in under 10 minutes.”

Insurance options includes gadget cover, baggage cover, cancellation cover, level of excess, cover for certain activities and travel disruption. As you add more cover, the price of your insurance changes in real time with each decision. Once you’ve built your policy, a short summary of your cover is displayed before you go ahead and purchase.

Meanwhile, the insurance itself — which, at launch, doesn’t cover pre-existing conditions, although that will be offered in the future — is in partnership with Zurich, which Rainey says was chosen because they had a 99 percent claims payout rate in 2017. “This is so so important for us to solve the trust issues in insurance,” he adds.

To that end, Pluto integrates with Facebook Messenger, including letting you use the messaging app to start a claim. You can also search your policy, check a summary of your cover or chat to a Pluto team member.

“Our customers want to do everything from their phone, when and where they want. We’ve made sure that’s possible,” says Rainey.

Powered by WPeMatico

Instacart has expanded its alcohol delivery to now be available in 14 states and Washington, DC from nearly 100 different retailers.

With the roll-out, Instacart alcohol delivery is currently available to 40 million homes in the U.S., and the number of alcohol deliveries on the platform has more than doubled since the same time last year.

Partners who participate in alcohol delivery on Instacart include Albertsons, Kroger, Publix, Schnucks and Stater Bros., alongside wine and liquor stores such as BevMo!, Binny’s Beverage Depot and Total Wine & More.

The list of states where Instacart offers alcohol delivery include California, Connecticut, Florida, Illinois, Kentucky, Massachusetts, Minnesota, Missouri, North Carolina, Ohio, Oregon, Texas, Virginia, Washington and Washington, DC.

Instacart started rolling out alcohol delivery a year ago, and has quickly become a competitive player in the space. Postmates introduced alcohol delivery in 2017, whereas strictly alcohol delivery services like Drizly, Minibar and Saucey have been around for a while.

Here is what Instacart’s chief business officer, Nilam Ganenthiran, had to say:

Part of grocery shopping for many people goes beyond getting fresh produce, meats and pantry staples, and includes picking up the perfect bottle of wine for a dinner party or their favorite beer to sip while watching the big game. By working alongside our retail partners to add alcohol to the marketplace, we’re offering customers more choice and making it easier for Instacart to be their ‘one-stop-shop’ to get the groceries they need – including beer, wine and spirits – from the retailers they love.

When Amazon bought Whole Foods in 2017, some speculated that Instacart might be hit hard. But the deal also represented the digitization of a massive, traditional industry. Considering Instacart’s retail partner growth over the past year, it seems that the Whole Foods acquisition might have made Instacart an attractive platform for some retailers.

The company now serves more than 80 percent of U.S. households, which was Instacart’s stated goal for the end of 2018. Across its 300 retail partners, Instacart now delivers from 20,000 grocery stores across 5,500 cities in North America.

Powered by WPeMatico